Financing Credit Line Agreement

Exhibit 10.1

Number: BC2022062900002650

Financing Credit Line Agreement

Agreement Version: SPDB202109

|

Credit Line Agreement |

Company: Neophotonics (China) Co., Ltd. (hereinafter referred to as Client)

Principle Office Location: Neophotonics Building, No. 8 12th South Xxxx Xxxx, Xx-Xxxx Xxxx,

Xxxxxxx Xxxxxxxx, Xxxxxxxx, Xxxxx

Liaison: Xxxxxxxxx Xxxxx Telephone: 0000-00000000

Fax: / Email: /

Bank: Shanghai Pudong Development Bank Company Limited Shenzhen Branch

(hereinafter referred to as Creditor)

Principle Office Location:

Liaison: Xxxxxx Xx Telephone: 0000-00000000

The parties have, through amicable consultation and on the principle of fairness and mutual benefit, equally and voluntarily reached the following agreements according to applicable laws and regulations:

Section I General terms and conditions

| 1. | Agreements refer to any and all instruments entered into by and between Client and Creditor within the term of credit line, including credit line change agreement (see Exhibit 1 for template) and Subsequent financing instruments, and such instruments shall be read together with this Agreement in its entirety. |

In case of any inconsistency between this Agreement (including the supplementary agreements hereto) and the Subsequent financing instruments, the content agreed in the Subsequent financing instruments shall prevail.

| 2. | Credit Line For the purpose of this Agreement, term of Credit Line refers to the term of credit line granted to the Client by the Creditor as specified by Credit Line Table (see Section II hereof) or any credit line change agreement, which shall the period during which the Client may request for usage of the credit line, instead of the debt discharge period. The debt discharge period for businesses hereunder shall be determined by the Parties in the corresponding Subsequent financing instruments or an undertaking to be issued. For the term of credit line set forth in the Credit Line Table (see Section II hereof) and the term of credit line set forth in any credit line change agreement between the Client and the Creditor, the term set forth in the document signed later shall prevail. Client shall apply Creditor for tapping into credit line within the term. Such application given after expiration of the term shall be refused by Creditor regardless of whether the related credit line has been used up. |

| 3. | Credit Line Change. In case of discrepancy between this provision and Credit Line Table, the latter one (including credit line change made by Client and Creditor from time to time by a signed credit line change agreement) shall prevail. If any Subsequent instruments executed by Client and Creditor within the term conflict with this Agreement, such instruments shall be applied to the services involved. |

Page 1

|

Credit Line Agreement |

Notwithstanding the foregoing, Creditor reserves the right to notify Client of early expiration of any loan under any Subsequent instruments in order to protect security of such loan where Creditor deems necessary to do so, in which case, Client is required to repay any debt due immediately and replenish any margin to a full amount for the letter of credit, bank guarantee/standby letter of credit and bank’s acceptance xxxx issued by Creditor upon request of Client and other business recognized by the Creditor.

| 4. | Financing. This Agreement and Subsequent instruments define that Client may apply Creditor for credit financing (collectively referred to as Financing) based on credit line within the term of Credit Line as agreed, in which case the Credit Line Table shall be applied to determine applicable financing type. Creditor offers irrevocable and revocable financing acceptance to Client under this Agreement. Revocable acceptance means that Creditor may (but is not obliged to) finance Client; while irrevocable one means that Creditor shall fulfill the obligations of acceptance under this Agreement as long as agreements on use of credit line and other prerequisites agreed by the parties concerning certain services have been are satisfied. |

| 5. | Subsequent Financing Instruments For the purpose of this Agreement, Subsequent Financing Instruments refer to the instruments signed by Client and include but not limit to: |

| (1) | cash credit contract, fixed assets loan contract and any other loan instruments signed by Client in case of the said service; |

| (2) | discounting xxxx agreement and any other instruments signed by Client in case of the said service; |

| (3) | agreement of guaranteed discounting of commercial acceptance xxxx and any other instruments signed by Client in case of the said service; |

| (4) | factoring agreement and any other instruments signed by Client in case of factoring; |

| (5) | agreements on export xxxx credit, advance against documentary collection and any other instruments signed by Client in case of export xxxx credit (inclusive of domestic letter of credit) and advance against documentary collection; |

| (6) | agreements on import xxxx credit and any other instruments signed by Client in case of the said service; |

| (7) | packing loan agreements and any other instruments signed by Client in case of the said service; |

| (8) | agreement of issuance of letter of credit and any other instruments signed by Client in case of the said service; |

| (9) | agreement of issuance of bank guarantee and standby letter of credit in case of the said service; |

| (10) | agreement of issuance of bank acceptance bills and any other instruments signed by Client in case of the said service; |

| (11) | other financing instruments entered into by and between Client and Creditor. |

Page 2

|

Credit Line Agreement |

In respect of Client’s application of credit line, where terms and conditions under this Agreement and related requirements of Creditor are satisfied, Creditor may release financing fund to Client in accordance with this Agreement and subsequent financing instruments or give bank guarantee to external party upon request of Client. However, Client is not allowed to withdraw or change any signed or submitted financing application/agreement, otherwise Client is required to pay Creditor any costs, expenses and loss incurred to Creditor due to such withdrawal or change.

| 6. | Submission of Instruments. Client guarantees that the following documents have been provided or the conditions hereinafter have been satisfied prior to execution of this Agreement or according to related requirements by Creditor: |

| (1) | Copy of Client’s latest articles of association, business license; |

| (2) | Resolutions of board of directors in authorizing Client to execute this Agreement and related subsequent financing instruments; |

| (3) | Power of attorney and signature sample of representatives of Client; |

| (4) | All subsequent financing instruments which have been signed by Client lawfully according to Creditor’s requirements; |

| (5) | Other instruments or conditions required by Creditor. |

| 7. | Prerequisites on Use of Credit Line |

The following prerequisites shall be satisfied prior to use of any credit line by Client:

| (1) | Client has normal business operation, sound finance state and not experienced significant deterioration in business performance in the latest three years; |

| (2) | Client has not committed any breaches under credit line agreement; |

| (3) | Where the loan under this Agreement is secured, related security instruments are supposed to have been executed, necessary procedures of mortgage/charge have been completed and the related security rights have been created prior to commencement of financing services by Creditor; |

| (4) | Client is required to give express and clear Credit Line Use Plan; elements for application of certain services, comply with Creditor’s regulations and credit granting approval systems as well as requirements for financing services; |

| (5) | Client has provided information concerning production, operation, finance activities and financial statements and undertakes to provide such information in a timely manner as well as accept supervision and inspection by Creditor within the term of this Agreement; |

| (6) | Amount to be used shall not exceed balance amount of the credit line; |

| (7) | Applications of certain services have to be given within the term of credit line, and loan release day or issuance day of letter of credit, bank guarantee/standby letter of credit, bank’s acceptance xxxx and other services falls on Creditor’s business day; |

| (8) | Other prerequisites required by Creditor (see Section II Other Arrangements if applicable). |

| 8. | Used Credit Line refers to the sum of (i) the principal amount of the loan which has been released by Creditor to Client and not yet been repaid by Client, (ii) the financing amount already committed to Client (including the committed amount under a signed specific financing agreement) which has not yet been withdrawn by the Client, and (iii) the amount involved in guarantee commitment (including, without limitation, L/C, bank guarantee/standby L/C) issued by Creditor upon request of Client, according to this Agreement and subsequent financing instruments at any time, less the amount which was paid by Client or Client’s guarantor by xxxxxxx money, certificate of deposit, treasury bond, banker’s acceptance and other security pairs, unless otherwise additionally specified by the parties. |

Page 3

|

Credit Line Agreement |

| 9. | Revolving. In respect of revolving credit line, where Client has completed performance of obligations (inclusive of repayment of loan or advancement of Creditor, release of Creditor from obligations under guarantee commitment due to its fulfillment of the obligations under the underlying contract, replenishing margin to a full amount, release of payment obligations of Creditor to external party) under this Agreement and subsequent financing instruments, used credit line attributable to such obligations shall be recovered in the amount equivalent to the amount involved by the completed obligations, in which case Client is allowed to apply Creditor for credit line again within the related term. In respect of non-revolving credit line, used credit line shall not be recovered upon Client’s fulfillment of its repayment obligations, unless otherwise with consent by Creditor. Unless otherwise specified by this Agreement, during the term of credit line, Creditor reserves the right to reexamine Client’s operation state and related collateral in a yearly basis, in which case Client is allowed to use credit line in the coming year if such reexamination passed; while Creditor is entitled to cancel credit line for the coming year if such reexamination failed and any unused and to be repaid credit line shall not be allowed again except that currently effective subsequent financing instruments are not affected. |

| 10. | Security. If credit line under this Agreement is secured, prerequisite for application of the financing contained herein is that Client has executed the related security instruments and such instruments have come into force and remain in full force and effect. If the security instrument is a mortgage/pledge contract, the security interest under such contract has been established and remains in full force and effect. In case Credit Line Table defines percentage of margin for letter of credit, bank guarantee/standby L/C and bank’s acceptance xxxx, prerequisite for application of issuance of the said instruments is that Client has paid margin in a full amount. If Client applies Creditor for change of credit line and such change causes credit line increase, at the request of Creditor, Client shall give additional security or cause Guarantor confirm such change and additional security. Where credit line is granted continuously in the coming year upon reexamination by Creditor, Client is required to make sure that security in relating to such credit line remains effective. |

| 11. | Taxation. Client is required to repay financing fund at full amount and no deductions are allowed except that related taxations are imposed on such repayment by law. If Client is required to withhold the said taxation by law, a tax payment receipt shall be given to Creditor within fifteen (15) days following such withholding, in which case Client is required to compensate Creditor with such additional charges so that Creditor receives the repayment without any deductions. |

| 12. | Representations and Warranties. Client represents and warrants as below, and such representations and warranties shall be deemed to have been made by Client every time when Creditor grants financing to Client according to this Agreement and subsequent financing instruments and remain effective. |

Page 4

|

Credit Line Agreement |

| (1) | Client is a corporation (enterprise) legal person and other economic organization incorporated according to applicable laws and has independent legal person qualification, complete finance system and repayment capacity, which is entitled to execute and fulfill this Agreement, sign this agreement and any related instruments, and has taken any necessary corporate action to make sure that this Agreement and any related instruments are lawful, valid and enforceable; |

| (2) | Execution and performance of this Agreement and obligations contained herein by Client are neither in violation of any signed contract or document, articles of association, any applicable laws, regulations or administrative order, related instruments, judgment, award by competent authority, nor conflict with any other obligations or arrangements of Client; |

| (3) | Client, its shareholders and affiliates are neither involved in any liquidation, bankruptcy, reconstructing, acquisition, merger, division, reorganization, dissolution, winding up, shutdown, suspension of business or similar proceedings, nor any circumstance possibly causing such proceedings occurred; |

| (4) | Client was neither involved in any economic, civil, criminal and administrative proceedings which may cause significant adverse impact, nor any circumstance possibly causing such involvement to the proceedings or similar arbitration procedures occurred; |

| (5) | Material assets of Client’s legal representative, directors, supervisors or other senior managers and Client are neither involved any mandatory execution, seizure, lien, freezing, encumbrance, regulatory measures, nor any circumstance possibly causing such measures occurred; |

| (6) | Client guarantees that the provided financial statements (if any) are in line with applicable laws, and true, complete and fair to reflect its finance state; all materials, documents and information (of Client or guarantor) provided for the purpose of execution and performance of this Agreement are true, effective, accurate, complete and without any concealment or omission; |

| (7) | Client strictly complies with applicable laws and regulations to operate, carries on business activities strictly according to regulations defined by business license or business scope determined by law and goes through registration annual review procedures; |

| (8) | Client has disclosed all important known or supposedly known facts and states (including but not limited to business conditions, finance state, security to external parties, etc.), on which Creditor depends to grant credit line under this Agreement; |

| (9) | Client’s internal management documents concerning environmental and social risks are in line with legal requirements and have been implemented efficiently; |

| (10) | Client warrants that there is no other circumstance or event which causes or may cause significant adverse impact on Client’s performance capabilities; |

| 13. | Commitments. Client undertakes as below, and such commitments shall be deemed to have been made by Client every time when Creditor grants financing to Client according to this Agreement and subsequent financing instruments and remain effective. |

| (1) | Client shall strictly abide by this Agreement and fulfill the obligations contained herein and its subsequent financing instruments; |

Page 5

|

Credit Line Agreement |

| (2) | Unless otherwise specified in this Agreement or subsequent financing instruments, Client is required to replay financing fund or out-of-pocket fund in a timely manner or replenish margin to a full amount upon request of Creditor according to this Agreement and subsequent instruments; Client shall apply for, obtain and comply with verification, authorization, registration and permit required by applicable laws and regulations, and maintain effectiveness of such official permits so that Client has the lawful power to sign and execute this Agreement and obligations under any documents related to this Agreement; upon request of Creditor, Client shall immediately give the relevant proof; |

| (3) | Client is required to give Creditor notice in writing within five (5) Creditor’s business days where Client is aware of its involvement in any economic, civil, criminal, administrative proceedings or similar proceedings which may cause significant adverse impact or where Client learns that its key assets are involved to any mandatory execution, seizure, lien, freezing, encumbrance, regulatory measures, and such notice shall state the consequences and remedy measures which have been taken or are to be taken; |

| (4) | Without prior written consent of Creditor, Client is not allowed to offer any third party security which is sufficient to cause significant adverse impact on its finance position or its obligations performance under this Agreement; |

| (5) | Without prior written consent of Creditor, Client is not allowed to repay other long-term debt and such repayment has significant adverse impact on Client’s obligations performance under this Agreement; |

| (6) | Following the day of execution of this Agreement and prior to full repayment of entire debts under this Agreement and subsequent financing instruments, without prior written consent of Creditor, Client is not allowed to: |

| a) | Conduct material external investment, equity transfer, change of actual controller or major shareholder, or substantially increase debt financing, proceed liquidation, reconstructing, bankruptcy, merger, acquisition, division, transfer of property rights, decrease of registered capital, reorganization, dissolution, winding-up, shutdown, suspension of business or similar proceedings, or have any other act which may affect the Client’s ability of repayment; |

| b) | In addition to demand of day-to-day operation, sell, lease, donate, offset against debt, exchange, transfer, assignment, mortgage, pledge or otherwise dispose all or substantially all of its material assets; |

| c) | Provide guarantee for any third party which is sufficient to produce material adverse effect on its financial conditions or its ability to perform the obligations hereunder, or incur new material debts or accelerate the repayment of other long-term debts to the extent that such repayment may have material adverse effect on the Client’s ability to perform the obligations hereunder |

| d) | Sign any contract / agreement which has significant adverse impact on its ability to perform obligations under this Agreement or assume any obligations with similar impact. |

| (7) | In case security under this Agreement suffers certain circumstance or certain change, upon request of Creditor, Client is required to give other security recognized by Creditor. Such circumstance or change includes but not limit to suspension of production or business, dissolution, business interruption for rectification, revoking or cancelation of business license, voluntary or mandatory application for reorganization and bankruptcy, material change of operation or financial position, involvement to significant litigation or arbitration cases, litigation of legal representative / responsible person, arbitration or other mandatory measures, decrease or possible decrease of collateral’s value, property preservation measures taken by seizure, breaches under security contract and request to terminate such security contract, etc.; |

Page 6

|

Credit Line Agreement |

| (8) | Upon request by Creditor, Client shall go through notarization (with mandatory enforcement effect) procedures with notary public authority recognized by Creditor, in which case Client shall accept such mandatory enforcement; |

| (9) | Client shall notify Creditor of any events which may impact performance of obligations under this Agreement and any other instruments related; |

| (10) | Special agreements for Group Client (Group Client applicable). |

If Client is a Group Client, the following commitments are required:

| a) | Client is required to promptly report the final grantee’s related-party transaction involving above 10% of net assets, including: a. relationship of the transaction parties; b transaction project and nature of the transaction; c. transaction amount or corresponding proportion; d. pricing policy (including transaction involving no specific amount or only with nominal amount); |

| b) | If the final grantee is under one of the following circumstances, Client shall be deemed in violation of this Agreement, in which case Creditor has the right unilaterally decide to cancel Client’s unused credit and recover entire or partial used credit or require Client to add margin to 100%: a. provide false information or conceal important operational and financial facts; b. change intended usage of credit line without prior consent of Creditor, misappropriate credit or use such credit to engage in illegal or unlawful transactions; c. take advantage of false contract with related-party, and take receivable notes, receivable accounts and other creditor notes which contain no real trading to apply for bank discounting or pledge to defraud money or credit from the bank; d. refuse to accept supervision and inspection by Creditor on fund use and related operational and financial activities; e. have material mergers, acquisitions and restructuring which in Creditor’s opinion may affect safety of credit; f. evade debts owning to bank by related-party transactions. |

| (11) | Special guarantees and commitments to green credit and arrangements (applicable to clients engaged in nuclear power plants, large-scale hydropower plant, water projects, resource extraction projects and other projects having construction, production and business activities possibly significantly change environmental status and cause adverse environmental and social consequences which are not easily eliminated, as well as petroleum processing, coking and nuclear fuel processing, chemical materials and chemical products manufacturing and its construction, production and business activities causing negative environmental and social consequences which are not easily eliminated through mitigation measures): |

| a) | Client undertakes to submit to the SPD Bank a report on environmental, social and governance risks, and represents and warrants that it shall strengthen the management of environmental, social and governance, including: a. internal management documents concerning environmental and social risks are in line with legal requirements and have been implemented efficiently; b. there is no critical mitigations related to environmental and social risks; |

Page 7

|

Credit Line Agreement |

| b) | Client undertakes to accept Creditor’s supervision, strengthen environmental and social risk management, including: a. undertake to keep all behavior and performance associate with environmental and social risks in compliance with related regulations; b. undertake to set up and improve a sound internal management system on environmental and social risks, and define detailed duties, obligations and penalties to related responsible persons; c. undertake to set up and improve emergency response mechanisms and measures for environmental and social risks; d. undertake to set up specialized department or appoint a specialized person to be in charge of environmental and social risk issues; e. undertake to assist Creditor or the third party recognized by Creditor to have environmental and social risk evaluation and examination; f. undertake to give proper response or take other necessary actions facing serious disputes raised by the public or other interest-related parties on Client’s control performance for environmental and social risks; g. undertake to urge Client’s key related-parties to strengthen their management to prevent impact from such parties’ environmental and social risks; h. undertake to fulfill other obligations which Creditor deems related with control environmental and social risks. |

| c) | Client undertakes to report promptly and sufficiently to Creditor in case of the following circumstances: a. permit, approval and inspection related with environmental and social risks in the course of project commencement, construction, operation and shutdown; b. assessment or inspection by environmental and social risks regulatory bodies or accredited institution; c. environment-related supporting facilities construction and operation; d. discharge of pollutants and compliance; e. safety and health of employees; f. complaints and protest by surrounding communities against Client; g. major environmental and social claims; h. other major cases related with environmental and social risks as Creditor deems so; |

| d) | If Client and the final grantee is under one of the following circumstances, Client shall be deemed in violation of this Agreement: a. representations and warranties made by Client concerning environmental and social risk management are not implemented with due diligence; b. Client is punished by relevant authority due to poor management of environmental and social risks; c. Client is seriously questioned by the public of media due to poor management of environmental and social risks; d. other defaults agreed by Creditor and Client concerning environmental and social risk management, including the cross-default event; |

In case of the defaults mentioned above, Creditor has the right to unilaterally decide: a. withdraw credit acceptance; b. interrupt release of loan until Client takes remedial measures satisfying Creditor; c. collect released loan early; d. execute related mortgage and pledge rights and other penalty measures early in case of failure to repay the loan; e. other penalty measures agreed by Creditor and Client.

| (12) | Client undertakes not to increase any implicit debt of local government in violation of the provisions, otherwise SPD Bank shall have the right to immediately suspend/terminate the financing or fund withdrawal, cancel the financing line and declare early maturity in part or in whole of the extended financing. Meanwhile, SPD Bank shall have the right to report relevant information to relevant regulatory authorities. |

Page 8

|

Credit Line Agreement |

| (13) | Regrading anti-money laundering Client confirms and agrees that the Creditor may conduct money laundry risks assessment against transactions involved hereunder in accordance with the applicable anti-money laundry laws and regulations and the internal management requirements, and if the Creditor has reasonable doubt that the Client and/or the transaction hereunder is suspected of participating in money laundry, terrorism financing or (WMD) financing activities, tax evasion and dodging or other illegal activities recognized by United Nations Security Council, Anti-Money Laundering Financial Action Task Force, the PRC, the United States, the European Union and other international organizations or countries, Creditor may take necessary control measures in accordance with the Regulations of the People’s Bank of China on Anti-Money Laundering Supervision and other regulations. And Creditor may directly restrict or suspend all or part of the business hereunder without notice to Client, declare the acceleration of loans, terminate this Agreement, and require Client to assume all losses so caused to the Creditor; |

| (14) | Client / Guarantor agrees and irrevocably authorizes that Creditor is entitled to provide information about entire contract/agreement/commitments entered into by and between Client/Guarantor and Creditor, including aforesaid contract/agreement/commitment of performance, as well as company profile and other information provided by Client/Guarantor to state-owned financial credit information database for credit inquiry by entities with approved access as long as Creditor is not in violation of prohibitive regulations under Credit Reference Administration Rules and applicable laws and regulations and makes such disclosure according to reference collection requirements of the database; meanwhile Creditor has the right to inquire and use Client/Guarantor’s credit information which has been input to the database. The aforesaid authorization extend to the whole procedures from execution of this Agreement to service management in the course of this Agreement, which shall be void upon actual termination of this Agreement. |

| (15) | Client hereby confirms that it has fully understood and been informed of the principle that Creditor forbids its employees to seek any form of interests by taking advantage of job position and undertakes to prevent such circumstance on the principle of honesty and fairness, not to offer privately Creditor’s employees any rebates, cash gifts, valuable securities, precious items, incentives, private expenses compensation, personal travel, high-value entertainment and consumption as well as other improper benefits. |

| 14. | Expenses and Costs. Client shall assume related expenses and costs according to applicable laws, regulations and this Agreement. |

| 15. | Penalty Interest. Overdue penalty interest, misappropriation penalty, calculation and payment arising out of the financing under this Agreement shall be defined by the Credit Line Table or subsequent financing instruments. |

| 16. | Currency Conversion. If currency of financing fund is different as the currency of credit line in calculating used credit line, Creditor has the right to have conversion at related exchange rate determined by itself. If at any time total amount of used credit line exceeds the maximum credit line under this Agreement due to vibration of exchange rate, Creditor has the right to require Client immediately repay the exceeding amount. If the Client repays (including authorized repayment) by the currency different as the financing currency, Creditor has the right to go through the repayment procedures at the exchange rate determined by itself, in which case exchange rate risk shall be borne by Client. |

Page 9

|

Credit Line Agreement |

| 17. | Authorized Repayment and Offsetting. Client hereby authorizes Creditor (on behalf of Client) to allocate the balance (in any currency) of Client’s bank account opened at Shanghai Pudong Development Bank Company Limited to repay directly any unrepaid maturing debt, and such authorization is irrevocable, in which case Creditor shall apply exchange rate determined by itself for conversion if applicable, and exchange rate risk shall be borne by Client. |

| 18. | Debt Books. Creditor shall maintain accounts and books which are related with business activities under this Agreement and subsequent financing instruments in accordance with Creditor’s operational guidelines, so as to prove the financing amount, interest and fees of Creditor. Client acknowledges that such accounts and books or other valid supporting materials issued or recorded by Creditor according to its business rules are, in the absence of manifest errors, the effective proof of Client’s financing debt hereunder. |

| 19. | Transfer. Client shall not transfer any rights or obligations under this Agreement. Creditor has the right to transfer rights or obligations under this Agreement to any third party at any time and disclose such third party any information concerning this Agreement, including any and all information provided by Client and Guarantor for the purpose of this Agreement. |

| 20. | Information Disclosure. Client agrees that: except for disclosure under Article 19, Creditor may disclose any and all information in relating to this Agreement to its headquarters, branches, affiliates and staff employed by such affiliates, meanwhile disclosure by Creditor to regulatory authorities, government or judicial authorities by laws and regulations is also allowed. |

| 21. | Default. |

| (1) | Event of Default. It shall constitute an event of default of Client to Creditor under this Agreement and the supporting business documents, if: |

| a) | Client is in violation of any representations and warranties under this Agreement, or such representations and warranties are proved to be inaccurate, untrue, or misleading, or have omission or have been violated; |

| b) | Client fails to repay the financing principal and interest and payables under a specific business application on time, breaches or fails to perform any committed matter hereunder and/or breaches the provisions hereof or of any specific financing instruments; |

| c) | Client has any material cross-default event, including without limitation, Client’s breach of provisions of any other financing contract to which it is a party, or Client’s failure to pay any debts under other financing contracts or agreements when due; |

| d) | the guarantor providing security for Client no longer has or will no long have the ability to provide security corresponding to the financing, or breaches any provision of the guarantee documents, or the value of the collateral reduces or may reduce or is subject to attachment or other property preservation measures that are adverse to Creditor; |

Page 10

|

Credit Line Agreement |

| e) | Client is suspected of being involved in money laundering, sanctions, terrorist financing or financing of weapons of mass destruction, export control, tax evasion or other illegal behaviors. |

| f) | Client increases any hidden debt owed by the local government in violation of the provisions; or |

| g) | or Client is under any circumstance which may affect the safety of the assets of Creditor. |

| (2) | Handling of Default. Where Client has any of the Event of Default stated above, Creditor is entitled to claim against Client for any and all losses (inclusive of attorney’s fee) in addition to taking (but is not obliged to take) the following measures separately or simultaneously: |

| a) | Adjust or cancel credit line under this Agreement; |

| b) | Declare that all debts under any subsequent financial instruments of this Agreement due early, and/or terminate entire or partial Agreement and subsequent financing instruments, require Client immediately repay all or partial principal and interests of the loan. For letter of credit, bank guarantee/standby letter of credit which has been accepted by Creditor within the term, Creditor has the right to require Client add margin or allocate balance of Client’s deposit account or settlement account as margin for external payments or future out-of-pocket payments for Client; if Creditor has paid out-of-pocket expenses, Creditor has the right to repay such expenses immediately; |

| c) | Interests shall be calculated according to penalty interest rate under this Agreement or subsequent financing instruments and the unpaid overdue interests shall be charged compound interests; |

| d) | Deduct any deposits of Client’s bank account opened by Creditor in accordance with Article 17 under this Agreement. |

| e) | To require the customer to provide other security acknowledged by the SPD Bank; |

| f) | Other remedy measures provided for by laws. |

| 22. | Applicable Law and Jurisdiction This Agreement is governed by and constructed according to the laws of the People’s Republic of China (for the purposes of this Agreement, the PRC exclusive of Hong Kong, Macao and Taiwan). Any dispute in connection with this Agreement shall be resolved through amicable consultations; should such consultation fails, appeal can be filed to the people’s court with jurisdiction over Creditor. The parties shall continue perform the not involved part of this Agreement in the course of such appeal. |

| 23. | Address of Service. Creditor acknowledges that the address first written above shall be its valid address for service, and notices to be directly delivered or mailed to Creditor by Client hereunder shall be sent to the address first written above until Creditor announces change of its address. Client agrees that all notices given by it to Creditor shall be deemed served upon actual receipt by the Creditor. |

Page 11

|

Credit Line Agreement |

Client acknowledges that the address, fax number, email and other information for service first written above shall be its valid mailing or email address. All notices and documents sent not for the purpose of litigation hereunder, and letters, summons, notices and legal instruments to be sent to it in the course of any litigation (including first instance, second instance and any other proceedings and enforcement procedures) arising out of this Agreement shall be deemed served if sent to the mailing or email address first written above by mail, or by fax, email or other electronic means, and the date of service shall be subject to the date of service set forth in the Civil Procedures Law. Any change to such mailing or email address for service without prior notice to Creditor shall have no legal effect, and the address for service acknowledged herein shall be still deemed as the valid address for service.

| 24. | Business Day. For the purpose of this Agreement, business day refers to any day when Creditor generally opens for corporate business, excluding any legal holidays. |

| 25. | Severability of Provisions. If any provisions of this Agreement or subsequent financing instruments turn to be invalid, unlawful or unenforceable, such provisions shall not affect validness, lawfulness and enforceability of the remaining provisions of this Agreement or any other subsequent financing instruments. |

| 26. | Grace. If Creditor allows any grace or suspends to take measures for Client’s any default or other acts, such grace or suspension shall not impair, affect or limit any and all rights or interest of Creditor by law or as a Creditor under this Agreement, and also constitute neither acceptance of Client’s default to this Agreement, nor waive by Creditor to take actions against Client’s current or future default. |

| 27. | Relation of Prior Credit Grant with this Agreement. Unless otherwise agreed by the parties, if there has been an existing credit grant agreement entered into by and between Client and Creditor, any unrepaid balance under such agreement shall be automatically integrated into this Agreement and directly account for the credit line under this Agreement. Client undertakes to obtain confirmation from Guarantor of debt under the originally existing agreement to continue security for the debt under this Agreement. |

| 28. | Effectiveness and Amendment. This Agreement comes into force upon signatures (or seals) by Client’s Legal Representative or authorized signatory and official seal as well as signatures (or seals) by Creditor’s Legal Representative or authorized signatory and official seal (or Contract Seal). This Agreement remains effective unless Creditor cancels entire credit line and there is no financing or debt balance under this Agreement and subsequent financing instruments. |

(The End of Section I)

Page 12

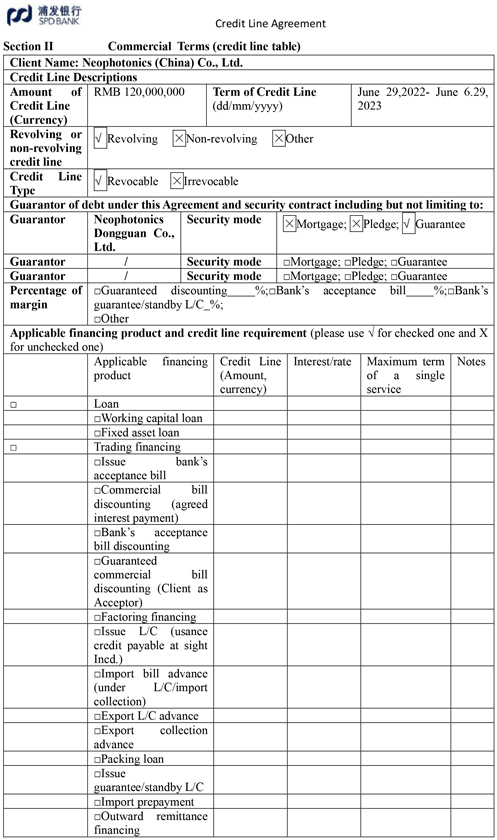

Section II Commercial Terms (credit line table) Client Name: Neophotonics (China) Co., Ltd. Credit Line Descriptions Amount of Credit Line (Currency) RMB 120,000,000 Term of Credit Line (dd/mm/yyyy) June 29,2022- June 6.29, 2023 Revolving or non-revolving credit line Revolving ×Non-revolving ×Other Credit Line Type Revocable ×Irrevocable Guarantor of debt under this Agreement and security contract including but not limiting to: Guarantor Neophotonics Dongguan Co., Ltd. Security mode ×Mortgage; ×Pledge; Guarantee Guarantor / Security mode Mortgage; Pledge; Guarantee Guarantor / Security mode Mortgage; Pledge; Guarantee Percentage of margin Guaranteed discounting %; Bank’s acceptance xxxx %; Bank’s guarantee/standby L/C %; Other Applicable financing product and credit line requirement (please use for checked one and X for unchecked one) Applicable financing product Credit Line (Amount, currency) Interest/rate Maximum term of a single service Notes Loan Working capital loan Fixed asset loan Trading financing Issue bank’s acceptance xxxx Commercial xxxx discounting (agreed interest payment) Bank’s acceptance xxxx discounting Guaranteed commercial xxxx discounting (Client as Acceptor) Factoring financing Issue L/C (usance credit payable at sight Incd.) Import xxxx advance (under L/C/import collection) Export L/C advance Export collection advance Packing loan Issue guarantee/standby L/C Import prepayment Outward remittance financing

Page 13

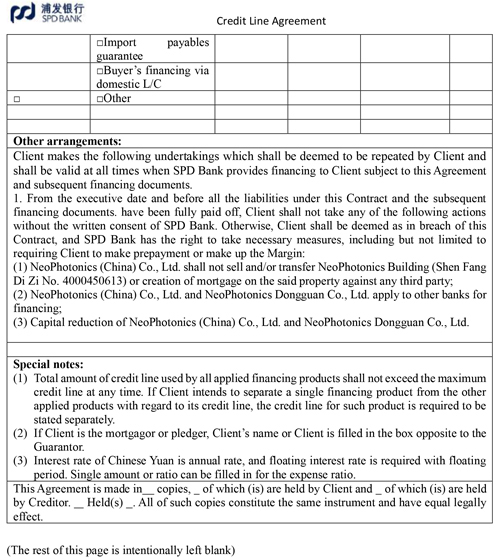

Import payables guarantee Buyer’s financing via domestic L/C Other Other arrangements: Client makes the following undertakings which shall be deemed to be repeated by Client and shall be valid at all times when SPD Bank provides financing to Client subject to this Agreement and subsequent financing documents. 1. From the executive date and before all the liabilities under this Contract and the subsequent financing documents. have been fully paid off, Client shall not take any of the following actions without the written consent of SPD Bank. Otherwise, Client shall be deemed as in breach of this Contract, and SPD Bank has the right to take necessary measures, including but not limited to requiring Client to make prepayment or make up the Margin: (1) NeoPhotonics (China) Co., Ltd. shall not sell and/or transfer NeoPhotonics Building (Shen Fang Di Zi No. 4000450613) or creation of mortgage on the said property against any third party; (2) NeoPhotonics (China) Co., Ltd. and NeoPhotonics Dongguan Co., Ltd. apply to other banks for financing; (3) Capital reduction of NeoPhotonics (China) Co., Ltd. and NeoPhotonics Dongguan Co., Ltd. Special notes: Total amount of credit line used by all applied financing products shall not exceed the maximum credit line at any time. If Client intends to separate a single financing product from the other applied products with regard to its credit line, the credit line for such product is required to be stated separately. If Client is the mortgagor or xxxxxxx, Client’s name or Client is filled in the box opposite to the Guarantor. Interest rate of Chinese Yuan is annual rate, and floating interest rate is required with floating period. Single amount or ratio can be filled in for the expense ratio. This Agreement is made in copies, of which (is) are held by Client and of which (is) are held by Creditor. Held(s) . All of such copies constitute the same instrument and have equal legally effect. (The rest of this page is intentionally left blank)

Page 14

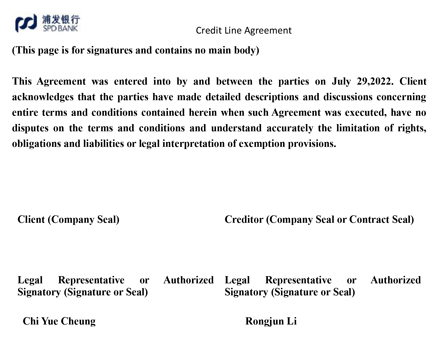

(This page is for signatures and contains no main body) This Agreement was entered into by and between the parties on July 29,2022. Client acknowledges that the parties have made detailed descriptions and discussions concerning entire terms and conditions contained herein when such Agreement was executed, have no disputes on the terms and conditions and understand accurately the limitation of rights, obligations and liabilities or legal interpretation of exemption provisions. Client (Company Seal) Creditor (Company Seal or Contract Seal) Legal Representative or Authorized Signatory (Signature or Seal) Legal Representative or Authorized Signatory (Signature or Seal) Chi Xxx Xxxxxx Xxxxxxx Xx

Page 15

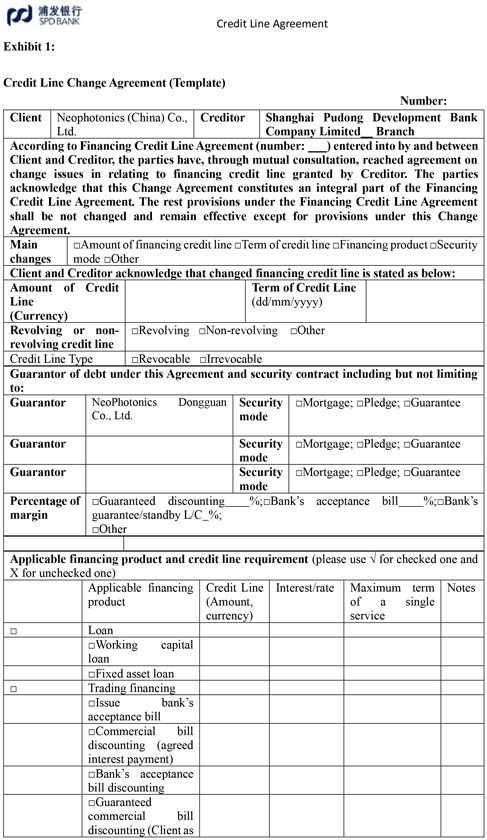

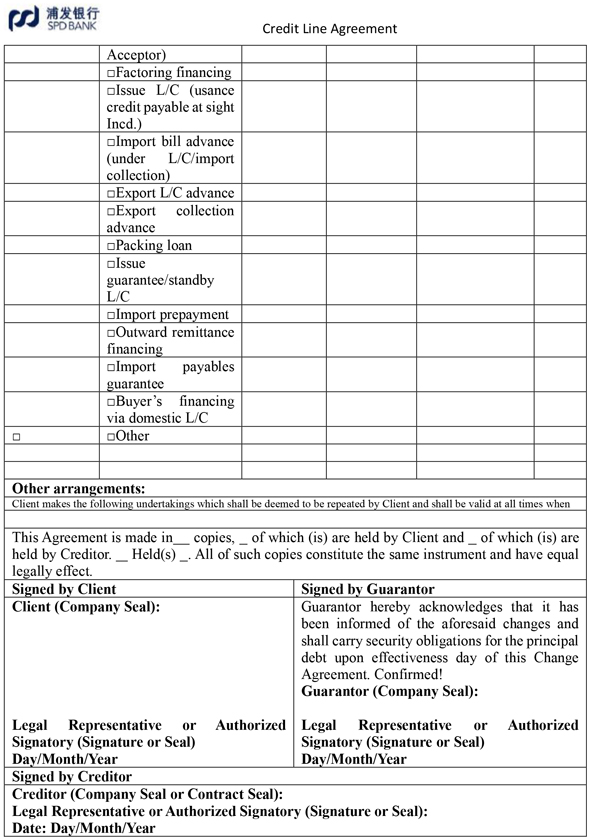

Exhibit 1: Credit Line Change Agreement (Template) Number: Client Neophotonics (China) Co., Ltd. Creditor Shanghai Pudong Development Bank Company Limited Branch According to Financing Credit Line Agreement (number: ) entered into by and between Client and Creditor, the parties have, through mutual consultation, reached agreement on change issues in relating to financing credit line granted by Creditor. The parties acknowledge that this Change Agreement constitutes an integral part of the Financing Credit Line Agreement. The rest provisions under the Financing Credit Line Agreement shall be not changed and remain effective except for provisions under this Change Agreement. Main changes Amount of financing credit line Term of credit line Financing product Security mode Other Client and Creditor acknowledge that changed financing credit line is stated as below: Amount of Credit Line (Currency) Term of Credit Line (dd/mm/yyyy) Revolving or non-revolving credit line Revolving Non-revolving Other Credit Line Type Revocable Irrevocable Guarantor of debt under this Agreement and security contract including but not limiting to: Guarantor NeoPhotonics Dongguan Co., Ltd. Security mode Mortgage; Pledge; Guarantee Guarantor Security mode Mortgage; Pledge; Guarantee Guarantor Security mode Mortgage; Pledge; Guarantee Percentage of margin Guaranteed discounting %; Bank’s acceptance xxxx %; Bank’s guarantee/standby L/C %; Other Applicable financing product and credit line requirement (please use for checked one and X for unchecked one) Applicable financing product Credit Line (Amount, currency) Interest/rate Maximum term of a single service Notes Loan Working capital loan Fixed asset loan Trading financing Issue bank’s acceptance xxxx Commercial xxxx discounting (agreed interest payment) Bank’s acceptance xxxx discounting Guaranteed commercial xxxx discounting (Client as

Page 16

Acceptor) Factoring financing Issue L/C (usance credit payable at sight Incd.) Import xxxx advance (under L/C/import collection) Export L/C advance Export collection advance Packing loan Issue guarantee/standby L/C Import prepayment Outward remittance financing Import payables guarantee Buyer’s financing via domestic L/C Other Other arrangements: Client makes the following undertakings which shall be deemed to be repeated by Client and shall be valid at all times when This Agreement is made in copies, of which (is) are held by Client and of which (is) are held by Creditor. Held(s) . All of such copies constitute the same instrument and have equal legally effect. Signed by Client Signed by Guarantor Client (Company Seal): Legal Representative or Authorized Signatory (Signature or Seal) Day/Month/Year Guarantor hereby acknowledges that it has been informed of the aforesaid changes and shall carry security obligations for the principal debt upon effectiveness day of this Change Agreement. Confirmed! Guarantor (Company Seal): Legal Representative or Authorized Signatory (Signature or Seal) Day/Month/Year Signed by Creditor Creditor (Company Seal or Contract Seal): Legal Representative or Authorized Signatory (Signature or Seal): Date: Day/Month/Year

Page 17