PURCHASE AND SALE AGREEMENT between FWH Legacy Park Frisco, LLC, the SELLER and CWI Legacy Park Hotel, LLC, the BUYER Dated as of December 7, 2012 Hampton Inn & Suites Legacy Park-Frisco 3199 Parkwood Boulevard, Frisco, Texas 75034

Exhibit 10.3

between

FWH Legacy Park Frisco, LLC, the SELLER

and

CWI Legacy Park Hotel, LLC, the BUYER

Dated as of December 7, 2012

Hampton Inn & Suites Legacy Park-Frisco

0000 Xxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx 00000

TABLE OF CONTENTS

|

ARTICLE I. DEFINITIONS |

1 | |

|

SECTION 1.1. |

Defined Terms |

1 |

|

ARTICLE II. SALE, PURCHASE PRICE AND CLOSING |

8 | |

|

SECTION 2.1. |

Sale of Asset |

8 |

|

SECTION 2.2. |

Purchase Price |

10 |

|

SECTION 2.3. |

Xxxxxxx Money |

11 |

|

SECTION 2.4. |

The Closing |

12 |

|

ARTICLE III. STUDY PERIOD |

13 | |

|

SECTION 3.1. |

Study Period |

13 |

|

SECTION 3.2. |

Title and Survey |

14 |

|

SECTION 3.3. |

Environmental Audit |

15 |

|

SECTION 3.4. |

Franchise |

15 |

|

SECTION 3.5. |

Buyer Audit Requirements |

17 |

|

SECTION 3.6. |

Buyer’s Due Diligence Reports |

18 |

|

ARTICLE IV. REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SELLER |

18 | |

|

SECTION 4.1. |

General Seller Representations and Warranties |

18 |

|

SECTION 4.2. |

Representations and Warranties of the Seller as to the Asset |

20 |

|

SECTION 4.3. |

Covenants of the Seller Prior to Closing |

22 |

|

SECTION 4.4. |

Updating |

24 |

|

ARTICLE V. REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE BUYER |

25 | |

|

SECTION 5.1. |

Formation; Existence |

25 |

|

SECTION 5.2. |

Power; Authority |

25 |

|

SECTION 5.3. |

No Consents |

25 |

|

SECTION 5.4. |

No Conflicts |

25 |

|

SECTION 5.5. |

Anti-Terrorism Laws |

25 |

|

SECTION 5.6. |

Bankruptcy |

26 |

|

SECTION 5.7. |

AS-IS, WHERE-IS |

26 |

|

ARTICLE VI. CONDITIONS PRECEDENT TO CLOSING |

27 | |

|

SECTION 6.1. |

Conditions Precedent to the Seller’s Obligations |

27 |

|

SECTION 6.2. |

Conditions to the Buyer’s Obligations |

29 |

|

ARTICLE VII. CLOSING DELIVERIES |

30 | |

|

SECTION 7.1. |

The Buyer Closing Deliveries |

30 |

|

SECTION 7.2. |

The Seller Closing Deliveries |

31 |

|

ARTICLE VIII. TRANSACTION COSTS; RISK OF LOSS |

32 | |

|

SECTION 8.1. |

Transaction Costs |

32 |

|

SECTION 8.2. |

Risk of Loss |

32 |

|

ARTICLE IX. ADJUSTMENTS |

33 | |

|

SECTION 9.1. |

Adjustments |

33 |

|

SECTION 9.2. |

Closing Statement |

37 |

|

SECTION 9.3. |

Accounts Receivable |

37 |

|

ARTICLE X. INDEMNIFICATION |

38 | |

|

SECTION 10.1. |

Indemnification by the Seller |

38 |

|

SECTION 10.2. |

Indemnification by the Buyer |

38 |

|

SECTION 10.3. |

Limitations on Indemnification |

39 |

|

SECTION 10.4. |

Survival and Process |

39 |

|

SECTION 10.5. |

Holdback or Guaranty |

39 |

|

SECTION 10.6. |

Indemnification as Sole Remedy |

40 |

|

ARTICLE XI. TERMINATION; REMEDIES |

40 | |

|

SECTION 11.1. |

Termination |

40 |

|

SECTION 11.2. |

Termination; Remedies Upon Termination |

40 |

|

ARTICLE XII. MISCELLANEOUS |

41 | |

|

SECTION 12.1. |

Brokers |

41 |

|

SECTION 12.2. |

Confidentiality and Press Release |

42 |

|

SECTION 12.3. |

Escrow Provisions |

42 |

|

SECTION 12.4. |

Successors and Assigns; No Third-Party Beneficiaries |

43 |

|

SECTION 12.5. |

Assignment |

43 |

|

SECTION 12.6. |

Further Assurances |

43 |

|

SECTION 12.7. |

Notices |

44 |

|

SECTION 12.8. |

Entire Agreement |

45 |

|

SECTION 12.9. |

Amendments |

45 |

|

SECTION 12.10. |

No Waiver |

45 |

|

SECTION 12.11. |

Days |

45 |

|

SECTION 12.12. |

Governing Law |

46 |

|

SECTION 12.13. |

Severability |

46 |

|

SECTION 12.14. |

Section Headings |

46 |

|

SECTION 12.15. |

Counterparts; Execution by Facsimile |

46 |

|

SECTION 12.16. |

Rules of Construction |

46 |

|

SECTION 12.17. |

Waiver Of Jury Trial |

46 |

|

SECTION 12.18. |

Time is of the Essence |

46 |

|

SECTION 12.19. |

Bulk Sale; Occasional Sale |

47 |

Schedules/Exhibits

|

Schedule A — |

Land | |

|

Schedule B — |

Diligence Materials List | |

|

Schedule 2.1(c) — |

Excluded Property | |

|

Schedule 4.1(c) — |

Consents | |

|

Schedule 4.1(d) — |

Conflicts with Agreements | |

|

Schedule 4.1(e) — |

Litigation—Seller | |

|

Schedule 4.2(a) — |

Operating Agreements | |

|

Schedule 4.2(c) — |

Tenant Leases | |

|

Schedule 4.2(e) — |

Litigation | |

|

Schedule 4.2(j) — |

Licenses and Permits | |

|

Exhibit A — |

Form Assignment of Leases | |

|

Exhibit B — |

Form Assignment of Contracts | |

|

Exhibit C — |

Form Xxxx of Sale | |

|

Exhibit D — |

Form Assignment of Intangibles | |

|

Exhibit E — |

Audit Request Materials | |

This PURCHASE AND SALE AGREEMENT (this “Agreement”) is made as of the 7th day of December, 2012 (the “Effective Date”) between FWH Legacy Park Frisco, LLC, a Delaware limited liability company (the “Seller”) and CWI Legacy Park Hotel, LLC, a Delaware limited liability company (the “Buyer”).

A. The Seller owns (1) the land more particularly described in Schedule A attached hereto, together with all of the Seller’s right, title and interest in and to all easements, covenants and other rights appurtenant thereto and all right, title and interest of the Seller, if any, in and to any (a) land lying in the bed of any street, road, avenue or alley, open or closed, in front of or adjoining thereto and to the center line thereof, and (b) unpaid award or payment which may hereafter be payable with respect to any taking by condemnation (the “Land”); (2) the hotel facility located on the Land having an address at 0000 Xxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx 00000, and commonly known as the “Hampton Inn & Suites Legacy Park-Frisco”, together with all improvements and structures constituting real property located on, over or under the Land (the “Hotel”, and with the Land, the “Property”); and (3) the Asset-Related Property (as defined below). The Land, the Hotel and the Asset-Related Property shall be referred to herein as the “Asset”.

B. The Seller desires to sell to the Buyer, and the Buyer desires to purchase from the Seller, the Asset, all on the terms and conditions hereinafter set forth.

ARTICLE I.

DEFINITIONS

SECTION 1.1. Defined Terms. The capitalized terms used herein will have the following meanings.

“Accounts Receivable” means all amounts which the Seller is entitled to receive, whether billed or unbilled, from the operation of the Hotel, but are not paid, as of the Closing, including, without limitation, charges accrued prior to the Closing for the use or occupancy of any guest, conference, meeting or banquet rooms or other facilities at the Hotel, or for the sale or provision of other goods or services provided prior to the Closing.

“Act of Bankruptcy” shall mean if a party hereto shall (a) apply for or consent to the appointment of, or the taking of possession by, a receiver, custodian, trustee or liquidator of itself

or of all or a substantial part of its property, (b) admit in writing its inability to pay its debts as they become due, (c) make a general assignment for the benefit of its creditors, (d) file a voluntary petition or commence a voluntary case or proceeding under the Federal Bankruptcy Code (as now or hereafter in effect), (e) be adjudicated bankrupt or insolvent, (f) file a petition seeking to take advantage of any other law relating to bankruptcy, insolvency, reorganization, winding-up or composition or adjustment of debts, (g) fail to controvert in a timely and appropriate manner, or acquiesce in writing to, any petition filed against it in an involuntary case or proceeding under the Federal Bankruptcy Code (as now or hereafter in effect), or (h) take any corporate action for the purpose of effecting any of the foregoing; or if a proceeding or case shall be commenced, without the application or consent of a party hereto, in any court of competent jurisdiction seeking (1) the liquidation, reorganization, dissolution or winding-up, or the composition or readjustment of debts, of such party, (2) the appointment of a receiver, custodian, trustee or liquidator of such party or of all or any substantial part of its assets, or (3) other similar relief under any law relating to bankruptcy, insolvency, reorganization, winding-up or composition or adjustment of debts, and such proceeding or case shall continue undismissed, or an order (including an order for relief entered in an involuntary case under the Federal Bankruptcy Code, as now or hereafter in effect) judgment or decree approving or ordering any of the foregoing shall be entered and continue unstayed and in effect, for a period of sixty (60) consecutive days.

“Additional Deposit” shall mean Two Hundred and Fifty Thousand Dollars ($250,000).

“Affiliate Buyers” shall have the meaning assigned thereto in SECTION 6.1(f).

“Agreement” shall mean this Purchase and Sale Agreement, together with the exhibits and schedules attached hereto, as the same may be amended, restated, supplemented or otherwise modified.

“Anti-Money Laundering and Anti-Terrorism Laws” shall have the meaning assigned thereto in SECTION 4.1(h)(i).

“Acquisition Threshold” means that the Buyer and/or Affiliate Buyers, respectively, and the Seller and/or Other Sellers, respectively, have satisfied and/or are willing and able to satisfy all of the conditions to close the acquisition of at least 4 of the 5 hotels under this Agreement and the Related Agreements; provided, however, the Acquisition Threshold shall not be satisfied unless it includes the Hampton Inn & Suites Memphis – Xxxxx Street hotel located in Memphis, Tennessee.

“Asset” shall have the meaning assigned thereto in “Recitals” paragraph A.

“Asset-Related Property” shall have the meaning assigned thereto in SECTION 2.1(b).

“Assignment of Contracts” shall have the meaning assigned thereto in SECTION 7.1(c).

“Assignment of Intangibles” shall have the meaning assigned thereto in SECTION 7.2(e).

“Assignment of Leases” shall have the meaning assigned thereto in SECTION 7.1(b).

“Audit Representation Letter” shall have the meaning assigned thereto in SECTION 3.5.

“Basket Limitation” shall mean an amount equal to One Hundred Thousand Dollars ($100,000).

“Xxxx of Sale” shall have the meaning assigned thereto in SECTION 7.2(b).

“Bookings” shall have the meaning assigned thereto in SECTION 2.1(b)(vii).

“Books and Records” shall have the meaning assigned thereto in SECTION 2.1(b)(xiv).

“Broker” shall mean Xxxxxx Xxxx Xxxxxxx, Inc.

“Business Day” shall mean any day other than a Saturday, Sunday or other day on which banks are authorized or required by law to be closed in New York City, New York.

“Buyer” shall have the meaning assigned thereto in the Preamble to this Agreement.

“Buyer’s Knowledge” shall mean the actual knowledge of the Buyer based upon the actual knowledge of Xxxxxxx Xxxxxxxxx, Xxxxxxx Xxxxxxxx and Xxx Xxxxxxx without any duty on the part of such Person to conduct any independent investigation or make any inquiry of any Person.

“Buyer Related Entities” shall have the meaning assigned thereto in SECTION 10.1.

“Cap Limitation” shall mean an amount equal to Three Hundred and Thirty-Eight Thousand, Six Hundred Twenty-Four Dollars and Thirty Four Cents ($338,624.34).

“Closing” shall have the meaning assigned thereto in SECTION 2.4(a).

“Closing Date” shall have the meaning assigned thereto in SECTION 2.4(a).

“Closing Documents” shall mean any certificate, assignment, instrument or other document delivered pursuant to this Agreement.

“Code” means the Internal Revenue Code of 1986, as amended from time to time, or any successor statute. Any reference herein to a particular provision of the Code shall mean, where appropriate, the corresponding provision in any successor statute.

“Cut-Off Time” shall have the meaning assigned thereto in SECTION 9.1.

“Deed” shall have the meaning assigned thereto in SECTION 7.2(a).

“Defaulted Agreement” shall have the meaning assigned thereto in SECTION 6.1(f).

“De-Identification” shall have the meaning assigned thereto in SECTION 3.4(b).

“Drop Dead Date” shall mean February 28, 2013.

“Xxxxxxx Money” shall mean, the Initial Deposit, the Additional Deposit and the Extension Deposit, if applicable, all together with all accrued interest thereon.

“Effective Date” shall have the meaning assigned thereto in the Preamble to this Agreement.

“Employees” shall mean, at any time, all persons who are employed in the ownership, operation and maintenance (whether on a full-time or part-time basis) of the Hotel.

“Employment Acts” shall have the meaning assigned thereto in SECTION 9.1(l).

“Environmental Laws” shall have the meaning assigned thereto in SECTION 4.2(f).

“Equipment Leases” shall have the meaning assigned thereto in SECTION 2.1(b)(vi).

“Escrow Account” shall have the meaning assigned thereto in SECTION 12.3(a).

“Escrow Agent” shall have the meaning assigned thereto in SECTION 2.3(a).

“Executive Order” shall have the meaning assigned thereto in SECTION 4.1(h)(i).

“Extended Closing Date’ shall mean February 19, 2013.

“Extension Deposit” shall mean Two Hundred Thousand Dollars ($200,000).

“FF&E” shall have the meaning assigned thereto in SECTION 2.1(b)(i).

“FIRPTA” shall have the meaning assigned thereto in SECTION 7.2(f).

“Franchise Agreement” shall mean that certain Franchise License Agreement dated December 15, 2010, by and between Franchisor and the Seller.

“Franchise Approval Period” shall have the meaning assigned thereto in SECTION 3.4(a).

“Franchisor” shall mean Hampton Inns Franchise LLC or its successors or assigns.

“Governmental Authority” shall mean any federal, state or local government or other political subdivision thereof, including, without limitation, any agency or entity exercising executive, legislative, judicial, regulatory or administrative governmental powers or functions, in each case to the extent the same has jurisdiction over the Person or property in question.

“Government List” shall mean any of (i) the two lists maintained by the United States Department of Commerce (Denied Persons and Entities), (ii) the list maintained by the United States Department of Treasury (Specially Designated Nationals and Blocked Persons), and (iii) the two lists maintained by the United States Department of State (Terrorist Organizations and Debarred Parties).

“Guest Ledger” means any and all charges accrued to the open accounts of any guests or customers at the Hotel as of the Cut-Off Time for the use or occupancy of any guest, conference, meeting or banquet rooms or other facilities at the Hotel, any restaurant, bar or banquet services, or any other goods or services provided by or on behalf of the Seller at the Hotel.

“Hazardous Materials” shall mean any substance, gas, material, chemical, biological/microbial matter, or waste whose presence, nature, quantity or intensity of existence, use, manufacture, disposal, transportation, spill, release or effect, either by itself or in combination with other materials is (i) potentially injurious to the public health, safety or welfare of the environment or the Property, (ii) regulated, monitored or designated by any Governmental Authority or by applicable federal, state or local law as radioactive, toxic, hazardous or otherwise a danger to health or the environment, including PCBs, asbestos, petroleum, urea-formaldehyde and all substances listed as hazardous substances pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (42 USC 9601(14)), as amended (“CERCLA”), (iii) defined as a “hazardous waste” or “hazardous material” under any federal, state or local statute, regulation or ordinance, including without limitation, pursuant to CERCLA, the United States Resource Conservation and Recovery Act of 1976 (42 USC 6903(5)), as amended, and the regulations promulgated pursuant to said laws; or (iv) a basis for liability of the owner of the Property to any Governmental Authority or third party.

“Hotel” shall have the meaning assigned thereto in “Recitals” paragraph A.

“Indemnitor” shall have the meaning assigned thereto in SECTION 10.4.

“Indemnitee” shall have the meaning assigned thereto in SECTION 10.4.

“Initial Closing Date’ shall mean January 28, 2013.

“Initial Deposit” shall mean Five Hundred Thousand Dollars ($500,000).

“Intangible Property” shall have the meaning assigned thereto in SECTION 2.1(b)(xii).

“Inventories” shall have the meaning assigned thereto in SECTION 2.1(b)(x).

“IRS” shall mean the Internal Revenue Service.

“Land” shall have the meaning assigned thereto in “Recitals” paragraph A.

“Licenses and Permits” shall have the meaning assigned thereto in SECTION 2.1(b)(ii).

“Losses” shall have the meaning assigned thereto in SECTION 10.1.

“Management Agreement” shall mean that certain Management Agreement, which is dated as of December 14, 2010 by and between Seller and Manager.

“Manager” shall mean MH Partners, LLC solely in its role as the manager of the Property under the Management Agreement.

“Miscellaneous Personal Property” shall have the meaning assigned thereto in SECTION 2.1(b)(xiii).

“New Franchise” shall have the meaning assigned thereto in SECTION 3.4.

“Operating Agreements” shall mean all maintenance, service and supply contracts, management agreements, credit card service agreements, booking and reservation agreements, and all other contracts and agreements which are held by or for the account of Seller in connection with the operation of the Hotel, other than the Franchise Agreement, the Management Agreement, Tenant Leases, Equipment Leases, the Bookings, and Licenses and Permits.

“Other Sellers” shall have the meaning assigned thereto in SECTION 6.1(f).

“Permitted Title Exceptions” shall have the meaning set forth in SECTION 3.2.

“Person” shall mean a natural person, partnership, limited partnership, limited liability company, corporation, trust, estate, association, unincorporated association or other entity.

“PIP” shall have the meaning assigned thereto in SECTION 3.4.

“Property” shall have the meaning assigned thereto in “Recitals” paragraph A.

“Property and Equipment” shall have the meaning assigned thereto in SECTION 2.1(b)(ix).

“Purchase Price” shall have the meaning assigned thereto in SECTION 2.2(a).

“Related Agreements” shall mean (i) the Purchase and Sale Agreement between FWH Memphis Xxxxx Street, LLC and CWI Xxxxx Street Hotel, LLC, dated as of the date hereof for the Hampton Inn & Suites Memphis—Xxxxx Street, Memphis, TN, (ii) the Purchase and Sale Agreement between FWH Atlanta Downtown, LLC and CWI Atlanta Downtown Hotel, LLC, dated as of the date hereof for the Hampton Inn & Suites—Downtown Atlanta, Atlanta Georgia, (iii) the Purchase and Sale Agreement between FWH Birmingham Colonnade, LLC and CWI Birmingham Hotel, LLC, dated as of the date hereof for the Hampton Inn Birmingham—Colonnade, Birmingham, AL, and (iv) the Purchase and Sale Agreement between FWH Baton Rouge, LLC and CWI Baton Rouge Hotel, LLC, dated as of the date hereof for the Hilton Garden Inn Baton Rouge Airport—Baton Rouge, LA.

“Retail Merchandise” shall have the meaning assigned thereto in SECTION 2.1(b)(xi).

“Retained Accounts Receivable” shall have the meaning assigned thereto in SECTION 9.3(b).

“Seller” shall have the meaning assigned thereto in the Preamble to this Agreement.

“Seller Related Entities” shall have the meaning assigned thereto in SECTION 10.2.

“Seller Releasees” should be defined as the Seller, its parent, subsidiaries and affiliates and their respective members, managers, directors, shareholders, partners, officers, employees, agents, representatives and consultants, including without limitation the Manager.

“Seller’s Knowledge” shall mean the actual knowledge of Xxxxx X. Xxxxxx, Xxxxxx X. Xxxxxxx, or Xxxxxx Xxxx Xxxxxxx, without any duty on the part of such Person to conduct any independent investigation or make any inquiry of any Person.

“Study Period” shall mean the period commencing at 9:00 a.m. Central Time on the Effective Date, and continuing until 5:00 p.m. Central Time on January 7, 2013.

“Supplies” shall mean all china, glassware, stemware, bath mats, bath rugs, shower curtains, tools, linens, towels, uniforms, bedding, silverware, engineering, maintenance, cleaning and housekeeping supplies, matches and ashtrays, fuel, soap and other toiletries, stationary, menus, directories and other printed materials, all other similar supplies and materials (whether located at the Property or stored off-site or ordered for future use at the Property as of the Closing).

“Survival Period” shall have the meaning assigned thereto in SECTION 10.4.

“Taxes” means, and is specifically limited to, all tax liabilities with respect to the Property, which, if unpaid, could impose successor or continuing liability on the Buyer, including to the extent applicable any gross or net receipts, sales, use tax, charge, assessment, duty, or levy (including any interest, additions to tax, or civil or criminal penalties thereon) of the United States or any state or local jurisdiction therein, or of any other nation or any jurisdiction therein.

“Tax Returns” means any report, form, return, statement or other information (including any amendments) required to be supplied to a Governmental Authority by a Person with respect to Taxes, including information returns, any amendments thereof or schedule or attachment thereto and any documents with respect to or accompanying requests for the extension of time in which to file any such report, return, document, declaration or other information.

“Tenant Leases” shall have the meaning assigned thereto in SECTION 2.1(b)(v).

“Title Company” shall mean First American Title Insurance Company.

“Title Policy” shall mean a 2006 ALTA Owner’s (6/17/06) extended coverage policy of title insurance issued by the Title Company insuring the Buyer’s good and indefeasible fee simple title to the Property subject only to the Permitted Title Exceptions in an amount equal to the portion of the Purchase Price allocated to the Property pursuant to SECTION 2.2(b).

“Trade Payables” shall have the meaning assigned thereto in SECTION 9.1(j).

“UCC” shall mean the Uniform Commercial Code.

“Uniform System of Accounts” shall have the meaning assigned thereto in SECTION 2.1(b)(ix).

ARTICLE II.

SALE, PURCHASE PRICE AND CLOSING

SECTION 2.1. Sale of Asset.

(a) On the Closing Date and pursuant to the terms and subject to the conditions set forth in this Agreement, the Seller shall sell to the Buyer, and the Buyer shall purchase from the Seller, the Asset.

(b) The Asset shall include all Asset-Related Property. For purposes of this Agreement, “Asset-Related Property” shall mean any and all of the following which is owned or used by the Seller in connection with the Property:

(i) all tangible personal property consisting of all furniture, furnishings, fixtures, machinery, and other personal property of every kind located on or used in the operation of the Property including, without limitation, all guest room furnishings, lobby and public area furnishings, all artwork, lighting fixtures, kitchen, lounge, meeting room and restaurant equipment and furnishings (including, without limitation, all silver serving pieces, tables, chairs, podiums and staging platforms, and linens), laundry and dry cleaning equipment, safes, safe deposit boxes, pool chairs and equipment, vehicles, rugs, mats, carpeting, appliances, devices, engines, telephone and other communications equipment, televisions and other video equipment, plumbing fixtures and other equipment, and all other equipment and other personal property which are now, or may hereafter prior to the Closing Date be, placed in or on or attached to the Property and are used in connection with the operation of the Property (but not including items owned or leased by tenants or which are leased under the Equipment Leases by the Manager) (the “FF&E”);

(ii) all right, title and interest in and to (to the extent transferable under applicable law) all licenses, permits and authorizations presently issued in connection with the operation of all or any part of the Property as it is presently being operated (the “Licenses and Permits”);

(iii) all right, title and interest in and to (to the extent assignable) all warranties, if any, issued by any manufacturer, contractor, subcontractor, supplier or xxxxxxx in

connection with the maintenance, repair, construction or installation of equipment or any component of the improvements included as part of the Property or FF&E;

(iv) all right, title and interest in and to (to the extent assignable) all Operating Agreements;

(v) all right, title and interest in and to all leases, subleases, licenses, contracts and other agreements, granting a real property interest to any other Person for the use or occupancy of all or any part of the Property (including without limitation all cell towers, billboards, and parking lots), other than the Bookings (the “Tenant Leases”) and all security and escrow deposits or other security held by or for the benefit of, or granted to, the Seller in connection with, such Tenant Leases;

(vi) all right, title and interest in and to all leases and purchase money security agreements for any equipment, machinery, vehicles, furniture or other personal property located at the Hotel or used in the operation of the Hotel (the “Equipment Leases”), together with all deposits made thereunder;

(vii) all right, title and interest in and to all bookings and reservations for guest, conference, meeting and banquet rooms or other facilities at the Hotel for dates from and after the Closing Date (the “Bookings”), together with all deposits held by the Seller with respect thereto;

(viii) all right, title and interest in and to the Guest Ledger as set forth in SECTION 9.3(a);

(ix) all items included within the definition of “Property and Equipment” under the latest edition of the Uniform System of Accounts for the Lodging Industry, as published by the Hotel Association of New York City, Inc. (the “Uniform System of Accounts”) and used in the operation of the Hotel, including, without limitation, linen, china, glassware, tableware, uniforms and similar items (“Property and Equipment”);

(x) all “Inventories” as defined in the Uniform System of Accounts and used in the operation of the Hotel, such as Supplies, provisions in storerooms, refrigerators, pantries, and kitchens, beverages in wine cellars and bars, other merchandise intended for sale or resale, and similar items and including all food and beverages which are located at the Hotel, or ordered for future use at the Hotel as of the Closing, but expressly excluding any alcoholic beverages to the extent the sale or transfer of the same is not permitted under applicable law (the “Inventories”);

(xi) all merchandise located at the Hotel and held for sale to guests and customers of the Hotel, or ordered for future sale at the Hotel as of the Cut-Off Time, but not including any such merchandise owned by any tenant at the Property or by the Manager (“Retail Merchandise”);

(xii) all right, title and interest in and to (to the extent such are assignable) all names, tradenames, trademarks, service marks, logos, the Hotel’s website and

web address, and other similar proprietary rights and all registrations or applications for registration of such rights used in the operation of the Hotel (the “Intangible Property”);

(xiii) all right, title and interest in and to (including without limitation to the extent not included in SECTION 2.1(b)(i) above) the Hotel’s telephone numbers, printed marketing materials and any slides, proofs or drawings used to produce such materials, to the extent such slides, proofs or drawings are in the Seller’s possession or control (“Miscellaneous Personal Property”); and

(xiv) to the extent in the Seller’s possession or control, all surveys, architectural, consulting and engineering blueprints, plans and specifications and reports, if any, related to the Hotel, all books and records, if any, related to the Hotel (collectively, “Books and Records”), and any goodwill of the Seller related to the Hotel; provided, however, that the Seller may retain a copy of all such books and records.

(c) Excluded Property. Notwithstanding anything to the contrary in SECTION 2.1(a) and SECTION 2.1(b), the property, assets, rights and interests set forth in this SECTION 2.1(c) are expressly excluded from the Asset:

(i) Cash. Except for deposits expressly included in SECTION 2.1(b) and except for any cash on hand or in house banks for which the Seller receives a credit under SECTION 9.1(k), all cash on hand or on deposit in any house bank, operating account or other account maintained in connection with the ownership of the Hotel, including, without limitation, any reserves maintained by the Seller or the Manager as required by the Management Agreement or the Franchise Agreement (subject to SECTION 9.1(k));

(ii) Third Party Property. Any fixtures, personal property or equipment owned by (A) the lessor under any Equipment Leases, (B) the supplier or vendor under any other Operating Agreements, (C) the tenant under any Tenant Lease, (D) [any Employees, (E) the Manager or (F) any guests or customers of the Hotel, including, without limitation, those items set forth on Schedule 2.1(c) attached hereto; provided, however, that at Closing the Buyer will have the same rights to the use and benefit to any of the foregoing as the Seller and the Hotel currently possess, unless otherwise terminated pursuant to the terms of this Agreement; and

(iii) Receivables. Any Retained Accounts Receivable as set forth in SECTION 9.3(b).

SECTION 2.2. Purchase Price.

(a) The consideration for the purchase of the Asset shall be $16,000,000.00 (the “Purchase Price”), which shall be paid by the Buyer to the Seller at the Closing in immediately available funds by wire transfer to such account or accounts that the Seller shall designate to the Buyer; provided that such amount shall be reduced by the Xxxxxxx Money and adjusted for Closing adjustments and credits provided for in ARTICLE IX and elsewhere in the Agreement.

(b) The Seller and the Buyer agree that the Purchase Price shall be allocated between the Property and the Asset-Related Property as of the Closing for federal, state and local tax purposes in accordance with the applicable provisions of Section 1060 of the Code. The Seller and the Buyer agree to file federal, state and local tax returns consistent with such allocations agreed upon between the parties; provided, however, if the Seller and the Buyer cannot mutually agree upon allocation of the Purchase Price, each party shall file federal, state and local returns based on each party’s own determination of the proper allocations of the Purchase Price, each bearing its own consequences of any discrepancies. The provisions of this SECTION 2.2(b) shall survive the Closing.

SECTION 2.3. Xxxxxxx Money.

(a) Within 3 Business Days of the Effective Date, the Buyer shall deposit with the Title Company, as escrow agent (in such capacity, “Escrow Agent”), cash in an amount equal to the Initial Deposit in immediately available funds by wire transfer to such account as Escrow Agent shall designate to the Buyer. If the Initial Deposit is not deposited by the Buyer by 5:00 p.m. (Central Time) on the third Business Day following the Effective Date, the Seller shall have the right, in the Seller’s sole and absolute discretion, upon written notice to the Buyer delivered prior to the Buyer’s deposit of the Xxxxxxx Money with the Title Company, to terminate this Agreement whereupon this Agreement shall terminate and neither party hereto shall have any further rights, liabilities or obligations hereunder except for those that expressly survive the termination of this Agreement. Notwithstanding any other provision of this Agreement to the contrary, the sum of One Hundred Dollars ($100.00) out of the Initial Deposit shall be paid by the Escrow Agent to the Seller as “independent consideration” (herein so called) for the execution of this Agreement and the rights granted herein, which said independent consideration shall be paid to the Seller in all instances, upon execution hereof is fully earned, and shall not be applied against the Purchase Price. The Seller and the Buyer acknowledge and agree that the independent consideration has been bargained for and agreed to as consideration for the Seller’s execution and delivery of this Agreement.

(b) Within 2 Business Days after the expiration of the Study Period, if Buyer does not terminate this Agreement prior to or on the Study Period pursuant to SECTION 3.1(a), the Buyer shall deposit with the Escrow Agent, and increase the Xxxxxxx Money by, an amount equal to the Additional Deposit in immediately available funds by wire transfer. Failure of the Buyer to deliver the Additional Deposit as provided herein shall result in the automatic termination of this Agreement whereupon the Initial Deposit shall be immediately returned to the Seller and this Agreement shall terminate and neither party hereto shall have any further rights, liabilities or obligations hereunder except for those that expressly survive the termination of this Agreement.

(c) If the Buyer elects to extend the Initial Closing Date pursuant to SECTION 2.4(a), then on or before the expiration of the Initial Closing Date, the Buyer shall deposit with the Escrow Agent, and increase the Xxxxxxx Money by, an amount equal to the Extension Deposit in immediately available funds by wire transfer. Failure of the Buyer to deliver the Extension Deposit as provided herein (or otherwise close on or before the Initial Closing Date) shall be a default by the Buyer under this Agreement, unless the Buyer is

otherwise expressly entitled to terminate this Agreement and elects to so terminate prior to the due date of such Extension Deposit.

(d) Upon delivery by the Buyer to Escrow Agent and upon receipt of an executed form W-9, any and all portions of the Xxxxxxx Money will be deposited by Escrow Agent in an account acceptable to the Buyer and the Seller and shall be held in escrow in an interest-bearing account in accordance with the provisions of SECTION 12.3. Any interest earned on the Xxxxxxx Money while held by Escrow Agent shall be paid to the party to whom the Xxxxxxx Money is paid, except that if the Closing occurs, the Buyer shall receive a credit for such interest in accordance with SECTION 2.2(a).

SECTION 2.4. The Closing.

(a) Subject to the provisions of SECTION 11.1, the closing of the purchase and sale of the Asset (the “Closing”) shall take place on the Initial Closing Date, or, if extended as described below, the Extended Closing Date, or such other earlier date as mutually agreed to by the Buyer and the Seller (such date or any extension thereof as described below, the “Closing Date”), Time Being Of The Essence with respect to the Buyer’s and the Seller’s obligations hereunder on the Closing Date, subject only to the rights to adjourn the Closing Date as it may otherwise be extended pursuant to SECTION 4.4 or as a result of either party’s cure right under SECTION 11.2. The Buyer may extend the Initial Closing Date for no longer than the Extended Closing Date upon written notice to the Seller of such extension delivered to the Seller prior to the expiration of the Initial Closing Date and delivery of the Extension Deposit in immediately available funds by wire transfer to the Escrow Agent on or prior to the expiration of the Initial Closing Date. Any extension of the Initial Closing Date or other adjournment of the Closing Date (including without limitation as the result of either party’s cure right under SECTION 11.2) pursuant to the express terms of this Agreement shall be deemed to be an extension or adjournment of the closing date under all of the other Related Agreements (and will require the delivery of the extension deposits under the other Related Agreements in the same manner as set forth above and vice versa in the event of any extension or adjournment of the closing date under any of the Related Agreements). Notwithstanding anything to the contrary herein, if the Closing shall not have occurred on or before the Drop Dead Date for any reason other than a material breach or default by the Seller or the Buyer, then either such non-defaulting party shall have the right to terminate this Agreement subject to the terms and provisions of SECTION 11.1.

(b) The Closing shall be held on the Closing Date at the offices of the Escrow Agent or at such other location agreed upon by the parties hereto.

(c) Notwithstanding any other provision herein to the contrary, there shall be no requirement that the Seller and the Buyer physically attend the Closing, and all funds and documents to be delivered at the Closing may be delivered to Escrow Agent unless the parties hereto mutually agree otherwise. The Buyer and the Seller hereby authorize their respective attorneys to execute and deliver to Escrow Agent any additional or supplementary instructions as may be necessary or convenient to implement the terms of this Agreement and facilitate the closing of the transactions contemplated hereby, provided that such instructions are consistent with and merely supplement this Agreement and shall not in any way modify, amend or supersede this Agreement.

ARTICLE III.

STUDY PERIOD

SECTION 3.1. Study Period.

(a) The Buyer shall have the right, upon prior reasonable written notice to the Seller to examine the books and records relating to the Property, to enter upon the Land and to perform, at the Buyer’s expense, such economic, surveying, engineering, environmental, topographic and marketing tests, studies and investigations as the Buyer may deem appropriate, taking care to cause minimal interference with the business conducted on the Property; provided that (i) no invasive testing may be conducted without the Seller’s prior written consent, which may be withheld by the Seller in its sole discretion, and (ii) none of the Buyer or any of its representatives, lender, consultants and agents shall (x) cause any damage or make any physical changes to any of the Property or (y) intentionally or unreasonably interfere with the rights of Hotel guests or others who may have a legal right to use or occupy the Property or (z) otherwise intentionally or unreasonably interfere with the operation of the Property. The Seller or its representatives shall have the right to be present to observe any testing or other inspection performed on any of the Property. If for any reason, or no reason, the Buyer notifies the Seller, in writing, prior to 5:00 p.m. Central Time on the last day of the Study Period that it has determined not to proceed to Closing, this Agreement automatically shall terminate, the Xxxxxxx Money shall be immediately returned to the Buyer, and, upon return of the Xxxxxxx Money, the Buyer and the Seller shall have no further rights, liabilities or obligations hereunder (except as expressly survive the termination of this Agreement).

(b) Promptly after the Effective Date, and throughout the term of this Agreement as any of the materials listed in Schedule B become available to the Seller or are amended or updated, (to the extent not previously provided or made available to the Buyer) the Seller shall deliver to the Buyer, copies of such materials which are in, or come into, the Seller’s possession or control.

(c) Buyer hereby agrees to indemnify, defend and hold the Seller, and its employees, guests, contractors, tenants, manager and their respective invitees harmless from all personal injury or property damage suffered or incurred by or claimed against the foregoing arising directly out of any due diligence activities conducted or the entry upon the Land by any of Buyer, its representatives, lenders, consultant or agents, provided, however, such indemnity shall not cover liability arising from pre-existing conditions unless such pre-existing conditions are exacerbated by the Buyer or its consultants, agents, contractors, employees or representatives, in which case the Buyer shall be liable for and to the extent of the exacerbated condition and not the pre-existing condition. The Buyer, at its own expense, shall restore any damage to the Property caused by any of the tests or studies made by the Buyer, or its agents or contractors, but specifically excluding restoring or correcting any environmental or other damage to the Real Property that is discovered as a result of such tests or studies. The Buyer and any of its agents and contractors shall maintain at all times during their entry upon any of the Property for the purpose of conducting any due diligence activities, commercial general liability insurance with limits of not less than Two Million Dollars ($2,000,000) combined single limit, bodily injury, death and property damage insurance per occurrence. Upon the Seller’s request, Buyer

(or its agents or contractor) will deliver a certificate issued by the insurance carrier of each such policy to the Seller prior to any entry upon any Property.

(d) The Buyer’s obligations under this SECTION 3.1 shall survive any termination of this Agreement or the Closing of the transaction contemplated herein.

SECTION 3.2. Title and Survey.

(a) The Seller shall order and cause to be delivered to each of the Buyer and the Seller a commitment for the Title Policy from the Title Company, together with all underlying title exception documents. The Buyer shall, at its expense, order and cause to be delivered to each of the Buyer and the Seller, an ALTA or Category 1A survey of the Property. After receipt of the survey and the title commitment, the Buyer shall notify the Seller of any defects in title or survey shown by such commitment and/or survey that the Buyer is unwilling to accept. Within 5 days after such notification, the Seller shall notify the Buyer whether the Seller is willing to cure such defects; the Seller’s failure to so notify the Buyer shall be deemed to be the Seller’s refusal to cure all such defects (except for any defects consisting of those items in the last sentence of this SECTION 3.2 below expressly required to be cured by the Seller). The Seller may cure any defect by causing the Title Company, at the Seller’s sole cost and expense, to omit such defect as an exception to the Title Policy or to “insure over” such defect to the Buyer’s reasonable satisfaction. If the Seller is willing to cure such defects, the Seller shall act promptly, diligently and use commercially reasonable efforts to cure such defects at its expense. Subject to those items below expressly required to be cured by the Seller, if the Seller is unwilling or unable to cure any other such defects by Closing (or fails to notify Buyer and therefore has elected not to cure such defects), then the Buyer shall elect, within 5 days after written notice thereof from the Seller to the Buyer (or within 5 days after the Seller’s time for giving notice has expired without any notice from the Seller), by giving the Seller written notice that the Buyer either (i) waives such defects and shall proceed to Closing without any abatement in the Purchase Price with respect thereto, or (ii) terminates this Agreement and shall be entitled to receive a full and immediate refund of the Xxxxxxx Money and, upon return of the Xxxxxxx Money, this Agreement shall terminate and the Buyer and the Seller shall have no further rights, liabilities or obligations hereunder (except as expressly survive the termination of this Agreement). In the event that the Buyer does not make such election within the applicable time frame, the Buyer shall be deemed to have elected to waive any such defects pursuant to clause (i) above. Subject to those items below expressly required to be cured by the Seller, all title matters not objected to by the Buyer during the Study Period (or objected to but which the Seller declines, or is deemed to decline, to cure as provided above without the Buyer thereafter electing to terminate this Agreement) shall be deemed “Permitted Title Exceptions.” Notwithstanding the foregoing, if any such defects of title consist of mortgages or deeds of trust, any other monetary liens and/or tax liens (other than liens for taxes not yet due and payable), the Buyer shall be deemed to have notified the Seller that the Buyer is unwilling to accept such defects and the Seller covenants and agrees that at or prior to Closing the Seller shall cure by payment, bonding, or escrow deposit acceptable to the Title Company (and the Escrow Agent is authorized to pay and discharge at Closing from the Seller’s proceeds, if not so cured) and cause to be cancelled and discharged such monetary title defects.

(b) The Seller shall promptly bring to the Buyer’s attention any defect in title which the Seller becomes aware of and which were created by, under or through the Seller to the extent not included in the initial title commitment received by the Buyer pursuant to SECTION 3.2(a) (each, an “Intervening Lien”). To the extent that there exist any Intervening Liens, other than the Permitted Title Exceptions, the Seller may, at its sole option, undertake, at its expense, all necessary actions to remove and cure any and all such Intervening Liens prior to Closing; provided, however, that in the event that the Seller elects not to remove and cure any Intervening Liens, other than the Permitted Title Exceptions, and such exist at Closing, the Buyer shall have the right to terminate this Agreement whereupon the Xxxxxxx Money shall be returned immediately to the Buyer, and, upon return of the Xxxxxxx Money, this Agreement shall terminate and the Buyer and the Seller shall have no further rights, liabilities or obligations hereunder (except as expressly survive the termination of this Agreement); provided, further, the Seller shall have the unconditional commitment to remove any Intervening Lien, other than the Permitted Title Exceptions, created directly by the affirmative actions of the Seller, or to the extent created at the Seller’s express direction by its agents and/or representatives (including the Manager), and the failure to so remove shall be a material breach of this Agreement.

SECTION 3.3. Environmental Audit. The Buyer shall, at its option and expense, order a Phase I environmental audit. If such audit reveals the existence of conditions which, in the reasonable judgment of the Buyer, require further investigation (including without limitation borings, soil samples or other invasive testing), then the Buyer will provide prompt written notice to the Seller of such additional testing required (including the scope and specifications of such additional testing). Within 5 days of such notice, the Seller shall elect in writing to the Buyer, at the Seller’s sole discretion, to either (a) allow such additional testing pursuant to the scope and specifications contained in the Buyer’s notice or (b) disallow such further environmental investigation (any failure by the Seller to respond timely will be deemed to be an election of (b) above). If the Seller elects (or is deemed to have elected) not to allow such additional testing, then the Buyer shall elect, within 5 days after written notice thereof from the Seller to the Buyer (or within 5 days after the Seller’s time for giving notice has expired without any notice from the Seller), by giving the Seller written notice that the Buyer either (i) waives such additional testing and shall proceed to Closing without any abatement in the Purchase Price with respect thereto, or (ii) terminates this Agreement, whereupon the Xxxxxxx Money shall be returned immediately to the Buyer, and, upon return of the Xxxxxxx Money, this Agreement shall terminate and the Buyer and the Seller shall have no further rights, liabilities or obligations hereunder (except as expressly survive the termination of this Agreement). In the event that the Buyer does not make such election within the applicable time frame, the Buyer shall be deemed to have elected to waive such additional testing pursuant to clause (i) above.

SECTION 3.4. Franchise

(a) Within 3 Business Days after the Effective Date, the Buyer shall submit a franchise application to Franchisor, together with all required related documents and submittals, and shall pay all fees and costs imposed by Franchisor in connection with such application. The Buyer acknowledges that the Seller has obtained and delivered to the Buyer the product improvement plan required by the Franchisor with respect to the Hotel (the “PIP”). During the Study Period (and commencing immediately upon the Effective Date), the Buyer shall use its commercially reasonable efforts, and pay all costs and expenses therewith associated, to obtain a franchise commitment (the “New Franchise”) with respect to the Property from the current

Franchisor, all upon terms and conditions reasonably acceptable to the Buyer; provided that the Buyer agrees that it will accept (if not able to negotiate any more favorable terms from Franchisor) (i) a term ending at the current expiration date of the existing Franchise Agreement, (ii) Franchisor’s standard fees (without requiring any waiver or reduction), and (iii) Franchisor’s current standard form of franchise agreement. The Seller and the Buyer shall cooperate with each other and the Franchisor to expedite completion of the same. If the Buyer does not receive the New Franchise or approval thereof from the Franchisor on or before the expiration of the Study Period, the Buyer may, at its option, upon written notice to the Seller have up to an additional 15 days to obtain the New Franchise or approval thereof (the Study Period as so extended solely for such purposes, the “Franchise Approval Period”); provided that the Buyer shall review and approve the PIP prior to the expiration of the Study Period and, if the Buyer has not elected to terminate this Agreement prior to the expiration of the Study Period, the Seller shall be deemed to have approved of the PIP. If, despite Buyer’s good faith, commercially reasonable efforts, the Buyer does not receive the New Franchise or approval thereof from the Franchisor on or before the expiration of the Franchise Approval Period, the Buyer may, at its option, upon written notice to the Seller and the Escrow Agent terminate this Agreement, at which time the Xxxxxxx Money shall be returned promptly to the Buyer and upon return of the Xxxxxxx Money, the Buyer and the Seller shall have no further rights, liabilities or obligations hereunder (except as expressly survive the termination of this Agreement). If the Buyer does not elect to terminate, to the extent permitted, on or before the expiration of the Franchise Approval Period, the Xxxxxxx Money shall remain non-refundable, except as otherwise expressly set forth in this Agreement, and the Buyer’s obligation to purchase the Property shall be conditional only as otherwise provided in accordance with the terms of this Agreement. All costs of the New Franchise, including, without limitation, costs associated with any required property improvement plan (including the PIP), attorneys’ fees and costs of Franchisor, and reserves required by Franchisor, shall be the responsibility of the Buyer.

(b) If the Buyer elects not to obtain a New Franchise from Franchisor (but instead elects another franchisor or brand or elects not to have any franchise or brand) or the Buyer does not obtain the New Franchise and does not terminate this Agreement in accordance with SECTION 3.4(a) and proceeds to Closing, the Buyer shall (i) pay all cancellation fees, termination fees, removal fees or other amounts owed to Franchisor as a result of cancellation and termination of the Franchise Agreement, (ii) immediately upon Closing, cease operating the Property as a “System Hotel” within the Franchisor system, including, without limitation, not directly or indirectly representing or giving the impression that it is a present or former franchisee or licensee of Franchisor or that the Property was previously a “System Hotel,” and (iii) immediately upon Closing, at its sole cost and expense, immediately and permanently remove or cause to be removed from the Property all identifying characteristics, marks and intellectual property of Franchisor and its “System Hotels,” including, without limitation, all electronic systems, signs, fixtures, furniture, furnishings, equipment, advertising materials, stationery, supplies, forms and other items containing the words, trademark, service marks or insignia for a “System Hotel,” return to Franchisor its intellectual property and other materials proprietary to Franchisor, make such alterations as may be necessary and required by Franchisor to distinguish the Hotel from its former appearance and other “System Hotels” and allow Franchisor to enter upon the Property to complete any of the foregoing not completed by the Buyer within thirty days after Closing (collectively, “De-Identification”). The De-Identification will involve, among other things, all de-identification required by the Franchise Agreement and

compliance with all other requirements of the Franchise Agreement that arise as a result of the sale of the Property to the Buyer. Upon Closing and in the event that the Buyer does not obtain a New Franchise from Franchisor (but instead elects another franchise or brand or elects not to have any franchise or brand), the Buyer agrees to indemnify and hold the Seller harmless from and against any and all losses, claims, damages, liabilities and expenses (including reasonable attorneys’ fees and costs) arising from the termination of the Franchise Agreement hereunder and/or the Seller’s ability or inability to obtain a release of Seller or any Seller related guarantor of the Franchise Agreement and any failure by the Buyer to comply with all obligations arising in connection with De-Identification and any obligations imposed by Franchisor on the owner of the Property after Closing.

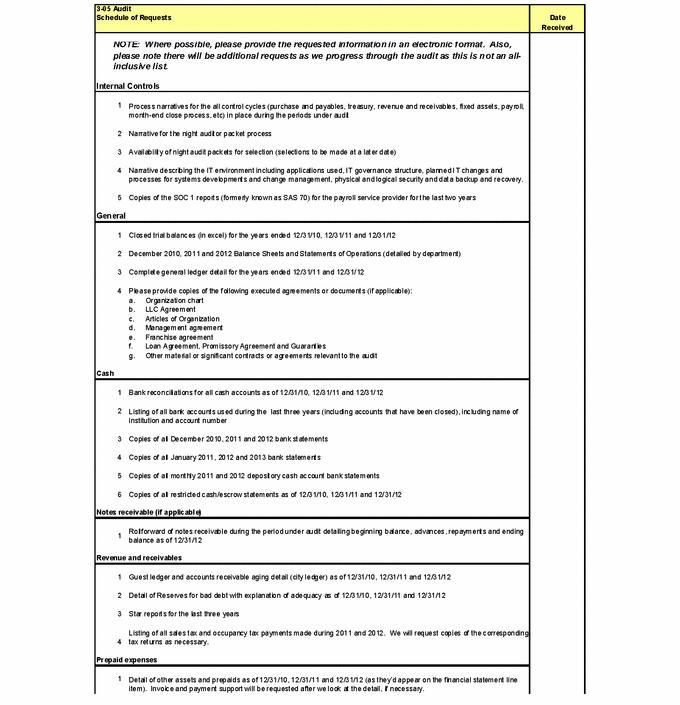

SECTION 3.5. Buyer Audit Requirements. The Seller agrees to use commercially reasonable efforts to promptly deliver to the Buyer all of the audit request materials listed on Exhibit E; provided, however, the Seller shall deliver all such materials within its possession (or which are otherwise reasonably accessible to the Seller as of the Effective Date) prior to the expiration of the Study Period; provided further, the Seller acknowledges and agrees to use its good faith efforts to also provide such additional information related to both the operation of the Property during the Seller’s period of ownership of the Property and the Seller as requested by the Buyer (or its accountants) which is deemed relevant and reasonably necessary (as reasonably determined by the Buyer, with the understanding than any such inquiry that is made by the Buyer or its accountants shall pertain solely to the affairs of the Seller as the owner of the Property and shall not extend to the financial or other information of any direct or indirect owner of the Seller) to enable the Buyer and its accountants to prepare financial statements in compliance with (a) Rule 3-05 of Regulation S-X of the Securities and Exchange Commission which audit will commence immediately upon Closing and which is required to be completed and filed with the Securities and Exchange Commission within 75 days after Closing; (b) any other rule issued by the Securities and Exchange Commission and applicable to the Buyer; and (c) any registration statement, report or disclosure statement filed with the Securities and Exchange Commission by, or on behalf of, the Buyer. Notwithstanding the foregoing and upon Buyer’s written request, the Seller shall engage (at the Buyer’s sole cost and expense) McGladrey LLP to commence any and all such required audits. The Seller acknowledges and agrees that the foregoing is a representative description of the information and documentation that the Buyer and its accountants may require in order to comply with (a), (b) and (c) above. In connection with the foregoing post-Closing audit(s), and in furtherance of the Seller’s obligations to assist the Buyer pursuant to this SECTION 3.5, the Seller covenants and agrees to execute and deliver to McGladrey LLP the audit representation letter solely for the benefit of McGladrey LLP, the form of which is attached hereto as Exhibit F (the “Audit Representation Letter”), provided that the form of such Audit Representation Letter may be modified as required to account for any issues identified during the audit. Notwithstanding the foregoing, to the extent permitted by law and without in any way limiting any of the Buyer’s rights and remedies expressly provided for under this Agreement (but subject to the limitations on such rights and remedies as expressly provided for under this Agreement), the Buyer, its agents, consultants and any other Person claiming by, through or under the Buyer (but expressly excluding McGladrey LLP) (a) shall have no claims against Seller Releasees solely as a result of the audit contemplated by this SECTION 3.5 or the Audit Representation Letter, and (b) hereby waive and release any claims against Seller Releasees that may arise solely from, or as a result of, such audit or the Audit Representation Letter, unless, in either of (a) or (b), such parties would otherwise have a claim expressly provided for under this Agreement (but subject to the limitations on any such claim as expressly provided for under this Agreement). The Seller’s obligations under this

SECTION 3.5 shall survive the Closing for a period of 12 months. The Buyer’s obligations under this SECTION 3.5 shall survive any termination of this Agreement.

SECTION 3.6. Buyer’s Due Diligence Reports. In the event the transaction contemplated by this Agreement is not closed for any reason whatsoever, the Seller may elect to have the Buyer deliver to the Seller originals or copies of all third party reports, documents, studies, analyses, and other written information obtained by the Buyer with respect to the Property, including results of physical inspections, engineering studies, engineering drawings and specifications, surveys, Hazardous Materials reports, soil tests, site plans, feasibility studies, market studies, property improvement plans, architectural plans, specifications and drawings, title reports, permits, approvals and authorizations (whether obtained from Governmental Authorities or third parties); and all other work product (excluding attorney client privileged materials, internal memoranda, and appraisals) generated by third parties for the Buyer solely in connection with the Property; provided, however, in the event the Buyer delivers any or all of the aforementioned materials to the Seller, the Buyer makes no representation or warranty as to the accuracy or completeness of the same and the Seller shall have no right to rely on such materials. In consideration for the Buyer providing all such aforementioned materials, the Seller shall pay the Buyer an amount equal to one-half of the actual out-of-pocket costs incurred by the Buyer in obtaining such materials (as evidenced by invoices, purchase orders and the like). The provisions of this SECTION 3.6 shall survive the termination of this Agreement.

ARTICLE IV.

REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SELLER

SECTION 4.1. General Seller Representations and Warranties. The Seller hereby represents and warrants to the Buyer, as of the date hereof, as follows:

(a) Formation; Existence. The Seller is a Delaware limited liability company duly formed, validly existing and in good standing under the laws of the State of Delaware. The Seller is duly qualified to conduct business and is in good standing under the laws of the State of Texas.

(b) Power and Authority. The Seller has all requisite power and authority to enter into this Agreement and to perform its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance of this Agreement, the sale and purchase of the Asset and the consummation of the transactions provided for in this Agreement have been duly authorized by all necessary action on the part of the Seller. This Agreement has been duly executed and delivered by the Seller and constitutes its legal, valid and binding obligation, enforceable against it in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights and by general principles of equity (whether applied in a proceeding at law or in equity).

(c) No Consents. Except as set forth in Schedule 4.1(c), no consent, license, approval, order, permit or authorization of, or registration, filing or declaration with, any court, administrative agency or commission or other Governmental Authority or instrumentality, domestic or foreign, is required to be obtained or made in connection with the Seller’s execution,

delivery and performance of this Agreement or any of the transactions required or contemplated hereby.

(d) No Conflicts. The execution, delivery and compliance with, and performance of the terms and provisions of, this Agreement, and the sale and purchase of the Asset, will not (i) conflict with or result in any violation of the Seller’s organizational documents, (ii) except as set forth in Schedule 4.1(d), conflict with or result in any violation of any provision of any bond, note or other instrument of indebtedness, contract, indenture, mortgage, deed of trust, loan agreement, lease or other agreement or instrument to which the Seller is a party in its individual capacity, or (iii) violate any existing term or provision of any order, writ, judgment, injunction, decree, statute, law, rule or regulation applicable to the Seller or its assets or properties.

(e) Litigation with Respect to Seller. Except as set forth in Schedule 4.1(e), there is no action, suit, claim or proceeding pending against the Seller or any of its assets in any court, before any arbitrator or before any Governmental Authority or other Person (i) that would materially adversely affect the Seller, (ii) that seeks restraint, prohibition, damages, or other relief in connection with this Agreement or the transactions contemplated hereby, or (iii) would delay consummation of any of the transactions contemplated hereby. The Seller is not subject to any judgment, decree, injunction, rule or order of any court or other Governmental Authority relating to the Seller’s participation in the transactions contemplated by this Agreement. The Seller has not received any written notice of any such threatened action or proceeding or litigation.

(f) Bankruptcy. No Act of Bankruptcy has occurred with respect to the Seller.

(g) Foreign Person. The Seller is not a “foreign person” as defined in Internal Revenue Code Section 1445 and the regulations issued thereunder.

(h) Anti-Terrorism Laws.

(i) None of the Seller or, to Seller’s Knowledge, any of its affiliates, is in violation of any laws relating to terrorism, money laundering or the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56 and Executive Order No. 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism) (the “Executive Order”) (collectively, the “Anti-Money Laundering and Anti-Terrorism Laws”).

(ii) None of the Seller or, to Seller’s Knowledge, any of its affiliates, is acting, directly or indirectly, on behalf of terrorists, terrorist organizations or narcotics traffickers, including those persons or entities that appear on the Annex to the Executive Order, or are included on any relevant lists maintained by the Office of Foreign Assets Control of U.S. Department of Treasury, U.S. Department of State, or other U.S. government agencies, all as may be amended from time to time.

(iii) None of the Seller, or, to Seller’s Knowledge, any of its affiliates or, without inquiry, any of its brokers or other agents, in any capacity in connection with the

purchase of the Property (A) conducts any business or engages in making or receiving any contribution of funds, goods or services to or for the benefit of any person included in the lists set forth in the preceding paragraph; (B) deals in, or otherwise engages in any transaction relating to, any property or interests in property blocked pursuant to the Executive Order; or (C) engages in or conspires to engage in any transaction that evades or avoids, or has the purpose of evading or avoiding, or attempts to violate, any of the prohibitions set forth in any Anti-Money Laundering and Anti-Terrorism Laws.

(iv) The Seller understands and acknowledges that the Buyer may become subject to further anti-money laundering regulations, and agrees to execute instruments, provide information, or perform any other acts as may reasonably be requested by the Buyer, for the purpose of: (A) carrying out due diligence as may be required by applicable law to establish the Seller’s identity and source of funds; (B) maintaining records of such identities and sources of funds, or verifications or certifications as to the same; and (C) taking any other actions as may be required to comply with and remain in compliance with anti-money laundering regulations applicable to the Seller.

(v) Neither the Seller, nor any person controlling or controlled by the Seller, is a country, territory, individual or entity named on a Government List, and the monies used in connection with this Agreement and amounts committed with respect thereto, were not and are not derived from any activities that contravene any applicable anti-money laundering or anti-bribery laws and regulations (including funds being derived from any person, entity, country or territory on a Government List or engaged in any unlawful activity defined under Title 18 of the United States Code, Section 1956(c)(7)).

SECTION 4.2. Representations and Warranties of the Seller as to the Asset. The Seller hereby represents and warrants to the Buyer, as of the date hereof, as follows:

(a) Operating Agreements. A correct and complete list of all material Operating Agreements (and any amendments or modification thereof) affecting the Property as of the date hereof are set forth on Schedule 4.2(a) attached hereto. None of such material Operating Agreements have been modified or amended in any material way, except as set forth on Schedule 4.2(a) and all material Operating Agreements are in full force and effect. To Seller’s Knowledge, the Seller has delivered to the Buyer true and complete copies of each material Operating Agreement to the extent in the Seller’s possession or control. The Seller has neither given nor received any written notice of a default under any material Operating Agreement which default remains uncured and, to the Seller’s Knowledge, there is no existing condition that, with notice or lapse of time or both, would constitute a material default by any party under any material Operating Agreement.

(b) Employees. None of the Seller or any of its affiliates has any employees with respect to the ownership, operation or maintenance of the Property (other than those in the employ of the Manager). Neither the Seller nor, to Seller’s Knowledge, Manager are parties to any written employment agreement, collective bargaining agreement or compensation agreement. To the Seller’s Knowledge, there are no union organization efforts pending or threatened with respect to any of the Employees.

(c) Tenant Leases and Equipment Leases. Schedule 4.2(c) sets forth a correct and complete list of the Tenant Leases and all material Equipment Leases for the Hotel as of the date hereof. Except as set forth in Schedule 4.2(c), as of the date hereof, all material Equipment Leases and Tenant Leases are in full force and effect and the Seller has delivered to the Buyer true and complete copies of all material Equipment Leases and Tenant Leases. The Seller has neither given nor received any written notice of a default under any material Tenant Lease or Equipment Lease which default remains uncured and, to the Seller’s Knowledge, there is no existing condition that, with notice or lapse of time or both, would constitute a material default by any party under any material Tenant Lease or Equipment Lease.

(d) Condemnation. As of the date hereof, there is no pending condemnation or similar proceedings affecting the Property, the Seller has not received any written notice of any potential condemnation or similar proceedings and, to the Seller’s Knowledge, there are no such threatened condemnation or similar proceedings.

(e) Litigation. Except as disclosed in Schedule 4.2(e) attached hereto, as of the date hereof, there are no actions, suits or proceedings pending against the Asset in any court or before or by an arbitration tribunal or regulatory commission, department or agency and, to the Seller’s Knowledge, none are threatened. Neither the Seller, nor to the Seller’s Knowledge, Manager has received any written notice of any such threatened action or proceeding or litigation.

(f) Environmental Matters. To the Seller’s Knowledge, neither the Seller or Manager has, during the Seller’s ownership, stored, produced or disposed of any Hazardous Materials at the Hotel, other than such products typically used in the operation of hotels similar to the Hotel. The Seller has not received any written notice from any Governmental Authority of a violation of any applicable Environmental Laws. The Seller has received no written notice from any Governmental Authority that the Seller does not have all required governmental permits and licenses, if any, relating to Hazardous Materials. For the purposes of this SECTION 4.2(f), “Environmental Laws” means any and all federal, state, county and local statutes, laws, regulations and rules in effect on the date of this Agreement relating to the protection of the environment or to the generation, recycling, use or reuse, sale, storage, handling, transportation and disposal of Hazardous Materials.

(g) Title to Real Property and Personal Property. Other than the excluded property set forth in SECTION 2.1(c), the Seller has good marketable title to the FF&E, Property and Equipment, Retail Merchandise and Inventories, free and clear of all liens and encumbrances as of the Closing Date. The Seller shall own and have good, marketable title to the Property, free and clear of all liens and encumbrances as of the Closing Date, other than the Permitted Title Exceptions.

(h) Franchise Agreement. All material conditions and obligations to be performed by the Seller under the Franchise Agreement, as of the date hereof, have been satisfied. The Franchise Agreement is in full force effect. The Seller has neither given nor received any written notice of a material default under the Franchise Agreement which default remains uncured and, to the Seller’s Knowledge, there is no existing condition that, with notice

or lapse of time or both, would constitute a material default by any party under the Franchise Agreement.

(i) Violation of Law. To Seller’s Knowledge, the Seller has not received any written notice from any Governmental Authority or other Person of a violation of any applicable material law with respect to the ownership, operation or maintenance of the Property within the past 18 months.

(j) Compliance with Existing Laws. The Licenses and Permits listed on Schedule 4.2(j) represent all of the licenses, permits and approvals held by the Seller (or its Manager) as relates to its ownership, operation and use of the Property or any part thereof (whether transferable or not pursuant to applicable law), each of which is valid and in full force and effect, and, to Seller’s Knowledge, no provision, condition or limitation thereof has been breached or violated.

(k) Financial Information. The Seller has provided to the Buyer profit and loss statements and balance sheets regarding the Property and the business operations of the Hotel for the Seller’s actual period of ownership of the Property. To the Seller’s Knowledge, all of the foregoing information has been prepared in conformity with generally accepted accounting principles and the Uniform System of Accounts and present fairly the results of operations by the Seller (and the Manager) of the Hotel.

(l) Taxes. The Seller has filed or caused to be filed (on a timely basis since its inception) all Tax Returns required to be filed with respect to the operations of the Hotel with the appropriate Governmental Authorities and all such Tax Returns are true, correct and complete in all material respects. The Seller has paid all Taxes, including penalties and interest that were due on or before such date and during the Seller’s ownership of the Hotel including, without limitation, all sales and use taxes required to be paid or collected during the Seller’s ownership and operation of the Hotel (which amounts have been collected and paid, in the ordinary course of business, to the appropriate Governmental Authority). There are no (i) actions currently pending or, to the Seller’s Knowledge, threatened against the Hotel by any Governmental Authority for the assessment or collection of Taxes; (ii) audits or other examinations in progress nor has the Hotel nor the Seller been notified in writing of any request for examination; or (iii) claims for assessment or collection of Taxes that have been asserted in writing against the Seller. There are no outstanding agreements, waivers or consents extending the statutory period of limitations applicable to any Taxes of the Seller, and the Seller has not requested any extensions of time within which to file any Tax Return.

SECTION 4.3. Covenants of the Seller Prior to Closing. From the date hereof until Closing or earlier termination of this Agreement:

(a) Insurance. The Seller or their agents shall keep the Property insured against fire and other hazards in coverage, amounts and deductibles not materially less than those in effect as of the date of this Agreement and otherwise under such terms as the Seller deems advisable consistent with past practices.

(b) New Operating Agreements. Without the prior written consent of the Buyer, which consent shall not be unreasonably withheld or delayed, the Seller or the Manager or any other agents shall not enter into any Operating Agreements or Equipment Leases, or renew, amend, terminate or supplement any such contracts; provided that any of such parties may enter into or renew such contracts, or amend, terminate or supplement such contracts, without the Buyer’s consent if such contract is entered into (or renewed, amended, terminated or supplemented, as the case may be) in the ordinary course of business at the Property, or is necessary as a result of an emergency to life or property at the Property and in either case, is either terminable on 90 days or less notice, without penalty. If the Seller or the Manager enters into or renews any such Operating Agreement and/or Equipment Lease, terminates, or amends or supplements any such contracts, after the date of this Agreement, then the Seller shall promptly provide written notice and a copy thereof to the Buyer and, unless the same required the Buyer’s prior written approval pursuant to this paragraph (b) and such approval was not obtained, the schedule of contracts attached to the Assignment of Contracts shall be so modified, and such contract shall be deemed added to Schedule 4.2(a) attached hereto and Schedule 4.2(a) shall be deemed amended at the Closing to include such contracts. If a new Operating Agreement and/or Equipment Lease, or a renewal, amendment, termination or supplement to any such existing contract, requires the Buyer’s prior written approval or Seller otherwise requests Buyer’s approval and the Buyer does not object within 7 days after receipt of a copy of such contract, then the Buyer shall be deemed to have approved such contract. The Seller and the Manager shall observe and perform all of the material obligations under the material Operating Agreements and Equipment Leases, excluding any such Operating Agreements or Equipment Leases which are terminated in the ordinary course of the operation of the Hotel or as a result of a default by the other party.