DATED OCTOBER 7, 2014 SECURITIES PURCHASE AGREEMENT by and between IFM INVESTMENTS LIMITED, And SOUFUN HOLDINGS LIMITED

Exhibit 99.2

DATED OCTOBER 7, 2014

by and between

IFM INVESTMENTS LIMITED,

And

SOUFUN HOLDINGS LIMITED

TABLE OF CONTENTS

| 1. |

DEFINITIONS. | 2 | ||||||

| 2. |

CLOSING AND FUNDING OF THE CONVERTIBLE NOTE. | 6 | ||||||

| 2.1 | Convertible Note | 6 | ||||||

| 2.2 | Closing and Funding | 7 | ||||||

| 3. |

CONVERSION AND EXCHANGE OF THE CONVERTIBLE NOTE. | 8 | ||||||

| 3.1 | Conversion | 8 | ||||||

| 3.2 | Conversion Notice | 8 | ||||||

| 3.3 | Closing of the Conversion | 8 | ||||||

| 3.4 | Adjustment of Conversion Rate | 9 | ||||||

| 4. |

TERMS OF THE CONVERTIBLE NOTE. | 17 | ||||||

| 4.1 | Maturity | 17 | ||||||

| 4.2 | Interest | 17 | ||||||

| 4.3 | Ranking | 17 | ||||||

| 4.4 | Note | 17 | ||||||

| 4.5 | Transferability | 17 | ||||||

| 5. |

REPRESENTATIONS AND WARRANTIES OF THE ISSUER. | 17 | ||||||

| 5.1 | Status | 17 | ||||||

| 5.2 | Power and Authority | 18 | ||||||

| 5.3 | Enforceability | 18 | ||||||

| 5.4 | No Conflicts, Etc. | 18 | ||||||

| 6. |

REPRESENTATIONS AND WARRANTIES OF THE INVESTOR. | 18 | ||||||

| 6.1 | Status | 18 | ||||||

| 6.2 | Power and Authority | 18 | ||||||

| 6.3 | Enforceability | 19 | ||||||

| 6.4 | No Conflicts, Etc. | 19 | ||||||

| 6.5 | Conversion for Their Own Account | 19 | ||||||

| 6.6 | Non-US Resident | 19 | ||||||

| 7. |

CONDITIONS TO THE OBLIGATIONS OF THE PARTIES AT THE CLOSING. | 20 | ||||||

| 7.1 | Conditions to the Obligations of the Investor | 20 | ||||||

| 7.2 | Conditions to the Obligations of the Issuer | 20 | ||||||

i

| 8. | CONFIDENTIALITY | 21 | ||||||

| 8.1 | Disclosure of Terms | 21 | ||||||

| 8.2 | Permitted Disclosures by the Parties | 21 | ||||||

| 8.3 | Legally Required Disclosure | 21 | ||||||

| 8.4 | Press Releases, Etc. | 21 | ||||||

| 8.5 | Notices | 21 | ||||||

| 9. | TERMINATION | 21 | ||||||

| 9.1 | Termination | 21 | ||||||

| 9.2 | Effect of Termination | 22 | ||||||

| 10. | MISCELLANEOUS. | 22 | ||||||

| 10.1 | Survival | 22 | ||||||

| 10.2 | Successors and Assigns | 22 | ||||||

| 10.3 | Governing Law | 22 | ||||||

| 10.4 | Counterparts | 22 | ||||||

| 10.5 | Titles and Subtitles | 23 | ||||||

| 10.6 | Notices | 23 | ||||||

| 10.7 | Amendments and Waivers | 23 | ||||||

| 10.8 | Severability | 23 | ||||||

| 10.9 | Entire Agreement | 23 | ||||||

| 10.10 | Dispute Resolution | 24 | ||||||

| 10.11 | Waiver of Jury Trial | 24 | ||||||

Exhibit

EXHIBIT A FORM OF CONVERTIBLE NOTE

ii

THIS SECURITIES PURCHASE AGREEMENT (this “Agreement”) is made on October 7, 2014 by and between:

| (A) | IFM Investments Limited, a company with limited liability incorporated under the laws of the Cayman Islands (the “Issuer”); and |

| (B) | SouFun Holdings Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands whose registered office is at Offshore Incorporations (Cayman) Limited, Floor 0, Xxxxxx Xxxxx, Xxxxxxx Xxxxxx, P O Box 2804, Grand Cayman KY1-1112, Cayman Islands. (the “Investor”). |

The foregoing parties shall be hereinafter referred to collectively as the “Parties” and individually as a “Party”.

RECITALS

WHEREAS:

| (A) | The Issuer desires to raise capital to fund, among other things, its business operations and development, and the Investor desires to provide to the Issuer such capital. |

| (B) | As a result of the Parties’ desires set forth above, the Issuer proposes to issue and sell to the Investor, and the Investor desires to subscribe for: (1) 175,836,255 newly issued Class A ordinary shares of the Issuer (the “Shares”), representing twenty (20) percent of the total issued and outstanding share capital of the Issuer immediately after the issuance of the Shares to the Investor; and (2) a convertible note in an aggregate principal amount of US$ 30,000,000, (Thirty Million US Dollars) which is convertible into Shares of the Issuer (each as defined herein) at the Conversion Rate on the terms and conditions set forth herein, evidenced by a promissory note of the Issuer substantially in the form of Exhibit A hereto (the “Convertible Note”). |

| (C) | The board of directors of each of the Issuer and Investor has independently determined that the proposed issuance of Shares and the Convertible Note by the Issuer to the Investor as contemplated hereby is fair, advisable and in the best interest of the respective shareholders of each of the Issuer and the Investor. |

1

NOW, THEREFORE, in consideration of the mutual covenants and undertakings contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and subject to and on the terms and conditions set forth herein, the Parties agree as follows:

1. DEFINITIONS.

As used in this Agreement, the following terms shall have the meanings set forth or referenced below:

“ADS” means the American depositary shares representing the underlying Shares deposited with JPMorgan Chase Bank N.A. as the depositary.

“Affiliate” means, with respect to a Person, any other Person that, directly or indirectly, Controls, is Controlled by or is under common Control with such Person.

The term “Affiliated” has the meaning correlative to the foregoing.

“Board of Directors” for any entity, the board of directors of such entity or a committee of such board duly authorized to act for it thereunder.

“Business Day” means a day (other than Saturday or Sunday) when banks are generally open for business in each of the United States, Hong Kong, Cayman and the PRC.

“Capital Stock” means, for any entity, any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) stock issued by that entity.

“Clause A Distribution” has the meaning set forth in Section 3.4(d) hereof.

“Clause B Distribution” has the meaning set forth in Section 3.4(d) hereof.

“Clause C Distribution” has the meaning set forth in Section 3.4(d) hereof. “Closing” has the meaning set forth in Section 2.2(a) hereof.

“Closing Date” has the meaning set forth in Section 2.2(a) hereof.

“Confidential Information” has the meaning set forth in Section 8.1 hereof.

“Consent” means any consent, approval, authorization, waiver, permit, grant, franchise, concession, agreement, license, certificate, exemption, order, registration, declaration, filing, report or notice of, with or to any Person.

“Contemplated Transactions” means the transactions contemplated hereby and by any of the other Transaction Documents.

“Contract” means, with respect to any specified Person, all loan agreements, indentures, letters of credit (including related letter of credit applications and reimbursement obligations), mortgages, security agreements, pledge agreements, deeds of trust, bonds, notes, guarantees, surety obligations, warranties, licenses, franchises, permits, powers of attorney, purchase orders, leases, and other agreements, contracts, instruments, obligations, offers, commitments, arrangements and understandings, written or oral, to which the specified Person is a party or by which it or any of its properties or assets may be bound or affected.

2

“Control”, “Controlled”, “Controlling” or “under common Control with” with respect to any Person means having the ability to direct the management and affairs of such Person, whether through the ownership of voting securities, by Contract or otherwise, and such ability shall be deemed to exist when any Person holds a majority of the outstanding voting securities, or the economic rights and benefits, of such Person.

“Conversion” has the meaning set forth in Section 3.1 hereof.

“Conversion Notice” has the meaning set forth in Section 3.2(a) hereof.

“Conversion Rate” means 25706.9 Shares per US$1,000 outstanding Note Amount, subject to adjustment pursuant to Section 3.4.

“Convertible Note” has the meaning set forth in the Recitals hereto, and references to “Convertible Note” shall include any promissory note delivered pursuant to Section 3.3 hereof.

“Ex-Dividend Date” means the first date on which the ADSs trade on the applicable exchange or in the applicable market, regular way, without the right to receive the issuance, dividend or distribution in question, from the Issuer or, if applicable, from the seller of the ADSs on such exchange or market (in the form of due bills or otherwise) as determined by such exchange or market.

“Disclosing Party” has the meaning set forth in Section 8.3 hereof.

“Dispute” has the meaning set forth in Section 10.11 hereof.

“Distributed Property” has the meaning specified in Section 3.4(d) hereof.

“Governmental Approval” means any Consent of, with or to any Governmental Authority.

“Governmental Authority” means any nation or government or any province or state or any other political subdivision thereof, and any entity, authority or body exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including government authority, agency, department, board, commission, court, tribunal, arbitration body or instrumentality of any such aforementioned body politic.

“GLAM II” means GL Asia Mauritius II Cayman Ltd. a company incorporated and existing under the laws of Cayman Islands with its registered office at Admiral Administration, Ltd. (Cayman Islands), X.X. Xxx 00000 SM, Anchorage Centre, 2nd Floor, Grand Cayman, Cayman Islands

“Hong Kong” means the Hong Kong Special Administrative Region of the PRC.

3

“Indebtedness” as applied to any Person, means, without limitation: (a) all indebtedness for borrowed money; (b) all obligations evidenced by a note, bond, debenture, letter of credit, draft or similar instrument; (c) that portion of obligations with respect to capital leases that is properly classified as a liability on a balance sheet in accordance with U.S. GAAP; (d) notes payable and drafts accepted representing extensions of credit; (e) any obligation owed for all or any part of the deferred purchase price of property or services, which purchase price is due more than six (6) months from the date of incurrence of the obligation in respect thereof; and (f) all indebtedness and obligations of the types described in the foregoing clauses (a) through (e) to the extent secured by any Lien on any property or asset owned or held by that Person regardless of whether the indebtedness secured thereby shall have been assumed by that Person or is non-recourse to the credit of that Person, provided that Indebtedness shall not include payables and accrued expenses, in each case arising in the ordinary course of business and reflected in the financial statements of that Person.

“Investors Rights Agreement” has the meaning set forth in Section 7.1 hereof.

“Last Reported Sale Prices” of the ADSs on any date means the closing sale price per ADS (or if no closing sale price is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in composite transactions for the principal U.S. national or regional securities exchange on which the ADSs are traded. If the ADSs are not listed for trading on a U.S. national or regional securities exchange on the relevant date, the “Last Reported Sale Price” shall be the last quoted bid price for the ADSs in the over-the-counter market on the relevant date as reported by OTC Markets Group Inc. or a similar organization. If the ADSs are not so quoted, the “Last Reported Sale Price” shall be the average of the mid-point of the last bid and ask prices for the ADSs on the relevant date from each of at least three nationally recognized independent investment banking firms selected by the Issuer for this purpose.

“Law” means all applicable provisions of all: (a) constitutions, treaties, statutes, laws (including the common law), codes, rules, regulations, ordinances, mandatory guidelines, circulars, orders or implemented policies of any Governmental Authority; (b) Governmental Approvals; and (c) awards, decisions, injunctions, judgments, decrees, settlements, orders, processes, rulings, subpoenas or verdicts (whether temporary, preliminary or permanent) entered, issued, made or rendered by any Governmental Authority.

“Liability” means any debt, liability, commitment or obligation of any kind, character or nature whatsoever, whether known or unknown, xxxxxx or inchoate, secured or unsecured, accrued, fixed, absolute, contingent or otherwise, and whether due or to become due.

“Lien” means any mortgage, pledge, deed of trust, hypothecation, security interest, encumbrance, burden, title defect, title retention agreement, lease, sublease, license, occupancy agreement, easement, covenant, condition, encroachment, voting trust agreement, security interest, option, right of first offer, negotiation or refusal, proxy, lien, charge, adverse claim or other restrictions (including, but not limited to, restrictions on transfer), encumbrances or limitations of any nature whatsoever, including, but not limited to, such Liens as may arise under any contract.

“Long-Stop Date” has the meaning set forth in Section 2.3 hereof.

4

“Note Amount” means, as of any date, the aggregate outstanding amount of the Principal Amount (being the aggregate outstanding amount of the Principal Amount referred to in Section 2.1 less the aggregate amount of the Convertible Note converted or repaid hereunder).

“Payment Date” has the meaning set forth in Section 4.1 hereof.

“Person” means any individual, Governmental Authority, corporation, partnership, joint venture, limited partnership, proprietorship, association, limited liability company, firm, trust, estate, unincorporated organization or other enterprise or entity.

“PRC” means the People’s Republic of China, but, solely for the purposes of this Agreement and all Transaction Documents, excluding Hong Kong, the Macau Special Administrative Region of the People’s Republic of China, and Taiwan.

“Principal Amount” has the meaning set forth in Section 2.1(b).

“Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of the Shares (directly or in the form of ADSs) (or other applicable security) have the right to receive any cash, securities or other property or in which the Shares (directly or in the form of ADSs) (or such other security) are exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of security holders entitled to receive such cash, securities or other property (whether such date is fixed by the Issuer’s Board of Directors, statute, contract or otherwise).

“Reference Price” shall mean US$ 0.0324 which is the per Share price arithmetically derived from the volume-weighted average trading price of the ADSs of the Issuer for the 60 trading days preceding September 26, 2014 (inclusive).

“Restructuring Deed” shall mean that certain restructuring deed, among IFM Overseas Partners L.P., IFM Overseas Limited, IFM Investments Limited, Xx. Xxxxxx Xxxxx, Mr. Xxxxx Xxxx Xx and GL Asia Mauritius II Cayman Ltd.

“SEC” means the U.S. Securities and Exchange Commission or any successor agency.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, as in effect from time to time.

“Shareholder” means, with respect to any specified Person, a holder of the capital stock or share capital of such specified Person.

“Share Subscription Price” means US$ 0.0341 per share of the Issuer representing a 5% premium over the Reference Price.

“Spin-Off” has the meaning set forth in Section 3.4(d) hereof.

5

“Subsidiary” shall mean, with respect to any Person (herein referred to as the “parent”), any corporation, limited liability company, partnership, association or other business entity of which securities of other ownership interests representing more than 50% of the equity or more than 50% of the ordinary voting power or more than 50% of the general partnership interests are, at the time any determination is being made, owned, controlled or held by the parent.

“Trading Day” means a day on which (i) trading in the ADSs (or other security for which a closing sale price must be determined) generally occurs on The New York Stock Exchange or, if the ADSs (or such other security) are not then listed on The New York Stock Exchange, on the principal other U.S. national or regional securities exchange on which the ADSs (or such other security) are then listed or, if the ADSs (or such other security) are not then listed on a U.S. national or regional securities exchange, on the principal other market on which the ADSs (or such other security) are then traded and (ii) a Last Reported Sale Price for the ADSs (or closing sale price for such other security) is available on such securities exchange or market; provided that if the ADSs (or such other security) are not so listed or traded, “Trading Day” means a Business Day.

“Trigger Event” has the meaning set forth in Section 3.4(d) hereof.

“Transaction Documents” means this Agreement, the Investors Rights Agreement, that certain loan agreement and share pledge agreement among IFM Overseas Partners L.P. and the Investor, dated at or about the date hereof, the employment agreements between the Issuer and each of Xx. Xxxxxx Xxxxx and Mr. Xxxxx Xxxx Xx dated at or about the date hereof (the “Employment Agreements”), a share purchase agreement among the Investor and GLAM II and any other documents contemplated by the foregoing agreements.

“U.S.” or “United States” means the United States of America.

“U.S. GAAP” means generally accepted accounting principles in the United States. “US$” means the legal currency of the United States.

“Valuation Period” has the meaning set forth in Section 3.4(d) hereof.

| 2. | CLOSING AND FUNDING OF THE CONVERTIBLE NOTE. |

2.1 Convertible Note. Subject to satisfaction or waiver of the conditions to Closing set forth in Section 7, at the Closing:

(a) The Issuer shall allot and issue to the Investor and the Investor shall subscribe from the Issuer 175,836,255 Shares at the Share Subscription Price, representing twenty (20) percent of the total issued and outstanding number of issued share capital of the Issuer immediately after the issuance of the Shares to the Investor; and

(b) the Issuer shall issue the Convertible Note to the Investor and the Investor shall subscribe from the Issuer the Convertible Note in the aggregate principal amount of US$30,000,000 (the “Principal Amount”).

6

2.2 Closing and Funding.

(a) The funding and closing of the issuance and subscription of the Shares and the Convertible Note (the “Closing”) as contemplated by this Agreement shall take place at the office of Skadden, Arps, Slate, Xxxxxxx & Xxxx, 00/X, Xxxxx World Office 2 | Xx. 0, Xxxx Xxx Xxx Xxx Xxxxxx, Xxxxxxx, commencing at 9:00 am (Beijing time) on the second (2nd) Business Day following the date when all conditions to the Closing under Section 7 hereof have been satisfied or duly waived, or at such other time, on such other date or at such other location as is agreed by the Parties in writing (the “Closing Date”).

(b) At the Closing, the Investor shall pay to the order of the Issuer, by wire transfer in immediately available funds, or by other payment methods mutually agreed in writing between the Issuer and the Investor prior to the Closing, an amount in the aggregate equal to $35,990,155, of which $ 5,990,155 shall be treated as the subscription price for the Shares (“Share Subscription Price”) and $30,000,000 shall be treated as the subscription price for the Convertible Note. Notwithstanding anything to the contrary herein, the obligations of the Issuer at the Closing under this Section 2 are subject to the Investor effecting the payment and the Issuer’s receipt of the Share Subscription Price and the Principal Amount. In no event shall the Issuer be obligated or required to issue the Shares or the Convertible Note except where the Issuer shall have received from the Investor the Share Subscription Price or the Principal Amount, as the case may be.

(c) At the Closing, the Issuer shall deliver, or cause to be delivered, to the Investor the following:

(i) a share certificate in definitive form and registered in the name of the Investor, representing of the 175,836,255 duly authorized and validly issued Shares to be subscribed by the Investor at Closing;

(ii) a copy of the register of members of the Issuer, as certified by a director or an executive officer of the Issuer and updated to reflect the subscription by the Investor of the 175,836,255 Shares as provided herein; and

(iii) the Convertible Note dated the Closing Date in the Principal Amount.

(d) Notwithstanding anything to the contrary herein, the obligations of the Investor at the Closing under this Agreement are subject to the closing of other transactions under the each of applicable Transaction Documents. In no event shall the Investor be obligated or required to purchase the Shares or the Convertible Note except where the conditions set forth in each of the Transaction Documents have been satisfied or waived by the Investor.

7

2.3 If any of the conditions to Closing set forth in Section 7 hereof have not been satisfied or waived by the Investor on or prior to the 60th day after the date of this Agreement (the “Long-Stop Date”), then each of the Investor and the Issuer shall have the right to terminate, at its sole discretion, this Agreement. Any such termination pursuant to this Section 2.3 shall have the effects as set forth in Section 9.2.

| 3. | CONVERSION AND EXCHANGE OF THE CONVERTIBLE NOTE. |

3.1 Conversion. At the option of the Investor, the Convertible Note shall be convertible into Shares at the Conversion Rate in whole or in part on the Payment Date (such event, the “Conversion”).

3.2 Conversion Notice.

(a) Subject to any applicable Law and Section 3.1, to exercise the Conversion, the Investor shall provide a written notice (the “Conversion Notice”) to the Issuer during a thirty (30) calendar day period prior to the Payment Date, stating its intention to exercise its option to convert the Convertible Note, the amount of the Convertible Note to be converted, the number of Shares to be transferred by the Issuer to the Investor in such conversion, Section 3.1.

(b) The right of the Investor to repayment of the principal amount of the Convertible Note being converted shall be extinguished and the Issuer shall be released on the Payment Date from such repayment obligations subject to the due delivery to the Investor of such Shares converted in accordance with Section 3.3.

(c) In the event the Investor does not convert the outstanding Note Amount of the Convertible Note in full, such outstanding Note Amount shall be due and payable by the Issuer to the Investor on the Payment Date.

3.3 Closing of the Conversion.

(a) The closing of the Conversion and the transfer and delivery of the Shares by the Issuer in connection therewith shall take place at the office of the Xxxxxxxx, X0X, Xxxxxxxx 0, Xxxx 0, Xxxxxx International Plaza, No. 186 South 0xx Xxxx Xxxx, Xxxxxxx Xxxxxxxx, Xxxxxxx 000000, The People’s Republic of China. at 10:00 am (Beijing time) on the Payment Date. The Parties agree that all transactions relating to the Conversion shall be deemed to occur simultaneously and none of them shall be deemed to have occurred until the consummation of the Conversion.

(b) At the Conversion, the Investor shall deliver to the Issuer the relevant original Convertible Note which the Investor shall xxxx “Cancelled” or “Paid in Full”.

8

(c) At the Conversion, the Issuer shall deliver, or cause to be delivered, to the Investor the following:

(i) a certificate representing the duly authorized and validly issued Shares to be transferred to the Investor by the Issuer upon the Conversion, registered in the name of the Investor; and

(ii) a copy of the register of members of the Issuer, as certified by a director or an executive officer of the Issuer and updated to reflect the Conversion.

3.4 Adjustment of Conversion Rate.

(a) General. As of the date of this Agreement, each of the ADSs represents forty-five (45) Shares. If the number of Shares represented by the ADSs is changed for any reason other than one or more of the events described below, the Issuer shall make an appropriate adjustment to the Conversion Rate such that the number of Shares represented by the ADSs upon which conversion of the Convertible Note is based remains the same. However, if any event described in Sections 3.4(b) through 3.4(f) below results in a change to the number of Shares represented by the ADSs, then such change shall be deemed to satisfy the Issuer’s obligation to effect the relevant Conversion Rate adjustment on account of such event to the extent such change produces the same economic result as the adjustment to the Conversion Rate that would otherwise have been made on account of such event. Subject to the foregoing, the Conversion Rate will be adjusted as described below, except that the Issuer shall not be required to make any adjustments to the Conversion Rate if the Investor participates (other than in the case of a share split or share combination), at the same time and upon the same terms as holders of the ADSs and solely as a result of holding the Convertible Note, in any of the transactions described below without having to convert the Convertible Note as if the Investor held a number of ADSs equal to the Note Amount then outstanding divided by the Conversion Rate and further divided by the ADS-to-Share conversion ratio. The Issuer shall give prompt notice of such adjustment to any Conversion Rate to the Investor, which adjustment shall be conclusive and binding on the Investor, absent manifest error.

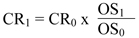

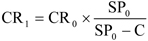

(b) Adjustment for Issuance of Share Dividend or Distribution. If the Issuer exclusively issues Shares as a dividend or distribution on the existing Shares, or if the Issuer effects a share split or share combination, the Conversion Rate will be adjusted based on the following formula:

where,

| CR0 = |

the Conversion Rate in effect immediately prior to the close of business on the record date (as defined below) of such dividend or distribution, or immediately prior to the open of business on the effective date of such share split or share combination, as applicable; | |||

| CR1 = | the Conversion Rate in effect immediately after the close of business on such record date or immediately after the open of business on such effective date, as applicable; | |||

| OS0 = | the number of Shares outstanding immediately prior to the close of business on such record date or immediately prior to the open of business on such effective date, as applicable; and | |||

| OS1 = | the number of Shares outstanding immediately after giving effect to such dividend, distribution, share split or share combination. | |||

9

Any adjustment made under this Section 3.4(b) shall become effective immediately after the close of business on the record date for such dividend or distribution, or immediately after the open of business on the effective date for such share split or share combination, as applicable. If any dividend or distribution of the type described in this Section 3.4(b) is declared but not so paid or made, the conversion rate shall be immediately readjusted, effective as of the date the Issuer’s Board of Directors determines not to pay such dividend or distribution, to the conversion rate that would then be in effect if such dividend or distribution had not been declared.

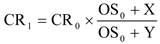

(c) If the Issuer issues to all or substantially all holders of the existing Shares (directly or in the form of ADSs) any rights, options or warrants entitling them, for a period of not more than 45 calendar days after the announcement date of such issuance, to subscribe for or purchase additional Shares (directly or in the form of ADSs) at a price per Share that is less than the average of the Last Reported Sale Prices of the Shares or the ADSs, as the case may be (divided by, in the case of the ADSs, the number of Shares then represented by one ADS), for the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement of such issuance, the Conversion Rate shall be increased based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to the close of business on the Record Date for the Shares (directly or in the form of ADSs) for such issuance; | ||||

| CR1 | = | the Conversion Rate in effect immediately after the close of business on such Record Date; | ||||

| OS0 | = | the number of Shares outstanding immediately prior to the close of business on such Record Date; | ||||

| X | = | the total number of Shares (directly or in the form of ADSs) deliverable pursuant to such rights, options or warrants; and | ||||

| Y | = | the number of Shares equal to (i) the aggregate price payable to exercise such rights, options or warrants, divided by (ii) the quotient of (a) the average of the Last Reported Sale Prices of the ADSs over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of the first public announcement of the issuance of such rights, options or warrants divided by (b) the number of Shares then represented by one ADS. | ||||

10

Any increase made under this Section 3.4(c) shall be made successively whenever any such rights, options or warrants are issued and shall become effective immediately after the close of business on the Record Date for the ADSs for such issuance. To the extent that Shares or ADSs are not delivered after the expiration of such rights, options or warrants, the Conversion Rate shall be decreased to the Conversion Rate that would then be in effect had the increase with respect to the issuance of such rights, options or warrants been made on the basis of delivery of only the number of Shares actually delivered (directly or in the form of ADSs). If such rights, options or warrants are not so issued, the Conversion Rate shall be decreased to the Conversion Rate that would then be in effect if such the Record Date for the ADSs for such issuance had not occurred.

For purposes of this Section 3.4(c), in determining whether any rights, options or warrants entitle the holders to subscribe for or purchase Shares (directly or in the form of ADSs) at a price per Share that is less than such average of the Last Reported Sale Prices of the Shares or the ADSs, as the case may be (divided by, in the case of the ADSs, the number of Shares then represented by one ADS), for the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement for such issuance, and in determining the aggregate offering price of such Shares or ADSs, there shall be taken into account any consideration received by the Issuer for such rights, options or warrants and any amount payable on exercise or conversion thereof, the value of such consideration, if other than cash, to be determined by the Issuer’s Board of Directors.

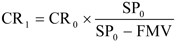

(d) If the Issuer distributes shares of its Capital Stock, evidences of its indebtedness, other assets or property of the Issuer or rights, options or warrants to acquire its Capital Stock or other securities, to all or substantially all holders of the Shares (directly or in the form of ADSs), excluding (i) dividends, distributions or issuances as to which an adjustment was effected pursuant to Section 3.4(b) or Section 3.4(c), (ii) dividends or distributions paid exclusively in cash as to which an adjustment was effected pursuant to Section 3.4(e), and (iii) Spin-Offs as to which the provisions set forth below in this Section 3.4(d) shall apply (any of such shares of Capital Stock, evidences of indebtedness, other assets or property or rights, options or warrants to acquire Capital Stock or other securities of the Issuer, the “Distributed Property”), then the Conversion Rate shall be increased based on the following formula:

where,

| CR0 | the Conversion Rate in effect immediately prior to the close of business on the Record Date for the Shares (directly or in the form of ADSs) for such distribution; | |||

| CR1 | the Conversion Rate in effect immediately after the close of business on such Record Date; | |||

| SP0 | the average of the Last Reported Sale Prices of the ADSs (divided by the number of Shares then represented by one ADS) over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the Ex-Dividend Date for such distribution; and | |||

| FMV = | the fair market value (as determined by the Issuer’s Board of Directors) of the Distributed Property with respect to each outstanding Share (directly or in the form of ADSs) on the Record Date for the ADSs for such distribution. | |||

11

Any increase made under the portion of this Section 3.4(d) above shall become effective immediately after the close of business on the Record Date for the ADSs for such distribution. If such distribution is not so paid or made, the Conversion Rate shall be decreased to the Conversion Rate that would then be in effect if such distribution had not been declared. Notwithstanding the foregoing, if “FMV” (as defined above) is equal to or greater than “SP0” (as defined above), in lieu of the foregoing increase, the holder of the Convertible Note shall receive, in respect of each US$1,000 Note Amount thereof, at the same time and upon the same terms as holders of the ADSs receive the Distributed Property, the amount and kind of Distributed Property such holder of the Convertible Note would have received if such holder owned a number of ADSs equal to the Conversion Rate in effect on the Record Date for the ADSs for the distribution.

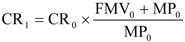

With respect to an adjustment pursuant to this Section 3.4(d) where there has been a payment of a dividend or other distribution on the Shares (directly or in the form of ADSs) of shares of Capital Stock of any class or series, or similar equity interest, of or relating to a Subsidiary or other business unit of the Issuer, that are, or, when issued, will be, listed or admitted for trading on a U.S. national securities exchange (a “Spin-Off”), the Conversion Rate shall be increased based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to the end of the Valuation Period; | ||||

| CR1 | = | the Conversion Rate in effect immediately after the end of the Valuation Period; | ||||

| FMV0 | = | the average of the Last Reported Sale Prices of the Capital Stock or similar equity interest distributed to holders of the Shares (directly or in the form of ADSs) applicable to one Share (determined by reference to the definition of Last Reported Sale Price as set forth in Article 1 as if references therein to the ADSs were to such Capital Stock or similar equity interest) over the first 10 consecutive Trading Day period after, and including, the Ex-Dividend Date of the Spin-Off (the “Valuation Period”); and | ||||

| MP0 | = | the average of the Last Reported Sale Prices of the ADSs (divided by the number of Shares then represented by one ADS) over the Valuation Period. | ||||

12

The adjustment to the Conversion Rate under the preceding paragraph shall occur on the last Trading Day of the Valuation Period; provided that in respect of any conversion during the Valuation Period, references in the portion of this Section 3.4(d) related to Spin-Offs to 10 Trading Days shall be deemed to be replaced with such lesser number of Trading Days as have elapsed from, and including, the Ex-Dividend Date of such Spin-Off to, and including, the Conversion Date in determining the Conversion Rate.

For purposes of this Section 3.4(d), rights, options or warrants distributed by the Issuer to all holders of the Shares (directly or in the form of ADSs) entitling them to subscribe for or purchase shares of the Issuer’s Capital Stock, including Shares (either initially or under certain circumstances), which rights, options or warrants, until the occurrence of a specified event or events (“Trigger Event”): (i) are deemed to be transferred with such Shares (directly or in the form of ADSs); (ii) are not exercisable; and (iii) are also issued in respect of future issuances of the Shares (directly or in the form of ADSs), shall be deemed not to have been distributed for purposes of this Section 3.4(d) (and no adjustment to the Conversion Rate under this Section 3.4(d) will be required) until the occurrence of the earliest Trigger Event, whereupon such rights, options or warrants shall be deemed to have been distributed and an appropriate adjustment (if any is required) to the Conversion Rate shall be made under this Section 3.4(d). If any such right, option or warrant, including any such existing rights, options or warrants distributed prior to the date of this Agreement, are subject to events, upon the occurrence of which such rights, options or warrants become exercisable to purchase different securities, evidences of indebtedness or other assets, then the date of the occurrence of any and each such event shall be deemed to be the date of distribution and Record Date with respect to new rights, options or warrants with such rights (in which case the existing rights, options or warrants shall be deemed to terminate and expire on such date without exercise by any of the holders thereof). In addition, in the event of any distribution (or deemed distribution) of rights, options or warrants, or any Trigger Event or other event (of the type described in the immediately preceding sentence) with respect thereto that was counted for purposes of calculating a distribution amount for which an adjustment to the Conversion Rate under this Section 3.4(d) was made, (1) in the case of any such rights, options or warrants that shall all have been redeemed or purchased without exercise by any holders thereof, upon such final redemption or purchase (x) the Conversion Rate shall be readjusted as if such rights, options or warrants had not been issued and (y) the Conversion Rate shall then again be readjusted to give effect to such distribution, deemed distribution or Trigger Event, as the case may be, as though it were a cash distribution, equal to the per Share redemption or purchase price received by a holder or holders of Shares (directly or in the form of ADSs) with respect to such rights, options or warrants (assuming such holder had retained such rights, options or warrants), made to all holders of Shares (directly or in the form of ADSs) as of the date of such redemption or purchase, and (2) in the case of such rights, options or warrants that shall have expired or been terminated without exercise by any holders thereof, the Conversion Rate shall be readjusted as if such rights, options and warrants had not been issued.

13

For purposes of Section 3.4(b), Section 3.4(c) and this Section 3.4(d), any dividend or distribution to which this Section 3.4(d) is applicable that also includes one or both of:

(A) a dividend or distribution of Shares (directly or in the form of ADSs) to which Section 3.4(b) is applicable (the “Clause A Distribution”); or

(B) a dividend or distribution of rights, options or warrants to which Section 3.4(c) is applicable (the “Clause B Distribution”),

then (1) such dividend or distribution, other than the Clause A Distribution and the Clause B Distribution, shall be deemed to be a dividend or distribution to which this Section 3.4(d) is applicable (the “Clause C Distribution”) and any Conversion Rate adjustment required by this Section 3.4(d) with respect to such Clause C Distribution shall then be made, and (2) the Clause A Distribution and Clause B Distribution shall be deemed to immediately follow the Clause C Distribution and any Conversion Rate adjustment required by Section 3.4(b) and Section 3.4(c) with respect thereto shall then be made, except that, if determined by the Issuer (I) the “Record Date” of the Clause A Distribution and the Clause B Distribution shall be deemed to be the Record Date of the Clause C Distribution and (II) any Shares (directly or in the form of ADSs) included in the Clause A Distribution or Clause B Distribution shall be deemed not to be “outstanding immediately prior to the close of business on such Record Date or immediately after the open of business on such effective date, as applicable” within the meaning of Section 3.4(b) or “outstanding immediately prior to the close of business on such Record Date” within the meaning of Section 3.4(c).

(e) If any cash dividend or distribution is made to all or substantially all holders of the Shares (directly or in the form of ADSs), the Conversion Rate shall be adjusted based on the following formula:

where,

| CR0 = | the Conversion Rate in effect immediately prior to the close of business on the Record Date for the ADSs for such dividend or distribution; | |||

| CR1 | the Conversion Rate in effect immediately after the close of business on such Record Date; | |||

| SP0 | the Last Reported Sale Price of the ADSs (divided by the number of Shares then represented by one ADS) on the Trading Day immediately preceding the Ex-Dividend Date for such dividend or distribution; and | |||

| C | the amount in cash per Share the Issuer distributes to all or substantially all holders of the Ordinary Shares (directly or in the form of ADSs). | |||

14

Any increase pursuant to this Section 3.4(e) shall become effective immediately after the close of business on the Record Date for the ADSs for such dividend or distribution. If such dividend or distribution is not so paid, the Conversion Rate shall be decreased, effective as of the date the Issuer’s Board of Directors thereof determines not to make or pay such dividend or distribution, to be the Conversion Rate that would then be in effect if such dividend or distribution had not been declared. Notwithstanding the foregoing, if “C” (as defined above) is equal to or greater than “SP0” (as defined above), in lieu of the foregoing increase, the holder of the Convertible Note shall receive, for each US$1,000 Note Amount, at the same time and upon the same terms as holders of the ADSs, the amount of cash that such holder of the Convertible Note would have received if such holder of the Convertible Note owned a number of ADSs equal to the Conversion Rate on the Record Date for the ADSs for such cash dividend or distribution.

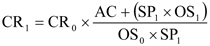

(f) If the Issuer or any of its Subsidiaries make a payment in respect of a tender or exchange offer for the Shares (directly or in the form of ADSs), to the extent that the cash and value of any other consideration included in the payment per Share exceeds the Last Reported Sale Price of the ADSs (divided by the number of Shares then represented by one ADS) on the Trading Day next succeeding the date such tender or exchange offer expires, the Conversion Rate shall be increased based on the following formula:

where,

| CR0 = | the Conversion Rate in effect immediately prior to the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; | |||

| CR1 = | the Conversion Rate in effect immediately after the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; | |||

| AC = | the aggregate value of all cash and any other consideration (as determined by the Issuer’s Board of Directors) paid or payable for Shares or ADSs, as the case may be, purchased in such tender or exchange offer; | |||

| OS0 = | the number of Shares outstanding immediately prior to the date such tender or exchange offer expires (prior to giving effect to the purchase of all Shares or ADSs, as the case may be, accepted for purchase or exchange in such tender or exchange offer); | |||

| OS1 = | the number of Shares outstanding immediately after the date such tender or exchange offer expires (after giving effect to the purchase of all Shares or ADSs, as the case may be, accepted for purchase or exchange in such tender or exchange offer); and | |||

| SP1 = | the average of the Last Reported Sale Prices of the ADSs (divided by the number of Shares then represented by one ADS) over the 10 consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires. | |||

15

The adjustment to the Conversion Rate under this Section 3.4(f) shall occur at the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; provided that in respect of any conversion within the 10 Trading Days immediately following, and including, the expiration date of any tender or exchange offer, references in this Section 3.4(f) with respect to 10 Trading Days shall be deemed replaced with such lesser number of Trading Days as have elapsed from, and including, the Trading Day next succeeding the expiration date of such tender or exchange offer to, and including, the Conversion Date in determining the Conversion Rate. No adjustment to the Conversion Rate under this Section 3.4(f) shall be made if such adjustment would result in a decrease in the Conversion Rate. In the event that the Issuer or one of the Issuer’s Subsidiaries is obligated to purchase Shares (directly or in the form of ADSs) pursuant to any such tender offer or exchange offer, but the Issuer or such Subsidiary is permanently prevented by applicable law from effecting any such purchases, or all such purchases are rescinded, then the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such tender offer or exchange offer had not been made.

16

(g) In addition to those adjustments required pursuant to clauses (b), (c), (d), (e) and (f) of this Section 3.4, and to the extent permitted by applicable law and subject to the applicable rules of The New York Stock Exchange and any other securities exchange on which any of the Issuer’s securities are then listed, the Issuer from time to time may increase the Conversion Rate by any amount for a period of at least 20 Business Days if the Issuer’s Board of Directors determines by a unanimous vote that such increase would be in the Issuer’s best interest, and the Issuer may (but is not required to) by unanimous decision of the Board of Directors increase the Conversion Rate to avoid or diminish any income tax to holders of the Shares or the ADSs or rights to purchase Shares or ADSs in connection with a dividend or distribution of Shares or ADSs (or rights to acquire Shares or ADSs) or similar event.

(h) All calculations and other determinations under this Section 3.4 shall be made by the Issuer in good faith and shall be made to the nearest one-ten thousandth (1/10,000) of an ADS.

(i) For purposes of this Section 3.4, the number of Shares at any time outstanding shall not include Shares held in the treasury of the Issuer (directly or in the form of ADSs) so long as the Issuer does not pay any dividend or make any distribution on Shares held in the treasury of the Issuer (directly or in the form of ADSs), but shall include Shares issuable in respect of scrip certificates issued in lieu of fractions of Shares.

(j) For purposes of this Section 3.4, the “effective date” means the first date on which the ADSs trade on the applicable exchange or in the applicable market, regular way, reflecting the relevant share split or share combination, as applicable.

| 4. | TERMS OF THE CONVERTIBLE NOTE. |

4.1 Maturity. The Convertible Note shall be due and payable on the last day following 42 months from the date of issuance show on the Convertible Note (the “Payment Date”) if the Convertible Note is not converted in full on the Payment Date in accordance with Section 3.1 hereof.

4.2 Interest. The Convertible Note shall bear interest at 2.5 percent per annum, payable by the Issuer in cash semi-annually in arrears.

4.3 Ranking. The Convertible Notes shall at all times rank pari passu with all existing and future unsubordinated and unsecured obligations of the Issuer.

4.4 Note. The Issuer’s obligation to repay the Convertible Note shall be evidenced by a promissory note issued by the Issuer substantially in the form of Exhibit A hereto.

4.5 Transferability. Subject to the applicable law the Investor shall have the right to effect the public sale or distribution of any Shares acquired pursuant to this Agreement or the Convertible Note.

| 5. | REPRESENTATIONS AND WARRANTIES OF THE ISSUER. |

As of the date hereof, the Issuer hereby represents and warrants to the Investor that:

5.1 Status. The Issuer is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation.

17

5.2 Power and Authority. The Issuer has the requisite power and authority to execute and deliver each of the Transaction Documents to which it is a party and to perform its obligations thereunder.

5.3 Enforceability. All action on the part of the Issuer necessary for the authorization, execution and delivery of each of the Transaction Documents to which it is a party, the performance of all obligations by it under each of the Transaction Documents to which it is a party and the consummation of the Contemplated Transactions has been taken or, to the extent expressly specified in any Transaction Document, will be taken prior to or at the Closing. This Agreement and each of the Transaction Documents to which the Issuer is a party has been or will be duly executed and delivered by it, and constitutes or will constitute legal, valid and binding obligations of it, enforceable in accordance with their respective terms, except that enforcement hereof and thereof may be limited by: (a) bankruptcy, insolvency, fraudulent transfer, reorganization and moratorium laws and by other similar laws of general applicability relating to or affecting the rights of creditors; or (b) laws relating to the availability of specific performance, injunctive relief or other equitable remedies or general equity principles.

5.4 No Conflicts, Etc. The execution, delivery and performance by the Issuer of this Agreement and each of the Transaction Documents to which it is a party, and the consummation of the Contemplated Transactions by it, do not and will not: (a) conflict with, contravene, or result in a violation or breach of or default (with or without the giving of notice or the lapse of time or both) under, or (b) result in the creation of any Lien (or any obligation to create any Lien) upon any of the properties or assets of the Issuer under, in each case, (i) any Law applicable to the Issuer or any of its properties or assets, (ii) any provision of any of the organizational documents of the Issuer, or (iii) any contract, agreement or other instrument to which the Issuer is a party or by which its properties or assets may be bound.

5.5 Any representation and warranties of the Issuer stated in the Investors Rights Agreement shall be included as the representation and warranties of the Issuer to the Investor in this Agreement.

| 6. | REPRESENTATIONS AND WARRANTIES OF THE INVESTOR. |

The Investor hereby represents and warrants to the Issuer that:

6.1 Status. The Investor is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation.

6.2 Power and Authority. The Investor has the requisite power and authority to execute and deliver each of the Transaction Documents to which it is a party and to perform its obligations thereunder.

18

6.3 Enforceability. All action on the part of the Investor necessary for the authorization, execution and delivery of each of the Transaction Documents to which it is a party, the performance of all obligations by it under each of the Transaction Documents to which it is a party and the consummation of the Contemplated Transactions has been taken or, to the extent expressly specified in this Agreement or any Transaction Document, will be taken prior to or at the Closing. This Agreement and each of the Transaction Documents to which the Investor is a party has been or will be duly executed and delivered by it, and constitutes or will constitute legal, valid and binding obligations of it, enforceable in accordance with their respective terms, except that enforcement hereof and thereof may be limited by: (a) bankruptcy, insolvency, fraudulent transfer, reorganization and moratorium laws and by other similar laws of general applicability relating to or affecting the rights of creditors; or (b) laws relating to the availability of specific performance, injunctive relief or other equitable remedies or general equity principles.

6.4 No Conflicts, Etc. The execution, delivery and performance by the Investor of this Agreement and each of the Transaction Documents to which it is a party, and the consummation of the Contemplated Transactions by it, do not and will not: (a) conflict with, contravene, or result in a violation or breach of or default (with or without the giving of notice or the lapse of time or both) under, or (b) result in the creation of any Lien (or any obligation to create any Lien) upon any of the properties or assets of such Investor under, in each case, (i) any Law applicable to the Investor or any of its properties or assets, (ii) any provision of any of the organizational documents of the Investor, or (iii) any contract, agreement or other instrument to which the Investor is a party or by which its properties or assets may be bound.

6.5 Conversion for Their Own Account. Any Shares received by the Investor will be acquired for investment purposes for the Investor’s own account or the account of one or more of the Investor’s Affiliates, not as a nominee or agent, with the present intention of holding such shares for purposes of investment and not with a current view to the resale or distribution of any part thereof, and the Investor does not have any present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, the Investor further represents that it has not been organized for the purpose of acquiring the Shares, and it does not have any Contract with any Person to, directly or indirectly, sell, transfer or grant participations, with respect to any of the Shares, and has not solicited any Person for such purpose.

6.6 Non-US Resident. The Investor represents that (A) it is domiciled and has its principal place of business outside the U.S., (B) it is not a “U.S. person” as defined under Rule 902 of Regulation S and is not acquiring the Securities for the account or benefit of any U.S. person, (C) at the time of offering to the Investor and communication of the Investor’s decision to purchase the Shares and the Convertible Note and at the time of the Investor’s execution of this Agreement, the Investor was located outside the U.S., and (D) at the time of the Closing the Investor, or persons acting on the Investor’s behalf in connection therewith, will be located outside the U.S. The Investor has been advised and acknowledges that: (A) the Shares and the Convertible Note issued pursuant to this Agreement have not been, and when issued, will not be registered under the Securities Act or the securities laws of any state of the U.S., and (B) in issuing and selling the Shares or the Convertible Note to the Investor pursuant hereto, the Issuer is relying upon the exemption from registration provided by Regulation S of the Securities Act. The Investor is not a “distributor” (as defined in Regulation S) or a “dealer” (as defined in the 1933 Act).

19

| 7. | CONDITIONS TO THE OBLIGATIONS OF THE PARTIES AT THE CLOSING. |

7.1 Conditions to the Obligations of the Investor. The obligations of the Investor at the Closing under Section 2.2 hereof are subject to the fulfillment on or before the Closing of the following conditions (unless duly otherwise waived in writing by the Investor):

(a) The Issuer and each of the other parties thereto shall have duly executed and delivered an investors rights agreement, in form and substance acceptable to the Investor (the “Investors Rights Agreement”);

(b) The Investor and each of the other parties thereto shall have duly executed and delivered an loan agreement, in form and substance acceptable to the Investor (the “Loan Agreement”);

(c) The Investor and each of the other parties thereto shall have been duly executed and delivered an share pledge agreement, in form and substance acceptable to the Investor (the “Share Pledge Agreement”);

(d) Third party consent that approval the transaction stipulated in this Agreement and the Investors Rights Agreement and in form and substance acceptable to the Investor;

(e) The Investor and GLAM II shall have been duly executed and delivered an share purchase agreement, in form and substance acceptable to the Investor (the “GLAM II Share Purchase Agreement”);

7.2 Conditions to the Obligations of the Issuer. The obligations of the Issuer at the Closing under Section 2.2 hereof are subject to the fulfillment on or before the Closing of each of the following conditions (unless duly otherwise waived in writing by the Issuer):

(a) The Investor shall have duly executed and delivered the Investors Rights Agreement;

(b) The Investor shall have duly executed and delivered the Loan Agreement;

(c) The Issuer shall have duly executed and delivered the Employment Agreements; and

(d) The Restructuring Deed shall have been duly terminated by the parties thereto in accordance with its terms.

20

| 8. | CONFIDENTIALITY. |

8.1 Disclosure of Terms. Subject to applicable Laws, the terms and conditions of this Agreement and the other Transaction Documents, as well as all other non-public information provided by one Party to another Party hereunder (collectively, the “Confidential Information”), including its or their existence, shall be considered confidential information and shall not be disclosed by the Party receiving such information from another Party, except as permitted in accordance with the provisions set forth below in this Section 8.

8.2 Permitted Disclosures by the Parties. Notwithstanding the foregoing, each Party may disclose the existence of the investment and the identity of the other Party, but solely to its current employees, investment bankers, lenders, accountants and attorneys, in each case, only where such Persons are under appropriate non-disclosure obligations substantially similar to those set forth in this Section 8.

8.3 Legally Required Disclosure. In the event that any Party is requested by any Governmental Authority or becomes legally required (including without limitation, pursuant to securities laws and regulations) to disclose, under applicable Laws, any Confidential Information in contravention of the provisions of this Section 8, such Party (the “Disclosing Party”) shall provide the other Parties hereto with prompt written notice of that fact and shall consult with the other Parties hereto regarding such disclosure.

8.4 Press Releases, Etc. Except as permitted by this Section 8, no press release or public announcements regarding the Investor’s investment in the Issuer as contemplated in this Agreement may be made by either Party in any press conference, professional or trade publication, marketing materials or otherwise to the general public without the prior written consent of the other Party.

8.5 Notices. All notices required under this Section 8 shall be made pursuant to Section 10.6 hereof.

| 9. | TERMINATION. |

9.1 Termination. Notwithstanding anything in this Agreement to the contrary and without prejudice to the termination provisions set out in each of the other Transaction Documents, this Agreement and the transactions contemplated hereby may, by written notice given at any time prior to the Closing, be terminated:

(a) by the Investor and the Issuer, upon their mutual written agreement;

(b) by the Investor or the Issuer pursuant to Section 2.3 hereof;

21

(c) by the Investor, if a material breach of any provision of this Agreement has been committed by the Issuer and such breach cannot be cured by the Long-Stop Date;

(d) by the Issuer, if a material breach of any provision of this Agreement has been committed by the Investor and such breach cannot be cured by the Long-Stop Date; or

(e) by either the Investor or the Issuer, if any Governmental Authority shall have issued, enacted, entered, promulgated or enforced any judgment, order, injunction, rule or decree, or taken any other action restraining, enjoining or otherwise prohibiting the consummation of any material transactions contemplated herein and such judgment, order, injunction, rule or decree or other action shall have become final and non-appealable; provided, however, that the right to terminate this Agreement pursuant to this Section 9.1(e) shall not be available to any Party that has failed to fully comply with its obligations hereunder in any manner that shall have proximately contributed to the occurrence of such judgment, order, injunction, rule or decree or other action.

9.2 Effect of Termination. In the event of the termination of this Agreement pursuant to Section 9.1 hereof, this Agreement (other than Section 8 (Confidentiality), this Section 9, Section 10.3 (Governing Law), Section 10.6 (Notices), and Section 10.10 (Dispute Resolution) hereof, which shall remain in full force and effect) shall forthwith become null and void and no Party (or any of their respective representatives or shareholders) shall have any Liability to any other Party hereto, except as provided in this Section 9.2.

| 10. | MISCELLANEOUS. |

10.1 Survival. Representations, warranties and covenants of Issuer and the Investor contained in or made pursuant to this Agreement shall survive 2 years after the Closing Date.

10.2 Successors and Assigns. Except as otherwise provided herein, the terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the Parties hereto whose rights or obligations hereunder are affected by such terms and conditions. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the Parties hereto or their respective permitted successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

10.3 Governing Law. This Agreement shall be interpreted, construed and governed by and in accordance with the Laws of New York without regard to any conflicts of law principles thereof.

10.4 Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts transmitted by facsimile or electronic mail shall be deemed to be originals.

22

10.5 Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

10.6 Notices. Any notice required or permitted pursuant to this Agreement shall be given in writing and shall be given either personally or by sending it by next-day or second-day courier service, fax, electronic mail or similar means to the address as set forth on the signature pages herein (or at such other address as such Party may designate by 15 days’ advance written notice to the other Party to this Agreement given in accordance with this Section). Where a notice is sent by next-day or second-day courier service, service of the notice shall be deemed to be effected by properly addressing, prepaying and sending by next-day or second-day service through an internationally recognized courier a letter containing the notice, with a confirmation of delivery, and to have been effected at the expiration of two days after the letter containing the same is sent as aforesaid. Where a notice is sent by fax or electronic mail, service of the notice shall be deemed to be effected by properly addressing, and sending such notice through a transmitting organization, with a written confirmation of delivery, and to have been effected on the day the same is sent as aforesaid.

10.7 Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively), only with the duly authorized written consent of each Party. Any amendment or waiver effected in accordance with this Section 10.7 shall be binding on all Parties, including all their permitted assigns and transferees.

10.8 Severability. The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof. If any provision of this Agreement, or the application thereof to any Person or any circumstance, is invalid or unenforceable: (a) a suitable and equitable provision shall be substituted therefor in order to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid or unenforceable provision; and (b) the remainder of this Agreement and the application of such provision to other Persons or circumstances shall not be affected by such invalidity or unenforceability, nor shall such invalidity or unenforceability affect the validity or enforceability of such provision, or the application thereof, in any other jurisdiction.

10.9 Entire Agreement. This Agreement and the other Transaction Documents, together with all schedules and exhibits hereto and thereto, constitute the entire agreement among the Parties hereto with respect to the subject matters hereof and no Party shall be liable or bound to any other Party in any manner by any warranties, representations, or covenants except as specifically set forth herein or therein; provided, however, that nothing in this Agreement or any Transaction Document shall be deemed to terminate or supersede the provisions of any confidentiality and non-disclosure agreements executed by the Parties hereto prior to the date of this Agreement, all of which agreements shall continue in full force and effect until terminated in accordance with their respective terms.

23

10.10 Dispute Resolution. The parties hereto irrevocably submit to the exclusive jurisdiction of any state or federal court sitting in the County of New York, in the State of New York over any dispute, controversy or claim arising out of or relating to this Agreement or the affairs of the Issuer.

10.11 Waiver of Jury Trial. EACH OF THE PARTIES HERETO HEREBY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT. EACH OF THE PARTIES HERETO HEREBY (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT, AS APPLICABLE, BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 10.11.

[Signature pages follow]

24

| IFM INVESTMENTS LIMITED | ||

| By: | /s/ Xxxxxx Xxxxx | |

| Name: | Xxxxxx Xxxxx | |

| Title: | Chairman & CEO | |

| [Address and Contact Details] | ||

| SOUFUN HOLDINGS LIMITED | ||

| By: | /s/ Xxxxxxx Tianquan Mo | |

| Name: | Xxxxxxx Tianquan Mo | |

| Title: | Chairman | |

| [Address and Contact Details] | ||

25

EXHIBIT A

FORM OF CONVERTIBLE NOTE

CONVERTIBLE NOTE

IFM Investments Limited

(An exempt company with limited liability incorporated in the Cayman Islands)

No.1

| US$30,000,000 | [ ], 2014 |

FOR VALUE RECEIVED, IFM Investments Limited, an exempt company incorporated and existing under the laws of the Cayman Islands (the “Issuer”), promises to pay to the order of Soufun Holdings Limited (the “Investor”) the principal sum of Thirty million United States dollars (US$30,000,000) (the “Principal Amount”), together with any interests accrued thereon in accordance with the terms of the SPA.

1. Securities Purchase Agreement. This Note is issued under a Securities Purchase Agreement (the “SPA”) dated October 7, 2014, by and between Issuer and the Investor, and is subject to all terms and conditions set forth in the SPA. The Investor is referred to the SPA for a statement of those terms and conditions. Capitalized terms used herein and not otherwise defined herein shall have the meaning ascribed to them in the SPA.

2. Conversion. Subject to, and in accordance with the terms of the SPA, at the option of the Investor, this Note is convertible into class A ordinary shares (the “Shares”) of the Issuer in accordance with Article 3 of the SPA.

3. Maturity. Any outstanding amount of the Principal Amount under this Note shall be due and payable on the Payment Date in accordance with the SPA, if this Note is not converted in full into the Shares of the Issuer in accordance with the SPA on the Payment Date.

4. Interest. Interest shall be payable by the Issuer in respect of the Principal Amount of this Note in accordance with Section 4.2 of the SPA.

5. Payments. All payments of the Principal Amount (except any amount that is converted or repaid in accordance with the SPA) shall be made in United States Dollars to the Investor, at the address specified on the SPA, or at such other address as may be specified from time to time by the Investor in a written notice delivered to the Issuer.

6. Lost, Stolen, Destroyed or Mutilated Note. In case this Note shall be mutilated, lost, stolen or destroyed, the Issuer shall issue a new Note of like date, tenor and denomination and deliver the same in exchange and substitution for and upon surrender and cancellation of any mutilated Note, or in lieu of any Note lost, stolen or destroyed, upon receipt of evidence satisfactory to Issuer of the loss, theft or destruction of such Note.

26

7. Amendment and Cancellation. This Note may be discharged, terminated, amended, supplemented or otherwise modified only in accordance with Section 10.7 of the SPA.

8. No Waiver. No failure, delay, omission or otherwise by the Investor hereof to insist upon the strict performance of any term hereof or to exercise any right, power or remedy consequent upon a breach hereof shall constitute a waiver of any such term or of any such breach. No waiver of any breach shall affect or alter this Note, which shall continue in full force and effect, or shall affect or alter the rights of the Investor with respect to any other then existing or subsequent breach. The remedies herein are cumulative and are not exclusive of any remedies provided by law. The acceptance by the Investor of any payment hereunder that is less than payment in full of all amounts due at the time of such payment shall not without the express written consent of the Investor: (i) constitute a waiver of the right to exercise any of Investor’s remedies at that time or at any subsequent time, (ii) constitute an accord and satisfaction, or (iii) nullify any prior exercise of any remedy.

9. Successors and Assigns; Transferability. This Note inures to the benefit of the Investor and binds the Issuer and its respective successors and assigns. This Note is not assignable by the Investor.

10. Governing Law; Dispute Resolution. This Note shall be governed by and construed in accordance with the laws of New York without regard to the conflicts of law principles thereof. All disputes and controversies arising out of or in connection with this Note shall be resolved pursuant to Article 10.10 (Dispute Resolution) of the SPA.

11. Notices. Except as may be otherwise provided herein, all notices, requests, waivers and other communications made to the Issuer pursuant to this Note shall be made in accordance with Article 10.6 (Notices) of the SPA.

12. Severability. If one or more provisions of this Note are held to be unenforceable under applicable law, such provision shall be excluded from this Note and the balance of the Note shall be interpreted as if such provision were so excluded and shall be enforceable in accordance with its terms.

13. No Partnership. Nothing contained in this Note or elsewhere shall be deemed or construed as creating a partnership or joint venture between the Investor and the Issuer or between the Investor and any other person. “Person” shall mean an individual, a partnership, a corporation, a limited liability company, an association, a joint stock company, a trust, a joint venture, an unincorporated organization and a governmental entity or any department, agency or political subdivision thereof.

[Signature page follows.]

27

IN WITNESS WHEREOF, the Issuer has caused this Note to be duly executed by its officer, thereunto duly authorized as of the date first above written.

| IFM INVESTMENTS LIMITED | ||

| By: | ||

| Name: | ||

| Title: | ||