PSA Agreement (Severance Plan Participants) Rev. January 2021 2 2. Grant of Performance Share Award. Subject to the terms of this Agreement, the Plan and the LTIP, the Company hereby grants the Participant a Performance Share Award (the “Award”) for...

Exhibit 10.1

| Exhibit 10.1 PSA Agreement (Severance Plan Participants) Rev. January 2021 Performance Share Award No. ____ ATLANTIC CAPITAL BANCSHARES, INC. 2015 STOCK INCENTIVE PLAN (As Amended and Restated Effective May 18, 2017) Performance Share Award Agreement (Employees) Name of Participant: _____________ Grant Date: _____________ Threshold Number of Shares Subject to Award: As set forth on Schedule A Target Number Subject to Award: As set forth on Schedule A Maximum Number of Shares Subject to Award: As set forth on Schedule A Performance Metrics: As set forth on Schedule A Performance Period: As set forth on Schedule A THIS AGREEMENT (together with Schedules A and B attached hereto, this “Agreement”) is made effective as of the __ day of ________, ______, (the “Grant Date”) between Atlantic Capital Bancshares, Inc., a Georgia corporation (the “Company”), and _______________, an Employee of the Company or an Affiliate (the “Participant”). R E C I T A L S: In furtherance of (i) the purposes of the Atlantic Capital Bancshares, Inc. 2015 Stock Incentive Plan, as amended and/or restated (the “Plan”), and (ii) the Atlantic Capital Bancshares, Inc. Executive Officer Long-Term Incentive Plan, as amended and/or restated (the “LTIP”), and in consideration of the services of the Participant and such other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the Participant hereby agree as follows: 1. Incorporation of Plan and LTIP. The rights and duties of the Company and the Participant under this Agreement shall in all respects be subject to and governed by the provisions of the Plan and the LTIP, copies of which are delivered herewith or have been previously provided to the Participant and the terms of which are incorporated herein by reference. In the event of any conflict between the provisions in this Agreement and those of the Plan or the LTIP, the provisions of the Plan or the LTIP, as the case shall be, shall govern, unless the Administrator determines otherwise. In addition, in the event of any conflict between the provisions in the Plan and the LTIP, the provisions of the Plan shall govern, unless the Administrator determines otherwise. Unless otherwise defined herein, capitalized terms in this Agreement shall have the same definitions as set forth in the Plan. |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 2 2. Grant of Performance Share Award. Subject to the terms of this Agreement, the Plan and the LTIP, the Company hereby grants the Participant a Performance Share Award (the “Award”) for up to the maximum number of shares of Common Stock (the “Shares”) as is set forth above and in Schedule A. The Award represents a Bonus opportunity granted under the LTIP and shall be payable, if and to the extent earned, solely in shares issued under the Plan (or a successor plan). The Participant expressly acknowledges that the terms of Schedules A and B shall be incorporated herein by reference and shall constitute part of this Agreement. 3. No Rights as a Shareholder. The Participant shall not be deemed to be the holder of any of the Shares subject to the Award and shall not have any rights of a shareholder unless and until (and then only to the extent that) the Award has vested and certificates for such Shares have been issued and delivered to him or her (or, in the case of uncertificated shares, other written evidence of ownership in accordance with Applicable Law shall have been provided); provided, however, that if any cash or non-cash dividends are declared and paid by the Company with respect to any Shares subject to the Award (to the extent that the Award is not then vested), the Participant shall have dividend equivalent rights with respect to such Shares, but such dividend equivalent rights shall be subject to the same vesting schedule, forfeiture terms and other restrictions as are applicable to the underlying Shares. 4. Earning of Award. (a) Subject to the terms of the Plan and this Agreement, including but not limited to Section 5 and Section 13 herein, the Award shall be deemed earned, and the Shares subject to the Award shall be distributable as provided in Section 6 herein, upon such date or dates, and subject to such conditions, as are described in this Agreement, including but not limited to Schedule A. To be entitled to distribution of Shares or other payment hereunder (if any) upon vesting and earning of the Award, the Participant must be employed by the Company on the last day of the Performance Period. The Participant expressly acknowledges that the Award shall be deemed earned only upon such terms and conditions as are provided in this Agreement (including but not limited to Schedule A) and otherwise in accordance with the terms of the Plan. Notwithstanding anything to the contrary herein, the protective covenants contained in the Company’s Executive Severance and Change in Control Plan and related Participation Agreement (such plan and agreement collectively, the “Severance Plan”), a copy of which Severance Plan is attached hereto as Schedule B and incorporated herein by reference, shall remain in full force and effect according to their terms regardless of whether the Participant’s rights under this Agreement have vested and been earned or not or have been forfeited or not. (b) The Administrator has sole authority to determine whether and to what degree the Award has vested and been earned and is payable and to interpret the terms and conditions of this Agreement and the Plan. 5. Effect of Termination of Employment or Service. (a) Except as otherwise provided in this Section 5 or in Section 13 herein, if the employment or service of the Participant is terminated for any reason (whether by the Company or the Participant and whether voluntary or involuntary or with or without Cause) (such date of |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 3 termination of employment or service being referred to as the “Termination Date”) and all or any part of the Award has not been earned pursuant to the terms of the Plan and this Agreement, then the Award, to the extent not earned as of the Participant’s Termination Date, shall be forfeited immediately upon such termination, and the Participant shall have no further rights with respect to the Award or the Shares underlying that portion of the Award that has not yet been earned. The Participant expressly acknowledges and agrees that the termination of his or her employment or service shall (except as may otherwise be provided in this Agreement or in the Plan) result in forfeiture of the Award and the Shares to the extent that the Award has not been earned as of his or her Termination Date. (b) Notwithstanding the provisions of Section 5(a), and subject to the terms of Section 3(c) of the Plan, in the event of the Participant’s termination due to (i) death; (ii) Disability; (iii) Retirement; or (iv) Good Reason (as defined in the Severance Plan or, if the Participant is not a participant in the Severance Plan, as defined in Section 5(c) of this Agreement), a pro-rata portion of the Award shall be eligible to be earned based on attainment of the Performance Metrics for the Performance Period as specified in this Agreement, including Schedule A. The pro-rata portion that may be earned and vested shall be determined by multiplying the total number of Shares earned under Schedule A by a fraction, the numerator of which is the number of calendar days the Participant was employed during the Performance Period, and the denominator of which is the number of calendar days in the Performance Period; any such shares so earned shall be payable as provided in Section 6 herein. (c) To the extent applicable pursuant to Section 5(b) herein, “Good Reason” shall occur if during the Participant’s employment, the Participant’s employment is materially and adversely altered by the Company, without the Participant’s consent, by: (i) a material reduction in the Participant’s base salary; (ii) the assignment to the Participant of duties or responsibilities materially inconsistent with, or a material diminution in, the Participant’s position, authority, duties or responsibilities; or (iii) the relocation of the Participant’s principal place of employment by more than 30 miles from the location at which the Participant is stationed. An event or condition that would otherwise constitute “Good Reason” shall constitute Good Reason only if the Company fails to rescind or cure such event or condition within 30 days after receipt from the Participant of written notice of the event which constitutes Good Reason, and Good Reason shall cease to exist for any event or condition described herein on the 60th day following the later of the occurrence or the Participant’s knowledge thereof, unless the Participant has given the Company written notice thereof prior to such date. (d) In the event that the Participant’s employment or service is terminated due to Cause, the Award shall immediately be forfeited and the Participant shall have no right to any Shares or other benefits related to the Award. |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 4 (e) The Administrator shall have the sole discretion to determine the basis for the Participant’s termination of employment or service, including whether such termination is due to Disability, Retirement, Good Reason or Cause. 6. Settlement of Award. The Administrator shall have discretion to determine the extent, if any, to which the Award has been earned. The Award, if earned in accordance with the terms of this Agreement, shall be payable in whole shares of Common Stock. The total number of Shares that may be acquired upon earning of the Award (or portion thereof) shall be rounded down to the nearest whole share. A certificate or certificates for the Shares subject to the Award or portion thereof shall be issued in the name of the Participant or his or her beneficiary (or, in the case of uncertificated shares, other written evidence of ownership in accordance with Applicable Law shall be provided) within 70 days following the date the Award or portion thereof has been earned in accordance with the terms of this Agreement; provided that the following shall apply: (i) in the event the Award is earned following completion of the Performance Period as described in Section 4 and Schedule A, herein, the Shares shall be distributable no later than 70 days following the completion of the Performance Period; (ii) in the event the Award is earned pursuant to Section 5(b) herein, the Shares shall be distributable no later than 70 days following the completion of the Performance Period; and (iii) in the event that the Award is earned pursuant to Section 13 herein, the Shares shall be distributable no later than 70 days following the occurrence of the Change of Control (as defined for these purposes under Code Section 409A) in the case of payment pursuant to Section 13(a)(i) or Section 13(a)(ii) (if the payment event is a Change in Control) or within 70 days of the Participant’s Termination Date if the payment event pursuant to Section 13(a)(ii) is the Participant’s termination of employment or service. If the 70-day period described herein begins in one calendar year and ends in another, the Participant (or his beneficiary) shall not have the right to designate the calendar year of the distribution (except as otherwise provided below with respect to a delay in distribution if the Participant is a “specified employee”). Notwithstanding the foregoing, if the Participant is or may be a “specified employee” (as defined under Code Section 409A), and the distribution is considered deferred compensation under Code Section 409A, then such distribution if made due to separation from service shall be subject to delay as provided in Section 21 of the Plan (or any successor provision thereto). 7. No Right of Continued Employment or Service; Forfeiture of Award; No Right to Future Awards. Neither the Plan, this Agreement, the grant of the Award nor any other action related to the Plan shall confer upon the Participant any right to continue in the employ or service of the Company or an Affiliate or to interfere in any way with the right of the Company or an Affiliate to terminate the Participant’s employment or service at any time. Except as otherwise provided in the Plan or this Agreement or as may be determined by the Administrator, all rights of the Participant with respect to the unvested and unearned portion of the Award shall terminate upon termination of the Participant’s employment or service with the Company or an Affiliate. The Participant acknowledges and agrees that the Company has no obligation to advise the Participant of the expiration of the Award. The grant of the Award does not create any obligation to grant further awards. 8. Nontransferability of Award and Shares. The Award shall not be transferable (including by sale, assignment, pledge or hypothecation) other than transfers by will or the laws |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 5 of intestate succession, and the Participant or other recipient of the Award shall not sell, transfer, assign, pledge or otherwise encumber the Shares subject to the Award until the Performance Period has expired and all conditions to earning and vesting in the Award have been met. The designation of a beneficiary in accordance with the Plan does not constitute a transfer. 9. Superseding Agreement; Binding Effect. This Agreement supersedes any statements, representations or agreements of the Company with respect to the grant of the Award, and the Participant hereby waives any rights or claims related to any such statements, representations or agreements. This Agreement does not supersede or amend the Severance Plan or any existing confidentiality agreement, non-competition agreement, non-solicitation agreement, employment agreement, consulting agreement or any other similar agreement between the Participant and the Company, including but not limited to any restrictive covenants contained in such agreements, which shall remain in full force and effect and enforceable in accordance with their terms. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective executors, administrators, next-of-kin, successors and assigns. 10. Representations and Warranties of Participant. The Participant represents and warrants to the Company that: (a) Agrees to Terms of the Plan and Agreement. The Participant has received a copy of the Plan and the LTIP, has read and understands the terms of the Plan, the LTIP and this Agreement and agrees to be bound by their terms and conditions. (b) Tax Consequences. The Participant acknowledges that he or she is solely responsible and liable for the satisfaction of all taxes and penalties that may arise in connection with the Award (including but not limited to any taxes arising under Code Section 409A), and the Company shall not have any obligation to indemnify or otherwise hold the Participant harmless from any or all such taxes. The Participant further acknowledges that the Company has made no warranties or representations to the Participant with respect to the tax consequences (including but not limited to income tax consequences) related to the transactions contemplated by this Agreement, and the Participant is in no manner relying on the Company or its representatives for an assessment of such tax consequences. The Participant acknowledges that there may be adverse tax consequences upon acquisition or disposition of the Shares subject to the Award and that the Participant should consult a tax advisor prior to such acquisition or disposition. The Participant acknowledges that he or she has been advised that he or she should consult with his or her own attorney, accountant and/or tax advisor regarding the decision to enter into this Agreement and the consequences thereof. The Participant also acknowledges that the Company has no responsibility to take or refrain from taking any actions in order to achieve a certain tax result for the Participant. 11. Restrictions on Award and Shares. (a) Other Agreements. As a condition to the issuance and delivery of the Shares subject to the Award, or the grant of any benefit pursuant to the terms of the Plan, the Company may require the Participant or other person to become a party to this Agreement, any shareholders’ agreement, other agreement(s) restricting the transfer, purchase or repurchase of shares of Common Stock of the Company, voting agreement and/or employment agreements, consulting |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 6 agreements, non-competition agreements, confidentiality agreements, non-solicitation agreements or other agreements imposing such restrictions as may be required by the Company. In addition, without in any way limiting the effect of the foregoing, the Participant or other holder of the Shares shall be permitted to transfer such Shares only if such transfer is in accordance with the terms of the Plan, this Agreement, any shareholders’ agreement and any other applicable agreements. The acquisition of the Shares by the Participant or any other holder of the Shares shall be subject to, and conditioned upon, the agreement of the Participant or other holder of such Shares to the restrictions described in the Plan, this Agreement, any shareholders’ agreement and any other applicable agreements. (b) Compliance with Applicable Law. The Company may impose such restrictions on the Award, the Shares and any other benefits underlying the Award as it may deem advisable, including without limitation restrictions under the federal securities laws, the requirements of any stock exchange or similar organization and any blue sky, state or foreign securities laws or other laws applicable to such securities. Notwithstanding any other provision of the Plan or this Agreement to the contrary, the Company shall not be obligated to issue, deliver or transfer shares of Common Stock, make any other distribution of benefits or take any other action, unless such delivery, distribution or action is in compliance with Applicable Law (including but not limited to the requirements of the Securities Act). The Company is under no obligation to register the Shares with the Securities and Exchange Commission or to effect compliance with the exemption, registration, qualification or listing requirements of any state securities laws, stock exchange or similar organization, and the Company shall have no liability for any inability or failure to do so. The Company may cause a restrictive legend or legends to be placed on any certificate for Shares issued pursuant to the Award in such form as may be prescribed from time to time by Applicable Law or as may be advised by legal counsel. 12. Certain Changes in Status. The Participant acknowledges that the Administrator has the sole discretion to determine (taking into account any Code Section 409A considerations), at any time, the effect, if any, on the Award (including but not limited to modifying the vesting and/or earning of the Award) of any changes in the Participant’s status (other than termination) as an Employee, including but not limited to a change from full-time to part-time, or vice versa, or other similar changes in the nature or scope of the Participant’s employment or service. 13. Effect of Change of Control. (a) Subject to the terms of the Plan (and unless otherwise required pursuant to Code Section 409A), the following provisions shall apply in the event of a Change of Control: (i) To the extent that the successor or surviving company in the Change of Control event does not assume or substitute the Award (or in which the Company is the ultimate parent corporation and does not continue the Award) on substantially similar terms or with substantially equivalent economic benefits (as determined by the Administrator) as the Award outstanding immediately prior to the Change of Control event, the Award shall be deemed to be vested, earned and payable at target (as determined by the Administrator). |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 7 (ii) Further, in the event that the Award is substituted, assumed or continued as provided in Section 13(a) herein, the Award shall nonetheless be deemed to be vested, earned and payable at target (as determined by the Administrator), if the employment or service of the Participant is terminated within six months before (in which case vesting shall not occur until the effective date of the Change of Control) or one year (or such other period after a Change of Control as may be stated in a Participant’s employment, change of control, consulting or other similar agreement, if applicable) after the effective date of a Change of Control if such termination of employment or service (i) is by the Company not for Cause or (ii) is by the Participant for Good Reason. For clarification, for the purposes of this Section 13, the “Company” shall include any successor to the Company. (iii) Notwithstanding any other provision of the Plan to the contrary, in the event that the Participant has entered into an employment agreement as of the Effective Date of the Plan or is a participant in the Company’s Change in Control Plan or similar arrangement, the Participant shall be entitled to the greater of the benefits provided upon a change of control of the Company under the Plan or the respective employment agreement, Change in Control Plan or other arrangement, and such agreement, Change in Control Plan or other arrangement shall not be construed to reduce in any way the benefits otherwise provided to the Participant upon a Change of Control as defined in the Plan. (b) For the purposes herein, except as may be otherwise required, if at all, under Code Section 409A, a “Change of Control” shall be deemed to have occurred on the earliest of the following dates: (i) The date any entity or person shall have become the beneficial owner of, or shall have obtained voting control over, more than fifty percent (50%) of the total voting power of the Company’s then outstanding voting stock; (ii) The date of the consummation of (A) a merger, consolidation or reorganization of the Company (or similar transaction involving the Company), in which the holders of the Common Stock immediately prior to the transaction have voting control over less than fifty-one percent (51%) of the voting securities of the surviving corporation immediately after such transaction, or (B) the sale or disposition of all or substantially all the assets of the Company; or (iii) The date there shall have been a change in a majority of the Board of Directors of the Company within a 12-month period unless the nomination for election by the Company’s shareholders of each new Director was approved by the vote of two- thirds of the members of the Board (or a committee of the Board, if nominations are approved by a Board committee rather than the Board) then still in office who were in office at the beginning of the 12-month period. (For the purposes herein, the term “person” shall mean any individual, corporation, partnership, group, association or other person, as such term is defined in Section 13(d)(3) or Section 14(d)(2) of the Exchange Act, other than the Company, a |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 8 Subsidiary of the Company or any employee benefit plan(s) sponsored or maintained by the Company or any Subsidiary thereof, and the term “beneficial owner” shall have the meaning given the term in Rule 13d-3 under the Exchange Act.) For the purposes of clarity, (i) a transaction shall not constitute a Change of Control if its principal purpose is to change the state of the Company’s incorporation, create a holding company that would be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction or is another transaction of other similar effect; and (ii) in no event shall a firm commitment underwritten public offering of the Common Stock pursuant to an effective registration statement under the Securities Act constitute a Change of Control. Notwithstanding the preceding provisions of Section 13(b), in the event that the Award is deemed to be deferred compensation subject to (and not exempt from) the provisions of Code Section 409A, then distributions related to the Award to be made upon a Change of Control may be permitted, in the Administrator’s discretion, upon the occurrence of one or more of the following events (as they are defined and interpreted under Code Section 409A): (A) a change in the ownership of the Company; (B) a change in effective control of the Company; or (C) a change in the ownership of a substantial portion of the assets of the Company. 14. Governing Law. Except as otherwise provided in the Plan or herein, this Agreement shall be construed and enforced according to the laws of the State of Georgia, without regard to the conflict of laws provisions of any state, and in accordance with applicable federal laws of the United States. The Company and the Participant agree that any dispute arising from this Agreement shall be resolved only in a state or federal court sitting in Xxxxxx County, Georgia, which shall have exclusive jurisdiction over any such dispute. The Company and the Participant consent to the personal jurisdiction and waive any objection to jurisdiction or venue in any such court. 15. Amendment and Termination; Waiver. Subject to the terms of the Plan, this Agreement may be amended, altered, suspended and/or terminated at any time, prospectively or retroactively, by the Administrator; provided, however, that any such amendment, alteration, suspension or termination of the Award shall not, without the written consent of the Participant, materially adversely affect the rights of the Participant with respect to the Award. Notwithstanding the foregoing, the Administrator shall have unilateral authority to amend the Plan and this Agreement (without Participant consent) to the extent necessary to comply with Applicable Law or changes to Applicable Law (including but in no way limited to Code Section 409A and federal securities laws). The Administrator also shall have unilateral authority to make adjustments to the terms and conditions of the Award in recognition of unusual or nonrecurring events affecting the Company or any Affiliate, or the financial statements of the Company or any Affiliate, or of changes in Applicable Law, or accounting principles, if the Administrator determines that such adjustments are appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan or necessary or appropriate to comply with applicable accounting principles or Applicable Law. The waiver by the Company of a breach of |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 9 any provision of this Agreement by the Participant shall not operate or be construed as a waiver of any subsequent breach by the Participant. 16. Withholding. The Participant acknowledges that the Company shall require the Participant or other person to pay to the Company in cash the amount of any tax or other amount required by any governmental authority to be withheld and paid over by the Company to such authority for the account of the Participant, and the Participant agrees, as a condition to the grant of the Award and delivery of the Shares or any other benefit, to satisfy such obligations. Notwithstanding the foregoing, the Administrator may in its discretion establish procedures to permit the Participant to satisfy such obligation in whole or in part, and any local, state, federal, foreign or other income tax obligations relating to the Award, by electing (the “election”) to deliver to the Company shares of Common Stock held by the Participant (which are fully vested and not subject to any pledge or other security interest) and/or have the Company withhold shares of Common Stock from the Shares to which the Participant is otherwise entitled. The number of shares to be withheld shall have a Fair Market Value as of the date that the amount of tax to be withheld is determined as nearly equal as possible to, but not exceeding (unless otherwise permitted by the Administrator in a manner in accordance with Applicable Law and applicable accounting principles), the amount of such obligations being satisfied. Each election must be made in writing to the Administrator in accordance with election procedures established by the Administrator. 17. Administration. The authority to construe and interpret this Agreement and the Plan, and to administer all aspects of the Plan, shall be vested in the Administrator, and the Administrator shall have all powers with respect to this Agreement as are provided in the Plan. Any interpretation of this Agreement by the Administrator and any decision made by it with respect to this Agreement shall be final and binding. 18. Notices. Except as may be otherwise provided by the Plan or determined by the Administrator, any written notices provided for in this Agreement or the Plan shall be in writing and shall be deemed sufficiently given if either hand delivered or if sent by fax or overnight courier, or by postage paid first class mail. Notices sent by mail shall be deemed received three business days after mailed but in no event later than the date of actual receipt. Notices shall be directed, if to the Participant, at the Participant’s address indicated in the Company’s records, or if to the Company, at the Company’s principal office. 19. Severability. If any provision of this Agreement shall be held illegal or invalid for any reason, such illegality or invalidity shall not affect the remaining parts of this Agreement, and this Agreement shall be construed and enforced as if the illegal or invalid provision had not been included. To the extent any provision of this Agreement or a Prohibited Activity (as defined herein) is deemed to be unenforceable as written but could be made enforceable by way of modification or reformation, then it is the intent of the parties that such provision be modified or reformed to make it enforceable to the fullest extent permitted by law. 20. Right of Offset. Notwithstanding any other provision of the Plan or this Agreement, the Company may at any time (subject to any Code Section 409A considerations) reduce the amount of any payment or other benefit otherwise payable to or on behalf of the Participant by the |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 10 amount of any obligation of the Participant to or on behalf of the Company or an Affiliate that is or becomes due and payable, and, by entering into this Agreement, the Participant shall be deemed to have consented to such reduction. 21. Forfeiture of Award. (a) Notwithstanding any other provision of this Agreement, if, at any time during the employment or service of the Participant or during the 12-month period following termination of employment or service (regardless of whether such termination was by the Company or the Participant, and whether voluntary or involuntary or with or without Cause or Good Reason), the Participant engages in a Prohibited Activity (as defined herein), then the Award shall immediately be terminated (to the extent not otherwise already terminated) and all of Participant’s rights under this Agreement shall be forfeited in their entirety. (b) For the purposes herein, a “Prohibited Activity” shall mean the Participant’s violation of any of the Protective Covenants, as set forth in Section 7 of the Severance Plan or any successor provision thereto. (c) Notwithstanding the provisions of Section 21(a) herein, the waiver by the Company in any one or more instances of any rights afforded to the Company pursuant to the terms of Section 21(a) herein shall not be deemed to constitute a further or continuing waiver of any rights the Company may have pursuant to the terms of this Agreement or the Plan (including but not limited to the rights afforded the Company in Section 20 herein). 22. Compliance with Recoupment, Ownership and Other Policies or Agreements. As a condition to receiving this Award, the Participant agrees that he or she shall abide by all provisions of any equity retention policy, stock ownership guidelines, compensation recovery policy and/or other policies adopted by the Company, each as in effect from time to time and to the extent applicable to the Participant. In addition, the Participant shall be subject to such compensation recovery, recoupment, forfeiture or other similar provisions as may apply to him or her under Applicable Law. 23. Counterparts; Further Instruments. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. The parties hereto agree to execute such further instruments and to take such further action as may be reasonably necessary to carry out the purposes and intent of this Agreement. [Signature Page Follows] |

| Exhibit 10.1 PSA Agreement (Severance Plan Participants) Rev. January 2021 IN WITNESS WHEREOF, this Agreement has been executed in behalf of the Company and by the Participant effective as of the day and year first above written. ATLANTIC CAPITAL BANCSHARES, INC. PARTICIPANT By: By: Printed Name: Printed Name: Title: Attest: Secretary [Corporate Seal] |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 ATLANTIC CAPITAL BANCSHARES, INC. 2015 STOCK INCENTIVE PLAN Performance Share Award Agreement (Employees) SCHEDULE A Performance Period: Grant Date: Performance Metric(s): Target Number of Shares Subject to Award: Threshold Number of Shares Subject to Award: Maximum Number of Shares Subject to Award: 1. Earning of Award: (a) General. The Award is granted to the Participant on the Grant Date set forth above and represents a right to receive some or all of the Shares (as defined in the Agreement) underlying the Award subject to satisfaction of the Performance Metric(s) (as defined below) as described herein. The Participant may earn from ___% to ___% of the target number of Shares subject to the Award, depending upon performance. The Performance Metric(s) are weighted _________________. The Award may be earned, if at all, based on attainment of performance goals specified below for performance metric(s) (each, a “Performance Metric” and collectively, the “Performance Metrics”): __________________________. The Award shall not be deemed earned, and none of the Shares attributable to a Performance Metric shall be issued, unless the particular Performance Metric is attained at a minimum of the threshold level for such Performance Metric. If performance falls below the threshold level with regard to a Performance Metric, then no Shares shall be distributed with respect to that Performance Metric. The extent to which the Performance Metrics are met, and the number of Shares distributable, if any, shall be calculated with respect to each Performance Metric pursuant to the terms and conditions described in Section 2 below. All determinations made with respect to the Performance Metrics and the earning of the Award shall be made by the Administrator in its sole discretion, and the applicable Performance Metrics shall not be deemed achieved and the Award shall not be deemed earned unless and to the extent that the Administrator determines that the Award has been earned. (b) Administrator Discretion. Notwithstanding any other terms of the Agreement, including this Schedule A, (i) the Administrator has sole discretion to reduce or eliminate that portion of the Award that shall be deemed earned and related Shares issuable, notwithstanding the attainment of threshold, target or maximum performance levels for either or both Performance Metrics, if the Administrator determines that ______________________________, and (ii) the actual number of Shares earned may be reduced by the Administrator in its sole and absolute discretion based on such factors as the Administrator determines to be appropriate and advisable (however, it is the intention of the Administrator that it shall exercise such negative discretion only in extreme and unusual circumstances). |

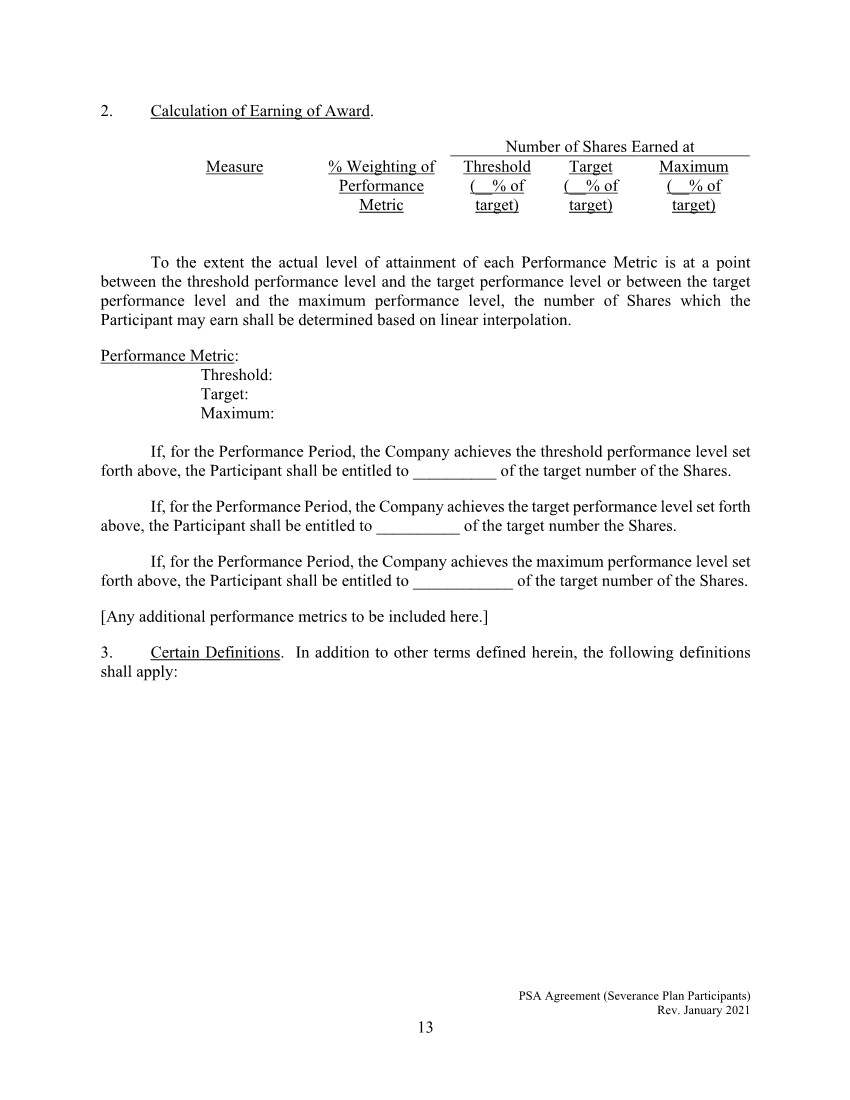

| PSA Agreement (Severance Plan Participants) Rev. January 2021 13 2. Calculation of Earning of Award. Number of Shares Earned at Measure % Weighting of Performance Metric Threshold (__% of target) Target (__% of target) Maximum (__% of target) To the extent the actual level of attainment of each Performance Metric is at a point between the threshold performance level and the target performance level or between the target performance level and the maximum performance level, the number of Shares which the Participant may earn shall be determined based on linear interpolation. Performance Metric: Threshold: Target: Maximum: If, for the Performance Period, the Company achieves the threshold performance level set forth above, the Participant shall be entitled to __________ of the target number of the Shares. If, for the Performance Period, the Company achieves the target performance level set forth above, the Participant shall be entitled to __________ of the target number the Shares. If, for the Performance Period, the Company achieves the maximum performance level set forth above, the Participant shall be entitled to ____________ of the target number of the Shares. [Any additional performance metrics to be included here.] 3. Certain Definitions. In addition to other terms defined herein, the following definitions shall apply: |

| PSA Agreement (Severance Plan Participants) Rev. January 2021 ATLANTIC CAPITAL BANCSHARES, INC. 2015 STOCK INCENTIVE PLAN Performance Share Award Agreement (Employees) SCHEDULE B Atlantic Capital Bancshares, Inc. Executive Severance and Change in Control Plan (Including Participation Agreement) [Attached] |