WARRANT INSTRUMENT

THIS WARRANT INSTRUMENT is made on June 3, 2020

BY

MEREO BIOPHARMA GROUP PLC, a public limited liability company incorporated and registered in England & Wales under company number 09481161, whose registered office is at ▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇ (the “Company”).

AGREED TERMS

This warrant instrument (this “Warrant Instrument”) has been entered into by the Company by way of deed poll to constitute the Warrants to subscribe for the Shares (as such terms are defined herein), subject to the Company’s articles of association.

This Warrant Instrument constitutes Warrants in respect of up to 161,048,366 Shares on the terms and conditions herein.

This Warrant Instrument and the exhibits and appendices set out the terms and conditions of the Warrants.

Subject to the terms and conditions herein, no modification to this Warrant Instrument may be effected except by deed poll executed by the Company.

The Warrants shall be binding on the Company and each Warrantholder (and all persons claiming through or under them respectively).

This Warrant Instrument, and any non-contractual rights or obligations arising out of or in connection with it or its subject matter, shall be governed by and construed in accordance with English law.

1

This Warrant Instrument has been duly executed by the Company and delivered as a deed on the date shown at the beginning.

| SIGNED as a DEED for and on behalf of by: |

) ) ) | |

|

|

||

| Director | ||

|

|

||

| Director/Secretary | ||

2

Terms and Conditions of the Warrants

| 1. | Terms and Conditions of the Warrants |

| 1.1 | Background and Reasons for Issuing the Warrants |

The issuance of Warrants (as defined below) by Mereo BioPharma Group plc (the “Company”) is made pursuant to the terms and conditions set out herein (the “Terms and Conditions”).

In respect of the Offering (defined below), these Terms and Conditions will be appended to a securities purchase agreement dated June 3, 2020 (the “Securities Purchase Agreement”) between the Company and certain investors (the “Investors”) in an offering exempt from registration pursuant to Regulation D (the “Offering”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”) under which the Investors have, subject to certain terms and conditions, undertaken to subscribe for the following securities of the Company: (a) units (the “Units”), with each Unit consisting of one ordinary share of the Company, nominal value £0.003 per share (such class of shares, the “Shares”), together with one warrant to subscribe for 0.50 Shares; and (b) one convertible promissory note in the original aggregate principal amount of £1 (all such convertible promissory notes to be issued to the Investors, the “Notes”), together with warrants to purchase a number of Shares equal to 0.5 times the number of Shares issuable upon conversion of each Note.

| 1.2 | Number of Warrants |

The Company shall issue warrants to the Investors entitling the holders thereof (the “Warrantholders”) conditional upon the receipt of the Shareholder Approval (as defined in the Securities Purchase Agreement) to subscribe for in aggregate a maximum of 161,048,366 Shares during the Share Subscription Period (as defined below) in accordance with Section 2, subject to adjustment as described in these Terms and Conditions (all such warrants to be issued to the Investors, the “Warrants”).

| 1.3 | Subscription for Warrants |

In accordance with the terms of the Offering, the Warrants have been subscribed for by, and shall be issued to, the Investors immediately following the execution of the Warrant Instrument.

The Warrants will be issued in certificated form in the form set out in Appendix (C) (each such certificate, a “Warrant Certificate”). The Company or its duly authorized agent shall maintain a register of the holders of Warrants, the Warrant Certificates they hold, and the number of Warrant Shares (defined below) for which their Warrants are exercisable.

The Company shall be entitled to treat each person named in the register of the holders of Warrants as a Warrantholder as the absolute owner of a Warrant and, accordingly, shall not, except as ordered by a court of competent jurisdiction or as required by law, be bound to recognise any equitable or other claim to or interest in a Warrant on the part of any other person, whether or not it shall have express or other notice of such a claim.

3

The Warrants will not be listed by the Company on a regulated market or other trading platform.

| 1.4 | Transfer of Warrants |

The Warrants shall not be transferred or pledged by a Warrantholder prior to August 8, 2020. Thereafter, the holder of any Warrants may freely transfer their Warrants, provided that such transfer of Warrants is made in compliance with these Terms and Conditions, applicable securities laws, and all requirements of regulatory authorities. The holder of the Warrant to be transferred or pledged must, prior to transfer or pledge of the Warrant, deliver to the Company: (a) the original Warrant Certificate (or an indemnity in a form satisfactory to the Company (acting reasonably) in the event that the Warrant Certificate is lost or destroyed); and (b) a duly executed Warrant Assignment in the form of Exhibit (A).

| 1.5 | Prior to the Commencement Date |

Notwithstanding that Sections 2.10 and 2.11 would apply to Warrants issued prior to the Commencement Date, those Sections shall not apply to any Warrants held by: (a) an Original Warrantholder (as defined in the Securities Purchase Agreement) who failed to attend (either in person or by proxy) any Shareholders Meeting called for the purpose of obtaining the Shareholder Approval and to vote in favour of such Shareholder Approval with the entirety of all voting rights available to such Original Warrantholder and (b) any person being a successor in title of, or claiming through or under, that Original Warrantholder.

| 1.6 | Lapse |

All Warrants shall lapse and no longer be outstanding upon the earliest of the Alternative Warrant Conversion Closing Date (as defined in the Securities Purchase Agreement) and the expiration of the Share Subscription Period and August 8, 2025, and rights of a holder with respect to the Warrant or the Warrant Shares issuable upon exercise thereof shall immediately terminate upon such lapse. Thereupon, all Warrant Certificates shall be deemed cancelled and will not in any circumstances be available for reissue or be valid for any purpose

| 2. | Terms and Conditions of Share Subscription |

| 2.1 | Right to Subscribe for Warrant Shares |

Each Warrant Certificate entitles its holder conditional upon receipt of Shareholder Approval to subscribe for a number of new Shares set forth in the Warrant Certificate (the “Warrant Shares”), subject to adjustment as described in these Terms and Conditions. The Warrants may be exercised in whole or in part and, if in part, may be exercised from time to time during the Share Subscription Period.

4

If this Warrant shall have been exercised in part, the Company shall, at the request of the Warrantholder and upon surrender of this Warrant Certificate, at the time of delivery of the Warrant Shares, deliver to the Warrantholder a new Warrant evidencing the rights of the Warrantholder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

No fractional shares shall be issued upon the exercise of any Warrant. As to any fraction of a share which the Warrantholder would otherwise be entitled to purchase upon such exercise (determined on an aggregate basis with all other Warrants then being exercised by the Warrantholder), the Company shall round down to the next whole share.

| 2.2 | Subscription Price |

The subscription price for each Warrant Share is £0.348 (which price is expressed on a per-Share basis), subject to adjustment as described in these Terms and Conditions (the “Warrant Exercise Price”). The Warrant Exercise Price shall be booked in its entirety to the share capital (including to the extent relevant the share premium account) of the Company.

| 2.3 | Share Subscription, Payment and Registration of Shares |

Unless otherwise specifically provided under these Terms and Conditions, the Warrants shall be exercisable for the Warrant Shares as set forth in this Section 2.3 during the subscription period that commences on the Shareholder Approval Date (as defined in the Securities Purchase Agreement) (the “Commencement Date”), and ends on the third anniversary of the Commencement Date (the “Share Subscription Period”). Notwithstanding any other provision of these Terms and Conditions, prior to the Commencement Date, the Warrantholders shall not be able to exercise any right to subscribe for Warrant Shares and the Board of Directors of the Company will only have exercised any power to grant such right for the purposes of s551 Companies ▇▇▇ ▇▇▇▇ on the Commencement Date.

The Warrants may be exercised in whole or in part, at any time or from time to time on any Business Day (as defined in the Securities Purchase Agreement) during the Share Subscription Period, by surrender of the Warrant Certificate and the exercise notice in the form set out in Exhibit (C) (the “Exercise Notice”), duly completed and executed by the Warrantholder, to the Company (or such other office or agency of the Company as it may designate by notice in writing to the registered Warrantholder at the address of the Warrantholder appearing on the books of the Company) specifying whether the Warrants will be exercised by way of:

| (a) | cash payment, with the Warrantholder making payment to the Company in cash of the Warrant Exercise Price for the Warrant Shares (the “Exercise Amount”) by wire transfer of immediately available funds to the following account of the Company: |

Account Name: Mereo BioPharma Group plc

Bank: [—]

Account No.: [—]

Sort Code: [—]

BIC/SWIFT: [—]

IBAN: [—]

5

(or such other account as the Company may from time to time notify the Warrantholder in replacement thereof) in an amount equal to the Exercise Amount; or

| (b) | the cashless exercise procedure specified in Section 2.4 below, |

together with in each case: (i) to the extent necessary under the Securities Act, delivery to the Company of an Accredited Investor Certification certifying the “accredited investor” status under the Securities Act of the recipient of the Warrant Shares to be received upon exercise of the Warrants in the form set out in Exhibit (B); and (ii) written certification from the Warrantholder that the exercise of the relevant Warrants will not result in the Warrantholder exceeding the exercise limitation provided for in Section 2.14, with such exercise to be effective upon receipt by the Company of such notice, such Exercise Amount and such Accredited Investor Certification (the “Effective Exercise”).

In the event the Warrantholder delivers an Accredited Investor Certification in connection with exercise of Warrants, unless there is then an effective registration statement covering the issuance or resale of the Warrant Shares to be issued upon exercise, the Warrant Shares shall bear the legend set forth in Section 2.13. If delivered to the Warrantholder via CREST, the Warrant Shares shall be issued free of any restrictive legends (with such Warrant Shares being eligible for trading on AIM, a market operated by London Stock Exchange plc (“AIM”) (if at the relevant time the Shares continue to be admitted to trading on AIM) and, if there is an effective registration statement covering the Warrant Shares to be issued upon exercise, then the Warrant Shares may be issued to the custodian of the Depositary (as defined in the Securities Purchase Agreement) and deposited with the Depositary, and, following such deposit the Company will direct the Depositary to issue an amount of ADSs (as defined in the Securities Purchase Agreement) via DTC (with such shares being eligible for listing on the Nasdaq Global Market or the Nasdaq Capital Market (“Nasdaq”) (in each case, as applicable).

Once received by the Company, an Exercise Notice shall be irrevocable save with the consent of the directors of the Company (or a duly authorised committee thereof). If the Company has reasonable grounds to object to any attempted exercise, it must give written notice of such objection within two (2) Business Days of receipt of the related Exercise Notice.

The Company shall issue Warrant Shares on the basis of the Warrants exercised in accordance with this Section 2.3, or resulting from the cashless exercise procedure pursuant to Section 2.4, to the exercising Warrantholder. Warrant Shares issued on the basis of Warrants exercised in accordance with this Section 2.3, or resulting from the cashless exercise procedure pursuant to Section 2.4, shall be: (i) written up in the Company’s register of members as soon as practicable (and in any event within 4 Business

6

Days) of the Effective Exercise, and if the applicable Exercise Notice requires the issue of share certificates, the applicable share certificates shall be issued to the relevant Warrantholders as soon as practicable (and in any event within 10 Business Days) of the issuance of the referable Warrant Shares; (ii) admitted to trading as set forth in Section 3.1; and (iii) if the applicable Exercise Notice requires delivery in uncertificated form, delivered to the relevant CREST account as set forth in Section 3.1.

Unless a relevant Exercise Notice is revoked or automatically cancelled in accordance with these Terms and Conditions, delivery of the Warrant Shares issuable upon exercise shall be made as soon as practicable (and in any event within 4 Business Days) after the Effective Exercise, provided that in the case of the cashless exercise procedure pursuant to Section 2.4 delivery of the Warrant Shares resulting therefrom shall be made as soon as practicable (and in any event within 4 Business Days) following receipt by the Company of the relevant Nominal Price (as defined in Section 2.4).

If by the close of the fourth Business Day period set out in the preceding paragraph, the Company fails (other than as a result of a failure within the CREST system) to deliver to the Warrantholder the required number of Warrant Shares to which the Warrantholder is entitled pursuant to the relevant exercise, and if after such 4 Business Day period and prior to the receipt of such Warrant Shares, the Warrantholder purchases (in an open market transaction or otherwise) Shares to deliver in satisfaction of a sale by the Warrantholder of the Warrant Shares which the Warrantholder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall, within 3 Business Days after the Warrantholder’s request promptly honor its obligation to deliver to the Warrantholder the Warrant Shares and pay cash to the Warrantholder in an amount equal to the excess (if any) of Warrantholder’s total purchase price (including brokerage commissions actually incurred, if any) for the Shares so purchased in the Buy-In over the product of (A) the number of Shares purchased in the Buy-In, multiplied by (B) the Closing Price (as defined above) of a Share on the date of Effective Exercise.

The Warrants shall be exercised and the Warrant Shares shall be issued subject to and in accordance with any applicable laws or regulations to which the Company is subject including the AIM Rules for Companies and the Market Abuse Regulation (EU 596/2014) and any other laws or regulations applicable in the jurisdiction in which the Warrantholder is located.

If, following delivery of Warrant Shares, the Warrantholder deposits those Warrant Shares with the Depositary for delivery of ADSs, the Company shall use its reasonable endeavours to cooperate with any reasonable request made of the Company by or on behalf of the Depositary in connection with such deposit and any sale of the ADSs under an effective registration statement covering such ADSs or pursuant to an exemption from registration available under the U.S. securities laws; provided, any ADSs (either certificates or book entry notations) shall be issued with restrictive legends under the Securities Act if, at the time of such deposit of the Warrant Shares, the ADSs have not then been registered for resale under that the Registration Rights Agreement (as defined in the Securities Purchase Agreement).

7

| 2.4 | Cashless Exercise |

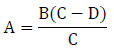

In place of a subscription at full Warrant Exercise Price, a Warrantholder may, at its sole discretion, elect to exchange all or any portion of its Warrants by way of cashless exercise for such number of Warrant Shares calculated using the following formula:

where:

| A = | the number of Warrant Shares to be issued to the Warrantholder; |

| B = | the number of Warrant Shares that would be issued to the Warrantholder in respect of the Warrants being exchanged if they were exercised at full Warrant Exercise Price rather than by way of cashless exercise; |

| C = | the Closing Price at the time of delivery of the Exercise Notice giving rise to the applicable cashless exercise; and |

| D = | the Warrant Exercise Price per Warrant Share, as adjusted hereunder. |

Where the Warrantholder elects to exchange its Warrants by way of cashless exercise, the Warrantholder shall subscribe at nominal value for the Warrant Shares resulting from the above formula (the aggregate nominal value payable to the Company in respect of all such Warrant Shares being so subscribed shall be rounded up to the nearest £1 (the “Nominal Price”)).

The Company shall notify the Warrantholder of the Nominal Price and the Warrantholder covenants to pay the Nominal Price to the Company in cash in the manner set out in sub-paragraph (a) of Section 2.3 within 4 Business Days of such notification.

An issue of Warrant Shares to the Warrantholder pursuant to an election made in accordance with this Section 2.4 shall fully satisfy the Company’s obligations to issue Warrant Shares to such Warrantholder and, following such issue, the number of Warrant Shares for which that Warrantholder shall be entitled to subscribe shall be reduced by the number of Warrant Shares represented by the figure “B” in the formula above in respect of the relevant election.

If the Closing Price is less than the Warrant Exercise Price, and Exercise Notice shall be automatically cancelled.

The “Closing Price” means: (i) if at the relevant time the Shares continue to be admitted to trading on AIM, the most recently reported closing price of one Share on AIM; or (ii) if at the relevant time the Shares are no longer admitted to trading on AIM, the implied price of one Share in pounds sterling by reference to the most recently reported closing price of an ADS on Nasdaq. For the purposes of (ii), the closing price of an ADS shall be converted into pounds sterling in accordance with Section 3.5.

8

The provisions above permitting “cashless exercise” are intended, in part, to enable the parties to take the position that the exchange of this Warrant for Warrant Shares pursuant to such provisions will be characterized as and constitute a valid reorganization in the form of a recapitalization under section 368(a)(1)(E) of the U.S. Internal Revenue Code of 1986, as amended.

| 2.5 | Shareholder Rights |

The Warrant Shares subscribed for on the basis of the Warrants will rank for all dividends declared, made or paid after the date of issue and otherwise rank pari passu with the existing ordinary shares in the capital of the Company.

| 2.6 | Adjustment for Subdivisions and Consolidations |

If the Company, prior to the Shareholder Approval Date (as defined in the Securities Purchase Agreement), or following Shareholder Approval (as defined in the Securities Purchase Agreement) and prior to the end of the Share Subscription Period, shall effect a subdivision of its ordinary shares, the Warrant Exercise Price then in effect immediately before that subdivision shall be proportionately decreased and the number of shares issuable upon exercise of such Warrant shall be proportionately increased. If the Company, prior to the end of the Share Subscription Period shall consolidate its ordinary shares, the Warrant Exercise Price then in effect immediately before the combination shall be proportionately increased and the number of shares issuable upon exercise of such Warrant shall be proportionately decreased. Any adjustment under this Section 2.6 shall become effective at the close of business on the date the subdivision or consolidation becomes effective.

| 2.7 | Adjustment for Certain Dividends and Distributions |

If the Company, prior to the Shareholder Approval Date, or following Shareholder Approval and prior to the end of the Share Subscription Period, shall make or issue, or fix a record date for the determination of holders of its ordinary shares entitled to receive, a dividend or other distribution to the shareholders payable in ordinary shares in the Company, then and in each such event the Warrant Exercise Price then in effect immediately before such event shall be decreased as of the time of such issuance or, in the event such a record date shall have been fixed, as of the close of business on such record date, by multiplying the Warrant Exercise Price then in effect by a fraction:

| (a) | the numerator of which shall be the total number of ordinary shares outstanding immediately prior to the time of such issuance or the close of business on such record date, and |

| (b) | the denominator of which shall be the total number of ordinary shares outstanding immediately prior to the time of such issuance or the close of business on such record date plus the number of ordinary shares issuable in payment of such dividend or distribution; |

9

and the number of shares issuable upon exercise of such Warrant shall be multiplied by the inverse of such fraction; provided, however, that (i) if such record date shall have been fixed and such dividend is not fully paid or if such distribution is not fully made on the date fixed therefor, the Warrant Exercise Price and the number of issuable shares shall be recomputed accordingly as of the close of business on such date and thereafter the Warrant Exercise Price and the number of issuable shares shall be adjusted pursuant to this paragraph as of the time of actual payment of such dividends or distributions, if any; and (ii) no such distribution or dividend shall be made to the extent that the consequent adjustment under this Section 2.7 would be unlawful (including pursuant to s549 Companies Act 2006) and/or would be subject to pre-emption rights (including pursuant to s561 Companies Act 2006).

| 2.8 | Adjustments for Other Dividends and Distributions |

If the Company, prior to the Shareholder Approval Date, or following Shareholder Approval and prior to the end of the Share Subscription Period, shall: (i) pay or declare a dividend payable to all shareholders payable in cash or in specie out of profits available for distribution; or (ii) make any distribution or return of share capital (including share premium account and capital redemption reserve) to shareholders in cash or in-specie, then and in each such event the Warrant Exercise Price then in effect immediately before such event shall be decreased as of such event by multiplying the Warrant Exercise Price then in effect by a fraction:

| (a) | the numerator of which shall be equal to (i) the Closing Price on the day immediately prior to the date when such event was first published (or if there is no such price, the fair market value of one ordinary share of the Company as of such date as determined in good faith by the Board of Directors) minus (ii) the amount per issued ordinary share of such dividend or distribution; and |

| (b) | the denominator of which shall be the Closing Price on the day immediately prior to the date when such event was first published (or if there is no such price, the fair market value of one ordinary share of the Company as of such date as determined in good faith by the Board of Directors). |

In the event that the application of the above fraction would result in an increase in the Warrant Exercise Price, then no adjustment shall be made hereunder. If the Company distributes assets other than cash, the amount per outstanding share of the distribution shall be calculated by reference to the fair market value of the assets distributed as determined in good faith by the Board of Directors of the Company. No adjustment shall be made pursuant to this Section 2.8 where the relevant dividend or distribution falls within Section 2.7.

10

| 2.9 | Adjustment for Reorganization |

If, prior to the Shareholder Approval Date, or following Shareholder Approval and prior to the end of the Share Subscription Period, there shall occur any reorganization, recapitalization, reclassification, consolidation, merger or demerger involving the Company in which the Company’s ordinary shares are converted into or exchanged for securities, cash or other property (other than an event covered by Sections 2.6, 2.7, 2.8 or 2.10) (collectively, a “Reorganization”), then, following such Reorganization, the Warrantholder shall receive upon exercise of the Warrants the kind and amount of securities, cash or other property, if any, which the Warrantholder would have been entitled to receive pursuant to such Reorganization if such exercise had taken place immediately prior to such Reorganization. Appropriate adjustment (as determined in good faith by the Board of Directors) shall be made in the application of the provisions set forth herein with respect to the rights and interests thereafter of the Warrantholder, to the end that the provisions set forth in these Terms and Conditions (including provisions with respect to changes in and other adjustments of the Warrant Exercise Price and the number of Warrant Shares issuable upon exercise of the Warrants) shall thereafter be applicable, as nearly as reasonably may be, in relation to any securities, cash or other property thereafter deliverable upon the exercise of the applicable Warrants.

| 2.10 | Treatment of Warrants in an Acquisition |

In the event of an Acquisition prior to the Shareholder Approval Date, or following Shareholder Approval and prior to the end of the Share Subscription Period, the Company shall use its best efforts to ensure that lawful and adequate provision shall be made whereby each Warrantholder shall thereafter continue to have the right to purchase and receive upon the Terms and Conditions and in lieu of the Warrant Shares issuable upon exercise of the Warrants held by such Warrantholder (without regard to any limitations on exercise contained in such Warrants), shares of voting stock (the “Alternate Warrants”) in such successor, surviving or acquiring entity (as the case may be, the “Acquirer”), such that the aggregate value of the Warrantholder’s warrants to purchase such number of shares of the Acquirer (where the value of a warrant to purchase one share in the Acquirer is determined in accordance with the Black-Scholes Option Pricing formula set forth in Appendix (A) hereto, without regard to any limitations on exercise contained in such Warrants), is equivalent to the aggregate value of the Warrants held by such Warrantholder (where the value of each Warrant to purchase one Warrant Share is determined in accordance with the Black-Scholes Option Pricing formula set forth Appendix (B) hereto, without regard to any limitations on exercise contained in such Warrants). Furthermore, the Alternate Warrants shall have the same expiration date as the Warrants, and shall have a strike price, KAcq, that is calculated in accordance with Appendix (A) hereto. For the avoidance of doubt, if the Acquirer surviving or acquiring entity, as the case may be, is a member of a consolidated group for financial reporting purposes, the “Acquirer” shall be deemed to be the parent of such consolidated group for purposes of this Section 2.10 and Appendix (A) hereto.

| (a) | Moreover, appropriate provision shall be made with respect to the rights and interests of each Warrantholder to the end that the provisions hereof (including, without limitation, provision for adjustment of the Warrant Exercise Price) shall thereafter be applicable, as nearly equivalent as may be practicable in relation to any shares of stock thereafter deliverable upon the exercise of the Alternate Warrants. The Company shall use its best efforts to ensure that prior to or simultaneously with the consummation thereof the successor corporation resulting |

11

| from such consolidation or merger, or the corporation purchasing or otherwise acquiring such assets or other appropriate corporation or entity shall assume by written instrument, reasonably deemed by the Board of Directors of the Company and the Warrantholder to be satisfactory in form and substance, the obligation to deliver to the holder of the Warrants, at the last address of such holder appearing on the books of the Company, the Alternate Warrants to purchase such shares of stock of the Acquirer, as, in accordance with the foregoing provisions, such holder may be entitled to purchase, and otherwise assume the other obligations under these Warrants. The provisions of this Section 2.10 shall similarly apply to successive Acquisitions. |

| (b) | If the Company, in spite of using its best efforts, is unable to ensure that the Warrantholder shall have the Alternate Warrants until the expiration of the Share Subscription Period in connection with any Acquisition, then the Company (or the Acquirer) shall (to the extent lawful) pay the Warrantholder an amount equal to the Black-Scholes Value of this Warrant (where the value of each Warrant to purchase one Warrant Share is determined in accordance with the Black-Scholes Option Pricing formula set forth Appendix (B) hereto), unless the holders together of Warrants and Note Warrants representing at least two-thirds of the aggregate number of Warrant Shares issuable upon the exercise of all outstanding Warrants and of Shares issuable upon the exercise of all outstanding Note Warrants (in each case without regard to any limitations on exercise) (the “Majority Holders”) determine to waive such requirement to make such payment. Such payment shall be made in cash in the event that the Acquisition results in the shareholders of the Company receiving cash from the Acquirer at the closing of the transaction, and shall be made in shares of the Company (with the value of each share in the Company determined according to SCorp in Appendix (B) hereto) in the event that the Acquisition results in the shareholders of the Company receiving shares in the Acquirer or other entity at the closing of the transaction. In the event that the shareholders of the Company receive both cash and shares at the closing of the transaction, such payment to the Warrantholders shall (to the extent lawful) also be made in both cash and shares in the same proportion as the consideration received by the shareholders. Following any payment required pursuant to this Section 2.10(b), the Warrant shall terminate, without payment of any additional consideration therefor. |

| (c) | Notwithstanding anything to the contrary hereunder, if the Acquisition is (1) a transaction where the consideration paid to the holders of the Shares consists of cash, (2) a “Rule 13e-3 transaction” as defined in Rule 13e-3 under the Securities Exchange Act of 1934, as amended, (3) an Acquisition involving a person or entity not traded on a regulated market (within the meaning of the Markets in Financial Instruments Directive (2004/39(EC))) or a United States national securities exchange or (4) a transaction for which the Majority Holders reasonably determine that the Alternate Warrants proposed to be provided by the Acquirer do not satisfy the terms hereof (provided, that such holders consult with the Company and provide a written basis for such determination and that includes evidence of such determination by the Majority Holders), at the request of the Warrantholder |

12

| delivered before the ninetieth (90th) day after such Acquisition, the Company (or the Acquirer) shall (to the extent lawful) purchase this Warrant from the Warrantholder by paying to the Warrantholder, within five (5) Business Days after such request (or, if later, on the effective date of the Acquisition), cash in an amount equal to the Black-Scholes Value of this Warrant (where the value of each Warrant to purchase one Warrant Share is determined in accordance with the Black-Scholes Option Pricing formula set forth Appendix (B) hereto). Following any payment required pursuant to this Section 2.10(c), the Warrant shall terminate, without payment of any additional consideration therefor. |

Notwithstanding the foregoing provisions of this Section 2.10, if Shareholder Approval has not then been received, this Section 2.10 shall not apply to any Acquisition occurring after August 8, 2023.

An “Acquisition” means any of the following: (i) any sale or similar transaction of all or substantially all of its assets in one or a series of related transactions; (ii) any merger, reorganization, consolidation, demerger or other similar transaction or a series of related transactions with or into another person in which the Company is not the survivor or the shareholders of the Company immediately before the transaction or series of related transactions own, directly or indirectly, less than a majority by voting power of the issued shares of the surviving or successor entity immediately after the transaction or series of related transactions; (iii) a scheme of arrangement under Part 26 of the Companies Act of 2006 pursuant to which all of the securities or shares in the Company become vested in a third party; (iv) a takeover offer within the meaning of Part 28 of the Companies ▇▇▇ ▇▇▇▇, or a public tender offer for the shares in the Company, pursuant to which a majority of its ordinary shares are acquired by a third party; or (v) the acquisition by any “person” or “group” (within the meaning of Section 13(d)(3) or 14(d)(2) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)), including any group acting for the purpose of acquiring, holding or disposing of securities (within the meaning of Rule 13d-5(b)(1) or any successor provision) directly or indirectly, of beneficial ownership (as such term is defined in Rule 13d-3 promulgated under the Exchange Act, or any successor provision) of outstanding shares of capital stock and/or other equity securities of the Company, in a single transaction or series of related transactions (including, without limitation, one or more tender offers or exchange offers), representing at least 50% of the voting power of the outstanding voting shares or economic interests in the then outstanding shares of capital stock of the Company.

| 2.11 | Rights of Warrantholders in Certain Situations |

| (a) | If, prior to the end of the Share Subscription Period, an effective resolution for the winding up of the Company is passed, which is preceded by the making of a statutory declaration of solvency under s89 Insolvency ▇▇▇ ▇▇▇▇, for the purposes of ascertaining its rights in the winding up, be treated as if it had, immediately before the passing of the resolution, fully exercised its outstanding Warrants and shall be entitled to receive out of the assets available in the liquidation pari passu with the holders of the ordinary shares such sum as it would have received had it been the holder of all such ordinary shares to which it would have been entitled by virtue of that exercise after deducting a sum equal to the sum which would have been payable for Warrant Shares, but nothing in this Section 2.11 shall require the Warrantholder to make any payment to the Company or any other person. |

13

| (b) | Without duplication in respect of Section 2.9 or Section 2.10: |

| (i) | If, prior to the end of the Share Subscription Period, the Company makes a resolution to acquire its own shares through a tender offer to all the shareholders or to acquire other special rights entitling to shares issued in one or more transactions that were related to the offering of the Warrants (the “Related Offerings”) through a tender offer to all holders of such rights, the Company shall make an equal offer to the Warrantholders in respect of the Warrants. If the Company acquires its own shares in any other manner, or if the Company acquires stock options or special rights entitling to shares other than those issued in the Related Offerings, no measures will need to be taken in relation to the Warrants. |

| (ii) | If, prior to the end of the Share Subscription Period, a tender offer regarding all shares, stock options and other special rights issued by the Company is made by a party other than the Company, including pursuant to a scheme of arrangement under Part 26 of the Companies ▇▇▇ ▇▇▇▇, then the Warrantholders may transfer all of their Warrants to such offeror, as the case may be. If any such tender offer results in the third party acquiring a majority of the ordinary shares of the Company, then that event shall be deemed an “Acquisition” as set forth above. |

The Board of Directors may at its discretion in any of the situations mentioned in this Section 2.11(b)(ii), also give the Warrantholders an opportunity (which for the avoidance of doubt shall not foreclose the Warrantholders from exercising the Warrants for the securities or other property for which they would otherwise have been exercisable) to exercise the Warrants or to convert the Warrants into equity issued by the offeror, as the case may be, on such terms and within such reasonable time period prior to the completion of the tender offer, as resolved by the Board of Directors.

Notwithstanding the foregoing provisions of this Section 2.11, if Shareholder Approval has not then been received, this Section 2.11 shall not apply to: (A) any winding up contemplated by Section 2.11(a), (B) any acquisition of own shares contemplated by Section 2.11(b)(i), or (C) any tender offer contemplated by Section 2.11(b)(i), in each case occurring after August 8, 2023.

| 2.12 | Notice of Adjustment |

To the extent reasonably practicable and not prohibited by law, not less than ten (10) Business Days prior to the record date or effective date, as the case may be, of: (i) any action which requires or might require an adjustment or readjustment of the Warrant Exercise Price or the number, amount or type of securities or other assets issuable upon

14

exercise of the Warrants; or (ii) an Acquisition, the Company shall give notice to the Warrantholder of such event, describing such event in reasonable detail and specifying the record date or effective date, as the case may be, and, with, if determinable, the required adjustment and computation thereof. If the required adjustment is not determinable as the time of such notice, the Company shall give notice to the Warrantholder of such adjustment and computation as soon as reasonably practicable after such adjustment becomes determinable.

| 2.13 | Legend |

Neither the Warrants nor the Warrant Shares issuable upon exercise of the Warrants have been or will be registered under the Securities Act or under any state securities laws of the United States, except as provided under the Registration Rights Agreement. Except as otherwise permitted by Section 2.3, each Warrant Certificate and each certificate representing the Warrant Shares shall bear the following legends or such variations thereof as the Company may prescribe from time to time:

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) EXCEPT PURSUANT TO (A) AN EFFECTIVE REGISTRATION STATEMENT IN COMPLIANCE WITH THE SECURITIES ACT, (B) RULE 903 or 904 PURSUANT TO THE SECURITIES ACT, OR (C) RULE 144 UNDER THE SECURITIES ACT (UPON FURNISHING TO THE COMPANY SUCH REPRESENTATION LETTERS AS THE COMPANY MAY REQUIRE), OR (II) UNLESS AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE COMPANY, SHALL BE PROVIDED TO THE COMPANY, PROVIDING THAT SUCH SALE, TRANSFER OR ASSIGNMENT DOES NOT REQUIRE REGISTRATION UNDER THE SECURITIES ACT.

| 2.14 | Exercise Limitation |

Notwithstanding any provisions herein to the contrary, the Warrantholder shall not be entitled to exercise Warrants if, immediately prior to or after giving effect to such exercise, such Warrantholder beneficially owns 9.99% or more of the outstanding Shares, and the Warrantholder shall not be entitled to exercise Warrants for a number of Shares in excess of that number of Shares which, upon giving effect to such exercise, would cause the aggregate number of Shares deemed beneficially owned by the Warrantholder to exceed 9.99% of the outstanding Shares following such exercise. For purposes of the foregoing proviso, the aggregate number of Shares beneficially owned by the Warrantholder shall include the number of Shares issuable upon exercise of this Warrant with respect to which determination of such proviso is being made, but shall exclude the Shares which would be issuable upon (i) exercise of the remaining, unexercised Warrants beneficially owned by the Warrantholder and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company beneficially owned by the Warrantholder subject to a limitation on conversion or exercise analogous to the limitation contained

15

herein. Except as set forth in the preceding sentence, for purposes of this Section 2.14, beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act. Notwithstanding the foregoing, the Warrantholder may increase or decrease the foregoing limitation to any other percentage, by written notice to the Company; provided, that the Warrantholder may not decrease the limitation prior to August 8, 2020; provided, further, that a request to increase such limitation requires not less than 61 days prior written notice (with such waiver of the foregoing limitation or request to increase such limitation taking effect only upon the expiration of such 61 day notice period and applying only to the Warrantholder and not to any other holder of Warrants) and that such limitation shall never be increased above 19.99%. For purposes of this Section 2.14, in determining the number of outstanding Shares, the Warrantholder may rely on the number of outstanding Shares as reflected in (x) the Company’s most recent periodic report filed with the SEC on the date thereof, (y) a more recent public announcement by the Company or (z) any other notice by the Company or its transfer agent setting forth the number of Shares outstanding. Upon the written request of the Warrantholder, the Company shall use commercially reasonable efforts to within confirm in writing or by electronic mail to the Warrantholder the number of Shares then outstanding within three (3) Business Days after written request by such Warrantholder. In any case, the number of outstanding Shares shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Warrantholder since the date as of which such number of outstanding Shares was reported.

| 2.15 | Exercise Price Limitation |

Notwithstanding anything to the contrary in these Terms and Conditions, no adjustment of the Warrant Exercise Price pursuant to any of Sections 2.6 to 2.9 shall result in the Warrant Exercise Price being less than the nominal value of a Warrant Share.

| 3. | Other Terms |

| 3.1 | Stock Exchange Listing and Government Approvals |

The Company will, at its own expense, use its commercially reasonable efforts to: (a) obtain and keep effective any and all permits, consents and approvals of governmental agencies and authorities which may from time to time be required of the Company in order to satisfy its obligations under these Terms and Conditions; (b) to effect the admission to trading of the Warrant Shares on AIM (if at the relevant time the Shares continue to be admitted to trading on AIM); (c) with respect to Warrant Shares that are to be delivered in uncertificated form (as specified in the applicable Exercise Notice), deliver such Shares, as soon as possible following issuance, to the CREST account provided for in such Exercise Notice, provided that, if there is a failure within the CREST system on the date of issuance of the Warrant Shares that renders delivery of uncertificated shares impracticable, the Company may either, at the Warrantholder’s election (1) deliver definitive share certificates in accordance with Section 2.3 in lieu of uncertificated shares or (2) delay delivery of Warrant Shares until such failure ceases to exist (such delay not to exceed three Business Days from the date the failure ceases to exist).and (d) maintain the listing of the ADSs on Nasdaq or another United States national securities exchange.

16

| 3.2 | Governing Law and Jurisdiction |

These Terms and Conditions, and any non-contractual rights or obligations arising out of or in connection with them or their subject matter, shall be governed by and construed in accordance with English law. By accepting Warrants, the Warrantholder submits to the non-exclusive jurisdiction of the English courts.

| 3.3 | Notices |

All notices related to the Warrants by the Company shall be sent by express courier or e-mail to the addresses provided to the Company by the respective Warrantholders. The notices related to the Warrants to the Company may be sent by express courier or e-mail to:

Address: ▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇

E-mail: ▇▇▇▇▇@▇▇▇▇▇▇▇▇▇▇▇▇▇▇.▇▇▇

Attention: General Counsel

A notice made in accordance with the above shall be deemed to have been received by its recipient on (i) the fourth (4th) Business Day after the day of sending if sent by express courier, or (ii) on the day of transmission if sent by e-mail, provided that a confirmation of successful transmission has been obtained from the recipient.

| 3.4 | Lost or destroyed Warrant Certificates |

If any certificate for Warrant Certificate is worn out or defaced then upon production of such Warrant Certificate to the Directors of the Company they may cancel the same and may issue a new Warrant Certificate in lieu thereof. If any such Warrant Certificate be lost or destroyed then upon proof thereof to the reasonable satisfaction of the Directors of the Company in their sole discretion (or in default of proof, on such indemnity as the Directors of the Company may deem adequate being given) a new Warrant Certificate in lieu thereof may be given to the persons entitled to such lost or destroyed Warrant Certificate free of charge (save as regards any payment pursuant to any such indemnity).

| 3.5 | Variation of Rights |

| (a) | All or any of the rights for the time being attached to the Warrants may from time to time (whether or not the Company is being wound up) be altered or abrogated with the consent in writing of the Company and with either the consent in writing of the Majority Holders or with the sanction of a Special Resolution of the Warrantholders. All the provisions of the Articles of Association of the Company as to general meetings of the Company shall mutatis mutandis apply to any separate meeting of the Warrantholders as though the Warrants were a class of shares forming part of the Company and as if such provisions were expressly set out in extenso herein but so that: |

| (i) | the necessary quorum shall be the Warrantholders (present in person or by proxy) entitled to subscribe for one-third in nominal amount of the Warrant Shares subject to outstanding Warrants; |

17

| (ii) | every Warrantholder present in person or by proxy at any such meeting shall be entitled on a show of hands to one vote and on a poll to one vote for every Warrant Share for which it is entitled to subscribe pursuant to the Warrants; |

| (iii) | any Warrantholder or Warrantholders of 10 per cent. or more of the aggregate outstanding Warrants present in person or by proxy may demand or join in demanding a poll; and |

| (iv) | if at any adjourned meeting a quorum as above defined is not present those holders of outstanding Warrants who are then present in person or by proxy shall be a quorum. |

| (b) | “Special Resolution” for the purposes of this Section 3.5 means a resolution proposed at a meeting of the Warrantholders duly convened and held and passed by a majority consisting of not less than 66 2/3 per cent. of the votes cast, whether on a show of hands or on a poll. |

| 3.6 | Other Matters |

By subscribing for the Warrants, the Warrantholders undertake to adhere to these Terms and Conditions.

In discharging any obligations hereunder, the parties acknowledge and agree that time shall be of the essence.

For the purpose of converting amounts specified in one currency into another currency where required, the rate of exchange to be used in converting amounts specified in one currency into another currency shall be the closing mid-point rate for exchanges between those currencies quoted in the Financial Times (London edition) at the close of business in the United Kingdom on the Business Day immediately prior to the date of the conversion.

Except as expressly provided in the following sentence, a person who is not a party to this Instrument shall not have any rights under the Contracts (Rights of Third Parties) ▇▇▇ ▇▇▇▇ to enforce any term of these Terms and Conditions. The provisions of these Terms and Conditions are intended to confer rights and benefits on the Warrantholders and such rights and benefits shall be enforceable by each of them to the fullest extent permitted by law.

The Warrantholders shall be solely responsible for any taxes, duties and other such payments possibly incurred by the holders of Warrants in relation to receiving the Warrants and the subscription or transfer of any Warrant Shares under these Terms and Conditions.

The Board of Directors shall resolve upon all other matters related to the Warrants and to amend the technical procedures relating to the Warrants (including, but not limited to, additional procedures related to the subscription of Warrant Shares), provided, in each case, that such actions, resolutions or amendments are not prejudicial to the Warrantholders.

18

Exhibit A

Form of Warrant Assignment

19

Exhibit B

Form of Accredited Investor Certification

20

Exhibit C

Form of Exercise Notice

21

APPENDIX A

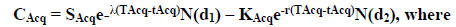

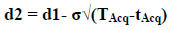

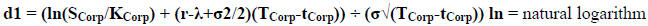

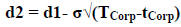

Black-Scholes Option Pricing formula to be used when calculating the value of each new warrant to purchase one share in the Acquirer shall be:

CAcq = value of each warrant to purchase one share in the Acquirer

SAcq = price of Acquirer’s stock as determined by reference to the average of the closing prices on the securities exchange or Nasdaq over the 20-day period ending three trading days prior to the closing of the Acquisition described in Section 2.10 if the Acquirer’s stock is then traded on such exchange or system, or the average of the closing bid or sale prices (whichever is applicable) in the over-the-counter market over the 20-day period ending three trading days prior to the closing of the Acquisition if the Acquirer’s stock is then actively traded in the over-the-counter market, or the then most recently completed financing if the Acquirer’s stock is not then traded on a securities exchange or system or in the over-the-counter market.

TAcq = expiration date of new warrants to purchase shares in the Acquirer = TCorp

tAcq = date of issue of new warrants to purchase shares in the Acquirer

TAcq-tAcq = time until warrant expiration, expressed in years

s = volatility = annualized standard deviation of daily log-returns (using a 262-day annualization factor) of the Acquirer’s stock price on the securities exchange or Nasdaq over a 20-day trading period, determined by the Majority Holders, that is within the 100-day trading period ending on the trading day immediately after the public announcement of the Acquisition described in Section 2.10 if the Acquirer’s stock is then traded on such exchange or system, or the annualized standard deviation of daily-log returns (using a 262-day annualization factor) of the closing bid or sale prices (whichever is applicable) in the over-the- counter market over a 20-day trading period, determined by the Majority Holders, that is within the 100-day trading period ending on the trading day immediately after the public announcement of the Acquisition if the Acquirer’s stock is then actively traded in the over-the-counter market, or 1.0 (or 100%) if the Acquirer’s stock is not then traded on a securities exchange or system or in the over-the- counter market. In no event will the volatility variable be more than 1.0 (or 100%).

N = cumulative normal distribution function

ln = natural logarithm

l = dividend rate of the Acquirer for the most recent 12-month period at the time of closing of the Acquisition.

KAcq = strike price of new warrants to purchase shares in the Acquirer = KCorp * (SAcq / SCorp)

r = annual yield, as reported by Bloomberg at time tAcq, of the United States Treasury security measuring the nearest time TAcq

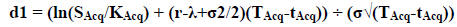

APPENDIX B

Black-Scholes Option Pricing formula to be used when calculating the value of each Warrant to purchase one Share in the Company shall be:

CCorp = value of each Warrant to purchase one share in the Company

SCorp = price of Company stock as determined by reference to the average of the Closing Prices over the 20-day period ending three trading days prior to the closing of the Acquisition described in Section 2.10 if the Company stock is then traded on AIM or Nasdaq, or the average of the closing bid or sale prices (whichever is applicable) in the over-the-counter market over the 20-day period ending three trading days prior to the closing of the Acquisition if the Company’s stock is then actively traded in the over-the-counter market, if the Company’s stock is not then traded on a securities exchange or system or in the over-the-counter market, or the most recently completed financing if the Company’s stock is not then traded on a securities exchange or system or in the over-the-counter market.

TCorp = expiration date of Warrants to purchase shares in the Company

tCorp = date of public announcement of transaction

TCorp-tCorp = time until Warrant expiration, expressed in years

s = volatility = the annualized standard deviation of daily log-returns (using a 262-day annualization factor) of the Company’s stock price on the securities exchange or Nasdaq Global Market over a 20- day trading period, determined by the Majority Holders, that is within the 100-day trading period ending on the trading day immediately after the public announcement of the Acquisition described in Section 2.10 if the Company’s stock is then traded on such exchange or system, or the annualized standard deviation of daily-log returns (using a 262-day annualization factor) of the closing bid or sale prices (whichever is applicable) in the over-the-counter market over a 20-day trading period, determined by the Majority Holders, that is within the 100-day trading period ending on the trading day immediately after the public announcement of the Acquisition if the Company’s stock is then actively traded in the over-the-counter market, or 1.0 (or 100%) if the Company’s stock is not then traded on a securities exchange or system or in the over-the-counter market. In no event will the volatility variable be more than 1.0 (or 100%).

N = cumulative normal distribution function

l = dividend rate of the Company for the most recent 12-month period at the time of closing of the Acquisition.

KCorp = strike price of Warrant

24

r = annual yield, as reported by Bloomberg at time tCorp, of the United States Treasury security measuring the nearest time TCorp

APPENDIX C

Form of Warrant Certificate

26