THIRD AMENDMENT TO CREDIT AGREEMENT LASALLE RETAIL FINANCE Date: December 12, 2007 THIS THIRD AMENDMENT TO CREDIT AGREEMENT (this “Third Amendment”) is made to the Credit Agreement (the “Credit Agreement”) dated as of July 2, 2007 by and among:

Exhibit 10.7

THIRD AMENDMENT TO

CREDIT AGREEMENT LASALLE RETAIL FINANCE

Date: December 12, 2007

THIS THIRD AMENDMENT TO CREDIT AGREEMENT (this “Third Amendment”) is

made to the Credit Agreement (the “Credit Agreement”) dated as of July 2, 2007 by and among:

(a) American Apparel, Inc. (“AAI”), a corporation organized under the laws of the State of California, with its principal executive offices at 000 Xxxxxxxxx Xxxxxx, Xxx Xxxxxxx, Xxxxxxxxxx, for itself and as agent (in such capacity, the “Lead Borrower”) for the other Borrowers now or hereafter party to the Credit Agreement; and

(b) the BORROWERS now or hereafter party to the Credit Agreement; and

(c) the FACILITY GUARANTORS now or hereafter party to the Credit Agreement; and

(d) LASALLE BUSINESS CREDIT, LLC, AS AGENT FOR LASALLE BANK MIDWEST NATIONAL ASSOCIATION, ACTING THROUGH ITS DIVISION, LASALLE RETAIL FINANCE, with offices at 000 Xxxxxxx Xxxxxx, 0xx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, as administrative agent (in such capacity, the “Administrative Agent”) for its own benefit and the benefit of the other Credit Parties; and

(e) LASALLE BUSINESS CREDIT, LLC, AS AGENT FOR LASALLE BANK MIDWEST NATIONAL ASSOCIATION, ACTING THROUGH ITS DIVISION, LASALLE RETAIL FINANCE, with offices at 000 Xxxxxxx Xxxxxx, 0xx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, as collateral agent (in such capacity, the “Collateral Agent”, and together with the Administrative Agent, individually an “Agent” and collectively, the “Agents”) for its own benefit and the benefit of the other Credit Parties; and

(f) XXXXX FARGO RETAIL FINANCE, LLC, with offices at Xxx Xxxxxx Xxxxx, 00xx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, as collateral monitoring agent (in such capacity, the “Collateral Monitoring Agent”) for its own benefit and the benefit of the other Credit Parties; and

(g) the LENDERS party to the Credit Agreement; and

-1-

(h) LASALLE BANK NATIONAL ASSOCIATION, a national banking association with offices at 000 Xxxxx XxXxxxx Xxxxxx, Xxxxxxx, Xxxxxxxx 00000, as Issuing Bank;

in consideration of the mutual covenants herein contained and benefits to be derived herefrom, the parties hereto agree as follows:

Background:

A. Amendment. On October 11, 2007, the parties hereto entered into that certain First Amendment to Credit Agreement, and on November 26, 2007, the parties hereto entered into that certain Second Amendment and Wavier to Credit Agreement. The parties hereto desire to further amend the Credit Agreement on the terms and conditions set forth herein.

B. Merger. Pursuant to the Merger Agreement (as such term is defined herein), (i) the SPAC Transaction shall be consummated, whereby AAI shall merge with and into AAI Acquisition LLC (“AAI LLC”), with AAI LLC as the surviving entity, and (ii) Endeavor Acquisition Corp. (“Endeavor”) shall hold all of the limited liability company membership interests or other equity interests of AAI LLC.

C. Assumption. Pursuant to that certain Assumption and Ratification Agreement dated as of even date herewith (as the same may be amended, modified, supplemented or restated, the “Assumption Agreement”) by and between, among others, AAI LLC and the Agents, AAI LLC shall, among other things, assume all of the Obligations of AAI as a Borrower and as Lead Borrower under the Loan Documents.

D. The parties hereto desire to amend certain provisions of the Credit Agreement in connection with the Merger. Accordingly, it is hereby agreed, as follows:

1. SPAC Transaction. The parties hereto acknowledge and agree that AAI and its Affiliates are hereby authorized to (i) consummate the SPAC Transaction in accordance with the terms of the Merger Document, and (ii) notwithstanding anything to the contrary in any Loan Document, take all such actions necessary therefor, including, without limitation, the following, in accordance with the funds flow set forth on Exhibit A annexed hereto:

a. make tax payments to Xxx Xxxxxx and Xxxx Xx Xxx with respect to the applicable portions of the 2006 and 2007 taxable year, including such payments of notes payable upon transfer of funds from Endeavor;

b. purchase Capital Stock from Xxxx Xx Lim as provided under the Merger Agreement; and

-2-

c. pay all Indebtedness set forth on Schedule 5.25(c) of the Merger Agreement.

2. Amendment to Credit Agreement: Subject to satisfaction of each and all of the Preconditions to Effectiveness set forth in Section 3 below, the Credit Agreement is amended, as follows:

a. By deleting the definition of “Consolidated” in its entirety and substituting the following in its place:

“Consolidated” means, when used to modify a financial term, test, statement, or report of a Person, the application or preparation of such term, test, statement or report (as applicable) based upon the consolidation, in accordance with GAAP, of the financial condition or operating results of such Person and its Subsidiaries, provided with respect to the phrase “such Person and its Subsidiaries”, only the Persons which would have been included within the definition of “Consolidated” prior to the consummation of the SPAC Transaction shall be included within the definition of “Consolidated” following the consummation of the SPAC Transaction.

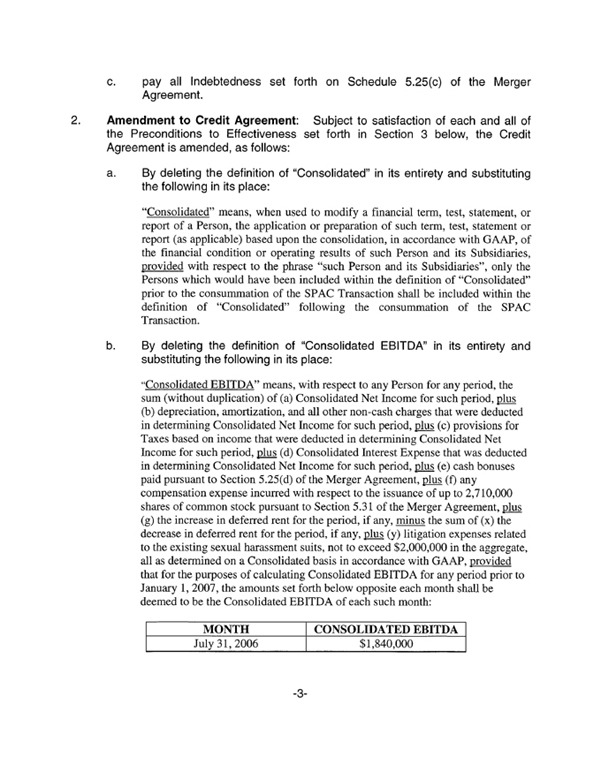

b. By deleting the definition of “Consolidated EBITDA” in its entirety and substituting the following in its place:

“Consolidated EBITDA” means, with respect to any Person for any period, the sum (without duplication) of (a) Consolidated Net Income for such period, plus (b) depreciation, amortization, and all other non-cash charges that were deducted in determining Consolidated Net Income for such period, plus (c) provisions for Taxes based on income that were deducted in determining Consolidated Net Income for such period, plus (d) Consolidated Interest Expense that was deducted in determining Consolidated Net Income for such period, plus (e) cash bonuses paid pursuant to Section 5.25(d) of the Merger Agreement, plus (f) any compensation expense incurred with respect to the issuance of up to 2,710,000 shares of common stock pursuant to Section 5.31 of the Merger Agreement, plus (g) the increase in deferred rent for the period, if any, minus the sum of (x) the decrease in deferred rent for the period, if any, plus (y) litigation expenses related to the existing sexual harassment suits, not to exceed $2,000,000 in the aggregate, all as determined on a Consolidated basis in accordance with GAAP, provided that for the purposes of calculating Consolidated EBITDA for any period prior to January 1, 2007, the amounts set forth below opposite each month shall be deemed to be the Consolidated EBITDA of each such month:

MONTH

CONSOLIDATED EBITDA

July 31,2006

$1,840,000

-3-

August 31, 2006

$1,840,000

September 30, 2006

$1,840,000

October 31, 2006

$1,100,000

November 30, 2006

$1,100,000

December 31, 2006

$1,100,000

c. By deleting the definition of “Consolidated Fixed Charge Coverage Ratio” in its entirety and substituting the following in its place:

“Consolidated Fixed Charge Coverage Ratio” means, with respect to any Person for any period, the ratio of (a) (i) Consolidated EBITDA for such period, minus (ii) Capital Expenditures, net of Capital Lease Obligations, made during such period, minus (iii) shareholder distributions made during such period, to (b) Debt Service Charges during such period, all as determined on a Consolidated basis in accordance with GAAP, provided that shareholder distributions made pursuant to Section 1.15 of the Merger Agreement shall be excluded from this calculation.

d. By deleting the definition of “Merger Agreement” in its entirety and substituting the following in its place:

“Merger Agreement” means that certain Amended and Restated Agreement and Plan of Reorganization dated as of November 7, 2007 by and among Endeavor, Merger Subsidiary, American Apparel, Inc., American Apparel, LLC, the Canadian Affiliates, Xxx Xxxxxxx, each of the stockholders of the Canadian Affiliates and Xxxx X. Xxx.

e. By deleting the definition of “Merger Subsidiary” in its entirety and substituting the following in its place:

“Merger Subsidiary” means AAI Acquisition LLC.

f. By amending the provisions of Section 6.07(b) by deleting the word “and” at the end of Section 6.07(b)(iii), renumbering subsection (iv) as (v) and inserting the following new subsection (iv):

(iv) to the extent incidental to the SPAC Transaction, transactions resulting in the incurrence of Indebtedness to Endeavor, whether funded by Endeavor to a Loan Party on or about the date of the Merger or thereafter, provided that no Loan Party shall make any payments on account of such Indebtedness to Endeavor to the extent that such payments exceed the aggregate amount of $2,000,000.00; and

-4-

g. By amending the provisions of Section 6.08 by deleting the word “and” at the end of clause (h) thereof, relettering clause (i) as (j) and inserting the following new clause (i):

(j) payments on account of Indebtedness to Endeavor to the extent permitted under Section 6.07(b)(iv); and

h. By deleting the provisions of Section 6.10 in their entirety and substituting the following in their place:

SECTION 6.10. Amendment of Material Documents.

No Loan Party will, or will permit any Subsidiary to, amend, modify or waive any of its rights under (a) its Charter Documents or (b) any Material Agreement, or (c) any Material Indebtedness, in each case to the extent that such amendment, modification or waiver would reasonably likely have a Material Adverse Effect, provided that notwithstanding anything to the contrary, the Lead Borrower may adopt as its Charter Documents those documents annexed to that certain Manager’s Certificate of AAI Acquisition LLC dated as of even date herewith (the “Manager’s Certificate”, which Manager’s Certificate has been delivered to the Agents as of the date hereof.

i. The provisions of Section 9.01 (b) are hereby deleted in their entirety and the following is inserted in their place:

(b) if to the Administrative Agent, the Collateral Agent or the Swingline Lender, to LaSalle Business Credit, LLC, 000 Xxxxxxx Xxxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, Attention: Xxxxxxx X. Xxxxxx (Telecopy No. (000) 000-0000), (E-Mail xxxxxxx. xxxxxx@xxxxxxxxxxxxx.xxx), with a copy to Xxxxxx & Xxxxxxxxxx, LLP, Xxxxx Xxxxxx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, Attention: Xxxxxx X. Xxxxxxx, Esquire (Telecopy No. (000) 000-0000), (E-Mail xxxxxxxx@xxxxxxxxx.xxx); and

The provisions of Section 9.04(c) are hereby amended by replacing the phrase “Chicago, Illinois” with the phrase “Boston, Massachusetts” in the second line of such Section 9.04(c).

3. Preconditions to Effectiveness. This Third Amendment shall not take effect unless and until each and all of the following items has been satisfied or delivered, as the case may be, and in all events, to the satisfaction of the Agents, in their sole and exclusive discretion. The willingness of the Agents and the Lenders to enter into this Third Amendment is expressly conditioned upon the receipt by the Administrative Agent of the following items:

-5-

a. On or prior to the date hereof, the Lead Borrower, the Borrowers, and the Facility Guarantors shall have delivered to the Administrative Agent a duly executed copy of this Third Amendment.

b. The Lead Borrower, the Borrowers, and the Facility Guarantors shall have delivered to the Administrative Agent such other and further documents as the Administrative Agent reasonably may require and shall have identified prior to the execution of this Third Amendment, in order to confirm and implement the terms and conditions of this Third Amendment.

c. On or prior to the date hereof, the Borrowers shall have paid to the Administrative Agent for the ratable benefit of the Lenders an amendment and waiver fee in the amount of $25,000.00. In this regard, the waiver and amendment fee shall be fully earned as of the date of execution of this Third Amendment, and the Administrative Agent is hereby authorized to make a Revolving Credit Loan under the Credit Agreement to pay the waiver and amendment fee.

d. Within seven (7) days following the date hereof, the Agents shall have received a favorable written opinion (addressed to each Agent, the Collateral Monitoring Agent and the Lenders and dated as of the date hereof) of counsel for Endeavor and AAI LLC substantially in the form of Exhibit B annexed hereto.

4. Ratification of Loan Documents. No Claims against the Lender:

a. Except as provided herein, all terms and conditions of the Credit Agreement and of each of the other Loan Documents remain in full force and effect. Each Loan Party hereby ratifies, confirms, and re-affirms all terms and provisions of the Loan Documents.

b. Each Loan Party represents and warrants to the Lender that as of the date of this Third Amendment, no Event of Default exists, or solely with the passage of time or notice, would exist under the Loan Documents.

c. Each Loan Party acknowledges and agrees that to its actual knowledge (i) there is no basis nor set of facts on which any amount (or any portion thereof) owed by any of the Loan Parties under any Loan Document could be reduced, offset, waived, or forgiven, by rescission or otherwise; (ii) nor is there any claim, counterclaim, off set, or defense (or other right, remedy, or basis having a similar effect) available to any of the Loan Parties with regard thereto; (iii) nor is there any basis on which the terms and conditions of any of the Obligations could be claimed to be other than as stated on the written instruments which evidence such Obligations.

-6-

5. Miscellaneous:

a. Terms used in this Third Amendment which are defined in the Credit Agreement are used as so defined.

b. This Third Amendment may be executed in counterparts, each of which when so executed and delivered shall be an original, and all of which together shall constitute one agreement.

c. This Third Amendment expresses the entire understanding of the parties with respect to the transactions contemplated hereby. No prior negotiations or discussions shall limit, modify, or otherwise affect the provisions hereof.

d. Any determination that any provision of this Third Amendment or any application hereof is invalid, illegal, or unenforceable in any respect and in any instance shall not affect the validity, legality, or enforceability of such provision in any other instance, or the validity, legality, or enforceability of any other provisions of this Third Amendment.

e. The Borrowers shall pay on demand all reasonable costs and expenses of the Agents and the Lenders, including, without limitation, attorneys’ fees incurred by the Agents in connection with the preparation, negotiation, execution, and delivery of this Third Amendment. The Administrative Agent is hereby authorized by the Borrowers to make one or more Revolving Credit Loans to pay all such costs, expenses, and attorneys’ fees and expenses.

f. In connection with the interpretation of this Third Amendment and all other documents, instruments, and agreements incidental hereto:

i. All rights and obligations hereunder and thereunder, including matters of construction, validity, and performance, shall be governed by and construed in accordance with the law of The Commonwealth of Massachusetts and are intended to take effect as sealed instruments.

ii. The captions of this Third Amendment are for convenience purposes only, and shall not be used in construing the intent of the parties under this Third Amendment.

iii. In the event of any inconsistency between the provisions of this Third Amendment and any of the other Loan Documents, the provisions of this Third Amendment shall govern and control.

-7-

g. The Agents, the Lenders, the Borrowers, and the Facility Guarantors have prepared this Third Amendment and all documents, instruments, and agreements incidental hereto with the aid and assistance of their respective counsel. Accordingly, all of them shall be deemed to have been drafted by the Agents, the Lenders, the Borrowers, and the Facility Guarantors and shall not be construed against any party.

[Signatures Follow]

-8-

IN WITNESS WHEREOF, the undersigned have caused this Third Amendment to be duly executed as of the date first set forth above.

as Lead Borrower and as a Borrower

By:

Name: Xxx Xxxxxxx

Title: CEO

AMERICAN APPAREL RETAIL, INC.

as a Borrower

By:

Name: Xxx Xxxxxxx

Title: CEO

AMERICAN APPAREL DYEING & FINISHING, INC.,

as a Borrower,.

By:

Name: Xxx Xxxxxxx

Title: CEO

KCL KNITTING, LLC,

as a Borrower

By:

American Apparel, Inc., its sole member

By:

Name: Xxx Xxxxxxx

Title: CEO

Signature Page to Third Amendment to Credit Agreement

AMERICAN APPAREL, LLC, as a Facility Guarantor

By:

Name: Xxx Xxxxxxx

Title: CEO

FRESH AIR FREIGHT, INC., as a Facility Guarantor

By:

Name: Xxx Xxxxxxx

Title: CEO

Signature Page to Third Amendment to Credit Agreement

LASALLE BUSINESS CREDIT, LLC,

As Agent for LaSalle Bank Midwest National Association, acting through its division, LaSalle Retail Finance

As Administrative Agent, as Collateral Agent, as Swingline Lender and as Lender

By:

Name: Xxxxxxx X. Xxxxxx Title: Vice President

Address: 000 Xxxxxxx Xxxxxx, 0xx Xxxxx Xxxxxx, Xxxxxxxxxxxxx 00000 Attn: Xxxxxxx X. Xxxxxx

Telephone: (000) 000-0000 Telecopy: (000) 000-0000

LASALLE BANK NATIONAL ASSOCIATION,

As Issuing Bank

By:

Name: Xxxxxxx X. Xxxxxx

Title: Vice President

Address: 000 Xxxxx XxXxxxx Xxxxxx

Xxxxxxx, Xxxxxxxx 00000 Attention:

Telephone: (000) 000-0000 Telecopy:

Signature Page to Third Amendment to Credit Agreement

XXXXX FARGO RETAIL FINANCE, LLC,

As Collateral Monitoring Agent and as a Lender

By:

Name: Xxxxx Xxxxxxxxxx

Title: Assistant Vice President/Account Executive

Address: Xxx Xxxxxx Xxxxx, 00xx Xxxxx Xxxxxx, Xxxxxxxxxxxxx 00000 Attn: Xxxxx Xxxxxxxxxx

Telephone: (000) 000-0000

Telecopy:

Signature Page to Third Amendment to Credit Agreement

Exhibit A

Funds Flow

[please see attached]

Exhibit A to Third Amendment to Credit Agreement

ENDEAVOR ACQUISITION CORP. 000 Xxxxxxx Xxxxxx

00xx Xxxxx Xxx Xxxx, Xxx Xxxx 00000

As of December 12, 2007

Continental Stock Transfer & Trust Company

00 Xxxxxxx Xxxxx

Xxx Xxxx, Xxx Xxxx 00000

Attention: Accounting Department

Dear Sirs:

Pursuant to the terms of the Investment Management Trust Agreement dated as of December 15, 2005, by and between Endeavor Acquisition Corp. and Continental Stock Transfer & Trust Company, you are hereby authorized to pay from Trust Account No. 530-060957 of Endeavor Acquisition Corp., to the designated persons on Schedule I hereto, the amounts set against their names.

Very truly yours,

ENDEAVOR ACQUISITION CORP.

By:

Name: Xxxxxxxx X. Xxxxxxx Title: President

SCHEDULE 1 PAYMENTS FROM TRUST ACCOUNT

Gross Proceeds in Trust $ 129,188,279.45

Payments

Xxxx Xx Xxx (for payment of Lim Buyout and tax distribution) $ 75,809,652.00

Payment of tax distribution to Xxx Xxxxxxx $ 7,857,318.00

Xxxxxxxx Xxxxxx (for unpaid legal fees and disbursements) $ 1,100,000.00

Ladenburg Xxxxxxxx & Co. Inc. for deferred commissions and expenses $ 2,301,431.52

Repayment of interest-free loans made by Xxxxxxxx X. Xxxxxxx to Endeavor $ 357,500.00

Repayment of interest-free loans made by Xxxx Xxxxxx to Endeavor. $ 357,500.00

RR Xxxxxxxx (for printing fees and expenses) $ 1,222,648.60

Total payments to above listed persons $ 89,006,050.12

Portion of trust account to be wired to Endeavor Acquisition Corp.

account, as parent of combined companies $ 24,530,796.33

Portion of trust account to be wired to American Apparel, Inc. account $ 13,694,252.00*

Portion of trust account to be wired to American Apparel (Canada). $ 1,957,181.00*

Total payments to Endeavor, American Apparel and affiliated companies. $ 40,182,229.33

*These amounts cover the following:

American Apparel directed payments for related party loan repayments: $16,955,733.00

American Apparel directed payments for cash bonuses: $ 2,500,000.00

2

Wire instructions for Xxxx Xx Xxx

Xxxxx Fargo Bank 00000 Xxxxxxx Xxxx. Xxxxxx Xxxx, XX 00000 ABA # 000000000 Account # 1482775580

3

Wire instructions for Xxxxxxxx Xxxxxx

Citibank N.A. 000 Xxxx 00xx Xxxxxx Xxx Xxxx, XX 00000 ABA 000000000

For further credit to: Xxxxxxxx Xxxxxx Attorney Business Account

Account No. 00000000

4

Wire Instructions for Ladenburg Xxxxxxxx & Co. Inc.:

BANK: XX Xxxxxx

ABA No.: 000000000 SWIFT: XXXX US 33

CREDIT TO: National Financial Services A/C #: 000-000-000

FURTHER CREDIT TO: Ladenburg Xxxxxxxx & Co. Inc.

A/C#: XXX000000

Wire instructions for Xxxxxxxx X. Xxxxxxx

JPMorgan Private Bank–DE

000 Xxxxxxx Xxxxxxxxxx Xx.

Xxxxxx, XX 00000

ABA# 000000000

SWIFT: XXXXXX00

Private Bank Division

Credit Account T&I #0000-00-000

Account Name: Xxxxxxxx X. Xxxxxxx

For Account of: X00000000

2

Wire instructions for Xxxx Xxxxxx

Currency

USD

Intermediary Bank Details

TO BE SENT BY MT103

Bank Name/Location

XXXXXXXX

Bank Identifier e.g.; Swift Code Sort code ABA number

000000000

Beneficiary Bank Details (if applicable)

For Credit To;

Bank of New Zealand

Bank Name/Location

Bank of New Zealand , Wellington Head Office

Bank Identifier e.g.; Swift Code Account Number Sort code ABA number

XXXXXX00 00000000

Account Number

For Further Credit To;

Account Name

Cullen Investments Limited

Account Number /IBAN

574658-0000

3

Wire instructions for RR Xxxxxxxx

Bank of America

ABA: 0000-0000-0

Account Number: 1233552859

Account Name: XX Xxxxxxxxx Receivables, Inc.

CHIPS Address: 0959 SWIFT Address: XXXXXX0X

Physical Address for routing Identifiers: 000 Xxxx 00xx Xxxxxx, XX 00000

In the OBI or Tag 6000 section please reference the invoice number: 1201412300

4

Wiring instructions for Xxx Xxxxxxx

Acct #: 0200572706 Routing #: 000000000 Swift Code: NARA US 6L Nara Bank Beneficiary: Xxx Xxxxxxx

5

Wire instructions for Endeavor Acquisition Corp.

CITIBANK NA

000 XXXXX XXX

XX, XX 00000

ABA 000000000

ACCT# 00000000

ACCOUNT NAME: Endeavor Acquisition Corp

Optional: Xxxxxxxx X. Xxxx, Service Officer

If international: SWIFT CODE: XXXXXX00

6

Wire instructions for American Apparel, Inc.

US Bank

Account Name: American Apparel, Inc.

Account #: 153492249385

Routing ABA#: 000000000

SWIFT: USBKUS 441MT

7

Wire instruction for American Apparel (Canada)

Beneficiary:

0000-0000 Xxxxxx Inc. d/b/a American Apparel 000 Xxxxxxx Xxxxxx Xxxx, Xxxxx 000 Xxxxxxxx, XX X0X 0X0

Corresponding Bank:

Bank of America National Trust and Savings Association New York, NY (BOFAUS3N) ABA #000-000-000

Account of TD Bank SWIFT: XXXXXXXXXXX)

Beneficiary Bank:

TD Canada Trust 0000 Xx-Xxxxxxx Xxxx. Xxxxxxxx, XX Transit No.: 47201-004 Account No.: 0000000

8

Exhibit B

Opinion of Counsel [please see attached]

Exhibit B to Third Amendment to Credit Agreement

December [XX], 2007

LaSalle Business Credit, LLC,

as agent for

LaSalle Bank Midwest National Association,

acting through its division,

LaSalle Retail Finance, as

administrative and collateral agent, and as a Lender

00 Xxxxxxxxx Xxxx Xxxxxx Xxxx, Xxxxx 000

Xxxxxxxxx, Xxxxxxxxxxxxx 00000

Xxxxx Fargo Retail Finance, LLC,

as collateral monitoring agent and as a Lender

Xxx Xxxxxx Xxxxx, 00xx Xxxxx

Xxxxxx, Xxxxxxxxxxxxx 00000

Re: Credit Agreement dated as of July 2, 2007 as currently amended, modified, supplemented or restated by and among (i) the Lenders from time to time party to the Credit Agreement, (ii) LaSalle Bank National Association, a national banking association, as Issuing Bank, (iii) LaSalle Business Credit, LLC, as Administrative and Collateral Agent, (iv) Xxxxx Fargo Retail Finance, LLC as Collateral Monitoring Agent, (v) American Apparel, Inc., KCL Knitting, LLC, American Apparel Retail, Inc., and American Apparel Dyeing & Finishing, Inc. as Borrowers, and (vi) American Apparel, LLC, and Fresh Air Freight, Inc., as Facility Guarantors

Ladies and Gentlemen:

We have acted as counsel for American Apparel, Inc., a California corporation (“American Apparel”), in connection with the execution and delivery of the Credit Agreement dated as of July 2, 2007 (as amended, modified, supplemented or restated, the “Credit Agreement”), by and among the Borrowers, the Guarantors, the Lenders from time to time party to the Credit Agreement (the “Lenders”), LaSalle Business Credit, LLC, as agent for LaSalle Bank Midwest National Association, acting through its division, LaSalle Retail Finance, as Administrative Agent and Collateral Agent, LaSalle Bank National Association, as Issuing Bank, and, pursuant to that certain First Amendment to Credit Agreement dated October 11, 2007, Xxxxx Fargo Retail Finance, LLC, as Collateral Monitoring Agent and Lender. This opinion is given to you pursuant to Section 3.d of that certain Third Amendment

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 2

to Credit Agreement by and among the parties to the Credit Agreement (the “Third Amendment”). All capitalized terms used but not otherwise defined herein have the meanings given them in the Credit Agreement.

The Credit Agreement references the merger (the “Merger”) of American with and into AAI Acquisition LLC, a California limited liability company (“AAI”), with AAI being the surviving entity (the “Surviving Company”) pursuant to the Merger Agreement. Pursuant to Section 6.03 of the Credit Agreement, the Administrative Agent has requested that certain agreements be executed and delivered to the Lenders by the Surviving Company and the parent of the Surviving Company, Endeavor Acquisition Corp., a Delaware corporation (“Endeavor” and, together with the Surviving Company, the “Additional Parties”).

As to matters of fact, we are relying upon the representations and warranties of all parties contained in the Credit Agreement and the certificates of certain officers of Endeavor and the manager of the Surviving Company attached hereto as Exhibit A (“Opinion Certificate”). In rendering the opinion expressed below, we have examined executed originals or copies of the following documents:

(a) the Guaranty executed by Endeavor:

(b) the Ownership Interest Pledge and Security Agreement executed by Endeavor (the “Pledge Agreement”);

(c) the Assumption and Ratification Agreement executed by the Surviving Company (the “Assumption Agreement”);

(d) the First Amendment to Ownership Interest and Security Agreement;

(e) the copy of the UCC-1 financing statement attached hereto as Exhibit B (the “Endeavor Financing Statement”);

(f) the copy of the UCC-1 financing statement attached hereto as Exhibit C (the “AAI Financing Statement”); and

(g) the Merger Agreement.

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 3

Hereinafter, the documents referred to in items (a) and (b) are referred to as the “Endeavor Documents”, the documents referred to in items (c) and (d) are referred to as the “Surviving Company Documents” and, collectively, the Endeavor Documents and the Surviving Company Documents shall together be referred to as the “Assumption Documents”. Together, the documents referred to in items (a) through (g) shall be referred to as the “Reviewed Documents”.

In rendering our opinion regarding the valid existence and good standing of Endeavor and the Surviving Company and qualification of the Surviving Company to conduct business in foreign jurisdictions, we have relied entirely on the certificates and advices attached hereto as Exhibit D and representations made to us in the Opinion Certificate without independent verification. We did not obtain tax good standing certificates from any jurisdiction and no opinion is provided with respect to tax good standing of either Endeavor or the Surviving Company in any jurisdiction.

In addition, in rendering the opinions given below, we have examined originals or copies of documents, corporate records and other writings that we consider relevant for the purposes of this opinion. In our examination of documents in connection with rendering our opinions, we have assumed with your permission that the signatures, original or copied, on all documents and instruments examined by us are genuine and authentic, that each is complete and what it purports to be, that all documents and instruments submitted to us as copies or facsimiles or electronically conform with the originals, and that the documents and instruments submitted to us have not been amended or modified since the date submitted.

In our examination of documents, we further assumed (i) the genuineness of all certificates and the authenticity of all documents submitted to us as original counterparts or as certified or photostatic copies, (ii) the genuineness of the signatures of all parties to the Assumption Documents other than those of officers of Endeavor and the Loan Parties and the manager of the Surviving Company, and (iii) that each person or entity entering into such documents (other than the Additional Parties and the Loan Parties in connection with the Assumption Documents) had the power, legal competence and capacity to enter into and perform all of such party’s obligations thereunder, (iv) the due authorization, execution and delivery by each party (other than the due authorization, execution and delivery of the Additional Parties), (v) the enforceability and binding nature of the obligations of the parties to such documents (other than as to the enforceability against, and the binding nature upon, the Additional Parties), (vi) that there is no fact or circumstance relating to any party that might prevent the Lenders from enforcing any of the rights provided for in the Assumption

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 4

Documents, (vii) performance on or before the closing of the Merger (the “Closing”) by all parties of their obligations under the Merger Agreement to be performed on or before the Closing and (viii) that no action has been taken or event occurred which amends, revokes, terminates or renders invalid any of the documents, records, consents or resolutions which we have reviewed since the date of the certificates we relied upon in rendering this opinion. We also assumed that there are no extrinsic agreements or understandings among the parties to the Assumption Documents that would modify or interpret the terms of the Assumption Documents or the respective rights or obligations of the parties thereunder.

In rendering the opinions set forth below which are stated to be to our knowledge, we have, with your consent, advised you only concerning information actually and currently known to Xxxxx Xxxxxxxxx and Xxxxxxx Xxxxxxxxxx, the attorneys within the firm with primary responsibility for the transactions covered by this opinion. Except to the extent expressly set forth herein we have not undertaken any independent investigation to determine the accuracy or completeness of any such statement, and no inference as to the accuracy or completeness of such statement should be drawn from our representation of any of the Loan Parties or our rendering the opinion set forth below.

For purposes of these opinions, we have, with your approval, made no independent review of the operations, transactions, or contractual arrangements of Endeavor, the Surviving Company, Borrowers or Guarantors, or made any search of court records or inquiry of any governmental agency.

We are licensed to practice law in the State of California and are not experts on and do not express any opinion concerning any laws of any jurisdiction other than the laws of the State of California and the federal laws of the United States, as such are in effect on the date hereof, and we have made no inquiry into, and we express no opinion as to, the statutes, regulations, treaties, common laws or other laws of any other nation, state or jurisdiction.

Based upon and subject to the foregoing and the qualifications and limitations set forth below, and except as set forth in the Credit Agreement, the Merger Agreement, the Assumption Documents, or the schedules attached to the foregoing, it is our opinion that:

1. Endeavor is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware, has all requisite corporate power and authority to own and operate its properties, to carry on its business as, to our knowledge, it is now conducted and as it is contemplated to be conducted following the consummation of the Merger, to execute, deliver and perform its obligations under the Endeavor Documents. The

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 5

Surviving Company is a limited liability company, duly formed, validly existing and in good standing under the laws of the State of California and has all requisite limited liability company power and authority to own and operate its properties, to carry on its business as, to our knowledge, it is now conducted and as it is contemplated to be conducted following the consummation of the Merger, to execute, deliver and perform its obligations under the Surviving Company Documents. Endeavor and the Surviving Company are each qualified to conduct business as a foreign entity in the jurisdictions set forth opposite their respective names on Exhibit D attached hereto.

2. The execution, delivery and performance by each of the Additional Parties of each of the Assumption Documents to which such Additional Party is a party has been duly authorized by all necessary corporate or limited liability company action, as applicable. Each of the Additional Parties has executed and delivered each of the Assumption Documents to which it is a party, and subject to the exceptions and qualifications set forth below, such Additional Documents constitute the valid and binding obligations of such Additional Party in accordance with their respective terms.

3. To the extent a security interest in such collateral may be created therein under Division 9 of the Commercial Code, the Endeavor Financing Statement is sufficient in form to perfect the security interest in the collateral described in the Endeavor Financing Statement, to the extent that security interests in such collateral can be perfected by the filing of the UCC-1 Financing Statement with the Secretary of State of the State of California.

4. To the extent a security interest in the collateral may be created therein under Division 9 of the Commercial Code, the AAI Financing Statement is sufficient in form to perfect the security interest in the collateral described in the AAI Financing Statement and in the Assumption and Ratification Agreement, to the extent that security interests in such collateral can be perfected by the filing of the UCC-1 Financing Statement with the Secretary of State of the State of California.

5. Based upon the permitted assumptions of due execution and delivery of the Merger Agreement, and valid implementation of the Merger in accordance with applicable laws and the terms of the Merger Agreement, the consummation of the Merger has no adverse effect on the security interest in the Borrowers’ assets, or the priority of that security interest established in the Credit Agreement and the Security Agreement.

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 6

With regard to the opinion set forth in paragraph 2 above regarding enforceability, we note that whenever an opinion herein states that an agreement is a “valid and binding obligation” of a party “enforceable in accordance with its terms,” or use words of similar import, such opinions are to be understood to mean that, subject to the qualifications and limitations set forth herein, (i) an effective contract has been formed under California law, (ii) the entire agreement is not invalid by reason of a specific statutory prohibition or the public policy of the State of California, (iii) contractual defenses to the entire agreement are not available and (iv) some remedy is available if a party to the agreement does not materially comply with its terms. This does not imply that any particular type of remedy is available.

We have further assumed that the governing law (exclusive of California laws relating to conflicts of laws) of each such Reviewed Document is California. We have not, however, reviewed the covenants in the Reviewed Documents that contain financial ratios and any other financial restrictions, and no opinion is provided with respect thereto. We also do not express any opinion on parol evidence bearing on interpretation or construction of any such Reviewed Documents or on any oral modifications to such contractual obligations made by the parties thereto. .

We have assumed that no party to any of the Loan Documents or Reviewed Documents will in the future take any discretionary action (including a decision not to act permitted by any of the Loan Documents) that would cause the performance of any of the Loan Documents to violate any California or federal statute, rule or regulation; constitute a violation or breach of or default under any of the Reviewed Documents; or require an order, consent, permit or approval to be obtained from a California or federal government authority.

Each of our opinions set forth above is further subject to the following exceptions, qualifications, limitations, comments and additional assumptions:

A. The enforceability of the Assumption Documents is subject to and we express no opinion on the effect of usury, bankruptcy, insolvency, reorganization, moratorium and other similar laws relating to or affecting the relief of debtors or the rights and remedies of creditors generally, including without limitation the effect of statutory or other law regarding fraudulent transfers or conveyance, preferential transfers and distributions and equitable subordination.

B. We express no opinion regarding (i) the effect of any limitations or exceptions imposed by principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, or upon the availability of equitable

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 7

remedies for the enforcement of provisions of the Loan Documents, whether considered in a proceeding at law or in equity, or (ii) the effect of an exercise of judicial discretion whether in a proceeding in equity or at law.

C. We express no opinion regarding (i) any of the rights or remedies available to any party for violations or breaches of any provisions which are immaterial or the enforcement of which would be unreasonable under the then existing circumstances, (ii) any of the rights or remedies available to any party for material violations or breaches which are the proximate result of actions taken by any party to the Loan Documents other than the party against whom enforcement is sought, which actions such other party is not entitled to take pursuant to the Assumption Documents or which otherwise violate applicable laws, (iii) any of the rights or remedies available to any party which takes discretionary action which is arbitrary, unreasonable or capricious, or is not taken in good faith or in a commercially reasonable manner, whether or not the Loan Documents permit such action, (iv) the enforceability of any provision deemed to be “unconscionable” within the meaning of Section 1670.5 of the California Civil Code or any other California law or United States federal law or equitable principle which provides that a court may refuse to enforce, or may limit the application of, a contract or any clause thereof which the court finds to have been unconscionable at the time it was made or contrary to public policy, (v) the enforceability of any provision authorizing the exercise of any remedy without reasonable notice and opportunity to cure, or (vi) the effect of any provision of any of the Loan Documents purporting to give a lender the right to make any conclusive determination in its sole discretion.

D. We express no opinion as to the legality, validity, binding nature or enforceability of (i) any provisions in the Assumption Documents providing for the payment or reimbursement of costs or expenses or indemnifying a party, or referring to a right of contribution, to the extent such provisions may be held unenforceable as contrary to public policy, (ii) any provision of any of the Loan Documents insofar as it provides for the payment or reimbursement of costs and expenses or indemnification for claims, losses or liabilities in excess of a reasonable amount determined by any court or other tribunal, (iii) any provisions regarding any party’s ability to collect attorneys’ fees and costs in an action involving the Loan Documents, including, but not limited to, when a party is not the prevailing party in an action (we call your attention to the effect of Section 1717 of the California Civil Code, which provides that where a contract permits one party thereto to recover attorneys’ fees, the prevailing party in any action to enforce any provision of the contract shall be entitled to recover its reasonable attorneys’ fees), (iv) any provisions of any of the Loan Documents

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 8

imposing penalties or forfeitures, late payment charges or any increase in interest rate, upon delinquency in payment or the occurrence of a default to the extent they constitute a penalty or forfeiture or are otherwise contrary to public policy, (v) any rights of set-off, (vi) any provision of the Loan Documents to the effect that a statement, certificate, determination or record shall be deemed conclusive absent manifest error (or similar effect), including, without limitation, that any such statement, certificate, determination or record shall be prima facie evidence of a fact, (vii) any provision of the Loan Documents which provides that notice not actually received may be binding on any party, or (viii) any severability provision.

E. We express no opinion with respect to the legality, validity, binding nature or enforceability of provisions of the Loan Documents expressly, or by implication, waiving or relinquishing broadly or vaguely stated rights or unknown future rights or defenses, or waiving defenses to obligations or rights granted by law (whether substantive or procedural) or waiving rights to damages, or the benefits of statutory, regulatory or constitutional rights.

F. We express no opinion with respect to the legality, validity, binding nature or enforceability of any provision of the Loan Documents purporting to (a) waive rights to trial by jury, service of process or objections to venue or jurisdiction in connection with any litigation arising out of or pertaining to the Loan Documents, (b) exclude conflict of law principles under California law, (c) establish particular courts as the forum for the adjudication of any controversy relating to the Loan Documents, (d) establish the laws of any particular state or jurisdiction for the adjudication of any controversy relating to the Loan Documents, (e) establish evidentiary standards or make determinations conclusive, or (f) provide for arbitration of disputes.

G. We express no opinion regarding the effect of judicial decisions which may permit the introduction of extrinsic evidence to modify the terms or the interpretation of the Loan Documents.

H. We express no opinion with respect to the legality, validity, binding nature or enforceability of any provision of the Loan Documents providing that (a) rights or remedies are or are not exclusive, (b) rights or remedies may be exercised without notice, (c) every right or remedy is cumulative and may be exercised in addition to or with any other right or remedy, (d) the election of a particular remedy or remedies does not preclude recourse to one or more other remedies, (e) liquidated damages are to be paid upon the breach of any of the Loan Documents, or (f) the failure to exercise, or any delay in exercising, rights or

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 9

remedies available under any of the Loan Documents will not operate as a waiver of any such right or remedy.

I. We express no opinion with respect to the legality, validity, binding nature or enforceability of any provision of the Loan Documents requiring written amendments or waivers insofar as it suggests that oral or other modifications, amendments or waivers could not be effectively agreed upon by the parties or that the doctrine of promissory estoppel might not apply. We note that a requirement that provisions of the Loan Documents may only be amended or waived in writing may not be binding or enforceable if an oral agreement has been created modifying such provision or an implied agreement by trade practice or course of conduct has given rise to an amendment or waiver.

J. We express no opinion with respect to the legality, validity, binding nature or enforceability of any provision of the Loan Documents to the extent that an arbitrator’s decision may be contrary to the law or the facts and not subject to reversal.

K. We express no opinion as to the applicability or effect of compliance or non-compliance by any lender (or its agent) with any state, federal or other laws applicable to such lender (or its agent) or to the transactions contemplated by the Loan Documents because of the nature of its business, including its legal or regulatory status.

L. Except as expressly set forth above, we express no opinion as to the creation, attachment, validity, perfection or priority of a security interest in any item of collateral or the necessity of making any filings or taking any other action in connection therewith.

M. We express no opinion as to the effect on a secured creditor’s ability to realize on collateral, of marshaling, substitution of collateral, or similar doctrines or laws.

N. We express no opinion as to the perfection of any security interest in collateral consisting of after-acquired property, except to the extent such property is properly classified in a category specifically referred to in the grant clause of the applicable security agreement and on the relevant financing statements.

O. We express no opinion as to any matter concerning perfection or continuation of a security interest in, or the ability of any of the Agents or any Lender to realize upon, (i) collateral located, or deemed located, in any jurisdiction other than the State of California and (ii) collateral moved outside the State of California at any time. Our

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 10

opinion is based on California law, which generally provides for the local law of the jurisdiction of where the debtor is located to govern the perfection, the effect of perfection, and the priority of a security interest in collateral of a debtor. However, California law recognizes that “while collateral is located in a jurisdiction, the local law of that jurisdiction governs perfection, the effect of perfection or nonperfection, and the priority of a possessory security interest in that collateral.” Cal. Comm. Code §9301(2). Under California law, perfection by possession has priority over perfection by filing for certain collateral, such as, but not limited to, instruments, negotiable documents of title, certificated and uncertificated securities, and investment property, but does not have priority in the case of goods. We call your attention to the other provisions of §9301 of the California Commercial Code which discuss the law governing perfection, effect of perfection or nonperfection, and priority. The Lender and Agents may be able to realize upon collateral located in other jurisdictions besides California if they follow California law, but priority rules are so extensive and diverse among the various states that we are unable to express any opinion regarding collateral located outside of the State of California. The above narrative regarding priority between perfection by filing verses possession was for explanatory purposes only and does not constitute a priority opinion.

P. We express no opinion on the effect of provisions permitting any of the Agents or Lenders to exercise, or the exercise of any of the Agents or Lenders of self-help and non-judicial remedies, such as a right, without judicial process, to enter upon, to take possession of, to collect, retain, use and enjoy rents, issues and profits from the Collateral, or to manage the Collateral or of provisions respecting sales or disposal of collateral or property other than in compliance with applicable law.

Q. We express no opinion as to the sufficiency of any description of the Collateral in the Security Agreement or the UCC-1 Financing Statements. We have assumed that such descriptions are sufficient and reasonably identifies what is described under Division 9 of the Commercial Code (within the meaning of Section 9108(a) of the California Uniform Commercial Code (hereinafter the “Commercial Code”)). We call your attention to Section 9108 of the Commercial Code.

R. We express no opinion as to the existence of, or the state of any rights or interest of the Surviving Company or Endeavor in or title to, any item of collateral or the priority of any security interest in any item of collateral over any other interest in the collateral. In this regard, we have assumed that the Surviving Company and Endeavor have

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 11

“rights” (within the meaning of Section 9203(b)(2) of the Commercial Code) in the collateral in which it purports to grant a security interest for the security interests to attach.

S. We have assumed that “value has been given” (within the meaning of Section 9203(b)(l) of the Commercial Code).

T. We express no opinion as to the effect of any provision of any of the Loan Documents purporting to give any of the Agents or any Lender the right to take control of any of the operations without formal acceleration, appropriate notice and compliance with the procedural limitations of Division 9 of the Commercial Code.

U. We call your attention to the fact that the security interest of the Collateral Agent in collateral consisting of proceeds is limited to the extent set forth in Section 9315 of the Commercial Code.

V. We express no opinion as to the effect of any provision of any of the Loan Documents purporting to relieve a secured party of any duty it may have to preserve the value of collateral in its possession (see Commercial Code Section 9207; see, also, Citibank, N.A. v. Data Lease Financial Corporation, 828 F.2d 686 (11th Cir. 1987)).

W. We advise you that if the difference between the name of the original debtor and a new debtor causes a financing statement to become seriously misleading under Section 9506 of the Commercial Code, an additional filing must be made. We direct your attention to Section 9508 of the Commercial Code.

X. We advise you that under certain circumstances, a surety agreement executed by an equity holder of a borrower may not be enforced as an obligation separate from the obligation guaranteed if it is determined that the borrower is merely an alter ego or nominee of the surety and that the “true” borrower is the surety. If the surety is deemed to be liable as a principal, it is likely that the surety will also be entitled to the rights and defenses otherwise available to a principal. For purposes of this opinion, we have assumed, with your consent and without independent investigation, that the Surviving Company is adequately capitalized for the purpose of conducting its business, that the Surviving Company was not formed for the purpose of acting as agent for or as an instrumentality of Endeavor, and that the Surviving Company maintains and will continue to maintain an identity independent of and separate from Endeavor.

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 12

Y. We advise you of statutory provisions and case law to the effect that a surety may be exonerated if the creditor alters the original obligation of the principal without the consent of the surety, elects remedies for default that may impair the subrogation rights of the surety against the principal, or otherwise takes any action without notifying the surety which materially prejudices the surety, unless the surety validly waives such rights. We express no opinion as to the effect of (i) any modification or amendment of the obligations of the Borrowers which materially increases such obligations, (ii) any election of remedies by any of the Lenders or Agents following the occurrence of an event of default under the obligation subject to the Guaranty, or (iii) any other action by any of the Agents or Lenders which materially prejudices the surety if, in each instance, such modification, election or action occurs without notice to Endeavor and without granting to Endeavor an opportunity to cure any default by the Borrowers.

Z. We express no opinion concerning the enforceability of assignment, transfer or other conveyance of any permit, license or approval to the extent any governmental agencies or authorities or other third parties may refuse or be unable to approve, acquiesce in, or consent to any such assignment, transfer or other conveyance.

AA. We express no opinion as to the legal effect of any provision of any of the Loan Documents purporting to reinstate, as against any obligor or guarantor, obligations or liabilities of such obligor which have been avoided or which have arisen from transactions which have been rescinded or the payment of which has been required to be returned by any court of competent jurisdiction.

BB. We call to your attention the fact that the perfection of a security interest will be terminated under Section 9507(c) of the Commercial Code as to any collateral acquired more than four months after a borrower changes its name so as to make any UCC-1 financing statement seriously misleading, unless an amendment to the financing statement which renders the financing statement not seriously misleading is properly filed before the expiration of such four-month period.

CC. In the case of all collateral, Division 9 of the Commercial Code requires the filing of continuation statements within six months prior to the expiration of each five-year period following the original filing of the UCC-1 financing statements describing such collateral in order to continue the perfection of lenders’ security interest therein.

DD. We have assumed the validity of any wire transfers, drafts or checks tendered by any of the Lenders or Issuing Bank.

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 13

EE. We express no opinion as to whether the members of the board of directors of Endeavor or the manager of the Surviving Company have complied with their fiduciary duties in connection with the authorization and performance of the Assumption Documents and we have assumed such compliance.

FF. We have assumed that the actions of Endeavor and its officers, directors and shareholders comply with the provisions of Section 310 of the California General Corporation Law.

GG. We express no opinion as to matters governed by any laws other than the laws of the State of California or the federal law of the United States of America. We express no opinion as to the laws of any other jurisdiction nor as to the statutes, administrative decisions, rales, regulations or requirements of any county, municipality, subdivision or local authority of any jurisdiction. We express no opinion as to whether the laws of any jurisdiction are applicable to the Loan Documents or the transactions contemplated thereby.

HH. We express no opinion as to matters governed by federal and state laws and regulations governing: usury; securities; broker-dealers, investment advisers; insurance; labor, employment (including, but not limited to, the Americans with Disabilities Act) and pension and employee benefits; antitrust and unfair competition, including covenants not to compete; escheat; health and safety, environmental protection and hazardous substances; taxation; or patents, copyrights, trademarks, trade names and other intellectual property rights.

H. We advise you that, pursuant to Section 17375 of the California Corporations Code, a limited liability company is generally not permitted to render professional services as defined in California Corporations Code section 13401 (a). In rendering the opinion set forth in paragraph (a), we have, with your permission, relied exclusively upon the Opinion Certificate in determining the principal business activities of the Surviving Company and have concluded that such activities do not constitute the rendering of professional services. We have not, however, engaged in any independent investigation of the scope of the business activities of the Surviving Company and render no opinion relating to any business activities of the Surviving Company that are not described in the Opinion Certificate.

JJ. We express no opinion regarding any entity organized outside of the State of California, except for Endeavor, and our opinion is qualified to the extent that any foreign entity impacts the opinions rendered.

LaSalle Business Credit, LLC

The Lenders From Time to Time Party

to the Credit Agreement

Page 14

KK. We note that the parties to the Loan Documents have designated the laws of the Commonwealth of Massachusetts as the laws governing the Loan Documents. Our opinion is premised upon the result that would be obtained if a California court were to apply the internal laws of the State of California to the interpretation and enforcement of the Loan Documents (notwithstanding the designation therein of the laws of the Commonwealth of Massachusetts).

LL. This opinion is qualified to the extent, and is rendered and delivered on the express condition and assumption that no counsel for any addressee has expressed or reached opinions which are contrary to the opinions set forth herein.

This opinion is rendered as of the date first written above solely for your benefit in connection with the Assumption Documents and may not be relied on by, nor may copies be delivered to, any other person other than your counsel, Xxxxxx & Xxxxxxxxxx LLP, without our prior written consent. Our opinion is expressly limited to the matters set forth above and we render no opinion, whether by implication or otherwise, as to any other matters relating to the Additional Parties, the Loan Parties or the Loan Documents. We assume no obligation to inform you of any facts, circumstances, events or changes in the law that may hereafter be brought to our attention that may alter, affect or modify the opinions expressed herein.

Respectfully submitted,

Xxxxx X. Xxxxxxxxx

Xxxxxxxxx, Xxxxx & Xxxx, LLP

EXHIBIT A

Opinion Certificates

EXHIBIT B

Endeavor Financing Statement

EXHIBIT C

AAI Financing Statement

EXHIBIT D

Good Standing and Qualifications to Conduct Business