Execution Version CREDIT AGREEMENT Dated as of May 11, 2018 among NSM INSURANCE GROUP, LLC, as the Borrower, NSM INSURANCE HOLDCO, LLC, as Holdings, ARES CAPITAL CORPORATION, as Administrative Agent, and THE LENDERS AND L/C ISSUERS PARTY HERETO FROM...

Execution Version CREDIT AGREEMENT Dated as of May 11, 2018 among NSM INSURANCE GROUP, LLC, as the Borrower, NSM INSURANCE HOLDCO, LLC, as Holdings, ARES CAPITAL CORPORATION, as Administrative Agent, and THE LENDERS AND L/C ISSUERS PARTY HERETO FROM TIME TO TIME ♦ ♦ ♦ ARES CAPITAL MANAGEMENT LLC, as Sole Bookrunner and Sole Lead Arranger and LAKE FOREST BANK & TRUST COMPANY, N.A., as Documentation Agent [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

SCHEDULES AND EXHIBITS Schedule I - Commitments Schedule II - Addresses for Notices Schedule 2.4 - Existing Letters of Credit Schedule 3.1(a) - Other Collateral Documents Schedule 4.2 - Permits, Filings, Consents and Notices Schedule 4.3 - Ownership of Group Members; Subsidiaries; Capitalization Schedule 4.12 - Labor Matters Schedule 4.14 - Environmental Matters Schedule 4.16 - Real Property Schedule 7.12 - Post-Closing Matters Schedule 8.1 - Indebtedness Schedule 8.2 - Liens Schedule 8.3 - Investments Schedule 8.9 - Affiliate Transactions Exhibit A - Form of Assignment Exhibit B - Form of [Revolving Loan][Term Loan] Note Exhibit C - Form of Notice of Borrowing Exhibit D - Form of Swingline Loan Request Exhibit E - Form of L/C Request Exhibit F - Form of Notice of Conversion or Continuation Exhibit G - Form of Compliance Certificate Exhibit H - Form of Guaranty and Security Agreement Exhibit I - Form of Affiliated Lender Assignment and Assumption Exhibit J - Form of Solvency Certificate vi [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

THIS CREDIT AGREEMENT, DATED AS OF MAY 11, 2018, IS ENTERED INTO AMONG NSM INSURANCE GROUP, LLC, A DELAWARE LIMITED LIABILITY COMPANY (THE “BORROWER”), NSM INSURANCE HOLDCO, LLC, A DELAWARE LIMITED LIABILITY COMPANY (“HOLDINGS”), THE LENDERS, THE L/C ISSUERS AND ARES CAPITAL CORPORATION (“ARES”), AS ADMINISTRATIVE AGENT FOR THE LENDERS AND THE L/C ISSUERS (IN SUCH CAPACITY, TOGETHER WITH ITS SUCCESSORS AND PERMITTED ASSIGNS IN SUCH CAPACITY, THE “ADMINISTRATIVE AGENT”). W I T N E S S E T H: WHEREAS, the Borrower has requested, and the Lenders (as this and other capitalized terms used in these preliminary statements are defined in Section 1.1 below) have agreed, that (a) the Lenders make Initial Term Loans on the Closing Date to the Borrower in an aggregate amount equal to $100,000,000, (b) the Lenders commit to making Delayed-Draw Term Loans in an aggregate principal amount equal to $51,000,000 and (c) the Lenders provide the Revolving Credit Facility in an aggregate amount of $10,000,000, including the letter of credit subfacility, in each case on the terms and subject to the conditions set forth in this Agreement; WHEREAS, the Borrower will use the proceeds of the Initial Term Loans, the Delayed-Draw Term Loans and the Initial Revolving Borrowing, if any, to (i) consummate the Refinancing, (ii) finance the Xxx Acquisition and (iii) pay the fees and expenses incurred in connection with the transactions contemplated hereby; and WHEREAS, on the Closing Date, White Mountains Catskill Holdings, Inc., a Delaware corporation (the “Buyer”), a wholly owned subsidiary of White Mountains Insurance Group, Ltd., a Bermuda exempted limited liability company, will purchase certain Stock and Stock Equivalents in Holdings from the Sellers (the “Acquisition”) pursuant to the terms of the Acquisition Agreement. NOW, THEREFORE, in consideration of the mutual agreements, provisions and covenants contained herein, the parties hereto agree as follows: ARTICLE 1 DEFINITIONS, INTERPRETATION AND ACCOUNTING TERMS Section 1.1 Defined Terms. As used in this Agreement, the following terms have the following meanings: “Acceptable Intercreditor Agreement” means (i) any intercreditor or subordination agreement or arrangement (which may take the form of a “waterfall” or similar provision), as applicable, the terms of which are consistent with market terms (as determined by the Borrower and the Administrative Agent in good faith) governing arrangements for the sharing and/or subordination of Liens and/or arrangements relating to the distribution of payments, as applicable, at the time the relevant intercreditor or subordination agreement or arrangement is proposed to be established in light of the type of Indebtedness subject thereto or (ii) any other intercreditor or subordination agreement or arrangement (which may take the form of a “waterfall” or similar provision), as applicable, the terms of which are reasonably acceptable to the Borrower and the Administrative Agent. “Acquisition” has the meaning specified in the recitals. [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Acquisition Agreement” means the Unit Purchase Agreement, dated as of March 31, 2018, by and among the Sellers, Holdings, the Buyer, Parent and ABRY Partners VIII, L.P., a Delaware limited partnership, solely in its capacity as the Seller Representative (as defined therein). “Acquisition Agreement Representations” means the representations and warranties regarding Holdings set forth in Article 3 of the Acquisition Agreement a breach of which would be materially adverse to the interests of the Lenders. “Administrative Agent” has the meaning specified in the preamble. “Affected Lender” has the meaning specified in Section 2.18(a). “Affiliate” means, with respect to any Person, any other Person that directly or indirectly controls, is controlled by, or is under common control with, such Person; provided, however, that none of the Administrative Agent nor any Lender shall be an Affiliate of the Borrower (other than Affiliated Lenders in accordance with the terms hereof). For purpose of this definition, “control” means the power to direct or cause the direction of the management and policies of such Person, whether by contract or otherwise. “Affiliated Debt Fund” means (a) any Affiliate of Parent that is a bona fide bank, debt fund, distressed asset fund, hedge fund, mutual fund, insurance company, financial institution or an investment vehicle that is engaged in the business of investing in, acquiring or trading commercial loans, bonds and similar extensions of credit in the ordinary course, in each case, that is not organized primarily for the purpose of making equity investments, and (b) any investment fund or account of an Affiliate of Parent managed by third parties (including by way of a managed account, a fund or an index fund in which an Affiliate of Parent has invested) that is not organized or used primarily for the purpose of making equity investments, in the case of each of the preceding clauses (a) and (b), with respect to which neither Parent nor any Permitted Investor directly or indirectly possesses the power to direct or cause the direction of the investment policies of such entity. In no event shall Holdings or any of its Subsidiaries be deemed an Affiliated Debt Fund. “Affiliated Lender” means, at any time, any Lender that is Parent or any of its Affiliates (other than Holdings, the Borrower or any of their respective Subsidiaries). “Affiliated Lender Assignment and Assumption” has the meaning specified in Section 11.2(g)(i)(A). “Agreement” means this Credit Agreement, as amended, restated, supplemented or otherwise modified from time to time. “AIG” means AIG Property Casualty U.S., Inc., a Delaware corporation. “AIG Renewal Rights” means the obligations of the Loan Parties under the Renewal Rights Agreement. “All-In Yield” means, as to any Indebtedness, the yield thereof, whether in the form of interest rate, margin, original issue discount, upfront fees, interest rate floor (with such interest rate floor equated to interest margins for purposes of determining any increase to the Applicable Margin); provided that original issue discount and upfront fees shall be equated to interest rates in a manner consistent with generally accepted financial practice assuming a 4-year life to maturity (or, if less, the stated life to maturity at the time of its incurrence of the applicable Indebtedness); provided, further, that “All-In 2 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

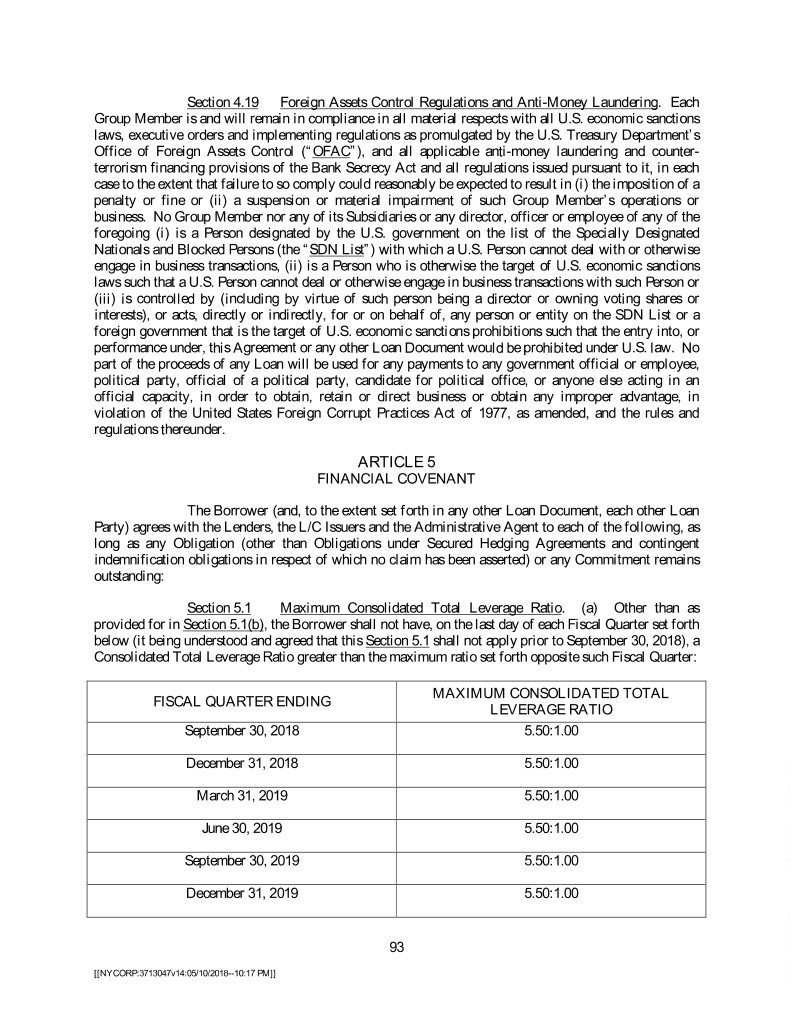

Yield” shall not include bona fide arrangement fees, structuring fees, underwriting fees, commitment fees, ticking fees or any other fees similar to the foregoing (regardless of how such fees are computed and whether paid in whole or in part to any or all lenders) paid to arrangers or underwriting lenders for such Indebtedness or commitments in respect thereof, and shall not include customary consent fees paid generally to consenting lenders. “Applicable Margin” means (a) with respect to the Initial Term Loans, Delayed-Draw Term Loans, Revolving Loans and Swingline Loans, (i) from the Closing Date until the third Business Day following the date of the delivery of the financial statements pursuant to Section 6.1(b) for the Fiscal Quarter ending June 30, 2018, 4.50% per annum in the case of Eurodollar Rate Loans and 3.50% in the case of Base Rate Loans and (ii) thereafter, as set forth in the table below, from and after the third Business Day after the date on which the Administrative Agent shall have received the applicable financial statements pursuant to Section 6.1(b) or 6.1(c) and the Compliance Certificate pursuant to Section 6.1(d) calculating the Consolidated Total Leverage Ratio with respect to the period of four consecutive Fiscal Quarters ended on the last day of such Fiscal Quarter and (b) with respect to Loans of any other tranche, the rate per annum specified in the Incremental Amendment, the Extension/Modification Amendment or in any amendment with respect to Replacement Loans, as the case may be, establishing Loans of such tranche. Applicable Margin for Consolidated Total Eurodollar Rate Applicable Margin for Pricing Level Leverage Ratio Loans Base Rate Loans I > 4.50:1.00 4.75% 3.75% II ≤ 4.50:1.00 4.50% 3.50% but > 3.50:1.00 III ≤ 3.50:1.00 4.25% 3.25% At any time the Borrower has not submitted to the Administrative Agent the applicable financial statements as and when required under Section 6.1(b) and 6.1(c) and the Compliance Certificate as and when required under Section 6.1(d), the Applicable Margin shall be determined based on the rates set forth in Pricing Level I. Within one Business Day of receipt of the applicable information under Section 6.1(b), 6.1(c) and 6.1(d), the Administrative Agent shall give the Borrower and each Lender facsimile or telephonic notice (confirmed in writing) of the Applicable Margin in effect from such date. In the event that any financial statement or Compliance Certificate delivered pursuant to Section 6.1(b), 6.1(c) or 6.1(d) is determined to be inaccurate, and such inaccuracy, if corrected, would have led to the application of a higher Applicable Margin for any period (an “Applicable Period”) than the Applicable Margin applied for such Applicable Period, then, if such determination of inaccuracy occurs prior to the repayment in full of the Loans and termination of the Commitments, (x) the Borrower shall as promptly as reasonably practicable following such determination deliver to the Administrative Agent correct financial statements and the related Compliance Certificate required by Section 6.1(b), 6.1(c) and 6.1(d) for such Applicable Period, (y) the Applicable Margin for such Applicable Period shall be determined as if the Consolidated Total Leverage Ratio were determined based on the amounts set forth in such correct financial statements and certificate and (z) the Borrower shall promptly (and in any event within ten Business Days) following delivery of such corrected financial statements and certificate pay to the Administrative Agent the accrued additional interest owing as a result of such increased Applicable Margin for such Applicable Period. 3 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Approved Fund” means, with respect to any Lender, any Person (other than a natural Person) that (a) is or will be engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business and (b) is advised or managed by (i) such Lender, (ii) any Affiliate of such Lender or (iii) any Person (other than an individual) or any Affiliate of any Person (other than an individual) that administers or manages such Lender. “Ares” has the meaning set forth in the introductory paragraph hereto. “Ares Capital” means Ares Capital Management LLC, together with its managed funds and accounts. “Assignment” means an assignment agreement entered into by a Lender, as assignor, and any Person, as assignee, pursuant to the terms and provisions of Section 11.2 (with the consent of any party whose consent is required by Section 11.2), accepted by the Administrative Agent in substantially the form of Exhibit A, or any other form approved by the Administrative Agent and, to the extent such other form adversely affects the interests of the Borrower, by the Borrower. “Available Excluded Contribution Amount” means, at any time, the amount of any capital contribution in respect of Qualified Capital Stock or the proceeds of any issuance of Qualified Capital Stock received in cash or Cash Equivalents by the Borrower or any of its Restricted Subsidiaries, plus the fair market value (as reasonably determined by the Borrower) of other property received by the Borrower or any Restricted Subsidiary as a capital contribution in respect of Qualified Capital Stock or in return for any issuance of Qualified Capital Stock (in each case, to the extent not otherwise applied and other than any amounts (x) constituting a Specified Equity Contribution or included as part of the Cumulative Available Amount or specified as excluded from the calculation of the Available Excluded Contribution Amount hereunder or (y) received from the Borrower or any Restricted Subsidiary), in each case, during the period from and including the day immediately following the Closing Date through and including such time. “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution. “Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule. “Banking Services” means each and any of the following bank services: commercial credit cards, stored value cards, purchasing cards, treasury management services, netting services, overdraft protections, check drawing services, automated payment services (including depository, overdraft, controlled disbursement, ACH transactions, return items and interstate depository network services), employee credit card programs, cash pooling services and any arrangements or services similar to any of the foregoing and/or otherwise in connection with cash management and deposit accounts. “Banking Services Obligations” means any and all obligations of any Loan Party, whether absolute or contingent and however and whenever created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor), under any arrangement in connection with Banking Services (a) between any Loan Party and a counterparty that is (or is an Affiliate of) the Administrative Agent, any Lender or the Lead Arranger or (b) under any arrangement by any Loan Party with any counterparty that have been designated to the Administrative Agent in writing by the Borrower as being Banking Services Obligations for the purposes of the Loan Documents, it being 4 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

understood that each counterparty thereto shall be deemed (A) to appoint the Administrative Agent as its agent under the applicable Loan Documents and (B) to agree to be bound by the provisions of Article 10, Section 11.3, Section 11.13, Section 11.14 and Section 11.15 and any Acceptable Intercreditor Agreement as if it were a Lender. “Bankruptcy Code” means the Federal Bankruptcy Reform Act of 1978 (11 U.S.C. §101, et seq.), as amended and in effect from time to time and the regulations issued from time to time thereunder. “Base Rate” means, for any day, a rate per annum equal to the highest of (a) the rate last quoted by The Wall Street Journal as the “Prime Rate” in the United States (or, if The Wall Street Journal ceases quoting a prime rate of the type described, either (i) the per annum rate quoted as the base rate on such corporate loans in a different nationally recognized financial publication as reasonably selected by Administrative Agent in consultation with the Borrower or (ii) the highest per annum rate of interest published by the Federal Reserve Board in Federal Reserve statistical release H.15 (519) entitled “Selected Interest Rates” as the bank prime loan rate or its equivalent), (b) the sum of 0.5% per annum and the Federal Funds Rate and (c) the sum of (x) the Eurodollar Rate calculated for each such day based on an Interest Period of three months determined at 11:00 a.m. London, England time, two (2) Business Days prior to such day, plus 1.00%. For purposes of clause (c) above, the Eurodollar Rate on any day shall be based on the Eurodollar Base Rate and the Screen Rate (or, if the Screen Rate is not available for such one month maturity, the Interpolated Screen Rate, if available). Any change in the Base Rate due to a change in any of the foregoing shall be effective on the effective date of such change in the “Prime Rate”, the Federal Funds Rate or the Eurodollar Rate for an Interest Period of three months. “Base Rate Loan” means any Loan that bears interest based on the Base Rate. “Benefit Plan” means any employee benefit plan as defined in Section 3(3) of ERISA (whether governed by the laws of the United States or otherwise), other than a Multiemployer Plan, to which any Group Member incurs or otherwise has any obligation or liability, contingent or otherwise. “Borrower” has the meaning set forth in the introductory paragraph hereto. “Borrowing” means a borrowing consisting of Loans (other than Swingline Loans and Loans deemed made pursuant to Section 2.3 or 2.4) made in one Facility on the same day by the Lenders according to their respective Commitments under such Facility. “Business Day” means any day of the year that is not a Saturday, Sunday or a day on which banks are required or authorized to close in New York City and, when determined in connection with notices and determinations in respect of any Eurodollar Rate or Eurodollar Rate Loan or any funding, conversion, continuation, Interest Period or payment of any Eurodollar Rate Loan, that is also a day on which dealings in Dollar deposits are carried on in the London interbank market. “Capital Expenditures” means, for any Person for any period, the aggregate of all expenditures, whether or not made through the incurrence of Indebtedness, by such Person and its Restricted Subsidiaries during such period for the acquisition, leasing (pursuant to a Capital Lease), construction, replacement, repair, substitution or improvement of fixed or capital assets or additions to equipment, in each case required to be capitalized under GAAP on a Consolidated balance sheet of such Person. “Capital Lease” means, with respect to any Person, and subject to Section 1.3, any lease of, or other arrangement conveying the right to use, any property (whether real, personal or mixed) by such Person as lessee that has been or should be accounted for as a capital lease on a balance sheet of such Person prepared in accordance with GAAP. 5 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Capitalized Lease Obligations” means, at any time, with respect to any Capital Lease, the amount of all obligations of such Person that is required to be capitalized on a balance sheet of such Person prepared in accordance with GAAP. “Captive Insurance Subsidiary” means any Subsidiary of the Borrower that is subject to regulation as an insurance company (or any Subsidiary thereof). “Cash Collateral Account” means a deposit account or securities account in the name of a Group Member and under the sole control (as defined in the applicable UCC) of the Administrative Agent and (a) in the case of a deposit account, from which a Group Member may not make withdrawals except as permitted by the Administrative Agent and (b) in the case of a securities account, with respect to which the Administrative Agent shall be the entitlement holder and the only Person authorized to give entitlement orders with respect thereto. “Cash Equivalents” means: (a) any readily-marketable securities (i) issued by, or directly, unconditionally and fully guaranteed or insured by the United States federal government or (ii) issued by any agency of the United States federal government or the United Kingdom government, the obligations of which are fully backed by the full faith and credit of the United States or United Kingdom government; (b) any readily-marketable direct obligations issued by any other agency of the United States or United Kingdom government, any state or territory of the United States or the United Kingdom or any political subdivision of any such state or any public instrumentality thereof, in each case having a rating of at least “A-2” from S&P or at least “P-2” from Moody’s; (c) any commercial paper rated at least “A-2” by S&P or “P-2” by Moody’s and issued by any Person organized under the laws of any state of the United States; (d) any Dollar-denominated or eurodollar denominated time deposit, insured certificate of deposit, overnight bank deposit or bankers’ acceptance issued or accepted by (i) any Lender or (ii) any commercial bank that is (A) organized under the laws of the United States, any state thereof or the District of Columbia, (B) “adequately capitalized” (as defined in the regulations of its primary federal banking regulators) and (C) has Tier 1 capital (as defined in such regulations) in excess of $100,000,000; (e) shares of any United States money market fund that (i) has substantially all of its assets invested continuously in the types of investments referred to in clause (a), (b), (c) or (d) above with maturities as set forth in the proviso below, (ii) has net assets in excess of $250,000,000 and (iii) has obtained from either S&P or Moody’s the highest rating obtainable for money market funds in the United States; provided, however, that the maturities of all obligations specified in any of clauses (a), (b), (c), (d) and (e) above shall not exceed 365 days; (f) instruments equivalent to those referred to in any of clauses (a), (b), (c), (d) and (e) above denominated in any foreign currency comparable in credit quality and tenor to Dollars and customarily used by corporations or other business entities for cash management purposes in any jurisdiction outside the United States or the United Kingdom to the extent required in connection with any business conducted by any Group Member in such jurisdiction; and (g) solely with respect to any Captive Insurance Subsidiary, any investment that such Captive Insurance Subsidiary is not prohibited to make in accordance with applicable law. 6 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“CERCLA” means the United States Comprehensive Environmental Response, Compensation, and Liability Act (42 U.S.C. §§ 9601 et seq.). “CFC” means (a) any Person that is a “controlled foreign corporation” (within the meaning of Section 957), but only if a “United States person” (within the meaning of Section 7701(a)(30)) that is an Affiliate of a Loan Party is, with respect to such Person, a “United States shareholder” (within the meaning of Section 951(b)) described in Section 951(a)(1); and (b) each Subsidiary of any Person described in clause (a). For purposes of this definition, all Section references are to the Code. “CFC Holdco” means a Domestic Subsidiary that has no material assets other than the equity interests (or equity interests and indebtedness) of one or more Foreign Subsidiaries that are CFCs or other CFC Holdcos. “Change of Control” means the occurrence of any of the following: (a) at any time prior to a Qualifying IPO, Parent ceases to be the beneficial owner, in the aggregate, directly or indirectly, of Stock of Holdings representing at least a majority of the aggregate total voting power represented by the issued and outstanding Stock of Holdings; (b) at any time on or after a Qualifying IPO, any Person or Persons (in each case, other than Parent, any employee benefit plan of Holdings and its Subsidiaries, any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan, and any other holder of Stock as of the Closing Date and their respective Affiliates) that together constitute a “group” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934) shall become the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Securities Exchange Act of 1934) of more than the greater of (i) 35% of the total voting power of all of the outstanding Stock for the election of the directors of Holdings and (ii) the percentage of the total voting power of all of the outstanding Stock of Holdings owned, directly or indirectly, beneficially by Parent; or (c) Holdings shall cease to own and control legally and beneficially all of the economic and voting rights associated with ownership of all outstanding Stock and Stock Equivalents of the Borrower (subject to any transaction permitted by Section 8.7). “Closing Date” means May 11, 2018. “Code” means the U.S. Internal Revenue Code of 1986, as amended. “Collateral” means all property and interests in property and proceeds thereof now owned or hereafter acquired by any Loan Party in or upon which a Lien is granted or purported to be granted pursuant to any Loan Document. “Collateral Documents” means collectively, the Guaranty and Security Agreement, the Mortgages, each Control Agreement and all other security agreements, pledge agreements, intellectual property security agreements and other similar agreements, and all amendments, restatements, modifications or supplements thereof or thereto, by or between any one or more of any Loan Parties pledging or granting a Lien on Collateral, and any Lender or the Administrative Agent for the benefit of the Secured Parties now or hereafter delivered to the Lenders or the Administrative Agent pursuant to or in connection with the transactions contemplated hereby, as any of the foregoing may be amended, restated and/or modified from time to time. 7 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Commitment” means, with respect to any Lender, such Lender’s Revolving Credit Commitment and Term Loan Commitment. “Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. § 1 et seq.). “Compliance Certificate” means a certificate substantially in the form of Exhibit G. “Consolidated” means, with respect to any Person, the accounts of such Person and its Restricted Subsidiaries consolidated in accordance with GAAP. “Consolidated Current Assets” means, with respect to any Person at any date, the total Consolidated current assets of such Person at such date other than cash, Cash Equivalents, current deferred tax assets and any Indebtedness owing to such Person or any of its Restricted Subsidiaries by Affiliates of such Person and excluding the effects of adjustments pursuant to GAAP resulting from the application of recapitalization accounting or purchase accounting, as the case may be, in relation to the Related Transactions or any consummated acquisition. “Consolidated Current Liabilities” means, with respect to any Person at any date, all liabilities of such Person and its Restricted Subsidiaries at such date that should be classified as current liabilities on a Consolidated balance sheet of such Person; provided, however, that “Consolidated Current Liabilities” shall exclude (i) the principal amount of the Loans then outstanding, (ii) obligations in respect of revolving loans under any working capital credit facility, (iii) the current portion of any Indebtedness (other than the Loans) of the Borrower and its Restricted Subsidiaries (and accrued interest thereon), (iv) current deferred tax liabilities and any current accrued interest and (v) liabilities in respect of unpaid earn- outs, and, furthermore, excluding the effects of adjustments pursuant to GAAP resulting from the application of recapitalization accounting or purchase accounting, as the case may be, in relation to the Transaction or any consummated acquisition. “Consolidated First Lien Debt” means, as to any Person at any date of determination, the aggregate principal amount of Consolidated Total Debt outstanding on such date that is secured by a first priority Lien on any Collateral. “Consolidated First Lien Leverage Ratio” of any Person as of any date means, the ratio of (a) Consolidated First Lien Debt of such Person outstanding as of such date to (b) LTM EBITDA for such Person. “Consolidated Interest Expense” means, for any Person for any period, without duplication, determined on a Consolidated basis, (a) Consolidated total interest expense of such Person and its Restricted Subsidiaries for such period and including, in any event, (i) interest capitalized during such period and net costs under Interest Rate Contracts for such period and (ii) all periodic fees with respect to letters of credit and banker’s acceptances payable by such Person and its Restricted Subsidiaries during such period minus (b) the sum of (i) Consolidated net gains of such Person and its Restricted Subsidiaries under Interest Rate Contracts for such period and (ii) Consolidated interest income of such Person and its Subsidiaries for such period plus (c) any cash dividend paid or payable in respect of Disqualified Stock during such period other than to such Person or any Loan Party plus (d) any net losses or obligations arising under any Interest Rate Contracts for such period. For purposes of this definition, interest in respect of any Capital Lease shall be deemed to accrue at an interest rate reasonably determined by such Person to be the rate of interest implicit in such Capital Lease in accordance with GAAP. “Consolidated Net Income” means, with respect to any Person for any period, the Consolidated net income (or loss) of such Person and its Restricted Subsidiaries for such period; provided, however, 8 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

that the following shall be excluded: (a) the net income (or loss) of any other Person that is not a majority-owned Subsidiary of such Person (which interest does not cause the net income of such other Person to be Consolidated into the net income of such Person), except to the extent of the amount of dividends or distributions paid to such Person or Restricted Subsidiary, (b) solely for purposes of calculating the Cumulative Available Amount, the net income of any Subsidiary (other than a Guarantor) of such Person that is, on the last day of such period, subject to any restriction or limitation on the payment of dividends or the making of other distributions, to the extent of such restriction or limitation, (c) solely for purposes of calculating Excess Cash Flow, and subject to the pro forma adjustments set forth in the definition of LTM EBITDA, the net income of any other Person arising prior to such other Person becoming a Restricted Subsidiary of such Person or merging or consolidating into such Person or its Restricted Subsidiaries and (d) any gain (or loss) resulting from any Permitted Loan Retirement. “Consolidated Secured Debt” means, as to any Person at any date of determination, the aggregate principal amount of Consolidated Total Debt outstanding on such date that is secured by a Lien on any Collateral. “Consolidated Secured Leverage Ratio” of any Person as of any date means, the ratio of (a) Consolidated Secured Debt of such Person outstanding as of such date to (b) LTM EBITDA for such Person. “Consolidated Total Debt” of any Person as of any date means all Indebtedness of a type described in clause (a), (b), (d) or (f) of the definition thereof (it being understood that obligations in respect of Banking Services do not constitute Consolidated Total Debt) and all non-contingent reimbursement obligations with respect to draws on letters of credit, bank guaranties or bankers’ acceptances, in each case of such Person and its Restricted Subsidiaries on a Consolidated basis as of such date, less unrestricted cash and Cash Equivalents of such Person and its Restricted Subsidiaries held in accounts located in the United States or the United Kingdom; provided that (a) the AIG Renewal Rights shall, to the extent it would otherwise be included herein, be excluded from Consolidated Total Debt for so long as Parent is providing a guarantee with respect thereto in form and substance reasonably satisfactory to the Administrative Agent (it being acknowledged that the guarantee in place as of the Closing Date is reasonably acceptable to the Administrative Agent) and (b) “earn-outs” and other similar deferred consideration payable in connection with Permitted Acquisitions or other Permitted Investments shall be included in Consolidated Total Debt only to the extent such consideration is due and payable but has not yet been paid. Notwithstanding the foregoing, the amount of commissions held in trust accounts shall be deemed to be unrestricted cash. “Consolidated Total Leverage Ratio” of any Person as of any date means, the ratio of (a) Consolidated Total Debt of such Person outstanding as of such date to (b) LTM EBITDA for such Person. “Constituent Documents” means, with respect to any Person, collectively and, in each case, together with any modification of any term thereof, (a) the articles of incorporation, certificate of incorporation, constitution or certificate of formation of such Person, (b) the bylaws, operating agreement or joint venture agreement of such Person, (c) any other equivalent constitutive, organizational or governing document of such Person and (d) any other document setting forth the manner of election or duties of the directors, officers or managing members of such Person or the designation, amount or relative rights, limitations and preferences of any Stock of such Person. “Contractual Obligation” means, with respect to any Person, any provision of any Security issued by such Person or of any document or undertaking (other than a Loan Document) to which such Person is a party or by which it or any of its property is bound or to which any of its property is subject. 9 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Control Agreement” means, with respect to any deposit account, any securities account, commodity account, securities entitlement or commodity contract, an agreement, in form and substance reasonably satisfactory to the Administrative Agent, among the Administrative Agent, the financial institution or other Person at which such account is maintained or with which such entitlement or contract is carried and the Loan Party maintaining such account, entitlement or contract, effective to grant “control” (as defined under the applicable UCC) over such account, securities entitlement or commodity contract to the Administrative Agent. “Controlled Deposit Account” means each deposit account (including all funds on deposit therein) that is the subject of an effective Control Agreement. “Copyrights” means all rights, title and interests (and all related IP Ancillary Rights) arising under any Requirement of Law in copyrights and all mask work, database and design rights, whether or not registered or published, all registrations and recordations thereof and all applications in connection therewith. “Cumulative Available Amount” means, on any date of determination, the sum of (without duplication): (a) $5,000,000; plus (b) Excess Cash Flow for each Fiscal Year of the Borrower not required to be applied to prepay Term Loans pursuant to Section 2.8(a), commencing with the Fiscal Year of the Borrower ended December 31, 2019; plus (c) an amount equal to any returns (including dividends, interest, distributions, returns of principal, profits on sale, repayments, income and similar amounts) actually received by the Borrower or any Restricted Subsidiary in respect of any Investments made pursuant to Section 8.3(q); plus (d) Eligible Equity Proceeds (other than to the extent used to fund Specified Equity Contributions or constituting an Available Excluded Contribution Amount); plus (e) an amount equal to the sum of (A) to the extent not already reflected as a return of capital with respect to such Investment for purposes of determining the amount of such Investment, the Investments of the Borrower and its Restricted Subsidiaries in any Unrestricted Subsidiary that has been re-designated as a Restricted Subsidiary or that has been merged or consolidated with or into the Borrower or any of its Restricted Subsidiaries (up to the fair market value (as determined in good faith by the Borrower) of the original Investments by the Borrower and its Restricted Subsidiaries in such Unrestricted Subsidiary) and (B) the fair market value (as determined in good faith by the Borrower) of the assets of any Unrestricted Subsidiary that have been transferred, conveyed or otherwise distributed to the Borrower or any of its Restricted Subsidiaries (up to the fair market value (as determined in good faith by the Borrower) of the original Investments by the Borrower and its Restricted Subsidiaries in such Unrestricted Subsidiary); plus (f) any amount of mandatory prepayments required to be prepaid pursuant to Section 2.8 that have been declined by Lenders pursuant to Section 2.8(h) and retained by the Borrower pursuant to Section 2.8(h); in each case, to the extent Not Otherwise Applied. “Customary Permitted Liens” means, with respect to any Person, any of the following: 10 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

(a) Liens (i) with respect to the payment of taxes, assessments or other governmental charges or (ii) of suppliers, carriers, materialmen, warehousemen, workmen or mechanics and other similar Liens, in each case imposed by law or arising in the ordinary course of business (and (x) for each of the Liens in clause (i) above for amounts that are not delinquent for more than thirty (30) days or (y) in the case of clause (ii) above, that are not delinquent for more than ninety (90) days) or that are being contested in good faith by appropriate proceedings diligently conducted and with respect to which adequate reserves or other appropriate provisions are maintained on the books of such Person in accordance with GAAP; (b) bankers liens or rights or setoff, including Liens of a collection bank on items in the course of collection arising under Section 4-208 of the UCC as in effect in the State of New York or any similar section under any applicable UCC or any similar Requirement of Law of any foreign jurisdiction; (c) pledges or cash deposits made in the ordinary course of business (i) in connection with workers’ compensation, unemployment insurance or other types of social security benefits (other than any Lien imposed by ERISA), (ii) to secure the performance of bids, tenders, leases (other than Capital Leases), statutory obligations (other than taxes), licenses, sales or other trade contracts (other than for the repayment of borrowed money), (iii) with the owner or lessor of premises leased by the Borrower or any of its Subsidiaries in the ordinary course of business of the Borrower and such Subsidiary to secure the performance of the Borrower’s or such Subsidiary’s obligations under the terms of the lease for such premises or (iv) made in lieu of, or to secure the performance of, surety, customs, reclamation or performance bonds (in each case not related to judgments or litigation); (d) judgment liens (other than for the payment of taxes, assessments or other governmental charges) securing judgments and other proceedings not constituting an Event of Default under Section 9.1(e) and pledges or cash deposits made in lieu of, or to secure the performance of, judgment or appeal bonds in respect of such judgments and proceedings; (e) Liens (i) arising by reason of zoning restrictions, easements, licenses, reservations, restrictions, covenants, rights-of-way, encroachments, minor defects or irregularities in title (including leasehold title) and other similar encumbrances on the use of real property or (ii) consisting of leases, licenses or subleases granted by a lessor, licensor or sublessor on its property (in each case other than Capital Leases) not prohibited by Section 8.4 that, for each of the Liens in clauses (i) and (ii) above, do not, in the aggregate, materially (x) impair the value or marketability of such real property or (y) interfere with the ordinary conduct of the business conducted and proposed to be conducted at such real property; (f) Liens of landlords and mortgagees of landlords (i) arising by statute or under any lease or related Contractual Obligation entered into in the ordinary course of business, (ii) on fixtures and movable tangible property located on the real property leased or subleased from such landlord, (iii) for amounts not yet due or that are being contested in good faith by appropriate proceedings diligently conducted and (iv) for which adequate reserves or other appropriate provisions are maintained on the books of such Person in accordance with GAAP; (g) the title and interest of a lessor or sublessor in and to personal property leased or subleased (other than through a Capital Lease), in each case extending only to such personal property; (h) Liens in favor of any Governmental Authority securing, in whole or in part, Environmental Liabilities and with respect to which adequate reserves or other appropriate provisions are maintained on the books of such Person in accordance with GAAP; (i) Liens on cash collateral posted in favor of insurance carriers to secure obligations under a Group Member’s insurance policies not to exceed one year’s cost of premiums thereunder; 11 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

(j) Liens arising out of conditional sale, title retention, consignment or similar arrangements for sale of goods entered into in the ordinary course of business; (k) Liens deemed to exist in connection with Investments in repurchase agreements under Section 8.3 and reasonable customary initial deposits and margin deposits and similar Liens attaching to commodity trading accounts or other brokerage accounts maintained in the ordinary course of business and not for speculative purposes; and (l) Liens imposed by law or incurred pursuant to customary reservations or retentions of title (including contractual Liens in favor of sellers and suppliers of goods) incurred in the ordinary course of business for sums not constituting borrowed money that are not overdue for a period of more than sixty (60) days or that are being contested in good faith by appropriated proceedings and for which adequate reserves have been established in accordance with GAAP (if so required). “Deemed LTM EBITDA Adjustment Date” has the meaning specified in the definition of “LTM EBITDA”. “Deemed LTM EBITDA Amounts” has the meaning specified in the definition of “LTM EBITDA”. “Default” means any Event of Default and any event that, with the passing of time or the giving of notice or both, would become an Event of Default. “Default Rate” means an interest rate equal to (a) in the case of any Loans, 2.0% per annum plus the rate otherwise applicable to such Loans and (b) in the case of any other Obligations that are past due, (i) in the case of past due interest, the Default Rate applicable to the Loans giving rise to such interest and (ii) in the case of all other Obligations, the Applicable Margin for Revolving Loans that are Base Rate Loans plus 2.0% per annum. “Defaulting Lender” shall mean (x) any Person, as determined by the Administrative Agent, that (a) has failed to fund any portion of its Loans or participations in Letters of Credit or Swingline Loans required to be funded by it hereunder within one Business Day of the date required to be funded by it hereunder, (b) has notified the Administrative Agent, the L/C Issuer, the Swingline Lender, any Lender or the Borrower in writing that it does not intend to comply with any of its funding obligations under this Agreement or has made a public statement to the effect that it does not intend to comply with its funding obligations under this Agreement or under other agreements in which it commits to extend credit, (c) has failed, within two (2) Business Days after request by the Administrative Agent, to confirm that it will comply with the terms of this Agreement relating to its obligations to fund prospective Loans and participations in then outstanding Letters of Credit or Swingline Loans, (d) has otherwise failed to pay over to the Administrative Agent or any other Lender any other amount required to be paid by it hereunder within three (3) Business Days of the date when due or (e) has become (or any parent company thereof has become) insolvent or been determined by any Governmental Authority having regulatory authority over such Person or its assets, to be insolvent, or the assets or management of which has been taken over by any Governmental Authority or (e)(i) become (or any parent company thereof has become) either the subject of (A) a bankruptcy or insolvency proceeding or (B) a Bail-In Action, (ii) has had a receiver, conservator, trustee, administrator, assignee for the benefit of creditors or similar Person charged with reorganization or liquidation of its business or custodian, appointed for it, or (iii) has taken any action in furtherance of, or indicating its consent to, approval of or acquiescence in, any such proceeding or appointment, unless in the case of any Person subject to this clause (e), the Borrower and the Administrative Agent have each determined that such Person intends, and has all approvals required to enable it (in form and substance satisfactory to the Borrower and the Administrative Agent), to continue 12 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

to perform its obligations hereunder; provided that no Person shall be deemed to be a Defaulting Lender solely by virtue of the ownership or acquisition of any Stock in such Lender or its parent by any Governmental Authority; provided that such action does not result in or provide such Lender with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Person (or such Governmental Authority) to reject, repudiate, disavow or disaffirm any contract or agreement to which such Person is a party or (y) any L/C Issuer that has failed to honor any drawing under a Letter of Credit in accordance with its terms. “Delayed-Draw Commitment Fee” has the meaning specified in Section 2.11(c). “Delayed-Draw Commitment Termination Date” means July 1, 2018. “Delayed-Draw Effective Date” means any date on which the conditions set forth in Section 3.4 with respect to the Delayed-Draw Term Loans have been satisfied and a Delayed-Draw Term Loan is made. “Delayed-Draw Expiration Date” means the earliest of (i) the date on with the Delayed-Draw Term Loans Commitments are $0 and (ii) the Delayed-Draw Commitment Termination Date. “Delayed-Draw Term Loan” has the meaning specified in Section 2.1(c). “Delayed-Draw Term Loan Commitment” means (a) as to any Lender with a Delayed-Draw Term Loan Commitment, the commitment of such Lender to make its Pro Rata Share of the Delayed- Draw Term Loans, and (b) as to all Lenders with Delayed-Draw Term Loan Commitments, the aggregate commitment of all Lenders to make the Delayed-Draw Term Loans, which aggregate commitment shall be $51,000,000 on the Closing Date. “Delayed-Draw Term Loan Facility” means the Delayed-Draw Term Loan Commitments and the provisions herein related to the Delayed-Draw Term Loans. “Delayed-Draw Term Loan Lenders” means, as of any date of determination, Lenders having Delayed-Draw Term Loan Commitments. “Designated Non-Cash Consideration” means the fair market value (as determined by the Borrower in good faith) of non-cash consideration received by the Borrower or any Restricted Subsidiary in connection with any Sale pursuant to Section 8.4(e) that is designated as Designated Non-Cash Consideration pursuant to a certificate of a Responsible Officer of the Borrower, setting forth the basis of such valuation (which amount will be reduced by the amount of cash or Cash Equivalents received in connection with a subsequent sale or conversion of such Designated Non-Cash Consideration to cash or Cash Equivalents). “Disclosure Documents” means, collectively, all documents filed by any Group Member with the United States Securities and Exchange Commission. “Disqualified Lender” means (without retroactive application): (1) the bona fide competitors of the Borrower and its Subsidiaries identified in writing by the Borrower or Parent to the Initial Lenders on or prior to the Closing Date, or from time to time after the Closing Date to the Administrative Agent, 13 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

(2) those particular banks, financial institutions and other institutional lenders identified in writing by the Borrower or Parent to the Lead Arranger prior to the Closing Date, and (3) any Affiliate of the entities described in the preceding clauses (1) or (2), in each case, that are either reasonably identifiable as such on the basis of their name or are identified as such in writing by the Borrower or Parent to the Lead Arranger on or prior to the Closing Date, or after the Closing Date to the Administrative Agent from time to time; provided that (x) in no event shall any Affiliates that are banks, financial institutions, bona fide debt funds, investment vehicles, regulated banking entities or non-regulated lending entities that are engaged in making, purchasing, holding or otherwise investing in commercial loans, bonds and/or similar extensions of credit in the ordinary course or business be a Disqualified Lender unless such Affiliate is identified under clause (2) above and (y) any Person that is a Lender and subsequently becomes a Disqualified Lender (but was not a Disqualified Lender on the Closing Date or at the time it became a Lender) shall be deemed to not be a Disqualified Lender hereunder. The list of Disqualified Lenders shall be made available to all Lenders by the Administrative Agent upon request. “Disqualified Stock” means any Stock or Stock Equivalents that, by its terms, or upon the happening of any event or condition (a) matures or is mandatorily redeemable, (b) is redeemable at the option of the holder thereof in whole or in part, (c) provides for the scheduled payments of dividends in cash, or (d) is or becomes convertible into or exchangeable for Indebtedness or any other equity interests, in each case prior to the date that is 90 days after the final maturity date of the Facilities; provided that the foregoing shall not apply to (i) a redemption, conversion or exchange into equity interests that do not themselves constitute Disqualified Stock, (ii) any offer to redeem or repurchase made in connection with a Change of Control or (iii) Stock or Stock Equivalents that are issued pursuant to a plan for the benefit of future, current or former employees, directors, or officers of Holdings, the Borrower or its Subsidiaries or by any such plan to such employees, directors or officers solely because they may be required to be repurchased by Holdings, the Borrower or its Subsidiaries in order to satisfy applicable statutory or regulatory obligations or as a result of such employee’s, director’s or officer’s termination, death or disability. “Dollar Equivalent” means the amount in Dollars for any amount denominated in Dollars and the Equivalent Amount in Dollars of any amount denominated in any other currency. “Dollars” and the sign “$” each mean the lawful money of the United States of America. “Domestic Person” means any “United States person” under and as defined in Section 7701(a)(30) of the Code. “Domestic Subsidiary” means any Subsidiary that is organized under the laws of the United States, any state thereof or the District of Columbia. “E-Fax” means any system used to receive or transmit faxes electronically. “ECF Payment Date” has the meaning specified in Section 2.8(a). “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of 14 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Environmental Liabilities” means all Liabilities (including costs of Remedial Actions, natural resource damages and costs and expenses of investigation and feasibility studies) that may be imposed on, incurred by or asserted against any Group Member as a result of, or related to, any claim, suit, action, investigation, proceeding or demand by any Person, whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute or common law or otherwise, arising under any Environmental Law or in connection with any environmental condition or any health or safety condition arising from Hazardous Materials or with any Release and resulting from the ownership, lease, sublease or other operation or occupation of property by any Group Member, whether on, prior or after the date hereof. “Equity Contribution” means the cash equity contribution made by Parent to the Buyer in an aggregate amount equal to, when combined with the fair market value of any capital contributions and investments by management and existing equity holders of Holdings rolled over or invested in connection with the Related Transactions (the “Rollover Equity”), not less than 40% (the “Minimum Equity Contribution”) of the sum of (i) the aggregate principal amount of the Initial Term Loans made on the Closing Date and (ii) the amount of the Equity Contribution and the Rollover Equity on the Closing Date. “Equivalent Amount” means, on any date of determination, with respect to obligations or valuations denominated in one currency (the “first currency”), the amount of another currency (the “second currency”) which would result from the conversion of the relevant amount of the first currency into the second currency, at the rate used by the Administrative Agent’s treasury function on such date or, if such date is not a Business Day, on the Business Day immediately preceding such date of determination, or at such other rate as may have been agreed in writing between Borrower, as the case may be, and the Administrative Agent. “Equivalent Percentage” means, with respect to any dollar amount, such percentage of Trailing EBITDA as such dollar amount represents of LTM EBITDA of Holdings, the Borrower and its Restricted Subsidiaries for the four quarters ended March 31, 2018, rounded to the nearest half-integral percentage. LTM EBITDA of Holdings, the Borrower and its Restricted Subsidiaries for the four quarters ended March 31, 2018 for such purpose shall be deemed to be equal to (i) prior to the consummation of the Xxx Acquisition, $26,000,000 and (ii) if the Xxx Acquisition is consummated, $31,500,000. “ERISA” means the United States Employee Retirement Income Security Act of 1974. “ERISA Affiliate” means, collectively, any Group Member, and any Person under common control, or treated as a single employer, with any Group Member, within the meaning of Section 414(b) or (c) of the Code or, solely for purposes of Section 412 of the Code, Section 414 (m) or (o) of the Code. “ERISA Event” means any of the following: (a) a reportable event described in Section 4043(c) of ERISA (unless the 30-day notice requirement has been duly waived under the applicable regulations) with respect to a Title IV Plan, (b) the withdrawal of any ERISA Affiliate from a Title IV Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer, as defined in Section 4001(a)(2) of ERISA, (c) the complete or partial withdrawal of any ERISA Affiliate from any Multiemployer Plan, (d) with respect to any Multiemployer Plan, the filing of a notice of reorganization, insolvency or termination (or treatment of a plan amendment as termination) under Section 4041A of ERISA, (e) the filing of a notice of intent to terminate a Title IV Plan (or treatment of a plan amendment as termination) under Section 4041 of ERISA, (f) the institution of proceedings to terminate a Title IV Plan or Multiemployer Plan by the PBGC, (g) the failure to make any required contribution to any Title IV Plan or Multiemployer Plan when due, (h) the imposition of a lien under Section 412 or 430(k) of the Code or Section 302, 303(k) or 4068 of ERISA on any property (or rights to property, whether real or personal) of any ERISA Affiliate or a violation of Section 436 of the Code with respect to a Title IV Plan, 16 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

(i) the failure of a Benefit Plan or any trust thereunder intended to qualify for tax exempt status under Section 401 or 501 of the Code to qualify thereunder, and (j) any other event or condition that would reasonably be expected to constitute grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Title IV Plan or Multiemployer Plan or for the imposition of any liability upon any ERISA Affiliate under Title IV of ERISA other than for PBGC premiums due but not delinquent. “E-Signature” means the process of attaching to or logically associating with an Electronic Transmission an electronic symbol, encryption, digital signature or process (including the name or an abbreviation of the name of the party transmitting the Electronic Transmission) with the intent to sign, authenticate or accept such Electronic Transmission. “E-System” means any electronic system, including Intralinks® and ClearPar® and any other Internet or extranet-based site, whether such electronic system is owned, operated or hosted by the Administrative Agent, any of its Related Persons or any other Person, providing for access to data protected by passcodes or other security system. “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “Eurodollar Base Rate” means, with respect to any Interest Period for any Eurodollar Rate Loan, the greater of (i) (a) with respect to Term Loans, 1.00% per annum and (b) with respect to Revolving Loans, 0.00% per annum and (ii) the offered rate per annum for deposits in Dollars in the London interbank market for the applicable Interest Period equal to the ICE LIBOR Rate, as published on the applicable Bloomberg screen page (or such other commercially available source providing quotations of ICE LIBOR as may be designated by the Administrative Agent from time to time) as of 11:00 a.m. (London, England time) on the day which is two Business Days prior to the first day of each Interest Period adjusted for reserve requirements (this clause (ii), the “Screen Rate”). If no Screen Rate shall be available for a particular period but Screen Rates shall be available for maturities both longer and shorter than such period, than the Screen Rate for such period shall be the Interpolated Screen Rate. If no such Screen Rate exists, such rate will be the rate of interest per annum, as determined by the Administrative Agent, at which deposits of Dollars in immediately available funds are offered at 11:00 a.m. (London, England time) two (2) Business Days prior to the first day of such Interest Period by major financing institutions reasonably satisfactory to the Administrative Agent in the London interbank market for such Interest Period for an amount equal or comparable to the principal amount on such date of determination. “Eurodollar Rate” means, with respect to any Interest Period and for any Eurodollar Rate Loan, an interest rate per annum determined as the ratio of (a) the Eurodollar Base Rate with respect to such Interest Period for such Eurodollar Rate Loan to (b) the difference between the number one and the Eurodollar Reserve Requirements with respect to such Interest Period and for such Eurodollar Rate Loan. “Eurodollar Rate Loan” means any Revolving Loan or Term Loan (or any portion thereof) that bears interest based on the Eurodollar Rate. “Eurodollar Reserve Requirements” means, with respect to any Interest Period and for any Eurodollar Rate Loan, a rate per annum equal to the aggregate, without duplication, of the maximum rates (expressed as a decimal number) of reserve requirements in effect 2 Business Days prior to the first day of such Interest Period (including basic, supplemental, marginal and emergency reserves) under any regulations of the Federal Reserve Board or other Governmental Authority having jurisdiction with respect thereto dealing with reserve requirements prescribed for eurocurrency funding (currently referred 17 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

to as “eurocurrency liabilities” in Regulation D of the Federal Reserve Board) maintained by a member bank of the United States Federal Reserve System. “Event of Default” has the meaning specified in Section 9.1. “Excess Cash Flow” means, for any Fiscal Year, (a) LTM EBITDA of the Borrower for such Fiscal Year, minus (b) without duplication, (i) any cash principal payment on and cash payments of penalties, premiums, prepayment or closing fees in connection with the Loans (including pursuant to a Permitted Loan Retirement) during such Fiscal Year or prior to the ECF Payment Date (but only, in the case of payment in respect of Revolving Loans, to the extent that the Revolving Credit Commitments are permanently reduced by the amount of such payment) other than (x) any mandatory prepayment required pursuant to Section 2.8(a) because of the existence of Excess Cash Flow and (y) the amount of any voluntary prepayment which reduces the prepayment required under Section 2.8(a), (ii) any scheduled or other mandatory cash principal payment made by the Borrower or any of its Restricted Subsidiaries during such Fiscal Year or prior to the ECF Payment Date and cash payments of penalties, premiums or prepayment fees in connection with any Capitalized Lease Obligation or other Indebtedness (but only, if such Indebtedness may be reborrowed, to the extent such payment results in a permanent reduction in commitments thereof), (iii) any Capital Expenditure made by such Person or any of its Restricted Subsidiaries during such Fiscal Year or prior to the ECF Payment Date, excluding any such Capital Expenditure to the extent financed through the incurrence of Capitalized Lease Obligations or incurrence of any long-term Indebtedness (other than the Revolving Loans), (iv) the Consolidated Interest Expense of such Person for such Fiscal Year paid or payable in cash, (v) any cash losses from extraordinary items, (vi) any cash payment made during such Fiscal Year to satisfy obligations for income taxes or other taxes measured by net income and franchise taxes, (vii) any increase in the Working Capital of Holdings during such Fiscal Year (measured as the excess of such Working Capital at the end of such period over such Working Capital at the beginning of such Fiscal Year and measured without giving effect to any (A) Permitted Acquisitions, (B) extraordinary or non-recurring Sales outside the ordinary course of business, or (C) the effect of fluctuations in currency exchange rates), (viii) cash purchase price payments made in connection with Permitted Acquisitions during such Fiscal Year or prior to the ECF Payment Date excluding any such Permitted Acquisition to the extent financed through the incurrence of any long-term Indebtedness (other than the Revolving Loans), (ix) “earn outs” paid in cash in connection with any Permitted Acquisition during such Fiscal Year or prior to the ECF Payment Date, excluding any such payments to the extent financed through the incurrence of any long-term Indebtedness (other than the Revolving Loans), 18 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

(x) any aggregate net loss on the Sale of property (other than accounts and inventory) outside the ordinary course of business, (xi) (x) Restricted Payments permitted by Section 8.5 paid in cash during such Fiscal Year or prior to the ECF Payment Date and (y) Investments permitted by Section 8.3 paid in cash during such Fiscal Year or prior to the ECF Payment Date, in each case excluding any such Restricted Payments and Investments to the extent financed through the incurrence of any long-term Indebtedness (other than the Revolving Loans), (xii) in each case, to the extent paid in cash during such Fiscal Year, amounts added back in determining LTM EBITDA pursuant to clauses (iii), (vii), (viii), (ix), (x), (xi), (xii), (xiii) and (xv) of the definition thereof, in each case, to the extent deducted in determining Consolidated Net Income, (xiii) without duplication of clause (xi), the amount of Investments made in reliance on Section 8.3(e)(iv) during such Fiscal Year or prior to the ECF Payment Date, but only to the extent such Investments are not made with proceeds of any long-term Indebtedness (other than Revolving Loans) or the sale of any Stock or Stock Equivalents or constitute Permitted Reinvestments, (xiv) the aggregate amount of any premium, make-whole or penalty payments actually paid in cash during such Fiscal Year or prior to the ECF Payment Date that are required to be made in connection with any prepayment of Indebtedness, and (xv) (A) the amount of contingent revenue included in Consolidated Net Income in such Fiscal Year, less (B) the amount of cash received by a Loan Party in such Fiscal Year in respect of contingent revenue that was excluded from Excess Cash Flow pursuant to the preceding clause (A) in a prior Fiscal Year with respect to which a payment pursuant to Section 2.8(a) was required, plus (c) without duplication, (i) to the extent included in the calculation of LTM EBITDA pursuant to clause (b)(i) of the definition thereof, any provision for United States federal income taxes or other taxes measured by net income, (ii) any decrease in the Working Capital of Holdings during such Fiscal Year (measured as the excess of such Working Capital at the beginning of such Fiscal Year over such Working Capital at the end thereof and measured without giving effect to (A) Permitted Acquisitions, (B) extraordinary and non- recurring Sales outside the ordinary course of business, or (C) the effect of fluctuations in currency exchange rates), (iii) any aggregate net gain from the sale or other disposition of property (other than accounts receivable and inventory) out of the ordinary course of business, (iv) (A) the amount of any contingent expenses included in Consolidated Net Income in such Fiscal Year, less (B) the amount of cash received by a Loan Party in such Fiscal Year in respect of contingent expenses that were excluded from Excess Cash Flow pursuant to the preceding clause (A) in a prior Fiscal Year with respect to which a payment pursuant to Section 2.8(a) was required. provided that, in the case of clauses (b)(i), (b)(ii), (b)(iii), (b)(viii), (b)(ix), (b)(xi), (b)(xiii) and (b)(xiv) above, (A) any amount committed to be paid or made within such time period that reduces Excess Cash Flow in such Fiscal Year pursuant to such clause will not be deducted again in the calculation of Excess Cash Flow for any subsequent Fiscal Year and (B) to the extent any such amount committed to be paid or 19 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

made after the end of such Fiscal Year is not actually paid or made in cash within such time period, such unpaid amount will, to the extent applicable, be added to the calculation of Consolidated Excess Cash Flow for the immediately succeeding Fiscal Year. “Excluded Accounts” has the meaning specified in Section 7.11(a). “Excluded Subsidiary” means (a) any Subsidiary that is not a Wholly Owned Subsidiary of the Borrower or a Guarantor, (b) any Foreign Subsidiary of the Borrower or of any direct or indirect Domestic Subsidiary or Foreign Subsidiary, (c) any CFC Holdco, (d) any Domestic Subsidiary that is a direct or indirect Subsidiary of a direct or indirect Foreign Subsidiary of the Borrower that is a CFC, (e) any Subsidiary that is prohibited or restricted by applicable law (including in connection with any capital requirements) or by a binding contractual obligation from providing a guaranty (provided that such contractual obligation is not entered into by the Borrower or its Subsidiaries principally for the purpose of qualifying as an “Excluded Subsidiary” under this definition) or if such guaranty would require governmental (including regulatory) or third party (other than a Loan Party or an Affiliate of a Loan Party) consent, approval, license or authorization, (f) any special purpose securitization vehicle (or similar entity), (g) any Subsidiary that is a not-for-profit organization, (h) any Captive Insurance Subsidiary, (i) Subsidiaries subject to regulation as a broker-dealer, (j) any Subsidiary a guaranty by which would result in material adverse tax consequences as reasonably determined by the Borrower in consultation with the Administrative Agent, (k) any Unrestricted Subsidiary, (l) each Immaterial Subsidiary and (m) any other Subsidiary to the extent Administrative Agent and the Borrower mutually determine the cost or burden of obtaining the guaranty (including any adverse tax consequences) outweigh the benefit to the Lenders. “Excluded Swap Obligation” means, with respect to any Guarantor, any Swap Obligation if, and to the extent that, all or a portion of the guaranty of such Guarantor of, or the grant by such Guarantor of a security interest to secure, such Swap Obligation (or any guaranty thereof) is or becomes illegal or unlawful under the Commodity Exchange Act or any rule, regulation or order of the Commodity Futures Trading Commission (or the application or official interpretation of any thereof) by virtue of such Guarantor’s failure for any reason to constitute an “eligible contract participant” as defined in the Commodity Exchange Act at the time the guaranty of such Guarantor or the grant of such security interest would otherwise have become effective with respect to such related Swap Obligation but for such Guarantor’s failure to constitute an “eligible contract participant” at such time. If any Swap Obligation arises under a master agreement governing more than one swap, such exclusion shall apply only to the portion of such Swap Obligation that is attributable to swaps for which such guaranty or security interest is or becomes illegal. “Existing Credit Agreement” means the Credit Agreement, dated as of September 1, 2016, among the Borrower, Ares, as a Lender, L/C Issuer and the Administrative Agent, and the other Lenders and L/C Issuers from time to time party thereto. “Existing Letters of Credit” means the Letters of Credit specified on Schedule 2.4. “Extended/Modified Commitments” means, collectively, Extended/Modified Revolving Credit Commitments and Extended/Modified Term Commitments. “Extended/Modified Loans” means, collectively, Extended/Modified Revolving Loans and Extended/Modified Term Loans. “Extended/Modified Revolving Credit Commitments” means the Revolving Credit Commitments held by an Extending/Modifying Lender. 20 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Extended/Modified Revolving Loans” means the Revolving Loans made pursuant to Extended/Modified Revolving Credit Commitments. “Extended/Modified Term Commitments” means the Term Loan Commitments held by an Extending/Modifying Lender. “Extended/Modified Term Loans” means the Term Loans made pursuant to Extended/Modified Term Commitments. “Extending/Modifying Lender” means each Lender accepting an Extension/Modification Offer. “Extension/Modification” has the meaning specified in Section 2.20(a). “Extension/Modification Amendment” has the meaning specified in Section 2.20(b). “Extension/Modification Facility” means any Extended/Modified Term Loans and/or Extended/Modified Revolving Loans and the provisions herein related to such Extended/Modified Term Loans and/or Extended/Modified Revolving Loans. “Extension/Modification Offer” has the meaning specified in Section 2.20(a). “Facilities” means (a) the Initial Term Loan Facility, (b) the Delayed-Draw Term Loan Facility, (c) the Revolving Credit Facility, (d) any Incremental Facility and (e) any Extension/Modification Facility. “FATCA” means Sections 1471 through 1474 of the Code, as in effect on the date hereof, and any current or future applicable United States Treasury regulations promulgated thereunder or published administrative guidance or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Code, any intergovernmental agreement entered into in connection with the implementation of such Sections of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to such intergovernmental agreement. “Federal Funds Rate” means, for any period, a fluctuating interest rate per annum equal for each day during such period to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers, as determined by the Administrative Agent in its sole discretion. “Federal Reserve Board” means the Board of Governors of the United States Federal Reserve System and any successor thereto. “Fee Letter” means the Fee Letter, dated as of May 11, 2018, among the Buyer and the Administrative Agent, as amended, restated, modified or supplemented from time to time in accordance with the terms thereof. “Financial Statement” means each financial statement described in or delivered pursuant to Section 4.4 or 6.1. “Fiscal Month” means any of the monthly accounting periods of the Borrower. “Fiscal Quarter” means each 3 Fiscal Month period ending on March 31, June 30, September 30 or December 31. 21 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]

“Fiscal Year” means the twelve-month period ending on December 31. “Fixed Amount” has the meaning specified in Section 1.1(d)(ii). “Fixed Incremental Amount” means (i) at any time prior to the consummation of the Xxx Acquisition, $26,000,000 and (ii) if the Xxx Acquisition is consummated, $31,500,000. “Foreign Subsidiary” means any Subsidiary of the Borrower that is not a Domestic Subsidiary. “GAAP” means generally accepted accounting principles in the United States of America, as in effect from time to time, set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants, in the statements and pronouncements of the Financial Accounting Standards Board and in such other statements by such other entity as may be in general use by significant segments of the accounting profession that are applicable to the circumstances as of the date of determination. Subject to Section 1.3, all references to “GAAP” shall be to GAAP applied consistently with the principles used in the preparation of the Financial Statements described in Section 4.4(a), including, without limitation, those qualifications to GAAP set forth on the disclosure schedules to the Acquisition Agreement. “Governmental Authority” means any nation, sovereign or government, any state or other political subdivision thereof, any agency, authority or instrumentality thereof and any entity or authority exercising executive, legislative, taxing, judicial, regulatory or administrative functions of or pertaining to government. “Group Members” means, collectively, the Borrower and its Restricted Subsidiaries. “Group Members’ Accountants” means Xxxxxx LLP or any other nationally- or regionally- recognized independent registered certified public accountants. “Guarantor” means Holdings, each Wholly Owned Subsidiary of the Borrower listed on Schedule 4.3 that is not an Excluded Subsidiary and each other Person that becomes a party to the Guaranty and Security Agreement pursuant to Section 7.10 after the Closing Date, provided that only Subsidiaries that are not Excluded Subsidiaries shall be required to become a party to the Guaranty and Security Agreement. For the avoidance of doubt, the Borrower may, in its sole discretion, cause any Domestic Subsidiary that is not required to be a Guarantor to guarantee the Obligations by causing such Subsidiary to become a party to the Guaranty and Security Agreement. “Guaranty and Security Agreement” means the guaranty and security agreement, in the form of Exhibit H, among the Administrative Agent, the Borrower and Guarantors from time to time party thereto, as amended. “Guaranty Obligation” means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of such Person for any Indebtedness, lease, dividend or other obligation (the “primary obligation”) of another Person (the “primary obligor”), if the purpose or intent of such Person in incurring such liability, or the economic effect thereof, is to guarantee such primary obligation or provide support, assurance or comfort to the holder of such primary obligation or to protect or indemnify such holder against loss with respect to such primary obligation, including (a) the direct or indirect guaranty, endorsement (other than for collection or deposit in the ordinary course of business), co-making, discounting with recourse or sale with recourse by such Person of any primary obligation, (b) the incurrence of reimbursement obligations with respect to any letter of credit or bank guarantee in support of any primary obligation, (c) the existence of any Lien, or any right, contingent or otherwise, to receive a 22 [[NYCORP:3713047v14:05/10/2018--10:17 PM]]