EXECUTION VERSION [[3652816]] FIRST AMENDMENT dated as of May 31, 2017 (this “Amendment”) to the CREDIT AGREEMENT dated as of January 6, 2015 (as in effect immediately prior to the effectiveness of this Amendment, the “Credit Agreement”) among PITNEY...

EXECUTION VERSION

[[3652816]]

FIRST AMENDMENT dated as of May 31, 2017 (this

“Amendment”) to the CREDIT AGREEMENT dated as of

January 6, 2015 (as in effect immediately prior to the effectiveness

of this Amendment, the “Credit Agreement”) among PITNEY

XXXXX INC., a corporation duly organized and validly existing

under the laws of the State of Delaware, each SUBSIDIARY

BORROWER party thereto, the BANKS party thereto, and

JPMORGAN CHASE BANK, N.A., as Administrative Agent.

WHEREAS, the Banks have agreed to extend credit to the Company and

the Subsidiary Borrowers under the Credit Agreement on the terms and subject to the

conditions set forth therein; and

WHEREAS, the parties hereto have agreed to amend the Credit

Agreement as set forth herein.

NOW, THEREFORE, in consideration of the mutual agreements herein

contained and other good and valuable consideration, the sufficiency and receipt of which

are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION 1. Defined Terms. Capitalized terms used but not otherwise

defined herein (including in the recitals hereto) have the meanings assigned to them in the

Credit Agreement.

SECTION 2. Amendment of Credit Agreement. Effective on the

Amendment Effective Date, the Credit Agreement is amended as follows:

(a) The following new definitions are inserted in their proper

alphabetical positions in Section 1.01 of the Credit Agreement:

“Bail-In Action” shall mean, as to any EEA Financial Institution,

the exercise of any Write-Down and Conversion Powers by the applicable

EEA Resolution Authority in respect of any liability of an EEA Financial

Institution.

“Bail-In Legislation” shall mean, with respect to any EEA Member

Country implementing Article 55 of Directive 2014/59/EU of the

European Parliament and of the Council of the European Union, the

implementing law for such EEA Member Country from time to time

which is described in the EU Bail-In Legislation Schedule.

“EEA Financial Institution” shall mean (a) any institution

established in any EEA Member Country that is subject to the supervision

of an EEA Resolution Authority, (b) any entity established in an EEA

Member Country that is a parent of an institution described in clause (a) of

this definition, or (c) any institution established in an EEA Member

[[3652816]]

Country that is a subsidiary of an institution described in clause (a) or (b)

of this definition and is subject to consolidated supervision with its parent.

“EEA Member Country” shall mean any of the member states of

the European Union, Iceland, Liechtenstein and Norway.

“EEA Resolution Authority” shall mean any public administrative

authority or any Person entrusted with public administrative authority of

any EEA Member Country (including any delegee) having responsibility

for the resolution of any EEA Financial Institution.

“EU Bail-In Legislation Schedule” shall mean the EU Bail-In

Legislation Schedule published by the Loan Market Association (or any

successor person), as in effect from time to time.

“NYFRB” shall mean the Federal Reserve Bank of New York.

“NYFRB Rate” shall mean, for any day, the greater of (a) the

Federal Funds Effective Rate in effect on such day and (b) the Overnight

Bank Funding Rate in effect on such day (or for any day that is not a

Business Day, for the immediately preceding Business Day); provided that

if none of such rates are published for any day that is a Business Day, the

term “NYFRB Rate” shall mean the rate for a federal funds transaction

quoted at 11:00 a.m., New York City time, on such day received by the

Administrative Agent from a Federal funds broker of recognized standing

selected by it; provided, further, that if any of the aforesaid rates shall be

less than zero, such rate shall be deemed to be zero for purposes of this

Agreement.

“Overnight Bank Funding Rate” shall mean, for any day, the rate

comprised of both overnight federal funds and overnight Eurodollar

borrowings by U.S.-managed banking offices of depository institutions, as

such composite rate shall be determined by the NYFRB as set forth on its

public website from time to time, and published on the next succeeding

Business Day by the NYFRB as an overnight bank funding rate (from and

after such date as the NYFRB shall commence to publish such composite

rate).

“Write-Down and Conversion Powers” shall mean, with respect to

any EEA Resolution Authority, the write-down and conversion powers of

such EEA Resolution Authority from time to time under the Bail-In

Legislation for the applicable EEA Member Country, which write-down

and conversion powers are described in the EU Bail-In Legislation

Schedule.

(b) The definition of “Base Rate” in Section 1.01 of the Credit

Agreement is amended by replacing each instance of the term “Federal Funds Rate”

therein with the term “NYFRB Rate”.

[[3652816]]

(c) The definition of “Defaulting Lender” in Section 1.01 of the

Credit Agreement is amended by deleting the word “or” at the end of clause (c)

thereof and inserting the following new clause immediately following clause (d)

thereof:

“or (e) become, or has a direct or indirect parent company that has

become, the subject of a Bail-In Action.”

(d) The definition of “Federal Funds Rate” in Section 1.01 of the

Credit Agreement is amended to read as follows:

““Federal Funds Rate” shall mean, for any day, the rate calculated

by the NYFRB based on such day’s federal funds transactions by

depository institutions (as determined in such manner as the NYFRB shall

set forth on its public website from time to time) and published on the next

succeeding Business Day by the NYFRB as the federal funds effective

rate; provided that if such rate shall be less than zero, such rate shall be

deemed to be zero for all purposes of this Agreement.”

(e) Section 7 of the Credit Agreement is amended by inserting the

following new Section 7.14 immediately following Section 7.13:

“7.14 EEA Financial Institutions. No Borrower is an EEA

Financial Institution.”

(f) Section 11 of the Credit Agreement is amended by inserting the

following new Section 11.18 immediately following Section 11.17:

“11.18 Acknowledgment and Consent to Bail-In of EEA Financial

Institutions. Notwithstanding anything to the contrary in any Loan

Document or in any other agreement, arrangement or understanding

among the parties hereto, each party hereto acknowledges that any liability

of any EEA Financial Institution arising under any Loan Document may

be subject to the Write-Down and Conversion Powers of an EEA

Resolution Authority and agrees and consents to, and acknowledges and

agrees to be bound by:

(a) the application of any Write-Down and Conversion Powers by

an EEA Resolution Authority to any such liabilities arising hereunder

which may be payable to it by any party hereto that is an EEA Financial

Institution; and

(b) the effects of any Bail-In Action on any such liability,

including, if applicable:

(i) a reduction in full or in part or cancelation of any such liability;

[[3652816]]

(ii) a conversion of all, or a portion of, such liability into shares or

other instruments of ownership in such EEA Financial Institution, its

parent entity, or a bridge institution that may be issued to it or otherwise

conferred on it, and that such shares or other instruments of ownership

will be accepted by it in lieu of any rights with respect to any such liability

under this Agreement or any other Loan Document; or

(iii) the variation of the terms of such liability in connection with

the exercise of the Write-Down and Conversion Powers of any EEA

Resolution Authority.”

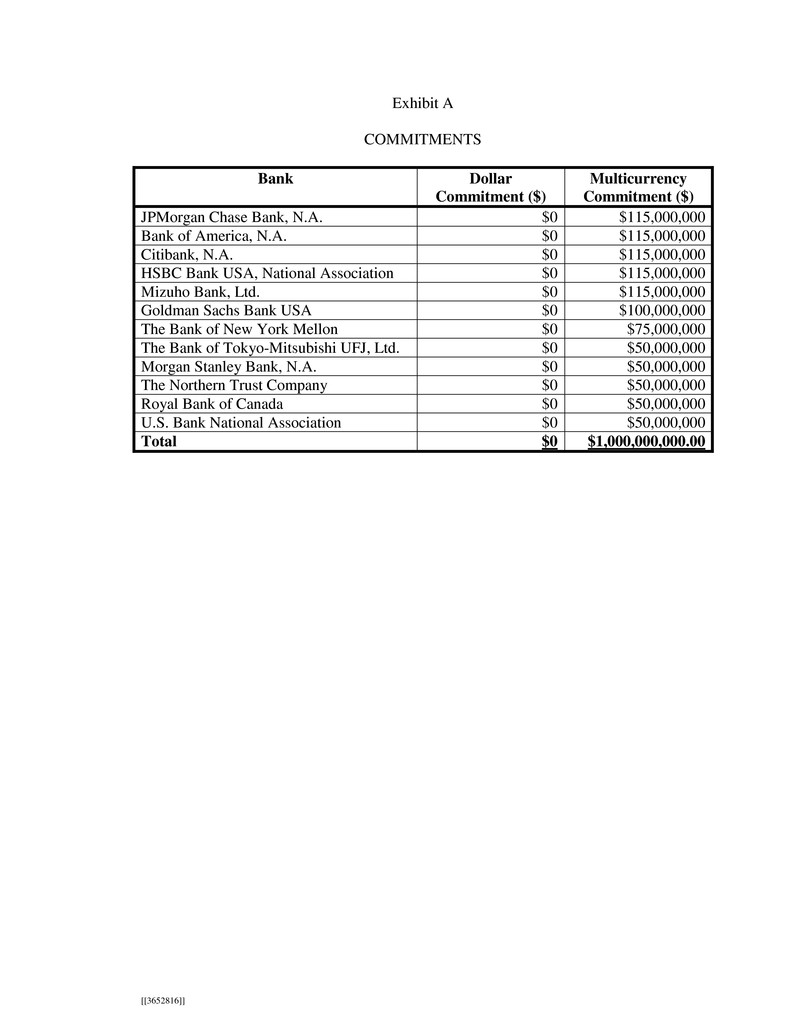

(g) The schedule set forth in Annex 1 to the Credit Agreement is

hereby replaced by the schedule attached as Exhibit A hereto.

SECTION 3. Representations and Warranties. To induce the other parties

hereto to enter into this Amendment, the Company represents and warrants to each of the

Banks and the Administrative Agent that this Amendment has been duly authorized,

executed and delivered by the Company and constitutes a legal, valid and binding

obligation of the Company, enforceable against it in accordance with its terms, subject to

bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’

rights generally and to general principles of equity, regardless of whether considered in a

proceeding in equity or at law.

SECTION 4. Effectiveness. This Amendment shall become effective on

the date (the “Amendment Effective Date”) on which it shall have been executed by the

Administrative Agent acting with the written consent of the Majority Banks and the

Administrative Agent shall have received a counterpart hereof executed by the Company.

SECTION 5. Expenses. The Company agrees to reimburse the

Administrative Agent for its reasonable out-of-pocket expenses in connection with this

Amendment and the transactions contemplated hereby, including the reasonable fees,

charges and disbursements of Cravath, Swaine & Xxxxx LLP.

SECTION 6. Effect of Amendment. Except as expressly set forth herein,

this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of

or otherwise affect the rights and remedies of the Banks or the Administrative Agent

under the Credit Agreement or any other Loan Document, and shall not alter, modify,

amend or in any way affect any of the terms, conditions, obligations, covenants or

agreements contained in the Credit Agreement or any other Loan Document, all of which

are ratified and affirmed in all respects and shall continue in full force and effect. This

Amendment shall apply and be effective only with respect to the provisions of the Credit

Agreement specifically referred to herein. This Amendment shall constitute a Loan

Document. On and after the Amendment Effective Date, any reference to the Credit

Agreement contained in the Loan Documents shall mean the Credit Agreement as

modified hereby.

[[3652816]]

SECTION 7. Counterparts. This Amendment may be executed in

counterparts, all of which taken together shall constitute one and the same instrument.

Delivery of an executed counterpart of a signature page of this Amendment by facsimile

or other electronic transmission shall be effective as delivery of a manually executed

counterpart of this Amendment.

SECTION 8. Governing Law. THIS AMENDMENT SHALL BE

GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF

THE STATE OF NEW YORK.

SECTION 9. Headings. The headings of this Amendment are for

purposes of reference only and shall not limit or otherwise affect the meaning hereof.

[Remainder of this page intentionally left blank]

[[3652816]]

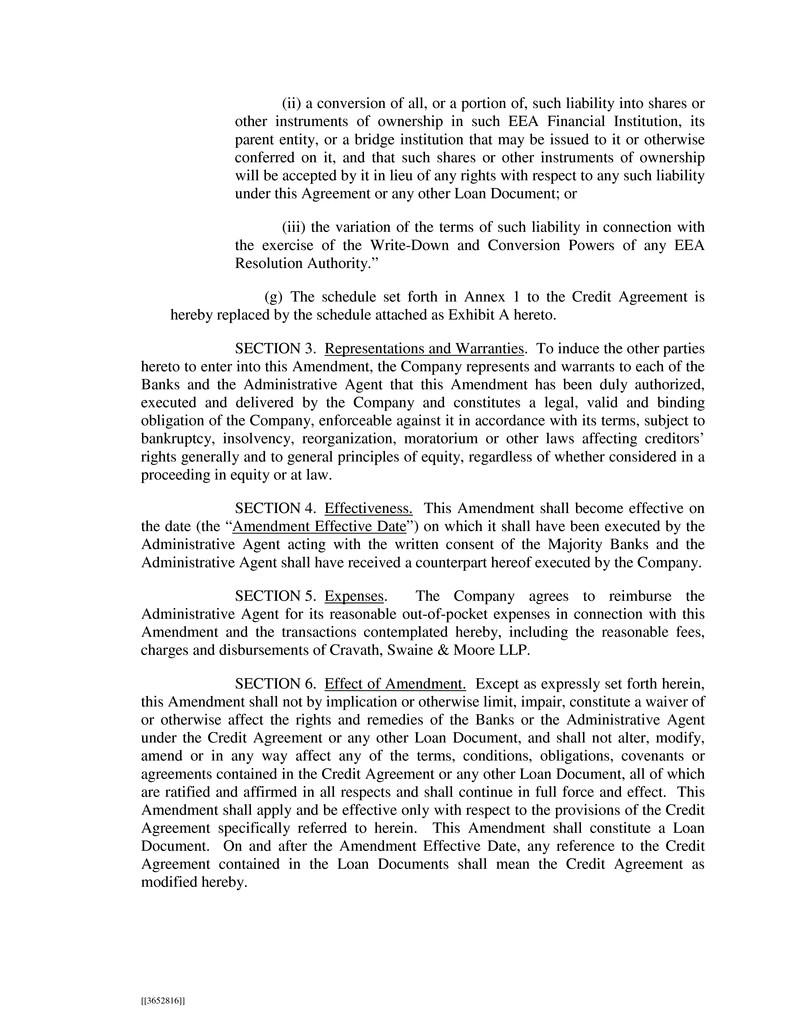

Exhibit A

COMMITMENTS

Bank Dollar

Commitment ($)

Multicurrency

Commitment ($)

JPMorgan Chase Bank, N.A. $0 $115,000,000

Bank of America, N.A. $0 $115,000,000

Citibank, N.A. $0 $115,000,000

HSBC Bank USA, National Association $0 $115,000,000

Mizuho Bank, Ltd. $0 $115,000,000

Xxxxxxx Xxxxx Bank USA $0 $100,000,000

The Bank of New York Mellon $0 $75,000,000

The Bank of Tokyo-Mitsubishi UFJ, Ltd. $0 $50,000,000

Xxxxxx Xxxxxxx Bank, N.A. $0 $50,000,000

The Northern Trust Company $0 $50,000,000

Royal Bank of Canada $0 $50,000,000

U.S. Bank National Association $0 $50,000,000

Total $0 $1,000,000,000.00