ASSET PURCHASE AGREEMENT

EXHIBIT 10.2

This ASSET PURCHASE AGREEMENT dated June 1, 2017 (this “Agreement”), is by and among: GENESIS FLOAT SPA, LLC, a Nevada limited liability company (the “Purchaser”); THC THERAPEUTICS, INC., a Nevada corporation, the sole member and parent company of the Purchaser (the “Parent”); URBAN OASIS FLOAT CENTER, LLC, a Nevada limited liability company (the “Seller”); and the members of the Seller, XXXXXX XXXXXXXXX, XXXXXX XXXXXXXXX, XX., and XXXXXX XXXXXXX

XXXXX (each a “Member” and all, collectively, the “Members”).

RECITALS

WHEREAS, the Purchaser desires to purchase from the Seller and the Seller desires to sell to the Purchaser all of Seller’s rights, title and interest in and to the Assets (as hereinafter defined), all upon the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the representations, warranties and covenants herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

1.1 CERTAIN DEFINITIONS.

(a) The following terms, when used in this Agreement, shall have the respective meanings ascribed to them below:

“ACTION” means any claim, action, suit, inquiry, hearing, investigation or other proceeding.

“AFFILIATE” means, with respect to a Person, any other Person that, directly or indirectly, through one or more intermediaries, Controls, is controlled by or is under common Control with, such Person. For purposes of this definition, “CONTROL” (including, with correlative meanings, the terms “Controlled by” and “under common Control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ownership of stock, as trustee or executor, by Contract or credit arrangement or otherwise.

“AGREEMENT” has the meaning set forth in the preamble hereto.

| 1 |

“ANCILLARY AGREEMENTS” means each of: (i) the Secured Promissory Note attached as Exhibit A hereto; (ii) the Certificate of Designation for the Parent’s Series B Preferred Stock attached as Exhibit B hereto; (iii) the Parent Warrants attached as Exhibit C hereto; and (iv) the Xxxx of Sale attached as Exhibit D hereto.

“ASSETS” has the meaning set forth in Section 2.1.

“XXXX OF SALE” has the meaning set forth in Section 3.2(b).

“CLAIM NOTICE” means written notification pursuant to Section 7.2(a) of a Third-Party Claim as to which indemnity under Section 7.1 is sought by an Indemnified Party, enclosing a copy of all papers served, if any, and specifying the nature of and basis for such Third-Party Claim and for the Indemnified Party’s claim against the Indemnifying Party under Section 7.1, together with the amount or, if not then reasonably ascertainable, the estimated amount, determined in good faith, of the Indemnified Party’s Losses in respect of such Third-Party Claim.

“CLOSING” has the meaning set forth in Section 3.1. “CLOSING DATE” has the meaning set forth in Section 3.1.

“CONTRACT” means any agreement, lease, debenture, note, bond, evidence of Indebtedness, mortgage, indenture, security agreement, option or other contract or commitment (whether written or oral).

“DISPUTE NOTICE” means a written notice provided by any party against which indemnification is sought under this Agreement to the effect that such party disputes its indemnification obligation under this Agreement.

“DISPUTE PERIOD” means the period ending thirty calendar days following receipt by an Indemnifying Party of either a Claim Notice or an Indemnity Notice.

“GAAP” means United States generally accepted accounting principles as in effect from time to time, consistently applied throughout the specified period and all prior comparable periods.

“GOVERNMENTAL ENTITY” means any government or political subdivision thereof, whether foreign or domestic, federal, state, provincial, county, local, municipal or regional, or any other governmental entity, any agency, authority, department, division or instrumentality of any such government, political subdivision or other governmental entity, any court, arbitral tribunal or arbitrator, and any nongovernmental regulating body, to the extent that the rules, regulations or orders of such body have the force of Law.

| 2 |

“INDEBTEDNESS” means, as to any Person: (i) all obligations, whether or not contingent, of such Person for borrowed money (including, without limitation, reimbursement and all other obligations with respect to surety bonds, letters of credit and bankers’ acceptances, whether or not matured), (ii) all obligations of such Person evidenced by notes, bonds, debentures, capitalized leases or similar instruments, (iii) all obligations of such Person representing the balance of deferred purchase price of property or services, (iv) all interest rate and currency swaps, caps, collars and similar agreements or hedging devices under which payments are obligated to be made by such Person, whether periodically or upon the happening of a contingency, (v) all indebtedness created or arising under any conditional sale or other title retention Contract with respect to property acquired by such Person (even though the rights and remedies of the seller or lender under such Contract in the event of default are limited to repossession or sale of such property), (vi) all indebtedness secured by any Lien on any property or asset owned or held by such Person regardless of whether the indebtedness secured thereby shall have been assumed by such Person or is non-recourse to the credit of such Person, and (vii) all indebtedness referred to in clauses (i) through (vi) above of any other Person that is guaranteed, directly or indirectly, by such Person.

“INDEMNIFIED PARTY” means any Person claiming indemnification under any provision of Article VII.

“INDEMNIFYING PARTY” means any Person against whom a claim for indemnification is being asserted under any provision of Article VII.

“INDEMNITY NOTICE” means written notification pursuant to Section 7.2(b) of a claim for indemnification under Article VII by an Indemnified Party, specifying the nature of and basis for such claim, together with the amount or, if not then reasonably ascertainable, the estimated amount, determined in good faith, of the Indemnified Party’s Losses in respect of such claim.

“INTELLECTUAL PROPERTY” means: all (i) discoveries and inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements thereto, and all United States, international, and foreign patents, patent applications (either filed or in preparation for filing), patent disclosures and statutory invention registrations, including all reissuances, divisions, continuations, continuations in part, extensions and reexaminations thereof, all rights therein provided by international treaties or conventions, (ii) trademarks, service marks, trade dress, logos, trade names, corporate names, and other source identifiers (whether or not registered) including all common law rights, all registrations and applications for registration (either filed or in preparation for filing) thereof, all rights therein provided by international treaties or conventions, and all renewals of any of the foregoing, (iii) all copyrightable works and copyrights (whether or not registered), all registrations and applications for registration thereof, all rights therein provided by international treaties or conventions, and all data and documentation relating thereto, (iv) confidential and proprietary information, trade secrets, know-how (whether patentable or nonpatentable and whether or not reduced to practice), processes and techniques, research and development information including patent and/or copyright searches conducted by Seller and/or any third party, ideas, technical data, designs, drawings and specifications, (v) software, (vi) coded values, formats, data and historical or current databases, whether or not copyrightable, (vii) domain names, Internet websites or identities used or held for use by the Seller, (viii) other proprietary rights relating to any of the foregoing (including without limitation any and all associated goodwill and remedies against infringements thereof and rights of protection of an interest therein under the laws of all jurisdictions), and (ix) copies and tangible embodiments of any of the foregoing.

| 3 |

“KNOWLEDGE” means the actual or constructive knowledge after due inquiry of any Member or any current officer or manager of the Seller.

“LAWS” means all laws, statutes, rules, regulations, ordinances and other pronouncements having the effect of law of the United States, any foreign country or any domestic or foreign state, county, city or other political subdivision or of any Governmental Entity.

“LIABILITY” means all Indebtedness, obligations and other Liabilities of a Person, whether absolute, accrued, contingent, fixed or otherwise, and whether due or to become due (including for Taxes).

“LIEN” means any mortgage, pledge, assessment, security interest, lease, lien, adverse claim, levy, charge or other encumbrance of any kind, whether voluntary or involuntary (including any conditional sale Contract, title retention Contract or Contract committing to grant any of the foregoing).

“LOSS” means any and all damages, fines, fees, penalties, deficiencies, losses and expenses (including, without limitation, all interest, court costs, fees and expenses of attorneys, accountants and other experts or other expenses of litigation or other proceedings or of any claim, default or assessment).

“MATERIAL ADVERSE EFFECT” means any material adverse effect on the condition, operations, business, prospects or results of sales of the Seller; PROVIDED, HOWEVER, that any adverse effect arising out of or resulting from the entering into of this Agreement or the consummation of the transactions contemplated hereby, shall be excluded in determining whether a Material Adverse Effect has occurred.

“ORDER” means any writ, judgment, decree, injunction or similar order of any Governmental Entity (in each case whether preliminary or final).

| 4 |

“PERSON” means any individual, partnership, limited liability company, corporation, association, joint stock company, trust, estate, joint venture, unincorporated organization, Governmental Entity or any other entity of any kind.

“PRIOR SECURED NOTE” means the Promissory Note issued by the Seller on May 13, 2016 to Go Float Yourself, LLC in the original principal amount of $50,000 (the “Secured Note”), a true and correct copy of which is attached hereto as Exhibit E.

“PURCHASE PRICE” has the meaning set forth in Section 2.1. “PURCHASER” has the meaning set forth in the preamble hereto.

“RESOLUTION PERIOD” means the period ending thirty days following receipt by an Indemnified Party of a Dispute Notice.

“SELLER” has the meaning set forth in the preamble hereto.

“SOFTWARE” means all computer software, including source code, object code, machine-readable code, HTML or other markup language, program listings, comments, user interfaces, menus, buttons and icons, web applications and all files, data, manuals, design notes, research and development documents, and other items and documentation related thereto or associated therewith.

“SOLVENT” means, with respect to the Seller, that (a) the Seller is able to pay its Liabilities, as they mature in the normal course of business, and (b) the fair value of the assets of the Seller is greater than the total amount of Liabilities of the Seller.

“TAXES” means all federal, state, local and foreign income, profits, franchise, license, social security, transfer, registration, estimated, gross receipts, environmental, customs duty, capital stock, severance, stamp, payroll, sales, employment, unemployment, disability, use, property, withholding, excise, production, value added, occupancy and other taxes, duties or assessments of any nature whatsoever together with all interest, penalties, fines and additions to tax imposed with respect to such amounts and any interest in respect of such penalties and additions to tax.

“THIRD-PARTY CLAIM” has the meaning set forth in Section 7.2(a).

“TRADEMARK ASSIGNMENT” has the meaning set forth in Section 3.2(c).

“TRANSFER TAXES” means all sales, use, value added, excise, registration, documentary, stamps, transfer, real property transfer, recording, gains, stock transfer and other similar Taxes and fees.

| 5 |

(b) For purposes of this Agreement, except as otherwise expressly provided herein or unless the context otherwise requires: (i) words using the singular or plural number also include the plural or singular number, respectively, and the use of any gender herein shall be deemed to include the other genders; (ii) references herein to “Articles”, “Sections”, “subsections” and other subdivisions without reference to a document are to the specified Articles, Sections, subsections and other subdivisions of this Agreement; (iii) a reference to a subsection without further reference to a Section is a reference to such subsection as contained in the same Section in which the reference appears, and this rule shall also apply to other subdivisions within a Section or subsection; (iv) the words “herein”, “hereof”, “hereunder”, “hereby” and other words of similar import refer to this Agreement as a whole and not to any particular provision; and (v) the words “include”, “includes” and “including” are deemed to be followed by the phrase “without limitation”. All accounting terms used herein and not expressly defined herein shall have the meanings given to them under GAAP.

1.2 MEMBERSHIP PURCHASE AGREEMENT CANCELLED AND REPLACED.

The Membership Purchase Agreement previously executed by the Seller, the Members, and the Parent, dated May 12, 2017, is hereby cancelled and rescinded by the agreement of all parties thereto, and shall be deemed to be of no legal effect. In place and instead of the transaction described thereunder, the parties enter into this Asset Purchase Agreement effective as of May 12, 2017. The Secured Promissory Note, shares of Series B Preferred Stock, and Parent Warrants issued by the Parent, and the cash paid by the Parent, under the terms of such prior agreement shall be accepted by the Seller and the Members as payment of the Purchase Price under this Asset Purchase Agreement as described in Section 2.1, below.

ARTICLE II

PURCHASE AND SALE OF ASSETS

2.1 PURCHASE AND SALE OF ASSETS.

(a) At the Closing, as hereinafter defined, Purchaser and the Parent shall pay Seller and the Members for the Assets (the “PURCHASE PRICE”) as follows:

i. Payment of Cash in the total amount of $20,000, to be paid to the Members as follows:

Xxxxxx Xxxxxxxxx and Xxxxxx Xxxxxxxxx, Xx. (jointly) – $10,200 Xxxxxx Xxxxxxx Xxxxx – $9,800

The Members acknowledge their prior receipt of such cash payments.

| 6 |

ii. Issuance of a Secured Promissory Note in the principal amount of $60,000, to be issued by the Parent and payable jointly to the Members (the “Parent Note”), in the form attached hereto as Exhibit A. The Members acknowledge the Parent’s issuance and their receipt of the Secured Promissory Note on May 12, 2017.

iii. Issuance of One hundred twenty thousand (120,000) shares of the Parent’s Series B Preferred Stock, stated value $1.00 per share (the “Parent Preferred Shares”), to be issued as follows:

Xxxxxx Xxxxxxxxx and Xxxxxx Xxxxxxxxx, Xx. (jointly) – 61,200 shares Xxxxxx Xxxxxxx Xxxxx – 58,800 shares

The Members acknowledge the Parent’s prior issuance of the Parent Preferred Shares to them on May 12, 2017.

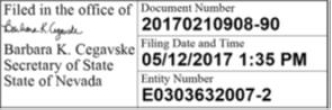

The rights, preferences, privileges, qualifications, limitations and restrictions of the Parent Preferred Shares shall be as set forth in the Certificate of Designation included as Exhibit B hereto. The Certificate of Designation has been filed with the Nevada Secretary of State. The Seller and the Members acknowledge and agree that such Certificate of Designation may be later amended by the Board of Directors of the Parent to increase the number of authorized Series B Preferred Shares, with such additional authorized preferred shares to be issued by the Parent in settlement of certain secured debt encumbering the Assets.

iv. Issuance of Warrants to purchase twenty-five thousand (25,000) shares of the Parent’s common stock at an exercise price of $2.00 per share, exercisable for a period of three (3) years from the date of issue (the “Parent Warrants”). The Parent Warrants shall be issued to the Members, in the form attached as Exhibit C hereto, as follows:

Xxxxxx Xxxxxxxxx and Xxxxxx Xxxxxxxxx, Xx. (jointly) – 12,750 warrants Xxxxxx Xxxxxxx Xxxxx – 12,250 warrants

The Members acknowledge the Parent’s prior issuance of the Parent Warrants to them on May 12, 2017.

| 7 |

(b) In consideration of the payment by the Purchaser and the Parent of the PURCHASE PRICE, the Seller hereby agrees to sell, convey, transfer, assign, grant and deliver to the Purchaser, and the Purchaser hereby agrees to purchase, acquire and accept from the Seller, at the Closing, all of the Seller’s right, title and interest in and to all of the Assets, free and clear of all Liens, with the sole exception of the Prior Secured Note. The term “ASSETS” means the following assets of Seller only: four float pods and related equipment, Seller’s client list, and general intangibles relating to such client list. For clarity, Seller shall retain and is not selling to Purchaser any other assets of Seller related in any way to the ownership and operation of the “Go Float Yourself” floatation therapy center located at 0000 Xxxx Xxxxxx Xxxx in Henderson, Nevada (the “Business”), including (a) the inventory on hand, furniture, fixtures, equipment (other than that equipment included in the Assets being sold to Purchaser) and other tangible assets related to the Business; (b) all trade names, common law trademarks, domain names, websites, ecommerce sites, Twitter, Facebook and all other social media sites of any nature relating to the Business;

(c) all rights under any contracts to which Seller is bound; and (d) all general intangibles relating or associated with the operation of the Business; and all goodwill generated by, and associated with, the Business (other than general intangibles related to the client list included in the Assets being sold to Purchaser).

2.2 ASSUMPTION OF LIABILITIES. For greater certainty, the Purchaser and the Parent assume no Liabilities relating to the Assets, the Members, or the Seller or the Seller’s business (including Tax Liabilities).

ARTICLE III

THE CLOSING

3.1 CLOSING. The closing of the transactions contemplated hereby (the “CLOSING”) shall take place upon the Parties’ execution of this Agreement, or on such other date as the parties hereto may mutually determine in writing (the “CLOSING DATE”).

3.2 DELIVERY OF ITEMS BY THE SELLER. The Seller shall deliver to the Purchaser at the Closing the items listed below:

(a) a Xxxx of Sale and General Assignment for the Assets, duly executed by the Seller, in the form attached hereto as EXHIBIT D (the “XXXX OF SALE”); and

(b) such other documents and instruments as the Purchaser may reasonably request.

| 8 |

3.3 DELIVERY OF ITEMS BY THE PURCHASER. The Purchaser shall deliver to the Seller at the Closing the items listed below:

(a) Cash in the amount of $20,000 to be paid as set forth above, prior payment of which is hereby acknowledged by the Seller and the Members;

(b) The Parent Note, the prior issuance and delivery of which is hereby acknowledged by the Seller and the Members;

(c) The Parent Preferred Shares, the prior issuance and delivery of which is hereby acknowledged by the Seller and the Members;

(d) The Parent Warrants, the prior issuance and delivery of which is hereby acknowledged by the Seller and the Members; and

(b) such other documents and instruments as the Seller and the Members may reasonably request.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE SELLER AND THE MEMBERS

As an inducement to the Purchaser and Parent to enter into this Agreement, the Seller and the Members represent and warrant to the Purchaser and the Parent as follows:

4.1 AUTHORIZATION. The Seller has full power and authority to execute and deliver this Agreement and the Ancillary Agreements, as applicable, and to perform its obligations hereunder and thereunder. This Agreement and the Ancillary Agreements have been duly executed and delivered by the Seller and, assuming the due authorization, execution and delivery hereto and thereof by the Purchaser and the Parent, constitute the valid and legally binding obligations of the Seller enforceable in accordance with their respective terms. Seller is a limited liability company organized under the laws of the State of Nevada, in good standing, and has obtained all consents and other approvals necessary under Nevada law, its Articles of Organization, and its Operating Agreement necessary for the execution, delivery and performance of this Agreement and the Ancillary Agreements.

4.2 BROKERS’ FEES. No agent, broker, finder, investment banker, financial advisor or other similar Person will be entitled to any fee, commission or other compensation in connection with any of the transactions contemplated by this Agreement on the basis of any act or statement made or alleged to have been made by the Seller, any of its Affiliates, or any investment banker, financial advisor, attorney, accountant or other Person retained by or acting for or on behalf of the Seller or any such Affiliate.

4.3 NONCONTRAVENTION.

| 9 |

(a) Neither the execution, delivery or performance of this Agreement or the Ancillary Agreements, as applicable, nor the consummation of the transactions contemplated hereby or thereby will, with or without the giving of notice or the lapse of time or both, (i) violate any Law or Order or other restriction of any Governmental Entity to which the Seller may be subject or (ii) conflict with, result in a breach of, constitute a default under, result in the acceleration of any right or obligation under, create in any party the right to accelerate, terminate, modify, cancel, require any notice under or result in the creation of a Lien on any of the Assets under, any Contract to which the Seller is a party or by which it is bound and to which any of its Assets is subject.

(b) The execution and delivery of this Agreement and the Ancillary Agreements, as applicable, by the Seller do not, and the performance of this Agreement and the Ancillary Agreements by the Seller and the consummation of the transactions contemplated hereby and thereby will not, require any consent, approval, authorization or permit of, or filing with or notification to, any Governmental Entity.

4.4 LITIGATION. There is no pending or, to the Knowledge of the Seller, threatened Action against or affecting the Assets. Neither the Seller nor the Assets are subject to any Order restraining, enjoining or otherwise prohibiting or making illegal any action by the Seller, this Agreement or any of the transactions contemplated hereby.

4.5 CONTRACTS. There are no executory Contracts (whether license agreements, development agreements or otherwise), to which any of the Assets are bound or subject (other than this Agreement).

4.6 INTELLECTUAL PROPERTY.

(a) The Seller is the sole and exclusive owner of, and has good and marketable title to, all of the Intellectual Property in and to the Assets, free and clear of all Liens, with the sole exception of the Prior Secured Note. The Seller has sole and exclusive right to develop, perform, use, create derivative works of, operate, reproduce, market, sell, license, display, distribute, publish and transmit the Intellectual Property in and to the Assets. Upon the Closing, the Purchaser will have sole and exclusive right, title and interest in and to the Intellectual Property in and to the Assets, such that the Purchaser shall thereafter have sole and exclusive rights to perform, reproduce, create derivative works of, develop, use, operate, market, sell, license, display, publish, transmit and distribute the Assets, free of all encumbrances. The Seller has taken reasonable measures to protect the proprietary nature of the Intellectual Property in and to the Assets and to maintain in confidence the trade secrets and confidential information that it owns or uses. With the sole exception of the holder of the Prior Secured Note, no other Person has any rights to any of Intellectual Property in and to the Assets and, to the knowledge of the Seller, no other Person is infringing, violating or misappropriating any of the Intellectual Property in and to the Assets.

| 10 |

(c) With respect to the Seller’s Intellectual Property contributed to the Assets, such Intellectual Property does not infringe upon, violate or constitute a misappropriation of any Intellectual Property or other right of any other Person. In addition, to Seller’s knowledge, none of the activities or business presently conducted by the Seller with respect to the Assets infringes or violates, or constitutes a misappropriation of, any Intellectual Property or other right of any other Person. Neither the Seller nor any Affiliate of the Seller has received any written complaint, claim or notice alleging any such infringement, violation or misappropriation. Further, neither the Seller nor any Affiliate of the Seller has disclosed to any Person, any product formula, or any portion or aspect of any product formula, which is part of the Assets, including the Intellectual Property.

4.7 COMPLIANCE WITH LAWS. The Seller is not in violation of, has not violated and, to the Knowledge of the Seller, is not under investigation with respect to any possible violation of, and has not been threatened to be charged with any violation of, any Order of Law applicable to the Assets.

4.8 TITLE TO ASSETS. Except as to Intellectual Property (which warranty is contained in Section 4.6): (i) the Seller has good and marketable title to all of the Assets free and clear of all Liens with the sole exception of the Prior Secured Note; (ii) this Agreement and the instruments of transfer to be executed and delivered pursuant hereto will effectively vest in the Purchaser good and marketable title to all of the Assets free and clear of all Liens with the sole exception of the Prior Secured Note; (iii) and no Person other than the Seller has any ownership interest in any of the Assets. Following the Closing, the Purchaser and the Parent shall arrange for satisfaction of the Prior Secured Note on such terms as they deems advisable.

4.9 SOLVENCY. The Seller is and, after consummation of the transactions contemplated by this Agreement, will be Solvent.

4.10 DISCLOSURE. The representations and warranties on the part of the Seller and the Members contained in this Agreement, and the statements contained in any of the Schedules or in any certificates furnished to the Purchaser or the Parent pursuant to any provisions of this Agreement, including pursuant to Article VI hereof, do not contain any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements herein or therein, in light of the circumstances under which they were made, not misleading.

4.11 ACQUISITION ENTIRELY FOR OWN ACCOUNT. The Parent Preferred Shares and the Parent Warrants proposed to be acquired by the Members hereunder will be acquired for investment for their own account, and not with a view to the resale or distribution of any part thereof, and the Members have no present intention of selling or otherwise distributing the Parent Preferred Shares or the Parent Warrants, except in compliance with applicable securities laws.

| 11 |

4.12 AVAILABLE INFORMATION. The Members have such knowledge and experience in financial and business matters that they are capable of evaluating the merits and risks of an investment in the Parent.

4.13 NON-REGISTRATION. The Members understand that the Parent Preferred Shares and the Parent Warrants have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and, if issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions of the Securities Act that depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Members’ representations as expressed herein. The non-registration shall have no prejudice with respect to any rights, interests, benefits and entitlements attached to the Parent Preferred Shares and the Parent Warrants in accordance with the Parent charter documents or the laws of its jurisdiction of incorporation.

4.14 RESTRICTED SECURITIES. The Members understand that the Parent Preferred Shares and the Parent Warrants are characterized as “restricted securities” under the Securities Act inasmuch as this Agreement contemplates that, if acquired by the Members pursuant hereto, the Parent Preferred Shares and the Parent Warrants would be acquired in a transaction not involving a public offering. The Members further acknowledge that if the Parent Preferred Shares and the Parent Warrants are issued to the Members in accordance with the provisions of this Agreement, the Parent Preferred Shares and the Parent Warrants may not be resold without registration under the Securities Act or the existence of an exemption therefrom. The Members represent that they are familiar with Rule 144 promulgated under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

4.15 LEGENDS. It is understood that the Parent Preferred Shares and the Parent Warrants will bear the following legend or another legend that is similar to the following:

THESE SECURITIES HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THESE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT SECURED BY SUCH SECURITIES.

| 12 |

and any legend required by the “blue sky” laws of any state to the extent such laws are applicable to the securities represented by the certificate so legended.

4.16 ADDITIONAL REPRESENTATIONS AND WARRANTIES OF THE MEMBERS

(a) The Members acknowledge that the acquisition of the Parent Preferred Shares and the Parent Warrants involves a high degree of risk in that the Parent has only recently commenced its current business operations and may require substantial additional funds;

(b) The Members recognize that an investment in the Parent is highly speculative and only investors who can afford the loss of their entire investment should consider investing in the Parent, the Parent Preferred Shares, and the Parent Warrants;

(c) The Members have such knowledge and experience in finance, securities, investments, including investment in unregistered securities, and other business matters so as to be able to protect their interests in connection with this transaction;

(d) The Members acknowledge that the Parent Preferred Shares and the Parent Warrants, and the shares of Parent common stock underlying such securities, are subject to significant restrictions on transfer as imposed by state and federal securities laws, including but not limited to a minimum holding period of at least one (1) year;

(e) The Members are not aware of any advertisement of the Parent Preferred Shares and the Parent Warrants or any general solicitation in connection with any offering of the Parent Preferred Shares and the Parent Warrants;

(f) The Members acknowledge review of the Parent’s Articles of Incorporation and the bylaws of the Parent, together with the opportunity and the Purchaser’s encouragement to seek the advice and consultation of independent investment, legal and tax counsel; and

(g) The Members acknowledge and agree that the Parent has previously made available to the Members the opportunity to ask questions of and to receive answers from representatives of the Parent concerning the Parent, the Parent Preferred Shares and the Parent Warrants, as well as to conduct whatever due diligence the Members, in their discretion, deems advisable. The Members are relying solely upon the information obtained during their due diligence investigation in making a decision to invest in the Parent, the Parent Preferred Shares and the Parent Warrants.

| 13 |

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF THE PURCHASER AND THE PARENT

As an inducement to the Seller and the Members to enter into this Agreement, the Purchaser and the Parent represent and warrant to the Seller and the Members as follows:

5.1 AUTHORIZATION. The Purchaser and the Parent have full power and authority to execute and deliver this Agreement and the Ancillary Agreements, as applicable, and to perform its obligations hereunder and thereunder. This Agreement and the Ancillary Agreements have been duly executed and delivered by the Purchaser and the Parent and, assuming the due authorization, execution and delivery hereof and thereof by the Seller and the Members, constitute the valid and legally binding obligations of the Purchaser and the Parent enforceable in accordance with their respective terms. Purchaser is a limited liability company organized under the laws of the State of Nevada, in good standing. Parent is a corporation organized under the laws of the State of Nevada, in good standing. Purchaser and Parent have obtained all consents and other approvals necessary under Nevada law and their respective governing documents necessary for the execution, delivery and performance of this Agreement and the Ancillary Agreements.

5.2 NONCONTRAVENTION.

(a) Neither the execution, delivery or performance of this Agreement or the Ancillary Agreements, as applicable, nor the consummation of the transactions contemplated hereby or thereby will, with or without the giving of notice or the lapse of time or both, (i) violate any Law or Order or other restriction of any Governmental Entity to which the Purchaser or Parent may be subject.

(b) The execution and delivery of this Agreement and the Ancillary Agreements, as applicable, by the Purchaser and the Parent does not, and the performance of this Agreement and the Ancillary Agreements by the Purchaser and the Parent and the consummation of the transactions contemplated hereby and thereby will not, require any consent, approval, authorization or permit of, or filing with or notification to, any Governmental Entity.

5.3 BROKERS’ FEES. No agent, broker, finder, investment banker, financial advisor or other similar Person will be entitled to any fee, commission or other compensation in connection with any of the transactions contemplated by this Agreement on the basis of any act or statement made or alleged to have been made by the Purchaser and the Parent, any of their Affiliates, or any investment banker, financial advisor, attorney, accountant or other Person retained by or acting for or on behalf of the Purchaser or the Parent or any such Affiliate.

| 14 |

5.4 PARENT PREFERRED SHARES AND PARENT WARRANTS. Upon issue, the Parent Preferred Shares will be duly and validly issued, fully paid and non-assessable preferred stock in the capital of the Parent. Upon conversion or exercise in accordance with the terms thereof, the shares of common stock in the Parent to be issued to the Members upon conversion or exercise of the Parent Preferred Shares and the Parent Warrants shall be validly issued, fully paid, and non-assessable common stock in the capital of the Parent.

ARTICLE VI

CONDITIONS TO OBLIGATION TO CLOSE

6.1 CONDITIONS TO CLOSING BY THE PURCHASER AND THE PARENT. The obligation of the Purchaser and the Parent to effect the transactions contemplated hereby is subject to the satisfaction or waiver by the Purchaser and the Parent of the following conditions:

(a) The representations and warranties of the Seller and the Members set forth in this Agreement shall be true and correct in all material respects, with respect to representations and warranties not qualified by materiality, or in all respects, with respect to representations and warranties qualified by materiality, as of the date of this Agreement and as of the Closing Date as though made on and as of the Closing Date.

(b) The Seller shall have performed in all material respects the covenants required to be performed by it under this Agreement at or prior to the Closing Date.

(c) The Seller shall have executed and delivered each of the Ancillary Agreements, as applicable.

(d) There shall be no effective or pending Law or Order that would prohibit the Closing, and the Seller shall have obtained all necessary approvals of any Governmental Entities in connection with the transactions contemplated hereby and by the Ancillary Agreements.

(e) The Seller shall have delivered each of the items described in Section 3.2.

6.2 CONDITIONS TO CLOSING BY THE SELLER AND THE MEMBERS. The obligation of the Seller and the Members to effect the transactions contemplated hereby is subject to the satisfaction or waiver by the Seller and the Members of the following conditions:

(a) The representations and warranties of the Purchaser and the Parent set forth in this Agreement shall be true and correct in all material respects, with respect to representations and warranties not qualified by materiality, and in all respects, with respect to representations and warranties qualified by materiality, in each case as of the date of this Agreement and as of the Closing Date as though made on and as of the Closing Date.

| 15 |

(b) The Purchaser and the Parent shall have performed in all material respects the covenants required to be performed by them under this Agreement at or prior to the Closing Date.

(c) The Purchaser and the Parent shall have executed and delivered each of the Ancillary Agreements, as applicable.

(d) There shall be no effective or pending Law or Order that would prohibit the Closing, and the Purchaser and the Parent shall have obtained all necessary approvals of any Governmental Entities in connection with the transactions contemplated hereby and by the Ancillary Agreements.

(e) The Purchaser and the Parent shall have delivered each of the items described in Section 3.3.

ARTICLE VII

INDEMNIFICATION

7.1 INDEMNIFICATION OBLIGATIONS.

(a) Purchaser and the Parent shall indemnify the Members, and the Seller and its officers, directors, employees, agents and Affiliates (each, an “INDEMNIFIED PARTY”) in respect of, and hold each harmless from and against, any and all Losses suffered, incurred or sustained by it or to which it becomes subject, resulting from, arising out of or relating to (i) any misrepresentation or breach of representation or warranty on the part of the Purchaser or Parent contained in this Agreement, (ii) any nonfulfillment of or failure to perform any covenant or agreement on the part of the Purchaser or Parent contained in this Agreement, and (iii) any Liabilities related to the Assets or the Business and arising from or related to facts, circumstances, or events occurring subsequent to the Closing.

(b) Seller and the Members shall indemnify the Purchaser, the Parent and their officers, directors, employees, agents and Affiliates (each, an “INDEMNIFIED PARTY”) in respect of, and hold each harmless from and against, any and all Losses suffered, incurred or sustained by them or to which they becomes subject, resulting from, arising out of or relating to (i) any misrepresentation or breach of representation or warranty on the part of the Seller or the Members contained in this Agreement, (ii) any nonfulfillment of or failure to perform any covenant or agreement on the part of the Seller or the Members contained in this Agreement, and (iii) any Liabilities related to the Assets or the Business and arising from or related to facts, circumstances, or events occurring prior to the Closing.

| 16 |

(c) For purposes of indemnification under this Article VII only, all qualifications as to materiality and/or Material Adverse Effect contained in any representation or warranty shall be disregarded.

7.2 METHOD OF ASSERTING CLAIMS. Claims for indemnification by an Indemnified Party under Section 7.1 will be asserted and resolved as follows:

(a) THIRD-PARTY CLAIMS. In the event that any claim or demand in respect of which an Indemnified Party might seek indemnification under Section 7.1 in respect of, arising out of or involving a claim or demand made by any Person not a party to this Agreement against an Indemnified Party (a “THIRD-PARTY CLAIM”), the Indemnified Party shall deliver a Claim Notice to the either the Purchaser and Parent or the Seller and the Members, as appropriate, as the “Indemnifying Party” within sixty (60) days after receipt by such Indemnified Party of written notice of the Third Party Claim. If the Indemnified Party fails to provide the Claim Notice within such time period, the Indemnifying Party will not be obligated to indemnify the Indemnified Party with respect to such Third-Party Claim to the extent that the Indemnifying Party’s ability to defend is actually prejudiced by such failure of the Indemnified Party. The Indemnifying Party will notify the Indemnified Party as soon as practicable within the Dispute Period whether the Indemnifying Party accepts or disputes its liability to the Indemnified Party under Section 7.1 and whether the Indemnifying Party desires, at its sole cost and expense, to defend the Indemnified Party against such Third-Party Claim.

(i) DEFENSE BY INDEMNIFYING PARTY. If the Indemnifying Party notifies the Indemnified Party within the Dispute Period that the Indemnifying Party desires to defend the Indemnified Party with respect to the Third-Party Claim pursuant to this Section 7.2, then the Indemnifying Party will have the right to defend, with counsel reasonably satisfactory to the Indemnified Party, at the sole cost and expense of the Indemnifying Party, such Third-Party Claim by all appropriate proceedings, which proceedings will be vigorously and diligently prosecuted or defended by the Indemnifying Party to a final conclusion or will be settled at the discretion of the Indemnifying Party (but only with the consent of the Indemnified Party in its sole discretion in the case of any settlement that provides for any relief other than the payment of monetary damages or that provides for the payment of monetary damages as to which the Indemnified Party will not be indemnified in full pursuant to Section 7.1). Subject to the immediately preceding sentence, the Indemnifying Party will have full control of such defense and proceedings, including any compromise or settlement thereof; PROVIDED, HOWEVER, that the Indemnified Party may, at the cost and expense of the Indemnifying Party, at any time prior to the Indemnifying Party’s delivery of notice to assume the defense of such Third Party Claim, file any motion, answer or other pleadings or take any other action that the Indemnified Party reasonably believes to be necessary or appropriate to protect its interests. The Indemnifying Party shall not be liable to the Indemnified Party for legal expenses incurred by the Indemnified Party in connection with the defense of such Third Party Claim after the Indemnifying Party’s delivery of notice to assume the defense. In addition, if requested by the Indemnifying Party, the Indemnified Party will, at the sole cost and expense of the Indemnifying Party, provide reasonable cooperation to the Indemnifying Party in contesting any Third- Party Claim that the Indemnifying Party elects to contest.

| 17 |

(ii) DEFENSE BY INDEMNIFIED PARTY. If the Indemnifying Party fails to notify the Indemnified Party within the Dispute Period that the Indemnifying Party desires to assume the defense of the Third-Party Claim, or if the Indemnifying Party fails to give any notice whatsoever within the Dispute Period, then the Indemnified Party will have the right to defend, at the sole cost and expense of the Indemnifying Party, the Third-Party Claim by all appropriate proceedings, which proceedings will be prosecuted by the Indemnified Party in good faith or will be settled at the discretion of the Indemnified Party. The Indemnified Party will have full control of such defense and proceedings, including any compromise or settlement thereof; PROVIDED, HOWEVER, that if requested by the Indemnified Party, the Indemnifying Party will, at the sole cost and expense of the Indemnifying Party, provide reasonable cooperation to the Indemnified Party and its counsel in contesting any Third-Party Claim which the Indemnified Party is contesting. Notwithstanding the foregoing provisions of this Section 7.2, if the Indemnifying Party has notified the Indemnified Party within the Dispute Period that the Indemnifying Party disputes its liability hereunder to the Indemnified Party with respect to such Third-Party Claim and if such dispute is resolved in all respects in favor of the Indemnifying Party in the manner provided in clause (iii) below, the Indemnifying Party will not be required to bear the costs and expenses of the Indemnified Party’s defense pursuant to this Section 7.2 or of the Indemnifying Party’s participation therein at the Indemnified Party’s request. The Indemnifying Party may participate in, but not control, any defense or settlement controlled by the Indemnified Party pursuant to this Section 7.2, and the Indemnifying Party will bear its own costs and expenses with respect to such participation.

(iii) ACCEPTANCE BY INDEMNIFYING PARTY. If the Indemnifying Party notifies the Indemnified Party that it accepts its indemnification liability to the Indemnified Party with respect to the Third-Party Claim under Section 7.1, the Loss identified in the Claim Notice, as finally determined, will be conclusively deemed a liability of the Indemnifying Party under Section 7.1 and the Indemnifying Party shall pay the amount of such Loss to the Indemnified Party on demand. If the Indemnifying Party timely disputes its liability with respect to such Third-Party Claim or fails to notify the Indemnified Party within the Dispute Period whether the Indemnifying Party disputes its liability to the Indemnified Party with respect to such Third-Party Claim, the Indemnifying Party and the Indemnified Party will proceed in good faith to negotiate a resolution of such dispute, and if not resolved through negotiations with the Resolution Period, such dispute shall be resolved by litigation in a court of competent jurisdiction.

(b) NON-THIRD PARTY CLAIMS. In the event any Indemnified Party should have a claim under Section 7.1 against any Indemnifying Party that does not involve a Third-Party Claim, the Indemnified Party shall deliver an Indemnity Notice with reasonable promptness to the Indemnifying Party. The failure or delay by any Indemnified Party to give the Indemnity Notice shall not impair such party’s rights hereunder except to the extent that the Indemnifying Party is actually prejudiced by such failure or delay. If the Indemnifying Party notifies the Indemnified Party that it does not dispute the claim described in such Indemnity Notice within the Dispute Period, the Loss indemnified in the Indemnity Notice will be conclusively deemed a Liability of the Indemnified Party under Section 7.1 and the Indemnifying Party shall pay the amount of such Loss to the Indemnified Party on demand. If the Indemnifying Party has timely disputed its liability with respect to such claim or fails to notify the Indemnified Party within the Dispute Period whether the Indemnifying Party disputes the claim described in such Indemnity Notice, the Indemnifying Party and the Indemnified Party will proceed in good faith to negotiate a resolution of such dispute and, if not resolved through negotiations within the Resolution Period, such dispute shall be resolved by litigation in a court of competent jurisdiction.

| 18 |

ARTICLE VIII

POST-CLOSING COVENANTS

8.1 TRANSFER TAXES. Notwithstanding anything herein to the contrary, Seller shall be liable for and shall pay any Transfer Taxes or other similar tax imposed in connection with the transfer of the Assets pursuant to this Agreement. The party responsible under applicable Law for remitting any such tax shall pay and remit such tax on a timely basis and, if such party is the Purchaser, the Purchaser shall notify the Seller of the amount of such tax, and the Seller shall promptly pay to the Purchaser the amount of such tax.

8.2 FURTHER ACTION. From and after the Closing each of the parties hereto shall execute and deliver such documents and take such further actions as may reasonably be required to carry out the provisions of this Agreement and the Ancillary Agreements and to give effect to the transactions contemplated hereby and thereby, including to give the Purchaser effective ownership and control of the Assets.

ARTICLE IX

MISCELLANEOUS

9.1 SURVIVAL. Notwithstanding any right of the Purchaser (whether or not exercised) to investigate the affairs of the Seller or any right of any party (whether or not exercised) to investigate the accuracy of the representations and warranties of the other party contained in this Agreement or the waiver of any condition to Closing, each of the parties hereto has the right to rely fully upon the representations, warranties, covenants and agreements of the other contained in this Agreement. The representations, warranties, covenants and agreements of the parties hereto contained in this Agreement and any certificate or other document provided hereunder or thereunder will survive the Closing.

9.2 NO THIRD-PARTY BENEFICIARIES. The terms and provisions of this Agreement are intended solely for the benefit of the parties hereto and their respective successors and permitted assigns, and it is not the intention of the parties to confer third-party beneficiary rights, and this Agreement does not confer any such rights, upon any other Person, except for any Person entitled to indemnity under Article VII.

| 19 |

9.3 ENTIRE AGREEMENT. This Agreement (including the Exhibits and the Schedules hereto) constitute the entire agreement between the parties hereto with respect to the subject matter hereof and thereof and supersede any prior understandings, agreements or representations by or between the parties hereto, written or oral, with respect to such subject matter.

9.4 SUCCESSION AND ASSIGNMENT. This Agreement shall be binding upon and inure to the benefit of the parties named herein and their respective successors and permitted assigns. No party hereto may assign either this Agreement or any of its rights, interests or obligations hereunder without the prior written approval of the other parties hereto.

9.5 DRAFTING. The parties have participated jointly in the negotiation and drafting of this Agreement and, in the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the parties and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any of the provisions of this Agreement.

9.6 NOTICES. All notices, requests and other communications hereunder must be in writing and will be deemed to have been duly given only if delivered personally against written receipt or by facsimile transmission or mailed (by registered or certified mail, postage prepaid, return receipt requested) or delivered by reputable overnight courier, fee prepaid, to the parties hereto at the following addresses or facsimile numbers:

|

| IF TO PURCHASER OR | Genesis Float Spa, LLC |

|

| PARENT, TO: | |

|

|

| 00000 X Xxxxxxxxxx Xxxx #00 |

|

|

| Xxx Xxxxx, XX 00000 |

|

|

| Attention: Xxxxxxx Xxxxxxx |

|

|

|

|

|

| With a copy to: | Xxxxxxx Law, Inc. Attn: Xxx Xxxxxxx, Esq. 0 Xxxx Xxxxxxx, Xxxxx 000 Xxxx, XX 000000 (000) 000-0000 (fax) |

|

|

|

|

|

| IF TO SELLER OR THE | Urban Oasis Float Center, LLC |

|

| MEMBERS, TO: | Xxxxxx Xxxxxxxxx and Xxxxxx Xxxxxxxxx, Xx. |

|

|

| Xxxxxx Xxxxxxx Xxxxx _______________________

_______________________ |

|

| Attention: _______________ |

| 20 |

Any party hereto may change the address to which notices, requests, demands, claims and other communications hereunder are to be delivered by giving the other parties hereto notice in the manner set forth herein.

9.7 GOVERNING LAW. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Nevada, without giving effect to any choice of law or conflict of law provision or rule that would cause the application of the Laws of any jurisdiction other than the State of Nevada.

9.8 [omitted].

9.9 AMENDMENTS AND WAIVERS. No amendment of any provision of this Agreement shall be valid unless such amendment is in writing and signed by each of the parties hereto. No waiver by any party hereto of any default, misrepresentation or breach of warranty or covenant hereunder, whether intentional or not, shall be deemed to extend to any prior or subsequent default, misrepresentation or breach of warranty or covenant hereunder or affect in any way any rights arising by virtue of any prior or subsequent such occurrence. No waiver shall be valid unless such waiver is in writing and signed by the party against whom such waiver is sought to be enforced.

9.10 SEVERABILITY. If any provision of this Agreement is held to be illegal, invalid or unenforceable under any present or future Law, and if the rights or obligations of any party hereto under this Agreement will not be materially and adversely affected thereby, (a) such provision will be fully severable, (b) this Agreement will be construed and enforced as if such illegal, invalid or unenforceable provision had never comprised a part hereof, (c) the remaining provisions of this Agreement will remain in full force and effect and will not be affected by the illegal, invalid or unenforceable provision or by its severance herefrom and (d) in lieu of such illegal, invalid or unenforceable provision, there will be added automatically as a part of this Agreement a legal, valid and enforceable provision as similar in terms of such illegal, invalid or unenforceable provision as may be possible.

9.11 EXPENSES. Except as otherwise expressly set forth herein or therein, each of the parties hereto will bear its own costs and expenses (including legal fees and expenses) incurred in connection with this Agreement, the Ancillary Agreements and the transactions contemplated hereby or thereby, whether or not the transactions contemplated hereby or thereby are consummated.

9.12 INCORPORATION OF EXHIBITS AND SCHEDULES. The Exhibits, Annexes and Schedules identified in this Agreement are incorporated herein by reference and made a part hereof. Unless otherwise specified, no information contained in any particular numbered Schedule shall be deemed to be contained in any other numbered Schedule unless explicitly included therein (by cross reference or otherwise).

9.13 SPECIFIC PERFORMANCE. The parties hereto agree that irreparable damage would occur in the event that any provision of this Agreement was not performed in accordance with the terms hereof and that the parties shall be entitled to specific performance of the terms hereof in addition to any other remedy available to them at law or equity.

9.14 HEADINGS. The descriptive headings contained in this Agreement are included for convenience of reference only and shall not affect in any way the meaning or interpretation of this Agreement.

9.15 COUNTERPARTS. This Agreement may be executed in one or more counterparts, and by the different parties hereto in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken together shall constitute one and the same agreement.

Remainder of page intentionally left blank; signature page follows

| 21 |

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the date first written above.

The Parent:

| THC THERAPEUTICS, INC. | ||

| By: | /s/ Xxxxxxx Xxxxxxx | |

| Name: | Xxxxxxx Xxxxxxx | |

| Title: | President and CEO | |

| The Purchaser: | ||

|

| ||

| GENESIS FLOAT SPA, LLC | ||

|

| ||

| By: | /s/ Xxxxxxx Xxxxxxx | |

| Name: | Xxxxxxx Xxxxxxx | |

| Title: | Manager | |

|

| ||

| The Seller: | ||

|

| ||

| URBAN OAISIS FLOAT CENTER, LLC | ||

|

| ||

| By: | /s/ Xxxxxx Xxxxxxxxx, Xx. | |

|

|

|

|

| Name: | Xxxxxx Xxxxxxxxx, Xx. | |

|

| ||

| Title: | ||

|

| ||

| The Members: | ||

|

| ||

|

|

| |

| Xxxxxx Xxxxxxxxx | ||

|

| ||

| /s/ Xxxxxx Xxxxxxxxx, Xx. |

| |

| Xxxxxx Xxxxxxxxx, Xx. | ||

|

| ||

| /s/ Xxxxxx Xxxxxxx Xxxxx |

| |

| Xxxxxx Xxxxxxx Xxxxx | ||

| 22 |

EXHIBIT A

Parent Note

PROMISSORY NOTE

| US $60,000 | Las Vegas, Nevada May ___, 2017 |

For good and valuable consideration, THC Therapeutics, Inc., a Nevada corporation, (“Maker”), hereby makes and delivers this Promissory Note (this “Note”) in favor of Xxxxxx Xxxxxxxxx, Xxxxxx Xxxxxxxxx, Xx., and Xxxxxx Xxxxxxxx Xxxxx, jointly and severally, or their assigns (“Holders”), and hereby agree as follows:

1. Principal Obligation and Subsequent Advances. For value received, Maker promises to pay to Holders, in currently available funds of the United States, the principal sum of Sixty Thousand Dollars ($60,000).

2. Interest and Payment Terms.

a. Maturity Date. All unpaid principal, together with any then unpaid and accrued interest and other amounts payable hereunder, shall be due and payable in full on or before April 30, 2018.

b. Interest. Maker’s obligation under this Note shall not accrue interest.

c. Payments. Beginning on May 31, 2017, and continuing monthly on the last day each month thereafter, Maker shall remit to Holders payments of principal due hereunder as follows:

|

| · | To Xxxxxx Xxxxxxxxx and Xxxxxx Xxxxxxxxx, Xx. (jointly) – $2,550 |

|

|

|

|

|

| · | To Xxxxxx Xxxxxxx Xxxxx – $2,450 |

5. Representations and Warranties of Maker. Maker hereby represents and warrants the following to Holders:

a. Maker and those executing this Note on its behalf have the full right, power, and authority to execute, deliver and perform the Obligations under this Note, which are not prohibited or restricted under the articles of incorporation or bylaws of Maker. This Note has been duly executed and delivered by an authorized officer of Maker and constitutes a valid and legally binding obligation of Maker enforceable in accordance with its terms.

b. The execution of this Note and Maker’s compliance with the terms, conditions and provisions hereof does not conflict with or violate any provision of any agreement, contract, lease, deed of trust, indenture, or instrument to which Maker is a party or by which Maker is bound, or constitute a default thereunder.

8. Defaults. The following shall be events of default under this Note:

a. Maker’s failure to remit any payment under this Note on before the date due, if such failure is not cured in full within five (5) days of written notice of default;

b. Maker’s failure to perform or breach of any non-monetary obligation or covenant set forth in this Note or in any other written agreement between Maker and Holders if such failure is not cured in full within ten (10) days following delivery of written notice thereof from Holders to Maker;

c. If Maker is dissolved, whether pursuant to any applicable articles of incorporation or bylaws, and/or any applicable laws, or otherwise;

| 23 |

d. The entry of a decree or order by a court having jurisdiction in the premises adjudging the Maker bankrupt or insolvent, or approving as properly filed a petition seeking reorganization, arrangement, adjustment or composition of or in respect of the Maker under the federal Bankruptcy Code or any other applicable federal or state law, or appointing a receiver, liquidator, assignee or trustee of the Maker, or any substantial part if its property, or ordering the winding up or liquidation of its affairs, and the continuance of any such decree or order unstayed and in effect for a period of twenty (20) days;

e. Maker’s institution of proceedings to be adjudicated a bankrupt or insolvent, or the consent by it to the institution of bankruptcy or insolvency proceedings against it, or its filing of a petition or answer or consent seeking reorganization or relief under the federal Bankruptcy Code or any other applicable federal or state law, or its consent to the filing of any such petition or to the appointment of a receiver, liquidator, assignee or trustee of the company, or of any substantial part of its property, or its making of an assignment for the benefit of creditors or the admission by it in writing of its inability to pay its debts generally as they become due, or the taking of corporate action by the Maker in furtherance of any such action; or

9. Rights and Remedies of Holders. Upon the occurrence of an event of default by Maker under this Note, then, in addition to all other rights and remedies at law or in equity, Holders may exercise any one or more of the following rights and remedies:

a. Accelerate the time for payment of all amounts payable under this Note by written notice thereof to Maker, whereupon all such amounts shall be immediately due and payable.

b. Pursue any other rights or remedies available to Holders at law or in equity.

10. Representation of Counsel. Maker and Holders acknowledge that they have consulted with or have had the opportunity to consult with legal counsel of their choice prior to Maker executing and delivering this Note. This Note has been freely negotiated by Maker and Holders and any rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Note.

12. Choice of Laws; Actions. This Note shall be constructed and construed in accordance with the internal substantive laws of the State of Nevada, without regard to the choice of law principles of said State. Maker acknowledges that this Note has been negotiated in Xxxxx County, Nevada. Accordingly, the exclusive venue of any action, suit, counterclaim or cross claim arising under, out of, or in connection with this Note shall be the state or federal courts in Xxxxx County, Nevada. Maker hereby consents to the personal jurisdiction of any court of competent subject matter jurisdiction sitting in Xxxxx County, Nevada.

13. Costs of Collection. Should the indebtedness represented by this Note, or any part hereof, be collected at law, in equity, or in any bankruptcy, receivership or other court proceeding, or this Note be placed in the hands of any attorney for collection after default, Maker agrees to pay, in addition to the principal and interest due hereon, all reasonable attorneys’ fees, plus all other costs and expenses of collection and enforcement, including any fees incurred in connection with such proceedings or collection of the Note.

14. Miscellaneous.

a. This Note shall be binding upon Maker and shall inure to the benefit of Holders and its successors, assigns, heirs, and legal representatives.

b. Any failure or delay by Holders to insist upon the strict performance of any term, condition, covenant or agreement of this Note, or to exercise any right, power or remedy hereunder shall not constitute a waiver of any such term, condition, covenant, agreement, right, power or remedy.

| 24 |

c. Any provision of this Note that is unenforceable shall be severed from this Note to the extent reasonably possible without invalidating or affecting the intent, validity or enforceability of any other provision of this Note.

d. This Note may not be modified or amended in any respect except in a writing executed by the party to be charged.

e. Time is of the essence.

15. Waiver of Certain Formalities. All parties to this Note hereby waive presentment, dishonor, notice of dishonor and protest. All parties hereto consent to, and Holders are hereby expressly authorized to make, without notice, any and all renewals, extensions, modifications or waivers of the time for or the terms of payment of any sum or sums due hereunder. Any such action taken by Holders shall not discharge the liability of any party to this Note.

IN WITNESS WHEREOF, this Note has been executed effective the date and place first written above.

“Maker”: THC Therapeutics, Inc.

By: ________________________________

Xxxxxxx Xxxxxxx, CEO

| 25 |

EXHIBIT B

Certificate of Designation

|

| XXXXXXX X. XXXXXXXX Secretary of State 000 Xxxxx Xxxxxx Xxxxxx Xxxxxx Xxxx, Xxxxxx 00000-0000 (000) 000-0000 Website: xxx.xxxxx.xxx | *150103* | |

| Certificate of Designation (PURSUANT TO NRS 78.1955) |

| ||

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY | ||

Certificate of Designation For

Nevada Profit Corporations

(Pursuant to NRS 78.1955)

| 1. Name of corporation: |

2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

| SERIES B PREFERRED STOCK

RESOLVED, that pursuant to the authority granted to and vested in the Board by the provisions of the articles of incorporation of the Company (the "Articles of Incorporation"), there hereby is created, out of the ten million (10,000,000) shares of preferred stock, par value $.001 per share, of the Company authorized by the Articles of Incorporation ( Preferred Stock ), a series of Series B Preferred Stock, consisting of one hundred twenty thousand (120,000) shares, which series shall have the following powers, designations, preferences and relative participating, optional and other special rights, and the following qualifications, limitations and restrictions:

SEE ATTACHED |

| 3. Effective date of filing: (optional) | |

| (must not be later than 90 days after the certificate is filed) |

4. Signature: (required)

X /s/ Xxxxxxx Xxxxxxx

Signature of Officer

Filing Fee: $175.00

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. | | Nevada Secretary of State Stock Designation Revised: 1-5-15 |

| 26 |

______________________________________

CERTIFICATE OF DESIGNATION

OF

Pursuant to Section 78.1955 of the

Nevada Revised Statutes

______________________________________

SERIES B PREFERRED STOCK

On behalf of THC Therapeutics, Inc., a Nevada corporation (the Company ), the undersigned hereby certifies that the following resolution has been duly adopted by the board of directors of the Company (the Board ):

RESOLVED, that, pursuant to the authority granted to and vested in the Board by the provisions of the articles of incorporation of the Company (the Articles of Incorporation ), there hereby is created, out of the ten million (10,000,000) shares of preferred stock, par value $.001 per share, of the Company authorized by the Articles of Incorporation ( Preferred Stock ), a series of Series B Preferred Stock, consisting of one hundred twenty thousand (120,000) shares, which series shall have the following powers, designations, preferences and relative participating, optional and other special rights, and the following qualifications, limitations and restrictions:

The specific powers, preferences, rights and limitations of the Series B Preferred Stock are as follows:

1. Designation; Rank. This series of Preferred Stock shall be designated and known as Series B Preferred Stock. The number of shares constituting the Series B Preferred Stock shall be 120,000 shares. Except as otherwise provided herein, the Series B Preferred Stock shall, with respect to rights on liquidation, winding up and dissolution, rank senior to the common stock, par value $0.001 per share (the Common Stock ) and any previously issued classes of capital stock of the Company (the Junior Securities ).

2. Dividends. The holders of shares of Series B Preferred Stock have no dividend rights except as may be declared by the Board in its sole and absolute discretion, out of funds legally available for that purpose.

3. Liquidation Preference.

(a) In the event of any dissolution, liquidation or winding up of the Company (a Liquidation ), whether voluntary or involuntary, the Holders of Series Preferred Stock shall be entitled to receive out of the assets of the Company, before any payment or distribution shall be made in respect of any Junior Securities, cash in an amount equal to $1.00 (the "Stated Value") for each one (1) share of Series B Convertible Preferred Stock plus an amount equal to all accrued but unpaid dividends thereon to the date of such payment. If upon the Liquidation, the assets to be distributed among the Holders of the Series B Convertible Preferred Stock are insufficient to permit the payment to such Holders of the full liquidation preference for their shares, then the entire assets of the Company legally available for distribution shall be distributed pro rata among the Holders of the Series B Convertible Preferred Stock.

| 27 |

(b) A sale of all or substantially all of the Company s assets or an acquisition of the Company by another entity by means of any transaction or series of related transactions (including, without limitation, a reorganization, consolidated or merger) that results in the transfer of fifty percent (50%) or more of the outstanding voting power of the Company (a Change in Control Event ), shall not be deemed to be a Liquidation for purposes of this Designation.

(c) If upon any Liquidation, whether voluntary or involuntary, payment shall have been made to the Holders of Series B Convertible Preferred Stock of the full preferential amount to which they shall be entitled pursuant to Section 3(a) of this Designation, the entire remaining assets, if any, of the Company available for distribution to stockholders shall be distributed to the holders of Junior Securities or Common Stock, as the case may be.

(d) The Company shall give each Holder of Series B Preferred Convertible Stock written notice of any Liquidation not later than thirty (30) days prior to any meeting of stockholders to approve such Liquidation or, if no meeting is to be held, not later than forty-five (45) days prior to the date of such Liquidation.

4. Mandatory Conversion of Series B Preferred Stock.

(a) Mandatory Conversion: Conversion Rate. All shares of Series B Convertible Preferred Stock shall, on that date which is one ()) year from the date of issuance (the "Conversion Date"), be automatically converted to Common Stock of the Company at the Conversion Rate. The Conversion Rate, for each share of Series B Preferred Stock, shall be the Stated Value of $1.00 per share divided by the Market Price for the Company's Common Stock. "Market Price" means the Trading Price for the Company's common stock on the last Trading Day prior to the Conversion Date. "Trading Price" means the closing bid price reported on the electronic marketplace operated by OTC Markets, Inc., or, if the electronic marketplace operated by OTC Markets, Inc. is not the principal trading market for such security, the closing bid price of such security on the principal securities exchange or trading market where such security is listed or traded. If the Trading Price cannot be calculated for such security on such date in the manner provided above, the Trading Price shall be the fair market value as mutually determined by the Company and the Holder. "Trading Day" shall mean any day on which the Company's common stock is tradable for any period on the electronic marketplace operated by OTC Markets, Inc., or on the principal securities exchange or other securities market on which the Company's common stock is then being traded.

(b) No Fractional Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series B Preferred Stock. In lieu of any fractional share to which the Holder would be entitled but for the provisions of this Section 4(b) based on the number of shares of Series B Preferred Stock held by such Holder, the Company shall issue a number of shares to such Holder rounded up to the nearest whole number of shares of Common Stock. No cash shall be paid to any Holder of Series B Preferred Stock by the Company upon conversion of Series B Preferred Stock by such Holder.

(c) Reservation of Stock. The Company shall at all times when any shares of Series B Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued Common Stock, such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series B Preferred Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding shares of the Series B Preferred Stock, the Company will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

(d) Issue Taxes. The converting Holder shall pay any and all issue and other non-income taxes that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of shares of Series B Preferred Stock.

5. Voting. Except as otherwise expressly provided herein or as required by the law, the Holders of Series B Preferred Stock shall not have voting rights.

| 28 |

IN WITNESS WHEREOF the undersigned has signed this Designation this 12th day of May, 2017.

| THC Therapeutics, Inc. | |||

| By: | /s/ Xxxxxxx Xxxxxxx | ||

| Name: | Xxxxxxx Xxxxxxx | ||

| Title: | CEO | ||

| 29 |

EXHIBIT C

Parent Warrant

| 30 |

EXHIBIT D

XXXX OF SALE

KNOW ALL MEN BY THESE PRESENTS, that pursuant to that certain Asset Purchase Agreement dated June 1, 2017 (the “Asset Purchase Agreement”), Urban Oasis Float Center, LLC (“Seller”), for and in consideration of the agreements contained therein and other good and valuable consideration paid to it by, or on behalf of, Genesis Float Spa, LLC, a Nevada limited liability company (“Buyer”), the receipt and sufficiency of which are hereby acknowledged, has granted, bargained, sold, transferred, conveyed and delivered and by these presents does hereby bargain, grant, sell, transfer, convey, assign and deliver unto Buyer, its successors and assigns, all right, title and interest of Seller in and to the Assets (as such term is defined in the Asset Purchase Agreement). TO HAVE AND TO HOLD the same unto Buyer, its successors and assigns forever.

Seller represents and warrants to Buyer that it is the lawful owner of such Assets and it is transferring such Assets free and clear of any liens and encumbrances, except as otherwise set forth in the Asset Purchase Agreement.

Seller covenants and agrees to warrant and defend the sale, transfer, assignment, conveyance, grant and delivery of the Assets hereby made against all persons whomsoever, to take all steps reasonably necessary to establish the record of Buyer’s title to the Assets and, at the request of Buyer, to execute and deliver further instruments of transfer and assignment and take such other action as Buyer may reasonably request to more effectively transfer and assign to and vest in Buyer each of the Assets, all at the sole cost and expense of Seller.

This Xxxx of Sale is being delivered subject and pursuant to the terms and conditions of the Asset Purchase Agreement. Seller acknowledges and agrees that the representations, warranties, covenants, agreements and indemnities contained in the Asset Purchase Agreement shall not be superseded hereby but shall remain in full force and effect to the full extent provided therein. In the event of any conflict or inconsistency between the terms of the Asset Purchase Agreement and the terms hereof, the terms of the Asset Purchase Agreement shall govern.

This Xxxx of Sale shall be subject to and construed and enforced in accordance with the laws of the State of Nevada without regard to principles of conflicts of laws.

[SIGNATURE PAGE FOLLOWS]

| 31 |

IN WITNESS WHEREOF, Seller has executed this Xxxx of Sale as of June , 2017.

| URBAN OAISIS FLOAT CENTER, LLC | |||

| By: | |||

|

| Print Name: | ||

| Title: | |||

STATE OF NEVADA )

) ss

COUNTY OF XXXXX )

On the day of June, 2017, before me, the undersigned, personally appeared