THIS RESTRUCTURING SUPPORT AND LOCK-UP AGREEMENT IS NOT AN OFFER WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY...

Exhibit 10.1

THIS RESTRUCTURING SUPPORT AND LOCK-UP AGREEMENT IS NOT AN OFFER WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. Nothing contained in thIS RESTRUCTURING SUPPORT and lock-up AGREEMENT shall be an admission of fact or liability or, UNTIL the occurrence of the Agreement effective date on THE TERMS DESCRIBED HEREIN, deemed binding on any of the parties hereto.

Restructuring Support and Lock-Up Agreement1

This RESTRUCTURING SUPPORT AND LOCK-UP AGREEMENT (including all exhibits and schedules attached hereto and incorporated herein, this “Agreement”) is made and entered into as of December 23, 2016, by and among the following parties:

| i. | Bonanza Creek Energy, Inc. (“BCEI”), a publicly traded company organized under the laws of the state of Delaware and its direct and indirect subsidiaries (collectively, the “Company” or the “Company Parties” and such Company Parties (including, without limitation, BCEI) that file petitions commencing the Chapter 11 Cases (as defined below), collectively, the “Debtors”); |

| ii. | those certain beneficial holders, or investment advisors or managers for the account of beneficial holders, of (i) the 63⁄4% senior notes due 2021 issued under that certain indenture dated as of April 9, 2013 by and among BCEI, as issuer, the Company Parties, as guarantors from time to time party thereto and Delaware Trust Company, as trustee (as successor to Xxxxx Fargo Bank, National Association) (the “Trustee”) (as amended, modified or otherwise supplemented from time to time prior to the date hereof, the “2021 Indenture” and the notes issued under the 2021 Indenture, the “2021 Notes”) and (ii) the 53⁄4% senior notes due 2023 issued under that certain indenture dated as of July 18, 2014 by and among BCEI, as issuer, the Company Parties, as guarantors from time to time party thereto and the Trustee, as trustee (as successor to Xxxxx Fargo Bank, National Association) (as amended, modified or otherwise supplemented from time to time prior to the date hereof, the “2023 Indenture” and, together with the 2021 Indenture, the “Indentures” and the notes issued under the 2023 indenture, the “2023 Notes” and, together with the 2021 Notes, the “Notes”), that execute signature pages hereto (such beneficial holders, or investment advisors or managers for the account of beneficial holders, the “Supporting Noteholders”); and |

| iii. | NGL Energy Partners LP, a publicly traded master limited partnership organized under the laws of the state of Delaware, and its indirect subsidiary NGL Crude Logistics, LLC, a limited liability company organized under the laws of Delaware |

| 1 | Capitalized terms used but not otherwise defined herein have the meaning ascribed to such terms in the Plan (as defined herein) attached hereto as Exhibit A, subject to Section 2 hereof. |

(together, “NGL” and, collectively, with (i) the Company Parties, (ii) the Supporting Noteholders and (iii) any transferee that becomes a Supporting Noteholder pursuant to section 4.04(a) of this Agreement, the “Parties” and each individually, a “Party”).

RECITALS

WHEREAS, the Supporting Noteholders, NGL and the Company have engaged in good faith, arm’s-length negotiations regarding a restructuring transaction (the “Restructuring”) pursuant to the terms and upon the conditions set forth in this Agreement;

WHEREAS, the Debtors intend to commence voluntary reorganization cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101-1532 (the “Bankruptcy Code”), in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) to effect the Restructuring through the prepackaged chapter 11 plan of reorganization (including all exhibits, appendices, and schedules thereto, as may be amended or supplemented from time to time in accordance with the terms of this Agreement, the “Plan”) attached hereto as Exhibit A and the other Definitive Documentation (as defined below);

WHEREAS, the Supporting Noteholders or affiliates of Supporting Noteholders have agreed to backstop a rights offering (the “Rights Offering”) for an investment in the Company in the amount of $200,000,000 as part of an approved Plan, backstopped by certain of the Supporting Noteholders (the “Backstop Parties”) pursuant to that certain backstop commitment agreement (the “Backstop Commitment Agreement”) to be executed by the Parties prior to the commencement of the Chapter 11 Cases and containing terms and conditions set forth in the term sheet attached as Exhibit B hereto (the “Rights Offering Term Sheet”) and otherwise acceptable to the Supporting Noteholders and the Company;

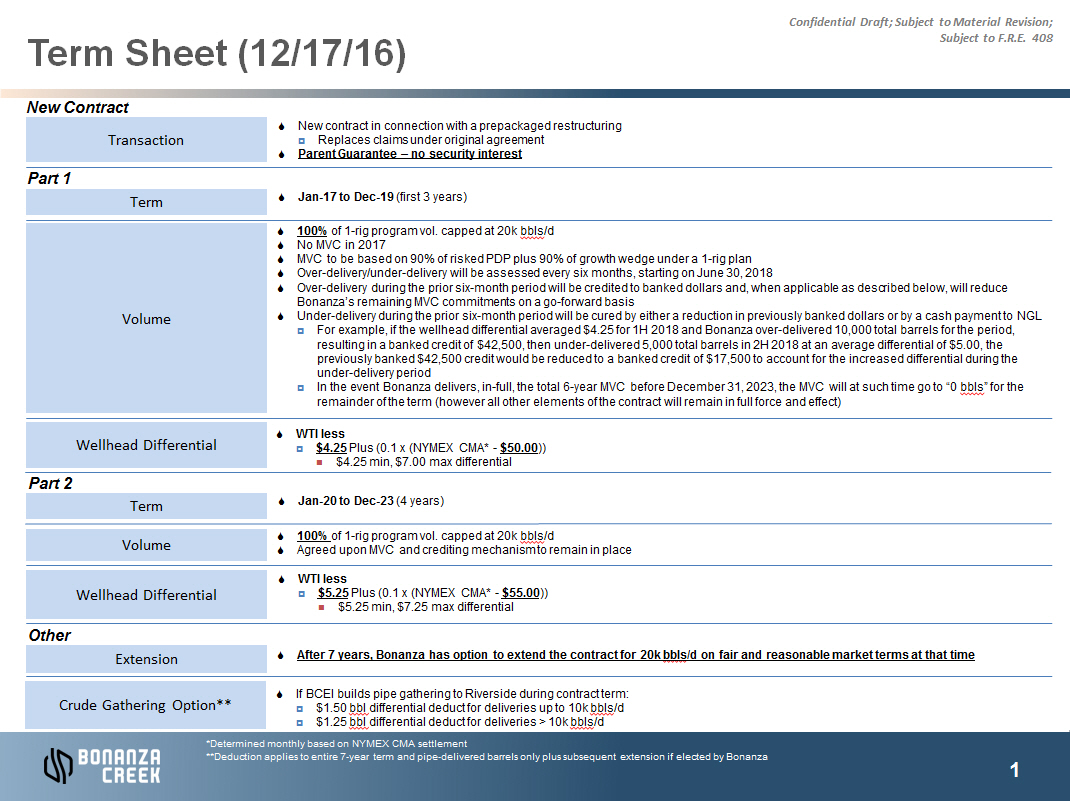

WHEREAS, the Parties have agreed that, on the Plan Effective Date, the Company and NGL Crude Logistics, LLC shall enter into a new crude oil purchase and sale agreement (the “New NGL Agreement”) in accordance with the term sheet attached hereto as Exhibit C (the “NGL Term Sheet”);

WHEREAS, the Parties have agreed to certain terms with respect to the organization and governance of the Company Parties following the effective date of the Plan (the “Plan Effective Date”);

WHEREAS, the Company Parties have agreed to take certain actions in support of the Restructuring on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Party, intending to be legally bound hereby, agrees as follows:

AGREEMENT

Section 1. Agreement Effective Date. This Agreement shall become effective and binding upon each of the Parties on the date (such date, the “Agreement Effective Date”) on which:

2

(1)(a)(i) the Company Parties shall have executed and delivered counterpart signature pages of this Agreement to counsel to the Supporting Noteholders and NGL, (ii) the Noteholders holding more than 50% of the aggregate outstanding principal amount of the Notes (determined without regard to any claims held by a person or entity that is an “insider” as that term is defined in section 101(31) of the Bankruptcy Code) shall have executed and delivered to counsel to the Debtors counterpart signature pages of this Agreement, and (iii) NGL shall have executed and delivered to counsel to the Debtors counterpart signature pages to this Agreement; (b) the Company Parties have given notice to counsel to the Supporting Noteholders and NGL in accordance with Section 10.12 hereof that each of the foregoing conditions set forth in this Section 1, in each case, has been satisfied, all signature pages held by such Company Parties as contemplated above shall have been released for attachment to the relevant agreements, and this Agreement is declared effective as to all Parties; and (c) the Company Parties shall have paid all fees and expenses required to be paid pursuant to Section 9 hereof or (2) in respect of any Supporting Noteholder that executes and delivers a counterpart signature page to this Agreement after the occurrence of the conditions described in the immediately preceding clause (1) of this Section 1, as of the date that such Supporting Noteholder delivers and the Company Parties accept such counterpart signature page.

Section 2. Exhibits Incorporated by Reference. Each of the exhibits attached hereto is expressly incorporated herein and made a part of this Agreement, and all references to this Agreement shall include such exhibits. In the event of any inconsistency between this Agreement (without reference to the exhibits) and the exhibits (other than the Plan) this Agreement (without reference to the exhibits) shall govern. In the event of any inconsistency between this Agreement (without reference to the exhibits) or the exhibits (other than the Plan) and the Plan, the Plan shall govern.

Section 3. Definitive Documentation. The definitive documents and agreements governing the Restructuring (collectively, the “Definitive Documentation”) shall consist of: (a) the Plan (and all exhibits thereto); (b) the order of the Bankruptcy Court entered pursuant to section 1129 of the Bankruptcy Code confirming the Plan (the “Confirmation Order”) and pleadings in support of entry of the Confirmation Order; (c) the disclosure statement relating to the Plan, including all exhibits, appendices and schedules thereto, as amended, supplemented or modified from time to time (the “Disclosure Statement”) and the other solicitation materials in respect of the Plan (such materials, collectively, the “Solicitation Materials”); (d) the order of the Bankruptcy Court approving the Disclosure Statement and the Solicitation Materials; (e) customary “first day” and “second day” motions and proposed orders (the “First Day and Second Day Pleadings”); (f) the motion and proposed order, if any, to be filed on the first day of the Chapter 11 Cases seeking use of cash collateral to fund the administration of the Chapter 11 Cases (collectively, the “Cash Collateral Motion”); (g) the motion and proposed order to be filed on the first day of the Chapter 11 Cases seeking Bankruptcy Court approval of certain procedures and forms related to the Rights Offering and assumption of the Backstop Commitment Agreement (collectively, the “Approval Motion”); (h) any settlement, compromise, amendment or other restructuring of the FT Agreements (as defined in the Plan), or any replacement agreement and (i) all other documents and forms of documents, agreements, schedules and exhibits to the Plan (the “Plan Supplement”). Where Definitive Documentation remains subject to negotiation and completion as of the Agreement Effective Date, such Definitive Documentation shall, upon completion, contain terms, conditions, representations, warranties,

3

and covenants consistent with the terms of this Agreement, and shall be subject to any consent rights set forth in this Agreement and otherwise be in form and substance reasonably acceptable to the Debtors and the Required Supporting Noteholders; provided, that provisions of the Plan and the Confirmation Order that affect the economic recovery of the Supporting Noteholders, the allocation of New Common Stock, or the releases granted therein to the Supporting Noteholders shall be in form and substance acceptable to the Required Supporting Noteholders; provided, further, that (i) any modification, amendment, or supplement to the Plan or the Confirmation Order that adversely affects the New NGL Agreement shall be in form and substance acceptable to NGL and (ii) any terms, provisions, or requests for relief contained in the Definitive Documentation that disproportionately adversely affect any particular Supporting Noteholder shall be in form and substance acceptable to such Supporting Noteholder. As used herein, the term “Required Supporting Noteholders” means, at any relevant time, the Supporting Noteholders holding greater than 50% of the outstanding principal amount of the Notes held by the Supporting Noteholders.

Section 4. Commitments Regarding the Restructuring.

4.01. Commitment of the Supporting Noteholders.

(a) During the period beginning on the Agreement Effective Date and ending on the Termination Date (as defined in Section 7.06) (such period, the “Effective Period”), each Supporting Noteholder shall (severally and not jointly), in each of its capacities as a holder of Claims (as defined below):

(i) use good faith efforts to implement the transactions and other actions contemplated hereby in accordance with the terms of the Plan, the Rights Offering Term Sheet and the New NGL Agreement;

(ii) support and take all actions reasonably necessary or reasonably requested by the Company Parties to facilitate consummation of the Restructuring in a timely and expeditious manner (but without limiting consent and approval rights provided for in this Agreement), including, to the extent a class is permitted to vote to accept or reject the Plan and upon receipt of a disclosure statement that is subject to approval by the Bankruptcy Court, vote each of its claims whether acquired prior to, on or subsequent to the Agreement Effective Date (all claims held against the Debtors, the “Claims”) to (A) accept the Plan by delivering its duly executed and completed ballot(s) accepting the Plan on a timely basis and (B) not withdraw, amend, or revoke (or cause to be withdrawn, amended, or revoked) its vote with respect to the Plan, provided, that the votes of the Supporting Noteholders shall be immediately revoked and deemed null and void ab initio upon termination of this Agreement other than pursuant to 7.05 of this Agreement;

(iii) (A) support the confirmation of the Plan, the transactions contemplated therein, and approval of the Disclosure Statement and the Solicitation Materials and (B) not (1) object to, delay, interfere, impede, or take any other action to delay, interfere or impede, directly or indirectly, with the Restructuring, confirmation of the Plan, or approval of the Disclosure Statement or the Solicitation Materials (including joining in, supporting or encouraging any efforts to object to or oppose any of the foregoing) or (2) propose, file, support, or vote for,

4

directly or indirectly, any restructuring, workout, plan of arrangement, alternative transaction, including, but not limited to, a sale pursuant to section 363 of the Bankruptcy Code, or chapter 11 plan for the Debtors other than the Restructuring and the Plan;

(iv) not commence any proceeding to oppose or alter any of the terms of the Plan or any other document filed by the Debtors in connection with the confirmation of the Plan (as long as such documents are consistent with the terms and conditions of this Agreement), provided, that nothing in this Agreement shall prevent any Supporting Noteholder from withholding, amending, or revoking its timely consent or vote with respect to the Plan if this Agreement is terminated with respect to such Supporting Noteholder other than pursuant to Section 7.05 of this Agreement;

(v) support (and not object to) any First Day and Second Day Pleadings consistent with this Agreement filed by the Debtors in furtherance of the Restructuring that the Supporting Noteholders have reviewed and consented to in accordance with and to the extent set forth in Section 3 of this Agreement prior to filing;

(vi) not, nor encourage any other person or entity to, take any action, including initiating or joining in any legal proceeding that is inconsistent with this Agreement, or delay, impede, appeal, or take any other negative action, directly or indirectly, that could reasonably be expected to interfere with the approval, acceptance, confirmation, consummation, or implementation of the Restructuring or the Plan, as applicable;

(vii) use reasonable efforts to execute any document and give any notice, order, instruction, or direction necessary or reasonably requested by the Debtors that is consistent with the transactions contemplated by this Agreement and the Plan to support, facilitate, implement, consummate, or otherwise give effect to the Restructuring, provided, that no Supporting Noteholder shall be required to make any such effort if prohibited by applicable law or government regulation;

(viii) use good faith efforts to negotiate, execute and implement the Definitive Documentation on terms consistent with this Agreement;

(ix) not, directly or indirectly, instruct (or join in any direction requesting that) any agent under any loan documents or the Trustee, as applicable, to take any action, or refrain from taking any action, that would be inconsistent with this Agreement, the Plan, or the Restructuring; and

(x) not object to or opt out of any release included in the Solicitation Materials or the Plan.

(b) Nothing contained herein shall limit (i) the rights of any Supporting Noteholder under applicable bankruptcy or insolvency law, or in any foreclosure or similar proceeding, including appearing as a party in interest in any matter to be adjudicated in the Chapter 11 Cases, so long as the exercise of any such right is consistent with such Supporting Noteholder’s obligations hereunder; (ii) subject to the terms of Section 4.05 hereof, the ability of any Supporting Noteholder to purchase, sell or enter into any transactions in connection with its Claims, subject to the terms hereof; (iii) subject to the terms of Section 4.01(a) hereof, any right of a Supporting

5

Noteholder under (x) the Notes or (y) any other applicable agreement, instrument or document that gives rise to any Claim or Interest of such Supporting Noteholder, nor shall anything contained herein be deemed to constitute a waiver or amendment of any provision of any such agreement described in the foregoing clauses (x) and (y); (iv) the ability of any Supporting Noteholder to consult with the Company or any creditor of the Company; or (v) the ability of any Supporting Noteholder to enforce any right, remedy, condition, consent or approval requirement under this Agreement or any of the Definitive Documentation.

4.02. Commitments of NGL.

(a) During the Effective Period, NGL agrees:

(i) its Claims shall be allowed in the amount of $98,406,124 as a General Unsecured Claim against Bonanza Creek Operating in its Chapter 11 Case, subject to this Agreement remaining in effect as to the Company and NGL; provided, that, in the event this Agreement is terminated as between the Company and NGL for any reason, any and all rights of NGL with respect to the assertion, allowance and estimation (for any purpose) of any Claim, in any amount, it may have against any Debtor shall be preserved, it being understood and agreed by the Parties that nothing contained herein is intended or should be construed as a waiver of any Parties’ rights with respect to any Claim NGL may have against any Debtor in the event that this Agreement is terminated with respect to NGL; provided, further, that the Company Parties and the Supporting Noteholders agree and acknowledge that the Claim amount referenced in this Section 4.02(a)(i) was determined as a result of compromise in relation to this Agreement, and if this Agreement is terminated for any reason, then (A) the Claim amount referenced herein shall be of no further force or effect, and (B) neither the Company Parties nor the Supporting Noteholders shall assert, reference or quote the NGL Claim amount referenced in this Section 4.01(a)(i), or the fact that NGL agreed to the Claim amount referenced in this Section 4.02(a)(i) in the context of this Agreement, in any proceeding, pleading, or otherwise, or any court filing in the Bankruptcy Court or any other venue (including joining in, supporting or encouraging any efforts by any other person or entity related to the foregoing). Notwithstanding anything to the contrary, the Parties agree that this Section 4.01(a)(i) shall survive termination of this Agreement;

(ii) to use good faith efforts, support, and take all actions reasonably necessary or reasonably requested by the other Parties to facilitate consummation of the Restructuring, including the New NGL Agreement, in a timely and expeditious manner (but without limiting consent and approval rights provided for in this Agreement), including, to the extent a class is permitted to vote to accept or reject the Plan and upon receipt of a disclosure statement that is subject to approval by the Bankruptcy Court, vote each of its Claims whether acquired prior to, on or subsequent to the Agreement Effective Date to (A) accept the Plan by delivering its duly executed and completed ballot(s) accepting the Plan on a timely basis and (B) not withdraw, amend, or revoke (or cause to be withdrawn, amended, or revoked) its vote with respect to the Plan, provided, that the votes of NGL shall be immediately revoked and deemed null and void ab initio upon termination of this Agreement other than pursuant to 7.05 of this Agreement; and

(iii) to not (1) object to, delay, interfere, impede, join, or take any other action to delay, interfere or impede, directly or indirectly, with the Restructuring or (2) propose, file,

6

support, or vote for, directly or indirectly, any restructuring, workout, plan of arrangement, alternative transaction other than the Restructuring and the Plan.

(b) Nothing contained herein shall limit (i) the rights of NGL under applicable bankruptcy or insolvency law, or in any foreclosure or similar proceeding, including appearing as a party in interest in any matter to be adjudicated in the Chapter 11 Cases, so long as the exercise of any such right is consistent with NGL’s obligations hereunder; (ii) subject to the terms of Section 4.02(a) hereof, any right of NGL under any other applicable agreement, instrument or document that gives rise to any Claim or Interest of NGL, nor shall anything contained herein be deemed to constitute a waiver or amendment of any provision of any such agreement described in the foregoing clause; (iii) the ability of NGL to consult with the Company or any creditor of the Company; (iv) the ability of NGL to terminate the NGL FT Agreement (as defined in the Plan); or (v) the ability of NGL to enforce any right, remedy, condition, consent or approval requirement under this Agreement or any of the Definitive Documentation.

4.03. Commitment of the Company Parties.

(a) During the Effective Period, the Company Parties agree to:

(i) pursue the Restructuring on the terms set forth in this Agreement, the Rights Offering Term Sheet, the NGL Term Sheet, and the Plan and not sign any agreement to pursue any auction, sale process or other restructuring transaction for the Company or substantially all of its assets;

(ii) use good faith efforts to implement this Agreement and the Plan in accordance with the Rights Offering Term Sheet, the NGL Term Sheet, the transactions and other actions contemplated hereby and thereby;

(iii) (A) support and complete the Restructuring and all transactions set forth in this Agreement; (B) negotiate in good faith all Definitive Documentation that is subject to negotiation as of the Agreement Effective Date; (C) execute and deliver any other required agreements to effectuate and consummate the Restructuring; (D) make commercially reasonable efforts to obtain required regulatory and/or third-party approvals for the Restructuring; (E) complete the Restructuring in a timely and expeditious manner, and as otherwise required by this Agreement and the Definitive Documentation; (F) not undertake any actions materially inconsistent with the Restructuring or the adoption and implementation of the Plan and confirmation thereof; and (G) use commercially reasonable efforts to obtain Bankruptcy Court approval of the releases set forth in the Plan;

(iv) not object to, delay, impede or take any other action that is materially inconsistent with, or is intended or is likely to interfere with, acceptance or implementation of the Restructuring or the New NGL Agreement;

(v) not seek to amend or modify, or file a pleading seeking authority to amend or modify, the Definitive Documentation or any other document related to the Notes or the Restructuring in a manner that is materially inconsistent with this Agreement;

7

(vi) not file any pleading materially inconsistent with the Restructuring or the terms of this Agreement;

(vii) not release, settle or compromise, other than in the ordinary course of business, any Claim or Cause of Action, other than the FT Agreement Claims, that is not specifically agreed to be released, settled, or compromised pursuant to this Agreement in a manner that is not reasonably acceptable to the Required Supporting Noteholders; and

(viii) not release, settle or compromise the FT Agreement Claims in a manner that is not acceptable to the Required Supporting Noteholders; provided that the NGL Term Sheet is an acceptable settlement of the FT Agreement Claims of NGL.

(b) During the Effective Period, the Company Parties or the Debtors, as applicable, also agree to the following affirmative covenants:

(i) the Debtors shall provide counsel for the Supporting Noteholders and NGL at least two (2) calendar days (or such shorter prior review period as necessary in light of exigent circumstances) prior to the date when the Debtors intend to file such document draft copies of all material motions and proposed orders intended to be filed with the Bankruptcy Court. To the extent reasonably practicable, the Debtors shall provide counsel for the Supporting Noteholders and NGL at least five (5) calendar days prior to the date when the Debtors intend to file such document draft copies of all First Day and Second Day Pleadings, the Cash Collateral Motion, the Approval Motion, the Confirmation Order, and the Plan Supplement. The Debtors shall consult in good faith with counsel for the Supporting Noteholders and NGL regarding the form and substance of all such material proposed filings with the Bankruptcy Court. Counsel to the Supporting Noteholders and NGL shall provide all comments to such motions by no later than one (1) calendar day (or within such time period as is reasonably practicable in light of the time at which such motions were provided to counsel for prior review) prior to the date when the Debtors intend to file with the Bankruptcy Court such motions, and Debtors’ counsel shall consult in good faith with such counsel regarding any comments so provided if Debtors’ counsel shall not be in agreement with such comments; provided, that the consent requirements set forth in Section 3 of this Agreement shall apply with respect to all First Day and Second Day Pleadings, the Cash Collateral Motion, the Approval Motion, and any other motions, declarations, proposed orders or other filings with the Bankruptcy Court that constitute Definitive Documentation; the Chapter 11 Cases shall be commenced on or before 11:59 p.m. Eastern Standard Time on January 5, 2017 (the “Petition Date”), subject to extension with the consent of the Required Supporting Noteholders;

(ii) the Debtors shall request, and take reasonable actions to prosecute such request, that the Bankruptcy Court schedule the hearing to consider confirmation of the Plan on or before 35 days after the Petition Date;

(iii) the Debtors shall request, and take reasonable actions to prosecute such request, that the Bankruptcy Court enter an order approving the Approval Motion on or before 5 days after the Petition Date;

8

(iv) the Debtors shall, within five (5) days of the Petition Date, file a motion, and thereafter take reasonable actions to prosecute such motion, seeking entry by the Bankruptcy Court of an order determining the amount of any Rejection Claim for purposes of (a) voting to accept or reject the Plan and (b) setting a reserve for distribution in respect of unliquidated claims;

(v) the Debtors shall timely file a formal objection to (or otherwise address in a manner reasonably acceptable to the Required Supporting Noteholders) any unresolved motion filed with the Bankruptcy Court by a third party seeking the entry of an order (A) directing the appointment of an examiner, (B) converting the Chapter 11 Cases to cases under chapter 7 of the Bankruptcy Code, (C) dismissing the Chapter 11 Cases, (D) modifying or terminating the Debtors’ exclusive right to file and/or solicit acceptances of a plan of reorganization under section 1121 of the Bankruptcy Code or (E) seeking relief that (x) is inconsistent with this Agreement in any respect or (y) that is contrary to, or would, or would reasonably be expected to, frustrate the purposes of this Agreement, including by preventing the consummation of the Restructuring;

(vi) the Debtors shall timely file a formal written response in opposition to (or otherwise address in a manner reasonably acceptable to the Required Supporting Noteholders) any objection filed with the Bankruptcy Court by any Person with respect to the Cash Collateral Motion;

(vii) the Debtors shall pay the reasonable and documented fees and expenses of the Supporting Noteholders (a) invoiced and outstanding as of the Petition Date in advance of the Petition Date and (b) thereafter, in the manner, and to the extent, provided for in this agreement or any order entered by the Bankruptcy Court;

(viii) the Debtors shall pay the reasonable and documented fees and expenses of NGL in the manner, and to the extent, provided for in this Agreement;

(ix) the Debtors shall promptly notify the Supporting Noteholders and NGL in writing of any governmental or third-party complaints, litigations, investigations, or hearings (or written communications indicating that the same may be contemplated or threatened); and

(x) the Debtors shall promptly notify the Supporting Noteholders and NGL of any uncured breach by the Company in respect of any of the obligations, representations, warranties or covenants set forth in this Agreement by furnishing written notice to the Supporting Noteholders and NGL pursuant to Section 10.12 hereof within three (3) business days of actual knowledge of such breach.

(c) The Company Parties shall not seek, solicit, or support any dissolution, winding up, liquidation, reorganization, assignment for the benefit of creditors, merger, transaction, consolidation, business combination, joint venture, partnership sale of assets, financing (debt or equity), refinancing, or restructuring of the Company, other than the Restructuring (each, an “Alternative Transaction”), except with the prior written consent of the Supporting Noteholders; provided that any refinancing of the Company’s RBL Credit Facility (as defined in the Plan) in connection with the Restructuring shall not constitute an Alternative Transaction. If

9

any Company Party, directly or indirectly, through any of its representatives or advisors, receives a bona fide proposal for an Alternative Transaction from any third party (who has not withdrawn such proposal) and such Debtor has determined in good faith that such Alternative Transaction is, or after reasonable commercial negotiations may be, higher or otherwise better than the Restructuring, then such Debtor shall, within two business days of making such determination, notify counsel to the Supporting Noteholders of the receipt of such proposal, with such notice to include the material terms thereof, including the identity of the person or group of persons involved. The Company Parties shall not enter into any confidentiality agreement with a party interested in an Alternative Transaction unless such party consents to identifying and providing to counsel to the Supporting Noteholders (under a reasonably acceptable confidentiality agreement) the foregoing information.

(d) Notwithstanding anything to the contrary herein, nothing in this Agreement shall require the board of directors, board of managers, directors, managers, or officers or any other fiduciary of a Debtor to take any action, or to refrain from taking any action, with respect to the Restructuring to the extent such board of directors, board of managers, or such similar governing body determines, based on advice of counsel, that taking such action, or refraining from taking such action, as applicable, may be required to comply with applicable law or its fiduciary obligations under applicable law; provided, that any such action that results in a termination of this Agreement in accordance with the terms hereof shall be subject to the provisions set forth in Section 7 hereof.

4.04. Transfer of Claims and Securities.

(a) During the Effective Period, (i) no Supporting Noteholder shall sell, assign, transfer, permit the participation in, or otherwise dispose of (each, a “Transfer”) any ownership in any of the Claims, unless the transferee thereof either (i) is a Supporting Noteholder, or (ii) prior to or contemporaneously with such Transfer, agrees in writing for the benefit of the other Parties to be bound by all of the terms of this Agreement with respect to such acquired Claim by executing the joinder substantially in the form attached hereto as Exhibit D (the “Joinder Agreement”), and delivering an executed copy thereof, within five (5) business days of the closing of such Transfer, to the parties set forth in Section 10.11 hereof, in which event the transferee shall be deemed to be a Supporting Noteholder under this Agreement with respect to such transferred Claims. Each Supporting Noteholder agrees and acknowledges that any Transfer of Claims that does not comply with the terms and procedures set forth in this Section 4.04 shall be deemed null and void ab initio.

(b) Notwithstanding anything herein to the contrary, (i) any Supporting Noteholder may Transfer (by purchase, sale, assignment, participation, or otherwise) any Claims to an entity that is acting in its capacity as a Qualified Marketmaker2 without the requirement that the Qualified

| 2 | For the purposes of this Section 4.04, a “Qualified Marketmaker” means an entity that (a) holds itself out to the market as standing ready in the ordinary course of its business to purchase from customers and sell to customers claims against and/or interests in (as applicable) the Debtors and their affiliates (including debt securities or other debt) or enter with customers into long and short positions in claims against the Debtors and their affiliates (including debt securities or other debt), in its capacity as a dealer or market maker in such claims against the Debtors and their affiliates and (b) is in fact regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt). |

10

Marketmaker be or become a Supporting Noteholder; provided, that the Qualified Marketmaker subsequently Transfers (by purchase, sale, assignment, participation, or otherwise) the right, title, or interest in such Claims to a transferee that is or becomes a Supporting Noteholder by executing a Joinder Agreement, prior to or contemporaneously with such Transfer, and delivering an executed copy thereof, within five (5) business days of the closing of such Transfer, to the parties set forth in Section 10.11 hereof, in which event the transferee shall be deemed to be a Supporting Noteholder under this Agreement with respect to such transferred Claims; and (ii) to the extent a Supporting Noteholder, acting in its capacity as a Qualified Marketmaker, acquires any Claims from a holder of such claim or interest who is not a Supporting Noteholder, it may transfer (by purchase, sale, assignment, participation, or otherwise) such claim or interest without the requirement that the transferee be or become a Supporting Noteholder in accordance with this Section 4.03.

(c) NGL shall not Transfer any Claims.

(d) This Agreement shall in no way be construed to preclude the Supporting Noteholders from acquiring additional Claims; provided, that (i) if any Supporting Noteholder or NGL acquires additional Claims after the Agreement Effective Date, such Party shall use commercially reasonable efforts to promptly notify counsel to the Debtors of such acquisition including the amount of such acquisition and (ii) such acquired Claims shall automatically and immediately upon acquisition by a Supporting Noteholder or NGL be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to the Debtors).

4.05. Representations and Warranties of Supporting Noteholders. Each Supporting Noteholder, severally, and not jointly, represents and warrants to all Parties that:

(a) it is the beneficial owner of the face amount or unit amount, as applicable, of the Claims, or is the nominee, investment manager, or advisor for beneficial holders of the Claims, as reflected, subject to Section 10.16 of this Agreement, in such Supporting Noteholder’s signature block to this Agreement (each such signature block, a “Supporting Noteholder Signature Block”), which amount each Party understands and acknowledges is proprietary and confidential to such Supporting Noteholder (such Claims, the “Supporting Noteholder Owned Debtor Claims”);

(b) it has the full power and authority to act on behalf of, vote and consent to matters concerning the Supporting Noteholder Owned Debtor Claims (or direct such action, vote, or consent);

(c) the Supporting Noteholder Owned Debtor Claims are free and clear of any lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal, or other limitation on disposition, transfer, or encumbrances of any kind, that would adversely affect in any material respect such Supporting Noteholder’s ability to perform any of its obligations under this Agreement at the time such obligations are required to be performed;

(d) it is either (A) a qualified institutional buyer as defined in Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”) or (B) an institutional “accredited

11

investor” (as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D promulgated under the Securities Act) (C) a Regulation S non-U.S. person or (D) the foreign equivalent of (A) or (B) above; and

(e) the execution, delivery, and performance of this Agreement does not and shall not: (i) violate any provision of law, rules or regulations applicable to it or any of its subsidiaries in any material respect, (ii) violate its certificate of incorporation, bylaws, or other organizational documents; or (iii) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any contractual obligation to which it is a party, which violation, conflict, breach, or default, would have a material adverse effect on the Restructuring.

4.06. Representations and Warranties of NGL. NGL represents and warrants to all Parties that:

(a) it is the beneficial owner of and has the full power and authority to act on behalf of, vote and consent (or direct such action, vote, or consent) to matters concerning its Claims, including all Claims related to the NGL FT Agreement, and has not Transferred any such Claims;

(b) NGL’s Claims are free and clear of any lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal, or other limitation on disposition, transfer, or encumbrances of any kind, that would adversely affect in any material respect NGL’s ability to perform any of its obligations under this Agreement at the time such obligations are required to be performed;

(c) it is either (A) a qualified institutional buyer as defined in Rule 144A of the Securities Act or (B) an institutional “accredited investor” (as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D promulgated under the Securities Act) (C) a Regulation S non-U.S. person or (D) the foreign equivalent of (A) or (B) above; and

(d) the execution, delivery, and performance of this Agreement does not and shall not: (i) violate any provision of law, rules or regulations applicable to it or any of its subsidiaries in any material respect, (ii) violate its certificate of incorporation, bylaws, or other organizational documents; or (iii) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any contractual obligation to which it is a party, which conflict, breach, or default, would have a material adverse effect on the Restructuring.

Section 5. Mutual Representations, Warranties, and Covenants. Each of the Parties, severally and not jointly represents, warrants, and covenants to each other Party:

5.01. Enforceability. It is validly existing and in good standing under the laws of the state of its organization, and this Agreement is a legal, valid, and binding obligation of such Party, enforceable against it in accordance with its terms, except as enforcement may be limited by applicable laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

5.02. No Consent or Approval. Except as expressly provided in this Agreement, the Plan or the Bankruptcy Code, no consent or approval is required by any other person or entity in

12

order for it to effectuate the Restructuring contemplated by, and perform the respective obligations under, this Agreement.

5.03. Power and Authority. Except as expressly provided in this Agreement, it has all requisite corporate or other power and authority to enter into, execute, and deliver this Agreement and to effectuate the Restructuring contemplated by, and perform its respective obligations under, this Agreement.

5.04. Governmental Consents. Except as expressly set forth herein and with respect to the Company Parties’ performance of this Agreement (and subject to necessary Bankruptcy Court approval and/or regulatory approvals associated with the Restructuring), the execution, delivery and performance by it of this Agreement does not, and shall not, require any registration or filing with consent or approval of, or notice to, or other action to, with or by, any federal, state, or other governmental authority or regulatory body.

Section 6. Acknowledgement. Notwithstanding any other provision herein, this Agreement is not and shall not be deemed to be an offer with respect to any securities or solicitation of votes for the acceptance of a plan of reorganization for purposes of sections 1125 and 1126 of the Bankruptcy Code or otherwise. Any such offer or solicitation will be made only in compliance with all applicable securities laws and provisions of the Bankruptcy Code. The Debtors will not solicit acceptances of the Plan from Supporting Noteholders in any manner inconsistent with the Bankruptcy Code or applicable bankruptcy law.

Section 7. Termination Events.

7.01. Supporting Noteholder Termination Events.

(a) This Agreement may be terminated as between the Supporting Noteholders and the other Parties by the delivery to counsel to the Company Parties, counsel to NGL and counsel to the other Supporting Noteholders of a written notice in accordance with Section 10.12 hereof by the Required Supporting Noteholders, upon the occurrence and continuation of any of the following events:

(i) the material breach by any of the Company Parties of any of the representations, warranties, or covenants of such breaching Party as set forth in this Agreement, and which breach remains uncured for a period of five (5) business days following such breaching Party’s receipt of notice pursuant to Section 10.11 hereof (with copies of any such notice being contemporaneously provided to the other Company Parties, counsel to NGL and Xxxxx Xxxx);

(ii) the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any injunction, judgment, decree, charge, ruling, or order enjoining the consummation of a material portion of the Restructuring, or materially affecting the recovery of the Supporting Noteholders in an adverse manner contemplated by this Agreement; provided, that the Company Parties shall have ten (10) business days after issuance of such injunction, judgment, decree, charge, ruling, or order to obtain relief that would allow consummation of the Restructuring that (i) does not prevent or diminish in a material way

13

compliance with the terms of this Agreement or (ii) is otherwise reasonably acceptable to the Required Supporting Noteholders;

(iii) an examiner (with expanded powers beyond those set forth in section 1106(a)(3) and (4) of the Bankruptcy Code), or a trustee or receiver shall have been appointed in one or more of the Chapter 11 Cases;

(iv) any Company Party files any motion or pleading with the Bankruptcy Court that is materially inconsistent with this Agreement and such motion or pleading has not been withdrawn or is not otherwise denied by the Bankruptcy Court within five (5) business days of receipt of notice by such Party that such motion or pleading is inconsistent with this Agreement;

(v) the entry of a ruling or order by the Bankruptcy Court that would prevent consummation of the Restructuring; provided, that the Debtors shall have sought a stay of such relief within five (5) business days after the date of such issuance and shall have five (5) business days after issuance of such ruling or order to obtain relief that (i) does not prevent or diminish in a material way compliance with the terms of this Agreement or (ii) is otherwise reasonably acceptable to the Required Supporting Noteholders;

(vi) the conversion or dismissal of the Chapter 11 Cases, unless such conversion or dismissal, as applicable, is made with the prior written consent of counsel to the Supporting Noteholders;

(vii) any of the Definitive Documentation shall have been amended or modified in a manner that materially affects the Supporting Noteholders in an adverse manner, without the prior written consent of the counsel to the Supporting Noteholders; provided, that modifying (a) the allocation of Subscription Rights and New Common Stock among Holders of Claims in Class 2D to equal the allocation of Subscription Rights and New Common Stock among Holders of Claims in Classes 1D and 3D-7D, (b) the conditions upon which holders of Existing Equity Interests may receive their distribution provided for in the Plan or (c) the amount of Subscription Rights and New Common Stock distributed to holders of General Unsecured Claims against Bonanza Creek Operating, if necessary solely as a result of the allowance, estimation, voting, recharacterization, or classification of General Unsecured Claims against Bonanza Creek Operating (other than Note Claims) by Final Order of the Court (each of the foregoing, a “Required Modification”) in the Plan or Definitive Documentation shall not give rise to any right to terminate this Agreement under this Section 7.01(a)(vii) if (x) the Bankruptcy Court rules or orders that such Required Modification is necessary to enter the Confirmation Order and (y) the Required Supporting Noteholders have not proposed an alternative modification or amendment reasonably acceptable to the Company Parties that would allow the Debtors to obtain confirmation of the Plan.

(viii) the Bankruptcy Court grants relief terminating, annulling or modifying the automatic stay (as set forth in section 362 of the Bankruptcy Code) to permit the exercise of remedies against any assets of the Company having an aggregate fair market value in excess of $10 million without the prior written consent of the Required Supporting Noteholders;

14

(ix) the Company Parties have not commenced solicitation of acceptances of the Plan within one (1) business day after the date hereof;

(x) the Chapter 11 Cases are not commenced before the Bankruptcy Court by the date set forth in Section 4.03(b)(i) of this Agreement (including as such date may be extended therein);

(xi) the Debtors have not filed within one (1) business day after the Petition Date (A) the Approval Motion, and (B) a motion requesting that the Bankruptcy Court schedule a joint hearing to consider the Approval Motion, confirmation of the Plan and approval of the Disclosure Statement on or before 35 days after the Petition Date;

(xii) the Bankruptcy Court has not entered within 35 days of the Petition Date an order approving the Approval Motion;

(xiii) the Confirmation Order has not been entered by the Bankruptcy Court within 105 days of the Petition Date (the “Confirmation Milestone”);

(xiv) the Plan Effective Date has not occurred within 14 days following the date of entry of the Confirmation Order; and

(xv) the Debtors release, settle or compromise the FT Agreement Claims in a manner not acceptable to the Required Supporting Noteholders, it being agreed that entering into the New NGL Agreement on terms substantially as set forth in the NGL Term Sheet represents a settlement of the FT Agreement Claims of NGL acceptable to the Required Supporting Noteholders.

(b) The milestones set forth in sections (x) through (xiv) may be extended with the written consent of the Required Supporting Noteholders; provided, that the Confirmation Milestone may not be extended beyond 120 days after the Petition Date as to any Supporting Noteholder who does not consent to any such extension.

7.02. NGL Termination Events.

(a) This Agreement may be terminated as between NGL and the other Parties by the delivery to counsel to the Company Parties and counsel to the Supporting Noteholders of a written notice in accordance with Section 10.12 hereof by NGL, upon the occurrence and continuation of any of the following events:

(i) the material breach by any of the Company Parties of any of the representations and warranties as set forth in this Agreement or the covenants contained in Sections 4.03(a)(i) through (vi), 4.03(a)(viii), 4.03(b)(ii), 4.03(b)(iv), 4.03(b)(vii) through (ix) or 4.03(c) as set forth in this Agreement, and which breach remains uncured for a period of five (5) business days following the Company’s receipt of notice pursuant to Section 10.11 hereof (with copies of any such notice being contemporaneously provided to the other Company Parties, counsel to the Supporting Noteholders and Xxxxx Xxxx);

15

(ii) the material breach by any of the Supporting Noteholders of any of the representations and warranties as set forth in this Agreement or the covenants contained in Sections 4.02(a)(i) through (ix) as set forth in this Agreement, which breach would result in the failure of the Debtors to obtain confirmation of the Plan, and which breach remains uncured for a period of ten (10) business days after the receipt by the Supporting Noteholders or NGL, as applicable, of notice of such breach;

(iii) the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any injunction, judgment, decree, charge, ruling, or order enjoining the consummation of a material portion of the Restructuring, or materially affecting the New NGL Agreement or NGL’s economic benefits thereunder in a manner adverse to NGL; provided, that the Company Parties shall have ten (10) business days after issuance of such injunction, judgment, decree, charge, ruling, or order to obtain relief that would allow consummation of the Restructuring that (i) does not prevent or diminish in a material way compliance with the New NGL Agreement or (ii) is otherwise reasonably acceptable to NGL;

(iv) any Company Party files any motion or pleading with the Bankruptcy Court that is materially inconsistent with this Agreement or the New NGL Agreement and such motion or pleading has not been withdrawn or is not otherwise denied by the Bankruptcy Court within five (5) business days of receipt of notice by such Party that such motion or pleading is inconsistent with this Agreement;

(v) the conversion or dismissal of the Chapter 11 Cases, unless such conversion or dismissal, as applicable, is made with the prior written consent of counsel to NGL; and

(vi) any of the Definitive Documentation shall have been amended or modified in a manner that materially affects NGL or that is inconsistent with this Agreement or the New NGL Agreement, without the prior written consent of the counsel to NGL.

7.03. Debtors’ Termination Events.

(a) The Debtors may terminate this Agreement as to all Parties upon five (5) business days’ prior written notice, delivered in accordance with Section 10.12 hereof, upon the occurrence of any of the following events: (i) the breach by any of the Supporting Noteholders of any material provision set forth in this Agreement that remains uncured for a period of ten (10) business days after the receipt by the Supporting Noteholders or NGL, as applicable, of notice of such breach; (ii) the board of directors, board of managers, or such similar governing body of any Debtor determines based on advice of counsel that proceeding with any of the Restructuring would be inconsistent with the exercise of its fiduciary duties, including any determination by the such governing body, in its sole discretion, that an insufficient number or amount of acceptances of the Plan had been received as of the date set forth in Section 4.03(b)(i) of this Agreement to support a decision to commence the Chapter 11 Cases; or (iii) the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable injunction, judgment, decree, charge, ruling or order enjoining the consummation of a material portion of the Restructuring unless the Supporting Noteholders shall have sought a stay of such injunction, judgment, decree, charge, ruling or order

16

within five (5) business days after the date of such issuance and shall have obtained relief from such injunction, judgment, decree, charge, ruling or order within five (5) business days after such issuance that would allow consummation of the Restructuring that (i) does not prevent or diminish in a material way compliance with the terms of this Agreement or (ii) is otherwise reasonably acceptable to the Company Parties.

(b) The Debtors may terminate this Agreement as to all Parties upon written notice, delivered in accordance with Section 10.12 hereof, if holders of at least two-thirds in amount of Claims classified in Class 2D under the Plan have not become Parties to this Agreement on or prior to January 5, 2017.

7.04. Mutual Termination. This Agreement, and the obligations of all Parties hereunder, may be terminated by mutual agreement among all of the following: (a) the Required Supporting Noteholders and (b) each of the Company Parties.

7.05. Termination Upon Completion of the Restructuring. This Agreement shall terminate automatically without any further required action or notice on the Plan Effective Date.

7.06. Effect of Termination.

(a) No Party may terminate this Agreement if such Party failed to perform or comply in all material respects with the terms and conditions of this Agreement, with such failure to perform or comply causing, or resulting in, the occurrence of one or more termination events specified herein. The date on which termination of this Agreement as to a Party is effective in accordance with Sections 7.01, 7.02, 7.03, 7.04 or 7.05, shall be referred to as the “Termination Date.”

(b) Except as set forth below, upon the occurrence of a Termination Date as to a Party, this Agreement shall be of no further force and effect and each Party subject to such termination shall be released from its commitments, undertakings, and agreements under or related to this Agreement and shall have the rights and remedies that it would have had, had it not entered into this Agreement, and shall be entitled to take all actions, whether with respect to the Restructuring or otherwise, that it would have been entitled to take had it not entered into this Agreement. Upon the occurrence of a Termination Date, any and all consents or ballots tendered by the Parties subject to such termination before a Termination Date shall be deemed, for all purposes, to be null and void from the first instance and shall not be considered or otherwise used in any manner by the Parties in connection with the Restructuring and this Agreement or otherwise.

(c) Notwithstanding anything to the contrary in this Agreement, the foregoing shall not be construed to prohibit the Debtors or any of the Supporting Noteholders from contesting whether any such termination is in accordance with the terms of, or to seek enforcement of any rights under this Agreement that arose or existed before a Termination Date. Except as expressly provided in this Agreement, nothing herein is intended to, or does, in any manner waive, limit, impair, or restrict (a) any right of any Debtor or the ability of any Debtor to protect and preserve its rights (including rights under this Agreement), remedies, and interests, including its claims against any Supporting Noteholder or NGL, (b) any right of any Supporting Noteholder, or the ability of any Supporting Noteholder to protect and preserve its rights (including rights under this

17

Agreement) and remedies including its claims against any Debtor or Supporting Noteholder and (c) any right of NGL, or the ability of NGL to protect and preserve its rights (including rights under this Agreement) and remedies including its claims against any Debtor.

Section 8. Amendments. This Agreement may not be modified, amended, or supplemented without the prior written consent of the Company Parties and the Required Supporting Noteholders; provided, that this Agreement may not be modified, amended, or supplemented in a manner that (i) adversely affects NGL without the prior written consent of Company Parties, the Required Supporting Noteholders and NGL, (ii) disproportionately affects any particular Supporting Noteholder without the prior written consent of such Supporting Noteholder and (iii) alters Section 7.01(b) without the prior written consent each Supporting Noteholder.

Section 9. Fees and Expenses. So long as this Agreement has not been terminated, the Company Parties hereby agree to pay in cash, in full, in accordance with their respective engagement letters, all invoiced fees and out-of-pocket expenses incurred by the Supporting Noteholders, including all invoiced fees and out-of-pocket expenses of (a) Xxxxxxxx & Xxxxx LLP; (b) Evercore Group L.L.C.; (c) local counsel in the venue in which the Company Parties commence the Chapter 11 Cases; and (d) such other professionals that the Supporting Noteholders deem reasonably necessary to consummate the Restructuring, with the prior written consent of the Company, not to be unreasonably withheld. So long as this Agreement has not been terminated, the Company Parties hereby agree to pay, on the Plan Effective Date, all invoiced fees and out-of-pocket expenses in cash, in full incurred by NGL, before and after the Petition Date, including all invoiced fees and out-of-pocket expenses of (a) Xxxxxxxxx Xxxxxxx, LLP; (b) Cypress Associates LLC; (c) local counsel in the venue in which the Company Parties commence the Chapter 11 Cases; and (d) such other professionals that NGL deems reasonably necessary to consummate the Restructuring, with the prior written consent of the Company, not to be unreasonably withheld, in each case incurred prior to the earlier of the Plan Effective Date and the termination of this Agreement. The Company Parties hereby acknowledge and agree that the fees and expenses incurred by the Supporting Noteholders and NGL prior to the termination of this Agreement are of the type that should be entitled to treatment as administrative expense claims pursuant to sections 503(b) and 507(a)(2) of the Bankruptcy Code.

Section 10. Miscellaneous.

10.01. Management Incentive Plan. The Restructuring will include a management incentive plan (the “Management Incentive Plan”) reserving New Common Stock (as defined in the Plan) constituting 10% of the equity of the Company on a fully-diluted basis (the “MIP Pool”). Unless otherwise agreed to by the Company and the Supporting Noteholders, 40% of the MIP Pool (the “Emergence Grants”) shall be allocated to employees (including, in the sole discretion of the existing board of directors, any reserve for open positions) prior to or during the Chapter 11 Cases in such amounts as determined by the compensation committee of the existing board of directors of BCEI, subject to the reasonable consent of appropriate representatives of the Supporting Noteholders within ten business days after receipt thereof, with such awards to be granted on the Plan Effective Date. The Emergence Grants shall be (i) 50% in the form of options with a 10-year term struck at plan value and (ii) 50% in the form of restricted stock units; and in each case shall vest one-third on each of the first three anniversaries of the Plan Effective Date. The vesting of the Emergence Grants will fully accelerate on a Change in Control (as

18

defined in the Severance Plan), unless, in connection with such Change in Control, the Emergence Grants are continued or assumed by the Company or the acquirer or are substituted or replaced by the acquirer with awards with substantially equivalent terms and value. All future grants under the Management Incentive Plan shall be determined by the compensation committee of the compensation committee of the board of directors of the Company following the Plan Effective Date and shall be awarded from the portion of the MIP Pool that does not constitute Emergence Grants. Additionally, BCEI shall assume the existing Executive Change in Control and Severance Plan and related executive employment agreements (such plan and the provisions of such agreements that provide for participation in such plan, collectively, the “Severance Plan”), subject to modification as necessary to ensure that (i) the Restructuring and any associated organizational changes shall not constitute a Change in Control or serve as a basis to trigger severance benefits under the Severance Plan and (ii) the New Board shall not be permitted to amend the Severance Plan to impair vesting (including accelerated vesting) of the Emergence Grants. BCEI shall also assume the existing 2016 short-term incentive plan (“STIP”). The Company will also establish, in consultation with the Note Parties, a 2017 STIP, reasonably consistent with prior STIPs of BCEI.

10.02. Forbearance. During the period commencing on the date hereof and ending on the termination of this Agreement in accordance with its terms, the Supporting Noteholders hereby agree to forbear from the exercise of any rights or remedies they may have under the Indentures and under applicable United States or foreign law or otherwise with respect to any defaults or events of default which may arise under the Indentures at any time on or before the termination of the Agreement. For the avoidance of doubt, the forbearance set forth in this Section 10.02 shall not constitute a waiver with respect to any defaults or events of default under the Indentures, and shall not bar any Supporting Noteholder from filing a proof of claim or taking action to establish the amount of such claim. If the transactions contemplated hereby are not consummated, or if this Agreement is terminated for any reason, the Parties fully reserve any and all of their rights.

10.03. Further Assurances. Subject to the other terms of this Agreement, the Parties agree to execute and deliver such other instruments and perform such acts, in addition to the matters herein specified, as may be reasonably appropriate or necessary, or as may be required by order of the Bankruptcy Court, from time to time, to effectuate the Restructuring, as applicable.

10.04. Complete Agreement. This Agreement constitutes the entire agreement among the Parties with respect to the subject matter hereof and supersedes all prior agreements, oral, or written, among the Parties with respect thereto.

10.05. Headings. The headings of all sections of this Agreement are inserted solely for the convenience of reference and are not a part of and are not intended to govern, limit, or aid in the construction or interpretation of any term or provision hereof.

10.06. GOVERNING LAW; SUBMISSION TO JURISDICTION; SELECTION OF FORUM. THIS AGREEMENT IS TO BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED IN SUCH STATE, WITHOUT GIVING EFFECT TO THE

19

CONFLICT OF LAWS PRINCIPLES THEREOF. Each Party hereto agrees that it shall bring any action or proceeding in respect of any claim arising out of or related to this Agreement, to the extent possible, in either the United States District Court for the Southern District of New York or any New York State court located in New York County (the “Chosen Courts”), and solely in connection with claims arising under this Agreement: (a) irrevocably submits to the exclusive jurisdiction of the Chosen Courts; (b) waives any objection to laying venue in any such action or proceeding in the Chosen Courts; and (c) waives any objection that the Chosen Courts are an inconvenient forum or do not have jurisdiction over any Party hereto; provided, that if the Debtors commence the Chapter 11 Cases, then the Bankruptcy Court (or court of proper appellate jurisdiction) shall be the exclusive jurisdiction, rather than any Chosen Court.

10.07. Confidentiality. The Company Parties shall keep strictly confidential and shall not, without the prior written consent of the applicable Supporting Noteholder, disclose publicly, or to any person the holdings or claims of any Supporting Noteholder, including the principal amount of any claims arising under the Notes.

10.08. Trial by Jury Waiver. EACH PARTY HERETO IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

10.09. Execution of Agreement. This Agreement may be executed and delivered in any number of counterparts and by way of electronic signature and delivery, each such counterpart, when executed and delivered, shall be deemed an original, and all of which together shall constitute the same agreement. Each individual executing this Agreement on behalf of a Party has been duly authorized and empowered to execute and deliver this Agreement on behalf of said Party.

10.10. Interpretation and Rules of Construction. This Agreement is the product of negotiations among the Parties, and in the enforcement or interpretation hereof, is to be interpreted in a neutral manner, and any presumption with regard to interpretation for or against any Party by reason of that Party having drafted or caused to be drafted this Agreement, or any portion hereof, shall not be effective in regard to the interpretation hereof. The Parties were each represented by counsel during the negotiations and drafting of this Agreement and continue to be represented by counsel. In addition, this Agreement shall be interpreted in accordance with section 102 of the Bankruptcy Code.

10.11. Successors and Assigns. This Agreement is intended to bind and inure to the benefit of the Parties and their respective successors and permitted assigns, as applicable. There are no third-party beneficiaries under this Agreement, and the rights or obligations of any Party under this Agreement may not be assigned, delegated, or transferred to any other person or entity.

10.12. Notices. All notices hereunder shall be deemed given if in writing and delivered, if sent by electronic mail, courier, or registered or certified mail (return receipt requested) to the following addresses (or at such other addresses as shall be specified by like notice):

20

(a) if to a Company Party, to:

000 00xx Xxxxxx, Xxxxx 0000

Xxxxxx, Xxxxxxxx 00000

Attention: Skip Xxxxxx

E-mail address: xxxxxxx@xxxxxxxxxx.xxx

with copies (which alone shall not constitute notice) to:

Xxxxx Xxxx & Xxxxxxxx LLP

000 Xxxxxxxxx Xxxxxx

Xxx Xxxx, Xxx Xxxx 00000

Attention: Xxxxxxxx Xxxxxxx, Xxxxx Xxxxxxx and Xxxxxx Xxxxxxxxx

E-mail addresses: xxxxxxxx.xxxxxxx@xxxxxxxxx.xxx,

xxxxx.xxxxxxx@xxxxxxxxx.xxx, and xxxxxx.xxxxxxxxx@xxxxxxxxx.xxx

(b) if to a Supporting Noteholder to:

Xxxxxxxx & Xxxxx

LLP

000 Xxxxxxxxx Xxxxxx

Xxx Xxxx, XX 00000

Attention: Xxxxxx Xxxxxxxx, P.C.

E-mail address: xxxxxx.xxxxxxxx@xxxxxxxx.xxx

-and-

Xxxxxxxx & Xxxxx

LLP

000 Xxxxx XxXxxxx

Xxxxxxx, XX 00000

Attention: Xxxxxx X. Serajeddini

E-mail address: xxxxxx.xxxxxxxxxxx@xxxxxxxx.xxx

(c) if to NGL

NGL

Crude Logistics, LLC

Attn: Vice President – Rockies

Brookhollow Central II, Suite 1250

0000 Xxxxx Xxxx Xxxx

Xxxxxxx, XX 00000

-and-

NGL

Crude Logistics, LLC

Attn: Senior Vice President

Brookhollow Central II, Suite 1250

21

0000

Xxxxx Xxxx Xxxx

Xxxxxxx, XX 00000

-and-

NGL

Energy Partners LP

Attn: Executive Vice President/General Counsel

0000 Xxxxxx Xxxxx Xxxxx Xxxxx, Xxxxx 0000

Xxxxxx, XX 00000

and-

Xxxxxxxxx

Xxxxxxx, LLP

MetLife Building

000 Xxxx Xxxxxx

Xxx Xxxx, Xxx Xxxx 00000

Attention: Xxxxxxxx X. Xxxxx and Xxxx X. Xxxxxx

E-mail addresses: xxxxxx@xxxxx.xxx and xxxxxxx@xxxxx.xxx

or such other address as may have been furnished by a Party to each of the other Parties by notice given in accordance with the requirements set forth above.

Any notice given by delivery, mail, or courier shall be effective when received.

10.13. Access. The Company Parties will provide the Supporting Noteholders and their respective attorneys, consultants, accountants, and other authorized representatives (each an “Access Party”) reasonable access, upon reasonable notice during normal business hours, to relevant properties, books, contracts, commitments, records, management personnel, and advisors of the Company Parties; provided, that the Company Parties’ obligation hereunder shall be conditioned upon such Access Party agreeing to maintain the confidentiality of any information received in connection with the foregoing, other than any such information that is available to such Access Party on a non-confidential basis (the “Information”) except that Information may be disclosed (a) to such Access Party’s affiliates and the partners, directors, officers, employees, service providers, agents and advisors of such Access Party and of such Access Party’s affiliates on a “need to know” basis solely in connection with the transactions contemplated hereby, (b) to the extent requested by any regulatory authority purporting to have jurisdiction over such Access Party or its affiliates, (c) to the extent required by applicable law, (d) to any of the Parties, or (e) with the consent of the Debtors.

10.14. Independent Due Diligence and Decision Making. Each Supporting Noteholder and NGL hereby confirms that it is (a) a sophisticated party with respect to the matters that are the subject of this Agreement, (b) has had the opportunity to be represented and advised by legal counsel in connection with this Agreement and acknowledges and agrees that it voluntarily and of its own choice and not under coercion or duress enters into the Agreement, (c) has adequate information concerning the matters that are the subject of this Agreement and (d) has independently and without reliance upon any other Party hereto, or any of their affiliates, or any officer, employee, agent or representative thereof, and based on such information as it has

22

deemed appropriate, made its own analysis and decision to enter into this Agreement, except that it has relied upon each other Party’s express representations, warranties, and covenants in this Agreement.

10.15. Waiver. If the Restructuring is not consummated, or if this Agreement is terminated for any reason, the Parties fully reserve any and all of their rights.

10.16. Reporting of Debtor Claims. The Parties agree and acknowledge that the reported amount of the Claims reflected in each Supporting Noteholder Signature Block does not necessarily reflect the full amount of such Supporting Noteholder’s Claims (including, without limitation, principal, accrued and unpaid interest, fees and expenses) and any disclosure made on any Supporting Noteholder Signature Block shall be without prejudice to any subsequent assertion by or on behalf of such Supporting Noteholder of the full amount of its Claims.

10.17. Automatic Stay. The Company acknowledges and agrees, and shall not dispute, that the giving of a termination notice in accordance with Sections 7 and 10.12 hereof by any of the Supporting Noteholders or NGL shall not be a violation of the automatic stay under section 362 of the Bankruptcy Code (and the Company hereby waives, to the greatest extent possible, the applicability of such automatic stay to the giving of such notice), and the Supporting Noteholders and NGL are hereby authorized to take any steps necessary to effectuate the termination of this Agreement notwithstanding section 362 of the Bankruptcy Code or any other applicable law, and no cure period contained in this Agreement shall be extended pursuant to sections 108 or 365 of the Bankruptcy Code or any other applicable law without the prior written consent of the Required Supporting Noteholders or NGL, as applicable.

10.18. Settlement Discussions; No Admission. This Agreement and the Plan are part of a proposed settlement of matters that could otherwise be the subject of litigation among the Parties hereto. Nothing herein shall be deemed an admission of any kind. Pursuant to Federal Rule of Evidence 408 and any applicable state rules of evidence, this Agreement and all negotiations relating thereto shall not be admissible into evidence in any proceeding other than a proceeding to enforce the terms of this Agreement. This Agreement shall in no event be construed as or be deemed to be evidence of an admission or concession on the part of any Party of any claim or fault or liability or damages whatsoever.

10.19. Several, Not Joint, Claims. The agreements, representations, warranties, and obligations of the Parties under this Agreement are, in all respects, several and not joint.

10.20. Severability. If any provision of this Agreement shall be held by a court of competent jurisdiction to be illegal, invalid, or unenforceable, the remaining provisions shall remain in full force and effect if essential terms and conditions of this Agreement for each Party remain valid, binding, and enforceable.

10.21. Specific Performance/Remedies. It is understood and agreed by the Parties that money damages would not be a sufficient remedy for any breach of this Agreement by any Party and each non-breaching Party shall be entitled to seek specific performance and injunctive or other equitable relief (including attorney’s fees and costs) as a remedy for any such breach, in addition to any other remedy to which such non-breaching Party may be entitled, at law or

23

equity, without the necessity of proving the inadequacy of money damages as a remedy, including an order of the Chosen Court or the Bankruptcy Court requiring any Party to comply promptly with any of its obligations hereunder. Each Party agrees to waive any requirement for the securing or posting of a bond in connection with such remedy.

10.22. Remedies Cumulative. All rights, powers, and remedies provided under this Agreement or otherwise available in respect hereof at law or in equity shall be cumulative and not alternative, and the exercise of any right, power, or remedy thereof by any Party shall not preclude the simultaneous or later exercise of any other such right, power, or remedy by such Party.

IN WITNESS WHEREOF, the Parties have executed this Agreement on the day and year first above written.

[Remainder of page intentionally left blank.]

24

Company Party Signature Page to the Restructuring Support and Lock-Up Agreement

on behalf of itself and all other Company Parties

| By: | /s/ Xxxxxxx Xxxxx | |

| Name: | Xxxxxxx Xxxxx | |

| Title: | President and Chief Executive Officer |

Supporting

Noteholder Signature Page to

the Restructuring Support and Lock-Up Agreement

[______], as [Noteholder]

| By: | |||

| Name: | |||

| Title: |

Address:

Email address(es):

Telephone:

| Aggregate Amounts or Units, as Applicable, Beneficially Owned or Managed on Account of: | |

| 2021 Notes Claims (if any) | $ |

| 2023 Notes Claims (if any) | $ |

| BCEI Common Shares (if any) | |

NGL Signature

Page to

the Restructuring Support and Lock-Up Agreement

| NGL Energy Partners LP | |||

| By: | |||

| Name: | |||

| Title: | |||

Address:

Email address(es):

Telephone:

NGL Signature

Page to

the Restructuring Support and Lock-Up Agreement

| NGL Crude Logistics, LLC | |||

| By: | |||

| Name: | |||

| Title: | |||

Address:

Email address(es):

Telephone:

EXHIBIT A to the Restructuring Support Agreement

Prepackaged Plan

IN

THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| ) | ||

In re:

BONANZA CREEK ENERGY, INC., et al.,

Debtors.1 |

) ) ) ) ) ) ) |

Chapter 11

Case No. 17-__________ (___)

Joint Administration Requested

|

| ) |

DEBTORS’

JOINT PREPACKAGED PLAN OF REORGANIZATION

UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

XXXXX

XXXX & XXXXXXXX LLP Facsimile: (000) 000-0000 Xxxxx X. Xxxxxxx Xxxxxx X. Xxxxxxxxx |

XXXXXXXX, XXXXXX & FINGER, P.A. One Xxxxxx Square 000 Xxxxx Xxxx Xxxxxx Xxxxxxxxxx, Xxxxxxxx 00000 Telephone: (000) 000-0000 Facsimile: (000) 000-0000 Xxxx X. Xxxxxxx (No. 2981) Xxxxxx X. Xxxxxx (No. 5530) Xxxxxxx X. Xxxxxxxx (No. 6115)

Counsel to the Debtors |

| Dated: | December 23, 2016 |

| Wilmington, Delaware |

1 The Debtors and debtors in possession in these cases and the last four digits of their respective Employer Identification Numbers are: Bonanza Creek Energy, Inc. (0631), Bonanza Creek Energy Operating Company, LLC (0537), Bonanza Creek Energy Resources, LLC (6378), Xxxxxx Eastern Company, LLC (5456), Rocky Mountain Infrastructure, LLC (6659), Bonanza Creek Energy Upstream LLC (6378) and Bonanza Creek Energy Midstream, LLC (6378). The Debtors’ mailing address is 000 00xx Xxxxxx, Xxxxx 0000, Xxxxxx, Xxxxxxxx 00000.

Table of Contents

Page

Article 1

| Definitions and Rules of Interpretation | 1 |

| Section 1.1. Definitions | 1 |

| Section 1.2. Rules of Interpretation | 16 |

| Section 1.3. Computation of Time | 17 |

| Section 1.4. References to Monetary Figures | 17 |

| Section 1.5. Exhibits; Schedules; Plan Supplement | 17 |

| Section 1.6. Consent Rights of Required Supporting Noteholders | 17 |

Article 2

| Treatment of Administrative Expense Claims and Priority Tax Claims | 17 |

| Section 2.1. Treatment of Administrative Expense Claims | 17 |

| Section 2.2. Treatment of Priority Tax Claims | 18 |

Article 3