Dated 15 December 2016 KOSMOS ENERGY SENEGAL and BP INDONESIA OIL TERMINAL INVESTMENT LIMITED and NORMANDY VENTURES LIMITED

Exhibit 10.31

Dated 15 December 2016

KOSMOS ENERGY SENEGAL

and

BP INDONESIA OIL TERMINAL INVESTMENT LIMITED

and

NORMANDY VENTURES LIMITED

SALE AND PURCHASE AGREEMENT

relating to the sale and purchase of shares in

Normandy Ventures Limited

CONTENTS

|

|

|

Page No |

|

1 |

Interpretation |

1 |

|

2 |

Sale and purchase |

12 |

|

3 |

Consideration |

12 |

|

4 |

First Completion |

13 |

|

5 |

Parties’ undertakings prior to Second Completion |

13 |

|

6 |

Conditions |

15 |

|

7 |

Second Completion |

18 |

|

8 |

Deferred Consideration Amounts |

18 |

|

9 |

Payment |

25 |

|

10 |

Parties’ warranties |

25 |

|

11 |

Further assurance |

28 |

|

12 |

Variation |

29 |

|

13 |

Confidentiality and Announcements |

29 |

|

14 |

Notices |

30 |

|

15 |

Tax; Costs |

31 |

|

16 |

Contracts (Rights of Third Parties) Xxx 0000 |

33 |

|

17 |

Counterparts |

33 |

|

18 |

Miscellaneous |

33 |

|

19 |

Governing law and Dispute Resolution |

35 |

THIS AGREEMENT is made on 15th December 2016

BETWEEN

1 Kosmos Energy Senegal, a company existing under the laws of the Cayman Islands (“Kosmos”); and

2 BP Indonesia Oil Terminal Investment Limited, a company incorporated in England and Wales under registered number 09978028 whose registered office is at Chertsey Rd, Sunbury on Thames, Middlesex TW16 7BP UK (the “BP”); and

3 Normandy Ventures Limited, a company incorporated in England and Wales under registered number 10520822 whose registered office is at C/o Wilmington Trust SP Services (London) Limited, King’s Xxxx Xxxx, Xxxxxx, XX0X 0XX (“JVCo”);

each a “Party” and together the “Parties”.

WHEREAS:

(A) At the date of this Agreement, JVCo is wholly-owned by Kosmos and Kosmos has subscribed for, and is the legal and beneficial owner of, 10,000 Ordinary Shares which have been issued and allotted by JVCo to Kosmos fully paid.

(B) In order to facilitate the JV Partners’ investments in JVCo, the Seller has agreed to sell, and the Purchaser has agreed to purchase, the Sale Shares on the terms and subject to the conditions of this Agreement.

WHEREBY IT IS AGREED as follows:

1 Interpretation

1.1 In this Agreement:

|

“Affiliate” |

means a legal entity which Controls, or is Controlled by, or which is Controlled by an entity which Controls, a Party, and “Affiliates” shall be construed accordingly; |

|

“Answer” |

Means a written response made by Kosmos to BP in respect of any question or clarification sought by BP in respect of or in relation to the Interests, the Interest Documents or the Senegal Area, as set out in Exhibit G. |

|

“Anti-Corruption Laws and Obligations” |

means: (a) the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, 1997; |

3

|

|

(b) the Foreign Corrupt Practices Act of 1977 of the United States of America, as amended by the Foreign Corrupt Practices Act Amendments of 1988 and 1998, and as may be further amended and supplemented from time to time; (c) the Xxxxxxx Xxx 0000 of the United Kingdom and any regulations or guidance issued pursuant to such legislation, as may be amended and supplemented from time to time; and (d) any act, rule or regulation of the United States of America, the United Kingdom, the Republic of Senegal or any other relevant jurisdiction related to prevention of bribery, corruption, or money laundering, provided that, in the event that a Party acting with respect to this Agreement is outside the jurisdiction or scope of any of the aforementioned laws, such laws shall be interpreted as though such Party were within the jurisdiction and scope of such law; |

|

“Approval” |

means the issuance of the approval of the Government required in order to effect the legal assignment and transfer of the Interests from Kosmos to JVCo; |

|

“Associated Person” |

means a person acting on behalf of the first Person or the first Person’s Affiliates, whether as personnel of any tier, as an officer, director or under a power of attorney or other similar authorization and specifically including consultants, representatives, agents, employees or other similar persons who have the right or power to act on behalf of the first Person or its Affiliate; |

|

“BP Warranties” |

means the warranties set out in Schedule 4; |

|

“Xxxxx” |

means the arithmetic average of the high and low spot daily assessments of Xxxxx (Dated) quotations as published in Xxxxx’x Crude Oil Marketwire for the relevant period of time; |

|

“Business Day” |

means each calendar day except Saturdays, Sundays, and any other day on which banks are generally closed for business in London, the Xxxxxx Xxxxxxx, xxx Xxx Xxxx Xxxx, XXX; |

|

“Commercial Production” |

means any production from the Senegal Area pursuant to a development and exploitation plan contemplated under and approved in accordance with the Senegal Area XXXx. |

4

|

“Completion” |

means First Completion or Second Completion, as the context requires; |

|

“Completion Date” |

means the First Completion Date or the Second Completion Date, as the context requires; |

|

“Conditions” |

has the meaning given in Clause 6.1; |

|

“Consideration Amount” |

means the First Completion Consideration Amount, the Second Completion Consideration Amount or a Deferred Consideration Amount, as the context requires; |

|

“Contracts” |

means together the Petroleum Agreements and any extension, renewal or amendment thereto, and all exploration authorizations granted pursuant to the Petroleum Agreements or any successor title that governs all or part of the Senegal Area, as all such instruments and titles are governed by the Hydrocarbon Code; |

|

“Control” |

means the ownership directly or indirectly of more than fifty percent (50%) of the voting rights in a legal entity. “Controls”, “Controlled by” and other derivatives shall be construed accordingly; |

|

“Data” |

means all accounts, books, data and reports in the possession, custody or control of Kosmos and its Affiliates relating to the Interests including correspondence, petroleum engineering, reservoir engineering, drilling, geoscientific, seismic and all other kinds of technical data and reports, samples, well logs and analyses in whatever form the same are maintained, including third party information, including seismic, which Kosmos or its Affiliates has the right to disclose, acquired pursuant to the Interest Documents, subject to the exclusion of work product of, or attorney-client communications with, legal counsel for Kosmos or any Affiliate of Kosmos; |

|

“Deferred Consideration Amounts” |

(a) the Interim Period Costs Consideration; (b) the Exploration & Appraisal Carry Consideration; (c) the Development Carry Consideration; and (d) the Success Fee Consideration, |

5

|

|

and each a “Deferred Consideration Amount”; |

|

“Development Carry Consideration” |

has the meaning given in Clause 8.4; |

|

“Disclosure Documents” |

means the Disclosure Letter and the documents stored in electronic form on a hard drive provided to each Party by Intralinks Inc., that represent the entire contents of Kosmos’s data room at 16.55 (GMT) m. (London time)/ 10.55 am Dallas time (CST) on 12th December 2016; |

|

“Disclosure Letter” |

means the letter described as such, dated as of the date of this Agreement and addressed to BP by Kosmos, which sets out certain disclosures against Kosmos’s Warranties; |

|

“Effective Date” |

means 1 July 2016; |

|

“Eligible Discovery” |

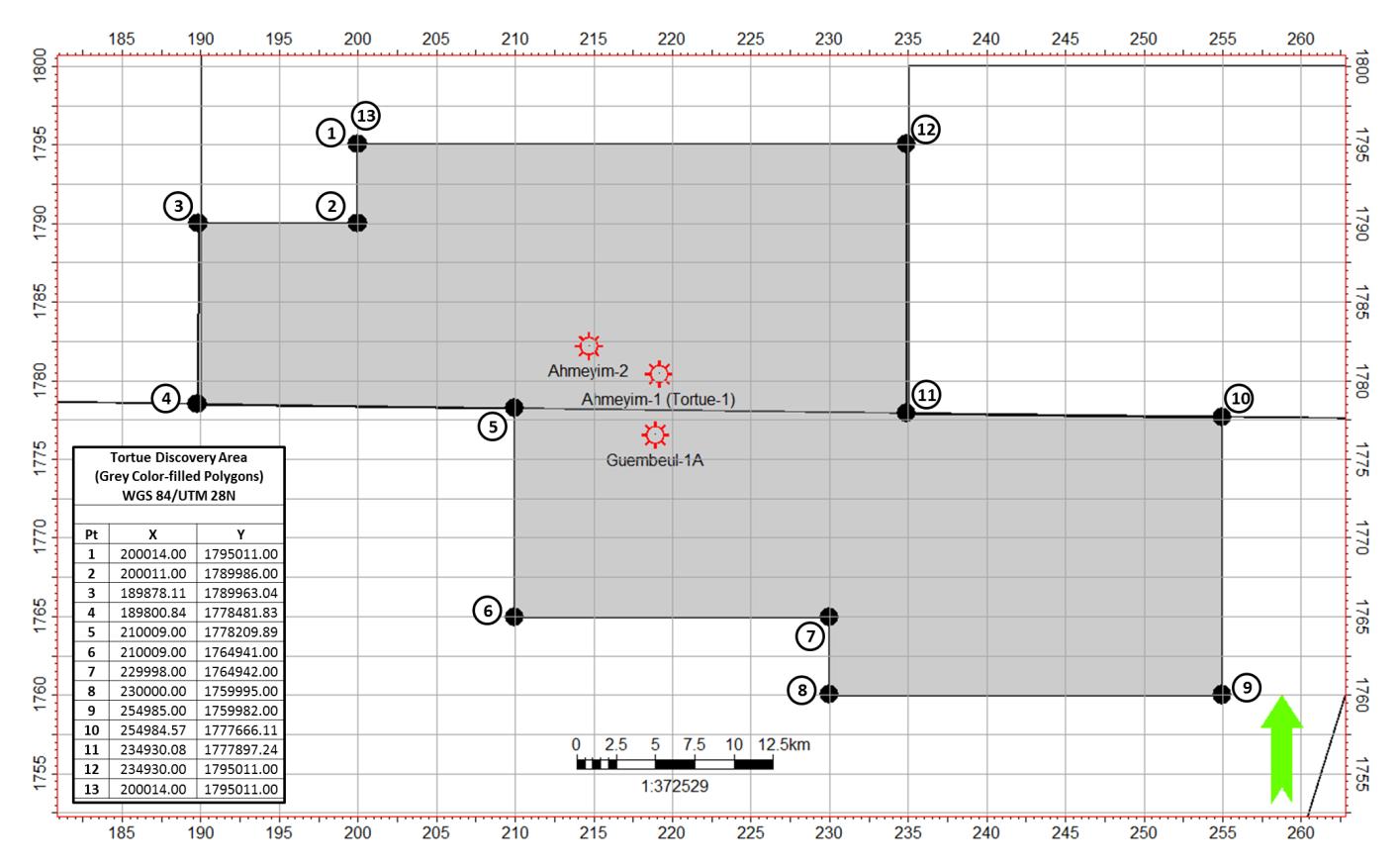

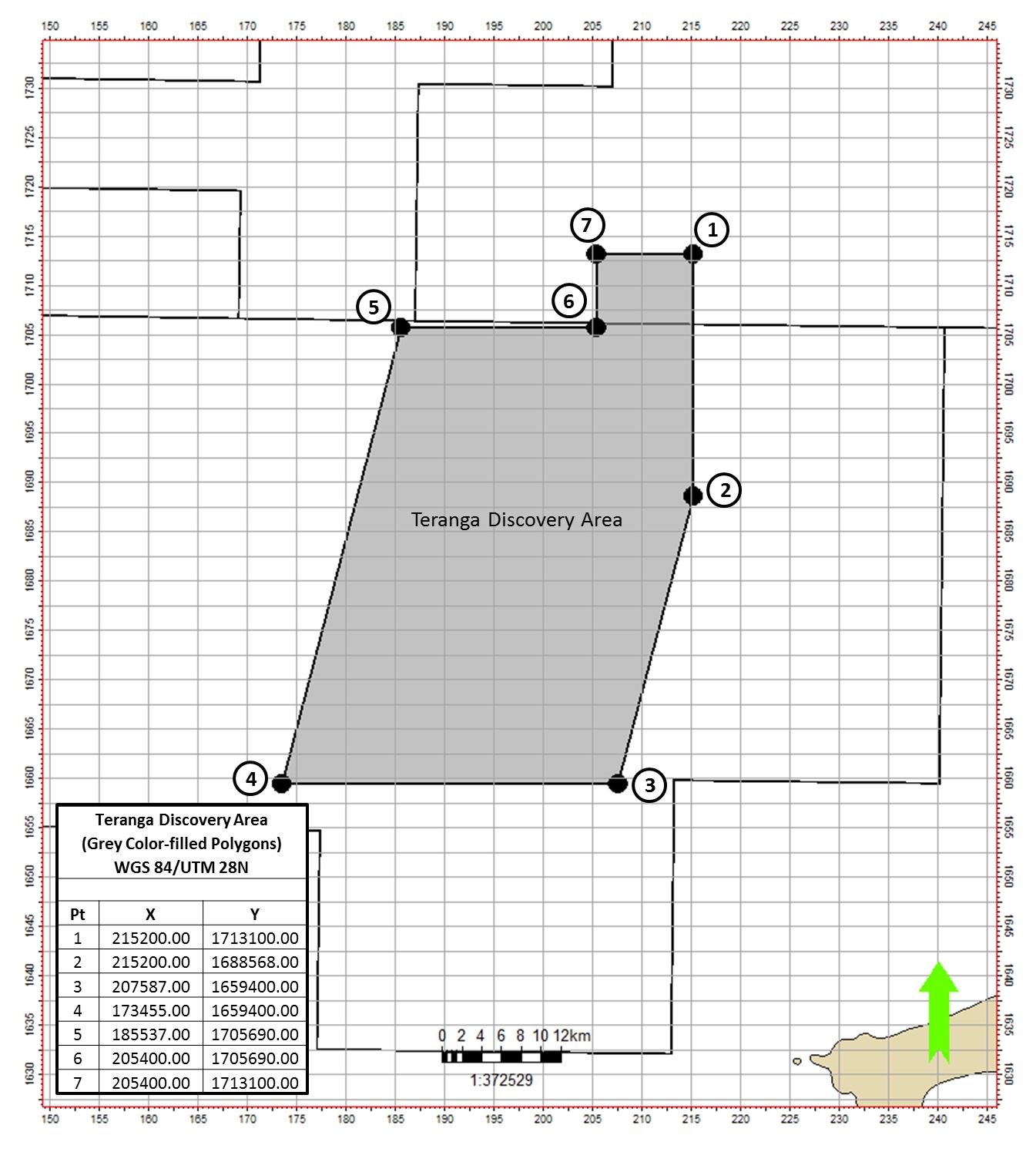

means a discovery of Hydrocarbons (as defined under the Contracts) in the Senegal Area, other than the Tortue Discovery Area (from the surface to the equivalent of the oldest stratigraphy currently penetrated in the development area in the Guembeul #1A Well) and the Teranga Discovery Area (from the surface to equivalent of the oldest stratigraphy currently penetrated in the development area in the Teranga #1 Well) as shown and described on Exhibit C, Parts 1 and 2; |

|

“Encumbrances” |

means all liens, charges (fixed or floating), mortgages, pledges, encumbrances or security or net profit interests or royalty or overriding interests, carried interests, production payments, claims, options, pre-emption rights or equities or any agreement to create any of the foregoing other than (in each case) those arising under the provisions of the Interest Documents and the farm out agreement dated 19 August 2014 and other arrangements between Kosmos and Timis Corporation entered into at the same time as the farm out agreement and as notified in writing on 13th December 2016 on behalf of Kosmos to BP “Encumbrance” and “Encumber” shall be construed accordingly; |

|

“Exploitation Perimeter” |

shall have the meaning given to the French term “Périmètre d’Exploitation” in the Contracts, which French term was translated as “Operations Perimeter” in the English version of the Contracts provided to BP; |

6

|

“Exploration & Appraisal Carry Consideration” |

has the meaning given in Clause 8.3; |

|

“Firm Work Programme (Development)” |

means the Tortue development studies required to support a late 2017 investment decision on the Tortue area as set out in Exhibit A 2; |

|

“Firm Work Programme (Exploration and Appraisal)” |

means the work programme as set out in Exhibit A 1; |

|

“First Completion” |

means completion of the sale and purchase of the Sale Shares, and the payment of the First Consideration Amount, in each case pursuant to, and in accordance with, the terms of this Agreement; |

|

“First Consideration Amount” |

means US$ 49.99, being the aggregate nominal value of the Sale Shares; |

|

“Good Industry Practice” |

means the exercise of that degree of skill, diligence, prudence and foresight which would reasonably and ordinarily be expected to be applied by a skilled and experienced person engaged in the same type of undertaking; |

|

“Government” |

means the government of the Republic of Senegal and any political subdivision, agency or instrumentality thereof, including PETROSEN; |

|

“Government Official” |

means, whether appointed, elected or otherwise, any: (a) minister, civil servant, director, officer, principal, agent or employee or other official of: (i) any government (whether central, federal, state, provincial or local) ministry, body, department, agency, instrumentality or part of any of them; (ii) any public international organization; (iii) any department, agency or body of any government-owned or controlled company, agency, enterprise, joint venture, or partnership; and (iv) any company, agency, enterprise, joint venture, or partnership in which a government owns an interest of more than thirty percent, and/or of any public international organization (such as the World Bank or United Nations); (b) person acting in any official, legislative, |

7

|

|

administrative or judicial capacity for or on behalf of any government department, agency, body, instrumentality or public international organization, including without limitation any judges or other court officials, military personnel and customs, police, national security or other law enforcement personnel; (c) officer or employee of a political party or any person acting in an official capacity on behalf of a political party; and/or (d) candidate for political office; |

|

“Hydrocarbon Code” |

means Petroleum Code (Law No. 98-05 dated 8 January 1998) as modified and completed; |

|

“Initial Asset Transfer Agreement” |

means the agreement dated on or around the date of this Agreement pursuant to which Kosmos agrees to transfer the Initial Interests to JVCo, in the form set out in Part 1 of Exhibit F; |

|

“Initial Asset Transfer Completion” |

means completion of the transfer of the Initial Interests from Kosmos to JVCo pursuant to the terms of the Initial Asset Transfer Agreement; |

|

“Initial Asset Transfer Completion Date” |

means the date on which Initial Asset Transfer Completion occurs pursuant to the terms of the Initial Asset Transfer Agreement; |

|

“Initial Interests” |

means an undivided legal and beneficial interest of sixty percent (60%) in the rights and obligations under the Contracts and an undivided interest of sixty percent (60%) participating interest and a sixty-six decimal sixty-seven percent (66.67%) Paying Interest in the rights and obligations under the Senegal XXXx; |

|

“Interests” |

means the Initial Interests and the TC Interests; |

|

“Interest Documents” |

means the Contracts and the Senegal Area XXXx; |

|

“Interim Period” |

means the period commencing from 1 July, 2016 until, but not including the Second Completion Date; |

|

“Interim Period Costs” |

means all costs properly incurred by Kosmos directly in relation to JVCo’s Paying Interest share under the Senegal Area XXXx for Joint Operations (as defined under the Senegal Area XXXx) undertaken by Kosmos |

8

|

|

pursuant to the terms of the Senegal Area XXXx during the Interim Period if applicable, and determined pursuant to Clause 8.2; |

|

“Interim Period Costs Consideration” |

means a cash amount in US dollars which is equal to 49.99 per cent. of the Interim Periods Costs; |

|

“JV Partners” |

means Kosmos and BP (each a “JV Partner”); |

|

“JVCo Group” |

means JVCo and its subsidiaries from time to time; |

|

“Kosmos’s Account” |

means the account information notified by Kosmos to BP from time to time with at least five Business Days’ notice; |

|

“Kosmos Mauritania” |

means Kosmos Energy Mauritania, a company existing under the laws of the Cayman Islands; |

|

“Kosmos Payment Failure” |

means: (i) any failure by Kosmos to pay any amount owed by Kosmos to BP under this Agreement; or (ii) any failure by the Farmor (as defined in the Mauritania Farmout Agreement) to pay any amount owed by the Farmor to the Farmee (as defined in the Mauritania Farmout Agreement) in respect of the Mauritania Farmout Agreement (other than Article 4.7B thereof); |

|

“Kosmos Asset Warranties” |

means the warranties set out in Part 1 of Schedule 3; |

|

“Kosmos Share Warranties” |

means the warranties set out in Part 2 of Schedule 3; |

|

“Kosmos Warranties” |

means the Kosmos Asset Warranties and the Kosmos Share Warranties; |

|

“LNG” |

means processed Natural Gas (as defined under the Contracts) consisting primarily of methane (CH4) in a liquid state at or below its boiling point and at a pressure of approximately one (1) atmosphere; |

|

“Long Stop Date” |

means 30 September 2017; |

|

“Mauritania Area” |

means the area covered by the Mauritania Contracts, copies of which are included in the Disclosure Documents; |

|

“Mauritania Contracts” |

means the Exploration and Production Contracts entered into by Kosmos Mauritania, SMHPM and the Islamic |

9

|

|

Republic of Mauritania for the exploration and exploitation of hydrocarbons in the Xxxxxx X0, X0, X00 xxx X00, xxxxxxxx Xxxxxxxxxx; |

|

“Mauritania XXXx” |

means (a) the three (3) Amended and Restated Joint Operating Agreements each dated 1 December 2014 entered into by Kosmos Mauritania and SMHPM for operations in the Blocks C8, C12 and C13 portions of the Mauritania Area; and (b) the Joint Operating Agreement to be entered into on terms substantially similar to the joint operating agreements set out in (a) above, by Kosmos Mauritania, SMHPM and, if such joint operating agreement has yet to be executed prior to completion of the Mauritania Farmout Agreement, by BP Exploration (West Africa) Limited for operations in the Block C6 portion of the Mauritania Area; |

|

“Mauritania Operator” |

means the operator under the Mauritania Contracts and the Mauritania XXXx; |

|

“Mauritania Farmout Agreement” |

means the Farmout Agreement concerning Xxxxxx X0, X0, X00 xxx X00, Xxxxxxxx Xxxxxxxxxx between Kosmos Mauritania and BP Exploration (West Africa) Limited of even date with this Agreement; |

|

“Ordinary Shares” |

means the ordinary shares of US$ 0.01 in the capital of JVCo; |

|

“Participating Interest” |

means as to any party to the Contracts or the Senegal Area XXXx, the undivided interest of such party expressed as a percentage of the total interest of all parties in the rights and obligations derived from the Contracts or the Senegal Area XXXx as the context so requires; |

|

“Paying Interest” |

means as to any party to the Senegal Area XXXx, other than PETROSEN, the undivided interest of such party in the payment obligations under the Senegal Area XXXx, including in respect of the Participating Interest share of PETROSEN in the Contracts, until PETROSEN elects to participate in an Exploitation Perimeter from which time the Paying Interests will be aligned with such party’s Participating Interests; |

|

“Person” |

means an individual, corporation, company, government entity, state enterprise, or any other legal entity; |

10

|

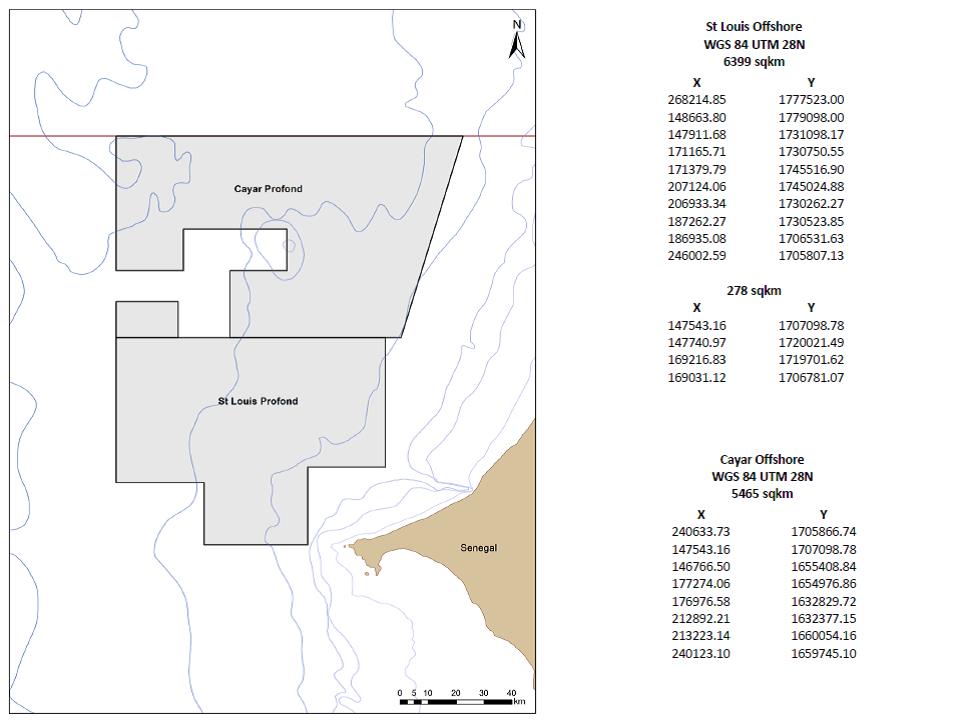

“Petroleum Agreements” |

means the Hydrocarbon Exploration and Production Sharing Contract granted by the Republic of Senegal dated January 17, 2012 covering the Saint Louis Offshore Profond Block and the Hydrocarbon Exploration and Production Sharing Contract granted by the Republic of Senegal dated January 17, 2012 covering the Cayar Offshore Profond Block; |

|

“PETROSEN” |

or La Société des Pétroles du Sénégal means, the oil company of the Republic of Senegal, a company governed by the laws of Senegal and having its registered office in Dakar, at Route du Service Géographique, Xxxx XX 0000, Xxxxxxx; |

|

“Quarter” |

means a period of three calendar months each commencing on 1 January, 1 April, 1 July and 1 October of each Calendar Year (as defined in the Contracts); |

|

“Sale Shares” |

means 4,999 Ordinary Shares; |

|

“Second Completion” |

means completion of the payment of the Second Consideration Amount pursuant to, and in accordance with, the terms of this Agreement; |

|

“Second Completion Date” |

means the fifth Business Day following the date on which the Conditions are satisfied (or waived in accordance with Clause 6.2); |

|

“Second Consideration Amount” |

has the meaning given in Clause 7.2; |

|

“Senegal Area” |

means the area covered by the Contracts, as more particularly described in Exhibit D; |

|

“Senegal Area XXXx” |

means the two Joint Operating Agreements, each dated 26 September 2012, entered into by and between XXXXX-XXX Limited (Kosmos’ predecessor in title) and, PETROSEN for operations in the Saint Louis Offshore Profond and in the Cayar Offshore Profond portions of the Senegal Area, as amended and supplemented and novated from time to time; |

|

“Success Fee Consideration” |

means a fee per Barrel (as defined under the Contracts) of total production of all liquid Hydrocarbons (as defined under the Contract) in the natural state or obtained from Natural Gas by condensation or separation with an API gravity equal to or greater than 22.3°, but excluding LNG, from each Eligible Discovery calculated on the basis of |

11

|

|

the average price of Xxxxx during the relevant Quarter of production multiplied by: (i) in respect of each Barrel up to the aggregate gross cumulative production from all Eligible Discoveries and all Eligible Discoveries (as such term is defined in the Mauritania Farmout Agreement) of one Billion Barrels (1bnbbl), decimal zero zero eight seven five US Dollars (US$ 0.00875), which yields a Success Fee of decimal five two five US Dollars (US$ 0.525) per Barrel of production at a Xxxxx xxxxx of sixty Dollars (US$ 60); provided that the Success Fee per Barrel in respect of the first one Billion Barrels (1bnbbl)shall not exceed one Dollar and five cents (US$ 1.05) per Barrel regardless of the average price of Xxxxx; and (ii) in respect of each Barrel over and above the aggregate gross cumulative production from all Eligible Discoveries and all Eligible Discoveries (as such term is defined in the Mauritania Farmout Agreement) of one Billion Barrels (1bnbbl), decimal zero zero zero zero eight seven five US Dollars (US$0.0000875), which yields a Success Fee of decimal zero zero five two five US Dollars (US$ 0.00525) per Barrel of production at a Xxxxx xxxxx of sixty Dollars (US$ 60); provided that the Success Fee per Barrel in respect of the Barrels over and above one Billion Barrels (1bnbbl) shall not exceed one cent (US$ 0.01) per Barrel regardless of the average price of Xxxxx] |

|

“Surviving Provisions” |

means Clauses 1, 10.3, 10.6, 11, 12, 13, 15, 16, 17, 18 (excluding 18.1 and 18.2) and 19; |

|

“Tax” |

means any tax, royalty, levy, charge, impost, duty, fee, deduction, compulsory loan or withholding which is assessed, levied, imposed or collected by the Government tax authorities or any tax authorities of any other jurisdiction and includes any interest, fine, penalty, |

12

|

|

charge, fee or other amount imposed in respect of the above and “Taxes” shall be construed accordingly; |

|

“TC Asset Transfer Agreement” |

means the agreement dated on or around the date of this Agreement pursuant to which Kosmos agrees to transfer the TC Interests to JVCo, in the form set out in Part 2 of Exhibit F; |

|

"TC Asset Transfer Completion" |

means completion of the acquisition of the TC Interests as contemplated by the TC Asset Transfer Agreement; |

|

"TC Asset Transfer Completion Date" |

means the date on which TC Asset Transfer Completion occurs; |

|

“TC Interests” |

means an undivided legal and beneficial interest of five percent (5%) in the rights and obligations under the Contracts and an undivided interest of five percent (5%) participating interest and a five decimal fifty-six percent (5.56%) Paying Interest in the rights and obligations under the Senegal XXXx, which interest is separate and distinct from the Initial Interests; |

|

“TC Option” |

means the option right of Kosmos to acquire from Timis Corporation the TC Interests pursuant to a Farm-out Agreement entered into between Kosmos and Timis Corporation in relation to interests in the Senegal Area; |

|

“TC Option Completion” |

means completion of the acquisition of the TC Interests, as contemplated pursuant to the TC Option; |

|

“TC Option Completion Date” |

means the date on which TC Option Completion occurs; and |

|

“Wholly-Owned Affiliate” |

means, in relation to any entity, any other entity that is wholly owned and controlled by such entity or that is wholly owned and controlled by a third person which has common control over the first two entities. |

1.2 In this Agreement, unless otherwise specified:

(A) “subsidiary” has the meaning given in the UK Companies Xxx 0000;

(B) references to Clauses are to clauses of this Agreement;

(C) references to “$” and “US$” are to US dollars;

(D) headings to Clauses are for convenience only and do not affect the interpretation of this Agreement;

13

(E) words in the singular shall include the plural and vice versa;

(F) the words "include" and "including" shall be inclusive without limiting the generality of the description proceeding such term and are used in an illustrative sense and not a limiting sense;

(G) performance of an obligation of any kind by a Party must be carried out at that Party’s cost, unless this Agreement states otherwise;

(H) the Schedules and Exhibits form part of this Agreement and have full force and effect as expressly set out in the main body of this Agreement; and

(I) references in this Agreement to any agreement shall, where the context permits, be construed as a reference to such agreement as the same may be supplemented, amended or novated from time to time.

2 Sale and purchase

2.1 Kosmos shall sell, with full title guarantee, and BP shall purchase, the Sale Shares free from all Encumbrances, together with all rights attached or accruing to them at First Completion, such that, immediately following First Completion, the JV Partners’ respective holdings of Ordinary Shares shall be as follows:

|

JV Partner |

Ordinary Shares |

Percentage of Ordinary Share capital |

|

Kosmos |

5,001 |

50.01 |

|

BP |

4,999 |

49.99 |

2.2 Kosmos waives all rights of pre-emption over any of the Sale Shares conferred upon it by the articles of association of the Company or in any other way.

3 Consideration

3.1 The total consideration for the Sale Shares shall be:

(A) the payment by BP of the First Consideration Amount in accordance with Clause 4;

(B) the payment by BP of the Second Consideration Amount in accordance with Clause 6; and

(C) the payment by BP of the Deferred Consideration Amounts in accordance with Clause 8.

14

3.2 Any payment made by either JV Partner under this Agreement, including any payments in respect of claims made under this Agreement, shall (so far as possible) be treated as an adjustment to the consideration for the Sale Shares to the extent of the payment.

4 First Completion

4.1 First Completion shall take place immediately following execution of this Agreement.

4.2 At First Completion:

(A) BP shall pay the First Consideration Amount to Kosmos (or to such person as directed by Kosmos) in accordance with Clause 9;

(B) Kosmos shall deliver to BP (or to such person as directed by BP) duly executed transfers in respect of the Sale Shares in favour of BP (or such person as BP may nominate);

(C) Kosmos shall procure that the board of directors of JVCo passes a Board resolution approving the transfer of the Sale Shares to BP pursuant to this Agreement and (subject to stamping of the transfers) gives instructions for JVCo to update its register of members to reflect that BP has become the registered holder of the Sale Shares; and

(D) JVCo shall comply with any other requirements in connection with the transfer of the Sale Shares to which JVCo is subject under applicable law.

4.3 Pending registration of the transfer of the Sale Shares, Kosmos shall:

(A) hold the legal title to the Sale Shares on trust for BP; and

(B) on request, provide BP with a voting power of attorney to enable BP to exercise all voting and other rights exercisable by the registered holder of the Sale Shares.

5 Parties’ undertakings prior to Second Completion

5.1 The JV Partners shall each exercise all such rights as are respectively available to them in their capacities as shareholders in JVCo to procure that, between the date of this Agreement and Second Completion, neither JVCo (nor any member of the JVCo Group) shall conduct any business or do any act or thing (or omit to do any act or thing) without the prior written consent of both JV Partners, and in particular, but without limitation to the generality of the foregoing, the JV Partners shall procure that neither JVCo (nor any member of the JVCo Group) shall:

(A) alter, amend, vary, terminate, assign any interest under, or waive any rights under, the Initial Asset Transfer Agreement or the TC Asset Transfer Agreement;

15

(B) enter into, alter, amend, vary, terminate, assign any interest under, or waive any rights under, any other agreement, contract or commitment;

(C) acquire, dispose of or Encumber any asset;

(D) incur any liability or obligation (whether actual or contingent); or

(E) make any amendment to its capital structure, constitutional documents or tax residence,

save if and to the extent the relevant member of the JVCo Group is required by applicable law or regulation, or in order to comply with its obligations under this Agreement, the Initial Asset Transfer Agreement or the TC Asset Transfer Agreement, to do the relevant act or thing (or omit to do the relevant act or thing).

5.2 The Parties shall use all reasonable endeavours (acting reasonably and in good faith) to negotiate and agree as soon as reasonably practicable the terms of a legally binding shareholders’ agreement and any relevant ancillary documentation (such as constitutional documents, pro forma shareholder loan agreements and services agreements) reflecting the principles described in Clause 5.3 for the purposes of regulating the management of JVCo and the JVCo Group, the relationship of the JV Partners as shareholders in JVCo and certain aspects of the affairs of, and the JV Partners’ dealings with, the JVCo Group (the “SHA”).

5.3 The Parties agree that the SHA will have the objective of achieving a level of governance and control consistent, insofar as practical, with the level of governance and control that the JV Partners would have, were they to hold their respective proportionate interests in JVCo directly as participating interests in the Contracts and the Senegal Area XXXx, whilst reflecting the principles that:

(A) JVCo is an “Affiliate” of Kosmos for the purposes of all existing contracts, agreements and laws to which Kosmos is party or subject in respect of the Senegal Area;

(B) JVCo exercises its rights under the Senegal Area XXXx and votes as a single block;

(C) the JV Partners shall have equal representation on the board of directors of JVCo, with all decisions of the JVCo taken on a joint and equal basis by the JV Partners (or their respective representatives), save in respect of (i) matters which the JV Partners agree should be delegated and (ii) decisions in respect of contracts or disputes which concern a JV Partner, in respect of which the relevant JV Partner shall recuse itself (and/or procure that that its representatives recuse themselves) from relevant decision-making;

(D) transfers of Ordinary Shares by the JV Partners will be subject to pre-emption rights and, in the case of Kosmos, will be prohibited to the extent that such transfer would otherwise result in (i) the transfer of the Interests to JVCo being

16

voided and such Interests being returned to Kosmos pursuant to Article 14.2(b) of the Senegal Area XXXx, or (ii) pre-emption rights over the Interests under a contract or agreement to which Kosmos is party at the date of this Agreement becoming exercisable, unless such rights have been waived;

(E) provisions will be included in the SHA to provide protections to a JV Partner in the event of a funding default or insolvency by the other JV Partner that are equivalent to and give the same economic benefit as the protections that co-venturers would typically enjoy in a joint operating agreement for an unincorporated joint venture; and

(F) Kosmos shall not carry out any business other than that of an oil and gas exploration and production company in Senegal and of holding (directly or indirectly) interests in JVCo and/or the Interests, and matters incidental thereto; and

(G) the provisions of Schedule 1 will be reflected in the SHA and/ or relevant ancillary documentation.

5.4 The Parties intend that the SHA will be finalised and entered into on or before Second Completion, but if it is not:

(A) the provisions of Clauses 5.2 and 5.3 shall continue to apply;

(B) the Parties shall proceed to Second Completion, and the Parties’ rights and obligations under this Agreement will not be affected, notwithstanding that the SHA has not been entered into; and

(C) the Parties shall give effect to the objective and principles described in Clause 5.3 and the provisions of Schedule 1.

5.5 Kosmos will comply with Schedule 2.

5.6 Save as contemplated pursuant to Clauses 4.2 and 6.8, pending Second Completion, neither JV Partner will dispose of any legal or beneficial interest in any Ordinary Shares without the prior written consent of the other JV Partner.

6 Conditions

6.1 Payment of the Second Consideration Amount and each of the Deferred Consideration Amounts is in all respects conditional upon:

(A) issuance of a decree (Arrête) by the Senegal Minister of Energy and Development of Renewable Energy Resources approving the transfer of Kosmos’s Initial Interests under the Contracts to JVCo (or such approval being deemed effective pursuant to the Contracts) and written approval of such Minister designating JVCo as operator of the Senegal Area and the occurrence of the Initial Asset Transfer Completion; and

17

(B) no notice of termination having been given in accordance with Clause 6.8 prior to the date on which the Condition at sub-clause (A) above is satisfied or waived,

(the “Conditions” and each a “Condition”).

6.2 Each Party shall use commercially reasonable efforts to execute all documents, and do and procure to be done all such acts and things as are reasonably within its power to ensure the Condition in Clause 6.1(A) are satisfied as soon as is reasonably practicable after execution of this Agreement. The Parties shall keep each other informed of progress towards the satisfaction of the Conditions and shall notify one another as soon as is reasonably practicable after they become aware that a Condition has been satisfied. The Conditions may only be waived by agreement in writing between the JV Partners. Without prejudice to the generality of the foregoing, Kosmos, or a Kosmos Affiliate (other than JVCo) shall offer to provide the Senegal Minister of Energy and Development of Renewable Energy Resources with a guarantee for JVCo’s Paying Interest share of the amount required under the Contracts.

6.3 Notwithstanding any other provision of this Agreement, if, prior to the Second Completion Date, Kosmos or any other person is or becomes the subject of any investigation, inquiry or enforcement proceeding by a governmental, administrative or regulatory body regarding an offence or alleged offence relating to the Interests under any of the Anti-Corruption Laws and Obligations that is likely to result in a material, detrimental impact to the Interests, the Interest Documents or this Agreement, BP shall have the right to terminate this Agreement on notice pursuant to Clause 6.8.

6.4 Notwithstanding any period of Force Majeure under Clause 18.1, if each of the Conditions are not satisfied (or waived pursuant to Clause 6.2) on or before the Longstop Date, then either JV Partner shall have the right to terminate this Agreement on notice pursuant to Clause 6.8.

6.5 Notwithstanding any other provision of this Agreement, BP shall have the right to terminate this Agreement prior to the Second Completion Date on notice pursuant to Clause 6.8, if:

(A) any of the Kosmos Asset Warranties (other than the warranties in paragraph 4.6(B), 4.9(BB), 4.11(A) insofar as it relates to the TC Interests, and 4.16D of Schedule 3) was at the date of this Agreement, or has since become, untrue in any material respect and is likely to prevent or inhibit the ability of JVCo to take title to the Interests; or

(B) any of the Kosmos Share Warranties was at the date of this Agreement untrue to an extent which is material in the context of the transactions contemplated by this Agreement; or

(C) Kosmos is in breach of any material undertaking in this Agreement and the breach is incapable of being cured before the Second Completion Date, has continued without cure for a period of 30 days after the notice of breach from

18

the JVCo or BP or remains uncured two (2) days prior to the Second Completion Date.

6.6 If the Government imposes conditions for approval of the assignment and transfer of the Interests or transition of operatorship as contemplated hereunder materially in excess of those which are usually imposed in similar circumstances or if such approval contains unusual and onerous conditions which either JV Partner is not willing to accept, then the JV Partners shall in good faith meet to consider whether to agree to any such conditions for approval by the Government, and if they are unable to agree to such request within 30 days of the notification by the Government of such conditions, the relevant JV Partner shall have the right to terminate this Agreement on notice pursuant to Clause 6.8.

6.7 Notwithstanding any period of Force Majeure under Clause 18.1 if any Party receives notice from the Government of a rejection of the transfer of the Initial Interests pursuant to the Initial Asset Transfer Agreement, then either JV Partner shall have the right to terminate this Agreement on notice pursuant to Clause 6.8.

6.8 A JV Partner may terminate this Agreement pursuant to Clause 6.3, 6.4, 6.5, 6.6 or 6.7 (other than the Surviving Provisions) by giving ten (10) days’ notice to the other Parties. Unless such notice is withdrawn prior to its expiry then, at noon (UK time) (or such other time as the JV Partners may agree in writing) on the Business Day immediately following the expiry of the notice (the “Unwind Time”):

(A) BP shall sell, with full title guarantee, and Kosmos shall purchase, the Sale Shares free from all Encumbrances, together with all rights attached or accruing to them at the Unwind Time and BP shall deliver to Kosmos duly executed transfers in respect of the Sale Shares in favour of Kosmos and share certificates for the Sale Shares in the name of BP (the “Unwind Sale”);

(B) in consideration for the Unwind Sale, Kosmos shall pay BP an amount equal to the First Consideration Amount by telegraphic transfer for same date value in US dollars in immediately available funds to such account at such bank as BP shall have notified to Kosmos;

(C) if any BP nominees have been appointed as directors of JVCo prior to the Unwind Time, BP shall procure that such nominees resign as directors of JVCo and waive any claims they may have in connection with their loss of office; and

(D) this Agreement shall automatically terminate (whereupon all obligations of the Parties under this Agreement shall terminate) but (for the avoidance of doubt) all rights and liabilities of the Parties which have accrued before termination shall continue to exist, save that any obligation to pay any Consideration Amount which has, as at the date of termination, not been paid shall not survive and shall automatically terminate.

6.9 Promptly following completion of the matters set out in Clause 6.8, JVCo shall update its register of members to reflect that Kosmos has become the registered holder of the

19

Sale Shares and JVCo shall comply with any other requirements in connection with the transfer of the Sale Shares to which JVCo is subject under applicable law;

7 Second Completion

7.1 Subject always to the provisions of Clause 6.1, Second Completion shall take place on the Second Completion Date.

7.2 At Second Completion, BP shall pay the sum of forty-one million, nine hundred thousand Dollars (US$ 41,900,000) (the “Second Consideration Amount”) to Kosmos (or to such person as directed by Kosmos) in accordance with Clause 9.

7.3 On First Completion, Kosmos shall procure that JVCo appoints Xxxxxx Xxxxx and Xxxx Xxxxx as directors of JVCo provided that such directors have consented to act.

7.4 On or before Second Completion, but in any event no sooner than five Business Days after signing of this Agreement, BP shall deliver to Kosmos:

(A) a duly executed guarantee from BP Exploration Operating Company Limited in the form set out in Exhibit I Part 1; and

(B) a duly executed “back-to-back” guarantee from BP Exploration Operating Company Limited in the form set out in Exhibit I Part 2.

8 Deferred Consideration Amounts

8.1 Subject always to the provisions of Clause 6.1, the Parties agree that the Deferred Consideration Amounts shall be payable by BP in accordance with the following provisions of this Clause 8 and Clause 9.

8.2 Interim Period Costs Consideration

(A) Kosmos shall keep BP advised of the costs expended by Kosmos during the Interim Period. Specifically, Kosmos shall provide BP with a written statement of the amount of the Dollar balance resulting from the initial calculation of the Interim Period Costs (the “Monthly Interim Costs Completion Statement”) no later than thirty (30) days following the end of each calendar month during the Interim Period. Kosmos and BP agree that if the information required for such timely preparation of a Monthly Interim Costs Completion Statement is not available, Kosmos’s good faith estimate of such information shall be substituted.

(B) Within sixty (60) days after the Second Completion Date, or within such other period as may be agreed in writing by the Parties, Kosmos shall provide BP with a written statement giving the final amount of the Interim Period Costs (the “Final Completion Statement”). Upon BP’s request, Kosmos shall provide BP with copies of reports, billing statements and correspondence and any other relevant documentation in Kosmos’s possession in support of the Final Completion Statement within ten (10) Business Days of such request, which

20

shall be made no later than ten (10) Business Days from the date the Final Completion Statement is supplied to BP. BP shall have the right, for a period of ninety (90) days following the date of delivery of the Final Completion Statement, to audit the Interim Period Costs on prior notice and during reasonable business hours in Kosmos’s offices; and Kosmos shall provide such confirmation of the said Interim Period Costs as may be requested by BP in order to confirm the amount of Interim Period Costs. Kosmos and BP shall endeavor in good faith to resolve any item of adjustment to the Interim Period Costs in the Final Completion Statement within one hundred twenty (120) days following the date of delivery of the Final Completion Statement. The agreed amount of the Interim Period Costs shall be subject to no adjustment or amendment. In the event that the Kosmos and BP are unable to agree upon any item of adjustment within the above period, such amount shall be determined in accordance with the procedures for settling disputed invoices under the Senegal Area XXXx.

(C) Kosmos shall provide BP with copies of all operator reports, billing statements and correspondence and any other relevant documentation in support of the Monthly Interim Costs Completion Statement and the Final Completion Statement at the same time such statements are supplied.

(D) The Interim Period Costs Consideration shall be paid by BP to Kosmos in accordance with Clause 9 within five (5) Business Days of the delivery of the Final Completion Statement (pursuant to Clause 8.2(B)), but without prejudice to BP's subsequent rights of audit and dispute under Clause 8.2(B).

8.3 Exploration and Appraisal Carry Consideration

(A) The “Exploration and Appraisal Carry Consideration” shall be an amount equal to 50.01 per cent of, Kosmos’s Paying Interest share (prior to Initial Asset Transfer Completion), and JVCo’s Paying Interest share (subsequent to Initial Asset Transfer Completion), of costs otherwise due and payable by Kosmos or JVCo (as applicable) after the Effective Date under the terms of the Senegal Area XXXx (including, for these purposes, Timis Corporation’s remaining interest share of the first one hundred and twenty million Dollars (US$120,000,000) of gross costs (including all general and administration costs and expenses (G&A)) to drill one exploration well or appraisal well (including testing) in the Senegal Area, the costs of which are to be carried pursuant to the TC Option, but excluding Timis Corporation’s remaining interests shares in respect of other costs in respect of the Senegal Area) pursuant to an approved work programme and budget thereunder in connection with all activities other than those activities covered under Clause 8.4 (the “Carried Exploration Costs”) PROVIDED THAT:

(i) the aggregate amount of (x) the Exploration and Appraisal Carry Consideration paid by BP under this Clause and (y) the Exploration and Appraisal Carry (as such term is defined in the Mauritania Farmout Agreement) paid by the Farmee (as such term is defined in the

21

Mauritania Farmout Agreement) (but excluding, for these purposes, amounts payable pursuant to Clause 8.3(B)(ii)) (the “Combined Exploration Total”) shall not exceed two hundred and twenty-one million Dollars ($US 221,000,000) (the “Combined Exploration Limit”);

(ii) if the Mauritania Farmout Agreement terminates in accordance with its terms for any reason other than breach by BP Exploration (West Africa) Limited, the aggregate amount of the Exploration and Appraisal Carry Consideration paid by BP under this Clause (excluding, for these purposes, amounts payable pursuant to Clause 8.3(B)(ii)) (the “Standalone Exploration Total”) shall not exceed fifty-seven million, two hundred thousand Dollars ($US 57,200,000) (the “Standalone Exploration Limit”); and

(iii) the Exploration and Appraisal Carry Consideration shall only apply in respect of Carried Exploration Costs that are due and payable on or before 31 December 2022.

(B) The Exploration and Appraisal Carry Consideration shall be payable by BP whenever JVCo is required to make any payment in respect of Carried Exploration Costs. BP will pay the Exploration and Appraisal Carry Consideration in sufficient time for JVCo to make such payments when due. Kosmos hereby directs BP to pay the Exploration and Appraisal Carry Consideration (other than the payments described in paragraphs (C) and (D) below) direct to JVCo on Kosmos’s behalf and Kosmos hereby undertakes not to revoke such payment direction without BP’s prior written consent. Payments made by BP direct to JVCo in this way:

(i) shall discharge BP’s obligation to make the relevant payment of Exploration and Appraisal Carry Consideration;

(ii) subject to the payment direction issued by Kosmos pursuant to this Clause 8.3(B) not having previously been revoked, shall be accompanied by an equivalent payment from BP (on its own account) to JVCo equal to 49.99% of JVCo's Paying Interest Share of costs otherwise due and payable by JVCo after the Effective Date under the terms of the Senegal Area XXXx; and

(iii) shall be paid and structured in a tax efficient manner (including by loan or a capital injection or a combination of both) from Kosmos to JVCo and the own account payment made by BP referred to in sub-paragraph (ii) above shall be paid from BP to JVCo and structured in a tax efficient manner (including by loan or a capital injection or a combination of both).

(C) If the Combined Exploration Total as at 1 January 2023 is less than the Combined Exploration Limit and sub-paragraph (A)(ii) above does not apply, BP shall pay an amount equal to the shortfall by no later than 1 February 2023

22

either to Kosmos’s Account in accordance with Clause 9 or, at Kosmos’s election, all or a portion of the shortfall will be paid to Kosmos Mauritania under the Mauritania Farmout Agreement with the balance being paid to Kosmos pursuant to this Clause and Clause 9.

(D) If sub-paragraph (A)(ii) above does apply and the Standalone Exploration Total as at 1 January 2023 is less than the Standalone Exploration Limit, BP shall pay an amount equal to the shortfall to Kosmos’s Account in accordance with Clause 9 by no later than 1 February 2023.

8.4 Development Carry Consideration

(A) The “Development Carry Consideration” shall be an amount equal to 50.01 per cent of Kosmos’s Paying Interest share (prior to Initial Asset Transfer Completion), and JVCo’s Paying Interest share (subsequent to Initial Asset Transfer Completion), of costs that are properly incurred and due and payable by Kosmos or JVCo (as applicable) after the Effective Date under the terms of the Senegal Area XXXx pursuant to an approved work programme and budget thereunder in connection with achieving Commercial Production of Hydrocarbons (as defined under the Contracts) from the Tortue Discovery Area as shown in Exhibit C, Part 1, including the Firm Work Programme (Development) in Exhibit A 2, or any alternative development in the Senegal Area (the “Carried Development Costs”) PROVIDED THAT:

(i) the aggregate amount of (x) the Development Carry Consideration paid by BP under this Clause and (y) the Development Carry (as such term is defined in the Mauritania Farmout Agreement) paid by the Farmee (as such term is defined in the Mauritania Farmout Agreement) (but excluding, for these purposes, amounts payable pursuant to Clause 8.4(B)(ii)) shall not exceed five hundred and thirty-three million, four hundred thousand Dollars ($US 533,400,000);

(ii) if the Mauritania Farmout Agreement terminates in accordance with its terms for any reason other than breach by BP Exploration (West Africa) Limited, the aggregate amount of the Development Carry Consideration paid by BP under this Clause (but excluding, for these purposes, amounts payable pursuant to Clause 8.4(B)(ii)) shall not exceed one hundred and eighty-three million, four hundred thousand Dollars ($US 183,400,000); and

(iii) the Development Carry Consideration shall only apply in respect of Carried Development Costs that are due and payable on or before the date on which first Commercial Production from a development within an Exploitation Perimeter is achieved from the Senegal Area and/or the Mauritania Area.

(B) The Development Carry Consideration shall be payable by BP whenever JVCo is required to make any payment in respect of Carried Development Costs. BP

23

will pay the Development Carry Consideration in sufficient time for JVCo to make such payments when due. Kosmos hereby directs BP to pay the Development Carry Consideration direct to JVCo on Kosmos’s behalf and Kosmos hereby undertakes not to revoke such payment direction without BP’s prior written consent. Payments made by BP direct to JVCo in this way:

(i) shall discharge BP’s obligation to make the relevant payment of Development Carry Consideration;

(ii) subject to the payment direction issued by Kosmos pursuant to this Clause 8.4(B) not having previously been revoked shall be accompanied by an equivalent payment from BP (on its own account) to JVCo equal to 49.99% of JVCo's Paying Interest Share of costs otherwise due and payable by JVCo after the Effective Date under the terms of the Senegal Area XXXx; and

(iii) shall be paid and structured in a tax efficient manner (including by loan or a capital injection or a combination of both) from Kosmos to JVCo and the own account payment made by BP referred to in sub-paragraph (ii) above shall be paid from BP to JVCo and structured in a tax efficient manner (including by loan or a capital injection or a combination of both).

(C) For the avoidance of any doubt, there shall be no double-counting of amounts payable under Clause 8.3 and this Clause 8.4, with the intention that BP shall not be required to pay more than once in respect of the same costs.

8.5 Success Fee Consideration

(A) The Success Fee Consideration in respect of each Eligible Discovery shall be paid quarterly by BP, or BP’s Affiliate, to Kosmos, or (at Kosmos’s election) Kosmos’s Affiliate, by electronic transfer in immediately available funds into Kosmos’s Account no later than thirty (30) days following the end of each Quarter after the date Commercial Production exceeds twenty thousand Barrels per day (20mbd) from such Eligible Discovery and in respect of each Barrel (as defined under the Contracts) of gross production of liquid Hydrocarbons (as defined under the Contracts) in the natural state or obtained from Natural Gas by condensation or separation with an API gravity equal to or greater than 22.3°, but excluding LNG, produced from such Eligible Discovery in the immediately preceding Quarter.

(B) The obligation to pay Success Fee Consideration falling within limb (i) of such definition shall expire on the earlier of (a) when the aggregate gross cumulative production from all Eligible Discoveries and all Eligible Discoveries (as such term is defined in the Mauritania Farmout Agreement) exceeds one Billion Barrels (1bnbbl); and (b) in respect of an Eligible Discovery, fifteen (15) years after the date of first production from such Eligible Discovery. The obligation to pay Success Fee Consideration falling within limb (ii) of such definition shall

24

expire five (5) years after the date when the aggregate gross cumulative production from all Eligible Discoveries and all Eligible Discoveries (as such term is defined in the Mauritania Farmout Agreement) exceeds one Billion Barrels (1bnbbl).

(C) If an index is required to be used in the calculation of Xxxxx, and such index ceases to be published, either Kosmos or BP may request the adoption of such substitute index as most closely resembles the original index prior to it ceasing to be published or changing. If the Parties are unable to agree within sixty (60) days of such request, the matter shall be referred for determination under Article 11.2.

(D) To the extent that a Success Fee (as defined in the Mauritania Farmout Agreement) is payable under the Mauritania Farmout Agreement and Success Fee Consideration is payable under this Agreement in respect of the same discovery, there shall be no double-counting of amounts payable under the Mauritania Farmout Agreement with amounts payable under this Agreement with the intention that BP shall not be required to pay more than once in respect of the same production.

8.6 Other Costs and Cost Recovery

(A) On and from the Effective Date JVCo shall assume and be liable for its Participating Interest share of costs incurred under the Contracts or Senegal Area XXXx pursuant to their terms. Any costs for which Kosmos or JVCo would otherwise be liable under the terms of the Senegal Area XXXx between the Effective Date and the Second Completion Date shall be funded by Kosmos (as to 50.01% for its own account and 49.99% on behalf of BP) and 49.99% of such costs shall be paid to Kosmos by BP after the Second Completion Date pursuant to Clause 8.2.

(B) JVCo shall be entitled to recover its Participating Interest share of costs incurred under the Contracts upon commencement of production from the relevant portion of the Senegal Area regardless of whether the costs were incurred before or after the Effective Date. For the avoidance of doubt, such Participating Interest share shall be the Participating Interest held at the time such costs become recoverable under the Contracts after the commencement of production and to the extent that any person (the "Receiving Party") receives the Participating Interest share of costs that should otherwise have been paid to JVCo, the Receiving Party shall pay such sums to JVCo within five (5) Business Days of receipt thereof.

8.7 Change in Participating Interest

(A) If JVCo owns less than a 65% Participating Interest as at 01 July 2018 (or such later date as the JV Partners may agree) other than as a result of JVCo selling part or all of its Participating Interest, then:

25

(i) the amount payable by BP under Clause 7.2;

(ii) the maximum amount payable by BP pursuant to Clause 8.3(A) (ii);

(iii) the maximum amount payable by BP pursuant to Clause 8.4(A)(ii); and

(iv) the multiplier in limb (i) of the definition of Success Fee Consideration,

shall, in each case, be reduced in proportion to the amount by which the Participating Interest so owned is less than 65%, and:

(a) the maximum amount payable by BP pursuant to Clause 8.3(A)(i) shall be reduced by the same amount by which the maximum amount referred to in (ii) above is reduced; and

(b) the maximum amount payable by BP pursuant to Clause 8.4(A)(i) shall be reduced by the same amount by which the maximum amount referred to in (iii) above is reduced; and

(c) all calculations resulting from the reduction in (iv) above shall be applied within the limb(i) of the definition of Success Fee Consideration.

(B) By way of example, if JVCo owns a 64% Participating interest as at the 01 July 2017, the amounts referred to above would be adjusted as follows:

|

|

|

Original Amount |

Revised Amount |

|

|

Clause 7.2 |

$41,900,000 |

$41,300,000 |

|

|

Clause 8.3(A)(ii) |

$57,200,000 |

$56,400,000 |

|

|

Clause 8.4(A)(ii) |

$183,400,000 |

$180,600,000 |

|

|

Clause 8.3(A)(i) |

$221,000,000 |

$220,200,000 |

|

|

Clause 8.4(A)(i) |

$533,400,000 |

$530,600,000 |

|

|

Limb (i) of Success Fee Consideration |

$0.00875 |

$0.00862 |

|

|

|

$0.525 |

$0.517 |

|

|

|

$1.05 |

$1.03 |

(C) If the Second Consideration Amount has already been paid when the adjustments described above are made, Kosmos shall repay to BP an amount equal to the amount by which the Second Consideration Amount is so adjusted.

26

(D) If the Participating Interest of JVCo subsequently increases to or above 65%, the adjustments described above will be reversed and appropriate adjusting payments made.

9 Payment

Where a Consideration Amount is expressed to be payable in accordance with or pursuant to this Clause 9, the relevant Consideration Amount payable by BP shall be paid to Kosmos (or to such person as Kosmos shall specify in writing) by telegraphic transfer for same date value on the due date for payment in US dollars in immediately available funds to Kosmos’s Account.

10 Parties’ warranties

10.1 Kosmos’s Warranties and Undertakings

Subject to the provisions of this Clause 10, and save as disclosed under the terms of the Kosmos Disclosure Letter, Kosmos warrants and undertakes to BP as at the date of this Agreement that:

(A) the Kosmos Warranties and the warranty at paragraph 1 of Exhibit B are true and accurate in all respects as at the date of this Agreement;

(B) save as provided in Clause 10.1(C), the Kosmos Asset Warranties and the warranty at paragraph 1 of Exhibit B shall be deemed to be repeated at the Initial Asset Transfer Completion Date; and

(C) the Kosmos Asset Warranty at paragraphs 4.6(B), 4.9(BB), 4.16(D) and (insofar as it relates to the TC Interests) 4.11(A) of Part 1 of Schedule 3 shall be deemed to be repeated at the TC Asset Transfer Completion Date.

10.2 BP’s Warranties and Undertakings

BP warrants and undertakes to Kosmos as at the date of the Agreement that the BP Warranties and the warranty at paragraph 1 of Exhibit B are true and accurate in all respects, and the BP Warranties and the warranty at paragraph 1 of Exhibit B shall be deemed to be repeated at the Second Completion Date.

10.3 Breach of Warranty

(A) Each of the JV Partners agrees to indemnify and hold the other JV Partner harmless against any costs, charges, expenses, duties, losses, liabilities and obligations which such other JV Partner pays, suffers or is liable for at any time which arise out of or in connection with the breach by the indemnifying Party of, in the case of Kosmos, any of the Kosmos Share Warranties, or, in the case of BP, any of the BP Warranties.

(B) Kosmos covenants to pay and hold BP harmless against an amount equal to the Relevant Portion of any costs, charges, expenses, duties, losses, liabilities

27

and obligations ("Relevant Losses") which JVCo pays, suffers or is liable for at any time which arise out of or in connection with the breach by Kosmos of any of the Kosmos Asset Warranties. For these purposes, the Relevant Portion shall be the lesser of (i) 49.99% and (ii) if the proportionate interest in the Ordinary Share capital of JVCo held by BP and its Affiliates is less than 49.99%, an amount equal to BP's (together with its Affiliates') then proportionate interest share of the ordinary shares of JVCo plus the amount of any liability BP has to the acquirer(s) of the Ordinary Shares in respect of the same Relevant Losses.

(C) Kosmos shall have no liability in respect of any claim made by BP for a breach of the Kosmos Warranties, and BP shall have no liability in respect of any claim made by Kosmos for a breach of BP Warranties, unless such claim:

(i) equals or exceeds one million Dollars (US$1,000,000); or

(ii) when aggregated with all other valid claims the Party concerned may have against the other Party that are each of a value under one million Dollars (US$1,000,000), would mean such aggregate equals or exceeds one million Dollars (US$1,000,000),

and in either case the Party concerned shall be entitled to recover the whole amount of the relevant claim(s) not only the amount the relevant claim(s) (alone or aggregated) exceed one million Dollars (US$1,000,000).

(D) Kosmos shall not be liable in respect of a claim for breach of a Kosmos Warranty set out in paragraphs 4.18(A) or 4.18(B) of Schedule 3 Part 1 or the warranty at paragraph 1 of Exhibit B to the extent that, as at the date of this Agreement, BP was actually aware: (i) of the facts or circumstances giving rise to the claim for breach of such Kosmos Warranty or the warranty set out at paragraph 1 of Exhibit B; and (ii) that such facts or circumstances would give rise to a claim for breach of such Kosmos Warranty or the warranty at paragraph 1 of Exhibit B.

10.4 Undertakings in relation to breaches

(A) Kosmos undertakes that:

(i) it shall not at any time before the Second Completion Date do (or permit or suffer to subsist or be done) any act or thing which would constitute a breach of any of the Kosmos Asset Warranties or the warranty at paragraph 1 of Exhibit B or which would make any of the Kosmos Asset Warranties untrue or misleading at any time; and

(ii) upon becoming aware before the Second Completion Date of the actual or impending occurrence or non-occurrence of any matter, event or circumstance (including any omission to act) which:

28

(a) would or might reasonably be expected to cause or constitute a breach of any Kosmos Asset Warranty or the warranty at paragraph 1 of Exhibit B;

(b) would or might reasonably be expected to make any of the Kosmos Asset Warranties or the warranty at paragraph 1 of Exhibit B untrue or misleading;

(c) would have caused or constituted a breach of any Kosmos Asset Warranty or the warranty at paragraph 1 of Exhibit B had it been known to Kosmos before the date of this Agreement; or

(d) would or might reasonably be expected to adversely affect (or has so affected) the Interests,

it will immediately give BP notice of such matter, event or circumstance with sufficient details to enable BP accurately to assess its impact.

(B) BP undertakes that:

(i) it shall not at any time before the Second Completion Date do (or permit or suffer to subsist or be done) any act or thing which would constitute a breach of any of the BP Warranties or the warranty at paragraph 1 of Exhibit B or which would make any of the BP Warranties or the warranty at paragraph 1 of Exhibit B untrue or misleading at any time; and

(ii) upon becoming aware before the Second Completion Date of the actual or impending occurrence or non-occurrence of any matter, event or circumstance (including any omission to act) which:

(a) would or might reasonably be expected to cause or constitute a breach of any BP Warranty or the warranty at paragraph 1 of Exhibit B;

(b) would or might reasonably be expected to make any of the BP Warranties or the warranty at paragraph 1 of Exhibit B untrue or misleading;

(c) would have caused or constituted a breach of any BP Warranty or the warranty at paragraph 1 of Exhibit B had it been known to BP before the date of this Agreement; or

(d) would or might reasonably be expected to adversely affect (or has so affected) the Interests,

it will immediately give Kosmos notice of such matter, event or circumstance with sufficient details to enable Kosmos accurately to assess its impact.

29

10.5 Disclaimer of Other Representations and Warranties

(A) Except for the Kosmos Warranties and the warranty in paragraph 1 of Exhibit B, Kosmos makes no, and disclaims any, warranty or representation of any kind, either express, implied, statutory, or otherwise, including, the accuracy or completeness of any data, reports, records, projections, information, or materials now, heretofore, or hereafter furnished or made available to JVCo or BP in connection with this Agreement.

(B) Except for the BP Warranties and the warranty in paragraph 1 of Exhibit B, BP makes no, and disclaims any, warranty or representation of any kind, either express, implied, statutory, or otherwise, including, without limitation, the accuracy or completeness of any data, reports, records, projections, information, or materials now, heretofore, or hereafter furnished or made available to Kosmos in connection with this Agreement.

10.6 Fraud and Wilful Concealment

Notwithstanding anything to the contrary herein, nothing in this Agreement shall limit any Party’s liability for fraud or willful concealment.

10.7 Set-off

BP is hereby authorized and entitled at any time and from time to time, to the fullest extent permitted by law, to withhold and set-off from any payment otherwise due to be made to Kosmos pursuant to Clauses 6 to 8 of this Agreement or from any payment due to be made by BP’s Affiliate to Kosmos Mauritania pursuant to clauses 4.3 to 4.6 of the Mauritania Farmout Agreement an amount equal to the amount owing pursuant to any and all Kosmos Payment Failures.

11 Further assurance

11.1 Each of the JV Partners shall at its own cost, from time to time on request, do or procure the doing of all acts and/or execute or procure the execution of all documents in a form reasonably satisfactory to the other JV Partner which the other JV Partner (acting reasonably) may consider necessary for giving full effect to this Agreement and the transactions contemplated by it.

11.2 Each of the JV Partners agrees to co-operate in good faith with the other in order to finalise the structure for the proposed joint venture between them, with the common intention that the Parties will seek to implement a structure that is efficient and cost-effective. The Parties recognise that this may involve changes to the structure currently envisaged in this Agreement, such as the introduction of a new joint venture holding company above JVCo or a new asset-owning subsidiary of JVCo.

30

12 Variation

No variation to or waiver under this Agreement shall be effective unless made in writing and signed by or on behalf of all the Parties.

13 Confidentiality and Announcements

13.1 Except as otherwise provided in the Contracts and the Senegal Area XXXx, each Party agrees that the existence of and all terms of this Agreement and all information disclosed under this Agreement by either Party (except information in the public domain or lawfully in possession of a Party prior to the date of this Agreement) shall be considered confidential information and shall not be disclosed to any other person or entity without the prior written consent of the other Parties. This obligation of confidentiality shall remain in force during the term of the Contracts and for a period of three (3) years thereafter. Notwithstanding the foregoing, confidential information may be disclosed without consent and without violating the obligations contained in this Clause 13 in the following circumstances:

(A) to an Affiliate provided the Affiliate is bound to the provisions of this Article 9 and the Party disclosing is responsible for the violation of an Affiliate;

(B) to a governmental agency or other entity when required by the Contracts;

(C) to the extent such information is required to be furnished in compliance with applicable laws or regulations, or pursuant to any legal proceedings or because of any order of any court binding upon a Party;

(D) to attorneys engaged, or proposed to be engaged, by any Party where disclosure of such information is essential to such attorneys' work for such Party and such attorneys are bound by an obligation of confidentiality;

(E) to contractors and consultants engaged, or proposed to be engaged, by any Party where disclosure of such information is essential to such contractor’s or consultant’s work for such Party;

(F) to a bank or other financial institution to the extent appropriate to a Party arranging for funding;

(G) to the extent such information must be disclosed pursuant to any rules or requirements of any government or stock exchange having jurisdiction over such Party, or its Affiliates; provided that such Party shall comply with the requirements of Clause 13.3;

(H) to its respective employees, subject to each Party taking sufficient precautions to ensure such information is kept confidential;

(I) to the other parties to the Contracts and the Senegal Area XXXx and the Government; and

31

(J) to the other parties, including the Government of the Islamic Republic of Mauritania, to the Mauritania Contracts, solely to the extent as may be required to satisfy the conditions precedent specified in the Mauritania Farmout Agreement.

13.2 Disclosure pursuant to Clauses 13.1 (v) and (vi) shall not be made unless prior to such disclosure the disclosing Party has obtained a written undertaking from the recipient party to keep the information strictly confidential for at least as long as the period set out above and to use the information for the sole purpose described in Clauses 13.1(v) and (vi), whichever is applicable, with respect to the disclosing Party.

13.3 No public announcement or statement regarding the terms or existence of this Agreement shall be made without prior written consent of all Parties; provided that, notwithstanding any failure to obtain such approval, no Party shall be prohibited from issuing or making any such public announcement or statement to the extent it is necessary to do so in order to comply with the applicable laws, rules or regulations of any government, legal proceedings or stock exchange having jurisdiction over such Party or its Affiliates, however, any such required public announcement or statement shall include only that portion of information which the disclosing Party is advised by written opinion of counsel (including in-house counsel) is legally required. Such opinion, along with the proposed public announcement or statement, shall be delivered to the other Party no later than two days prior to any such public announcement or statement.

14 Notices

14.1 All notices authorized or required between the Parties by any of the provisions of this Agreement shall be:

(A) in writing (in English) and addressed to the relevant Party as set out in this Clause (unless such party gives notice in writing of a change of address or addressee as set out below);

(B) must be signed or in the case of a facsimile, appear to have been signed, by an authorized representative of the sender;

(C) regarded as given and received:

(i) if delivered by hand or by express courier, when delivered to the addressee; or

(ii) if sent by post, three Business Days from and including the date of postage; or

(iii) if sent by facsimile transmission, when the transmission is successfully transmitted as reported by the sender’s machine,

but if the delivery or receipt is on a day which is not a Business Day or is after 4.00pm (addressee’s time) it is regarded as received at 9:00am on the following Business Day.

32

E-mail notification of any notices delivered pursuant to this Article will also be provided for information only.

14.2 A facsimile transmission is not regarded as successfully transmitted if the addressee telephones the sender within four (4) hours after the transmission is received or regarded as received under Clause 14.1(C)(iii) and informs the sender that it is not legible or incomplete. E-mail addresses are provided for convenience only.

KOSMOS:

|

Kosmos Energy Senegal |

|

|

x/x Xxxxxxxxxx Xxxxx (Xxxxxx Xxxxxxx) |

x/x Xxxxxx Energy, LLC |

|

4th Floor, Century Yard |

8176 Park Lane, Suite 000 |

|

Xxxxxxx Xxxxxx, Xxxxxxxx Xxxxx |

Xxxxxx, XX 00000 XXX |

|

Xxxxx Xxxxxx, Xxxxxx Xxxx |

Xxxxx Xxxxxx XX0-0000 |

|

Fax: x0 000 000-0000 |

|

Attn.: General Counsel |

|

E-mail: XxxxxxxXxxxxxxxxxxxx@xxxxxxxxxxxx.xxx |

|

Fax: x0 000 000-0000 |

|

Attn.: Xxxxx Xxxx, Vice President, Exploration, North Africa |

BP:

BP Exploration Operating Company Limited

Xxxxxxxx Xxxxxxxx

Xxxxxxxx Xxxx

Xxxxxxx-xx-Xxxxxx

Xxxxxxxxx

XX00 0XX

Xxxxxx Xxxxxxx

E-mail: xxxx.xxxx@xx.xx.xxx

Fax: x00 (0) 0000 000000

Attn.: Xxxx X. Xxxx, Head of Business Development, Gas Value Chain

JVCo:

Shall be to both JV Partners as above

33

15 Tax; Costs

15.1 Kosmos shall pay, and shall indemnify and hold JVCo and BP harmless against any liability for any capital gains tax (or equivalent tax) which may be, or become, payable in connection with the sale, assignment or transfer of the Interests pursuant to the Initial Asset Transfer Agreement or the TC Asset Transfer Agreement and in respect of any costs (including reasonable legal costs), expenses, loss or damage occasioned by its failure to pay, or any delay in paying, such tax.

15.2 BP shall be responsible for payment in a timely fashion of any and all transfer taxes, such as stamp duties and taxes (or equivalent duties and taxes) (including interest, penalties and/or fines thereof) (the “Share Transfer Taxes”) payable on or in respect of the sale and purchase or transfer of the Sale Shares including the execution and enforcement of this Agreement and shall indemnify and hold JVCo and Kosmos harmless in respect of any costs (including reasonable legal costs), expenses, loss or damage occasioned by its failure to pay, or any delay in paying, such Share Transfer Taxes.

15.3 The JV Partners shall be responsible for payment to JVCo in a timely fashion of any and all transfer taxes, such as stamp duties and taxes (or equivalent duties and taxes) (including interest, penalties and/or fines thereof) (the “Asset Transfer Taxes”) payable on or in respect of the assignment and transfer of the Interests to JVCo pursuant to the Initial Asset Transfer Agreement or the TC Asset Transfer Agreement. Each JV Partner shall indemnify and hold JVCo and the other JV Partner harmless in respect of any costs (including reasonable legal costs), expenses, loss or damage occasioned by its failure to pay, or any delay in paying, such Asset Transfer Taxes, in each case on the basis that (i) 50.01% of any and all such amounts shall be for the account of Kosmos and (ii) 49.99% any and all such amounts shall be for the account of BP.

15.4 Except as otherwise stated in this Agreement, each Party shall pay its own costs and expenses in relation to the preparation, execution and carrying into effect of this Agreement and all other documents entered into pursuant to, or in connection with, it.

15.5 If, for United States federal income tax purposes, this Agreement and the operations under this Agreement are regarded as a partnership and if the Parties have not agreed to form a tax partnership, each Party elects to be excluded from the application of all of the provisions of Subchapter “K”, Chapter 1, Subtitle “A” of the United States Internal Revenue Code of 1986, as amended (the “Code”), to the extent permitted and authorized by Section 761(a) of the Code and the regulations promulgated under the Code. JVCo, if it is a U.S. Party, is authorized and directed to execute and file for each Party such evidence of this election as may be required by the Internal Revenue Service, including all of the returns, statements, and data required by United States Treasury Regulations Sections 1.761-2 and 1.6031(a)-1(b)(5) and shall provide a copy thereof to each U.S. Party. However, if JVCo is not a U.S. Party, the Party who holds the greatest Participating Interest among the U.S. Parties shall fulfill the obligations of JVCo under this Clause 15.5. Should there be any requirement that any Party give further evidence of this election, each Party shall execute such documents and furnish such other evidence as may be required by the Internal Revenue Service or as may be necessary to evidence this election.

34

35

15.6 No US Party shall give any notice or take any other action inconsistent with the foregoing election described at Clause 15.5. If any income tax laws of any state or other political subdivision of the United States or any future income tax laws of the United States or any such political subdivision contain provisions similar to those in Subchapter “K”, Chapter 1, Subtitle “A” of the Code, under which an election similar to that provided by Section 761(a) of the Code is permitted, each Party shall make such election as may be permitted or required by such laws. In making the foregoing election or elections, each U.S. Party states that the income derived by it from operations under this Agreement can be adequately determined without the computation of partnership taxable income.