AWARD AGREEMENT under the SUNCOKE ENERGY, INC. LONG-TERM CASH INCENTIVE PLAN

EXHIBIT 10.6.1

This Award Agreement (the “Agreement”), is entered into as of ____________, by and between SunCoke Energy, Inc. (“SunCoke”) and XX, an employee of SunCoke or one of its Affiliates (the “Participant”).

W I T N E S S E T H:

WHEREAS, the SunCoke Energy, Inc. Long-Term Cash Incentive Plan (the “LTIP”) is administered by the Compensation Committee (the “Committee”), and the Committee has determined to grant to the Participant, pursuant to the terms and conditions of the LTIP, an award (the “Award”), representing the opportunity to receive a cash payment following the end of a Performance Period, with the payout of such Award being conditioned upon the attainment of one or more Performance Goals established by the Committee for the applicable Performance Period and the Participant’s continued employment with SunCoke or one of its Affiliates.

NOW, THEREFORE, in consideration of these premises and the mutual promises of each of the Parties herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, SunCoke and the Participant, each intending to be legally bound hereby, agree as follows:

ARTICLE I

AWARD

AWARD

1.1 Acceptance of Award. The Award is conditioned upon its acceptance by the Participant in the space provided therefore at the end of this Agreement and the return of an executed copy of this Agreement to the Senior Vice President Human Resources, no later than ___________.

1.2 Identifying Provisions. For purposes of this Agreement, the following terms shall have the following respective meanings:

(a) Participant: ____________

(b) Grant Date: ____________

(c) | Target Award: $_____________________, in the aggregate, divided as follows: |

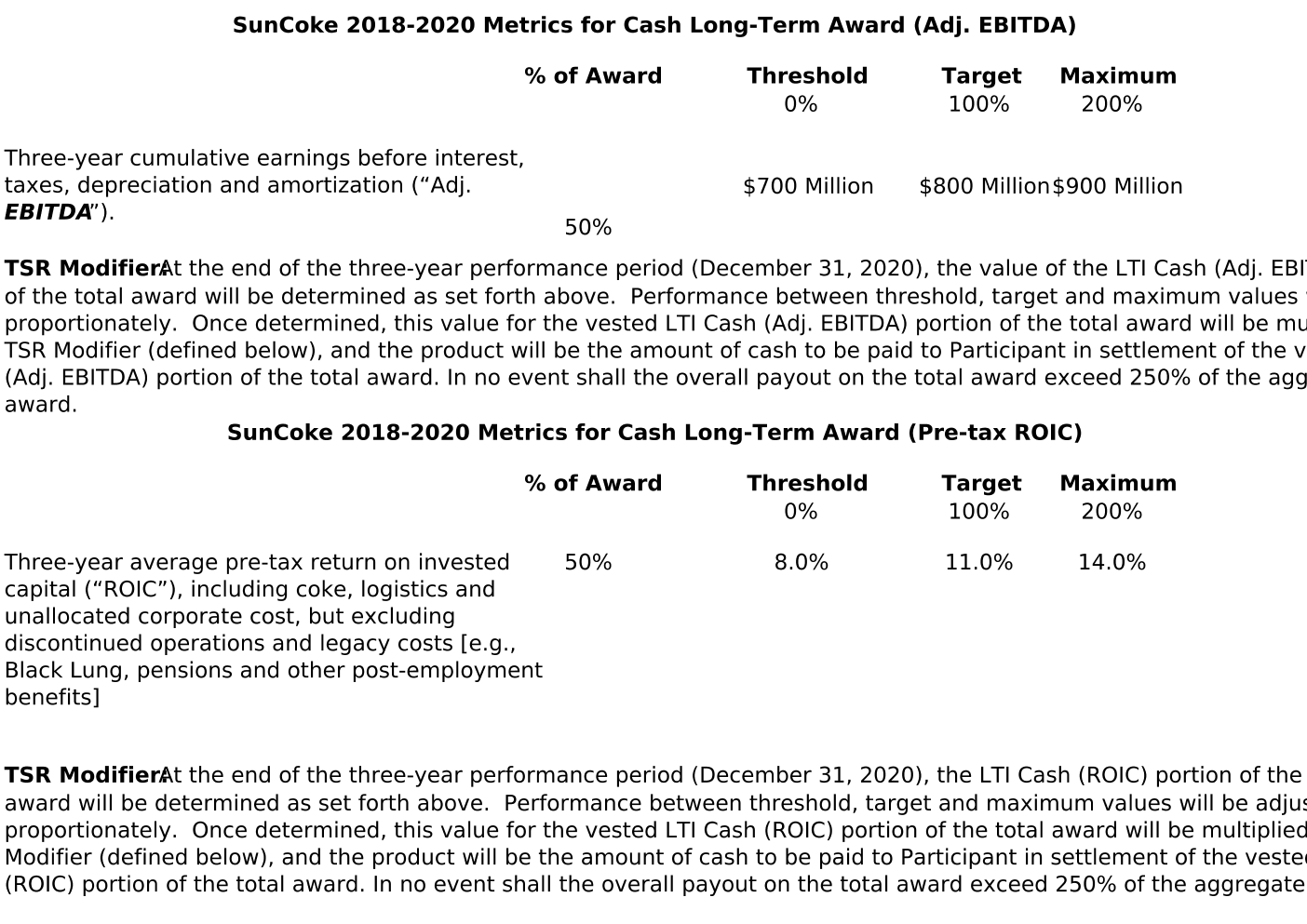

(i) | A target value of $________, for the LTI Cash (Adj. EBITDA) portion of the total award. The eventual payout of this portion of the award is dependent upon the level of attainment of certain targets for three-year cumulative adjusted earnings before interest, taxes, depreciation and amortization (“Adj. EBITDA”), and further adjusted for three-year total shareholder return (“TSR”), relative to the NASDAQ U.S. Benchmark Iron & Steel Total Return Index, as more particularly described on “Exhibit A,” attached hereto. |

Page 1 of 6

(ii) | A target value of $__________, for the LTI Cash (ROIC) portion of the total award. The eventual payout of this portion of the award is dependent upon the level of attainment of certain targets for three-year average pre-tax return on invested capital, including coke, logistics and unallocated corporate cost, but excluding discontinued operations and legacy costs [e.g., Black Lung, pensions and other post-employment benefits] (“ROIC”), and further adjusted for TSR, relative to the NASDAQ U.S. Benchmark Iron & Steel Total Return Index, as more particularly described on “Exhibit A,” attached hereto. |

(d) | Performance Period: Three-year period ending on _____________. |

The term “Award” used herein shall mean and refer to the LTI Cash (Adj. EBITDA) portion of the total award and the LTI Cash (ROIC) portion of the total award, collectively. Any initially capitalized terms and phrases used in this Agreement but not otherwise defined herein, shall have the respective meanings ascribed to them in the Plan.

1.3 Grant of Award. Subject to the terms and conditions of the LTIP and this Agreement, the Participant is hereby granted the target Award set forth in Section 1.2.

1.4 Adjustment, Vesting and Payment of Award.

(a) Adjustment. The target value of each of: (i) the LTI Cash (Adj. EBITDA) portion; and (ii) the LTI Cash (ROIC) portion of the total Award shall be adjusted by the Committee after the end of the Performance Period, based on the level of achievement of the respective performance goal(s) established with for the Performance Period, as set forth in the attached Exhibit A. The date that the Committee determines the level of performance goal achievement applicable to the Award is the “Determination Date”.

(b) Vesting. Except as set forth in Section 1.5(a), (b) and (c) below, a Participant shall become vested in his Award (as adjusted pursuant to (a) above) if he remains in continuous employment with SunCoke or one of its Affiliates until the Determination Date. An Award that does not vest shall be forfeited.

(c) Payment. Except as set forth in Section 1.5(a) and (c) below, actual payment for Award shall be made to the Participant within one month after the Determination Date.

1.5 Termination of Employment.

(a) Termination of Employment - In General. Upon termination of the Participant’s employment with SunCoke and its Affiliates prior to the Determination Date for any reason other than a Qualifying Termination or Just Cause or due to death or permanent disability, the Award shall remain outstanding and shall be adjusted at the end of the Performance Period as described in Section 1.4(a). The Participant shall vest in a pro rata portion of the adjusted Award, determined by multiplying the adjusted Award by a fraction, the numerator of which is the number of full months elapsed from the beginning of the Performance Period to the employment termination date, and the denominator of which is the number of full months in the Performance Period. The vested portion of the Award will be paid in cash within one month following the Determination Date, and the unvested portion will be forfeited.

(b) Qualifying Termination of Employment. In the event of the Participant’s Qualifying Termination prior to the Determination Date, the Participant’s outstanding Award shall vest immediately as follows:

Page 2 of 6

(i) For the LTI Cash (Adj. EBITDA) portion: at the higher of (A) the target level, or (B) the actual performance level attained for cumulative Adj. EBITDA; and

(ii) For the LTI Cash (ROIC) portion: at the higher of (A) the target level, or (B) the actual performance level attained for pre-tax ROIC,

in each case, calculated as of the fiscal quarter ending on, or immediately prior to, the date of the Change in Control, and adjusted for TSR (calculated as of the date of the Change in Control) relative to the NASDAQ U.S. Benchmark Iron & Steel Total Return Index, as more particularly described on “Exhibit A,” attached hereto. Each of such vested LTI Cash (Adj. EBITDA) portion and vested LTI Cash (ROIC) portion shall be paid in cash within one month following such Qualifying Termination.

(c) Termination of Employment Due to Death or Permanent Disability. In the event of the Participant’s termination of employment due to death or permanent disability prior to the Determination Date, the Participant’s outstanding Award shall not be adjusted pursuant to Section 1.4(a) above, but shall vest immediately at the target level and be paid in cash within one month following such termination of employment. For purposes of this Section 1.5(c), a Participant shall have a “permanent disability” if he is found to be disabled, under the terms of SunCoke’s long-term disability policy in effect at the time of the Participant’s termination, due to such condition or if the Committee in its discretion makes such determination.

(d) In the event the Participant’s employment is terminated prior to the Determination Date by SunCoke or an Affiliate for Just Cause, the Participant’s Award shall be forfeited.

ARTICLE II

GENERAL PROVISIONS

GENERAL PROVISIONS

2.1 Effect of Plan; Construction. The entire text of the LTIP is expressly incorporated herein by this reference and so forms a part of this Agreement. In the event of any inconsistency or discrepancy between the provisions of the Award covered by this Agreement and the terms and conditions of the LTIP under which such Award is granted, the provisions in the LTIP shall govern and prevail. The Award and this Agreement are each subject in all respects to, and SunCoke and the Participant each hereby agree to be bound by, all of the terms and conditions of the LTIP, as the same may have been amended from time to time in accordance with its terms.

2.2 Tax Withholding. The payment of an Award under this Agreement shall be net of any applicable federal, state, or local withholding taxes.

2.3 Administration. Pursuant to the LTIP, the Committee is vested with conclusive authority to interpret and construe the LTIP, to adopt rules and regulations for carrying out the LTIP, and to make determinations with respect to all matters relating to this Agreement, the LTIP and Awards made pursuant thereto. The authority to manage and control the operation and administration of this Agreement shall be likewise vested in the Committee, and the Committee shall have all powers with respect to this Agreement as it has with respect to the LTIP. Any interpretation of this Agreement by the Committee, and any decision made by the Committee with respect to this Agreement, shall be final and binding.

2.4 Amendment. This Agreement may be amended in accordance with the terms of the LTIP.

Page 3 of 6

2.5 Captions. The captions at the beginning of each of the numbered Sections and Articles herein are for reference purposes only and will have no legal force or effect. Such captions will not be considered a part of this Agreement for purposes of interpreting, construing or applying this Agreement and will not define, limit, extend, explain or describe the scope or extent of this Agreement or any of its terms and conditions.

2.6 Governing Law. The validity, construction, interpretation and effect of this instrument shall be governed exclusively by and determined in accordance with the law of the State of Delaware (without giving effect to the conflicts of law principles thereof), except to the extent preempted by federal law, which shall govern.

2.7 Notices. All notices, requests and demands to or upon the respective parties hereto to be effective shall be in writing, by facsimile, by overnight courier or by registered or certified mail, postage prepaid and return receipt requested. Notices to SunCoke shall be deemed to have been duly given or made upon actual receipt by SunCoke. Such communications shall be addressed and directed to the parties listed below (except where this Agreement expressly provides that it be directed to another) as follows, or to such other address or recipient for a party as may be hereafter notified by such party hereunder:

(a) If to SunCoke: SunCoke Energy, Inc.

Compensation Committee of the Board of Directors

0000 Xxxxxxxxxxx Xxxx

Xxxxx, XX 00000

Attention: Corporate Secretary

(b) | If to the Participant: To the address for the Participant as it appears on SunCoke’s records. |

2.8 Severability. If any provision hereof is found by a court of competent jurisdiction to be prohibited or unenforceable, it shall, as to such jurisdiction, be ineffective only to the extent of such prohibition or unenforceability, and such prohibition or unenforceability shall not invalidate the balance of such provision to the extent it is not prohibited or unenforceable, nor invalidate the other provisions hereof.

2.9 Entire Agreement. This Agreement constitutes the entire understanding and supersedes any and all other agreements, oral or written, between the parties hereto, in respect of the subject matter of this Agreement and embodies the entire understanding of the parties with respect to the subject matter hereof.

2.10 Forfeiture. The cash payment received in connection with the Award granted pursuant to this Agreement constitutes incentive compensation. The Participant agrees that any cash payment received with respect to the Award will be subject to any clawback/forfeiture provisions applicable to SunCoke that are required by any law in the future, including, without limitation, the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act and/or any applicable regulations.

* * *

Page 4 of 6

IN WITNESS WHEREOF, this Agreement is delivered by the Company as of the _____ day of ________.

By: Its: | |

AGREED AND ACCEPTED: Participant Signature Print Name Date | |

Page 5 of 6

EXHIBIT A

Long Term Cash Incentive Plan

2018 Award Agreement

Calculation of TSR Modifier*

Three-year TSR calculation: TSR = [Pf - Pi+ D]/[Pi], where:

TSR = Three-year total shareholder return on SXC common stock, expressed as a percent.

Pf = average closing price for SXC common stock for the ten-day trading period immediately preceding December 31, 2020.

D = reinvested dividends during the period from January 1, 2018 through December 31, 2020.

Pi = average closing price for SXC common stock for the ten-day trading period immediately preceding January 1, 2018.

Page 6 of 6