AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

NOTE: PORTIONS OF THIS EXHIBIT INDICATED BY “[****]” HAVE BEEN OMITTED FROM THIS EXHIBIT AS THESE PORTIONS ARE NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM IF PUBLICLY DISCLOSED.

Exhibit 10.7c

AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

This Amended and Restated Loan and Security Agreement (as from time to time amended, restated, amended and restated, supplemented or otherwise modified from time to time and together with any Transaction Statements, as hereinafter defined, this “Agreement”) is entered into as of July 9, 2021, by and between the persons listed in the section of this Agreement entitled “List of Dealers” (each, individually, a “Dealer” and, collectively, “Dealers”), Xxxxx Fargo Commercial Distribution Finance, LLC (in its individual capacity, “CDF”) as Agent (CDF, in such capacity as agent, is herein referred to as “Agent”) for the several financial institutions that are parties to this Agreement or may from time to time become party to this Agreement (collectively, the “Lenders” and individually each a “Lender”) and for itself as a Lender, and such Lenders.

RECITALS

(a)Dealers do business together or are related entities.

(b)Dealers, Agent and Lenders are currently parties to that certain Loan and Security Agreement dated as of May 20, 2020 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Existing Financing Agreement”).

(c)Dealers have requested that Agent and Lenders agree to certain revisions to the credit facility under the Existing Financing Agreement and Agent and Lenders are willing to do so upon the terms and conditions set forth in this Agreement.

(d)This Agreement amends and restates the Existing Financing Agreement in its entirety. Any references in this Agreement or any other Loan Document (as defined below) to the Existing Financing Agreement shall be deemed to be references to this Agreement.

1.Definitions. Capitalized terms not otherwise defined in this Agreement shall have the following meanings:

“AAA” has the meaning set forth in Section 30(b) of this Agreement.

“Account Debtor” shall mean each Person who is or who may become obligated to any Dealer under, with respect to, or on account of an Account or other Collateral.

“Accounts” shall mean collectively any and all accounts (as such term is defined in the UCC) of each Dealer and each and every right of said Dealer, whether such right now exists or hereafter arises, to (i) the payment of money or (ii) the receipt or disbursement of products, goods, services or other valuable consideration, in each case arising out of (a) a sale, lease or other disposition of Inventory, (b) a rendering of services, or (c) a policy of insurance issued or to be issued covering such Inventory, together with all other rights and interests (including all liens and security interests) which said Dealer may at any time have by law or agreement against any Account Debtor or other Person obligated to make any such payment or against any property of such Account Debtor or other Person.

“Acquired Assets” has the meaning set forth in Section 6(d)(iv) of this Agreement.

“Acquired Person” has the meaning set forth in Section 6(d)(iv) of this Agreement.

“Advance Date” has the meaning set forth in Section 2(a)(iv) of this Agreement.

“Advance Rate” with respect to Eligible Inventory Collateral is determined for each category of inventory as set forth in the section entitled “Inventory Advance Rate” in the Program Terms Letter.

“Affiliate” means any Person that (i) directly or indirectly controls, is controlled by or is under common control of any other Person, (ii) directly or indirectly owns 25% or more of any other Person, (iii) is a director, partner, manager, or officer of any other Person or an affiliate of any other Person, or (iv) any natural person related to any such Person or an affiliate of such Person.

“Agent” has the meaning set forth in the Preamble of this Agreement.

1

“Agent Companies” has the meaning set forth in Section 30(a) of this Agreement.

“Agent-Related Persons” means Agent, together with its Affiliates, officers, directors, employees, attorneys, and agents.

“Agent Report” has the meaning set forth in Section 21(e)(iii) of this Agreement.

“Aggregate Excess Funding Amount” of a Non-Funding Lender shall be the aggregate amount of all unpaid obligations owing by such Lender to Agent and other Lenders under the Loan Documents, including such Lender’s Ratable Share of Loans.

“Agreement” has the meaning set forth in the Preamble of this Agreement.

“Allocation” means, with respect to each Lender, the amount set forth opposite such Lender’s name on Exhibit D hereto, under the heading “Allocation”, as such amount may be reduced or increased from time to time in accordance with this Agreement.

“Approval” means Agent’s indication to a Vendor that the Lenders will provide financing to Dealers with respect to a particular invoice or invoices for which CDF has not financed an Invoice for the inventory subject thereto.

“Approval Date” has the meaning set forth in Section 2(a)(iv) of this Agreement.

“Assignment” means an assignment agreement entered into by a Lender, as assignor, and any Person, as assignee, pursuant to the terms and provisions of Section 20 (with the consent of any party whose consent is required by Section 20), accepted by Agent.

“Automatic Default” has the meaning set forth in Section 12(h) of this Agreement.

“Availability” means

(i)the lesser of (a) the Borrowing Base and (b) the Maximum Aggregate Credit Amount minus the outstanding amount of Approvals, minus

(ii)the aggregate outstanding principal amount of Obligations, minus

(iii)the amount of any Reserves.

“Borrowing Base” means the sum of the following:

(i)the applicable Advance Rate multiplied by the invoice amount of the applicable Eligible Inventory Collateral, subject to the following;

(a) if the Fixed Charge Coverage ratio is equal to or greater than 1.2x and TTM EBITDA is equal to or greater than twenty five million dollars ($25,000,000.00), in each case as shown on the most recent Trigger Compliance Certificate delivered pursuant to Section 8(i) hereof, 100% of the applicable Advance Rate multiplied by the invoice amount of the applicable Eligible Inventory Collateral shown on the most recent inventory certificate (“Total Eligible Inventory”), or

(b) if the Fixed Charge Coverage ratio is less than 1.2x or TTM EBITDA is less than twenty five million dollars ($25,000,000.00), in each case as shown on the most recent Trigger Compliance Certificate delivered pursuant to Section 8(i) hereof, 100% of the applicable Advance Rate multiplied by the invoice amount of the applicable Total Eligible Inventory shown on the most recent inventory certificate, less the lesser of (x) twenty million dollars ($20,000,000.00) or (y) 10% of Total Eligible Inventory shown on such inventory certificate (such lesser amount, the “Collateral Block”) ((a) or (b), as applicable, the “Net Eligible Inventory Amount”),

2

(ii)80% of the net amount of Eligible Accounts; plus

(iii)50% of the invoice amount of Eligible Parts.

“Borrowing Base Certificate” means a complete certificate, executed by an officer of Dealer Representative in the form set forth on Exhibit G indicating the Borrowing Base and the calculations used to determine such amounts.

“Business Day” means any day the Federal Reserve Bank of Chicago is open for the transaction of business.

“Capital Expenditures” means with respect to any Person, all expenditures (by the expenditure of cash or the incurrence of Debt) by such Person during any measuring period for any fixed assets or improvements or for replacements, substitutions or additions thereto that have a useful life of more than one year and that are required to be capitalized under GAAP, but excluding from such calculation expenditures made with the cash proceeds received by Dealer from any insurance claim payable by reason of theft, loss, physical damage or similar event with respect to any of Dealer’s respective property or assets.

“CDF” has the meaning set forth in the Preamble of this Agreement.

“Charges” has the meaning set forth in Section 10(a) of this Agreement.

“Closing Date” means the date of this Agreement.

“Closing Date Guaranty Agreement” means that certain Guaranty executed by KCS RE and Wave Aviation in favor of Agent for the benefit of Lenders as of the date hereof.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Collateral” means all personal property of each Dealer, whether such property or such Dealer’s right, title or interest therein or thereto is now owned or existing or hereafter acquired or arising, and wherever located, including without limitation, all Accounts, Inventory, Equipment, other Goods, General Intangibles (including without limitation, Payment Intangibles), Chattel Paper (whether tangible or electronic), Instruments (including without limitation, Promissory Notes), Deposit Accounts, Investment Property and Documents, any cash collateral such Dealer may have paid to Agent, and all Products and Proceeds of the foregoing; provided that “Collateral” shall exclude (a) all Fixtures (other than Goods affixed to Inventory) and (b) all equipment leases and agreements between Dealers and vendors, but only to the extent such leases and agreements prohibit or restrict such Dealers from granting a security interest therein and such prohibition or restriction is not ineffective under Article 9 of the Illinois Uniform Commercial Code or any other applicable law, rule or regulation; provided, further, that “Collateral” shall include (x) all Accounts and General Intangibles arising under such equipment leases and agreements between Dealers and vendors and (y) all payments and other property received or receivable in connection with any sale or other disposition of such leases and agreements. Without limiting the foregoing, the Collateral includes each Dealer’s right to all Vendor Credits. Similarly, the Collateral includes, without limitation, all books and records, electronic or otherwise, which evidence or otherwise relate to any of the foregoing property, and all computers, disks, tapes, media and other devices in which such records are stored. For purposes of this definition only, capitalized terms used in this definition, which are not otherwise defined, shall have the meanings given to them in Article 9 of the Illinois Uniform Commercial Code.

“Collateral Block” has the meaning set forth in the definition of Borrowing Base.

“Collections” mean all monies that Agent receives from a Dealer or other sources (other than Lenders) on account of the Obligations.

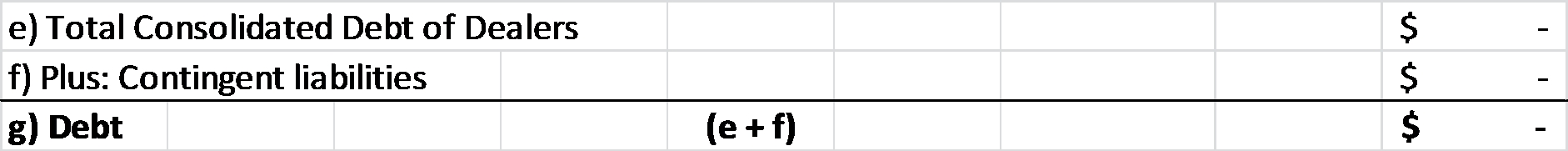

“Contingent Liabilities” means any obligation, contingent or otherwise, of any Dealer guaranteeing or having the economic effect of guaranteeing any Debt or obligation of another in any manner, whether directly or indirectly, including without limitation any obligation of such Dealer, direct or indirect, (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Debt or any security for the payment thereof, (b) to purchase property or services for the purpose of assuring the owner of such Debt of its payment, or (c) to maintain the solvency, working capital, equity, cash flow, fixed charge or other coverage ratio, or any other financial condition of the primary obligor so as to enable the primary obligor to pay any Debt or to comply with any agreement relating to any Debt or obligation.

3

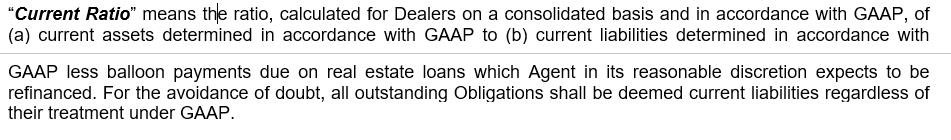

“Current Ratio” means the ratio, calculated for Dealers on a consolidated basis and in accordance with GAAP, of (a) current assets determined in accordance with GAAP to (b) current liabilities determined in accordance with GAAP less balloon payments due on real estate loans which Agent in its reasonable discretion expects to be refinanced. For the avoidance of doubt, all outstanding Obligations shall be deemed current liabilities regardless of their treatment under GAAP.

“Daily Interest” means, with respect to a Lender, for each calendar day of each calendar month, the product of: (a) the outstanding principal amount of Outstandings that are actually funded by Lender pursuant to this Agreement, multiplied by (b) the applicable interest rate set forth in Section 2(a)(vi) of this Agreement.

“Dealer Affiliate” means any Affiliate of a Dealer.

“Dealer Materials” has the meaning set forth in Section 33 of this Agreement.

“Dealer Representative” has the meaning set forth in Section 31(b) of this Agreement.

“Dealers” has the meaning set forth in the Preamble of this Agreement.

“Debt” means all obligations, contingent or otherwise of Dealers which, in accordance with GAAP, should be classified on the balance sheet as liabilities, and in any event including capital leases, Contingent Liabilities that are required to be disclosed and quantified in notes to financial statements in accordance with GAAP, and liabilities secured by any Lien on any property regardless of whether such secured liability is with or without recourse.

“Default” has the meaning set forth in Section 12 of this Agreement.

“Default Notice” means written notice from a Dealer received by Agent’s account manager for Dealer or any officer of Agent, specifically advising Agent of the existence of a Default.

“Default Rate” means the lesser of 3% per annum above the rate in effect immediately prior to the Default or the highest lawful contract rate of interest permitted under applicable law.

“Disputes” has the meaning set forth in Section 30(a) of this Agreement.

“Disqualified Person” has the meaning set forth in Section 20(b) of this Agreement.

“Eligible Accounts” has the meaning set forth in Section 2(e) of this Agreement.

“Eligible Inventory Collateral” means all marine product inventory of the Dealers (other than (i) spare parts, (ii) inventory held by KCS, and (iii) inventory held by MarineMax Products, Inc.) that is eligible for inclusion in the Borrowing Base pursuant to the requirements of this Agreement and the Program Terms Letter.

“Eligible Parts” means spare parts inventory of the Dealers that (a) is new, (b) is not subject to or encumbered by any Lien or security interest other than a Lien permitted pursuant to Section 6(a), and (c) has been held in inventory for no more than 12 months.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time

“ERISA Affiliate” shall mean any trade or business (whether or not incorporated) under common control with any Dealer within the meaning of Section 414(b) or (c) of the Code (and Sections 414(m) and (o) of the Code for purposes of provisions relating to Section 412 of the Code) or Section 4001 of ERISA.

“ERISA Event” shall mean (a) any of the events set forth in Section 4043(c) of ERISA, other than events for which the 30 day notice period has been waived, with respect to a pension plan; (b) a withdrawal by any Dealer or any ERISA Affiliate from a pension plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer (as defined in Section 4001(a)(2) of ERISA) or a cessation of operations that is treated as such a withdrawal under Section 4062(e) of ERISA; (c) a complete or partial withdrawal by any Dealer or any ERISA Affiliate from a multi-employer plan or notification that a multi-employer plan is in reorganization; (d) the filing of a notice of intent to terminate, the treatment of a plan amendment as a termination under Sections 4041 or 4041A of ERISA, or the commencement of proceedings by the Pension Benefit Guaranty Corporation to terminate a pension plan or multi-

4

employer plan; (e) an event or condition which constitutes grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any pension plan or multi-employer plan; or (f) the imposition of any liability under Title IV of ERISA, other than for Pension Benefit Guaranty Corporation premiums due but not delinquent under Section 4007 of ERISA, upon any Dealer or any ERISA Affiliate.

“Erroneous Payment” has the meaning set forth in Section 3(c) of this Agreement.

“Erroneous Payment Deficiency Assignment” has the meaning set forth in Section 3(c) of this Agreement.

“Erroneous Payment Return Deficiency” has the meaning set forth in Section 3(c) of this Agreement.

“Existing Financing Agreement” has the meaning set forth in the Recitals of this Agreement.

“FAA” has the meaning set forth in Section 30(f) of this Agreement.

“FCPA” means the United States Foreign Corrupt Practices Act of 1977.

“Federal Funds Rate” means, for any day, the rate per annum equal to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System, as published by the Federal Reserve Bank of New York on the Business Day next succeeding such day, provided that if such rate is not so published for any day which is a Business Day, the Federal Funds Rate for such day shall be the average of the quotation for such day on such transactions received by Xxxxx Fargo Bank, National Association from three federal funds brokers of recognized standing selected by Xxxxx Fargo Bank, National Association. Notwithstanding the foregoing, if the Federal Funds Rate shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement.

“Fixed Charge Coverage Ratio” means the ratio of (a) TTM EBITDA less Capital Expenditures for the trailing twelve month period (to the extent not financed) to (b) Fixed Charges for the trailing twelve month period.

“Fixed Charges” means cash interest plus scheduled principal payments plus income taxes paid in cash plus dividends and distributions.

“Foreign OEM” means an original manufacturer whose primary headquarters or primary operations are located outside of the United States, including without limitation Alexander Marine Company, Ltd., Galeon, LLP, Azimut-Benetti S.p.A, and Sino Eagle Yacht Co., Ltd.

“Free Floor Period” means a period equal to the number of days during which a Vendor agrees to assume the cost of financing Collateral purchased by a Dealer by granting Agent a Vendor Credit.

“Funded Debt” of any Person means without duplication, (a) all indebtedness of such Person for borrowed money, (b) all indebtedness evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person as lessee under capital leases which have been or should be recorded as liabilities on a balance sheet of such Person in accordance with GAAP, (d) all obligations of such Person to pay the deferred purchase price of property or services (excluding (i) trade accounts payable in the ordinary course of business and compensation or bonus arrangements with persons who are employees or independent contractors of a person, and (ii) any obligation under this Agreement or any other inventory financing agreement among Dealers and CDF), (e) all indebtedness secured by a Lien on the property of such Person, whether or not such indebtedness shall have been assumed by such Person; provided that if such Person has not assumed or otherwise become liable for such indebtedness, such indebtedness shall be measured at the fair market value of such property securing such indebtedness at the time of determination, (f) all obligations, contingent or otherwise, with respect to the face amount of all letters of credit (whether or not drawn), bankers’ acceptances and similar obligations issued for the account of such Person, (g) all hedging obligations of such Person, (h) all Contingent Liabilities of such Person, (i) all debt of any partnership of which such Person is a general partner, (j) all non-compete payment obligations, earn-outs and similar obligations and (k) any Stock or other equity instrument, whether or not mandatorily redeemable, that under GAAP is characterized as debt, whether pursuant to financial accounting standards board issuance No. 150 or otherwise.

“Future Advances” means any amount that CDF is obligated to pay to a Vendor pursuant to this Agreement within a certain period after an Approval is issued by CDF.

5

“GAAP” means generally accepted accounting principles as of the Closing Date. Notwithstanding anything to the contrary, leases shall continue to be classified and accounted for on a basis consistent with that reflected in the financial statements delivered pursuant to Section 8(a) for the fiscal year ending September 30, 2018, including without limitation for purposes of calculating TTM EBITDA and the Fixed Charge Coverage Ratio, without giving effect to any change in accounting treatment of “operating” and “capital” leases scheduled to become effective for fiscal years beginning after December 15, 2018 as set forth in the Accounting Standards Update No. 2016-02, Leases (Topic 842), issued by the Financial Accounting Standards Board in February 2016, 0r any similar publication issued by the Financial Accounting Standards Board in connection therewith, in each case if such change would require treating any lease (or similar arrangement conveying the right to use) as a capital lease where such lease (or similar arrangement) was not required to be so treated under GAAP as in effect prior to December 15, 2018..

“Governmental Authority” means any nation, sovereign or government, any state or other political subdivision thereof, any agency, authority or instrumentality thereof and any entity or authority exercising executive, legislative, taxing, judicial, regulatory or administrative functions of or pertaining to government, including any central bank, stock exchange, regulatory body, arbitrator, public sector entity, and supra-national entity.

“Guarantor” means (a) each Person that guaranties all or a portion of the Obligations, including KCS RE and Wave Aviation under the Closing Date Guaranty Agreement, and (b) each other Person that becomes a guarantor after the Closing Date pursuant to Section 6(d)(iv) of this Agreement or otherwise.

“Intervening Default” has the meaning set forth in Section 2(a)(iv) of this Agreement.

“Inventory Sublimit” means the specific sublimits set forth in the section entitled “Total Eligible Inventory Sublimits” in the Program Terms Letter.

“Investment” means any direct or indirect investment in any Person, including contributions of capital or assets to any Person, investments in or the acquisition of debt securities or equity interests of any Person, or any loans, advances or other extensions of credit to any Person, including any guarantee of obligations of another Person.

“Invoice” means any invoice issued by a Vendor related to an Approval.

“Kawasaki” means Kawasaki Motors Finance Corporation.

“Kawasaki Intercreditor” means that certain Intercreditor Agreement by and among Agent and Kawasaki to be entered into by and between Agent and Kawasaki following the Closing Date, as it may be amended, restated, amended and restated, supplemented or otherwise modified from time to time as permitted therein.

“Kawasaki Reserve” means a reserve in an amount equal to five hundred thousand dollars ($500,000.00).

“KCS” means KCS International Inc., a Wisconsin corporation.

“KCS RE” means KCS RE Acquisition Company, LLC, a Wisconsin limited liability company.

“KCS Vendor Agreement” means, collectively, that certain (i) Amended and Restated Vendor Agreement dated as of August 6, 2020 between CDF and KCS, and (ii) Amended and Restated Vendor Agreement dated as of August 4, 2020 between Xxxxx Fargo Capital Finance Corporation Canada and KCS, as each may be amended, restated, amended and restated, supplemented or otherwise modified from time to time.

“Lender Affiliate” means the Affiliate of a Lender.

“Lender Credit” has the meaning set forth in Section 3(a) of this Agreement.

“Lender Rate” means the Dealer Rate as set forth in the Program Terms Letter less any applicable Performance Rebate as set forth in the Program Terms Letter.

“Lenders” has the meaning set forth in the Preamble of this Agreement.

6

“LIBOR” means the greater of (a) the London Interbank Offered Rate (in U.S. dollar deposits) for a term of one month as published in the Money Rates column of The Wall Street Journal on the first Business Day of each calendar month, plus required regulatory reserves, if applicable (or any Benchmark Replacement as determined pursuant to Section 3(c) of this Agreement) or (b) 0.75%.

“Liens” has the meaning set forth in Section 6(a) of this Agreement.

“Loan Document” means this Agreement, any Program Terms Letter or Transaction Statement entered into pursuant to this Agreement, the Closing Date Guaranty Agreement, and all documents delivered to Agent and/or any Lender in connection with any of the foregoing.

“Loans” has the meaning set forth in Section 2(a)(i) of this Agreement.

“Material Adverse Effect” means a material adverse effect in (a) Dealers’ business, operations or financial condition, taken as a whole, (b) the performance and enforceability of this Agreement, (c) any portion of the Collateral in excess of one million dollars ($1,000,000.00), or (d) the perfection and priority of Agent’s Liens in the Collateral.

“Maximum Aggregate Credit Amount” means an aggregate total of five hundred million dollars ($500,000,000.00).

“Monthly Interest” means, with respect to each Lender, for each calendar month, the sum of the Daily Interest for each calendar day of such calendar month.

“MM Vendor Guaranty” means, collectively, that certain (i) Guaranty executed by MarineMax, Inc. in favor of Xxxxx Fargo Commercial Distribution Finance, LLC dated on or about the date of the Third Omnibus Amendment Closing Date, as it may be amended, restated, amended and restated, supplemented or otherwise modified from time to time and (ii) Guarantee executed by MarineMax, Inc. in favor of Xxxxx Fargo Capital Finance Corporation Canada dated on or about the date of the Third Omnibus Amendment Closing Date, as it may be amended, restated, amended and restated, supplemented or otherwise modified from time to time.

“Net Eligible Inventory Amount” has the meaning set forth in the definition of Borrowing Base.

“Non-Funding Lender” means any Lender that has (a) failed to fund any payments required to be made by it under the Loan Documents within two (2) Business Days after any such payment is due (excluding expense and similar reimbursements that are subject to good faith disputes), (b) given written notice (and Agent has not received a revocation in writing), to Agent, any Lender, or Dealer, or has otherwise publicly announced (and Agent has not received notice of a public retraction) that such Lender believes it will fail to fund payments required to be funded by it under the Loan Documents or (c) (or any Person that directly or indirectly controls such Lender has), (i) become subject to a voluntary or involuntary case under the Federal Bankruptcy Reform Act of 1978, or any similar bankruptcy laws, (ii) a custodian, conservator, receiver or similar official appointed for it or any substantial part of such Person’s assets, or (iii) made a general assignment for the benefit of creditors, been liquidated, or otherwise been adjudicated as, or determined by any Governmental Authority having regulatory authority over such Person or its assets to be, insolvent or bankrupt, and for this clause (c), Agent has determined that such Lender is reasonably likely to fail to fund any payments required to be made by it under the Loan Documents.

“Obligations” means all indebtedness and other obligations of any nature whatsoever of each Dealer to Agent, Lenders and/or a Lender Affiliate, arising under this Agreement or any other Loan Document, and whether for principal, interest, fees, expenses, indemnification obligations or otherwise, and whether such indebtedness or other obligations are existing, future, direct, indirect, acquired, contractual, noncontractual, joint and/or several, fixed, contingent or otherwise.

“OFAC” shall mean the U.S. Department of the Treasury’s Office of Foreign Assets Control.

“Other Lender” has the meaning set forth in Section 22(a)(i) of this Agreement.

“Outstandings” means, at any time, an amount equal to the aggregate unpaid principal amount of all Loans.

“Participant Register” has the meaning set forth in Section 20(h) of this Agreement.

“Payment Default” means any failure by Dealers to make any payment with respect to the Obligations by the date due and after any applicable grace period under the applicable Loan Document (such date being the “Final Payment

7

Date”). Payment Default shall not mean, and shall exclude, any deductions, offsets or other disputes made or asserted by a Dealer which are accepted by or under negotiation with Agent.

“Payment Recipient” has the meaning set forth in Section 3(c) of this Agreement.

“Performance Rebate” has the meaning set forth in the Program Terms Letter.

“Permitted Discretion” means a determination made in good faith and in the exercise of reasonable (from the perspective of a secured asset-based lender) business judgment.

“Permitted Locations” has the meaning set forth in Section 6(b)(xiii) of this Agreement.

“Person” means any individual, partnership, corporation (including a business trust and a public benefit corporation), joint stock company, estate, association, firm, enterprise, trust, limited liability company, unincorporated association, joint venture and any other entity or Governmental Authority.

“Platform” has the meaning set forth in Section33 of this Agreement.

“Post-Close Period” has the meaning set forth in Section 6(b)(xvii) of this Agreement.

“Public Lender” has the meaning set forth in Section 33 of this Agreement.

“Pre-Owned Inventory Reserve” has the meaning set forth in the section entitled “Inventory Advance Rate” in the Program Terms Letter.

“Prime Rate” means, for any calendar month, an interest rate (calculated on a 360-day year basis as set forth herein) equal to the highest “prime rate” as published in the “Money Rates” column of The Wall Street Journal on the first Business Day of such month; if for any reason such rate is no longer published in The Wall Street Journal, Lender shall select such replacement index as Lender in its sole discretion determines most closely approximates such rate.

“Principal” has the meaning set forth in Section 31(b) of this Agreement.

“Program Terms Letter” means the Seventh Amended and Restated Program Terms Letter, dated as of the Closing Date, between the Dealers and Agent (as further amended, restated, amended and restated, supplemented or otherwise modified from time to time).

“Ratable Share” means, with respect to each Lender, the percentage equal to such Lender’s Allocation divided by the Maximum Aggregate Credit Amount, as such percentage is set forth opposite such Lender’s name on Exhibit D hereto, under the heading “Ratable Share”, and as such percentage may be reduced or increased from time to time in accordance with this Agreement.

“Related Persons” means, with respect to any Person, each Affiliate of such Person and each director, officer, employee, agent, trustee, representative, attorney, accountant and each insurance, environmental, legal, financial and other advisor (including those retained in connection with the satisfaction or attempted satisfaction of any condition precedent to the execution of this Agreement) and other consultants and agents of or to such Person or any of its Affiliates.

“Rent Reserve” means reserves instituted by Agent in its Permitted Discretion in an amount not to exceed the aggregate of three months’ rent with respect to each leased Collateral location for which the applicable landlord has not executed and delivered to Agent an agreement, in form and substance acceptable to Agent, subordinating such landlord’s lien in the Collateral and providing Agent reasonable access to such Collateral.

“Replacement Lender” has the meaning set forth in Section 22(b) of this Agreement.

“Reporting Date” means (a) each Tuesday that this Agreement is in effect or, if such Tuesday is not a Business Day, the next succeeding Business Day, or (b) any other Business Day selected by Agent in its reasonable discretion. Agent and Lenders hereby acknowledge and agree that the Ratable Shares set forth in Exhibit D attached hereto

8

shall not take effect until the first Reporting Date after the date hereof. Until such Reporting Date, the Ratable Shares of Lenders immediately prior to the date of this Agreement shall continue to be in effect.

“Required Lenders” means Lenders whose aggregate Ratable Share exceeds 50%; provided, however, if there are two or more Lenders, Required Lenders shall mean no less than two unaffiliated Lenders.

“Reserves” means, as of any date of determination, any Kawasaki Reserves, Pre-Owned Inventory Reserves and Rent Reserves.

“Sale” has the meaning set forth in Section 20(b) of this Agreement.

“SPV” means any Person established by Agent, a Lender or a Lender Affiliate, as a bankruptcy-remote special purpose vehicle and identified as such in a writing by any Lender to Agent.

“Start Date” has the meaning set forth in Section 10(a) of this Agreement.

“Stock” means all shares of capital stock (whether denominated as common stock or preferred stock), equity interests, beneficial, partnership or membership interests, joint venture interests, participations or other ownership or profit interests in or equivalents (regardless of how designated) of or in a Person (other than an individual), whether voting or non-voting.

“Tangible Net Worth” means the shareholders’ equity of Dealers on a consolidated basis, determined in accordance with GAAP, minus items treated as intangible assets under GAAP, amounts owing by any employee, officer or other Dealer Affiliate, other than draws to commissioned and seasonally compensated employees and advances made for customary travel expenses incurred in the conduct of Dealers’ business, and any other assets that cannot be identified as tangible assets to Agent’s reasonable satisfaction.

“Third Omnibus Amendment Closing Date” means May 2, 2021.

“Total Eligible Inventory” has the meaning set forth in the definition of Borrowing Base.

“Transaction Statement” has the meaning set forth in Section 3(a) of this Agreement.

“TTM EBITDA” shall mean consolidated net income plus the sum of taxes, interest, depreciation and amortization, and one-time costs related to acquisitions plus non-cash stock-based compensation less non-recurring gains or non-cash items increasing net income and tax credits to the extent they increased net income for the trailing twelve month period.

“UCC” means the Uniform Commercial Code as enacted and amended in the State of Illinois, and as may be further amended from time to time, or any other Uniform Commercial Code which governs the creation or perfection of the Liens granted hereunder.

“USA&M” has the meaning set forth in Section 30(b) of this Agreement.

“USA PATRIOT Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (Title III of Pub. L. No. 107- 56 (signed into law October 26, 2001)).

“Vehicle Certification” means the (1) California Vehicle Dealer, Vehicle Rental Company or Affiliate Certification, (2) New York Vehicle Dealer, Rental Vehicle Company or Affiliate Certificate, and (3) such other vehicle certifications which may be required to be delivered to Agent from time to time, each in form and substance satisfactory to Agent.

“Vendor Credits” means all of each Dealer’s rights to any price protection payments, rebates, discounts, credits, factory holdbacks, incentive payments and other amounts which at any time are due a Dealer from a Vendor.

“Vendors” means all manufacturers and vendors from which Dealers purchase inventory.

“Wave Aviation” means Wave Aviation LLC, a Florida limited liability company.

9

2.Extensions of Credit.

(a)Advances.

(i)Subject to the terms and conditions of this Agreement (including, without limitation, Sections 2(a)(iv) and (v) below), the Lenders severally and not jointly agree to make available to Dealers extensions of credit (“Loans”) in an amount equal to each such Lender’s Ratable Share of such Loan to any one or more Dealers on a revolving basis in such amounts as Dealers may from time to time request up to the amount of Availability to purchase inventory, which will be subject to a purchase money security interest in favor of Agent, as collateral agent for Lenders, and for other general corporate purposes not in violation of law. With respect to each request by Dealers for a Loan, Agent will calculate the components of Availability as of the date of issuance of an Approval by Agent with respect to such request based upon (A) with respect to Borrowing Base, the most recent Borrowing Base Certificate delivered in accordance with Section 8(f) of this Agreement acceptable to Agent in its reasonable discretion and (B) with respect to the outstanding amount of Approvals, the outstanding principal amount of Obligations and the amount of any Reserves, the applicable amount of each as of such date. For the avoidance of doubt, the principal amount outstanding under the Existing Financing Agreement as of the close of business on the date hereof shall be deemed a Loan outstanding under this Agreement, and shall be subject to the funding procedure set forth in Section 2(a)(v) below on the first Reporting Date following the Closing Date.

(ii)(A) Repayments from time to time of the outstanding balance of the indebtedness hereunder shall be available to be re-borrowed pursuant to the terms and conditions of this Agreement; (B) no Loan will be made to the extent such Loan would cause any Lender to have outstanding Loans in a principal amount in excess of such Lender’s Allocation; (C) if the Obligations hereunder outstanding at any time or from time to time exceed the lesser of (I) the Maximum Aggregate Credit Amount minus the outstanding amount of Approvals and any Reserves and (II) the Borrowing Base minus any Reserves, Dealers shall immediately (but in any event within two (2) Business Days) pay the amount of such excess to Agent for the benefit of Lenders; provided that, in its reasonable discretion, Agent may cause the Lenders to immediately cease to make Loans and/or Agent may immediately cease to issue Approvals until such repayment occurs; (D) if the Obligations outstanding at any time or from time to time with respect to any specific category of inventory exceed any applicable Inventory Sublimit, Dealers shall immediately (but in any event within two (2) Business Days) pay the amount of such excess to Agent for the benefit of Lenders; and (E) notwithstanding anything else contained in this Agreement, (I) in its reasonable discretion, Agent may cause the Lenders to immediately cease to make any Loans and/or Agent may immediately cease to issue Approvals (x) upon the occurrence and during the continuance of any Default or upon the occurrence and during the continuance of any event which, with the giving of notice, the passage of time, or both would result in a Default, or (y) if any remittance for any Obligations is dishonored when first presented for payment, until such payment is honored, and (II) upon termination of this Agreement, Dealers shall repay to Agent on behalf of Lenders all Obligations hereunder, plus interest accrued to the date of payment.

(iii)In addition to all other requirements of this Agreement, but subject to Section 2(a)(iv), below, each Lender’s obligation to make each Loan is subject to the fulfillment or waiver of each and every of the following conditions prior to or contemporaneously with the making of each and every such Loan:

(A)each representation and warranty made to Agent and Lenders by or on behalf of any Dealer is true and correct as of the date hereof, except to the extent that such representation or warranty expressly relates to an earlier date, in which event such representation or warranty was true and correct as of such earlier date; and

(B)neither a Default nor any event which with the giving of notice, the passage of time or both would result in a Default has occurred and is continuing or would reasonably be expected to result after giving effect to the Loan requested.

(iv)Each Lender shall have the obligation to fund its Ratable Share of a Loan upon issuance by CDF of an Approval. Lenders acknowledge and agree that: (A) CDF typically issues Approvals on a date (each, an “Approval Date”) prior to the date CDF is required actually to fund the Loan (each, an “Advance Date”) that is based on such Approval, (B) once an Approval has been issued, and the Vendor receiving such Approval shall have shipped its product based thereon, CDF may deem itself obligated to fund the related Loan on the Advance Date, notwithstanding any Automatic Default, Payment Default, Default Notice or other Default that may arise on or prior to an Approval Date (each, an “Intervening Default”), and (C) each Lender shall be obligated to fully fund in cash such Lender’s Ratable Share in any Loans which derive from all Approvals issued by CDF in good faith, as well as any Approvals and Future Advances based thereon, notwithstanding any Intervening Default.

10

(v)On each Reporting Date on or before 2:00 p.m. central time, Agent shall deliver notice to each Lender of the amount of Loans Lender has funded and such Lender’s Ratable Share multiplied by Outstandings, and: (A) if the amount of Loans Lender has funded is less than Lender’s Ratable Share multiplied by the Outstandings calculated as of such Reporting Date, then Lender shall remit such deficiency to Agent (on behalf of CDF) by 5:00 p.m. central time on the Business Day immediately following such Reporting Date, and (B) if the amount of Loans Lender has funded is more than Lender’s Ratable Share multiplied by the Outstandings calculated as of such Reporting Date, then Agent (on behalf of CDF) will remit such excess to such Lender by 5:00 p.m. central time on the Business Day immediately following such Reporting Date. Each payment due to Agent or Lenders will be paid in immediately available funds according to the electronic transfer instructions set forth on Exhibit E attached hereto, and, if not timely paid in accordance with this Agreement, will bear interest until paid at a rate per annum equal to the Lender Rate. If CDF is acting as Agent, it shall be deemed to have paid its deficiency or received its excess as set forth above on each Reporting Date. Each Lender hereby waives any right it may now or in the future have to set-off its obligation to make any payment to CDF or Agent under this Agreement against any obligation of CDF or Agent to such Lender, whether under this Agreement or any other agreement between CDF and such Lender or Agent and such Lender.

(vi)The amount of Loans each Lender has funded shall bear interest at the Lender Rate, as such rate may change pursuant to the terms of the applicable Program Terms Letter. Interest will be computed on the basis of a 360-day year and assess for the actual number of days elapsed. Provided Lender is not a Non-Funding Lender, then the amount of Monthly Interest, if any, payable to Lender, less any Administrative Fee due to Agent pursuant to a Fee Letter between Agent and Lender, shall be distributed by Agent to Lender monthly in arrears on the latter of: (A) the fifteenth (15th) day of the applicable month, or if the fifteenth (15th) is not a Business Day, the next succeeding Business Day, or (B) within five (5) Business Days after Agent’s receipt thereof from all Dealers. To the extent that Lender is entitled to receive interest income in excess of the Monthly Interest, if such additional interest has not previously been distributed to Lender, then Lender shall be entitled to receive an additional payment from Agent equivalent to Lender’s Ratable Share of such interest income. Any amounts due to Lender for income in excess of the Monthly Interest shall be reflected and paid with Monthly Interest as set forth above. Lenders acknowledge and agree that the rate of return paid on any Loan is dependent on numerous factors, including discounts and subsidies offered by Vendors. Application of any Collections received by Agent as interest in cash or good collected funds representing payment of interest on the Loans may result in the payment of interest to Lender in excess of the rate set forth in this subsection.

(vii)Provided a Lender is not a Non-Funding Lender, any Collections received by Agent in good collected funds representing payment of any part of the Unused Line Fee (as described in the Program Terms Letter) shall be paid by Agent to each Lender in an amount equal to such Lender’s Ratable Share monthly in arrears, with Monthly Interest as set forth in Section 2(a)(vi).

(viii)Lenders acknowledge that Dealers may be entitled to receive a Performance Rebate on a calendar quarter basis pursuant to the terms of the Program Terms Letter. Notwithstanding anything contained herein to the contrary, if the Performance Rebate is not earned by or otherwise paid to Dealers during any calendar quarter, each Lender may be entitled to receive an additional payment from Agent equivalent to such Lender’s share of such portion of the Performance Rebate not earned by or otherwise paid to Dealers. Any amounts due to Lenders under this Section 2(a)(viii) shall be reflected in a notice to be delivered in the manner set forth in Section 2(a)(v) of this Agreement within forty-five (45) days following the end of the applicable calendar quarter.

(ix)As of the Closing Date, all outstanding advances under the Existing Financing Agreement shall be deemed Loans under this Agreement.

(b)Advance Rates. The advance rates with respect to inventory as well as additional details of the financing program are set forth in the Program Terms Letter, the terms of which are incorporated herein by this reference. This Agreement concerns the extension of credit, and not the provision of goods or services.

(c)Erroneous Payments.

(i)Each Lender, each other secured party, and any other party hereto hereby severally agrees that if (A) the Agent notifies (which such notice shall be conclusive absent manifest error) such Lender or any other secured party (or the Lender Affiliate of a secured party) or any other Person that has received funds from the Agent or any of its Affiliates, either for its own account or on behalf of a Lender, or other secured party (each such recipient, a “Payment Recipient”), that the Agent has determined in its sole

11

discretion that any funds received by such Payment Recipient were erroneously transmitted to, or otherwise erroneously or mistakenly received by, such Payment Recipient (whether or not known to such Payment Recipient) or (B) any Payment Recipient receives any payment from the Agent (or any of its Affiliates) (1) that is in a different amount than, or on a different date from, that specified in a notice of payment, prepayment or repayment sent by the Agent (or any of its Affiliates) with respect to such payment, prepayment or repayment, as applicable, (2) that was not preceded or accompanied by a notice of payment, prepayment or repayment sent by the Agent (or any of its Affiliates) with respect to such payment, prepayment or repayment, as applicable, or (3) that such Payment Recipient otherwise becomes aware was transmitted or received in error or by mistake (in whole or in part) then, in each case, an error in payment shall be presumed to have been made (any such amounts specified in clauses (A) or (B) of this Section 2(c)(i), whether received as a payment, prepayment or repayment of principal, interest, fees, distribution or otherwise; individually and collectively, an “Erroneous Payment”), then, in each case, such Payment Recipient is deemed to have knowledge of such error at the time of its receipt of such Erroneous Payment; provided that nothing in this Section 2(c) shall require the Agent to provide any of the notices specified in clauses (A) or (B) above. Each Payment Recipient agrees that it shall not assert any right or claim to any Erroneous Payment, and hereby waives any claim, counterclaim, defense or right of set-off or recoupment with respect to any demand, claim or counterclaim by the Agent for the return of any Erroneous Payments, including without limitation waiver of any defense based on “discharge for value” or any similar doctrine.

(ii)Without limiting the immediately preceding clause (i), each Payment Recipient agrees that, in the case of clause (i)(B) above, it shall promptly notify the Agent in writing of such occurrence.

(iii)In the case of either clause (i)(A) or (i)(B) above, such Erroneous Payment shall at all times remain the property of the Agent and shall be segregated by the Payment Recipient and held in trust for the benefit of the Agent, and upon demand from the Agent such Payment Recipient shall (or, shall cause any Person who received any portion of an Erroneous Payment on its behalf to), promptly, but in all events no later than one Business Day thereafter, return to the Agent the amount of any such Erroneous Payment (or portion thereof) as to which such a demand was made in same day funds and in the currency so received, together with interest thereon in respect of each day from and including the date such Erroneous Payment (or portion thereof) was received by such Payment Recipient to the date such amount is repaid to the Agent at the greater of the Federal Funds Rate and a rate determined by the Agent in accordance with banking industry rules on interbank compensation from time to time in effect.

(iv)In the event that an Erroneous Payment (or portion thereof) is not recovered by the Agent for any reason, after demand therefor by the Agent in accordance with the immediately preceding clause (iii), from any Lender that is a Payment Recipient or an Affiliate of a Payment Recipient (such unrecovered amount as to such Lender, an “Erroneous Payment Return Deficiency”), then at the sole discretion of the Agent and upon the Agent’s written notice to such Lender, such Lender shall be deemed to have made a cashless assignment of the full face amount of the portion of its Loans (but not its Allocation commitment) with respect to which such Erroneous Payment was made to the Agent or, at the option of the Agent, the Agent’s applicable lending affiliate in an amount that is equal to the Erroneous Payment Return Deficiency (or such lesser amount as the Agent may specify) (such assignment of the Loans (but not Allocation commitment), the “Erroneous Payment Deficiency Assignment”) plus any accrued and unpaid interest on such assigned amount, without further consent or approval of any party hereto and without any payment by the Agent or its applicable lending affiliate as the assignee of such Erroneous Payment Deficiency Assignment. Without limitation of its rights hereunder, the Agent may cancel any Erroneous Payment Deficiency Assignment at any time by written notice to the applicable assigning Lender and upon such revocation all of the Loans assigned pursuant to such Erroneous Payment Deficiency Assignment shall be reassigned to such Lender without any requirement for payment or other consideration. The parties hereto acknowledge and agree that (A) any assignment contemplated in this clause (iv) shall be made without any requirement for any payment or other consideration paid by the applicable assignee or received by the assignor, (B) the provisions of this clause (iv) shall govern in the event of any conflict with the terms and conditions of Section 20 and (C) the Agent may reflect such assignments in any register maintained by Agent without further consent or action by any other Person.

(v)Each party hereto hereby agrees that (A) in the event an Erroneous Payment (or portion thereof) is not recovered from any Payment Recipient that has received such Erroneous Payment (or portion thereof) for any reason, the Agent (1) shall be subrogated to all the rights of such Payment Recipient with respect to such amount and (2) is authorized to set off, net and apply any and all amounts at any time owing to such Payment Recipient under any Loan Document, or otherwise payable or distributable by the Agent to such Payment Recipient from any source, against any amount due to the Agent under this Section 2(c) or

12

under the indemnification provisions of this Agreement, (B) the receipt of an Erroneous Payment by a Payment Recipient shall not for the purpose of this Agreement be treated as a payment, prepayment, repayment, discharge or other satisfaction of any Obligations owed by the Borrower or any other loan party, except, in each case, to the extent such Erroneous Payment is, and solely with respect to the amount of such Erroneous Payment that is, comprised of funds received by the Agent from the Borrower or any other loan party for the purpose of making for a payment on the Obligations and (C) to the extent that an Erroneous Payment was in any way or at any time credited as payment or satisfaction of any of the Obligations, the Obligations or any part thereof that were so credited, and all rights of the Payment Recipient, as the case may be, shall be reinstated and continue in full force and effect as if such payment or satisfaction had never been received.

(vi)Each party’s obligations under this Section 2(c) shall survive the resignation or replacement of the Agent or any transfer of right or obligations by, or the replacement of, a Lender, the termination of the Allocation commitments or the repayment, satisfaction or discharge of all Obligations (or any portion thereof) under any Loan Document.

(vii)Nothing in this Section 2(c) will constitute a waiver or release of any claim of any party hereunder arising from any Payment Recipient’s receipt of an Erroneous Payment.

(d)[reserved]

(e)Eligible Accounts.

(i)“Eligible Accounts” means all Accounts of the Dealers other than the following:

(A)Accounts created from the sale of goods and services on non-standard terms and/or that allow for payment to be made more than sixty (60) days from the date of sale;

(B)Accounts unpaid more than ninety (90) days from date of invoice;

(C)all Accounts of any obligor if fifty percent (50%) or more of the aggregate outstanding balance of such obligor’s Accounts are unpaid for more than ninety (90) days from the date of invoice;

(D)Accounts for which the obligor is an officer, director, shareholder, partner, member, owner, employee, agent, parent, subsidiary, affiliate of, or is related to any Dealer or has common shareholders, officers, directors, owners, partners or members with Dealer;

(E)consignment sales;

(F)Accounts for which the payment is or may be conditional;

(G)Accounts for which the obligor is not a commercial or institutional Person or is not a resident of the United States;

(H)Accounts with respect to which any warranty or representation provided in Subsection 2(e)(ii) is not true and correct;

(I)Accounts which represent goods or services purchased for a personal, family or household purpose;

(J)Accounts which represent goods used for demonstration purposes or loaned by any Dealer to another party;

(K)Accounts which are progress payment, barter, or contra accounts;

(L)Accounts in which CDF does not have a first priority perfect security interest therein;

(M)Accounts arising from the sale of goods other than inventory;

(N)Accounts with respect to which Agent has not completed due diligence reasonably satisfactory to Agent; and

(O)any and all other Accounts which Agent deems to be ineligible.

(ii)For each Account that Dealers include in any Borrowing Base Certificate, each Dealer represents and warrants to Agent and Lenders that at all times:

(A)such Account is genuine;

(B)such Account is not evidenced by a judgment or promissory note or similar instrument or agreement;

(C)such Account represents an undisputed bona fide transaction completed in accordance with the terms of the invoices and purchase orders relating thereto;

(D)the goods sold or services rendered which resulted in the creation of such Account have been delivered or rendered to and accepted by the obligor;

13

(E)the amounts shown on the Borrowing Base Certificate, Dealers’ books and records and all invoices and statements delivered to Agent with respect thereto are owing to a Dealer and are not contingent;

(F)there are no offsets, counterclaims or disputes existing or asserted with respect thereto and no Dealer has made any agreement with any obligor for any deduction or discount of the sum payable thereunder except regular discounts allowed by Dealers in the ordinary course of its business for prompt payment which have been disclosed to Agent;

(G)there are no facts or events which in any way impair the validity or enforceability thereof or reduce the amount payable thereunder from the amount shown on the Borrowing Base Certificate, such Dealer’s books and records and the invoices and statements delivered to Agent with respect thereto;

(H)all persons acting on behalf of obligors thereon have the authority to bind the obligor;

(I)the goods sold or transferred giving rise thereto were not, immediately prior to such sale or transfer, subject to any lien, claim, encumbrance or security interest which is superior to that of Agent for the benefit of Lenders; and

(J)there has been no material adverse change in the obligor’s financial condition since the creation of the Account, and there are no proceedings or actions known to Dealer which are threatened or pending against any obligor thereon which might result in any material adverse change in such obligor’s financial condition.

3.Financing Terms.

(a)Certain financial terms of any Loan made under this Agreement are set forth in the Program Terms Letter. In connection with financing an item of inventory for any Dealer, Agent, on behalf of the Lenders, will transmit or otherwise make available to such Dealer and Lenders a “Transaction Statement” which is a record that may be transmitted by Agent to such Dealer from time to time which identifies the Collateral financed and/or the advance made and the terms and conditions of repayment of such advance as provided in this Agreement. Dealers agree that a Dealer’s failure to notify Agent in writing of any objection to a Transaction Statement within thirty (30) days after a Transaction Statement is transmitted or otherwise sent to such Dealer shall constitute Dealers’ (i) acceptance thereof, (ii) agreement that the Lenders are financing such inventory at Dealers’ request, and (iii) agreement that such Transaction Statement will be incorporated herein by reference to the extent not inconsistent with the terms hereof. To the extent any Transaction Statement is inconsistent with the terms hereof, this Agreement (including any applicable Program Terms Letter) shall govern and control. If any Dealer objects to any Transaction Statement, such Dealer and Agent, on behalf of Lenders, will work in good faith to resolve such objection within sixty (60) days after the applicable Transaction Statement is transmitted or otherwise sent to such Dealer. However, notwithstanding such objection, Dealers will pay Agent on behalf of Lenders for such inventory in accordance with this Agreement. With respect to any advance made to a Vendor on behalf of a Dealer, Agent, on behalf of any one or more Lenders, may apply against any such amount owed to Vendor any amount such Lender or Lenders is owed from such Vendor with respect to Free Floor Periods (each, a “Lender Credit”) or any other amounts such Lender or Lenders is owed from such Vendor. Notwithstanding the foregoing, Dealers agree to pay the full amount reflected on any Transaction Statement. Notwithstanding anything to the contrary contained herein, including without limitation the provisions of Section 17 hereof, without the consent of Lenders, CDF may change any aspect or portion of any Transaction Statement at any time, provided that such change is not inconsistent with the terms and conditions of this Agreement.

(b)Upon receipt by Agent of a request for a Loan under and pursuant to CDF’s standard advance request procedures and the issuance of a Transaction Statement by Agent as set forth in Section 3(a) above, each Lender shall follow the funding procedures established by Agent, from time to time, and shall, as and when requested by Agent, advance funds to Agent to fund such Loan in amounts equal to such Lender’s Ratable Share of such Loan.

(c)Effect of Benchmark Transition Event.

(i)Notwithstanding anything to the contrary herein or in any other Loan Document, upon the occurrence of a Benchmark Transition Event or an Early Opt-in Election, as applicable, the Agent and the Dealers may amend this Agreement to replace LIBOR with a Benchmark Replacement. Any such amendment with respect to a Benchmark Transition Event will become effective at 5:00 p.m. on the fifth (5th) Business Day after the Agent has posted such proposed amendment to all Lenders and the Dealers so long as the Agent has not received, by such time, written notice of objection to such amendment from Lenders comprising the Required Lenders. Any such amendment with respect to an Early Opt-in Election will become effective on the date that Lenders comprising the Required Lenders have delivered to the Agent written notice that such Required Lenders accept such amendment. No replacement of LIBOR with a Benchmark Replacement pursuant to this Section titled “Effect of Benchmark Transition Event” will occur prior to the applicable Benchmark Transition Start Date.

(ii)In connection with the implementation of a Benchmark Replacement, the Agent will have the right to make Benchmark Replacement Conforming Changes from time to time and, notwithstanding anything to the contrary herein or in any other Loan Document, any amendments implementing such

14

Benchmark Replacement Conforming Changes will become effective without any further action or consent of any other party to this Agreement.

(iii)Standards for Decisions and Determinations. The Agent will promptly notify the Dealers and the Lenders of (i) any occurrence of a Benchmark Transition Event or an Early Opt-in Election, as applicable, and its related Benchmark Replacement Date and Benchmark Transition Start Date, (ii) the implementation of any Benchmark Replacement, (iii) the effectiveness of any Benchmark Replacement Conforming Changes and (iv) the commencement or conclusion of any Benchmark Unavailability Period. Any determination, decision or election that may be made by the Agent or Lenders pursuant to this Section titled “Effect of Benchmark Transition Event,” including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action, will be conclusive and binding absent manifest error and may be made in its or their sole discretion and without consent from any other party hereto, except, in each case, as expressly required pursuant to this Section titled “Effect of Benchmark Transition Event.”

(iv)Upon the Dealers’ receipt of notice (which may be via electronic means, including e-mail) of the commencement of a Benchmark Unavailability Period, the Dealers may revoke any request for a LIBOR borrowing of, conversion to or continuation of LIBOR Loans to be made, converted or continued during any Benchmark Unavailability Period and, failing that, the Dealers will be deemed to have converted any such request into a request for a Dealer of or conversion to Prime Rate Loans. During any Benchmark Unavailability Period, the component of Prime Rate based upon LIBOR, if any, will not be used in any determination of Prime Rate.

(v)As used in this Section 3(c):

(A)“Benchmark Replacement” means the sum of: (a) the alternate benchmark rate (which may include Term SOFR) that has been selected by the Agent and the Dealers giving due consideration to (i) any selection or recommendation of a replacement rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a rate of interest as a replacement to LIBOR for U.S. dollar-denominated syndicated credit facilities and (b) the Benchmark Replacement Adjustment; provided that, if the Benchmark Replacement as so determined would be less than zero, the Benchmark Replacement will be deemed to be zero for the purposes of this Agreement.

(B)“Benchmark Replacement Adjustment” means, with respect to any replacement of LIBOR with an Unadjusted Benchmark Replacement for each applicable interest period, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Agent and the Dealers giving due consideration to (i) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of LIBOR with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of LIBOR with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated syndicated credit facilities at such time.

(C)“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including timing and frequency of determining rates and making payments of interest and other administrative matters) that the Agent decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof by the Agent in a manner substantially consistent with market practice (or, if the Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Agent determines that no market practice for the administration of the Benchmark Replacement exists, in such other manner of administration as the Agent decides is reasonably necessary in connection with the administration of this Agreement).

(D)“Benchmark Replacement Date” means the earlier to occur of the following events with respect to LIBOR:

(1)in the case of clause (i) or (ii) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of LIBOR permanently or indefinitely ceases to provide LIBOR; or

(2)in the case of clause (iii) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

(E)“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to LIBOR:

(1)a public statement or publication of information by or on behalf of the administrator of LIBOR announcing that such administrator has ceased or will cease to provide LIBOR, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide LIBOR;

15

(2)a public statement or publication of information by the regulatory supervisor for the administrator of LIBOR, the U.S. Federal Reserve System, an insolvency official with jurisdiction over the administrator for LIBOR, a resolution authority with jurisdiction over the administrator for LIBOR or a court or an entity with similar insolvency or resolution authority over the administrator for LIBOR, which states that the administrator of LIBOR has ceased or will cease to provide LIBOR permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide LIBOR; or

(3)a public statement or publication of information by the regulatory supervisor for the administrator of LIBOR announcing that LIBOR is no longer representative.

(F)“Benchmark Transition Start Date” means (i) in the case of a Benchmark Transition Event, the earlier of (a) the applicable Benchmark Replacement Date and (b) if such Benchmark Transition Event is a public statement or publication of information of a prospective event, the 90th day prior to the expected date of such event as of such public statement or publication of information (or if the expected date of such prospective event is fewer than 90 days after such statement or publication, the date of such statement or publication) and (ii) in the case of an Early Opt-in Election, the date specified by the Agent or the Required Lenders, as applicable, by notice (which may be via electronic means, including e-mail) to the Dealers, the Agent (in the case of such notice by the Required Lenders) and the Lenders.

(G) “Benchmark Unavailability Period” means, if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to LIBOR and solely to the extent that LIBOR has not been replaced with a Benchmark Replacement, the period (i) beginning at the time that such Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced LIBOR for all purposes hereunder in accordance with the Section titled “Effect of Benchmark Transition Event” and (ii) ending at the time that a Benchmark Replacement has replaced LIBOR for all purposes hereunder pursuant to the Section titled “Effect of Benchmark Transition Event.”

(H)“Early Opt-in Election” means the occurrence of:

(1)(a) a determination by the Agent or (b) a notification by the Required Lenders to the Agent (with a copy to the Dealers) that the Required Lenders have determined that U.S. dollar-denominated syndicated credit facilities being executed at such time, or that include language similar to that contained in this Section titled “Effect of Benchmark Transition Event,” are being executed or amended, as applicable, to incorporate or adopt a new benchmark interest rate to replace LIBOR, and

(2)(a) the election by the Agent or (b) the election by the Required Lenders to declare that an Early Opt-in Election has occurred and the provision, as applicable, by the Agent of written notice (which may be via electronic means, including e-mail) of such election to the Dealers and the Lenders or by the Required Lenders of written notice (which may be via electronic means, including e-mail) of such election to the Agent.

(I)“Federal Reserve Bank of New York’s Website” means the website of the Federal Reserve Bank of New York at xxxx://xxx.xxxxxxxxxx.xxx, or any successor source.

(J)“Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto.

(K)“SOFR” with respect to any day means the secured overnight financing rate published for such day by the Federal Reserve Bank of New York, as the administrator of the benchmark, (or a successor administrator) on the Federal Reserve Bank of New York’s Website.

(L)“Term SOFR” means the forward-looking term rate based on SOFR that has been selected or recommended by the Relevant Governmental Body.

(M)“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

(vi) On March 5, 2021, the ICE Benchmark Administration (the "IBA"), the administrator of the London interbank offered rate, and the Financial Conduct Authority, the regulatory supervisor of the IBA, announced in public statements (the "Announcements") that the final publication or representativeness date for (i) 1-week and 2-month London interbank offered rate tenor settings will be December 31, 2021 and (ii) overnight, 1-month, 3-month, 6-month and 12-month London interbank offered rate tenor settings will be June 30, 2023. No successor administrator for the IBA was identified in such Announcements. The parties hereto agree and acknowledge that the Announcements resulted in the occurrence of a Benchmark Transition Event with respect to the London interbank offered rate pursuant to the terms of this Agreement and that any obligation of the Administrative Agent to notify any parties of such Benchmark Transition Event pursuant to clause (c)(iii) of this Section 3 shall be deemed satisfied.

16

4.Security Interest.

(a)Each Dealer hereby grants to Agent, as collateral agent for the Lenders, a security interest in all of the Collateral as security for all Obligations under this Agreement.

(b)Agent will not exercise sole dominion and control over any Deposit Account included in the Collateral except as contemplated by Section 13 of this Agreement after a Default.

5.Representations and Warranties. Each Dealer represents and warrants that at the time of execution of this Agreement and at the time of each Approval and each advance hereunder:

(a)such Dealer is in good standing in its jurisdiction of organization and is qualified to transact business in each other jurisdiction in which the nature of its business or property requires such qualification, unless failure to so qualify could not result, individually or in the aggregate, in a Material Adverse Effect;

(b)such Dealer does not conduct business under any trade styles or trade names except as disclosed by such Dealer to Agent in writing and except to the extent that such conduct could not result, individually or in the aggregate, in a Material Adverse Effect;

(c)such Dealer has all the necessary authority to enter into and perform this Agreement, and the execution, delivery and performance of this Agreement will not violate (i) such Dealer’s organizational documents, (ii) any agreement binding upon it, unless such violation could not result, individually or in the aggregate, in a Material Adverse Effect, or (iii) any law, rule, regulation, order or decree, unless such violation could not result, individually or in the aggregate, in a Material Adverse Effect;

(d)this Agreement and each other Loan Document to which any such Dealer is a party constitute the legal, valid and binding obligations of each such Dealer, enforceable against such Dealer in accordance with their respective terms, except as enforceability may be limited by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability;

(e)such Dealer keeps its records respecting accounts and chattel paper at its chief executive office identified below and keeps the Collateral only at locations permitted by Section 6(b)(xiii) of this Agreement;

(f)this Agreement correctly sets forth such Dealer’s true legal name, the type of its organization, the jurisdiction in which such Dealer is incorporated or otherwise organized, and such Dealer’s organizational identification number, if any, in each case, as of the date hereof;

(g)all information supplied by such Dealer to Agent or any Lender, including any Vehicle Certification, financial, credit or accounting statements or application for credit, in connection with this Agreement is true, correct and complete in all material respects;

(h)all advances and other transactions hereunder are for business purposes and not for personal, family, household or any other consumer purposes;

(i)such Dealer has good title to all Collateral in which it purports to have any interest;

(j)there are no actions or proceedings pending or threatened against Dealers which could reasonably be expected to result, individually or in the aggregate, in a Material Adverse Effect; and

(k)on the Closing Date, neither a Default nor an event which, with the giving of notice, the passage of time, or both, would result in a Default has occurred and is continuing, and, at the time of each Approval and each advance hereunder, a Default has not occurred and is not continuing.

6.Covenants.

(a)Permitted Liens. Until sold as permitted by this Agreement, each Dealer shall own all of its Collateral free and clear of all liens, security interests, claims and other encumbrances, whether arising by agreement or operation of law (collectively “Liens”), other than:

(i)Liens in favor of Agent;

(ii)Other than as set forth in Section 6(a)(x) below, purchase money Liens on Dealers’ new inventory manufactured by Vendors for which Agent does fund invoices directly on behalf of Dealers;

17

(iii)Liens on Dealers’ new, used and pre-owned inventory manufactured by Vendors t for which Agent does fund invoices directly on behalf of Dealers; provided that such Liens are subject to subordination or intercreditor agreements in form and substance acceptable to Agent, in its sole discretion, whereby Agent subordinates its Liens in such inventory;

(iv)Liens for taxes, assessments or other governmental charges that are not due or payable or that are due or payable, but are being diligently contested in good faith by appropriate proceedings; provided that such contested taxes, assessments or other governmental charges do not exceed five hundred thousand dollars ($500,000.00) in aggregate at any time;

(v)Liens of carriers, warehousemen, mechanics, materialmen and landlords incurred in the ordinary course of business for sums not yet due or payable; provided, however, that Liens of landlords are permitted only to the extent that such Liens are subordinate to the Liens in favor of Agent pursuant to an agreement in form and substance acceptable to Agent or if such subordination is not required pursuant to the terms of the Program Terms Letter;

(vi)Liens incurred in the ordinary course of business in connection with workers’ compensation, unemployment insurance or other forms of governmental insurance or benefits;