Contract

1 CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE REGISTRANT IF PUBLICLY DISCLOSED. [*****] INDICATES THAT INFORMATION HAS BEEN REDACTED. SIDE LETTER NO. 4 TO THE COMMON TERMS AGREEMENT AND BAREBOAT CHARTER DATED 9 SEPTEMBER 2015 To: XXXXX XXXXX CORPORATION c/o Golar Management Ltd 6th Floor, The Zig Zag 00 Xxxxxxxx Xxxxxx Xxxxxx XX0X 0XX Xxxxxx Xxxxxxx To: GOLAR LNG LIMITED 2nd Floor, X.X. Xxxxxxx Building 0 Xxx-xx-Xxxxx Xxxx Xxxxxxxx XX00 Xxxxxxx (as Guarantor) To: XXXXX XXXXX LLC Trust Company Complex Ajeltake Road Ajeltake Island Majuro MH96960 Xxxxxxxx Islands (as Shareholder) To: GOLAR MANAGEMENT AS Xxxxxxxx Xxxxxxx xxxxx 0, XX-0000, Xxxx, Xxxxxx (as Manager) To: GOLAR MANAGEMENT LTD 6th Floor, the Zig Zag, 00 Xxxxxxxx Xxxxxx, Xxxxxx, XX0X 0XX Xxxxxx Xxxxxxx (as Manager, and, together with the other Manager, the Shareholder, the Guarantor and Xxxxx Xxxxx, the Relevant Parties and each a Relevant Party) 5 July 2023 Dear Sirs, Bareboat charter (the “Bareboat Charter”) and additional clauses thereto dated 9 September 2015 relating to the FLNG “Hilli Episeyo” and made between Fortune Lianjiang Shipping S.A. (“Fortune”) as owner and Xxxxx Xxxxx Corporation (“Xxxxx Xxxxx”) as bareboat charterer and Common terms agreement (the “Common Terms Agreement”), dated 9 September 2015 and made between (inter alios) Fortune as lender, buyer and owner and Xxxxx Xxxxx as borrower, seller and bareboat charterer (as the same has been amended and supplemented from time to time, and as may be further amended or supplemented in the future)

2 1 We refer to: (a) the Bareboat Charter; and (b) the Common Terms Agreement. 2 Terms defined in the Common Terms Agreement shall have the same meaning when used in this letter unless otherwise defined herein. 3 In this letter “Effective Date” has the meaning given in paragraph 6 of this letter. 4 The Common Terms Agreement shall, with effect on and from the Effective Date, be amended by: (a) Including a new definition of “Balloon” in clause 1.1 of the Common Terms Agreement as follows: “Balloon” means US$207,900,000.” (b) Deleting the definition of “Business Day” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in Oslo, London, Singapore and Hong Kong, and in relation to: (a) a day on which a payment is to be made or would fall to be made by any person on that day in Dollars, in New York; and (b) the fixing of an interest rate for Term SOFR, which is a US Government Securities Business Day.” (c) Deleting the definition of “Charter Period” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Charter Period” means the period of charter of the Vessel under the Bareboat Charter, which shall commence from (and including) the Delivery Date and shall terminate on the date which falls one hundred and twenty (120) calendar months after the Restructuring Date unless otherwise terminated in accordance with the terms of the Bareboat Charter.” (d) Including a new definition of “Effective Date” in clause 1.1 of the Common Terms Agreement as follows: “Effective Date” has the meaning given to such term in the Fourth Side Letter.” (e) Including a new definition of “Fourth Side Letter” in clause 1.1 of the Common Terms Agreement as follows: “Fourth Side Letter” means the fourth side letter dated 5 July 2023 made between the Owner, the Shareholder, the Guarantor, Xxxxx Xxxxx and the Managers.” (f) Including a new definition of “Historic Term SOFR” in clause 1.1 of the Common Terms Agreement as follows: “Historic Term SOFR” means, in relation to the Charter-hire Principal, the most recent applicable Term SOFR for a period of three (3) months and which is as of a day which is not more than three (3) US Government Securities Business Days before the Quotation Day.”

3 (g) Deleting the definition of “Interest Rate” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Interest Rate” means the aggregate annual rate of the Margin and three (3) month Term SOFR.” (h) Including a new definition of “Interpolated Historic Term SOFR” in clause 1.1 of the Common Terms Agreement as follows: “Interpolated Historic Term SOFR” means, in relation to the Charter-hire Principal, the rate (rounded to the same number of decimal places as Term SOFR) which results from interpolating on a linear basis between: (a) either: (i) the most recent applicable Term SOFR (as of a day which is not more than three (3) US Government Securities Business Days before the Quotation Day) for the longest period (for which Term SOFR is available) which is less than three (3) months; or (ii) if no such Term SOFR is available for a period which is less than three (3) months, the most recent SOFR for a day which is not more than three (3) US Government Securities Business Days before the Quotation Day; and (b) the most recent applicable Term SOFR (as of a day which is not more than three (3) US Government Securities Business Days before the Quotation Day) for the shortest period (for which Term SOFR is available) which exceeds three (3) months.” (i) Including a new definition of “Interpolated Term SOFR” in clause 1.1 of the Common Terms Agreement as follows: “Interpolated Term SOFR” means, in relation to the Charter-hire Principal, the rate (rounded to the same number of decimal places as Term SOFR) which results from interpolating on a linear basis between: (a) either: (i) the applicable Term SOFR (as of the Quotation Day) for the longest period (for which Term SOFR is available) which is less than three (3) months; or (ii) if no such Term SOFR is available for a period less than three (3) months, SOFR for the day that is three (3) US Government Securities Business Days before the Quotation Day; and (b) the applicable Term SOFR (as of the Quotation Day) for the shortest period (for which Term SOFR is available) which exceeds three (3) months.” (j) Deleting the definition of “LIBOR” in clause 1.1 of the Common Terms Agreement. (k) Deleting the definition of “Margin” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Margin” means three point three six per cent (3.36%) per annum.” (l) Deleting the definition of “Purchase Obligation Price” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Purchase Obligation Price” means an amount equal to the Balloon.”

4 (m) Deleting the definition of “Purchase Option Date” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Purchase Option Date” means the date falling on the fifth (5th) anniversary of the Restructuring Date and each of the dates falling at six (6) calendar months intervals thereafter, up to (and including) the expiry of the Charter Period; provided that should any Purchase Option Date fall on a date other than a Business Day, that Purchase Option Date shall be advanced to be the immediately preceding Business Day.” (n) The reference to “Appendix IV” in the definition of “Purchase Option Price” in clause 1.1 of the Common Terms Agreement shall be updated to refer to “Appendix III”. (o) Deleting the definition of “Quotation Day” in clause 1.1 of the Common Terms Agreement and replacing it with the following new definition: “Quotation Day” means, in relation to any period for which an interest rate is to be determined, five (5) Business Days before the first day of that period (unless market practice differs in the relevant syndicated loan market, in which case the Quotation Day will be determined by the Owner in accordance with that market practice (and if quotations would normally be given on more than one day, the Quotation Day will be the last of those days)).” (p) Including a new definition of “Restructuring Charter-hire Principal” in clause 1.1 of the Common Terms Agreement as follows: “Restructuring Charter-hire Principal” means an amount equal to the Charter-hire Principal as of the Restructuring Date, being US$630,000,000.” (q) Including a new definition of “Restructuring Date” in clause 1.1 of the Common Terms Agreement as follows: “Restructuring Date” means 20 June 2023.” (r) Including a new definition of “SOFR” in clause 1.1 of the Common Terms Agreement as follows: “SOFR” means the secured overnight financing rate administered by the Federal Reserve Bank of New York (or any other person which takes over the administration of that rate) published (before any correction, recalculation or republication by the administrator) by the Federal Reserve Bank of New York (or any other person which takes over the publication of that rate).” (s) Including a new definition of “Term SOFR” in clause 1.1 of the Common Terms Agreement as follows: “Term SOFR” means: (a) the Term SOFR reference rate administered by CME Group Benchmark Administration Limited (or any other person which takes over the administration of that rate) for the relevant period published (before any correction, recalculation or republication by the administrator) by CME Group Benchmark Administration Limited (or any other person which takes over the publication of that rate) as of 11:00 a.m. on the Quotation Day for a period equal in length to the Hire Calculation Period or relevant part of it; or (b) if (a) is not available, as otherwise determined pursuant to clause 39.1 (Charter- Hire), and, if, in either case, that rate is less than zero, Term SOFR shall be deemed to be zero.”

5 (t) Including a new definition of “US Government Securities Business Day” in clause 1.1 of the Common Terms Agreement as follows: “US Government Securities Business Day” means any day other than: (a) a Saturday or a Sunday; and (b) a day on which the Securities Industry and Financial Markets Association (or any successor organisation) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in US Government securities.” (u) Including a new limb (bb) in clause 1.2 (Interpretation) of the Common Terms Agreement as follows: “A reference in each of the Common Terms Documents to a page or screen of an information service displaying a rate shall include: (i) any replacement page of that information service which displays that rate; and (ii) the appropriate page of such other information service which displays that rate from time to time in place of that information service, and, if such page or service ceases to be available, shall include any other page or service displaying that rate specified by the Owner after consultation with the Bareboat Charterer.” and the Common Terms Agreement (as so amended) will continue to be binding upon the parties thereto in accordance with their respective terms as so amended. 5 The Bareboat Charter shall, with effect on and from the Effective Date be amended by: (a) Deleting clause 37 (Charter Period) of the Bareboat Charter and replacing it with the following: “The Charter Period shall start on the Delivery Date and end on the date falling one hundred and twenty (120) calendar months from the Restructuring Date, unless otherwise terminated in accordance with the terms of the Bareboat Charter.” (b) Deleting clause 39.1 (Charter-Hire) of the Bareboat Charter and replacing it with the following: “(a) With effect from the Restructuring Date, the Bareboat Charterer shall pay Charter-hire quarterly in advance to the Owner’s Account on each Charter-hire Payment Date. Such Charter-hire shall consist of: (i) 40 consecutive equal quarterly payments of 2.5% of the Restructuring Charter-hire Principal minus the Balloon (“Fixed Charter-Hire”); and (ii) Interest accrued on the Charter-hire Principal in respect of the actual number of days elapsed during the Hire Calculation Period ending on the relevant Payment Date calculated on the basis of a year of three hundred sixty (360) days at a rate per annum which is the sum of (a) the Margin and (b) Term SOFR in respect of such Hire Calculation Period (“Variable Charter-Hire”). (b) The Charter-hire which was owing on the Restructuring Date is agreed by the Owner and the Bareboat Charterer to be deferred until 28 June 2023 and for the avoidance of doubt the non-payment of such Charter-hire from the

6 Restructuring Date to 27 June 2023 (inclusive) is waived by the Owner and no default interest shall be payable. The first Charter-hire Payment Date after the Restructuring Date shall be 28 June 2023, but shall be for the Hire Calculation Period from 20 June 2023 to 19 September 2023. (c) All subsequent Charter-hire Payment Dates thereafter shall continue to fall on the dates falling at three (3) calendar month intervals from the Delivery Date (or as otherwise determined pursuant to the definition of Charter-hire Payment Date). (c) In addition to the Charter-hire owing (as set out above), on 28 June 2023, the Bareboat Charterer shall pay to the Owner an amount equal to the difference (if positive) between (i) the pro rata Variable Charter-Hire which would have been payable in respect of the days from (and including) the Restructuring Date to (and excluding) the Effective Date, had the Fourth Side Letter not been entered into, and (ii) the pro rata Variable Charter-Hire payable under the Fourth Side Letter in respect of such period. For illustration, if the Effective Date of the Fourth Side Letter is 28 June 2023, such amount will be $147,606.19. (d) Unavailability of Term SOFR: (i) Interpolated Term SOFR: If Term SOFR is not available for any Hire Calculation Period, the applicable Term SOFR rate for such Hire Calculation Period shall be the Interpolated Term SOFR for three (3) months. (ii) Historic Term SOFR: If sub-paragraph (ii applies but it is not possible to calculate the Interpolated Term SOFR for that Hire Calculation Period, the applicable Term SOFR rate for such Hire Calculation Period shall be Historic Term SOFR for a period equal in length to that Hire Calculation Period. (iii) Interpolated Historic Term SOFR: If sub-paragraph (ii) applies but Historic Term SOFR is not available for that Hire Calculation Period, the applicable Reference Rate shall be Interpolated Historic Term SOFR for a period equal in length to that Hire Calculation Period. (c) If a Market Disruption Event occurs in relation to any Hire Calculation Period, then the Interest Rate for the relevant Hire Calculation Period shall be the rate per annum which is the sum of:- (i) the Margin; and (ii) the rate notified to the Bareboat Charterer by the Owner as soon as practicable and in any event before Variable Charter-Hire is due to be paid in respect of that Hire Calculation Period, to be that which expresses as a percentage rate per annum the cost to the Owner of funding the Charter-hire Principal from whatever comparable source it may select. In this Bareboat Charter, "Market Disruption Event" means an event where: (i) before close of business in Hong Kong on the Quotation Day for the relevant Hire Calculation Period, the cost to the Owner of funding the Charter-hire Principal from whatever source it may select, acting reasonably, would be in excess of Term SOFR; or (ii) clause 39.1(b)(iii) applies but it is not possible to calculate the Interpolated Historic Term SOFR for that Hire Calculation Period.” (c) Deleting the reference to “Appendix IV” in clause 50.5 of the Bareboat Charter and replacing it with “Appendix III”.

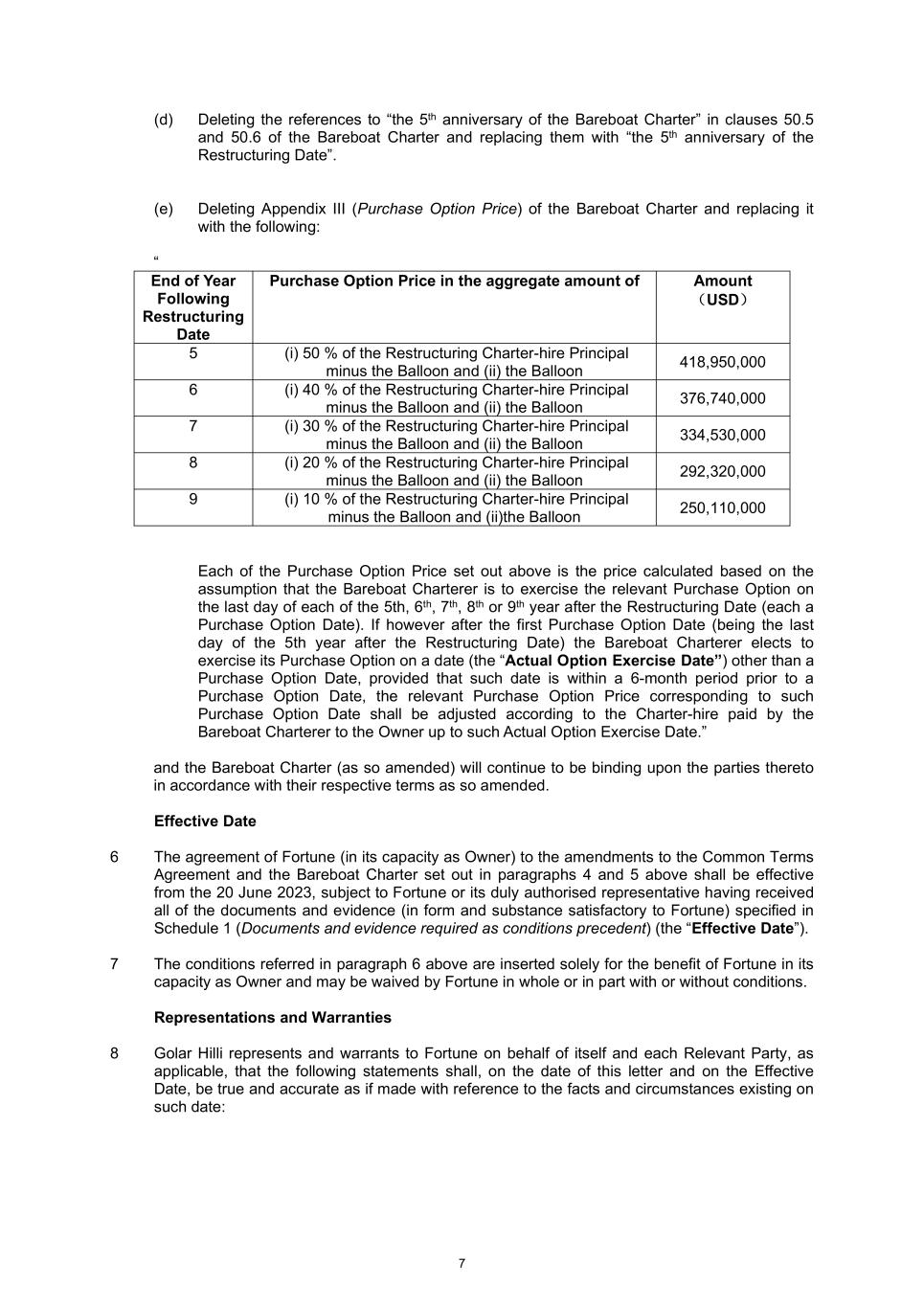

7 (x) Xxxxxxxx the references to “the 5th anniversary of the Bareboat Charter” in clauses 50.5 and 50.6 of the Bareboat Charter and replacing them with “the 5th anniversary of the Restructuring Date”. (e) Deleting Appendix III (Purchase Option Price) of the Bareboat Charter and replacing it with the following: “ End of Year Following Restructuring Date Purchase Option Price in the aggregate amount of Amount (USD) 5 (i) 50 % of the Restructuring Charter-hire Principal minus the Balloon and (ii) the Balloon 418,950,000 6 (i) 40 % of the Restructuring Charter-hire Principal minus the Balloon and (ii) the Balloon 376,740,000 7 (i) 30 % of the Restructuring Charter-hire Principal minus the Balloon and (ii) the Balloon 334,530,000 8 (i) 20 % of the Restructuring Charter-hire Principal minus the Balloon and (ii) the Balloon 292,320,000 9 (i) 10 % of the Restructuring Charter-hire Principal minus the Balloon and (ii)the Balloon 250,110,000 Each of the Purchase Option Price set out above is the price calculated based on the assumption that the Bareboat Charterer is to exercise the relevant Purchase Option on the last day of each of the 5th, 6th, 7th, 8th or 9th year after the Restructuring Date (each a Purchase Option Date). If however after the first Purchase Option Date (being the last day of the 5th year after the Restructuring Date) the Bareboat Charterer elects to exercise its Purchase Option on a date (the “Actual Option Exercise Date”) other than a Purchase Option Date, provided that such date is within a 6-month period prior to a Purchase Option Date, the relevant Purchase Option Price corresponding to such Purchase Option Date shall be adjusted according to the Charter-hire paid by the Bareboat Charterer to the Owner up to such Actual Option Exercise Date.” and the Bareboat Charter (as so amended) will continue to be binding upon the parties thereto in accordance with their respective terms as so amended. Effective Date 6 The agreement of Fortune (in its capacity as Owner) to the amendments to the Common Terms Agreement and the Bareboat Charter set out in paragraphs 4 and 5 above shall be effective from the 20 June 2023, subject to Fortune or its duly authorised representative having received all of the documents and evidence (in form and substance satisfactory to Fortune) specified in Schedule 1 (Documents and evidence required as conditions precedent) (the “Effective Date”). 7 The conditions referred in paragraph 6 above are inserted solely for the benefit of Fortune in its capacity as Owner and may be waived by Fortune in whole or in part with or without conditions. Representations and Warranties 8 Xxxxx Xxxxx represents and warrants to Fortune on behalf of itself and each Relevant Party, as applicable, that the following statements shall, on the date of this letter and on the Effective Date, be true and accurate as if made with reference to the facts and circumstances existing on such date:

8 (a) the representations and warranties set out in clause 47 (Charterer’s Representations and Warranties) of the Bareboat Charter are true and correct on the date hereof as if each was made with respect to the facts and circumstances existing at such time; (b) each Relevant Party has power to execute, deliver and perform its obligations under this letter and all necessary corporate, shareholder and other action has been taken to authorise the execution, delivery and performance of the same; (c) subject to the Legal Reservations, this letter as executed constitutes the legal, valid, binding and enforceable obligations of each Relevant Party in accordance with its terms; (d) each Relevant Party’s entry into, exercise of its rights and/or performance of or compliance with its obligations under this letter does not and will not violate, exceed or conflict with any borrowing or other power or restriction granted or imposed by any law or regulation or any official or judicial order or document to which it is subject or which is binding upon it or any assets or its Memorandum and Articles of Association or Articles of Incorporation or Bye-laws or Partnership Agreement (as the case may be) or any agreement to which it is a party or which is binding on its assets; and (e) no Default has occurred and is continuing at the time of the date hereof. Confirmations 9 The Guarantor hereby confirms its consent to the amendments to the Common Terms Agreement contained in this letter and agrees that: (a) the Bareboat Charter Guarantee and the obligations of the Guarantor thereunder shall remain and continue in full force and effect notwithstanding the amendments to the Common Terms Agreement contained in this letter; and (b) with effect from the Effective Date, references in the Bareboat Charter Guarantee to “the “Common Terms Agreement” and “Bareboat Charter” shall henceforth be reference to the Common Terms Agreement and the Bareboat Charter as amended by this letter. 10 Each Relevant Party further acknowledges and agrees that: (a) each of the Security Documents to which it is a party, and its obligations thereunder, shall remain in full force and effect notwithstanding the amendments made to the Common Terms Agreement and the Bareboat Charter by this letter; and (b) with effect from the Effective Date, references to “the Common Terms Agreement” and “the Bareboat Charter” in the Common Terms Agreement, the Bareboat Charter or the Security Documents to which it is a party shall henceforth be reference to the Common Terms Agreement and Bareboat Charter as amended by this letter and as from time to time hereafter amended. Further assurance 11 Each of Xxxxx Xxxxx, the Guarantor, the Shareholder and the Managers undertake that it will at its expense execute, sign, perfect and do any and every such further assurance, document, act or thing as in the reasonable opinion of Fortune may be necessary or desirable to carry out the purpose of this letter or protect or enforce any right of Fortune hereunder. Fees and expenses 12 Xxxxx Xxxxx shall pay to Fortune on demand all expenses (including legal fees) reasonably incurred by it in connection with the negotiation, preparation, printing and execution of this letter and any other document referred to in this letter.

9 Miscellaneous 13 Save as otherwise set out in this letter, the other terms and conditions under the Common Terms Agreement and the Bareboat Charter remain unchanged and shall continue in full force and effect and the Common Terms Agreement and the Bareboat Charter and this letter shall be read and construed as one instrument. 14 References in the Common Terms Agreement and the Bareboat Charter to “this Agreement” shall, with effect from the Effective Date and unless the context otherwise requires, be references to the Common Terms Agreement and the Bareboat Charter as amended by this letter and words such as “herein”, “hereof”, “hereunder”, “hereafter”, “hereby” and “hereto”, where they appear in the Common Terms Agreement and the Bareboat Charter shall be construed accordingly. 15 References in any of the Finance Documents to the Common Terms Agreement and the Bareboat Charter shall, with effect from the Effective Date and unless the context otherwise requires, be references to the Common Terms Agreement and the Bareboat Charter as amended by this letter. 16 This letter is (i) a Finance Document under, and as such term is defined in, the Common Terms Agreement, and (ii) a Common Terms Document under, and as such term is defined in, the Common Terms Agreement. 17 This letter may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this letter. 18 If any provision of this letter is invalid, that shall not affect the validity of any other provision. 19 This letter may not be amended or waived except in writing by the parties to this letter. 20 This letter and all non-contractual obligations arising from or in connection with it is governed by English law. 21 Any dispute arising out of or in connection with this letter including any question regarding its existence, validity or termination, shall be referred to the Hong Kong International Arbitration Centre (HKIAC) and finally resolved by arbitration under the rules promulgated by the HKIAC (the HKIAC Rules), which HKIAC Rules are deemed to be incorporated by reference to this clause. The seat, or legal place, of arbitration shall be Hong Kong. The language to be used in the arbitral proceedings shall be English. In cases where neither the claim nor any counterclaim exceeds the sum of United States Dollars Fifty Thousand (US$50,000) (or such other sum as the Parties may agree) the arbitration shall be conducted in accordance with the HKIAC Small Claims Procedure current at the time when the arbitration proceedings are commenced and the number of arbitrators shall be one. 22 Kindly acknowledge your agreement to the above by countersigning below and returning to us a copy of this letter. Yours faithfully /s/ Xxxx Xxx ………………………………………… FORTUNE LIANJIANG SHIPPING S.A. (in its capacity as Owner) By: Xxxx Xxx

10 We accept and agree to the terms of this letter and confirm that each of the other Finance Documents to which we are a party, and our respective obligations thereunder, shall remain in full force and effect notwithstanding the amendments made to the Common Terms Agreement by this letter. /s/ Xx Xxxx Xxxx ………………………………………… Signed by for and on behalf of XXXXX XXXXX CORPORATION (as Bareboat Charterer) Date: 5 July 2023 /s/ Xxxxxxxx Xxxxx ………………………………………… Signed by for and on behalf of GOLAR LNG LIMITED (as Guarantor) Date: 5 July 2023 /s/ Xxxxxxxx Xxxxx ………………………………………… Signed by for and on behalf of XXXXX XXXXX LLC (as Shareholder) Date: 5 July 2023 /s/ Xxxxxxx Xxxxxxxx ………………………………………… Signed by for and on behalf of GOLAR MANAGEMENT LTD (as Manager) Date: 5 July 2023 /s/ Xxxxx Xxxxxx ………………………………………… Signed by for and on behalf of GOLAR MANAGEMENT AS (as Manager) Date: 5 July 2023

11 Schedule 1 (Documents and evidence required as conditions precedent) (i) each Relevant Party acknowledging and agreeing to the terms of this letter by duly executing and countersigning where indicated; (ii) a copy of the resolutions duly passed by the Directors or the managing member, as applicable, of each Relevant Party authorizing the entry into, execution of and performance of its obligations under this letter; (iii) a certificate signed by a Director or officer of each Relevant Party confirming that: (A) its constitutional documents are true, complete and correct and have not been amended, modified or revoked and remain in full force and effect, since being delivered to Fortune by its officer’s certificate dated 11 April 2023, or, in the case of the Managers only, by its director’s certificate dated 20 April 2023; (B) the resolutions referred to in paragraph (a)(ii) above are true, complete and correct and have not been amended, modified, rescinded, revoked or withdrawn, and remain in full force and effect; and (C) all consents, authorisations, licenses and approvals required to authorise or in connection with, the execution, delivery, validity, enforceability and admissibility in evidence of this letter and the performance by each Relevant Party of their respective obligations under this letter have been obtained; (iv) certificates of goodstanding with respect to Xxxxx Xxxxx, the Guarantor and the Shareholder, dated no earlier than 30 days before the date of this Agreement; (v) such legal opinions in relation to the laws of England, and any other legal opinions as Fortune shall in its reasonable discretion deem appropriate; (vi) evidence of the payment by Xxxxx Xxxxx to Fortune of a handling fee, equal to [*****] of US$630,000,000; and (vii) such further conditions, opinions or evidence as may be reasonably required by Fortune in connection with or contemplated by this letter and notified in writing to Xxxxx Xxxxx in advance of being requested.