AMENDED AND RESTATED LEASE

Exhibit 10.13

AMENDED AND RESTATED LEASE

This Amended and Restated Lease (“Lease”), dated as of November 1, 2011, is made by and between Eagle CPT, LLC, a Nevada limited liability company (“Lessor”), and Zulily, Inc., a Delaware corporation (“Lessee”) (collectively the “Parties,” or individually a “Party”). This Lease is intended to amend and restate in its entirety that certain Lease dated September 2011 by and between Lessor and Lessee.

1. Basic Provisions.

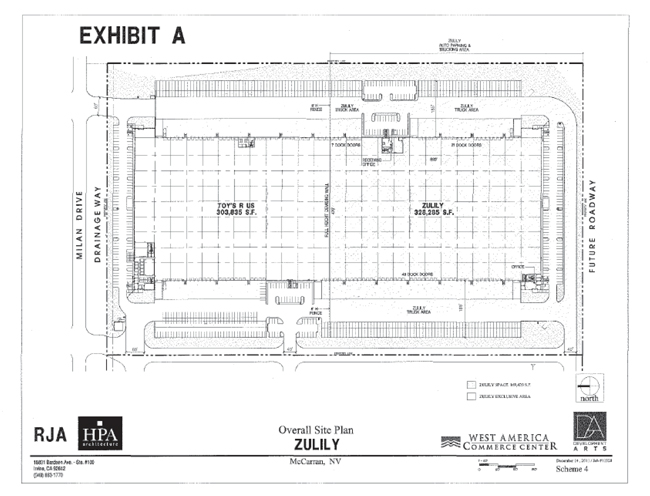

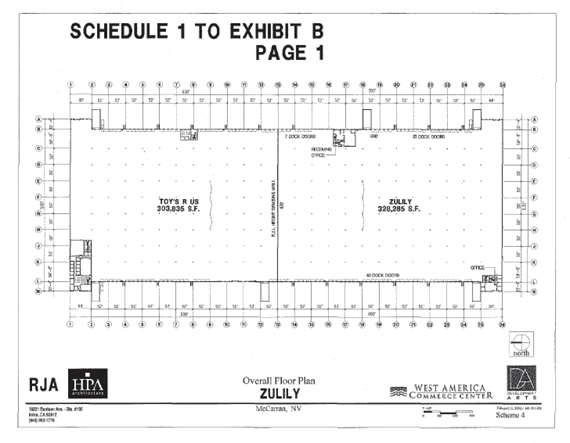

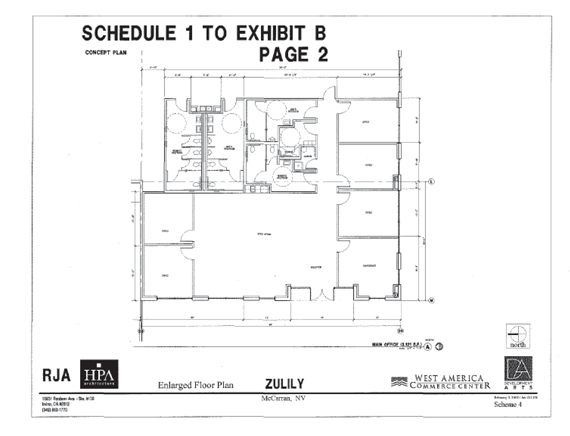

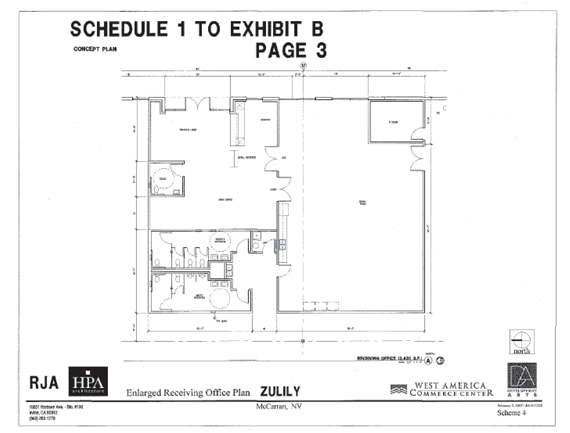

1.1 Premises: The “Premises” comprise a portion of that certain building commonly known as 000 Xxxxx Xxxxx, XxXxxxxx, Xxxxxx (the “Building”), containing approximately 632,120 square feet of gross leasable area, which Building, in turn, comprises a portion of the Project, as described below, all as generally depicted on the site plan attached hereto as Exhibit A. The Premises consist of (a) approximately 171,080 square feet of gross leasable area (the “Initial Premises”), comprising approximately 27.06% of the Building, and (b) approximately 157,205 square feet of gross leasable area (the “Expansion Premises”), comprising approximately 24.87% of the Building, and together comprise approximately 328,285 square feet of gross leasable area (51.93% total) within the Building

1.2 Project: That certain industrial park located within the Tahoe Reno Industrial Center, Storey County, Nevada, and commonly known as West America Commerce Center (the “Project”). The Project consists of three parcels. The parcel on which the Building is located is designated “Lot 1,” while the other two parcels are designated “Lot 2” and “Lot 3.”

1.3 Term: The “Term” of this Lease shall commence on November 1, 2011 (the “Commencement Date”) and shall expire on December 31, 2014 (“Expiration Date”).

1.4 Early Possession: From and after the date on which this Lease is fully executed, Lessee shall have access to the Premises for the limited purpose of installation of Lessee’s racking systems, utility installations, and telecommunications systems, unloading and staging inventory, testing systems and processes, and training employees. (See also Paragraphs 3.2 and 3.3.)

1.5 Rent Commencement: Lessee shall begin paying Base Rent (as defined below) on the Initial Premises commencing on May 1, 2012, and shall begin paying Base Rent on the Expansion Premises commencing on October 1, 2012.

1.

1.6 Base Rent: Lessee shall pay monthly base rent (“Base Rent”), payable on the first day of each month of the Term; in accordance with the rates set forth below:

| Lease Months |

Monthly Base Rent/square feet of gross leasable area |

Monthly Base Rent | ||||||

| Nov 2011 – Apr 2012 |

$ | 0.00 | $ | 0.00 | ||||

| May 2012 – Oct 2012 |

$ | 0.25 | $ | 42,770.00 | ||||

| Oct 2012 |

$ | 0.25 | $ | 82,071.25 | ||||

| Nov 2012 – Oct 2013 |

$ | 0.26 | $ | 85,354.10 | ||||

| Nov 2013 – Oct 2014 |

$ | 0.275 | $ | 90,278.38 | ||||

| Nov 2014 – Dec 2014 |

$ | 0.2875 | $ | 94,381.94 | ||||

1.7 Base Rent Paid Upon Execution: $42,770.00 to be applied to Base Rent for the month of May 2012 (based on 171,080 square feet of gross leasable area in the Initial Premises).

1.8 Intentionally Omitted.

1.9 Agreed Use: The Premises shall be used for warehouse, storage and distribution of retail goods, general office use, and related ancillary legal purposes. (See also Paragraph 6.)

1.10 Real Estate Brokers: The following real estate brokers (collectively, the “Brokers”) and brokerage relationships exist in this transaction:

| (a) | Investment Property Advisors (Xxxxxxx Xxxxxxxx) represents Lessor exclusively (“Lessor’s Broker”); and |

| (b) | CB Xxxxxxx Xxxxx (Xxxx X. Xxxxxxx and Xxxxx Childs) represents Lessee exclusively (“Lessee’s Broker”). |

1.11 Exhibits: The following exhibits are attached to and form a part of this Lease:

Exhibit A Site Plan

Exhibit B Tenant Improvement Construction Agreement

Exhibit C Rules and Regulations

Exhibit D Notice of Lease Term Dates

Exhibit E ERISA Certification

2. Premises.

2.1 Letting. Lessor hereby leases to Lessee, and Lessee hereby leases from Lessor, the Premises, for the term, at the rental, and upon all of the terms, covenants and conditions set forth in this Lease. Unless otherwise provided herein, any statement of size set forth in this Lease, or that may have been used in calculating rental, is an approximation which the Parties agree is reasonable, and the rental based thereon is not subject to revision. The site plan which is attached as Exhibit A to this lease generally depicts the general layout of the Project and the location of the Premises, including the Zulily Parking Area and Zulily Truck Area (each defined below). It shall not be deemed a warranty, representation or agreement on the part of Lessor that the Project will be (or has been) constructed exactly as indicated on said site plan, or that it will continue in the future to be exactly as indicated thereon.

2.

(a) Condition of Premises. Lessor represents and warrants that the Premises shall be in sound structural condition and otherwise in accordance with all applicable laws on the Commencement Date. In addition, Lessor shall deliver the Premises to Lessee in broom-clean condition and free of debris, with the existing Building-standard plumbing, lighting, mechanical, water and sewer, HVAC and life safety systems and subsystems in good operating condition. If any of such Building systems or structural elements should malfunction or fail within the first one hundred eighty (180) days of this Lease for reasons other than Lessee’s misuse or negligence, Lessor shall, promptly after receipt of written notice from Lessee setting forth with specificity the nature and extent of such non-compliance, malfunction or failure, repair same at Lessor’s sole cost and expense (and not as an Operating Expense). Subject to the foregoing and except as expressly set forth elsewhere in this Lease and the Improvement Agreement, Lessor shall have no obligation to perform any construction within the Premises, the Building or the Project, and Lessee shall lease the Premises in an AS-IS condition, it being expressly acknowledged that Lessee has had the full opportunity to inspect, and has approved the condition of, the Premises, the Building and the Project.

2.2 Common Areas. From and after the Commencement Date (as defined below), Lessor grants to Lessee, for the benefit of Lessee and its employees, suppliers, shippers, contractors, customers and invitees, during the term of this Lease, the non-exclusive right to use, in common with others entitled to such use, the Common Areas (as defined below) as they exist from time to time, subject to any rights, powers, and privileges reserved by Lessor under the terms hereof or under the terms of any rules and regulations or restrictions governing the use of the Project. The term “Common Areas” is defined as all areas and facilities outside the Premises and within the exterior boundary line of Lot 1 and interior utility raceways and installations within the Premises that are provided and designated by the Lessor from time to time for the general non-exclusive use of Lessor, Lessee and other tenants of the Project and their respective employees, suppliers, shippers, customers, contractors and invitees, including parking areas, loading and unloading areas, trash areas, roadways, walkways, driveways and landscaped areas. Under no circumstances shall the right herein granted to use the Common Areas be deemed to include the right to store any property, temporarily or permanently, in the Common Areas. Any such storage shall be permitted only by the prior written consent of Lessor or Lessor’s designated agent, which consent may be revoked at any time. In the event that any unauthorized storage shall occur then Lessor shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove the property and charge the cost to Lessee, which cost shall be immediately payable upon demand by Lessor. Lessor or such other person(s) as Lessor may appoint shall have the exclusive control and management of the Common Areas and shall have the right, from time to time, to establish, modify, amend and enforce reasonable rules and regulations (“Rules and Regulations”) for the management, safety, care, and cleanliness of the grounds, the parking and unloading of vehicles and the preservation of good order, as well as for the convenience of other occupants or tenants of the Building and the Project and their invitees. Attached hereto as Exhibit C are the Rules and Regulations in effect as of the date of this Lease. Lessee agrees to abide by and conform to the Rules and Regulations and to cause its employees, suppliers, shippers, customers, contractors and invitees to so abide and conform. Lessor shall not be responsible to Lessee for the non-compliance with

3.

said Rules and Regulations by other tenants of the Project, but will make reasonable efforts to resolve disputes in a timely manner. Lessor shall have the right, in Lessor’s sole discretion, from time to time (i) to make changes to the Common Areas, including, without limitation, changes in the location, size, shape and number of driveways, entrances, parking spaces, parking areas, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas, walkways and utility raceways; (ii) to close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available; (iii) to designate other land outside the boundaries of the Project to be a part of the Common Areas; (iv) to add additional buildings and improvements to the Common Areas; (v) to use the Common Areas while engaged in making additional improvements, repairs or alterations to the Project, or any portion thereof; and (vi) to do and perform such other acts and make such other changes in, to or with respect to the Common Areas and Project as Lessor may, in the exercise of sound business judgment, deem to be appropriate. In the event that Lessor makes any of the Common Area changes set forth herein, Lessor and Lessee agree that there shall be no change to the square footage of the Premises as a result thereof, no increase in Lessee’s financial obligations hereunder and Lessor shall use reasonable efforts to minimize any interference with Lessee’s business caused by such changes and the construction thereof. Lessor shall have the further right, in Lessor’s sole discretion and with notice to Lessee of forty-five (45) days, to designate portions of the Common Area as “Exclusive Common Area” available only for the use of certain occupants of the Project. In the event Lessor designates a portion of the Common Area as Exclusive Common Area for the benefit of one or more occupants and not for the benefit of Lessee, Lessee shall not have the right to use such Exclusive Common Area, and the Operating Expenses associated with maintaining such Exclusive Common Area shall not be included in the cost pool(s) established by Lessor pursuant to Paragraph 4.2(a) of which Lessee is responsible for paying its Proportionate Share. Lessor shall not designate Exclusive Common Areas not for the benefit of Lessee if the same would prevent Lessee from reasonable access to and use of the Premises or the parking to which Lessee is entitled pursuant to Paragraph 2.3.

(a) Vehicle Parking. Lessee shall be entitled to use the parking spaces in the area designated on the Site Plan as “Zulily Parking Area.” Said parking spaces shall be used for parking by vehicles no larger than full-size passenger automobiles or pick-up trucks, herein called “Permitted Size Vehicles”; provided, however, that Lessee shall have the right to park passenger vehicles, trucks and trailers, loaded or unloaded, within the area designated on the Site Plan as “Zulily Truck Area” and at loading docks serving the Premises. Lessor may regulate the loading and unloading of vehicles by adopting Rules and Regulations as provided above. No vehicles other than Permitted Size Vehicles may be parked in the Zulily Parking Area (other than trucks and trailers within the Zulily Truck Area) without the prior written permission of Lessor. Lessee shall not permit or allow any vehicles that belong to or are controlled by Lessee or Lessee’s employees, suppliers, shippers, customers, contractors or invitees to be loaded, unloaded, or parked in areas other than those designated by Lessor for such activities. Lessee shall not service or store any vehicles in the Common Areas. If Lessee permits or allows any of the prohibited activities described in this paragraph, then Lessor shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove or tow away the vehicle involved and charge the cost to Lessee, which cost shall be immediately payable upon demand by Lessor.

4.

2.3 Expansion of Lot 1 and Building. Lessor shall have the right, but not the obligation, to expand Lot 1 by adding thereto approximately 13.5 acres of land to the immediate south of the current Lot 1 and consisting of a portion of APN 000-000-00 (the “Xxx 0 Xxxxxxxxx Xxxx”) and to construct on the Xxx 0 Xxxxxxxxx Xxxx and those portions of the Common Areas to the immediate south of the Building an additional approximately 241,808 square feet of leasable area (the “Building Addition”). From and after Substantial Completion of the Building Addition, the Building Addition shall be considered part of the Building. From and after the addition of the Xxx 0 Xxxxxxxxx Xxxx, xxx Xxx 0 Xxxxxxxxx Xxxx shall, except to the extent contained within the footprint of the Building, be considered part of the Common Areas. The cost of acquiring the Xxx 0 Xxxxxxxxx Xxxx and constructing the Building Addition shall not be included in Operating Expenses nor shall Lessee’s financial obligations hereunder increase as a result of such additions.

3. Term.

3.1 Term. The Commencement Date, Expiration Date and Term of this Lease are as specified in Paragraph 1.3.

3.2 Early Possession. If Lessee totally or partially occupies the Premises prior to the Commencement Date, all terms of this Lease (other than the obligation to pay Base Rent and Operating Expenses) shall be in effect during such period, including, without limitation, the obligation to carry the insurance required hereunder, to maintain the Premises and to comply with all Rules and Regulations.

3.3 Intentionally Omitted.

3.4 Lessee Compliance. Lessor shall not be required to tender possession of the Premises to Lessee, or to permit Early Possession, until Lessee complies with its obligation to provide evidence of insurance in accordance with the provisions of this Lease. Pending delivery of such evidence, Lessee shall be required to perform all of its obligations under this Lease from and after the Commencement Date, including the payment of Rent, notwithstanding Lessor’s election to withhold possession pending receipt of such evidence of insurance. Further, if Lessee is required to perform any other conditions prior to or concurrent with the Commencement Date, the Commencement Date shall occur but Lessor may elect to withhold possession until such conditions are satisfied.

4. Rent.

4.1 Rent Defined. All obligations of Lessee to pay money to Lessor under the terms of this Lease are deemed to be rent (“Rent”).

4.2 Operating Expenses Defined. As used herein, the following terms shall have the following meanings:

(a) “Proportionate Share” shall mean the percentage factor determined by dividing the gross leasable square footage contained in the Premises by the square footage of building space in Lot 1, subject to the following exceptions: (i) Lessee’s Proportionate Share of the Operating Expenses attributable to the common drive shared by Lot 1

5.

and Lot 2 shall mean the percentage factor determined by dividing the gross leasable square footage contained in the Premises by the square footage of building space in Xxx 0 xxx Xxx 0, xxx (xx) Xxxxxx’s Proportionate Share of the Operating Expenses attributable to the fire suppression facility serving Xxx 0, Xxx 0 xxx Xxx 0 xxxxx xx the percentage factor determined by dividing the Gross Leasable Area contained in the Premises by the building space in Xxx 0, Xxx 0 xxx Xxx 0.

(x) “Operating Expenses” shall mean all costs and expenses incurred by Lessor with respect to the ownership, maintenance and operation of Lot 1, including the Building and the fire suppression facility serving Xxx 0, Xxx 0 and Lot 3, and all costs and expenses incurred by Lessor with respect to the ownership, maintenance and operation of the common drive shared by Lot 1 and Lot 2. Without limitation, Operating Expenses shall include: (i) costs of Lessor which are allocable to the Premises under the terms of any CC&Rs affecting the Premises; (ii) insurance deductibles and the costs of and/or relating to the insurance maintained by Lessor with respect to the Building (provided however, with respect to any earthquake or flood insurance that Lessor does or may in the future carry, Lessee’s Proportionate Share of any deductible thereunder shall not exceed $200,000); (iii) all costs paid or incurred by Lessor to maintain, repair or replace any portion of the Premises, the Building or the Common Areas or facilities; (iv) Real Estate Taxes (as hereinafter defined); (v) electricity, gas, water and other utility charges for the Common Areas; (vi) license permits and inspection fees; (vii) supplies and materials used by Lessor or its vendors in the operation and management of the Building and Common Areas and facilities; (viii) equipment not treated by Lessor as capital expenditures of the Building and Common Areas and facilities; (ix) personal property taxes on property used in the operation, maintenance, service and management of the Building and Common Areas and facilities; (x) the cost of Lessor’s property manager, such cost not to exceed 3% of the gross rents of the Building, and (xi) all other expenses necessary for the operation and management of the Building and Common Areas and facilities, except as otherwise set forth herein. To the extent any such expenditure constitutes a capital expenditure as reasonably determined by Lessor in accordance with generally acceptable accounting principles, then such capital expenditure shall be amortized (including annualized interest on the unamortized cost at a rate of 8%) over its useful life as reasonably determined by Lessor in accordance with generally acceptable accounting principles.

Notwithstanding the foregoing, Operating Expenses shall not include the following: (1) interest, principal, points or amortization (except in connection with the financing of items which may be included in Operating Expenses) on any mortgage, deed of trust or any other debt instrument encumbering the Building or the Project; (2) rent and other payments under any ground lease of the Project; (3) any costs for which Lessor has received reimbursement or contribution from any insurance carrier, condemning authority, contractor warranty or third party in response to any claim made by Lessor; (4) Lessor’s general corporate overhead costs; (5) all costs relating to activities for the marketing, solicitation, negotiation and execution of new leases of space in the Building or Project (or renewal of existing leases), including without limitation, costs of advertising, promotional materials, leasing commissions, legal fees, allowances, rental abatement and tenant improvements; (6) capital reserves; (7) expenses that relate to preparation of rental space for a lessee or for services separately billed to, rendered to or for the benefit of other lessees but not made available to or for the benefit of Lessee; (8) legal expenses relating to other lessees; (9) costs of repairing, maintaining or replacing the Building’s roof structure and membrane, foundation and structural components; (10) salaries of executive officers of Lessor;

6.

(11) depreciation; (12) any fines, interest, penalties or costs of compliance incurred by Lessor (and attorneys’ fees relating thereto) as a result of Lessor’s violation of any Applicable Requirements or due to the breach of this Lease or any other lease in the Building or Project by Lessor; (13) the cost to remediate, remove or otherwise comply with Applicable Regulations relating to Hazardous Substances, to the extent Hazardous Substances were present upon, in or about the Premises, Building or Project prior to the Start Date or Hazardous Substances were brought onto the Premises, Building or Project after the Start Date by Lessor or its agents, employees or invitees in violation of Applicable Requirements; (14) overhead profit increments paid to Lessor’s subsidiaries or affiliates for management or other services on or to the Premises, Building or Project or for supplies or other materials to the extent that the cost of the services, supplies or materials materially exceeds the cost that would have been paid had the services, supplies or materials been provided by unaffiliated parties on a competitive basis; (15) salaries, compensation and fringe benefits of ownership and management personnel to the extent that such persons (A) are above the grade of Building or Project manager or (B) provide services to properties other than the Building, except to the extent equitably prorated as among the Project and other projects for which services of such personnel apply; (16) costs of selling the Building or Project; (17) charitable or political contributions or fees paid to trade associations; and (18) costs for sculpture, paintings or other objects of art (and insurance thereon or extraordinary security in connection therewith).

(c) “Controllable Operating Expenses” shall mean all Operating Expenses other than utilities, snow removal, Real Estate Taxes and insurance.

(d) “Real Estate Taxes” shall mean all real property and personal property taxes, charges, and assessments which are levied or assessed upon or imposed by any governmental authority during the term of this Lease, or with respect to each fiscal year falling in whole or in part during the term of this Lease with respect to Lot 1 or any part thereof, including the land, buildings and any improvements, fixtures and equipment and all other property of Lessor, real or personal, comprising Lot 1 and used in connection with the operation thereof. As used herein, the term “Real Estate Taxes” shall include, without limitation, any form of assessment, license fee, license tax, business license fee, business license tax, commercial rent tax, levy, charge, penalty, tax or similar imposition, imposed by any authority having the direct power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, drainage or other improvement or special assessment district thereof, including, but not limited to, the following: (i) any tax on Lessor’s right to rental or other income from Lot 1 or as against Lessor’s business of leasing the space in Lot 1; (ii) any assessment, tax, fee, levy or charge in substitution, partially or totally, or any assessment, tax, fee, levy or charge previously included within the definition of Real Estate Taxes; (iii) any assessment, tax, fee, levy, or charge allocable to or measured by the area of Lot 1 or the rental payable hereunder, including, without limitation, any gross income tax or excise tax levied by the state, city or federal government, or any political subdivision thereof, with respect to the receipt of such rental, or upon or with respect to the possession, leasing, operating, management, maintenance, alteration, repair, use or occupancy by Lessee of Lot 1, or any portion thereof; and (iv) any assessment, tax, fee, levy or charge, upon this transaction or any document to which Lessee is a party, creating or transferring an interest or an estate in Lot 1. Without limiting the foregoing, the term “Real Estate Taxes” shall include any taxes paid by Lessor to any taxing authority pursuant to any lease by which Lessor holds possession of any part of the land comprising Lot 1. If the tax statement from the

7.

taxing authority does not allocate assessments with respect to the Project and assessments relating to any other improvements located upon the land, Lessor shall make a reasonable determination of the proper allocation of such assessment bases, to the extent possible, upon records of the assessor.

Real Estate Taxes also shall include the expense of contesting, in good faith, the amount or validity of any such taxes, charges or assessments, such expense to be applicable to the period of the item contested. Real Estate Taxes shall not, however, include income, franchise, capital stock, transfer, estate, gift, succession or inheritance taxes unless such taxes are in lieu of real estate taxes, assessments, rental, occupancy and other like excise taxes. For purposes of this Lease, Real Estate Taxes for any calendar year shall be those taxes the last timely payment date for which occurs within such calendar year. In case of special taxes or assessments payable in installments, only the amount of the installment(s) the last timely payment date for which occurs on or after the first day and on or before the last day of such calendar year shall be included in Real Estate Taxes for that calendar year.

Lessor shall retain the sole right to participate in any proceedings to establish or contest, in good faith, the amount of Real Estate Taxes. If a complaint against valuation, protest of tax rates or other action increases or decreases the Real Estate Taxes for any calendar year, resulting in an increase or decrease in rent hereunder, the Real Estate Taxes for the affected calendar year shall be recalculated accordingly and the resulting increased rent plus the expenses incurred in connection with such contest, or decreased rent, less the expenses incurred in connection with such contest, shall be paid simultaneously with or applied as a credit against, as the case may be, the rent next becoming due.

4.3 Payment of Proportionate Share of Operating Expenses. Lessee shall pay to Lessor, as additional Rental, Lessee’s Proportionate Share of the Operating Expenses; provided, however, that, beginning with the second full calendar year of the Lease term and continuing in each of the subsequent calendar years of the term, the amount of Lessee’s Proportionate Share of the Controllable Operating Expenses shall not be more than five percent (5%) greater than Lessee’s Proportionate Share of the Controllable Operating Expenses in the immediately preceding calendar year. If this Lease commences on a date other than January 1 or expires or terminates on a date other than December 31, the annual Operating Expenses shall be prorated by multiplying one-twelfth (1/12) of the annual Operating Expenses by the number of full or partial months between the Commencement Date and December 31 of the year of commencement or between January 1 of the year of expiration or termination and the Expiration Date or date of termination, as the case may be. To provide for current payments of Operating Expenses, Lessee shall pay Lessee’s Proportionate Share of the Operating Expenses, as estimated by Lessor from time to time, in twelve (12) monthly installments, commencing on the first day of the month following the month in which Lessor notifies Lessee of the amount of its estimated Proportionate Share. Lessor shall, on or before the beginning of each calendar year, estimate the amount of Operating Expenses for the upcoming calendar year and, within one hundred twenty (120) days after the end of each calendar year, reconcile the estimated expenses paid by Lessee in the preceding year based on actual Operating Expenses for such calendar year paid by Lessor. If Lessee’s Proportionate Share of the actual Operating Expenses shall be greater than or less than the aggregate of all installments so paid on account to Lessor for such twelve (12) month period, then within thirty (30) days of Lessee’s receipt of Lessor’s statement of reconciled

8.

Operating Expenses, Lessee shall pay to Lessor the amount of such underpayment, or Lessor shall credit Lessee for the amount of such overpayment against the next maturing installment(s) of rent, as the case may be. The obligation of Lessee with respect to the payment of Lessee’s Proportionate Share of the Operating Expenses shall survive the termination of this Lease. Any payment, refund, or credit made pursuant to this Paragraph 4.3 shall be made without prejudice to any right of Lessee to dispute the statement as hereinafter provided, or of Lessor to correct any item(s) as billed pursuant to the provisions hereof. Lessor’s failure to give such statement shall not constitute a waiver by Lessor of its right to recover rent that is due and payable pursuant to this paragraph. Lessor shall have the right, from time to time, to change to a fiscal year that does correspond to a calendar year, or vice versa. If Lessor does so, Lessor shall appropriately prorate Operating Expenses for the year in which such change occurs.

4.4 Dispute of Operating Expenses. Lessee shall have the right, within ninety (90) days following receipt of a notice of reconciled Operating Expenses (or revised notice thereof), to deliver written notice to Lessor of Lessee’s intent to challenge such reconciliation, which notice shall set forth in reasonable detail the basis for such challenge. If Lessee does not deliver such written notice within such ninety (90) day period, Lessee shall be deemed to have accepted Lessor’s reconciliation. If Lessee timely provides such notice, and if the challenge raised by Lessee is not amicably settled between Lessor and Lessee within thirty (30) days after such notice of challenge, Lessee shall have the right, during the ninety (90) days next following the expiration of such thirty (30) day period, to employ an independent certified public accountant to audit Operating Expenses. Any such audit shall be conducted during normal business hours of Lessor in a diligent and prompt fashion and in such a manner as to minimize impact on the conduct of Lessor’s business. Provided that Lessor does not dispute the results of such audit (in which case the parties shall proceed to arbitration in accordance with the provisions of Paragraph 54), any change in the reconciled Operating Expenses required by such accountant’s determination shall be made within thirty (30) days after such determination has been rendered. Lessee understands that the actual itemization of, and the amount of individual items constituting, Operating Expenses is confidential, and, while Lessor shall keep and make available to such accountant all records in reasonable detail, and shall permit such accountant to examine and audit such of Lessor’s records as may reasonably be required to verify such reconciled Operating Expenses, at reasonable times during business hours, Lessor shall not be required to (and the accountant and Lessee shall not be permitted to) disclose to any person, firm or corporation, other than its legal and financial advisors, any such details. The expenses involved in such audit shall be borne by Lessee, unless the results of such audit determine that Lessor overstated Lessee’s Proportionate Share of the Operating Expenses by more than five percent (5%), in which case Lessor shall promptly reimburse Lessee for the reasonable and actual costs of such audit up to a maximum of $5,000.

4.5 Adjustments to Operating Expenses. If a clerical error occurs or Lessor or Lessor’s accountants discover new facts, which error or discovery causes Operating Expenses for any period to increase or decrease, upon notice by Lessor to Lessee of the adjusted additional Operating Expenses for such calendar year, which notice must be given within one (1) year after Lessor delivers its original statement of reconciled Operating Expenses for such calendar year, the adjusted additional Operating Expenses shall apply and any deficiency or overpayment of Lessee’s Proportionate Share of the Operating Expenses, as the case may be, shall be paid by Lessee or taken as a credit by Lessee according to the provisions set forth above. This provision shall survive the termination of the Lease.

9.

4.6 Other Charges. All costs, expenses and other sums that Lessee assumes or agrees to pay to Lessor pursuant to this Lease shall be deemed Rent and, in the event of nonpayment thereof, Lessor shall have all the rights and remedies herein provided for in case of nonpayment of Base Rent.

4.7 Payment. Lessee shall cause payment of Base Rent and other rent or charges, as the same may be adjusted from time to time, to be received by Lessor in lawful money of the United States, without offset or deduction (except as specifically permitted in this Lease), on or before the day on which it is due. Base Rent and other Rent or charges for any period during the term hereof which is for less than one (1) full calendar month shall be prorated based upon the actual number of days of said month. Payment of Base Rent and other Rent or charges shall be made to Lessor at its address stated herein or to such other persons or place as Lessor may from time to time designate in writing. Acceptance of a payment which is less than the amount then due shall not be a waiver of Lessor’s rights to the balance of such Base Rent and other Rent or charges, regardless of Lessor’s endorsement or notation on any check so stating.

4.8 Rent Control. If the amount of Rent or any other payment due under this Lease violates the terms of any governmental restrictions on such Rent or payment, then the Rent or payment due during the period of such restrictions shall be the maximum amount allowable under those restrictions. Upon termination of the restrictions, Lessor shall, to the extent it is legally permitted, recover from Lessee the difference between the amounts received during the period of the restrictions and the amounts Lessor would have received had there been no restrictions.

5. Intentionally Omitted.

6. Use.

6.1 Use. Lessee shall use and occupy the Premises only for the Agreed Use, and for no other purpose. Lessee shall not use or permit the use of the Premises in a manner that is unlawful, creates damage, waste or a nuisance, or that disturbs owners and/or occupants of, or causes damage to neighboring properties.

6.2 Hazardous Substances.

(a) Reportable Uses Require Consent. The term “Hazardous Substance” as used in this Lease shall mean any product, substance, or waste whose presence, use, manufacture, disposal, transportation, or release, either by itself or in combination with other materials expected to be on the Premises, is either: (i) potentially injurious to the public health, safety or welfare, the environment or the Premises, (ii) regulated or monitored by any governmental authority, or (iii) a basis for potential liability of Lessor to any governmental agency or third party under any applicable statute or common law theory. Hazardous Substances shall include, but not be limited to, PCB’s, hydrocarbons, petroleum, gasoline, and/or crude oil or any products, by-products or fractions thereof. Lessee shall not engage in any activity in or on the Premises which constitutes a Reportable Use of Hazardous Substances without the express

10.

prior written consent of Lessor, which consent may be given or withheld in Lessor’s sole discretion, and timely compliance (at Lessee’s expense) with all Applicable Requirements. “Reportable Use” shall mean (i) the installation or use of any above ground storage tank, (ii) the generation, possession, storage, use, transportation, or disposal of a Hazardous Substance that requires a permit from, or with respect to which a report, notice, registration or business plan is required to be filed with, any governmental authority, and/or (iii) the presence at the Premises of a Hazardous Substance with respect to which any Applicable Requirements requires that a notice be given to persons entering or occupying the Premises or neighboring properties. Notwithstanding the foregoing, Lessee may use any ordinary and customary materials, in reasonable quantities, which are reasonably required to be used in the normal course of the Agreed Use, so long as such use is in compliance with all Applicable Requirements, is not a Reportable Use, and does not expose the Premises or neighboring property to any meaningful risk of contamination or damage or expose Lessor to any liability therefor. In addition, Lessor may condition its consent to any Reportable Use upon receiving such additional assurances as Lessor reasonably deems necessary to protect itself, the public, the Premises and/or the environment against damage, contamination, injury and/or liability, including, but not limited to, the installation (and removal on or before Lease expiration or termination) of protective modifications (such as concrete encasements) and/or increasing the Security Deposit.

(b) Duty to Inform Lessor. If Lessee knows, or has reasonable cause to believe, that a Hazardous Substance has come to be located in, on, under or about the Premises, other than as previously consented to by Lessor, Lessee shall immediately give written notice of such fact to Lessor, and provide Lessor with a copy of any report, notice, claim or other documentation which it has concerning the presence of such Hazardous Substance.

(c) Lessee Remediation. Lessee shall not cause or knowingly permit any Hazardous Substance to be spilled or released in, on, under, or about the Premises (including through the plumbing or sanitary sewer system) and shall promptly, at Lessee’s sole cost and expense, take all investigatory and/or remedial action reasonably recommended, whether or not formally ordered or required, for the cleanup of any contamination of, and for the maintenance, security and/or monitoring of the Premises or neighboring properties, that was caused or materially contributed to by Lessee, or pertaining to or involving any Hazardous Substance brought onto the Premises during the term of this Lease, by or for Lessee, or any third party agent, representative or contractor of Lessee.

(d) Lessee Indemnification. Lessee shall indemnify, defend and hold Lessor, its agents, employees and lenders, if any, harmless from and against any and all loss of rents and/or damages, liabilities, judgments, claims, expenses, penalties, and attorneys’ and consultants’ fees arising out of or involving any Hazardous Substance brought onto the Premises during the term of this Lease by or for Lessee, or any third party agent, representative or contractor of Lessee (provided, however, that Lessee shall have no liability under this Lease with respect to underground migration of any Hazardous Substance under the Premises from adjacent properties which Lessee did not contribute to or exacerbate). Lessee’s obligations shall include, but not be limited to, the effects of any contamination or injury to person, property or the environment created or suffered by Lessee, and the cost of investigation, removal, remediation, restoration and/or abatement thereof, and shall survive the expiration or termination of this Lease. No termination, cancellation or release agreement entered into by Lessor and Lessee shall

11.

release Lessee from its obligations under this Lease with respect to Hazardous Substances, unless Lessor specifically agrees thereto in writing at the time of such agreement and such agreement specifically identifies this paragraph of the Lease.

(e) Investigations and Remediations. Lessor shall retain the responsibility and pay for any investigations or remediation measures required by governmental entities having jurisdiction with respect to the existence of Hazardous Substances on the Premises prior to the Commencement Date, unless such remediation measure is required as a result of Lessee’s use (including “Alterations”, as defined below) of the Premises, in which event Lessee shall be responsible for such payment if any violation is found. Lessee shall cooperate fully in any such activities at the request of Lessor, including allowing Lessor and Lessor’s agents to have reasonable access to the Premises at reasonable times in order to carry out Lessor’s investigative and remedial responsibilities. To Lessor’s actual knowledge, Lessor has delivered to Lessee a complete copy of the report of any third party that has investigated the potential presence of Hazardous Substances on the Premises at the request of Lessor.

(f) Lessor’s Responsibilities. Lessor warrants and represents to Lessee that, to Lessor’s actual knowledge, the Premises are free from Hazardous Substances. Lessor shall indemnify and hold Lessee harmless from and against any liability (but not consequential damages) arising from the presence of Hazardous Substances in or around the Premises caused by other than Lessee or its agents, employees, guests, invitees or sublessees.

6.3 Lessee’s Compliance with Applicable Requirements. With the exception of compliance of the Premises upon completion of Tenant Improvements in accordance with the provisions of Exhibit B with the requirements of the Americans with Disabilities Act as it may be amended from time to time (“ADA”), which compliance shall be the responsibility of Lessor, Lessee shall, at Lessee’s sole expense, fully, diligently and in a timely manner, materially comply with all applicable laws, covenants or restrictions of record, regulations and ordinances applicable to the Premises (“Applicable Requirements”), including, without limitation, any requirements of the ADA subsequently imposed as a result of any changes to the Premises made by Lessee, whether with or without Lessor consent, and also including the requirements of any applicable fire insurance underwriter or rating bureau and the recommendations of Lessor’s engineers and/or consultants which relate in any manner to the Lessee’s use of Premises, without regard to whether said requirements are now in effect or become effective after the Commencement Date. Lessee shall indemnify and hold Lessor harmless from Lessee’s failure to comply with this Paragraph 6.3, including without limitation, any failure by Lessee to comply with its ADA obligations. Lessee shall, within ten (10) days after receipt of Lessor’s written request, provide Lessor with copies of all permits and other documents, and other information evidencing Lessee’s compliance with any Applicable Requirements specified by Lessor, and shall immediately upon receipt by Lessee, notify Lessor in writing (and immediately provide to Lessor copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint or report pertaining to or involving the failure of Lessee or the Premises to comply with any Applicable Requirements. Notwithstanding the foregoing, in no event shall Lessee be required to make structural alterations or changes to the Premises or Building unless and to the extent necessitated by Lessee’s Alterations or by the specific use of the Premises or nature of the goods being stored in the Premises by Lessee (as opposed to the mere use of the Premises for warehousing and distribution of goods generally).

12.

6.4 Inspection; Compliance. Lessor, it consultants, and any ground lessor, mortgagee and/or beneficiary of a deed of trust (each, a “Lender”) under a ground lease, mortgage, deed of trust, or other hypothecation or security device recorded against the Project or any part thereof (collectively, “Security Device”) shall have the right to enter the Premises at any time, in the case of an emergency, and otherwise at reasonable times upon reasonable prior telephonic notice, for the purpose of inspecting the condition of the Premises and for verifying compliance by Lessee with this Lease. The reasonable cost of any such inspections shall be paid by Lessee if any violation is found to exist and be the responsibility of Lessee hereunder.

7. Maintenance and Repair

7.1 Lessee’s Obligations. Except as set forth in subsection (b), below, Lessee shall, at Lessee’s sole expense, keep the non-structural portions of the Premises, and every part thereof, in good order, condition and repair, including, but not limited to, all equipment or facilities, such as plumbing, heating, ventilating, air-conditioning, electrical, lighting facilities, (but only to the extent such facilities serve only the Premises and are not part of the common portion of shared facilities), fixtures, interior walls, interior surfaces of exterior walls, ceilings, floors, windows, doors, plate glass and skylights. Notwithstanding the foregoing, Lessee shall not be obligated to effect repairs to the Premises that are made necessary by reason of structural defects in the Building, and Lessor shall be responsible for such repairs. Lessee, in keeping the Premises in good order, condition and repair, shall exercise and perform good maintenance practices, specifically including the procurement and maintenance of the service contracts required below. Lessee’s obligations shall include restorations, replacements or renewals when necessary to keep the Premises, and each portion thereof, and all improvements thereon, in good order, condition and state of repair. Without limiting the foregoing, Lessee’s maintenance obligations shall be subject to each of the following:

(a) Service Contracts. Lessee shall, at Lessee’s sole expense, procure and maintain contracts, in form and substance reasonably satisfactory to Lessor, with copies to Lessor, for, and with contractors specializing and experienced in the maintenance of the following equipment and improvements, if any, if and when installed on and exclusively serving the Premises: (i) HVAC equipment, (ii) boiler, and pressure vessels, (iii) clarifiers, and (iv) any other equipment, if reasonably required by Lessor; provided, however, that Lessor reserves the right, upon notice to Lessee, to procure and maintain any or all of such service contracts, and, if Lessor so elects, Lessee shall reimburse Lessor, promptly upon demand, for the cost thereof.

(b) Qualifications to Lessee’s Maintenance Obligations. In the event that (i) the HVAC system(s) or a major component of the HVAC system(s) or any major operating system need to be replaced for reasons other than Lessee’s negligence, and the cost exceeds $2,000 for any single such replacement, or (ii) Lessee is required to make a repair or replacement that constitutes a capital expenditure, then, subject to the reimbursement obligation of Lessee in the next sentence, Lessee shall have the right to elect to have Lessor effect the repair or replacement at Lessor’s initial cost; provided that, for HVAC replacements, Lessee shall be responsible for the first $2,000 of such cost. Lessor shall amortize the cost of any repair or

13.

replacement made in accordance with the immediately preceding sentence over the useful life of the component repaired or replaced at a reasonable interest rate, all as reasonably determined by Lessor in accordance with generally accepted accounting principles, and Lessee shall, in addition to Lessee’s Proportionate Share of Operating Expenses, pay each month to Lessor during the term of this Lease, as the same may be extended, the monthly amount of such amortization. Lessor shall maintain all subgrade sewer and plumbing lines and the fire life safety equipment serving the Premises, and the cost of such maintenance shall be included in Operating Expenses.

(c) Lessor’s Election. If Lessee fails to perform Lessee’s maintenance and repair obligations set forth in this Lease, Lessor may at its option (but shall not be required to) enter upon the Premises after ten (10) days prior written notice to Lessee (except in the case of an emergency, in which case no notice shall be required), perform such obligations on Lessee’s behalf and put the same in good order, condition and repair, and the cost thereof, together with interest at the Lease Rate (as defined below) shall become due and payable as additional Rent to Lessor, together with Lessee’s next installment of Base Rent. Lessee shall indemnify, defend and hold Lessor, its employees, partners, directors, officers, representatives, agents and affiliates harmless from any and all claims of any kind or nature arising from or related to the foregoing.

7.2 Lessor’s Obligations. Subject to the foregoing, Lessor shall keep and maintain in good and tenantable condition and repair all the roof (including structural elements and coverings), bearing walls and foundations of the Building, Building systems, including HVAC, electrical, plumbing and the fire protection (but only those portions thereof that are shared, and not including portions located in and exclusively serving the Premises), and the Common Areas; provided, however, that Lessor shall not be required to make repairs necessitated by reason of the negligence or willful misconduct of Lessee, its servants, agents, employees or contractors, or anyone claiming under Lessee, or by reason of the failure of Lessee to perform or observe any conditions or agreements contained in this Lease, or caused by alterations, additions or improvements made by Lessee or anyone claiming under Lessee. Notwithstanding anything to the contrary contained in this Lease, Lessor shall not be liable to Lessee for failure to make repairs as herein specifically required of it unless Lessee has previously notified Lessor, in writing, of the need for such repairs and Lessor has failed to commence and complete said repairs within such period of time following receipt of Lessee’s written notification as is reasonable under the circumstances. Lessor shall have no liability to Lessee nor shall Lessee’s obligations under this Lease be reduced or abated in any manner whatsoever by reason of any inconvenience, annoyance, interruption or injury to business arising from Lessor’s making any repairs or changes which Lessor is required or permitted by this Lease or by any other lessee’s lease or required by law to make in or to any portion of the Project, Building or Premises unless arising from the gross negligence or willful misconduct of Lessor. It is the intention of the Parties that the terms of this Lease govern the respective obligations of the Parties as to maintenance and repair of the Premises, and they expressly waive the benefit of any statute now or hereafter in effect to the extent it is inconsistent with the terms of this Lease, including any statute now or hereafter in effect which would otherwise afford Lessee the right to make repairs at Lessor’s expense or to terminate this Lease because of Lessor’s failure to keep the Premises in good order, condition and repair.

14.

8. Utility Installations; Trade Fixtures; Alterations.

8.1 Definitions; Consent Required. The term “Utility Installations” refers to all floor and window coverings, air lines, power panels, electrical distribution, security and fire protection systems, communication systems, lighting fixtures, HVAC equipment, plumbing, and fencing in or on the Premises. The term “Trade Fixtures” shall mean Lessee’s machinery and equipment that can be removed without doing material damage to the Premises. The term “Alterations” shall mean any modification of the improvements, other than Utility Installations or Trade Fixtures, whether by addition or deletion. “Lessee Owned Alterations and/or Utility Installations” are defined as Alterations and/or Utility Installations made by Lessee that are not yet owned by Lessor pursuant to the provisions set forth below. Lessee shall not make any Alterations or Utility Installations to the Premises without Lessor’s prior written consent; provided that, Lessee may, however, make Alterations, which do not affect the structural components of the Building or building systems, to the interior of the Premises (excluding the roof or ceiling) without such consent but upon written prior notice to Lessor, so long as the Utility Installations are not visible from the outside, do not involve puncturing, relocating or removing the roof or any existing walls, and the cumulative cost thereof during this Lease as extended does not exceed $100,000 in the aggregate during the term, or $25,000 in any one year.

8.2 Consent. Any Alterations or Utility Installations that Lessee shall desire to make and which require the consent of the Lessor shall be presented to Lessor in written form with detailed plans. Consent shall be deemed conditioned upon Lessee’s: (i) acquiring all applicable governmental permits, (ii) furnishing Lessor with copies of both the permits and the plans and specifications prior to commencement of the work, and (iii) compliance with all conditions of said permits and other Applicable Requirements in a prompt and expeditious manner. Any Alterations or Utility Installations shall be performed in a workmanlike manner with good and sufficient materials. Lessee shall promptly upon completion furnish Lessor with as-built plans and specifications for any Alterations or Utility Installations, whether or not Lessor’s consent is required. For work which costs more than $100,000, Lessor may condition its consent upon Lessee providing a lien and completion bond in an amount equal to one and one-half times the estimated cost of such Alteration or Utility Installation and/or upon Lessee’s posting additional security for the completion of such Alterations or Utility Installations with Lessor.

8.3 Indemnification. Lessee shall pay, when due, all claims for labor or materials furnished or alleged to have been furnished to or for Lessee at or for use on the Premises, which claims are or may be secured by any mechanic’s or materialmen’s lien against the Premises or any interest therein. Lessee shall give Lessor not less than ten (10) days’ notice prior to the commencement of any work in, on or about the Premises, and Lessor shall have the right to post notices of non-responsibility. If, notwithstanding the foregoing, any liens or encumbrances for any obligation or for work claimed to have been furnished, done for, obligations incurred for or materials claimed to have been furnished to Lessee or any other party are asserted against the Project, or any portion thereof, such liens will be discharged by Lessee, by bond or otherwise, within ten (10) days after demand by Lessor, at the cost and expense of Lessee, and Lessee further agrees to defend, indemnify and hold harmless Lessor from and against any such liens or claims or actions thereon, together with costs of suit and attorneys’ fees incurred by Lessor in connection with any such claims or actions. If Lessee fails to discharge

15.

any such lien within such ten (10) day period, Lessor may, without waiving its rights and remedies based on such breach of Lessee and without releasing Lessee from any of its obligations, cause such liens to be released by any means it shall deem proper, including payment in satisfaction of the claims giving rise to such liens. Lessee shall reimburse Lessor, within ten (10) days after demand therefor, for any sum paid or incurred by Lessor to remove such liens.

8.4 Ownership; Removal; Surrender; and Restoration.

(a) Ownership. Subject to Lessor’s right to require removal or elect ownership as hereinafter provided, all Alterations and Utility Installations made by Lessee shall be the property of Lessee, but considered a part of the Premises. Lessor may, at any time, elect in writing to be the owner of all or any specified part of the Lessee Owned Alterations and Utility Installations. Unless Lessor requires removal as provided below, all Lessee Owned Alterations and Utility Installations shall, at the expiration or termination of this Lease, become the property of Lessor and be surrendered by Lessee with the Premises.

(b) Removal. By delivery to Lessee of written notice from Lessor not later than thirty (30) days prior to the end of the term of this Lease, Lessor may require that any or all Lessee Owned Alterations or Utility Installations be removed by the expiration or termination of this Lease; provided, however, that Lessor will not require removal of any such items that were made with Lessor’s consent unless Lessor conditioned such consent on such removal at the end of the term. Lessor may require the removal at any time of all or any part of any Lessee Owned Alterations or Utility Installations made without the required consent of Lessor

(c) Surrender/Restoration. Lessee shall surrender the Premises on or before the Expiration Date or any earlier termination date, with all of the improvements, parts and surfaces thereof broom clean and free of debris, and in good operating order, condition and state of repair, ordinary wear and tear, casualty damage that is not Lessee’s responsibility to repair and Lessor’s obligations hereunder excepted. “Ordinary wear and tear” shall not include any damage or deterioration that would have been prevented by good maintenance practice. Lessee shall repair any damage occasioned by the installation, maintenance or removal of Trade Fixtures, Lessee Owned Alterations and/or Utility Installations, furnishings, and equipment as well as the removal of any storage tank installed by or for Lessee, and the removal, replacement, or remediation of any soil, material or groundwater contaminated by Lessee. Trade Fixtures shall remain the property of Lessee and shall be removed by Lessee. The failure by Lessee to timely vacate the Premises pursuant to this subparagraph without the express written consent of Lessor shall constitute a holdover under the provisions of this Lease.

8.5 Construction Covenants.

(a) Lessee acknowledges that labor disruption during Lessor’s development, construction, ownership and operation of the Project would result in damages to Lessor. Accordingly, Lessee covenants and agrees that all work performed on the Premises, including tenant improvements, which is covered by or the subject of collective bargaining agreements in effect from time-to-time for carpentry work between employers and the Southwest

16.

Regional Council of Carpenters shall be done in its entirety by general contractors signatory to and abiding by a collective bargaining agreement with xxx Xxxxxxxxxx Union (each, a “Xxxxxxxxx Entity”). Further, Lessee agrees that the foregoing construction covenant will be included in all of Lessee’s contracts and subcontracts relating to construction work at the Premises. In addition, Lessee shall be responsible for all unpaid fringe benefit contributions of delinquent or bankrupt contractors or subcontractors for the carpentry work on the Premises.

(b) At least ten (10) days prior to the commencement of construction of any work to be performed by Lessee, Lessee shall submit to Lessor the names and addresses of all contractors and subcontractors selected by Lessee to perform such work, and Lessor shall have the right to disapprove the use of any contractor that Lessor believes, in good faith, would result in labor disruption or otherwise interfere with the development, construction and operation of the Project. Without limiting the foregoing, Lessor shall have the absolute right to disapprove any contractor or subcontractor whom Lessee proposes to use for carpentry work if such contractor or subcontractor is not signatory to and abiding by a collective bargaining agreement with xxx Xxxxxxxxxx Union. Upon Lessee’s request, Lessor shall provide Lessee with a copy of xxx Xxxxxxxxxx Union collective bargaining agreement.

(c) As used herein, the term “Qualified Non-Xxxxxxxxx Entity” shall mean any contractor or subcontractor which is not a Xxxxxxxxx Entity but which has comparable experience and competence in the performance of the applicable work. Lessor shall pay to Lessee the difference between (i) the amounts paid by Lessee to Xxxxxxxxx Entities performing carpentry and millwright work in the Premises, and (ii) the cost that Lessee would have incurred if such work had been performed by Qualified Non-Xxxxxxxxx Entities (“Increased Labor Cost”). The Increased Labor Cost shall be paid to Lessee following completion of the applicable work, subject to Lessee’s delivery to Lessor of the lowest bid for performance of the carpentry and millwright work by a Xxxxxxxxx Entity and the lowest bid from a Qualified Non-Xxxxxxxxx Entity.

9. Insurance; Indemnity.

9.1 Lessee’s Insurance. From and after the Commencement Date or the date of Early Possession of the Premises, whichever first occurs, and continuing thereafter until the expiration or sooner termination of the term of the Lease, Lessee shall carry and maintain, at its sole cost and expense, the following types of insurance in the amounts specified and in the form hereinafter provided for:

(a) Liability Insurance. A Commercial General Liability Policy of Insurance protecting Lessee and Lessor against claims for bodily injury, personal injury and property damage based upon or arising out of the ownership, use, occupancy or maintenance of the Premises and all areas appurtenant thereto. Such insurance shall be on an occurrence basis providing single limit coverage in an amount not less than $1,000,000 per occurrence with an “Additional Insured-Managers or Lessors of Premises Endorsement” and contain the “Amendment of the Pollution Exclusion Endorsement” for damage caused by heat, smoke or fumes from a hostile fire. The Policy shall not contain any intra-insured exclusions as between insured persons or organizations, but shall include coverage for liability assumed under this Lease as an “insured contract” for the performance of Lessee’s indemnity obligations under this

17.

Lease. The limits of said insurance shall not, however, limit the liability of Lessee nor relieve Lessee of any obligation hereunder. In addition, Lessee shall obtain and keep in force excess or umbrella insurance in the amount of $5,000,000 which shall comply in all respects with requirements set forth herein for insurance.

(b) Property Insurance. A policy or policies of property damage insurance covering Lessee’s personal property, Trade Fixtures, and Lessee Owned Alterations and Utility Installations. Such insurance shall be full replacement cost coverage with a reasonable deductible. The proceeds from any such insurance shall be used by Lessee for the replacement of personal property, Trade Fixtures and Lessee Owned Alterations and Utility Installations. Lessee shall provide Lessor with written evidence that such insurance is in force.

(c) Comprehensive Automobile Liability Insurance. Business automobile liability insurance, or equivalent form, with a combined single limit of not less than One Million Dollars ($1,000,000) per occurrence. Such insurance shall include coverage for owned, non-owned and hired automobiles. If Lessee is not using automobiles in connection with its business, the foregoing coverage will not be required.

(d) Business Interruption. Business interruption insurance covering loss of income and extra expense in such amounts as will reimburse Lessee for loss of earnings, income and extra expense for at least six (6) months attributable to all perils commonly insured against by prudent lessees, or attributable to the inaccessibility of or to the Premises, the Building or the Project as a result of such perils, or otherwise, preferably by the same insurance carrier that issues Lessee’s property insurance.

(e) Worker’s Compensation. Workers’ compensation as required by law, including employer’s liability insurance, with limits of not less than $1,000,000. Such policy shall be in full compliance with all current laws governing Worker’s Compensation.

(f) Other. Such other form(s) of insurance as Lessee, Lessor, or Lessor’s Lenders may reasonably require from time to time. Such insurance shall be in such form and amounts, and cover such risks as would be maintained by a prudent lessee of comparable size in a comparable business.

9.2 Lessee Policy Requirements. Insurance required herein shall be provided by companies duly licensed or admitted to transact business in the state where the Premises are located, and maintaining during the policy term a “General Policyholders Rating” of at least A-, VII, or such other rating as may be required by a Lender, as set forth in the most current issue of “Best’s Insurance Guide”. Lessee shall not do or permit to be done anything which invalidates the required insurance policies. Lessee shall, prior to the earlier of the Commencement Date or the date of Early Possession, deliver to Lessor certificates evidencing the existence and amounts of the required insurance. No such policy shall be cancelable or subject to material modification except after ten (10) business days’ prior written notice to Lessor. As used herein, “material modifications” shall mean changes that, if implemented, would cause Lessee not to be in compliance with the insurance requirements set forth in this Lease, including reduction in policy limits below the minimum required limits described in Paragraph 9.1. Lessee shall, at least ten (10) business days prior to the expiration of such policies, furnish Lessor with evidence of

18.

renewals or “insurance binders” evidencing renewal thereof, or Lessor may order such insurance and charge the cost thereof to Lessee, which amount shall be payable by Lessee to Lessor upon demand. Such policies shall be for a term of at least one year, or the length of the remaining term of this Lease, whichever is less. All public liability, property damage and other casualty policies shall be written as primary policies, not contributing with and not in excess of coverage carried by Lessor, whose insurance shall be considered excess insurance only. If Lessee shall fail to procure and maintain the insurance required to be carried by it, Lessor may, but shall not be required to, procure and maintain the same, in which case, Lessee shall reimburse Lessor for all costs incurred by Lessor in procuring and maintaining such insurance within thirty (30) days after written notice from Lessor.

9.3 Lessor’s Insurance. During the term of this Lease, Lessor shall maintain casualty insurance covering the Building and the Project (excluding Trade Fixtures, Lessee Owned Alterations and Utility Installations). Such insurance shall provide protection against any peril included within the classification “Fire and Extended Coverage.” Lessor shall also maintain comprehensive public liability and property damage insurance with respect to the use, operation and condition of the Common Areas of the Building and the Project. Such insurance shall be in such amounts and with such deductibles as Lessor considers appropriate. Lessor may, but shall not be obligated to, obtain and carry any other form or forms of insurance as it or Lessor’s Lenders may determine advisable. The cost of all insurance maintained by Lessor shall be included in Operating Expenses. Notwithstanding any contribution by Lessee to the cost of insurance premiums as provided in this Lease, Lessee acknowledges that it has no right to receive any proceeds from any insurance policies maintained by Lessor.

9.4 Waiver of Subrogation. Without affecting any other rights or remedies, Lessee and Lessor each hereby release and relieve the other, and waive their entire right to recover damages against the other, for loss of or damage to its property arising out of or incident to the perils required to be insured against herein. The effect of such releases and waivers is not limited by the amount of insurance carried or required, or by any deductibles applicable hereto. The Parties agree to have their respective property damage insurance carriers waive any right to subrogation that such companies may have against Lessor or Lessee, as the case may be, so long as the insurance is not invalidated thereby, and to provide evidence thereof.

9.5 Indemnity. Except for Lessor’s negligence or willful misconduct, Lessee shall indemnify, protect, defend and hold harmless the Premises, Lessor and its agents, Lessor’s master or ground lessor, partners, property managers and Lenders, from and against any and all claims, loss of rents and/or damages, liens, judgments, penalties, attorneys’ and consultants’ fees, expenses and/or liabilities arising out of, involving, or in connection with, the use and/or occupancy of the Premises by Lessee. If any action or proceeding is brought against Lessor by reason of any of the foregoing matters, Lessee shall upon notice defend the same at Lessee’s expense by counsel reasonably satisfactory to Lessor and Lessor shall cooperate with Lessee in such defense. Lessor need not have first paid any such claim in order to be defended or indemnified. Lessee shall pay for any increase in the premiums for Lessor’s property insurance applicable to the Building or the Project if said increase is caused by Lessee’s acts, omissions, use or occupancy of the Premises.

19.

9.6 Exemption of Lessor from Liability. Except for Lessor’s gross negligence or willful misconduct, Lessor shall not be liable for injury or damage to the person or goods, wares, merchandise or other property of Lessee, Lessee’s employees, contractors, invitees, customers, or any other person in or about the Premises, whether such damage or injury is caused by or results from fire, steam, electricity, gas, water or rain, or from the breakage, leakage, obstruction or other defects of pipes, fire sprinklers, wires, appliances, plumbing, HVAC or lighting fixtures, or from any other cause, whether the said injury or damage results from conditions arising upon the Premises or upon other portions of the Building of which the Premises are a part, or from other sources or places. Lessor shall not be liable for any damages arising from any act or neglect of any other tenant of Lessor. Notwithstanding Lessor’s negligence or breach of this Lease, Lessor shall under no circumstances be liable for injury to Lessee’s business or for any loss of income or profit therefrom.

10. Damage and Destruction.

10.1 Definitions.

(a) “Premises Partial Damage” shall mean damage or destruction to the improvements on the Premises, other, than Lessee Owned Alterations and Utility Installations, which can reasonably be repaired in nine (9) months or less from the date of the damage or destruction. Lessor shall notify Lessee in writing within thirty (30) days from the date of the damage or destruction as to whether or not the damage is Partial or Total.

(b) “Premises Total Destruction” shall mean damage or destruction to the Premises, other than Lessee Owned Alterations and Utility Installations and Trade Fixtures, which cannot reasonably be repaired in nine (9) months or less from the date of the damage or destruction. Lessor shall notify Lessee in writing within thirty (30) days from the date of the damage or destruction as to whether or not the damage is Partial or Total.

(c) “Insured Loss” shall mean damage or destruction to improvements on the Premises, other than Lessee Owned Alterations and Utility Installations and Trade Fixtures, which was caused by an event required to be covered by the insurance described in this Lease, irrespective of any deductible amounts or coverage limits involved.

(d) “Replacement Cost” shall mean the cost to repair or rebuild the improvements owned by Lessor at the time of the occurrence to their condition existing immediately prior thereto, including demolition, debris removal and upgrading required by the operation of Applicable Requirements, and without deduction for depreciation.

(e) “Hazardous Substance Condition” shall mean the occurrence or discovery of a condition involving the presence of, or a contamination by, a Hazardous Substance as defined in this Lease, in, on, or under the Premises.

10.2 Partial Damage - Insured Loss. If a Premises Partial Damage that is an Insured Loss occurs, Lessor shall, at Lessor’s expense (subject to receipt of adequate insurance proceeds), repair such damage (but not Lessee’s Trade Fixtures or Lessee Owned Alterations and Utility Installations) as soon as reasonably possible and this Lease shall continue in full force and effect.

20.

10.3 Partial Damage - Uninsured Loss. If a Premises Partial Damage that is not an Insured Loss occurs, unless caused by a negligent or willful act of Lessee (in which event Lessee shall make the repairs at Lessee’s expense), Lessor may either: (i) repair such damage as soon as reasonably possible at Lessor’s expense, in which event this Lease shall continue in full force and effect, or (ii) terminate this Lease by giving written notice to Lessee within 30 days after receipt by Lessor of knowledge of the occurrence of such damage. Such termination shall be effective 60 days following the date of such notice.

10.4 Total Destruction. Notwithstanding any other provision hereof, if a Premises Total Destruction occurs, at the election of Lessor or Lessee, this Lease shall terminate thirty (30) days following such Premises total Destruction. If the damage or destruction was caused by the gross negligence or willful misconduct of Lessee, Lessor shall have the right to recover Lessor’s damages from Lessee, to the extent not covered by insurance required to be carried hereunder. If neither Lessor nor Lessee elects to terminate this Lease, then the Premises Total Destruction shall be treated as a Premises Partial Damage and the provisions set forth above shall apply.

10.5 Damage Near End of Term. If at any time during the last year of this Lease there is damage for which the cost to repair exceeds three (3) months’ Base Rent, whether or not an Insured Loss, Lessor or Lessee may terminate this Lease effective sixty (60) days following the date of occurrence of such damage by giving written termination notice to Lessee within thirty (30) days after the date of occurrence of such damage. Notwithstanding the foregoing, if Lessee at that time has an exercisable option to extend this Lease, then Lessee may preserve this Lease by, (a) exercising such option and (b) providing Lessor with any shortage in insurance proceeds (or adequate assurance thereof) needed to make the repairs on or before the earlier of (i) the date which is ten days after Lessee’s receipt of Lessor’s written notice purporting to terminate this Lease, or (ii) the day prior to the date upon which such option expires. If Lessee duly exercises such option during such period and provides Lessor with funds (or adequate assurance thereof) to cover any shortage in insurance proceeds, Lessor shall, at Lessor’s commercially reasonable expense, repair such damage as soon as reasonably possible and this Lease shall continue in full force and effect. If Lessee fails to exercise such option and provide such funds or assurance during such period, then this Lease shall terminate on the date specified in the termination notice and Lessee’s option shall be extinguished.

10.6 Abatement of Rent; Lessee’s Remedies.

(a) Abatement. In the event of Premises Partial Damage or Premises Total Destruction or a Hazardous Substance Condition for which Lessee is not responsible under this Lease, the Rent thereafter payable by Lessee for the remaining period required for the repair, remediation or restoration of such damage shall be abated in proportion to the degree to which Lessee’s use of the Premises is impaired. All other obligations of Lessee hereunder shall be performed by Lessee, and Lessor shall have no liability for any such damage, destruction, remediation, repair or restoration except as provided herein.

(b) Remedies. If Lessor shall be obligated to repair or restore the Premises and does not commence, in a substantial and meaningful way, such repair or restoration within sixty (60) days after such obligation shall accrue, Lessee may, at any time prior to the

21.

commencement of such repair or restoration, give written notice to Lessor and to any Lenders of which Lessee has actual notice, of Lessee’s election to terminate this Lease on a date not less than sixty (60) days following the giving of such notice. If Lessee gives such notice and such repair or restoration is not commenced within thirty (30) days thereafter, this Lease shall terminate as of the date specified in said notice. If the repair or restoration is commenced within said thirty (30) days, this Lease shall continue in full force and effect. “Commence” shall mean either the unconditional authorization of the preparation of the required plans, or the beginning of the actual work on the Premises, whichever first occurs.

10.7 Termination-Advance Payments. Upon termination of this Lease pursuant to the provisions of the damage and destruction provisions of this Lease, an equitable adjustment shall be made concerning advance Base Rent and any other advance payments made by Lessee to Lessor.

10.8 Waive Statutes. Lessor and Lessee agree that the terms of this Lease shall govern the effect of any damage to or destruction of the Premises with respect to the termination of this Lease and hereby waive the provisions of any present or future statute to the extent inconsistent herewith.

11. Utilities and Personal Property Taxes.

11.1 Utilities. Lessor, as part of the Tenant Improvements, shall stub and submeter all utilities and services supplied to the Premises, including water, gas, heat, light, power, and telephone, and trash disposal. Lessee shall pay for all utilities and services supplied to the Premises, as measured by such sub-meters, together with any taxes thereon. If any such services cannot be separately metered to Lessee, Lessee shall pay a reasonable proportion of all charges jointly metered.

11.2 Personal Property Taxes. Lessee shall pay, prior to delinquency, all taxes assessed against and levied upon Lessee Owned Alterations, Utility Installations, Trade Fixtures, furnishings, equipment and all personal property of Lessee. When possible, Lessee shall cause such property to be assessed and billed separately from the real property of Lessor. If any of Lessee’s said personal property shall be assessed with Lessor’s real property, Lessee shall pay Lessor the taxes attributable to Lessee’s property within thirty (30) days after receipt of a written statement.

12. Assignment and Subletting.

12.1 Lessor’s Consent Required.

(a) Lessee shall not voluntarily or by operation of law assign, transfer, mortgage or encumber (collectively, “assign or assignment”) or sublet all or any part of Lessee’s interest in this Lease or in the Premises without Lessor’s prior written consent, which consent, subject to the provisions of this Paragraph 12, shall not be unreasonably withheld.