LOAN AGREEMENT Made as of the 26th day of January, 2007 by and among FutureIT, Inc. and The Lenders listed therein

Exhibit 10.2

Made as of the 26th day of January, 2007

by and among

and

The Lenders listed therein

THIS LOAN AGREEMENT (this “Agreement”) made as of the 26th day of January, 2007, by and among FutureIT, Inc., a Delaware Corporation, (the “Company”), and the persons and entities identified in Schedule 1 attached hereto (each a “Lender” and collectively the “Lenders”).

W I T N E S S E T H:

WHEREAS, the Company is seeking equity financing;

WHEREAS, the Company requires until the consummation of the aforementioned financing, an infusion of funds in order to conduct its business activities and to register its shares of common stock; and

WHEREAS, the Lenders are willing to make available loans to the Company on the terms and conditions set forth in this Agreement;

NOW, THEREFORE, the parties hereto hereby agree as follows:

1. Loan and Issuance of Shares. The Lenders will lend to the Company, severally and not jointly, an aggregate minimum of US$250,000 and a maximum of US$375,000 (the “Loans”), in units of $25,000, in the respective amounts set forth next to the name of each Lender in Schedule 1 hereto. Each Lender, severally and not jointly, will transfer its portion of the Loan to the Company by wire transfer of immediately available funds at the Closing (as defined below). The Company has authorized the issuance, in accordance with the terms hereof, of (i) the Company’s Promissory Notes in the aggregate principal amount of up to $375,000 (collectively, the “Notes” and individually a “Note”), and (ii) 90,000 shares of common stock, par value $0.0001 per share of the Company (“Common Stock”) (which represents approximately 0.465% of the total number of outstanding shares of Common Stock on a fully diluted basis as of the date hereof) for each $25,000 unit of the Notes provided according to this Agreement and an aggregate of 1,350,000 shares of Common Stock (the “Shares”) (which represents approximately 6.98% of the total number of outstanding shares of Common Stock on a fully diluted basis as of the date hereof), assuming the full amount of $375,000 in Loans is provided to the Company. Each Note will be substantially in the form set forth in Exhibit A hereto (for the purposes hereof, “fully-diluted basis” does not include any securities to be issued in connection with one or more equity rounds that may take place after the date of this Agreement). The Company agrees that upon, and subject to, receipt of the principal amount of each Note from each Lender, to issue to such Lender (i) a Note in the principal amount set forth opposite such Lender’s name on Schedule 1, (ii) the number of Shares set forth opposite such Lender’s name on Schedule 1, and (iii) validly executed stock certificates covering the Shares, issued in the name of such Lender. The amount of the par value of the Shares issued to each Lender will be deducted by the Company from such Lender’s Loan (and the principal amount of the Loan will be reduced accordingly so that all the Shares issued to such Lender shall be fully paid-up and nonassesable.

2. Effectiveness. The obligations of the Lenders pursuant to this Agreement are subject to (a) the receipt by the Lenders of the following: (i) duly executed resolutions of the Company’s Board of Directors authorizing the Company to enter into this Agreement and its exhibits and schedules and the issuance of the Shares to the Lenders against and subject to payment of the Loan amounts as set out herein, in the form attached hereto as Schedule 2(A), which shall be provided by the Company to the Lenders upon the execution by the Lenders of this Agreement, and (ii) a certificate of the Company’s legal existence and good standing and a certified copy of the Company’s Certificate of Incorporation, each issued by the Secretary of State of the State of Delaware, dated as closely as possible to Closing and in no event earlier than three days prior to Closing; and (b) the requirement that an aggregate minimum of US$250,000 be transferred by all of the Lenders to the Company pursuant to this Agreement; The date on which all of the above documentation shall be executed and delivered to the reasonable satisfaction of a majority in interest of the Lenders shall be referred to herein as the “Closing”, provided however, that the Closing shall occur no later than January 26, 2007 or such later date approved in writing by the Company and a majority in interest of the Lenders. The Closing shall be subject to the execution of this Agreement by the Company and all Lenders.

The Loans will be paid by wire transfer of immediately available funds to the following bank account of the Company:

Future

IT, Inc.

Account Number

0000000

Israel Discount

Bank of New York

000 Xxxxx Xxxxxx

Xxx Xxxx, XX 00000

ABA # 000000000

(for wires within the US)

SWIFT code XXXXXX00

3. Use of Proceeds. The Company will use the proceeds from the Loans solely for paying expenses of preparation of this Agreement, to make payments under the Option Agreement (defined in Section 7.1 (b) below) (which such payments shall be made by the Company pursuant to its execution of the Option (as such term is defined in Section 7.1(b) below) under the Option Agreement as soon as possible following the Closing), working capital and for preparation of a registration statement to register shares of the Common Stock with the Securities and Exchange Commission under the Securities Act of 1933 (the “Securities Act”).

4. Adjustments. If after the date hereof the number of outstanding shares of Common Stock shall be changed into a different number by reason of any stock dividend, stock split, combination of shares, reclassification, recapitalization, spin-off or other similar event affecting the capital stock of the Company, the number of Shares owned by each of the Lenders shall be proportionately adjusted.

-2-

5. Registration Rights. The Shares will be registered pursuant to the initial registration statement to be filed by the Company for the registration of the shares of Common Stock issued in private placements or a public offering of the Common Shares in which the Company cumulatively raises a minimum aggregate sum of $1,500,000, prior to commencement of trading. In addition, as to any such Shares that were not sold by a Lender pursuant to the initial registration statement until such time as all such Shares have been sold, any Lender can submit a written request to the Company and the Company shall cause to be included for registration under the Securities Act all of the Shares that each such Lender has requested to be registered in the next registration statement that the Company will file under the Securities Act.

6. Security. The Notes shall be secured by a perfected first priority lien (the “Lien”) covering all of the assets of the Company, in the form attached hereto as Exhibit B (the “Security Agreement”).

7. Representations and Warranties of the Company.

The Company hereby represents and warrants to the Lenders, and acknowledges that the Lenders are entering into this Agreement in reliance thereon, as follows:

7.1 Organization.

(a) The Company is duly organized, validly existing and in good standing under the laws of the State of Delaware, and has full corporate power and authority to own, lease and operate its properties and assets and to conduct its business as now being conducted. The Company has all requisite power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby.

(b) The Company has the option (the “Option”) to purchase all the issued and outstanding shares of Future IT Ltd. (the “Israeli Subsidiary”), a company duly organized and, validly existing under the laws of the State of Israel in accordance with the Option Agreement in the form attached hereto as Exhibit C (the “Option Agreement”), which such Option the Company shall exercise pursuant to the terms of the Option Agreement as soon as possible following the Closing. The Israeli Subsidiary has the power and authority to own, lease and operate its properties and assets and to conduct its business as now being conducted.

(c) Future IT Software Limited a company duly organized and validly existing under the laws of England (the “UK Subsidiary” and together with the Israeli Subsidiary, the “Subsidiaries”) is wholly-owned by the Company; however the UK Subsidiary is negotiating with a party who has expressed interest in acquiring an equity share of approximately 25% in the UK Subsidiary.

7.2 Authorization; Approvals. All corporate action on the part of the Company necessary for the authorization, execution, delivery, and performance of all of Company’s obligations under this Agreement, the Notes and the Security Agreement has been taken.

-3-

7.3 No Breach. Neither the execution and delivery of this Agreement nor compliance by the Company with the terms and provisions hereof, will conflict with, or result in a breach or violation of, any of the terms, conditions and provisions of: (i) the Company’s Certificate of Incorporation, the Company’s By-Laws, or other governing instruments of the Company, or the organizational documents of any of the Subsidiaries, (ii) any judgment, order, injunction, decree, or ruling of any court or governmental authority, domestic or foreign, (iii) any agreement, contract, lease, license or commitment to which either the Company or any Subsidiary is a party or to which any of them is subject, or (iv) law applicable to any of the Company or any Subsidiary. The execution, delivery and compliance Agreement will not (a) give to others any rights, including rights of termination, cancellation or acceleration, in or with respect to any agreement, contract or commitment referred to in this paragraph, or to any of the properties of the Company or any Subsidiary, or (b) otherwise require the consent or approval of any person, which consent or approval has not heretofore been obtained.

7.4 Enforceability. The execution and delivery of this Agreement, the Notes and the Security Agreements by the Company, and the issuance and sale by the Company of the Shares, are and will result in legally binding obligations of the Company, enforceable against it in accordance with the respective terms and provisions hereof and thereof, except to the extent that (a) such enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors’ rights, and (b) the availability of the remedy of specific performance or injunctive or other equitable relief will be subject to the discretion of the court before which any proceeding therefor may be brought.

7.5 The Shares. The Shares have been duly authorized and when issued in accordance with this Agreement shall be duly and validly issued, fully-paid up and nonassesable and shall be free and clear of any liens, encumbrances, claims, or third party rights of any kind imposed by, or on behalf of, the Company.

7.6 Legal Proceedings. There is no (i) action, suit, claim, proceeding or investigation pending or, to the Company’s knowledge, threatened against, affecting, or related to the Company or the Subsidiary, at law or in equity, including, without limitation, (i) before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, (ii) arbitration proceeding relating to the Company or the Subsidiary pending under collective bargaining agreements or otherwise or (iii) governmental inquiry pending or, to the Company’s knowledge, threatened against or affecting the Company or the Subsidiary (including, without limitation, any inquiry as to the qualification of the Company or the Subsidiary to hold or receive any license, permit or approval), and to the Company’s knowledge, there is no basis for any of the foregoing. There is no action or suit by the Company pending, threatened or contemplated against others.

7.7 Governmental Consents. The Company has obtained all consents, approvals, orders, or authorizations of, or registrations, qualifications, designations, declarations, or filings with, any governmental authority, required on the part of the Company in connection with the valid execution and delivery of this Agreement or the consummation of any other transaction contemplated hereby.

7.8 Capitalization.

(a) On the date hereof, before giving effect to the transactions contemplated by this Agreement, the authorized capital stock of the Company consists of 20,000,000 shares of Common Stock, $0.0001 par value per share, of which 15,500,000 shares are issued and outstanding, all of which are owned beneficially and of record as set forth in Schedule 7.8 hereto.

-4-

(b) Other than as set forth on Schedule 7.8 hereto, there are no outstanding rights or options to subscribe for or purchase from the Company, or any warrants or other agreements providing for or requiring the issuance by the Company of any capital stock or other equity interest, or any securities convertible into or exchangeable for its capital stock or other equity interest. The execution, delivery and issuance of each of this Agreement and the issuance by the Company of the Shares do not and will not trigger the rights of and do not and will not require the waiver or consent of the holders of any rights (either pre-emptive or other) or options to subscribe for or purchase any securities from the Company, or rights under any warrants or other agreements providing for or requiring the issuance by the Company of any capital stock or other equity interest, or any securities convertible into or exchangeable for its capital stock or other equity interest.

(c) The Company owns all of the outstanding equity interests in the UK. Subsidiary and no other person has any debt or equity interest therein, or any right, contingent or otherwise, to acquire any such interest. The Company does not own, directly or indirectly, any stock or other equity interest in any other corporation, partnership or other entity.

7.9 Financial Statements. The Company has delivered to the Lenders copies of (i) the unaudited Balance Sheets of the Israeli Subsidiary as at December 31, 2005, March 31, 2006, June 30, 2006 and September 30, 2006, and the Statements of Profit and Loss of the Subsidiary as of January 1, 2005, January 1, 2006, April 1, 2006, and July 1, 2006 (such Balance Sheets and Statements of Profit and Loss are referred to herein as the “Financial Statements”). Each of the Financial Statements is complete and correct in all material respects, subject to audit, has been prepared in accordance with Israeli GAAP consistently applied by the Israeli Subsidiary and presents fairly the financial position and results of operations of the Israeli Subsidiary as at the dates and for the periods indicated.

7.10 Corporate Records. The Company has delivered to the Lenders true, correct and complete copies of the certificate of incorporation and by-laws of the Company and comparable organizational documents of each Subsidiary.

7.11 No Encumbrances. All properties and assets of the Company and the UK Subsidiary are free and clear of any and all liens, charges, claims, security interests or restrictions of any kind (each an “Encumbrance”).

7.12 No Undisclosed Liabilities. Except for debts and liabilities of the Israeli Subsidiary in the aggregate amount of $1,200,000 as of December 31, 2006, the Company and the Subsidiaries do not have any indebtedness, obligations or liabilities of any kind (whether accrued, absolute, contingent or otherwise, and whether due or to become due) in excess of $50,000 in the aggregate that would have been required to be reflected in, reserved against or otherwise described on the financial statements or in the notes thereto in accordance with applicable GAAP.

-5-

7.13 Compliance with Laws.

(a) Each of the Company and each Subsidiary is in compliance with all laws of any governmental body applicable to its business or operations except where failure to be in such compliance will not have a material adverse effect on the business, liabilities or operations of the Company and the Subsidiaries, taken as a whole. Neither the Company nor any Subsidiary has received any written or other notice or been charged with the violation of any laws. To the best knowledge of the Company, neither the Company nor anye Subsidiary is under investigation with respect to the violation of any laws and, to the best knowledge of the Company, there are no facts or circumstances which could form the basis for any such violation. Each of the Company and each Subsidiary currently has all permits which are required for the operation of the respective businesses as presently conducted.

(b) Each of the Company and each Subsidiary (i) is not in default or violation (and no event has occurred which, with notice or lapse of time or both, would constitute a default or violation) of any term, condition or provision of the certificate of incorporation and the by-laws of the Company or the organizational documents of the applicable Subsidiary (as applicable), and (ii) is not in default or violation (and no event has occurred which, with notice or the lapse of time or both, would constitute a default or violation) in any material respect of any term, condition or provision of any permit or contract to which it is a party, to which its business is subject or by which its properties or assets are bound, and to the best knowledge of the Company there are no facts or circumstances which could form the basis for any such default or violation.

7.14 No Misrepresentation. Neither this Agreement (including the Schedules and Exhibits hereto) nor any document, certificate or instrument furnished by the Company to the Lenders, with respect to the Company or the Subsidiary, any untrue statement of a material fact or omits to state a material fact necessary to make the statements therein not misleading.

8. Representation and Warranties of the Leaders. Without derogating from the Lender’s rights to be repaid in accordance with the provisions of Sections 3, each of the Lenders, severally and not jointly, represents and warrants to the Company that:

8.1 The Lender has been advised that this Agreement and the Shares have not been registered, under the Securities Act or any securities laws, and therefore cannot be resold unless they are registered under the Securities Act and applicable state securities laws or an exemption from such registration is available;

8.2 The Lender is aware that the Company is under no obligation to affect any such registration with respect to the Shares or to file for or comply with any exemption from registration except pursuant to Section 5 above;

8.3 The Lender has not been formed solely for the purpose of making this investment and is providing the Loan to the Company and is purchasing the Shares for its own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof;

8.4 The Lender has knowledge and experience in financial and business matters, is capable of evaluating the merits and risks of the transactions evidenced by this Agreement and can bear the economic consequences of such investment for an indefinite period of time;

-6-

8.5 The Lender is an accredited investor as such term is defined in Rule 501 of Regulation D under the Securities Act; and

8.6 The Lender acknowledges that the Company has given the Lender access to the corporate records and accounts of the Company and to all information in its possession relating to the Company and has furnished the Lender with all documents and other information requested by the Lender to make an informed decision with respect to the execution of this Agreement.

9. Miscellaneous.

9.1 Each of the parties hereto shall perform such further acts and execute such further documents as may reasonably be necessary to carry out and give full effect to the provisions of this Agreement and the intentions of the parties as reflected thereby.

9.2 This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, excluding that body of law pertaining to conflict of law. Any disputes arising under or in relation to this Agreement shall be resolved exclusively by the competent courts of the State of Delaware.

9.3 The terms and provisions of this Agreement shall be binding upon and inure to the benefit of, and be enforceable by, the respective successors and assigns of the parties hereto. This Agreement shall not inure to the benefit of or be enforceable by any person other than a party to this Agreement and its successors and assigns.

9.4 This Agreement and the Schedules and Exhibits hereto constitute the full and entire understanding and agreement between the parties with regard to the subject matter hereof and thereof. The preamble hereto constitutes an integral part hereof. Any term of this Agreement may be amended and the observance of any term hereof may be waived (either prospectively or retroactively and either generally or in a particular instance) only with the written consent of the Lenders holding at least sixty six percent (66%) of the principal amount of the outstanding Notes.

9.5 All notices and other communications required or permitted hereunder to be given to a party to this Agreement shall be in writing and shall be telecopied or mailed by registered or certified mail, postage prepaid, by recognized national or international overnight courier or otherwise delivered by hand or by messenger, to the address set forth opposite such party’s name in Schedule 1, or such other address with respect to a party as such party shall notify each other party in writing as above provided. Any notice sent in accordance with this Section 8.7 shall be effective (i) if mailed, five (5) business days after mailing, (ii) one day after deposit with a nationally recognized overnight courier, specifying next day delivery, or two days after deposit with an internationally recognized overnight courier, specifying two day delivery, in either case with written verification of receipt; (iii) if sent by messenger, upon delivery, and (iii) if sent via telecopier, upon transmission and electronic confirmation of receipt or (if transmitted and received on a non-business day) on the first business day following transmission and electronic confirmation of receipt.

9.6 No delay or omission to exercise any right, power, or remedy accruing to any party upon any breach or default under this Agreement, shall be deemed a waiver of any other breach or default theretofore or thereafter, occurring. All remedies, either under this Agreement or by law or otherwise afforded to any of the parties, shall be cumulative and not alternative.

-7-

9.7 If any provision of this Agreement is held by a court of competent jurisdiction to be unenforceable under applicable law, then such provision shall be excluded from this Agreement and the remainder of this Agreement shall be interpreted as if such provision were so excluded and shall be enforceable in accordance with its terms, provided, however, that in such event this Agreement shall be interpreted so as to give effect, to the greatest extent consistent with and permitted by applicable law, to the meaning and intention of the excluded provision as determined by such court of competent jurisdiction.

9.8 This Agreement may be executed in any number of counterparts, each of which shall be deemed an original and enforceable against the parties actually executing such counterpart, and all of which together shall constitute one and the same instrument. Facsimile signatures shall be considered originals.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

-8-

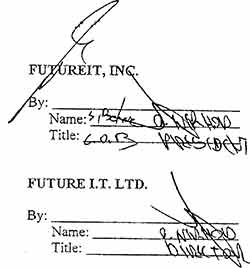

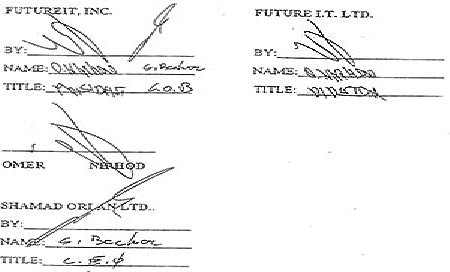

IN WITNESS WHEREOF the parties have signed this Loan Agreement in one or more counterparts as of the date first hereinabove set forth.

|

|

|

|

|

|

|

|

||

|

|

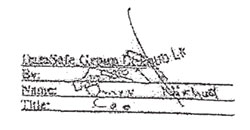

By: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title: |

C. O. B PRESIDENT |

|

|

|

|

|

|

-9-

SCHEDULE 1 - THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$25000 |

90,000 |

|

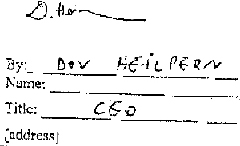

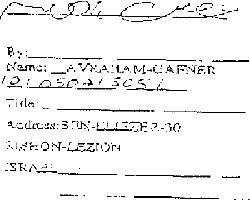

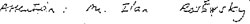

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

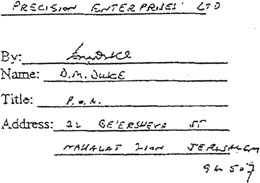

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

-10-

SCHEDULE 1 - THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

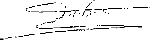

By:

Name: Xxxx Xxxxxx Address: Xxxx xxxx st no 00 Xxxxxxxx , Xxxxxx

|

$25000 |

900000 |

|

By:

Name:

Title:

Address:

|

$________ |

____________ |

|

By:

Name:

Title:

Address:

|

$________ |

____________ |

|

By:

Name:

Title:

Address:

|

$________ |

____________ |

[Signature Page of FutureIT, Inc. Bridge Loan Agreement]

SCHEDULE 1 - THE LENDER

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$50,000 |

180,000 |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

-10-

|

|

|

|

24/01/07 |

|

SCHEDULE 1 - THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$25000 |

________ |

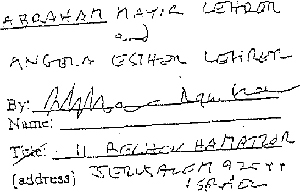

By:

Name: BAR-XXX XXXXX

ID: 47555347

Title:

Address:_BROSH-9

XXXXXX-XXXXX

ISRAEL 99797

|

$25000 |

________ |

|

By:

Name:

Title:

Address:

|

$________ |

_________ |

[Signature Page of FutureIT, Inc. Loan Agreement]

SCHEDULE 1 - THE LENDER

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$25000 |

90,000 |

|

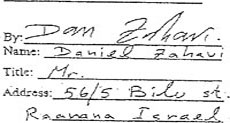

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

|

By:

Name:

Title:

[address:]

|

$________ |

____________ |

-10-

SCHEDULE 1 – THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

By: XXXXXX XXXXXX

Name:

Title:

Address: 00 XXXXXX XX.

XXX XXXX 00000

|

$25,000

|

90,000

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

[Signature Page of FutureIT, Inc. Bridge Loan Agreement]

-10-

SCHEDULE 1 – THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$25,000

|

90,000

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

[Signature Page of FutureIT, Inc. Bridge Loan Agreement]

-10-

SCHEDULE 1 – THE LENDER

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

Thrift Warehouses, Inc. By:

Name: Xxxxxxx Xxxx

Title: President

C/O Xxxxxxx Xxxx, 14/3 Ha’Efroni Xx.

Xxxxxxxxxx Xxxx, 00000, Xxxxxx |

$25,000

|

90,000

|

|

By:

Name:

Title:

[address]

|

$________

|

_________

|

|

By:

Name:

Title:

[address]

|

$________

|

_________

|

|

By:

Name:

Title:

[address]

|

$________

|

_________

|

SCHEDULE 1 – THE LENDERS

|

|

|

|

|

Name and Address: |

Principal Amount of Loan |

Number of Shares |

|

$25,000

|

90,000

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

|

By:

Name:

Title:

Address:

|

$________

|

_________

|

[Signature Page of FutureIT, Inc. Bridge Loan Agreement]

-10-

WRITTEN CONSENT

OF THE BOARD OF DIRECTORS

OF

Dated as of January 8, 2007

The undersigned, being all the members of the board of directors (the “Board”) of FutureIT, Inc., a Delaware corporation (the “Corporation”), do hereby unanimously consent to and adopt the following resolutions in lieu of a meeting, in accordance with. Section 141(f) of the General Corporation Law of the State of Delaware, and approve and adopt such resolutions with the same force and effect as if they were adopted at a duly constituted meeting of the Board, the same to be effective immediately upon the signing of this instrument, and the Secretary of the Corporation is hereby directed to file this Consent in the minute books of the Corporation:

WHEREAS, the Board has determined that it is advisable and in the best interests of the Corporation, in connection with the Loan Agreement (as defined below), to amend and restate the Corporation’s Certificate of Incorporation in the form attached hereto as Exhibit A (the “Amended and Restated Certificate”), to increase the authorized number of shares of Common Stock to 20,000,000, par value $0.0001 each;

WHEREAS, the Board has determined that it is advisable and in the best interests of the Corporation for the Corporation to raise up to $375,000 but not less than $250,000 through the issuance and sale of secured promissory notes pursuant to a Loan Agreement substantially in the form attached hereto as Exhibit B (the “Loan Agreement”);

WHEREAS, the Board has determined that it is advisable and in the best interests of the Corporation for the Corporation to deliver to each purchaser set forth on Schedule 1 of the Loan Agreement (each an “Lender” and collectively, the “Lenders”), a secured promissory note in the principal amount set forth next to each such Lender’s name on Schedule 1 of the Loan Agreement, in substantially the form attached hereto as Exhibit C (the “Note” and collectively, the “Notes”);

WHEREAS, the Board has determined that it is advisable and in the best interests of the Corporation for the Corporation to enter into the Security Agreement with the Lenders substantially in the form attached hereto as Exhibit D (the “Security Agreement”);

WHEREAS, the Board has determined that it is advisable and in the best interests of the Company for the Company to issue to each Lender 90,000 shares of its Common Stock for each $25,000 of principal amount of Notes purchased by each Lender and up to an aggregate of 1,350,000 shares of Common Stock in the aggregate to be issued to the Lenders (the “Shares”);

NOW THEREFORE, BE IT

Approval of Amended and Restated. Certificate of Incorporation

RESOLVED, that the Amended and Restated Certificate be, and it hereby is, adopted and approved;

RESOLVED, that the officers of the Company be, and each of them hereby is, authorized and directed to solicit the necessary stockholder approval of the Amended and Restated Certificate; and

RESOLVED, that, subject to the approval of the stockholders of the Company, the officers of the Company be, and each of them hereby is, authorized, empowered and directed to file the Amended Certificate with the Secretary of State of the State of Delaware, and to take any and all actions and to execute and deliver any and all further instruments and documents as the officer or officers so acting shall determine to be necessary or appropriate to accomplish the filing and effectuation of the Amended and Restated Certificate, the taking of any action to be conclusive evidence that the same was deemed to be necessary or appropriate and was authorized hereby.

2. Approval of the Loan Agreement, the Notes and the Security Agreement

RESOLVED, that the form, terms and provisions of each of the Loan Agreement, the Notes and the Security Agreement and the transactions contemplated by each of them, be, and they hereby are, ratified, confirmed and approved, in such form and with such changes thereto as the person executing the same shall approve, such approval to be conclusively evidenced by such person’s execution and delivery thereof;

RESOLVED, that, the officers of the Company be, and each of them hereby is, authorized and directed to issue and sell Notes in the aggregate principal amount of up to $375,000, such that after giving effect to such transaction, the Notes will be held by the Lenders in the principal amounts set forth opposite their respective names on Schedule 1 to the Loan Agreement, and otherwise to consummate the transactions contemplated by the Loan Agreement, the Notes and the Security Agreement, and

RESOLVED, that the officers of the Company be, and each of them hereby is, authorized and directed to execute each of the Loan Agreement, the Notes and the Security Agreement, and any related agreements, and to take all actions necessary and appropriate to deliver such agreements and to perform the Company’s obligations thereunder.

3. Issuance of Shares

RESOLVED, that, upon proper filing of the Amended and Restated Certificate, the issuance of the Shares to the Lenders upon providing of the loan by the Lenders in accordance with the terms of the Loan Agreement is hereby approved and such Shares when issued, will be validly issued, fully paid, and non-assessable.

-2-

4. Omnibus

RESOLVED, that the officers of the Company be, and each of them hereby is, authorized and empowered to do or perform, or cause to be done or performed, all such acts, deeds and things, and to make, execute and deliver or cause to be made, executed or delivered, all such agreements, undertakings, documents, instruments or certificates in the name or on behalf of the Company as such officer or officers may deem necessary or appropriate to effect the purposes and intent of the foregoing resolutions; and be it further

RESOLVED, that any action relating to the subject matter of these resolutions taken by any director, officer or agent of the Company prior to the date hereof hereby be, and it hereby is, ratified, confirmed and approved in all respects.

IN WITNESS WHEREOF; the undersigned have executed this Written Consent of the Board of Directors of the Company as of the date first written above.

|

|

|

|

|

|

|

|

|

|

Xxxxx Nirhod |

|

|

|

|

|

|

|

|

|

|

|

Xxxxxx Xxxxxx |

|

-3-

NEITHER THESE SECURITIES NOR THE SECURITIES FOR WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS OR BLUE SKY LAWS.

FUTUREIT, INC.

SECURED PROMISSORY NOTE

|

|

|

|

$25,000 |

January 26, 2007 |

FOR VALUE RECEIVED, upon the terms and subject to the conditions set forth in this secured promissory note (this “Note”), FUTUREIT, INC., a Delaware corporation (the “Company”), promises to pay to of ____________________ (together with his successors and permitted assigns, the “Lender”),or to his order, the principal amount of $ loaned by the Lender to the Company pursuant to the Loan Agreement (as defined herein), together with interest thereon as specified in §3 hereof.

This Note is one of a series of Secured Promissory Notes containing substantially identical terms and conditions (the “Notes”) being issued to the Lenders (the “Lenders”) pursuant to a Loan Agreement dated January 24, 2007 (the “Loan Agreement”) among the Company, the Lender and the other Lenders named therein. The Notes are pari passu such that all Notes are ranked equally, and no payments shall be made under this Note unless a pro rata payment is simultaneously made under all other Notes.

The Note will be senior in all respects (including the right of payment) to all other indebtedness of the Company now existing or hereafter incurred.

§1. Maturity; Interest.

Maturity. The entire principal amount hereof, and all accrued and unpaid interest thereon, shall become due and payable on the sooner to occur of (i) within three (3) business days following the receipt of funds by the Company from private placements or a public offering of shares of the Company’s common stock, par value $0.0001 per share, in which the Company cumulatively raises a minimum aggregate sum of $1,500,000 (in which event the Company shall set aside the amount of money required to pay the entire principal amount under all of the Notes and all accrued and unpaid interest thereon), or (ii) twelve (12) months from the date hereof. All payments made by the Company hereunder shall be made without any deduction, set-off or withholding, and shall be credited first to the accrued interest then due and payable and the remainder applied to the outstanding principal, except that the Company shall deduct from any payments due hereunder, all amounts that it is required to withhold under applicable law.

Interest. This Note shall bear interest on the principal amount outstanding and unpaid from time to time at a rate of ten percent (10%) per annum (the “Interest”), compounded annually, from the date hereof until 5:00 p.m. New York, NY, time on the date of repayment; provided that, in the event that an Event of Default (as defined in Section 3 below) occurs and is existing, the accrued Interest on this Note shall automatically increase to eighteen percent (18%) or the maximum rate allowed by applicable law, whichever is less, compounded annually, from the date of the Event of Default. Interest shall be calculated monthly on the basis of a 365 day year and shall accrue for the actual number of days elapsed until repayment and shall be payable upon maturity unless paid prior to such date as provided in §2 hereto. Interest shall be paid in quarterly installments on each April 30, July 31, October 31 and January 31 (or the next succeeding Business Day) and the maturity date hereof.

Payment Mechanism. Any payment of principal or Interest under this Note shall be conclusively deemed to have been made if made by wire transfer of immediately available funds to a bank account specified in writing to the Company or, if no such bank account is specified, by deposit of the required amount in an escrow account of an attorney or any other escrow agent determined by the Company in its discretion. No Interest will accrue commencing from the date of such transfer or deposit.

§2. Prepayment. The Company shall have the right to prepay, in whole or in part, the unpaid principal amount of the Notes or Interest accrued thereon, without requiring the prior written consent of the Lenders and without any penalty.

§3. Event of Default. Any of the following events or circumstances (each an “Event of Default”) which shall occur prior to the payment in full of the Loan amount and Interest:

(a) the Company shall fail to pay any amount of principal amount or interest on the date on which such amount is due and payable hereunder, whether on demand or otherwise; or

(b) the Company shall fail to cure any breach of its other covenants, agreements or obligations hereunder or under the Security Agreement (as defined below) within seven (7) business days after the Company becomes aware of such breach; or

(c) any representation or warranty or certification made by the Company in the Loan Agreement or the Security Agreement shall have been false or misleading in any material respect when made; or

-2-

(d) the Company or any of its subsidiaries shall make a general assignment for the benefit of creditors, or admit in writing its inability to pay its debts as they mature or become due, or shall petition or apply for the appointment of a trustee or other custodian, liquidator or receiver of the Company or such subsidiary or of any substantial part of its assets or shall commence any case or other proceeding relating to its assets under any bankruptcy, reorganization, arrangement, insolvency, readjustment of debt, dissolution or liquidation or similar law of any jurisdiction, or shall take any corporate action to authorize or in furtherance of any of the foregoing; or any such petition or application shall be filed or any such case or other proceeding shall be commenced against the Company or any of its subsidiaries, and the same shall not have been dismissed within 30 days of the filing or commencement thereof or the Company or such subsidiary shall indicate its approval thereof, consent thereto or acquiescence therein; or a decree or order shall be entered appointing any such trustee, custodian, liquidator or receiver or adjudicating the Company or such subsidiary bankrupt or insolvent, or approving a petition in any such case or other proceeding, or a decree or order for relief shall be entered in respect of the Company or such subsidiary in an involuntary case under any such bankruptcy or insolvency laws, and such decree, order, judgment, petition or other proceeding shall not have been dismissed within 30 days of the filing or commencement thereof; or

(e) the Company or any of its subsidiaries shall take any corporate action to liquidate its assets or dissolve, or shall take any corporate action to consolidate or merge with or into any other corporation or business entity unless the Company or such subsidiary shall be the surviving legal entity of such consolidation or merger or the surviving legal entity of such consolidation or merger shall have assumed in full by a written instrument the obligations under and in respect of this Note.

§4. Negative Covenants. Until all of the Company’s obligations under this Note are paid and performed in full, neither the Company nor any of its subsidiaries shall, without the prior written consent of a representitive of the Lenders that will be acceptable to the Company and X.X. Xxxxxx & Co., Inc. (the “Representative”):

(a) as to the Company only, create, incur, assume, or suffer to exist any liens, claims, options, charges, pledges, security interests, trusts, encumbrances, rights, mortgages or restrictions of any nature upon any of its property or assets, whether now owned or hereafter acquired, except in the ordinary course of busniness;

(b) as to the Company only, assume, guarantee, endorse, contingently agree to purchase, become liable in respect to any letter of credit, or otherwise become liable upon the obligation of any person or entity, except pursuant to the Option Agreement (as defined in the Loan Agreement);

(c) materially change the nature of its business or engage in any business unrelated to the business currently being conducted by the Company or such subsidiary (as applicable);

(d) sell, lease, or otherwise dispose of, or agree to sell, lease, or otherwise dispose of, any of its assets, properties, rights, or claims, except for sales of inventory in the ordinary course of business;

-3-

(e) except as set forth on Schedule 4(e) attached hereto and transactions in the ordinary course of business that are not material to the Company and its subsidiaries taken as a whole, directly or indirectly enter into or permit to exist any material transaction with any Affiliate of the Company. For these purposes, “Affiliate” means, with respect to any Person, any Person that owns or controls directly or indirectly such Person, any Person that controls or is controlled by or is under common control with such Person, and each of such Person’s senior executive officers, directors, and partners. “Person” means any individual, sole proprietorship, partnership, limited liability company, joint venture, trust, unincorporated organization, association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or governmental agency; or

(f) incur any additional debt following the date hereof to financial institutions and to Affiliates in an amount in excess of $270,000 in the aggregate.

The initial Representative shall be Xxxx Xxxxxx, until replaced by Note holders holding $200,000 or more in principal amount of Notes (any replacement Representative to be reasonably acceptable to the Company).

§5. Affirmative Covenants. The Company covenants and agrees that, until payment in full of the outstanding obligations under this Note, each of the Company and its subsidiaries shall comply with the following:

(a) Good Standing. Each such entity shall maintain its corporate existence in its jurisdiction of incorporation and maintain qualification in each jurisdiction in which the failure to so qualify could have a material adverse effect on the business, assets or financial condition of such entity taken as a whole.

(b) Compliance with Laws. Each such entity shall comply in all material respects with all statutes, laws, ordinances and government rules and regulations to which it is subject.

(c) Financial Statements, Reports. The Company shall deliver to the Representative on behalf of the Lenders: (i) all financial management accounts and financial reports delivered to its Board of Directors (ii) audited financial statements of the Company prepared in accordance with GAAP, consistently applied; (iii) if applicable, copies of all statements, reports and notices sent or made available generally by the Company to its security holders; and (iv) promptly upon receipt of notice thereof, a report of any legal actions pending or threatened against the Company that could result in damages or costs to the Company of $30,000 or more.

(d) Access. The Company shall permit the Representative to examine its books of account and records and to discuss the Company’s affairs, finances and accounts with its officers, all at such reasonable times as may be requested by the Representative, and after reasonable coordination with the Company.

-4-

§6. Exchange. In case of transfer as set out in §8 below, this Note shall be exchangeable, upon the surrender hereof by the Lender at the principal office of the Company, for new promissory notes of like tenor and date representing in the aggregate the then outstanding principal balance hereof (together with interest theretofore accrued and unpaid), each of such new notes to evidence the portion of such then outstanding principal balance (and accrued and unpaid interest on such principal amount) as shall be designated by the Lender at the time of such transfer and surrender.

§7. Loss, Theft, Destruction or Mutilation of Note. Upon receipt by the Company of evidence reasonably satisfactory to it of the loss, theft, destruction or mutilation of this Note, and, in case of loss, theft or destruction, of indemnity or security reasonably satisfactory to it, and upon reimbursement to the Company of all reasonable expenses incidental thereto, and upon surrender and cancellation of this Note, if mutilated, the Company will make and deliver a new promissory note of like tenor and date, and in the principal balance then outstanding, in lieu of this Note.

§8. Title to Note. Subject to the prior written consent of the Company, this Note and all rights hereunder are transferable (subject to applicable law), in whole or in part, at the office or agency of the Company by the Lender in person or by a duly authorized attorney, upon surrender of this Note together with an assignment hereof properly endorsed. Until transfer hereof on the registration books of the Company, the Company may treat the registered Lender as the owner hereof for all purposes. The Company may not assign, endorse or transfer any of its rights or obligations under this Note.

§9. Security Interest and Collateral. This Note shall be secured by a security interest in all of the assets of the Company pursuant to that certain Security Agreement as of the date hereof made by the Company in favor of the lenders listed on Schedule 1 thereto.

§10. Communications and Notices. All notices, demands, requests, certificates or other communications hereunder must be in writing, either delivered in hand or sent by private expedited courier for overnight delivery with signature required or by facsimile, in each such case, such notice, demand, request, certificate or other communications being deemed to have been given upon delivery, transmission or receipt, as the case may be (if sent by facsimile upon electronic confirmation of receipt or, if transmitted on a non-business day, on the first business day following transmission and electronic confirmation of receipt), or by certified mail, postage prepaid, in which case, such notice, demand, request, certificate or other communications shall be deemed to have been given five (5) business days after the date on which it is first deposited in the mails, and, if to the Company, shall be addressed to it at its principal place of business referred to in the first paragraph hereof, or at such other address as the Company may hereafter designate in writing by notice to the registered Lender, addressed to the Lender at the address of the Lender as shown on the books of the Company, one day after deposit with a nationally recognized overnight courier, specifying next day delivery, or two days after deposit with an internationally recognized overnight courier, specifying two day delivery, in either case with written verification of receipt.

-5-

§11. Miscellaneous.

(a) THIS NOTE SHALL BE BINDING UPON THE COMPANY’S SUCCESSORS IN TITLE AND ASSIGNS. THIS NOTE SHALL CONSTITUTE A CONTRACT AND, FOR ALL PURPOSES, SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF DELAWARE (WITHOUT REGARD TO THE LAWS OR RULES OF LAW APPLICABLE TO CONFLICT OR CHOICE OF LAW). ANY DISPUTES ARISING UNDER OR IN RELATION TO THIS NOTE SHALL BE RESOLVED EXCLUSIVELY BY THE COMPETENT COURTS OF THE STATE OF DELAWARE.

(b) The Company hereby irrevocably waives notice of acceptance, presentment, notice of nonpayment, notice of any Event of Default under this Note, protest, notice of protest, suit and all other conditions precedent in connection with the delivery, acceptance, collection and/or enforcement of this Note or any collateral or security therefor. The failure of either the Company or the Lender to exercise any or all of its rights, remedies, powers or privileges hereunder in any instance shall not constitute a waiver thereof in that or any other instance.

(c) Should all or any part of the indebtedness represented by this Note be collected by action at law, or in bankruptcy, insolvency, receivership or other court proceedings, or should this Note be placed in the hands of attorneys for collection after default, the Company hereby promises to pay to the Lender, upon demand by the Lender at any time, in addition to the outstanding principal balance of and accrued interest on, and all (if any) other amounts payable on or in respect of this Note, all court costs and reasonable attorneys’ fees and other collection charges and expenses incurred or sustained by the Lender.

(d) No provision of this Note shall be waived or modified without the written consent of the Company and the Lenders holding at least sixty six percent (66%) of the principal amount of the outstanding Notes. Any amendment or waiver effected in accordance with this §8(d) shall be binding upon the Company, the holders of all outstanding Notes and any transferee of such Notes.

IN WITNESS WHEREOF, the Company has caused this Note to be signed in its corporate name and its corporate seal to be impressed hereon by its duly authorized officers.

| FUTUREIT. INC. By: —————————————— Name: Title: |

-6-

FUTUREIT, INC.

WRITTEN CONSENT OF THE SOLE STOCKHOLDER

TO

ACTION TAKEN WITHOUT A MEETING

The undersigned, being the sole stockholder of Futurelt, Inc., a Delaware corporation (the “Company”), does hereby consent pursuant to the provisions of Section 228(b) of the General Corporation Law of the State of Delaware to the adoption of the following resolutions with like force and effect as it had been adopted at the meeting of the stockholders of the Company:

RESOLVED, that in order to increase the authorized number of shares of Common Stock to 20,000,000, par value $0.0001 each, the Company is hereby authorized to amend and restate the Certificate of Incorporation of the Company pursuant to the form of Amended and Restated Certificate of Incorporation of FutureIT Inc. attached hereto as Exhibit A to increase the authorized number of shares of Common Stock to 20,000,000, par value $0.0001 each; and further

RESOLVED, that the terms, provisions and transactions contemplated by the: (i) Loan Agreement (the “Loan Agreement”) by and among the Company and the Lenders stated therein (each entity referred to as a “Lender” and collectively the “Lenders”); (ii) the Security Agreement among the Company and the Lenders; and (iii) the Secured Promissory Note issued by the Company to each of the Lenders, substantially in the form attached to this resolution as Exhibits B, C and D respectively, be, and hereby are approved in all respects; and further

RESOLVED, subject to the execution of the Loan Agreement and the receipt of the funds from each Lender according to the Loan Agreement, it is hereby resolved that the Company issue to each of the Lenders up to 1,350,000 shares of Common Stock, par value $0.0001 each, according to the terms of the Loan Agreement, and such shares of Common Stock when issued, will be validly issued, fully paid, and non-assessable; and further

RESOLVED, to approve the Side Agreement between the Company, FutureIT Ltd., an Israeli company and the Lenders, substantially in the form attached hereto as Exhibit E.

RESOLVED, that the officers of the Company be, and each of them hereby is, authorized, empowered, and directed to take all such further action to execute, deliver, certify and file all such further instruments and documents, in the name and on behalf of the Company and under its corporate seal or otherwise, and to take all such actions as such officers or any of them shall approve as necessary or advisable to carry out the intent and accomplish the purposes of the foregoing resolutions.

[Signature Page Follows]

IN

WITNESS WHEREOF, the undersigned has executed this Written Consent of Sole

Stockholder as of January 8, 2007.

-2-

SECURITY AGREEMENT

THIS SECURITY AGREEMENT (this “Agreement”), dated as of this 26th day of January 2007, is made by FUTUREIT INC. (the “Borrower”) in favor of the lenders listed in Schedule 1 hereto (the “Lenders”).

Under the terms hereof, the Lenders desire to obtain and the Borrower desires to grant the Lenders security for all of the Secured Obligations (as hereinafter defined).

NOW, THEREFORE, the Borrower and the Lenders, intending to be legally bound, hereby agree as follows:

|

|

|

|

|

|

1. |

Definitions. |

||

|

|

|

|

|

|

|

|

(i) |

“Borrower”: FutureIT, Inc., a company incorporated under the laws of Delaware. |

|

|

|

|

|

|

|

|

(ii) |

“Business Day”: a day other than a Friday, Saturday or other day on which commercial banks in Delaware are authorized or required by law to close. |

|

|

|

|

|

|

|

|

(iii) |

“Collateral”: shall include all assets of the Borrower, including all personal and intellectual property of the Borrower and all equity securities beneficially owned by the Borrower in subsidiaries of the Borrower, all whether now owned or hereafter acquired or arising and wherever located, including all books and records pertaining to the Collateral and all Proceeds and products of any and all of the foregoing. |

|

|

|

|

|

|

|

|

(iv) |

“Default”: any event which, with the giving of notice or lapse of time (or both), would be an Event of Default. |

|

|

|

|

|

|

|

|

(v) |

“Event of Default”: as defined in Section 5 below. |

|

|

|

|

|

|

|

|

(vi) |

“Lien”: any mortgage, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or other), claim, right, charge or other security interest or any preference, priority, restriction or other security agreement or preferential arrangement of any kind or nature whatsoever (including, without limitation, any conditional sale or other title retention agreement and any financing leases having substantially the same economic effect as any of the foregoing). |

|

|

|

|

|

|

|

|

(vii) |

“Loan Documents”: means the Loan Agreement between the Borrower and the Lenders dated January ___ 2007, and the Secured Promissory Notes issued pursuant to the said Loan Agreement. |

|

|

|

|

|

|

|

|

(viii) |

“Delaware UCC”: the Uniform Commercial Code (“UCC”) as from time to time in effect in the State of Delaware. Terms used herein which are defined in the Delaware UCC and not otherwise defined herein shall have the respective meanings ascribed to such terms in the Delaware UCC. |

|

|

|

|

|

|

|

|

(ix) |

“Permitted Liens”: purchase money Liens upon or in real property, vehicles or equipment or any other property acquired or held by the Borrower in the ordinary course of business to secure the purchase price of such property, vehicle or equipment or to secure indebtedness incurred solely for the purpose of financing the acquisition of any property, vehicles or equipment to be subject to such Liens, or Liens existing on any such property or equipment at the time of acquisition (other than any such Liens created in contemplation of such acquisition that do not secure the purchase price), or extensions, renewals or replacements of any of the foregoing for the same or a lesser amount; provided, however, that (i) such Lien attaches solely to the property, vehicle or equipment so acquired and, (ii) the principal amount of the indebtedness secured thereby does not exceed 100% of the fair market value of such property at the time of incurrence of such indebtedness. |

|

|

|

|

|

|

|

|

(x) |

“Person”: an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture, Governmental Authority or other entity of whatever nature. |

|

|

|

|

|

|

|

|

(xi) |

“Proceeds”: all “proceeds” as such term is defined in Section 9-102 of the Delaware UCC. |

|

|

|

|

|

|

|

|

(xii) |

“Requisite Lenders”: Lenders holding at least sixty-six percent (66%) of the principal amount of the Secured Obligations. |

|

|

|

|

|

|

|

|

(xiii) |

“Secured Obligations”: shall be the unpaid principal and interest under the Loan Documents and all other obligations and liabilities due or to become due to the Lenders which may arise under, out of, or in connection with, the Loan Documents. |

|

|

|

|

|

|

2. |

Grant of Security Interest. The Borrower hereby assigns and transfers to the Lenders, and hereby grants to the Lenders, a first priority security interest in the Collateral as collateral security for the prompt and complete payment and performance when due (whether at the stated maturity, by acceleration or otherwise) of the Secured Obligations. The security interest and this Agreement will automatically terminate and be of no force and effect upon the satisfaction of all the Secured Obligations. |

||

|

|

|

|

|

|

3. |

Representations and Warranties. To induce the Lenders to enter into the Credit Agreement the Borrower hereby represents, warrants and covenants to the Lenders that: |

||

2

|

|

|

|

|

|

|

3.1 |

Title: No Other Liens. Except for the security interest granted to the Lenders pursuant to this Agreement and the Permitted Liens, the Borrower owns each item of the Collateral free and clear of any and all Liens or claims of others. No financing statement or other public notice with respect to all or any part of the Collateral is on file or of record in any public office. |

|

|

|

|

|

|

|

|

3.2 |

Perfected First Priority Liens. The security interests granted pursuant to this Agreement upon completion of the required filings will constitute (i) valid, enforceable perfected first priority security interests in all of the Collateral in favor of the Lenders other than general intangibles and (ii) valid, enforceable security interests in general intangibles included in the Collateral in favor of the Lenders, in each case as collateral security for the Secured Obligations, enforceable in accordance with the terms hereof against all creditors of the Borrower and any Persons purporting to purchase any Collateral from the Borrower and are prior to all other Liens on the Collateral in existence on the date hereof except for the Permitted Liens. |

|

|

|

|

|

|

|

4. |

Borrower’s Covenants. The Borrower covenants and agrees with the Lenders that, from and after the date of this Agreement until the Secured Obligations shall have been paid in full and all the Secured Obligations have been satisfied: |

||

|

|

|

|

|

|

|

4.1 |

Payment of Obligations. The Borrower will pay and discharge or otherwise satisfy at or before maturity or before they become delinquent, as the case may be, all taxes, assessments and governmental charges or levies imposed upon the Collateral or in respect of income or profits there from, as well as all claims of any kind (including, without limitation, claims for labor, materials and supplies) against or with respect to the Collateral, except that no such charge need be paid if the amount or validity thereof is currently being contested in good faith by appropriate proceedings, reserves in conformity with GAAP with respect thereto have been provided on the books of the Borrower and such proceedings could not reasonably be expected to result in the sale, forfeiture or loss of any material portion of the Collateral or any interest therein. |

|

|

|

|

|

|

|

|

4.2 |

Maintenance of Perfected Security Interest: Further Documentation. The Borrower shall (i) maintain the security interest created by this Agreement as a perfected security interest and shall defend such security interest against the claims and demands of all Persons whomsoever and (ii) maintain or cause all of the Collateral to be maintained and preserved in good condition, repair and working order, ordinary wear and tear excepted. In addition, the Borrower will not permit any tangible Collateral with a value of greater than $5, 000 (in the aggregate for all such items of Collateral) to be located in any jurisdiction in which a financing statement covering such Collateral is required to be, but has not in fact been, filed in order to perfect Lenders’ security interests granted hereunder, other than in the ordinary course of business in jurisdictions disclosed by the Borrower to the Requisite Lenders. |

|

3

|

|

|

|

|

|

|

4.3 |

Notices. The Borrower will advise the Lenders promptly, in reasonable detail, of: |

|

|

|

|

|

|

|

|

(i) any Lien (other than security interests created hereby or Liens permitted under the Loan Documents) on any of the Collateral which would adversely affect the ability of the Lenders to exercise any of its remedies hereunder; and |

||

|

|

|

|

|

|

|

(ii) of any claim made or asserted against the Collateral by any Person and of the occurrence of any other event which could reasonably be expected to have a material adverse effect on the aggregate value of the Collateral or on the security interests created hereby. |

||

|

|

|

|

|

|

|

4.4 |

Filings. Borrower hereby authorizes the Requisite Lenders to file a record or records (as defined in the Delaware UCC), including, without limitation, financing statements, in all jurisdictions and with all filing offices as the Requisite Lenders may determine, in their sole discretion, are necessary or advisable to perfect the security interests granted to the Lenders hereby. Such financing statements may describe the Collateral in the same manner as described herein or may contain an indication or description of collateral that describes such property in any other manner as the Lenders may determine, in their sole discretion, is necessary, advisable, or prudent, after consultation with the Company, to ensure the perfection of the security interests in the Collateral granted to the Lenders hereby, including, without limitation, describing such property as “all assets” or “all personal property.” Upon satisfaction in full of the Secured Obligations, the Company is authorized to make all filings that are necessary or advisable to cancel the security interests granted to the Lenders hereby. |

|

|

|

|

|

|

|

|

4.5 |

Other Action. Borrower agrees that from time to time it shall promptly execute and deliver all further instruments and documents, and take all further action, that may be necessary or desirable, or that the Requisite Lenders may reasonably request, in order to create and/or maintain the validity, perfection, or priority of and protect any security interests granted or purported to be granted hereby or to enable the Lenders to exercise and enforce their rights and remedies hereunder with respect to any Collateral. Without limitation of the foregoing, Borrower agrees that it will, upon request of the Requisite Lenders (i) deliver to the Lenders all stock certificates representing any or all of the Collateral that consists of certificated securities, (ii) deliver to the Lenders all instruments and chattel paper, and all other rights to payment at any time evidenced by promissory notes, trade acceptances or other instruments, (iii) xxxx all chattel paper with such legends as the Lenders shall specify, and (iv) cause the Lenders’ security interests to be duly noted on any certificate of title covering the Collateral. |

|

|

|

|

|

|

|

5. |

Default. The Borrower shall, at the Requisite Lenders’ option, be in default under this Agreement upon the happening of any of the following events or conditions (each, an “Event of Default”): (a) any event of default under the Loan Documents; (b) the failure by the Borrower to perform any of its obligations under this Agreement that has not been cured within fifteen (15) days of receipt of a written notice from the Requisite Lenders; (c) falsity, inaccuracy or material breach by the Borrower of any written warranty, representation or statement made or furnished to the Lenders by or on behalf of the Borrower; (d) the entry of a material judgment against the Borrower or any lien against or the making of any levy, seizure or attachment of or on the Collateral; or (e) the failure of the Lenders to have a perfected first priority security interest in the Collateral (except with respect to Collateral encumbered by Permitted Liens). |

||

4

|

|

|

|

|

|

6. |

Remedies. Upon the occurrence of any such Event of Default and at any time thereafter, the Requisite Lenders may declare any or all Secured Obligations secured hereby to be immediately due and payable and shall have, in addition to any remedies provided herein or by any applicable law or in equity, all the remedies of a secured party under the Delaware UCC. In addition, whenever a Default shall be existing, all Secured Obligations may (notwithstanding any provisions thereof), at the option of the Requisite Lenders, and without demand or notice of any kind, be declared, and thereupon immediately shall become, due and payable, and the Lenders may exercise from time to time any rights and remedies available to them under applicable law.. Borrower agrees, in case of Default, to assemble, all Collateral at a convenient place acceptable to the Lenders. Any notification of intended disposition of any of the Collateral required by law shall be deemed reasonably and properly given if given at least five (5) days before such disposition. Any proceeds of any disposition by the Lenders of any of the Collateral may be applied by the Lenders to the payment of expenses in connection with the Collateral, including reasonable attorneys’ fees and legal expenses, and any balance of such proceeds shall be applied by the Lenders (i) first, to the payment of such of the Secured Obligations, and in such order of application, as the Lenders may from time to time elect; (ii) second, to the payment to whosoever may be lawfully entitled to receive the same or as a court of competent jurisdiction may direct, of any surplus then remaining from such proceeds; and (iii) if any balance is remaining, to the Borrower. |

||

|

|

|

|

|

|

7. |

Payment of Expenses. At its option, the Lenders may discharge taxes, liens, security interests or such other encumbrances as may attach to the Collateral, may pay for required insurance on the Collateral and may pay for the maintenance, appraisal or reappraisal, and preservation of the Collateral, as determined by the Lenders to be necessary. The Borrower will reimburse the Lenders on demand of the Requisite Lenders for any payment so made or any expense incurred by the Lenders pursuant to the foregoing authorization, and the Collateral also will secure any advances or payments so made or expenses so incurred by the Lenders. |

||

|

|

|

|

|

|

8. |

Borrower Remains Liable. Anything herein to the contrary notwithstanding, (i) Borrower shall remain liable under any agreements and other documents included in the Collateral, to the extent set forth therein, to perform all of its duties and obligations thereunder to the same extent as if this Agreement had not been executed, (ii) the exercise by the Lenders of any of the rights hereunder shall not release Borrower from any of its duties or obligations under such agreements and other documents included in the Collateral, and (iii) the Lenders shall not have any obligation or liability under any agreements and other documents included in the Collateral by reason of this Agreement, nor shall the Lenders be obligated to perform any of the obligations or duties of Borrower thereunder or to take any action to collect or enforce any such agreement or other document included in the Collateral hereunder. |

||

5

|

|

|

|

9. |

Notices. Any notice or other communication herein required or permitted to be given shall be in writing and may be personally served, telexed or sent by facsimile or United States mail or courier service and shall be deemed to have been given when delivered in person or by courier service, upon receipt of facsimile, or three Business Days after depositing it in the United States mail with postage prepaid and properly addressed; provided that notices to Lenders shall not be effective until received. For the purposes hereof, the address of each party hereto shall be set forth above or to such other address as any party may give to the other in writing for such purpose. |

|

|

|

|

10. |

Preservation of Rights. No delay or omission on the Lenders part to exercise any right or power arising hereunder will impair any such right or power or be considered a waiver of any such right or power, nor will the Lenders action or inaction impair any such right or power. The Lenders rights and remedies hereunder are cumulative and not exclusive of any other rights or remedies which the Lenders may have under other agreements, at law or in equity. |

|

|

|

|

11. |

Illegality. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, such provision shall be deemed modified to the extent required by to law so as to not be invalid, illegal or unenforceable, and the validity, legality and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby. |

|

|

|

|

12. |

Changes in Writing. No modification, amendment or waiver of any provision of this Agreement nor consent to any departure by the Borrower therefrom will be effective unless made in a writing signed by the Requisite Lenders, and then such waiver or consent shall be effective only in the specific instance and for the purpose for which given. No notice to or demand on the Borrower in any case will entitle the Borrower to any other or further notice or demand in the same, similar or other circumstance. |

|

|

|

|

13. |

Entire Agreement. This Agreement (including the documents and instruments referred to herein) constitutes the entire agreement and supersedes all other prior agreements and understandings, both written and oral, between the parties with respect to the subject matter hereof. |

|

|

|

|

14. |

Counterparts. This Agreement may be signed in any number of counterpart copies and by the parties hereto on separate counterparts, but all such copies shall constitute one and the same instrument. Delivery of an executed counterpart of signature page to this Agreement by facsimile transmission shall be effective as delivery of a manually executed counterpart. Any party so executing this Agreement by facsimile transmission shall promptly deliver a manually executed counterpart, provided that any failure to do so shall not affect the validity of the counterpart executed by facsimile transmission. |

|

|

|

|

15. |

Successors and Assigns. This Agreement will be binding upon and inure to the benefit of the Borrower and the Lenders and their respective heirs, executors, administrators, successors and assigns; provided, however, that the Borrower may not assign this Agreement in whole or in part without the Requisite Lenders prior written consent. |

6

|

|

|

|

16. |

Interpretation. In this Agreement, unless the Requisite Lenders and the Borrower otherwise agree in writing, the singular includes the plural and the plural the singular; words importing any gender include the other genders; references to statutes are to be construed as including all statutory provisions consolidating, amending or replacing the statute referred to; the word “or” shall be deemed to include “and/or”, the words “including”, “includes” and “include” shall be deemed to be followed by the words “without limitation”; references to articles, sections (or subdivisions of sections) or exhibits are to those of this Agreement unless otherwise indicated. Section headings in this Agreement are included for convenience of reference only and shall not constitute a part of this Agreement for any other purpose. |

|

|

|

|

17. |