GENERAL SECURITY AGREEMENT

Exhibit 10.8

|

TO: |

M&T BANK |

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Debtor, the Debtor hereby agrees as follows:

Definitions and Interpretation

|

1. |

In this agreement, the following words shall, unless otherwise provided, have the meanings set out below: |

“Bank” means M&T Bank, and its successors and assigns;

“Business Day” means a day, other than a Saturday, Sunday or statutory holiday in the Province of Ontario;

“Collateral” means all present and future property, assets and undertaking of the Debtor pledged, assigned, mortgaged, charged, hypothecated or made subject to a security interest pursuant to this agreement;

“Collateral Access Agreement” has the meaning set out in the Credit Agreement;

“Contractual Right” means any agreement, right, franchise, licence, authorization, approval, privilege or permit (a) to which the Debtor is now or hereafter becomes a party, (b) in which the Debtor now or hereafter has any interest or (c) of which the Debtor is or hereafter becomes a beneficiary;

“Credit Agreement” means the amended and restated loan and security agreement dated as of October 15, 2021 between inTEST Corporation, as borrower, and the Bank, as lender, as it may be amended, supplemented, otherwise modified, restated or replaced from time to time;

“Debtor” means Acculogic Inc. and its successors and assigns;

“Event of Default” has the meaning set out in the Credit Agreement;

“Guarantee” means the guarantee dated the date hereof granted by the Debtor to the Bank in respect of the present and future indebtedness, liabilities and obligations of inTEST Corporation to the Bank pursuant to the Credit Agreement, as such guarantee may be amended, supplemented, otherwise modified, restated or replaced from time to time;

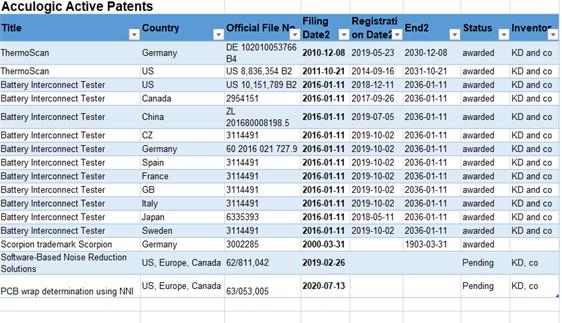

“Intellectual Property” means all patents, trademarks, trade names, business names, trade styles, logos and other business identifiers, copyrights, technology, inventions, industrial designs, know-how, trade secrets and other industrial and intellectual property in which the Debtor now or in the future has any right, title or interest, including any industrial or intellectual property specifically listed or otherwise described in Schedule “A” hereto;

“Investment Collateral” means all present and future Investment Property (as such term is defined in the PPSA) and Financial Assets (as such term is defined in the STA) of the Debtor, including all present and future options and warrants of the Debtor and all other rights and entitlements arising therefrom or related thereto, and the Debtor’s present and future interests in partnerships, limited partnerships, limited liability partnerships and limited liability companies, and including all substitutions for any of the foregoing and dividends and income derived therefrom or payable in connection therewith;

“Joinder” means the joinder and second amendment to the amended and restated credit agreement dated the date hereof pursuant to which the Debtor became party to the Credit Agreement;

“Obligations” means all present and future indebtedness, liabilities and obligations, direct or indirect, absolute or contingent, matured or unmatured, joint or several, of the Debtor to the Bank, including all such indebtedness, liabilities and obligations pursuant to or in respect of the Credit Agreement, the Joinder and the Guarantee;

“Permitted Encumbrances” means any and all liens, charges, mortgages, security interests, hypothecs and other encumbrances which affect all or any portion of the Collateral and which have been permitted or consented to in writing by the Bank, including any such liens, charges, mortgages, security interests and encumbrances the particulars of which are listed in Schedule “B” hereto;

“Person” means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, limited partnership or other entity;

“PPSA” means the Personal Property Security Act (Ontario), as amended from time to time and any legislation substituted therefor and any amendments thereto;

“Receiver” means a receiver, receiver-manager and receiver and manager;

“Security Interest” means the pledges, assignments, mortgages, charges and hypothecations of and the security interests in the Collateral created in favour of the Bank hereunder; and

“STA” means the Securities Transfer Act, 2006 (Ontario), as amended from time to time and any legislation substituted therefor and any amendments thereto.

|

2. |

References such as “this agreement”, “hereof”, “herein”, “hereto” and like references refer to this agreement and any schedules, exhibits or appendices attached hereto (all of which schedules, exhibits and appendices form a part of this agreement) and not to any particular section, subsection, paragraph or other subdivision of this agreement. |

|

3. |

The division of this agreement into sections, subsections and paragraphs and the insertion of headings in this agreement are for convenience of reference only and shall not affect the construction or interpretation of this agreement. |

|

4. |

Terms used herein which are defined in the PPSA shall have the same meanings herein as are ascribed to such terms in the PPSA, unless such terms are otherwise defined. |

|

5. |

The word “Debtor”, the personal pronoun “it” or “its” and any verb relating thereto and used therewith shall be read and construed as required by and in accordance with the context in which such words are used. The term “successors” shall include, without limiting its meaning, any corporation resulting from the amalgamation of a corporation with another corporation. Where the context so requires, words used herein (including defined terms) importing the singular shall include the plural and vice versa and words used herein (including defined terms) importing gender shall include all genders (including the neuter). |

|

6. |

Nothing herein (including the definition and use of the term Permitted Encumbrances) is intended or shall be deemed to subordinate the Security Interest to any Permitted Encumbrance or any other lien, charge, mortgage, security interest, hypothec or encumbrance affecting all or any portion of the Collateral. |

|

7. |

If one or more of the provisions contained herein shall be invalid, illegal or unenforceable in any respect, such provision or provisions shall be severed from this agreement only to the extent necessary, and the validity, legality and enforceability of the remaining provisions hereof, including the provision or provisions remaining after such severance, shall not in any way be affected or impaired thereby. |

|

8. |

Unless otherwise expressly provided in this agreement, if any matter in this agreement is subject to the determination, consent or approval of the Bank or is to be acceptable to the Bank, such determination, consent, approval or determination of acceptability will be in the sole discretion of the Bank, which means the Bank shall have sole and absolute discretion. The term “including” shall mean “including, without limitation” and the use of the term “includes” shall mean “includes, without limitation”. |

|

9. |

This agreement shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein. The Debtor hereby irrevocably and unconditionally attorns and submits to the non-exclusive jurisdiction of the courts of the Province of Ontario, provided that nothing herein shall prevent the Bank from proceeding at its election against the Debtor in the courts of any other province, country or jurisdiction. |

Grant of Security Interest

|

10. |

As continuing security for the payment and performance of all Obligations, the Debtor hereby pledges, assigns, mortgages, charges and hypothecates to the Bank and grants to the Bank a security interest in the following: |

|

(a) |

all present and future equipment of the Debtor, including all of its present and future machinery, fixtures, plant, tools, furniture, books, records, documents, vehicles of any nature, kind or description, and all accessions to any of the foregoing, including all spare parts and accessories installed in or affixed or attached to any of the foregoing, and all drawings, specifications, plans and manuals relating to the forgoing; |

|

(b) |

all present and future inventory of the Debtor, including all of its present and future raw materials, materials used or consumed in its business, work-in-progress, finished goods, goods used for packing and goods acquired or held for sale or lease or that have been leased or furnished or that are to be furnished under contracts of rental or service, and all accessions to any of the foregoing, including all spare parts and accessories installed in or affixed or attached to any of the foregoing; |

|

(c) |

all present and future intangibles of the Debtor, including all of its present and future accounts and other amounts receivable, book debts, goodwill, Intellectual Property and choses in action of every nature and kind; |

|

(d) |

all present and future documents of title, chattel paper, instruments and money of the Debtor; |

|

(e) |

all present and future Investment Collateral; |

|

(f) |

all present and future real property, personal property, assets, and undertaking of the Debtor of any nature or kind, including all real property, personal property, assets and undertaking at any time owned, leased or licenced by the Debtor or in which the Debtor at any time has any right or interest or to which the Debtor is or may at any time become entitled (other than the property, assets and undertaking of the Debtor validly pledged or assigned or subjected to a valid mortgage, charge, hypothec or security interest by subsection 10(a), 10(b), 10(c) 10(d) or 10(e) hereof and subject to the exceptions hereinafter contained); and |

|

(g) |

all proceeds arising from the property, assets and undertaking of the Debtor referred to in this section 10, including insurance proceeds and any other payment representing indemnity or compensation for loss of or damage thereto. |

Limited Exceptions to Grant of Security Interest

|

11. |

Despite any other provision of this agreement, the last day of any term reserved by any lease of real property, oral or written, or any agreement therefor, now held or hereafter acquired by the Debtor, and whether falling within the general or particular description of the Collateral, is hereby and shall be excepted out of the Security Interest, but the Debtor shall stand possessed of the reversion of one day remaining in the Debtor in respect of any such term, for the time being demised, as aforesaid, upon trust to assign and dispose of the same as any purchaser of such term shall direct. |

|

12. |

Despite any other provision of this agreement, the Security Interest shall not attach to any Contractual Right to the extent that the granting of the Security Interest therein would constitute a breach of, or permit any Person to terminate such Contractual Right, but the Debtor shall hold its interest in each such Contractual Right in trust for the Bank and shall, after the Security Interest shall have become enforceable, specifically assign each such Contractual Right to the Bank, or as the Bank may otherwise direct. The Debtor agrees that it shall, upon the written request of the Bank, whether before or after the Security Interest has become enforceable, use all commercially reasonable efforts to obtain any consent required to permit any such Contractual Right to be subjected to the Security Interest, and the Security Interest shall attach to such Contractual Right following the receipt of such consent. |

|

13. |

Despite any other provision of this agreement, the interests granted to the Bank pursuant to this agreement in the Debtor’s existing and after-acquired trademarks shall be limited to the Bank’s security interests therein. |

Attachment

|

14. |

The Debtor confirms and agrees that: |

|

(a) |

value has been given by the Bank to the Debtor; |

|

(b) |

the Debtor has rights in all existing Collateral and power to transfer rights in the Collateral to the Bank; and |

|

(c) |

the Debtor and the Bank have not postponed the time for attachment of the Security Interest, and the Security Interest shall attach to existing Collateral upon the execution of this agreement and shall attach to Collateral in which the Debtor hereafter acquires rights at the time that the Debtor acquires rights in such Collateral. |

Provisions with respect to Investment Collateral

|

15. |

Whenever any Investment Collateral is a certificated security, an uncertificated security or a security entitlement, promptly at the written request of the Bank, the Debtor shall, or shall cause the issuer of such Investment Collateral to, or shall cause the securities intermediary that holds such Investment Collateral to, take all steps as are necessary to give exclusive control over such Investment Collateral to the Bank in a manner satisfactory to the Bank. |

|

16. |

All certificates representing Investment Collateral may remain registered in the name of the Debtor, but the Debtor shall, promptly at the written request of the Bank, duly endorse such certificates in blank for transfer or execute stock powers of attorney in respect thereof and deliver such certificates or powers of attorney to the Bank; in either case with all documentation being in form and substance satisfactory to the Bank. Upon the request of the Bank: |

|

(a) |

the Debtor shall promptly cause the Investment Collateral to be registered in the name of the Bank or its nominee, and the Bank is hereby appointed the irrevocable attorney (coupled with an interest) of the Debtor with full power of substitution to cause any or all of the Investment Collateral to be registered in the name of the Bank or its nominee; |

|

(b) |

the Debtor shall promptly cause each securities intermediary that holds any Investment Collateral that is a security entitlement to record the Bank as the entitlement holder of such Investment Collateral; and |

|

(c) |

the Debtor shall promptly: |

|

(i) |

cause a security certificate to be issued for any Investment Collateral that is in the form of an uncertificated security or a security entitlement; |

|

(ii) |

endorse such security certificate in blank; |

|

(iii) |

deliver such security certificate to the Bank; and |

|

(iv) |

take all other steps necessary to give exclusive control over such certificated security to the Bank, |

in a manner satisfactory to the Bank.

|

17. |

So long as no Event of Default has occurred and is then continuing, the Debtor shall be entitled to exercise all voting rights attached to the Investment Collateral and give consents, waivers and ratifications in respect thereof; provided that no vote shall be cast or consent, waiver or ratification given or action taken which would have the effect of reducing the value of the Investment Collateral as security for the Obligations, or imposing any restriction on the transferability of any of the Investment Collateral. All such rights of the Debtor to vote and give consents, waivers and ratifications shall cease immediately upon the occurrence of an Event of Default which is then continuing. |

|

18. |

So long as no Event of Default has occurred and is then continuing, all dividends, distributions, interest and other income in respect of Investment Collateral and all proceeds received by the Debtor in respect of Investment Collateral may be received by the Debtor in the ordinary course and distributed in the ordinary course to the Debtor’s shareholder or shareholders. Upon the occurrence of an Event of Default which is then continuing, the Debtor shall not be entitled to retain or distribute to its shareholder or shareholders any such dividends, distributions, interest or other income or proceeds and, if any such amounts are received by the Debtor after the Debtor receives such notice by the Bank, the Debtor shall hold such amounts in trust, as trustee for the Bank, and the Debtor shall forthwith pay such amounts to the Bank, to be applied to reduce the Obligations or, at the option of the Bank, to be held as additional security for the Obligations. |

|

19. |

The responsibility of the Bank in respect of any Investment Collateral held by the Bank shall be limited to exercising the same degree of care which it gives valuable property of the Bank at the Bank’s office where such Investment Collateral is held. The Bank shall not be bound under any circumstances to realize on any Investment Collateral or allow any Investment Collateral to be sold, or exercise any option or right attaching thereto, or be responsible for any loss occasioned by any sale of Investment Collateral or by the retention or other refusal to sell the same; nor shall the Bank be obliged to collect or see to the payment of interest or dividends thereon but, subject to section 18, all such interest and dividends, if and when received by the Debtor, shall be held by the Debtor in trust for the Bank and shall be forthwith paid to the Bank. |

Representations and Warranties of the Debtor

|

20. |

The Debtor hereby represents and warrants to the Bank that: |

|

(a) |

the Debtor has the capacity and authority to incur the Obligations, to create the Security Interest and to execute and deliver and perform its obligations under this agreement; |

|

(b) |

the execution and delivery of this agreement and the performance by the Debtor of its obligations hereunder have been duly authorized by all necessary proceedings; |

|

(c) |

this agreement constitutes a legal, valid and binding obligation of the Debtor, enforceable against the Debtor in accordance with its terms subject only to bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application affecting creditors’ rights and the discretion exercisable by courts of competent jurisdiction in respect of the availability of equitable remedies; |

|

(d) |

except for the Security Interest and any Permitted Encumbrances, the Collateral is owned by the Debtor free from any mortgage, charge, lien, pledge, security interest or other encumbrance or claim whatsoever; |

|

(e) |

the registered office of the Debtor is located at the address listed in Part I of Schedule “C” of this agreement; |

|

(f) |

the Debtor does not keep tangible Collateral at any location(s) except: |

|

(i) |

the location listed in Part I of Schedule “C” hereto, and |

|

(ii) |

any location(s) listed in Part II of Schedule “C” hereto, |

other than tangible Collateral in transit to or from such locations;

|

(g) |

Schedule “A” hereto contains a complete and accurate list of all of the presently registered Intellectual Property of the Debtor, including all registered patents, trademarks and copyrights of the Debtor; and |

|

(h) |

subject to section 12, the Debtor has no Contractual Right which, because of the granting of the Security Interest therein, would be breached or could be terminated. |

Covenants of the Debtor

|

21. |

The Debtor agrees with the Bank that, until the Obligations have been satisfied and paid in full: |

|

(a) |

it will: |

|

(i) |

pay and satisfy the Obligations when due; |

|

(ii) |

defend the Collateral against any actions, claims and demands of any Person (other than the Bank) claiming the Collateral (or any of it) or an interest therein; |

|

(iii) |

pay all taxes, rates, levies, assessments and other impositions and charges, of every nature and kind, which may now or hereafter be lawfully levied, assessed or imposed on or in respect of the Debtor or the Collateral (or any of it), including those which could result in the creation of a statutory lien or deemed trust affecting the Debtor or the Collateral, as and when the same become due and payable. Notwithstanding the foregoing, the Debtor may contest the assertion of a tax liability provided that (A) a reserve with respect to such obligation is established on the books of the Debtor in accordance with GAAP; (B) the Debtor diligently pursues such contest pursuant to appropriate proceedings; and (C) Bank has determined in good faith that while any such contest is pending, there would be no impairment on of the enforceability, validity or priority of any of the Liens in favour of the Bank in and to the Collateral; |

|

(iv) |

maintain its corporate existence and file or cause to be filed any returns, documents or other information necessary to preserve such corporate existence; |

|

(v) |

hold the proceeds received from any direct or indirect dealing with the Collateral in trust for the Bank upon the occurrence and during the continuance of an Event of Default; |

|

(vi) |

prevent any Collateral from becoming an accession to any personal property not subject to the Security Interest, or becoming affixed to any real property; |

|

(vii) |

deliver to the Bank, at the Bank’s written request, duly endorsed and/or accompanied by such assignments, transfers, powers of attorney or other documents as the Bank may request, all items of the Collateral comprising chattel paper, instruments, Investment Collateral and documents of title; |

|

(viii) |

deliver to the Bank, at the Bank’s written request, a Collateral Access Agreement from lessors, warehousemen, bailees, and other third persons as the Bank may require with respect to all Collateral locations; |

|

(ix) |

pay, on written demand by the Bank, all documented, out of pocket costs and expenses (including all legal fees) incurred by the Bank in the preparation, perfection, administration and enforcement of this agreement (including expenses incurred in considering, protecting or improving the Bank’s position, or attempting to do so, whether before or after default) and all such costs and expenses shall bear interest at the then prevailing applicable to the Obligations, shall form part of the Obligations and shall be secured by the Security Interest; |

|

(x) |

at all times, both before and after the occurrence of a default, do or cause to be done such further and additional acts and things and execute and deliver or cause to be executed and delivered all such further and additional documents and agreements as the Bank may reasonably require to better pledge, assign, mortgage, charge and hypothecate the Collateral in favour of the Bank, to perfect the Security Interest and, without limiting the generality of the forgoing, to accomplish the intentions of this agreement; and |

|

(xi) |

preserve the Debtor’s rights, powers, licences, privileges and franchises and goodwill, comply with all applicable laws, regulations and orders (including environmental laws, regulations and orders) affecting the Debtor or the Collateral and conduct its business in a proper and efficient manner so as to protect the Collateral, the Security Interest and the business and undertaking of the Debtor; and |

|

(b) |

it will not, without the prior written consent of the Bank: |

|

(i) |

create any lien upon, assign or transfer as security, or pledge, hypothecate, charge, mortgage or grant a security interest in any Collateral except to the Bank and except for Permitted Encumbrances; |

|

(ii) |

change the location of its registered office from that set out in Part I of Schedule “C” hereto or create further places of business in addition to those set out in Part II of Schedule “C”, without providing the Bank with thirty (30) Business Days’ prior written notice thereof; or |

|

(iii) |

keep tangible Collateral at any location other than the locations listed in Parts I and II of Schedule “C” hereto without providing the Bank with thirty (30) Business Days’ prior written notice thereof. |

Default

|

22. |

The Security Interest shall become enforceable upon the occurrence and during the continuance of an Event of Default. |

Remedies of the Bank

|

23. |

Whenever the Security Interest shall have become enforceable, and so long as it shall remain enforceable, the Bank may proceed to realize the Security Interest and the Collateral and to enforce its rights by doing any one or more of the following: |

|

(a) |

entering upon the Collateral and any lands and premises where any Collateral is or may be located; |

|

(b) |

taking possession of Collateral by any method permitted by law; |

|

(c) |

occupying any lands and premises owned or occupied by the Debtor and using all or any part of such lands and premises and the equipment and other Collateral located thereon; |

|

(d) |

leasing, selling, licensing or otherwise disposing of the whole or any part or parts of the Collateral; |

|

(e) |

collecting, selling or otherwise dealing with any accounts or other amounts receivable of the Debtor, including notifying any person obligated to the Debtor in respect of an account, chattel paper or instrument to make payment to the Bank of all present and future amounts due thereon; |

|

(f) |

taking steps and expending such monies as it considers necessary or desirable in its sole discretion to maintain, preserve and protect the Collateral, including making payments on account of other security interests affecting the Collateral; provided that the Bank shall have no obligation to take any such actions or make any such expenditures; but any such amounts paid by the Bank shall be added to the Obligations and shall be secured by the Security Interest; |

|

(g) |

collecting any rents, income, and profits received in connection with the business of the Debtor or the Collateral, without carrying on such business; |

|

(h) |

exercising all voting rights attached to any Collateral constituting Investment Collateral (whether or not registered in the name of the Bank or its nominee) and giving or withholding all consents, waivers and ratifications in respect thereof and otherwise acting with respect thereto as though it were the absolute owner thereof; |

|

(i) |

exercising any and all rights of conversion, exchange, subscription or any other rights, privileges or options pertaining to any Collateral constituting Investment Collateral as if it were the absolute owner thereof including the right to exchange at its sole discretion any and all of such Investment Collateral upon the merger, consolidation, reorganization, recapitalization or other readjustment of any issuer thereof, or upon the exercise by any issuer of any right, privilege or option pertaining to any such Investment Collateral , and in connection therewith, to deposit and deliver any such Investment Collateral with any committee, depositary, transfer agent, registrar or other designated agency upon such terms and conditions as it may determine in its sole discretion, all without liability except to account for property actually received by it; |

|

(j) |

complying with any limitation or restriction in connection with any proposed sale or other disposition of Collateral constituting Investment Collateral as may be necessary in order to comply with applicable law or regulation or any policy imposed by any stock exchange, securities commission or other governmental or regulatory authority or official, and the Debtor agrees that such compliance shall not result in such sale being considered or deemed not to have been made in a commercially reasonable manner, and the Bank shall not be liable or accountable to the Debtor for any discount in the sale price of any such Investment Collateral which may be given by reason of the fact that such Investment Collateral are sold in compliance with any such limitation or restriction; |

|

(k) |

carrying on the business of the Debtor or any portion thereof; |

|

(l) |

exercising any and all of the rights and remedies granted pursuant to the PPSA and any other applicable legislation, or otherwise available at law or in equity; |

|

(m) |

demanding, commencing, continuing or defending any judicial or administrative proceedings for the purpose of protecting, seizing, collecting, realizing or obtaining possession or payment of the Collateral, and giving valid and effectual receipts and discharges therefor and to compromise or give time for the payment or performance of all or any part of the accounts or other amounts receivable of the Debtor or any other obligation of any third party to the Debtor; |

|

(n) |

borrowing money for the maintenance, preservation or protection of the Collateral or for the carrying on of the business of the Debtor, and charge and grant further security interests in the Collateral in priority to the Security Interest or otherwise, as security for the money so borrowed; |

|

(o) |

to the extent permitted by applicable law, accepting the Collateral in satisfaction of the Obligations; |

|

(p) |

appointing by instrument in writing a Receiver or Receivers of the Collateral or any part thereof; |

|

(q) |

bringing proceedings in any court of competent jurisdiction for the appointment of a Receiver or Receivers or for the sale of the Collateral or any part thereof; and |

|

(r) |

filing such proofs of claim and other documents as may be necessary or advisable in order to have its claim lodged in any bankruptcy, winding-up or other judicial proceedings relating to the Debtor or the Collateral. |

|

24. |

Any Receiver appointed by the Bank may be any person or persons (including one or more officers or employees of the Bank), and the Bank may remove any Receiver so appointed and appoint another or others instead. Any such Receiver may exercise any and all of the rights, remedies and powers of the Bank provided in this agreement. The Bank shall not be responsible for the actions, errors or omissions of any Receiver it appoints and any such Receiver shall be deemed to act as agent for the Debtor for all purposes, including the occupation of any lands and premises of the Debtor and in carrying on the Debtor’s business, unless the Bank expressly specifies in writing that the Receiver shall be agent for the Bank for one or more purposes. Without limiting the generality of the forgoing, for the purposes of realizing upon the Security Interest, any Receiver may sell, lease, or otherwise dispose of Collateral as agent for the Debtor or as agent for the Bank as the Bank may specify in writing in its sole discretion. The Debtor agrees to ratify and confirm all actions of any Receiver appointed by the Bank acting as agent for the Debtor, and to release and indemnify the Receiver in respect of all such actions. |

|

25. |

Without limiting the ability of the Bank or any Receiver to dispose of Collateral in any other manner, the Debtor agrees that any sale, lease or other disposition of the Collateral hereunder may be completed by public auction, public tender or private contract, with or without notice, with or without advertising and with or without any other formality (in each case, except as required by law), all of which are hereby waived by the Debtor to the maximum extent permitted by applicable law. Any such disposition of Collateral may involve all or part of the Collateral and may be on such terms and conditions as to credit or otherwise and as to upset or reserve bid or price as the Bank or any Receiver appointed by the Bank may, in its sole discretion, deem advantageous and may take place whether or not the Bank or any such Receiver has taken possession of such Collateral. Any purchaser or lessee of Collateral may be a customer of the Bank. |

|

26. |

The Bank shall not be liable for any delay or failure to enforce any rights, powers or remedies available to it or to institute any proceedings for such purposes. |

|

27. |

No right, power or remedy of the Bank (whether granted herein or otherwise) shall be exclusive of or dependent on or merge in any other right, power or remedy, but all such rights, powers and remedies may from time to time be exercised independently or in combination. |

|

28. |

The Debtor agrees to pay to the Bank, forthwith on demand by the Bank, all documented, out-of-pocket costs and expenses incurred by the Bank in connection with the exercise by the Bank of its rights, powers and remedies hereunder, including: |

|

(a) |

any costs and expenses incurred by the Bank in taking, holding, moving, storing, recovering, possessing, repairing, processing, preparing for disposition or disposing of Collateral; |

|

(b) |

any legal fees and expenses incurred by the Bank in enforcing it rights, powers and remedies, including those incurred in connection with any proceedings taken for the purpose of enforcing its rights, powers and remedies hereunder or otherwise relating to the non-payment or non-performance of any Obligations; |

|

(c) |

the cost of borrowing amounts as hereinbefore provided (for the purpose of carrying on the Debtor’s business or otherwise), including, the principal amount or any such amount borrowed, all interest thereon and fees relating thereto; and |

|

(d) |

all costs and expenses of or incurred by any Receiver, agent or consultant appointed by the Bank (including any legal fees and expenses incurred by any such Receiver, agent or consultant). |

All such sums shall bear interest at the then prevailing rate applicable to the Obligations, shall form part of the Obligations and shall be secured by the Security Interest.

|

29. |

Any and all payments made in respect of the Obligations from time to time and moneys realized from any Collateral (including moneys realized on any enforcement of this agreement) may be applied to such part or parts of the Obligations as the Bank may see fit, and the Bank shall at all times and from time to time have the right to change any appropriation as the Bank may see fit. |

|

30. |

The Debtor shall remain liable for all Obligations that are outstanding following realization of all or any part of the Collateral. |

Rights of the Bank

|

31. |

The Bank may pay the whole or any part of any liens, taxes, rates, charges or encumbrances now or hereafter existing in respect of any Collateral and such payments together with all costs, charges and expenses which may be incurred in connection with making such payments shall form part of the Obligations, shall bear interest at the then prevailing rate applicable to the Obligations, and shall be secured by the Security Interest. Whenever the Bank pays any such lien, tax, rate, charge or encumbrance, it shall be entitled to all the equities and securities of the Person or Persons so paid and is hereby authorized to obtain any discharge thereof and hold such discharge without registration for so long as it may deem advisable to do so. |

|

32. |

If the Debtor fails to perform or comply with any covenant or other obligation of the Debtor under this agreement, the Bank may, but need not, perform or otherwise cause the performance or compliance of such covenant or other obligation, provided that any performance or compliance undertaken by the Bank will not constitute a waiver, remedy or satisfaction of such failure. The costs and expenses of the Bank incurred in connection with any such performance or compliance shall be payable by the Debtor to the Bank on demand, form part of the Obligations, bear interest at the then prevailing applicable to the Obligations and be secured by the Security Interest. |

|

33. |

The Debtor grants to the Bank the right to set off against the Obligations (or any portion thereof) any amount owed by the Bank to the Debtor, including the amount of any and all accounts, credits or balances maintained by the Debtor with the Bank. |

|

34. |

The Bank, without exonerating in whole or in part the Debtor, may grant time, renewals, extensions, indulgences, releases and discharges to, may take securities from and give the same and any or all existing securities up to, may abstain from taking securities from or from perfecting securities of, may accept compositions from, and may otherwise deal with the Debtor and all other Persons and securities as the Bank may see fit. |

|

35. |

Nothing herein shall obligate the Bank to extend or amend any credit to the Debtor or to any other Person. |

|

36. |

The Bank may only assign, transfer and deliver the Obligations or any security or any documents or instruments held by the Bank in respect thereof in accordance with the terms of the Credit Agreement. The Debtor shall not assign any of its rights or obligations hereunder without the prior written consent of the Bank. |

Amalgamation of Debtor

|

37. |

If the Debtor amalgamates with any other corporation or corporations, this agreement shall continue in full force and effect and shall be binding on the amalgamated corporation and, for greater certainty: |

|

(a) |

the Security Interest shall: |

|

(i) |

continue to secure payment of all obligations of the Debtor to the Bank; |

|

(ii) |

secure payment of all obligations of each other amalgamating corporation to the Bank; and |

|

(iii) |

secure payment of all obligations of the amalgamated corporation to the Bank arising on or after the amalgamation; |

and the term “Obligations” shall include all such obligations of the Debtor, the other amalgamating corporations and the amalgamated corporation;

|

(b) |

the Security Interest shall: |

|

(i) |

continue to charge all property and assets of the Debtor; |

|

(ii) |

charge all property and assets of each other amalgamating corporation; and |

|

(iii) |

charge all property and assets of the amalgamated corporation in existence at the time of the amalgamation and all property and assets acquired by the amalgamated corporation after the amalgamation; |

and the term “Collateral” shall include all such property and assets of the Debtor, the other amalgamating corporations and the amalgamated corporation;

|

(c) |

all defined terms and other provisions of this agreement shall be deemed to have been amended to reflect such amalgamation, to the extent required by the context; and |

|

(d) |

the parties agree to execute and deliver all such further documents and assurances as may be necessary or desirable in connection with the foregoing. |

Notices

|

38. |

Any notice, demand or other communication permitted or required to be given hereunder shall be in writing and may be effectively given by delivering it to the address(es) hereinafter set forth or by sending the same by fax to such address(es). Any notice, demand or other communication so given prior to 5:00 p.m. (Toronto time) on a Business Day by personal delivery or by fax shall be deemed to have been given, received and made on such Business Day and if so given after 5:00 p.m. (Toronto time) on a Business Day or a day which is not a Business Day, such notice, demand or other communication shall be deemed to have been given, received and made on the next following Business Day. The addresses of the parties for the purposes hereof shall be: |

|

(a) |

in the case of the Bank, addressed as follows: |

M&T Bank

000 Xxxx Xxxxx Xxxx, Xxxxx 000

Xxxxxxxxx Xxxxx Corporate Park

Xxxxxx Xxxx, XX 00000

Attn: Xxxxxx X. Vivardi, Vice President

Email: [REDACTED]

|

(b) |

in the case of the Debtor, addressed as follows: |

Acculogic Inc.

000 Xxxx Xxxx Xxxxx – Suite 000

Xxxxx Xxxxxx, Xxx Xxxxxx 00000

Attn: Xxxxxx Xxxxxxx

Email: [REDACTED]

Either party may from time to time notify the other, in accordance with the provisions hereof, of any change of address which thereafter, until changed by like notice, shall be the address of such party for all purposes of this agreement.

Miscellaneous

|

39. |

In the event that any day, on or before which any action is required to be taken hereunder, is not a Business Day, then such action shall be required to be taken on or before the first Business Day thereafter. |

|

40. |

Time shall be of the essence of this agreement. |

|

41. |

Upon payment and fulfillment by the Debtor, its successors or permitted assigns, of all Obligations and provided that the Bank is then under no obligation (conditional or otherwise) to make any further loan or extend any other type of credit to the Debtor or to any other Person, the payment of which is secured, directly or indirectly, by this agreement, the Bank shall promptly, upon request in writing by the Debtor, delivered to the Bank at the Bank’s address as set out in subsection 38(a) hereof and at the Debtor’s expense, discharge this agreement. |

|

42. |

This agreement is in addition to and not in substitution for any other security now or hereafter held by the Bank and shall be general and continuing security notwithstanding that the Obligations shall be at any time or from time to time fully satisfied or paid. |

|

43. |

The Bank may in writing (and not otherwise) waive any default by the Debtor in the observance or performance of any provision of this agreement; provided that no waiver by the Bank shall extend to or be taken in any manner whatsoever to affect any subsequent default, whether of the same or a different nature, or the rights resulting therefrom. |

|

44. |

This agreement shall enure to the benefit of the Bank, its successors and assigns, and shall be binding on the Debtor, its successors and permitted assigns. |

|

45. |

The Debtor agrees that the Bank may from time to time provide information concerning this agreement (including a copy hereof), the Collateral and the Obligations to any Person the Bank in good faith believes is entitled thereto pursuant to applicable legislation. |

|

46. |

This agreement may be executed by facsimile, pdf or other electronic means, and any such signature contained hereon shall be deemed to be equivalent to an original signature for all purposes. |

|

47. |

The Debtor acknowledges receipt of an executed copy of this agreement. |

[Remainder of page intentionally blank; signature page follows.]

IN WITNESS WHEREOF this agreement has been executed by the Debtor as of December 30, 2021.

| ACCULOGIC INC. | ||

| By: | /s/ Xxxxxx Xxxxxxx | |

| Name: Xxxxxx Xxxxxxx | ||

|

Title: Secretary |

||

| By: | /s/ Xxxx Xxxxx | |

| Name: Xxxx Xxxxx | ||

| Title: President | ||

| I/We have the authority to bind the Corporation. | ||

Signature Page – General Security Agreement

SCHEDULE “A”

Intellectual Property

Trademarks

|

Trademark |

Country |

App. # |

Reg # |

Filing Date |

Reg. Date |

|

ACCULOGIC |

Canada | 1,430,624 |

TMA771,692 |

2009/3/11 |

2010/07/12 |

|

ACCULOGIC |

U.S. |

77/779941 |

4,065,067 |

2009/7/13 |

2011/12/6 |

|

Germany |

300228058 | 30022805 | 2000/3/23 | 2000/7/31 |

Trademark Applications - None.

Patents & Patent Applications

|

Title |

Country |

Status |

Application No. |

Application Date |

Registration No. |

Registration Date |

|

Method and Device for Reducing Incorrect Measurements During the Determination of Electrical Parameters of Electrical Components |

Canada |

Pending |

3127969 |

February 26, 2020 |

N/A |

N/A |

Copyrights & Copyright Applications - None.

Material IP Licenses - None.

SCHEDULE “B”

Permitted Encumbrances

|

1. |

statutory liens which secure payment of amounts not then overdue; |

|

2. |

statutory liens which secure payment of amounts which are then overdue but the validity of which is being contested in good faith and in respect of which reserves satisfactory to the Bank in its sole discretion have been established; |

|

3. |

security given to a public utility, municipality, government or statutory or public authority to secure obligations incurred to such utility, municipality, government or other authority in the ordinary course of business and not then overdue; |

|

4. |

liens and privileges arising out of judgments or awards in respect of which an appeal or proceeding for review has been commenced, provided a stay of execution pending such appeal or proceedings for review has been obtained and provided reserves satisfactory to the Bank in its sole discretion have been established; |

|

5. |

purchase-money security interests in the Debtor’s equipment permitted pursuant to the Credit Agreement; |

|

6. |

liens or rights of distress reserved in or exercisable under any lease of real property for rent not then overdue or for compliance with the provisions of such lease not then in default; |

|

7. |

security deposits given under leases of real property not in excess of an amount equivalent to six months’ rent; |

|

8. |

liens securing obligations or duties affecting real property due to any public utility, municipality, government, or statutory or public authority with respect to any franchise, grant, licence or permit in good standing and any minor irregularities in title to any real property, provided such obligations, duties and minor title irregularities do not materially impair the use, value or marketability of such real property; |

|

9. |

liens incurred or deposits made in connection with contracts, bids or tenders made in the ordinary course of business or in connection with expropriation proceedings, surety or appeal bonds or costs of litigation to the extent required by law; |

|

10. |

liens (including construction liens) arising in connection with the construction or improvement of any real property or arising out of the furnishing of materials or supplies therefor, provided that such liens secure payment of amounts not then overdue (or if overdue, the validity of which is being contested in good faith and in respect of which reserves satisfactory to the Bank in its sole discretion have been established) and provided notice of such lien has not been given to the Bank and such lien has not been registered against title to such real property; |

|

11. |

zoning and building by-laws affecting real property provided they are complied with; |

|

12. |

storers’ and repairers’ liens securing amounts not then overdue; |

|

13. |

encumbrances in favour of the Bank; and |

|

14. |

liens permitted under the Credit Agreement. |

SCHEDULE “C”

Part I

Location of the Debtor’s Registered Xxxxxx

00 Xxxx Xxxxxx Xxxx

Xxxxx 0000

Xxxxxxx, Xxxxxxx

X0X 0X0

Part II

Other Location(s) of the Debtor’s Tangible Collateral

000 Xxxxxxx Xxxxx,

Xxxxxxx, Xxxxxxx

X0X 0X0

000 Xxxxxxx Xxxxx,

Xxxxx 00 & 00

Xxxxxxx, Xxxxxxx

X0X 0X0

00000 Xxxx Xxxxxxx, Xxxxx 000

Xxxx Xxxxxx, Xxxxxxxxxx

00000