OFFICE LEASE BY AND BETWEEN 405 HOWARD, LLC AND FITBIT, INC. Date: September 30, 2013

Exhibit 10.6

EXECUTION COPY

BY AND BETWEEN

405 ▇▇▇▇▇▇, LLC

AND

FITBIT, INC.

Date: September 30, 2013

▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇

Suites 400 and 550

| TABLE OF CONTENTS | ||||||

| ARTICLE 1 | Basic Lease Information |

1 | ||||

| ARTICLE 2 | Agreement |

6 | ||||

| ARTICLE 3 | Use |

7 | ||||

| ARTICLE 4 | The Premises |

8 | ||||

| ARTICLE 5 | Monthly Rent |

14 | ||||

| ARTICLE 6 | Additional Rent for Operating Expenses |

14 | ||||

| ARTICLE 7 | Additional Rent for Taxes |

20 | ||||

| ARTICLE 8 | Insurance |

21 | ||||

| ARTICLE 9 | Requirements of Law and Environmental Hazards |

22 | ||||

| ARTICLE 10 | Assignment and Subletting |

23 | ||||

| ARTICLE 11 | Rules and Regulations |

28 | ||||

| ARTICLE 12 | Common Areas |

28 | ||||

| ARTICLE 13 | Landlord’s Services |

29 | ||||

| ARTICLE 14 | Tenant’s Care of the Premises |

32 | ||||

| ARTICLE 15 | Alterations |

32 | ||||

| ARTICLE 16 | Construction Liens |

35 | ||||

| ARTICLE 17 | End of Term |

35 | ||||

| ARTICLE 18 | Eminent Domain |

36 | ||||

| ARTICLE 19 | Damage and Destruction |

37 | ||||

| ARTICLE 20 | Subordination |

38 | ||||

| ARTICLE 21 | Entry by Landlord |

40 | ||||

| ARTICLE 22 | Indemnification, Waiver, and Release |

41 | ||||

| ARTICLE 23 | Security Deposit and Prepaid Rent |

42 | ||||

| ARTICLE 24 | Quiet Enjoyment |

44 | ||||

| ARTICLE 25 | Effect of Sale |

44 | ||||

| ARTICLE 26 | Default |

44 | ||||

| ARTICLE 27 | Parking |

48 | ||||

| ARTICLE 28 | Arbitration |

48 | ||||

| ARTICLE 29 | Miscellaneous |

50 | ||||

| ARTICLE 30 | Extension Option |

56 | ||||

| ARTICLE 31 | Right of First Offer |

57 | ||||

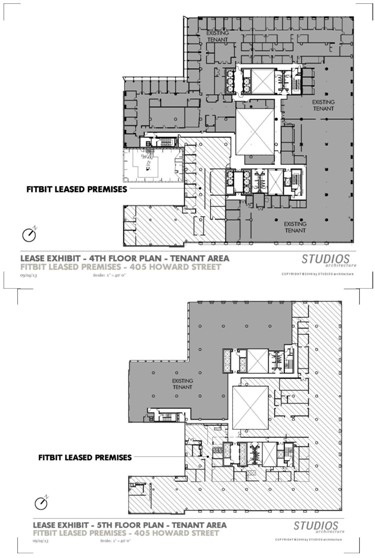

| EXHIBIT A | THE PREMISES |

|||||

| EXHIBIT B | LEGAL DESCRIPTION OF LAND |

|||||

| EXHIBIT C | RULES AND REGULATIONS |

|||||

| EXHIBIT D | COMMENCEMENT DATE AGREEMENT |

|||||

| EXHIBIT E | LETTER OF CREDIT FORM |

|||||

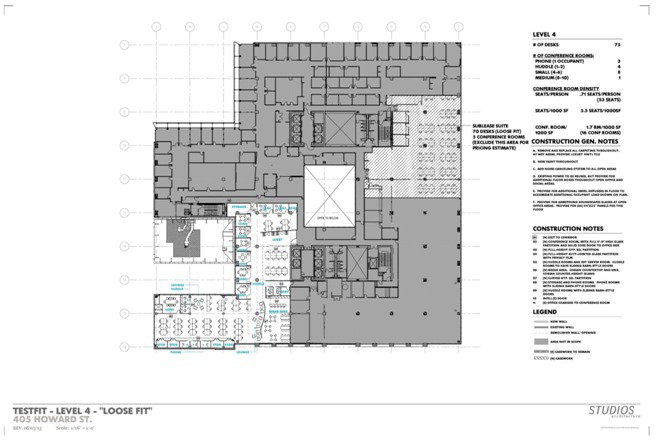

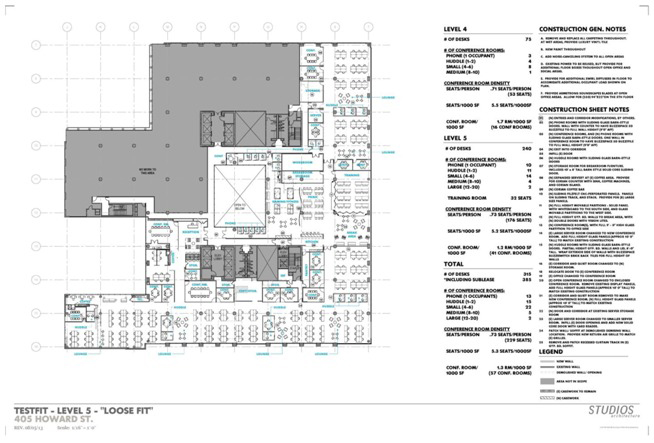

| Schedule 1 | Approved Test-Fit |

|||||

| Schedule 2 | Pre-approved Subcontractors |

|||||

| Schedule 3 | Hardware Lab Substances |

|||||

THIS OFFICE LEASE is entered into by Landlord and Tenant as described in the following Basic Lease Information on the date that is set forth for reference only in the following Basic Lease Information. Landlord and Tenant agree:

W I T N E S S E T H:

ARTICLE 1

BASIC LEASE INFORMATION

Section 1.1 Basic Lease Information. The following terms are referred to in other provisions of the Lease. Each such reference shall incorporate the applicable Basic Lease Information. In the event of any conflict between the Basic Lease Information and the provisions of the Lease, the latter shall control.

(a) LEASE DATE: September 30, 2013.

(b) LANDLORD: 405 ▇▇▇▇▇▇, LLC.

(c) LANDLORD’S ADDRESS:

c/▇ ▇▇▇▇▇▇▇ Investment Properties, Inc.

▇▇▇▇ ▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇

▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇

Attention: ▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇

with a copy at the same time to:

The Ashforth Company

▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇

▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇

Attention: ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, Esq.

(d) TENANT: Fitbit, Inc.

(e) TENANT’S ADDRESS:

Prior to the Suite 400 Delivery Date:

Fitbit, Inc.

▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇

▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: General Counsel

After Lease Commencement:

Fitbit, Inc.

▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attn: General Counsel

1

(f) BUILDING ADDRESS: ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇.

(g) PREMISES: As shown on Exhibit A and known as Suites 400 and 550.

(h) RENTABLE AREA OF THE PREMISES: Landlord represents that the Rentable Areas of the Premises has been measured in accordance with 1996 standards as promulgated by the Building Owners and Managers Association.

Suite 400: 13,199 square feet; and

Suite 550: 44,170 square feet.

(i) RENTABLE AREA OF THE BUILDING: 521,555 square feet.

(j) TERM: Beginning on the Commencement Date and expiring on the Expiration Date.

(k) COMMENCEMENT DATE: As used herein, the term “Commencement Date” shall have different meanings as applied to ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇. The “Suite 400 Commencement Date” shall mean the earliest to occur of (i) the date that is sixty (60) days after the Suite 400 Delivery Date or (ii) the date of substantial completion of “Tenant’s Initial Alterations” (as hereinafter defined) in Suite 400 or (iii) the date of Tenant’s occupancy of Suite 400 for the conduct of business. The “Suite 550 Commencement Date” shall mean the earliest to occur of (i) the date that is three (3) months after the Suite 550 Delivery Date or (ii) the date of Tenant’s occupancy of Suite 550 for the conduct of business.

(l) DELIVERY DATE:

Suite 400 Delivery Date: The date that is five (5) business days after the Lease Date.

Suite 550 Delivery Date: Upon the date the following conditions have been met (i) expiration of the Lease of the existing tenant of Suite 550 (scheduled for December 31, 2013) and (ii) such tenant has vacated possession of Suite 550 and has removed its personal property, equipment and fixtures therefrom.

(m) RENT COMMENCEMENT DATE:

Suite 400 Rent Commencement Date: Two (2) months after the Suite 400 Commencement Date.

Suite 550 Rent Commencement Date: Two (2) months after the Suite 550 Commencement Date.

2

(n) EXPIRATION DATE: The last day of the calendar month in which the day preceding the six (6) year anniversary of the Suite 550 Commencement Date occurs.

(o) SECURITY DEPOSIT: $2,100,000.00, subject to the provisions of Section 23.5 hereof.

(p) FIRST MONTH’S RENT: $249,270.17.

(q) MONTHLY RENT:

▇▇▇▇▇ ▇▇▇: ▇▇▇▇▇ ▇▇▇ Rent

Commencement Date –

Suite 550 Rent Commencement

| Date: |

$ | 54,946.67 | ||

| Lease Year 1: |

$ | 57,060.00 | ||

| Lease Year 2: |

$ | 58,771.80 | ||

| Lease Year 3: |

$ | 60,536.43 | ||

| Lease Year 4: |

$ | 62,353.00 | ||

| Lease Year 5: |

$ | 64,224.20 | ||

| Lease Year 6: |

$ | 66,147.33 | ||

| Suite 550: |

||||

| Lease Year 1: |

$ | 194,323.50 | ||

| Lease Year 2: |

$ | 200,153.21 | ||

| Lease Year 3: |

$ | 206,162.84 | ||

| Lease Year 4: |

$ | 212,352.40 | ||

| Lease Year 5: |

$ | 218,721.90 | ||

| Lease Year 6: |

$ | 225,271.32 | ||

(r) TENANT’S SHARE: 11.00%.

(s) BROKER: Avison Young and ▇▇▇▇▇ ▇▇▇▇ LaSalle.

3

(t) BASE YEAR: For Operating Expenses: The 2014 calendar year.

For Taxes: The 2014 calendar year.

(u) FIRST MONTHLY RENT ADJUSTMENT DATE:

For Operating Expenses: January 1, 2015.

For Taxes: January 1, 2015.

(v) TENANT IMPROVEMENT ALLOWANCE: $1,612,490.00

Section 1.2 Definitions.

(a) ADA: Americans with Disabilities Act of 1990, as amended, and applicable provisions, standards or regulations under local, state or federal law requiring standards for making new or existing facilities accessible to persons with disabilities. “Certified Access Specialist” shall mean a person certified as to perform inspections of places of public accommodations under applicable ADA standards.

(b) ADDITIONAL RENT: Any amounts that this Lease requires Tenant to pay in addition to Monthly Rent.

(c) BUILDING: The ▇▇▇▇▇▇ Building located at ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇.

(d) ISSUING BANK: A commercial bank whose commercial paper, short-term debt obligations and other short-term deposits are rated at least “A-1+” or the equivalent by Standard & Poors Rating Services, Inc. (“S&P”) and ▇▇▇▇▇’▇ Investors Services, Inc. (“Moody’s”), and whose long-term senior unsecured deposits are rated at least “AA” or the equivalent by S&P and Moody’s.

(e) LAND: The Land on which the Project is located and which is described on Exhibit B.

(f) LEASE YEAR: The twelve (12) month period beginning on the first day of the month in which the Suite 550 Rent Commencement Date occurs and each succeeding twelve (12) month period thereafter.

(g) LEGAL REQUIREMENTS: Any of the following which affect the Project, Building or Premises or any part thereof: (i) all laws, orders, rules, judgments, regulations, directions, requirements, certificates, permits, policies, codes or ordinances of any governmental or quasi-governmental agency, authority, instrumentality, officer or utility, whether federal, state, county, municipal or local or any business improvement or other community district; (ii) the provisions of any and all recorded documents; and (iii) the requirements of any insurance carrier or rating organization.

4

(h) ENVIRONMENTAL LAWS: Legal Requirements governing either safety, health or the protection of the environment, including without limitation the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. 9601 et seq., the Resource Conservation and Recovery Act, 42 U.S.C. 6901 et seq., the Clean Water Act, 33 U.S.C. 1251 et seq., the Clean Air Act, 42 U.S.C. 7401 et seq., the Toxic Substance Control Act, 15 U.S.C. 2601 et seq., and the Safe Drinking Water Act, 42 U.S.C. 300f through 300j, all as amended, and all regulations promulgated thereunder.

(i) HAZARDOUS SUBSTANCES: Any substance which is toxic, ignitable, reactive or corrosive or which is regulated by Environmental Laws. “Hazardous Substance” includes any and all materials or substances which are defined as “hazardous waste”, “extremely hazardous waste” or a “hazardous substance” pursuant to state, federal or local governmental law. Hazardous Substance also include asbestos, polychlorinated biphenyls (“PCBs”) and petroleum products.

(j) NOTICE: Notices shall be in writing and (i) personally delivered to the offices set forth above, in which case such notice shall be deemed given on the date of delivery or the first (1st) business day thereafter if delivered other than on a business day or after 5:00 p.m. Pacific time to said offices; (ii) sent by registered or certified mail, postage prepaid, return receipt requested, in which case such notice shall be deemed given on the date shown on the receipt; or (iii) sent for next day delivery with a nationally recognized overnight courier, in which case such notice shall be deemed given on the first (1st) business day after the date such notice was delivered to or picked up by the courier. If delivery is refused or delayed by the addressee, such Notice shall be deemed given on the business day on which the first attempted delivery occurred.

Either party may add additional addresses or change its address for purposes of receiving Notices upon at least ten (10) days prior Notice of such change or addition. Tenant’s current billing contact is ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇.

(k) PRIME RATE: The rate of interest from time to time announced by U.S. Bank National Association (“USB”), or any successor to it, as its prime rate. If USB, or any successor to it, ceases to announce a prime rate, the Prime Rate will be a comparable interest rate designated by Landlord.

(l) PROJECT: The Land and all improvements built on the Land, including without limitation the Building, parking lot(s), parking structure, if any, walkways, driveways, fences, and landscaping.

(m) RENT: The Monthly Rent and Additional Rent.

(n) TAXES: All real and personal property taxes, school taxes, sewer rates and charges, transit taxes or other Governmental assessments or charges, general, specific, ordinary or extraordinary, foreseen or unforeseen, assessed, levied or imposed upon the Project. If at any

5

time during the Term the methods or standards of taxation prevailing at the date hereof shall be altered so that in lieu of, or as an addition to, or as a substitute for the whole or any part of the Taxes now levied, assessed or imposed, there shall be imposed (a) a tax, assessment, levy, imposition or charge based on the rents received (whether or not wholly or partially as a capital levy or otherwise), or (b) a license fee measured by the Rent, other tax, levy, imposition, charge or license fee; then all such taxes, assessments, levies, impositions, charges or license fees or the part thereof so measured or based, shall be deemed to be Taxes. The term “Taxes” shall not include, and Tenant shall not be liable for the payment of any of the following: (i) any tax, levy, assessment, charge or surcharge resulting from the contamination of the Project, the Building and/or the Premises by Hazardous Substances, (ii) interest or penalties for the late payment or failure to pay real property taxes, and (iii) transfer taxes payable in connection with any sale or other transfer of any interest of Landlord in the Building.

(o) TRANSFER: Any assignment or transfer of this Lease, any interest therein, or any right or privilege appurtenant thereto, whether by pledge, hypothecation, encumbrance, operation of law or otherwise; any subletting or licensing of the Premises or any portion thereof; any permission granted to any other person, party or entity to use or occupy the Premises, any portion thereof or any right or privilege appurtenant thereto; and any agreement to enter into or perform any of the foregoing. As used herein, a “Transfer” shall include a transfer of the stock or other beneficial interest of the Tenant, whether accomplished by one or more transfers, voluntarily or by operation of law.

(p) UNAVOIDABLE DELAYS: Delays resulting from acts of God, governmental restrictions or guidelines, strikes, labor disturbances, shortages of materials and supplies and from any other causes or events whatsoever beyond Landlord’s or Tenant’s reasonable control.

(q) Exhibits. The following addendum and exhibits are attached to this Lease and are made part of this Lease:

EXHIBIT A — The Premises

EXHIBIT B — Legal Description of the Land

EXHIBIT C — Rules and Regulation

EXHIBIT D — Commencement Date Agreement

EXHIBIT E — Letter of Credit Form

ARTICLE 2

AGREEMENT

Section 2.1 Lease of Premises. Landlord leases the Premises to Tenant, and Tenant leases the Premises from Landlord, together with the right to utilize in common with others, for ingress and egress, the common areas of the Project as described in Article 12. Nothing herein contained shall be construed to permit Tenant the use of the roof or exterior walls of the Building, of the space above or below the Premises or of any parking or other areas adjacent to the Building, except as expressly stated otherwise.

6

ARTICLE 3

USE

Section 3.1 General. (a) The Premises shall be used for general office purposes and for no other purpose. In addition, Tenant may use up to 5,000 square feet of the Premises, in the aggregate, for one (1) or more hardware labs for the research, testing and prototyping of Tenant’s products in its business of developing mobile software applications and accessories for use in the health and wellness industry, provided and subject to the following conditions: (i) such hardware labs shall be located at not more than four (4) separate locations in the Premises unless otherwise approved by Landlord in its sole discretion, (ii) the use of such portions of the Premises as hardware labs shall be consistent with office occupancy and shall not include any manufacturing or production or life science or chemical laboratories; (iii) the use of such portions of the Premises as hardware labs shall not include the use of any Hazardous Substances other than those normally utilized in connection with typical office occupancy or as provided below; and (iv) Tenant shall not sublease any hardware lab to any sub-tenant separate and apart from a bona fide sublease of office space where the predominant use of the subleased premises is for office purposes and the subtenant’s use of the hardware lab is ancillary to its use of the balance of the subleased premises for office purposes. Landlord and Tenant recognize that Tenant’s use of the hardware labs may include Tenant’s use of reasonable amounts of the Hazardous Substances listed on Schedule 3 attached to this Lease and Tenant shall not be considered to be in violation of the foregoing provision by virtue of the use of such Substances in quantities reasonably necessary for Tenant’s use of the hardware lab for the purposes herein described provided and so long as (1) Tenant’s use, storage, generation and disposition of such Substances shall be in accordance with and subject to the provisions of Section 9.3 of this Lease, and (2) all flammable Substances will be stored in a fire-proof cabinet in the hardware lab. Landlord reserves the right to require Tenant, at its expense, to take remedial measures to address any deleterious effects of the use of the Premises, or applicable portion thereof, as hardware labs, including without limitation, to address the presence of such Substances in the Premises or Building, installing adequate venting and filtration of any smoke, fumes, vapors or odors generated by the use of the Premises, or applicable portion thereof, as a hardware lab and installing one arm extraction system at each soldering station.

(b) The Premises are leased together with the appurtenances thereto, including the non-exclusive right to use the lobbies, elevators, stairways and other public portions of the Building, the non-exclusive use of any restrooms on any multi-tenant floors and the exclusive right to use any restrooms on single-tenant floors included within the Premises. Tenant shall not do, nor permit anything to be done, in or about the Premises which will in any way obstruct or interfere with the rights of other tenants of the Building, or injure or annoy them, or use or allow the Premises to be used for any improper, immoral, unlawful or objectionable purpose, nor shall Tenant cause, maintain or permit any nuisance in, on or about the Premises or the Building, or commit or suffer to be committed any waste in, on or about the Premises or the Building.

7

Section 3.2 Commercial Facility. The Premises will be used only as a commercial facility and not as a place of public accommodation as defined by ADA. Tenant shall not offer its goods and services to the general public at the Premises. Landlord hereby advises Tenant that the Demised Premises has not been inspected by a Certified Access Specialist.

Section 3.3 Building Name. Tenant shall not be allowed to use the name of the Building for any purpose other than as the address of the business to be conducted by Tenant in the Premises. Landlord reserves the right in its sole discretion to change the name of the Building at any time.

Section 3.4 Signs and Advertising. (a) Tenant shall not inscribe, paint, post, place, or in any manner display any sign, notice, picture, placard, poster, name or advertising matter anywhere in or about the Building or Premises at places visible (either directly or indirectly as an outline or shadow on or through a glass pane) from outside the Premises. In the event that Landlord permits any such signs or notices, upon expiration or termination of this Lease, Tenant shall, at its expense, promptly remove all such signs or advertising and shall repair any damage caused by such removal.

(b) Landlord shall provide Tenant, at Landlord’s cost, one standard sign in each of the common elevator lobbies on the fourth (4th) and fifth (5th) floors of the Building.

Section 3.5 Smoking Prohibited. Tenant acknowledges that smoking is not permitted within the Project (except in areas specifically designated as smoking areas) and agrees that it will not allow smoking within the Premises by employees, invitees or visitors.

ARTICLE 4

THE PREMISES

Section 4.1 Delivery of Possession. (a) Tenant agrees to accept possession of Suite 400 in its “as-is” condition as of the Suite 400 Delivery Date, subject to the removal of any personal property therefrom, and further subject to all Building mechanical, electrical, life safety and plumbing systems serving Suite 400 (which does not include any supplemental air-conditioning systems located in Suite 400) being in good working order and Building standard window coverings in Suite 400 being in good working order. Tenant agrees to accept possession of Suite 550 in its “as-is” condition as of the Suite 550 Delivery Date, subject to the existing tenant of Suite 550 vacating possession thereof and removing its personal property therefrom and further subject to all Building mechanical, electrical and plumbing systems serving Suite 550 (which does not include any supplemental air-conditioning systems located in Suite 550) being in good working order and Building standard window coverings in Suite 550 being in good working order. Tenant acknowledges that neither Landlord nor its agents or employees have made any representations or warranties as to the suitability or fitness of the Premises for the conduct of Tenant’s business or for any other purpose, nor has Landlord or its agents or employees agreed to undertake any alterations or construct any tenant improvements to the Premises, except as expressly provided in this Lease. Tenant shall have a period of ninety (90) days after the respective Delivery Dates for ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇ to inspect ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇, respectively, and to provide Landlord with Notice within such ninety (90) day period

8

of any respects in which ▇▇▇▇▇ ▇▇▇ ▇▇ ▇▇▇▇▇ ▇▇▇ have not been delivered to Tenant in the condition required hereunder. Once the Commencement Date and Rent Commencement Date have been established, the parties shall execute and exchange an agreement (“Commencement Date Agreement”) specifying the Commencement Date, Rent Commencement Date, Expiration Date and any other dates related thereto, which Agreement shall be in substantially the same form as Exhibit D. Failure to execute such an agreement shall not; however, affect Tenant’s obligations pursuant to this Lease.

(b) (i) Suite 550 is currently occupied by two (2) occupants-Uber Technologies, Inc. and Studios Architecture, Inc. In the event Landlord is unable to deliver possession of Suite 550 in the condition required under this Lease on or before April 1, 2014, as such date may be extended by delays caused or consented to by Tenant or Unavoidable Delays (herein, the “Outside Delivery Date”), then Tenant may, at its option and as its sole remedy, cancel this Lease by giving Notice to Landlord (herein, a “Cancellation Notice”) within thirty (30) days of the Outside Delivery Date (but before delivery of Suite 550 occurs), TIME OF THE ESSENCE, which Cancellation Notice shall specify a date for the cancellation of this Lease not less than ten (10) days after Landlord’s receipt of the Cancellation Notice (the “Cancellation Date”).

(ii) Should Tenant elect to cancel the Lease as herein provided, Tenant shall, as a condition to Tenant’s exercise of such cancellation right, simultaneously with the delivery of the Cancellation Notice to Landlord, pay to Landlord, in immediately available funds, the amount of any Tenant Improvement Allowance previously disbursed by Landlord. If delivery of Suite 550 does not occur by the Cancellation Date for reasons other than delays caused or consented to by Tenant or Unavoidable Delays, then this Lease shall be deemed cancelled from and after the Cancellation Date, except nothing contained herein shall be deemed to release Landlord or Tenant from any obligations accrued prior to the Cancellation Date or which by their terms survive the expiration or termination of the Term of this Lease (including without limitation, the provisions of Section 29.10 hereof). Should Tenant exercise its right to cancel this Lease as set forth herein, provided Tenant is not then in default under this Lease and timely surrenders possession of the Suite 400 to Landlord in the condition required hereunder, Landlord shall upon confirmation thereof, return to Tenant the Security Deposit and any prepaid rent provided to Landlord in accordance with this Lease

Section 4.2 Early Entry. Tenant shall be permitted early entry into ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇, as applicable, as of the Suite 400 Delivery Date and the Suite 550 Delivery Date, as applicable, but prior to the Suite 400 Commencement Date and the Suite 550 Commencement Date, as applicable, for the purpose of performing Tenant’s Initial Alterations, and installing its equipment, furniture and equipment. Any such early entry shall be at Tenant’s sole risk and subject to all the terms and provisions of this Lease; provided Tenant shall have no obligation to pay Monthly Rent during such early entry period with respect to any portion of the Premises as to which the applicable Rent Commencement Date has not yet occurred.

9

Section 4.3 Tenant Improvement Allowance.

(i) Subject to the terms and conditions hereinafter contained, Landlord agrees to contribute up to the Tenant Improvement Allowance to Alterations to be performed in the Premises by Tenant to prepare the Premises for Tenant’s occupancy (herein, “Tenant’s Initial Alterations”). Landlord hereby acknowledges and consents to the lay-out of the Premises shown on the Test-Fit attached hereto as Schedule 1, subject to Tenant submitting detailed plans and specifications for such work to Landlord for its review and approval and Tenant performing all such work in accordance with all applicable terms and conditions of this Lease. Tenant’s Initial Alterations shall be performed in accordance with all applicable terms and conditions of this Lease, including, without limitation, Articles 15 and 16 hereof and shall be based upon plans and specifications to be prepared by Tenant’s architect and approved by Landlord. The Tenant Improvement Allowance shall be applicable only to Tenant’s Initial Alterations (including the cost of architectural and engineering fees) completed prior to the twelve (12) month anniversary of the Suite 550 Delivery Date and, if not fully used by such date shall not be credited against rent or other sums due under the Lease or other Tenant’s renovations to be performed at a subsequent date. No portion of the Tenant Improvement Allowance shall be applied toward other costs including, without limitation, the cost of personal property, moving expenses, furniture, artwork, interest or late charges.

(ii) Tenant shall pay to Landlord’s managing agent, ▇▇▇▇▇▇▇ Investment Properties, Inc. the “Administration Fee” set forth below as applied to the “Cost of the Work” (as hereinafter defined) for its administration and coordination of Tenant’s selected contractor’s activities with the Building in connection with Tenant’s Initial Alterations. In no event, however, shall Landlord or its managing agent be responsible for performance or warranties by Tenant’s contractors, subcontractors (of any tier), engineers or other vendors or for providing any insurance or general conditions, such as temporary light and power, HVAC, or rubbish removal services, all of which shall be provided solely by Tenant’s contractors, subcontractors, engineers or other vendors. As used herein, the “Cost of the Work” shall mean

| (A) | All architectural and engineering fees and expenses (except to the extent already part of the Test-Fit Allowance); |

| (B) | The sum of all third-party costs incurred in order to construct Tenant’s Initial Alterations and all costs reasonably related thereto; and |

| (C) | Permits and taxes. |

The “Administration Fee” shall mean a fee to be computed relative to the Cost of the Work as follows:

| - | For the first $500,000: 3%; |

| - | For the next $501,000: 2%; and |

| - | Thereafter: 1%. |

The Administration Fee shall be payable in monthly installments as the Cost of the Work is incurred. To the extent the Tenant Improvement Allowance has not yet been fully expended and is available to be disbursed (e.g., is not being held for purposes of retainage), any Administration Fee payable as above provided may, to

10

the extent not already reflected on such “Requisition”, be added to any Requisition received and shall be paid directly to Landlord’s managing agent out of the Tenant Improvement Allowance at the time of any “Installment Payment” hereunder (as such quoted terms are hereinafter defined). To the extent the Tenant Improvement Allowance has been fully expended or is not otherwise available to be disbursed, Tenant shall pay the Administration Fee within ten (10) days of demand, which demand(s) may be made monthly.

(iii) Provided there is not then an Event of Default under this Lease, Landlord shall contribute the Tenant Improvement Allowance to the Cost of the Work as follows:

(A) Promptly upon completion of the Tenant’s Initial Alterations in the Premises for the preceding calendar month, Tenant shall submit to Landlord:

(1) contractor’s invoices for all work done and all supplies furnished in connection with the Tenant’s Initial Alterations performed in the Premises in the preceding month;

(2) a detailed breakdown of the aggregate cost of all the Tenant’s Initial Alterations completed to date;

(3) certificates from Tenant’s architect and contractor(s) that (i) the Tenant’s Initial Alterations performed in the Premises in the preceding month have been fully completed; (ii) the Tenant’s Initial Alterations in the Premises were prosecuted in accordance with the plans and specifications previously approved by Landlord; and (iii) there are no violations or liens pending as a result of any of Tenant’s Initial Alterations.;

(4) Tenant’s and its architect’s and contractor’s statements of the total Cost of the Work, the Cost of the Work expended to date and the remaining Cost of the Work yet to be incurred and paid; and

(5) Tenant’s request and approval of Landlord’s payment of the invoices submitted. If Tenant is requesting that Landlord reimburse Tenant for sums already paid by Tenant, Tenant shall also submit to Landlord evidence reasonably satisfactory to Landlord that such sums have been paid, which may include lien waivers. Such requests may include requests that Landlord reimburse Tenant for up to fifty percent (50%) of the Cost of the Work incurred by Tenant prior to the commencement of Tenant’s Initial Alterations for items such as architect’s or engineer’s fees or deposits reasonably required, if any, for the ordering of materials in connection with Tenant’s Initial Alterations notwithstanding that Tenant’s Initial Alterations have not yet commenced.

The foregoing items (1) through (5) are herein collectively called a “Requisition”.

11

(iv) Within thirty (30) days of Landlord’s receipt of a Requisition for labor, services or materials, for which Landlord has not previously made an “Installment Payment” (as hereinafter defined), provided there is no Event of Default under Lease, Landlord will reimburse Tenant for sums previously paid by Tenant or, if requested by Tenant, pay directly to Tenant’s general contractor ninety percent (90%) of Landlord’s pro rata share of such Requisition, which pro rata share shall be computed by dividing the Tenant Improvement Allowance by the total Cost of the Work, as reflected in the most recent Requisition. Such payment is herein called an “Installment Payment”. The remaining ten percent (10%) of Landlord’s pro rata share of each Requisition shall be paid by Landlord, as hereinafter provided, directly to Tenant or Tenant’s general contractor as a separate and final Installment Payment upon submission of a final Requisition following completion of all the Tenant’s Initial Alterations in accordance with all applicable provisions of the Lease. Such final Installment Payment shall be paid within thirty (30) days of (A) the satisfaction of the provisions of sub-paragraph (iii) above for payment of such final Requisition, except references in said sub-paragraph (iii) to “the preceding month” shall be deemed deleted or to refer to “all Tenant’s Initial Alterations” (or words of similar import), as the context may require, and (B) the delivery to Landlord of all final governmental approvals required for all the Tenant’s Initial Alterations.

(v) In no event Landlord be required to disburse or shall Tenant be entitled to any Installment Payment either (x) as long as Tenant shall be in breach or default of any of the terms, covenants or conditions of the Lease beyond any applicable notice or cure periods, or (y) once Landlord has made Installment Payments aggregating the Tenant Improvement Allowance or (z) for any of Tenant’s Initial Alterations not completed by the date that is the twelve (12) month anniversary of the Suite 550 Delivery Date.

(vi) Any sum due or payable to any Tenant’s contractors, subcontractors, engineers or other vendors or suppliers and not required to be paid by Landlord hereunder shall be paid by Tenant at its sole cost and expense.

Section 4.4 Test-Fit Allowance. As used herein, the “Test-Fit Allowance” shall mean $8,400.00. Landlord’s architect is preparing up to two (2) Test Fits for the Premises and Landlord will pay the invoices of Landlord’s architect up to the amount of the Test-Fit Allowance for such services in accordance with such contract. The Test-Fit Allowance if not fully used shall not be credited against rent or other sums due under the Lease.

Section 4.5 (a) Construction of Tenant’s Initial Alterations. The plans and specifications for the Tenant’s Initial Alterations shall be approved by Landlord (the “TI Plans”) prior to the commencement of construction of the Tenant’s Initial Alterations by Tenant. Landlord shall deliver written notice to Tenant within fifteen (15) days after Landlord’s receipt of the TI Plans for the Premises which notice shall advise Tenant whether the submitted TI Plans are approved, or are unsatisfactory or incomplete in any respect or whether Landlord requires any additional information in order to respond to the same. Landlord shall provide a reasonably detailed explanation for any disapproval or request for additional information. If Tenant is advised that the TI Plans are unsatisfactory or incomplete in any respect or Landlord requires additional information, Tenant shall promptly revise the TI Plans in accordance with such review and submit the revised TI Plans to Landlord addressing Landlord’s response no later than five (5)

12

business days after Landlord delivers its notice. Landlord shall respond to any such changes, modifications or alterations addressing Landlord’s responses within five (5) business days of Landlord’s receipt thereof. Once the TI Plans are approved, no changes, modifications or alterations in the TI Plans may be made without the prior written consent of Landlord, which consent may not be unreasonably withheld, conditioned or delayed with respect to any proposed alterations that are not structural, do not affect any Building systems or areas outside the Premises. If Landlord fails to respond to a request for Landlord’s approval within the fifteen (15) day or five (5) business day periods set forth above, Tenant may send to Landlord a second notice referring to this Section 4.5(a) and advising Landlord that Landlord has failed to respond to a request for Landlord’s approval to TI Plans within the fifteen (15) day or five (5) business day periods referred to in this Section 4.5(a) and should Landlord fail to respond to Tenant’s second request in writing within five (5) business days of such second request, Landlord shall be deemed to have approved such TI Plans. Should Landlord in fact fail to respond in writing to a request for Landlord’s approval complying with the provisions hereof within five (5) business days after Landlord’s receipt of such second notice, Landlord’s approval to such TI Plans shall be deemed given.

(b) A general contractor (“Contractor”) shall be retained by Tenant to construct the Tenant’s Initial Alterations, which Contractor shall be subject to Landlord’s consent, which consent shall not be unreasonably withheld, conditioned or delayed provided that such Contractor is a California licensed contractor with a successful track record of constructing first class tenant improvements in first class office buildings, provides the insurance required by this Lease and otherwise agrees to comply with the applicable provisions of this Lease and such Contractor hires only sub-contractors previously approved by Landlord, which approval will not be unreasonably withheld, conditioned or delayed. The foregoing notwithstanding, Tenant shall be required to utilize Landlord’s designated sub-contractors for the following items of Tenant’s Initial Alterations: (i) Mechanical, Electrical and Plumbing Engineers, (ii) fire life safety contractor; (iii) Riser, cable and data management contractor; and (iv) Building Management Systems contractor re: computerized controls. Landlord shall notify Tenant within five (5) business days after Tenant’s request for consent to the Contractor selected by Tenant and such Contractor’s choice of sub-contractors. If Landlord fails to respond to a request for Landlord’s approval of a contractor or sub-contractor within five (5) business days after Tenant’s request, Tenant may send to Landlord a second notice referring to this Section 4.5(b) and advising Landlord that Landlord has failed to respond to a request for Landlord’s approval of a contractor or sub-contractor within the five (5) business day period referred to in this Section 4.5(b) and should Landlord fail to respond to Tenant’s second request in writing within three (3) business days of Landlord’s receipt of such second request, Landlord shall be deemed to have approved such contractor or sub-contractor. Should Landlord in fact fail to respond in writing to a request for Landlord’s approval of a contractor or sub-contractor complying with the provisions hereof within three (3) business days after Landlord’s receipt of such second notice, Landlord’s approval of such contractor or sub-contractor shall be deemed given. As of the Lease Date, the sub-contractors listed on Schedule 2 annexed hereto are approved to perform Alterations in the Building, which Schedule is subject to change by Landlord or its managing agent from time to time.

13

ARTICLE 5

MONTHLY RENT

Section 5.1 Monthly Rent. Monthly Rent shall be paid beginning on the Rent Commencement Date and throughout the Term in advance on or before the first day of each calendar month of the Term. If the Term commences on a day other than the first day of a calendar month or ends on a day other than the last day of a calendar month, then Monthly Rent will be appropriately prorated by Landlord based on the number of days in such month. Monthly Rent and all Additional Rent will be paid to Landlord, without Notice or demand, and without deduction or offset, in lawful money of the United States of America at 405 ▇▇▇▇▇▇ LLC – ▇▇▇▇, ▇▇ ▇▇▇▇▇▇, ▇.▇. ▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇, or to such other address as Landlord may from time to time designate in writing.

Section 5.2 Late Payments/Uncollected Funds. (a) All sums due Landlord which are past due for a period of ten (10) days or more shall bear interest on the unpaid portion from their respective due dates until paid at the rate of one and one-half percent (1 1⁄2%) for each month or part of a month, or if such rate under the circumstances then prevailing shall not be lawful, then at the maximum lawful rate. In addition, if Tenant fails to pay any installment of Monthly Rent or Additional Rent within ten (10) days of the date when due and payable hereunder, a late charge equal to five percent (5%) of such unpaid amount will be due and payable immediately by Tenant to Landlord. Nothwithstanding the foregoing, Tenant shall not be obligated to pay the interest charge and/or late penalty fee set forth above with respect to the first time any sum is not paid within the time periods prescribed above in any twelve (12) month period. The foregoing shall be in addition to any other right or remedy which may be available to Landlord in the event of default by Tenant. The payment of such interest or late charge shall not excuse or cure any default by Tenant pursuant to this Lease.

(b) Should any check or other payment on account of Rent be returned uncollected for insufficient funds or any other reason, Tenant shall reimburse Landlord for any fees imposed by Landlord’s financial institution for the return of such check or other payment.

ARTICLE 6

ADDITIONAL RENT FOR OPERATING EXPENSES

Section 6.1 General.

(a) Whenever for any calendar year the “Operating Expenses” (as defined below) exceed the Operating Expenses for the Base Year, then, effective January 1 of such year, Tenant shall pay as Additional Rent the product of Tenant’s Share multiplied by such excess subject to the provisions of Section 6.2. The first payment of Additional Rent for increases in Operating Expenses, if any, shall be effective on the First Monthly Rent Adjustment Date set forth in Section 1.1.

(b) As used in this Lease, the term “Operating Expenses” means:

(i) All reasonable costs paid, payable, or incurred by Landlord for the management, operation, and maintenance of the Project, computed in accordance with generally

14

accepted accounting principles (“GAAP”), including wages, salaries, benefits and compensation employees, and payroll taxes; any gross receipts tax or excise tax levied with respect to the receipt of rent; consulting, accounting, legal, janitorial, maintenance, security, window washing and other services; management fees (not to exceed market rate management fees for comparable buildings, however in no event shall management fees exceed 5% of gross operating revenue for the Building) and costs; that part of office rent or rental value of space in the Project used or furnished by Landlord to enhance, manage, operate, and maintain the Project; reasonable allocation of costs to provide and operate free or discounted visitor parking for the Project; power, water, waste disposal, and other utilities; consumable materials and supplies, tools, and equipment; maintenance and repairs; insurance obtained with respect to the Project (other than earthquake deductibles which shall be governed by Section 6.1 (f) below); depreciation or rental on personal property and equipment used in the management, operation, or maintenance of the Project which is or should be capitalized on the books of Landlord except as set forth in subsection (ii) below; and any other costs, charges, and expenses that under generally accepted accounting principles would be regarded as management, maintenance, and operating expenses. The preceding list is for definitional purposes only and does not impose any obligation to incur such expenses or provide such services. Any services provided by Landlord or any affiliate of Landlord shall be at rates competitive with prevailing rates for comparable services and projects.

(ii) (A) The cost (amortized in accordance with GAAP) together with interest (at the actual or imputed rate that Landlord would reasonably be required to pay to finance the cost of such capital improvement) on the unamortized balance of any capital improvements that are made to the Project by Landlord (1) for the purpose of reducing operating expenses (provided that the annual anticipated savings in the component of operating expenses that such capital improvement is intended to reduce are reasonably expected to exceed the annual amortized cost of such improvement) or (2) after the Lease Date and by requirement of any governmental law, code or regulation (including without limitation the ADA and any provisions of ADA applicable to the Project or any part thereof as a result of the use, occupancy, or alteration thereof by Landlord) that was not applicable to the Project at the time it was constructed and is not as a result of special requirements for any tenant’s use of the Project or (B) The cost of any capital items to the extent provided in Section 6.1(f) below.

(c) The Operating Expenses will not include:

(i) depreciation on the Project (other than depreciation on personal property, equipment);

(ii) costs of alterations of space or other improvements made for tenants of the Project;

(iii) finders’ fees and real estate brokers’ commissions;

(iv) ground lease payments, mortgage principal or interest;

(v) items that are or should be capitalized under GAAP other than those referred to in subsection (b)(ii) above or Section 6.1(f) below;

15

(vi) costs of replacements to personal property and equipment for which depreciation costs are included as an operating expense;

(vii) costs of excess or additional services provided to any tenant in the Building that are directly billed to such tenants;

(viii) the cost of repairs due to casualty or condemnation that are reimbursed by third parties;

(ix) any cost due to Landlord’s breach of this Lease;

(x) all costs, including legal fees, relating to activities for the solicitation and execution of leases of space in the Building or disputes with other tenants of the Building;

(xi) any legal fees incurred by Landlord in enforcing its rights under other leases for space in the Project;

(xii) fines, penalties or interest resulting from late payment of Taxes or Operating Expenses, provided however Operating Expenses shall include fines, penalties or interest that are incurred with respect to Operating Expenses which Landlord disputed in good faith;

(xiii) advertising and promotional expenses;

(xiv) Landlord’s charitable and political contributions;

(xv) costs of purchasing or leasing major sculptures, paintings or other artwork, except as may be required to comply with governmental restrictions affecting the Building or Project;

(xvi) penalties or fines incurred by Landlord due to a violation by Landlord of any legal requirement building codes, or any other governmental rule or requirement (other than the underlying cost of such compliance itself) and penalties or fines resulting from the negligence or willful misconduct of Landlord or its employees, agents or contractors;

(xvii) reserves;

(xviii) costs of selling, financing or refinancing the Building;

(xix) The cost of operating any commercial concession which is operated by Landlord at the Building;

(xx) Replacement of the structural portions of the roof or exterior walls, foundations, load bearing walls or base building, except as provided in Section 6.1(f) below;

16

(xxi) Landlord’s general overhead expenses not related to the Building;

(xxii) Costs of abatement or remediation of Hazardous Substances brought upon, stored, used or disposed of in or about the Building by Landlord or by a particular tenant or occupant of the Building, except for amounts used in the ordinary course of operating the Building;

(xxiii) Sums (other than management fees, it being agreed that the management fees included in Operating Expenses are as described in Section 6.1(b)(i) above) paid to subsidiaries or other affiliates of Landlord for services on or to the Building and/or Premises, but only to the extent that the costs of such services exceed the market rate cost for such services rendered by unrelated persons or entities of similar skill, competence and experience; and

(xxiv) Costs incurred for repairs, replacements or restoration due to damage caused by earthquake to the extent within the deductible under Landlord’s earthquake insurance policy, except as provided under the provisions of Section 6.1(f) below.

If, in any calendar year following the Base Year, as defined hereinbelow (a “Subsequent Year”), a new service or category of expense (e.g., earthquake insurance, concierge services; entry card systems), is included in Operating Expenses which was not included in the Base Year Operating Expenses, then the cost of such new service or category of expense shall be added to the Base Year Operating Expenses for purposes of determining the Additional Rent payable under this Article 6 for such Subsequent Year. During each Subsequent Year, the same amount shall continue to be included in the computation of Operating Expenses for the Base Year, with the Subsequent Year’s Operating Expenses including the original charge and any increase in the cost of such new service or category of expense in such Subsequent Year’s Operating Expenses. However, if in any Subsequent Year thereafter, such new service or category of expense is not included in Operating Expenses, no such addition shall be made to Base Year Operating Expenses

Conversely, as reasonably determined by Landlord, when a service or category of expense that was originally included in the Base Year Operating Expenses is, in any Subsequent Year, no longer included in Operating Expenses, then the cost incurred for such service or category of expense in the Base Year shall be deleted from the Base Year Operating Expenses for purposes of determining the Additional Rent payable under this Article 6 for such Subsequent Year. The same amount shall continue to be deleted from the Base Year Operating Expenses for each Subsequent Year thereafter that the service or category of expense is not included. However, if such service or category of expense is again included in the

17

Operating Expenses for any Subsequent Year, then the amount of said service or category of expense originally included in the Base Year Operating Expenses shall again be added back to the Base Year Operating Expenses.

(d) If during any calendar year at least ninety-five percent (95%) of the Project is not provided with full Building standard services or is not at least ninety-five percent (95%) occupied, in determining Operating Expenses Landlord shall compute all variable Operating Expenses for such calendar year as though ninety-five percent (95%) of the Project were provided with full Building standard services and were ninety-five percent (95%) occupied. For purposes of this Section, the term variable Operating Expenses shall mean any Operating Expense (or portion thereof) that increases or decreases with the level of occupancy of the Project. In the event that Operating Expenses do not include any specific costs billed to or otherwise incurred for the particular benefit of specific tenants of the Project, Landlord shall have the right to increase Operating Expenses by an amount equal to the cost of providing standard services similar to the services for which such excluded specific costs were billed or incurred.

(e) Tenant acknowledges that Landlord has not made any representation or given Tenant any assurances that any estimate of Operating Expenses will equal or approximate the actual Operating Expenses for any calendar year or partial calendar year during the Term.

(f) The costs for repairs, or replacements, or restoration necessitated due to damage caused by earthquakes, whether or not such costs are to be capitalized under GAAP, shall be included within Operating Expenses to the extent actually incurred by Landlord in order to perform and complete such repairs, replacements and restoration and within the deductible under Landlord’s policy of earthquake insurance, but shall only be included on an amortized basis over a one hundred twenty (120) month period with interest at a fixed rate of eight percent (8%) per annum, provided however no such costs shall be included for the purpose of determining Tenant’s Base Year Operating Expenses, including Base Year Operating Expenses for any renewal term, but the foregoing shall not relieve Tenant from the obilgation to pay the portion of such costs that may be amortized during the Base Year occurring during any renewal term. Should the Term of this Lease terminate or expire, including without limitation as a result of Tenant’s exercise of its right to terminate this Lease under Article 19 of this Lease (but other than as a result of Tenant’s default under the provisions of Article 26 of this Lease), before any such costs are fully amortized, Tenant shall not be responsible for any portion of such costs which are to be amortized after the expiration or termination of the Term of this Lease.

Section 6.2 Estimated Payments.

(a) Commencing with the calendar year in which the First Monthly Rent Adjustment Date occurs, Landlord will give Tenant a statement of the estimated Operating Expense increase, if any, for such calendar year. On or before the first day of each month during each calendar year, Tenant shall pay to Landlord Additional Rent monthly, in advance, an amount equal to 1/12 of the product of Tenant’s Share multiplied by Landlord’s estimate of the excess of the Operating Expenses for such year over the Operating Expenses for the Base Year. In the month

18

in each calendar year in which Tenant first makes a payment based upon such estimate, if not January 1st of such year, Tenant shall pay to Landlord or in the case of an overpayment, Landlord shall credit Tenant, for each month which has elapsed since January 1st the difference, if any, between the Additional Rent based upon such estimate of Operating Expenses and the Additional Rent for Operating Expenses actually paid.

(b) If at any time or times it reasonably appears to Landlord that the actual Operating Expenses for any calendar year will vary substantially from the estimated Operating Expenses for such calendar year, Landlord may deliver to Tenant a revised statement of the estimated Operating Expense increase for such calendar year, and subsequent Additional Rent payments by Tenant in such calendar year will be based upon such revised estimated Operating Expense increase.

Section 6.3 Annual Settlement. Within one hundred twenty (120) days after the end of each calendar year or as soon thereafter as reasonably practicable, Landlord will deliver to Tenant a statement setting forth Tenant’s Share of actual amounts payable under this Article 6 for the prior calendar year. Such statement will be final and binding upon Landlord and Tenant unless Tenant objects to it in writing to Landlord within one hundred twenty (120) days after delivery to Tenant. If such statement shows an amount owing by Tenant that is less than the estimated payments previously made by Tenant for such calendar year, the excess will be held by Landlord and credited against the next payment of Rent; however, if the Term has ended and Tenant was not in default at its end, Landlord will refund the excess to Tenant. Subject to Tenant’s right to object to such statement for the one hundred twenty (120) day period referred to above, acceptance or resolution of the first such statement shall constitute acceptance of the Operating Expense amount for the Base Year. If such statement shows an amount owing by Tenant that is more than the estimated payments previously made by Tenant for such calendar year, Tenant will pay the deficiency to Landlord within thirty (30) days after the delivery of such statement. Tenant may review Landlord’s records of the Operating Expenses, at Tenant’s sole cost and expense, at the place Landlord normally maintains such records during Landlord’s normal business hours upon reasonable advance Notice. If Tenant elects to audit the Annual Statement, and such audit reveals an overstatement by Landlord of six (6%) or more, of the Building Operating Expenses for such year, then Landlord shall pay the reasonable out-of-pocket cost incurred and paid by Tenant for such audit.

Section 6.4 Final Proration. If this Lease ends on a day other than the last day of a calendar year, the amount of Additional Rent payable by Tenant applicable to the calendar year in which this Lease ends will be calculated on the basis of the number of days of the Term falling within such calendar year. Tenant’s obligation to pay any deficiency between estimated increase in Operating Expenses and actual increase in Operating Expenses or Landlord’s obligation to refund any overage shall survive the expiration or other termination of this Lease.

Section 6.5 Decrease in Operating Expenses. Notwithstanding anything contained in this Article, the Monthly Rent payable by Tenant shall in no event be less than the Monthly Rent specified in Section 1.1.

19

Section 6.6 Dispute Resolution. Any dispute regarding the provisions of this Article shall be resolved by arbitration as provided in Article 28.

ARTICLE 7

ADDITIONAL RENT FOR TAXES

Section 7.1 Calculation. Tenant shall pay, as Additional Rent, an amount equal to Tenant’s Share of the excess of Taxes due for each calendar year of the Term over the amount of Taxes due with respect to the Base Year for Taxes. Additional Rent on account of increase in Taxes shall be payable separately in accordance with the provisions of Section 7.4.

Section 7.2 Adjustment of Taxes. If in the Base Year and/or any subsequent tax year the Project is less than fully assessed, then the Taxes for such year(s) shall be appropriately adjusted to reflect what the Taxes for such year(s) would have been had the Project been fully assessed. In the event that there are tenants in the Building from time to time that are entitled to exemptions from Taxes, Taxes for such year(s) shall be appropriately adjusted to reflect the full assessment. Tenant shall only be responsible for Tenant’s Share of such Taxes if Landlord is required to pay the same.

Section 7.3 Tax Appeal. If, by virtue of any application or proceeding brought by or on behalf of Landlord, there shall be a reduction of the assessed valuation of the Project for any year, including the Base Year, which affects the Taxes, or part thereof, for which Additional Rent has been paid by Tenant pursuant to this Article, such Additional Rent payment shall be recomputed on the basis of any such reduction and Landlord will credit against the next accruing installment of Monthly Rent due under this Lease, after receipt by Landlord of a tax refund or credit, any sums paid by Tenant in excess of the recomputed amounts, less a sum equal to Tenant’s Share of all costs, expenses, and fees, including reasonable attorney’s fees incurred by Landlord in connection with such application or proceeding.

Section 7.4 Estimated Payments and Annual Settlement. Commencing with the calendar year in which the First Monthly Rent Adjustment Date occurs, Landlord will give Tenant a statement of the estimated Additional Rent for increases in Taxes for such calendar year. On or before the first day of each month during each such calendar year, Tenant shall pay to Landlord Additional Rent of one-twelfth (1/12) of the product of Tenant’s Share of such estimated increase. In the month in each calendar year in which Tenant first makes a payment based upon such estimate, if not January 1st of such year, Tenant shall pay to Landlord for each month which has elapsed since January 1st the difference, if any, between the Additional Rent based upon such estimate and the Additional Rent for Taxes actually paid. After the end of each calendar year, there shall be a reconciliation of the Additional Rent for Taxes actually due and the total of estimated payments for such Additional Rent, as provided in Section 6.3.

Section 7.5 Final Proration. Any Additional Rent payable pursuant to this Article for any partial year shall be adjusted in proportion to the number of days in such partial year during which this Lease is in effect. The obligation of Tenant with respect to any Additional Rent pursuant to this Article applicable to the last fiscal or calendar year of the Term shall survive the expiration or termination of this Lease.

20

Section 7.6 Decrease in Taxes. Notwithstanding anything contained in this Article, the Monthly Rent payable by Tenant shall in no event be less than the Monthly Rent specified in Section 1.1.

Section 7.7 Dispute Resolution. Any dispute regarding the provisions of this Article shall be resolved by arbitration as provided in Article 28.

ARTICLE 8

INSURANCE

Section 8.1 Landlord’s Insurance. At all times during the Term, Landlord will carry insurance coverages and amounts reasonably determined by Landlord, based on coverages carried by prudent owners of comparable buildings in the vicinity of the Project.

Section 8.2 Certain Insurance Risks. Tenant will not do or permit to be done any act or thing upon the Premises or the Project which would jeopardize or be in conflict with casualty insurance policies covering the Project or increase the rate of fire or any other insurance applicable to the Project.

Section 8.3 Tenant’s Insurance.

(a) During the entire Term, and for so long thereafter as Tenant shall occupy any portion of the Premises, Tenant shall keep in full force and effect, at its own expense, a policy or policies of:

(i) Commercial General Liability insurance, in occurrence form, covering bodily injury or death to persons and damage to or destruction of property, and including contractual liability coverage for Tenant’s indemnity obligations required by this Lease to afford protection of not less than $2,000,000 per occurrence and $2,000,000 combined single limit in the aggregate for any one accident.

(ii) Worker’s Compensation insurance as required by all state and/or federal laws.

(b) Such policies will be maintained with companies having a “General Policyholders Rating” of at least A:IX as set forth in the most current issue of “Best’s Insurance Guide,” and will be written as primary policy coverage and not contributing with, or in excess of, any coverage which Landlord shall carry. Tenant shall have the right to provide the coverages required herein under blanket policies provided that the coverage afforded Landlord shall not be diminished by reason thereof. No more frequently than once every thirty-six (36) months, Landlord shall have the right to review the provisions of this Article and to require reasonable changes in the amounts or types of insurance, or both, as it may deem reasonably necessary in order to adequately protect its interests.

Section 8.4 Certificates of Insurance. Tenant shall, prior to the Commencement Date, cause to be delivered to Landlord an original certificate of insurance providing a minimum of thirty (30) days prior notice of cancellation or reduction in coverage. Renewal certificates shall

21

be furnished to Landlord at least thirty (30) days prior to the expiration date of each policy. All such certificates shall indicate that Landlord, Landlord’s managing agent and such additional parties as Landlord shall designate are additional insureds with respect to the Commercial General Liability coverage.

Section 8.5 Waiver of Subrogation. All property insurance policies carried by either party shall contain a waiver by the insurer of any rights of subrogation to any cause of action (including negligent acts) against the Tenant or Landlord (as the case may be) and their officers, directors, and employees. Further, each party waives any claim or cause of action against the other party hereto arising from any loss or damage to property which is covered by such insurance or which could be covered by such insurance if either party self-insures but only insofar as such party is compensated by such insurance for such loss or damage.

Section 8.6 Tenant’s Property. All furnishings, fixtures, equipment and property of every kind and description of Tenant and of persons claiming by or through Tenant which may be on the Premises shall be at the sole risk and hazard of Tenant and no part of loss or damage thereto for whatever cause is to be charged to or borne by Landlord.

ARTICLE 9

REQUIREMENTS OF LAW AND ENVIRONMENTAL HAZARDS

Section 9.1 General. (a) Landlord shall be responsible for all costs to cause the restrooms and common areas of the Building serving the Premises to comply with all Legal Requirements, including the ADA, as of the applicable Delivery Date. At its sole cost and expense, Tenant shall promptly comply with all Legal Requirements now in force or in force after the Delivery Date relating to the condition, use, or occupancy of the Premises, excluding requirements of structural changes to the Premises or Building, unless such structural changes are required by the unique nature of Tenant’s use or occupancy (including without limitation, the hardware lab referred to in Section 3.1 of this Lease), Tenant’s employee capacity or proposed non-Building standard Alterations. Tenant shall participate in all Building practice fire drills and Building evacuations and shall prepare and maintain a Fire and Life Safety Plan for its employees and guests.

(b) In the event that Tenant’s employee capacity or any non-Building standard Alteration proposed to be performed by Tenant or any proposed use of the Premises, or any portion thereof, for any purpose other than office use (whether or not expressly permitted under this Lease or consented to by Landlord and including without limitation, the hardware lab referred to in Section 3.1 of this Lease) shall trigger any Legal Requirement that any other repair or Alteration be performed in or to the Premises, Building or Project (herein, the “Triggered Requirement”), then Tenant, at its sole cost and expense, shall comply with the Triggered Requirement and deliver to Landlord reasonably satisfactory evidence thereof.

Section 9.2 Americans with Disabilities Act. Tenant shall be responsible for all modifications to the Premises required for compliance with ADA.

22

Section 9.3 Environmental Hazards. Tenant shall not cause or permit any Hazardous Substances to be used, stored, generated or disposed of in, on or about the Land, Building or Premises by Tenant, its agents, employees, contractors or invitees, except for such Hazardous Substances as are normally utilized in connection with the use permitted by this Lease and then only in strict compliance with all applicable Environmental Laws. Any such Hazardous Substances permitted on the Premises, and all containers therefor, shall be used, kept, stored and disposed of in a manner that complies with all Environmental Laws. Tenant shall indemnify and hold harmless the Landlord from any and all claims, damages, fines, judgments, penalties, costs, expenses or liabilities (including, without limitation, any and all sums paid for settlement of claims, attorneys’ fees, consultant and expert fees) arising during or after the Term from or in connection with the use, storage, generation or disposal of Hazardous Substances in, on or about the Land, Building or Premises by Tenant, Tenant’s agents, employees, contractors or invitees. Landlord shall indemnify and hold harmless the Tenant from any and all claims, damages, fines, judgments, penalties, costs, expenses or liabilities (including, without limitation, any and all sums paid for settlement of claims, attorneys’ fees, consultant and expert fees) in connection with the use, storage, generation or disposal of Hazardous Substances in, on or about the Land, Building or Premises by Landlord, Landlord’s agents, employees, contractors or invitees. Tenant shall have no liability or responsibility for any remediation costs and/or fees arising from the use, storage, generation or disposal of Hazardous Substances in, on or about the Land, Building or Premises not otherwise caused by Tenant or its agents, employees, contractors or invitees. Landlord represents to Tenant that (1) to Landlord has received no written notice that there are any environmental conditions affecting the Premises in violation of Environmental Laws, and (2) to the best of Landlord’s knowledge, there is no asbestos or asbestos-containing materials in the Premises.

ARTICLE 10

ASSIGNMENT AND SUBLETTING

Section 10.1 Consent Required.

(a) Except as provided in Section 10.4, Tenant shall not enter into or agree to any Transfer without in each case first obtaining the written consent of Landlord in accordance with the provisions of this Article. Any Transfer without such consent shall be voidable by Landlord, at its sole option and discretion, and shall constitute a default under this Lease. Any consent to any Transfer which may be given by Landlord shall not constitute a waiver of the provisions of this Article or a release of Tenant from the full performance of the covenants herein contained.

(b) Upon obtaining a proposed assignee, subtenant or transferee upon terms satisfactory to Tenant, Tenant shall submit to Landlord: (i) a copy of the fully executed proposed assignment or sublease or other instrument of Transfer; (ii) a description of the nature and character of the business of the proposed assignee or subtenant or transferee; (iii) such financial information as Landlord may reasonably request, including financial statements, either audited independently or signed by an authorized officer or principal, for the two (2) most recent completed fiscal years of the proposed subtenant or assignee or transferee (financial statements furnished to Landlord which are not independently audited must be in accordance with GAAP and must include all four (4) GAAP financial statements); and (iv) such other reasonably

23

available information as Landlord may request. Upon receipt of the items set forth above, Landlord shall have thirty (30) days to (i) elect to recapture the Premises or portion thereof described in the Tenant’s notice in accordance with Section 10.1(d) below, (ii) consent to the proposed Transfer as provided in the remainder of this Article 10, (iii) not consent to the proposed Transfer (iv) or request additional information with respect to such Transfer. Should Landlord elect not to consent to the proposed Transfer, Landlord shall provide in writing its reasons for withholding such consent. If Landlord fails to respond to a request for Landlord’s consent to a Transfer complying with the provisions hereof within thirty (30) days of Landlord’s receipt of the last of the items completing such request, Tenant may send to Landlord a second notice referring to this Section 10.01 (b) and advising Landlord that Landlord has failed to respond to a request for Landlord’s consent within the thirty (30) day period referred to in this Section 10.01 (b) and should Landlord fail to respond to Tenant’s second request in writing within seven (7) business days of such second request, Landlord shall be deemed to have consented to such Transfer request. Should Landlord in fact fail to respond in writing to a request for Landlord’s consent complying with the provisions hereof such second request within seven (7) business days after Landlord’s receipt of such second notice, Landlord’s consent to such Transfer shall be deemed given.

(c) With respect to any request by Tenant for consent from Landlord to any document, Tenant shall submit simultaneously with any information required hereunder a payment of $1,000.00 as a non-refundable fee for the processing of Tenant’s request.

(d) Landlord shall have the option, to be exercised by giving Notice to Tenant no later than thirty (30) days after receipt by Landlord of all of the information required in the previous paragraph, to cancel and terminate this Lease as of the date proposed by Tenant for the commencement of such assignment or subletting, either (i) in its entirety, in the case of an assignment or a sublease of seventy-five (75%) percent or more of the total area of the Premises; (ii) that portion of the Premises that Tenant desires to sublet, as well as the balance of the Premises not previously sublet in the case of any sublease which, together with all other subleases then in effect, totals seventy-five (75%) percent or more of the total area of the Premises for the remainder of the Term; or (iii) in the case of any other sublease, only as to that portion of the Premises that Tenant desires to sublet. The foregoing notwithstanding, Landlord’s option to cancel and terminate the Lease set forth above shall not apply to one or more proposed sublease(s) (herein, each a “Tenant Permitted Sublease”), which when taken together, do not aggregate more than thirty-five percent (35%) of the rentable area of the Premises, provided each such sublease expires not later than forty-eight (48) months after the Suite 550 Commencement Date. Such subleases shall nevertheless remain subject to Landlord’s consent and the remainder of the provisions of this Article 10.

(e) If Landlord does not exercise its options contained in sub-paragraph (d) above within said thirty (30) day period or said option do not apply, its consent to any such proposed Transfer shall not be withheld or delayed provided that it shall be deemed reasonable for Landlord to withhold its consent (i) if the proposed assignee or subtenant’s use and character are not in Landlord’s reasonable opinion in keeping with the character of the Building; (ii) if Landlord has not obtained Landlord’s mortgagee’s consent to such Transfer, if required, provided Landlord acknowledges that mortgagee’s consent shall not be required for any Tenant Permitted

24

Sublease; (iii) if Landlord has available for rent comparable or similar space in the Building, Tenant is or has solicited other tenants or occupants of the Building or is subleasing or assigning to same; (iv) no Transfer shall be to a person or entity which has a financial standing, is of a character, is engaged in business, is of a reputation, or proposes to use any part of the Premises in a manner, not in keeping with the standards of a first-class office building; (v) such Transfer does not expressly provide that it is subject to all of the obligations of Tenant pursuant to Lease (other than those specific economic and business terms (e.g. rent, term) that are specifically applicable to such sublease and/or assignment) and that there shall be no further Transfer without such further Transfer again being subject to the provisions of this Article 10; (vi) any such Transfer shall result in there being more than five (5) occupants other than Tenant in the Premises; (vii) the proposed subtenant or assignee or transferee shall not be a person then negotiating with Landlord for the rental of any space in the Building; and (viii) the proposed subtenant or assignee or transferee is a governmental agency that, in Landlord’s reasonable judgment, is likely to cause public assembly or “walk-in” traffic not consistent with class “A” office use.

As a condition of Landlord’s consent, Tenant shall require its subtenant or assignee, as the case may be, to obtain and maintain throughout the term of any such sublease or assignment the same insurance coverage that Tenant is required to maintain pursuant to Article 8, including providing certificates verifying such coverage and naming Landlord and its managing agent and such other persons or entities as Landlord may designate as additional insureds and to waive subrogation against the Landlord. Landlord’s consent to any assignment or sublease, if given, shall be evidenced only in a written agreement provided by Landlord and signed by Landlord, Tenant and its assignee or subtenant, as the case may be.

Section 10.2 Tenant’s Continued Liability. If this Lease shall be assigned, or if the Premises or any part thereof shall be sublet or occupied by any person or persons other than Tenant, Tenant shall continue to be liable for the performance of all the provisions of this Lease. Landlord may, after default by Tenant, collect rent from the assignee, subtenant or occupant and apply the net amount collected to the Rent herein reserved, but no such assignment, subletting, occupancy or collection of Rent shall be deemed a waiver of the covenants in this Article 10, nor shall it be deemed acceptance of the assignee, subtenant or occupant as a tenant, or a release of Tenant from the full performance by Tenant of all the terms, conditions and covenants of this Lease.

Section 10.3 Sublease Premium. Tenant shall pay Landlord, as Additional Rent, fifty (50%) percent of the Sublease Premium derived from any Transfer as and when received, except in the event of a Transfer pursuant to Section 10.4. “Sublease Premium” shall mean all rent, additional rent, and/or other monies, property, and other consideration of every kind whatsoever received by Tenant from the subtenant, assignee or transferee for, or by reason of, the Transfer (including all amounts received by Tenant for, or attributable to, any personal property included with any such Transfer, less: (a) commissions actually paid by Tenant to a licensed real estate broker to list and procure the sublease or assignment, amortized over the term of the sublease or assignment, commencing with the date on which the sublease or assignment term commences; (b) the actual cost of leasehold improvements undertaken by Tenant (subject to Landlord’s consent as provided in this Lease) solely to prepare the subleased space for the subtenant or the Premises for the assignee, but amortized over the term of the Transfer) commencing with the

25

date on which the Transfer term commences; (c) Monthly Rent and Additional Rent provided for in this Lease allocable to the space covered by such sublease or assignment and (d) reasonable out of pocket legal fees paid by Tenant to third parties in connection with such assignment or subletting