SERIES B CONVERTIBLE PREFERRED STOCK AND WARRANT PURCHASE AGREEMENT

Exhibit 10.24

SERIES B CONVERTIBLE PREFERRED

STOCK AND WARRANT PURCHASE AGREEMENT

This Series B Convertible Preferred Stock and Warrant Purchase Agreement (this “Agreement”), dated this 23rd day of April, 2013, is entered into by and among Radius Health, Inc., a Delaware corporation (the “Corporation”), and the persons listed on Schedule I attached hereto (the “Investors,” and each individually, an “Investor”).

WHEREAS, the Corporation and the Investors wish to provide for the issuance of shares of Series B Preferred Stock (as defined below) and warrants to purchase Common Stock (as defined below), each as more specifically set forth hereinafter.

NOW, THEREFORE. in consideration of the mutual covenants and agreements herein contained, the parties hereto, intending to be legally bound, hereby agree as follows:

SECTION 1. Authorized Preferred Stock. Prior to the Initial Closing (as defined in Section 4.1 hereof), the Corporation shall have filed a Certificate of Designations of the Series B Convertible Preferred Stock of the Corporation, in the form attached hereto as Exhibit A (the “Series B Certificate”), with the Secretary of State of the State of Delaware, providing for the authorization of a series of preferred stock of the Corporation to be designated as Series B Convertible Preferred Stock, par value $.0001 per share (the “Series B Preferred Stock”).

SECTION 2. Authorization of Issuance and Sale of Series B Preferred Stock and Warrants. Subject to the terms and conditions of this Agreement, the Corporation has authorized the following:

(a) the issuance and sale to the Investors, in one or more Closings, of up to an aggregate of 980,000 shares of Series B Preferred Stock (the “Shares”);

(b) the issuance and sale to the Investors, in one or more Closings, of warrants to acquire up to an aggregate of 2,450,000 shares (the “Warrant Shares”) of the Corporation’s Common Stock, par value $.0001 per share (the “Common Stock”), with each such warrant to acquire Common Stock being in the form attached hereto as Exhibit B (individually, a “Warrant” and, collectively, the “Warrants”); and

(c) the reservation of 9,800,000 shares of Common Stock for issuance upon conversion of the Shares (the “Reserved Common Shares”) and 2,450,000 shares of Common Stock for issuance upon exercise of the Warrants.

SECTION 3. Sale and Delivery of Shares and Warrants.

3.1 Agreement to Sell and Purchase the Shares and Warrants. Subject to the terms and conditions hereof, the Corporation is selling to each Investor and each Investor is severally (but not jointly) purchasing from the Corporation, for the aggregate purchase price set forth opposite such Investor’s name under the heading “Aggregate Purchase Price” on Schedule I hereto: (i) the number of Shares set forth opposite the name of such Investor under the heading “Series B Shares” on Schedule I hereto; and (ii) a Warrant to acquire the number of Warrant Shares set forth opposite the name of such Investor on Schedule I hereto under the heading “Warrant Shares”.

3.2 Delivery of Shares and Warrants. At each Closing (as defined in Section 4.2), the Corporation shall deliver to each Investor (i) a certificate or certificates, registered in the name of such Investor, representing the number of Shares being purchased by such Investor at such Closing and (ii) a

Warrant issued in the name of such Investor to acquire the number of Warrant Shares being purchased by such Investor, in each case in accordance with Section 3.1 above. In each case, delivery to each Investor of certificates representing Shares and of a Warrant shall be made against receipt by the Corporation of a check payable to the Corporation or a wire transfer to an account designated by the Corporation in the full amount of the aggregate purchase price set forth opposite such Investor’s name under the heading “Aggregate Purchase Price” on Schedule I hereto.

SECTION 4. The Closings.

4.1 Initial Closing. An initial closing (the “Initial Closing”) hereunder with respect to the transactions contemplated by Sections 2 and 3 hereof will take place on the date hereof concurrently with the execution and delivery of this Agreement by the Corporation and the Investors (such date sometimes being referred to herein as the “Initial Closing Date”). The Initial Closing will take place remotely by facsimile or electronic transmission of executed copies of the documents contemplated hereby.

4.2 Subsequent Closings. Subject to the terms and conditions of this Agreement, the Corporation may sell, on or before May 10, 2013, to such other persons and entities as are acceptable to the Corporation, up to the total number of Shares that were not issued and sold by the Corporation at the Initial Closing, together with Warrants for the purchase of a total number of shares of Common Stock equal to 25% of the number of shares issuable upon conversion of the Shares to be issued pursuant to this Section 4.2 (each sale and issuance of such remaining Shares and associated Warrants at any time after the Initial Closing Date being sometimes referred to herein as a “Subsequent Closing”). Any such sale shall be upon the same terms and conditions as those contained herein. Each such person or entity, by delivery of an executed Investor signature page to this Agreement, shall become a party to this Agreement and, as a condition to such sale, such person or entity shall become a party to the Stockholders’ Agreement (as defined in Section 5.2(c)) by executing and delivering to the Corporation an Instrument of Adherence substantially in the form attached to the Stockholders’ Agreement. Following the execution and delivery by such person or entity of an Investor signature page to this Agreement and of such Instrument of Adherence to the Stockholders’ Agreement, such person or entity shall become a party to this Agreement, shall have the rights and obligations of an Investor hereunder, and shall be added to Schedule I hereto (together with all relevant information regarding the number of Shares, Warrant Shares and aggregate purchase price) without any further action by the Corporation or the other Investors. The Investors party to this Agreement and the Stockholders’ Agreement hereby irrevocably waive any pre-emptive rights or rights of first offer they may possess now or hereafter with respect to sales of Shares and Warrants (and any related issuances of Reserved Common Shares and Warrant Shares) made pursuant to this Section 4.2. For convenience of reference, each of the Initial Closing and each Subsequent Closing are sometimes hereinafter singly referred to as a “Closing” and, together, they are referred to as the “Closings”.

SECTION 5. Representations and Warranties of the Corporation to the Investors.

Except as set forth in the Corporation’s disclosure schedule dated as of the date hereof and delivered herewith (the “Corporation’s Disclosure Schedule”), which shall be arranged to correspond to the representations and warranties in this Section 5, or, in each case, as applicable to the relevant other Sections of this Agreement, and the disclosure in any portion of the Corporation’s Disclosure Schedule shall qualify the corresponding provision in this Section 5 and any other provision of this Agreement, including but not limited to the provisions of this Section 5, to which it is reasonably apparent on its face that such disclosure relates notwithstanding the lack of any explicit cross-reference, the Corporation hereby represents and warrants to the Investors as of the date hereof as follows, except as set forth in the Public Filings (as defined below):

5.1 Organization. The Corporation is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has all requisite corporate power and authority to own and lease its property and to carry on its Business (as defined in Section 5.6) as presently conducted and as proposed to be conducted as described in the Public Filings (as defined in Section 5.6). The Corporation is duly qualified to do business as a foreign corporation in the Commonwealth of Massachusetts. The Corporation does not own or lease property or engage in any activity in any other jurisdiction which would require its qualification in such jurisdiction and in which the failure to be so qualified would have a material adverse effect on the Business, properties, assets, liabilities, condition (financial or otherwise) or prospects of the Corporation (a “Corporation Material Adverse Effect”).

5.2 Capitalization.

(a) The authorized capital stock of the Corporation immediately prior to the Initial Closing consists of:

(i) 100,000,000 shares of Common Stock, of which:

(1) 867,470 shares are validly issued and outstanding, fully paid and nonassessable (including 266 shares issuable upon exercise of warrants to purchase Common Stock);

(2) 30,702,220 shares have been duly reserved for issuance upon conversion of the Series B Preferred, the Corporation’s Series A-1 Convertible Preferred Stock, par value $.0001 per share (the “Series A-1 Preferred Stock”), the Corporation’s Series A-2 Convertible Preferred Stock, par value $.0001 per share (the “Series A-2 Preferred Stock”), the Corporation’s Series A-3 Convertible Preferred Stock, par value $.0001 per share, (the “Series A-3 Preferred Stock”), the Corporation’s Series A-4 Convertible Preferred Stock, par value $.0001 per share (the “Series A-4 Preferred Stock”), and the Corporation’s Series A-5 Convertible Preferred Stock, par value $.0001 per share (the “Series A-5 Preferred Stock” and together with the Series A-1 Preferred Stock, the Series A-2 Preferred Stock, the Series A-3 Preferred Stock, the Series A-4 Preferred Stock, the Series A-5 Preferred Stock and the Corporation’s Series A-6 Convertible Preferred Stock, par value $.0001 per share (the “Series A-6 Preferred Stock”), the “Existing Preferred Stock”, and the Existing Preferred Stock together with the Series B Preferred Stock, the “Preferred Stock”) (including 147,340 shares of Series A-1 Preferred Stock issuable upon exercise of warrants to purchase Series A-1 Preferred Stock); and

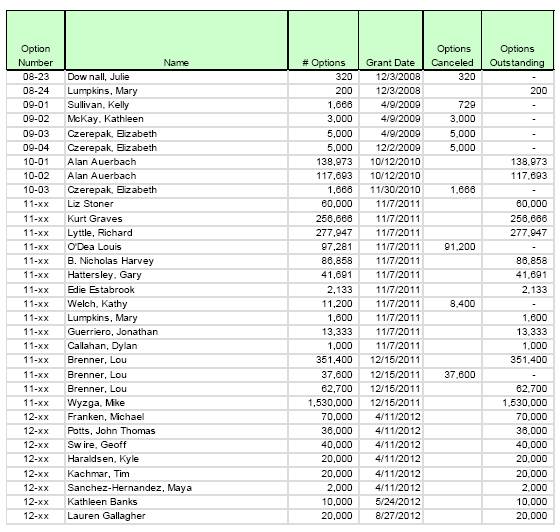

(3) 4,252,953 shares have been duly reserved for issuance in connection with options outstanding or available under the Corporation’s 2011 Equity Incentive Plan, as amended, or 2003 Long-Term Incentive Plan, as amended (collectively, the “Plan Option Shares”).

(ii) 10,000,000 shares of Preferred Stock, of which:

(1) 980,000 have been designated the Series B Preferred Stock, none of which is issued or outstanding;

(2) 1,000,000 have been designated the Series A-1 Preferred Stock, 939,612 of which are issued and outstanding, fully paid and nonassessable;

(3) 983,213 have been designated the Series A-2 Preferred Stock, 983,208 of which are issued and outstanding, fully paid and nonassessable;

(4) 142,230 have been designated the Series A-3 Preferred Stock, 142,227 of which are issued and outstanding, fully paid and nonassessable;

(5) 4,000 have been designated the Series A-4 Preferred Stock, 3,998 of which are issued and outstanding, fully paid and nonassessable;

(6) 7,000 have been designated the Series A-5 Preferred Stock, 6,443 of which are issued and outstanding, fully paid and nonassessable; and

(7) 800,000 have been designated the Series A-6 Preferred Stock, none of which are issued or outstanding.

(b) Except (i) pursuant to the terms of this Agreement, (ii) at any time prior to the Initial Closing, pursuant to the terms of the Amended and Restated Stockholders’ Agreement, dated as of May 17, 2011, by and among the Corporation and the stockholders named therein, as amended to date (the “Existing Stockholders’ Agreement”), (iii) as of and at all times following the Initial Closing, pursuant to the terms of that certain Amended and Restated Stockholders’ Agreement to be entered into in connection with the Initial Closing, as contemplated by Section 7.1(e), in the form attached hereto as Exhibit C (the “Stockholders’ Agreement”), and (iv) as set forth in Schedule 5.2 attached hereto, there are and, immediately following the Initial Closing, there will be: (1) no outstanding warrants, options, rights, agreements, convertible securities or other commitments or instruments pursuant to which the Corporation is or may become obligated to issue, sell, repurchase or redeem any shares of capital stock or other securities of the Corporation (other than the Plan Option Shares); (2) no preemptive, contractual or similar rights to purchase or otherwise acquire shares of capital stock of the Corporation pursuant to any provision of law, , the Certificate of Incorporation of the Corporation (as amended and/or restated, including without limitation, the Series B Certificate and the Certificate of Designations of the Series A-1 Convertible Preferred Stock, Series A-2 Convertible Preferred Stock, Series A-3 Convertible Preferred Stock, Series A-4 Convertible Preferred Stock, Series A-5 Convertible Preferred Stock and Series A-6 Convertible Preferred Stock of the Corporation filed by the Corporation with the Secretary of State of the State of Delaware on May 17, 2011, as amended to date and from time to time (the “Existing Certificate”), the “Charter”), the by-laws of the Corporation (the “by-laws”) or any agreement to which the Corporation is a party or may otherwise be bound; (3) no restrictions on the transfer of capital stock of the Corporation imposed by the Charter or by-laws of the Corporation, any agreement to which the Corporation is a party, any order of any court or any governmental agency to which the Corporation is subject, or any statute other than those imposed by relevant state and federal securities laws; (4) no cumulative voting rights for any of the Corporation’s capital stock; (5) no registration rights under the Securities Act of 1933, as amended (the “Securities Act”), with respect to shares of the Corporation’s capital stock; (6) to the Corporation’s Knowledge (as defined below), no options or other rights to purchase shares of capital stock from stockholders of the Corporation granted by such stockholders; and (7) no agreements, written or oral, between the Corporation and any holder of its securities, or, to the Corporation’s Knowledge, among holders of its securities, relating to the acquisition, disposition or voting of the securities of the Corporation.

5.3 Authorization of this Agreement and the Stockholders’ Agreement. The execution, delivery and performance by the Corporation of this Agreement and the Stockholders’ Agreement and the consummation of the transactions contemplated hereby and thereby, including the filing of the Series B Certificate, have been duly authorized by all requisite action on the part of the Corporation. Each of this Agreement and the Stockholders’ Agreement has been duly executed and delivered by the Corporation and constitutes a valid and binding obligation of the Corporation, enforceable in accordance with its respective terms. The execution, delivery and performance of this Agreement and the Stockholders’ Agreement, the filing of the Series B Certificate and the compliance

with the provisions hereof and thereof by the Corporation, will not:

(a) violate any provision of law, statute, ordinance, rule or regulation or any ruling, writ, injunction, order, judgment or decree of any court, administrative agency or other governmental body;

(b) conflict with or result in any breach of any of the terms, conditions or provisions of, or constitute (with due notice or lapse of time, or both) a default (or give rise to any right of termination, cancellation or acceleration) under (i) any agreement, document, instrument, contract, understanding, arrangement, note, indenture, mortgage or lease to which the Corporation is a party or under which the Corporation or any of its assets is bound, which conflict, breach or default would have a Corporation Material Adverse Effect, (ii) the Charter, or (iii) the by-laws;

(c) result in the creation of any lien, security interest, charge or encumbrance upon any of the properties or assets of the Corporation; or

(d) conflict with any stockholder’s rights to participate in the transactions contemplated hereby, including but not limited to any rights to purchase Shares or Warrants hereunder.

5.4 Authorization of Shares, Warrants and Reserved Common Shares.

(a) The issuance, sale and delivery of the Shares and Warrants pursuant to the terms hereof have been duly authorized by all requisite action of the Corporation, and, when, in the case of the Shares, issued, sold and delivered in accordance with the terms of this Agreement or, in the case of the Warrants, exercised in accordance with the terms of the Warrants, the Shares and Warrant Shares, respectively, will be validly issued and outstanding, fully paid and nonassessable, with no personal liability attaching to the ownership thereof, and, except as may be set forth in the Stockholders’ Agreement (with respect to which the Corporation is in compliance with its obligations thereunder), not subject to preemptive or any other similar rights of the stockholders of the Corporation or others.

(b) The reservation, issuance, sale and delivery by the Corporation of the Reserved Common Shares and the Warrant Shares have been duly authorized by all requisite action of the Corporation, and the Reserved Common Shares and the Warrant Shares have been duly reserved in accordance with Section 2 of this Agreement. Upon the issuance and delivery of the Reserved Common Shares in accordance with the terms of this Agreement, the Reserved Common Shares will be validly issued and outstanding, fully paid and nonassessable and, except as may be set forth in the Stockholders’ Agreement, not subject to preemptive or any other similar rights of the stockholders of the Corporation or others.

5.5 Consents and Approvals. No authorization, consent, approval or other order of, or declaration to or filing with, any governmental agency or body (other than filings of a Form D required to be made under applicable federal securities laws and filings required to be made under applicable state securities laws) or any other person, entity or association is required for: (a) the valid authorization, execution, delivery and performance by the Corporation of this Agreement and the Stockholders’ Agreement; (b) the valid authorization, issuance, sale and delivery of the Shares; (c) the valid authorization, issuance, sale and delivery of the Warrants and Warrant Shares; (d) the valid authorization, reservation, issuance, sale and delivery of the Reserved Common Shares; or (e) the filing of the Series B Certificate. The Corporation has obtained all other consents that are necessary to permit the consummation of the transactions contemplated hereby and thereby.

5.6 Business of the Corporation.

(a) Except as set forth in Schedule 5.6(a) of the Corporation’s Disclosure Schedule, the business of the Corporation (the “Business”) is described in the annual and other reports filed by the Corporation with the Securities and Exchange Commission (collectively, the “Public Filings”).

(b) All agreements or commitments to which the Corporation is a party or by which the Corporation or the Corporation’s assets and properties are bound that are material to the business of the Corporation as currently conducted are included as exhibits to the Public Filings. Without limitation of the foregoing, Schedule 5.6 of the Corporation’s Disclosure Schedule sets forth a list of all of the types of agreements or commitments set forth below that are not included as exhibits to the Public Filings (each such agreement included in the Public Filings and each agreement listed on Schedule 5.6 of the Corporation’s Disclosure Schedule being sometimes referred to herein as a “Material Agreement”):

(i) agreements which require future expenditures by the Corporation in excess of $250,000 or which might result in payments to the Corporation in excess of $250,000;

(ii) employment and consulting agreements, employee benefit, bonus, pension, profit-sharing, stock option, stock purchase and similar plans and arrangements;

(iii) agreements involving research, development, or the license of Intellectual Property (as defined in Section 5.12) (other than research, development, or license agreements which require future expenditures by the Corporation in amounts less than $250,000 or which might result in payments to the Corporation in amounts less than $250,000 in each case that do not grant to a third party or to the Corporation any rights in connection with the commercialization of any products), the granting of any right of first refusal, or right of first offer or comparable right with respect to any Intellectual Property or payment or receipt by the Corporation of milestone payments or royalties;

(iv) agreements relating to a joint venture, partnership, collaboration or other arrangement involving a sharing of profits, losses, costs or liabilities with another person or entity;

(v) distributor, sales representative or similar agreements;

(vi) agreements with any current or former stockholder, officer or director of the Corporation or any “affiliate” or “associate” of such persons (as such terms are defined in the rules and regulations promulgated under the Securities Act), including without limitation agreements or other arrangements providing for the furnishing of services by, rental of real or personal property from, or otherwise requiring payments to, any such person or entity;

(vii) agreements under which the Corporation is restricted from carrying on any business, or competing in any line of business, anywhere in the world;

(viii) indentures, trust agreements, loan agreements or notes that involve or evidence outstanding indebtedness, obligations or liabilities for borrowed money;

(ix) agreements for the disposition of a material portion of the Corporation’s assets (other than for the sale of inventory in the ordinary course of business);

(x) agreements of surety, guarantee or indemnification;

(xi) interest rate, equity or other swap or derivative instruments;

(xii) agreements obligating Corporation to register securities under the Securities Act; and

(xiii) agreements for the acquisition of any of the assets, properties, securities or other ownership interests of the Corporation or another person or the grant to any person of any options, rights of first refusal, or preferential or similar rights to purchase any of such assets, properties, securities or other ownership interests.

(c) The Corporation has no present expectation or intention of not fully performing all of its obligations under each Material Agreement and, to the Corporation’s Knowledge, there is no breach or anticipated breach by any other party or parties to any Material Agreements.

(d) All of the Material Agreements are valid, in full force and effect and binding against the Corporation and to the Corporation’s Knowledge, binding against the other parties thereto in accordance with their respective terms. Neither the Corporation, nor, to the Corporation’s Knowledge, any other party thereto, is in default of any of its obligations under any of the Material Agreements, nor, to the Corporation’s Knowledge, does any condition exist that with notice or lapse of time or both would constitute a default thereunder. The Corporation has delivered or made available to each Investor or its representative true and complete copies of all of the foregoing Material Agreements or an accurate summary of any oral Material Agreements (and all written amendments or other modifications thereto).

(e) Except as provided in Schedule 5.6(e) of the Corporation’s Disclosure Schedule: (i) there are no actions, suits, arbitrations, claims, investigations or legal or administrative proceedings pending or, to the Corporation’s Knowledge, threatened, against the Corporation, whether at law or in equity; (ii) there are no judgments, decrees, injunctions or orders of any court, government department, commission, agency, instrumentality or arbitrator entered or existing against the Corporation or any of its assets or properties for any of the foregoing or otherwise; and (iii) the Corporation has not admitted in writing its inability to pay its debts generally as they become due, filed or consented to the filing against it of a petition in bankruptcy or a petition to take advantage of any insolvency act, made an assignment for the benefit of creditors, consented to the appointment of a receiver for itself or for the whole or any substantial part of its property, or had a petition in bankruptcy filed against it, been adjudicated a bankrupt, or filed a petition or answer seeking reorganization or arrangement under the federal bankruptcy laws or any other laws of the United States or any other jurisdiction.

(f) Except as set forth in Schedule 5.6(f) of the Corporation’s Disclosure Schedule, the Corporation is in compliance with all obligations, agreements and conditions contained in any evidence of indebtedness or any loan agreement or other contract or agreement (whether or not relating to indebtedness) to which the Corporation is a party or is subject (collectively, the “Obligations”), the lack of compliance with which could afford to any person the right to accelerate any indebtedness or terminate any right of or agreement with the Corporation. To the Corporation’s Knowledge, all other parties to such Obligations are in compliance with the terms and conditions of such Obligations.

(g) Except for employment and consulting agreements set forth on Schedule 5.6 attached hereto and for agreements and arrangements relating to the Plan Option Shares and except as provided in Schedule 5.6(g) of the Corporation’s Disclosure Schedule, this Agreement and the Stockholders’ Agreement, there are no agreements, understandings or proposed transactions between the Corporation and any of its officers, directors or other “affiliates” (as defined in Rule 405 promulgated under the Securities Act).

(h) To the Corporation’s Knowledge, no employee of or consultant to the Corporation is in violation of any term of any employment contract, patent disclosure agreement or any other contract or agreement, including, but not limited to, those matters relating (i) to the relationship of any such employee with the Corporation or to any other party as a result of the nature of the Corporation’s Business as currently conducted, or (ii) to unfair competition, trade secrets or proprietary or confidential information.

(i) Each employee and director of or consultant to the Corporation, and each other person who has been issued shares of the Corporation’s Common Stock or options to purchase shares of the Corporation’s Common Stock is a signatory to, and is bound by, the Stockholders’ Agreement and, in the case of Common Stock issued to employees, directors and consultants, a stock restriction agreement, all with stock transfer restrictions and rights of first offer in favor of the Corporation in a form previously approved by the Board of Directors of the Corporation (the “Board of Directors”). In addition, each such stock restriction agreement contains a vesting schedule previously approved by the Board of Directors.

(j) The Corporation does not have any collective bargaining agreements covering any of its employees or any employee benefit plans.

(k) The Corporation has at all times complied with all provisions of its by-laws and Charter, and is not in violation of or default under any provision thereof, any contract, instrument, judgment, order, writ or decree to which it is a party or by which it or any of its properties are bound, and the Corporation is not in violation of any material provision of any federal or state statute, rule or regulation applicable to the Corporation.

5.7 Disclosure. None of this Agreement, the Stockholders’ Agreement or the Public Filings, nor any document, certificate or instrument furnished to any of the Investors or their counsel in connection with the transactions contemplated by this Agreement, contains or will contain any untrue statement of a material fact or omits or will omit to state a material fact necessary in order to make the statements contained herein or therein, in light of the circumstances under which they were made, not misleading. To the Corporation’s Knowledge, there is no fact which the Corporation has not disclosed to the Investors or their counsel which would reasonably be expected to result in a Corporation Material Adverse Effect.

5.8 Financial Statements. The Corporation has furnished or made available to each of the Investors (i) a complete and accurate copy of the audited balance sheet of the Corporation at December 31, 2012 and the related audited statements of operations and cash flows for the fiscal year then ended, and (ii) the unaudited balance sheet of the Corporation (the “Balance Sheet”) at February 28, 2013 (the “Balance Sheet Date”) and the related unaudited statements of operations and cash flows for the two month period then ended (collectively, the “Financial Statements”). The Financial Statements are in accordance with the books and records of the Corporation, present fairly in all material respects the financial condition and results of operations of the Corporation at the dates and for the periods indicated, and have been prepared in accordance with generally accepted accounting principles (“GAAP”) consistently applied, except, in the case of any unaudited Financial Statements, for the absence of footnotes normally contained therein and subject to normal and recurring year-end audit adjustments that are substantially consistent with prior year-end audit adjustments.

5.9 Absence of Undisclosed Liabilities. The Corporation has no liabilities of any nature (whether known or unknown and whether absolute or contingent), except for (a) liabilities shown on the Balance Sheet and (b) contractual and other liabilities incurred in the ordinary course of business which are not required by GAAP to be reflected on a balance sheet and which would not, either

individually or in the aggregate, have or result in a Corporation Material Adverse Effect. The Corporation does not have any liabilities (and there is no basis for any present or, to the Corporation’s Knowledge, future proceeding against the Corporation giving rise to any liability) arising out of any personal injury and/or death or damage to property relating to or arising in connection with any clinical trials conducted by or on behalf of the Corporation.

5.10 Absence of Changes. Since the Balance Sheet Date and except as contemplated by this Agreement, there has been (i) no event or fact that individually or in the aggregate has had a Corporation Material Adverse Effect, (ii) no declaration, setting aside or payment of any dividend or other distribution with respect to, or any direct or indirect redemption or acquisition of, any of the capital stock of the Corporation, (iii) no waiver of any valuable right of the Corporation or cancellation of any debt or claim held by the Corporation, (iv) no loan by the Corporation to any officer, director, employee or stockholder of the Corporation, or any agreement or commitment therefor, (v) no increase, direct or indirect, in the compensation paid or payable to any officer, director, employee or agent Corporation and no change in the executive management of the Corporation or the terms of their employment, (vi) no material loss, destruction or damage to any property of the Corporation, whether or not insured, (vii) no labor disputes involving the Corporation, or (viii) no acquisition or disposition of any assets (or any contract or arrangement therefor), nor any transaction by the Corporation otherwise than for fair value in the ordinary course of business.

5.11 Payment of Taxes. The Corporation has prepared and filed within the time prescribed by, and in material compliance with, applicable law and regulations, all federal, state and local income, excise or franchise tax returns, real estate and personal property tax returns, sales and use tax returns, payroll tax returns and other tax returns required to be filed by it, and has paid or made provision for the payment of all accrued and paid taxes and other charges to which the Corporation is subject and which are not currently due and payable. The federal income tax returns of the Corporation have never been audited by the Internal Revenue Service. Neither the Internal Revenue Service nor any other taxing authority is now asserting nor is threatening to assert against the Corporation any deficiency or claim for additional taxes or interest thereon or penalties in connection therewith, and the Corporation does not know of any such deficiency or basis for such deficiency or claim.

5.12 Intellectual Property.

(a) Schedule 5.12(a) lists each patent, patent application, copyright registration or application therefor, mask work registration or application therefor, and trademark, trademark application, trade name, service xxxx and domain name registration or application therefor owned by the Corporation, licensed by the Corporation or otherwise used by the Corporation (collectively, the “Listed Rights”). For each of the Listed Rights set forth on Schedule 5.12(a), an assignment to the Corporation of all right, title and interest in the Listed Right (or license to practice the Listed Right if owned by others) has been executed. All employees of and consultants to the Corporation have executed an agreement providing for the assignment to the Corporation of all right, title and interest in any and all inventions, creations, works and ideas made or conceived or reduced to practice wholly or in part during the period of their employment or consultancy with the Corporation, including all Listed Rights, to the extent described in any such agreement and providing for customary provisions relating to confidentiality and non-competition.

(b) Except as set forth on Schedule 5.12(b), the Listed Rights comprise all of the patents, patent applications, registered trademarks and service marks, trademark applications, trade names, registered copyrights and all licenses that have been obtained by the Corporation, and which, to the Corporation’s Knowledge, are necessary for the conduct of the Business of the Corporation as now being conducted and as proposed to be conducted in the Public Filings. Except as set forth on Schedule

5.12(b), the Corporation owns all of the Listed Rights and Intellectual Property, as hereinafter defined, free and clear of any valid and enforceable rights, claims, liens, preferences of any party against such Intellectual Property. To the Corporation’s Knowledge, except as set forth in Schedule 5.12(b), the Listed Rights and Intellectual Property are valid and enforceable rights and the practice of such rights does not infringe or conflict with the rights of any third party.

(c) To the Corporation’s Knowledge, the Corporation owns or has the right to use all Intellectual Property necessary (i) to use, manufacture, market and distribute the Customer Deliverables (as defined below) and (ii) to operate the Internal Systems (as defined below). The Corporation has taken all reasonable measures to protect the proprietary nature of each item of Corporation Intellectual Property (as defined below), and to maintain in confidence all trade secrets and confidential information that it owns or uses. To the Corporation’s Knowledge no other person or entity has any valid and enforceable rights to any of the Corporation Intellectual Property owned by the Corporation (except as set forth in Schedule 5.12(c)), and no other person or entity is infringing, violating or misappropriating any of the Corporation Intellectual Property.

(d) To the Corporation’s Knowledge, none of the Customer Deliverables, or the manufacture, marketing, sale, distribution, importation, provision or use thereof, infringes or violates, or constitutes a misappropriation of, any valid and enforceable Intellectual Property rights of any person or entity; and, to the Corporation’s Knowledge neither the marketing, distribution, provision or use of any Customer Deliverables currently under development by the Corporation will, when such Customer Deliverables are commercially released by the Corporation, infringe or violate, or constitute a misappropriation of, any valid and enforceable Intellectual Property rights of any person or entity that exist today. To the Corporation’s Knowledge, none of the Internal Systems, or the use thereof, infringes or violates, or constitutes a misappropriation of, any valid and enforceable Intellectual Property rights of any person or entity.

(e) There is neither pending nor overtly threatened, or, to the Corporation’s Knowledge, any basis for, any claim or litigation against the Corporation contesting the validity or right to use any of the Listed Rights or Intellectual Property, and the Corporation has not received any notice of infringement upon or conflict with any asserted right of others nor, to the Corporation’s Knowledge, is there a basis for such a notice. To the Corporation’s Knowledge, no person, corporation or other entity is infringing the Corporation’s rights to the Listed Rights or Intellectual Property. Schedule 5.12(e) lists any complaint, claim or notice, or written threat thereof, received by the Corporation alleging any such infringement, violation or misappropriation, and the Corporation has provided to the Investors complete and accurate copies of all written documentation in the possession of the Corporation relating to any such complaint, claim, notice or threat. The Corporation has provided to the Investors complete and accurate copies of all written documentation in the Corporation’s possession relating to claims or disputes known to each of the Corporation concerning any Corporation Intellectual Property.

(f) Except as otherwise provided in Schedule 5.12(f), the Corporation, to the Corporation’s Knowledge has no obligation to compensate others for the use of any Listed Right or any Intellectual Property, nor has the Corporation granted any license or other right to use, in any manner, any of the Listed Rights or Intellectual Property, whether or not requiring the payment of royalties. Schedule 5.12(f) identities each license or other agreement pursuant to which the Corporation has licensed, distributed or otherwise granted any rights to any third party with respect to any Corporation Intellectual Property. Except as described in Schedule 5.12(f), the Corporation has not agreed to indemnify any person or entity against any infringement, violation or misappropriation of any Intellectual Property rights with respect to any Corporation Intellectual Property.

(g) Schedule 5.12(g) identifies each item of Corporation Intellectual

Property that is owned by a party other than the Corporation, and the license or agreement pursuant to which the Corporation uses it (excluding off-the-shelf software programs licensed by the Corporation pursuant to “shrink wrap” licenses).

(h) The Corporation has not disclosed the source code for any software developed by it, or other confidential information constituting, embodied in or pertaining to such software, to any person or entity, except pursuant to the agreements listed in Schedule 5.12(h), and the Corporation has taken reasonable measures to prevent disclosure of any such source code.

(i) All of the copyrightable materials incorporated in or bundled with the Customer Deliverables have been created by employees of the Corporation within the scope of their employment by the Corporation or by independent contractors of the Corporation who have executed agreements expressly assigning all right, title and interest in such copyrightable materials to the Corporation. Except as listed in Schedule 5.12(i), no portion of such copyrightable materials was jointly developed with any third party.

(j) To the Corporation’s Knowledge, the Customer Deliverables and the Internal Systems are free from significant defects or programming errors and conform in all material respects to the written documentation and specifications therefor.

(k) For purposes of this Agreement, the following terms shall have the following meanings:

(i) “Customer Deliverables” shall mean (a) the products that the Corporation (i) currently manufactures, markets, sells or licenses or (ii) currently plans to manufacture, market, sell or license in the future and (b) the services that the Corporation (i) currently provides or (ii) currently plans to provide in the future.

(ii) “Internal Systems” shall mean the internal systems of each of the Corporation that are presently used in its Business or operations, including, computer hardware systems, software applications and embedded systems.

(iii) “Intellectual Property” shall mean all: (A) patents, patent applications, patent disclosures and all related continuation, continuation-in-part, divisional, reissue, reexamination, utility model, certificate of invention and design patents, design patent applications, registrations and applications for registrations, including Listed Rights; (B) trademarks, service marks, trade dress, internet domain names, logos, trade names and corporate names and registrations and applications for registration thereof; (C) copyrights and registrations and applications for registration thereof; (D) mask works and registrations and applications for registration thereof; (E) computer software, data and documentation; (F) inventions, trade secrets and confidential business information, whether patentable or nonpatentable and whether or not reduced to practice, know-how, manufacturing and product processes and techniques, research and development information, copyrightable works, financial, marketing and business data, pricing and cost information, business and marketing plans and customer and supplier lists and information; (G) other proprietary rights relating to any of the foregoing (including remedies against infringements thereof and rights of protection of interest therein under the laws of all jurisdictions); and (H) copies and tangible embodiments thereof.

(iv) “Corporation Intellectual Property” shall mean the Intellectual Property owned by or licensed to the Corporation and incorporated in, underlying or used in connection with the Customer Deliverables or the Internal Systems.

(v) “Corporation’s Knowledge” shall mean (a) with respect to matters relating directly to the Corporation and its operations, the knowledge of Xxxxxxx Xxxxx, Xxxxxxxx Xxxxxx, Xxxxx Xxxxxxx and Xxxx Xxxxxxxxxx (the “Officers”) as well as other knowledge which such Officers would have possessed had they made diligent inquiry of appropriate employees and agents of the Corporation with respect to the matter in question; provided, that such Officers shall not be obligated to inquire further with respect to any list herein or in any schedule hereto, and (b) with respect to external events or conditions, the actual knowledge of the Officers.

5.13 Securities Laws. Neither the Corporation nor anyone acting on its behalf has offered securities of the Corporation for sale to, or solicited any offers to buy the same from, or sold securities of the Corporation to, any person or organization, in any case so as to subject the Corporation, its promoters, directors and/or officers to any Liability under the Securities Act, the Securities and Exchange Act of 1934, as amended, or any state securities or “blue sky” law (collectively, the “Securities Laws”). The offer, grant, sale and/or issuance of the following were not, are not, or, as the case may be, will not be, in violation of the Securities Laws when offered, sold and issued in accordance with (i) this Agreement, (ii) the Series A-1 Convertible Preferred Stock Purchase Agreement, dated as of April 25, 2011, as amended, by and among the Corporation and the Investors listed therein, (iii) the Amended and Restated Stock Issuance Agreement, dated May 16, 2011, by and among the Corporation and Nordic Bioscience Clinical Development VII A/S, as amended, (iv) the 2003 Long-Term Incentive Plan, as amended, and (v) the 2011 Equity Incentive Plan, as amended: (a) the Shares, Warrants, Warrant Shares and Reserved Common Shares, as contemplated by this Agreement and the Exhibits and Schedules hereto, and in partial reliance upon the representations and warranties of the Investors set forth in Section 6 hereof; (b) the Existing Preferred Stock; (c) the Common Stock issuable upon the conversion of the Existing Preferred Stock; and (d) the Plan Option Shares and stock options covering such shares.

5.14 Title to Properties.

(a) The Corporation has valid title to, or in the case of leased properties and assets, valid leasehold interests in, all of its properties and assets, necessary to conduct the Business in the manner in which it is currently conducted (in each case, free and clear of all liens, security interests, charges and other encumbrances of any kind, except liens for taxes not yet due and payable), including without limitation, all rights under any investigational drug application of the Corporation filed in the United States and in foreign countries, all rights pursuant to the authority of the FDA (as hereinafter defined) and any foreign counterparts to conduct clinical trials with respect to any investigational drug application filed with such agency relating to biologics or drugs relating to the Business and all rights, if any, to apply for approval to commercially market and sell biologics or drugs and none of such properties or assets is subject to any lien, security interest, charge or other encumbrance of any kind, other than those the material terms of which are described in Schedule 5.14(a).

(b) The Corporation does not own any real property or any buildings or other structures, nor have options or any contractual obligations to purchase or acquire any interest in real property. Schedule 5.14(b) lists all real property leases to which the Corporation is a party and each amendment thereto. All such current leases are in full force and effect, are valid and effective in accordance with their respective terms, and there is not, under any of such leases, any existing default or event of default (or event that with notice or lapse of time, or both, would constitute a default). The Corporation, in its capacity as lessee, is not in violation of any zoning, building or safety ordinance, regulation or requirement or other law or regulation applicable to the operation of its leased properties, nor has it received any notice of violation with which it has not complied.

(c) The equipment, furniture, leasehold improvements, fixtures, vehicles, any related capitalized items and other tangible property material to the Business are in good operating

condition and repair, ordinary wear and tear excepted.

5.15 Investments in Other Persons. Except as indicated in Schedule 5.15 attached hereto, (a) the Corporation has not made any loan or advance to any person or entity which is outstanding on the date hereof nor is it committed or obligated to make any such loan or advance, and (b) the Corporation has never owned or controlled and does not currently own or control, directly or indirectly, any subsidiaries and has never owned or controlled and does not currently own or control any capital stock or other ownership interest, directly or indirectly, in any corporation, association, partnership, trust, joint venture or other entity.

5.16 ERISA. Except as set forth in Schedule 5.16, neither the Corporation nor any entity required to be aggregated with the Corporation under Sections 414(b), (c), (m) or (n) of the Code (as hereinafter defined), sponsors, maintains, has any obligation to contribute to, has any liability under, or is otherwise a party to, any Benefit Plan. For purposes of this Agreement, “Benefit Plan” shall mean any plan, fund, program, policy, arrangement or contract, whether formal or informal, which is in the nature of (i) any qualified or non-qualified employee pension benefit plan (as defined in Section 3(2) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”)) or (ii) an employee welfare benefit plan (as defined in section 3(1) of ERISA). With respect to each Benefit Plan listed in Schedule 5.16, to the extent applicable:

(a) Each such Benefit Plan has been maintained and operated in all material respects in compliance with its terms and with all applicable provisions of ERISA, the Internal Revenue Code of 1986, as amended (the “Code”), and all statutes, orders, rules, regulations, and other authority which are applicable to such Benefit Plan;

(b) All contributions required by law to have been made under each such Benefit Plan (without regard to any waivers granted under Section 412 of the Code) to any fund or trust established thereunder in connection therewith have been made by the due date thereof:

(c) Each such Benefit Plan intended to qualify under Section 401(a) of the Code is the subject of a favorable unrevoked determination letter issued by the Internal Revenue Service as to its qualified status under the Code, which determination letter may still be relied upon as to such tax qualified status, and no circumstances have occurred that would adversely affect the tax qualified status of any such Benefit Plan;

(d) The actuarial present value of all accrued benefits under each such Benefit Plan subject to Title IV of ERISA did not, as of the latest valuation date of such Benefit Plan, exceed the then current value of the assets of such Benefit Plan allocable to such accrued benefits, all as based upon the actuarial assumptions and methods currently used for such Benefit Plan;

(e) None of such Benefit Plans that are “employee welfare benefit plans” as defined in Section 3(1) of ERISA provides for continuing benefits or coverage for any participant or beneficiary of any participant after such participant’s termination of employment, except as required by applicable law; and

(f) Neither the Corporation nor any trade or business (whether or not incorporated) under common control with the Corporation within the meaning of Section 4001 of ERISA has, or at any time has had, any obligation to contribute to any “multiemployer plan” as defined in Section 3(37) of ERISA.

5.17 Use of Proceeds. The net proceeds received by the Corporation from the sale of

the Series B Preferred Stock shall be used by the Corporation generally for the purposes set forth on Schedule 5.17 attached hereto.

5.18 Permits and Other Rights; Compliance with Laws. The Corporation has all permits, licenses, registrations, certificates, accreditations, orders, authorizations or approvals from any Governmental Entity (“Permits”) issued to or held by the Corporation. Other than the Permits listed on Schedule 5.18, there are no Permits, the loss or revocation of which would result in a Corporation Material Adverse Effect. The Corporation has all Permits necessary to permit it to own its properties and to conduct its Business as presently conducted and as proposed to be conducted. Each such Permit is in full force and effect and, to the Corporation’s Knowledge, no suspension or cancellation of such Permit is threatened and there is no basis for believing that such Permit will not be renewable upon expiration. The Corporation is in compliance in all material respects under each such Permit, and the transactions contemplated by this Agreement will not cause a violation under any of such Permits. The Corporation is in compliance in all material respects with all provisions of the laws and governmental rules and regulations applicable to its Business, properties and assets, and to the products and services sold by it, including, without limitation, all such rules, laws and regulations relating to fair employment practices and public or employee safety. The Corporation is in compliance with the Clinical Laboratories Improvement Act of 1967, as amended.

5.19 Insurance. Schedule 5.19 sets forth a true and complete list of all policies or binders of fire, theft, liability, product liability, workmen’s compensation, vehicular, directors’ and officers’ and other insurance held by or on behalf of the Corporation. Such policies and binders are in full force and effect, are in the amounts not less than is customarily obtained by corporations of established reputation engaged in the same or similar business and similarly situated and are in conformity with the requirements of all leases or other agreements to which the Corporation is a party and are valid and enforceable in accordance with their terms. The Corporation’s product liability insurance covers its clinical trials. The Corporation is not in default with respect to any provision contained in such policy or binder nor has the Corporation failed to give any notice or present any claim under any such policy or binder in due and timely fashion. There are no outstanding unpaid claims under any such policy or binder. The Corporation has not received notice of cancellation or non-renewal of any such policy or binder.

5.20 Board of Directors. Except as provided in Schedule 5.20 attached hereto, the Corporation has not extended any offer or promise or entered into any agreement, arrangement, understanding or otherwise, whether written or oral, with any person or entity by which the Corporation has agreed to allow such person or entity to participate, in any way, in the affairs of the Board of Directors, including without limitation, appointment or nomination as a member, or right to appear at, or receive the minutes of a meeting of the Board of Directors.

5.21 Books and Records. The minute books of the Corporation contain complete and accurate records of all meetings and other corporate actions of the stockholders and Boards of Directors and committees thereof. The stock ledger of the Corporation is complete and accurate and reflects all issuances, transfers, repurchases and cancellations of shares of capital stock of the Corporation.

5.22 Environmental Matters.

(a) The Corporation has not used, generated, manufactured, refined, treated, transported, stored, handled, disposed, transferred, produced, processed or released (together defined as “Release”) any Hazardous Materials (as hereinafter defined) in any manner or by any means in violation of any Environmental Laws (as hereinafter defined). To the Corporation’s Knowledge, neither the Corporation nor any prior owner or tenant of the Property (as hereinafter defined) has Released any

Hazardous Material or other pollutant or effluent into, on or from the Property in a way which can pose a risk to human health or the environment, nor is there a threat of such Release. As used herein, the term “Property” shall include, without limitation, land, buildings and laboratory facilities owned or leased by the Corporation or as to which the Corporation now has any duties, responsibilities (for clean-up, remedy or otherwise) or liabilities under any Environmental Laws, or as to which the Corporation or any subsidiary of the Corporation may have such duties, responsibilities or liabilities because of past acts or omissions of the Corporation or any such subsidiary or their predecessors, or because the Corporation or any such subsidiary or their predecessors in the past was such an owner or operator of, or some other relationship with, such land, buildings and/or laboratory facilities, all as more fully described in Schedule 5.22(a) of the Corporation’s Disclosure Schedule. The term “Hazardous Materials” shall mean (A) any chemicals, materials or substances defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “extremely hazardous wastes,” “restricted hazardous wastes,” “toxic substances,” “toxic pollutants,” “hazardous air pollutants,” “contaminants,” “toxic chemicals,” “toxins,” “hazardous chemicals,” “extremely hazardous substances,” “pesticides,” “oil” or related materials as defined in any applicable Environmental Law, or (B) any petroleum or petroleum products, oil, natural or synthetic gas, radioactive materials, asbestos-containing materials, urea formaldehyde foam insulation, radon, and any other substance defined or designated as hazardous, toxic or harmful to human health, safety or the environment under any Environmental Law.

(b) No notice of lien under any Environmental Laws has been filed against any Property of the Corporation.

(c) The use of the Property complies with lawful, permitted and conforming uses in all material respects under all applicable building, tire, safety, subdivision, zoning, sewer, environmental, health, insurance and other such laws, ordinances, rules, regulations and plan approval conditions of any governmental or public body or authority relating to the use of the Property.

(d) Except as described in Schedule 5.22(d) of the Corporation’s Disclosure Schedule, to the Corporation’s Knowledge, the Property does not contain: (i) asbestos in any form; (ii) urea formaldehyde foam insulation; (iii) transformers or other equipment which contain dialectic fluid containing levels of polychlorinated biphenyls; (iv) radon; or (v) any other chemical, material or substance, the exposure to which is prohibited, limited or regulated by a federal, state or local government agency, authority or body, or which, even if not so regulated, to the Corporation’s Knowledge after reasonable investigation, may or could pose a hazard to the health and safety of the occupants of the Property or the owners or occupants of property adjacent to or in the vicinity of the Property.

(e) The Corporation has not received written notice that the Corporation is a potentially responsible party for costs incurred at a cleanup site or corrective action under any Environmental Laws. The Corporation has not received any written requests for information in connection with any inquiry by any Governmental Authority (as defined hereinafter) concerning disposal sites or other environmental matters. As used herein, “Governmental Authority” shall mean any nation or government, any federal, state, municipal, local, provincial, regional or other political subdivision thereof and any entity or person exercising executive, legislative, judicial, regulatory or administrative functions of, or pertaining to, government, Schedule 5.22(e) of the Corporation’s Disclosure Schedule identifies all locations where Hazardous Materials used in whole or in part by the Business of the Corporation or resulting from the Business, facilities or Property of the Corporation have been stored or disposed of by or on behalf of the Corporation. As used herein, “Environmental Laws” shall mean all applicable federal, state and local laws, ordinances, rules and regulations that regulate, fix liability for, or otherwise relate to, the handling, use (including use in industrial processes, in construction, as building materials, or otherwise), storage and disposal of hazardous and toxic wastes and substances, and to the discharge, leakage, presence, migration, threatened Release or Release (whether by disposal, a discharge into any

water source or system or into the air, or otherwise) of any pollutant or effluent. Without limiting the preceding sentence, the term “Environmental Laws” shall specifically include the following federal and state laws, as amended:

FEDERAL

Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. § 9601 et seq.; the Emergency Planning and Community Xxxxx-xx-Xxxx Xxx, 00 X.X.X. § 00000 et seq.; the Resource Conservation and Recovery Act, 42 U.S.C. § 6901 et seq.; the Federal Water Pollution Control Act, 33 U.S.C. § 1251 et seq.; the Federal Insecticide, Fungicide and Rodenticide Act, 7 U.S.C. § 136 et seq.; the Toxic Substance Control Act, 15 U.S.C. § 2601 et seq.; the Oil Pollution Act of 1990, 33 U.S.C. § 1001 et seq.; the Hazardous Materials Transportation Act, as amended, 49 U.S.C. § 1801 et seq.; the Atomic Energy Act, as amended 42 U.S.C. § 2011 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. § 651 et seq.; the Federal Food, Drug and Cosmetic Act, as amended 21 U.S.C. § 301 et seq. (insofar as it regulates employee exposure to Hazardous Substances); the Clean Air Act, 42 U.S.C. 7401 et. seq.

STATE

MASSACHUSETTS ENVIRONMENTAL STATUTES

Massachusetts Clean Waters Act, Mass. Gen. L. Ch. 21, Section 26, et. seq., and regulations thereto; Massachusetts Solid Waste Disposal Laws. Mass. Gen. L. Ch. 16, Section 18, et. seq., and Ch. 111, Section 1 05A, and regulations thereto; Massachusetts Oil and Hazardous Materials Release Prevention and Response Act, Mass. Gen. L., Ch. 21 E, Section 1, et. seq., and regulations thereto; Massachusetts Solid Waste Facilities Law, Mass. Gen. L., Ch. 21H, Section 1, et. seq., and regulations thereto; Massachusetts Toxic Use Reduction Act, Mass. Gen. L., Ch. 211, Section 1, et. seq., and regulations thereto; Massachusetts Litter Control Laws, Mass. Gen. L. Ch. 111. Section 1 50A, et. seq., and regulations thereto; Massachusetts Wetlands Protection Laws, Mass. Gen. L., Ch. 130, Section 105, et. seq., and regulations thereto; Massachusetts Environmental Air Pollution Control Law, Mass. Gen. L.. Ch. 101, Section 2B, et. seq., and regulations thereto; Massachusetts Environmental Policy Act, Mass. Gen. L. Ch. 30, Section 61, et. seq., and regulations thereto; and Massachusetts Hazardous Waste Laws, Mass. Gen. L. Ch. 21C, Section 1, et. seq., and regulations thereto.

(f) The Corporation has maintained all environmental and operating documents and records substantially in the manner and for the time periods required by the Environmental Laws and any other laws, regulations or orders and has never conducted an environmental audit except as disclosed in Schedule 5.22(f) of the Corporation’s Disclosure Schedule. For purposes of this Section 5.22(f), an environmental audit shall mean any evaluation, assessment, study or test performed at the request of or on behalf of a Governmental Authority, including, but not limited to, a public liaison committee, but does not include normal or routine inspections, evaluations or assessments which do not relate to a threatened or pending charge, restraining order or revocation of any permit, license, certificate, approval, authorization, registration or the like issued pursuant to the Environmental Laws and any other law, regulation or order.

(g) To the Corporation’s Knowledge, no part of the Property of the Corporation is (i) located within any wetlands area, (ii) subject to any wetlands regulations, or (iii) included in or is proposed for inclusion in, or abuts any property included in or proposed for inclusion in, the National Priority List or any similar state lists.

5.23 FDA Matters.

(a) The Corporation has (i) complied in all material respects with all applicable laws, regulations and specifications with respect to the manufacture, design, sale, storing, labeling, testing, distribution, inspection, promotion and marketing of all of the Corporation’s products and product candidates and the operation of manufacturing facilities promulgated by the U.S. Food and Drug Administration (the “FDA”) or any corollary entity in any other jurisdiction and (ii) conducted, and in the case of any clinical trials conducted on its behalf, caused to be conducted, all of its clinical trials with reasonable care and in compliance in all material respects with all applicable laws and the stated protocols for such clinical trials.

(b) All of the Corporation’s submissions to the FDA and any corollary entity in any other jurisdiction, whether oral, written or electronically delivered, were true, accurate and complete in all material respects as of the date made, and remain true, accurate and complete in all material respects and do not misstate any of the statements or information included therein, or omit to state a fact necessary to make the statements therein not materially misleading.

(c) The Corporation has not committed any act, made any statement or failed to make any statement that would breach the FDA’s policy with respect to “Fraud, Untrue Statements of Material Facts, Bribery, and Illegal Gratuities” set forth in 56 Fed. Reg. 46191 (September 10, 1991) or any similar laws, rules or regulations, whether under the jurisdiction of the FDA or a corollary entity in any other jurisdiction, and any amendments or other modifications thereto. Neither the Corporation nor, to the Corporation’s Knowledge, any officer, employee or agent of the Corporation has been convicted of any crime or engaged in any conduct that would reasonably be expected to result in (i) debarment under 21 U.S.C. Section 335a or any similar state or foreign law or regulation or (ii) exclusion under 42 U.S.C. Section 1320a 7 or any similar state or foreign law or regulation, and neither the Corporation nor, to the Corporation’s Knowledge, any such person has been so debarred or excluded.

(d) The Corporation has not sold or marketed any products prior to receiving any required or necessary approvals or consents from any federal or state governmental authority, including but not limited to the FDA under the Food, Drug & Cosmetics Act of 1976, as amended, and the regulations promulgated thereunder, or any corollary entity in any jurisdiction. The Corporation has not received any notice of, nor is the Corporation aware of any, actions, citations, warning letters or Section 305 notices from the FDA or any corollary entity.

5.24 Compliance with Privacy Laws

(a) For purposes of this Agreement:

(i) “Foreign Privacy Laws” shall mean (a) the Directive 95/46/EC of the Parliament and of the Council of the European Union of 24 October 1995 on the protection of individuals with regard to the collection, use, disclosure, and processing of personal data and on the free movement of such data, (b) the corresponding national rules, regulations, codes, orders, decrees and rulings thereunder of the member states of the European Union and (c) any rules, regulations, codes, orders, decree, and rulings thereunder related to privacy, data protection or data transfer issues implemented in other countries.

(ii) “US Privacy Laws” shall mean any rules, regulations, codes, orders, decrees, and rulings thereunder of any federal, state, regional, county, city, municipal or local government of the United States or any department, agency, bureau or other administrative or regulatory body obtaining authority from any of the foregoing that relate to privacy, data protection or data transfer issues, including all implementing laws, ordinances or regulations, including, without limitation, the Health Insurance Portability and Accountability Act of 1996, as amended; the Children’s Online Privacy Protection Act (COPPA) of 1998, as amended; the Financial Modernization Act (Xxxxxx-Xxxxx-Xxxxxx Act) of 2000, as amended; the Fair Credit Reporting Act of 1970, as amended; the Privacy Act of 1974, as amended; the Family Education Rights and Privacy Act of 1974, as amended; the Right to Financial Privacy Act of 1978, as amended; the Privacy Protection Act of 1980, as amended; the Cable Communications Policy Act of 1984, as amended; the Electronic Communications Privacy Act of 1986, as amended; the Video Privacy Protection Act of 1988, as amended; the Telephone Consumer Protection Act of 1991, as amended; the Driver’s Privacy Protection Act of 1994, as amended; the Communications Assistance for Law Enforcement Act of 1994, as amended; the Telecommunications Act of 1996, as amended; and any implementing regulations related thereto;

(b) The Corporation is currently and has been at all times in compliance in all material respects with all Foreign Privacy Laws and US Privacy Laws; and the Corporation has not received notice (in writing or otherwise) regarding violation of such Foreign Privacy Laws or US Privacy Laws.

(c) No action, suit, proceeding, investigation, charge, complaint, claim, demand, or notice has been filed or commenced against the Corporation, nor to the Corporation’s Knowledge threatened against the Corporation, relating to Foreign Privacy Laws and US Privacy Laws; nor has the Corporation incurred any material liabilities (whether accrued, absolute, contingent or otherwise) under any Foreign Privacy Laws or US Privacy Laws.

(d) Health Insurance Portability and Accountability Act of 1996. The Corporation (i) has assessed the applicability of the Health Insurance Portability and Accountability Act of 1996 and its implementing regulations (collectively, “HIPAA”) to the Corporation, including the fully insured and self-insured health plans that the Corporation sponsors or has sponsored or contributes to or has contributed to and health care provider activities, if any, in which the Corporation engages, (ii) has complied in all relevant respects with HIPAA, including 45 C.F.R. Part 160 and Subparts A and E of Part 164 (the “HIPAA Privacy Rule”), including but not limited to HIPAA Privacy Rule requirements relating to health information use and disclosure, notices of privacy rights, appointment of a Privacy Officer, adoption of a privacy policy, amendment of plan documents, and implementation of employee training as to the handling of protected health information, and (iii) if required under the HIPAA Privacy Rule, has entered into business associate agreements on behalf of the Corporation’s health plans covering the handling of protected health information with vendors and others categorized under HIPAA as business associates of the Corporation’s health plans.

(e) Other Health Information Laws. Without limiting the generality of Section 5.24(a) through Section 5.24(d),

(i) the Corporation is currently, and has been at all times since its incorporation, in compliance in all material respects with all applicable health insurance, health information security, health information privacy, and health information transaction format Laws (each a “Health Information Law”), including, without limitation, any rules, regulations, codes, orders, decrees, and rulings thereunder of any federal, state, regional, county, city, municipal or local government, whether foreign or domestic, or any department, agency, bureau or other administrative or regulatory body obtaining authority from any of the foregoing; and

(ii) no action, suit, proceeding, investigation, charge, complaint, claim, demand, or notice has been filed or commenced against the Corporation nor to the Corporation’s Knowledge threatened against the Corporation, alleging any failure to comply with any Health Information Law; nor has the Corporation incurred any material liabilities (whether accrued, absolute, contingent or otherwise) under any Health Information Law.

5.25 Health Care and Affiliated Transactions; Xxxxx and Anti-Kickback Laws.

(a) For purposes of the Xxxxx II law and implementing regulations, if applicable, none of the directors or officers of the Corporation, or physicians employed by the Corporation, any other affiliates of the Corporation, or any of their respective immediate family members is (i) to the Corporation’s Knowledge, a partner or stockholder or has any other economic interest in any customer or supplier of the Corporation; (ii) a party to any transaction or contract with the Corporation; or (iii) indebted to the Corporation. The Corporation has not paid, or incurred any obligation to pay, any fees, commissions or other amounts to and is not a party to any agreement, business arrangement or course of dealing with any firm of or in which any of directors, officers or affiliates of the Corporation, or any of their respective immediate family members, is a partner or stockholder or has any other economic interest, other than ownership of less than one percent (1%) of a publicly traded corporation. No physician or family member of a physician has a financial relationship with the Corporation in violation of Section 1877 of the Social Security Act. The Corporation has made all filings required by Section 1877 of the Social Security Act.

(b) The Corporation has complied with all applicable state and federal “anti-kickback,” fraud and abuse, false claims and related statutes and regulations. The Corporation has received no notice of nor is otherwise aware of any inquiries, audits, subpoenas or other investigations involving Corporation by the U.S. Department of Health and Human Services, the U.S. Office of Inspector General, any U.S. Attorney’s Office or any other federal or state agency with jurisdiction over such statutes or regulations.

SECTION 6. Representations and Warranties of the Investors to the Corporation.

Each of the Investors, as to itself, represents and warrants to the Corporation as follows:

(a) It is acquiring the Shares and Warrants and, in the event it should acquire Reserved Common Shares upon conversion of the Series B Preferred Stock or Warrant Shares upon the exercise of its Warrant, it will be acquiring such Reserved Common Shares or Warrant Shares, for its own account, for investment and not with a view to the distribution thereof within the meaning of the Securities Act.

(b) It is an “accredited investor” as such term is defined in Rule 501(a) promulgated under the Securities Act.

(c) It agrees that the Corporation may place a legend on the certificates and Warrants delivered hereunder stating that the Shares, Warrants and any Reserved Common Shares and Warrant Shares have not been registered under the Securities Act, and, therefore, cannot be offered, sold or transferred unless they are registered under the Securities Act or an exemption from such registration is available and that the offer, sale or transfer of the Shares, Warrants and any Reserved Common Shares and Warrant Shares is further subject to any restrictions imposed by this Agreement and the Stockholders’ Agreement.

(d) The execution, delivery and performance by it of this Agreement have

been duly authorized by all requisite action of it.

(e) It further understands that the exemptions from registration afforded by Rule 144 and Rule 144A (the provisions of which are known to it) promulgated under the Securities Act depend on the satisfaction of various conditions, and that, if applicable, Rule 144 may afford the basis for sales only in limited amounts.

(f) It has such knowledge and experience in business and financial matters and with respect to investments in securities of privately-held companies so as to enable it to understand and evaluate the risks of its investment in the Shares and Warrants and form an investment decision with respect thereto. It has been afforded the opportunity during the course of negotiating the transactions contemplated by this Agreement to ask questions of, and to secure such information from, the Corporation and its officers and directors as it deems necessary to evaluate the merits of entering into such transactions.

(g) If it is a natural person, it has the power and authority to enter into this Agreement. If it is not a natural person, it is duly organized and validly existing and has the power and authority to enter into this Agreement. Any Investor which is a corporation, partnership or trust represents that it has not been organized, reorganized or recapitalized specifically for the purpose of acquiring the securities of the Corporation.

(h) It has adequate net worth and means of providing for its current needs and personal contingencies to sustain a complete loss of its investment in the Corporation. The Investors understand that the foregoing representations and warranties shall be deemed material and to have been relied upon by the Corporation.

SECTION 7. Closing Conditions.

7.1 Deliveries; Conditions Precedent to Each Closing. The several obligations of each Investor to purchase and pay for the Shares and Warrants under this Agreement at the Initial Closing are subject to the satisfaction or waiver by such Investor or any waiver adopted or implemented pursuant to Section 17 of the following conditions precedent:

(a) All proceedings to have been taken and all waivers and consents to be obtained in connection with the transactions contemplated by this Agreement shall have been taken or obtained, and all documents incidental thereto shall be satisfactory to each Investor and its counsel, and each Investor and its counsel shall have received copies (executed or certified, as may be appropriate) of all documents which such Investor or its counsel may reasonably have requested in connection with such transactions.

(b) All legal matters incident to the purchase or acquisition of the Shares and Warrants shall be satisfactory to each Investor’s counsel, and the Investors shall have received from Xxxxxx & Xxxxxxx LLP a legal opinion addressed to the Investors and dated the date of the Initial Closing in a form reasonably acceptable to the Investors.

(c) All consents, permits, approvals, qualifications and/or registrations required to be obtained or effected under any applicable securities or “Blue Sky” laws of any jurisdiction shall have been obtained or effected.

(d) Except as set forth in the Disclosure Schedules hereto, on the Initial Closing Date, the representations and warranties of the Corporation contained herein shall be true and

correct on and as of the date of such Closing with the same force and effect as though such representations and warranties had been made on and as of such date (other than any representation or warranty made as of a particular date which shall be true and correct as of such date).

(e) A duly executed Series B Certificate in the form of Exhibit A hereto shall have been filed with and accepted by the Secretary of State of Delaware and shall be effective under the laws of the State of Delaware, and a Stockholders’ Agreement in form and substance attached hereto as Exhibit C shall have been executed by the Corporation and the requisite stockholders of the Corporation such that the Stockholders’ Agreement amends and restates in its entirety the Existing Stockholders’ Agreement, and such executed Stockholders’ Agreement shall have been delivered to the Investors.