SPECIFIC TERMS IN THIS EXHIBIT HAVE BEEN REDACTED BECAUSE SUCH TERMS ARE BOTH NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE COMPANY IF PUBLICLY DISCLOSED. THESE REDACTED TERMS HAVE BEEN MARKED IN THIS EXHIBIT WITH THREE ASTERISKS [***]....

Exhibit 10.1

SPECIFIC TERMS IN THIS EXHIBIT HAVE BEEN REDACTED BECAUSE SUCH TERMS ARE BOTH NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE COMPANY IF PUBLICLY DISCLOSED. THESE REDACTED TERMS HAVE BEEN MARKED IN THIS EXHIBIT WITH THREE ASTERISKS [***].

LEASE AGREEMENT BETWEEN

TENNYSON CAMPUS OWNER, LP,

AS LANDLORD, AND

DIRTT ENVIRONMENTAL SOLUTIONS, INC.

AS TENANT

DATED MARCH 4, 2020

0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX

XXXXX, XX 00000

| 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

BASIC LEASE INFORMATION

| Lease Date: | March 4, 2020 | |||||

| Landlord: | TENNYSON CAMPUS OWNER, LP, a Delaware limited partnership | |||||

| Tenant: | DIRTT ENVIRONMENTAL SOLUTIONS, INC., a Colorado corporation | |||||

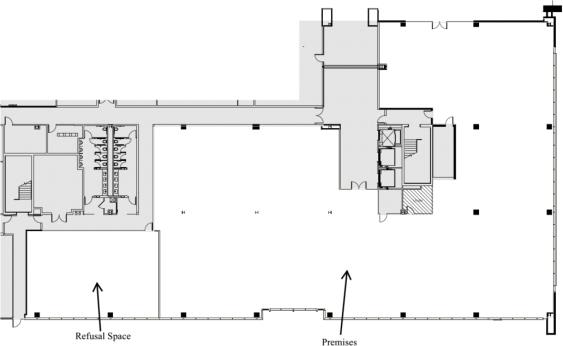

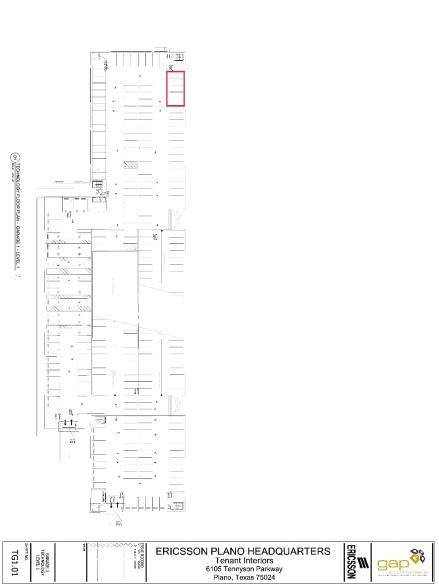

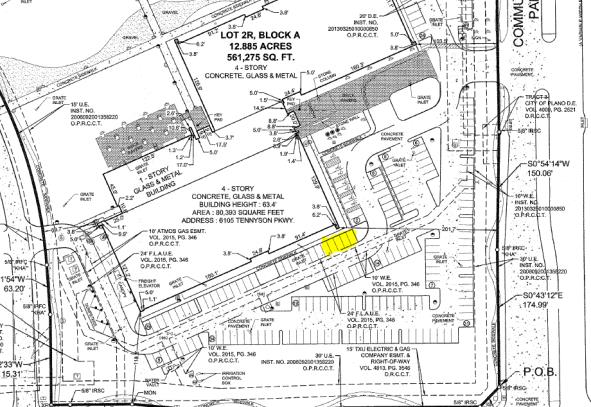

| Premises: | Suite No. 100, containing [***] rentable square feet, in the building commonly known as The Tennyson – South Building (the “Building”), and whose street address is 0000 Xxxxxxxx Xxxxxxx – Xxxxx Xxxxxxxx, Xxxxx, XX 00000. The Premises are outlined on the plan attached to the Lease as Exhibit A. The land on which the Building is located (the “Land”) is described on Exhibit B. The term “Project” shall collectively refer to the Building, the Land and the driveways, parking facilities, and similar improvements and easements associated with the foregoing or the operations thereof. | |||||

| Term: | 89 full calendar months, plus any partial month from the Commencement Date to the end of the month in which the Commencement Date falls, starting on the Commencement Date and ending at 5:00 p.m. local time on the last day of the 89th full calendar month following the Commencement Date, subject to adjustment and earlier termination as provided in the Lease. | |||||

| Commencement Date: | The earlier of (a) the date on which Tenant occupies any portion of the Premises and begins conducting business therein, or (b) September 1, 2020, as the same may be extended for each Landlord Delay Day. | |||||

| Basic Rent: | Subject to the abatement of Basic Rent provided below, Basic Rent shall be the following amounts for the following periods of time: | |||||

| Lease Months |

Annual Basic Rent Rate Per Rentable |

Monthly Basic Rent | ||||

| 1 – 17 | $[***] | $[***] | ||||

| 18 – 29 | $[***] | $[***] | ||||

| 30 – 41 | $[***] | $[***] | ||||

| 42 – 53 | $[***] | $[***] | ||||

| 54 – 65 | $[***] | $[***] | ||||

| 66 – 77 | $[***] | $[***] | ||||

| 78 – 89 | $[***] | $[***] | ||||

| Basic Rent shall be abated during the first five (5) months of the Term, e.g., if the Commencement Date is June 15, 2020, Basic Rent shall be abated through November 14, 2020. Commencing with the first day after the end of the abatement period referred to above, Tenant shall make Basic Rent payments for any remaining partial calendar month and on the first day of the first full calendar month thereafter shall make Basic Rent payments as otherwise provided in this Lease. Notwithstanding such abatement of Basic Rent (a) all other sums due under this Lease, including Additional Rent, after-hours HVAC charges, etc., shall be payable as provided in this Lease, and (b) any increases in Basic Rent set forth in this Lease shall occur on the dates scheduled therefor. | ||||||

| As used herein, the term “Lease Month” means each calendar month during the Term (and if the Commencement Date does not occur on the first day of a calendar month, the period from the Commencement Date to the first day of the next calendar month shall be included in the first Lease Month for purposes of determining the duration of the Term and the monthly Basic Rent rate applicable for such partial month). | ||||||

| Security Deposit: | $[***] | |||||

| Additional Rent: | Tenant’s Proportionate Share of Operating Costs and Taxes. | |||||

| i | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

| Rent: | Basic Rent, Additional Rent, and all other sums that Tenant may owe to Landlord or otherwise be required to pay under the Lease. | |||

| Permitted Use: | General office and product showroom use in compliance with Section 9 of the Lease. | |||

| Tenant’s Proportionate Share: | [***]%, which is the percentage obtained by dividing (a) the number of rentable square feet in the Premises as stated above by (b) the [***] rentable square feet in the Project. Landlord and Tenant stipulate that the number of rentable square feet in the Premises and in the Project set forth above is conclusive and shall be binding upon them. | |||

| Building Hours: | Between 7:00 a.m. and 6:00 p.m. on weekdays and between 7:00 a.m. and 1:00 p.m. on Saturdays (in each case other than holidays). | |||

| Tenant’s Address: | Prior to Commencement Date: | Following Commencement Date: | ||

| c/o DIRTT Environmental Solutions Ltd. | c/o DIRTT Environmental Solutions Ltd. | |||

| 0000 00xx Xxxxxx XX | 0000 Xxxxxxxx Xxxxxxx – Xxxxx Xxxxxxxx, Xxxxx 000 | |||

| Xxxxxxx, Xxxxxxx | Xxxxx, XX 00000 | |||

| Xxxxxx X0X 0X0 | Attention: [To be determined pursuant to Exhibit E hereto.] | |||

| Attention: Xxxxxxxx Xxxxx | ||||

| Landlord’s Address: | For all Notices: | With a copy to: | ||

| Tennyson Campus Owner, LP x/x Xxxxx Xxxxxx Capital, LLC Xxx Xxxxxx Xxxxx Xxxxx Xxxxx, Xxxxx 0000 Xxx Xxxxxxxxx, XX 00000 Attention: Xxxxx X. Xxxxx |

Xxxxxxxx Campus Owner, LP x/x Xxxxx Xxxxxx Capital, LLC Xxx Xxxxxx Xxxxx Xxxxx Xxxxx, Xxxxx 0000 Xxx Xxxxxxxxx, XX 00000 Attention: Asset Manager—The Tennyson | |||

|

Wiring Instructions: Payee: Xxxxx Fargo Bank, NA Bank Address: 000 Xxxxxxxxxx Xxxxxx Xxx Xxxxxxxxx, XX 00000 ABA Routing #: 000000000 For Account: Tennyson Campus Owner, LP Account #: 4009071580 |

||||

The foregoing Basic Lease Information is incorporated into and made a part of the Lease identified above. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

| ii | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

TABLE OF CONTENTS

| Page No. | ||||||||

| 1. | DEFINITIONS AND BASIC PROVISIONS |

1 | ||||||

| 2. | LEASE GRANT |

1 | ||||||

| 3. | TENDER OF POSSESSION |

1 | ||||||

| 4. | RENT |

2 | ||||||

| 4.1 | Payment |

2 | ||||||

| 4.2 | Additional Rent |

2 | ||||||

| 5. | DELINQUENT PAYMENT; HANDLING CHARGES |

5 | ||||||

| 6. | SECURITY DEPOSIT |

5 | ||||||

| 7. | LANDLORD’S OBLIGATIONS |

6 | ||||||

| 7.1 | Services |

6 | ||||||

| 7.2 | Excess Utility Use |

7 | ||||||

| 7.3 | Restoration of Services; Abatement |

7 | ||||||

| 7.4 | Repair and Maintenance by Landlord |

7 | ||||||

| 7.5 | Access |

7 | ||||||

| 8. | IMPROVEMENTS; ALTERATIONS; REPAIRS; MAINTENANCE |

8 | ||||||

| 8.1 | Improvements; Alterations |

8 | ||||||

| 8.2 | Repair and Maintenance by Tenant |

8 | ||||||

| 8.3 | Performance of Work |

8 | ||||||

| 8.4 | Mechanic’s Liens |

9 | ||||||

| 9. | USE |

10 | ||||||

| 10. | ASSIGNMENT AND SUBLETTING |

10 | ||||||

| 10.1 | Transfers |

10 | ||||||

| 10.2 | Consent Standards |

10 | ||||||

| 10.3 | Request for Consent |

11 | ||||||

| 10.4 | Conditions to Consent |

11 | ||||||

| 10.5 | Attornment by Subtenants |

12 | ||||||

| 10.6 | Cancellation |

12 | ||||||

| 10.7 | Additional Compensation |

12 | ||||||

| 10.8 | Permitted Transfers |

12 | ||||||

| 11. | INSURANCE; WAIVERS; SUBROGATION; INDEMNITY |

14 | ||||||

| 11.1 | Tenant’s Insurance |

14 | ||||||

| 11.2 | Landlord’s Insurance |

15 | ||||||

| 11.3 | No Subrogation; Waiver of Property Claims |

15 | ||||||

| 11.4 | Indemnity |

16 | ||||||

| 12. | SUBORDINATION; ATTORNMENT; NOTICE TO LANDLORD’S MORTGAGEE |

16 | ||||||

| 12.1 | Subordination |

16 | ||||||

| 12.2 | Attornment |

17 | ||||||

| 12.3 | Notice to Landlord’s Mortgagee |

17 | ||||||

| 12.4 | Landlord’s Mortgagee’s Protection Provisions |

17 | ||||||

| 12.5 | Subordination, Non-Disturbance and Attornment Agreement |

17 | ||||||

| iii | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

| 13. | RULES AND REGULATIONS |

17 | ||||||

| 14. | CONDEMNATION |

18 | ||||||

| 14.1 | Total Taking |

18 | ||||||

| 14.2 | Partial Taking—Tenant’s Rights |

18 | ||||||

| 14.3 | Partial Taking—Landlord’s Rights |

18 | ||||||

| 14.4 | Award |

18 | ||||||

| 15. | FIRE OR OTHER CASUALTY |

18 | ||||||

| 15.1 | Repair Estimate |

18 | ||||||

| 15.2 | Tenant’s Rights |

18 | ||||||

| 15.3 | Landlord’s Rights |

18 | ||||||

| 15.4 | Repair Obligation |

18 | ||||||

| 15.5 | Abatement of Rent |

19 | ||||||

| 15.6 | Waiver of Statutory Provisions |

19 | ||||||

| 16. | PERSONAL PROPERTY TAXES |

19 | ||||||

| 17. | EVENTS OF DEFAULT |

19 | ||||||

| 17.1 | Payment Default |

19 | ||||||

| 17.2 | Prohibited Payments |

19 | ||||||

| 17.3 | Abandonment |

19 | ||||||

| 17.4 | Estoppel; Subordination; Financial Reports |

19 | ||||||

| 17.5 | Insurance |

19 | ||||||

| 17.6 | Mechanic’s Liens |

20 | ||||||

| 17.7 | Unpermitted Transfer |

20 | ||||||

| 17.8 | Other Defaults |

20 | ||||||

| 17.9 | Insolvency |

20 | ||||||

| 18. | REMEDIES |

20 | ||||||

| 18.1 | Termination of Lease |

20 | ||||||

| 18.2 | Termination of Possession |

20 | ||||||

| 18.3 | Perform Acts on Behalf of Tenant |

21 | ||||||

| 18.4 | Suspension of Above-Building Standard Services |

21 | ||||||

| 18.5 | Alteration of Locks |

21 | ||||||

| 19. | PAYMENT BY TENANT; NON-WAIVER; CUMULATIVE REMEDIES; MITIGATION OF DAMAGE |

21 | ||||||

| 19.1 | Payment by Tenant |

21 | ||||||

| 19.2 | No Waiver |

21 | ||||||

| 19.3 | Cumulative Remedies |

21 | ||||||

| 19.4 | Mitigation of Damage |

21 | ||||||

| 20. | LANDLORD’S XXXX |

00 | ||||||

| 00. | SURRENDER OF PREMISES |

22 | ||||||

| 22. | HOLDING OVER |

23 | ||||||

| 23. | CERTAIN RIGHTS RESERVED BY LANDLORD |

23 | ||||||

| 23.1 | Building Operations |

23 | ||||||

| 23.2 | Security |

23 | ||||||

| 23.3 | Prospective Purchasers and Lenders |

23 | ||||||

| 23.4 | Prospective Tenants |

23 | ||||||

| 24. | SUBSTITUTION SPACE |

23 | ||||||

| 25. | MISCELLANEOUS |

24 | ||||||

| 25.1 | Landlord Transfer |

24 | ||||||

| 25.2 | Landlord’s Liability |

24 | ||||||

| iv | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

| 25.3 | Force Majeure |

24 | ||||||

| 25.4 | Brokerage |

24 | ||||||

| 25.5 | Estoppel Certificates |

24 | ||||||

| 25.6 | Notices |

24 | ||||||

| 25.7 | Separability |

25 | ||||||

| 25.8 | Amendments; Binding Effect; No Electronic Records |

25 | ||||||

| 25.9 | Counterparts |

25 | ||||||

| 25.10 | Quiet Enjoyment |

25 | ||||||

| 25.11 | No Merger |

25 | ||||||

| 25.12 | No Offer |

25 | ||||||

| 25.13 | Entire Agreement; Arms’-Length Negotiation; No Reliance |

25 | ||||||

| 25.14 | Waiver of Jury Trial |

25 | ||||||

| 25.15 | Governing Law; Jurisdiction |

26 | ||||||

| 25.16 | Recording |

26 | ||||||

| 25.17 | Water or Mold Notification |

26 | ||||||

| 25.18 | Joint and Several Liability |

26 | ||||||

| 25.19 | Financial Reports |

26 | ||||||

| 25.20 | Landlord’s Fees |

26 | ||||||

| 25.21 | Telecommunications |

27 | ||||||

| 25.22 | Confidentiality |

27 | ||||||

| 25.23 | Authority |

27 | ||||||

| 25.24 | Hazardous Materials |

27 | ||||||

| 25.25 | List of Exhibits |

28 | ||||||

| 25.26 | Determination of Charges |

28 | ||||||

| 25.27 | Prohibited Persons and Transactions |

28 | ||||||

| 25.28 | Waiver of Consumer Rights |

28 | ||||||

| 25.29 | UBTI and REIT Qualification |

28 | ||||||

| 25.30 | Sustainability |

28 | ||||||

| 25.31 | No Construction Contract |

29 | ||||||

| 25.32 | Abated Rent Buy-Out |

29 | ||||||

| 26. | OTHER PROVISIONS |

29 | ||||||

| 26.1 | Guaranty |

29 | ||||||

| 26.2 | Monument Signage |

29 | ||||||

| 26.3 | First Floor Restrooms |

29 | ||||||

| v | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

LIST OF DEFINED TERMS

| vi | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

LEASE

This Lease Agreement (this “Lease”) is entered into as of the Lease Date between Landlord and Tenant (as each such term is defined in the Basic Lease Information).

1. Definitions and Basic Provisions. The definitions and basic provisions set forth in the Basic Lease Information (the “Basic Lease Information”) are incorporated herein by reference for all purposes. Additionally, the following terms shall have the following meanings when used in this Lease: “Affiliate” means any person or entity which, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the party in question; “Building’s Structure” means the Building’s roof and roof membrane, elevator shafts, footings, foundations, structural portions of load-bearing walls, structural floors and subfloors, structural columns and beams, and curtain walls; “Building’s Systems” means the Building’s HVAC, life-safety, plumbing, electrical, mechanical and elevator systems, in each case which were not constructed by any Tenant Party; “including” means including, without limitation; “Laws” means all federal, state and local laws, ordinances, building codes and standards, rules and regulations, all court orders, governmental directives, and governmental orders and all interpretations of the foregoing, and all restrictive covenants affecting the Project, and “Law” means any of the foregoing; “Tenant’s Off-Premises Equipment” means any of Tenant’s equipment or other property that may be located on or about the Project or the related complex (other than inside the Premises); and “Tenant Party” means any of the following persons: Tenant; any assignees claiming by, through or under Tenant; any subtenants claiming by, through or under Tenant; and any of their respective agents, contractors, officers, employees, licensees, guests and invitees.

2. Lease Grant. Subject to the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises.

3. Tender of Possession. Landlord and Tenant presently anticipate that possession of the Premises will be tendered to Tenant in the condition required by this Lease on or about two business days after the latest to occur of the following: (a) Tenant’s full execution and delivery of this Lease to Landlord, (b) approval of the Working Drawings, and (c) Tenant’s delivery to Landlord of evidence of the insurance required in Section 11.1 below (the “Estimated Delivery Date”). If Landlord is unable to tender possession of the Premises in such condition to Tenant by the Estimated Delivery Date, then (1) the validity of this Lease shall not be affected or impaired thereby, (2) Landlord shall not be in default hereunder or be liable for damages therefor, and (3) Tenant shall accept possession of the Premises when Landlord tenders possession thereof to Tenant. Notwithstanding the foregoing, if the Premises are not tendered to Tenant by the Liquidated Damages Date, Tenant may offset from its Basic Rent obligations first accruing following the Commencement Date, liquidated damages equal to one day of Basic Rent per day for each day thereafter and ending on the day Landlord tenders possession of the Premises. The abatement rights afforded to Tenant under this Section 3 shall be Tenant’s sole remedy for Landlord’s failure to tender possession of the Premises by the Estimated Delivery Date. As used herein, “Liquidated Damages Date” means thirty (30) days after the Estimated Delivery Date, plus the number of Tenant Delay Days and the number of Force Majeure Delay Days. As used herein, “Tenant Delay Days” means each day of delay in the performance of the Work which is directly attributable to the affirmative acts or willful refusal to reasonably cooperate of Tenant or the employees, agents or contractors of Tenant, and “Force Majeure Delay Days” means each day of delay in the performance of the Work that occurs for the reasons specified in Section 25.3 of this Lease. By occupying the Premises, Tenant shall be deemed to have accepted the Premises in their condition as of the date of such occupancy, subject to the performance of punch-list items that remain to be performed by Landlord, if any. Prior to occupying the Premises, Tenant shall execute and deliver to Landlord a letter substantially in the form of Exhibit E hereto confirming (A) the Commencement Date and the expiration date of the initial Term, (B) that Tenant has accepted the Premises, and (C) that Landlord has performed all of its obligations with respect to the Premises (except for punch-list items specified in such letter that are the responsibility of Landlord pursuant to the express terms and conditions of this Lease); however, the failure of the parties to execute such letter shall not defer the Commencement Date or otherwise invalidate this Lease. Entry into the Premises by any Tenant Party prior to the Commencement Date shall be subject to all of the provisions of this Lease excepting only those requiring the payment of Basic Rent and Additional Rent and before Tenant may occupy the Premises to conduct business therein, Tenant shall, at its expense, obtain and deliver to Landlord a certificate of occupancy from the appropriate governmental authority for the Premises.

| 1 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

4. Rent.

4.1 Payment. Tenant shall timely pay to Landlord Rent, without notice, demand, deduction or set off (except as otherwise expressly provided herein), by good and sufficient check drawn on a national banking association, or, at Tenant’s election, by electronic or wire transfer, at Landlord’s address provided for in this Lease or such other address as may be specified in writing by Landlord, and shall be accompanied by all applicable state and local sales or use taxes; provided, that following any Event of Default, Landlord shall be permitted to require alternative methods of payment, in Landlord’s sole discretion. The obligations of Tenant to pay Rent to Landlord and the obligations of Landlord under this Lease are independent obligations. Basic Rent, adjusted as herein provided, shall be payable monthly in advance. The first monthly installment of Basic Rent (with respect to the first full calendar month of the Term for which Basic Rent is due and payable without abatement) is due upon execution of this Lease by Tenant; thereafter, Basic Rent shall be payable on the first day of each calendar month. The monthly Basic Rent for any partial month at the beginning of the Term shall equal the product of 1/365 of the annual Basic Rent in effect during the partial month and the number of days in the partial month, and such Basic Rent payment is due upon execution of this Lease by Tenant; however, if the Commencement Date is not a fixed date that is ascertainable as of the Lease Date, then such Basic Rent payment for any fractional calendar month at the beginning of the Term shall be due by Tenant on the Commencement Date. Payments of Basic Rent for any fractional calendar month at the end of the Term shall be similarly prorated. Tenant shall pay to Landlord monthly installments of Additional Rent and any parking rent payable pursuant to Exhibit G in advance on the first day of each calendar month and otherwise on the same terms and conditions described above with respect to Basic Rent. Unless a shorter time period is specified in this Lease, all payments of miscellaneous Rent charges hereunder (that is, all Rent other than Basic Rent and Additional Rent) shall be due and payable within 30 days following Landlord’s delivery to Tenant of an invoice therefor.

4.2 Additional Rent.

4.2.1 Operating Costs. Tenant shall pay to Landlord Tenant’s Proportionate Share of Operating Costs. Landlord may make a good faith estimate of Operating Costs to be due by Tenant for any calendar year or part thereof during the Term. During each calendar year or partial calendar year of the Term after the Base Year, Tenant shall pay to Landlord, in advance on the first day of each calendar month, an amount equal to Tenant’s estimated Operating Costs for such calendar year or part thereof divided by the number of months therein. From time to time, Landlord may estimate and re-estimate the Operating Costs to be due by Tenant and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Operating Costs payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant shall have paid all of the Operating Costs as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment as herein provided when actual Operating Costs are available for each calendar year.

4.2.2 Operating Costs Defined. The term “Operating Costs” means all costs, expenses, disbursements, and amounts of every kind and nature (subject to the limitations set forth below) that Landlord pays or accrues in connection with the ownership, management, operation, maintenance, security, repair, replacement, renovation, restoration or operation of the Building, the Project, or any portion thereof, or performing Landlord’s obligations under this Lease, in each case, determined in accordance with sound accounting principles consistently applied, including the following costs: (a) wages and salaries of all on-site employees at or below the grade of general manager engaged in the operation, maintenance or security of the Project (together with Landlord’s reasonable allocation of expenses of off-site employees at or below the grade of general manager who perform a portion of their services in connection with the operation, maintenance or security of the Project including accounting personnel), including taxes, insurance and benefits relating thereto; (b) all supplies, materials and computer software licenses used in the operation, maintenance, repair, replacement, and security of the Project; (c) costs for improvements made to the Project which, although capital in nature, are expected to reduce the normal operating costs (including all utility costs) of the Project, as amortized using an interest rate equal to the Prime Rate plus two percent (2.00%) per annum over the time period reasonably estimated by Landlord to recover the costs thereof taking into consideration the anticipated cost savings, as determined by Landlord using its good faith, commercially reasonable judgment, as well as capital improvements made in order to comply with any Law hereafter promulgated by any governmental authority, or any amendment to or any interpretation hereafter rendered

| 2 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

with respect to any existing Law that have the effect of changing the legal requirements applicable to the Project from those currently in effect, or that relate to the safety or security of the Project, to maintain the Project in good order or condition, in each case amortized using an interest rate equal to the Prime Rate plus two percent (2.00%) per annum over the lesser of seven years or the useful economic life of such improvements as determined by Landlord in its reasonable discretion, or to repair, maintain and replace any equipment in the amenities, the cost of which shall be included in Operating Costs the year in which such costs are incurred; (d) cost of all utilities, other than the cost of any metered or submetered utilities paid separately by other tenants; (e) insurance expenses, including the cost of any deductibles; (f) repairs, replacements, and general maintenance of the Project; (g) fair market rental and other costs with respect to the management office, and any amenities such as any common use fitness facility and/or conference center for the Project; and (h) service, maintenance and management contracts and fees (payable to Landlord, Landlord’s Affiliate or a third-party management company; provided that any costs paid to Landlord or Landlord’s Affiliate for management services shall exclude amounts paid in excess of the competitive rates for management services of comparable quality rendered by persons or entities of similar skill, competence and experience) for the operation, maintenance, management, repair, replacement, or security of the Project (including alarm service, window cleaning, janitorial, security, landscape maintenance and elevator maintenance). The property management fee will be calculated assuming that all leasable space in the Project is leased to tenants paying full fair market value rent, as reasonably determined by Landlord (as contrasted with paying free rent, half rent and the like) without abatement, and will not exceed the greater of (i) five percent (5.00%) of gross revenues for the Project, as reasonably determined by Landlord, or (ii) $5,000.00 per month. Landlord shall have the right to allocate costs among different uses of space in the Project if Landlord reasonably determines the costs for operating, maintaining and repairing such different spaces differ from other spaces within the Project. If the Building is part of a multi-building complex (a “related complex”), Taxes and Operating Costs for the related complex may be prorated among the Building and the other buildings at the related complex, as reasonably determined by Landlord.

Operating Costs shall not include costs for (1) capital improvements made to the Project, other than capital improvements described in Section 4.2.2(c) and except for items which are generally considered maintenance and repair items, such as painting and wall covering of common areas, replacement of carpet or other floor coverings in elevator lobbies and common areas, and the like; (2) repair, replacements and general maintenance paid by proceeds of insurance or by Tenant or other third parties; (3) interest, amortization or other payments on loans to Landlord; (4) depreciation; (5) leasing commissions; (6) legal expenses for services, other than those that benefit the Project tenants generally (e.g., negotiation of vendor contracts); (7) renovating or otherwise improving space for specific occupants of the Project or vacant leasable space in the Project, other than costs for repairs, maintenance and compliance with Laws provided or made available to the Project tenants generally; (8) Taxes; and (9) federal income taxes imposed on or measured by the income of Landlord from the operation of the Project.

4.2.3 Taxes; Taxes Defined. Tenant shall also pay Tenant’s Proportionate Share of Taxes. Tenant shall pay Tenant’s Proportionate Share of Taxes in the same manner as provided above for Tenant’s Proportionate Share of Operating Costs. “Taxes” means taxes, assessments, and governmental charges or fees whether federal, state, county or municipal, and whether they be by taxing districts or authorities presently taxing or by others, subsequently created or otherwise, and any other taxes and assessments (including non-governmental assessments and charges [including assessments and charges from any applicable property owner’s association] under any restrictive covenant, declaration of covenants, restrictions and easements or other private agreement that are not treated as part of Operating Costs) now or hereafter attributable to the Project (or its operation), excluding, however, penalties and interest thereon and federal and state taxes on income. However, if the present method of taxation changes so that in lieu of or in addition to the whole or any part of any Taxes, there is levied on Landlord a tax directly on the rents or revenues received therefrom or a franchise tax, margin tax, assessment, or charge based, in whole or in part, upon such rents or revenues for the Project, then all such taxes, assessments, or charges, or the part thereof so based, shall be deemed to be included within the term “Taxes” for purposes hereof. Notwithstanding anything to the contrary herein, Taxes shall include the Texas margin tax and/or any other business tax imposed under Texas Tax Code Chapter 171 and/or any successor statutory provision. Taxes shall include the costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Project. For property tax purposes, Tenant waives all rights to

| 3 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

protest or appeal the appraised value of the Premises, as well as the Project, and all rights to receive notices of reappraisement as set forth in Sections 41.413 and 42.015 of the Texas Tax Code. Tenant shall have the right to request Landlord, by written notice to Landlord given not less than sixty (60) days before the last date for filing any necessary protest or petition or taking any other necessary action, to initiate and prosecute any proceeding for the purpose of reducing the assessed valuation of the Project for tax purposes if the appraised value of the Project increases by more than ten percent (10.00%) over the previous year’s appraised value; provided, however, that if Landlord reasonably determines that such protest may have adverse consequences, Landlord may elect not to pursue such protest. From time to time during any calendar year, Landlord may estimate or re-estimate the Taxes to be due by Tenant for that calendar year and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Taxes payable by Tenant shall be appropriately adjusted in accordance with the estimations.

4.2.4 Reconciliation Statement. By April 30 of each calendar year, or as soon thereafter as practicable, Landlord shall furnish to Tenant a statement of Operating Costs for the previous year, adjusted as provided in Section 4.2.5, and of the Taxes for the previous year (the “Reconciliation Statement”). If Tenant’s estimated payments of Operating Costs or Taxes under this Section 4.2 for the year covered by the Reconciliation Statement exceed Tenant’s Proportionate Share of such items as indicated in the Reconciliation Statement, then Landlord shall credit or reimburse Tenant for such excess within 30 days after Landlord furnishes the Reconciliation Statement to Tenant; likewise, if Tenant’s estimated payments of Operating Costs or Taxes under this Section 4.2 for such year are less than Tenant’s Proportionate Share of such items as indicated in the Reconciliation Statement, then Tenant shall pay Landlord such deficiency within 30 days of invoice from Landlord.

4.2.5 Gross Up. With respect to any calendar year or partial calendar year in which the Project is not occupied to the extent of 100% of the rentable area thereof, or Landlord is not supplying comparable services to 100% of the rentable area thereof, the Operating Costs for such period which vary with the occupancy of the Project or level of service shall, for the purposes hereof, be increased to the amount which would have been incurred had the Project been occupied to the extent of 100% of the rentable area thereof and Landlord had been supplying comparable services to 100% of the rentable area thereof, and, for the purpose of calculating the property management fee, assuming that all leasable space is leased to tenants paying fair market value rent (as contrasted with paying free rent, half rent and the like).

4.2.6 Operating Costs Cap. For purposes of calculating Operating Costs under Section 4.2, the maximum increase in the amount of Controllable Operating Costs (defined below) that may be included in calculating such Operating Costs for each calendar year after the Cap Base Year (defined below) shall be limited to 5% per calendar year on a cumulative, compounded basis; for example, the maximum amount of Controllable Operating Costs that may be included in the calculation of such Operating Costs for each calendar year after the Cap Base Year shall equal the product of the Cap Base Year Controllable Operating Costs and the following percentages for the following calendar years: 105% for the first calendar year following the Cap Base Year; 110.25% for the second calendar year following the Cap Base Year; 115.76% for the third calendar year following the Cap Base Year; 121.55% for the fourth calendar year following the Cap Base Year; etc. However, any increases in Operating Costs not recovered by Landlord due to the foregoing limitation shall be carried forward into succeeding calendar years during the Term (subject to the foregoing limitation) to the extent necessary until fully recouped by Landlord. “Cap Base Year” means the first full calendar year following the Commencement Date; however, Controllable Operating Costs for the Cap Base Year only shall be increased to reflect Landlord’s commercially reasonable estimate of the maintenance and repair costs that would have been incurred in the absence of any warranties and adjusted to the amount that would have been incurred had the Project been fully occupied, and Landlord had been supplying services to the entirety of the Project, for the duration of such Cap Base Year. “Controllable Operating Costs” means all Operating Costs which are within the reasonable control of Landlord; thus, excluding taxes, insurance, utilities, snow removal costs and other weather-related costs (including landscape maintenance costs, such as those resulting from infestation, storms, drought and other severe weather), costs incurred to comply with governmental requirements, increased costs due to union or other collective bargaining negotiations, costs resulting from acts of force majeure, amortized costs of capital expenditures, and other costs beyond the reasonable control of Landlord.

| 4 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

4.2.7 Tenant’s Inspection Right. Provided no Event of Default then exists, after receiving an annual Reconciliation Statement and giving Landlord 30 days’ prior written notice thereof, Tenant may inspect or audit Landlord’s records relating to Additional Rent for the period of time covered by such Reconciliation Statement in accordance with the following provisions. If Tenant fails to object to the calculation of Additional Rent on an annual Reconciliation Statement within 60 days after the statement has been delivered to Tenant, or if Tenant fails to conclude its audit or inspection within 120 days after the statement has been delivered to Tenant, then Tenant shall have waived its right to object to the calculation of Additional Rent for the year in question and the calculation of Additional Rent set forth on such statement shall be final. Tenant’s audit or inspection shall be conducted where Landlord maintains its books and records, shall not unreasonably interfere with the conduct of Landlord’s business, and shall be conducted only during business hours reasonably designated by Landlord. Tenant shall pay the cost of such audit or inspection unless the total Additional Rent for the period in question is determined to be overstated by more than 5% in the aggregate, and, as a result thereof, Tenant paid to Landlord more than the actual Additional Rent due for such period, in which case Landlord shall pay the audit cost (not to exceed $2,500). Tenant may not conduct an inspection or have an audit performed more than once during any calendar year. Tenant or the accounting firm conducting such audit shall, at no charge to Landlord, submit its audit report in draft form to Landlord for Landlord’s review and comment before the final approved audit report is submitted to Landlord, and any reasonable comments by Landlord shall be incorporated into the final audit report. If such inspection or audit reveals that an error was made in the Additional Rent previously charged to Tenant, then Landlord shall refund to Tenant any overpayment of any such costs, or Tenant shall pay to Landlord any underpayment of any such costs, as the case may be, within 30 days after notification thereof. Provided Landlord’s accounting for Additional Rent is consistent with the terms of this Lease, Landlord’s good faith judgment regarding the proper interpretation of this Lease and the proper accounting for Additional Rent shall be binding on Tenant in connection with any such audit or inspection. Tenant shall maintain the results of each such audit or inspection confidential and shall not be permitted to use any third party to perform such audit or inspection, other than an independent firm of certified public accountants (a) reasonably acceptable to Landlord (and any member of the “Big Four” accounting firms shall be deemed acceptable to Landlord), (b) which is not compensated on a contingency fee basis or in any other manner which is dependent upon the results of such audit or inspection (and Tenant shall deliver the fee agreement or other similar evidence of such fee arrangement to Landlord upon request), and (c) which agrees with Landlord in writing to maintain the results of such audit or inspection confidential. Notwithstanding the foregoing, Tenant shall have no right to conduct an audit if Landlord furnishes to Tenant an audit report for the period of time in question prepared by an independent certified public accounting firm of recognized national standing (whether originally prepared for Landlord or another party). Nothing in this Section 4.2.7 shall be construed to limit, suspend or xxxxx Tenant’s obligation to pay Rent when due, including Additional Rent. Tenant hereby acknowledges that Tenant’s sole right to audit Landlord’s books and records and to contest the amount of Additional Rent payable by Tenant shall be as set forth in this Section 4.2.7, and Tenant hereby waives any and all other rights pursuant to applicable law to audit such books and records and/or to contest the amount of Additional Rent payable by Tenant. This provision shall survive the expiration or earlier termination of the Lease.

5. Delinquent Payment; Handling Charges. All past due payments required of Tenant hereunder shall bear interest from the date due until paid at the lesser of eight percent per annum or the maximum lawful rate of interest (such lesser amount is referred to herein as the “Default Rate”); additionally, Landlord, in addition to all other rights and remedies available to it, may charge Tenant a late fee equal to the greater of (a) three percent (3.00%) of the delinquent payment, and (b) $250, to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant’s delinquency. In no event, however, shall the charges permitted under this Section 5 or elsewhere in this Lease, to the extent they are considered to be interest under applicable Law, exceed the maximum lawful commercial rate of interest. Notwithstanding the foregoing, the late fee referenced above shall not be charged with respect to the first occurrence (but not any subsequent occurrence) during any 12-calendar month period that Tenant fails to make any payment of Additional Rent when due, until ten (10) days after Landlord delivers written notice of such delinquency to Tenant. Landlord and Tenant agree that the late fee referenced above represents a fair and reasonable estimate of the costs Landlord will incur by reason of Tenant’s delinquent payment.

6. Security Deposit. Contemporaneously with the execution of this Lease, Tenant shall pay to Landlord the Security Deposit, which shall be held by Landlord to secure Tenant’s performance of its obligations under this Lease. The Security Deposit is not an advance payment of Rent or a measure or limit of Landlord’s damages

| 5 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

upon an Event of Default (as defined herein). Landlord may, from time to time following an Event of Default and without prejudice to any other remedy, use all or a part of the Security Deposit to perform any obligation Tenant fails to perform hereunder. Following any such application of the Security Deposit, Tenant shall pay to Landlord on demand the amount so applied in order to restore the Security Deposit to its original amount. Provided that Tenant has performed all of its obligations hereunder, Landlord shall, within 60 days after the expiration of the Term and Tenant’s surrender of the Premises in compliance with the provisions of this Lease, return to Tenant the portion of the Security Deposit which was not applied to satisfy Tenant’s obligations. Notwithstanding the preceding sentence and to the extent permitted by applicable Law, Landlord may retain the Security Deposit until such time after the expiration of the Term that Landlord is able to reconcile and confirm all amounts payable by Tenant under this Lease have been paid in full by Tenant (e.g., Landlord cannot reconcile and confirm Tenant has paid Tenant’s Proportionate Share of Taxes for the calendar year in which the Term expires if Landlord has not received a Tax xxxx from all applicable taxing authorities at the time of such expiration). The Security Deposit may be commingled with other funds, and no interest shall be paid thereon. If Landlord transfers its interest in the Premises and the transferee assumes Landlord’s obligations under this Lease, then Landlord shall, in Landlord’s sole discretion, either assign any unused balance of the Security Deposit to the transferee or provide a credit to the Transferee in an amount equal to any unused balance of the Security Deposit, whereupon Landlord shall have no further liability for the return of the Security Deposit. The rights and obligations of Landlord and Tenant under this Section 6 are subject to any other requirements and conditions imposed by Laws applicable to the Security Deposit.

7. Landlord’s Obligations.

7.1 Services. Landlord shall use commercially reasonable efforts to furnish to Tenant: (a) water at those points of supply provided for general use of tenants of the Building; (b) the equipment to provide heated and refrigerated air conditioning (“HVAC”) as appropriate, at such temperatures and in such amounts as are standard for comparable buildings with comparable densities and heat loads in the vicinity of the Building (not to exceed the current HVAC system’s capacity existing as of the Lease Date); (c) janitorial service to the Premises five days per week, other than holidays, for Building-standard installations and such window washing as may from time to time be reasonably required; (d) elevators for ingress and egress to the floor on which the Premises are located, in common with other tenants, provided that Landlord may reasonably limit the number of operating elevators during non-business hours and holidays; (e) replacement of Building-standard light bulbs and fluorescent tubes, provided that Landlord’s standard charge for such bulbs and tubes shall be paid by Tenant; and (f) electrical current during normal business hours for electrical energy consumption that does not exceed normal office usage. If Tenant desires janitorial service at other than normal service times, or HVAC service at other than Building Hours, then such services shall be supplied to Tenant upon the written request (or such other means as may be requested by Landlord, including, if applicable, request through an internet portal system) by Tenant delivered to Landlord through the Building’s work order system before 1:00 p.m. on the business day preceding such extra usage, and Tenant shall pay to Landlord its then standard cost of such services (which shall not be included in Tenant’s Proportionate Share of Operating Costs) within 30 days after Landlord has delivered to Tenant an invoice therefor. However, with respect to HVAC services on Saturdays, in order to conserve energy and reduce Operating Costs, Tenant shall notify Landlord whether Tenant desires HVAC services to the Premises on Saturdays by 3:00 p.m. on the immediately preceding business day. If Tenant so notifies Landlord that Tenant desires such HVAC services on Saturday, Landlord shall provide such HVAC service during the Building’s standard hours on Saturday (as described above) at no additional separate charge to Tenant. If Tenant desires HVAC services on Saturdays in excess of the Building’s standard hours on Saturdays, then Landlord shall provide such services subject to the additional HVAC charges for such additional hours in excess of the Building’s standard hours. Tenant acknowledges that the cost components for providing after-hours HVAC service to the Premises are not separately metered; accordingly, Landlord’s determination of after-hours HVAC charges is an estimate of the costs incurred by Landlord in providing such after-hours HVAC service to Tenant. The costs charged to Tenant for such after-hours service shall include Landlord’s reasonable allocation of the costs for electricity, water, sewage, water treatment, labor, metering, filtering, equipment depreciation, wear and tear and maintenance to provide such service. Landlord’s reasonable estimate of 2020 after-hours charges for HVAC is $75.00 per hour per floor of the Building (with a two-hour minimum), plus any applicable sales or other taxes; however, Landlord and Tenant agree that such figure shall not be interpreted as the maximum amount which may be charged to Tenant for such services.

| 6 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

7.2 Excess Utility Use. Landlord shall not be required to furnish electrical power for equipment that requires more than 110 volts or other equipment whose electrical energy consumption exceeds normal office usage. If Tenant’s requirements for or consumption of electricity exceed the electricity to be provided by Landlord as described in Section 7.1, Landlord shall, at Tenant’s expense, make reasonable efforts to supply such service through the then-existing feeders and risers serving the Building and the Premises, provided the additional use of such feeders and risers caused by Tenant’s excess electrical requirements do not adversely affect Landlord’s ability to provide reasonable electrical service to the balance of the Building (as determined by Landlord in the exercise of its reasonable discretion); and Tenant shall pay to Landlord the cost of such service within 30 days after Landlord has delivered to Tenant an invoice therefor. Landlord may determine the amount of such utility consumption by any verifiable method, including installation of a separate meter or monitor in the Premises installed, maintained, and read by Landlord, at Tenant’s expense. Tenant shall not install any electrical equipment requiring special wiring or requiring electricity in excess of 110 volts unless approved in advance by Landlord, which approval shall not be unreasonably withheld. Tenant shall not install any electrical equipment requiring electricity in excess of the pro rata capacity available to the Premises as of the Lease Date unless approved in advance by Landlord, which approval may be withheld in Landlord’s sole discretion. The use of electricity in the Premises shall not exceed the capacity of existing feeders and risers to or wiring in the Premises. Any risers or wiring required to meet Tenant’s excess electrical requirements shall, upon Tenant’s written request, be installed by Landlord, at Tenant’s cost, if, in Landlord’s judgment, the same are necessary and shall not cause permanent damage to the Building or the Premises, cause or create a dangerous or hazardous condition, entail excessive or unreasonable alterations, repairs, or expenses, adversely affect Landlord’s ability to provide reasonable service to the balance of the Building, or interfere with or disturb other tenants of the Building. If Tenant (a) uses machines or equipment in the Premises or (b) operates within the Premises or any portion thereof (e.g., training rooms, conference rooms, computer rooms, server rooms, etc.) at a density, either of which (1) affects the temperature otherwise maintained by the air conditioning system or (2) otherwise overloads any utility, Landlord may install supplemental air conditioning units or other supplemental equipment in the Premises (and any necessary electrical submetering equipment and wiring), and the cost thereof, including the cost of design, installation, operation, use, and maintenance, in each case plus an administrative fee of 10% of such cost, shall be paid by Tenant to Landlord within 30 days after Landlord has delivered to Tenant an invoice therefor.

7.3 Restoration of Services; Abatement. Landlord shall use reasonable efforts to restore any service required of it under Section 7.1 that becomes unavailable; however, such unavailability shall not render Landlord liable for any damages caused thereby, be a constructive eviction of Tenant, constitute a breach of any implied warranty, or, except as provided in the next sentence, entitle Tenant to any abatement of Tenant’s obligations hereunder. If, however, Tenant is prevented from using, and does not use, the Premises because of the unavailability of any such service for a period of 10 consecutive business days following Landlord’s receipt from Tenant of a written notice regarding such unavailability, the restoration of which is within Landlord’s reasonable control, and such unavailability was not caused by a Tenant Party, a governmental directive, or the failure of public utilities to furnish necessary services, then Tenant shall, as its exclusive remedies: (i) be entitled to a reasonable abatement of Basic Rent and Additional Rent for each consecutive day (after such 10-day period) that Tenant is so prevented from using the Premises; and (ii) if such unavailability of services is caused by a willful refusal of Landlord to provide such services, be entitled to seek specific performance of Landlord’s restoration obligations under this Section 7.3.

7.4 Repair and Maintenance by Landlord. Landlord shall maintain and repair the common areas of the Project, Building’s Structure, the core portions of the Building’s Systems, the parking areas and other exterior areas of the Project, including driveways, alleys, landscape and grounds of the Project and utility lines in a good condition, consistent with the operation of similar class office buildings in the market in which the Project is located, including maintenance, repair and replacement of the exterior of the Project (including painting), landscaping, sprinkler systems and any items normally associated with the foregoing. All costs in performing the work described in this Section shall be included in Operating Costs except to the extent excluded by Section 4.2. In no event shall Landlord be responsible for alterations to the Building’s Structure required by applicable Law because of Tenant’s use of the Premises or alterations or improvements to the Premises made by or for a Tenant Party (which alterations shall be made by Landlord at Tenant’s sole cost and expense and on the same terms and conditions as Landlord performed repairs as described in Section 8.2 below). Notwithstanding anything to the contrary contained herein, Landlord shall, in its commercially-reasonable discretion, determine whether, and to the extent, repairs or replacements are the appropriate remedial action.

7.5 Access. Subject to the Building rules and regulations attached as Exhibit C hereto and the other provisions of this Lease (including Section 9 hereof), Tenant will be provided access to the Premises 24 hours per day, seven days per week.

| 7 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

8. Improvements; Alterations; Repairs; Maintenance.

8.1 Improvements; Alterations. Improvements to the Premises shall be installed at Tenant’s expense only in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, which approval shall be governed by the provisions set forth in this Section 8.1. No alterations or physical additions in or to the Premises (including the installation of systems furniture or other equipment or personal property that affects or otherwise connects to the Building’s Systems) may be made without Landlord’s prior written consent, which shall not be unreasonably withheld or delayed; however, Landlord may withhold its consent in its sole discretion to any alteration or addition that would (a) adversely affect (which determination shall be made by Landlord in its commercially reasonable discretion) the Building’s Structure or the Building’s Systems (including the Project’s restrooms or mechanical rooms), or (b) affect (which determination shall be made by Landlord in its sole and absolute discretion) the (1) exterior appearance of the Project, (2) appearance of the Project’s common areas or elevator lobby areas, (3) quiet enjoyment of other tenants or occupants of the Project, or (4) provision of services to other occupants of the Project. In no event may any Tenant Party install any power or data poles or other vertical drop poles in the Premises. To the extent that Landlord grants Tenant the right to use areas within the Project, whether pursuant to the terms of this Lease or through plans and specifications subsequently approved by Landlord (and without implying that Landlord shall grant any such approvals), (A) in no event may Tenant use more than its Proportionate Share of the areas within the Building or utility or systems capacity made available by Landlord for general tenant usage for Tenant’s installations and operations in the Premises (including chilled water, electricity and other Building’s Systems, telecommunications room space, electrical room space, plenum space and riser space), and (B) Tenant shall comply with the provisions of this Section with respect to all such items, including Tenant’s Off- Premises Equipment. Tenant shall not paint or install decorations, signs, window or door lettering, or advertising media of any type visible from the exterior of the Premises without the prior written consent of Landlord, which consent may be withheld in Landlord’s sole and absolute discretion. Notwithstanding the foregoing, Tenant shall not be required to obtain Landlord’s consent for repainting, recarpeting, or other alterations, tenant improvements, or physical additions to the Premises which are exclusively interior, non-structural and cosmetic in nature, in each case provided that (i) the installation thereof does not require the issuance of any building permit or other governmental approval, or involve any core drilling or the configuration or location of any exterior or interior walls (other than the configuration or location of temporary interior modular office walls displayed for purposes of sale [“Temporary Walls”]) of the Building, and (ii) such alterations, additions and improvements will not affect (a) the Building’s Structure or the Building’s Systems, (b) the provision of services to other Building tenants, or (c) the appearance of the Building’s common areas (except for Tenant’s installation of Temporary Walls, provided, however, that if Landlord has any objection to the location of any Temporary Walls, Landlord may notify Tenant of such objection, Tenant shall promptly remove such Temporary Walls, and Tenant may relocate such Temporary Walls to another location on the Premises acceptable to Landlord in its reasonable discretion) or the exterior of the Building. All water heaters in the Premises must be tankless and must include automatic shut-off valves and water sensors. All alterations, additions, and improvements shall be constructed, maintained, and used by Tenant, at its risk and expense, in accordance with all Laws; Landlord’s consent to or approval of any alterations, additions or improvements (or the plans therefor) shall not constitute a representation or warranty by Landlord, nor Landlord’s acceptance, that the same comply with sound architectural and/or engineering practices or with all applicable Laws, and Tenant shall be solely responsible for ensuring all such compliance. Landlord and Tenant hereby acknowledge and agree that all alterations, improvements, fixtures, equipment and/or appurtenances which may be installed or placed in or about the Premises (excluding Tenant’s removable trade fixtures, furniture or non-affixed office equipment), from time to time, shall be at the sole cost of Tenant and shall be and become part of the Premises and the property of Landlord (subject to the provisions of Section 21).

8.2 Repair and Maintenance by Tenant. Tenant shall maintain the Premises in a clean, safe, and operable condition, and shall not permit or allow to remain any waste or damage to any portion of the Premises. If the Premises include, now or hereafter, one or more floors of the Building in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered to be a part of the Premises. Additionally, Tenant, at its sole expense, shall repair, replace and maintain in good condition and in accordance with all Laws and the equipment manufacturer’s suggested service programs, all portions of the Premises (excluding the core portion of the Building’s Systems, which shall be maintained by Landlord pursuant to Section 7.4) and Tenant’s Off-Premises Equipment and all areas, improvements and systems exclusively serving the Premises, including the branch lines of the plumbing, electrical and HVAC systems, including all duct work, and Tenant shall utilize all of the foregoing items in accordance with the applicable design specifications and capacities. Notwithstanding any other provision in this Lease to the

| 8 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

contrary, with respect to any portion of the Premises visible from any common area inside or outside of the Building (the “Visible Premises”), Tenant shall (a) maintain such Visible Premises, including the furniture, fixtures, equipment and improvements located therein in a neat and first-class condition throughout the Term and any extension thereof, (b) not use the Visible Premises for storage, (c) complete within the Visible Premises any requested cleaning within one business day after Landlord’s written request therefor, and (d) complete within the Visible Premises any requested repairs, alterations or changes within five business days after Landlord’s written request therefor. Tenant shall repair or replace, subject to Landlord’s direction and supervision, any damage to the Project caused by a Tenant Party. If (1) Tenant fails to commence to make such repairs or replacements within 15 days after the occurrence of such damage and thereafter diligently pursue the completion thereof (or, in the case of an emergency, such shorter period of time as is reasonable given the circumstances), or (2) notwithstanding such diligence, Tenant fails to complete such repairs or replacements within 30 days after the occurrence of such damage (or, in the case of an emergency, such shorter period of time as is reasonable given the circumstances), then Landlord may make the same at Tenant’s cost. If any such damage occurs outside of the Premises, or if such damage occurs inside the Premises but affects the Building’s Systems and/or Building’s Structure or any other area outside the Premises, then Landlord may elect to repair such damage at Tenant’s expense, rather than having Tenant repair such damage. The cost of all maintenance, repair or replacement work performed by Landlord under this Section 8, in each case plus an administrative fee of 10% of such cost, shall not be included in Operating Costs but instead shall be paid by Tenant to Landlord within 30 days after Landlord has invoiced Tenant therefor.

8.3 Performance of Work. Except for the Work (which is governed by the attached Work Letter), all work described in this Section 8 shall be performed only by Landlord or by contractors and subcontractors approved in writing by Landlord and only in accordance with plans and specifications approved by Landlord in writing. If Landlord elects, in its sole discretion, to supervise any work described in this Section 8, Tenant shall pay to Landlord a construction management fee equal to 3% of the cost of such work. Tenant shall cause all contractors and subcontractors to procure and maintain insurance coverage listing the Landlord Insured Parties (defined below) as additional insureds against such risks, in such amounts, and with such companies as Landlord may reasonably require. Tenant shall provide Landlord with the identities, mailing addresses and telephone numbers of all persons performing work in excess of $50,000 or supplying materials in excess of $25,000 prior to beginning such construction and Landlord may post on and about the Premises notices of non-responsibility pursuant to applicable Laws. All such work shall be performed in accordance with all Laws and in a good and workmanlike manner so as not to damage the Building (including the Premises, the Building’s Structure and the Building’s Systems) and shall use materials of a quality that is at least equal to the quality designated by Landlord as the minimum standard for the Building, and in such manner as to cause a minimum of disruption to the other occupants of the Project and interference with other construction in progress and with the transaction of business in the Project and the related complex. Landlord may designate reasonable rules, regulations and procedures for the performance of all such work in the Building (including insurance requirements for contractors) and, to the extent reasonably necessary to avoid disruption to the occupants of the Building, shall have the right to designate the time when such work may be performed. All such work which may affect the Building’s Structure or the Building’s Systems must be approved by the Project’s engineer of record, at Tenant’s expense and, at Landlord’s election, must be performed by Landlord’s usual contractor for such work. All work affecting the roof of the Building must be performed by Landlord’s roofing contractor and no such work will be permitted if it would void or reduce or otherwise adversely affect the warranty on the roof. Upon completion of any work described in this Section 8, Tenant shall furnish Landlord with accurate reproducible “as-built” CADD files (or a comparable format subject to Landlord’s prior written approval) of the improvements as constructed.

8.4 Mechanic’s Liens. All work performed, materials furnished, or obligations incurred by or at the request of a Tenant Party shall be deemed authorized and ordered by Tenant only, and Tenant shall not permit any mechanic’s or construction liens to be filed against the Premises or the Project in connection therewith. Upon completion of any such work, Tenant shall deliver to Landlord final unconditional lien waivers from all contractors, subcontractors and materialmen who performed such work in excess of $5,000 in a form approved by Landlord. If such a lien is filed, then Tenant shall, within thirty (30) days after Landlord has delivered notice of the filing thereof to Tenant (or such earlier time period as may be necessary to prevent the forfeiture of the Premises, the Project or any interest of Landlord therein or the imposition of a civil or criminal fine with respect thereto), either (a) pay the amount of the lien and cause the lien to be released of record, or (b) diligently contest such lien and deliver to Landlord a bond or other security reasonably satisfactory to Landlord. If Tenant fails to timely take either such action, then Landlord may pay the lien claim, and any amounts so paid, including expenses and interest, shall be paid by Tenant to Landlord within ten days after Landlord has invoiced Tenant therefor. Landlord and Tenant acknowledge and agree that their

| 9 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

relationship is and shall be solely that of “landlord-tenant” (thereby excluding a relationship of “owner-contractor,” “owner-agent” or other similar relationships) and that Tenant is not authorized to act as Landlord’s common law agent or construction agent in connection with any work performed in the Premises. Accordingly, all materialmen, contractors, artisans, mechanics, laborers and any other persons now or hereafter contracting with Tenant, any contractor or subcontractor of Tenant or any other Tenant Party for the furnishing of any labor, services, materials, supplies or equipment with respect to any portion of the Premises, at any time from the Lease Date until the end of the Term, are hereby charged with notice that they look exclusively to Tenant to obtain payment for same. Nothing herein shall be deemed a consent by Landlord to any liens being placed upon the Premises, the Project or Landlord’s interest therein due to any work performed by or for Tenant or deemed to give any contractor or subcontractor or materialman any right or interest in any funds held by Landlord to reimburse Tenant for any portion of the cost of such work. Tenant shall defend, indemnify and hold harmless Landlord and its agents and representatives from and against all claims, demands, causes of action, suits, judgments, damages and expenses (including attorneys’ fees) in any way arising from or relating to the failure by any Tenant Party to pay for any work performed, materials furnished, or obligations incurred by or at the request of a Tenant Party. This indemnity provision shall survive termination or expiration of this Lease.

9. Use. Tenant shall occupy and use the Premises only for the Permitted Use and for no other use or purpose and shall comply with all Laws relating to the use, condition, access to, and occupancy of the Premises and will not commit waste, overload the Building’s Structure or the Building’s Systems or subject the Premises to use that would damage the Premises. The population density within all or any portion of the Premises shall at no time exceed one person for each 175 rentable square feet in the Premises; however, such population density may from time to time exceed such number on a temporary basis for meetings, conferences and other events of a temporary nature. Tenant shall not conduct second or third shift operations within the Premises; however, Tenant may use the Premises after Building Hours, so long as Tenant is not generally conducting business from the Premises after Building Hours. Notwithstanding anything in this Lease to the contrary, as between Landlord and Tenant, (a) Tenant shall bear the risk of complying with Title III of the Americans With Disabilities Act of 1990, any state laws governing handicapped access or architectural barriers, and all rules, regulations, and guidelines promulgated under such laws, as amended from time to time (the “Disabilities Acts”) in the Premises, and (b) Landlord shall bear the risk of complying with the Disabilities Acts in the common areas of the Building, including restrooms located in such common areas, other than compliance that is necessitated by the use of the Premises for other than the Permitted Use or as a result of any alterations or additions, including any initial tenant improvement work (including the Work), made by or on behalf of a Tenant Party (which risk and responsibility shall be borne by Tenant). The Premises shall not be used for any use which is disreputable, creates extraordinary fire hazards, or results in an increased rate of insurance on the Project or its contents. Tenant shall not use any substantial portion of the Premises for a “call center,” any other telemarketing use, any credit processing use or any co-working use (i.e., a shared office environment for persons who are self- employed or working for different employers). Tenant acknowledges and agrees that Tenant’s use of the Premises shall not include, and neither the Premises nor any portion of the Project shall be used for, the use, growing, producing, processing, storing (short- or long-term), distributing, transporting, or selling of cannabis, cannabis derivatives, or any cannabis containing substances (collectively, “Cannabis”), or any uses related to the same, nor shall Tenant permit, allow or suffer, any Tenant Party to bring any Cannabis onto the Premises or any portion of the Project. Furthermore, the Premises may not be used in any manner that would violate any exclusive use covenant or use restriction then in effect for the benefit of any tenant or occupant of the Project or violate any restrictive covenants or other covenants and restrictions then affecting the Project. If, because of a Tenant Party’s acts or omissions or because Tenant vacates the Premises, the rate of insurance on the Building or its contents increases, then such acts or omissions shall be an Event of Default, Tenant shall pay to Landlord the amount of such increase on demand, and acceptance of such payment shall not waive any of Landlord’s other rights. Tenant shall conduct its business and control each other Tenant Party so as not to create any nuisance or unreasonably interfere with other tenants or Landlord in its management of the Project.

10. Assignment and Subletting.

10.1 Transfers. Except as provided in Section 10.8 and Section 10.9, Tenant shall not, without the prior written consent of Landlord, (a) assign, transfer, or encumber this Lease or any estate or interest herein, whether directly or by operation of law, (b) permit any other entity to become Tenant hereunder by merger, consolidation, or other reorganization, (c) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current direct or indirect

| 10 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |

control of Tenant, (d) sublet any portion of the Premises, (e) grant any license, concession, or other right of occupancy of any portion of the Premises, (f) permit the use of the Premises by any parties other than Tenant, or (g) sell or otherwise transfer, in one or more transactions, a majority of Tenant’s assets (any of the events listed in Section 10.1(a) through 10.1(g) being a “Transfer”).

10.2 Consent Standards. Landlord shall not unreasonably withhold its consent to any assignment of Tenant’s entire interest in this Lease or subletting of the Premises, provided that the proposed transferee (a) is creditworthy, (b) will use the Premises for the Permitted Use (thus, excluding, without limitation, uses for credit processing, telemarketing, and co-working) and will not use the Premises in any manner that would conflict with any exclusive use agreement or other similar agreement entered into by Landlord with any other tenant of the Project or any related complex, (c) will not use the Premises, Building or Project in a manner that would materially increase Operating Costs or the pedestrian or vehicular traffic to the Premises, Building or Project, (d) is not a governmental or quasi-governmental entity, or subdivision or agency thereof, or any other entity entitled to the defense of sovereign immunity, (e) is not another occupant of the Project or any related complex or an Affiliate of such occupant, (f) is not currently and has not in the past been involved in litigation with Landlord or any of its Affiliates, (g) meets Landlord’s reasonable standards for tenants of the Project and any related complex and is otherwise compatible with the character of the occupancy of the Project and any related complex, and (h) is not a person or entity with whom Landlord is then, or has been within the nine-month period prior to the time Tenant seeks to enter into such assignment or subletting, negotiating to lease space in the Project or any related complex or any Affiliate of any such person or entity; otherwise, Landlord may withhold its consent in its sole discretion. Additionally, Landlord may withhold its consent in its sole discretion to any proposed Transfer if any Event of Default by Tenant then exists. Any Transfer made while an Event of Default exists hereunder, irrespective whether Landlord’s consent is required hereunder with respect to the Transfer, shall be voidable by Landlord in Landlord’s sole discretion. In agreeing to act reasonably, Landlord is agreeing to act in a manner consistent with the standards followed by large institutional owners of commercial real estate and Landlord is permitted to consider the financial terms of the Transfer and the impact of the Transfer on Landlord’s own leasing efforts and the value of the Project. Landlord may condition its consent to a Transfer on an increase in the Security Deposit or receipt of a guaranty from a suitable party. Landlord shall not be required to act reasonably in considering any request to pledge or encumber this Lease or any interest therein.

10.3 Request for Consent. If Tenant requests Landlord’s consent to a Transfer, then, at least 15 business days prior to the effective date of the proposed Transfer, Tenant shall provide Landlord with a written description of all terms and conditions of the proposed Transfer, copies of the proposed documentation, and the following information about the proposed transferee: name and address of the proposed transferee and any entities and persons who own, control or direct the proposed transferee; reasonably satisfactory information about its business and business history; its proposed use of the Premises; banking, financial, and other credit information; and general references sufficient to enable Landlord to determine the proposed transferee’s creditworthiness and character. Tenant shall also reimburse Landlord immediately upon request for its reasonable attorneys’ fees and other expenses incurred in connection with considering any request for consent to a Transfer (whether or not consent is granted) and in documenting (and negotiating the terms of) Landlord’s consent (which shall not exceed $2,500 for consents to subleases provided Landlord’s standard consent to sublease form is used without material modification or negotiation). If Landlord does not consent to a Transfer, Tenant’s sole remedy against Landlord will be an action for specific performance or declaratory relief, and Tenant may not terminate this Lease or seek monetary damages.

10.4 Conditions to Consent. If Landlord consents to a proposed Transfer, then the proposed transferee shall deliver to Landlord a written agreement on Landlord’s consent form whereby it expressly assumes Tenant’s obligations hereunder (among other terms and conditions reasonably required by Landlord in connection with providing its consent); however, any transferee of less than all of the space in the Premises shall be liable only for obligations under this Lease that are properly allocable to the space subject to the Transfer for the period of the Transfer. No Transfer shall release Tenant from its obligations under this Lease, but rather Tenant and its transferee shall be jointly and severally liable therefor. Landlord’s consent to any Transfer shall not waive Landlord’s rights as to any subsequent Transfers and no subtenant of any portion of the Premises shall be permitted to further sublease any portion of its subleased space. If an Event of Default occurs while the Premises or any part thereof are subject to a Transfer, then Landlord, in addition to its other remedies, may collect directly from such transferee all rents becoming due to Tenant and apply such rents against Rent. Tenant authorizes its transferees to make payments of rent directly to Landlord upon receipt of notice from Landlord to do so following the occurrence of an Event of Default hereunder. Tenant shall pay for the cost of any demising walls or other improvements necessitated by a proposed subletting or assignment.

| 11 | 0000 XXXXXXXX XXXXXXX – XXXXX XXXXXXXX XXXXX, XX 00000 4812-0074-7958.V2 |