ASSET PURCHASE AGREEMENT

Exhibit 10.1

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) is effective as of the 1st day of June, 2016 (the “Effective Date”) by and among: Hanwood Arkansas, LLC, an Arkansas limited liability company, and Hanwood Oklahoma, LLC, an Oklahoma limited liability company (collectively Hanwood Arkansas, LLC, and Hanwood Oklahoma, LLC, shall be referenced as the “Hanwood Entities” or “Sellers”); and Command Center, Inc., a Washington corporation (“Command Center” or “Buyer”).

RECITALS

A. Sellers desire to sell to Buyer and Buyer desires to purchase from Sellers, on the terms and subject to the conditions of this Agreement, all the assets and properties of Sellers, with the exception only of those assets and properties described in Schedule 2.1 attached to this Agreement (the “Excluded Assets”).

B. Through two office locations, Sellers are the owners and operators of a staffing business that operated collectively as “Xxxxxxx Staffing” providing temporary workers in day labor, light industrial, as well as office and clerical positions (the “Sellers’ Business”).

C. Buyer is also in the staffing business as the owner and operator of approximately 60 staffing offices located in 20 states.

AGREEMENTS

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants, conditions, and agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties, the parties to this Agreement hereby agree as follows:

1. Purchase and Sale. Subject to the terms and conditions of this Agreement and with the exception of the Excluded Assets, Sellers agree to sell, convey, transfer, assign, and deliver to Buyer, and Buyer agrees to purchase from Sellers on the Closing Date, free and clear of any liens or encumbrances, all rights, title and interest of the assets and property rights, now owned or hereafter acquired, whether tangible or intangible, which will include all fixtures, furnishings and equipment; all inventories, goods and supplies; all telephone listings and telephone numbers; all software and software licenses, and all passwords, codes and documentation needed for use of the same; all financial records relating to Sellers’ Business (including historical records and information); all permits, licenses, franchises and any other authorization obtained from federal, state or local governments or agencies necessary to operate Sellers’ Business; goodwill; all real property leases and leasehold improvements, including prepaid rent and deposits; books and records, all corporate files, and archives; all customer lists and other customer information; all signs and signage at or within the offices of Sellers; assignment of all contracts requested by Command Center, including employee contracts, equipment leases, vendor and customer contracts; prepaid deposits, including lease deposits; and all other assets and property of every kind and description, all of which are referred to collectively in this Agreement as the “Assets.”

The Assets to be conveyed, transferred, assigned, and delivered as provided by this Agreement will include, without limitation, the following, which may be set forth in additional detail in Schedule A of the Xxxx of Sale attached to this Agreement:

1.1. Leasehold Interests in Real Property. All leasehold interests held by Sellers in all land, buildings, structures, fixtures, and other improvements located on or attached to such Leasehold Interests and all easements and other rights, title or interests appurtenant to, including but not limited to security deposits, reserves or unpaid rents paid in connection therewith, or owned or used by Sellers (“Leasehold Interests”), including, without limitation, the Leasehold Interests described on Schedule 1.1 attached to this Agreement;

1.2. Inventory. All raw equipment, materials, work in process, and finished goods produced or used in Sellers’ business (“Inventory”);

1.3. Personal Property. All equipment, tools, machinery, furniture, motor vehicles, computers, telephones, supplies, materials, and other tangible personal property used in any manner in connection with Sellers’ Business, whether owned or leased (“Personal Property”), including, but not limited to all items listed in the Xxxx of Sale, attached hereto as Exhibit A;

1.4. Contractual Rights. As may be requested by Buyer, any and all rights in any manner related to the ownership, possession, lease, or use of the Assets or to the ownership, operation, or conduct of Sellers’ Business, rights in or claims under leases, permits, licenses, franchises, purchase and sales orders, covenants not to compete, and all other contracts of any nature whatsoever (“Contractual Rights”);

1.5. Vehicles. Sellers’ interest in all vehicles owned or leased by Sellers and described on Schedule 1.5 attached to this Agreement;

1.6. Books and Records. All of Sellers’ books, records, and other documents and information relating to the Assets and Sellers’ business, including, without limitation, all customer and supplier lists, past and present contracts, sales literature, inventory records, purchase orders and invoices, sales orders and sales order log books, commission records, correspondence, product data, price lists, quotes and bids, catalogues and brochures of every kind and nature; Sellers may maintain copies of all financial and other information which may be necessary or helpful in any audit of state or federal taxes, workers compensation or any other business purpose;

1.7. Intellectual Property. All of the following in any manner related to the ownership, possession, or use of the Assets or to the ownership, operation, or conduct of Sellers’ business (“Intellectual Property”), including, without limitation, the Intellectual Property described below:

A. All trade names, trademarks, service marks, and trade dress, including all registrations, renewals, extensions and applications, including, without limitation, all rights to the names “Xxxxxxx Staffing”, “Xxxxx Labor & Staffing” (and any reasonably similar derivations thereof and any related trademarks and services marks), any telephone, telecopy numbers, all universal resource locators (“URL’s”) domain names (including, if any, the domain names for “Xxxxxxx Staffing”, “Xxxxx Labor & Staffing”, and copyright for associated websites), website, social networking and internet addresses, domain names (including “xxxxxxxxxxxxxxx.xxx”, “xxxxxxxxxx.xxx” and “xxxxxxxxxxxxx.xxx”), electronic mail addresses (including “@xxxxxxxxxxxxxxx.xxx”, @xxxxxxxxxx.xxx”, and “@xxxxxxxxxxxxx.xxx”), company and any trade names related thereto or to the Sellers’ Business. (collectively the “Trademarks”), this shall include all legal rights and interest currently owned and possessed by individual shareholders or owners of either of Sellers to any such names and information contemplated within this paragraph 1.7;

|

B.

|

All patents and patent applications, including all inventions contained therein, any reissue, continuation, partial continuation, division, extension, or reexamination thereof (collectively, the “Patents”);

|

|

C.

|

All copyrights and mask works, registered or unregistered, statutory or common law, including all applications for registration therefor (collectively, the “Copyrights”);

|

|

D.

|

All trade secrets, know-how, inventions, models, confidential business information, product designs, processes, drawings, formulae, customer lists, historical customer information, supplier and distribution lists, price lists, customer files, computer programs and software, technical and engineering data, trade information, catalogs, marketing materials, and software (collectively, the “Other Proprietary Rights”); and

|

|

E.

|

Except as contained within Schedule 2.1 (Excluded Assets), all licenses or similar agreements to which Sellers are a party, either as licensee or licensor, relating to Trademarks, Patents, Copyrights, or Other Proprietary Rights (collectively, the “Licenses”);

|

1.8. Goodwill. Goodwill, all tangible and intangible, which relate to the operation of Sellers’ Business and all rights to continue to use the Assets in the conduct of the going business;

1.9. Receivables. All accounts or notes receivable owing to Sellers as of 11:59 p.m., June 3, 2016, including, without limitation, all customer accounts receivable (collectively, the “Receivables”);

1.10. Intangible Property. All intangible property, other than previously described, of Sellers in any manner related to the ownership, operation, or conduct of Sellers’ Business (“Intangible Property”);

1.11. Prepaid Expenses. All prepaid expenses, credits, advance payments, claims, security, refunds, rights of recovery, rights of set-off, rights of recoupment, deposits, charges, sums and fees (including any such item relating to the payment of any taxes) with respect to the Assets and Assumed Liabilities; and

1.12. Miscellaneous Assets. Any and all other assets, properties, rights, or other interests of Sellers, tangible or intangible, used in connection with Sellers’ business or in any way relate to the Assets including, without limitation, all of Sellers’ interest in any applicable covenants not to compete.

2. Excluded Assets; Assumed Liabilities.

2.1. Excluded Assets. Buyer will not assume or be deemed to have purchased the Excluded Assets set forth on Schedule 2.1 attached to this Agreement.

2.2. Assumed Liabilities. Buyer will not assume or be deemed to have assumed, or to have any obligations with respect to, any liabilities or obligations of Sellers other than the contracts, liabilities and obligations specifically assumed pursuant to this Section 2.2 and specified on Schedule 2.2 (“Assumed Liabilities”). All liabilities and obligations of Sellers other than those listed on Schedule 2.2 will remain solely the liabilities and obligations of Sellers (the “Retained Liabilities”).

3. Purchase Price; Closing.

3.1. Purchase Price. The purchase price for the Assets will be paid by the assumption of the Assumed Liabilities and by the payment of Two Million Two Hundred Thousand Dollars ($2,200,000) (“Purchase Price”). The parties agree that the purchase price for the Assets owned by Hanwood Oklahoma is $1,391,000 and the purchase price for the Assets owned by Hanwood Arkansas is $809,000. Subject to the terms of section 3.2, the balance of the purchase price shall be due and payable to Sellers, without interest, on the one-year anniversary of the Closing date.

3.2. Payment of Purchase Price. Subject to the terms and conditions of this Agreement, in reliance on the representations, warranties, and agreements of Sellers contained herein and in consideration of the aforesaid assignment and delivery of the assets of Seller, Buyer will deliver at the Closing, as hereinafter defined, as partial payment of the purchase price the sum of One Million Nine Hundred Eighty Thousand Dollars ($1,980,000) in cash, ACH transfers, certified checks, or cashier’s checks, to be paid to the Sellers, with $1,164.511.58 paid to Hanwood Oklahoma, $728,046 being paid to Hanwood Arkansas, and $87,442.42 paid to Arvest Bank (as set forth in section 3.2.2). Subject to the terms of section 3.2, one year from the date of the Closing, Buyer will pay to Sellers the remainder of the Purchase Price, without interest, in the amount of $219,955.00, with $139,106 paid to Hanwood Oklahoma and $80,849 being paid to Hanwood Arkansas. Buyer may deduct such amounts from the remaining purchase price balance to satisfy any claims, losses, liabilities or obligations threatened or imposed in any way on Buyer as the result of Sellers’ Business, from any misrepresentations or omissions in this Agreement, whether intentional or not, or from any items set forth in this Agreement or any other agreements or documents executed in conjunction with this Agreement. However, in the event the parties do not agree with Buyer’s assessment and withholding from the retained amount of the Purchase Price, the parties will work together in good faith to resolve the issue. If all attempts at amicable resolution should fail, the parties agree to have the matter of payment of the retained amount of the purchase price decided by binding arbitration before a single arbitrator to take place in Little Rock, Pulaski County, Arkansas administered pursuant to the commercial rules of the American Arbitration Association in effect at the time the arbitration is commenced. Nothing in this section 3.2 shall obligate the parties to participate in arbitration or other alternate dispute resolution proceedings for any other matter or issue of any kind, including other matters or issues contemplated in or by this Agreement.

3.2.1. Adjustment. Seller and Buyer agree that there shall be an adjustment made within ninety (90) days of the Closing Date to adjust for any liabilities, other than the Assumed Liabilities, or misapplication of payments that are found to exist of the Seller as of the Closing Date or thereafter, as such liabilities may relate to the Purchased Assets or the business of Seller. Any money paid to Seller after the Closing for products or services provided by Buyer after the Closing and any other accounts receivables will be paid over to Buyer without demand; however, if Buyer demands such payment from Seller, Seller shall provide payment to Buyer within three (3) business days. Failure to make a demand shall not result in any waiver of Buyer’s rights.

3.2.2. Payment to Arvest Bank. The Parties acknowledge that Arvest Bank has filed a UCC Financing Statement (UCC1) in the State of Oklahoma, County of Oklahoma, covering certain collateral owned by Hanwood Oklahoma, LLC. Specifically, Arvest Bank has filed UCC Financing Statement document number 20120524020553100 as of May 12, 2102 (hereinafter “the UCC Statement”). At or prior to Closing, Buyer will provide attorney Xxxxxx Xxxxxxx with payment in the amount of $87,442.42, or such other amount as is then specified by Arvest Bank to be the then-current payoff amount, made payable to Arvest Bank to be held in trust until such time as Arvest Bank provides an executed and filed copy of the UCC Financing Statement Amendment (generally Form UCC3), terminating the UCC Statement. Upon receipt of the filed termination of the UCC Statement, attorney Xxxxxx Xxxxxxx shall then release payment to Arvest Bank, which will satisfy all remaining debt owed by Hanwood Oklahoma, LLC, to Arvest Bank and will operate to release any and all encumbrances Arvest Bank has against any and all property and assets owned or leased by Hanwood Oklahoma, LLC. Release of the remaining Purchase Price funds due at Closing to the Hanwood Entities is contingent upon Arvest Bank providing Buyer with the filed termination of the UCC Statement.

3.3. Allocation of the Purchase Price. Buyer and Sellers agree to cooperate in reporting the allocation of the Purchase Price as provided on the attached Schedule 3.3.

3.4. Closing Date. The “Closing Date” or “Closing” will occur on June 3, 2016, at 11:59 p.m., CST, and will take place at the offices of Buyer at 0000 X. Xxxxxxxxx Xxxxxxxxx, Xxxxx 000, Xxxxxxxx, Xxxxxxxx, or at such other time and place as the parties may agree to in writing.

3.4.1. Control. At Closing and upon payment of the Purchase Price to Sellers, Buyer shall have sole and unfettered operational control, possession and right to occupancy of the Assets.

3.4.2. Deliveries at Closing. At the Closing: (a) Sellers shall deliver to Buyer the duly executed various agreements, certificates, instruments and documents referred to in Section 9.1; (b) Buyer shall deliver to Sellers the duly executed various agreements, certificates, instruments and documents referred to in Section 9.2; (c) Buyer will deliver payment of $1,980,000 to Sellers as partial payment of the Purchase Price payable at the Closing as specified in Section 3.2;

3.4.3. Risk and Loss Prior to Closing. Subject to the provisions of Section 3.4.1, possession and title of the Assets will be given to Buyer at the Closing, and assumption of the Assumed Liabilities will occur at the Closing. Buyer will not acquire any title to the Assets or assume any of the Assumed Liabilities until possession has been given to it in accordance with this Section 3.4 and accordingly, all risk and loss with respect to the Assets will be borne by Sellers until possession has been given to Buyer at the Closing.

3.5. Payment of Taxes and Other Charges. Sellers will pay any and all transaction privilege tax, sales tax, use tax, property tax, income tax, payroll tax, excise tax, business and occupation tax, or other transfer fee, tax, charge, or assessment which may be imposed by any governmental agency with respect to the sale, transfer, conveyance, and assignment of the Assets and Assumed Liabilities pursuant to this Agreement.

4. Conditions to Obligation of Buyer to Perform. The obligation of Buyer to purchase the Assets and assume the Assumed Liabilities from Sellers at the Closing is subject to the satisfaction, on or before the Closing Date, of all of the following conditions precedent, any or all of which may be waived by Buyer by delivery to Sellers of a written notice of such waiver:

4.1. Due Diligence. Buyer, in its sole and unrestricted discretion, shall be satisfied with the results of its due diligence investigation as regards Sellers, the Assets, and Sellers’ representations made in this Agreement;

4.2 Representations and Warranties True on the Closing Date. The representations and warranties of Sellers contained in this Agreement, in the exhibits and schedules attached hereto, including those contained in Schedule 4.2, or in any certificate, document, or statement delivered pursuant to the provisions hereof, will be true and correct on and as of the Closing Date as though such representations and warranties were made on and as of the Closing Date;

4.3. Compliance with Agreement. Sellers will have performed and complied with all agreements, covenants, conditions, and obligations required by this Agreement prior to or on the Closing Date;

4.4. Key Personnel Non-competition/Non-solicitation Agreements. Xxxxx Xxxxxxx, Xxxx Xxxxxxxx and Xxxxxx Xxxxxx Xxxxx will each have duly executed and delivered a non-compete/non-solicitation agreement, in the form attached to this Agreement as Exhibit B, in which each of them agrees for a period of two years not to compete with or solicit the business conducted by Buyer through the Assets purchased and not to solicit or hire for employment any individual employed by Buyer or who was at the time of the Closing working at or for any of the offices comprising the Assets;

4.5. Hanwood Entities’ Covenants not to Compete. Sellers will have executed and delivered a non-competition agreement, in the form attached to this Agreement as Exhibit C, wherein Seller agrees that for a period of two years from the Closing it will not compete with or solicit the business conducted by Buyer, nor will they place temporary workers or other employees to work on any job or project within the same time period;

4.6. Legal Opinion. Sellers will provide a legal opinion from Seller’s legal counsel in from and content substantial to the form of Exhibit D and acceptable to Buyer;

4.7. Third Party Consents. Sellers will have obtained all consents, waivers, permits, approvals, and authorizations and completed all filings or registrations required and will have delivered executed copies or other written evidence thereof to Buyer;

4.8. Transfer of Licenses. Except as contained within Schedule 2.1, Sellers will have transferred or assigned to Buyer on or before the Closing Date all licenses, permits, franchises, certificates, and authorizations which are transferable or assignable and which are required or necessary to enable Buyer to operate and conduct Sellers’ Business in the manner in which Sellers currently operate and conduct their business;

4.9. Assignment of Warranties. Sellers will assign to Buyer any and all warranties covering or affecting the Personal Property or Inventory;

4.10. Taxes. Sellers will have delivered to Buyer evidence of payment showing that no taxes are due in any state, county, or municipal jurisdictions where such taxes are required to be paid by Sellers, and Sellers will have filed all relevant and required returns and reports;

4.11. Assignment of Leases. The Lease Assignment and Assumption Agreement attached hereto in Exhibit E have been duly executed;

4.12. No Action. No action or proceeding before any court or governmental body will be pending or threatened wherein an unfavorable judgment, decree, injunction or order would prevent the carrying out of this Agreement or any of the transactions contemplated hereby, declare unlawful the transactions contemplated by this Agreement or cause such transactions to be rescinded.

4.13. Due Diligence. Buyer shall have completed, and shall be satisfied (in Buyer’s sole discretion) with the results of, all due diligence Buyer may elect to perform regarding the Assets or Seller’s Business.

4.14. Approval of Documentation. The form and substance of all certificates, instruments, opinions, and other documents and information delivered to Buyer under this Agreement and required to carry out this Agreement will be approved by Buyer and/or counsel for Buyer, and in the event any such certificates, instruments, opinions, or any other documents or information delivered to Buyer does not meet with the approval of Buyer and/or counsel for Buyer, Buyer shall have the express right to unilaterally withdraw from this Agreement, without penalty;

5. Conditions to Obligation of Sellers to Perform. The obligation of Sellers to sell the Assets at the Closing is subject to the satisfaction, on or before the Closing Date, of all of the following conditions precedent, any or all of which may be waived by Sellers by delivery to Buyer of a written notice of such waiver:

5.1. Representations and Warranties True on the Closing Date. The representations and warranties of Buyer contained in this Agreement, in the exhibits and schedules attached hereto, or in any certificate, document, or statement delivered pursuant to the provisions hereof, will be true and correct on and as of the Closing Date as though such representations and warranties were made on and as of the Closing Date; and

5.2. Compliance with Agreement. Buyer will have performed and complied with all agreements, covenants, conditions, and obligations required by this Agreement prior to or on the Closing Date.

6. Representations and Warranties of Sellers. Sellers represent and warrant to Buyer that, as of the Effective Date and as of the Closing the following are true and accurate. The representations and warranties contained in sections 6.7 and 6.25 are subject to the financial and other information presented to Buyer in the course of Buyer’s due diligence investigation:

6.1. Organization and Standing. Hanwood Arkansas, LLC, is a limited liability company duly organized, validly existing, and in good standing under the laws of the State of Arkansas. Hanwood Oklahoma, LLC, is a limited liability company duly organized, validly existing, and in good standing under the laws of the State of Arkansas. Sellers are qualified to do business as foreign corporations under the laws of each jurisdiction where Sellers conduct their business outside of their respective states of incorporation. Sellers have the requisite corporate power and authority to own, lease, and operate its properties and are duly authorized and licensed to carry on their businesses in the places where, and in the manner in which, such business is presently being conducted.

6.2. Capacity. Sellers have full corporate power, legal capacity, and authority to execute and deliver this Agreement, to consummate the transactions contemplated hereby, and to perform their obligations under this Agreement. The execution and delivery of this Agreement, the consummation of the transactions contemplated hereby, and the performance of Sellers’ obligations under this Agreement have been duly authorized by Sellers’ shareholders and no other corporate proceedings on the part of the Sellers are necessary in connection therewith. This Agreement constitutes, and each other agreement or instrument to be executed and delivered by Sellers in connection with this Agreement will constitute, valid and binding obligations of Sellers, enforceable against Sellers in accordance with their respective terms.

6.3. Compliance with Member Rights. Sellers have complied or will comply with all shareholder-dissent and appraisal right statutes in entering into and consummating this transaction and shall have obtained at or prior to the Closing Date all necessary authorizations and approvals required for the execution, delivery and consummation of the transactions provided for in this Agreement.

6.4. Authority. Neither the execution and delivery of this Agreement by Sellers, the consummation of the transactions contemplated hereby, nor the performance of Sellers’ obligations hereunder will: (a) violate any provisions of the Articles of Incorporation, Operating Agreements or Bylaws of Sellers; (b) violate any statute, code, ordinance, rule, or regulation of any jurisdiction applicable to Sellers or the Assets or Assumed Liabilities; (c) violate any judgment, order, writ, decree, injunction, or award of any court, arbitrator, mediator, government, or governmental agency or instrumentality, which is binding upon Sellers or which would have an adverse effect on the Assets or Assumed Liabilities or the operation and conduct of Sellers’ businesses; or (d) violate, breach, conflict with, constitute a default under (whether with or without notice or lapse of time, or both), result in termination of, or accelerate the performance required by, any of the terms, conditions, or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement, or other instrument or obligation to which Sellers is a party or by which Sellers, the Assets or Assumed Liabilities, or Sellers’ Business is bound, except for obligations under loan agreements to be paid and terminated at Closing.

6.5. Consents. No consents, approvals, filings, or registrations with or by any federal, state, or local court, administrative agency or commission or other governmental authority or instrumentality, whether domestic or foreign (each a “Governmental Entity”) or any other person or entity are necessary in connection with the execution and delivery by Sellers of this Agreement, the consummation by Sellers of the transactions contemplated hereby, or the performance of Sellers’ obligations under this Agreement, except for obligations under loan agreements to be paid and terminated at Closing.

6.6. Absence of Defaults. Sellers are not in default under, or in violation of, any provision of their respective Articles of Incorporation, Operating Agreements or Bylaws of Sellers or any indenture, mortgage, deed of trust, loan agreement, or similar debt instrument, or any other agreement to which Sellers are a party or by which Sellers are bound or to which any of their properties are subject, nor are Sellers aware of any fact, circumstance, or event that has occurred which, upon notice, lapse of time, or both, would constitute such a default or violation. Sellers are not in violation of any statute, rule, regulation, or order of any Governmental Entity having jurisdiction over Sellers or any of their properties.

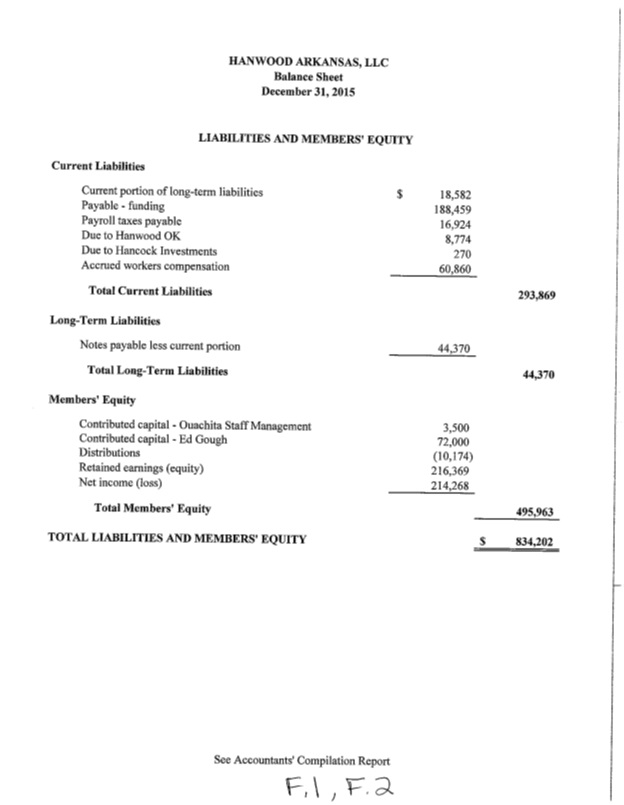

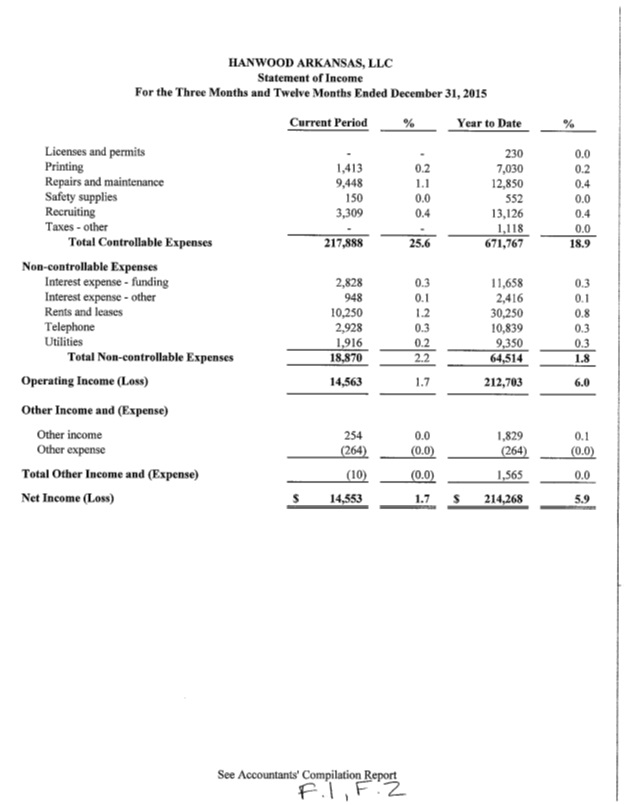

6.7. Financial Statements. The following documents are attached hereto as Exhibit F: unaudited statements of each of the Seller’s income and expenses for the twelve month periods ended December 25, 2015, and December 26, 2014 (collectively referred to as “Financial Statements”). The Financial Statements do not contain any untrue statement of material fact or omit to state any material fact necessary to make the statements or information therein not misleading. The Financial Statements have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”), applied on a consistent basis for the periods indicated, and each of the Financial Statements is a compilation of the books and records of the Sellers. Such Financial Statements disclose that Hanwood Arkansas and Hanwood Oklahoma are each solvent and will not be rendered insolvent by the consummation of the transactions contemplated by this Agreement.

Asset Purchase Agreement

Page 9 of 79

6.8. Absence of Specified Changes. From January 1, 2016, through the Closing Date there has not been any:

A. Transactions by Sellers except in the ordinary course of business;

B. Capital expenditures by each of Sellers exceeding $5,000;

C. Adverse change in the Assets, the financial condition, liabilities, business, operations, or prospects of Sellers;

D. Destruction, damage to, or loss of any of the Assets (whether or not covered by insurance) that adversely affects the financial condition, business, operations, or prospects of Sellers;

E. Loss of key employees, suppliers, or customers or other event or condition of any character adversely affecting the Assets, the financial condition, business, or prospects of Sellers;

F. Change in accounting methods or practices (including, without limitation, any change in depreciation or amortization policies or rates) by Sellers;

G. Revaluation by Sellers of any of the Assets;

H. Increase in the salary or other compensation payable, or to become payable, by Sellers to any of its employees, or any declaration, payment, commitment, or obligation of any kind for the payment by Sellers of a bonus or other additional salary or compensation to any such person;

I. Hiring or promoting any person or hiring or promoting any employee except to fill a vacancy in the ordinary course of business;

J. Adoption, modification or termination of any: (i) employment, severance, retention or other agreement with any current or former employee, officer, director, independent contractor or consultant of Sellers, (ii) Benefit Plan, or (iii) collective bargaining or other agreement with a Union, in each case whether written or oral;

K. Acquisition or disposition of any of the Assets, except in the ordinary course of business;

L. Amendment or termination of any contract, agreement, or license to which Sellers is a party, except in the ordinary course of business;

M. Loan by Sellers to any person or entity, or guaranty by Sellers of any loan which may any in any way affect the Assets;

Asset Purchase Agreement

Page 10 of 79

N. Mortgage, pledge, security interest, lien, or other encumbrance of any of the Assets;

O. Waiver or release of any right or claim of Sellers, except in the ordinary course of business;

P. Other event or condition of any character that has or might have an adverse effect on the Assets, or the financial condition, business, or prospects of Sellers and Sellers’ Business;

Q. Incurrence of any liability or obligation (whether absolute, accrued, or contingent) affecting the Sellers, Sellers’ Business or the Assets;

R. Distribution on account of any Members’ interest or other equity security, including, without limitation, any dividend or redemption;

S. Issuance or sale of any ownership or member shares or any options, warrants or other rights to acquire any ownership interest any kind in the Sellers’ businesses; and

T. Agreement or any action or omission by Sellers that would result in any of the things described in the preceding Subsections A. through S., inclusive.

6.9. Litigation and Claims. Sellers are not a party to any and there are no pending or threatened suit, action, arbitration, legal, administrative, or other proceeding or governmental investigation against Sellers or affecting the Assets, the operation and conduct of Sellers’ Business or their prospects, or challenging the validity or propriety of or seeking to enjoin or to set aside the transactions contemplated by this Agreement. To the best of Sellers’ knowledge, there is no basis for the assertion of any such proceeding, claim, action, or governmental investigation that could affect the Assets or Sellers’ ability to transfer the Assets to Buyer. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such actions. Sellers are not a party to any judgment or decree, nor are Sellers in default with respect to any order, writ, injunction, or decree of any federal, state, local, or foreign court, department, agency, or instrumentality which will, or is likely to, affect the Assets, Sellers’ title thereto, the ability of Sellers to perform its obligations under this Agreement, or Sellers’ Business or prospects. No event has occurred or circumstances exist that may constitute or result in (with or without notice or lapse of time) a violation of any governmental orders. Sellers are not parties to any legal or administrative action or proceeding, including any lawsuit of any kind or nature.

6.10. Compliance with Laws. Sellers are in compliance with and not in default under any applicable foreign, federal, state, and local statutes, regulations, ordinances, zoning laws, engineering standards, safety standards, environmental standards, and any other applicable laws in connection with the ownership and use of the Assets and the conduct and operation of Sellers’ Business. Sellers hold all required franchises, permits, licenses, certificates, and authorizations necessary or appropriate in connection with the ownership and use of the Assets and the conduct and operation of Sellers’ Business, and all are current and valid as of the Effective Date and the Closing Date. All fees and charges with respect to such permits, licenses, franchises, certificates or authorizations have been paid in full. No event has occurred that, with or without notice or lapse of time or both, would reasonably be expected to result in the revocation, suspension, lapse or limitation of any permits, licenses, franchises, certificates or authorizations.

Asset Purchase Agreement

Page 11 of 79

6.11. Intellectual Property. Sellers (a) own and possess all right, title, and interest in and to the Intellectual Property, free and clear of all liens, security interests, and encumbrances, except for obligations under loan agreements to be paid and terminated at Closing and no claim has been made or threatened by any third party against Sellers contesting the validity, enforceability, use, or ownership of the Intellectual Property, and (b) have and possess valid rights to use, all Intellectual Property contemplated by this Agreement, and immediately after the Closing, Buyer will have the right and authority to use the Intellectual Property in the operation of the Assets that have been transferred by operation of this Agreement. Such use does not and will not conflict with, infringe upon, or violate the proprietary rights of any other person or entity. Neither Sellers nor any of their officers, directors, shareholders or employees have received any notice of, or is aware of any fact which would indicate a likelihood of, any infringement of, misappropriation by, or conflict with any third party with respect to the Intellectual Property. Sellers have not infringed, misappropriated, or otherwise engaged in any conduct which conflicted with any proprietary rights of any third parties in the Intellectual Property, nor are Sellers aware of any infringement, misappropriation, or conflict which will occur as a result of the continued operation of Sellers’ business as they are presently conducted or by use of Buyer of same. No event or circumstance has occurred that, with notice or lapse of time or both, would constitute an event of default under any Intellectual Property agreement or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of any benefit thereunder. The transactions contemplated by this Agreement will not adversely affect Sellers’ rights with respect to the Intellectual Property or Sellers’ ability to transfer to Buyer Sellers’ right, title, and interest in and to the Intellectual Property. All registrations relating to the Intellectual Property, if any, were validly issued and are currently in full force and effect. Sellers will execute such documents as may be necessary and will otherwise cooperate with Buyer to have any such registrations assigned to Buyer or re-registered in Buyer’s name. Sellers have not granted to any third party any license, right, or other interest in the Intellectual Property. Sellers have taken all action necessary or appropriate to protect their rights with respect to the Intellectual Property, and will continue to preserve and protect their rights in the Intellectual Property prior to the Closing.

6.11.1. Insider Interests. No officer or director of Sellers has any interest in any material property, real or personal, tangible or intangible, including without limitation any computer software or Sellers’ Intellectual Property used in or pertaining to the business of Sellers.

6.12. Title to Assets. Sellers have good and marketable title to the Assets, free and clear of all liens, deeds of trust, mortgages, pledges, charges, security interests, encumbrances, claims, conditional sales agreements, easements, licenses, rights-of-way, covenants, conditions, restrictions on transfer, or other restrictions or other rights of third parties, except for obligations under loan agreements to be paid and terminated at Closing. All Assets are adequate for their intended use, in good operating condition and repair, reasonable wear and tear excepted, are sufficient for the conduct of the Sellers’ businesses as currently conducted and as proposed to be conducted up to the Closing and are available for immediate use in Sellers’ Business.

Asset Purchase Agreement

Page 12 of 79

6.13. Contractual Rights. Sellers have performed all obligations required to be performed to date under all Contractual Rights, contracts, written or oral, including contracts to provide services to customers and employment contracts with Sellers’ temporary workforce, entered into in the normal course of business to which Sellers are parties and which affect the Assets, Sellers’ title to the Assets, or the operation and conduct of Sellers’ title to the Assets, or the operation and conduct of Sellers’ business, including, but not limited to, leases, guaranties, indemnifications of any third person or entity, licenses, commission agreements, distribution and advertising agreements, loan agreements (whether as borrower or lender), franchises and permits, distributors’ or manufacturers’ representative or agency agreements, output and requirements agreements, are not in default under any such contracts, have no knowledge of any event or knows of no facts that, with notice or lapse of time, or both, would constitute a default by any party to any such contracts, and has no information that any party to any such contracts intends to cancel or terminate such contracts. Sellers are not party to, nor is their property bound by, any contract that may have an adverse effect on their financial condition, assets, business, or prospects.

6.14. Leasehold Interests. The representations, warranties, and statements of Sellers regarding the Leasehold Interests are complete, current, and accurate, do not contain or will not contain any untrue statement of material fact, and do not omit or will not omit to state any fact necessary to make each such representation, warranty, or statement accurate and not misleading in any material respect. As to the Leasehold Interests: (a) all leases under which the Sellers lease any real property (the “Real Property Leases”) are valid and in full force and effect and constitute binding obligations of the Sellers and the counterparties thereto, and Seller enjoys peaceful and undisturbed possession of the Real Property Leases, in accordance with their respective terms; (b) there are not any existing default by the Sellers under any of the Real Property Leases that would give the lessor under such Real Property Lease the right to terminate such Real Property Lease or amend or modify such Real Property Lease in a manner adverse to the Sellers or Buyer (after Closing); (c) no event has occurred which, after notice or lapse of time or both, would constitute a default by Sellers under any Real Property Lease, where such default if uncured would give the lessor under such Real Property Lease the right to terminate such Real Property Lease or amend or modify such Real Property Lease in a manner adverse to the Sellers or Buyer (after Closing); (d) Sellers have not subleased, assigned or otherwise granted to any person the right to use or occupy such Real Property Leases or any portion thereof; and (e) Sellers have not pledged, mortgaged or otherwise granted an encumbrance on its leasehold interest in any Real Property Lease.

6.15. Brokers. No broker or finder has acted for Sellers in connection with this Agreement or the transactions contemplated hereby and no broker or finder is entitled to any brokerage commissions, finder’s fee, or other compensation based on agreements or arrangements made by Sellers.

6.16. Capital Structure. Hanwood Arkansas, LLC, is a limited liability company duly organized pursuant to documents filed with the Secretary of State of Arkansas. Hanwood Oklahoma, LLC, is a limited liability company duly organized pursuant to documents filed with the Secretary of State of Oklahoma. Each of the Sellers is validly existing and in good standing under the laws of the state of their incorporation. Each of the Sellers has all requisite power to own its respective properties and interests and conduct its respective business as now conducted and as presently contemplated, and each is in good standing in each jurisdiction where a failure to be so qualified in such jurisdiction could have a material adverse effect on the business, assets or financial condition of such person or entity.

Asset Purchase Agreement

Page 13 of 79

6.16.1. Ownership of Hanwood Arkansas, LLC. The ownership of Hanwood Arkansas, LLC, is as follows:

Xxxxx Xxxxxxx Revocable Trust dated October 26, 2015 = 74% ownership

Devil Dog Management, LLC = 25% ownership

Ouachita Staff Management, Inc. = 1% ownership

No Membership Interests in the company is held in treasury. All of the outstanding shares or portions of Hanwood Arkansas, LLC’s Membership Interests have been duly authorized, are validly issued, fully paid, non-assessable, and have been issued in compliance with all applicable Laws. There are no outstanding or authorized options, warrants, purchase rights, preemptive rights, rights of first refusal, subscription rights, conversion rights, exchange rights, or other contracts or commitments that could require Hanwood Arkansas, LLC to issue, sell, or otherwise cause to become outstanding any of its Membership Interests. Hanwood Arkansas, LLC is not a party or subject to any agreement or understanding, and there is no agreement or understanding between any persons that affects or relates to the voting or giving of written consents with respect to any ownership or securities of Hanwood Arkansas, LLC or the voting by any Member or Manager of Hanwood Arkansas, LLC.

6.16.2 Ownership of Hanwood Oklahoma, LLC. Hanwood Oklahoma, LLC, is fully owned (100% ownership) by Ouachita Staff Management, Inc., an Arkansas corporation. No Membership Interests in the company is held in treasury. All of the outstanding shares or portions of Hanwood Oklahoma, LLC’s Membership Interests have been duly authorized, are validly issued, fully paid, non-assessable, and have been issued in compliance with all applicable Laws. There are no outstanding or authorized options, warrants, purchase rights, preemptive rights, rights of first refusal, subscription rights, conversion rights, exchange rights, or other contracts or commitments that could require Hanwood Oklahoma, LLC to issue, sell, or otherwise cause to become outstanding any of its Membership Interests. Hanwood Oklahoma, LLC is not a party or subject to any agreement or understanding, and there is no agreement or understanding between any persons that affects or relates to the voting or giving of written consents with respect to any ownership or securities of Hanwood Oklahoma, LLC or the voting by any Member or Manager of Hanwood Oklahoma, LLC.

6.17. Taxes.

Asset Purchase Agreement

Page 14 of 79

A. Sellers each have timely filed (or caused to be filed or will file before Closing) all federal, state, local, and foreign tax returns, reports, and information statements required to be filed by each of them, which returns, reports, and statements are true, correct, and complete in all material respects, and paid all taxes required to be paid as shown on such returns, reports, and statements. All taxes required to be paid in respect of the periods covered by such returns (“Return Periods”) have been paid. Sellers have fully accrued all unpaid taxes in respect of all periods (or the portion of any such periods) subsequent to the Return Periods. All taxes required to be paid to all federal, state and local taxing authorities where Sellers conduct Sellers’ Business have been paid. Seller represents there are no delinquent tax obligations to any federal, state or local taxing authority as regards the Assets or any place where Sellers conduct Sellers’ Business. No deficiencies or adjustments for any tax have been claimed, proposed, or assessed, or to the knowledge of Sellers, threatened as regards the Assets or Sellers’ Business. The Sellers’ federal and state income tax returns, respectively, are not the subject of any pending audit by the Internal Revenue Service and/or applicable state agencies. Sellers are not subject to any pending or, to the knowledge of Sellers, threatened tax audit or examination, and Sellers have not waived any statutes of limitation with respect to the assessment of any tax. For the purposes of this Agreement, the terms “tax” and “taxes” will include all federal, state, local, and foreign taxes, assessments, duties, tariffs, registration fees, and other governmental charges including, without limitation, all income, franchise, property, production, sales, use, payroll, license, windfall profits, severance, withholding, excise, gross receipts, and other taxes, as well as any interest, additions, or penalties relating thereto and any interest in respect of such additions or penalties. Sellers have provided Buyer true and correct copies of all tax returns, information, statements, reports, work papers, and other tax data reasonably requested by Buyer.

B. At the time of Closing, there are no liens for taxes upon the Assets. Sellers have not entered into any agreements, waivers, or other arrangements in respect of the statutes of limitations in respect of their respectable taxes or tax returns. Sellers have withheld all taxes required to be withheld in respect of wages, salaries, and other payments to all employees, officers, and directors and timely paid all such amounts withheld to the proper taxing authority. Sellers shall at all times remain responsible for payment of all taxes in any way resulting from the operation of Seller’ Business through the end of the day on the Closing.

C. All taxes required to be withheld or collected by the Sellers in connection with amounts paid or owing to any employee, independent contractor, creditor or shareholder have been withheld and collected and, to the extent required by law, timely paid to the appropriate Governmental Entity, and all Forms W-2 and 1099 have been completed and timely filed.

6.18. Undisclosed Liabilities. Sellers have no liabilities except for liabilities reflected or reserved against Sellers in the Financial Statements and current liabilities incurred in the ordinary course of business, except for obligations under loan agreements to be paid and terminated at Closing and except for any unknown or contingent claim.

6.19. Solvency. Sellers are solvent under all other applicable Laws.

Asset Purchase Agreement

Page 15 of 79

6.20. Tax Consequences. Sellers represent that they have consulted with a qualified attorney, tax advisor, or accountant and assumes the risk of all potential income tax risks associated with the transactions contemplated by this Agreement.

6.21. Employee Benefit Matters. Seller has not established any pension, benefit, retirement, compensation, employment, consulting, profit-sharing, deferred compensation, incentive, bonus, performance award, phantom equity, stock or stock-based, change in control, welfare, fringe-benefit and other similar agreement, plan, policy, program or arrangement (and any amendments thereto), in each case whether or not reduced to writing and whether funded or unfunded, including each “employee benefit plan” within the meaning of Section 3(3) of ERISA, whether or not tax-qualified and whether or not subject to ERISA, which is or has been maintained, sponsored, contributed to, or required to be contributed to by Seller for the benefit of any current or former employee, retiree, independent contractor or consultant or any spouse or dependent of such individual, or under which Seller or any of its ERISA affiliates has or may have any liability.

6.22. Employment Matters.

A. Sellers are not, and have not been for the past two years, a party to, bound by, or negotiating any collective bargaining agreement or other contract with a union, works council or labor organization (collectively, “Union”), and there is not, and has not been for the past two years, any Union representing or purporting to represent any employee of Sellers, and no Union or group of employees is seeking or has sought to organize employees for the purpose of collective bargaining.

X. Xxxxxxx are and have been in compliance with all applicable laws pertaining to employment and employment practices, including all laws relating to labor relations, equal employment opportunities, fair employment practices, employment discrimination, harassment, retaliation, reasonable accommodation, disability rights or benefits, immigration, wages, hours, overtime compensation, child labor, hiring, promotion and termination of employees, working conditions, meal and break periods, privacy, health and safety, workers’ compensation, leaves of absence and unemployment insurance. There are no actions against Sellers (individually or collectively) pending, or threatened to be brought or filed, by or with any governmental authority or arbitrator in connection with the employment of any current or former applicant, employee, consultant, volunteer, intern or independent contractor, including, without limitation, any claim relating to unfair labor practices, employment discrimination, harassment, retaliation, equal pay, wages and hours or any other employment related matter arising under applicable laws.

6.23. Customers. Sellers have not received any notice, and have no reason to believe, that any customer which has provided revenue of $100,000 or more to Sellers’ Business (through either of the offices or both) in 2015 (“Material Customers”) has ceased, or intends to cease after the Closing, to use the goods or services of the Offices or to otherwise terminate or materially reduce its relationship with the Offices.

Asset Purchase Agreement

Page 16 of 79

6.25. Full Disclosure. The representations, warranties, and statements of Sellers in this Agreement, in any exhibit or schedule attached hereto, or in any certificate or other document furnished by Sellers to Buyer pursuant to this Agreement are complete, current, and accurate, do not contain or will not contain any untrue statement of material fact, and do not omit or will not omit to state any material fact necessary to make each representation, warranty, or statement accurate and not misleading in any material respect. Sellers have, and prior to Closing will have, provided to Buyer, in writing, any information necessary to ensure that all representations, warranties, or statements made by Sellers to Buyer are complete, current, and accurate and are not misleading in any material respect.

7. Representations and Warranties of Buyer. Buyer represents and warrants to Sellers that, as of the Effective Date and as of the Closing Date:

7.1. Organization and Standing. Buyer is a corporation duly organized, validly existing, and in good standing under the laws of the State of Washington. Buyer has the requisite corporate power and corporate authority to own, lease, and operate its properties and is duly authorized and licensed to carry on its business in the places where and in the manner in which its business is presently being conducted and where the Assets are located.

7.2. Capacity. Buyer has full corporate power, legal capacity, and authority to execute and deliver this Agreement, to consummate the transactions contemplated hereby, and to perform its obligations under this Agreement. The execution and delivery of this Agreement, the consummation of the transactions contemplated hereby, and the performance of Buyer’s obligations under this Agreement have been duly authorized by the Board of Directors of Buyer, and no other corporate proceedings on the part of Buyer are necessary in connection therewith. This Agreement constitutes, and each other agreement or instrument to be executed and delivered by Buyer in connection with this Agreement will constitute valid and binding obligations of Buyer, enforceable against Buyer in accordance with their respective terms.

7.3. Authority. Neither the execution and delivery of this Agreement by Buyer, the consummation of the transactions contemplated hereby, nor the performance of Buyer’s obligations hereunder will: (a) violate any provision of the Articles of Incorporation, Operating Agreements or Bylaws of Buyer; (b) violate any statute, code, ordinance, rule, or regulation of any jurisdiction applicable to Buyer, or its properties or assets; (c) violate any judgment, order, writ, decree, injunction, or award of any court, arbitrator, mediator, government, or governmental agency or instrumentality, which is binding upon Buyer or which would have an adverse effect on its properties or assets; or (d) violate, breach, conflict with, constitute a default under, result in termination of, or accelerate the performance required by, any of the terms, conditions, or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement, or other instrument or obligation to which Buyer is a party or by which Buyer or any of its properties or assets is bound.

7.4. Consents. No consents, approvals, filings, or registrations with or by any governmental agency or instrumentality or any other person or entity are necessary in connection with the execution and delivery by Buyer of this Agreement, the consummation by Buyer of the transactions contemplated hereby, or the performance of Buyer’s obligations under this Agreement.

Asset Purchase Agreement

Page 17 of 79

7.5. Brokers. No broker or finder has acted for Buyer in connection with this Agreement or the transactions contemplated hereby and no broker or finder is entitled to any brokerage commissions, finder’s fee, or other compensation based on agreements or arrangements made by Buyer.

7.6. Full Disclosure. The representations, warranties, and statements of Buyer in this Agreement, in any exhibit or schedule attached hereto, or in any certificate or other document furnished by Buyer to Sellers pursuant to this Agreement are complete, current, and accurate, do not contain or will not contain any untrue statement of material fact, and do not omit or will not omit to state any material fact necessary to make each representation, warranty, or statement accurate and not misleading in any material respect.

8. Covenants of Sellers. Sellers covenant and agree as follows:

8.1. Right of Inspection. From the Effective Date through the Closing Date, Sellers will permit Buyer and its authorized representatives to have full access to Sellers’ properties during regular business hours, will make its employees and authorized representatives available to confer with Buyer and its authorized representatives, will make available to Buyer and its authorized representatives all books, papers, and records relating to the Assets and Assumed Liabilities, Sellers’ business, or the obligations and liabilities of Sellers relating thereto which may be reasonably requested by Buyer, including, but not limited to, all books of account (including the general ledgers), tax records, organizational documents, contracts and agreements, filings with any regulatory authority, any financial operating data, accounting workpapers, attorney audit response letters, and any other business information relating to Sellers’ business activities or prospects as Buyer may from time to time request. No such investigation by Buyer will affect the representations, statements and warranties of Sellers and each such representation, statement, and warranty will survive any such investigation.

8.2. Conduct of Business. From the Effective Date until the Closing Date:

A. Sellers will conduct Sellers’ Business and will engage in transactions only in the usual and ordinary course of business and in a commercially reasonable manner and will do so diligently and in substantially the same manner as it has previously. Sellers will use all commercially reasonable efforts to preserve their business organizations intact and to preserve all present relationships of Sellers with, and the goodwill of, suppliers, customers, and others having a business relationship with Sellers. Sellers further agree to protect the Assets and to maintain the Leasehold Interests, Inventory, Material Customers, and Personal Property in good operating condition and repair, ordinary wear and tear excepted, and will, at its expense, repair, replace, or restore, as applicable, any item of Leasehold Interests, Inventory, or Personal Property which ceases to be in such condition. Sellers will take all steps reasonably necessary to preserve all Contractual Rights and rights in all tangible property, Intellectual Property and Intangible Property of Sellers. Sellers further agree to maintain their business premises at each of the offices, including fixtures and heating, ventilation, cooling, plumbing, and electrical systems in good operating condition and repair and to maintain and leave such business premises in a clean and orderly condition;

Asset Purchase Agreement

Page 18 of 79

X. Xxxxxxx will not, except in the usual and ordinary course of business or as otherwise consented to or approved by Buyer in writing, or as permitted or required by this Agreement: (a) institute any method of manufacture, purchase, sale, lease, management, accounting, or operation that will vary from those methods used by Sellers as of the Effective Date; (b) cancel any existing policy of insurance; (c) enter into any new contract, commitment, or other transaction not in the usual and ordinary course of business at each of Sellers’ offices and, if in the usual and ordinary course of business, not in an amount exceeding $5,000 per transaction, or $10,000 in the aggregate; (e) offer for sale, sell, dispose of, or encumber any of the Assets; (f) incur any new indebtedness or other liabilities as regards the Assets other than in the usual and ordinary course of business, and, if in the usual and ordinary course of business, not in an amount exceeding $5,000 per transaction, or $10,000 in the aggregate; (g) waive or compromise any right, claim or account or cancel, without full payment, any note, loan, or other obligation owing to Sellers through or related to the Assets; (h) modify, amend, cancel, renew, or terminate any contract currently in place in Sellers’ Business; (i) take any action or fail to take any action which would cause any of Sellers’ representations and warranties or in the Joinder Agreement (Exhibit G), herein to be untrue or inaccurate as of the Closing Date; (j) grant any lien in any of the Assets; (k) except as required by applicable tax law, make or change any material election in respect of taxes, adopt or change in any material respect any accounting method in respect of taxes, file any material tax return or any amendment to a material tax return, enter into any closing agreement, or consent to any extension or waiver of the limitation period applicable to any claim or assessment in respect of taxes; (l) lay off, hire, promote any employees, independent contractors or consultants of Sellers; (m) enter into, modify, terminate any employment or severance agreements with respect to any employee or consultant of Sellers; or (n) enter into any agreement obligating Sellers to do any of the foregoing prohibited acts.

|

X.

|

Xxxxxxx will maintain their corporate existence and powers and will not dissolve or liquidate;

|

X. Xxxxxxx will not do any act or omit to do any act that will cause a breach or default of any contract, obligation, lease, license, or other agreement to which Sellers are a party and which affects the Assets or the Assumed Liabilities, Sellers’ title thereto or interest therein, or the operation and conduct of Sellers’s Business; and

X. Xxxxxxx shall obtain prior to the Closing Date all consents, authorizations, waivers, approvals of, or exemptions by, any Person, including, without limitation, any governmental body or agency or instrumentality thereof, required to be obtained in connection with the transactions contemplated by this Agreement.

8.3. Consents. Sellers will obtain any and all necessary consents, waivers, permits, approvals, and authorizations of, and to complete any and all filings or registrations with, all federal, state, and local governmental bodies which are necessary to consummate the transactions contemplated by this Agreement or to permit Buyer to continue Sellers’ business after the Closing Date. Sellers will obtain any and all consents, waivers, approvals, or authorizations of all other persons or entities as may be required for the sale, assignment, and transfer to Buyer of the Assets and the Assumed Liabilities.

Asset Purchase Agreement

Page 19 of 79

8.4. Cooperation. Sellers agree to take or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper, or advisable to consummate the transactions contemplated by this Agreement and to perform Seller’ obligations hereunder. Sellers agree to provide Buyer with full and complete cooperation in the event Buyer becomes involved in any administrative or legal proceedings in any way related to, of, or by the Assets or any obligations of Sellers either before or after the Closing.

8.5. Disclosure of Changes. Sellers will promptly and, in any event, in less than three calendar days notify Buyer in writing of the following: (a) the commencement or threat of any threatened lawsuit or claim against Sellers or affecting the Assets or Assumed Liabilities, the operation and conduct of Sellers’ Business or their prospects, or challenging the validity or propriety of or seeking to enjoin or to set aside the transactions contemplated by this Agreement; (b) any adverse change in the financial condition of Sellers or Sellers’ Business or businesses; and (c) any change in any representations or warranties of Sellers set forth in this Agreement or in any exhibit, schedule, certificate, or other documents delivered to Buyer by Sellers pursuant to this Agreement.

8.6. Exclusivity; Acquisition Proposals. Sellers will not (and will use its best efforts to ensure that none of its officers, directors, shareholders, agents, representatives, or affiliates) take or cause or permit any person to take, directly or indirectly, any of the following actions with any party other than Buyer: (a) solicit, encourage, initiate, or participate in any negotiations, inquiries, or discussions with respect to any offer or proposal to acquire all or any significant part of its ownership, business, assets, or the Assets, whether by merger, consolidation, other business combination, purchase of assets, tender, or exchange offer or otherwise (each of the foregoing, an “Acquisition Transaction”); (b) disclose, in connection with an Acquisition Transaction, any information not customarily disclosed to any person other than Buyer or its representatives concerning Sellers’ Business or properties or afford to any person or entity other than Buyer or its representatives access to its properties, books, or records, except in the ordinary course of business and as required by law or pursuant to a request for information by a Governmental Entity; (c) enter into or execute any agreement relating to an Acquisition Transaction; or (d) make or authorize any public statement, recommendation, or solicitation in support of any Acquisition Transaction or any offer or proposal relating to an Acquisition Transaction. In the event that Sellers are contacted by any third party expressing an interest in discussing an Acquisition Transaction, Sellers will promptly notify Buyer of such contact.

8.7. Noncompetition Agreements. At or prior to the Closing, Xxxxx Xxxxxxx, Xxxx Xxxxxxxx and Xxxxxx Xxxxxx Xxxxx will each have executed a Noncompetition Agreement (collectively, the “Noncompetition Agreement”), substantially in the form attached as Exhibit B.

Asset Purchase Agreement

Page 20 of 79

8.8. Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective affiliates to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

9. Obligations at Closing.

9.1. Sellers’ Obligations at Closing. At the Closing, Sellers will deliver or cause to be delivered to Buyer the following:

A. All instruments of transfer, properly executed by Sellers and acknowledged, including, but not limited to, a xxxx of sale, deeds, and assignments, transferring and assigning to Buyer all of Sellers’ rights, title, and interest in and to the Assets and Assumed Liabilities, including, but not necessarily limited to, the following:

(1) Xxxx of Sale in a form substantially identical to Exhibit A attached to this Agreement;

(2) Assignment and Assumption of Leases for each of the offices of Sellers in a form substantially identical to Exhibit E attached to this Agreement;

|

(3)

|

Assignment and Assumption Agreement in a form substantially identical to Exhibit H attached to this Agreement;

|

|

B.

|

All instruments evidencing any and all consents, waivers, permits, approvals, authorizations, filings, or registrations as provided for in this Agreement;

|

|

C.

|

The Noncompetition Agreement in a form substantially identical to Exhibit B attached to this Agreement, each separately signed by Xxxxx Xxxxxxx, Xxxx Xxxxxxxx and Xxxxxx Xxxxxx Xxxxx;

|

|

D.

|

The Noncompetition Agreement in a form substantially identical to Exhibit C attached to this Agreement duly executed by and on behalf of each of the Sellers;

|

|

E.

|

Original opinion letter from Sellers’ legal counsel in a form substantially similar to Exhibit D;

|

|

F.

|

Duly executed title documents transferring title of the vehicles listed in Schedule 1.5 from Buyers to Seller;

|

|

G.

|

All keys, items or information that provide access the property, offices or any personal property of or related to the Assets, including security cards, security codes, passwords or any other item or information necessary or required to access, operate or possess any of the Assets or the offices of Sellers;

|

Asset Purchase Agreement

Page 21 of 79

|

H.

|

At the time of closing, Sellers agree to transfer to Buyer all of Seller’ right, title and interest in and to the telephone lines, cell phone numbers, facsimile lines, listings and numbers presently assigned to the Assets which are the subject of this sale, including specifically, but not limited to, the telephone numbers (000) 000-0000 and (000) 000-0000 and facsimile numbers (000) 000-0000 and (000) 000-0000. Sellers agree to execute any necessary documents and to cooperate fully with Buyer in accomplishing the transfer of the aforesaid telephone numbers to Buyer; and

|

I. All material agreements and covenants required by this Agreement to be performed or complied with by the Sellers on or prior to the Closing Date.

9.2. Buyer’s Obligation at Closing. On the Closing Date, Buyer will deliver or cause to be delivered to Sellers the following:

A. The part of the Purchase Price as set forth in Section 3, which is then deliverable to Sellers;

B. Executed resolutions of Buyer’s Board of Directors authorizing the execution and performance of this Agreement and all actions taken by Buyer in furtherance of this Agreement; and

10. Obligations After Closing.

10.1. Seller’s Indemnification.

A. Sellers agree to indemnify and hold Buyer and its officers, directors, employees, members, managers, and successors (collectively, the “Buyer Indemnified Parties”) harmless for, from, and against any and all damages, of any kind, including, without limitation, costs of investigation, interest, penalties, reasonable attorneys’ fees, and any and all costs, expenses, and fees incident to any suit, action, or proceeding, incurred or sustained by Buyer Indemnified Parties, which arise out of, result from, or are related to: (a) any inaccuracy in or omission or Sellers’ breach or non-fulfillment of any representation, warranty, condition, agreement, or covenant contained in this Agreement or in any exhibits to this Agreement; or (b) any and all liabilities or obligations relating to the operation of Sellers’ Business on or prior to the Closing Date, including, without limitation, all tax liabilities, liabilities for breach of contract, liabilities arising in tort, liabilities for materials sold or services rendered, payroll liabilities and liabilities to any creditors, or third parties, except to the extent such liabilities or obligations have been expressly assumed by Buyer in writing pursuant to this Agreement.

|

C.

|

Buyer agrees that, upon its receipt of a third-party claim in respect of which indemnity may be sought under this Section 10.1, Buyer will give written notice within ten (10) days of such claim (the “Buyer’s Notice of Claim”) to Sellers. Sellers will be entitled, at their own expense, to participate in the defense of any such claim or action against Buyer. Sellers will have the right to assume the entire defense of such claim, provided that: (a) Sellers give written notice of their desire to defend such claim (the “Buyer’s Notice of Defense”) to Buyer within 15 days after Sellers’ receipt (either individually or collectively) of the Buyer’s Notice of Claim; (b) Sellers’ defense of such claim will be without cost of Buyer or prejudice to Buyer’s rights under this Section 10.1; (c) counsel chosen by Sellers to defend such claim will be reasonably acceptable to Buyer; (d) Seller will bear all costs and expenses in connection with the defense of such claim; (e) Buyer will have the right, at Buyer’s expense, to have Buyer’s counsel participate in the defense of such claim; and (f) Buyer will have the right to receive periodic reports from Sellers and Sellers’ counsel with respect to the status and details of the defense of such claim and will have the right to make direct inquiries to Buyer’s counsel in this regard.

|

Asset Purchase Agreement

Page 22 of 79

|

D.

|

This Section 10.1. shall survive any termination of this Agreement.

|

10.2. Buyer’s Indemnification.

A. Buyer agrees to indemnify and hold Sellers and their officers, directors, employees, members, managers, and successors (collectively, the “Seller Indemnified Parties”) harmless for, from, and against any and all damages, of any kind, including, without limitation, costs of investigation, interest, penalties, reasonable attorneys’ fees, and any and all costs, expenses, and fees incident to any suit, action, or proceeding, incurred or sustained by Seller Indemnified Parties, which arise out of, result from, or are related to: (a) any inaccuracy in or omission or Buyer’s breach or non-fulfillment of any representation, warranty, condition, agreement, or covenant contained in this Agreement; or (b) any and all liabilities or obligations relating to the operation of Buyer’s business after the Closing Date, including, without limitation, all tax liabilities, liabilities for breach of contract, liabilities arising in tort, liabilities for materials sold or services rendered, payroll liabilities and liabilities to any creditors, or third parties, except to the extent such liabilities or obligations have been expressly excluded by Buyer in writing pursuant to this Agreement.

|

X.

|

Xxxxxxx agree that, upon the receipt of a third-party claim in respect of which indemnity may be sought under this Section 10.2 Sellers will give written notice within ten (10) days of such claim (the “Sellers’ Notice of Claim”) to Buyer. Sellers will be entitled, at their own expense, to participate in the defense of any such claim or action against Buyer. Buyer will have the right to assume the entire defense of such claim, provided that: (a) Buyer gives written notice of its desire to defend such claim (the “Sellers’ Notice of Defense”) to Sellers within 15 days after Sellers’ receipt (either individually or collectively) of the Notice of Claim; (b) Buyer’s defense of such claim will be without cost of Sellers or prejudice to Sellers’ rights under this Section 10.2; (c) counsel chosen by Buyer to defend such claim will be reasonably acceptable to Sellers; (d) Buyer will bear all costs and expenses in connection with the defense of such claim; (e) Sellers will have the right, at Sellers’ expense, to have Sellers’ counsel participate in the defense of such claim; and (f) Sellers will have the right to receive periodic reports from Buyer and Buyer’s counsel with respect to the status and details of the defense of such claim and will have the right to make direct inquiries to Seller’s counsel in this regard.

|

Asset Purchase Agreement

Page 23 of 79

|

D.

|

This Section 10.2. shall survive any termination of this Agreement.

|

10.2. Utilities. Buyer and Sellers will cooperate to take all steps necessary to transfer all utilities and services related to the operation and conduct of Sellers’ business, including, without limitation, electric service, gas service, telephone service, sewage, water, and trash removal, into Buyer’s name effective as of the Closing Date; provided, however, that Buyer will pay for any new deposits or connection fees required.

10.3. Transition. Sellers will maintain the goodwill of Sellers’ suppliers, customers, and business, and will otherwise cooperate with Buyer to effectuate a smooth and orderly transition in the operation and conduct of Sellers’ Business following the Closing Date.

11. Remedies.

11.1. Remedies Prior to or on Closing.

|

|

A.

|

In the event of any breach or default of any representation, warranty, covenant, agreement, condition, or other obligation of Sellers under this Agreement, or in the event Buyer determines in its sole discretion that the results if Buyer’s due diligence investigation demonstrate the contemplated transaction to purchase the Assets is not what was represented previously, Buyer may, at its option, and without prejudice to any rights or remedies Buyer may have at law or in equity for any such breach or default terminate this Agreement by delivering written notice of termination to Sellers on or before the Closing Date. The notice will specify the breach, default or reason on which the notice is based. Notwithstanding the foregoing, the parties acknowledge that the Assets are unique and that, in the event of a breach or default by Sellers under this Agreement, it would be extremely impracticable to measure monetary damages and such damages would be an inadequate remedy for Buyer. Therefore, in the event of any such breach or default, Buyer may, at its option, xxx for specific performance in addition to any other available right or remedies.

|

|

|

B.

|

In the event of any breach or default of any representation, warranty, covenant, agreement, condition, or other obligation of Buyer under this Agreement, Sellers may, at their option, and without prejudice to any rights or remedies Sellers may have at law or in equity for any such breach or default terminate this Agreement by delivering written notice of termination to Buyer on or before the Closing Date. The notice will specify the breach, default or reason on which the notice is based. Notwithstanding the foregoing, the parties acknowledge that the Assets are unique and that, in the event of a breach or default by Buyer under this Agreement, it would be extremely impracticable to measure monetary damages and such damages would be an inadequate remedy for Sellers. Therefore, in the event of any such breach or default, Sellers may, at their option, xxx for specific performance in addition to any other available right or remedies.

|

C. In the event of termination of this Agreement by either Buyer or Seller as provided in this Section 11.1, this Agreement will become null and void.

Asset Purchase Agreement

Page 24 of 79

11.2. Remedies Subsequent to Closing. In the event of any breach or default of any representation, warranty, covenant, agreement, condition, or other obligation by either party to this Agreement, the non-defaulting party may pursue whatever rights and remedies are available to such party at law or in equity, including, without limitation, the rights and remedies provided in this Agreement.

12. General Provisions.