LOAN AGREEMENT BETWEEN BHARAT BUSINESS CHANNEL LIMITED AS BORROWER AND UNITED BANK OF INDIA AS LENDER LOAN AGREEMENT

Exhibit 10.14

BETWEEN

BHARAT BUSINESS CHANNEL LIMITED

AS BORROWER

AND

UNITED BANK OF INDIA

AS LENDER

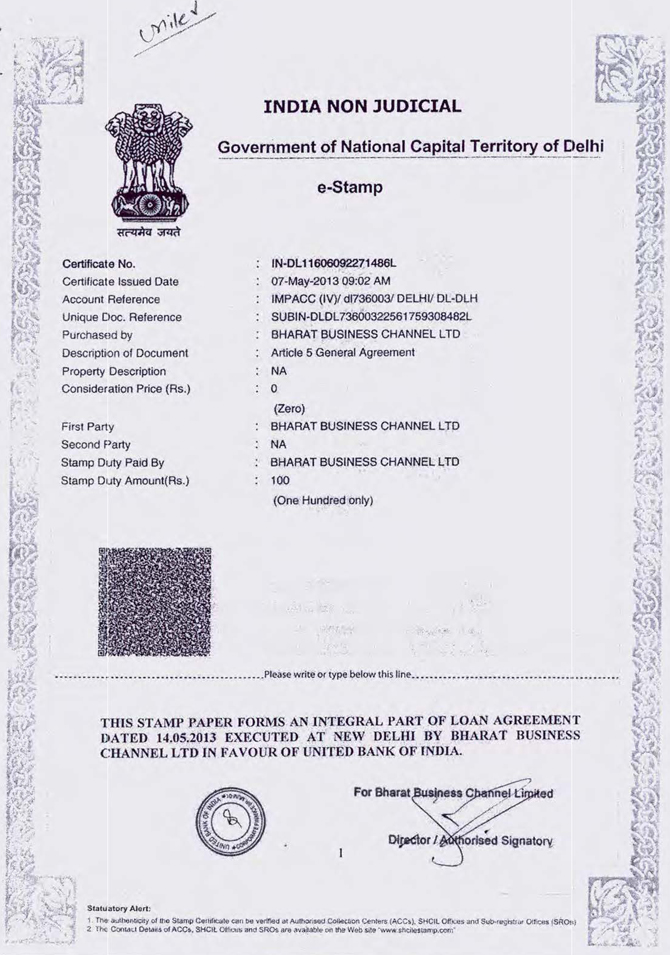

THIS AGREEMENT made at New Delhi this 14th day of May, 2013.

BETWEEN

BHARAT BUSINESS CHANNEL LIMITED, a company within the meaning of the Companies Act, 1956 (1 of 1956) and having its Company Identification No. U92100MH2002PLC137947 and Registered Office at Auto Card Compound, Adalat Road, Aurangabed - 431 005 (hereinafter referred to as the “Borrower” which expression shall, unless it be repugnant to the subject, meaning or context thereof, be deemed to mean and include its successors of the FIRST PART;

AND

United Bank of India, acting through its office at Corporate Finance Branch, United Bank of India Building, 2nd Floor, 25, Sir X.X. Xxxx, Xxxx, Xxxxxx-000 001 (hereinafter referred to as the “Lender” which expression shall, unless it be repugnant to the subject, meaning or context thereof, be deemed to mean and include its successors, assigns, transferees and novatees) of the SECOND PART.

WHEREAS:

| A. | The Borrower intends to part finance the Purpose as per the Financing Plan which includes availing of the Total Loan from the lenders; |

| B. | The Borrower has requested the Lender to provide the Loan to enable the Borrower to part finance the Purpose; and |

| C. | The Lender has at such request of the Borrower has agreed to grant the Loan to the Borrower on the terms and conditions set out in this Agreement. |

NOW IT IS HEREBY AGREED AS FOLLOWS:

ARTICLE I

THE LOAN

| 1.1 | Definitions and Interpretation |

| For the purpose of this Agreement, (i) capitalised terms, not otherwise defined in this Agreement, shall have the meanings set forth in Article 7.1 of this Agreement, and (ii) the principles of interpretations of this Agreement shall be as set forth in Article 7 .2 of this Agreement. | |

| 1.2 | Amount and terms of the Loan |

| (a) | The Borrower agrees to borrow from the Lender and the Lender agrees to lend and advance to the Borrower a rupee term loan of Rs.150,00,00,000/- (Rupees one hundred fifty crore only) for the Purpose on the terms and conditions contained herein forming part of the Total Loan (hereinafter referred to as the “Loan”). |

| (b) | The Borrower agrees that the proceeds of the Loan shall be utilized for the Purpose as per the Financing Plan. |

| 1.3 | Interest |

| (i) | The Borrower shall pay to the Lender interest for the Interest Period at the Applicable Interest Rate on the principal amount of the Loan and all other monies outstanding from time to time. Such interest shall be paid monthly in arrears on the Interest Payment Date. |

| (ii) | The Lender reserves the right to reset the interest rate (including margin/ Spread) at the end of 12 (twelve) months from the date of 1st (first) disbursement under this Agreement and every year thereafter. The Borrower agrees to pay the interest at the reset rate as may be notified by the Lender from time to time. |

| (iii) | The Borrower agrees and acknowledges that the IDBI Base Rate shall be floating till the Final Settlement Date. |

| (iv) | All interest on the Loan, Additional Interests, Liquidated Damages and all other monies accruing under this Agreement and other Financing Documents shall, in case the same are not paid on the respective due dates, carry interest/further interest at the Applicable Interest Rate (hereinafter referred to as the “Further Interest”) computed from the respective due date until such payment and shall become payable upon the footing of compound interest with monthly rests on demand and in the absence of any such demand on the next Interest Payment Date falling after the date of default. |

| (v)(a) | In the event the Security as provided in Article II of this Agreement is not created and perfected within the time lines as provided under Article II of this Agreement, the Borrower shall pay to the Lender an additional interest at the rate of 1% (one percent) per annum in addition to the Applicable Interest Rate on the disbursements made pending the creation of security within the time line as stated above for the period from the date of 1st (first) disbursement till the security is created and perfected as per Article II of this Agreement (hereinafter referred to as the “Additional Interest for Non – Creation of Security”). |

| (b) | The Borrower recognizes that the payment of Additional Interest for Non – Creation of Security as above does not absolve the Borrower from creating the Security promptly and notwithstanding the payment of any Additional Interest for Non – Creation of Security to the Lender, non-creation of Security within the stipulated time, shall entitle the Lender to call an Event of Default. Any delay in calling such Event of Default or acceptance of payments of Additional Interest for Non – Creation of Security shall not be construed as a waiver of, or an estoppel against, the right of the Lender to call an Event of Default at their sole discretion at such time as they deem fit. |

| (vi) | If Borrower defaults in payment of any installment of principal amount of the Loan, interest thereon or any other monies (except Liquidated Damages) on the respective due dates, the Borrower shall pay on such defaulted amounts, liquidated damages at the rate of 2 % (two percent) per annum for the period of default (hereinafter referred to as the “Liquidated Damages”), which shall be payable on demand or in the absence of any such demand on the next Interest Payment Date falling after the date of default. |

| (vii) | In the event of adverse deviation by more than 10% (ten percent) in the Financial Covenants from the levels stipulated in the definition of Financial Covenants for a minimum period of 1 (one) year, the Borrower shall pay to the Lender a deviation interest at the rate of 1% (one percent) per annum on the Loan outstanding (hereinafter referred to as the “Additional Interest for Non-Adherence of Financial Covenant”). Such interest shall be payable for the entire Financial Year(s) during which the Financial Covenants are not adhered to; which shall be payable on demand or in the absence of any such demand on the next Interest Payment Date falling after the date of default. |

| The determination of any such deviation in the Financial Covenants for the aforesaid purposes shall be done once in a Financial Year on the basis of annual audited financial statements of the Borrower with the first such determination being done for the financial year 2015 and thereafter for every financial year till the Final Settlement Date. | |

| (viii) | Interest, Further Interest, Additional Interests, Liquidated Damages and all other charges shall accrue from day to day and shall be computed on the basis of 365 days’ a year and the actual number of days elapsed. |

| (ix) | The Borrower agrees and acknowledges that the Further Interest, Additional Interests and the Liquidated Damages stated above are a genuine pre-estimate of loss that will be incurred or suffered by the Lender if the event(s) specified respectively therein occur(s). |

| 1.4 | Debt Service Reserve |

| (i) | The Borrower shall on or before January 1, 2015, create and thereafter maintain, at all times till the Final Settlement Date, the DSR in the DSRA out of cash flows of the Borrower available after meeting its debt service obligations hereunder. |

| (ii) | In lieu of the cash DSR as stipulated in Article 1.4(i) above, the Borrower shall procure and furnish to the Lender, an unconditional and irrevocable bank guarantee/ letter of credit from a bank acceptable to the Lender, in a form, manner and on terms and conditions acceptable to the Lender. Such bank guarantee/ letter of credit shall, amongst other terms, entitle the Lender to make a demand at any time, if there is any shortfall in the payment of principal amount of the Loan or the interest by the Borrower. The bank guarantee/ letter of credit as above shall not have any recourse to the assets of the Borrower or the Lender and shall be suitably renewed/ enhanced till the Final Settlement Date. |

| (iii) | The amounts accumulated in the DSRA shall not be used for any purpose other than for meeting shortfall in the payment of principal amount of the Loan or the interest by the Borrower from time to time. The Borrower shall invest the funds in the DSRA only in Permitted Investments. |

| 1.5 | Last Date Of Drawal |

| (i) | Unless the Lender otherwise agrees, the right of the Borrower to request for disbursement of the Loan shall cease at the end of the period of 2 (two) years from the date of 1st (First) disbursement of the Loan under this Agreement (hereinafter referred to as the “Availability Period”) and any undrawn portion of the Loan shall automatically stand cancelled at the expiry of the said period of 2 (two) years from the date of 1st (first) disbursement of the Loan. |

| (ii) | All disbursements under this Agreement shall be made pursuant to the quarterly drawdown schedule submitted by the Borrower to the Lender on or prior to the date of this Agreement indicating the date and the amount of disbursement sought by the Borrower on the respective dates under the Availability Period (hereinafter referred to as the “Drawdown Schedule”). However, the Drawdown Schedule may be amended or replaced by the Borrower with 30 (thirty) days prior written notice to the Lender before the commencement of the each quarter with the prior written approval of the Lender. Such modified or amended drawdown schedule shall be treated as the Drawdown Schedule. |

| (iii) | Commitment Fee |

| The Borrower shall pay to the Lender a non-refundable commitment fee at the applicable rate on the amounts not drawn or drawn in variance with the Drawdown Schedule, quarterly in arrears on the last day of each quarter. Such charges shall be calculated on the basis of the drawdown not sought and the number of days deviated from the dates indicated in the Drawdown Schedule. | |

| 1.6 | Repayment |

| (i) | The Borrower undertakes to repay the principal amount of the Loan in accordance with the Amortization Schedule as set forth in Schedule or as advised and pay the interest, Additional Interests, Further Interest, Liquidated Damages, fees and other charges as stipulated in this Agreement. |

| (ii) | The Lender may, wherever warranted, revise, accelerate, vary or postpone the repayment of the principal amounts of the Loan or the balance outstanding for the time being or any installments(s) of the said principal amounts of the Loan or any part thereof by giving prior notice to the Borrower on such terms and conditions as may be decided by it and the Borrower shall be deemed to have consented to the same. |

| (iii) | In the event of any default in the payment of installments of principal, any interest. Additional Interests, Further Interest and Liquidated Damages, postponement, if any, allowed by the Lender shall be at the rate of interest as may be stipulated by the Lender at the time of postponement and the Borrower shall be deemed to have consented to the same. |

| (iv) | If, for any reason, the amount finally disbursed by the lender out of the Loan is less than the amount of the Loan, the number of installments of repayment of the Loan shall stand reduced accordingly and be payable as per the revised Amortisation Schedule advised by the Lender and the Borrower shall be deemed to have consented to the same. |

| 1.7 | Appropriation of payments |

| Unless otherwise agreed to by the Lender, any payments due and payable under this Agreement and made by the Borrower shall be appropriated towards such dues in the folio wing order, viz.: | |

i) Interest on costs, charges, expenses and other monies; ii) Costs, charges, expenses and other monies; iii) Further interest and Liquidated Damages on defaulted amounts; iv) Interest including Additional Interests, payable in terms of this Agreement; v) Premium on prepayment vi) Repayment of principal/ installments of principal due and payable under this Agreement. |

| 1.8 | Place and mode of payment by the Borrower | |

| All the monies payable by the Borrower to the Lender shall be made directly to the Lender to any of its branches /offices as may be specified by them by Real Time Gross Settlement or such other electronic mode acceptable to the Lender to the account of such office (s). Credit for payment will be given on realization of the amount by the Lender or the relative due date, whichever is later. | ||

| 1.9 | Premature repayment | |

| (i) | Any prepayment of the Loan shall be subject to payment of prepayment premium at the rate of 2 % (two percent) per annum of the pre-paid principal amount. | |

| Provided that no prepayment premium shall be payable by the Borrower, if the prepayment is at instance of the Lender or if the Borrower opts to prepay the entire outstanding of the Loan and other monies within 90 (ninety) days from the date of advise of the increase in the Spread on interest rest dates and after serving due notice upon the Lender. | ||

| (ii) | Any notice of prepayment under this Agreement shall be given to the Lender or to and shall be irrevocable. | |

| (iii) | No amount prepaid under this Agreement may subsequently be re-borrowed under the Loan. | |

| (iv) | All prepayments under this Agreement shall be made together with accrued interest on the amount prepaid and any other amounts payable under this Agreement. | |

| 1.10 | Due date of payment | |

| If the due date in respect of any installment of principal, interest, Additional Interests, Further Interest and Liquidated Damages and all other monies payable under this Agreement falls on a day which is a bank holiday at the place where the payment is to be made, the immediately preceding working day shall be the due date for such payment. | ||

| 1.11 | Interest Tax, etc. | |

| The Borrower agrees and acknowledges that, all rates of interest including the Applicable Interest Rate. Further Interest, Additional Interests and Liquidated Damages are exclusive of interest tax, service tax and/ or any other levies/ duties, which shall be payable by the Borrower to the Lender in addition to such rates of interest. | ||

| 1.12 | Pre-Commitment Conditions | |

| In order to induce the Lender to sign this Agreement and to make available the Loan, the Borrower represents and warrants to the Lender that prior to or at the time of the signing of this Agreement the following has been satisfied: | ||

| (i) | Corporate Actions | |

| (a) | The Borrower has furnished to the Lender | |

| (A) | up to date certified true copies of its and the Promoters’ constitutional documents (memorandum of association and articles of association) including certificate of incorporation; | |

| (B) | evidence of the corporate power, authority/ resolutions and required corporate action to enter into, and signature authority of the Person(s) executing the Financing Documents on its behalf; | |

| (C) | certified true copy of its shareholders’ resolution under Section 293(1)(a) and Section 293(1)(d) of the Companies Act, 1956 authorizing creation of security and availing of the Loan; | |

| (D) | a certificate of the Auditor confirming that (i) the availing of the Loan will not cause any borrowing limit binding on the Borrower to be exceeded; (ii) providing the authorized, issued and paid up capital of the Borrower; | |

| (E) | a certificate of the Authorised Officer of (i) the Borrower certifying that the Borrower and its directors have the necessary powers under the constitutional documents (memorandum of association and articles of association) to borrow and enter into the various Financing Documents, that the borrowing under this Agreement will not cause any borrowing limit binding on the Borrower to be exceeded; and | |

| (G) | know your customer documents to the satisfaction of lender. |

| (b) | The Borrower shall have agreed to carry out such alterations to its memorandum of association and articles of association for suitably increasing its authorised equity capital, borrowing power as per the envisaged Financing Plan, if required and incorporate any other changes, if required, by the Lender. |

| (ii) | Appointment of LLC |

| LLC shall have been appointed on behalf of the Lender to undertake such scope of work as may be decided by the Lender. The Borrower shall have agreed to pay or arrange to make payments of all fees, expenses and other charges payable to LLC. | |

| (iv) | Up-front Fee |

| The Borrower shall pay to the Lender non-refundable upfront fee of 0.10 % (zero point ten percent) (together with applicable taxes and cess, if any) on the Loan amount on or before the date this Agreement. The Borrower shall also pay the legal fee plus other charges as advised by the Lender. | |

| 1.13 | Terms of disbursement |

| The obligation of the Lender to make disbursements under this Agreement shall be subject to the Borrower performing all its obligations and undertakings under this Agreement besides compliance by the Borrower with the disbursement procedure stipulated by the Lender, including submission of necessary information, documents, margin/matching contribution, tenure of Loan etc. to the satisfaction of the Lender and compliance of the condition stipulated in Article 1.14 of this Agreement. | |

| 1.14 | Disbursement Conditions |

| 1.14.1 | Conditions Precedent to 1st (first) Disbursement |

| The obligation of the Lender to make the 1st (first) disbursement under this Agreement shall be subject to the satisfaction or waiver or extension by the Lender of the following conditions in addition to the Borrower complying with the conditions specified in Article 1.14.2 of this Agreement and disbursement procedure as stipulated by the Lender. |

| a) | Execution of Financing Documents | |

| All the Financing Documents (other than documents which arc to be executed at a later date in terms of this Agreement) in a form acceptable to the Lender shall have been duly executed by the Borrower and/ or the Promoters, as the case may be, and the same shall be in full force and effect. | ||

| b) | Promoters’ Undertaking | |

| The Borrower shall have procured and furnished an undertaking duly and validly executed by the Promoters in a form and substance satisfactory to the Lender, agreeing and undertaking that the Promoters shall jointly and severally - | ||

| (i) | provide funds to the Borrower without any recourse to the Lender and/ or the assets of the Borrower, to meet any cost overrun in the envisaged Business Plan/ Financing Plan; and | |

| (ii) | provide funds to the Borrower for funding the losses that may be incurred by the Borrower after the financial year ending 2014 onwards. | |

| c) | Approvals | |

| The Borrower shall have applied for and received all approvals that are, in the opinion of the Lender, required to be obtained prior to the date of 1st (first) disbursement. | ||

| d) | Wilful Defaulter | |

| The Borrower shall, have removed its director(s), whose name(s) appear in willful defaulters list maintained by RBI or CIBIL and/ or any other authority from its Board and/ or get their names deleted from the list maintained by the aforesaid authorities. | ||

| e) | Guarantees | |

| The Borrower shall have procured from the guarantors, the guarantees in favour and for the benefit of the Lender as provided under Article 2. 1(v) of this Agreement. | ||

| 1.14.2 | Conditions Precedent to Subsequent Disbursements |

| The obligation of the Lender to make the 1st (first) disbursement and each of the subsequent disbursement shall, in addition to the compliance by the Borrower or waiver/ relaxation by the Lender of the conditions stipulated in Article 1.14.1 above and the disbursement procedure stipulated by the Lender, be also subject to the following conditions, namely - |

| b) | Events of Default |

| The Borrower shall have delivered to the Lender a certificate issued by its Authorised Officer confirming that no Event of Default has occurred and is continuing under the Financing Documents and no Event of Default under the Financing Documents shall occur as a result of requested disbursement. | |

| c) | Material Adverse Effect |

| The Borrower shall have delivered to the Lender a certificate from its Authorised Officer certifying that no event has occurred which has or would be expected to have a Material Adverse Effect. | |

| d) | Representations and Warranties |

| The Borrower shall have delivered to the Lender a certificate issued by its Authorised Officer confirming that the representations, warranties and covenants made or deemed to be made pursuant to Article III of this Agreement or under other Financing Documents are true and correct in all material respects both before and after the disbursement is made. | |

| e) | Litigation |

| The Borrower shall have delivered to the Lender a certificate from its Authorised Officer certifying that no litigation is pending in India or in any other jurisdiction against the Borrower or its assets or regarding the effectiveness or validity of any of the Financing Documents or the Security except as disclosed in writing by the Borrower to the Lender on the date of signing of this Agreement which if determined adversely shall have a Material Adverse Effect. | |

| f) | Certificate of Independent Chartered Accountant |

| The Borrower shall have furnished to the Lender a certificate from its statutory’ auditor or independent chartered accountant acceptable to the Lender certifying the expenditure incurred on the Purpose and the means of finance thereof, before each disbursement. | |

| g) | Fees |

| The Borrower shall have paid all fees, expenses and other charges then payable by it under the terms of the Financing Documents. |

| 1.14.3 | Conditions to be complied within specific time lines |

| a) | No Objection Certificates |

| The Borrower shall have procured no objection certificates from its Existing Secured Lenders for creation of the security interest on the Borrower’s assets for securing the loan within a period of 3 (three) months from the date of 1st (first) disbursement. | |

| b) | Security |

| The Rupee Term Loan, together with interest thereon, further interest, liquidated damages, costs, expenses and all other monies whatsoever, shall be secured by way of first pari passu charge on |

| • | all movable/immovable asset of the company (both present as well as future) on pari passu chare with existing term lenders | |

| • | DSRA for 1 quarter debt service payment to be created latest by January 1, 2015. | |

| • | Assignment of DTH license, on pari passu basis with existing term lenders. | |

| • | First pari passu charge on the escrow account of the Company |

Company to be allowed 3 months time from the date of first disbursement for availing NOC from the existing lenders and to perfect the security. Further the company is allowed another 3 months time for assignment of DTH license.

| c) | Credit Rating |

| The Borrower shall get all it borrowings rated by any one or more accredited rating agencies within a period of 6 (six) months from the date of lst (first) disbursement in compliance with the Basel II norms. |

ARTICLE II

SECURITY

| 2.1 | Security for the Loan |

| The Rupee Term Loan, together with interest thereon, further interest, liquidated damages, costs, expenses and all other monies whatsoever, shall be secured by way of first pari passu charge on |

| • | all movable/immovable asset of the company (both present as well as future) on pari passu chare with existing term lenders | |

| • | DSRA for 1 quarter debt service payment to be created latest by January 1, 2015. | |

| • | Assignment of DTH license, on pari passu basis with existing term lenders. | |

| • | First pari passu charge on the escrow account of the Company |

| • | an irrevocable, unconditional, joint and several guarantee from - | |

| (a)Shri Xxxxxxxxx Xxxxx; | ||

| (b)Shri Xxxxxxx Xxxxx X. Xxxxx | ||

| (c)Solitaire Appliances Private Limited; | ||

| (d)Platinum Appliances Private Limited and | ||

(e)Greenfield Appliances Private Limited. |

| No guarantee commission shall be payable by the Borrower to the guarantors. | ||

| Company to be allowed 3 months time from the date of first disbursement for availing NOC from the existing lenders and to perfect the security. Further the company is allowed another 3 months time for assignment of DTH license. | ||

| Provided the mortgages, charges and assignment referred to in Article 2.1(i) to (iii) above to be created for the benefit of the Lender shall in all respects rank pari passu with the mortgages, charges and assignment on the assets referred to in Article 2.1(i) to (iii) above created and/or to be created by the Borrower for securing the financial assistance granted by the Existing Secured Lenders (details of the Existing Secured Lenders are set out in Schedule II of this Agreement), without any preference or priority to one over the other. | ||

| Provided further the mortgages, charges, assignment and guarantees referred to in Article 2.1(i) to (v) above created/ to be created for the benefit of the Lender shall in all respects rank pari passu with the mortgages, charges, assignments and guarantees created and/or to be created by the Borrower and procured/ to be procured by the Borrower for the benefit of the other lenders providing the Total Loan to the Borrower, without any preference or priority to one over the other. |

| Provided that the - | ||

| (i) | guarantees stated at Article 2.1(v) above shall be procured for the benefit of the Lender prior to the date of 1st (first) disbursement of the Loan under this Agreement; | |

| (ii) | mortgages and charges on the assets stated at Article 2.1(i) and (ii) above shall be created and perfected within a period of 3 (three) months from the date of 1st (first) disbursement; | |

| (iii) | mortgages and charges on the assets stated at Article 2.1 (iii) above shall be created and perfected within a period of 6 (six) months from the date of 1st (first) disbursement; and | |

| (iv) | mortgages and charges on the assets stated at Article 2.1 (iv) above shall be created and perfected on or prior to January 1, 2015. | |

| (hereinafter collectively referred to as the “Security”) | ||

| 2.2 | The Borrower shall make out a good and marketable title to its properties to the satisfaction of the Lender and comply with all such formalities as may be necessary or required for the said purpose including obtaining consents from the existing charge holders. | |

| 2.3 | So long as any monies remain due and outstanding to the Lender, the Borrower undertakes to notify the Lender in writing of all its acquisitions of immovable properties. | |

| 2.4 | If, at any time during the subsistence of this Agreement, the Lender is of the opinion that the security provided by the Borrower has become inadequate to cover the balance of the Loan then outstanding, then, on the Lender advising the Borrower to that effect, the Borrower shall provide and furnish to the Lender, to its satisfaction such additional security as may be acceptable to the Lender to cover such deficiency. | |

| 2.5 | The Borrower shall not, without prior consent of the Lender, till the Final Settlement Date, create in favour of any other person any charge(s) on the assets, which are charged/agreed to be charged for the benefit of the Lender pursuant to Section 2.1 hereof. | |

| 2.6 | The Borrower shall have furnished, prior to creation of security as stated in Article 2.1 (i) to (iv), a certificate under Section 281(1) of the Income-tax Act, 1961 in respect of the creation of security, as applicable. | |

ARTICLE III

BORROWER’S WARRANTIES AND COVENANTS

| 3.1 | Except to the extent already disclosed in writing by the Borrower to the Lender, the Borrower shall be deemed to have assured, confirmed and undertaken as follows: |

| (a) | Conflict with Constitutional documents |

| Nothing in this Agreement conflicts with any provisions of the Borrower’s constitutional documents | |

| (b) | No director who is on the board of a company declared as a willful defaulter |

| No director is on its Board who is also a director on the board of a willful defaulter | |

| (c) | Right to disclose the names and particulars of the Borrower and the credit facilities availed of / to be availed, by the Borrower. |

| (i) | The Lender shall have the right to disclose the information relating to the Borrower to Credit Information Bureau (India) Limited (CIBIL) or any other similar agency, which in turn shall have the right to use the information as authorized in this behalf by RBI. |

| (i) | The Lender shall have the right to disclose the information and data relating to the Borrower to other agencies in the business of credit. |

| (ii) | The Borrower hereby declares that the information and data furnished by the Borrower to the Lender are true and correct. |

| (d) | Valid and Subsisting Licenses |

| (i) | The Borrower duly owns or holds valid and subsisting licenses in respect of all trade names, trade marks, patents, designs and other intellectual property used or intended to be used by the Borrower in the course of its business and the same are duly registered in the name of the Borrower and have not become voidable. |

| (ii) | The Borrower duly owns or holds all other material consents, licenses, franchises, permits and authorisations necessary for the lawful conduct, ownership and operation, of its business including DTH License, and the same are valid and subsisting and have not become voidable. |

| (e) | No Claims and liabilities other than those disclosed |

| The Borrower does not have any claims or liabilities including, without limitations, provident fund or labour dues, income /corporate or other taxes, duties, levies or cesses, royalties, license fees, lease rentals, interest costs, penal levies, default rates, damages, claims, penalties etc. (whether present, future or contingent) which are not expressly disclosed either: | |

| (i) | in the Borrower’s last audited balance sheet furnished to the Lender; or |

| (ii) | otherwise to the Lender in writing as “off-balance sheet liabilities”; or |

| (iii) | in any other written communication to the Lender. |

| (v) | Non-existence of event of default | |

| The Borrower shall satisfy the Lender that no Event of Default and no event which, with the lapse of time or giving of notice and lapse of time as specified in Article V, would become an Event of Default, has happened and been continuing. | ||

| (vi) | Project/ Purpose | |

| The Borrower shall, | ||

| (i) | Project/ Purpose changes | |

| Promptly notify the Lender of any proposed change in the nature or scope of the project / Purpose and of any event or condition, which might materially and adversely affect or delay completion of the project/ Purpose or result in substantial overrun in the original estimate of costs. Any proposed change in the nature or scope of the project/ Purposes hall not be implemented or funds committed therefore without the prior approval of the Lender; | ||

| (ii) |

Contract change Obtain concurrence of the Lender to any material modification or cancellation of the Borrower’s agreements with its machinery suppliers, collaborators, technical consultants and suppliers of raw materials; | |

| (iii) |

Delay in completing the project/ Purpose Promptly inform the Lender of the circumstances and conditions, which are likely to disable the Borrower from implementing the project/ Purpose, or which are likely to delay its completion or compel the Borrower to abandon the same. | |

| (h) | Utilisation of the Loan | |

| The Borrower shall furnish to the Lender: | ||

| (a) | Information and statements relating to its business, utilisation of the Loan, its assets and other information relating to the group/ subsidiaries as may be required from time to time, including duly audited annual account. | |

| (b) | The Loan shall not be utilised for any purpose other than for which it is sanctioned and, in particular (including but not limited to), it shall not be utilised for any of the following purposes: | |

| i)i) | subscription to or purchase of shares/debentures and investment in real estate; | |

| i)ii) | repayment of dues of Promoters/associate concerns/inter-corporate deposits, etc; | |

| i)iii) | for extending loans/facilities to subsidiary or associate companies or for making any inter-corporate deposits, and | |

| i)iv) | for any other speculative purposes. | |

| 3.2 | General covenants | |

| A) | Unless otherwise agreed to by the Lender, the Borrower shall, | |

| (i) | Notice of winding up or other legal process | |

| Promptly inform the Lender regarding any litigation against the Borrower, any of its properties or business or undertaking or if a Receiver is appointed of any of its properties or business or undertaking; | ||

| (ii) | Adverse changes in profits and production |

| Promptly inform the Lender of the happening of any labour strikes, lockouts, shutdowns, fires or any event likely to have a substantial effect on the Borrower’s profits or business and of any material changes in the rate of production or sales of the Borrower with an explanation of the reasons therefor; | |

| (iii) | Insurance |

| (a) | keep all its assets adequately insured at all time and such of its other properties as are of an insurable nature against fire, theft, lightning, explosion, earthquake, riot, strike, civil commotion, xxxxx, xxxxxxx, flood, marine risks, erection risks, war risks, and such other risks as may be specified by the Lender and shall duly pay all premia and other sums payable for that purpose. The insurance in respect of the properties charged/to be charged to the Lender shall be taken in the joint names of the Borrower and the Lender and any other person or institution having an insurable interest in the properties of the Borrower and acceptable to the Lender. The Borrower shall keep deposited with the Lender the copies of insurance policies and renewals thereof; |

| (b) | agree that, in the event of failure on the part of the Borrower to insure the assets or to pay the insurance premia or other sums referred to above, the Lender may get the assets insured or pay the insurance premia and other sums referred to above, as the case may be, |

| (c) | agree that the Lender shall have sole discretion to appropriate the proceeds, if any received from the insurance company in satisfaction of the Loan, |

| (d) | agree that it shall furnish certificate from an auditor, acceptable to the Lender, certifying the adequacy of insurance taken by, |

| (e) | agree that it shall inform the Lender of the happening of any of the events specified in sub clause (a) above and the loss or damage which the Borrower may suffer due to any of the aforesaid events for which the assets are insured. |

| (iv) | Imposts, costs, charges and expenses |

| Untill the Final Settlement Date bear all such imposts, duties and taxes (including interest and other taxes, if any) as may be levied from time to time by the Government or other authority with the sanction of law pertaining to or in respect of the Loan, | |

| (a) | pay all other costs, charges and expenses in any way incurred by the Lender (including costs of investigation of title and protection of Lender’s interest) and such additional stamp duty, other duties, taxes, charges and other penalties if and when the Borrower is required to pay according to the laws for the time being in force in the State in which its properties are situated or otherwise; |

| (b) | agree that in the event of the Borrower failing to pay the monies referred to in sub-clause (a) the Lender will be at liberty (but shall not be obliged) to pay the same. The Borrower shall reimburse all sums paid by the Lender in accordance with the provisions contained in this Agreement. |

| (i) The Borrower shall reimburse all sums paid by the Lender under demand from the Lender. All such sums shall be debited to the Borrower’s Loan Account and shall carry interest from the date of payment till such reimbursement at the maximum Applicable Lending Rate (in the case of rupee loans). |

(ii) In case of default in making such reimbursement within 30 days from the date of notice of demand, the Borrower shall also pay on the defaulted amounts, Liquidated Dam ages at the rate of 2% per annum from the expiry’ of 30 days from the date of notice of demand till reimbursement.

(iii) The Borrower hereby authorise the Lender to debit its current account with the Lender to the extent of expenditure incurred under this Agreement.

| (v) | Annual accounts |

Submit to the Lender its duly audited annual accounts within six months from the close of its accounting year. In case statutory audit (if required) is not likely to be completed during this period, the Borrower shall get its accounts audited by an independent firm of Chartered Accountants and furnish the same to the Lender;

| (vi) | Memorandum and Articles of Association |

Carry out such alterations to its Memorandum and Articles of Association as may be deemed necessary in the opinion of the Lender to safeguard the interests of the Lender arising out of this Agreement;

| (vii) | Escrow Account |

The Borrower shall enter into the Escrow Agreement to establish special purpose no-lien accounts viz. Escrow Account with the Escrow Bank and make firm arrangements (i) for prompt deposit of all proceeds of the Purpose as stated in the Financing Plan to the credit of the said Escrow Account and (ii) for transfer by the Escrow Bank of the proceeds of the Escrow Account into various sub-accounts in the manner and priority as may be specified/prescribed by the Lender.

| B) | Without the prior written approval of the Lender, the Borrower shall not, |

| (i) | New project |

Undertake any new project, diversification, modernisation or substantial expansion of the project described in this Agreement. The word “substantial” shall have the same meaning as under the Industries (Development and Regulation) Act, 1951.

| (ii) | Loans, debentures and charges |

Issue any debentures, raise any loans, accept deposits from public, issue equity or preference capital, change its capital structure or create any charge on its assets (except as permitted by this Agreement) or give any guarantees. This provision shall not apply to normal trade guarantees or temporary loans and advances granted to staff or contractors or suppliers in the ordinary course of business or raising of unsecured loans, overdrafts, cash credit or other facilities from banks in the ordinary course of business.

| (iii) | Premature Repayment |

Prepay any loan availed by it from any other party for the project without prior written approval of the Lender, which may be granted subject to such conditions as may be stipulated by the Lender.

| (iv) | Commission |

Pay any commission to its Promoters, guarantor, directors, managers, or other persons for furnishing guarantees, counter guarantees or indemnities or for undertaking any other liability in connection with any financial assistance obtained for or by the Borrower or in connection with any other obligation undertaken for or by the Borrower for the purpose of the project.

| (v) | Subsidiaries |

Create any subsidiary or permit any company to become its subsidiary.

| (vi) | Merger, Consolidation, Etc. |

Undertake or permit any merger, consolidation, re-organisation, scheme of arrangement or compromise with its creditors or shareholders or effect any scheme of amalgamation or reconstruction.

| (vii) | Dividend |

Declare or pay dividend to its shareholders so long as an Event of Default has occurred and is continuing and the Borrower is not in compliance with stipulated Financial Covenants. Further any dividend payment by the Borrower shall be done with a prior written approval of the Lender.

| (viii) | Investments by Borrower |

Make any investments by way of deposits, loans or in share capital of any other concerns (including subsidiaries) beyond projected and accepted level by the Lender so long as any money remains due and payable to the Lender; the Borrower will however be free to deposit funds by way of security with third party in the normal course of business or if required for the business.

| (ix) | Revaluation of assets |

Revalue its assets at any time until the Final Settlement Date.

| (x) | Subordination to the Loan |

The Borrower agrees and undertakes that, the subordinate unsecured loan amounting to Rs. 225,00,00,000/- (rupees two hundred and twenty crores only) or other monies brought in by any Person as loans (except the loans advanced by the Existing Secured Lenders), shall:

| (a) | be subordinated to the Loan; |

| (b) | not be repaid/redeemed till the Final Settlement Date; |

| (c) | not carry any interest till the Final Settlement Date; and |

| (d) | be without recourse to the Lender and the assets of the Borrower. |

Provided however, the subordinate unsecured loan amounting to Rs.225,00,00,000/- (rupees two hundred and twenty crores only) may be withdrawn by infusion of equal amount of fresh capital by way of issue of initial public offering or private placement of shares by the Borrower.

| (xi) | Sale, Disposal and Removal of Assets |

The Borrower shall not sell, dispose off, charged, encumbered or alienated, any land, building, structures or plant & machinery forming part of its assets, except in the ordinary course of business.

| 3.3 | Management |

| a. | The Borrower shall, as and when required by the Lender, appoint and change to the satisfaction of the Lender, the managing director, whole time director, suitable technical, financial and executive staff of proper qualifications and experience for the key posts. The terms of such appointments, including any changes therein, shall be subject to prior approval of the Lender. |

| b.(i) | Lender shall have the right to appoint, whenever they consider necessary, any person, firm, company or association of persons engaged in technical, management or any other consultancy business to inspect and examine the working of the Borrower and its factory and to report to the Lender. The Lender shall have the right to appoint, whenever they consider necessary, any Chartered Accountants/Cost Accountants as auditors for carrying out any specific assignment(s) or to examine the financial or cost accounting system and procedures adopted by the Borrower for its working or as concurrent or for conducting a special audit of the Borrower. The costs, charges and expenses including professional fees and travelling and other expenses of such consultants or auditors shall be payable by the Borrower. |

| (ii) | The Borrower shall constitute such committees of the Board with such composition and functions as may be required by the Lender for close monitoring of different aspects of its working. |

| 3.4 | Nominee Director |

| (i) | The Lender shall have the right to appoint and remove from time to time, a Director on Board of Directors of the Borrower. |

| (ii) | The Nominee Director shall not be required to hold qualification shares and not be liable to retire by rotation. |

| (iii) | The Nominee Director shall be entitled to all the rights and privileges of other directors including the sitting fees and expenses as payable to other directors but if any other fees, commission, monies or remuneration in any form is payable to the directors, the fees, commission, monies and remuneration in relation to such Nominee Director shall accrue to the Lender and the same shall accordingly be paid by the Borrower directly to the Lender. |

Provided that if any such Nominee Director is an officer of the Lender, the sitting fees in relation to such Nominee Director shall also accrue to the Lender and the same shall according be paid by the Borrower directly to the Lender.

Any expenditure incurred by the Lender or the Nominee Director in connection with his appointment or directorship shall be borne by the Borrower.

| (iv) | The Nominee Director shall be appointed a Member of the Management Committee or other committees of the Board, if so desired by the Lender. |

| (v) | The Nominee Director shall be entitled to receive all notices, agenda and minutes, etc. and to attend all General Meetings and Board Meetings and meetings of any committees of the Board of which he is a member. |

| (vi) | If, at any time, the Nominee Director is not able to attend a meeting of the Board of Directors or any of its committees, of which he is a member, the Lender may depute an observer to attend the meeting. The expenses incurred by the Lender in this connection shall be borne by the Borrower. |

| 3.5 | Financial Covenants |

The Borrower agrees to maintain the Financial Covenants at all times till the Final Settlement Date

The Borrower agrees and acknowledges that the Financial Covenants as above shall be calculated annually with reference to the audited financial statements of the Borrower. The first testing of compliance with Financial Covenants shall be done for the financial year 2015 and thereafter, for every financial year till the Final Settlement Date.

The Borrower shall submit to the Lender a compliance certificate from its statutory auditor for each financial year within a period of 6 (six) months from the end of such Financial Year, clearly stating that the Borrower is in compliance with the Financial Covenants as per the audited financial statements.

| 6.6. | Credit Rating |

The Borrower shall get all it borrowings rated by any one or more accredited rating agencies within a period of 6 (six) months from the date of lst (first) disbursement in compliance with the Basel II norms. The Borrower shall thereafter obtain credit ratings for all its borrowings at least at annual intervals and produce satisfactory evidence to the Lender in that regard.

ARTICLE IV

REPORTS AND INSPECTION

| 4.1 | Auditor’s certificate |

| (i) | At the request of the Lender, caused an investigation conducted by its statutory auditors to ascertain whether there had been any diversion / siphoning of funds by the Borrower. The cost of the investigation shall be borne by the Borrower. |

| (ii) | Notwithstanding anything contained in hereinabove, the Borrower agrees that the Lender may give instructions to its statutory auditors to carry out the investigation as to whether there was any incidence of diversion / siphoning of funds by the Borrower. The cost of the investigation to be borne by the Borrower. |

| 4.2 | Reports |

| (i) | The Borrower shall furnish to the Lender project completion certificate from the statutory auditor/ Lender’s' engineer and such other reports as may be required by them. |

| (ii) | The Borrower shall maintain fixed assets register as required by law from time to time and shall furnish to the Lender the extract of the fixed asset register within one month after implementation of the project and thereafter as on March 31st of each year until the Final Settlement Date. |

| 4.3 | Expenditure records: Inspection |

The Borrower shall,

| i) | Maintain records showing expenditure incurred, utilisation of the disbursements out of the Loan the operations and financial condition of the Borrower and such records shall be open to examination by the Lender, and their authorised representatives. |

| ii) | Allow the authorised representatives or nominees of the Lender including any auditor or technically qualified person to inspect the assets purchased out of the Loan and will give all facilities to enable such persons to report thereon. |

| iii) | The cost of inspection, including travelling and all other expenses, shall be payable by the Borrower to the Lender in this behalf. |

| 4.4 | The Borrower agrees and undertake to inform the Lender about the term and conditions of the initial public offering of Rs.700,00,00,000/- (Rupees seven hundred crores only) approved by SEBI, within 7 days from the date of approval by SEBI of the terms and conditions of the said initial public offering. |

ARTICLE V

EVENTS OF DEFAULTS AND CONSEQUENCES

| 5.1 | If one or more of the events specified in this section happen(s), the Lender may by a notice in writing to the Borrower, declare the principal of and all accrued interest on the Loan to be due and payable forthwith and the security created in terms of this Agreement shall become enforceable. |

| (a) | Default in payment of principal sum of the Loan |

Default has occurred in the payment of principal sum of the Loan on the due dates.

| (b) | Default in payment of interest |

Default has been committed by the Borrower in payment of any installment of interest on the Loan and such default has continued for a period of thirty days.

| (c) | Default in performance of covenants and conditions |

Default has occurred in the performance of any representation, warranty, other covenant condition or agreement on the part of the Borrower under this Agreement or any other agreement and such default has continued for a period of thirty days after notice in writing thereof has been given to the Borrower by the Lender.

| (d) | Inability to pay debts |

The Borrower is unable to pay its debts or proceedings for taking it into liquidation, either voluntarily or compulsorily, may be or have been commenced.

| (e) | Attachment or distraint on charged assets |

If an attachment or distraint has been levied on the assets or any part thereof hypothecated/mortgaged to the Lender or certificate proceedings have been taken or commenced for recovery of any dues from the Borrower.

| (f) | Appointment of receiver or liquidator |

A receiver or liquidator has been appointed or allowed to be appointed of all or any part of the undertaking of the Borrower.

| (g) | Sale, disposal and removal of assets |

If, without the prior approval of the Lender, any land, buildings, structures or plant and machinery of the Borrower are sold, disposed of, charged, encumbered or alienated or the said buildings, structures, machinery, plant or other equipment are removed, pulled down or demolished.

| (h) | Submission of misleading information |

Any information given by the Borrower in its application for Loan, in the report and other information furnished by the Borrower in accordance with the Reporting System and the warranties given / deemed to have been given by the Borrower to the Lender is misleading or incorrect in any material respect.

| (i) | Cross defaults and cross acceleration |

| (i) | The Borrower’s failure to pay any amount more than Rs.5,00,00,000/- (rupees five crores only) when due to any person other than the Lender or an event of default being constituted in relation to any of the Borrower’s credit, borrowing or any other arrangement with any person other than the Lender. |

| (ii) | Any person other than the Lender accelerating repayment (i.e demanding repayment ahead of the previously agreed repayment schedule) due from the Borrower to such other person under the Borrower’s credit, borrowing or any other arrangement with that person. |

| 5.2 | If an Event of Default has taken place then the Lender shall have the right to publish the information in the manner it may consider appropriate. |

| 5.3 | Notice to the Lender on the happening of an event of default |

If any Event of Default or any event which, after the notice, or lapse of time, or both, would constitute an Event of Default has happened, the Borrower shall, forthwith give notice thereof to the Lender in writing specifying the nature of such Event of Default, or of such event.

| 5.4 | Expenses of preservation of assets of Borrower and of collection |

All expenses incurred by the Lender after an Event of Default has occurred in connection with -

| (a) | preservation and protection of the Borrower’s assets (whether then or thereafter existing); and |

| (b) | collection of amounts due under this Agreement; shall be payable by the Borrower. |

| 5.5 | Consequences of Event of Default |

If one or more of the aforesaid Events of Default shall occur thereupon and in every such event and anytime thereafter, the Lender shall have the right to terminate the Loan and accelerate the obligations of the Borrower and in exercise of such rights, the Lender may, without prejudice to any rights that it may have, take one or more of the following actions including but not limited to:

| (i) | declare that all the outstanding principal amount, interest and other monies due and payable by the Borrower hereunder shall forthwith become due and payable, whereupon such amounts shall become forthwith due and payable without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived, anything contained herein to the contrary notwithstanding; |

| (ii) | exercise any and all rights specified in the Security Documents including, enforce all of the security created pursuant to the Security Documents; |

| (iii) | exercise such other remedies as permitted or available under applicable law; |

| (iv) | enter upon and take possession of the assets of the Borrower; transfer the assets of the Borrower by way of lease or leave and license or sale to any Person; |

| (v) | instruct any Person, who is liable to make any payment to the Borrower, to pay directly to the Lender; |

| (vi) | review the management set-up and/ or organisation of the Borrower by appointing any independent/ concurrent auditor/ consultants and require the Borrower to restructure it as may be considered necessary by the Lender, including the information of management committees with such powers and functions as may be considered suitable by the Lender, if in the opinion of the Lender, the business of the Borrower is conducted in a manner opposed to public policy or in a manner prejudicial to the Lender’s interests; |

| 5.6 | Other Consequences of Event of Default |

| (a) | Right to appoint whole time director / nominee director |

Upon the occurrence of an Event of Default the Lender has the right to appoint and remove from time to time Whole -time Director(s) /Nominee Director (s) on the Board of Directors of the Borrower. Such Whole -time Director(s) /Nominee Director (s) shall exercise such powers and duties as may be approved by the Lender and have such rights as are usually exercised by or are available to a Whole -time Director/Nominee Director (s) in the management of the affairs of the Borrower. Such Whole -time Director (s) /Nominee Director (s) shall not be required to hold qualification shares nor liable to retire by rotation and shall be entitled to receive such remuneration, fees, commission and monies as may be approved by the Lender. Such Whole -time Director(s) /Nominee Director (s) shall have the right to receive notices of and attend all general meetings and board meetings or any committee of the Borrower of which they are members.

Any expenses that may be incurred by the Lender or such Whole -time Directors)/ Nominee Director (s) in connection with their appointment or directorship shall be paid or reimbursed by the Borrower to the Lender or as the case may be, to such Whole -time Director(s) /Nominee Directors).

| (b) | Conversion right |

If the Borrower continues to be in default for a period of thirty (30) days or more from due date of installments of principal amounts of the Loan or interest thereon or any combination thereof, then, the Lender shall have the right to convert (which right is hereinafter referred to as “the conversion right”) at their option the whole or part of the outstanding amount of the Loan into fully paid-up equity shares of the Borrower, at par in the manner specified in a notice in writing to be given by the Lender to the Borrower (which notice is hereinafter referred to as the “notice of conversion”) prior to the date on which the conversion is to take effect, which date shall be specified in the said notice (hereinafter referred to as the “date of conversion”).

| (i) | On receipt of notice of conversion, the Borrower shall allot and issue the requisite number of fully paid-up equity shares to the Lender as from the date of conversion and the Lender shall accept the same in satisfaction of the principal amount of the Loan to the extent so converted. The part of the Loan so converted shall cease to carry interest as from the date of conversion and the Loan shall stand correspondingly reduced. Upon such conversion, the installments of the Loan payable after the date of conversion as per the Amortization Schedule in this Agreement shall stand reduced proportionately by the amounts of the Loan so converted. The equity shares so allotted and issued to the Lender shall carry, from the date of conversion, the right to receive proportionately the dividends and other distributions declared or to be declared in respect of the equity capital of the Borrower. Save as aforesaid, the said shares shall rank pari passu with the existing equity shares of the Borrower in all respects. |

| ii) | The conversion right reserved as aforesaid may be exercised by the Lender on one or more occasions until the Final Settlement Date. |

| iii) | The Borrower assures and undertakes that in the event of the Lender exercising the right of conversion as aforesaid, the Borrower shall get the equity shares which will be issued to the Lender as a result of the conversion, listed with the Stock Exchange(s) at Mumbai and such other places as may be notified by the Lender to the Borrower. | |

| For the purposes of this clause it shall not be construed as a default, if the Borrower approaches the Lender well in advance for postponement of principal or interest, as the case may be, and the Lender agree to the same. | ||

| Explanation: the term “outstanding” shall mean the principal amount of the Loan, interest and other monies payable thereon as at the time when the amounts are sought to be converted into equity shares of the Borrower. |

ARTICLE V1

MISCELLANEOUS.

| 6.1 | Cancellation by notice to the Borrower |

The Lender may, by notice in writing to the Borrower, cancel the Loan or any part the reof, which the Borrower has not withdrawn prior to the giving of such notice.

| 6.2 | Suspension |

Further access by the Borrower to the use of the Loan may be suspended or terminated by the Lender:

| i) | Upon failure by the Borrower to carry out all or any of the terms of this Agreement or on the happening of any Event of Default as provided in this Agreement. | |

| ii) | If any extra-ordinary situation makes it improbable that the Borrower would be able to perform its obligations under this Agreement. | |

| iii) | If any change in the Borrower’s set-up has taken place which, in the opinion of the Lender (which shall be final and binding the Borrower), would adversely affect the conduct of the Borrower’s business or the financial position or the efficiency of the Borrower’s management or personnel or carrying on its activities. |

| 3.3. | Suspension to continue till default remedied |

The right of the Borrower to make withdrawals from the Loan shall continue to be suspended until the Lender has notified the Borrower that the right to make withdrawals has been restored.

| 4.4. | Termination |

If any of the events described above and elsewhere in this Agreement has been continuing or if the right of the Borrower to make withdrawals from the Loan shall have been suspended with respect to any amount of the Loan for a continuous period of thirty days or if the Borrower has not withdrawn the Loan by the date referred to herein or such later date as may be agreed to by the Lender then, in such event, the Lender may by notice in writing to the Borrower, terminate the right of the Borrower to make with drawals. Upon such notice, the undrawn amount of the Loan shall stand cancelled. Notwithstanding any cancellation, suspension or termination pursuant to the aforesaid provisions, all the provisions of this Agreement shall continue to be in full force and effect as herein specifically provided.

| 4.5. | Provisions relating to waiver |

No delay in exercising or omission to exercise any right, power or remedy accruing to the Lender upon any default under this Agreement, security documents or any other agreement or document shall impair any such right, power or remedy or shall be construed to be a waiver thereof or any acquiescence in such default, nor shall the action or inaction of the Lender in respect of any default or any acquiescence by the Lender in any default, affect or impair any of its right, power or remedy in respect of any other default.

| 4.6. | Evidence and calculations |

(a) Accounts

In any legal action or proceedings arising out of or in connection with this Agreement, the entries made in the accounts maintained by the Lender shall be conclusive evidence of the existence and amount of obligations of the Borrower as therein recorded.

(b) Statement of accounts

Any certification or determination by the Lender of a rate of interest or amount under this Agreement is conclusive evidence of the matters to which it relates.

| 4.7. | Effective date of Agreement |

This Agreement shall become binding on the Borrower and the Lender on and from the date first above written. It shall be in force till all monies due and payable and disbursed from time to time under this Agreement are fully paid off.

| 8.8. | Assignments etc. |

(a) The Borrower shall have no right of assignment under this Agreement without the prior approval of the Lender.

(b) The Lender may securitise, assign, transfer or novate any of its rights and obligations under this Agreement, and or under the loan/security documents and the Borrower shall take such action as may be necessary to perfect such transaction.

| 6.9 | Service of notice |

Any notice or request to be given or made to the Lender or to the Borrower or to any other party shall be in writing. Such notice or request shall be deemed to have been given or made when it is delivered by hand or despatched by mail, e-mail, or fax, or overnight courier to the party to which it is required to be given or made at such party’s designated address.

ARTICLE VII

DEFINITIONS AND INTERPRETATION

| 7.1 | DEFINITIONS |

“Additional Interests” shall mean collectively the Additional Interest for Non - Creation of Security and Additional Interest for Non-Adherence of Financial Covenant.

“Agreement” shall mean this loan agreement together with all recitals and schedules, attached to this Agreement and shall include any amendment to this Agreement made by the Parties from time to time after the date hereof.

“Amortization Schedule” shall mean the schedule of repayment of the Loan set forth in Schedule I of this Agreement as amended by the Lender.

“Applicable Interest Rate” shall mean at any relevant time, and in relation to the Loan, the interest rate as set out below, including the interest rate as revised pursuant to the reset of the Spread as per Article 1.3 (ii) of this Agreement -

| APPLICABLE INTEREST RATE | |

| United Bank of India |

Applicable Interest Rate shall be floating at a Spread of 275 basis points above the Bank’s Base Rate. The present Bank’s Base Rate is 10.25 %. The interest as above, shall be payable by the borrower in arrears, on the 1st of each month. The proposed rate of UBI shall not be lower than any other lenders, if any lenders charge the higher rate, the same shall be applicable to UBI also. |

“Authorised Officer” shall mean with respect to any person, any officer of such person that is authorized to sign on behalf of such person and at the time being listed as such by the comp any secretary of such person in the most recent certificate of such company secretary delivered to the Lender.

“Business Plan” shall mean 3 year business plan financing of Rs.2411 crore, to be financed by way of: Rupee Term Loan (RTL) of Rs.1200 crore (Rs.750 crore in FY 2013, Rs.400 crore in FY 2014 and Rs.50 crore in FY 2015), Rs.630 crore in the form of equity capital through IPO and Rs.581 crore in the form of, internal accruals & decrease in net current assets.

“Contributed Equity” shall mean equity share capital (including share premium) and unsecured loan from promoters.

“DTH License” shall mean DTH License agreement dated December 28, 2007, executed between our Company and the President of India acting through the Director, Broadcasting, Policy & Legislation, Ministry of Information and Broadcasting, Government of India, to provide DTH services.

“Debt Service Reserve" or “DSR” shall mean the reserve equivalent to ensuing 1 (one) quarter of debt service payment be created and maintained by the Borrower.

“Debt Service Reserve Account" or "DSRA" shall have the meaning ascribed to it Under the Escrow Agreement.

“Escrow Account” shall mean an escrow account established in terms of and under the Escrow Agreement and shall include the sub-accounts.

“Escrow Agreement” shall mean the escrow agreement entered/ to be entered into among, inter alia, the Borrower and the Lender on or about the date of this Agreement, as may be amended and supplemented from time to time.

“Escrow Bank” shall mean any bank appointed by the Lender in writing for operating and maintain the Escrow Account.

“Events of Default” shall mean all or any of the events specified in Article 5.1 of this Agreement.

“Existing Secured Lenders” shall mean all the existing secured lenders of the Borrower as listed in Schedule II of this Agreement.

“Financial Covenant” shall mean -

| (i) | Total Debt to Contributed Equity shall not be more than 2 (two); and |

| (ii) | Fixed Asset Coverage Ratio not less than 1.25 (one point twenty five). |

“Financing Documents” shall mean, as the context may require or admit, any or all of the following documents, as may be amended from time to time, namely-

| (i) | this Agreement; |

| (ii) | the Security Documents; and |

| (iii) | any other document designated as the Financing Documents by the Lender. |

“Financing Plan” shall mean the 3 (three) year Business Plan financing of Rs.2410,69,00,000/- (rupees two thousand four hundred and ten crores and sixty nine lakhs only) to be financed as under –

| Amount | ||||

| Source of fund | (Rs. in Crores) | |||

| Rupee Term Loans | ||||

| (i) FY 2013 | 750 | |||

| (ii) FY 2014 | 400 | |||

| (iii) FY 2015 | 50 | |||

| (A) Total Rupee Term Loans (i + ii + iii) | 1200 | |||

| (B) Equity Capital Through IPO | 630 | |||

| (C) Internal Accruals and Decrease in Net Current Assets | 580.69 | |||

| TOTAL (A+B+C) | 2410.69 | |||

“Final Settlement Date” shall mean the date on which all the monies due under the Financing Documents shall have been irrevocably and unconditionally paid, performed and discharged in full to the satisfaction of the Lender.

“Fixed Asset Coverage Ratio” shall mean Net Fixed Assets divided by Secured Term Loan.

“Greenfield Appliances Private Limited” shall mean a company within the meaning of the Companies Act. 1956 (1 of 1956) and having its Company identification No. U32204MH197PTC021984 and Registered Office at 2275, Xxxxx Xxxxx, Xxxxxxxxxx - 000000.

“IDBI Base Rate” shall mean the rate of interest per annum as determined, from time to time by IDBI Bank Limited, whether known as base rate or any other nomenclature for the same as applicable to rupee loans and such rate shall be fully floating for the tenor of the Loan.

“Interest Payment Date” shall mean at any time, the 1st (first) day of each month on which the Borrower is required to pay interest at the Applicable Interest Rate on the Loans as per this Agreement.

“Interest Period” shall mean (i) in the first instance, the period commencing from the date of disbursement of the Loan under this Agreement and ending on and including the next Interest Payment Date; and (ii) subsequently, each period commencing from and excluding one Interest Payment Date and ending on (and including) the next Interest Payment Date.

“Loan” shall have the meaning ascribed to it under Article 1.2(a) of this Agreement.

“Lenders’ Legal Counsel” or “LLC” shall mean M/s Link Legal - India Law Services, or any replacement therefor, as may be selected and appointed by the Lender.

“Material Adverse Effect” shall mean the effect or consequence of an event, circumstance, occurrence or condition which has caused, as of any date of determination, or could reasonably be expected to cause a material and adverse effect on: (i) the financial condition, business or operation of the Borrower; (ii) the ability of the Borrower to perform its obligations under the Financing Documents; (iii) the ability of the Borrower to comply in all respects with the terms or conditions of any of the approvals; and (iv) the legality, validity or enforceability of any of the Financing Documents, (including the ability of any Lender to enforce any of its remedies under the Financing Documents), the other agreements/ contracts to which it is a party or the approvals.

“Nominee Director” shall mean the nominee director appointed by the Lender pursuant to Article 3.4 of this Agreement.

“Permitted Investments” shall mean any of the investments mentioned below made with the prior approval of the Lender – Government of India securities;

| (ii) | Rupee negotiable certificates of deposit, debt instruments or similar instruments denominated in Rupees, which is for the time being rated at least AAA or equivalent short term money market ratings by either of CRISIL or CARE or FITCH or ICRA or any other reputed rating agency; |

| (iii) | Interest bearing deposits with the Lender; |

| (iv) | Money market mutual funds rated at least AAA or equivalent money market ratings by either of CRISIL or CARE or FITCH or ICRA or any other reputed rating agency; |

| (v) | Commercial paper (rated at least P-l + or its equivalent thereof by either of CRIS1IL or XXXX or FITCH or ICRA or any other reputed rating agency); and |

| (vi) | Any other investment that may be permitted by the Lender in writing. |

“Promoters” shall mean (a) Solitaire Appliances Private Limited; (d) Platinum Appliances Private Limited: and (e) Greenfield Appliances Private Limited.

“Purpose” shall mean the purpose of meeting the funding requirements during the Business Plan period viz. solely towards creation of assets including -

| (i) | Subscriber acquisition cost viz. the cost of consumer premises equipment (“CPE”) (consisting of set top box, outdoor unit and smart card) |

| (ii) | Cost of CPE inventory build-up; and |

| (iii) | Other general capital expenditure. |

“Platinum Appliances Private Limited” shall mean a company within the meaning of the Companies Act, 1956 (1 of 1956) and having its Company Identification No. U32109MII1979 PTC021997 and Registered Office at 2275, Adate Bazar. Ahmednagar - 414001.

“Rupees” and the sign of “‘”shall mean the lawful currency of India.

“Security” shall have the meaning ascribed to it under Article 2.1 of this Agreement.

“Security Documents” shall mean, as the context may require or admit, any or all of the foil owing documents, as may be amended from time to time, namely-

| (i) | guarantees to be provided by the (a) Shri Xxxxxxxxx Xxxxx; (b) Shri Pradcep Kumar X. Xxxxx (c) Solitaire Appliances Private Limited; (d) Platinum Appliances Private Limited and (e) Greenfield Appliances Private Limited; |

| (ii) | the deed of hypothecation; |

| (iii) | any document executed or obtained in favour of/ for the benefit of the Lender for creation of/ perfection of/ maintaining the Security; and |

| (iv) | any other document designated as such by the Lender. |

“Solitaire Appliances Private Limited” shall mean a company within the meaning of the Compamies Act, 1956 (1 of 1956) and having its Company Identification No. U32204MH1979P TC021985 and Registered Office at 2275. Xxxxx Xxxxx, Xxxxxxxxxx - 000000..

“Spread” shall mean the margin over and above the IDBI Base Rate to derive at the Applicable Interest Rate as may be notified by the IDBI Bank Limited.

“Total Loan” shall mean the rupee term loans aggregating Rs. 1200,00,00,000/- (rupees twelve hundred crores only) agreed to be provided by the lenders to the Borrower to part finance the Purpose.

“Total Debt” shall mean Secured Term Loan from various Banks and Financial Institutions.

[Note LL-ILS: Lender to provided]

| 7.2 | INTERPRETATION |

In this Agreement unless the context otherwise requires:

| i) | the singular includes the plural and vice versa; |

| ii) | headings and the use of bold typeface shall be ignored in its construction; |

| iii) | a reference to a Section or Article or Schedule is, unless indicated to the contrary, a reference to a section/ article in, or schedule to, this Agreement; |

| iv) | references to this Agreement shall be construed as references also to any separate or independent stipulation or agreement contained in it; |

| v) | the words “other”, “or otherwise” and “whatsoever” shall not be construed ejusdem generis or as any limitation upon the generality of any preceding words or matters specifically referred to; |

| vi) | references to the word “includes” or “including” arc to be construed without limitation; |

| vii) | references to a Party or a Person shall include their respective successors, assigns or transferees (to the extent assignment or transfer is permitted under the relevant agreement); |

| viii) | all references to agreements, documents or other instruments include a reference to that agreement, document or instrument as amended, supplemented, substituted, novated or assigned from time to time; |

| ix) | the words “herein”, “hereto” and “hereunder” refer to this Agreement as a whole and not to the particular section in which such word may be used; |

| x) | words importing a particular gender shall include all genders; |

| xi) | references to any law shall include references to such law as it may, after the date of this Agreement, from time to time be amended, supplemented or re-enacted; |

| xii) | unless the reference to month is for specifying a period, all references to “month” shall mean English calendar month provided that wherever the reference to the expression “month” is used in the context of period, it shall mean a period of 30 (thirty) days. All references to quarter shall mean a period of 3 (three) months commencing on lst January, 1st April, 1st July and 1st October, provided that for repayment of the Loans, the period of quarter shall be construed as per the Amortization Schedule; |

| xiii) | the currency of money shall be Indian Rupee; |

| xiv) | all consents, approvals, permissions, waivers, relaxations or extensions required to be given by the Lender shall be given by the Lender in writing; and |

| xv) | in the event of any disagreement or dispute between the Lender and the Borrower regarding the materiality of any matter including of any event, occurrence, circumstance, charge, fact, information, document, authorisation, proceeding, act, omission, claims, breach, default or otherwise, the opinion of the Lender as to materiality of any of the forgoing shall be final and binding on the Borrower. |

SCHEDULE I

(AMORTISATION SCHEDULE)

The company shall repay the principal amount of the Loan in 24 (twenty four) unequal quarterly installments commencing after 2¼ years from the date of 1st (first) disbursement (tentatively April 1, 2015) as under:

| Year | Amt. out of total loan to be repaid during the year | No. of quarterly instalments | ||||||

| 2015-16 | 5.00 | % | 4 | |||||

| 2016-17 | 7.50 | % | 4 | |||||

| 2017-18 | 15.00 | % | 4 | |||||

| 2018-19 | 20.00 | % | 4 | |||||

| 2019-20 | 25.00 | % | 4 | |||||

| 2020-21 | 27.50 | % | 4 | |||||

| Total | 100 | % | 24 | |||||

SCHEDULE II

PARTICULARS OF THE EXISTING SECURED LENDERS

| (a) | Central Bank of India for their rupee term loan of Rs.350 Crore; |

| (b) | IDBI Bank Term Loan of Rs.360 crore |

| (c) | Bank of Baroda (RTL of Rs.100 crore |

| (d) | Oriental Bank of Commerce (RTL of Rs.l00 crore) |

| (e) | Bank of India (RTL of Rs.50 crore) |

| (f) | ICICI Bank Ltd (RTL of Rs.300 crore) |

| (g) | Karur Vyasya Bank Ltd. (RTL of Rs.50 crore) |

| (h) | Canara Bank (RTL of Rs.200 crore) |

| (i) | Syndicate Bank (RTL of Rs.100 crore) |

| (j) | Jammu & Kashmir Bank (RTL of Rs.100 crore) |

| (k) | Xxxx Bank (RTL of Rs.l00 crore) |

IN WITNESS WHEREOF the Borrower has caused its Common Seal to be affixed hereto and to a duplicate hereof on the day, month and year first hereinabove written and the Lender has caused the same and the said duplicate to be executed by the hand of Shri. S.Murukan – Authorised Signatory and POA Holder authorised official of the Lender as hereinafter appearing.

| THE COMMON SEAL OF BHARAT BUSINESS CHANNEL LIMITED has (pursuant to the Resolution of its Board of Directors passed in that behalf on the 11th Day of May, 2013 hereunto been affixed in the presence of Shri S. Murukan, Authorised Signatory and POA Holder. |  | |

| ||

| SIGNED AND DELIVERED BY the withinnamed Lender by the hand of Shri Xxxxxx Xxxx, an authorised official of the Lender. |  |