UNIT EXCHANGE AGREEMENT

Exhibit 10.16

This Unit Exchange Agreement (this “Agreement”) is made and entered into as of November 11, 2022 (the “Effective Date”) by and among Triller Hold Co LLC, a Delaware limited liability company (“Triller”); JuliusWorks, LLC, a Delaware limited liability company and the successor by conversion of JuliusINC. (“JuliusLLC” and, together with XxxxxxXXX, individually or collectively, as the context may require, “Xxxxxx”); and Xxxxxx Holdings Inc., a Delaware corporation (“HoldCo”). Xxxxxxx, Xxxxxx and XxxxXx are referred to collectively herein as the “Parties” and individually as a “Party.” Capitalized terms used but not otherwise defined throughout in this Agreement shall have the meanings set forth in Section 6.1.

RECITALS

A. Prior to the Reorganization (as defined below), the Persons set forth on Exhibit A attached hereto owned those certain Equity Interests in Juliusworks, Inc., a Delaware corporation (“JuliusINC”), in each case, as set forth next to such Person’s name on Exhibit A attached hereto, which Equity Interests constituted all of the issued and outstanding Equity Interests of Xxxxxx on a fully diluted basis as of immediately prior to the Reorganization.

B. In anticipation of the consummation of the transactions contemplated herein, prior to the execution and delivery of this Agreement, JuliusINC underwent an internal reorganization and entered into a series a transactions (collectively, the “Reorganization”) pursuant to which: (a) the Promissory Notes were amended such that (i) all outstanding rights and obligations of JuliusINC to issue Equity Interests in respect thereof were terminated and (ii) payoff of such Promissory Notes shall occur concurrently or immediately following payoff of the senior indebtedness with Silicon Valley Bank; (b) all outstanding principal sum, together with all accrued and unpaid interest thereon, in respect of the Convertible Notes were converted or exchanged into shares of common stock, par value $0.0001 per share, of JuliusINC; (c) immediately after the transactions contemplated in clauses (a) and (b), Xxxxxx Xxxxxx Co. Inc., a Delaware corporation and direct, wholly-owned Subsidiary of HoldCo (“Merger Sub”), merged with and into JuliusINC, with JuliusINC being the surviving company and direct, wholly-owned Subsidiary of HoldCo (the “Merger”); (d) in connection with the Merger, each share of common stock, par value $0.0001 per share of JuliusINC, issued and outstanding immediately prior to the effective time of the Merger, converted into the right to receive one validly issued, fully paid and non-assessable shares of common stock, par value $0.0001 per share, of HoldCo, all pursuant to the Merger Agreement; (e) in connection with the Merger, all of the issued and outstanding options granted under the Stock Incentive Plan and the applicable incentive stock option agreements to which each grantee is a party was assumed by HoldCo pursuant to the Merger Agreement; (f) in connection with the Merger, all of the unexpired and unexercised warrants to acquire Xxxxxx common stock to which each holder is a party was assumed by HoldCo pursuant to the Merger Agreement and (g) immediately after the effective time of the Merger, a certificate of conversion and a certificate of formation were filed with the Delaware Secretary of State pursuant to the Merger Agreement to effectuate a conversion of JuliusINC’s organizational structure from a Delaware corporation into a Delaware limited liability company (the “Conversion”).

C. As of immediately after the Reorganization, XxxxXx owns all of the issued and outstanding securities of Xxxxxx (the “Xxxxxx Securities”).

D. On the terms and subject to the conditions set forth in this Agreement, Xxxxxxx desires to acquire from HoldCo, and HoldCo desires to transfer, convey and contribute to Triller, the Xxxxxx Securities, free and clear of any Liens (as defined in this Agreement), in exchange for the consideration of up to 703,829 newly-issued Class B Common Units of Triller, as determined pursuant to Section 1.1 of this Agreement, plus any Earnout Consideration that Holdco may become entitled to receive pursuant to Section 1.3 of this Agreement (such transaction, the “Exchange”).

In consideration of the foregoing premises, the mutual agreements and covenants set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

ARTICLE 1

THE BASIC TRANSACTION

1.1 Exchange; Indemnification Holdback; Management Incentive Consideration.

(a) On the terms and subject to the conditions set forth in this Agreement, on the Effective Date, simultaneously with the execution and delivery of this Agreement and the Related Agreements, (i) HoldCo shall contribute, transfer, assign, convey and deliver to Triller, and Xxxxxxx shall acquire and accept from HoldCo, the Xxxxxx Securities, free and clear of any Liens; and (ii) Triller shall pay or issue to HoldCo, and HoldCo shall acquire and accept from Triller, the Closing Unit Consideration.

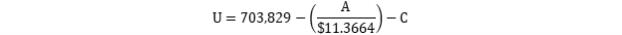

(b) The Closing Unit Consideration shall be calculated in accordance with the following formula:

Where:

| U | = The number of Class B Common Units issuable by Triller to HoldCo at the Closing (the “Closing Unit Consideration”); |

| A | = The amount of Closing Indebtedness; and |

| C | = The Indemnification Holdback Amount. |

(c) 175,957 Class B Common Units (the “Indemnification Holdback Amount”) shall be held back and retained by Xxxxxxx as partial security for Losses in respect of Claims for which the Triller Indemnified Parties are entitled to indemnification from HoldCo pursuant to Article 5. Any portion of the Indemnification Holdback Amount remaining available to HoldCo after the expiration of the General Survival Period shall be released to HoldCo in accordance with the terms, conditions and limitations set forth in Article 5.

(d) Concurrently with the consummation of the Exchange, Triller shall grant to the Key Employees 88,000 Restricted Class B Common Units (the “Management Incentive Equity”). The Management Incentive Equity shall be allocated as set forth on Exhibit B and subject to the terms and conditions set forth in the form of Management Equity Agreement attached hereto as Exhibit X. Xxxxxxx and each Key Employee shall enter into a Management Equity Agreement, effective as of the Effective Date.

1.2 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place simultaneously with the execution and delivery of this Agreement via the remote exchange of documents and signatures. Notwithstanding the date on which the Closing actually occurs (the “Closing Date”), the Exchange will be deemed effective as of 12:01 am Pacific Time on the Closing Date.

1.3 Earnout Consideration.

(a) In the event that Xxxxxx satisfies the Annual Cash Flow Conditions and achieves the Gross Revenue Milestones set forth on Schedule 1.3 (the “Earnout Calculation Schedule”), HoldCo shall be entitled to receive up to $16 million in contingent consideration (“Earnout Consideration”) based upon the financial performance of Xxxxxx during the Measurement Periods as set forth on the Earnout Calculation Schedule.

2

(b) Promptly following the expiration of each Measurement Period, Xxxxxx and Xxxxxxx shall deliver to HoldCo a notice containing a calculation of Xxxxxx’s Gross Revenue and Cash Flows during such Measurement Period based on the financial statements of Xxxxxx for such Measurement Period, together with supporting documentation reasonably acceptable to HoldCo that validates such calculation (each such notice, an “Earnout Calculation Notice”). HoldCo shall have a period of fifteen (15) days after receipt of a Earnout Calculation Notice (each, a “Review Period”) to review the Earnout Calculation Notice and the evidence Xxxxxx and Xxxxxxx submitted therewith and, if HoldCo so determines, to dispute the calculations set forth in the Earnout Calculation Notice. In the event HoldCo so disputes any such calculation, the Parties shall attempt to resolve the dispute privately for a period of thirty (30) days (the “Negotiation Period”). If after the expiration of a Negotiation Period no resolution has been reached, the Parties shall submit the dispute to an independent accounting firm mutually acceptable to HoldCo and Xxxxxxx, who shall review Xxxxxx’s financial statements and make a determination as to Xxxxxx’s Gross Revenue and Cash Flows during the applicable Measurement Period, which determination shall be final and binding upon the Parties (the “Accountant Determination”).

(c) Provided that Xxxxxx shall have satisfied the applicable Annual Cash Flow Condition, promptly (but in any event within five (5) business days) after the expiration of each Review Period or, if applicable, Negotiation Period or, if applicable, an Accountant Determination, Triller shall pay or issue to HoldCo Earnout Consideration consisting of:

(i) With respect to the First Measurement Period, (x) an amount, via certified check or wire transfer of immediately available funds, equal to the amount set forth on Schedule 1.3 which corresponds with the percentage on Schedule 1.3 equal to the percentage obtained by calculating the fraction, the numerator of which is Xxxxxx’s Gross Revenue during the First Measurement Period and the denominator of which is the First Period Target (the “First Period Earnout Amount”), expressed as a percentage; or, if Triller elects in its sole and absolute discretion, (y) that number of Earnout Units which equals the amount obtained by calculating the fraction, the numerator of which is the First Period Earnout Amount and the denominator of which is the Triller Per-Unit Value, rounded down to the nearest whole unit; and

(ii) With respect to the Second Measurement Period, (x) an amount, via certified check or wire transfer of immediately available funds, equal to the sum of (I) the amount set forth on Schedule 1.3 which corresponds with the percentage on Schedule 1.3 equal to the percentage obtained by calculating the fraction, the numerator of which is Xxxxxx’s Gross Revenue during the Second Measurement Period and the denominator of which is the Second Period Target (the “Second Period Earnout Amount”), expressed as a percentage, plus (II) in the event that Xxxxxx’s Gross Revenue during the Second Measurement Period exceeds the Second Period Target (such excess, “Excess Revenue”), an amount equal to (A) the amount set forth on Schedule 1.3 which corresponds with the percentage on Schedule 1.3 equal to the percentage obtained by calculating the fraction, the numerator of which is the sum of Xxxxxx’s Gross Revenue during the First Measurement Period plus the Excess Revenue and the denominator of which is the First Period Target (the “First Period Earnout Amount”), expressed as a percentage, less (B) the First Period Earnout Amount (such calculated amount, the “Excess Revenue Earnout Amount”); or, if Triller elects in its sole and absolute discretion, (y) that number of Earnout Units which equals the amount obtained by calculating the fraction, the numerator of which is the sum of the Second Period Earnout Amount plus the Excess Revenue Earnout Amount and the denominator of which is the Triller Per-Unit Value, rounded down to the nearest whole unit.

(d) Triller may make business decisions in good faith as it deems appropriate in connection with the conduct of Xxxxxx’s business (including actions that may have an impact on Gross Revenue), and this covenant shall not be the basis for any Actions arising from or in connection with actions taken (or omitted from being taken) by or on behalf of Triller whereby the primary purpose was not to decrease Xxxxxx’s Gross Revenue or negatively impact achievement of the Annual Cash Flow Conditions.

3

Without limiting the foregoing, Xxxxxxx agrees to comply with the obligations set forth on Schedule 1.3 during the period commencing upon the Closing and expiring concurrently with the Second Measurement Period.

(e) From and following the Closing until the conclusion of the Second Measurement Period, Triller shall provide HoldCo with copies of all financial statements, budgets, materials and other information that it provides to any member of Triller pursuant to Section 9.3 of the LLC Agreement at the same time and in the same manner as provided to such members.

1.4 Closing Deliverables.

(a) Deliveries by XxxxXx and Xxxxxx. At or prior to the Closing, HoldCo will deliver or cause to be delivered to Triller all of the following:

(i) to the extent Xxxxxx Securities are evidenced by certificates, certificates evidencing the Xxxxxx Securities, free and clear of all Liens, duly endorsed in blank or accompanied by stock powers or other instruments of transfer duly executed in blank, with all required stock transfer tax stamps affixed thereto;

(ii) a duly executed assignment transferring to Triller good and marketable title to the Xxxxxx Securities;

(iii) the consents, waivers, authorizations and approvals set forth on Schedule 2.4;

(iv) a joinder to the LLC Agreement, in the form provided by Xxxxxxx, duly executed by XxxxXx;

(v) resignations of the directors of XxxxxxXXX effective as of immediately prior to the Conversion;

(vi) a certificate, dated the Closing Date and signed by a duly authorized officer of Xxxxxx, that each of the representations and warranties set forth in Article 2 and Article 3 are true and correct in all respects;

(vii) certificate of the Secretary (or equivalent officer) of Xxxxxx certifying that (A) attached thereto are true and complete copies of (1) all resolutions adopted by the board of directors (or equivalent governing body) of Xxxxxx authorizing the execution, delivery and performance of this Agreement and the Related Agreements and the consummation of the transactions contemplated hereby and thereby and (2) resolutions of the sole equityholder approving the Exchange, adopting this Agreement and the Related Agreements, and (B) all such resolutions are in full force and effect and are all the resolutions adopted in connection with the transactions contemplated hereby and thereby;

(viii) certificate of the Secretary (or equivalent officer) of HoldCo certifying that (A) attached thereto are true and complete copies of (1) all resolutions adopted by the board of directors of HoldCo authorizing the execution, delivery and performance of this Agreement and the Related Agreements and the consummation of the transactions contemplated hereby and thereby and (2) resolutions of the stockholders of HoldCo approving the Exchange, adopting this Agreement and the Related Agreements, and (B) all such resolutions are in full force and effect and are all the resolutions adopted in connection with the transactions contemplated hereby and thereby;

(ix) a certificate of good standing from the Secretary of State of the State of Delaware with respect to each of XxxxXx and Xxxxxx;

4

(x) a certificate executed by the Chief Financial Officer of Xxxxxx certifying on behalf of Xxxxxx that, after the Closing, Xxxxxx has no outstanding Indebtedness other than the Indebtedness set forth on Schedule 1.4(a)(x);

(xi) a certificate of non-foreign status, dated as of the Closing Date and duly executed by XxxxXx, that meets the requirements set forth in Treasury Regulations Section 1.1445-2(b)(2) and Section 1446(f) of the Code; and

(xii) such other documents or instruments as Triller reasonably requests and are reasonably necessary to consummate the transactions contemplated by this Agreement.

(b) Deliveries by Xxxxxxx. Except as otherwise set forth below, on or prior to the Closing, Xxxxxxx shall deliver to HoldCo the following:

(i) a certificate of the Secretary (or equivalent officer) of Triller certifying that attached thereto are true and complete copies of (A) all resolutions adopted by the board of managers of Triller authorizing the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby, and that all such resolutions are in full force and effect as of the Effective Date and (B) the certificate of formation of Triller and the LLC Agreement, each of which is in full force and effect as of the Effective Date;

(ii) Evidence of the issuance of the Closing Unit Consideration to HoldCo reasonably satisfactory to HoldCo, together with a notation of a legend substantially in the following form in the unit register, stock records or other equivalent record of Triller next to the written entry reflecting the Closing Unit Consideration:

THE CLASS B COMMON UNITS REPRESENTED BY THIS WRITTEN ENTRY ARE SUBJECT TO THAT CERTAIN UNIT EXCHANGE AGREEMENT, DATED AS OF NOVEMBER 11, 2022, BY AND AMONG THE COMPANY, JULIUSWORKS, LLC, AND XXXXXX HOLDINGS INC. THE CLASS B COMMON UNITS REPRESENTED BY THIS WRITTEN ENTRY ARE SUBJECT TO REDEMPTION BY THE COMPANY IN ACCORDANCE WITH THE PROVISIONS OF SUCH UNIT EXCHANGE AGREEMENT. EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF SUCH UNIT EXCHANGE AGREEMENT, NO SALE, TRANSFER OR OTHER DISPOSITION OF THE CLASS B COMMON UNITS REPRESENTED BY THIS WRITTEN ENTRY MAY BE MADE.

(iii) a certificate of good standing from the Secretary of State of the State of Delaware with respect to Xxxxxxx;

(iv) such other documents or instruments as HoldCo reasonably requests and are reasonably necessary to consummate the transactions contemplated by this Agreement; and

(v) promptly after the Closing, evidence of payment of $10,000 of transaction expenses of Xxxxxx or HoldCo incurred in connection with the consummation of the transactions contemplated by this Agreement, on behalf of Xxxxxx, to Xxxxx Xxxxxxx LLP.

1.5 Conditions to Closing. The obligations of each Party to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of each of the following conditions:

(a) Conditions to Obligations of Triller.

(i) Xxxxxxx’x receipt of all closing deliverables set forth in Section 1.4(a).

5

(ii) No Action shall have been commenced against Xxxxxx or HoldCo. No injunction or restraining order shall have been issued by any Governmental Authority, and be in effect, which restrains or prohibits any transaction contemplated hereby.

(iii) All approvals, consents and waivers that are listed on Schedule 2.4 shall have been received, and executed counterparts thereof shall have been delivered to Triller at or prior to the Closing.

(iv) Xxxxxx having no Indebtedness other than the Indebtedness set forth on Schedule 1.4(a)(x).

(v) Silicon Valley Bank shall have executed and delivered a consent to the Transactions, in substantially the form attached hereto as Exhibit 1.5(a)(v) (the “SVB Consent”).

(b) Conditions to Obligations of HoldCo.

(i) No Action shall have been commenced against Triller. No injunction or restraining order shall have been issued by any Governmental Authority, and be in effect, which restrains or prohibits any transaction contemplated hereby.

(ii) HoldCo’s receipt of all closing deliverables set forth in Section 1.4(b).

(iii) Silicon Valley Bank shall have executed and delivered the SVB Consent.

1.6 Tax Matters. The Parties acknowledge and agree that the Exchange is intended to constitute a tax-deferred exchange described in Section 721 of the Code and will file their Tax Returns and reports consistent with, and take no Tax position inconsistent with, such treatment.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES WITH RESPECT TO XXXXXX

HoldCo hereby represents and warrants to Triller that, subject to such exceptions as are disclosed in the attached disclosure schedules (the “Disclosure Schedules”), the following representations are true and complete as of the Effective Date. The Disclosure Schedules shall be arranged in sections corresponding to the numbered and lettered sections and subsections contained in this Article 2, and the disclosures in any section or subsection of the Disclosure Schedules shall qualify other sections and subsections in this Article 2 only to the extent it is reasonably apparent from a reading of the disclosure and/or of the disclosed item(s) that such disclosure is applicable to such other sections and subsections. For purposes of Article 2, the term “Xxxxxx” shall refer Xxxxxx and its Subsidiaries.

2.1 Organization and Qualification; Standing; Governing Documents.

(a) Xxxxxx is a corporation or limited liability company (as applicable) duly organized, validly existing and in good standing under the Laws of its jurisdiction of formation and has full company power and authority to own, lease and operate its properties and assets and carry out its business as it has been and is now conducted. Xxxxxx is duly qualified or licensed to do business as a foreign corporation and is in good standing in each jurisdiction where the character of its assets and properties owned, leased or operated by it or the nature of its business makes such qualification or license necessary, except where the failure to be so qualified or licensed or to be in good standing would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect on Xxxxxx.

(b) The Xxxxxx Governing Documents as provided to Triller are true, correct and complete copies of such documents as in effect as of the Effective Date. Xxxxxx is not in violation of any of the provisions of the Xxxxxx Governing Documents.

6

2.2 Authority; Binding Effect. Xxxxxx has all requisite company power and authority to execute, deliver and perform its obligations under this Agreement and the Related Agreements to which it is a party and to carry out the transactions contemplated hereby and thereby. The execution, delivery and performance of this Agreement and the Related Agreements to which Xxxxxx is a party and transactions contemplated hereby and thereby have been duly and validly authorized by all necessary action of Xxxxxx. This Agreement and any Related Agreements to which Xxxxxx is a party have been duly and validly executed and delivered by Xxxxxx and constitute valid and binding obligations of Xxxxxx, enforceable against it in accordance with their terms, except to the extent such enforcement may be limited by bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium, receivership, conservatorship or similar Laws or judicial decisions relating to or affecting the rights of creditors generally or by the limiting effect of rules of law governing specific performance, equitable relief and other equitable remedies (whether considered in a proceeding in equity or at law.

2.3 Non-Contravention. The execution, delivery and performance of each of this Agreement and the Related Agreements to which it is a party by Xxxxxx (and the consummation of the transactions contemplated hereby and thereby) do not and will not (a) violate, contravene or conflict with, or result in the violation or breach of, any provision of Xxxxxx Governing Documents, (b) violate any provision of Law applicable to Xxxxxx or any of its properties or assets, (c) violate or result in a breach of, or constitute (with or without due notice or lapse of time or both) a default under, or result in Xxxxxx’s loss of any benefit or the imposition of any additional payment or other liability under, or alter the rights or obligations of any third party under, result in the acceleration of or create in any party the right to accelerate, terminate, modify or cancel, any Material Contract of Xxxxxx, subject to the receipt of the consents listed in Schedule 2.4, or (d) result in the imposition of any Lien on any of the assets of Xxxxxx, except in the cases of clauses (b) or (c), where the violation, breach, conflict, default or failure to give notice would not have a Material Adverse Effect.

2.4 Consents and Approvals. Schedule 2.4 sets forth a list of each consent (including any spousal consents), waiver, authorization or approval of any Governmental Authority or any other Person required in connection with Xxxxxx’s execution and delivery of this Agreement and the Related Agreements to which it is a party. Other than the consents, waivers, authorizations and approvals set forth on Schedule 2.4, there are no consents, waivers, authorizations or approvals of any Governmental Authority or any other Person required in connection with Xxxxxx’s execution and delivery of this Agreement and the Related Agreements to which it is a party.

2.5 Capitalization; Subsidiaries.

(a) Except for the Xxxxxx Securities, (x) there are no Equity Interests of Xxxxxx that are issued and outstanding and (y) there are no: (i) outstanding securities convertible or exchangeable into Equity Interests of Xxxxxx; (ii) options, warrants, calls, subscriptions or other rights, agreements or commitments obligating Xxxxxx to issue, transfer or sell any of its Equity Interests or any securities convertible or exchangeable into Equity Interests or to purchase, redeem, or otherwise acquire any of its outstanding Equity Interests; or (iii) voting trusts or other agreements or understandings to which Xxxxxx is a party or by which Xxxxxx is bound with respect to the voting, transfer or other disposition of its Equity Interests. All of the Xxxxxx Securities are duly authorized, validly issued, fully paid and nonassessable and were issued in accordance with all applicable Laws.

(b) All issued and outstanding Xxxxxx Securities are (i) duly authorized, validly issued, fully paid and non-assessable; (ii) not subject to any preemptive rights created by statute, the Xxxxxx Governing Documents or any agreement to which Xxxxxx is a party; and (iii) free and clear of any Liens in respect thereof.

(c) None of the Xxxxxx Securities were issued in violation of any agreement, arrangement or commitment or are subject to any preemptive or similar rights of any Person.

7

Unit Exchange Agreement

(d) No bonds, debentures, notes, or other indebtedness issued by Xxxxxx (i) having the right to vote on any matters on which stockholders or equityholders of Xxxxxx may vote (or which is convertible into or exchangeable for securities having such right); or (ii) the value of which is directly based upon or derived from the capital stock, voting securities, or ownership interests of Xxxxxx, are issued or outstanding.

(e) Xxxxxx (i) has no Subsidiaries and (ii) does not hold any right to acquire any Equity Interest in any Person.

2.6 Title to and Totality of Assets. Xxxxxx has good and marketable fee simple title to or, with respect to Leased Real Property, a valid leasehold interest in, all of the real property and tangible personal property which are reasonably necessary for the conduct of Xxxxxx’s business as presently conducted or as proposed to be conducted. All of such properties and tangible assets are free and clear of all Liens and are accurately reflected on the Balance Sheet. Xxxxxx’s assets are sufficient for the continued conduct of Xxxxxx’s business in substantially the same manner as conducted prior to the Effective Date and constitute all rights, property and assets necessary to conduct Xxxxxx’s business as currently conducted.

2.7 Financial Statements; Absence of Certain Changes, Events and Conditions.

(a) Xxxxxx has provided to Triller (i) the unaudited balance sheets of Xxxxxx as at December 31, 2020 and 2021 and the related statements of income and cash flows for the fiscal years then ended and (ii) unaudited balance sheet of Xxxxxx (the “Balance Sheet”) as of June 30, 2022 (the “Balance Sheet Date”) and the related statements of income and cash flows for the fiscal year then ended (the items listed in subsections (i) and (ii), collectively, the “Financial Statements”). The Financial Statements (a) have been prepared from and are consistent with the books and records of Xxxxxx, (b) have been prepared in conformity with GAAP, applied on a consistent basis throughout the period involved, (c) are complete and correct in all respects, and (d) present fairly in all material respects the financial position and results of operations of Xxxxxx as of their respective dates and for the respective periods covered thereby. Xxxxxx maintains a standard system of accounting established and administered in accordance with GAAP.

(b) Since the Balance Sheet Date, other than in the ordinary course of business consistent with past practice, there has not been, with respect to Xxxxxx, any:

(i) event, occurrence or development that has had, or could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect;

(ii) amendment of the Xxxxxx Governing Documents, except with respect to the merger and conversion described in the Agreement and Plan of Merger, dated November 10, 2022, by and among XxxxXx, Merger Sub and JuliusINC (the “Merger Agreement”) and the Reorganization;

(iii) split, combination or reclassification of any shares of its capital stock except with respect to the merger and conversion described in the Merger Agreement;

(iv) issuance, sale or other disposition of any of its capital stock, or grant of any options, warrants or other rights to purchase or obtain (including upon conversion, exchange or exercise) any of its capital stock except with respect to the merger and conversion described in the Merger Agreement;

(v) declaration or payment of any dividends or distributions on or in respect of any of its capital stock or redemption, purchase or acquisition of its capital stock;

(vi) material change in any method of accounting or accounting practice of Xxxxxx, except as required by GAAP or as disclosed in the notes to Xxxxxx’s financial statements;

8

Unit Exchange Agreement

(vii) material change in any of the following: (a) Xxxxxx’s cash management practices, and (b) Xxxxxx’s policies, practices and procedures with respect to collection of accounts receivable, establishment of reserves for uncollectible accounts, accrual of accounts receivable, inventory control, prepayment of expenses, payment of trade accounts payable, accrual of other expenses, deferral of revenue and acceptance of customer deposits;

(viii) except as provided in Schedule 2.12, entry into any Contract that would constitute a Material Contract;

(ix) incurrence, assumption or guarantee of any indebtedness for borrowed money except unsecured current obligations and Liabilities incurred in the ordinary course of business consistent with past practice;

(x) transfer, assignment, sale or other disposition of any of the assets shown or reflected in the Balance Sheet or cancellation of any debts or entitlements;

(xi) transfer, assignment or grant of any license or sublicense under or with respect to any Xxxxxx Intellectual Property or Xxxxxx IP Agreements, except non-exclusive licenses or sublicenses received or granted in the ordinary course of business consistent with past practice;

(xii) abandonment or lapse of or failure to maintain in full force and effect any registration of Xxxxxx Intellectual Property which exists as of the Balance Sheet Date, or failure to take or maintain reasonable measures to protect the confidentiality or value of any material Trade Secrets included in Xxxxxx Intellectual Property owned by Xxxxxx;

(xiii) material damage, destruction or loss (whether or not covered by insurance) to its property;

(xiv) any capital investment in, or any loan to, any other Person;

(xv) acceleration, termination, material modification to or cancellation of any Material Contract to which Xxxxxx is a party or by which it is bound;

(xvi) imposition of any Lien upon any of Xxxxxx properties, capital stock or assets, tangible or intangible;

(xvii) (i) grant of any bonuses, whether monetary or otherwise, or increase in any wages, salary, severance, pension or other compensation or benefits in respect of its current or former employees, officers, directors, independent contractors or consultants, other than as provided for in any written agreements or required by applicable Law, (ii) change in the terms of employment for any employee or payment to an employee in connection with any termination of such employee, in each case where the aggregate costs or expenses for each such case exceed $20,000.00, (iii) action to accelerate the vesting or payment of any compensation or benefit for any current or former employee, officer, director, independent contractor or consultant, or (iv) hire or terminate any employee;

(xviii) any loan to (or forgiveness of any loan to), or entry into any other transaction with, any of its stockholders or current or former directors, officers and employees, other than reimbursement of expenses incurred in the ordinary course of business, consistent with past practice;

(xix) adoption of any plan of merger, consolidation, reorganization, liquidation or dissolution or filing of a petition in bankruptcy under any provisions of federal or state bankruptcy Law or consent to the filing of any bankruptcy petition against it under any similar Law;

9

Unit Exchange Agreement

(xx) purchase, lease or other acquisition of the right to own, use or lease any property or assets for an amount in excess of $50,000.00, individually (in the case of a lease, per annum) or $100,000.00 in the aggregate (in the case of a lease, for the entire term of the lease, not including any option term), except for purchases of inventory or supplies or inbound software licenses (including, without limitation, right to use software as a service) in the ordinary course of business consistent with past practice;

(xxi) acquisition by merger or consolidation with, or by purchase of a substantial portion of the assets or stock of, or by any other manner, any business or any Person or any division thereof;

(xxii) action to make, change or rescind any Tax election, amend any Tax Return or take any position on any Tax Return, take any action, omit to take any action or enter into any other transaction that would have the effect of increasing the Tax liability or reducing any Tax asset of Xxxxxx in respect of any post-closing Tax Period; or

(xxiii) any Contract to do any of the foregoing, or any action or omission that would result in any of the foregoing.

(c) Xxxxxx is and has been in compliance in all material respects with the CARES Act. Xxxxxx has no amount outstanding or any other Liabilities under or relating to any loan under the Paycheck Protection Program administrated by the Small Business Administration under the CARES Act.

2.8 No Undisclosed Liabilities. Xxxxxx is not subject to any liability, obligation or commitment of any kind whatsoever, asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured, or otherwise, except (i) those which are adequately reflected or reserved against in the balance sheet as of the Balance Sheet Date, and (ii) those which have been incurred in the ordinary course of business consistent with past practice since the Balance Sheet Date and which are not, individually or in the aggregate, material in amount.

2.9 Taxes.

(a) All federal, state, local or foreign Taxes due and payable by XxxxXx or Xxxxxx have been timely paid. There are no accrued and unpaid federal, state, local or foreign taxes of HoldCo or Xxxxxx that are due, whether or not assessed or disputed. There have been no examinations or audits of any Tax Returns or reports of HoldCo or Xxxxxx by any applicable Governmental Authority. XxxxXx and Xxxxxx have duly and timely filed all federal, state, local and foreign Tax Returns required to have been filed and there are in effect no waivers of applicable statutes of limitations with respect to Taxes for any year. All Tax Returns required to be filed by XxxxXx and Xxxxxx have been duly and timely filed and each such Tax Return is true, complete and correct in all respects.

(b) No claim has been made by any taxing authority in any jurisdiction where XxxxXx and Xxxxxx do not file Tax Returns where such claim is that HoldCo or Xxxxxx is, or may be, subject to Tax by that jurisdiction.

(c) No extensions or waivers of statutes of limitations have been given or requested with respect to any Taxes of HoldCo or Xxxxxx.

(d) None of HoldCo or Xxxxxx is a party to, or bound by, any Tax indemnity, Tax sharing or Tax allocation agreement.

(e) None of HoldCo or Xxxxxx has been a member of an affiliated, combined, consolidated or unitary Tax group for Tax purposes, and none of HoldCo or Xxxxxx has liability for Taxes of any Person under Section 1.1502-6 of the treasury regulations (or any corresponding provision of state, local or foreign law) as transferee or successor, by contract or otherwise.

(f) XxxxXx and Xxxxxx have withheld and paid each Tax required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, customer, shareholder or other party, and complied with all information reporting and backup withholding provisions of applicable Law.

10

Unit Exchange Agreement

(g) Neither HoldCo nor Xxxxxx prior to the Reorganization is a “foreign person” as that term is used in Section 1.1445-2 of the treasury regulations or a “distributing corporation” or “controlled corporation” in connection with a distribution described by Section 355 of the Internal Revenue Code. Neither HoldCo nor Xxxxxx is, or has been, a party to, or a promoter of, a “reportable transaction” within the meaning of 6707A(c)(1) of the Code and Section 1.6011 4(b) of the treasury regulations.

2.10 Real Property. Xxxxxx does not currently and has never owned any real property or any option to acquire any real property. Schedule 2.10 sets forth a list of each existing lease or similar agreement (showing the parties thereto and the physical address covered by such lease or other agreement) under which any of Xxxxxx is lessee of, or holds or operates, any real property owned and used in or relating to Xxxxxx’s business (the “Leased Real Property”). Each Lease Agreement for the Leased Real Property has been provided or made available to Triller and is in full force and effect. Xxxxxx is not in breach under the terms of such Lease Agreements. There are no actions pending or, to the Knowledge of Xxxxxx, threatened against or affecting any Leased Real Property.

2.11 Intellectual Property.

(a) Schedule 2.11 contains a correct, current, and complete list of: (i) all Xxxxxx IP Registrations, specifying as to each, as applicable: the title, mark, or design; the record owner and inventor(s), if any; the jurisdiction by or in which it has been issued, registered, or filed; the patent, registration, or application serial number; the issue, registration, or filing date; and the current status; (ii) all unregistered trademarks included in the Xxxxxx Intellectual Property; (iii) all proprietary software of Xxxxxx; and (iv) all other Xxxxxx Intellectual Property used or held for use in Xxxxxx’s business as currently conducted and as proposed to be conducted. Schedule 2.11 also contains a correct, current and complete list of all Xxxxxx IP Agreements, specifying for each the date, title and parties thereto, and separately identifying the Xxxxxx IP Agreements: (i) under which Xxxxxx is a licensor or otherwise grants to any Person any right or interest relating to any Xxxxxx Intellectual Property; (ii) under which Xxxxxx is a licensee or otherwise granted any right or interest relating to the Intellectual Property of any Person; and (iii) which otherwise relate to Xxxxxx’s ownership or use of Intellectual Property, in each case identifying the Intellectual Property covered by such Xxxxxx IP Agreement.

(b) Xxxxxx has provided to Triller true and complete copies (or in the case of any oral agreements, a complete and correct written description) of all Xxxxxx IP Agreements, including all modifications, amendments and supplements thereto and waivers thereunder. Each Xxxxxx IP Agreement is valid and binding on Xxxxxx in accordance with its terms and is in full force and effect. Neither Xxxxxx nor any other party thereto is, or is alleged to be, in breach of or default under, or has provided or received any notice of breach of, default under, or intention to terminate (including by non-renewal), any Xxxxxx IP Agreement.

(c) Xxxxxx is the sole and exclusive legal and beneficial, and, with respect to the Xxxxxx IP Registrations, record, owner of all right, title and interest in and to the Xxxxxx Intellectual Property and has the valid and enforceable right to use all other Intellectual Property used or held for use in or necessary for the conduct of Xxxxxx’s business as currently conducted and as proposed to be conducted, in each case, free and clear of any Liens. Xxxxxx has entered into binding, valid and enforceable written contracts with each current and former employee and independent contractor who is or was involved in or has contributed to the invention, creation or development of any Intellectual Property during the course of employment or engagement with Xxxxxx whereby such employee or independent contractor (i) acknowledges Xxxxxx’s exclusive ownership of all Intellectual Property invented, created or developed by such employee or independent contractor within the scope of his or her employment or engagement with Xxxxxx; (ii) grants to Xxxxxx a present, irrevocable assignment of any ownership interest such employee or independent contractor

11

Unit Exchange Agreement

may have in or to such Intellectual Property, to the extent such Intellectual Property does not constitute a “work made for hire” under applicable Law; and (iii) irrevocably waives any right or interest, including any so-called “moral rights,” regarding any Intellectual Property, to the extent permitted by applicable Law. Xxxxxx has provided Triller with true and complete copies of all such contracts. All assignments and other instruments necessary to establish, record and perfect Xxxxxx’s ownership interest in the Xxxxxx IP Registrations have been validly executed, delivered and filed with the relevant Governmental Authorities and authorized registrars.

(d) Neither the execution, delivery or performance of this Agreement, nor the consummation of the transactions contemplated hereunder, will result in the loss or impairment of, or require the consent of any other Person in respect of, Xxxxxx’s right to own or use any Xxxxxx Intellectual Property or Licensed Intellectual Property.

(e) All of the Xxxxxx Intellectual Property and Licensed Intellectual Property are valid and enforceable, and all Xxxxxx IP Registrations are subsisting and in full force and effect. Xxxxxx has taken all necessary steps to maintain and enforce the Xxxxxx Intellectual Property and Licensed Intellectual Property and to preserve the confidentiality of all Trade Secrets included in the Xxxxxx Intellectual Property, including by requiring all Persons having access thereto to execute binding, written non-disclosure agreements. All required filings and fees related to the Xxxxxx IP Registrations have been timely submitted with and paid to the relevant Governmental Authorities and authorized registrars. Xxxxxx has provided Xxxxxxx with true and complete copies of all file histories, documents, certificates, office actions, correspondence, assignments, and other instruments relating to the Xxxxxx IP Registrations.

(f) The conduct of Xxxxxx’s business as currently and formerly conducted, including the use of the Xxxxxx Intellectual Property and Licensed Intellectual Property in connection therewith, and the products, processes and services of Xxxxxx have not infringed, misappropriated or otherwise violated, and will not infringe, misappropriate or otherwise violate, the Intellectual Property or other rights of any Person. To the Knowledge of Xxxxxx, no Person has infringed, misappropriated or otherwise violated any Xxxxxx Intellectual Property or Licensed Intellectual Property.

(g) There are no Actions (including any opposition, cancellation, revocation, review or other proceeding), whether settled, pending or threatened (including in the form of offers to obtain a license): (i) alleging any infringement, misappropriation, or other violation by Xxxxxx of the Intellectual Property of any Person; (ii) challenging the validity, enforceability, registrability, patentability, or ownership of any Xxxxxx Intellectual Property or Licensed Intellectual Property or Xxxxxx’s right, title, or interest in or to any Xxxxxx Intellectual Property or Licensed Intellectual Property; or (iii) by Xxxxxx or by the owner of any Licensed Intellectual Property alleging any infringement, misappropriation or other violation by any Person of the Xxxxxx Intellectual Property or such Licensed Intellectual Property. Xxxxxx is not aware of any facts or circumstances that could reasonably be expected to give rise to such Action. Xxxxxx is not subject to any outstanding or prospective governmental order (including any motion or petition therefor) that does or could reasonably be expected to restrict or impair the use of any Xxxxxx Intellectual Property or Licensed Intellectual Property.

2.12 Contracts.

(a) Schedule 2.12 lists each of the following Contracts to which Xxxxxx is a party (such Contracts, together with all Contracts concerning the occupancy, management or operation of any Real Property listed or otherwise disclosed on Schedule 2.10 and all Xxxxxx IP Agreements set forth on Schedule 2.11 being “Material Contracts”):

(i) each Contract involving aggregate consideration in excess of $50,000.00 and which, in each case, cannot be cancelled by Xxxxxx without penalty or without more than 30 days’ notice;

(ii) all Contracts that require Xxxxxx to purchase its total requirements of any product or service from a third party or that contain “take or pay” provisions;

12

Unit Exchange Agreement

(iii) all Contracts that provide for the indemnification by Xxxxxx of any Person or the assumption of any Tax, environmental or other liability of any Person;

(iv) all Contracts that relate to the acquisition or disposition of any business, a material amount of stock or assets of any other Person or any real property (whether by merger, sale of stock, sale of assets or otherwise);

(v) all broker, distributor, dealer, manufacturer’s representative, franchise, agency, sales promotion, market research, marketing consulting and advertising Contracts;

(vi) all employment agreements and Contracts with independent contractors or consultants (or similar arrangements) which are not cancellable without material penalty or without more than 30 days’ notice;

(vii) except for Contracts relating to trade receivables, all Contracts relating to indebtedness (including, without limitation, guarantees) of Xxxxxx;

(viii) all Contracts with any Governmental Authority;

(ix) all Contracts that limit or purport to limit the ability of Xxxxxx to compete in any line of business or with any Person or in any geographic area or during any period of time;

(x) any Contracts that provide for any joint venture, partnership or similar arrangement;

(xi) any Contract for which Xxxxxx has an outstanding demand for refund of money paid to third parties that are parties to such Contracts and the respective written demands made with respect to the money for which a refund is sought;

(xii) any customer Contract whose aggregate revenue to Xxxxxx constitutes more than ten percent (10%) of the xxxxxxxx of Xxxxxx during the fiscal year ended December 31, 2020 or which Xxxxxx reasonably expects to exceed such percentage in the fiscal year ending December 31, 2021;

(xiii) any Contract containing “most favored nation” or any other preferential pricing provisions;

(xiv) any Contract regarding any Related Party Asset; or

(xv) any other contract that is material to Xxxxxx and not previously disclosed pursuant to this Section 2.12(a).

(b) Each Material Contract is valid and binding on Xxxxxx in accordance with its terms and is in full force and effect. Neither Xxxxxx nor, to Xxxxxx’s Knowledge, any other party thereto is in breach of or default under (or alleged to be in breach or default under), or has provided or received any notice of any intention to terminate, any Material Contract. No event or circumstance has occurred that, with notice or lapse of time or both, would constitute an event of default under any Material Contract or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of any benefit thereunder. Complete and correct copies of each Material Contract (including all modifications, amendments and supplements thereto and waivers thereunder) have been made available to Triller.

2.13 Compliance with Laws. All activities of Xxxxxx have been conducted in compliance with all applicable Laws. Xxxxxx has not received any written notice from any Governmental Authority to the effect that Xxxxxx is not or may not be in compliance with such Laws.

13

Unit Exchange Agreement

2.14 Claims and Proceedings.

(a) There are no claims, actions, suits, legal or administrative proceedings, orders, injunctions, decrees, stipulations or investigations (each, an “Action”) pending, or to the Knowledge of Xxxxxx, threatened, by or against Xxxxxx (i) affecting any of its properties or assets or (ii) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

(b) There are no outstanding governmental orders and no unsatisfied judgments, penalties or awards against or affecting Xxxxxx or any of its properties or assets. Xxxxxx is in compliance with the terms of each governmental order set forth in Schedule 2.14, and no event has occurred or circumstances exist that may constitute or result in (with or without notice or lapse of time) a violation of any such governmental order.

2.15 Licenses and Permits. Schedule 2.15 contains a complete list of all material licenses, certificates, privileges, immunities, approvals, franchises, authorizations and permits from any Governmental Authority (collectively, “Permits”) owned or possessed by or applied for by Xxxxxx and there are no other Permits required for Xxxxxx to operate as currently conducted or as proposed to be conducted. Xxxxxx has provided to Triller copies of all such Permits. The Permits are in full force and effect, and Xxxxxx is in compliance in all respects with each such Permit. No loss or expiration of any Permit is pending or, to the Knowledge of Xxxxxx, threatened other than a loss resulting from expiration in accordance with the terms thereof.

2.16 Employee Benefit Plans.

(a) Schedule 2.16 contains a complete and accurate list of each Employee Benefit Plan. Xxxxxx has separately identified (i) each Benefit Plan that contains a change in control provision and (ii) each Benefit Plan that is maintained, sponsored, contributed to or required to be contributed to by Xxxxxx primarily for the benefit of employees outside of the United States. With respect to each Employee Benefit Plan, Xxxxxx has made available to Triller, to the extent applicable, accurate and complete copies of (1) the Employee Benefit Plan document, including any amendments thereto, and all related trust agreements, insurance contracts or other funding vehicles, (2) a written description of such Employee Benefit Plan if such plan is not set forth in writing, (3) the most recently prepared actuarial report, (4) the most recent Internal Revenue Service favorable determination or opinion letter, Form 5500 and summary plan description, and (5) all material correspondence to or from an Governmental Entity received within the last three years.

(b) Each Employee Benefit Plan has been established, maintained and administered in compliance in all material respects with its terms and the applicable Laws, including ERISA and the Code (if applicable). No Employee Benefit Plan is subject to the minimum funding requirements under Section 412 of the Code or Title IV of ERISA, and neither Xxxxxx nor any ERISA Affiliate has sponsored or maintained any such plan within the last six (6) years. No Employee Benefit Plan is a multiemployer plan (as defined in Section 3(37) of ERISA), and neither Xxxxxx nor any ERISA Affiliate currently has or has ever had any obligation to contribute to any such multiemployer plan.

(c) No Employee Benefit Plan is the subject of any Action or audit or examination by the Internal Revenue Service, the United States Department of Labor or any other governmental entity.

(d) Neither the execution and delivery of this Agreement nor the consummation of the transactions contemplated by this Agreement will, either alone or in combination with other events, (i) result in any payment becoming due from Xxxxxx under any Employee Benefit Plan, (ii) increase any benefits otherwise payable under any Employee Benefit Plan, (iii) result in the acceleration of the time of payment or vesting of any benefits under any Employee Benefit Plan, or (iv) result in payment of any amount that could, individually or in combination with any other such payment, constitute an “excess parachute payment” as defined in Section 280G(b)(1) of the Code.

14

Unit Exchange Agreement

2.17 Employment Matters; Employee Relations.

(a) Schedule 2.17 contains a list of all persons who are employees, independent contractors or consultants of Xxxxxx as of the date hereof, including any employee who is on a leave of absence of any nature, paid or unpaid, authorized or unauthorized, and sets forth for each such individual the following: (i) name; (ii) title or position (including whether full-time or part time); (iii) hire or engagement date; (iv) current annual base compensation rate or contract fee; (v) bonus, commission or other incentive-based compensation; and (vi) a description of the fringe benefits provided to each such individual as of the date hereof. As of the Effective Date, all compensation (including wages, commissions, bonuses, fees and all other forms of compensation) to all employees, independent contractors or consultants of Xxxxxx for services performed on or prior to the Effective Date have been paid in full, and there are no outstanding agreements, understandings or commitments of Xxxxxx with respect to any compensation, commissions, bonuses or fees.

(b) Xxxxxx has complied in all material respects with all applicable Laws relating to wages, hours, and discrimination in employment. To the Knowledge of Xxxxxx, Xxxxxx’s relations with its employees are satisfactory. There have been no union organizing or election activities involving any non-union employees of Xxxxxx and, to the Knowledge of Xxxxxx, none are threatened as of the date hereof.

2.18 Insurance. Attached hereto as Schedule 2.18 is a list of all insurance policies carried by or for the benefit of Xxxxxx, specifying the insurer, the name of the policy holder, the amount of coverage, the risk insured against, the deductible amount (if any) and the date through which coverage shall continue by virtue of premiums already paid. All such insurance policies are in full force and effect and Xxxxxx is not in default with respect to its respective obligations under any such insurance policies. There are no pending claims that have been denied insurance coverage, and none of those policies may be terminated by the insurer by reason of any change in control of Xxxxxx.

2.19 Affiliate Relationships. Schedule 2.19 contains an accurate and complete list of all arrangements between Xxxxxx, on the one hand, and any Affiliate, on the other hand, that (a) are currently in effect, (b) are material, and (c) relate to Xxxxxx. The assets owned by Affiliates subject to the foregoing arrangements are collectively referred to as the “Related Party Assets.”

2.20 No Brokers. No agent, broker, investment banker or other Person has acted on behalf, or under the authority, of Xxxxxx nor will be entitled to any fee or commission directly or indirectly from Xxxxxx in connection with the transactions contemplated hereby.

2.21 Books and Records. The minutes books and stock record books of Xxxxxx are complete and correct and have been maintained in accordance with sound business practices. The minute books of Xxxxxx contain accurate and complete records of all meetings, and actions taken by written consent of, the stockholders, the board of directors and any committees of the board of directors of Xxxxxx, and no meeting, or action taken by written consent, or any such stockholders, board of directors or committee has been held for which minutes have not been prepared and are not contained in such minute books. All books and records of Xxxxxx are in the possession of Xxxxxx.

2.22 Full Disclosure. No representation or warranty by HoldCo in this Agreement, and no statement contained in the Disclosure Schedules or any certificate or other document furnished or to be furnished to Triller pursuant to this Agreement, contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they are made, not misleading.

15

Unit Exchange Agreement

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF HOLDCO

HoldCo hereby represents and warrants to Triller that as of the Effective Date:

3.1 Organization. HoldCo is a corporation duly formed, validly existing and in good standing under the Laws of the State of Delaware. HoldCo has all requisite organizational power and authority necessary to own and operate its properties and assets and carry out its business as now conducted.

3.2 Authority; Binding Effect. HoldCo has all requisite power and authority to execute, deliver and perform this Agreement and the Related Agreements to which it is a party, and to carry out the transactions contemplated hereby and thereby. This Agreement and the Related Agreements to which it is a party have been duly and validly executed and delivered by HoldCo and constitute the valid and binding obligation of HoldCo, enforceable in accordance with their terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium, receivership, conservatorship or similar Laws or judicial decisions relating to or affecting the rights of creditors generally.

3.3 No Conflicts. The execution, delivery and performance of this Agreement and each of the Related Agreements to which it is a party by HoldCo does not and will not (a) violate or conflict with any provision of the Governing Documents of such Shareholder, (b) violate any provision of Law applicable to HoldCo, (c) subject to the receipt of the consents listed in Schedule 2.4, violate or result in a breach of, or constitute (with or without due notice or lapse of time or both) a default under, any Contract to which HoldCo is a party, or (d) result in the imposition of any Lien on the Xxxxxx Securities.

3.4 Consents and Approvals. Schedule 3.4 sets forth a list of each consent, waiver, authorization or approval of any Governmental Authority or any other Person required in connection with the execution and delivery of this Agreement or any of the Related Agreements by XxxxXx, including in connection with the exchange of the Xxxxxx Securities or the performance by HoldCo of its obligations hereunder or thereunder.

3.5 Title. HoldCo is the sole record and beneficial owner of, and holds good and valid title to, the Xxxxxx Securities, free and clear of Liens. The Xxxxxx Securities constitute all of the issued and outstanding securities of Xxxxxx. There are no outstanding or authorized warrants, options, rights of first refusal, rights of first offer, or other preferential rights, agreements, arrangements or commitments relating to such Xxxxxx Securities or obligating HoldCo to sell, assign or grant rights in its respective Xxxxxx Securities to any Person except as described in the Merger Agreement. Upon the consummation of the transactions contemplated by this Agreement, Xxxxxxx will possess good and valid title to the Xxxxxx Securities, free and clear of any Liens.

3.6 Securities Law Compliance. HoldCo (a) is acquiring its Class B Common Units for its own account for investment purposes, and not with a view to or intention of distribution, resale, granting any participation in, or otherwise distributing the same, and agrees not to sell or otherwise dispose of the Class B Common Units except in strict compliance with the terms of the LLC Agreement and applicable securities Laws; (b) is an “accredited investor” within the meaning of Rule 501 of Regulation D under the Securities Act; (c) recognizes that no federal or state agency has made any finding or determination as to the fairness of an investment in Triller, nor any recommendation or endorsement of an investment in Triller; (d) has conducted its own analysis and investigation with respect to its investment in the Class B Common Units and has had an opportunity to discuss Xxxxxxx’x business, management, financial affairs and the terms and conditions of the Exchange with Xxxxxx’s management and Xxxxxxx’x management; (e) understands that the Class B Common Units have not been and will not be registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of HoldCo’s representations as expressed herein; (f) understands that the Class B Common Units are “restricted securities” under applicable U.S. federal and state securities laws and that, pursuant to these laws, HoldCo must hold the

16

Unit Exchange Agreement

Class B Common Units indefinitely unless they are registered with the SEC and qualified by state authorities, or an exemption from such registration and qualification requirements is available; (g) acknowledges that Triller has no obligation to register or qualify the Class B Common Units; (h) acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Class B Common Units, and on requirements relating to Triller which are outside HoldCo’s control and which Triller is under no obligation and may not be able to satisfy; and (i) understands that no public market now exists for the Class B Common Units, and Triller has made no assurances that a public market will ever exist for the Class B Common Units. Neither HoldCo nor any of its affiliates has either directly or indirectly, including through a broker or finder, (a) engaged in any general solicitation or (b) published any advertisement in connection with the Exchange.

3.7 Claims and Proceedings. There are no Actions pending, or to the Knowledge of Xxxxxx, threatened against HoldCo in connection with the transactions contemplated in this Agreement.

3.8 No Brokers. No agent, broker, investment banker or other Person has acted on behalf, or under the authority, of HoldCo or will be entitled to any fee or commission directly or indirectly from HoldCo in connection with the transactions contemplated hereby.

3.9 Non-Reliance. HoldCo has not relied and is not relying on any representations, warranties or other statements whatsoever, whether written or oral, or from or by Triller or any Person acting on Xxxxxxx’x behalf (including as investment advice or recommendation to acquire the Class B Common Units) relating to the Class B Common Units, Triller or otherwise, other than those expressly set forth in this Agreement (or other related documents referred to herein).

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF TRILLER

Triller hereby represents and warrants to HoldCo that, as of the Effective Date, subject to such exceptions as are disclosed in the attached Triller disclosure schedules (the “Triller Disclosure Schedules”) or in the SEC Documents:

4.1 Organization. Triller is a limited liability company duly formed, validly existing and in good standing under the Laws of the State of Delaware. Triller has all requisite organizational power and authority necessary to own and operate its properties and assets and carry out its business as now conducted, except for any such failures that would not adversely impact, in any material respect, the ordinary course operation of Xxxxxxx’x business.

4.2 Due Authorization. Xxxxxxx has all requisite organizational power and authority to execute, deliver and perform this Agreement and the Related Agreements to which it is a party and to carry out Xxxxxxx’x obligations pursuant to the transactions contemplated hereby and thereby. This Agreement and the Related Agreements to which it is a party have been duly and validly executed and delivered by Xxxxxxx and constitute the valid and binding obligation of Triller, enforceable against Triller in accordance with their terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium, receivership, conservatorship or similar Laws or judicial decisions relating to or affecting the rights of creditors generally, or by the limiting effect of rules of law governing specific performance, equitable relief and other equitable remedies (whether considered in a proceeding in equity or at law).

4.3 No Conflicts. The execution, delivery and performance of this Agreement and each of the Related Agreements to which it is a party by Triller do not and will not (a) violate or conflict with any provision of the Triller Governing Documents, (b) violate any provision of Law applicable to Triller, or (c) violate or result in a material breach of, or constitute (with or without due notice or lapse of time or both) a default under, any Contract to which Triller is a party, except in the cases of clauses (b) and (c) where the violation, breach, conflict, default or failure to give notice would not adversely impact, in any material respect, the ordinary course operation of Xxxxxxx’x business.

17

Unit Exchange Agreement

4.4 Consents and Approvals. No consent, waiver, authorization or approval of any Governmental Authority or any other Person is required in connection with the execution and delivery of this Agreement or any of the Related Agreements to which it is a party by Xxxxxxx or the performance by Xxxxxxx of its obligations hereunder or thereunder.

4.5 Capitalization; Subsidiaries.

(a) The authorized capital of Triller consists of (i) an unlimited number of Class A Common Units, (ii) an unlimited number of Class B Common Units, and (iii) an unlimited number of Service Provider Units. Exhibit D sets forth the fully-diluted capitalization of Triller immediately following the Closing, assuming full exercise, conversion and exchange of all convertible, exercisable and exchangeable securities of Triller then outstanding and any notes, instruments or commitments containing a right to securities in Triller. Except for the securities described on Exhibit D as of immediately prior to the Closing, (x) there are no Equity Interests of Triller that are issued and outstanding and (y) there are no: (i) outstanding securities convertible or exchangeable into Equity Interests of Triller; (ii) options, warrants, calls, subscriptions or other rights, agreements or commitments obligating Triller to issue, transfer or sell any of its Equity Interests or any securities convertible or exchangeable into Equity Interests or to purchase, redeem, or otherwise acquire any of its outstanding Equity Interests; or (iii) voting trusts or other agreements or understandings to which Triller is a party or by which Xxxxxxx is bound with respect to the voting, transfer or other disposition of its Equity Interests. All of the Triller securities described on Exhibit D are (i) duly authorized, validly issued, fully paid and nonassessable, (ii) were issued in accordance with all applicable Laws, (iii) not subject to any preemptive rights created by statute, the Triller Governing Documents or any agreement to which Triller is a party; and (iv) free and clear of any Liens in respect thereof.

(b) None of the units described on Exhibit D were issued in violation of any agreement, arrangement or commitment or is subject to any preemptive or similar rights of any Person.

(c) No bonds, debentures, notes, or other indebtedness issued by Xxxxxxx (i) having the right to vote on any matters on which stockholders or equityholders of Triller may vote (or which is convertible into or exchangeable for securities having such right); or (ii) the value of which is directly based upon or derived from the capital stock, voting securities, or ownership interests of Triller, are issued or outstanding.

(d) Triller (i) has no Subsidiaries and (ii) does not hold any right to acquire any Equity Interest in any Person.

4.6 Title to and Totality of Assets. Triller’s assets are sufficient for the continued conduct of its business in substantially the same manner as conducted prior to the Effective Date and constitute all rights, property and assets necessary to conduct its business as currently conducted.

4.7 Equity Valuation. Xxxxxxx received a draft valuation report from an independent third party, dated June 2, 2022, assessing the liquidation threshold of Triller to be $3,701,008.00 as of March 31, 2022 and the corresponding Fair Market Value given such liquidation threshold to be $11.3664.

4.8 Taxes.

(a) Triller is classified as a partnership for U.S. federal income tax purposes.

18

Unit Exchange Agreement

(b) There are no federal, state, local or foreign Taxes due and payable by Xxxxxxx that have not been timely paid. There are no accrued and unpaid federal, state, local or foreign taxes of Triller that are due, whether or not assessed or disputed. There have been no examinations or audits of any Tax Returns or reports by any applicable Governmental Authority. Xxxxxxx has duly and timely filed all federal, state, local and foreign Tax Returns required to have been filed by it and there are in effect no waivers of applicable statutes of limitations with respect to Taxes for any year. All Triller Tax Returns required to be filed on or before the Effective Date are true, complete and correct in all respects.

(c) Xxxxxxx has withheld and paid each Tax required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, customer, shareholder or other party, and complied with all information reporting and backup withholding provisions of applicable Law.

4.9 Intellectual Property.

(a) Triller and its Subsidiaries own or possess sufficient legal rights to all Triller Intellectual Property without any conflicts with, or to the Knowledge of Triller, infringement of, the rights of others and no product or service marketed or sold (or proposed to be marketed or sold) by Triller or its Subsidiaries violates or will violate any license or to the Knowledge of Triller, infringes or will infringe any intellectual property rights of any other party. Other than with respect to commercially available software products under standard end-user object code license agreements, there are no outstanding options, licenses, agreements, claims, encumbrances or shared ownership interests of any kind relating to the Triller Intellectual Property, nor are Triller or any of its Subsidiaries bound by or a party to any options, licenses or agreements of any kind with respect to the patents, trademarks, service marks, trade names, copyrights, trade secrets, licenses, information, proprietary rights and processes of any other Person. Neither Triller nor any of its Subsidiaries has received any communications in writing that Triller in good faith believes will have a Material Adverse Effect on Xxxxxxx’x business alleging that Triller or any such Subsidiary has violated, or by conducting Triller business, would violate any of the patents, trademarks, service marks, trade names, copyrights, trade secrets or other proprietary rights or processes of any other Person. To the Knowledge of Triller, it will not be necessary to use any inventions of any of its or any Subsidiary’s employees or consultants made prior to or outside the scope of their employment or engagement by Xxxxxxx or such Subsidiary.

4.10 Compliance with Laws. To the Knowledge of Triller, all activities of Triller and its Subsidiaries have been conducted in all material respects in compliance with all applicable Laws. Neither Triller nor any of its Subsidiaries has received any written notice from any Governmental Authority to the effect that Triller or such Subsidiary is not or may not be in compliance with such Laws.

4.11 Claims and Proceedings. Except for Actions which in the reasonable opinion of Xxxxxxx are unlikely to have a Material Adverse Effect on Triller, there are no Actions pending or, to the Knowledge of Triller, threatened against Triller or any of its Subsidiaries at law or in equity or before or by any Governmental Authority.

4.12 Securities Laws Compliance. Triller (a) is acquiring the Xxxxxx Securities for its own account for investment, and not with a view to distribution or resale, and agrees not to sell or otherwise dispose of the Xxxxxx Securities except in strict compliance with applicable securities Laws; (b) is an “accredited investor” within the meaning of Rule 501 of Regulation D under the Securities Act; and (c) recognizes that no federal or state agency has made any finding or determination as to the fairness of an investment in Xxxxxx, nor any recommendation or endorsement of an investment in Xxxxxx.

4.13 No Brokers. No agent, broker, investment banker or other Person has acted on behalf, or under the authority, of Xxxxxxx or will be entitled to any fee or commission directly or indirectly from Triller in connection with the transactions contemplated hereby.

19

Unit Exchange Agreement

ARTICLE 5

INDEMNIFICATION

5.1 Survival Period. For purposes of this Agreement, (a) the representations and warranties contained in Sections 2.1, 2.2, 2.5, 2.9, 2.20, 3.1, 3.2, 3.5, 3.8, 4.1, 4.2, 4.5, 4.8 and 4.13 (each, a “Fundamental Representation”) shall survive until the expiration of the applicable statute of limitations, and (b) all other representations and warranties shall survive for a period of twelve (12) months following the Effective Date. No Party shall be entitled to recover for any Losses pursuant to Sections 5.2 or 5.3 unless a Claim Notice is delivered to the Indemnifying Party on or before the applicable date set forth in this Section 5.1, in which case the Claim set forth in the Claim Notice shall survive the applicable date set forth in this Section 5.1 until such time as such Claim is fully and finally resolved. The covenants and agreements set forth in this Agreement and to be performed to any extent at or after the Effective Date shall survive until fully discharged and performed, and any Claims in respect of a breach of such covenants to be performed in any respect after the Effective Date may be made at any time within the applicable statute of limitations. Notwithstanding the foregoing, any Claims asserted in good faith with reasonable specificity (to the extent known at such time) and in writing by notice from the Indemnified Party to the Indemnifying Party prior to the expiration date of the applicable survival period shall not thereafter be barred by the expiration of the relevant representation or warranty and such Claims shall survive until finally resolved.

5.2 Indemnification by Xxxxxxx. Triller shall indemnify and hold harmless HoldCo and its Affiliates and their respective stockholders, officers, directors, managers, agents and representatives (collectively, the “HoldCo Indemnified Parties”) from and against all Losses that the HoldCo Indemnified Parties may suffer or sustain by reason of or arising out of (a) any inaccuracy in any representation or warranty of Triller contained in Article 4, or (b) any breach of any covenant or agreement of Triller contained in this Agreement (the amount of such Losses, the “Triller Indemnifiable Amount”).

5.3 Indemnification by XxxxXx. HoldCo shall indemnify and hold harmless Triller and its Affiliates (including, after the Closing, Xxxxxx and its Subsidiaries) and their respective officers, directors, managers, members, agents and representatives (collectively, the “Triller Indemnified Parties”) from and against all Losses that the Triller Indemnified Parties may suffer or sustain by reason of or arising out of (a) any inaccuracy in any representation or warranty of HoldCo contained in Article 2 or Article 3, (b) any breach of any covenant or agreement of HoldCo or Xxxxxx contained in this Agreement and/or Indebtedness of Xxxxxx outstanding as of the Closing, to the extent not paid or satisfied by Xxxxxx or HoldCo (as applicable) at or prior to the Closing or not accounted for in the adjustments set forth in Section 1.1; or (c) any appraisal rights under Section 262 of the Delaware General Corporation Law arising in connection with the Merger (the amount of such Losses, the “HoldCo Indemnifiable Amount”). No Triller Indemnified Party shall be permitted to make a Claim in respect of, and HoldCo shall not have any indemnification obligation with respect to, any amount of any Losses to the extent such amount of Losses have been accounted for in adjustments set forth in Section 1.1.

5.4 Limitations on Indemnification.