OPTION AGREEMENT

Exhibit 10.1

DATED the 15th of July, 2014

BETWEEN:

XIMEN MINING CORP., a company with an office at ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇▇▇▇ ▇▇, ▇▇▇ ▇▇▇

(the “Optionee”, or “XIMEN”)

AND:

NORTH BAY RESOURCES INC., a company with an office at ▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇

(“North Bay”)

WHEREAS:

|

A.

|

North Bay is the registered and beneficial owner of a 100% interest in and to certain mineral claims located in the Province of British Columbia, as are more properly described in Schedule “A” attached hereto (the “Property”); and

|

|

B.

|

North Bay wishes to grant, and the Optionee wishes to acquire, the exclusive right and option to earn up to an undivided 100% right, title and interest in and to the Property, subject to the terms and conditions contained herein.

|

NOW THEREFORE THIS AGREEMENT WITNESSES THAT, in consideration of the premises and of the mutual covenants herein set forth, the receipt and sufficiency of all of the foregoing being acknowledged by the parties hereto, the parties hereto do hereby mutually covenant and agree as follows:

ARTICLE 1 OPTION

1.1 Grant of Option. North Bay hereby grants to the Optionee the sole and exclusive right and option (the “Option”), subject to the terms of this Agreement, to acquire, free and clear of all Encumbrances (as defined herein) except Permitted Encumbrances (as defined herein), an undivided 100% interest in and to:

|

(a)

|

the Property; and

|

|

(b)

|

any and all data, maps, surveys, technical reports and other information in relation to the Property (collectively, the “Data”).

|

For the purposes of this Agreement, “Encumbrances” means any and all rights and interests (whether actual or contingent), options, agreements, liens, pledges, mortgages, encroachments, encumbrances, deeds of trust, hypothecations, security interests, net profits interests, royalties or overriding royalty interests, other payments out of production, restrictions, easements, rights of way, or other burdens of any nature and “Permitted Encumbrances” means:

- 2 -

|

(a)

|

easements, rights of way, servitudes and other similar rights in land (including without limitation rights of way and servitudes for highways and other roads, railways, sewers, drains, gas and oil pipelines, gas and water mains, electric light, power, telephone, telegraph and cable television conduits, poles, wires and cables) which do not materially impair the use of the Property affected thereby;

|

|

(b)

|

the right reserved to or vested in any municipality or government or other public authority by the terms of any lease, license, franchise, grant or permit or by any statutory provision, to terminate any such lease, license, franchise, grant or permit or to require annual or other periodic payments as a condition of the continuance thereof;

|

|

(c)

|

rights of general application reserved to or vested in any governmental authority to levy taxes on the or any of them or the income therefrom, and governmental requirements and limitations of general application as to production rates on the operations of any property; and

|

|

(d)

|

statutory exceptions to title, and the reservations, limitations, provisos and conditions in any original grants from the Crown of any of the mines and minerals within, upon or under the Property.

|

1.2 Good Standing: To maintain the Option in good standing, the Optionee shall:

|

(a)

|

pay to North Bay an aggregate total amount of USD $300,000 in the amounts and times (the “Cash Payments”) as follows:

|

|

(i)

|

upon five days from the date on which the Optionee receives all necessary written approvals of the TSX Venture Exchange with respect to the transactions contemplated hereunder this Agreement (the “Closing Date”), an amount of USD $100,000;

|

- 3 -

|

(ii)

|

on or before the first sixth month anniversary of the Closing Date, an additional amount of USD $50,000;

|

|

(iii)

|

on or before the second sixth month anniversary of the Closing Date, an additional amount of USD $50,000;

|

|

(iv)

|

on or before the third sixth month anniversary of the Closing Date, an additional amount of USD $50,000;

|

|

(v)

|

on or before the fourth sixth month anniversary of the Closing Date, an additional amount of USD $50,000;

|

|

(b)

|

issue to North Bay the following amounts and by such dates of common shares in the capital of the Optionee (the “Consideration Shares”):

|

|

(i)

|

Consideration Shares valued at $100,000 on or before that date which is five days from the date on which the Optionee receives all necessary written approvals of the TSX Venture Exchange with respect to the transactions contemplated hereunder this Agreement (the “Closing Date”), and

|

|

(ii)

|

an additional $50,000 in Consideration Shares on or before the first sixth month anniversary of the Closing Date;

|

|

(iii)

|

an additional $50,000 in Consideration Shares on or before the second sixth month anniversary of the Closing Date;

|

|

(iv)

|

an additional $50,000 in Consideration Shares on or before the third sixth month anniversary of the Closing Date;

|

|

(v)

|

an additional $50,000 in Consideration Shares on or before the fourth sixth month anniversary of the Closing Date;

|

1.3 Legending: North Bay acknowledges and agrees that the Consideration Shares issuable hereunder shall be subject to such resale restrictions and legending requirements as are required under applicable securities laws and the policies of the TSX Venture Exchange and/or the OTCQX Exchange.

1.4 No Obligation: North Bay acknowledges and agrees that no provision in this Agreement shall obligate the Optionee to issue any Consideration Shares or make any Cash Payments, and the Optionee may at any time and in its sole discretion terminate the Option and this Agreement by providing written notice.

ARTICLE 2 EXERCISE OF OPTION

2.1 Deemed Exercise: In the event that the Optionee has issued all of the Consideration Shares and paid all of the Cash Payments required under Section 1.2, the Optionee shall without any further payment or action be deemed to have exercised the Option and to have acquired and be vested with an undivided 100% interest in and to the Property and the Data, free and clear of all Encumbrances except Permitted Encumbrances.

2.2 Transfer of Interest: Within 10 days after the exercise of the Option pursuant to Section 2.1 herein, North Bay shall execute and deliver to the Optionee such deeds of transfer or other documents or assurances as the Optionee may request to convey, transfer and assign the legal title to an undivided 100% interest in and to the Property to the Optionee, and shall appoint the Optionee as its agent for the purpose of filing the same. The Optionee shall be entitled to record the transfers contemplated hereby at its own cost with the appropriate government office.

ARTICLE 3 OPERATORSHIP, RIGHT OF ACCESS AND INTERIM OBLIGATIONS

3.1 Operatorship: North Bay hereby grants to the Optionee, its employees, agents and independent contractors, the sole and, subject to Section 3.2, exclusive right and option to:

|

(a)

|

enter upon and have immediate possession of the Property;

|

|

(b)

|

carry out operations on the Property as the Optionee may in its sole discretion determine;

|

|

(c)

|

bring and install on the Property and remove from time to time such buildings, plant, machinery, equipment, tools, appliances and supplies as the Optionee may deem necessary; and

|

- 4 -

|

(d)

|

remove from the Property reasonable quantities of rocks, ores, minerals and metals and to transport the same for the purpose of sampling, testing and assaying.

|

3.2 Right of Access: Subject to the Optionee’s exclusive rights set forth in Subsections 3.13.1(b), (c) and (d) herein, North Bay will continue to have a right of access to the Property, at its sole risk and expense. Notwithstanding the foregoing, until the expiry of the Option, North Bay shall not grant a right of access to conduct exploration activities or other operations on the Property to any other person without the Optionee’s prior written consent.

3.3 Interim Obligations of the Optionee: The Optionee shall maintain the Property in good standing as required under applicable law, and shall conduct all operations in a proper and workmanlike manner.

3.4 Interim Obligations of North Bay: North Bay shall:

|

(a)

|

not enter into any agreement, right or option, present or future, contingent, absolute or capable of becoming an agreement, right or option, or which with the passage of time or the occurrence of an event could become an agreement, right or option to acquire any interest in and to the Property or the Data except as provided for under this Agreement;

|

|

(b)

|

ensure that no Encumbrances shall be created or registered against the Property or any portion thereof without the Optionee’s prior written consent;

|

ARTICLE 4 REPRESENTATIONS AND WARRANTIES

4.1 Representations and Warranties of North Bay: North Bay hereby represents and warrants to the Optionee that:

|

(a)

|

North Bay is the legal, registered, beneficial and exclusive owner of the Property, free and clear of all Encumbrances (including any royalty interest) except Permitted Encumbrances;

|

|

(b)

|

to the best of its knowledge, the Property has been legally and validly staked and is in good standing in accordance with relevant governing bodies, statutes and regulations;

|

|

(c)

|

to the best of its knowledge, there is no adverse claim or challenge against or to the ownership of or title to any of the Property, nor is there any basis therefor, and there are no outstanding agreements or options to acquire or purchase the Property or any portion thereof, and no person has any royalty, net profits or other interest whatsoever in production from any of the Property;

|

|

(d)

|

North Bay has good and sufficient right and authority to grant the Option to the Optionee and to sell, transfer and assign to the Optionee an undivided 100% interest in and to the Property to free and clear of any Encumbrances except Permitted Encumbrances;to the best of its knowledge, all rights or powers necessary in, over or to the surface area of the Property to access the Property and to conduct exploration and mining activities on the Property may be obtained upon compliance with applicable regulations;

|

- 5 -

|

(e)

|

all work or expenditure obligations applicable to the Property, all reports of work or expenditure and other requirements to be satisfied or filed to keep the Property in good standing which were to be satisfied by the date hereof have been satisfied or filed to the satisfaction of the applicable governmental authority;

|

|

(f)

|

all rentals, taxes, assessments or other governmental charges applicable to, or imposed on, the Property which were due to be paid on or before the date hereof have been paid in full;

|

|

(g)

|

any and all activities on or in respect to the Property conducted by North Bay, its representatives or, to the best of North Bay’s knowledge, its predecessors in title and the Property itself are in material compliance with all applicable laws;

|

|

(h)

|

there are no outstanding, pending or, to the best of its knowledge, threatened, actions, suits or claims affecting or in respect of the Property or ownership of or title to the Property, or any part thereof;

|

|

(i)

|

to the best of its knowledge, the Property does not lie within any protected area, rescued area, reserve, reservation, reserved area or special needs lands as designated by any governmental authority having jurisdiction that would impair exploration activities or development of a mining project on the Property;

|

|

(j)

|

there are no orders or directions relating to environmental matters requiring any work, repairs, construction or capital expenditures with respect to the Property or the conduct of business related to the Property, nor, to the best of its knowledge, has any activity on the Property been in violation of any applicable environmental laws;

|

|

(k)

|

there has been no material spill, discharge, leak, emission, ejection, escape, dumping or any release or threatened release of any kind, of any toxic or hazardous substance or waste (as defined by any applicable law) from, on, in or under the Property, except as expressly permitted or authorized under applicable laws;

|

|

(l)

|

no toxic or hazardous substance or waste has been treated, disposed of or is located or stored on the Property as a result of activities of North Bay or, to the best of its knowledge, their predecessors in title or interest;

|

|

(m)

|

to the best of its knowledge, there is no pending or ongoing claims or actions taken by or on behalf of any native or indigenous persons with respect to any lands included in the Property;

|

|

(n)

|

the consummation of the transactions contemplated by this Agreement will not conflict with or result in any breach of any indenture, agreement or other instrument whatsoever to which North Bay is a party or by which North Bay is bound or to which North Bay 's interest in the Property may be subject;

|

|

(o)

|

North Bay has obtained all corporate authorizations for the execution of this Agreement and for the performance of its obligations under this Agreement, and the consummation of the transactions contemplated by this Agreement will not conflict with or result in any breach of any indenture, agreement or other instrument whatsoever to which North Bay is a party or by which North Bay is bound or to which North Bay's interest in the Property may be subject;

|

- 6 -

|

(p)

|

North Bay is unaware of any facts or circumstances that have not been disclosed in this Agreement which should be disclosed by it to the Optionee in order to prevent the representations and warranties made by it to the Optionee in this Agreement from being materially misleading.

|

4.2 Survival: The representations, warranties and covenants contained in section 4.1 are provided for the exclusive benefit of the Optionee, and any misrepresentation or breach of warranty may be waived by the Optionee in whole or in part at any time without prejudice to its rights in respect of any other misrepresentation or breach of the same or any other representation or warranty; and the representations, warranties and covenants contained in section 4.1 shall survive the execution and performance of this Agreement. The representations, warranties and covenants hereinbefore set out are conditions on which the parties have relied in entering into this Agreement and shall survive the acquisition of any interest in the Property by the Optionee and North Bay shall indemnify and save the Optionee, its directors, officers, employees and agents (collectively, the "Ximen Indemnifiees") harmless from any and all claims, actions, suits, proceedings, demands, assessments, judgments, losses, damages, liabilities expenses, costs (including all reasonable legal fees) to which the Ximen Indemnifiees may, jointly or severally, be put or suffer as a result of or arising from any breach of any representation, warranty, covenant, agreement or condition made by North Bay and contained in this Agreement.

4.3 Representations and Warranties of the Optionee: The Optionee represents and warrants to North Bay that:

|

(a)

|

it validly exists as a corporation in good standing under the laws of the jurisdiction of its incorporation;

|

|

(b)

|

it has duly obtained all corporate authorizations for the execution of this Agreement and for the performance of this Agreement by it;

|

|

(c)

|

the common shares in the capital of the Optionee (the " Ximen Shares") are listed for trading on the TSX Venture Exchange, and the Optionee will use its commercially reasonable efforts to obtain all required regulatory approvals and acceptances for the transactions contemplated by this Agreement.

|

4.4 Survival: The representations and warranties contained in section 4.3 are provided for the exclusive benefit of North Bay and a misrepresentation or breach of warranty may be waived by North Bay in whole or in part at any time without prejudice to its rights in respect of any other misrepresentation or breach of the same or any other representation or warranty; and the representations and warranties contained in section 4.3 shall survive the execution hereof. The representations and warranties hereinbefore set out are conditions on which the parties have relied in entering into this Agreement and the Optionee shall indemnify and save North Bay harmless from any and all claims, actions, suits, proceedings, demands, assessments, judgments, losses, damages, liabilities expenses, costs (including all reasonable legal fees) to which North Bay may be put or suffer as a result of or arising from any breach of any representation, warranty, covenant, agreement or condition made by the Optionee and contained in this Agreement.

- 7 -

ARTICLE 5 DUE DILIGENCE AND CONDITIONS PRECEDENT

5.1 Due Diligence: Upon execution of this Agreement, North Bay shall deliver or cause to deliver to the Optionee all information in its possession or control, whether in tangible or electronic form, relating to the Property, true copies of all the mineral rights comprising the Property and all maps, assays, surveys, drill logs, samples, metallurgical, geological, geophysical, geochemical and engineering data (whether in tangible or electronic form) in respect of the Property. North Bay shall also ensure that the Optionee has full access to the Property to conduct investigations as the Optionee sees fit.

5.2 Conditions Precedent: The parties acknowledge and agree that the completion of the transactions contemplated hereunder is subject to:

|

(a)

|

prior approval of the TSX Venture Exchange;

|

|

(b)

|

the parties receiving all other necessary third party consents or approvals with respect to the transactions contemplated hereunder including any consent or approval that is required under applicable law, by virtue of a condition or covenant of any mining claim forming part of the Property;

|

|

(c)

|

the representations and warranties of each of the parties hereunder being true as at the Closing Date; and

|

|

(d)

|

the Optionee being satisfied with its due diligence review pursuant to section 5.1 herein and reasonably determining that there are no material inaccuracies or omissions in the information furnished, and that there are no issues that arise as a result of the due diligence investigation or otherwise that would cause the Optionee, in its sole discretion and for any reason whatsoever, not to want to proceed with the transactions contemplated herein.

|

5.3 Waiver: The condition precedent described in Subsection 5.2(d) is for the benefit of the Optionee and cannot be waived unless agreed to in writing by the Optionee in its sole discretion.

ARTICLE 6 TERMINATION

6.1 Termination: This Agreement may be terminated prior to the exercise of the Option:

|

(a)

|

upon mutual agreement of the parties;

|

|

(b)

|

by North Bay if:

|

|

(i)

|

the Optionee is in default of its obligations under this Agreement and North Bay has provided written notice (a “Default Notice”) to the Optionee of such default; and

|

|

(ii)

|

the Optionee remains in default of such obligations after 30 days from its receipt of the Default Notice;

|

|

(c)

|

by the Optionee pursuant to Section 1.4 herein;

|

- 8 -

|

(d)

|

by either party if the Optionee has not received all required approvals from the conditions precedent described in Section 5.2 are not satisfied or otherwise waived on or before August 14, 2014.

|

6.2 Survival: Article 8 shall survive any termination of this Agreement.

ARTICLE 7 SURRENDER OF PROPERTY INTERESTS

7.1 Surrender: The Optionee may at any time prior to exercising the Option elect to abandon any one or more of the mineral claims comprised in the Property by giving notice to North Bay of such intention. For a period of 30 days after the date of delivery of such notice North Bay may elect to have any or all of the mineral claims in respect of which such notice has been given transferred to it by delivery of a request therefor to the Optionee, whereupon the Optionee will deliver to North Bay a quit claim deed or other required form of transfer or assurance in registrable form transferring such mineral claims to North Bay. If North Bay fails to make request for the transfer of any mineral claims as aforesaid within such 30 day period, the Optionee may then abandon such mineral claim without further notice to North Bay. Upon any such transfer or abandonment the mineral claims so transferred or abandoned will for all purposes of this Agreement cease to form part of the Property.

ARTICLE 8 CONFIDENTIALITY

8.1 Confidentiality: Except as otherwise provided in this Agreement, each party agrees that without the prior written consent of the other party, it will treat as confidential and prevent disclosure to any third parties of any geological, geophysical or other factual and technical information and data relating to the Property or activities related to the Property. This obligation shall be a continuing obligation of each party throughout the term of this Agreement and for a period of two years following termination of this Agreement. Except as expressly provided herein, each of the parties shall be entitled to all information respecting the Property or activities related to the Property, including copies of all maps, data and reports which can be reproduced and which have not previously been furnished to the party.

8.2 Exceptions: The consent required by section 8.1 shall not apply to a disclosure:

|

(a)

|

to an affiliate, consultant, contractor, or subcontractor that has a bona fide need to be informed;

|

|

(b)

|

to a governmental agency or to the public which the disclosing party believes in good faith is required by pertinent law or regulation or the rules or policies of any stock exchange or securities regulatory authority;

|

|

(c)

|

information which is or becomes part of the public domain other than through a breach of this Agreement; or

|

|

(d)

|

information lawfully received by a party or an affiliate from a third party not under an obligation of secrecy to the other party.

|

ARTICLE 9 GENERAL

9.1 Force Majeure: In the event that the Optionee is at any time prevented from or delayed in complying with any provisions of this Agreement by reason of strikes, lock-outs, labour shortages, power shortages, fuel shortages, fires, wars, inclement weather, acts of God, governmental regulations restricting normal operations, shipping delays, delays in obtaining required governmental, aboriginal or regulatory approvals or permits, aboriginal land claims, environmental claims or notices (or inability to obtain or delays in obtaining environmental consents) or any other reason or reasons (other than lack of funds) beyond the control of the Optionee, the time limited for the performance by the Optionee of its obligations hereunder shall be extended by a period of time equal in length to the period of each such prevention or delay. The Optionee shall give prompt notice to North Bay of each event of force majeure under this section 9.1 and upon cessation of such event shall furnish North Bay with notice to that effect together with particulars of the number of days by which the obligations of the Optionee hereunder have been extended by virtue of such event of force majeure and all preceding events of force majeure.

- 9 -

9.2 Notice: Each notice, demand or other communication required or permitted to be given under this Agreement shall be in writing and shall be sent by prepaid registered mail addressed to the party entitled to receive the same, or delivered to such party by hand, or communicated by telex or telecopy, at the address for such party specified above. The date of receipt of any notice, demand or other communication shall be the date of delivery thereof if delivered, the date of transmission if communicated by fax, or, if given by registered mail as aforesaid, shall be deemed conclusively to be the third day after the same shall have been so mailed except in the case of interruption of postal services for any reason whatever, in which case the date of receipt shall be the date on which the notice, demand or other communication is actually received by the addressee. Either party may at any time and from time to time notify the other party in writing of a change of address and the new address to which notice shall be given to it thereafter until further change.

9.3 Entire Agreement: This Agreement supersedes and replaces all other agreements or arrangements, whether oral or written, heretofore existing between the parties in respect of the subject matter of this Agreement.

9.4 No Waiver: No consent or waiver, expressed or implied, by either party in respect of any breach or default by the other in the performance by such other of its obligations hereunder shall be deemed or construed to be a consent to or a waiver of any other breach or default.

9.5 Further Assurances: The parties will promptly execute or cause to be executed all documents, deeds, conveyances and other instruments of further assurance and to perform such other acts which may be reasonably necessary or advisable to carry out fully the intent of this Agreement or to record wherever appropriate the respective interests from time to time of the parties in the Property.

9.6 Jurisdiction: This Agreement will be interpreted in accordance with and governed by the laws of the Province of British Columbia, and all references herein to monetary amounts are references to United States dollars.

9.7 No Assignment: Neither party shall assign its interest in this Agreement without the prior written consent of the other party.

9.8 Enurement: This Agreement shall enure to the benefit of and be binding upon the parties and their respective successors and permitted assigns.

- 10-

9.9 Recording of this Agreement: Either party may, in its sole discretion, record this Agreement or a memorandum of this Agreement in the office of any applicable governmental authority in order to give notice to third persons of this Agreement, and each of the parties agrees to execute all such documents as are necessary to perfect such recording.

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

- 11 -

9.10 Counterparts: This Agreement and any instrument or document in furtherance of this Agreement may be executed in several counterparts, each of which shall be deemed to be an original and such counterparts together shall be but one and the same instrument.

DATED as of the date first written above.

|

XIMEN MINING CORP.,

PER:

/s/ ▇▇▇▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇

|

PER:

/s/ ▇▇▇▇▇ ▇▇▇▇▇▇▇

|

|

|

Authorized signatory

Print Name: ▇▇▇▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇▇

Title: President

|

Authorized signatory

Print Name: ▇▇▇▇▇ ▇▇▇▇▇▇▇

Title: CEO

|

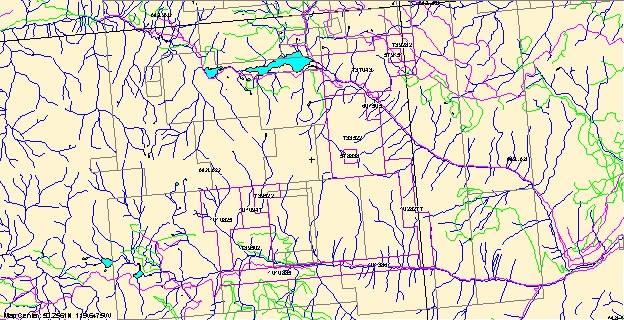

SCHEDULE A

PROPERTY

|

Tenure Number

|

Type

|

Claim Name

|

Good Until

|

Area (ha)

|

|

578838

|

Mineral

|

BOULEAU

|

20160301

|

20.6586

|

|

579151

|

Mineral

|

SIWASH

|

20160301

|

20.6461

|

|

601505

|

Mineral

|

BOULEAU 2

|

20160301

|

41.3046

|

|

733522

|

Mineral

|

BOULEAU CK

|

20160301

|

433.7778

|

|

▇▇▇▇▇▇

|

▇▇▇▇▇▇▇

|

▇▇▇▇▇▇▇ ▇

|

20160301

|

371.657

|

|

739282

|

Mineral

|

SIWASH 2

|

20160301

|

61.9346

|

|

739502

|

Mineral

|

▇▇▇▇▇ ▇▇▇▇

|

20180117

|

186.0219

|

|

739522

|

Mineral

|

▇▇▇▇▇ NW

|

20180117

|

61.9877

|

|

1010825

|

Mineral

|

▇▇▇▇▇ ▇▇

|

20180117

|

247.9811

|

|

1010835

|

Mineral

|

▇▇▇▇▇ SW

|

20141006

|

186.0543

|

|

1010947

|

Mineral

|

▇▇▇▇▇ ▇▇▇

|

20180117

|

82.6568

|

|

1013861

|

Mineral

|

▇▇▇▇▇ SE

|

20141008

|

124.0363

|

|

1028277

|

Mineral

|

BOULEAU E

|

20150514

|

206.6596

|

|

Total Area: 2045.3764 ha

|