Reinsurance Agreement #0852301 This Automatic Self Administered YRT Reinsurance Agreement Effective March 1, 2006 (hereinafter referred to as the “Agreement”) is made between TIAA-CREF Life Insurance Company a New York insurance company (hereinafter...

Exhibit (g)(3)

Reinsurance Agreement #0852301

This Automatic Self Administered YRT Reinsurance Agreement

Effective March 1, 2006

(hereinafter referred to as the “Agreement”)

is made between

TIAA-CREF Life Insurance Company

a New York insurance company

(hereinafter referred to as “the Company”)

and

Swiss Re Life & Health America Inc.

a Connecticut insurance company

(hereinafter referred to as “the Reinsurer”)

Table of Contents

| Article 1 | ||

| 1.1 | General | |

| 1.2 | Scope of Coverage | |

| Article 2 | ||

| 2.1 | Automatic Reinsurance | |

| 2.2 | Facultative Reinsurance | |

| Article 3 | ||

| 3.1 | Automatic Submissions | |

| 3.2 | Facultative Submissions | |

| Article 4 | ||

| 4.1 | Liability | |

| 4.2 | Commencement of Automatic Reinsurance Liability | |

| 4.3 | Commencement of Facultative Reinsurance Liability | |

| 4.4 | Conditional Receipt or Temporary Insurance Agreement Liability | |

| Article 5 | ||

| 5.1 | Premium Accounting | |

| 5.2 | Currency | |

| 5.3 | Non-Payment of Premiums | |

| Article 6 | ||

| 6.1 | Right of Offset | |

| Article 7 | ||

| 7.1 | Conversions | |

| 7.2 | Policy Changes | |

| 7.3 | Reductions | |

| 7.4 | Lapses | |

| 7.5 | Reinstatements | |

| 7.6 | Reinsurance Limits | |

| Article 8 | ||

| 8.1 | Retention Limit Change | |

| 8.2 | Recapture | |

| 8.3 | Waiver of Premium | |

| Article 9 | ||

| 9.1 | Claims Notice and Consultation | |

| 9.2 | Claims Payment | |

| 9.3 | Contested Claims | |

| 9.4 | Claims Expenses | |

| 9.5 | Extra Contractual Obligations | |

| 9.6 | Misstatement of Age or Sex | |

| Article 10 | ||

| 10.1 | Errors and Omissions in Administration of Reinsurance | |

| 10.2 | Dispute Resolution | |

| 10.3 | Arbitration | |

| 10.4 | Expedited Dispute Resolution Process | |

| Article 11 | ||

| 11.1 | Insolvency | |

| Article 12 | ||

| 12.1 | DAC Tax Election | |

| 12.2 | Taxes and Expenses | |

| Article 13 | ||

| 13.1 | Entire Agreement | |

| 13.2 | Inspection of Records | |

| 13.3 | Utmost Good Faith | |

| 13.4 | Confidentiality | |

| Article 14 | ||

| 14.1 | Representations and Warranties | |

| Article 15 | ||

| 15.1 | Business Continuity | |

| Article 16 | ||

| 16.1 | Duration of Agreement | |

| 16.2 | Severability | |

| 16.3 | Construction | |

| 16.4 | Credit for Reinsurance | |

| 16.5 | Non-Waiver; Retrocession | |

| 16.6 | Survival; Governing Law | |

| Execution | ||

| Exhibits | ||

| A | Business Covered | |

| X-0 | Xxxxxxxx Xxxxxxxxxx | |

| X-0 | Facultative Submissions | |

| B | Reinsurance Application | |

| B-1 | Fac Easy Application | |

| C | General Terms | |

| C-1 | Rates and Terms for Specific Plans | |

| D | The Company’s Retention Limits | |

| E | Automatic Issue and Acceptance Limits | |

| F | Reinsurance Reports | |

Article 1

| 1.1 | General |

This Agreement is an indemnity reinsurance agreement solely between the Company and the Reinsurer. The Company’s liability to its insureds is separate and apart from the Reinsurer’s liability to the Company. The acceptance of risks under this Agreement by the Reinsurer will create no right or legal relation between the Reinsurer and the insured, owner, beneficiary, or assignee of any insurance policy of the Company.

This Agreement will be binding upon the parties hereto and their respective successors and assigns including any rehabilitator, conservator, liquidator or statutory successor of either party.

| 1.2 | Scope of Coverage |

This Agreement applies to all directly issued insurance policies and supplemental benefits and riders listed in Exhibit A (hereinafter referred to as “policies” or “policy”). On and after the effective date of this Agreement, the Company will cede and the Reinsurer will accept its share of the benefits specified in Exhibit A in accordance with the terms of this Agreement. The policies accepted by the Reinsurer will be hereinafter referred to as “Reinsured Policies.”

The Company may not reinsure the retained amounts specified in Exhibit D on any basis without the Reinsurer’s prior written consent.

This Agreement does not cover the following unless specified elsewhere:

| a) | Noncontractual conversions, replacements, exchanges or group conversions; or |

| b) | Policies issued under a program where full current evidence of insurability consistent with the amount of insurance is not obtained, or where conventional selection criteria are not applied in underwriting the risk; or |

| c) | Any conversion of a previously issued policy that had been reinsured with another reinsurer; or |

| d) | Corporate, bank or other entity owned life insurance programs that are not fully underwritten. |

Each Reinsured Policy must provide for the maximum periods of suicide and contestability protection permitted by applicable law.

Article 2

| 2.1 | Automatic Reinsurance |

The Company will automatically cede and the Reinsurer will automatically accept its share of the Company’s policies provided that:

| a) | The Company has retained on each Reinsured Policy the amount set out in Exhibit D according to the age and mortality rating at the time of underwriting; and |

| b) | The total of the new ultimate face amount of reinsurance required, including any contractual increases and the amount already reinsured on that life under this Agreement and all other life agreements between the Reinsurer and the Company, does not exceed the Automatic Acceptance Limits set out in Exhibit E; and |

| c) | The total new ultimate face amount of insurance, including any contractual increases on that life in force with all companies, including the Company, does not exceed the In Force Limits set out in Exhibit E; and |

| d) | The application is on a life for which the current or any previous application had not been submitted by the Company on a facultative basis to the Reinsurer or any other reinsurer within the last five years, unless the reason for the previous facultative submission was for exceeding Automatic Acceptance Limits or exceeding In Force Limits and no longer applies; and |

| e) | Other than as agreed to by the Reinsurer in writing, the Policy is not purchased, to the knowledge of the Company, as part of a third party investment program where such third party lacks an insurable interest in the insured or where such third party is engaging in insurance arbitrage. |

For purposes of this Article, “ultimate face amount” will mean the projected maximum policy face amount that could be reached based on reasonable assumptions made about the policy.

If the Company is already on the risk for its retention under previously issued policies, the Reinsurer will automatically accept reinsurance for newly issued policies according to the limits set out in Exhibit E, provided the Company has complied with the business guidelines specified in Exhibit A-1 (hereinafter the “Business Guidelines”) that would have applied if the new policy had fallen completely within the Company’s retention.

| 2.2 | Facultative Reinsurance |

Policies that do not qualify for automatic reinsurance may be submitted to the Reinsurer on a facultative basis. Additionally, policies that qualify for automatic reinsurance may be submitted to the Reinsurer for facultative consideration. If a policy that qualifies for automatic reinsurance is submitted to the Reinsurer or other reinsurers for consideration, the policy will be treated as if proposed on a facultative basis.

Article 3

| 3.1 | Automatic Submissions |

The Company will report Reinsured Policies ceded automatically to the Reinsurer according to the terms specified in Exhibit F.

Upon request, the Company will provide the Reinsurer copies of the application, underwriting papers and other information pertaining to any automatic cession under this Agreement.

| 3.2 | Facultative Submissions |

Applications for reinsurance on a facultative basis will be made in accordance with Exhibit A-2. Unless the Reinsurer provides written consent to an extension, the Company will have the number of days specified in Exhibit A-2 from the date of the Reinsurer’s final offer in which to place the policy with the insured/owner, after which the Reinsurer’s offer will expire without further notice or obligation.

The terms of this Agreement will apply to each accepted facultative offer, unless the offer specifies different terms.

Article 4

| 4.1 | Liability |

The Reinsurer’s liability to the Company will be based upon the terms of this Agreement and not the Reinsured Policy. Unless specified elsewhere in this Agreement:

| a) | The Reinsurer will not participate in any ex gratia payments made by the Company (i.e., payments the Company is not required to make under the policy terms); and |

| b) | The Reinsurer will not share in any Extra Contractual Obligations (except as set forth in Article 9.5); and |

| c) | The Reinsurer’s liability is limited to its share of the Company’s contractual benefits owed under the express terms of the Reinsured Policies. Damages or other payments resulting from insolvency and attributable to the termination or restructure of the Reinsured Policies are not covered by this Agreement; and |

| d) | The Reinsurer will not be liable unless the policy was issued and delivered in accordance with applicable law nor will the Reinsurer be liable for any payment prohibited by law. |

| 4.2 | Commencement of Automatic Reinsurance Liability |

The Reinsurer’s liability for any Reinsured Policy accepted automatically will begin simultaneously with the Company’s contractual liability for that policy.

| 4.3 | Commencement of Facultative Reinsurance Liability |

The Reinsurer’s liability for facultative reinsurance will begin simultaneously with the Company’s contractual liability if the Company has accepted, during the lifetime of the insured, the Reinsurer’s offer of coverage. The Reinsurer will be bound to facultative policies that are placed by the Company in accordance with the Company’s reasonably documented facultative acceptance procedures.

The Reinsurer will have no liability for any application submitted for facultative consideration if the Reinsurer declined facultative coverage or made an offer of coverage that was not accepted by the Company as required by the terms of this Agreement.

| 4.4 | Conditional Receipt or Temporary Insurance Agreement Liability |

Automatic reinsurance coverage for the Company’s conditional receipt or temporary insurance agreement will be limited to amounts accepted within the Company’s usual cash-with-application procedures for temporary coverage, up to the limits shown in Exhibit E.

However, for facultative applications submitted to the Reinsurer, the Reinsurer’s liability under a conditional receipt or a temporary insurance agreement will commence when the Reinsurer has received notice from the Company, during the lifetime of the insured and in accordance with the terms specified in Article 4.3 and Exhibit F, that the Reinsurer’s offer has been accepted, and then is limited to the Company’s usual cash-with-application procedures for temporary coverage, up to the limits shown in Exhibit E.

Article 5

| 5.1 | Premium Accounting |

The Company will pay the Reinsurer premiums in accordance with the terms specified in Exhibit C-1.

The method and requirements for reporting and remitting premiums are specified in Exhibit F.

The Reinsurer reserves the right to charge interest on overdue premiums. If applicable, interest will be calculated according to the terms specified in Exhibit C.

| 5.2 | Currency |

All payments due under this Agreement will be made in U.S. Dollars.

| 5.3 | Non-Payment of Premiums |

The payment of reinsurance premiums is a condition to the liability of the Reinsurer for reinsurance provided by this Agreement. If reinsurance premiums are not paid within 60 days of the due date, the Reinsurer may terminate reinsurance for all Reinsured Policies having reinsurance premiums in arrears. If the Reinsurer elects to terminate any Reinsured Policies after such 60 day period, it will then give the Company at least 15 days’ prior written notice of its intention to terminate such reinsurance. If all reinsurance premiums in arrears, including any which may become in arrears during such 15 day notice period, are not paid before the end of the notice period, the Reinsurer’s obligations for those Reinsured Policies will be limited to obligations relating to events arising on or before the last date for which reinsurance premiums have been paid in full for each Reinsured Policy.

If reinsurance is terminated according to this Article, a termination settlement will be made according to the terms specified in the Business Transfer Events provision of Exhibit C-1.

The Reinsurer’s right to terminate reinsurance will not prejudice its right to collect premiums and interest for the period reinsurance was in force, through and including the 15 day notice period.

The Company may not force termination through the non-payment of reinsurance premiums to avoid the Agreement’s requirements or to transfer the Reinsured Policies to another party.

Article 6

| 6.1 | Right of Offset |

The Company and the Reinsurer will have the right to offset any balances, whether on account of premiums, allowances, credits, claims or otherwise due from one party to the other under this Agreement or under any other reinsurance agreement between the Company and the Reinsurer.

The rights provided under this Article are in addition to any rights of offset that may exist at common law. The parties’ offset rights may be enforced notwithstanding any other provision of this Agreement including, without limitation, the provisions of Article 11.

Article 7

| 7.1 | Conversions |

If a Reinsured Policy is converted according to its terms and the applicable provisions of the Business Guidelines, the Company will notify the Reinsurer as specified in Exhibit F. The amount to be reinsured will be determined on the same basis as used for the original Reinsured Policy (excess of retention or quota share) but will not exceed the amount reinsured as of the date of conversion unless mutually agreed otherwise.

If the policy arising from a conversion is on a plan that is:

| a) | Reinsured on a coinsurance basis with the Reinsurer either under this Agreement or another agreement, the rates will be those in the agreement covering the plan to which the original policy is converting, based on the attained age of the insured and allowances based on the duration of the original Reinsured Policy; or |

| b) | Reinsured on a YRT basis with the Reinsurer either under this Agreement or another agreement, the YRT rates, with percentage reductions if applicable, will be those in the agreement covering the plan to which the original policy is converting, based on the attained age of the insured and duration of the original Reinsured Policy; or |

| c) | Not covered by any reinsurance agreement with the Reinsurer, reinsurance will be on a YRT basis using the YRT Rates for Conversions to Non-Reinsured Plans specified in Exhibit C-1, at the attained age and duration of the original Reinsured Policy. |

The above terms will apply unless specified otherwise in the Special Conditions provision in Exhibit C-1.

Unless mutually agreed otherwise, policies that had been reinsured with another reinsurer and which convert to a plan covered under this Agreement will not be reinsured with the Reinsurer.

| 7.2 | Policy Changes |

“Policy changes” refers to the variety of actions that may be made to a policy after issue. These actions include, but are not limited to, replacements, changes in plans or a change in the face amount of the policy. If there is a change to the reinsurance on a Reinsured Policy, the Company will inform the Reinsurer in the subsequent Changes and Terminations Report specified in Exhibit F.

Except as provided in this Article, whenever a Reinsured Policy is changed and the Company’s underwriting guidelines do not require that full evidence of insurability be obtained, the reinsurance will remain in effect with the Reinsurer, whether the change is made before or after any cancellation of this Agreement for new business. The suicide and contestability periods applicable to the original Reinsured Policy will apply to the reissued Reinsured Policy and the duration will be measured from the effective date of the original Reinsured Policy.

Whenever a Reinsured Policy is changed and the Company’s underwriting guidelines require that full evidence of insurability be obtained, and the suicide and contestability periods are based on the reissued policy date, the reinsurance will remain in effect with the Reinsurer, if the change is made before any cancellation of this Agreement for new business. If the change is made after any termination of this Agreement for new business, the reinsurance will be as specified in the termination document.

Policy changes to Reinsured Policies will be subject to the Reinsurer’s prior written approval, if:

| a) | The new amount of the policy would be in excess of the Automatic Acceptance Limit in effect at the time of the change, as set out in Exhibit E; or |

| b) | The new amount of the policy and the amount already in force on the same life exceeds the In Force Limits stated in Exhibit E; or |

| c) | The policy was reinsured on a facultative basis; or |

| d) | Evidence of insurability is not obtained. |

Premium rates and allowances for new issues as specified in Exhibit C-1 will apply to the amount underwritten for a non-contractual increase.

| 7.3 | Reductions |

Unless specified otherwise in this Agreement, if the amount of a policy issued by the Company is reduced and:

| a) | The amount of reinsurance is on excess basis, then the amount of reinsurance on that life will be reduced effective the same date by the full amount of the reduction under the original policy. If the amount of insurance terminated equals or exceeds the amount of reinsurance, the full amount of reinsurance will be terminated; or |

| b) | The amount of reinsurance is on a quota share basis, then the amount of reinsurance on that policy will be reduced effective the same date by the same proportion as the reduction under the original policy. |

The reduction will first apply to any reinsurance on the Reinsured Policy being reduced and then, if applicable, in chronological order according to policy date (“first in, first out”) to any reinsurance on other policies in force on the life. However, the Company will not be required to assume a risk for an amount in excess of its regular retention for the age at issue and the mortality rating of the policy under which reinsurance is being terminated.

If the reinsurance for a Reinsured Policy has been placed with more than one reinsurer, the reduction will be applied to all reinsurers pro rata to the amounts originally reinsured with each reinsurer.

A reduction to one of the Company’s policies not reinsured hereunder will require that the Company’s retention be increased to its full retention.

| 7.4 | Lapses |

When a policy issued by the Company lapses, the corresponding reinsurance on the Reinsured Policy will be terminated effective the same date. Unless specified otherwise in this Agreement, if a policy fully retained by the Company lapses, the terms of Article 7.3 will apply.

If a policy issued by the Company lapses and extended term insurance is elected under the terms of that policy, the corresponding reinsurance on the Reinsured Policy will continue on the same basis as the original Reinsured Policy until the expiry of the extended term period.

If a policy issued by the Company lapses and reduced paid-up insurance is elected under the terms of that policy, the amount of the corresponding reinsurance on the Reinsured Policy will be reduced according to the terms of Article 7.3.

If the Company allows the policy to remain in force under its automatic premium loan regulations, the corresponding reinsurance on the Reinsured Policy will continue unchanged and in force as long as such regulations remain in effect, except as otherwise provided in this Agreement.

| 7.5 | Reinstatements |

If a policy reinsured on an automatic basis is reinstated according to its terms and the Company’s reinstatement rules, the Reinsurer will, upon notification, reinstate the reinsurance. The Reinsurer’s approval is required for the reinstatement of a facultative policy if the Company’s regular reinstatement rules indicate that evidence of insurability, in addition to a statement of good health, is required.

The Company will pay all premiums in arrears on reinstated policies and such premiums will be subject to Article 5.1 and Exhibit F.

| 7.6 | Reinsurance Limits |

The Company will not submit a policy to the Reinsurer unless the amount of reinsurance on the policy equals or exceeds the Minimum Initial Reinsurance Limit specified in Exhibit C. A Reinsured Policy will no longer be reinsured when its reinsured Net Amount at Risk (as defined in Exhibit C-1) is less than the Minimum Final Reinsurance Limit specified in Exhibit C.

This Agreement will automatically terminate for new business if the gross first year reinsurance premium is less than the amount specified in the Dormant Agreement Termination Limit specified in Exhibit C. The Dormant Agreement Termination Limit will not include contractual increases arising from the terms of the inforce Reinsured Policy.

The Reinsurer will provide the Company with notice of any Dormant Agreement Termination effective under this Article.

Article 8

| 8.1 | Retention Limit Change |

If the Company changes its retention limit (hereinafter “Retention Limit”), it will provide the Reinsurer with written notice of the new Retention Limit at least 90 days prior to the effective date. Changes to the Company’s Retention Limits in Exhibit D will not affect the Reinsured Policies in force at the time of such a change except as specifically provided for elsewhere in this Agreement, and will not affect the Automatic Acceptance Limits in Exhibit E unless mutually agreed in writing by the Company and the Reinsurer.

If the Company decreases its Retention Limit, no reinsurance may be ceded on an automatic basis until the parties have reviewed and either expressly affirmed or revised the Automatic Acceptance Limits set out in Exhibit E.

| 8.2 | Recapture |

The Company may apply an increase in its Retention Limit to reduce the ceded amount of inforce reinsurance provided, however, that:

| a) | The Company gives the Reinsurer an irrevocable written notice of its intention to recapture within one year after the effective date of the increase in its Retention Limit; and |

| b) | Recapture will be effected on the next anniversary of each Reinsured Policy eligible for recapture unless agreed otherwise by both parties and with no recapture being made until the Reinsured Policy has been in force for the period specified in Exhibit C-1. For a conversion or re-entry, the recapture terms of the original policy will apply and the duration for the recapture period will be measured from the effective date of the original policy; and |

| c) | The Company has maintained, from the time the policy was issued, its quota share retention as set out in Exhibit D, and has applied its increased Retention Limit to all categories set out in Exhibit D; and |

| d) | Other than as respects catastrophe or financial reinsurance arrangements, the Company will retain all recaptured risks. |

No recapture will occur if the Company has either obtained or increased stop loss reinsurance coverage as justification for the increase in retention.

In applying its increased Retention Limit to Reinsured Policies, the age and mortality rating at the time of issue will be used to determine the amount of the Company’s increased retention. The amount of reinsurance eligible for recapture will be the difference between the amount originally retained and the amount the Company would have retained on the same quota share basis had the new retention been in effect at the time of issue. If there is reinsurance with other reinsurers on risks eligible for recapture, the reduction will be applied pro rata to the total outstanding reinsurance.

Recapture is optional, but if any reinsured business is recaptured, all eligible reinsured business must be recaptured. In addition, all life risks reinsured under any other reinsurance agreement between the Reinsurer and the Company which are eligible for recapture must be similarly recaptured.

Any successor of the Company will have the option to recapture reinsurance in accordance with this Article, provided that the successor company has or adopts a higher retention limit than previously used by the Company.

If the Company elects to terminate reinsurance under this Article, a termination settlement will be made according to the terms specified in the Business Transfer Events provision of Exhibit C-1, but will not include amounts specified in 12(d) of that provision.

Effective as of the recapture date, the Reinsurer will not be liable for any eligible business which was overlooked. The parties’ obligations for any recaptured business will be limited to those relating to events or circumstances arising or occurring before the recapture date, including payment of the termination settlement amount.

Upon payment of the termination settlement amount, each party will be deemed to be fully and finally released from all obligations under this Agreement with respect to the recaptured business.

| 8.3 | Waiver of Premium Claims |

If there is a Waiver of Premium (W.P.) claim in effect with respect to a Reinsured Policy when recapture takes place, the W.P. claim will stay in effect and the Reinsurer will continue to pay its share of the W.P. claim until such claim terminates. During such period, the Reinsurer will not be liable for any other benefits with respect to the Reinsured Policy, including the basic life risk, which are eligible for recapture. All eligible benefits will be recaptured as if there was no W.P. claim.

Article 9

| 9.1 | Claims Notice and Consultation |

The Company is responsible for the settlement of claims in accordance with applicable law and policy terms. For purposes of this Article, Reinsured Policies include conditional receipts and temporary insurance agreements covered under the terms of this Agreement. It is a condition to the Reinsurer’s obligation to pay a claim that the Company notify the Reinsurer in writing as soon as possible, but in any event not later than 12 months, after the Company receives notice of a claim on a Reinsured Policy. The Company will promptly provide the Reinsurer with copies of all claims documents.

As a condition to the Reinsurer’s obligation to pay a claim, before making a claim decision or settlement offer, the Company will seek the Reinsurer’s recommendation on such matters to the extent specified in Exhibit C-1. The Reinsurer will promptly make a recommendation; failing such, the Company may settle the claim without further consultation. The terms of Exhibit C-1 notwithstanding, the Company may request a recommendation from the Reinsurer on any claim on a Reinsured Policy. The Company will provide the Reinsurer all information, including underwriting files, requested by the Reinsurer for consideration of any claim on a Reinsured Policy.

The Company, if notified, will notify the Reinsurer of deaths that do not trigger policy benefits.

| 9.2 | Claims Payment |

The Reinsurer will be liable to the Company for its share of the benefits reinsured under this Agreement. The payment of death benefits by the Reinsurer will be in one lump sum regardless of the mode of settlement under the Reinsured Policy. The Reinsurer’s share of any interest payable under the terms of a Reinsured Policy or applicable law which is based on the death benefits paid by the Company, will be payable provided that the Reinsurer will not be liable for interest accruing on or after the date of the Company’s payment of benefits.

The Reinsurer will make payment to the Company for each such claim.

For claims on Accelerated Benefit riders reinsured under this Agreement, the benefit amount payable by the Reinsurer will be calculated by multiplying the total accelerated death benefit rider payout by the ratio of the reinsured Net Amount at Risk, as defined in Exhibit C-1, to the face amount of the Reinsured Policy.

| 9.3 | Contested Claims |

The Company will notify the Reinsurer promptly of its intention to investigate, contest, compromise, or litigate any claim involving a Reinsured Policy (hereinafter a “Contested Claim”). The Company will provide the Reinsurer all relevant information and documents, as such become available, pertaining to Contested Claims and will promptly report any developments during the Reinsurer’s review. If the Reinsurer:

| a) | Does not support the contest of the Claim, the Reinsurer will pay the Company its full share of the reinsurance benefit, and will not share in any subsequent reduction or increase in liability or in any subsequent expenses incurred by the Company; or |

| b) | Supports the Company’s decision to contest the claim and the Contested Claim results in a reduction or increase in liability, the Reinsurer will share in any reduction or increase in proportion to its share of the risk on the Contested Claim. |

If the Reinsurer supports the decision to contest the claim, the Company will promptly advise the Reinsurer of all significant developments, including notice of legal proceedings (including, but not limited to, consumer complaints or actions by governmental authorities) initiated in connection with the Contested Claim.

If the Company returns premiums to the policy owner or beneficiary as a result of misrepresentation, the Reinsurer will refund net reinsurance premiums received on that policy to the Company, without interest.

| 9.4 | Claims Expenses |

The Reinsurer will pay its share of reasonable investigation and legal expenses incurred in investigating, adjudicating or litigating a claim, except as otherwise provided in this Agreement. The Reinsurer will not be liable for any routine investigative or administrative claim expenses (such as compensation of salaried employees) or for any expenses incurred in connection with conflicting claims of entitlement to Reinsured Policy benefits that the Company admits are payable.

| 9.5 | Extra Contractual Obligations |

For purposes of this Agreement, “Extra Contractual Obligations” are any obligations or expenses other than contractual obligations incurred by the Company, its affiliates, directors, officers, employees, agents or other representatives and arising under the express written terms and conditions of a policy, including but not limited to, punitive damages, bad faith damages, compensatory damages, and other damages or fines or penalties which may arise from the acts, errors or omissions of the Company or its affiliates, directors, officers, employees, agents or other representatives.

The Reinsurer is not liable for Extra Contractual Obligations associated with a Contested Claim unless it concurred in writing and in advance with the claim actions which were the basis for the Extra Contractual Obligations. In these situations, the Company and the Reinsurer will share in Extra Contractual Obligations, in equitable proportions, but all factors being equal, the Reinsurer’s assessments would be in proportion to the risk accepted for the Reinsured Policy involved.

The Reinsurer will not be liable for any Extra Contractual Obligations incurred as a result of errors or omissions of the Company, directors, officers, employees, agents or other representatives in the implementation of agreed upon claims action (e.g., such as making timely filing of pleadings, etc.).

| 9.6 | Misstatement of Age or Sex |

In the event of a change in the amount payable under a Reinsured Policy due to a misstatement in age or sex, the Reinsurer’s liability will change proportionately. The Reinsured Policy will be rewritten from commencement on the basis of the adjusted amounts using premiums and amounts at risk for the correct ages and sex, and the proper adjustment for the difference in reinsurance premiums, without interest, will be made.

Article 10

| 10.1 | Errors and Omissions in Administration of Reinsurance |

Any unintentional or accidental failure to comply with the terms of this Agreement which can be shown to be the result of an oversight or clerical error relating to the administration of reinsurance by either party will not constitute a breach of this Agreement. Upon discovery, the error will be promptly corrected so that both parties are restored to the position they would have occupied had the oversight or clerical error not occurred. In the event a payment is corrected, the party receiving the payment may charge interest calculated according to the terms specified in Exhibit C. Should it not be possible to restore both parties to this position, the party responsible for the oversight or clerical error will be responsible for any resulting liabilities and expenses. The Reinsurer will not be responsible for negligent or deliberate acts of the Company or for intentional or known recurring errors by the Company.

This provision will not apply to the administration of the insurance provided by the Company to its insureds.

If the Company has failed to cede reinsurance as provided under this Agreement or has failed to comply with reporting requirements with respect to business ceded hereunder, the Reinsurer may require the Company to audit its records for similar errors and take reasonable actions necessary to correct errors and avoid similar errors. Failing prompt correction, the Reinsurer may limit its liability to the correctly reported Reinsured Policies.

| 10.2 | Dispute Resolution |

As a condition to the parties’ right to arbitration under this Agreement, either the Company or the Reinsurer will give written notification to the other party of any dispute relating to or arising from this Agreement, including, but not limited to, the formation or breach thereof. Within 15 days of notification, both parties must designate an officer of their respective companies to attempt to resolve the dispute. The officers will meet at a mutually agreeable location as soon as possible and as often as necessary to attempt to negotiate a resolution of the dispute. During the negotiation process, all reasonable requests made for information concerning the dispute will be promptly honored. The format for discussions will be determined mutually by the officers.

If these officers are unable to resolve the dispute within 30 days of their first meeting, the parties may agree in writing to extend the negotiation period for an additional 30 days. If the matter is not resolved within 30 days of the first meeting or the additional 30 day period, if any, then either party may demand arbitration pursuant to Article 10.3. The discussions and all information exchanged for the purposes of such discussions will be confidential and without prejudice.

| 10.3 | Arbitration |

Except with respect to disputes subject to the Expedited Dispute Resolution Process in Article 10.4, if the Company and Reinsurer are unable to resolve any dispute arising from this Agreement, including but not limited to the formation or breach thereof, pursuant to Article 10.2, the matter will be referred to arbitration.

The arbitration will be conducted in accordance with the Procedures for Resolution of U.S. Insurance and Reinsurance Disputes, Neutral Panel Version, April 2004 (the “Procedures”) available at xxx.xxxxxxxxxxxxxxxxxxxx.xxx, except as modified herein.

The arbitration will be held in New York City or another place as the parties may mutually agree. The arbitration will be conducted before a three person Panel qualified as:

| a) | Current or former officers of life insurance or reinsurance companies, or |

| b) | Professionals with no less than 10 years of experience in or serving the life insurance or reinsurance industries. |

The parties will select such candidates from the XXXXX-US Certified Arbitrators List available at xxx.XXXXX-XX.xxx.

The customs and practices of the life insurance and reinsurance industries may be considered by the Panel to resolve any ambiguities in the Agreement but only insofar as such customs and practices are consistent with a strict construction of the terms of this Agreement. The Panel will not have the authority to award punitive or exemplary damages.

The Panel will award the remedy sought by the party seeking relief to the extent the remedy is provided for in this Agreement or otherwise reasonably compensates the damaged party for the economic effect of any demonstrated breach. Such remedies may include, but will not be limited to, monetary damages, revisions to the terms of the Agreement, including adjustments to premiums or allowances paid or to be paid, or any combination of the foregoing.

The Panel shall issue an order, appropriate for confirmation in a court of competent jurisdiction, to resolve all matters in dispute. In addition, the Panel shall issue a written opinion setting forth the reasons for the award, with citations to the record of the hearing that support the reasoning.

The decision of the Panel will be final and binding upon the parties and their respective successors and assigns. Each party hereby consents to the entry of a judgment confirming or enforcing the award in the United States District Court for the Southern District of New York and/or in any other court of competent jurisdiction.

Within 20 days after the transmittal of an award, either party, upon notice to the other party, may request the Panel to correct any clerical, typographical, or computational errors in the award. The other party will be given ten days to respond to the request. The Panel will dispose of the request within 20 days of its receipt of such request and any response thereto. The Panel will not be empowered to re-determine the merits of any claim already decided.

Each party will:

| a) | Bear its own fees and expenses in connection with the arbitration, including the fees of any outside counsel and witness fees, and |

| b) | Share equally in the fees for the members of the Panel and the costs of the arbitration, such as hearing rooms, court reporters, etc. |

It is the intent of the parties that these arbitration provisions replace and be in lieu of any statutory arbitration provision, if permitted by law.

| 10.4 | Expedited Dispute Resolution Process |

The parties agree that the following types of issues and disputes will be subject to arbitration under the expedited procedures set forth in this Article:

| a) | Any dispute regarding the obligations of the parties with respect to a single Reinsured Policy, regardless of the amount in controversy; or |

| b) | Any dispute in which the amount in controversy, exclusive of interest or costs, is less than $1 million. |

Arbitration proceedings under this Article will be commenced as specified in Article 10.3, and shall be subject to the requirements of Article 10.3 to the extent they are not inconsistent with this Article.

The proceedings will be held before a single neutral umpire meeting the qualifications set forth in Article 10.3. If the parties are unable to agree on an umpire within 30 days following commencement of the action, the selection will be made pursuant to the Umpire Selection Procedure of the XXXXX-US Certified Arbitrators List available at xxx.XXXXX-XX.xxx. No ex parte communication will be permitted with the umpire at any time prior to the conclusion of the proceedings.

Within 21 days from the date the selection of the umpire is agreed upon, the parties and umpire will conduct an organizational meeting by teleconference to familiarize the umpire with the dispute and to set a timetable for submission of briefs. There will be no discovery, and the dispute will be submitted on briefs and documentary evidence only, unless otherwise agreed by the parties or ordered by the umpire for good cause.

Within 30 days of submission of briefs by the parties, the umpire will render a written award which will be final and binding on the parties.

Article 11

| 11.1 | Insolvency |

A party to this Agreement will be deemed “insolvent” when it:

| a) | Applies for or consents to the appointment of a receiver, rehabilitator, conservator, liquidator or statutory successor (hereinafter referred to as the Authorized Representative) of its properties or assets; or |

| b) | Is adjudicated as bankrupt or insolvent; or |

| c) | Files or consents to the filing of a petition in bankruptcy, seeks reorganization or an arrangement with creditors or takes advantage of any bankruptcy, dissolution, liquidation, rehabilitation, conservation or similar law or statute; or |

| d) | Becomes the subject of an order to rehabilitate or an order to liquidate as defined by the insurance code of the jurisdiction of the party’s domicile. |

In the event of the insolvency of the Company, all reinsurance ceded, renewed or otherwise becoming effective under this Agreement will be payable by the Reinsurer directly to the Company or to its Authorized Representative on the basis of the liability of the Company for benefits under the Reinsured Policies without diminution because of the insolvency of the Company.

The Reinsurer will be liable only for benefits reinsured as benefits become due under the terms of the Reinsured Policies and will not be or become liable for any amounts or reserves to be held by the Company as to the Reinsured Policies or for any damages owed by the Company as a result of issuance of any of the policies. The Company or its Authorized Representative will give written notice to the Reinsurer of all pending claims against the Company on any Reinsured Policies within a reasonable time after filing in the insolvency proceedings. While a claim is pending, the Reinsurer may investigate such claim and interpose, at its own expense, in the proceedings where the claim is to be adjudicated, any defense or defenses which it may deem available to the Company or its Authorized Representative.

The expense incurred by the Reinsurer will be chargeable, subject to court approval, against the Company as part of the expense of its insolvency proceedings to the extent of a proportionate share of the benefit which may accrue to the Company solely as a result of the defense undertaken by the Reinsurer. Where two or more reinsurers are involved in the same claim and a majority in interest elect to interpose a defense to such claim, the expense will be apportioned in accordance with the terms of the Agreement as though such expense had been incurred by the Company.

In the event of the insolvency of the Reinsurer, the Company may cancel this Agreement for new business by promptly providing the Reinsurer or its Authorized Representative with

written notice of cancellation, to be effective as of the date on which the Reinsurer’s insolvency is established by the authority responsible for such determination. Any requirement for a notification period prior to the cancellation of the Agreement would not apply under such circumstances.

In addition, in the event of the insolvency of the Reinsurer, the Company may provide the Reinsurer or its Authorized Representative with written notice of its intent to recapture all reinsurance in force under this Agreement regardless of the duration the reinsurance has been in force or the amount retained by the Company on the Reinsured Policies. The effective date of a recapture due to insolvency will be at the election of the Company but may not be earlier

than the date on which the Reinsurer’s insolvency is established by the authority responsible for such determination. If the Company elects to terminate reinsurance under this Article, a termination settlement will be made according to the terms specified in the Business Transfer Events provision of Exhibit C-1.

In the event of the insolvency of either party, the rights or remedies of this Agreement will remain in full force and effect.

Article 12

| 12.1 | DAC Tax Election (If applicable to the Company) |

The Company and the Reinsurer agree to the election pursuant to Section 1.848-2(g)(8) of the Income Tax Regulations effective December 29, 1992, under Section 848 of the Internal Revenue Code of 1986, as amended (such election being referred to as the “DAC Tax Election”), whereby:

| a) | The party with the net positive consideration for this Agreement for each taxable year will capitalize specified policy acquisition expenses with respect to this Agreement without regard to the general deductions limitation of Section 848(c)(1) of the Internal Revenue Code of 1986, as amended (the “Code”); |

| b) | The parties agree to exchange information pertaining to the amount of net consideration under this Agreement each year to ensure consistency. If requested, the Company will provide supporting information reasonably requested by the Reinsurer. (The term “net consideration” means “net consideration” as defined in Regulation Section 1.848-2(f)); |

| c) | This DAC Tax Election will be effective for the first taxable year in which this Agreement is effective and for all years for which this Agreement remains in effect. |

The Company and the Reinsurer will each attach a schedule to their respective federal income tax returns filed for the first taxable year for which this DAC Tax Election is effective. Such schedule will identify the Agreement as a reinsurance agreement for which the DAC Tax Election under Regulation Section 1.848-2(g)(8) has been made.

The Company and the Reinsurer represent and warrant that each is respectively subject to U.S. taxation under either the provisions of subchapter L of Chapter 1 or the provisions of subpart F of subchapter N of Chapter 1 of the Code.

| 12.2 | Taxes and Expenses |

Apart from any taxes, allowances, refunds, and expenses specifically referred to in this Agreement, no assessments by guaranty associations or comparable organizations, taxes, allowances, or expense will be paid by the Reinsurer to the Company for any Reinsured Policy.

Article 13

| 13.1 | Entire Agreement |

This Agreement and Exhibits constitute the entire agreement between the parties with respect to the business reinsured hereunder and supersede any and all prior representations, warranties, prior agreements or understandings between the parties pertaining to the subject matter of this Agreement. There are no understandings between the parties other than as expressed in this Agreement and Exhibits. In the event of any discrepancy between the Agreement and the Exhibits, the Exhibits will control.

Any change or modification to this Agreement and Exhibits will be null and void unless made by written amendment and signed by both parties.

| 13.2 | Inspection of Records |

The Reinsurer or its duly appointed representatives will have access to records of the Company, whether written or electronic, and including system view access, concerning the business reinsured hereunder for the purpose of inspecting, auditing and photocopying those records. Such access will be provided at the office of the Company and will be during reasonable business hours. Assuming the Reinsurer has continued to perform the undisputed portion of its obligations under this Agreement, the Company may not withhold access to information and records on the grounds that the Reinsurer is in breach.

The Reinsurer’s right of access as specified above will survive until all of the Reinsurer’s obligations under this Agreement have terminated or been fully discharged.

| 13.3 | Utmost Good Faith |

All matters with respect to this Agreement require the utmost good faith of each of the parties.

| 13.4 | Confidentiality |

The parties will keep confidential and not disclose or make competitive use of any shared Proprietary Information, as defined below, unless:

| a) | The information becomes publicly available other than through unauthorized disclosure by the party seeking to disclose or use such information; |

| b) | The information is independently developed by the recipient; |

| c) | The disclosure is, in the reasonable judgment of the Reinsurer, required or deemed advantageous (in terms of pricing, ease of execution or otherwise) for the purpose of any reinsurance, retrocession, securitization, or structured, asset-backed or asset-based financing; |

| d) | The disclosure is required by external auditors; or |

| e) | The disclosure is required by law. |

“Proprietary Information” includes, but is not limited to, underwriting manuals and guidelines, applications, contract forms, and premium rates and allowances of the Reinsurer and the Company, but shall not include the existence of this Agreement and the identity of the parties.

In addition, the Reinsurer will protect the confidentiality of Non-Public Personal Information, as defined below, by:

| a) | Holding all Non-Public Personal Information in strict confidence; |

| b) | Maintaining appropriate measures that are designed to protect the security, integrity and confidentiality of Non-Public Personal Information; |

| c) | Using Non-Public Personal Information only to carry out the Reinsurer’s obligations under this Agreement; and |

| d) | Disclosing Non-Public Personal Information to third parties only as necessary to perform services under this Agreement, for purposes of retrocession, or as may be required or permitted by law. |

“Non-Public Personal Information” is personally identifiable medical, financial, and other personal information about proposed, current and former applicants, policy owners, contract holders, insureds, annuitants, claimants, and beneficiaries of Reinsured Policies or contracts issued by the Company, and their representatives, that is not publicly available. Non-Public Personal Information does not include de-identified personal data, i.e., information that does not identify, or could not reasonably be associated with, an individual.

The Company will obtain, if required by any law, appropriate consent to the collection, use and disclosure of Non-Public Personal Information, from each insured to enable the parties to fully exercise their rights and perform their obligations under this Agreement.

Article 14

| 14.1 | Representations and Warranties |

The Company makes no representations and warranties as to the future experience or profitability arising from the Reinsured Policies.

Each party represents and warrants that it is solvent on a statutory basis on the date hereof in all states in which it does business or is licensed.

“Material” or “materially” for purposes of Articles 14 and 15 will mean facts that a prudent actuary would consider as reasonably likely to affect the Reinsurer’s experience under the Agreement. Prior to the execution of this Agreement, the Company has provided to the Reinsurer the Business Guidelines for use in its assessment of the risks covered hereunder. The Company represents and warrants that, to the best of its knowledge:

| a) | It has disclosed to the Reinsurer all information which is material to the risks being assumed hereunder; and |

| b) | The Business Guidelines were complete and accurate when disclosed; and |

| c) | There has been no material change in the Business Guidelines between the “as of” dates of the information and the date of Agreement execution. |

This Article will not terminate or expire until all Reinsured Policies have been discharged or terminated in full.

Article 15

| 15.1 | Business Continuity |

All Reinsured Policies will be issued and administered in accordance with the Business Guidelines. The parties acknowledge that changes to or failure to comply with the Business Guidelines may materially affect the Reinsurer’s experience under this Agreement. Therefore, the Company will notify the Reinsurer of any change that materially affects the reinsured business, including changes to the Business Guidelines. This Agreement will not cover policies affected by such changes unless the Reinsurer has agreed in writing and in advance to accept the affected policies. Outsourcing of underwriting functions, administrative functions or claims administration with respect to the Reinsured Policies will be considered a material change. If the Reinsurer agrees to accept policies affected by the outsourcing, the Company will secure the Reinsurer’s right to audit and inspect the party performing such outsourced services.

In the event the Company makes a change that materially affects the reinsured business, including changes to the Business Guidelines, without the Reinsurer’s consent to accept the affected policies:

| a) | The parties will attempt to negotiate revised terms as necessary under which the affected Reinsured Policies may continue to be reinsured; and |

| b) | If the parties are unable to agree on revised terms within 120 days, any Reinsured Policies materially and adversely affected by the change will be excluded from coverage under this Agreement . |

If Reinsured Policies are excluded, the parties will make returns of Agreement Cash Settlements previously made in connection with the subject Reinsured Policies. For purposes of this Agreement, the term “Agreement Cash Settlements” will mean premiums, allowances, commissions, cash surrender values, death claims, dividends, experience refund payments and similar settlements made under this Agreement, but excludes items relating to reserves or interest on reserves.

Article 16

| 16.1 | Duration of Agreement |

This Agreement is unlimited as to its duration.

Except as provided in Article 7.6, the Reinsurer or the Company may terminate this Agreement or any plan listed in Exhibit A with respect to the reinsurance of new business by giving at least 90 days’ written notice of termination to the other party or pursuant to Article 15.1 of this Agreement. During the 90 day notification period, the Company will continue to cede and the Reinsurer will continue to accept policies covered under the terms of this Agreement.

The Reinsurer remains liable for all Reinsured Policies in force as of the date of the termination, until their natural expiration, unless the parties mutually decide otherwise or as specified otherwise in this Agreement.

| 16.2 | Severability |

Determination that any provision of this Agreement is invalid or unenforceable will not affect or impair the validity or the enforceability of the remaining provisions of this Agreement.

| 16.3 | Construction |

This Agreement will be construed and administered without regard to authorship and without any presumption or rule of construction in favor of either party. This Agreement is between sophisticated parties, each of which has reviewed the Agreement and is fully knowledgeable about its terms and conditions.

| 16.4 | Credit for Reinsurance |

The parties intend that the Company will receive statutory reserve credit in its state of domicile for reinsurance provided under this Agreement. The parties agree to use reasonable efforts to ensure that such reserve credit will remain available to the Company.

| 16.5 | Non-Waiver; Retrocession |

A waiver by either party of any violation, or the default by the other party in its adherence to any term of this Agreement, will not constitute a waiver of any other or subsequent violation or default. No prior transaction or dealing between the parties will establish any custom or usage waiving or modifying any provision of the Agreement. The failure of either party to enforce any part of this Agreement will not constitute a waiver of any right to do so.

The Reinsurer may reinsure or retrocede any risks or business assumed hereunder, but may not effect any novation of this Agreement without the Company’s prior written consent.

| 16.6 | Survival; Governing Law |

All provisions of this Agreement will survive its termination to the extent necessary to carry out the purpose of this Agreement. This Agreement shall be governed by the laws of the State of New York.

Execution

This Agreement has been made in duplicate and hereby executed by both parties.

Signed for and on behalf of TIAA-CREF Life Insurance Company

| By: |

|

By: |

| |||||

| Title: |

|

Title: |

| |||||

| Date: |

|

Place: |

| |||||

Signed for and on behalf of Swiss Re Life & Health America Inc.

| By: |

|

By: |

| |||||

| Title: |

|

Title: |

| |||||

| Date: |

|

Place: |

| |||||

Exhibit A

Business Covered

Agreement Effective Date:

March 1, 2006. The commencement dates for specific plans are shown below.

Coverage:

The policies on the plans shown below which have policy issue dates falling in the period that begins with the Commencement Date and ends with the Termination Date and that qualify for automatic reinsurance are covered according to the Basis specified below, provided that the policies are on residents of the United States.

Basis:

20% on a First Dollar Quota Share basis (28.57% of the total reinsurance) to the maximum Automatic Acceptance Limits stated in Exhibit E, applicable to policies on lives with surnames commencing with the letters A to Z inclusive.

Company’s State of Domicile: New York

Plans, Riders and Benefits:

| Plan Identification |

Exhibit Reference for Rates |

Commencement Date |

Termination Date | |||

| Intelligent Life VUL | X-0 | Xxxxx 0, 0000 | ||||

| Xxxxxxxxxxx Life XX | X-0 | Xxxxx 0, 0000 |

Xxxxxx/Xxxxxxxxxxxx:

Higher Education Charitable Benefit Rider (Face amount of policy is increased by 1% if this rider is taken.)

Level Cost of Insurance Endorsement

Accelerated Death Benefit

Exhibit A-1

Business Guidelines

The Company affirms that the following have been supplied to the Reinsurer and are in use as of the effective date of this Agreement:

| 1. | Policy Application Form(s) |

AM-VUL1.02 (NC)TIVIAV; AM-VUL1.02 APP SUPP (NC) TIVIAV; 0307L/BUC-CIP; A10605 (01/06)

| 2. | Underwriting Requirements Grid (medical and non-medical) |

TIAA medreqs.pdf Und. Req. version 7, 09/20/2003; Height, Weight.xls

| 3. | Preferred Underwriting Criteria or Rules |

Criteria 200503.doc TIAA-CREF Underwriting Criteria for Term & UL*/VUL** Products

| 4. | Policy Form(s) |

| 5. | Higher Education Charitable Benefit Rider Specifications |

| 6. | Level Cost of Insurance Endorsement Specifications |

The Company affirms that the following Underwriting Manual is in use as of the effective date of this Agreement:

Swiss Re LifeGuide Manual

Exhibit A-2

Facultative Submissions

The Company may submit on a facultative basis to the Reinsurer any application for a policy which meets the conditions outlined in Article 2.2 by sending to the Reinsurer an Application for Reinsurance, a sample of which is included as Exhibit B. The Application for Reinsurance will include copies of all underwriting evidence that is available for risk assessment, including copies of the application for insurance, medical examiners’ reports, attending physicians’ statements, inspection reports, and other papers bearing on the insurability of the risk as requested by the Reinsurer. The Company will also notify the Reinsurer of any outstanding underwriting requirements at the time of the facultative submission. Any subsequent information pertinent to the risk assessment will be transmitted to the Reinsurer immediately.

After consideration of the Application for Reinsurance and related papers, the Reinsurer will promptly inform the Company of its underwriting decision. The Reinsurer’s facultative offer will expire at the end of 120 days, unless otherwise specified by the Reinsurer. If the Company accepts the Reinsurer’s offer and the policy is placed in force in accordance with the Business Guidelines provided to the Reinsurer, the Company will duly notify the Reinsurer according to the New Business Report specified in Exhibit F. The Reinsurer’s share of liability for such policy will commence at the time specified in Article 4.3 of the Agreement.

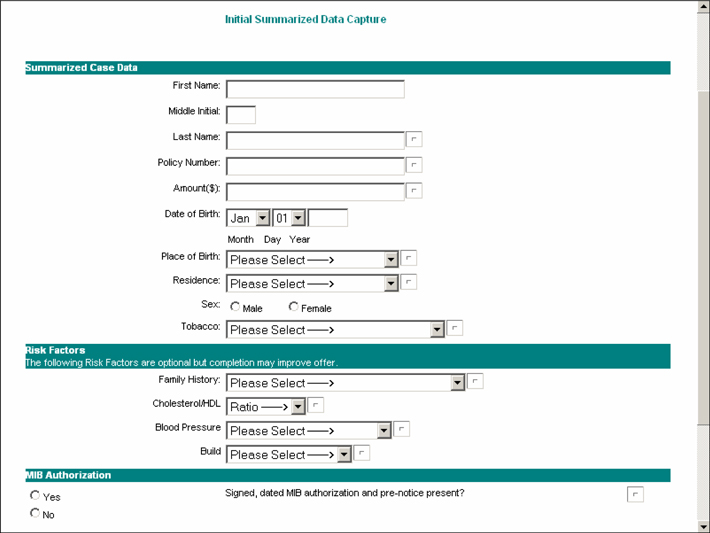

FacEasy Submissions

The Reinsurer may, at its option, permit the Company to apply for facultative reinsurance by using the FacEasy method of submission. Only policies with face amounts of $2,500,000 or less and on proposed insureds aged 75 or less may be submitted as FacEasy submissions.

If this option is made available to the Company by the Reinsurer, the Company may apply for reinsurance on a facultative basis by sending to the Reinsurer an Application for Reinsurance, a sample of which is included as Exhibit B-1. Unless specified elsewhere in the Agreement, only those documents relevant to issues prompting facultative submission will be provided to the Reinsurer, and all other documents will be considered reviewed and approved by the Company. The Company will also notify the Reinsurer of any outstanding underwriting requirements at the time of the facultative submission. Any subsequent information pertinent to the risk assessment will be transmitted to the Reinsurer immediately.

After consideration of the Application for Reinsurance and related papers, the Reinsurer will promptly inform the Company of its underwriting decision. The Reinsurer’s facultative offer will expire at the end of 120 days, unless otherwise specified by the Reinsurer. If the Company accepts the Reinsurer’s offer and the policy is placed in force in accordance with the Business Guidelines provided to the Reinsurer, the Company will duly notify the Reinsurer according to the New Business Report specified in Exhibit F. The Reinsurer’s share of liability for such policy will commence at the time specified in Article 4.3 of the Agreement.

If any risk is submitted to more than one reinsurer for consideration, the Company’s rules for placement of facultative cases will apply.

Exhibit B

Reinsurance Application

| From: Company Name |

| Company Name |

| Last | First | Middle | Date of Birth | Age | Sex | |||||||

| Applicant’s Name |

||||||||||||

Social Security Number

| Plan |

Preferred | Smoker | Nonsmoker | Reunderwriting |

| Curr |

Residence For Premium Tax | Policy Number | Policy Date | Preliminary Term From | ||||

| Type of Application | ||||||||||

| Facultative |

Automatic | Placement Date | Self Administered (Bulk) | Terms YRT | Coinsurance | |||||

| Decrement |

Cash Values | Reserves | Age Basis | Retention Code | Full | Reduced | Nil | |||||||

| Reinsurance Amounts | Basic Coverage | Additional Coverage | Waiver Premium Benefit |

Accidental Death Benefit |

Other Benefits | |||||

| Previous Insurance In force | ||||||||||

| Of Which We Retained - | ||||||||||

| Insurance Now Applied For - | ||||||||||

| Of Which We Retain - | ||||||||||

| Reinsurance This Cession - | ||||||||||

| Extra Premium | ||||||||||

| Rating If Substandard - | ||||||||||

| Coinsurance Premium - | ||||||||||

| *For YRT cases state Gross Premiums and Expiry Ages for benefits |

WP | AD | Other | Amount of Premium to be Waived |

Annual Decrement for Amount at Risk | |||||

Additional Information or Remarks

| Date | By |

Exhibit B-1

FacEasy Application

Exhibit C

General Terms

| 1. | Premium Tax: |

The Reinsurer will not reimburse the Company for premium taxes.

| 2. | Dividend Payments: |

The Reinsurer will not reimburse the Company for dividends paid to policyholders.

| 3. | Policy Loans: |

The Reinsurer will not participate in policy loans or other forms of indebtedness as respects the Reinsured Policies.

| 4. | Cash Surrender Values: |

The Reinsurer will not reimburse the Company for cash surrender values paid to the policyholder.

| 5. | Reinsurance Limits: |

| Minimum Initial Reinsurance Limit: | $20,000 | |

| Minimum Final Reinsurance Limit: | N/A | |

| Minimum Initial Facultative Reinsurance Limit: | $250,000 (face amount) to age 70 $100,001 (face amount) over age 70 | |

| Dormant Agreement Termination Limit: | If the aggregate gross first year reinsurance premium is less than $1,000 for any period of twelve consecutive months, an automatic termination of new business will result. |

| 6. | Interest Calculation on Late Payments: Premiums or other amounts remaining unpaid for more than 30 days from the due date as specified in Exhibit F or otherwise required will accrue interest from the due date at a rate equal to the Three Month London Interbank Offering Rate (LIBOR) as published in the Wall Street Journal (or if not available, a comparable publication) on the due date or, if the due date is not a business day, on the next business day after the due date, plus 50 basis points per annum to be compounded and adjusted every three months after such due date. |

| 7. | Rates Applicable to Increases: New issue reinsurance premium rates and allowances will apply to the amount normally underwritten of a non-contractual increase. |

Exhibit C-1

Rates and Terms for Intelligent Life VUL and Intelligent Life UL

| 1. | Reinsurance Structure: YRT |

| 2. | Age Basis: Age Last Basis |

| 3. | Premium Mode: Annual in Advance |

| 4. | Billing Frequency: Monthly |

| 5. | Premiums: |

Basic Premiums: The Company will pay to the Reinsurer a basic premium calculated by multiplying the net amount at risk of the Reinsured Policy, as defined in the Net Amounts At Risk provision of this Exhibit, by the appropriate rate from the set of rates included at the end of this Exhibit, subject to the percentages shown below. The Company will continue to pay the appropriate premium to the Reinsurer as long as the Reinsured Policy is in force.

The following percentages of the 2001 VBT ALB Sex- and Smoker- Distinct Select & Ultimate Rate Tables will be applied to the reinsurance premiums in all years:

| Issue Ages | |||||||||

| <70 | 70-79 | >79 | |||||||

| Pref Plus NS |

41 | % | 50 | % | 55 | % | |||

| Pref NS |

45 | % | 55 | % | 65 | % | |||

| Std NS |

57 | % | 67 | % | 77 | % | |||

| Smoker |

65 | % | 75 | % | 91 | % | |||

Extra Premiums: Any extra premiums payable due to additional mortality risk will be payable to the Reinsurer.

Multiple extra premiums are equal to the sum of the standard premium and 25% of the standard premium for each assessed table of extra mortality.

The maximum annual reinsurance premium rate per dollar of Net Amount at Risk will be subject to a maximum of 1.

Policy Fee: There is no policy fee applicable

Higher Education Charitable Benefit Rider: The Company will pay the basic reinsurance rates for any increase in the net amount at risk due to the existence of the Charitable Benefit Rider.

Level Cost of Insurance Endorsement: Selection of this endorsement requires full re-underwriting. The Reinsurer will restart the select period for the reinsurance rates using the attained age at time of re-underwriting.

Accelerated Death Benefit: The Reinsurer will participate in its share of any accelerated death benefit available to the policyholder under the terms of the base policy. There is no additional cost for this benefit.

| 6. | All Other Allowances: |

On Flat Extra Premiums: When a flat extra premium is payable for 5 years or less, an allowance of 10% of the gross flat extra charged by the Company will be made each year. When a flat extra premium is payable for more than 5 years, an allowance of 100% of the gross flat extra charged by the Company will be made in the first year and an allowance of 10% in each year thereafter.

| 7. | Net Amounts At Risk: |

The reinsured net amount at risk will be equal to the death benefit less the cash value multiplied by the Reinsurer’s share of the policy. For the purposes of calculating the net amount at risk, the death benefit will be defined as follows:

Option A — the death benefit will be the same as the policy’s face amount.

Option B — the death benefit will equal the policy’s face amount plus the cash value.

Option C — the death benefit will equal the policy’s face amount plus all premiums credited to the policy since the policy issue date.

Under all three options, the death benefit will increase if necessary to meet the definition of life insurance under Internal Revenue Code Section 7702.

Fluctuations in the amount at risk caused by the normal workings of the cash value fund in Universal Life type plans will be shared by the Company and the Reinsurer using the same retention method as for the base policy.

| 8. | Rate Basis: |

The rates in this subsection are on a non-participating basis.

| 9. | Rate Guarantee: |

The reinsurance rates set out in this Exhibit are guaranteed for the first policy year. In subsequent policy years, the Reinsurer reserves the right to increase the premiums for reinsurance but not above the statutory net valuation premium applicable to the Reinsured Policies after increase.

If the Reinsurer exercises its right to increase reinsurance premiums under this Agreement in an amount greater than that required to ensure that the Reinsurer will participate in its share of any increases in premium rates, costs, charges or fees as implemented by the Company for the Reinsured Policies, the Company may recapture all of the Reinsured Policies on which reinsurance rates have been increased regardless of the Reinsured Policies’ duration in force. If the Company elects to terminate reinsurance under this provision, a termination settlement will be made according to the terms specified in the Business Transfer Events provision of this Exhibit.

| 10. | Deficiency Reserves: No deficiency reserves will be held by the Reinsurer for the Reinsured Policies. |

| 11. | Minimum Recapture Period: |

30 Years

| 12. | Business Transfer Events: |

If a Business Transfer Event occurs, a Transfer Settlement Amount will be calculated and paid.

The Transfer Settlement Amount will be:

| (a) | Any amounts due the Company on the reinsured amounts being transferred, determined as of the effective date of the transfer; less |

| (b) | Any amounts due the Reinsurer on the reinsured amounts being transferred, determined as of the effective date of the transfer; plus |

| (c) | The appropriate amount of benefit reserves to be held in respect of the reinsured amounts being transferred determined as of the effective date of the transfer, based on net U.S. generally accepted accounting principles (“GAAP”) consistent with FASB Statement 60 computed using original pricing assumptions without provision for adverse deviation, less any amount of unamortized deferred acquisition cost assets related thereto and excluding any provisions for adverse deviations or similar deficiency or special reserves; less |

| (d) | An aggregate amount equal to the sum as respects all reinsured amounts transferred of (i) the premium in force for such policy as of the month end immediately preceding the effective date of the transfer times (ii) a “Business Transfer Factor” to be determined at the time of the event. |

If the Transfer Settlement Amount is greater than zero, the Reinsurer will pay the amount to the Company in cash. If the Transfer Settlement Amount is less than zero, the Company will pay the absolute value of the Transfer Settlement Amount to the Reinsurer in cash.

The Transfer Settlement Amount will be paid not later than 15 days following final determination of such amount in accordance with the provisions of this Section. However if the amount of the Transfer Settlement Amount required as to any Business Transfer Event exceeds $25 million, the party making the payment will have the option to make the payment in five equal annual installments, including accrued interest, commencing on the effective date of the transfer.

The parties will cooperate with each other in order to provide any information reasonably requested by either party in connection with the determination or assessment of the Transfer Settlement Amount.

| 13. | Conditions Requiring Claims Consultation: For purposes of this provision, “retention” will refer to the limits specified in the appropriate Exhibit D in effect at the time of policy issue. |

Before conceding liability or making settlement to the claimant, the Company will seek the Reinsurer’s recommendation if:

| a) | The claim occurs during the contestable period and the Company is contesting the claim, or |

| b) | The claim occurs during the contestable period and the Company kept its retention at the time of issue and it is not contesting the claim, but the face amount per life exceeds $0, or |

| c) | The claim occurs outside of the contestable period and the Company kept its retention at the time of issue and it is not contesting the claim, but the face amount per life exceeds $500,000, or |

| d) | The claim occurs outside of the United States or Canada, and the face amount per life exceeds $0, or |

| e) | The claim is one for which there is no body, i.e. the insured is missing and presumed dead, or |

| f) | The claim is one for which there is reasonable doubt as to the authenticity of the death certificate or the reliability of the medical report concerning such death or |

| g) | The claim is for accelerated death benefits. |

If the Reinsurer discovers that the Company’s claims paying practices and procedures differ materially from those performed at the inception of the Agreement or from the Business Guidelines, then, in addition to any other remedies, the Reinsurer may, with 30 days’ written notice, adjust the threshold amounts specified above.

| 14. | Special Conditions: |

None

Exhibit D

The Company’s Retention Limits

Life:

The Company will retain 30% of each Reinsured Policy, not to exceed its Retention Limits stated below.

| Issue Age |

Standard to Table 6 | Table 7 to Table 16 | ||||

| 0-70 |

$ | 5,000,000 | $ | 5,000,000 | ||

| 71-80 |

$ | 3,000,000 | $ | 3,000,000 | ||

It is understood that the sum of all amounts retained on a life will not exceed the Company’s Retention Limit on a per life basis.

Retention On Benefits:

The Company’s retention amounts apply to Life and ADB separately.

Risk Retention

Any change in the net amount at risk due to changes in the cash value applicable to the policy will be shared proportionately between the Company and its reinsurers.

Exhibit E

Automatic Issue and Acceptance Limits

The total Automatic Issue Amounts available to the Company on a per life basis, including amounts retained by the Company and all automatic reinsurance, will be as follows:

| Issue Age |

Standard to Table 6 | Table 7 to Table 16 | ||||

| 0-70 |

$ | 19,000,000 | $ | 19,000,000 | ||

| 71-80 |

$ | 11,400,000 | $ | 0 | ||

The Reinsurer will automatically accept 20% of each Policy, not to exceed the limits specified below on a per life basis. If the Company has filled its maximum retention on the life as specified in Exhibit D, the percentage the Reinsurer will automatically accept will increase to 28.57%, but the limits stated below will not change.

| Issue Age |

Standard to Table 6 | Table 7 to Table 16 | ||||

| 0-70 |

$ | 4,000,000 | $ | 4,000,000 | ||

| 71-80 |

$ | 2,400,000 | $ | 0 | ||

For the purpose of determining the Automatic Acceptance Limit in the above table, flat extra ratings are converted at a rate of one table (25%) for each $2.50 per thousand charged through age 70, and $5.00 per thousand ages 71 and up, and added to any multiple ratings.

In Force Limits:

In force and applied for on any one life: $50,000,000 - Ages 0-80, Standard to Table 16

Conditional Receipt or Temporary Insurance Agreement Liability

The amount of coverage provided by the Reinsurer under a Conditional Receipt (or Interim Receipt) or Temporary Insurance Agreement will not exceed the lesser of:

| 1. | The Reinsurer’s share of $500,000; or |

| 2. | The Reinsurer’s Automatic Acceptance Limits; or |

| 3. | The Reinsurer’s share of the difference between the amount of insurance provided by the Conditional Receipt (or Interim Receipt) or Temporary Insurance Agreement and the Company’s maximum Retention Limit assuming the life had been underwritten as standard. The Company’s Retention Limit will include any amounts retained under any inforce policies on the life. |

Exhibit F

Reinsurance Reports

The Company acknowledges that timely and correct compliance with the reporting requirements of this Agreement are a material element of the Company’s responsibilities hereunder and an important basis of the Reinsurer’s ability to reinsure the risks hereunder. Consistent and material non-compliance with reporting requirements, including extended delays, will constitute a material breach of the terms of this Agreement.

Remittance Reporting: