Eli Lilly and Company Shareholder Value Award (for Executive Officers)

Xxx Xxxxx and Company

(for Executive Officers)

This Shareholder Value Award has been granted on February 7, 2019 (“Grant Date”) by Xxx Xxxxx and Company, an Indiana corporation, with its principal offices in Indianapolis, Indiana (“Lilly” or the “Company”), to the Eligible Individual who has received this Shareholder Value Award Agreement (the “Grantee”).

Lilly Stock Price Performance Levels:

No Payout | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | |

Final Lilly Stock Price | < $103.43 | $103.43 -- $118.07 | $118.08 -- $132.72 | $132.73 – $147.37 | $147.38 – $162.02 | > $162.02 |

Percent of Target | 0% | 50% | 75% | 100% | 125% | 150% |

Total Shareholder Return (TSR) Modifier

Performance Period: January 1, 2019 - December 31, 2021

Section 1. | Grant of Shareholder Value Award |

Xxx Xxxxx and Company, an Indiana corporation (“Lilly” or the “Company”), has granted to the Eligible Individual who has received this Shareholder Value Award Agreement (the “Grantee”) a Performance-Based Award (the “Shareholder Value Award” or the “Award”) with respect to the target number of shares of Xxxxx Xxxxxx Stock (the “Shares”) that the Grantee may view by logging on to the Xxxxxxx Xxxxx website at xxxx://xxxxxxxx.xxxxx.xxx (the "Target Number of Shares").

The Award is made pursuant to and subject to the terms and conditions set forth in the Amended and Restated 2002 Lilly Stock Plan (the “Plan”) and to the terms and conditions set forth in this Shareholder Value Award Agreement, including all appendices, exhibits and addenda hereto (the “Award Agreement”). In the event of any conflict between the terms of the Plan and this Award Agreement, the terms of the Plan shall govern.

Any capitalized terms used but not defined in this Award Agreement shall have the meanings set forth in the Plan.

Section 2. | Vesting |

As soon as reasonably practicable following the end of the Performance Period, the Committee shall determine the number of Shares that are eligible to vest which shall be equal to the product of (i) the Target Number of Shares, multiplied by (ii) the Percent of Target, multiplied by (iii) the TSR Modifier, where:

a. | “Percent of Target” shall mean the percentage set forth in the Lilly Stock Price Performance Levels table set forth on the first page of this document representing the attainment level of the Final Lilly Stock Price measured against the performance goal attainment levels set forth in the table. |

b. | “Final Lilly Stock Price” shall mean the average of the closing price of a share of Lilly Common Stock on the New York Stock Exchange for each trading day in the last two months of the Performance Period, rounded to the nearest cent. |

1

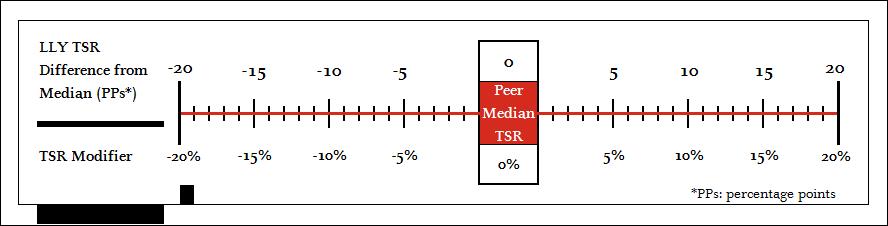

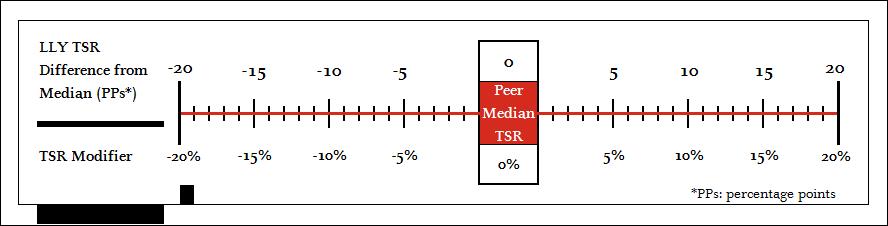

c. | “TSR Modifier” shall mean a whole percentage (as set forth in the TSR Modifier graphic on page 1 of this document) representing the absolute percentage point difference in the performance of the Company’s TSR compared to the Peer Group’s median TSR, subject to a maximum TSR Modifier of plus or minus 20% (i.e., each whole percentage point represents the percentage that the Company’s TSR is above or below the Peer Group’s median TSR). |

d. | “Total Shareholder Return” or “TSR” shall mean the quotient of (i) the Final Lilly Stock Price or Final Peer Stock Price, as applicable, minus the corresponding Beginning Stock Price, including the impact of Dividend reinvestment on each ex-dividend date, if any, paid by the applicable issuer during the Performance Period, divided by (ii) the corresponding Beginning Stock Price. |

The stock prices and cash dividend payments reflected in the calculation of TSR shall be adjusted to reflect stock splits during the Performance Period and dividends shall be assumed to be reinvested in the relevant issuer’s shares for purposes of the calculation of TSR.

e. | “Beginning Stock Price” shall mean the average closing price of a share of Lilly Common Stock on the New York Stock Exchange or a share of each Peer Group company’s stock, as applicable, for each trading day in the two month period immediately preceding the Performance Period, rounded to the nearest cent. |

f. | “Final Peer Stock Price” shall mean the average of the closing price of a share of each Peer Group company’s stock, on Nasdaq, the New York Stock Exchange, or other market where an independent share price can be determined, for each trading day in the last two months of the Performance Period, rounded to the nearest cent. |

g. | “Dividend” shall mean ordinary or extraordinary cash dividends paid by Xxxxx or a Peer Group company to its shareholders of record at any time during the Performance Period. |

h. | “Peer Group” shall mean all companies identified and most recently approved by the Committee as a member of the Company’s Peer Group in effect as of the Grant Date. Companies that are members of the Peer Group at the beginning of the Performance Period that subsequently cease to be traded on a market where an independent share price can be determined shall be excluded from the Peer Group. |

In the event the Grantee’s Service with the Company or an Affiliate is terminated prior to the end of the Performance Period for any reason or in any circumstance other than a Qualifying Termination (as described below), the Award shall be forfeited.

Section 3. | Adjustments for Certain Employment Status Changes |

Unless the Committee determines, in its sole discretion, that such adjustments are not advisable after consideration of Applicable Laws, the number of Shares that are eligible to vest shall be adjusted for changes in employment status of the Grantee during the Performance Period as follows:

a. | Leaves of Absence. The number of Shares eligible to vest shall be reduced proportionally for any portion of the total days in the Performance Period during which the Grantee is on an approved unpaid leave of absence longer than ninety (90) days. |

b. | Demotions, Disciplinary Actions and Misconduct. The Committee may, in its sole discretion, cancel this Shareholder Value Award or reduce the number of Shares eligible to vest, prorated according to time or other measure as determined appropriate by the Committee, if during any portion of the Performance Period the Grantee has been (i) subject to disciplinary action by the Company or (ii) determined to have committed a material violation of law or Company policy or to have failed to properly manage or monitor the conduct of an employee who has committed a material violation of law or Company policy whereby, in either case, such conduct causes significant harm to the Company, as determined in the sole discretion of the Company. |

c. | Qualifying Termination. In the event the Grantee’s employment is subject to a Qualifying Termination (as defined below), the number of Shares eligible to vest shall be reduced proportionally for the portion of the total days during the Performance Period in which the Grantee was not in active Service. |

For purposes of this Award Agreement, a “Qualifying Termination” means any one of the following:

i. | retirement as a “retiree,” which is a person who is (A) a retired employee under the Lilly Retirement Plan; (B) a retired employee under the retirement plan or program of an Affiliate; or (C) a retired employee under a retirement program specifically approved by the Committee; |

ii. | the Grantee’s Service is terminated due to the Grantee’s death; |

iii. | the Grantee’s Service is terminated by reason of Disability; |

iv. | the Grantee’s Service is terminated due to a plant closing or reduction in workforce (as defined below); |

2

v. | the Grantee’s Service is terminated as a result of the Grantee’s failure to locate a position within the Company or an Affiliate following the placement of the Grantee on reallocation or medical reassignment in the United States (or equivalent as determined by the Committee). |

“Plant closing” means the closing of a plant site or other corporate location that directly results in termination of the Grantee’s Service.

“Reduction in workforce” means the elimination of a work group, functional or business unit or other broadly applicable reduction in job positions that directly results in termination of the Grantee’s Service.

The Committee’s determination as to whether (1) the Grantee’s Service has been terminated by reason of Disability, (2) the Grantee’s Service has been terminated as a direct result of either a plant closing or a reduction in workforce, (3) the Grantee’s Service has been terminated as a result of the failure to locate a position within the Company or an Affiliate following reallocation or medical reassignment, and (4) a leave of absence or a transfer of employment between Lilly and an Affiliate or between Affiliates constitutes a termination of Service shall be final and binding on the Grantee.

Section 4. | Change in Control |

The provisions of Section 13.2 of the Plan apply to this Award with the following modifications:

a. | The only Change in Control event that shall result in a benefit under this Section 4 shall be the consummation of a merger, share exchange, or consolidation of the Company, as defined in Section 2.6(c) of the Plan (a “Transaction”). |

b. | In the event of a Transaction that occurs prior to the end of the Performance Period, the Grantee will be credited with an award of Restricted Stock Units equal to the number of Shares eligible to vest, calculated in a manner consistent with Section 2, but the Final Lilly Stock Price shall be equal to the value of Shares established for the consideration to be paid to holders of Shares in the Transaction (the “Credited RSU Award”). The Credited RSU Award shall be eligible to vest on the last day of the Performance Period, subject to the Grantee’s continued Service through the last day of the Performance Period, except as provided below: |

i. | In the event that (A) the Grantee is subject to a Qualifying Termination prior to the end of the Performance Period or (B) the Credited RSU Award is not converted, assumed, substituted, continued or replaced by a successor or surviving corporation, or a parent or subsidiary thereof, in connection with a Transaction, then immediately prior to the Transaction, the Credited RSU Award shall vest automatically in full. |

ii. | In the event that the Credited RSU Award is converted, assumed, substituted, continued or replaced by a successor or surviving corporation, or a parent or subsidiary thereof, in connection with the Transaction and the Grantee is subject to a Covered Termination (as defined below) prior to the end of the Performance Period, then immediately as of the date of the Covered Termination, the Credited RSU Award shall vest automatically in full. |

For purposes of this Award Agreement, “Covered Termination” shall mean a Qualifying Termination, Grantee’s termination of Service without Cause or the Grantee’s resignation for Good Reason. “Cause” and “Good Reason” shall have the meanings ascribed to them in the Xxx Xxxxx and Company 2007 Change in Control Severance Pay Plan for Select Employees (as amended from time to time) or any successor plan or arrangement thereto.

c. | If the Grantee is entitled to receive stock of the acquiring entity or successor to the Company as a result of the application of this Section 4, then references to Shares in this Award Agreement shall be read to mean stock of the successor or surviving corporation, or a parent or subsidiary thereof, as and when applicable. |

Section 5. | Settlement |

a. | Except as provided below, the Award shall be paid to the Grantee as soon as practicable, but in no event later than sixty (60) days, following the last day of the Performance Period. |

b. | If the Award vests pursuant to Section 4(b)(i), the Award shall be paid to the Grantee immediately prior to the Transaction, provided that if the Award is considered an item of non-qualified deferred compensation subject to Section 409A of the Code (“NQ Deferred Compensation”) and the Transaction does not constitute a “change in control event,” within the meaning of the U.S. Treasury Regulations (a “409A CIC”), then the Award shall be paid in cash (calculated based on the value of the Shares established for the consideration to be paid to holders of Shares in the Transaction) on the earliest of the date that the Grantee experiences a “separation from service” within the meaning of Section 409A of the Code (a “Section 409A Separation”), the date of the Grantee’s death and the date set forth in Section 5(a) above. |

3

c. | If the Award vests pursuant to Section 4(b)(ii), the Award shall be paid to the Grantee as soon as practicable, but in no event later than sixty (60) days, following the date the Grantee is subject to a Covered Termination, provided that if the Award is NQ Deferred Compensation, (i) the Award shall be paid within sixty (60) days following the date the Grantee experiences a Section 409A Separation and (ii) if the Grantee is a “specified employee” within the meaning of Section 409A of the Code as of the payment date, the Award shall instead be paid on the earliest of (1) the first day following the six (6) month anniversary of the Grantee’s Section 409A Separation, (2) the date of a 409A CIC, and (3) the date of the Grantee’s death. |

d. | At the time of settlement provided in this Section 5, Lilly shall issue or transfer Shares or the cash equivalent, as contemplated under Section 5(e) below, to the Grantee. In the event the Grantee is entitled to a fractional Share, the fraction may be paid in cash or rounded, in the Committee’s discretion. |

e. | At any time prior to the end of the Performance Period or until the Award is paid in accordance with this Section 5, the Committee may, if it so elects, determine to pay part or all of the Award in cash in lieu of issuing or transferring Shares. The amount of cash shall be calculated based on the Fair Market Value of the Shares on the last day of the Performance Period in the case of payment pursuant to Section 5(a) and on the date of payment in the case of a payment pursuant to Section 5(c). |

f. | In the event of the death of the Grantee, the payments described above shall be made to the successor of the Grantee. |

Section 6. | Rights of the Grantee |

a. | No Shareholder Rights. The Shareholder Value Award does not entitle the Grantee to any rights of a shareholder of Lilly until such time as the Shareholder Value Award is settled and Shares are issued or transferred to the Grantee. |

b. | No Trust; Xxxxxxx’s Rights Unsecured. Neither this Award Agreement nor any action in accordance with this Award Agreement shall be construed to create a trust of any kind. The right of the Grantee to receive payments of cash or Shares pursuant to this Award Agreement shall be an unsecured claim against the general assets of the Company. |

Section 7. | Prohibition Against Transfer |

The right of a Grantee to receive payments of Shares and/or cash under this Award may not be transferred except to a duly appointed guardian of the estate of the Grantee or to a successor of the Grantee by will or the applicable laws of descent and distribution and then only subject to the provisions of this Award Agreement. A Grantee may not assign, sell, pledge, or otherwise transfer Shares or cash to which he or she may be entitled hereunder prior to transfer or payment thereof to the Grantee, and any such attempted assignment, sale, pledge or transfer shall be void.

Section 8. | Responsibility for Taxes |

a. | Regardless of any action Lilly and/or the Grantee’s employer (the “Employer”) takes with respect to any or all income tax (including federal, state, local and non-U.S. tax), social insurance, payroll tax, fringe benefits tax, payment on account or other tax related items related to the Grantee’s participation in the Plan and legally applicable to the Grantee (“Tax Related Items”), the Grantee acknowledges that the ultimate liability for all Tax Related Items is and remains the Grantee’s responsibility and may exceed the amount actually withheld by Xxxxx or the Employer. The Grantee further acknowledges that Xxxxx and the Employer (i) make no representations or undertakings regarding the treatment of any Tax Related Items in connection with any aspect of the Award, including the grant of the Shareholder Value Award, the vesting of the Shareholder Value Award, the transfer and issuance of any Shares, the receipt of any cash payment pursuant to the Award, the receipt of any dividends and the sale of any Shares acquired pursuant to this Award; and (ii) do not commit to and are under no obligation to structure the terms of the grant or any aspect of the Award to reduce or eliminate the Grantee’s liability for Tax Related Items or achieve any particular tax result. Furthermore, if the Grantee becomes subject to Tax Related Items in more than one jurisdiction, the Grantee acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax Related Items in more than one jurisdiction. |

b. | Prior to the applicable taxable or tax withholding event, as applicable, the Grantee shall pay or make adequate arrangements satisfactory to Lilly and/or the Employer to satisfy all Tax Related Items. |

i. | If the Shareholder Value Award is paid to the Grantee in cash in lieu of Shares, the Grantee authorizes the Company and/or the Employer, or their respective agents, at their discretion, to satisfy any obligation for Tax Related Items by withholding from the cash amount paid to the Grantee pursuant to the Award or from the Grantee’s wages or other cash compensation paid to the Grantee by the Company and/or the Employer. |

ii. | If the Shareholder Value Award is paid to the Grantee in Shares and the Grantee is not subject to the short-swing profit rules of Section 16(b) of the Exchange Act, the Grantee authorizes Xxxxx and/or the Employer, or their respective agents, at their discretion, to (A) withhold from the Grantee’s wages or |

4

other cash compensation paid to the Grantee by the Company and/or the Employer, (B) arrange for the sale of Shares to be issued upon settlement of the Award (on the Grantee’s behalf and at the Grantee’s direction pursuant to this authorization or such other authorization as the Grantee may be required to provide to Lilly or its designated broker in order for such sale to be effectuated) and withhold from the proceeds of such sale, and/or (C) withhold in Shares otherwise issuable to the Grantee pursuant to this Award.

iii. | If the Shareholder Value Award is paid to the Grantee in Shares and the Grantee is subject to the short-swing profit rules of Section 16(b) of the Exchange Act, Xxxxx will withhold in Shares otherwise issuable to the Grantee pursuant to this Award, unless the use of such withholding method is prevented by Applicable Laws or has materially adverse accounting or tax consequences, in which case the withholding obligation for Tax Related Items may be satisfied by one or a combination of the methods set forth in Section 8(b)(ii)(A) and (B) above. |

c. | Depending on the withholding method, Lilly and/or the Employer may withhold or account for Tax Related Items by considering applicable minimum statutory withholding amounts or other applicable withholding rates, including maximum applicable rates, in which case the Grantee may receive a refund of any over-withheld amount in cash as soon as practicable and without interest and will not be entitled to the equivalent amount in Shares. If the obligation for Tax Related Items is satisfied by withholding Shares, for tax purposes, the Grantee will be deemed to have been issued the full number of Shares to which he or she is entitled pursuant to this Award, notwithstanding that a number of Shares are withheld to satisfy the obligation for Tax Related Items. |

x. | Xxxxx may require the Grantee to pay Lilly and/or the Employer any amount of Tax Related Items that Lilly and/or the Employer may be required to withhold or account for as a result of any aspect of this Award that cannot be satisfied by the means previously described. Xxxxx may refuse to deliver Shares or any cash payment to the Grantee if the Grantee fails to comply with the Grantee’s obligation in connection with the Tax Related Items as described in this Section 8. |

Section 9. | Section 409A Compliance |

To the extent applicable, it is intended that this Award comply with the requirements of Section 409A of the U.S. Internal Revenue Code of 1986, as amended and the Treasury Regulations and other guidance issued thereunder (“Section 409A”) and this Award shall be interpreted and applied by the Committee in a manner consistent with this intent in order to avoid the imposition of any additional tax under Section 409A.

Section 10. | Xxxxxxx’s Acknowledgment |

In accepting this Award, the Grantee acknowledges, understands and agrees that:

a. | the Plan is established voluntarily by Xxxxx, it is discretionary in nature and it may be modified, amended, suspended or terminated by Xxxxx at any time, as provided in the Plan; |

b. | the Award is voluntary and occasional and does not create any contractual or other right to receive future Performance-Based Awards, or benefits in lieu thereof, even if Performance-Based Awards have been granted in the past; |

c. | all decisions with respect to future Performance-Based Awards or other awards, if any, will be at the sole discretion of the Committee; |

d. | the Grantee’s participation in the Plan is voluntary; |

e. | the Award and any Shares subject to the Award are not intended to replace any pension rights or compensation; |

f. | the Award and any Shares subject to the Award, and the income and value of same, are not part of normal or expected compensation for any purpose, including but not limited to, calculating any severance, resignation, termination, redundancy, dismissal, end of service payments, bonuses, long-service awards, holiday pay, leave pay, pension or welfare or retirement benefits or similar mandatory payments; |

g. | neither the Award nor any provision of this Award Agreement, the Plan or the policies adopted pursuant to the Plan, confer upon the Grantee any right with respect to employment or continuation of current employment, and in the event that the Grantee is not an employee of Lilly or any subsidiary of Lilly, the Award shall not be interpreted to form an employment contract or relationship with Xxxxx or any Affiliate; |

h. | the future value of the underlying Shares is unknown, indeterminable and cannot be predicted with certainty; |

i. | no claim or entitlement to compensation or damages shall arise from forfeiture of the Award resulting from the Grantee ceasing to provide employment or other services to Lilly or the Employer (for any reason whatsoever, whether or not later found to be invalid or in breach of local labor laws in the jurisdiction where the Grantee is employed or the terms of Grantee’s employment agreement, if any); |

j. | for purposes of the Award, the Grantee’s employment will be considered terminated as of the date he or she is no longer actively providing services to the Company or an Affiliate and the Grantee’s right, if any, to earn |

5

and be paid any portion of the Award after such termination of employment or services (regardless of the reason for such termination and whether or not such termination is later found to be invalid or in breach of employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any) will be measured by the date the Grantee ceases to actively provide services and will not be extended by any notice period (e.g., active service would not include any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any); the Committee shall have the exclusive discretion to determine when the Grantee is no longer actively providing services for purposes of the Award (including whether the Grantee may still be considered to be actively providing services while on a leave of absence) in accordance with Section 409A;

k. | unless otherwise provided in the Plan or by the Committee in its discretion, the Award and the benefits evidenced by this Award Agreement do not create any entitlement to have the Award or any such benefits transferred to, or assumed by, another company nor to be exchanged, cashed out or substituted for, in connection with any corporate transaction affecting the Shares; |

l. | the Grantee is solely responsible for investigating and complying with any laws applicable to him or her in connection with the Award; and |

m. | the Company has communicated share ownership guidelines that apply to the Grantee, and the Grantee understands and agrees that those guidelines may impact any Shares subject to, or issued pursuant to the Award. |

Section 11. | Data Privacy |

a. | Data Collection and Usage. The Company and the Employer may collect, process and use certain personal information about the Grantee, and persons closely associated with the Grantee, including, but not limited to, the Grantee’s name, home address and telephone number, email address, date of birth, social insurance number, passport or other identification number (e.g., resident registration number), salary, nationality, job title, any shares of stock or directorships held in the Company, details of all Shareholder Value Awards or any other entitlement to shares of stock awarded, canceled, exercised, vested, unvested or outstanding in the Grantee’s favor (“Data”), for the purposes of implementing, administering and managing the Plan. The legal basis, where required, for the processing of Data is the Grantee’s consent. Where required under applicable law, Data may also be disclosed to certain securities or other regulatory authorities where the Company’s securities are listed or traded or regulatory filings are made and the legal basis, where required, for such disclosure are the applicable laws. |

b. | Stock Plan Administration Service Providers. The Company transfers Data to Bank of America Xxxxxxx Xxxxx and/or its affiliated companies (“Xxxxxxx Xxxxx”), an independent service provider, which is assisting the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share Data with such other provider serving in a similar manner. The Grantee may be asked to agree on separate terms and data processing practices with the service provider, with such agreement being a condition to the ability to participate in the Plan. The Company may also transfer Data to KPMG, an independent service provider, which is also assisting the Company with certain aspects of the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share Data with such other provider serving in a similar manner. |

c. | International Data Transfers. The Company and its service providers are based in the United States. The Grantee’s country or jurisdiction may have different data privacy laws and protections than the United States. For example, the European Commission has issued a limited adequacy finding with respect to the United States that applies only to the extent companies register for the EU-U.S. Privacy Shield program, which is open to companies subject to Federal Trade Commission jurisdiction and in which the Company participates with respect to employee data. The Company’s legal basis, where required, for the transfer of Data is Xxxxxxx’s consent. |

d. | Data Retention. The Company will hold and use the Data only as long as is necessary to implement, administer and manage the Grantee’s participation in the Plan, or as required to comply with legal or regulatory obligations, including under tax and security laws. |

e. | Voluntariness and Consequences of Consent Denial or Withdrawal. Participation in the Plan is voluntary and the Grantee is providing the consents herein on a purely voluntary basis. If the Grantee does not consent, or if the Grantee later seeks to revoke the Grantee’s consent, the Grantee’s salary from or employment and career with the Employer will not be affected; the only consequence of refusing or withdrawing the Grantee’s consent is that the Company would not be able to grant this Award or other awards to the Grantee or administer or maintain such awards. |

6

f. | Declaration of Consent. By accepting the Award and indicating consent via the Company’s online acceptance procedure, the Grantee is declaring that he or she agrees with the data processing practices described herein and consents to the collection, processing and use of Data by the Company and the transfer of Data to the recipients mentioned above, including recipients located in countries which do not adduce an adequate level of protection from a European (or other non-U.S.) data protection law perspective, for the purposes described above. |

The Grantee understands that the Company may rely on a different legal basis for the processing or transfer of Data in the future and/or request that the Grantee provide another data privacy consent form. If applicable and upon request of the Company, the Grantee agrees to provide an executed acknowledgement or data privacy consent form to the Employer or the Company (or any other acknowledgements, agreements or consents that may be required by the Employer or the Company) that the Company and/or the Employer may deem necessary to obtain under the data privacy laws in the Grantee’s country, either now or in the future. The Grantee understands that he or she will not be able to participate in the Plan if he or she fails to execute any such acknowledgement, agreement or consent requested by the Company and/or the Employer.

Section 12. | Additional Terms and Conditions |

The Company reserves the right to impose other requirements on the Award and any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable for legal or administrative reasons, and to require the Grantee to execute any additional agreements or undertakings that may be necessary to accomplish the foregoing. Without limitation to the foregoing, the Grantee agrees that the Shareholder Value Award and any benefits or proceeds the Grantee may receive hereunder shall be subject to forfeiture and/or repayment to the Company to the extent required to comply with any requirements imposed under applicable laws or any compensation recovery policy of the Company that reflects the provisions of applicable laws.

Section 13. | Governing Law and Choice of Venue |

The validity and construction of this Award Agreement shall be governed by the laws of the State of Indiana, U.S.A. without regard to laws that might cause other law to govern under applicable principles of conflict of laws. For purposes of litigating any dispute that arises under this Award Agreement, the parties hereby submit to and consent to the jurisdiction of the State of Indiana, and agree that such litigation shall be conducted in the courts of Xxxxxx County, Indiana, or the federal courts for the United States for the Southern District of Indiana, and no other courts, where this Award is granted and/or to be performed.

Section 14. | Miscellaneous Provisions |

a. | Notices and Electronic Delivery and Participation. Any notice to be given by the Grantee or successor Grantee shall be in writing, and any notice shall be deemed to have been given or made only upon receipt thereof by the Treasurer of Lilly at Lilly Corporate Center, Indianapolis, Indiana 46285, U.S.A. Any notice or communication by Lilly in writing shall be deemed to have been given in the case of the Grantee if mailed or delivered to the Grantee at any address specified in writing to Lilly by the Grantee and, in the case of any successor Xxxxxxx, at the address specified in writing to Lilly by the successor Xxxxxxx. In addition, Xxxxx may, in its sole discretion, decide to deliver any documents related to the Award and participation in the Plan by electronic means or request the Grantee’s consent to participate in the Plan by electronic means. By accepting this Award, the Grantee hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an on-line or electronic system established and maintained by Xxxxx or a third party designated by Xxxxx. |

b. | Language. If the Grantee has received this Award Agreement or any other document related to the Plan translated into a language other than English and if the meaning of the translated version is different than the English version, the English version will control. |

c. | Waiver. The waiver by Xxxxx of any provision of this Award Agreement at any time or for any purpose shall not operate as or be construed to be a waiver of the same or any other provision of this Award Agreement at any subsequent time or for any other purpose. |

d. | Severability and Section Headings. If one or more of the provisions of this Award Agreement shall be held invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and the invalid, illegal or unenforceable provisions shall be deemed null and void; however, to the extent permissible by law, any provisions which could be deemed null and void shall first be construed, interpreted or revised retroactively to permit this Award Agreement to be construed so as to xxxxxx the intent of this Award Agreement and the Plan. |

7

The section headings in this Award Agreement are for convenience of reference only and shall not be deemed a part of, or germane to, the interpretation or construction of this instrument.

e. | No Advice Regarding Grant. Xxxxx is not providing any tax, legal or financial advice, nor is Xxxxx making any recommendations regarding the Grantee’s participation in the Plan or the Grantee’s acquisition or sale of the underlying Shares. The Grantee should consult with his or her own personal tax, legal and financial advisors regarding the Grantee’s participation in the Plan before taking any action related to the Plan. |

Section 15. | Compensation Recovery |

At any time during the three years following the date on which the number of Shares eligible to vest under this Award has been determined under Section 2 above, the Company reserves the right to and, in appropriate cases, will seek restitution of all or part of any Shares that have been issued or cash that has been paid pursuant to this Award if:

a. | (i) the number of Shares or the amount of the cash payment was calculated based, directly or indirectly, upon the achievement of financial results that were subsequently the subject of a restatement of all or a portion of the Company’s financial statements, (ii) the Grantee engaged in intentional misconduct that caused or partially caused the need for such a restatement; and (iii) the number of Shares or the amount of cash payment that would have been issued or paid to the Grantee had the financial results been properly reported would have been lower than the number of Shares actually issued or the amount of cash actually paid; or |

b. | the Grantee has been determined to have committed a material violation of law or Company policy or to have failed to properly manage or monitor the conduct of an employee who has committed a material violation of law or Company policy whereby, in either case, such misconduct causes significant harm to the company. |

Furthermore, in the event the number of Shares issued or cash paid pursuant to this Award is determined to have been based on materially inaccurate financial statements or other Company performance measures or on calculation errors (without any misconduct on the part of the Grantee), the Company reserves the right to and, in appropriate cases, will (A) seek restitution of the Shares or cash paid pursuant to this Award to the extent that the number of Shares issued or the amount paid exceeded the number of Shares that would have been issued or the amount that would have been paid had the inaccuracy or error not occurred, or (B) issue additional Shares or make additional payment to the extent that the number of Shares issued or the amount paid was less than the correct amount.

This Section 15 is not intended to limit the Company’s power to take such action as it deems necessary to remedy any misconduct, prevent its reoccurrence and, if appropriate, based on all relevant facts and circumstances, punish the wrongdoer in a manner it deems appropriate.

Section 16. | Award Subject to Acknowledgement of Acceptance |

Notwithstanding any provisions of this Award Agreement, the Award is subject to acknowledgement of acceptance by the Grantee prior to 4:00 PM (EDT) April 30, 2019, through the website of Xxxxxxx Xxxxx, the Company’s stock plan administrator. If the Grantee does not acknowledge acceptance of the Award prior to 4:00 PM (EDT) April 30, 2019, the Award will be cancelled, subject to the Committee’s discretion for unforeseen circumstances.

IN WITNESS WHEREOF, Lilly has caused this Award Agreement to be executed in Indianapolis, Indiana, by its proper officer.

XXX XXXXX AND COMPANY

By: ______________________

Xxxxx X. Xxxxx

Chairman of the Board, President and

Chief Executive Officer

8