AMENDMENT TO EQUITY PARTICIPATION AND EARN-IN AGREEMENT

Exhibit 4.2

AMENDMENT TO

EQUITY PARTICIPATION

AND EARN-IN AGREEMENT

THIS AMENDING AGREEMENT made as of the ___ day of November, 2004.

BETWEEN:

IVANHOE MINES LTD., a corporation incorporated under the laws of the Yukon Territory

(“Ivanhoe”)

AND:

ENTRÉE GOLD INC., a corporation incorporated under the laws of the Yukon Territory

(“Entree”)

|

A.

|

Ivanhoe and Entrée are parties to an Equity Participation and Earn-in Agreement dated as of the 15th day of October, 2004 (the “Earn-in Agreement”); and

|

|

B.

|

the parties wish to amend the Earn-in Agreement on the terms hereinafter provided;

|

NOW THEREFORE THIS AGREEMENT WITNESSES THAT, in consideration of the premises and the respective covenants and agreements herein contained, the parties hereto covenant and agree as follows:

|

1.

|

Capitalized terms used in these recitals without definition have the meanings assigned to them in the Earn-in Agreement.

|

|

2.

|

The parties hereby agree that the Joint Venture Agreement to be entered into by the parties pursuant to the terms of the Earn-in Agreement will be in the form attached hereto as Appendix “A”, that all references in the Earn-in Agreement to the Joint Venture Agreement will be deemed to be a reference to the form of agreement attached hereto as Appendix”A” and that the condition in Section 7.3(b) of the Earn-in Agreement that the parties must have agreed to the form of the Joint Venture Agreement within 30 days of execution of the Earn-in Agreement has been satisfied.

|

|

3.

|

Schedule “B” is hereby deleted from the Earn-in Agreement.

|

|

4.

|

Section 5.5(a) of the Earn-in Agreement is hereby deleted and replaced by the following:

|

|

|

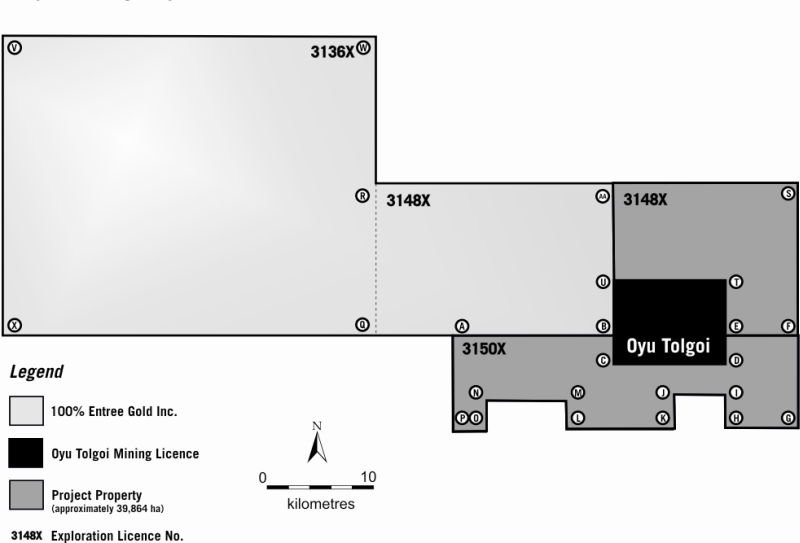

“(a) before the Earn-in Period ends as provided in Section 3.3, Entree intends to directly or indirectly dispose of any interest, other than its Participating Interest, in any geographical areas that are the subject of the Existing Licenses, Mineral Exploration License number 3136X or any successor licenses in whole or in part; or”.

|

|

5.

|

The Earn-in Agreement, as amended by this Amending Agreement, is hereby ratified and confirmed.

|

|

6.

|

This Amending Agreement may be executed in any number of counterparts, and it will not be necessary that the signatures of both parties be contained on any counterpart. Each counterpart will be deemed an original, but all counterparts together will constitute one and the same instrument.

|

By___________________________________

Title:

IVANHOE MINES LTD.

By___________________________________

Title:

2

JOINT VENTURE AGREEMENT

THIS AGREEMENT made as of the ● day of ●, ●,

BETWEEN:

IVANHOE MINES LTD., a corporation incorporated under the laws of the Yukon Territory

(“Ivanhoe”)

AND:

ENTRÉE GOLD INC., a corporation incorporated under the laws of the Yukon Territory

(“Entree”),

WITNESSES that in consideration of the covenants and conditions contained herein, Ivanhoe and Entree agree as follows:

|

1.

|

DEFINITIONS AND CROSS-REFERENCES

|

|

1.1.

|

Definitions.

|

The terms defined in Exhibit D and elsewhere shall have the defined meaning wherever used in this Agreement, including in Exhibits.

|

1.2.

|

Cross-References

|

References to "Exhibits," "Articles," "Sections" and "Subsections" refer to Exhibits, Articles, Sections and Subsections of this Agreement. References to "Paragraphs" and "Subparagraphs" refer to paragraphs and subparagraphs of the referenced Exhibits.

|

1.3.

|

Exhibits

|

The following Exhibits are attached to and form part of this Agreement:

Exhibit A Properties

Exhibit B Accounting Procedures

Exhibit C [Deleted]

Exhibit D Definitions

Exhibit E Net Smelter Returns Royalty

Exhibit F Insurance

Exhibit G [Deleted]

Exhibit H Pre-emptive Rights

|

2.

|

NAME, PURPOSES AND TERM

|

|

2.1.

|

General.

|

Ivanhoe and Entrée hereby enter into this Agreement for the purposes hereinafter stated. All of the rights and obligations of the Participants in connection with the Assets or the Area of Interest and all Operations shall be subject to and governed by this Agreement.

|

2.2.

|

Name

|

The Assets shall be managed and operated by the Participants under the name “Xxxxxx East”. The Manager shall accomplish any registration required by applicable assumed or fictitious name statutes and similar statutes.

|

2.3.

|

Purposes

|

This Agreement is entered into for the following purposes and for no others, and shall serve as the exclusive means by which each of the Participants accomplishes such purposes:

|

(a)

|

to conduct Exploration within the area of the Properties;

|

|

(b)

|

to acquire additional real property and other interests within the area of the Properties;

|

|

(c)

|

to evaluate the possible Development and Mining of the Properties, and, if justified, to engage in Development and Mining;

|

|

(d)

|

to engage in Operations on the Properties;

|

|

(e)

|

to engage in marketing Products, to the extent provided by Article 12;

|

|

(f)

|

to complete and satisfy all Environmental Compliance obligations and Continuing Obligations affecting the Properties; and

|

|

(g)

|

to perform any other activity necessary, appropriate, or incidental to any of the foregoing.

|

|

2.4.

|

Limitation

|

Unless the Participants otherwise agree in writing, the Operations shall be limited to the purposes described in Section 2.3, and nothing in this Agreement shall be construed to enlarge such purposes or to change the relationships of the Participants as set forth in Article 4.

2

|

2.5.

|

Term

|

The term of this Agreement shall be for twenty (20) years from the Effective Date and for so long thereafter as the Participants are engaged in Development or Mining of the Properties on a continuous basis, and thereafter until all materials, supplies, equipment and infrastructure have been salvaged and disposed of, any required Environmental Compliance is completed and accepted and the Participants have agreed to a final accounting, unless the Business is earlier terminated as herein provided.

|

2.6.

|

Mongolian Subsidiary

|

The parties hereby acknowledge and agree that, in order to fully and effectually enjoy their respective rights, and perform their respective obligations, under this Agreement, it may be necessary or desirable, from time to time, for a party to cause a company incorporated under the laws of Mongolia and controlled by such party (a “Mongolian Subsidiary”) such as, in the case of Entrée, the Entrée Subsidiary to do, or refrain from doing, certain acts and things in Mongolia in furtherance of the covenants and agreements of such party in this Agreement. Each party hereby covenants and agrees with the other party that, whenever the performance by that party of an obligation under this Agreement requires any involvement by a Mongolian Subsidiary of that party, such party will cause its Mongolian Subsidiary to promptly execute all such instruments and do all such acts and things as may be necessary or desirable in order for such party’s obligations hereunder to be fully and effectually performed on a timely basis. Wherever in this Agreement an obligation is ascribed to a party and such obligation can only be legally and effectually performed by such party’s Mongolian Subsidiary, such party will be deemed to have obliged itself, as principal, and its Mongolian Subsidiary, as the Mongolian Subsidiary’s authorized agent, to perform such obligation.

|

3.

|

REPRESENTATIONS AND WARRANTIES;

|

|

3.1.

|

Representations and Warranties of Both Participants

|

As of the Effective Date, each Participant represents and warrants to the other that:

|

(a)

|

it is a corporation duly organized and in good standing in its jurisdiction of incorporation and is qualified to do business and is in good standing in those jurisdictions where necessary in order to carry out the purposes of this Agreement;

|

|

(b)

|

it has the capacity to enter into and perform this Agreement and all transactions contemplated herein and that all corporate, board of directors and shareholder actions required to authorize it to enter into and perform this Agreement have been properly taken;

|

3

|

(c)

|

it will not breach any other agreement or arrangement by entering into or performing this Agreement;

|

|

(d)

|

it is not subject to any governmental order, judgment, decree, debarment, sanction or Laws that would preclude the permitting or implementation of Operations under this Agreement; and

|

|

(e)

|

this Agreement has been duly executed and delivered by it and is valid and binding upon it in accordance with its terms.

|

|

3.2.

|

No Encumbrances

|

Each Participant represents and warrants to the other that, since the Effective Date of the Earn-in Agreement (as defined therein), it has not created nor allowed to continue any Encumbrance of its interest in the Properties or has knowledge of any Encumbrance of the Properties arising between the Effective Date of the Earn-in Agreement and the Effective Date hereof.

|

3.3.

|

Disclosures

|

Each of the Participants represents and warrants that it is unaware of any material facts or circumstances that have not been disclosed in this Agreement, which should be disclosed to the other Participant in order to prevent the representations and warranties in this Article from being materially misleading.

|

3.4.

|

Record Title

|

Title to the Assets shall be held by the Participant which is the Manager for the Participants, as their respective Participating Interests are determined pursuant to this Agreement. Each Participant shall have the right to receive, forthwith upon making demand therefor, from the Manager such documents as it may reasonably require to confirm its Participating Interest.

|

3.5.

|

Loss of Title

|

Any failure or loss of title to the Assets, and all costs of defending title, shall be charged to the Business Account, unless such failure or loss is attributable to a breach by a Participant of any covenant or representation or warranty in this Agreement in which case such failure or loss and such costs shall be for the account of such Participant.

|

3.6.

|

Royalties, Production Taxes and Other Payments Based on Production

|

All required payments of production royalties, taxes based on production of Products, and other payments out of production to private parties and governmental entities shall be determined and made by each Participant in proportion to its Participating Interest, and each Participant undertakes to make such payments timely and otherwise in accordance with applicable laws and agreements. If separate payment is not permitted, each Participant shall determine and pay its proportionate share in advance to the Participant obligated to make such payment and such Participant shall timely make such payment. Each Participant shall furnish to the other Participant evidence of timely payment for all such required payments. In the event that either Participant fails to make any such required payment, the other Participant shall have the right to make such payment and shall thereby become subrogated to the rights of such third party; provided, however, that the making of any such payment on behalf of the other Participant shall not constitute acceptance by the paying Participant of any liability to such third party for the underlying obligation.

4

|

3.7.

|

Indemnities/Limitation of Liability

|

|

(a)

|

Each Participant shall indemnify the other Participant, its directors, officers, employees, agents and attorneys, or Affiliates (collectively "Indemnified Participant") from and against the entire amount of any Loss. A " Loss" shall mean all costs, expenses, damages or liabilities, including attorneys' fees and other costs of litigation (either threatened or pending) arising out of or based on a breach by a Participant ("Indemnifying Participant") of any representation, warranty or covenant contained in this Agreement, including without limitation:

|

|

(i)

|

any failure by a Participant to determine accurately and make timely payment of its proportionate share of required royalties, production taxes and other payments out of production to third parties as required by Section 3.6;

|

|

(ii)

|

any action taken for or obligation or responsibility assumed on behalf of the other Participant, its directors, officers, employees, agents and attorneys, or Affiliates by a Participant, any of its directors, officers, employees, agents and attorneys, or Affiliates, in violation of Section 4.1;

|

|

(iii)

|

failure of a Participant or its Affiliates to comply with the provisions of Section 13.5 or Article 14; and

|

|

(iv)

|

failure of a Participant or its Affiliates to comply with the pre-emptive right under Section 17.3 and Exhibit H.

|

|

(b)

|

If any claim or demand is asserted against an Indemnified Participant in respect of which such Indemnified Participant may be entitled to indemnification under this Agreement, written notice of such claim or demand shall promptly be given to the Indemnifying Participant. The Indemnifying Participant shall have the right, but not the obligation, by notifying the Indemnified Participant within thirty (30) days after its receipt of the notice of the claim or demand, to assume the entire control of (subject to the right of the Indemnified Participant to participate, at the Indemnified Participant's expense and with counsel of the Indemnified Participant's choice), the defense, compromise, or settlement of the matter, including, at the Indemnifying Participant's expense, employment of counsel of the Indemnifying Participant's choice. Any damages to the assets or business of the Indemnified Participant caused by a failure by the Indemnifying Participant to defend, compromise, or settle a claim or demand in a reasonable and expeditious manner requested by the Indemnified Participant, after the Indemnifying Participant has given notice that it will assume control of the defense, compromise, or settlement of the matter, shall be included in the damages for which the Indemnifying Participant shall be obligated to indemnify the Indemnified Participant. Any settlement or compromise of a matter by the Indemnifying Participant shall include a full release of claims against the Indemnified Participant which has arisen out of the indemnified claim or demand.

|

5

|

4.

|

RELATIONSHIP OF THE PARTICIPANTS

|

|

4.1.

|

No Partnership

|

Nothing contained in this Agreement shall be deemed to constitute either Participant the partner of the other, or, except as otherwise herein expressly provided, to constitute either Participant the agent or legal representative of the other, or to create any fiduciary relationship between them. The Participants do not intend to create, and this Agreement shall not be construed to create, any mining, commercial or other partnership. Neither Participant, nor any of its directors, officers, employees, agents and attorneys, or Affiliates, shall act for or assume any obligation or responsibility on behalf of the other Participant, except as otherwise expressly provided herein, and any such action or assumption by a Participant's directors, officers, employees, agents and attorneys, or Affiliates shall be a breach by such Participant of this Agreement. The rights, duties, obligations and liabilities of the Participants shall be several and not joint or collective. Each Participant shall be responsible only for its obligations as herein set out and shall be liable only for its share of the costs and expenses as provided herein, and it is the express purpose and intention of the Participants that their ownership of Assets and the rights acquired hereunder shall be as tenants in common.

|

4.2.

|

Taxation

|

All costs of Operations incurred hereunder shall be for the account of the Participants in proportion to their respective Participating Interests, and each Participant on whose behalf any costs have been so incurred shall be entitled to claim all tax benefits, write-offs and deductions with respect thereto.

|

4.3.

|

Other Business Opportunities

|

Except as expressly provided in this Agreement, each Participant shall have the right to engage in and receive full benefits from any independent business activities or operations, whether or not competitive with this Business, without consulting with, or obligation to, the other Participant. The doctrines of "corporate opportunity" or "business opportunity" shall not be applied to this Business nor to any other activity or operation of either Participant. Neither Participant shall have any obligation to the other with respect to any opportunity to acquire any property outside the area of the Properties at any time, or, except as otherwise provided in Section 13.5, within the area of the Properties after the termination of the Business.

|

4.4.

|

Waiver of Rights to Partition or Other Division of Assets

|

The Participants hereby waive and release all rights of partition, or of sale in lieu thereof, or other division of Assets, including any such rights provided by Law.

6

|

4.5.

|

Transfer or Termination of Rights to Properties

|

Except as otherwise provided in this Agreement, neither Participant shall Transfer all or any part of its interest in the Assets or this Agreement or otherwise permit or cause such interests to terminate.

|

4.6.

|

Implied Covenants

|

There are no implied covenants contained in this Agreement other than those of good faith and fair dealing.

|

4.7.

|

No Third Party Beneficiary Rights

|

This Agreement shall be construed to benefit the Participants and their respective successors and assigns only, and shall not be construed to create third party beneficiary rights in any other party or in any governmental organization or agency, except to the extent required by Project Financing and as provided in Subsection 3.7(a).

|

5.

|

INTERESTS OF PARTICIPANTS

|

|

5.1.

|

Participants' Initial Contributions

|

Each Participant, as its Initial Contribution, hereby contributes all its undivided right, title and interest in and to the Properties to the Business.

|

5.2.

|

Value of Initial Contributions

|

The agreed value of the Participants' respective Initial Contributions shall be as follows:

Ivanhoe $___________

Entrée $___________

[Prior to execution, complete the blanks above in accordance with the following and then delete this square-bracketed text: the value of Ivanhoe’s initial contribution is the amount of Earn-in Expenditures incurred by it under the Earn-in Agreement and the value of Entrée’s initial contribution is in the same proportion thereto as its initial Participating Interest is to the initial Participating Interest of Ivanhoe.]

|

5.3.

|

Initial Participating Interests

|

The Participants shall have the following initial Participating Interests:

Ivanhoe %

Entrée %

7

[Prior to execution, complete the blanks in accordance with the following and then delete this square-bracketed text:

|

|

i)

|

In the circumstances described in section 4.5(a) of the Earn-in Agreement the blanks are completed Ivanhoe - 51% and Entrée - 49%.

|

|

|

ii)

|

In the circumstances described in section 4.5(b) of the Earn-in Agreement the blanks are completed Ivanhoe - 60% and Entrée - 40%.

|

|

|

iii)

|

In the circumstances described in section 4.5(c) of the Earn-in Agreement the blanks are completed Ivanhoe - 80% and Entrée - 20% and add the following text:

|

provided that for the purposes of Article 12 only, in respect of Products extracted from the Properties pursuant to Mining carried out at depths from the surface of the Properties to 560 meters below the surface of the Properties, the initial Participating Interest of Ivanhoe will be 70% and the initial Participating Interest of Entrée will be 30%.]

|

5.4.

|

Additional Contributions

|

The Participants, subject to Section 8.2 and to any elections permitted by Subsection 8.5(a), shall be obligated to contribute funds to adopted Programs and Budgets in proportion to their respective Participating Interests.

[If the Joint Venture is formed in the circumstances described in section 4.5(c) of the Earn-in Agreement, add the following text:

Notwithstanding that in respect of Products extracted from the Properties pursuant to Mining carried out at depths from the surface of the Properties to 560 meters below the surface of the Properties the initial Participating Interest of Ivanhoe is 70% and the initial Participating Interest of Entrée is 30%, subject to Section 8.2 and to any elections as aforesaid, Ivanhoe shall be obligated to contribute funds to adopted Programs and Budgets based on a Participating Interest of 80% and Entrée shall be obligated to contribute funds to adopted Programs and Budgets based on a Participating Interest of 20% (subject in each case to adjustment as provided in Section 5.5), provided that to the extent Ivanhoe can demonstrate before the Program and Budget is adopted that costs incurred on or in respect of the surface to or to a depth of 560 metres below the surface should reasonably and fairly be allocated to the production of Products above a depth of 560 metres from the surface, Entrée’s share of such costs will be based on a 30% Participating Interest and Ivanhoe’s share of such costs will be based on a 70% Participating Interest (subject in each case to adjustment as provided in Section 5.5).]

8

|

5.5.

|

Changes in Participating Interests

|

The Participating Interests shall be eliminated or changed as follows:

|

(a)

|

upon deemed withdrawal or termination as provided in Section 5.6, and Article 13;

|

|

(b)

|

upon an election by either Participant pursuant to Section 8.5 to contribute less to an adopted Program and Budget than the percentage equal to its Participating Interest, or to contribute nothing to an adopted Program and Budget or an election by Entrée pursuant to Section 4.6(b) of the Earn-in Agreement to sole fund the first $400,000 of costs under the first adopted Program and Budget;

|

|

(c)

|

in the event of default by either Participant in making its agreed-upon contribution to an adopted Program and Budget, followed by an election by the other Participant to invoke any of the remedies in Section 9.5;

|

|

(d)

|

upon Transfer by either Participant of part or all of its Participating Interest in accordance with Article 17; or

|

|

(e)

|

upon acquisition by either Participant of part or all of the Participating Interest of the other Participant, however arising, including without limitation pursuant to Section 4.6 or Section 4.7 of the Earn-in Agreement.

|

[If the Joint Venture was formed in the circumstances described in section 4.5(c) of the Earn-in Agreement add the following text:

If the Participating Interests are changed pursuant to Subsection 5.5(b) or (c), the respective Participating Interests of each of Ivanhoe and Entrée in respect of Products extracted from the Properties pursuant to Mining carried out at depths from the surface of the Properties to 560 meters below the surface of the Properties will also be changed pro rata, by multiplying the change by a fraction (i) the denominator of which is the Reduced Participant’s Participating Interest immediately before the change and (ii) the numerator of which is the Reduced Participant’s Participating Interest immediately before the change in respect of Products extracted from the Properties pursuant to Mining carried out at depths from the surface of the Properties to 560 meters below the surface of the Properties.]

|

5.6.

|

Elimination of Minority Interest

|

|

(a)

|

A Reduced Participant whose Recalculated Participating Interest becomes less than ten percent (10%) shall be deemed to have withdrawn from the Business and shall relinquish its entire Participating Interest free and clear of any Encumbrances arising by, through or under the Reduced Participant, except any such Encumbrances listed in Paragraph 1.1 of Exhibit A or to which the Participants have agreed. Such relinquished Participating Interest shall be deemed to have accrued automatically to the other Participant. The Reduced Participant shall have the right to receive two percent (2%) of Net Smelter Returns, if any.

|

9

|

(b)

|

The relinquishment, withdrawal and entitlements for which this Section provides shall be effective as of the effective date of the recalculation under Sections 8.5 or 9.5. However, if the final adjustment provided under Section 8.5 for any recalculation under Section 8.6 results in a Recalculated Participating Interest of greater than ten percent (10%): (i) the Recalculated Participating Interest shall be deemed, effective retroactively as of the first day of the Program Period, to have automatically revested; (ii) the Reduced Participant shall be reinstated as a Participant, with all of the rights and obligations pertaining thereto; (iii) the right to Net Smelter Returns under Subsection 5.6(a) shall terminate; and (iv) the Manager, on behalf of the Participants, shall make any necessary reimbursements, reallocations of Products, contributions and other adjustments as provided in Subsection 8.6(d). Similarly, if such final adjustment under Section 8.6 results in a Recalculated Participating Interest for either Participant of ten percent (10%) or less for a Program Period as to which the provisional calculation under Section 8.5 had not resulted in a Participating Interest of ten percent (10%) or less, then such Participant, at its election within thirty (30) days after notice of the final adjustment, may contribute an amount resulting in a revised final adjustment and resultant Recalculated Participating Interest which is greater than ten percent (10%). If no such election is made, such Participant shall be deemed to have withdrawn under the terms of Subsection 5.6(a) as of the beginning of such Program Period, and the Manager, on behalf of the Participants, shall make any necessary reimbursements, reallocations of Products, contributions and other adjustments as provided in Subsection 8.6(d), including of any Net Smelter Returns to which such Participant may be entitled for such Program Period.

|

|

5.7.

|

Continuing Liabilities Upon Adjustments of Participating Interests

|

Any reduction or elimination of either Participant's Participating Interest under Section 5.6 shall not relieve such Participant of its share of any liability, including, without limitation, Continuing Obligations, Environmental Liabilities and Environmental Compliance, whether arising, before or after such reduction or elimination, out of acts or omissions occurring or conditions existing prior to the Effective Date or out of Operations conducted during the term of this Agreement but prior to such reduction or elimination, regardless of when any funds may be expended to satisfy such liability. For purposes of this Section, such Participant's share of such liability shall be equal to its Participating Interest at the time the act or omission giving rise to the liability occurred, after first taking into account any reduction, readjustment and restoration of Participating Interests under Sections 5.6, 8.5, 8.6 and 9.5 (or, as to such liability arising out of acts or omissions occurring or conditions existing prior to the Effective Date, equal to such Participant's initial Participating Interest). Should the cumulative cost of satisfying Continuing Obligations be in excess of cumulative amounts accrued or otherwise charged to the Environmental Compliance Fund as described in Exhibit B, each of the Participants shall be liable for its proportionate share (i.e., Participating Interest at the time of the act or omission giving rise to such liability occurred), after first taking into account any reduction, readjustment and restoration of Participating Interests under Sections 5.6, 8.5, 8.6 and 9.5, of the cost of satisfying such Continuing Obligations, notwithstanding that either Participant has previously withdrawn from the Business or that its Participating Interest has been reduced or converted to an interest in Net Smelter Returns pursuant to Subsection 5.6(a).

10

|

5.8.

|

Documentation of Adjustments to Participating Interests

|

Adjustments to the Participating Interests need not be evidenced during the term of this Agreement by the execution and recording of appropriate instruments, but each Participant's Participating Interest and related Equity Account balance shall be shown in the accounting records of the Manager, and any adjustments thereto, including any reduction, readjustment, and restoration of Participating Interests under Sections 5.6, 8.5, 8.6 and 9.5, shall be made monthly. However, either Participant, at any time upon the request of the other Participant, shall execute and acknowledge instruments necessary to evidence such adjustments in form sufficient for filing and recording in the jurisdiction where the Properties are located.

|

5.9.

|

Grant of Lien and Security Interest

|

|

(a)

|

Subject to Section 5.10, each Participant grants to the other Participant a lien upon and a security interest in its Participating Interest, including all of its right, title and interest in the Assets, whenever acquired or arising, and the proceeds from and accessions to the foregoing.

|

|

(b)

|

The liens and security interests granted by Subsection 5.9(a) shall secure every obligation or liability of the Participant granting such lien or security interest created under this Agreement, including the obligation to repay a Cover Payment in accordance with Section 9.4. Each Participant hereby agrees to take all action necessary to perfect such lien and security interest and hereby appoints the other Participant its attorney-in-fact to execute, file and record all financing statements and other documents necessary to perfect or maintain such lien and security interest.

|

|

5.10.

|

Subordination of Interests

|

Each Participant shall, from time to time, take all necessary actions, including execution of appropriate agreements, to pledge and subordinate its Participating Interest, any liens it may hold which are created under this Agreement other than those created pursuant to Section 5.9 hereof, and any other right or interest it holds with respect to the Assets (other than any statutory lien of the Manager) to any secured borrowings for Operations approved by the Management Committee, including any secured borrowings relating to Project Financing, and any modifications or renewals thereof.

11

|

6.

|

MANAGEMENT COMMITTEE

|

|

6.1.

|

Organization and Composition

|

The Participants hereby establish a Management Committee to determine overall policies, objectives, procedures, methods and actions under this Agreement. The Management Committee shall consist of two (2) members appointed by Ivanhoe and two (2) members appointed by Entree. Each Participant may appoint one or more alternates to act in the absence of a regular member. Any alternate so acting shall be deemed a member. Appointments by a Participant shall be made or changed by notice to the other members. The Participant which is the Manager shall designate one of its members to serve as the chair of the Management Committee.

|

6.2.

|

Decisions

|

Each Participant, acting through its appointed members in attendance at the meeting, shall have the votes on the Management Committee in proportion to its Participating Interest. All decisions of the Management Committee shall be decided by a simple majority vote of the Participating Interests such that, by way of example and for greater clarity, the vote of a party holding a Participating Interest greater than fifty percent (50%) is a simple majority vote which would be effective to make the decision of the Management Committee. The Manager shall be entitled to break all tie votes with a second or casting vote.

|

6.3.

|

Meetings

|

|

(a)

|

The Management Committee shall hold regular meetings at least quarterly in Vancouver, British Columbia or at other agreed places. The Manager shall give thirty (30) days notice to the Participants of such meetings. Additionally, either Participant may call a special meeting upon seven (7) days notice to the other Participant. In case of an emergency, reasonable notice of a special meeting shall suffice. There shall be a quorum if at least one member representing each Participant is present; provided, however, that if a Participant fails to attend two consecutive properly called meetings, then a quorum shall exist at the second meeting if the other Participant is represented by at least one appointed member, and a vote of such Participant shall be considered the vote required for the purposes of the conduct of all business properly noticed even if such vote would otherwise require unanimity.

|

|

(b)

|

If business cannot be conducted at a regular or special meeting due to the lack of a quorum, either Participant may call the next meeting upon seven (7) days notice to the other Participant.

|

|

(c)

|

Each notice of a meeting shall include an itemized agenda prepared by the Manager in the case of a regular meeting or by the Participant calling the meeting in the case of a special meeting, but any matters may be considered if either Participant adds the matter to the agenda at least five (5) days before the meeting or with the consent of the other Participant. The Manager shall prepare minutes of all meetings and shall distribute copies of such minutes to the other Participant within thirty (30) days after the meeting. Either Participant may electronically record the proceedings of a meeting with the consent of the other Participant. The other Participant shall sign and return or object to the minutes prepared by the Manager within thirty (30) days after receipt, and failure to do either shall be deemed acceptance of the minutes as prepared by the Manager. The minutes, when signed or deemed accepted by both Participants, shall be the official record of the decisions made by the Management Committee. Decisions made at a Management Committee meeting shall be implemented in accordance with adopted Programs and Budgets. If a Participant timely objects to minutes proposed by the Manager, the members of the Management Committee shall seek, for a period not to exceed thirty (30) days from receipt by the Manager of notice of the objections, to agree upon minutes acceptable to both Participants. If the Management Committee does not reach agreement on the minutes of the meeting within such thirty (30) day period, the minutes of the meeting as prepared by the Manager together with the other Participant's proposed changes shall collectively constitute the record of the meeting. If personnel employed in Operations are required to attend a Management Committee meeting, reasonable costs incurred in connection with such attendance shall be charged to the Business Account. All other costs shall be paid by the Participants individually.

|

12

|

6.4.

|

Action Without Meeting in Person

|

In lieu of meetings in person, the Management Committee may conduct meetings by telephone or video conference, so long as minutes of such meetings are prepared in accordance with Subsection 6.3(c). The Management Committee may also take actions in writing signed by all members.

|

6.5.

|

Matters Requiring Approval

|

Except as otherwise delegated to the Manager in Section 7.2, the Management Committee shall have exclusive authority to determine all matters related to overall policies, objectives, procedures, methods and actions under this Agreement.

|

7.

|

MANAGER

|

|

7.1.

|

Appointment

|

The Participants hereby appoint _______________ as the Manager with overall management responsibility for Operations. _______________ hereby agrees to serve until it resigns as provided in Section 7.4. The Manager shall have overall management responsibility for Operations and shall serve until it resigns or is deemed to resign as provided in Section 7.4.

[Prior to execution, complete the blanks above by inserting the name of the Participant with the greater Participating Interest and then delete this square-bracketed text.]

13

|

7.2.

|

Powers and Duties of Manager

|

Subject to the terms and provisions of this Agreement including without limitation Article 11 and the general oversight and direction of the Management Committee, the Manager shall have the following powers and duties, which shall be discharged in accordance with adopted Programs and Budgets:

|

(a)

|

the Manager shall manage, direct and control Operations, and shall prepare and present to the Management Committee proposed Programs and Budgets as provided in Article 8;

|

|

(b)

|

the Manager shall implement the decisions of the Management Committee, shall make all expenditures necessary to carry out adopted Programs, and shall promptly advise the Management Committee if it lacks sufficient funds to carry out its responsibilities under this Agreement;

|

|

(c)

|

the Manager shall use reasonable efforts to:

|

|

(i)

|

purchase or otherwise acquire all material, supplies, equipment, water, utility and transportation services required for Operations, such purchases and acquisitions to be made to the extent reasonably possible on the best terms available, taking into account all of the circumstances;

|

|

(ii)

|

obtain such customary warranties and guarantees as are available in connection with such purchases and acquisitions; and

|

|

(iii)

|

keep the Assets free and clear of all Encumbrances, except any such Encumbrances listed in Paragraph 1.1 of Exhibit A and those existing at the time of, or created concurrent with, the acquisition of such Assets, or mechanic's or materialmen's liens (which shall be contested, released or discharged in a diligent matter) or Encumbrances specifically approved by the Management Committee.

|

|

(d)

|

the Manager shall conduct such title examinations of the Properties and cure such title defects pertaining to the Properties as may be advisable in its reasonable judgment;

|

|

(e)

|

the Manager shall:

|

|

(i)

|

make or arrange for all payments required by leases, licenses, permits, contracts and other agreements related to the Assets,

|

|

(ii)

|

pay all taxes, assessments and like charges on Operations and Assets except taxes determined or measured by a Participant's sales revenue or net income and taxes, including production taxes, attributable to a Participant's share of Products, and shall otherwise promptly pay and discharge expenses incurred in Operations; provided, however, that if authorized by the Management Committee, the Manager shall have the right to contest (in the courts or otherwise) the validity or amount of any taxes, assessments or charges if the Manager deems them to be unlawful, unjust, unequal or excessive, or to undertake such other steps or proceedings as the Manager may deem reasonably necessary to secure a cancellation, reduction, readjustment or equalization thereof before the Manager shall be required to pay them, but in no event shall the Manager permit or allow title to the Assets to be lost as the result of the non-payment of any taxes, assessments or like charges, and

|

14

|

(iii)

|

do all other acts reasonably necessary to maintain the Assets;

|

|

(f)

|

the Manager shall:

|

|

(i)

|

apply for all necessary permits, licenses and approvals,

|

|

(ii)

|

comply with all Laws,

|

|

(iii)

|

notify promptly the Management Committee of any allegations of substantial violation thereof, and

|

|

(iv)

|

prepare and file all reports or notices;

|

required for or as a result of Operations. The Manager shall not be in breach of this provision if a violation has occurred in spite of the Manager's good faith efforts to comply consistent with its standard of care under Section 7.3. In the event of any such violation, the Manager shall timely cure or dispose of such violation on behalf of both Participants through performance, payment of fines and penalties, or both, and the cost thereof shall be charged to the Business Account.

|

(g)

|

the Manager shall prosecute and defend, but shall not initiate without consent of the Management Committee, all litigation or administrative proceedings arising out of Operations. The non-managing Participant shall have the right to participate, at its own expense, in such litigation or administrative proceedings. The non-managing Participant shall approve in advance any settlement involving payments, commitments or obligations in excess of Five Hundred Thousand Dollars ($500,000) in cash or value;

|

|

(h)

|

the Manager shall provide insurance for the benefit of the Participants as provided in Exhibit F or as may otherwise be determined from time to time by the Management Committee;

|

15

|

(i)

|

the Manager may dispose of Assets, whether by abandonment, surrender, or Transfer in the ordinary course of business, except that Properties may be abandoned or surrendered only as provided in Article 15. Without prior authorization from the Management Committee, however, the Manager shall not:

|

|

(i)

|

dispose of Assets in any one transaction (or in any series of related transactions) having a value in excess of Five Hundred Thousand Dollars ($500,000),

|

|

(ii)

|

enter into any sales contracts or commitments for Product, except as permitted in Section 12.2,

|

|

(iii)

|

begin a liquidation of the Business, or

|

|

(iv)

|

dispose of all or a substantial part of the Assets necessary to achieve the purposes of the Business;

|

|

(j)

|

the Manager shall have the right to carry out its responsibilities hereunder through agents, Affiliates or independent contractors;

|

|

(k)

|

the Manager shall perform or cause to be performed any and all work and make any and all filings and do all such other lawful things, and shall pay all Governmental Fees required by Law, in order to maintain the Properties in good standing;

|

|

(l)

|

the Manager shall keep and maintain all required accounting and financial records pursuant to the procedures described in Exhibit B and in accordance with customary cost accounting practices in the mining industry, and shall ensure appropriate separation of accounts unless otherwise agreed by the Participants;

|

|

(m)

|

the Manager shall maintain Equity Accounts for each Participant. Each Participant's Equity Account shall be credited with the value of its Initial Contribution under Sections 5.2 and shall be credited with amounts contributed by such Participant under Section 5.4. Each Participant's Equity Account shall be charged with the cash and the fair market value of property distributed to such Participant (net of liabilities assumed by such Participant and liabilities to which such distributed property is subject). Contributions and distributions shall include all cash contributions or distributions plus the agreed value (expressed in dollars) of all in-kind contributions or distributions. Solely for purposes of determining the Equity Account balances of the Participants, the Manager shall reasonably estimate the fair market value of all Products distributed to the Participants, and such estimated value shall be used regardless of the actual amount received by each Participant upon disposition of such Products;

|

|

(n)

|

the Manager shall keep the Management Committee advised of all Operations by submitting in writing to the members of the Management Committee:

|

|

(i)

|

monthly progress reports that include statements of expenditures and comparisons of such expenditures to the adopted Budget,

|

|

(ii)

|

quarterly summaries of data acquired,

|

|

(iii)

|

copies of reports concerning Operations,

|

|

(iv)

|

a detailed final report within sixty (60) days after completion of each Program and Budget, which shall include comparisons between actual and budgeted expenditures and comparisons between the objectives and results of Programs, and

|

|

(v)

|

such other reports as any member of the Management Committee may reasonably request.

|

16

Subject to Article 19, at all reasonable times the Manager shall keep the other Participant fully informed of Operations and shall provide the Management Committee, or other representative of a Participant upon the request of such Participant's member of the Management Committee, access to, and the right to inspect and, at such Participant's cost and expense, copies of the Existing Data and all maps, drill logs and other drilling data, core, pulps, reports, surveys, assays, analyses, production reports, operations, technical, accounting and financial records, and other Confidential Information, to the extent preserved or kept by the Manager, subject to Article 19. In addition, the Manager shall allow the non-managing Participant, at the latter's sole risk, cost and expense, and subject to reasonable safety regulations, to inspect the Assets and Operations at all reasonable times, so long as the non-managing Participant does not unreasonably interfere with Operations; All reports and summaries will be accompanied by copies of all internal memoranda, maps, plans, photographs, electromagnetic surveys, test results, reports, drill logs and other information and data including electronic data and the Manager’s analyses, interpretations, compilations, studies and evaluations of such information, data and knowledge. All such information will be deemed to be Confidential Information. If requested, the Manager will consult with the non-managing Participant to assist the non-managing Participant to fully understand the information provided and the implications of it for the value and prospectivity of the Properties;

|

(o)

|

the Manager shall prepare an Environmental Compliance plan for all Operations consistent with the requirements of any applicable Laws or contractual obligations and shall include in each Program and Budget sufficient funding to implement the Environmental Compliance plan and to satisfy the financial assurance requirements of any applicable Law or contractual obligation pertaining to Environmental Compliance. To the extent practical, the Environmental Compliance plan shall incorporate concurrent reclamation of Properties disturbed by Operations;

|

|

(p)

|

the Manager shall undertake to perform Continuing Obligations when and as economic and appropriate, whether before or after termination of the Business. The Manager shall have the right to delegate performance of Continuing Obligations to persons having demonstrated skill and experience in relevant disciplines. As part of each Program and Budget submittal, the Manager shall specify in such Program and Budget the measures to be taken for performance of Continuing Obligations and the cost of such measures. The Manager shall keep the other Participant reasonably informed about the Manager's efforts to discharge Continuing Obligations. Authorized representatives of each Participant shall have the right from time to time to enter the Properties to inspect work directed toward satisfaction of Continuing Obligations and audit books, records, and accounts related thereto;

|

17

|

(q)

|

the funds that are to be deposited into the Environmental Compliance Fund shall be maintained by the Manager in a separate, interest bearing cash management account, which may include, but is not limited to, money market investments and money market funds, and/or in longer term investments if approved by the Management Committee. Such funds shall be used solely for Environmental Compliance and Continuing Obligations, including the committing of such funds, interests in property, insurance or bond policies, or other security to satisfy Laws regarding financial assurance for the reclamation or restoration of the Properties, and for other Environmental Compliance requirements;

|

|

(r)

|

if Participating Interests are adjusted in accordance with this Agreement the Manager shall propose from time to time one or more methods for fairly allocating costs for Continuing Obligations;

|

|

(s)

|

the Manager shall undertake all other activities reasonably necessary to fulfil the foregoing, and to implement the policies, objectives, procedures, methods and actions determined by the Management Committee pursuant to Section 6.1.

|

|

7.3.

|

Standard of Care

|

The Manager shall discharge its duties under Section 7.2 and conduct all Operations in a good, workmanlike and efficient manner, in accordance with sound mining and other applicable industry standards and practices, and in accordance with Laws and with the terms and provisions of leases, licenses, permits, contracts and other agreements pertaining to the Assets. The Manager shall not be liable to the other Participant for any act or omission resulting in damage or loss except to the extent caused by or attributable to the Manager's wilful misconduct or gross negligence. The Manager shall not be in default of any of its duties under Section 7.2 if its inability or failure to perform results from the failure of the other Participant to perform acts or to contribute amounts required of it by this Agreement.

|

7.4.

|

Resignation; Deemed Offer to Resign

|

The Manager may resign upon not less than three (3) months' prior notice to the other Participant, in which case the other Participant may elect to become the new Manager by notice to the resigning Participant within thirty (30) days after the notice of resignation. If any of the following shall occur, the Manager shall be deemed to have resigned upon the occurrence of the event described in each of the following Subsections, with the successor Manager to be appointed by the other Participant at a subsequently called meeting of the Management Committee, at which the Manager shall not be entitled to vote and at which the other Participant may appoint itself or a third party as the Manager.

18

|

(a)

|

the aggregate Participating Interest of the Manager and its Affiliates becomes less than fifty percent (50%);

|

|

(b)

|

the Manager fails to perform a material obligation imposed upon it under this Agreement and such failure continues for a period of sixty (60) days after notice from the other Participant demanding performance;

|

|

(c)

|

the Manager fails to pay or contest in good faith its bills and Business debts as such obligations become due;

|

|

(d)

|

a receiver, liquidator, assignee, custodian, trustee, sequestrator or similar official for a substantial part of its assets is appointed and such appointment is neither made ineffective nor discharged within sixty (60) days after the making thereof, or such appointment is consented to, requested by, or acquiesced in by the Manager;

|

|

(e)

|

the Manager commences a voluntary case under any applicable bankruptcy, insolvency or similar law now or hereafter in effect; or consents to the entry of an order for relief in an involuntary case under any such law or to the appointment of or taking possession by a receiver, liquidator, assignee, custodian, trustee, sequestrator or other similar official of any substantial part of its assets; or makes a general assignment for the benefit of creditors; or takes corporate or other action in furtherance of any of the foregoing; or

|

|

(f)

|

entry is made against the Manager of a judgment, decree or order for relief affecting its ability to serve as Manager, or a substantial part of its Participating Interest or its other assets by a court of competent jurisdiction in an involuntary case commenced under any applicable bankruptcy, insolvency or other similar law of any jurisdiction now or hereafter in effect.

|

Under Subsections (d), (e) or (f) above, the appointment of a successor Manager shall be deemed to pre-date the event causing a deemed resignation.

|

7.5.

|

Payments To Manager

|

The Manager shall be compensated for its services and reimbursed for its costs hereunder in accordance with Exhibit B.

|

7.6.

|

Transactions With Affiliates

|

If the Manager engages Affiliates to provide services hereunder, it shall do so on terms no less favourable than would be the case in arm's-length transactions with unrelated persons.

|

7.7.

|

Activities During Deadlock

|

If the Management Committee for any reason fails to adopt an Exploration, Pre-Feasibility Study, Feasibility Study or Development Program and Budget, the Manager shall continue Operations at levels sufficient to maintain the Properties. If the Management Committee for any reason fails to adopt an initial Mining Program and Budget or any Expansion or Modification Programs and Budgets, the Manager shall continue Operations at levels sufficient to maintain the then current Operations and Properties. If the Management Committee for any reason fails to adopt Mining Programs and Budgets subsequent to the initial Mining Program and Budget, subject to the contrary direction of the Management Committee and receipt of necessary funds, the Manager shall continue Operations at levels comparable with the last adopted Mining Program and Budget. All of the foregoing shall be subject to the contrary direction of the Management Committee and the receipt of necessary funds.

19

|

8.

|

PROGRAMS AND BUDGETS

|

|

8.1.

|

Operations Pursuant to Programs and Budgets

|

Except as otherwise provided in Section 8.13, Operations shall be conducted, expenses shall be incurred, and Assets shall be acquired only pursuant to adopted Programs and Budgets. Every Program and Budget adopted pursuant to this Agreement shall provide for accrual of reasonably anticipated Environmental Compliance expenses for all Operations contemplated under the Program and Budget. Programs and Budgets shall provide only for Exploration, Development or mining operations on the Properties and for no other activities or expenditures.

|

8.2.

|

Programs which Benefit Oyu Tolgoi

|

All costs of Operations under each Program and Budget will, to the extent practicable, be allocated at the time the Program and Budget is adopted between the Properties and the Oyu Tolgoi Property, based on the proportions in which each of them benefits most from such Operations and:

|

(a)

|

Ivanhoe shall bear and pay for one hundred percent (100%) of such costs allocated to the Oyu Tolgoi Property and all associated liabilities including for Environmental Compliance; and

|

|

(b)

|

the balance of such costs shall be borne and paid by the Participants in accordance with their respective Participating Interests, subject to any elections made under Subsection 8.5(a).

|

If, and to the extent that, it is impracticable to fully allocate costs of Operations between the Properties and the Oyu Tolgoi Property at the time that a Program and Budget is adopted, such costs will be provisionally allocated based on all information available to the Participants respecting the Properties and the Oyu Tolgoi Property and, if warranted based on additional information obtained from future Operations, will be re-allocated to equitably reflect the relative benefits to each such property. Any such provisional or definitive allocation or re-allocation of costs as aforesaid will be agreed by the Participants. A failure to agree will be a dispute for the purposes of Section 18.3.

For illustration purposes only, if a shaft is sunk on the Properties which also provides access to the Oyu Tolgoi Property and fifty five percent (55%) of mineral production is from the Oyu Tolgoi Property and forty five percent (45%) of mineral production is from the Properties, Entrée would have responsibility for a share of those costs equal to its Participating Interest multiplied by forty five percent (45%).

20

|

8.3.

|

Presentation of Programs and Budgets

|

Proposed Programs and Budgets shall be prepared by the Manager for a period of one (1) year or any other period as approved by the Management Committee, and shall be submitted to the Management Committee for review and consideration. All proposed Programs and Budgets may include Exploration, Pre-Feasibility Studies, Feasibility Study, Development, Mining and Expansion or Modification Operations components, or any combination thereof, and shall be reviewed and adopted upon a vote of the Management Committee in accordance with Sections 6.2 and 8.4. Each Program and Budget adopted by the Management Committee, regardless of length, shall be reviewed at least once a year at a meeting of the Management Committee. During the period encompassed by any Program and Budget, and at least one (1) month prior to its expiration, a proposed Program and Budget for the succeeding period shall be prepared by the Manager and submitted to the Management Committee for review and consideration.

Within thirty (30) days after submission of a proposed Program and Budget, each Participant shall submit in writing to the Management Committee:

|

(a)

|

notice that the Participant approves any or all of the components of the proposed Program and Budget;

|

|

(b)

|

modifications proposed by the Participant to the components of the proposed Program and Budget; or

|

|

(c)

|

notice that the Participant rejects any or all of the components of the proposed Program and Budget.

|

If a Participant fails to give any of the foregoing responses within the allotted time, the failure shall be deemed to be a vote by the Participant for adoption of the Manager's proposed Program and Budget. If a Participant makes a timely submission to the Management Committee pursuant to Subsections 8.4(a), (b) or (c), then the Manager working with the other Participant shall seek for a period of time not to exceed twenty (20) days to develop a complete Program and Budget acceptable to both Participants. The Manager shall then call a Management Committee meeting in accordance with Section 6.3 for purposes of reviewing and voting upon the proposed Program and Budget, provided however that the Management Committee shall make the final determination of the Program and Budget notwithstanding the inability to accommodate an individual Participant’s objections.

21

|

8.5.

|

Election to Participate

|

|

(a)

|

By notice to the Management Committee within twenty (20) days after the final vote adopting a Program and Budget, and notwithstanding its vote concerning adoption of a Program and Budget, a Participant may elect to participate in the approved Program and Budget:

|

|

(i)

|

in proportion to its respective Participating Interest,

|

|

(ii)

|

in some lesser amount than its respective Participating Interest, or

|

|

(iii)

|

not at all;

|

subject to Entrée’s overriding right to elect to sole fund the first $400,000 of costs under the first approved Program and Budget provided in Section 4.6(b) of the Earn-in Agreement. In case of any such election except an election under Subsection 8.5(a)(i), the Participating Interest of the electing Participant shall be recalculated as provided in Subsection 8.5(b) below, with dilution effective as of the first day of the Program Period for the adopted Program and Budget. If a Participant fails to so notify the Management Committee of the extent to which it elects to participate, the Participant shall be deemed to have elected to contribute to such Program and Budget in proportion to its respective Participating Interest as of the beginning of the Program Period.

|

(b)

|

If a Participant elects to contribute to an adopted Program and Budget some lesser amount than in proportion to its respective Participating Interest, or not at all, and the other Participant elects to fund all or any portion of the deficiency, the Participating Interest of the Reduced Participant shall be provisionally recalculated as follows:

|

|

(i)

|

for an election made before Payout, by dividing: (A) the sum of (1) the amount credited to the Reduced Participant's Equity Account with respect to its Initial Contribution under Section 5.2, (2) the total of all of the Reduced Participant's contributions under Section 5.4, and (3) the amount, if any, the Reduced Participant elects to contribute to the adopted Program and Budget; by (B) the sum of (1), (2) and (3) above for both Participants; and then multiplying the result by one hundred; or

|

|

(ii)

|

for an election made after Payout, by reducing its Participating Interest in an amount equal to two (2) times the amount by which it would have been reduced under Subsection 8.5(b)(i) if such election were made before Payout.

|

The Participating Interest of the other Participant shall be increased by the amount of the reduction in the Participating Interest of the Reduced Participant, and if the other Participant elects not to fund the entire deficiency, the Manager shall adjust the Program and Budget to reflect the funds available.

22

|

(c)

|

Whenever the Participating Interests are recalculated pursuant to this Section 8.5, the Equity Accounts of both Participants shall be revised to bear the same ratio to each other as their recalculated Participating Interests.

|

|

(a)

|

If a Participant makes an election under Subsection 8.5(a)(ii) or (iii), then within thirty (30) days after the conclusion of such Program and Budget, the Manager shall report the total amount of money expended plus the total obligations incurred by the Manager for such Budget.

|

|

(b)

|

If the Manager expended or incurred obligations that were more or less than the adopted Budget, the Participating Interests shall be recalculated pursuant to Subsection 8.5(b) by substituting each Participant's actual contribution to the adopted Budget for that Participant's estimated contribution at the time of the Reduced Participant's election under Subsection 8.5(a).

|

|

(c)

|

If the Manager expended or incurred obligations of less than seventy-five percent (75%) of the adopted Budget, within ten (10) days of receiving the Manager's report on expenditures, the Reduced Participant may notify the other Participant of its election to reimburse the other Participant for the difference between any amount contributed by the Reduced Participant to such adopted Program and Budget and the Reduced Participant's proportionate share (at the Reduced Participant's former Participating Interest) of the actual amount expended or incurred for the Program, plus interest on the difference accruing at the rate described in Section 9.3 plus four (4) percentage points. The Reduced Participant shall deliver the appropriate amount (including interest) to the other Participant with such notice. Failure of the Reduced Participant to so notify and tender such amount shall result in dilution occurring in accordance with this Article 8 and shall bar the Reduced Participant from its rights under this Subsection 8.5(c) concerning the relevant adopted Program and Budget.

|

|

(d)

|

All recalculations under this Article 8 shall be effective as of the first day of the Program Period for the Program and Budget. The Manager, on behalf of both Participants, shall make such reimbursements, reallocations of Products, contributions and other adjustments as are necessary so that, to the extent possible, each Participant will be placed in the position it would have been in had its Participating Interests as recalculated under this Article 8 been in effect throughout the Program Period for such Program and Budget. If the Participants are required to make contributions, reimbursements or other adjustments pursuant to this Section, the Manager shall have the right to purchase or sell a Participant's share of Products in the same manner as under Section 12.2 and to apply the proceeds of such sale to satisfy that Participant's obligation to make such contributions, reimbursements or adjustments.

|

|

(e)

|

Whenever the Participating Interests are recalculated pursuant to this Article 8, the Participants' Equity Accounts shall be revised to bear the same ratio to each other as their Recalculated Participating Interests.

|

23

|

(a)

|

At such time as either Participant is of the good faith and reasonable opinion that economically viable Mining Operations may be possible on the Properties, the Participant may propose to the Management Committee that a Pre-Feasibility Study Program and Budget, or a Program and Budget that includes Pre-Feasibility Studies, be prepared. Such proposal shall be made in writing to the other Participant, shall reference the data upon which the proposing Participant bases its opinion, and shall call a meeting of the Management Committee pursuant to Section 6.3. If such proposal is adopted by the Management Committee, the Manager shall prepare or have prepared a Pre-Feasibility Study Program and Budget as approved by the Management Committee and shall submit the same to the Management Committee within thirty (30) days following adoption of the proposal or such other period of time as the Management Committee may prescribe based on a good faith pre-estimate of the time actually required under the circumstances.

|

|

(b)

|

Pre-Feasibility Studies may be conducted by the Manager, Feasibility Contractors, or both, or may be conducted by the Manager and audited by Feasibility Contractors, as the Management Committee determines. A Pre-Feasibility Study Program shall include the work necessary to prepare and complete the Pre-Feasibility Study approved in the proposal adopted by the Management Committee, which may include some or all of the following:

|

|

(i)

|

analyses of various alternatives for mining, processing and beneficiation of Products;

|

|

(ii)

|

analyses of alternative mining, milling, and production rates;

|

|

(iii)

|

analyses of alternative sites for placement of facilities (i.e., water supply facilities, transport facilities, reagent storage, offices, shops, warehouses, stock yards, explosives storage, handling facilities, housing, public facilities);

|

|

(iv)

|

analyses of alternatives for waste treatment and handling (including a description of each alternative of the method of tailings disposal and the location of the proposed disposal site);

|

|

(v)

|

estimates of recoverable proven and probable reserves of Products and of related substances, in terms of technical and economic constraints (extraction and treatment of Products), including the effect of grade, losses, and impurities, and the estimated mineral composition and content thereof, and review of mining rates commensurate with such reserves;

|

24

|

(vi)

|

analyses of environmental impacts of the various alternatives, including an analysis of the permitting, environmental liability and other Environmental Law implications of each alternative, and costs of Environmental Compliance for each alternative;

|

|

(vii)

|

conduct of appropriate metallurgical tests to determine the efficiency of alternative extraction, recovery and processing techniques, including an estimate of water, power, and reagent consumption requirements;

|

|

(viii)

|

conduct of hydrology and other studies related to any required dewatering; and

|

|

(ix)

|

conduct of other studies and analyses approved by the Management Committee.

|

|

(c)

|

The Manager shall have the discretion to base its and any Feasibility Contractors' Pre-Feasibility Study on the cumulative results of each discipline studied, so that if a particular portion of the work would result in the conclusion that further work based on these results would be unwarranted for a particular alternative, the Manager shall have no obligation to continue expenditures on other Pre-Feasibility Studies related solely to such alternative.

|

As soon as reasonably practical following completion of all Pre-Feasibility Studies required to evaluate fully the alternatives studied pursuant to Pre-Feasibility Programs, the Manager shall prepare a report summarizing all Pre-Feasibility Studies and shall submit the same to the Management Committee. Such report shall incorporate the following:

|

(a)

|

the results of the analyses of the alternatives and other matters evaluated in the conduct of the Pre-Feasibility Programs;

|

|

(b)

|

reasonable estimates of capital costs for the Development and start-up of the mine, mill and other processing and ancillary facilities required by the Development and Mining alternatives evaluated (based on flowsheets, piping and instrumentation diagrams, and other major engineering diagrams), which cost estimates shall include reasonable estimates of:

|

|

(i)

|

capitalized pre-stripping expenditures, if an open pit or surface mine is proposed,

|

|

(ii)

|

expenditures required to purchase, construct and install all machinery, equipment and other facilities and infrastructure (including contingencies) required to bring a mine into commercial production, including an analysis of costs of equipment or supply contracts in lieu of Development costs for each Development and Mining alternative evaluated,

|

|

(iii)

|

expenditures required to perform all other related work required to commence commercial production of Products and, if applicable, process Products (including reasonable estimates of working capital requirements), and

|

25

|

(iv)

|

all other direct and indirect costs and general and administrative expenses that may be required for a proper evaluation of the Development and Mining alternatives and annual production levels evaluated. The capital cost estimates shall include a schedule of the timing of the estimated capital requirements for each alternative;

|

|

(c)

|

a reasonable estimate of the annual expenditures required for the first year of Operations after completion of the capital program described in Subsection 8.8(b) for each Development alternative evaluated, and for subsequent years of Operations, including estimates of annual production, processing, administrative, operating and maintenance expenditures, taxes (other than income taxes), working capital requirements, royalty and purchase obligations, equipment leasing or supply contract expenditures, work commitments, Environmental Compliance costs, post-Operations Environmental Compliance and Continuing Obligations funding requirements and all other anticipated costs of such Operations. This analysis shall also include an estimate of the number of employees required to conduct such Operations for each alternative;

|

|

(d)

|

a review of the nature, extent and rated capacity of the mine, machinery, equipment and other facilities preliminarily estimated to be required for the purpose of producing and marketing Products under each Development and Mining alternative analyzed;

|

|

(e)

|

an analysis (and sensitivity analyses reasonably requested by either Participant), based on various target rates of return and price assumptions requested by either Participant, of whether it is technically, environmentally, and economically feasible to place a prospective ore body or deposit within the Properties into commercial production for each of the Development and Mining alternatives analyzed (including a discounted cash flow rate of return investment analysis for each alternative and net present value estimate using various discount rates requested by either Participant); and

|

|

(f)

|

such other information as the Management Committee deems appropriate.

|

Within sixty (60) days after delivery of the Pre-Feasibility Study summary to the Participants, a Management Committee meeting shall be convened for the purposes of reviewing the Pre-Feasibility Study summary and selecting one or more Approved Alternatives, if any.

Within thirty (30) days following the selection of an Approved Alternative or such other period of time as the Management Committee may prescribe based on a good faith pre-estimate of the time actually required under the circumstances, the Manager shall submit to the Management Committee a Program and a Budget, which shall include necessary Operations, for the preparation of a Feasibility Study. A Feasibility Study may be prepared by the Manager, Feasibility Contractors, or both, or may be prepared by the Manager and audited by Feasibility Contractors, as the Management Committee determines.

26

|

(a)

|

Unless otherwise determined by the Management Committee, the Manager shall not submit to the Management Committee a Program and Budget including Development of the mine described in a completed Feasibility Study until thirty (30) days following the receipt by Manager of the Feasibility Study. The Program and Budget, which includes Development of the mine described in the completed Feasibility Study, shall be based on the estimated cost of Development described in the Feasibility Study for the Approved Alternative, unless otherwise directed by the Management Committee.

|

|

(b)

|

Promptly following adoption of the Program and Budget, which includes Development as described in a completed Feasibility Study, but in no event more than sixty (60) days thereafter, the Manager shall submit to the Management Committee a report on material bids received for Development work ("Bid Report"). If bids described in the Bid Report result in the aggregate cost of Development work exceeding twenty percent (20%) of the Development cost estimates that formed the basis of the Development component of the adopted Program and Budget, the Program and Budget, which includes relevant Development, shall be deemed to have been resubmitted to the Management Committee based on the aggregate costs as described in the Bid Report on the date of receipt of the Bid Report and shall be reviewed and adopted in accordance with Sections 6.2 and 8.4.

|

|

(c)

|

If the Management Committee approves the Development of the mine described in a Feasibility Study and also decides to seek Project Financing for such mine, each Participant shall, at its own cost, cooperate in seeking to obtain Project Financing for such mine; provided, however, that all fees, charges and costs (including attorneys and technical consultants fees) paid to the Project Financing lenders shall be borne by the Participants in proportion to their Participating Interests, unless such fees are capitalized as a part of the Project Financing.

|