OFFICE LEASE by and between Mainstreet CV North 40, LLC, a Delaware limited liability company (“Landlord”) and FlexShopper, LLC, a North Carolina limited liability company (“Tenant”) Dated as of the date set forth below Landlord’s signature OFFICE LEASE

Exhibit 10.38

OFFICE LEASE

by and between

Mainstreet CV North 40, LLC, a Delaware limited liability company

(“Landlord”)

and

FlexShopper, LLC, a North Carolina limited liability company

(“Tenant”)

Dated as of

the date set forth below Landlord’s signature

THIS OFFICE LEASE (this “Lease”) is made as of January 29, 2019, by and between Mainstreet CV North 40, LLC, a Delaware limited liability company (“Landlord”), and FlexShopper, LLC, a North Carolina limited liability company (the “Tenant”).

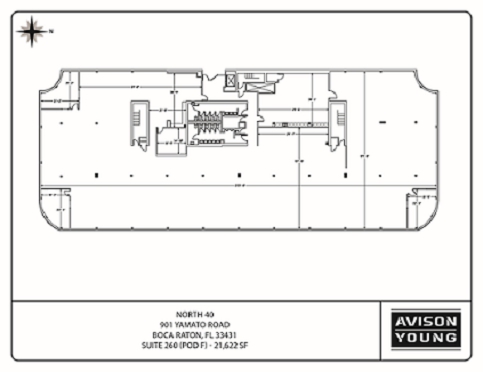

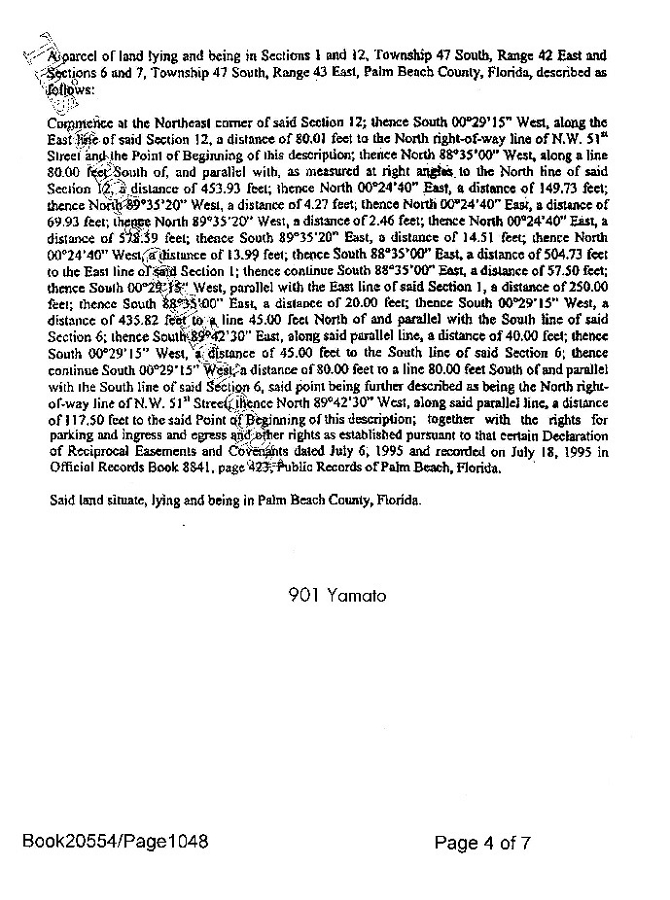

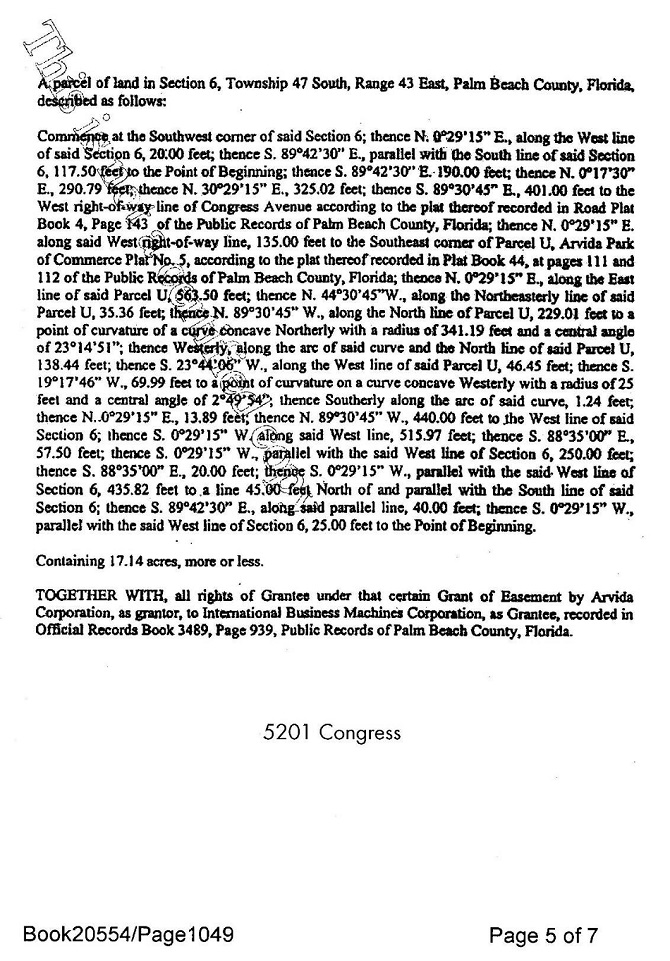

LEASE OF PREMISES

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to all of the terms and conditions set forth herein, those certain premises (the “Premises”) described in Item 3 of the Basic Lease Provisions and as shown in the drawing attached hereto as Exhibit A-1. The Premises are located in the Building described in Item 2 of the Basic Lease Provisions. The Building is located on that certain land (the “Land”) more particularly described on Exhibit A-2 attached hereto, which is also improved with landscaping, parking facilities and other improvements, fixtures and common areas and appurtenances now or hereafter placed, constructed or erected on the Land (sometimes hereinafter referred to as the “Project”).

BASIC LEASE PROVISIONS

| 1. | Tenant:

|

FlexShopper, LLC, a North Carolina limited liability company

|

| 2. | Building Address:

|

000 Xxxxxx Xxxx Xxxx Xxxxx, Xxxxxxx 00000

|

| 3. | Description of Premises:

|

A total of 21,622 square feet of Rentable Area located on the 2nd floor of the Building and commonly referred to as Suites 260.

|

Rentable Area:

|

21,622 square feet of Rentable Area. For purposes hereof, the measurement of the Premises was calculated in accordance with the Standard Method of Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1 – 1996. | |

Building Size:

|

149,284 square feet of Rentable Area [subject to Paragraph 18(c)]

| |

| 4. | Tenant’s Proportionate Share:

|

14.48% (i.e. 21,622 square feet of Rentable Area / 000,000 xxxxxx xxxx xx Xxxxxxxx Xxxx) [See Paragraphs 3 and 18(c)] |

| 5. | Base Rent:

|

(See Paragraph 2)

|

Months 1 to 12, inclusive:

Monthly Installment: |

$378,385.001 (calculated on the basis of $17.50 per square foot of Rentable Area/annum) 2

$31,532.083 |

| 1 | Subject to increase in the event Tenant elects to request the Additional Tenant Allowance in accordance with Section 4(c). |

| 2 | Plus applicable sales tax thereon and subject to the Abatement Period (hereinafter defined). |

| 3 | Id. |

1

| Escalation | The Base Rent for the Premises shall be increased by three percent (3%) on each yearly anniversary of the Commencement Date throughout the Initial Term | |

| 6. | Installment Payable Upon Execution: | An amount equal to one (1) month of Base Rent and Tenant’s Proportionate Share of Operating Expenses. |

| 7. | Security Deposit Payable Upon Execution: | NONE. |

| 8. | (a) Initial Term: | One hundred and eight (108) months, commencing on the Commencement Date and ending at midnight on the day immediately preceding the 108th monthly anniversary of the Commencement Date (See Paragraph 1(a) |

| (b) Renewal Term | One additional term of five (5) years pursuant to Paragraph1(d) | |

| 9. | Commencement Date: | The later of (i) July 1, 2019; or (ii) substantial completion of all of the Tenant Improvements (as evidenced by the issuance of a temporary or permanent certificate of occupancy for the Premises or its local equivalent by the appropriate governmental authority, subject to punch-list items identified in the written declaration attached hereto as Exhibit E. |

| 10. | Brokers (See Paragraph 19(k)): | |

| Landlord’s Broker: | Avison Young – Florida, LLC | |

| Tenant’s Broker: | The Easton Group |

2

| 11. | Number of Parking Spaces: | One hundred thirty (130) unreserved parking spaces, on a “first come, first served” basis, in common with other occupants of the Building, in the surface parking area serving the Building at no charge to Tenant. At Tenant’s written election, up to two (2) of the parking spaces may be converted to covered parking spaces for Tenant’s exclusive use at a cost of $75.00 per space per month. |

| 12. | Addresses for Notices: | |

| To: TENANT: | To: LANDLORD: | |

| Prior to occupancy of the Premises: | ||

| FlexShopper, LLC | Mainstreet CV North 40, LLC | |

| 0000 X. Xxxxxxxx Xxxxx, Xxxxx 000 | c/o Mainstreet Real Estate Services, Inc. | |

| Xxxx Xxxxx, XX 00000 | 0000 Xxxx Xxxxxxxxxx Xxxxxxxxx, Xxxxx 0000 | |

| Xxxx: H. Xxxxxxx Xxxxxx, Xx., CFO | Xxxx Xxxxxxxxxx, Xxxxxxx 00000 | |

| and | With a copy to: | |

| FlexShopper, LLC | Broad and Xxxxxx | |

| 0000 X. Xxxxxxxx Xxxxx, Xxxxx 000 | Attn: Xxxxx X. Xxxxxxx, Esq. | |

| Xxxx Xxxxx, XX 00000 | 0000 XX Xxxxxxxxx Xxxxxxxxx, Xxxxx 000 | |

| Attn: Xxxxx Xxxxx, Controller | Xxxx Xxxxx, Xxxxxxx 00000 | |

| After occupancy of the Premises to the same individuals listed above, but substitute the Premises address. | ||

| With a copy to: | ||

| Xxxxxxxxx & Xxxxxxxx, P.A. | ||

| 0000 X. Xxxxxxxx Xxxxx, Xxxxx 000 Xxxx Xxxxx, XX 00000 | ||

| Attn: Xxxxxxx X. Xxxxxxxxx, Esq. | ||

| or such other address as Tenant may designate in writing. |

3

| 13. | Address for Payment of Rent: | All payments payable under this Lease shall be sent to Landlord at: |

| x/x Xxxxxxxxxx Xxxx Xxxxxx Services, Inc. | ||

| 0000 Xxxx Xxxxxxxxxx Xxxxxxxxx, Xxxxx 0000 | ||

| Xxxx Xxxxxxxxxx, Xxxxxxx 00000 | ||

| or to such other address as Landlord may designate in writing. | ||

| 14. | Guarantor: | None applicable |

| 15. | Effective Date: | Date of execution by Landlord |

| 16. | Tenant Allowances: | Up to $540,550.00 ($25.00 per square foot of Rentable Area of the Premises). |

| 17. | The “State” is the state, commonwealth, district or jurisdiction in which the Building is located. | Florida |

This Lease consists of the foregoing introductory paragraphs and Basic Lease Provisions, the provisions of the Standard Lease Provisions (the “Standard Lease Provisions”) (consisting of Paragraph 1 through Paragraph 26 which follow) and Exhibits X-0, X-0, X, X-0, C-2, D, E, and F, all of which are incorporated herein by this reference. In the event of any conflict between the provisions of the Basic Lease Provisions and the provisions of the Standard Lease Provisions, the Standard Lease Provisions shall control.

4

EXECUTION VERSION

STANDARD LEASE PROVISIONS

1. TERM

(a) The Initial Term of this Lease and the Rent (defined below) shall commence in accordance with Item 9 of the Basic Lease Provisions (the “Commencement Date”). Unless earlier terminated in accordance with the provisions hereof, the Initial Term of this Lease shall be the period shown in Item 9 of the Basic Lease Provisions. As used herein, “Lease Term” shall mean the Initial Term referred to in Item 9 of the Basic Lease Provisions, and the “Expiration Date” shall mean the last day of the Initial Term, in each case, subject to any extension of the Initial Term hereof exercised in accordance with the terms and conditions expressly set forth herein. Unless Landlord is terminating this Lease prior to the Expiration Date in accordance with the provisions hereof, Landlord shall not be required to provide notice to Tenant of the Expiration Date. This Lease shall be a binding contractual obligation effective upon execution hereof by Landlord and Tenant, notwithstanding the later commencement of the Initial Term of this Lease.

(b) Keys to the Premises will be delivered to Tenant following Landlord’s completion of the “Tenant Improvements,” as hereinafter defined in Paragraph 4(a). Tenant shall provide Landlord with copies of certificates of insurance complying in all respects with the terms of this Lease for all insurance required to be provided hereunder prior to entering any portion of the Premises. Tenant agrees that Tenant’s entry into the Premises prior to the Commencement Date shall be governed by and subject to all terms, covenants, conditions and obligations of this Lease during the period between the date possession is delivered and the Commencement Date, other than the payment of Rent until the Commencement Date. If the Commencement Date is delayed or otherwise does not occur on the Estimated Commencement Date, set forth in Item 9 of the Basic Lease Provisions, this Lease shall not be void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom.

(c) Upon Substantial Completion of the Tenant Improvements to the entire Premises by Tenant, Landlord shall prepare and deliver to Tenant, Tenant’s Commencement Letter in the form of Exhibit E attached hereto (the “Commencement Letter”) which Tenant shall acknowledge by executing a copy and returning it to Landlord. If Tenant fails to sign and return the Commencement Letter to Landlord within ten (10) days of its receipt from Landlord, the Commencement Letter as sent by Landlord shall be deemed to have correctly set forth the Commencement Date and the other matters addressed in the Commencement Letter. Failure of Landlord to send the Commencement Letter shall have no effect on the Commencement Date.

(d) Renewal. Provided that no event of default exists under this Lease at the time of delivery of a Renewal Notice or at the commencement of the Renewal Term, as such terms are hereinafter defined, Tenant shall have the option to extend (each an “Extension Option”) the Initial Term for one (1) additional term of five (5) years (“Renewal Term”) which shall commence as of the date immediately following the expiration of the Initial Term, subject to the covenants and conditions of this subparagraph (1)(d).

5

(i) Tenant shall give Landlord written notice (a “Renewal Notice”) of (a) Tenant’s election to exercise its Extension Option with respect to the Renewal Term no later than nine (9) months prior to the expiration of the Initial Term; provided that Tenant’s failure to give a Renewal Notice by such time and within such period, whether due to Tenant’s oversight or failure to cure any existing defaults after notice and applicable grace periods, if any, or otherwise, shall render this Extension Option null and void. Within thirty (30) days of receipt of the Renewal Notice, Landlord shall advise Tenant in writing of the new Base Rent for the Renewal Term, determined in accordance with subparagraph (1)(d)(iii) below.

(ii) Tenant shall be deemed to have accepted the Premises in its “AS-IS” condition as of the commencement of the Renewal Term, as applicable, subject to any other repair and maintenance obligations of Landlord under this Lease.

(iii) The covenants and conditions of this Lease in force during the Initial Term, as the same may be modified from time to time, shall continue to be in effect during the Renewal Term, except the “Base Rent” for the Renewal Term shall be equal to the “Fair Market Rental Value” (hereinafter defined) as determined by Landlord. As used herein, “Fair Market Rental Value” shall mean the then prevailing renewal market rental rate for comparable space in comparable buildings in the Yamato corridor submarket of Boca Raton, Florida area taking into account, among other considerations, (i) the quality, size, and location of the Building and the Premises, (ii) the lease term, (iii) the creditworthiness of Tenant, and (iv) the extent of services provided to the Premises; (v) market inducements, such as rental concessions, and other inducements given to renewing tenants in the submarket.

Within thirty (30) days after receipt of a Renewal Notice, Landlord shall advise Tenant of the applicable Fair Market Rental Value for Base Rent during the Renewal Term. Tenant, within fifteen (15) days after the date that Landlord advises Tenant of the applicable Base Rent during the Renewal Term, shall either: (a) give Landlord a final binding notice (“Binding Notice”) of Tenant’s exercise of its option at the Landlord’s stated Fair Market Rental Value for Base Rent; or (b) if Tenant disagrees with Landlord’s determination of the Fair Market Rental Value, provide Landlord with notice of rejection (the “Rejection Notice”). If Tenant fails to provide Landlord with either a Binding Notice or Rejection Notice within the fifteen (15) day period, then Tenant’s Renewal Term, at Landlord’s option, shall be deemed null and void and of no further force and effect. If Tenant provides Landlord with a Binding Notice, Landlord and Tenant shall promptly enter into an amendment to this Lease to incorporate the terms of the Renewal Terms, as provided herein.

In the event that Tenant provides Landlord with a Rejection Notice and Landlord and Tenant are unable to agree upon the Fair Market Rental Value for Base Rent during the Renewal Term within fifteen (15) days from the date of Tenant’s Rejection Notice, both Landlord and Tenant shall then, within five (5) days of the end of said fifteen (15) day period, (i) submit to each other their respective determinations of Fair Market Rental Value and (ii) each shall appoint an arbitrator who must be an independent licensed appraiser, a Member of the Appraisal Institute and has no less than ten (10) years of experience in the commercial real estate market in which the Premises is located; and notify the other of such appointment. If either Landlord or Tenant fails to timely appoint an arbitrator, the arbitrator selected shall select the second (2nd) arbitrator, who shall be impartial, within five (5) days after such party’s failure to appoint. The two arbitrators shall, within fifteen (15) days of their appointment, select from the two determinations originally submitted by Landlord and Tenant the one that is closer to the Fair Market Rental Value as determined by the arbitrators, and said selection shall thereafter be deemed the Fair Market Rental Value. If the two arbitrators so appointed fail to agree as to which of the determinations submitted by Landlord and Tenant is the closest to the actual Fair Market Rental Value within thirty (30) days of their appointment, the two arbitrators shall appoint a third (3rd) arbitrator within five (5) days after the failure of the initial arbitrators to agree on a Fair Market Rental Value, to decide upon which of the two determinations submitted is the closest to the actual Fair Market Rental Value. The arbitrators shall not be permitted to choose any results other than the determination presented by either Landlord or Tenant. The fees and expenses of any arbitration shall be borne by the losing party. The arbitrators’ determination shall be final and binding on the parties.

6

(iv) The Extension Option shall not be transferable by Tenant, except in conjunction with a permissible assignment of Tenant’s interest in the Lease in accordance with the applicable provisions hereof.

2. BASE RENT AND SECURITY DEPOSIT

(a) Commencing on the Commencement Date, Tenant agrees to pay during each month of the Lease Term as Base Rent (“Base Rent”) for the Premises the sums shown for such periods in Item 5 of the Basic Lease Provisions, subject to increase in the event that Tenant requests the Additional Tenant Allowance in accordance with Section 4(c) hereof.

Notwithstanding anything to the contrary, Landlord will xxxxx Base Rent for the 1st six (6) months (collectively, the “Abatement Period”) immediately following the Commencement Date. In the event the Lease is terminated because of a Tenant event of default prior to the expiration of the Term, Tenant shall immediately pay to Landlord the then unamortized portion of the Base Rent abated during the Abatement Period. Tenant shall pay Additional Rent during the Abatement Period.

(b) Except as expressly provided to the contrary herein, Base Rent shall be payable in consecutive monthly installments, in advance, without demand, deduction or offset, commencing on the Commencement Date and continuing on the first day of each calendar month thereafter until the expiration of the Lease Term. The first full monthly installment of Base Rent and Tenant’s Proportionate Share of Operating Expenses shall be payable upon Tenant’s execution of this Lease and shall be applied to Base Rent and Tenant’s Proportionate Share of Operating Expenses plus sales tax thereon due for the month commencing on the Commencement Date. The obligation of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. If the Commencement Date is a day other than the first day of a calendar month, or the Lease Term expires on a day other than the last day of a calendar month, then the Rent for such partial month shall be calculated on a per diem basis. In the event Landlord delivers possession of the Premises to Tenant prior to the Commencement Date, Tenant agrees it shall be bound by and subject to all terms, covenants, conditions and obligations of this Lease during the period between the date possession is delivered and the Commencement Date, other than the payment of Base Rent, in the same manner as if delivery had occurred on the Commencement Date.

7

(c) Security Deposit. Not applicable.

(d) Base Rent shall be paid to Landlord absolutely net of all Operating Expenses. The provisions for payment of Operating Expenses by means of periodic payment of Tenant’s Proportionate Share of estimated Operating Expenses and the year end adjustment of such payments are intended to pass on to Tenant and reimburse Landlord for Tenant’s Proportionate Share of all costs and expenses of the nature described in Paragraph 3 of this Lease.

3. ADDITIONAL RENT

(a) Commencing on the Commencement Date Tenant shall pay to Landlord each month as additional rent (“Additional Rent”) an amount equal to Tenant’s Proportionate Share (defined below) of Operating Expenses (defined below), plus applicable sales tax.

(b) “Tenant’s Proportionate Share” is, subject to the provisions of Paragraph 18(c), the percentage number described in Item 4 of the Basic Lease Provisions. Tenant’s Proportionate Share represents, subject to the provisions of Paragraph 18(c), a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Building, as determined and adjusted by Landlord pursuant to Paragraph 18(c).

(c) “Operating Expenses” means all costs, expenses and obligations incurred or payable by Landlord in connection with the operation, ownership, management, repair or maintenance of the Building, the Common Areas of the Building, and the Common Areas of the Project allocated by Landlord to the Building during or allocable to the Lease Term, including without limitation, the following:

(i) Any form of assessment, license fee, license tax, business license fee, levy, charge, improvement bond, tax, gross receipts tax, excise tax, water and sewer rents and charges, utilities and communications taxes and charges or similar or dissimilar imposition imposed by any authority having the direct power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, drainage or other improvement or special assessment district thereof, or any other governmental charge, general and special, ordinary and extraordinary, foreseen and unforeseen, which may be assessed against any legal or equitable interest of Landlord in the Premises, Building and Common Areas of the Building and the Project (collectively, “Taxes”). Landlord shall pay all Taxes so as to obtain all maximum allowable discounts, if any, and any amount for which the Tenant is liable under this Lease shall be based on the maximum allowable discount for payment of such Taxes, regardless of whether Landlord paid such Taxes on a timely basis to receive such maximum allowable discount. Notwithstanding anything to the contrary, Taxes shall not include any inheritance taxes, gift taxes, transfer taxes, franchise taxes, income taxes, profit taxes, capital levies and excise taxes except as set forth in Paragraph 3(f), or gross receipts taxes (as opposed to a sales tax on rent received). Taxes shall also include, without limitation, reasonable attorneys’ fees incurred in attempting to protest, reduce or minimize Taxes.

8

(ii) The cost of services and utilities (including taxes and other charges incurred in connection therewith) provided to the Premises, the Building or the Project, including, without limitation, water, power, gas, sewer, waste disposal, telephone and cable television facilities, fuel, supplies, equipment, tools, materials, service contracts, janitorial services, waste and refuse disposal, window cleaning, maintenance and repair of sidewalks and Building exterior and services areas, gardening and landscaping; insurance, including, but not limited to, public liability, fire, property damage, wind, hurricane, terrorism, flood, rental loss, rent continuation, boiler machinery, business interruption, contractual indemnification and All Risk or Causes of Loss - Special Form coverage insurance for up to the full replacement cost of the Project and such other insurance as is customarily carried by operators of other similar class office buildings in the city in which the Project is located, to the extent carried by Landlord in its discretion, and the deductible portion of any insured loss otherwise covered by such insurance; except for executive’s compensation above the grade of building or project manager, the cost of compensation, including employment, welfare and social security taxes, paid vacation days, disability, pension, medical and other fringe benefits of all persons (including independent contractors) who perform services connected with the operation, maintenance, repair or replacement of the Project; any association assessments, costs, dues and/or expenses relating to the Project; personal property taxes on and maintenance and repair of equipment and other personal property used in connection with the operation, maintenance or repair of the Project; repair and replacement of window coverings provided by Landlord in the premises of tenants in the Project; such reasonable auditors’ fees and legal fees as are incurred in connection with the operation, maintenance or repair of the Project except as specifically excluded in the following paragraph; administration fees; a property management fee (which fee may be imputed if Landlord has internalized management or otherwise acts as its own property manager provided however, such charges shall not include any costs associated with executive’s salaries above the grade of building manager); the maintenance of any easements leases benefiting the Project, a reasonable allowance for depreciation of personal property used in the operation, maintenance or repair of the Project; except as excluded in the paragraph below, license, permit and inspection fees; all costs and expenses required by any governmental or quasi-governmental authority or by applicable law, for any reason, including capital improvements (required in order to comply with Laws enacted after the Effective Date), whether capitalized or not, and the cost of any capital improvements made to the Project by Landlord that improve life-safety systems or reduce operating expenses and the costs to replace items which Landlord would be obligated to maintain under the Lease (such costs to be amortized on a straight line basis over the usable life of the item; the cost of air conditioning, heating, ventilating, plumbing, elevator maintenance and repair (to include the replacement of components) and other mechanical and electrical systems repair and maintenance (including repair and maintenance of life safety components of any back-up generator); sign maintenance; and Common Areas (defined below) repair, resurfacing, operation and maintenance; the reasonable cost for temporary lobby displays and events commensurate with the operation of a similar class building, and the cost of providing security services, if any, deemed appropriate by Landlord.

The following items shall be excluded from Operating Expenses:

(A) any ground lease rental;

(B) leasing commissions, rent concessions to tenants, attorneys’ fees, costs and disbursements and other expenses incurred in connection with leasing, renovating or improving vacant space in the Building or Project for tenants or prospective tenants of the Building or Project;

9

(C) costs (including permit, license and inspection fees) incurred in renovating or otherwise improving or decorating, painting or redecorating space for tenants or vacant space in the Building or Project;

(D) Landlord’s costs of any services provided to tenants for which Landlord is entitled to be reimbursed by such tenants as an additional charge or rental over and above the Base Rent and Operating Expenses payable under the lease with such tenant or other occupant;

(E) any depreciation or amortization of the Premises, Building or Project except as expressly permitted herein;

(F) costs incurred due to a violation of Law (defined below) by Landlord relating to the Building or Project;

(G) interest on debt or amortization payments on any mortgages or deeds of trust or any other debt for borrowed money;

(H) all items and services for which Tenant or other tenants reimburse Landlord outside of Operating Expenses;

(I) repairs or other work occasioned by fire, windstorm or other work paid for through insurance or condemnation proceeds (excluding any deductible);

(J) legal expenses incurred for (i) negotiating lease terms for prospective tenants, (ii) negotiating termination or extension of leases with existing tenants, (iii) proceedings against any other specific tenant relating solely to the collection of rent or other sums due to Landlord from such tenant, or (iv) the development and/or construction of the Building or Project;

(K) interest or other penalties for the late payment of any Taxes;

(L) expenses in connection with services or other benefits that are not offered to Tenant;

(M) costs incurred by Landlord due to the violation by Landlord or any tenant of the terms and conditions of any lease of space in the Building or Project;

(N) cost of items considered capital repairs, replacements, improvements, and equipment under generally accepted accounting principles (“capital items”); except for those capital items specifically permitted in Paragraph 3(c)(ii);

(O) costs incurred by Landlord for repair of damage to the Building and Project, to the extent that Landlord is reimbursed by insurance proceeds, and costs of all capital improvements, regardless of whether such repairs are covered by insurance;

(P) costs, (including all attorneys’ fees, and costs of settlement, judgments, and payments) arising from claims, disputes, or potential disputes in connection with potential or actual claims litigation or arbitrations pertaining to this Lease or another lease with a tenant of the Building; and

10

(Q) repairs resulting from any defect in the original design or construction of the Building and Project.

(d) Operating Expenses for any calendar year during which actual occupancy of the Project is less than one hundred percent (100%) of the Rentable Area of the Project shall be appropriately adjusted to reflect one hundred percent (100%) occupancy of the existing Rentable Area of the Project during such period. In determining Operating Expenses, if any services or utilities are separately charged to tenants of the Project or others, Operating Expenses shall be adjusted by Landlord to reflect the amount of expense which would have been incurred for such services or utilities on a full-time basis for normal Project operating hours. In the event (i) the Commencement Date shall be a date other than January 1, (ii) the date fixed for the expiration of the Lease Term shall be a date other than December 31, (iii) of any early termination of this Lease, or (iv) of any increase or decrease in the size of the Premises, then in each such event, an appropriate adjustment in the application of this Paragraph 3 shall, subject to the provisions of this Lease, be made to reflect such event on a basis determined by Landlord to be consistent with the principles underlying the provisions of this Paragraph 3. In addition, Landlord shall have the right, from time to time, to equitably allocate and prorate some or all of the Operating Expenses among different tenants and/or different buildings of the Project and/or on a building-by-building basis (the “Cost Pools”). Such Cost Pools may include, without limitation, the office space tenants and retail space tenants of the buildings in the Project.

(e) Within a reasonable period after the commencement of each calendar year of the Lease Term following the Commencement Date, Landlord shall give to Tenant a written estimate of Tenant’s Proportionate Share of the Operating Expenses for the Building and the Common Areas of the Building and Project for the then current year. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance on the first day of each month. Within a reasonable period after the end of each calendar year, Landlord shall furnish Tenant a statement indicating in reasonable detail the Operating Expenses for such period, and the parties shall, within thirty (30) days thereafter, make any payment or allowance necessary to adjust Tenant’s estimated payments to Tenant’s actual share of such Operating Expenses as indicated by such annual statement. Any amount due Tenant shall be credited against installments next becoming due under this Paragraph 3(e) or refunded to Tenant, if no further sums are due from Tenant.

(f) All capital levies or other taxes assessed or imposed on Landlord upon the rents payable to Landlord under this Lease and any excise, transaction, sales or privilege tax, assessment, levy or charge measured by or based, in whole or in part, upon such rents from the Premises and/or the Project or any portion thereof shall be paid by Tenant to Landlord monthly in estimated installments or upon demand, at the option of Landlord, as additional rent to be allocated to monthly Operating Expenses.

(g) Tenant shall pay before delinquency, all taxes and assessments (i) levied against any personal property, Alterations, tenant improvements or trade fixtures of Tenant in or about the Premises, (ii) based upon this Lease or any document to which Tenant is a party creating or transferring an interest in this Lease or an estate in all or any portion of the Premises, and (iii) levied for any business, professional, or occupational license fees. If any such taxes or assessments are levied against Landlord or Landlord’s property or if the assessed value of the Project is increased by the inclusion therein of a value placed upon such personal property or trade fixtures, Tenant shall upon demand reimburse Landlord for the taxes and assessments so levied against Landlord, or such taxes, levies and assessments resulting from such increase in assessed value. To the extent that any such taxes are not separately assessed or billed to Tenant, Tenant shall pay the amount thereof as invoiced to Tenant by Landlord.

11

(h) Any delay or failure of Landlord in (i) delivering any estimate or statement described in this Paragraph 3 or (ii) computing or billing Tenant’s Proportionate Share of Operating Expenses shall not constitute a waiver of its right to require an increase in Rent, or in any way impair the continuing obligations of Tenant under this Paragraph 3. In the event of any dispute as to any Additional Rent due under this Xxxxxxxxx 0, Xxxxxx, an officer of Tenant or Tenant’s certified public accountant (but (a) in no event shall Tenant hire or employ an accounting firm or any other person to audit Landlord as set forth under this Paragraph who is compensated or paid for such audit on a contingency basis; and (b) in the event Tenant hires or employs an independent party to perform such audit, Tenant shall provide Landlord with a copy of the engagement letter) shall have the right after reasonable notice and at reasonable times to inspect Landlord’s accounting records at Landlord’s accounting office. If, after such inspection, Tenant still disputes such Additional Rent, upon Tenant’s written request therefor, a certification as to the proper amount of Operating Expenses and the amount due to or payable by Tenant shall be made by an independent certified public accountant mutually agreed to by Landlord and Tenant. If Landlord and Tenant cannot mutually agree to an independent certified public accountant, then the parties agree that Landlord shall choose an independent certified public accountant to conduct the certification as to the proper amount of Tenant’s Proportionate Share of Operating Expenses due by Tenant for the period in question; provided, however, such certified public accountant shall not be the accountant who conducted Landlord’s initial calculation of Operating Expenses to which Tenant is now objecting. Such certification shall be final and conclusive as to all parties. If the certification reflects that Tenant has overpaid Tenant’s Proportionate Share of Operating Expenses for the period in question, then Landlord shall credit such excess to Tenant’s next payment of Operating Expenses or, at the request of Tenant, promptly refund such excess to Tenant and conversely, if Tenant has underpaid Tenant’s Proportionate Share of Operating Expenses, Tenant shall promptly pay such additional Operating Expenses to Landlord. Tenant agrees to pay the cost of such certification and the investigation with respect thereto and no adjustments in Tenant’s favor shall be made unless it is determined that Landlord’s original statement was in error in Landlord’s favor by more than eight percent (8%). Tenant waives the right to dispute any matter relating to the calculation of Operating Expenses or Additional Rent under this Paragraph 3 if any claim or dispute is not asserted in writing to Landlord within ninety (90) days after delivery to Tenant of the original billing statement with respect thereto. Notwithstanding the foregoing, Tenant shall maintain strict confidentiality of all of Landlord’s accounting records and shall not disclose the same to any other person or entity except for (a) Tenant’s professional advisory representatives (such as Tenant’s employees, accountants, advisors, attorneys and consultants) with a need to know such accounting information, who agree to similarly maintain the confidentiality of such financial information, or (b) disclosure in any action based upon this Agreement; or (c) disclosure pursuant to court order or compulsory process.

12

(i) Even though the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Proportionate Share of Operating Expenses for the year in which this Lease terminates, Tenant shall within thirty (30) days pay any increase due over the estimated Operating Expenses paid, and conversely, any overpayment made by Tenant shall be promptly refunded to Tenant by Landlord, subject to offset for any amounts due to Landlord from Tenant under this Lease.

(j) The Base Rent, Additional Rent, late fees, and other amounts required to be paid by Tenant to Landlord hereunder are sometimes collectively referred to as, and shall constitute, “Rent.”

(k) Further notwithstanding the foregoing, Tenant’s share of Operating Expenses, other than Taxes, insurance, government mandated costs (such as increases in minimum wages), and utilities and cost of casualty not covered by insurance (collectively, the “Non-Controllable Expenses”), shall not be increased during any calendar year by more than a maximum of five percent (5%) of such expenses for the preceding calendar year, calculated on a cumulative and compounding basis (i.e., Landlord may carry forward unused increases in Operating Expenses). This cap shall not apply to the Non-Controllable Expenses.

4. IMPROVEMENTS AND ALTERATIONS

(a) Landlord shall improve the Premises using standard Building materials equal to or of better quality than those materials currently used in the Premises and finishes in accordance with a space plan being prepared by Treieschmann Dumala Architectural Group (the “Architect”), a draft of which is dated October 17, 2018 (the “Space Plan”), and attached hereto as Exhibit “B.” Within ten (10) days from the date hereof, Tenant shall submit an updated Space Plan for Landlord’s review and approval, provided however, Tenant shall have no right to request any changes to the Space Plan that would materially alter the exterior appearance or basic nature of the Building or the Building systems. Landlord shall have three (3) business days after receipt of the updated Space Plan to review and to give Tenant written notice of Landlord’s approval of the updated Space Plan or its requested changes thereto. If Landlord requests any changes to the updated Space Plan, then Tenant shall make those changes and re-submit within three (3) business days thereof the further revised Space Plan to Landlord for approval. Landlord and Tenant shall continue such process until Tenant addresses Landlord’s comments and Landlord issues written approval of the Space Plan (the “Final Space Plan”). Within fifteen (15) days after the date of the Final Space Plan, Tenant shall cause the Architect to prepare and submit construction drawings to Landlord for approval based on the Final Space Plan and in accordance with the same procedure set forth above. Landlord shall not be required to install any partition or improvements which are not in conformity with the Final Space Plan. The improvements referenced in this Paragraph shall be referred to as the “Tenant Improvements.” Notwithstanding any provision in this Lease to the contrary, the Tenant Improvements shall be completed in a good and workmanlike manner and shall comply with all laws. In addition to (and not in lieu of) Landlord’s obligations under this Lease, Landlord shall cause the general contractor performing the Tenant Improvements to provide a warranty in favor of Tenant against defects in workmanship and materials for a period of twelve (12) months after the Commencement Date. If Tenant notifies Landlord of any such defects within such twelve (12) month period, then Landlord will cause to be repaired, the defects as soon as practicable and shall use commercially reasonable efforts to repair the defects with minimal disruption and interference to Tenant’s use of the Premises. At any time after the expiration such twelve (12) month period, Landlord will promptly, upon written request of Tenant, assign to Tenant (to the extent assignable, available and without warranty or representation by Landlord) all rights which Landlord may have under the contract for the construction of the Tenant Improvements against the contractor respecting defects in workmanship and materials.

13

(b) Except as expressly provided herein and described in the Space Plan, Landlord shall not be responsible for any other renovation, construction or installation of any improvements relating to the Premises. Tenant acknowledges that Landlord has not made any representations or warranties with respect to the condition of the Premises and neither Landlord nor any assignee of Landlord shall be liable for any latent defect therein. The taking of possession of the Premises by Tenant shall be conclusive evidence that the Premises were in good and satisfactory condition at the time such possession was taken. Landlord, through its designated contractor (the “Contractor”), will perform and complete the Tenant Improvements as described in the Space Plan. All costs related to change-orders, alterations and additions to the Space Plan requested by Tenant and approved by Landlord which increase the cost of the Tenant Improvements above the Tenant Allowance shall be borne by Tenant. All work will be scheduled by Landlord in such a manner as to not inconvenience other tenants in the Building. Landlord and its Contractor assume no liability for Tenant’s equipment, furniture or other personal property located at the Premises during the construction of the Tenant Improvements and Tenant shall hold Landlord, its contractors and their respective agents and employees (“Landlord’s Indemnified Parties”) harmless and indemnify same from and against any damage or injury relating to Tenant’s equipment, furniture or personal property left in the Premises during the construction of the Tenant Improvements. Tenant hereby acknowledges that Tenant shall be solely responsible for the installation and any other associated costs relating to the use of low voltage wiring, card readers and telephone cabling in the Premises.

(c) Tenant Improvement Allowance. Landlord shall contribute an improvement allowance not to exceed the product of the Rentable Area of the Premises (21,622 rentable square feet of Rentable Area) and $25.00 (i.e. $540,550.00) (the “Tenant Allowance”) toward payment for the “hard costs” of the Tenant Improvements, Consultant Fee, and FF&E Costs, subject to the conditions and limitations set forth herein. If the Tenant Allowance is inadequate to pay for the sum total of the “hard costs” for the Tenant Improvements, Consultant Fee, and FF&E Costs, then within five (5) days after the date of the Final Space Plan, Tenant may elect upon delivery of written notice to Landlord to request that Landlord increase the Tenant Allowance by the lesser of (i) the difference between the amount of the Tenant Allowance and the sum total amount of the “hard costs” of the Tenant Improvements, Consultant Fee, and FF&E Costs; or (ii) $5.00 per square foot of Rentable Area in the Premises (the “Additional Tenant Allowance”). In no event shall the Additional Tenant Allowance exceed $108,110.00. Each Monthly Installment of Base Rent for the Premises over the Initial Term shall be increased by an amount calculated based upon the amortized Additional Tenant Allowance4 over a period of 102 months, together with eight percent (8%) interest per annum. Landlord shall update Section 5 of the Basic Lease Provisions prior to the Commencement Date to account for the Additional Tenant Allowance (if applicable). The Tenant Allowance plus the Additional Tenant Allowance, if any, shall be collectively referred to as the “Maximum Tenant Allowance” which shall not exceed $648,660.00s. As used herein, the phrase “hard costs” means all costs and expenses incurred by Landlord in connection with the construction and design of the Tenant Improvements, including, without limitation, amounts paid to the Architect (including, permitting expeditor fees incurred by Landlord in connection with the Tenant Improvements), engineers, contractors, subcontractors and material suppliers. Except as otherwise provided below, the Maximum Tenant Allowance may not be applied to any other costs such as, but not limited to, the cost of Tenant’s trade fixtures, equipment, moving expenses, low voltage wiring, card readers and cabling. Tenant hereby acknowledges that all Tenant Improvements paid for using any portion of the Maximum Tenant Allowance shall be the sole property of Landlord from the date of construction or installation in the Premises and shall remain in the Premises following the expiration of the Lease. Notwithstanding anything to the contrary, Tenant may elect to apply a portion of the unused Maximum Tenant Allowance against the cost and expense of (i) the fees paid to X. Xxxxx Advisors, Inc., as the Tenant’s designated relocation consultant (“Consultant Fee”) engaged by Tenant to supervise its relocation into the Premises from Tenant’s current office location; and (ii) the purchase or installation of Tenant’s equipment including, but not limited to, demountable partitions, furniture, and low voltage wiring (collectively, the “FF&E Costs”), provided that the Consultant Fee and FF&E Costs do not exceed an aggregate of twenty-five percent (25%) of the Maximum Tenant Allowance5 (to the extent funds are available and have not been exhausted in connection with the construction of the Tenant Improvements), Landlord shall then reimburse Tenant for Consultant Fees and FF&E Costs from the Maximum Tenant Allowance (subject to the limitations set forth herein6) within thirty (30) days after the substantial completion of the Tenant Improvements and Tenant’s delivery to Landlord true copies of final contractor’s affidavit and waivers of lien in accordance with Florida Construction Lien Law (F.S. 713) for work performed and all paid receipts, bills, invoices and supporting information concerning payment for the Consultant Fee, and FF&E Costs that Landlord may reasonably request.

(d) Tenant shall be solely responsible for all costs associated with completing the Tenant Improvements over and above the Maximum Tenant Allowance. If the cost to construct and install the Tenant Improvements will exceed the Maximum Tenant Allowance, Tenant shall deliver to Landlord, within ten (10) days following Landlord’s written request, an amount equal to one-half (1/2) of such excess. Within thirty (30) days following substantial completion of the Tenant Improvements, Tenant shall pay to Landlord the remaining balance of any costs in excess of the Maximum Tenant Allowance. Tenant’s failure to deliver the payments required in this paragraph shall entitle Landlord to stop the construction and installation of the Tenant Improvements until such payment is received, and any resulting delay shall constitute a Tenant Delay (as hereinafter defined) hereunder. In addition, all delinquent payments required in this sub-section shall accrue interest at 15% per annum. The Maximum Tenant Allowance or portion thereof must be utilized not later than six (6) months after Commencement Date (the “Allowance Period”). If the Maximum Tenant Allowance exceeds the total of the hard costs incurred for the Tenant Improvements, Consultant Fee, and FF&E Costs, then (i) Tenant may elect during the period of time between the Commencement Date and the expiration of the Allowance Period to apply such excess as a credit against Base Rent immediately following the expiration of the Abatement Period as it becomes due (until exhausted in full), provided that such credit shall in no event exceed the product of the Rentable Area of the Premises (21,622 rentable square feet of Rentable Area) and $5.00 (i.e. $108,110.00, the “Credit Cap”); and (ii) any unused portion of the Maximum Tenant Allowance that exceeds the Credit Cap shall be the property of Landlord, it being agreed that Tenant shall not be entitled to any credit, offset, abatement or payment with respect thereto. In addition, if any portion of the Maximum Tenant Allowance remains unused by Tenant prior to the expiration of the Allowance Period, then, upon the expiration of the Allowance Period, such unused portion of the Maximum Tenant Allowance shall be the property of Landlord, it being agreed that Tenant shall not be entitled to any credit, offset, abatement or payment with respect thereto.

| 4 | Escalation shall not apply to any portion of Base Rent attributable to the amortized Additional Tenant Allowance. |

| 5 | Not to exceed $162,165.00 |

| 6 | Id. |

14

(e) Tenant shall request in writing Landlord’s approval to any changes to the Final Space Plan or corresponding construction documents at any time (each, a “Change Order”, and collectively, “Change Orders”), provided such Change Order is accompanied by a copy of the revised Final Plans (incorporating the Change Order) and description of the impact on cost and schedule resulting from said Change Order (the “Change Order Memorandum of Agreement”). Approval of Change Orders shall be subject to the process set forth in Section 4(a) above. At Landlord’s option, Tenant shall pay to Landlord (or Landlord’s designee), within ten (10) days following Landlord’s request, any increase in the cost to construct the Tenant Improvements resulting from the Change Order, as set forth in the Change Order Memorandum of Agreement.

(f) Should a “Tenant Delay” or “Force Majeure Delay” occur, or if the Tenant Improvements have not been substantially completed by the Commencement Date due to any act, omission or default by Tenant, or anyone acting under or for Tenant, or due to any cause other than Landlord’s default, Landlord shall have no liability therefor, and the obligations of this Lease (including, without limitation, the obligation to pay Rent) shall nonetheless commence as of the date upon which the Commencement Date would have occurred but for such Tenant Delay, act, omission or default. If the Premises are not substantially completed due to a delay, act, omission or default by Landlord, then as Tenant’s sole remedy for the delay in Tenant’s occupancy of the Premises, the Commencement Date shall be delayed, and the Rent shall not commence, until the earlier of the date of actual occupancy by Tenant or the date on which the Tenant Improvements which Landlord has agreed to construct are substantially completed

(g) For the purposes hereof, the following terms shall have the following meanings:

(i) “Tenant Delay” shall mean any actual delay in the Commencement Date caused as a result of: (i) Change Orders, change by Tenant in the Final Space Plan or Tenant’s failure to timely deliver the updated Space Plan and construction documents in compliance with Section 4(a) above; (ii) failure by Tenant to fully incorporate and address Landlord’s comments (if any) to the updated Space Plan and deliver the Final Space Plan to Landlord on or before February 15, 2019; (iii) the inability of Landlord to substantially complete the Tenant Improvements solely because of Landlord’s inability to purchase any so called long-lead items required pursuant to the Space Plan; (iv) Tenant or any of its employees (or duly authorized contractors) interfering with completion of the Tenant Improvements; (v) Tenant’s failure to respond to a request in writing by Landlord for information about the Tenant Improvements within five (5) business days after Landlord delivers such written request to Tenant; and (vi) any work performed or to be performed by Tenant or its duly authorized contractors.

15

(ii) “Force Majeure Delay” shall mean a delay caused by any one or combination of the following events: on-site casualty, act of God, on-site explosion, war, invasion, insurrection, riot, mob violence, sabotage, strikes, lockouts, labor disputes, condemnation, governmental restriction first adopted and effective after the date the Lease has been signed and delivered or laws first adopted and effective after the date the Lease has been signed and delivered.

Landlord shall notify Tenant in writing of any act which Landlord reasonably believes may result in a Tenant Delay or a Force Majeure Delay within five (5) days of its occurrence.

(h) Within ten (10) days after the Commencement Date, Tenant will execute and deliver to Landlord a written declaration stating the Commencement Date and expiration date of the Initial Term pursuant to Exhibit E.

(i) Landlord’s title is and always will be paramount to the title of Tenant, and Tenant will not do or be empowered to do any act which encumbers or may encumber Landlord’s title or which subjects the Premises or the Building or any part of either to any lien. Tenant must immediately remove and cause to be fully released any and all liens or encumbrances which are filed against the Premises or the Building as a result of any act or omission of Tenant or Tenant’s Agents (but not if caused by a failure of Landlord to pay the cost of work that is paid by Landlord as part of the Tenant Allowance). If Tenant fails to remove and cause to be fully released any such lien within ten (10) business days following Tenant’s receipt of notice thereof, then Landlord may, but is not obligated to, remove such lien, and Tenant shall pay all costs of removal or bonding the lien to Landlord upon demand. Tenant shall never, under any circumstances, have the power to subject the interest of Landlord in the Premises, the Building, or the Land to any mechanic’s, materialmen’s, or construction liens of any kind. In order to comply with the provisions of Chapter 713.10, Florida Statutes, it is specifically provided that neither Tenant nor anyone claiming by, through or under Tenant, including, but not limited to, contractors, subcontractors, materialmen, mechanics and/or laborers, shall have any right to file or place any mechanics’, materialmen’s or construction liens of any kind whatsoever upon the Premises, the Building, the Land, or improvements thereon, and any such liens are hereby specifically prohibited. All parties with whom Tenant may deal are put on notice that Tenant has no power to subject Landlord’s interest to any mechanics’, materialmen’s or construction lien of any kind or character, and all such persons so dealing with Tenant must look solely to the credit of Tenant, and not to Landlord’s interest or assets. IN ADDITION, THE INTEREST OF LANDLORD IN THE PREMISES, THE BUILDING, AND THE LAND SHALL NOT BE SUBJECT TO LIENS FOR IMPROVEMENTS TO THE PREMISES, THE BUILDING, AND/OR THE LAND MADE BY TENANT, NOTWITHSTANDING ANY APPROVAL BY LANDLORD OF ANY CONTRACT(S) WITH ANY CONTRACTOR(S), AND/OR LANDLORD’S APPROVAL OF ANY SUCH IMPROVEMENT(S) AND/OR PLANS. PRIOR TO ENTERING INTO ANY CONTRACT FOR THE CONSTRUCTION OF ANY ALTERATION OR IMPROVEMENT, TENANT SHALL NOTIFY THE CONTRACTOR MAKING IMPROVEMENTS TO THE PREMISES, THE BUILDING AND/OR THE LAND OF THE FOREGOING PROVISION, AND TENANT’S KNOWING OR WILLFUL FAILURE TO PROVIDE SUCH NOTICE TO THE CONTRACTOR SHALL RENDER THE CONTRACT BETWEEN TENANT AND THE CONTRACTOR VOIDABLE AT THE OPTION OF THE CONTRACTOR. Simultaneously with the Landlord’s and Tenant’s execution of this Lease, but in no event, later than the filing of any notice of commencement against the Premises, Tenant agrees to execute and deliver to Landlord a memorandum of lease in such form as set forth in Exhibit F attached hereto and made a part hereof, which, among other things, sets forth the covenant against liens as described in this Section for purposes of compliance with Florida Statute 713.10. Tenant agrees that in no event shall a notice of commencement be recorded in the public records of Palm Beach County, Florida against the Premises prior to the recording of the memorandum of lease. Landlord shall have the right, in its sole and absolute discretion, to record the memorandum of lease in the public records of Palm Beach County, Florida. Further, Tenant appoints Landlord its attorney in fact coupled with an interest to terminate any such memorandum of lease which, if any, has been recorded, upon the expiration or termination of this Lease due to the lapse of time or otherwise.

16

(j) Except for the Tenant Improvements any alterations, additions, or improvements made by or on behalf of Tenant to the Premises (collectively, the “Alterations”) shall be subject to Landlord’s prior written consent, and shall (i) comply with all applicable laws, ordinances, rules and regulations; (ii) be compatible with the Building and its mechanical, electrical, HVAC and life safety systems; (iii) not interfere with the use and occupancy of any other portion of the Building by any other tenant or their invitees; (iv) not affect the structural portions of the Building; and, (v) not, whether alone or taken together with other improvements, require the construction of any other improvements or alterations within the Building. Tenant shall cause, at its sole cost and expense, all Alterations to comply with insurance requirements and with Laws and shall construct, at its sole cost and expense, any alteration or modification required by Laws as a result of any Alterations. All Alterations shall be constructed at Tenant’s sole cost and expense, in a first class and good and workmanlike manner by contractors reasonably acceptable to Landlord and only good grades of materials shall be used. All plans and specifications for any Alterations shall be submitted to Landlord for its approval, which shall not be unreasonably withheld, delayed or conditioned. Landlord may monitor construction of the Alterations, and except for the initial build out before the Commencement Date, Tenant shall reimburse Landlord for any reasonable out-of-pocket costs paid to third parties, which are incurred by Landlord in monitoring such construction. Landlord’s right to review plans and specifications and to monitor construction shall be solely for its own benefit, and Landlord shall have no duty to see that such plans and specifications or construction comply with applicable laws, codes, rules and regulations. Without limiting the other grounds upon which Landlord may refuse to approve any contractor or subcontractor, Landlord may take into account the desirability of maintaining harmonious labor relations at the Project. Landlord may also require that all life safety related work be performed by contractors designated by Landlord, and all mechanical, electrical, plumbing and roof related work be performed by contractors approved by Landlord, which approval shall not be unreasonably withheld. Landlord shall have the right, in its sole discretion, to instruct Tenant to remove those improvements or Alterations from the Premises upon the expiration of this Lease if Landlord conditions its approval of the Alterations on Tenant’s removal of the improvements at the expiration or earlier termination of the Lease. If upon the termination of this Lease Landlord requires Tenant to remove any or all of such Alterations from the Premises, then Tenant, at Tenant’s sole cost and expense, shall promptly remove such Alterations and improvements and Tenant shall repair and restore the Premises to its original condition as of the Commencement Date, reasonable wear and tear excepted. Any Alterations remaining in the Premises following the expiration of the Lease Term or following the surrender of the Premises from Tenant to Landlord shall become the property of Landlord unless Landlord notifies Tenant otherwise. Tenant shall provide Landlord with the identities and mailing addresses of all persons performing work or supplying materials, prior to beginning such construction, and Landlord may post on and about the Premises notices of non-responsibility pursuant to applicable law. Tenant shall assure payment for the completion of all work free and clear of liens and shall provide certificates of insurance for worker’s compensation and other coverage in amounts and from an insurance company reasonably satisfactory to Landlord protecting Landlord against liability for bodily injury or property damage during construction. Upon completion of any Alterations and upon Landlord’s reasonable request, Tenant shall deliver to Landlord sworn statements setting forth the names of all contractors and subcontractors who did work on the Alterations and final lien waivers from all such contractors and subcontractors. Additionally, upon completion of any Alteration, Tenant shall provide Landlord, at Tenant’s expense, with a complete set of plans in reproducible form and specifications reflecting the actual conditions of the Alterations, together with a copy of such plans on diskette in the AutoCAD format or such other format as may then be in common use for computer assisted design purposes. Tenant shall reimburse Landlord, as additional rent, the reasonable out-of-pocket costs of Landlord’s third-party engineers and other consultants for review of all plans, specifications and working drawings for the Alterations and for the incorporation of such Alterations in the Landlord’s master Building drawings, within fifteen (15) days after Tenant’s receipt of invoices either from Landlord or such consultants. In addition to such costs, Tenant shall pay to Landlord, within ten (10) days after completion of any Alterations, the actual, reasonable costs incurred by Landlord for services rendered by Landlord’s management personnel and engineers to coordinate and/or supervise any of the Alterations to the extent such services are provided in excess of or after the normal on-site hours of such engineers and management personnel.

(k) Tenant shall keep the Premises, the Building and the Project free from any and all liens arising out of any Alterations, work performed, materials furnished, or obligations incurred by or for Tenant. In the event that Tenant shall not, within ten (10) days following the imposition of any such lien, cause the same to be released of record by payment or posting of a bond in a form and issued by a surety acceptable to Landlord, Landlord shall have the right, but not the obligation, to cause such lien to be released by such means as it shall deem proper (including payment of or defense against the claim giving rise to such lien); in such case, Tenant shall reimburse Landlord for all amounts so paid by Landlord in connection therewith, together with all of Landlord’s costs and expenses, with interest thereon at the Default Rate (defined below) and Tenant shall indemnify and defend each and all of the Landlord Indemnitees (defined below) against any damages, losses or costs arising out of any such claim. Tenant’s indemnification of Landlord contained in this Paragraph shall survive the expiration or earlier termination of this Lease. Such rights of Landlord shall be in addition to all other remedies provided herein or by law.

17

(l) NOTICE IS HEREBY GIVEN THAT LANDLORD SHALL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO TENANT, OR TO ANYONE HOLDING THE PREMISES THROUGH OR UNDER TENANT, AND THAT NO MECHANICS’ OR OTHER LIENS FOR ANY SUCH LABOR, SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LANDLORD IN THE PREMISES.

(m) Nothing contained in this Lease shall be construed as consent on the part of Landlord to subject the estate of Landlord to liability under the Construction Lien Law of the State of Florida, it being expressly understood that the Landlord’s estate shall not be subject to such liability. Tenant shall strictly comply with the Construction Lien Law of the State of Florida as set forth in Chapter 713, Florida Statutes. Tenant agrees to obtain and deliver to Landlord prior to the commencement of any work or Alterations or the delivery of any materials, written and unconditional waivers of contractors’ liens with respect to the Premises, the Building and the Project Common Areas for all work, service or materials to be furnished at the request or for the benefit of Tenant to the Premises, and any Notice of Commencement filed by Tenant shall contain, in bold print, the first sentence of this Paragraph 4(e). Such waivers shall be signed by all architects, engineers, designers, contractors, subcontractors, materialmen and laborers to become involved in such work. Notwithstanding the foregoing, Tenant at its expense shall cause any lien filed against the Premises, the Building or the Common Areas of the Building or Project for work, services or materials claimed to have been furnished to or for the benefit of Tenant to be satisfied or transferred to bond within ten (10) days after Tenant’s having received notice thereof. In the event that Tenant fails to satisfy or transfer to bond such claim of lien within said ten (10) day period, Landlord may do so and thereafter charge Tenant as Additional Rent, all costs incurred by Landlord in connection with the satisfaction or transfer of such claim, including attorneys’ fees. Further, Tenant agrees to indemnify, defend, and save the Landlord harmless from and against any damage to and loss incurred by Landlord as a result of any such contractor’s claim of lien. If so requested by Landlord, Tenant, at Tenant’s cost, shall execute a short form or memorandum of this Lease, which may, in Landlord’s sole discretion be recorded in the Public Records of the County in which the Premises is located for the purpose of protecting Landlord’s estate from contractors’ Claims of Lien, as provided in Chapter 713.10, Florida Statutes. In the event such short form or memorandum of this Lease is executed, Tenant shall simultaneously execute and deliver to Landlord an instrument in recordable form terminating Tenant’s interest in the real property upon which the Premises are located, which instrument may be recorded by Landlord at the expiration or earlier termination of the term of this Lease. The security deposit paid by Tenant may be used by Landlord for the satisfaction or transfer of any Contractor’s Claim of Lien, as provided in this Paragraph. This Paragraph shall survive the termination of this Lease.

18

5. REPAIRS

(a) Landlord’s obligation with respect to repair as part of Basic Services shall be limited to (i) the structural portions of the Building including, without limitation, the foundation, (ii) the exterior walls of the Building, including, without limitation, glass and glazing, (iii) the roof, (iv) mechanical, electrical, heating, ventilating and air conditioning, plumbing and life safety systems [except for any lavatory, shower, toilet, wash basin and kitchen facilities that serve Tenant exclusively and any supplemental heating and air conditioning systems (including all plumbing connected to said facilities or systems)], (v) Common Areas (including paving), (vi) utility lines located outside of the Premises and (vii) life safety components of any backup generator for the Premises. Landlord shall not be deemed to have breached any obligation with respect to the condition of any part of the Project unless Tenant has given to Landlord written notice of any required repair and Landlord has not made such repair within a reasonable time following the receipt by Landlord of such notice. The foregoing notwithstanding: (i) Landlord shall not be required to repair damage to any of the foregoing to the extent caused by the acts or omissions of Tenant or it agents, employees or contractors, except to the extent covered by insurance carried by Landlord; and (ii) the obligations of Landlord pertaining to damage or destruction by casualty shall be governed by the provisions of Paragraph 9. Landlord shall have the right but not the obligation to undertake work of repair that Tenant is required to perform under this Lease and that Tenant fails or refuses to perform in a timely and efficient manner. All costs incurred by Landlord in performing any such repair for the account of Tenant (because of Tenant’s failure to perform such repair) shall be repaid by Tenant to Landlord upon demand, together with an administration fee equal to ten percent (10%) of such costs. Except as expressly provided in Paragraph 9 of this Lease, there shall be no abatement of Rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Premises, the Building or the Project. Tenant waives the right to make repairs at Landlord’s expense under any law, statute or ordinance now or hereafter in effect.

(b) Tenant, at its expense, (i) shall keep the Premises and all fixtures contained therein in a safe, clean and neat condition, and (ii) shall bear the cost of maintenance and repair, by contractors selected by Landlord, of all facilities which are not expressly required to be maintained or repaired by Landlord and which are located in the Premises, including, without limitation, lavatory, shower, toilet, wash basin and kitchen facilities, and supplemental heating and air conditioning systems (including all plumbing connected to said facilities or systems installed by or on behalf of Tenant or existing in the Premises at the time of Landlord’s delivery of the Premises to Tenant). Tenant shall make all repairs to the Premises not required to be made by Landlord under subparagraph (a) above with replacements of any materials to be made by use of materials of equal or better quality. Tenant shall do all decorating, remodeling, alteration and painting required by Tenant during the Lease Term. Tenant shall pay for the cost of any repairs to the Premises, the Building or the Project made necessary by any negligence or willful misconduct of Tenant or any of its assignees, subtenants, employees or their respective agents, representatives, contractors, or other persons permitted in or invited to the Premises or the Project by Tenant. If Tenant fails to make such repairs or replacements within fifteen (15) days after written notice from Landlord, Landlord may at its option make such repairs or replacements, and Tenant shall upon demand pay Landlord for the cost thereof, together with an administration fee equal to fifteen percent (15%) of such costs.

19

(c) Upon the expiration or earlier termination of this Lease, Tenant shall surrender the Premises in a safe, clean and neat condition, normal wear and tear excepted. Except as otherwise set forth in Paragraph 4(b) of this Lease, Tenant shall remove from the Premises all trade fixtures, furnishings and other personal property of Tenant and all computer and phone cabling and wiring installed by or on behalf of Tenant, shall repair all damage caused by such removal, and shall restore the Premises to its original condition, reasonable wear and tear excepted. Notwithstanding this paragraph, Tenant shall have no obligation to remove the FF&E of the Prior Occupant of the Premises as defined in Paragraph 24 of this Lease. In addition to all other rights Landlord may have, in the event Tenant does not so remove any such fixtures, furnishings or personal property, Tenant shall be deemed to have abandoned the same, in which case Landlord may store or dispose of the same at Tenant’s expense, appropriate the same for itself, and/or sell the same in its discretion.

6. USE OF PREMISES

(a) Tenant shall use the Premises only for a corporate headquarters which shall consist of executive offices, and general office space for the following business divisions and departments: administration, accounting, business development, marketing, sales, customer service, information technology and similar uses that are customary for a corporate headquarters facility (collectively, the “Permitted Use”), as permitted by applicable zoning and shall not use the Premises or permit the Premises to be used for any other purpose. Landlord shall have the right to deny its consent to any change in the Permitted Use of the Premises in its reasonable discretion.

(b) Use Contingency. This Lease shall be conditioned upon Tenant obtaining a zoning confirmation letter7 (the “Use Contingency”) on or before February 28, 2019 (the “Contingency Period”), from the City of Boca Raton, Florida, that either (i) confirms the Permitted Use as being permitted at the Premises under applicable zoning designation; or (ii) fails to identify the Permitted Use as prohibited at the Premises under applicable zoning designation. Tenant, within three (3) business days of its execution of this Lease, shall complete and submit all required applications and other necessary documentation to the City of Boca Raton, Florida to request (on an expedited basis, to extent possible) the zoning confirmation letter in satisfaction of the Use Contingency. True and accurate copies of all such applications shall be provided by Tenant to Landlord promptly after submission to the City of Boca Raton, Florida. Tenant shall use its commercially reasonable effort to pursue the satisfaction of the Use Contingency during the Contingency Period. Immediately upon receipt, Tenant shall provide Landlord with a true and accurate copy of the zoning confirmation letter. Following the exhaustion of all commercially reasonable and diligent efforts, in the event Tenant fails to satisfy the Use Contingency on or before the expiration of the Contingency Period, then Tenant may elect to terminate this Lease by delivery of written notice to Landlord prior to the expiration of the Contingency Period. If Tenant elects to terminate the Lease prior to the expiration of the Contingency Period in accordance herewith, then within five (5) business days following the expiration of the Contingency Period and receipt of an invoice from Landlord, Tenant shall reimburse Landlord for the actual costs incurred by Landlord in connection with the preparation of the Space Plan, Final Space Plan and the Tenant Improvements, in an amount not to exceed $10,000.00. If Tenant fails to timely terminate this Lease in accordance with the conditions of this Section, then the Use Contingency and corresponding termination option shall be automatically deemed waived, void and of no further force or effect.

| 7 | Or local equivalent, as applicable. |

20

(c) Tenant shall not at any time use or occupy the Premises, or permit any act or omission in or about the Premises in violation of any law, statute, ordinance or any governmental rule, regulation or order (collectively, “Law” or “Laws”) and Tenant shall, upon written notice from Landlord, discontinue any use of the Premises which is declared by any governmental authority to be a violation of Law. Tenant shall be responsible for compliance with all Laws within the Premises including, without limitation, the Americans with Disabilities Act (which shall be included within the meaning of “Law” or “Laws” hereunder) and the cost of such compliance may be paid from funds available in the Allowance, and if any Law shall, by reason of the nature of Tenant’s Permitted Use or particular use or particular manner of use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to (i) modification or other maintenance of the Premises, the Building or the Project, or (ii) the use, Alteration or occupancy thereof, Tenant shall comply with such Law at Tenant’s sole cost and expense; provided that Tenant shall not be required to modify or otherwise improve the Premises unless required as a result of any Tenant Improvements or other Alterations or Tenant’s particular use of the Premises. Landlord shall be responsible to assure that the Building (excluding the Premises) and the Common Areas of the Building and the Project comply with all Laws at Landlord’s sole cost and expense; provided that any costs of such compliance incurred by Landlord as a result of changes to Laws effective subsequent to the Effective Date shall be a component of “Operating Expenses” as defined in Paragraph 3(c).

(d) Tenant shall not at any time use or occupy the Premises in violation of the certificates of occupancy issued for or restrictive covenants pertaining to the Building or the Premises, and in the event that any architectural control committee or department of the state or the city or county in which the Project is located shall at any time contend or declare that the Premises are used or occupied in violation of such certificate or certificates of occupancy or restrictive covenants, Tenant shall, upon ten(10) business days notice from Landlord or any such governmental agency, immediately discontinue such use of the Premises (and otherwise remedy such violation). The failure by Tenant to discontinue such use shall be considered a default under this Lease and Landlord shall have the right to exercise any and all rights and remedies provided herein or by Law. Any statement in this Lease of the nature of the business to be conducted by Tenant in the Premises shall not be deemed or construed to constitute a representation or guaranty by Landlord that such business is or will continue to be lawful or permissible under any certificate of occupancy issued for the Building or the Premises, or otherwise permitted by Law.

(e) Tenant shall not do or permit to be done anything which may invalidate or increase the cost of any fire, All Risk, Causes of Loss - Special Form or other insurance policy covering the Building, the Project and/or property located therein and shall comply with all rules, orders, regulations and requirements of the appropriate fire codes and ordinances or any other organization performing a similar function. In addition to all other remedies of Landlord, Landlord may require Tenant, promptly upon demand, to reimburse Landlord for the full amount of any additional premiums charged for such policy or policies by reason of Tenant’s failure to comply with the provisions of this Paragraph 6.

21

(f) Tenant shall not in any way interfere with the rights or quiet enjoyment of other tenants or occupants of the Premises, the Building or the Project. Tenant shall not use or allow the Premises to be used for any improper, immoral, or unlawful purpose, nor shall Tenant cause, maintain, or permit any nuisance in, on or about the Premises, the Building or the Project. Tenant shall not place weight upon any portion of the Premises exceeding the structural floor load (per square foot of area) which such area was designated (and is permitted by Law) to carry or otherwise use any Building system in excess of its capacity or in any other manner which may damage such system or the Building. Tenant shall not create within the Premises a working environment with a density of greater than the maximum density permitted by Law. Business machines and mechanical equipment shall be placed and maintained by Tenant, at Tenant’s expense, in locations and in settings sufficient in Landlord’s reasonable judgment to absorb and prevent vibration, noise and annoyance. Tenant shall not commit or suffer to be committed any waste in, on, upon or about the Premises, the Building or the Project.

(g) Tenant shall take all reasonable steps necessary to adequately secure the Premises from unlawful intrusion, theft, fire and other hazards, and shall keep and maintain any and all security devices in or on the Premises in good working order, including, but not limited to, exterior door locks for the Premises and smoke detectors and burglar alarms located within the Premises and shall cooperate with Landlord and other tenants in the Project with respect to access control and other safety matters.