SECOND AMENDED AND RESTATED SECOND LIEN CREDIT AGREEMENT DATED AS OF February 12, 2018 Between: PLATINUM GROUP METALS LTD. as Borrower - and - PLATINUM GROUP METALS (RSA) PROPRIETARY LIMITED as Guarantor - and - LIBERTY METALS & MINING HOLDINGS, LLC...

SECOND AMENDED AND RESTATED SECOND LIEN CREDIT AGREEMENT

DATED AS OF February 12, 2018

Between:

PLATINUM GROUP METALS LTD.

as Borrower

- and -

PLATINUM GROUP METALS (RSA) PROPRIETARY LIMITED

as Guarantor

- and -

LIBERTY METALS & MINING HOLDINGS, LLC

as Production

Payment Termination Fee Holder

- and -

LIBERTY METALS & MINING HOLDINGS, LLC

as Agent

- and -

THE SEVERAL LENDERS FROM TIME TO TIME PARTY HERETO

as

Lenders

TABLE OF CONTENTS

| Page | ||

| ARTICLE 1 INTERPRETATION | 2 | |

| 1.1 | Definitions | 2 |

| 1.2 | Subdivisions, Table of Contents and Headings | 24 |

| 1.3 | References to Bodies Corporate, Statutes, Contracts | 24 |

| 1.4 | Currency | 25 |

| 1.5 | Use of the Words “Best Knowledge” | 25 |

| 1.6 | Governing Law | 25 |

| 1.7 | Paramountcy | 26 |

| 1.8 | Interpretation | 26 |

| 1.9 | Time of Essence | 26 |

| 1.10 | Rule of Construction | 26 |

| 1.11 | Pro Rata Shares | 27 |

| ARTICLE 2 THE FACILITY | 27 | |

| 2.1 | The Facility | 27 |

| 2.2 | Non-Revolvement | 27 |

| 2.3 | Term | 27 |

| 2.4 | Interest | 27 |

| 2.5 | Default Interest | 28 |

| 2.6 | Computations | 28 |

| 2.7 | No Set-off | 28 |

| 2.8 | Consideration | 28 |

| 2.9 | Administrative Matters Re: Payments | 29 |

| 2.10 | Time and Place of Payments | 29 |

| 2.11 | Remittance of Payments | 29 |

| 2.12 | Evidence of Indebtedness | 30 |

| 2.13 | Lenders’ Securities Law Matters | 30 |

| ARTICLE 3 PREPAYMENT, REPAYMENT AND REDUCTIONS | 30 | |

| 3.1 | Voluntary Prepayment | 30 |

| 3.2 | Asset Sale Mandatory Prepayment | 30 |

| 3.3 | Financing Mandatory Prepayment | 31 |

ii

| 3.4 | Insurance Mandatory Prepayment | 31 |

| 3.5 | Mnombo and Waterberg Mandatory Prepayment | 31 |

| 3.6 | Application of Mandatory Prepayments | 32 |

| 3.7 | RBPlat Transaction Payments | 32 |

| 3.8 | Paramountcy of First Lien Facility | 32 |

| 3.9 | Priority of Payments | 32 |

| ARTICLE 4 SECURITY | 32 | |

| 4.1 | Security Documents | 32 |

| 4.2 | Registration of the Security | 33 |

| ARTICLE 5 CONDITIONS PRECEDENT | 33 | |

| 5.1 | Conditions Precedent to Effectiveness of Agreement | 33 |

| 5.2 | Waiver | 34 |

| ARTICLE 6 REPRESENTATIONS AND WARRANTIES | 35 | |

| 6.1 | Representations and Warranties of the Credit Parties | 35 |

| 6.2 | Representations and Warranties Relating to ▇▇▇▇▇▇ | ▇▇ |

| 6.3 | Reliance | 51 |

| 6.4 | Survival and Inclusion | 51 |

| ARTICLE 7 COVENANTS OF THE CREDIT PARTIES | 51 | |

| 7.1 | Positive Covenants | 51 |

| 7.2 | Additional Positive Covenants | 54 |

| 7.3 | Negative Covenants | 58 |

| 7.4 | Reimbursement of Expenses | 63 |

| 7.5 | Agent May Perform Covenants | 64 |

| ARTICLE 8 DEFAULT AND ENFORCEMENT | 64 | |

| 8.1 | Events of Default | 64 |

| 8.2 | Acceleration on Default | 69 |

| 8.3 | Waiver of Default | 69 |

| 8.4 | Enforcement by the Agent | 70 |

| 8.5 | Set-Off | 70 |

| 8.6 | Agent Appointed Attorney | 70 |

| 8.7 | Remedies Cumulative | 70 |

| ARTICLE 9 AGENT | 71 | |

| 9.1 | Appointment and Authorization of Agent | 71 |

| 9.2 | Interest Holders | 71 |

iii

| 9.3 | Consultation with Counsel | 71 |

| 9.4 | Documents | 71 |

| 9.5 | Agent as Lender | 71 |

| 9.6 | Responsibility of Agent | 72 |

| 9.7 | Action by Agent | 72 |

| 9.8 | Notice of Events of Default | 72 |

| 9.9 | Responsibility Disclaimed | 73 |

| 9.10 | Indemnification | 73 |

| 9.11 | Credit Decision | 73 |

| 9.12 | Successor Agent | 74 |

| 9.13 | Delegation by Agent | 74 |

| 9.14 | Waivers and Amendments | 74 |

| 9.15 | Delegation by Agent Conclusive and Binding | 75 |

| 9.16 | Adjustments among Lenders after Acceleration | 76 |

| 9.17 | Redistribution of Payment | 76 |

| 9.18 | Distribution of Notices | 77 |

| 9.19 | Discharge of Security | 77 |

| 9.20 | Decision to Enforce Security | 77 |

| 9.21 | Enforcement | 77 |

| 9.22 | Application of Cash Proceeds of Realization | 78 |

| 9.23 | Collective Action of the Transaction Parties | 79 |

| 9.24 | Assignment of Security | 79 |

| ARTICLE 10 NOTICES | 79 | |

| 10.1 | Notice to the Borrower | 79 |

| 10.2 | Notice to the Finance Parties | 80 |

| 10.3 | Valid Notice | 80 |

| 10.4 | Waiver of Notice | 81 |

| ARTICLE 11 INDEMNITIES, TAXES, CHANGES IN CIRCUMSTANCES | 81 | |

| 11.1 | General Indemnity | 81 |

| 11.2 | Environmental Indemnity | 82 |

| 11.3 | Action by Agent to Protect Interests | 82 |

| 11.4 | Currency Indemnity | 83 |

| 11.5 | Payments Free and Clear of Taxes | 83 |

| ARTICLE 12 MISCELLANEOUS | 87 | |

iv

| 12.1 | No Waiver; Remedies Cumulative | 87 |

| 12.2 | Survival | 87 |

| 12.3 | Benefits of Agreement | 87 |

| 12.4 | Binding Effect; Assignment | 87 |

| 12.5 | Maximum Return | 89 |

| 12.6 | Entire Agreement | 90 |

| 12.7 | Severability | 90 |

| 12.8 | Counterparts and Electronic Transmission | 90 |

| SCHEDULE A LENDERS, PRINCIPAL ADVANCED AND NOTICE PARTICULARS | 1 | |

| SCHEDULE B SECURITY DOCUMENTS | 1 | |

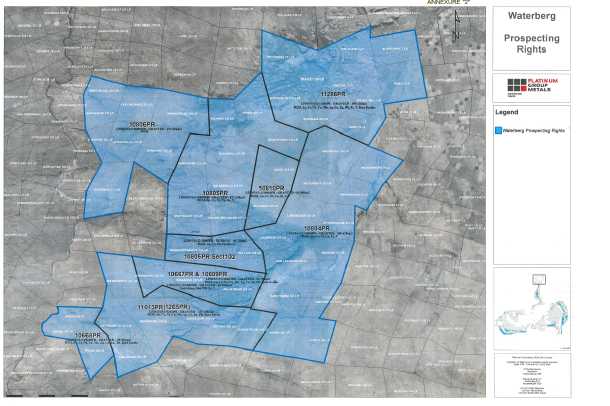

| SCHEDULE C PROJECT MAP | 2 | |

| SCHEDULE D MATERIAL AGREEMENTS | 1 | |

| SCHEDULE E EQUITY INTERESTS OF CREDIT PARTIES AND SUBSIDIARIES | 1 | |

| SCHEDULE F ACCOUNTS | 1 | |

SECOND AMENDED AND RESTATED SECOND LIEN CREDIT AGREEMENT

THIS AGREEMENT made as of February 12, 2018

BETWEEN:

PLATINUM GROUP METALS LTD., a

company existing

under the laws of British Columbia

(the “Borrower”) AND:

PLATINUM GROUP METALS

(RSA) PROPRIETARY

LIMITED, a company existing under

the laws of South Africa, as

Guarantor

AND:

LIBERTY METALS & MINING

HOLDINGS, LLC, a limited

liability company formed under the laws of

Delaware, as

Production Payment Termination Fee Holder

AND:

LIBERTY METALS & MINING

HOLDINGS, LLC, a limited

liability company formed under the laws of

Delaware, as Agent

AND:

THE SEVERAL LENDERS FROM TIME TO

TIME PARTY

HERETO AS LENDERS

WHEREAS the parties hereto entered into a second lien credit agreement dated as of November 2, 2015 (the “Initial Credit Agreement”) as amended by a first credit agreement modification agreement dated as of May 3, 2016, a second credit agreement modification agreement dated as of September 19, 2016, a third credit agreement modification agreement dated as of January 13, 2017, a fourth credit agreement modification agreement dated as of April 13, 2017, a fifth credit agreement modification agreement dated as of June 13, 2017, a sixth credit agreement modification agreement dated as of June 27, 2017 and the Side Letter (the Initial Credit Agreement as so amended, the “Previous Credit Agreement”) and amended and restated by an amended and restated second lien credit agreement dated as of October 30, 2017 (the “Existing Credit Agreement”);

AND WHEREAS the Borrower, Guarantor and Liberty Metals & Mining Holdings, LLC entered into a Production Payment Agreement Termination Agreement dated October 30, 2017, pursuant to which they terminated the Production Payment Agreement (as hereinafter defined) in consideration for the payment by the Borrower to Liberty Metals & Mining Holdings, LLC of the Termination Fee (or if applicable, the Reduced Termination Fee);

2

AND WHEREAS the Agent, the Lenders and the Production Payment Termination Fee Holder consented on the date hereof to the sale of the Project pursuant to the terms of the RBPlat Transaction Documents;

AND WHEREAS the parties hereto wish to amend and restate the Existing Credit Agreement as follows.

NOW THEREFORE for good and valuable consideration, the receipt and sufficiency of which are acknowledged, each of the parties agrees with each of the others as follows:

ARTICLE 1

INTERPRETATION

| 1.1 | Definitions |

In this Agreement, unless there is something in the subject matter or context inconsistent therewith:

“2018 SARB Approval” has the meaning attributed to such term in Section 7.2(s);

“Advance” means the advance of the Facility contemplated herein;

“Affiliate” has the meaning attributed to that term in the Business Corporations Act (British Columbia) and for the purposes of this Agreement includes Subsidiaries;

“Affiliate Transaction” has the meaning attributed to that term in Section 7.3(k);

“Africa Wide” means Africa Wide Mineral Prospecting and Exploration (Pty) Ltd.;

“Africa Wide Claim” has the meaning ascribed to that term in clause 7.3 of the Scheme Agreement;

“Agent” means Liberty Metals & Mining Holdings, LLC, in its capacity as agent of the Lenders and the Production Payment Termination Fee Holder as contemplated by this Agreement, and any successor thereto pursuant to Section 9.12;

“Aggregate Consideration” has the meaning attributed to such term in Section 8.1(v);

“Agreement”, “this Agreement”, “hereto”, “hereby”, “hereunder”, “hereof”, “herein” and similar expressions refer to this amended and restated second lien credit agreement and not to any particular Article, section, subsection, paragraph, clause, subdivision or other portion hereof, and include any and every supplemental agreement; and the expressions “Article”, “Section”, “subsection” and “paragraph” followed by a number mean and refer to the specified Article, section, subsection or paragraph of this Agreement;

3

“AIF” means the Borrower’s annual information form for the fiscal year ended August 31, 2017;

“Amount Payable” means any principal amount advanced and any other amount payable hereunder or under any of the Facility Documents;

“Amendment Fee Shares” has the meaning attributed to such term in the Previous Credit Agreement;

“Anti-Corruption Policy” means the anti-bribery and anti-corruption policy adopted by the board of directors of the Borrower;

“Applicable Law” means, at any time, with respect to any Person, property, transaction, event or other matter, as applicable, all laws, rules, statutes, regulations, treaties, orders, judgments and decrees, and all official requests, directives, rules, guidelines, orders, policies, practices and other requirements of any Governmental Authority relating or applicable at such time to such Person, property, transaction, event or other matter, and also includes any interpretation thereof by any Person having jurisdiction over it or charged with its administration or interpretation;

“Applicable Securities Legislation” means all applicable securities laws of each of the Reporting Jurisdictions and the respective rules and regulations under such laws together with applicable published fee schedules, prescribed forms, policy statements, national or multilateral instruments, orders, blanket rulings and other applicable regulatory instruments of the securities regulatory authorities in any of the Reporting Jurisdictions and such other jurisdictions as may be agreed to between the Borrower and the Agent;

“arm’s length” has the meaning attributed to that term in the ITA;

“Authorization” means any authorization, consent, permit, certificate, approval, resolution, licence, concession, exemption, filing, notarization or registration;

“BCSC” means the British Columbia Securities Commission;

“Blocked Account” means the bank account referenced in Schedule A, Part I of the Blocked Account Agreement and which bank account is subject to the terms of the Blocked Account Agreement;

“Blocked Account Agreement” means a blocked account agreement, in form and substance satisfactory to the Agent, entered into (or to be entered into) among the Borrower, the Agent and Royal Bank of Canada as host financial institution for the Blocked Account;

“BMONB” has the meaning attributed to such term in Section 7.3(aa) hereof;

“BMONB Letter Agreement” has the meaning attributed to such term in Section 7.3(aa) hereof;

4

“Business Day” means any day (other than Saturday, Sunday or a statutory holiday) when banks are open in the cities of Vancouver, British Columbia, Toronto, Ontario and Johannesburg, South Africa;

“Call Option Agreement” has the meaning attributed to such term in Schedule D;

“Capital Expenditures” means expenditures made by the Borrower on a consolidated basis in any period for tangible assets (after deducting the net proceeds received by the Borrower on a consolidated basis during such period from the disposal of similar tangible assets in the Ordinary Course of Business) required to be classified as fixed assets or leasehold improvements on the balance sheet of the Borrower on a consolidated basis in accordance with IFRS;

“Capital Lease” means, with respect to a Person, a lease or other arrangement in respect of real or personal property that is required to be classified and accounted for as a capital lease obligation on a balance sheet of the Person in accordance with IFRS;

“Capital Lease Obligation” means, with respect to a Person, the obligation of the Person to pay rent or other amounts under a Capital Lease and for the purposes of this definition, the amount of such obligation at any date shall be the capitalized amount of such obligation at such date as determined in accordance with IFRS;

“Care & Maintenance Budget” has the meaning attributed to that term in the Side Letter Consent;

“Cash Proceeds of Realization” means the aggregate of (a) all Proceeds of Realization in the form of cash, and (b) all cash proceeds of the sale or disposition of non-cash Proceeds of Realization, in each case expressed in U.S. Dollars;

“Cash Sweep” has the meaning ascribed to that term in Section 3.3;

“Cession and Pledge in Security” has the meaning attributed to that term in Schedule B hereto;

“Change of Control” means the occurrence of any of the following events:

| (a) |

a report is filed with any securities commission or securities regulatory authority in Canada, disclosing that any offeror (as such term is defined in Section 1.1 of Multilateral Instrument 62-104), has acquired beneficial ownership (within the meaning of the Securities Act) of, or the power to exercise control or direction over, or securities convertible into, any Voting Shares of the Borrower, that together with the offeror’s securities (as such term is defined in Section 1.1 of Multilateral Instrument 62-104) in relation to the Voting Shares of the Borrower, would constitute Voting Shares of the Borrower representing more than 30% of the total voting power attached to all Voting Shares of the Borrower then outstanding; |

5

| (b) |

any amalgamation, consolidation, statutory arrangement (involving a business combination) or merger of any Credit Party is consummated (1) in which such Credit Party is not the continuing or surviving corporation, or (2) pursuant to which any Voting Shares of such Credit Party would be reclassified, changed or converted into or exchanged for cash, securities or other property, other than (in each case) an amalgamation, consolidation, statutory arrangement or merger of any Credit Party in which the holders of the Voting Shares of such Credit Party immediately prior to the amalgamation, consolidation, statutory arrangement or merger have, directly or indirectly, more than 50% of the Voting Shares of the continuing or surviving corporation immediately after such transaction; | |

|

| ||

| (c) |

any Person or group of Persons shall succeed in having a sufficient number of its nominees elected as Directors of the Borrower such that such nominees, when added to any existing Directors after such election who was a nominee of or is an Affiliate or related Person of such Person or group of Persons, will constitute a majority of the Directors; | |

|

| ||

| (d) |

Maseve ceases to be a direct Subsidiary of the Guarantor (other than pursuant to the RBPlat Transactions); or | |

|

| ||

| (e) |

the Guarantor shall cease to be a direct wholly-owned Subsidiary of the Borrower; |

“Closing Date” means the date on which the conditions precedent to the effectiveness of this Agreement or any amendment or modification to this Agreement are satisfied, fulfilled or otherwise met to the satisfaction of the Transaction Parties, as the case may be;

“Code” means the United States Internal Revenue Code of 1986;

“Common Shares” means common shares in the capital of the Borrower as such common shares exist at the close of business on the date of execution and delivery of this Agreement;

“Consideration Shares” means the RBPlat Shares received by the Guarantor pursuant to the Scheme Agreement;

“Consideration Share Pledge Agreement” means the first lien pledge agreement and account control agreement, each in form and substance satisfactory to the Agent, to be executed and delivered by the Guarantor prior to each issuance of Consideration Shares, pursuant to which the Guarantor pledges all of its interest in the Consideration Shares in favour of the Agent and which share pledge shall rank in priority to all other claims, liens and encumbrances;

“Constating Documents” means:

| (a) |

with respect to a corporation, its articles of incorporation, amalgamation or continuance or other similar documents and its by-laws or other similar documents; and |

6

| (b) |

with respect to any other Person which is an artificial body, whether with or without legal personality, the organization and governance documents of such Person, |

in each case as amended or supplemented from time to time;

“Contingent Liabilities” means, with respect to a Person, any agreement, undertaking or arrangement by which the Person guarantees, endorses or otherwise becomes or is contingently liable upon (by direct or indirect agreement, contingent or other, to provide funds for payment, to supply funds to, or otherwise to invest in a debtor, or otherwise to assure a creditor against loss) the obligation, debt or other liability of any other Person or guarantees the payment of dividends or other distributions upon the shares (or other ownership interests) of any Person. The amount of any contingent liability will, subject to any limitation contained therein, be deemed to be the outstanding principal amount (or maximum principal amount, if larger) of the obligation, debt or other liability to which the contingent liability is related;

“Credit Parties” means the Borrower and the Guarantor and “Credit Party” means any one of them;

“Current Assets” means, at any time, all cash and accounts receivable from third parties (net of accounts receivable which are more than 30 past due) on the consolidated balance sheet of the Borrower, determined as of such time in accordance with IFRS;

“Current Liabilities” means, at any time, all accounts payable and accrued liabilities to third parties (excluding the Facility and the First Lien Facility) on the consolidated balance sheet of the Borrower, determined as of such time in accordance with IFRS;

“Default” means an Event of Default or any event or circumstance which would (with the expiry of a grace period, the giving of notice, the making of any determination or any combination of any of the foregoing) be an Event of Default;

“Deposit” means the amount of ZAR41,367,300 paid by RBPlat, on behalf of Royal Bafokeng Resources Proprietary Limited into the Escrow Account on October 9, 2017;

“Deposit Amount” means the sum of the Deposit and ZAR 676,883.31;

“Deposit Consideration” has the meaning attributed to such term in Section 8.1(v);

“Deposit Security Agreement” has the meaning attributed to such term in Section 7.2(y);

“DFS Plan and Budget” has the meaning attributed to that term in the Side Letter Consent;

“Direct Agreement” has the meaning attributed to such term in Schedule D;

7

“Director” means a director of the Borrower for the time being and “Directors” means the board of directors of the Borrower or, whenever duly empowered, a committee of the board of directors of the Borrower, and reference to action by the Directors means action by the directors as a board or action by such a committee of the board as a committee;

“Drawdown” means the borrowing or credit of funds by way of the Advance in an amount of $40,000,000;

“Drawdown Shares” has the meaning attributed to such term in the Previous Credit Agreement;

“Enforcement Date” means the date on which the Agent notifies the Borrower, pursuant to Section 8.2, that the entire unpaid principal amount of the Facility is forthwith due and payable or on which such indebtedness automatically becomes due and payable pursuant to such section, whichever occurs first;

“Environmental Deposit Amount” has the meaning attributed to such term in the Scheme Agreement;

“Environmental Laws” means all federal, provincial, state, municipal, county, local and other laws including statutes, codes, ordinances, by-laws, rules, regulations, policies, guidelines, certificates, approvals, permits, consents, directions, standards, judgments, orders and other Authorizations, as well as common law, civil law and other jurisprudence or authority, in each case, domestic or foreign, having the force of law at any time relating in whole or in part to any Environmental Matters and any permit, order, direction, certificate, approval, consent, registration, licence or other Authorization of any kind held or required to be held in connection with any Environmental Matters;

“Environmental Matters” means:

| (a) |

any condition, any activity, or substance, heat, energy, sound, vibration, radiation, odour or other pollution that either (1) may affect ambient or indoor air, water, soils, land, groundwater or other sub-surface strata or affect human health, including workplace safety, or any plant, animal or other living organism or (2) may give rise to any violation of, liability or any claim under any Environmental Law; and | |

|

| ||

| (b) |

any use, generation, distribution, disposal, storage, transportation, processing, management, handling, manufacture, treatment, release, spilling, emitting, leaching, migrating or discharge of any Hazardous Material or other pollution on, at or into ambient or indoor air, water, soils, land, groundwater or other sub- surface strata or any other location from which any such Hazardous Material or pollution may enter any ambient or indoor air, water, soils, land, groundwater or other sub-surface strata; |

“Escrow Account” has the meaning attributed to such term in the RBPlat Escrow Agreement;

8

“Escrow Agreement” means the escrow agreement dated October 30, 2017 between the Borrower, the Guarantor, the First Lien Agent, the Agent and counsel to the First Lien Agent;

“Event of Default” has the meaning attributed to such term in Section 8.1 hereof;

“Exchanges” means the TSX and the NYSE MKT LLC and each of their respective successors thereto;

“Excluded Taxes” means, with respect to a Finance Party or Tax Related Person (each, a “Recipient”) and any payment to be made to a Recipient by or on account of any obligation of any Credit Party under any of the Facility Documents, (i) any Taxes imposed on (or measured by) its net or gross income or any other Taxes imposed as a result of such Recipient being organized or having its principal office located in or, in the case of any Finance Party or Tax Related Person, having its applicable lending office located in, the taxing jurisdiction or that are Other Connection Taxes, and (ii) any US federal withholding tax under FACTA;

“Existing Credit Agreement” has the meaning attributed to such term in the recitals hereof;

“Facility” has the meaning attributed to such term in Section 2.1 hereof;

“Facility Documents” means this Agreement, the Security Documents, the Production Payment Agreement Termination Agreement, the Side Letter, the Side Letter Consent, the Escrow Agreement and all other certificates, instruments, notices and documents delivered or to be delivered by the Credit Parties hereunder or thereunder, each as amended, modified, supplemented, restated or replaced from time to time;

“Facility Indebtedness” means all present and future debts, liabilities and obligations of the Borrower and each other Credit Party to any of the Finance Parties under or in connection with this Agreement and the other Facility Documents, including all Amounts Payable, the Termination Fee and all fees, interest and other money payable or owing from time to time pursuant to the terms of this Agreement or the Production Payment Agreement Termination Agreement;

“FACTA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantially comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to current Section 1471(b)(l) of the Code (or any amended or successor version described above) and any intergovernmental agreements implementing any of the foregoing and related legislation or official administrative rules or practices with respect thereto;

“Finance Parties” means the Agent and the Lenders and where the context requires or permits, the Production Payment Termination Fee Holder;

9

“Financial Instrument Obligations” means, with respect to any Person, obligations arising under:

| (a) |

interest rate swap agreements, forward rate agreements, floor, cap or collar agreements, futures or options, insurance or other similar agreements or arrangements, or any combination thereof, entered into or guaranteed by the Person where the subject matter thereof is interest rates or the price, value or amount payable thereunder is dependent or based upon interest rates or fluctuations in interest rates in effect from time to time (but excluding non- speculative conventional floating rate Indebtedness); | |

|

| ||

| (b) |

currency swap agreements, cross-currency agreements, forward agreements, floor, cap or collar agreements, futures or options, insurance or other similar agreements or arrangements, or any combination thereof, entered into or guaranteed by the Person where the subject matter thereof is currency exchange rates or the price, value or amount payable thereunder is dependent or based upon currency exchange rates or fluctuations in currency exchange rates in effect from time to time; and | |

|

| ||

| (c) |

any agreement for the making or taking of any commodity (including but not limited to platinum, gold, silver, copper, nickel, cobalt, coal, natural gas, oil and electricity), swap agreement, floor, cap or collar agreement or commodity future or option or other similar agreement or arrangement, or any combination thereof, entered into or guaranteed by the Person where the subject matter thereof is any commodity or the price, value or amount payable thereunder is dependent or based upon the price or fluctuations in the price of any commodity; |

or any other similar transaction, including any option to enter into any of the foregoing, or any combination of the foregoing, in each case to the extent of the net amount due or accruing due by the Person under the obligations determined by marking the obligations to market in accordance with their terms;

“First Addendum to Sale of Business Agreement” means the Amended and Restated First Addendum to the Sale of Business Agreement between RBPlat Purchaser, Maseve and the Guarantor;

“First Addendum to Scheme Agreement” means the Amended and Restated First Addendum to the Scheme Implementation Agreement between RBPlat, Maseve and the Guarantor;

“First Lien Agent” means Sprott Resource Lending Partnership, in its capacity as administrative agent under the First Lien Credit Agreement, and any successors thereto in such capacity;

“First Lien Credit Agreement” means the senior secured first lien amended and restated credit agreement dated as of October 11, 2016 (as amended from time to time) among Platinum Group Metals Ltd., as borrower, Platinum Group Metals (RSA) Proprietary Limited, as guarantor, Sprott Resource Lending Partnership, as administrative agent and the several lenders from time to time party thereto as lenders;

10

“First Lien Default” means an Event of Default, as each such term is defined in the First Lien Credit Agreement;

“First Lien Facility” means the Facility, as defined in the First Lien Credit Agreement;

“First Lien Facility Documents” means the Facility Documents, as defined in the First Lien Credit Agreement;

“First Lien Facility Indebtedness” means the Facility Indebtedness, as defined in the First Lien Credit Agreement;

“First Lien Security” means the Security, as defined in the First Lien Credit Agreement;

“First Lien Termination Date” means the date on which all First Lien Facility Indebtedness has been permanently paid in full;

“First Outside Financing Date” has the meaning ascribed to that term in Section 7.1(n);

“First Required Financing” has the meaning attributed to such term in Section 7.1(n) hereof;

“Group” means the Credit Parties and each of their Subsidiaries;

“Governmental Authority” means each national, state, provincial, county, municipal or other such governmental, legislative, regulatory or other public authority (whether domestic or foreign), including their authorized administrative bodies, boards, tribunals, courts, commissions and agencies which has legal jurisdiction over a Person or a matter relevant to this Agreement;

“Guarantee” has the meaning attributed to that term in Schedule B hereto;

“Guarantor” means Platinum Group Metals (RSA) Proprietary Limited, a company incorporated under the laws of the Republic of South Africa, and any other guarantors from time to time party hereto, and their respective successors and permitted assigns;

“Hazardous Materials” means any radioactive materials, asbestos materials, urea formaldehyde, pollutants, deleterious substances, dangerous substances or goods, hazardous, corrosive or toxic substances, hazardous waste or waste of any kind or any other substance the storage, manufacture, disposal, treatment, generation, use, transport, remediation or release into the environment of which impairs or may impair the environment, injure or damage property, plant or animal life, or harm or impair the health of any individual;

“IASB” means the International Accounting Standards Board or any successor thereto;

11

“IFRS” means international financial reporting standards, approved by the IASB, as at the date on which any calculation or determination is required to be made, provided that, in accordance with such international financial reporting standards, where the IASB includes a recommendation concerning the treatment of any accounting matter, such recommendation shall be regarded as the only international financing reporting standard;

“Impala” means Impala Platinum Holdings Limited;

“Impala Guarantor Pledge Agreement” has the meaning attributed to such term in Schedule B;

“Impala Transactions” has the meaning attributed to that term in the Side Letter Consent;

“Indebtedness” means, with respect to a Person, without duplication:

| (a) |

all obligations of the Person for borrowed money, including debentures, notes or similar instruments and other financial instruments and obligations with respect to bankers’ acceptances and contingent reimbursement obligations relating to letters of credit; | |

|

| ||

| (b) |

all Financial Instrument Obligations of the Person; | |

|

| ||

| (c) |

all Capital Lease Obligations and Purchase Money Obligations of the Person; | |

|

| ||

| (d) |

all Indebtedness of any other Person secured by a Security Interest on any asset of the Person; | |

|

| ||

| (e) |

all obligations to repurchase or redeem any Common Shares or any other shares of the Borrower prior to the Stated Maturity Date; | |

|

| ||

| (f) |

all Contingent Liabilities of the Person with respect to obligations of another Person if such obligations are of the type referred to in paragraphs (a) to (f) above; and | |

|

| ||

| (g) |

all financial obligations under the Production Payment Agreement Termination Agreement; |

“Indemnified Parties” has the meaning attributed to such term in Section 11.1 hereof;

“Indemnified Taxes” means Taxes imposed on or with respect to any payment made by or on account of any obligation of any Credit Party under any Facility Document other than Excluded Taxes;

“Initial Credit Agreement” has the meaning attributed to such term in the recitals hereof;

12

“Initial Lender” means Liberty Metals & Mining Holdings, LLC as Lender on the date hereof;

“Initial Lender’s Certificate” has the meaning attributed to such term in the Previous Credit Agreement;

“Intercreditor Agreement” means the intercreditor agreement to be dated November 19, 2015 among the Agent, the First Lien Agent, the Production Payment Termination Fee Holder, the Borrower and the Guarantor;

“Interest Expense” for a period means the interest expense of the Borrower for such period on a consolidated basis;

“Interest Period” means, initially, the period from and including the date of the Advance to and including the last day of the fiscal quarter in which such Advance was made and thereafter each successive fiscal quarter ending on the last day of March, June, September and December in each calendar year; provided that any Interest Period which would otherwise end on a day which is not a London Banking Day shall be extended to end on the next London Banking Day, unless that next London Banking Day falls in the next fiscal quarter, in which case that Interest period shall be shortened to end on the preceding London Banking Day;

“Interim Period Agreement” means the interim period agreement among the Guarantor, Maseve and the RBPlat Purchaser;

“International Trade Laws” has the meaning attributed to such term in Section 6.1(ddd);

“Investment” shall mean any advance, loan, extension of credit or capital contribution to, purchase of shares, bonds, notes, debentures or other securities of, or any other investment made in, any Person. The amount of any Investment shall be the original principal or capital amount thereof less all returns of principal or equity, or distributions or dividends paid, thereon and shall, if made by the transfer or exchange of property other than cash, be deemed to have been made in an original principal or capital amount equal to the fair value of such property at the time of such Investment;

“ITA” means the Income Tax Act (Canada);

“Lawyer’s Account” has the meaning ascribed to that term in Section 7.2(z);

“Lenders” means the Person listed on the signature pages hereto as Lender and any other Person who becomes party to this Agreement pursuant to an assignment agreement by a Lender which is permitted hereunder, in each case its capacity as a lender hereunder, and “Lender” means any one of them;

“Lenders’ Counsel” means Fasken ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ LLP and, at any time, any other legal counsel retained by the Agent for and on behalf of the Finance Parties in the relevant jurisdiction to the matter in question;

13

“LIBOR” means, in respect of an Interest Period, the rate expressed as a percentage per annum for deposits in US Dollars in the London interbank market for a period equal to twelve (12) months that appears on the Reuters LIBOR 01 Page or the Bloomberg Screen BBAM (or any successor source from time to time) as of 11:00 a.m. (London time) on the first day of the relevant Interest Period;

“London Banking Day” means a day on which dealings in US Dollar deposits by and between banks may be transacted in the London interbank market;

“Macquarie” has the meaning attributed to such term in Section 7.3(aa) hereof;

“Macquarie Letter Agreement” has the meaning attributed to such term in Section 7.3(aa) hereof;

“Majority Creditors” means, at any time and from time to time, such group of Lenders and Production Payment Termination Fee Holder(s) whose Pro Rata Share hereunder and under the Production Payment Agreement Termination Agreement aggregate at least 51% of the aggregate Pro Rata Share of the Lenders and the Production Payment Termination Fee Holder(s) hereunder and under the Production Payment Agreement Termination Agreement at such time;

“Majority Lenders” means, at any time and from time to time, such group of Lenders whose Pro Rata Share hereunder aggregate at least 51% of the aggregate Pro Rata Share of the Lenders hereunder at such time;

“Management Agreement” means the management agreement dated October 13, 2017 between the Guarantor and Waterberg JV;

“Maseve” means Maseve Investments 11 Proprietary Limited, a company incorporated under the laws of the Republic of South Africa;

“Material Adverse Effect” means, individually or in the aggregate, a material adverse effect on:

| (a) | the business, operations, prospects, results of operations, assets, liabilities or condition (financial or otherwise) of any Credit Party; | |

| (b) | the ability of any Credit Party to observe or perform its material obligations under this Agreement or any of the other Facility Documents in accordance with the terms hereof and thereof; | |

| (c) | the validity or enforceability of this Agreement or any other Facility Document; | |

| (d) | any rights or remedies of any Finance Party under this Agreement or any other Facility Document; or | |

| (e) | the priority or ranking of any Security Interest granted pursuant to the Security Documents or any of the rights or remedies of the Agent thereunder; |

14

“Material Agreements” means any Project Document which (i) is prudent or necessary for the maintenance, existence, continuing operation or development, as applicable of the Waterberg JV Project and, until completion of the RBPlat Transactions, the assets of the Project owned by Maseve at the applicable time and (ii) contains terms and conditions which, if amended or, upon breach, termination, non-renewal or non-performance, could reasonably be expected to have a Material Adverse Effect and for greater certainty includes the documents listed in Schedule D hereto;

“Material Subsidiaries” means the Guarantor, Waterberg JV and Mnombo and, until completion of the RBPlat Transactions, Maseve;

“Mnombo” means Mnombo Wethu Consultants Proprietary Limited, a company incorporated under the laws of the Republic of South Africa;

“MOI” has the meaning attributed to such term in Schedule D;

“Money Laundering Laws” has the meaning attributed to such term in Section 6.1(ccc);

“MPRDA” means the Mineral and Petroleum Resources Development Act, 28 of 2002 (South Africa);

“NI 43-101” means National Instrument 43-101 (Standards of Disclosure for Mineral Projects), as adopted by the Canadian Securities Administrators, as it may be amended, replaced or superseded from time to time;

“NI 45-102” means National Instrument 45-102 (Resale of Securities), as adopted by the Canadian Securities Administrators, as it may be amended, replaced or superseded from time to time;

“NI 51-102” means National Instrument 51-102 (Continuous Disclosure Obligations), as adopted by the Canadian Securities Administrators, as it may be amended, replaced or superseded from time to time;

“Notice of Borrowing” means, in relation to the Advance, the notice by the Borrower to the Agent requesting the Drawdown, which shall be in form and substance acceptable to the Agent;

“Obligations” means, without duplication, with respect to a Person, all items which, in accordance with IFRS, would be included as liabilities on the liability side of the balance sheet of the Person and all Contingent Liabilities of the Person;

“OFAC” has the meaning attributed to such term in Section 6.1(eee);

“Ordinary Course of Business” means an action taken by a Credit Party or its Subsidiaries if:

| (a) |

such action is consistent with past practices and is taken in the ordinary course of the normal day-to-day operations; |

15

| (b) |

such action is not required to be authorised by the board of directors or general meeting of shareholders (or by any person or group of persons exercising similar authority) and is not required to be specifically authorised by an affiliate of such company; or | |

|

| ||

| (c) |

such action is similar in nature, magnitude and frequency to actions customarily taken, without any authorisation by the board of directors or general meeting of shareholders (or by any person or group of persons exercising similar authority), in the ordinary course of the normal day-to-day operations of other companies that are in the same line of business; |

“Other Connection Taxes” means, with respect to a Lender, Tax Related Person, or the Agent, Taxes imposed as a result of a present or former connection between such Person and the jurisdiction imposing such Tax (other than connections arising from such Person having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Facility Document, or sold or assigned an interest in the Facility or Facility Document);

“Other Taxes” has the meaning attributed to such term in Section 11.5(c);

“Permitted Encumbrances” means:

| (a) |

any Security Interest granted pursuant to the Security Documents; | |

|

| ||

| (b) |

any Security Interest or deposit under workers’ compensation, social security or similar legislation or in connection with bids, tenders, leases, contracts or expropriation proceedings or to secure related public or statutory obligations, surety and appeal bonds or costs of litigation where required by law; | |

|

| ||

| (c) |

any Security Interest imposed pursuant to statute such as builders’, mechanics’, materialman’s, carriers’, warehousemen’s and landlords’ liens and privileges, in each case, which relate to obligations not yet due or delinquent or, if due or delinquent, which the Credit Party or Subsidiary is contesting in good faith if such contest will involve no material risk of loss of any material part of the property of any Credit Parties and their Subsidiaries, taken as a whole; | |

|

| ||

| (d) |

any Security Interest for Taxes, assessments, unpaid wages or governmental charges or levies for the then current year, or not at the time due and delinquent or the validity of which is being contested at the time in good faith; | |

|

| ||

| (e) |

any right reserved to or vested in any Governmental Authority by the terms of any lease, licence, franchise, grant, claim, bond or permit held or acquired by any Credit Party or Subsidiary, or by any Applicable Law, to terminate the lease, licence, franchise, grant, claim, bond or permit or to purchase assets used in connection therewith or to require annual or other periodic payments as a condition of the continuance thereof; |

16

| (f) |

any reservations, limitations, provisos and conditions expressed in original grants or authorizations from any Governmental Authority or existing under Applicable Law; | |

|

| ||

| (g) |

any encumbrance, such as easements, rights-of-way, servitudes or other similar rights in land granted to or reserved by other Persons, rights-of-way for sewers, electric lines, telegraph and telephone lines, oil and natural gas pipelines and other similar purposes, or zoning or other restrictions applicable to the use of real property by any Credit Party or Subsidiary, or title defects, encroachments or irregularities, that do not in the aggregate detract from the value of the property or impair its use in the operation of the business of any Credit Party or Subsidiary, in each case, in a way that is material to the Credit Parties and their Subsidiaries, taken as a whole; | |

|

| ||

| (h) |

Security Interests which secure any Purchase Money Obligations or Capital Lease Obligations in respect of Indebtedness permitted under clause (b) of “Permitted Indebtedness”; | |

|

| ||

| (i) |

any Security Interests which secure Indebtedness permitted under clause (c) of “Permitted Indebtedness”; | |

|

| ||

| (j) |

the First Lien Security; and | |

|

| ||

| (k) |

any other Security Interest which the Agent (in accordance with the instructions of the Majority Lenders) agrees in writing is a Permitted Encumbrance for the purposes of this Agreement; |

“Permitted Indebtedness” means:

| (a) |

Indebtedness under this Agreement and the Production Payment Agreement Termination Agreement; | |

|

| ||

| (b) |

Indebtedness in an aggregate amount not to exceed $1,000,000 that is either: |

| (i) |

Purchase Money Obligations and Capital Lease Obligations acquired by a Credit Party after the date hereof, provided that the Security Interests for any such obligation are limited to the particular financed/leased equipment and proceeds thereof; or | |

|

| ||

| (ii) |

secured against surface rights outside of surface rights of the footprint of the Project’s mine area as shown on Schedule C, provided that the Security Interests for any such obligation are limited to the assets financed and the proceeds thereof; |

| (c) |

Unsecured subordinated Indebtedness of the Borrower provided that (i) until the principal constituting Facility Indebtedness has been paid, cash payments of interest under such unsecured subordinated Indebtedness in excess of $2,500,000 are postponed to the prior indefeasible payment in full of the Facility Indebtedness, (ii) cash payments of principal under such unsecured subordinated Indebtedness are postponed to the prior indefeasible payment in full of the Facility Indebtedness, (iii) the maturity date of such unsecured subordinated Indebtedness is at least 180 days after the Stated Maturity Date, and (iv) such unsecured subordinated Indebtedness is not cross-defaultable or cross-accelerable to the Facility Indebtedness; |

17

| (d) |

Indebtedness comprised of amounts owed to trade creditors and accruals in the Ordinary Course of Business, in each case (i) outstanding less than 90 days, or (ii) which are being disputed in good faith and, if material, in respect of which reasonable reserves have been established; | |

|

| ||

| (e) |

Indebtedness comprised of Financial Instrument Obligations which comply with Section 7.3(s); | |

|

| ||

| (f) |

with respect to government royalties payable pursuant to the terms of the Mineral and Petroleum Resources Royalty Act, No. 28 of 2008 and the Mineral and Petroleum Resources Royalty (Administration) Act, No. 29 of 2008; | |

|

| ||

| (g) |

Indebtedness in respect of judgments that do not result in a Default; | |

|

| ||

| (h) |

Indebtedness comprising all present and future debts, liabilities and obligations of any kind owing or remaining unpaid by any Credit Party to the other Credit Party or any of its Subsidiaries, provided always that all such Indebtedness is and remains unsecured, subordinated and postponed to the Facility Indebtedness; | |

|

| ||

| (i) |

Indebtedness under the First Lien Facility Documents up to a maximum principal amount of $45,000,000; and | |

|

| ||

| (j) |

any other Indebtedness which the Agent (in accordance with the instructions of the Majority Lenders) agrees in writing is Permitted Indebtedness for the purposes of this Agreement; |

“Person” means any individual, partnership, limited partnership, joint venture, syndicate, sole proprietorship, company or corporation with or without share capital, body corporate, unincorporated association, trust, trustee, executor, administrator or other legal personal representative, government or Governmental Authority or entity, however designated or constituted;

“Plant Consideration” has the meaning attributed to such term in Section 8.1(v);

“Plant Transaction” has the meaning attributed to such term in the Sale of Business Agreement;

“Platinum Group Assets” means all of the assets now owned or leased or hereafter acquired by the Credit Parties or any of their Subsidiaries including (i) the Credit Parties’ interest in the Waterberg JV Project and (ii) until completion of the applicable transactions contemplated by the RBPlat Transactions, all properties and assets comprising the Project owned by Maseve at the applicable time;

18

“PPSA” means the Personal Property Security Act (British Columbia);

“Previous Credit Agreement” has the meaning attributed to such term in the recitals hereof;

“Pro Rata Share” means, at any particular time with respect to a particular Transaction Party, the ratio of the Transaction Indebtedness owing to such Transaction Party at such time to the aggregate of the Transaction Indebtedness owing to all of the relevant Transaction Parties at such time;

“Proceeds of Realization” means all cash and non-cash proceeds derived from any sale, disposition or other realization of the Platinum Group Assets or received from a Guarantor pursuant to a guarantee (a) after any notice being sent by the Agent to the Borrower pursuant to Section 8.2 declaring all indebtedness of the Borrower hereunder to be immediately due and payable, (b) upon any dissolution, liquidation, business rescue, winding-up, reorganization, bankruptcy, insolvency or receivership of any Credit Party (or any other arrangement or marshalling of the Platinum Group Assets that is similar thereto), or (c) upon the enforcement of, or any action taken with respect to, a guarantee or other Security Document. For greater certainty, insurance proceeds derived as a result of the loss or destruction of any of the Platinum Group Assets or cash or non-cash proceeds derived from any expropriation or other condemnation of any of the Platinum Group Assets shall not constitute Proceeds of Realization prior to the Enforcement Date;

“Process Agent” has the meaning ascribed thereto in Section 1.6;

“Production Payment Agreement” means the production payment agreement dated November 19, 2015 among the Production Payment Termination Fee Holder, the Borrower and the Guarantor;

“Production Payment Agreement Termination Agreement” means the Production Payment Agreement Termination Agreement dated October 30, 2017 among the Production Payment Termination Fee Holder, the Borrower and the Guarantor;

“Production Payment Default” means a breach of the Production Payment Agreement Termination Agreement;

“Production Payment Termination Fee Holder” means Liberty Metals & Mining Holdings, LLC and its successors and assigns;

“Production Payment Termination Obligations” means the Termination Fee or the Reduced Termination Fee, as applicable, (as such terms are defined in the Production Payment Agreement Termination Agreement) and all present and future debts, liabilities and obligations of the Borrower and each other Credit Party to the Production Payment Termination Fee Holder under or in connection with the Production Payment Agreement Termination Agreement and all fees, interest, liquidated damages and other money payable or owing from time to time pursuant to the terms of the Production Payment Agreement Termination Agreement;

19

“Project” means the Western Bushveld Joint Venture Project 1 and 3 located on the western limb of the Bushveld Complex approximately ▇▇ ▇▇ ▇▇▇▇▇ ▇▇▇▇ ▇▇ ▇▇▇ ▇▇▇▇ ▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇ and comprised of various portions of Remaining Extent of Portion 1, Portion of Remaining Extent of Portion 2, Portion 8, Remaining Extent of Portion 9, Portion 12 and Remaining Extent of Portion 14 of the farm Elandsfontein 102 JQ, Portion of the Remaining Extent and Portion 1 of the farm Koedoesfontein 94 JQ, Remaining Extent of Portion 2, Portion 7, 8, 13, 15, 16, 18, 19 and the Remaining Extent of the farm Frischgewaagd 96 JQ, Remaining Extent of Portions 3, 4, 5, 6 and 8 of the farm Onderstepoort 98 JQ and Portion of the Remainder of the farm Mimosa 81 JQ, collectively measuring 4781.9036 hectares, all situated in the District of Mankwe/Rustenburg in the North West Province, as indicated on the map attached hereto as Schedule C, which properties are described as the mining area under the mining right granted to Maseve under and in terms of section 23 of the MPRDA, with MPT number 111/2012 (MR) and DMR reference number NW 30/5/1/2/2/528 MR, as amended and varied by the registration of an amendment in terms of section 102 of the MPRDA under Amendments Number 14/2012, as illustrated in Schedule C attached hereto until such time as such assets are transferred by Maseve pursuant to the Plant Transaction or the Share Transaction, as applicable;

“Project Document” means any agreement, contract, license, permit, instrument, lease, easement or other document which (i) deals with or is related to the maintenance, existence, construction, operation or development of the Waterberg JV Project or, until completion of the Plant Transaction or the Share Transaction, as applicable, the Project as it is owned by Maseve at the applicable time, and (ii) is executed from time to time by or on behalf of or is otherwise made or issued in favour of any Credit Party or any Subsidiary relating to the Waterberg JV Project or, until completion of the Plant Transaction or the Share Transaction, as applicable, the Project;

“Public Disclosure Record” means all information circulars, prospectuses (including preliminary prospectuses), annual information forms, offering memoranda, financial statements, annual and other reports, SEC filings, material change reports and news releases filed from time to time by the Borrower with the Exchanges and all securities regulatory authorities in each Reporting Jurisdiction;

“Purchase Money Obligation” means, with respect to a Person, indebtedness of the Person issued, incurred or assumed to finance all or part of the purchase price of any asset or property acquired by such Person;

“RBPlat” means Royal Bafokeng Platinum Limited;

“RBPlat Consent” means the consent letter dated as of the date hereof issued by the Finance Parties in favour of the Borrower whereby the Finance Parties consented to the RBPlat Transactions;

20

“RBPlat Escrow Agreement” means the escrow agreement concluded between RBPlat,, Maseve and Rand Merchant Bank signed on October 9, 2017.

“RBPlat Purchaser” means Royal Bafokeng Resources Proprietary Limited;

“RBPlat Shares” means the ordinary shares of RBPlat;

“RBPlat Term Sheet” means the executed term sheet between the Guarantor and RBPlat dated September 5, 2017 and executed on September 6, 2017;

“RBPlat Transactions” means the purchase and sale transactions expressly provided for in the Scheme Agreement and the Sale of Business Agreement;

“RBPlat Transaction Documents” means, collectively, the Scheme Agreement, the RBPlat Escrow Agreement, the Sale of Business Agreement the First Addendum to the Sale of Business Agreement, the First Addendum to the Scheme Agreement, the Redpath Agreement, the Redpath Security Escrow Agreement and the Interim Period Agreement;

“Redpath” means Redpath Mining South Africa Proprietary Limited;

“Redpath Contribution” has the meaning ascribed to that term in the Scheme Agreement;

“Redpath Agreement” means the full and final settlement of all claims by Redpath against Maseve and the Credit Parties in respect of goods and services sold and rendered by Redpath to Maseve and the Credit Parties will be recorded;

“Redpath Security Escrow Agreement” means the escrow agreement to be concluded between RBPlat, RBPlat Purchaser, Maseve, Guarantor and Maseve's South African counsel into which funds will be deposited for the purpose of securing the claims of Redpath against Maseve;

“Reduced Termination Fee” has the meaning attributed to that term in the Production Payment Agreement Termination Agreement;

“Relevant Jurisdiction” means, from time to time, any jurisdiction in which any of the Credit Parties have material properties or assets, or in which they carry on any material business being, on the date hereof, the Province of British Columbia, Canada and the Republic of South Africa;

“Reporting Jurisdictions” means all of the jurisdictions in Canada in which the Borrower is a “reporting issuer” (being, as of the date hereof, the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, ▇▇▇▇▇▇ ▇▇▇▇▇▇ Island, and Newfoundland) and the United States;

“Sale of Business Agreement” means the Sale of Business Agreement signed on November 23, 2017 and between the RBPlat Purchaser, Maseve and the Guarantor, as amended by the First Addendum to Sale of Business Agreement;

21

“Scheme Agreement” means the Scheme Implementation Agreement signed on November 23, 2017 and between RBPlat, Maseve and the Guarantor, as amended by the First Addendum to Scheme Agreement;

“Second Amendment Fee Shares” has the meaning attributed to such term in the Previous Credit Agreement;

“Second Outside Financing Date” has the meaning ascribed to that term in Section 7.1(n);

“Second Required Financing” has the meaning attributed to such term in Section 7.1(n) hereof;

“Second Side Letter” means the side letter agreement dated October 30, 2017 between the parties hereto;

“SEC” means the U.S. Securities and Exchange Commission;

“Securities” means, collectively, the Drawdown Shares, the Amendment Fee Shares and the Second Amendment Fee Shares;

“Securities Act” means the Securities Act (British Columbia);

“Security” means the security including Security Interests provided by the Security Documents;

“Security Documents” means, collectively, the agreements, instruments and documents listed in Schedule B hereto and delivered pursuant to Section 4.1 of this Agreement and any other guarantees or security documents from time to time delivered hereunder;

“Security Interest” means any security interest, assignment by way of security, mortgage, charge (whether fixed or floating), hypothec, deposit arrangement, pledge, lien, encumbrance, preference, priority or other security interest or preferential arrangement of any kind or nature whatsoever (including any conditional sale or other title retention agreement, any financing lease having substantially the same economic effect as any of the foregoing and any other “Security Interest” as defined in section 1(1) of the PPSA);

“Share Consideration” has the meaning attributed to such term in Section 8.1(v);

“Share Purchase Agreement” has the meaning attributed to such term in Schedule D;

“Share Transaction” has the meaning attributed to such term in the Scheme Agreement;

“Shares” as applied to the shares of any corporation or other entity, means the shares or other ownership interests of every class whether now or hereafter authorized, regardless of whether such shares or other ownership interests shall be limited to a fixed sum or percentage with respect to the rights of the holders thereof to participate in dividends and in the distribution of assets upon the voluntary or involuntary liquidation, business rescue, dissolution or winding-up of such corporation or other entity;

22

“Side Letter” means the side letter agreement dated as of September 25, 2017 between the parties hereto;

“Side Letter Consent” means the Consent as defined in the Side Letter;

“Sprott Direct Agreement” has the meaning attributed to such term in Schedule D;

“Stated Maturity Date” means the later of (A) September 30, 2018 and (B) four months after the closing of the Plant Transaction (as such term is defined in the RBPlat Term Sheet), provided that if the Plant Transaction does not occur by December 31, 2018 the Stated Maturity Date shall be December 31, 2018;

“Subsidiaries” means, (i) with respect to the Credit Parties, (a) the Material Subsidiaries, and (b) any corporation, company or other similar business entity (including, for greater certainty, a chartered bank) of which more than 49% of the outstanding Shares or other equity interests (in the case of Persons other than corporations) having ordinary voting power to elect a majority of the board of directors or the equivalent thereof of such corporation, company or similar business entity (irrespective of whether at the time Shares of any other class or classes of the Shares of such corporation, company or similar business entity shall or might have voting power upon the occurrence of any contingency) is at the time directly or indirectly owned by such Person, by such Person and one or more other Subsidiaries of such Person, or by one or more other Subsidiaries of such Person and “Subsidiary” means any one of them and (ii) with respect to any other Person any corporation, company or other similar business entity (including, for greater certainty, a chartered bank) of which more than 49% of the outstanding Shares or other equity interests (in the case of Persons other than corporations) having ordinary voting power to elect a majority of the board of directors or the equivalent thereof of such corporation, company or similar business entity (irrespective of whether at the time Shares of any other class or classes of the Shares of such corporation, company or similar business entity shall or might have voting power upon the occurrence of any contingency) is at the time directly or indirectly owned by such Person, by such Person and one or more other Subsidiaries of such Person, or by one or more other Subsidiaries of such Person and “Subsidiary” means any one of them; “

Tax Related Person” means any Person (including a beneficial owner of an interest in a pass-through entity) who is required to include in income amounts realized (whether or not distributed) by the Agent or a Lender;

“Taxes” means all present or future taxes, assessments, rates, levies, imposts, deductions, withholdings, dues, duties, fees and other charges of any nature, including any interest, fines, penalties or other liabilities with respect thereto, imposed, levied, collected, withheld or assessed by any Governmental Authority (of any jurisdiction), and whether disputed or not;

23

“Termination Fee” has the meaning attributed to that term in the Production Payment Agreement Termination Agreement;

“Tiger Gate” means Tiger Gate Platinum Propriety Limited;

“Transaction Documents” means the Facility Documents;

“Transaction Indebtedness” means all present and future debts, liabilities and obligations of the Borrower and each other Credit Party to any of the Transaction Parties under or in connection with this Agreement and the other Facility Documents, including all Amounts Payable and all fees, interest and other money payable or owing from time to time pursuant to the terms of this Agreement;

“Transaction Material Adverse Effect” means, individually or in the aggregate, a material adverse effect on:

| (a) |

the business, operations, prospects, results of operations, assets, liabilities or condition (financial or otherwise) of any Credit Party; | |

|

| ||

| (b) |

until the completion of the RBPlat Transaction, the assets, liabilities or condition (financial or otherwise) of the Project that are owned by Maseve at the applicable time; | |

|

| ||

| (c) |

the ability of any Credit Party to observe or perform its material obligations under this Agreement or any of the other Facility Documents in accordance with the terms hereof and thereof; | |

|

| ||

| (d) |

the ability of any Credit Party or Maseve to observe or perform its material obligations under RBPlat Transaction Documents in accordance with the terms thereof | |

|

| ||

| (e) |

the validity or enforceability of this Agreement or any other Facility Document or any RBPlat Transaction Document; | |

|

| ||

| (f) |

any rights or remedies of any Transaction Party under this Agreement or any other Facility Document; or | |

|

| ||

| (g) |

the priority or ranking of any Security Interest granted pursuant to the Security Documents or any of the rights or remedies of the Agent or the Transaction Parties thereunder; |

“Transaction Parties” means, collectively, the Finance Parties and the Production Payment Termination Fee Holder;

“TSX” means the Toronto Stock Exchange;

“Unfunded Capital Expenditures” means Capital Expenditures other than Purchase Money Obligations and Capital Lease Obligations;

24

“United States” means United States of America, its territories and possessions, any state of the United States and the District of Columbia;

“U.S. Exchange Act” means the United States Securities Exchange Act of 1934, as amended;

“Voting Shares” means shares of capital stock of any class of any corporation carrying voting rights under all circumstances, provided that for the purposes of such definition, shares which only carry the right to vote conditionally on the happening of any event shall not be considered Voting Shares, whether or not such event shall have occurred, nor shall any shares be deemed to cease to be Voting Shares solely by reason of a right to vote accruing to shares of another class or classes by reason of the happening of such event;

“Waterberg JV” means Waterberg JV Resources Proprietary Limited, a limited liability private company duly incorporated in the Republic of South Africa;

“Waterberg JV Project” means the Waterberg joint venture project located on the north limb of the Bushveld Igneous Complex;

“Waterberg Shareholder Agreement” has the meaning attributed to such term in Schedule D;

“Working Capital” means Current Assets less Current Liabilities; and

“ZAR Equivalent” has the meaning attributed to such term in the Sale of Business Agreement.

| 1.2 | Subdivisions, Table of Contents and Headings |

The division of this Agreement into articles, sections, subsections and paragraphs, the provision of a table of contents and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement.

| 1.3 | References to Bodies Corporate, Statutes, Contracts |

Any reference in this Agreement:

| (a) |

to any body corporate shall include successors thereto, whether by way of amalgamation, merger or otherwise; provided that transfers and assignments by the parties and corporate and other reorganizations shall nonetheless be undertaken only in accordance with any restrictions imposed by the terms of this Agreement; | |

|

| ||

| (b) |

to any statute, enactment or legislation or to any section or provision thereof shall include a reference to any order, ordinance, regulation, rule or by-law or proclamation made under or pursuant to that statute, enactment or legislation and all amendments, modifications, consolidations, re-enactments or replacements thereof or substitutions therefor from time to time; and |

25

| (c) |

to any agreement, instrument, Authorization or other document (including Material Agreements) shall include reference to such agreement, instrument, Authorization or other document as the same may from time to time be amended, supplemented, replaced or restated, irrespective of whether particular reference shall have been made to some (but not all) amendments, supplements, replacements or restatements thereof; provided that transfers, amendments, supplements, replacements and restatements shall nonetheless be undertaken only in accordance with any restrictions imposed by the terms of this Agreement. |

| 1.4 | Currency |

Any reference in this Agreement to “U.S. Dollars”, “USD”, “US$”, “dollars” or “$” shall be deemed to be a reference to lawful money of the United States and any reference to any payments to be made by any Credit Party shall be deemed to be a reference to payments made in lawful money of the United States. Any reference in this Agreement to “CAD Dollars”, “CAD” or “C$”, shall be deemed to be a reference to lawful money of Canada.

| 1.5 | Use of the Words “Best Knowledge” |

The words “best knowledge”, “to the best of the Borrower’s knowledge”, “to the knowledge of”, “of which they are aware”, “any knowledge of” or other similar expressions limiting the scope of any representation, warranty, acknowledgement, covenant or statement by the Borrower or the Credit Parties will be understood to be made on the basis of the actual knowledge of any of the executive officers of the Borrower or Credit Party, in each case, after due inquiry.

| 1.6 | Governing Law |

This Agreement shall be governed by the laws of the Province of British Columbia and the federal laws of Canada applicable therein and shall be treated in all respects as a British Columbia contract. The parties hereby irrevocably attorn to the exclusive jurisdiction of the Courts of the Province of British Columbia and agree to be bound by any suit, action or proceeding commenced in such courts and by any order or judgment resulting from such suit, action or proceeding.

The parties further agree that service of any process, summons, notice or document by delivery in the manner set forth in Article 10 shall be effective service of process for any action, suit or proceeding brought against any party in such court. The parties hereby irrevocably and unconditionally waive any objection to the laying of venue of any action, suit or proceeding arising out of this Agreement or the matters contemplated hereby in the courts of the Province of British Columbia and hereby further irrevocably and unconditionally waive and agree not to plead or claim in any such court that any such action, suit or proceeding so brought has been brought in an inconvenient forum.

26

The Guarantor hereby irrevocably designates the Borrower (in such capacity, the “Process Agent”), with an office at 788 – ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇.▇., ▇▇▇ ▇▇▇, as its designee, appointee and agent to receive, for and on its behalf service of process in such jurisdiction in any legal action or proceedings with respect to this Agreement or the transactions contemplated hereby, and such service shall be deemed complete upon delivery thereof to the Process Agent; provided that in the case of any such service upon the Process Agent, the party effecting such service shall also deliver a copy thereof to the Guarantor in the manner provided in Article 10. Guarantor shall take all such action as may be necessary to continue said appointment in full force and effect or to appoint another agent so that Guarantor will at all times have an agent for service of process for the above purposes.

Nothing herein shall affect the right of any party to serve process in any manner permitted by Applicable Law. Borrower and the Guarantor each expressly acknowledge that the foregoing waiver is intended to be irrevocable under all Applicable Laws and that nothing contained herein will in anyway limit any Finance Party’s right to commence suits, actions or proceedings in any jurisdiction.

| 1.7 | Paramountcy |

In the event of any conflict or inconsistency between the provisions of any of the Facility Documents and the provisions of the Intercreditor Agreement, the provisions of the Intercreditor Agreement shall prevail and be paramount. In the event of any conflict or inconsistency between the provisions of this Agreement and the Production Payment Agreement Termination Agreement, the provisions of this Agreement shall prevail and be paramount. If any covenant, representation, warranty or event of default contained in any other Facility Document (other than the Intercreditor Agreement) is in conflict with or is inconsistent with a provision of this Agreement relating to the same specific matter, such covenant, representation, warranty or event of default shall be deemed to be amended to the extent necessary to ensure that it is not in conflict with or inconsistent with the provision of this agreement relating to the same specific matter.

| 1.8 |

Interpretation |

|

| |

|

In this Agreement and each other Facility Document, unless the context otherwise requires, words importing the singular include the plural and vice versa and words importing gender include all genders. The words “including” and “includes” mean “including” (or “includes”) without limitation. | |

|

| |

| 1.9 |

Time of Essence |

|

| |

|

Time shall be of the essence in all respects of this Agreement. | |

|

| |

| 1.10 |

Rule of Construction |

|

| |

|

The Facility Documents have been negotiated by each party with the benefit of legal representation, and any rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not apply to the construction or interpretation of the Facility Documents. |

27

| 1.11 | Pro Rata Shares |

Any calculation of a Pro Rata Share shall, as concerns the Production Payment Termination Fee Holder, be calculated on the basis of the Termination Fee (as defined in the Production Payment Agreement Termination Agreement) which would be due and owing at the relevant moment of determination had all Indebtedness under the Production Payment Agreement Termination Agreement been accelerated at such time.

ARTICLE 2

THE FACILITY

| 2.1 |

The Facility |

|

| |

|

Subject to the terms and conditions hereof, the Initial Lender hereby establishes in favour of the Borrower a $40,000,000 non-revolving, single advance, second lien, secured reducing term credit facility (the “Facility”) which was made available to the Borrower by way of a single Drawdown on the Closing Date (as defined in the Previous Credit Agreement). | |

|

| |

| 2.2 |

Non-Revolvement |

|

| |

|

The Facility is a non-revolving facility, and any repayment under the Facility shall not be re-borrowed. | |

|

| |

| 2.3 |

Term |

|

| |

|

The outstanding principal amount of the Facility and the Termination Fee, together with all accrued but unpaid interest and other costs, fees or charges payable hereunder and thereunder from time to time, will be immediately due and payable by the Borrower to the respective Lenders and the Production Payment Termination Fee Holder on the Stated Maturity Date. | |

|

| |

| 2.4 |

Interest |

|

| |

|

Interest shall accrue (i) on the principal amount of the Advance from and including the date of advance to the Borrower, (ii) on all accrued and capitalized interest thereon and (iii) on all overdue amounts outstanding in respect of interest, costs or other fees or expenses payable under the Facility Documents, in each case at the rate equal to LIBOR plus 9.50% (nine and one half percent) per annum, calculated daily and compounded: |

| (a) |

at all times up to including June 30, 2018, monthly and shall be capitalized and thereafter constitute principal hereunder; and |

28

| (b) |

at all times after June 30, 2018, quarterly shall be payable by the Borrower to the respective Lenders quarterly on the last Business Day of every fiscal quarter during such period; |

in each case before as well as after each of maturity, default and judgment.

| 2.5 |

Default Interest |

|

| |

|

Upon the occurrence and during the continuance of any Event of Default, the Borrower shall pay to the Finance Parties, interest on such Facility Indebtedness in the same currency as such overdue amount is payable from and including such due date to but excluding the date of actual payment (as well after as before judgment) at the rate per annum, calculated daily and compounded monthly, equal to, without duplication of the interest referenced in Section 2.4, LIBOR plus 12.50%. | |

|

| |

| 2.6 |

Computations |

|

| |

|

The rates of interest under this Agreement are nominal rates, and not effective rates or yields. Unless otherwise stated, wherever in this Agreement reference is made to a rate of interest “per annum” or a similar expression is used, such interest shall be calculated on the basis of a year of 360 days for the actual number of days occurring in the period for which any such interest is payable. For the purposes of the Interest Act (Canada) and disclosure thereunder, whenever any interest to be paid hereunder or in connection herewith is to be calculated on the basis of a 360-day year, the yearly rate of interest to which the rate used in such calculation is equivalent is the rate so used multiplied by the actual number of days in the calendar year in which the same is to be ascertained and divided by 360. The parties hereto acknowledge and agree that LIBOR is used herein as a reference rate and that while such reference rate is based on the 12-month LIBOR rate, such rate shall be reset to the prevailing 12-month LIBOR rate as of the first day of each Interest Period. | |

|

| |

| 2.7 |

No Set-off |

|

| |

|