contents

|

Exhibit 4.13

STANDBY BANK ACCOUNT AGREEMENT

SCOTIABANK COVERED BOND GUARANTOR LIMITED PARTNERSHIP, as Guarantor

- and -

THE BANK OF NOVA SCOTIA, as Cash Manager and Issuer

- and -

CANADIAN

IMPERIAL BANK OF COMMERCE,

- and -

COMPUTERSHARE TRUST COMPANY OF CANADA, as Bond Trustee

DATED AS OF JULY 19, 2013

|

contents

| - ii - |

| ARTICLE 9 NON-PETITION | 17 | |

| 9.1 | Non-Petition | 17 |

| ARTICLE 10 FURTHER ASSURANCES | 17 | |

| 10.1 | Further Assurances | 17 |

| ARTICLE 11 CONFIDENTIALITY | 18 | |

| 11.1 | Confidentiality | 18 |

| ARTICLE 12 NOTICES | 18 | |

| 12.1 | Notices | 18 |

| ARTICLE 13 INTEREST | 19 | |

| 13.1 | Interest Payments on Standby Transaction Account | 19 |

| 13.2 | Interest Payments on Standby GDA Account | 19 |

| ARTICLE 14 PAYMENTS AND WITHHOLDING | 19 | |

| 14.1 | Payments and Withholding | 19 |

| ARTICLE 15 ENTIRE AGREEMENT | 20 | |

| 15.1 | Entire Agreement | 20 |

| ARTICLE 16 ASSIGNMENT | 20 | |

| 16.1 | Assignment | 20 |

| 16.2 | Assignment to Bond Trustee | 20 |

| ARTICLE 17 LIMITATION OF LIABILITY | 20 | |

| 17.1 | Limitation of Liability | 21 |

| ARTICLE 18 AMENDMENTS, MODIFICATION, VARIATION OR WAIVER | 21 | |

| 18.1 | Amendments, Modification, Variation or Waiver | 21 |

| ARTICLE 19 EXCLUSION OF THIRD PARTY RIGHTS | 22 | |

| 19.1 | Exclusion of Third Party Rights | 22 |

| ARTICLE 20 SCOPE OF DUTY | 22 | |

| 20.1 | Scope of Duty | 22 |

| ARTICLE 21 WAIVER OF FORMALITIES | 22 | |

| 21.1 | Waiver of Formalities | 22 |

| ARTICLE 22 COUNTERPARTS | 23 | |

| - iii - |

| 22.1 | Counterparts | 23 |

| ARTICLE 23 GOVERNING LAW | 23 | |

| 23.1 | Governing Law | 23 |

| 23.2 | Submission to Jurisdiction | 23 |

| SCHEDULE 1 | 1 | |

THIS STANDBY BANK ACCOUNT AGREEMENT is made as of July 19, 2013

bETWEEN:

| (1) | SCOTIABANK COVERED BOND GUARANTOR LIMITED PARTNERSHIP, a limited partnership formed under the laws of the Province of Ontario, whose registered office is at 000 Xxxx Xxxxxx Xxxx, Xxxxx 0000, 1 First Xxxxxxxx Xxxxx, Xxxxxxx, Xxxxxxx, X0X 0X0, by its managing general partner, Scotiabank Covered Bond GP Inc. (in its capacity as the Guarantor); |

| (2) | THE BANK OF NOVA SCOTIA, a bank named in Schedule I to the Bank Act, whose executive office is at Scotia Plaza, 00 Xxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx, X0X 0X0, in its capacity as Cash Manager (hereinafter the “Cash Manager”) and as Issuer (hereinafter the “Issuer”); |

| (3) | CANADIAN IMPERIAL BANK OF COMMERCE, a bank named in Schedule I to the Bank Act, whose executive office is at Commerce Court, 000 Xxx Xxxxxx, Xxxxxxx, Xxxxxxx, X0X 0X0, as Standby Account Bank (hereinafter the “Standby Account Bank”) and as Standby GDA Provider (hereinafter the “Standby GDA Provider”); and |

| (4) | COMPUTERSHARE TRUST COMPANY OF CANADA, a trust company incorporated under the laws of Canada, whose registered office is at 000 Xxxxxxxxxx Xxxxxx, 00xx Xxxxx, Xxxxxxx, Xxxxxxx, X0X 0X0, in its capacity as Bond Trustee. |

WHEREAS:

| (A) | As part of the transactions contemplated in the Bank’s registered covered bond program (hereinafter the “Program”), the Cash Manager has agreed, pursuant to the cash management agreement dated as of the date hereof (as amended and/or supplemented and/or restated from time to time) (hereinafter the “Cash Management Agreement”) by and among the Cash Manager, the Guarantor and the Bond Trustee to provide cash management services in connection with the business of the Guarantor. |

| (B) | The Standby Account Bank has agreed following service of a Standby Account Bank Notice by the Guarantor (or the Cash Manager on its behalf) that the Standby Account Bank will open and maintain the Standby Transaction Account and the Standby GDA Account as interest bearing accounts in the name of the Guarantor in accordance with the terms of this Agreement. |

| (C) | Following service of a Standby Account Bank Notice by the Guarantor (or the Cash Manager on its behalf) the Standby GDA Provider has agreed pursuant to the terms of the Standby GDA Agreement to pay interest on the funds standing to the credit of the Guarantor in the Standby GDA Account at specified rates determined in accordance with and pursuant to the terms of the Standby GDA Agreement. |

| - 2 - |

NOW THEREFORE, IT IS HEREBY AGREED that in consideration of the mutual covenants and agreements herein set forth, the parties agree as follows:

Article 1

Definitions and Interpretation

| 1.1 | Definitions |

The following terms when used in this Agreement will have the following meanings and terms used in this Agreement and defined in the recitals hereto will have the meanings given to such terms in such recitals:

“Bank Act” means the Bank Act (Canada);

“Bond Trustee” means Computershare Trust Company of Canada, in its capacity as bond trustee under the Trust Deed or as trustee under the Security Agreement, together with any successor or additional bond trustee or trustee appointed from time to time thereunder;

“Business Day” means a day (other than a Saturday or Sunday) on which commercial banks are open for general business (including dealings in foreign exchange and foreign currency deposits) in Toronto;

“Calculation Date” means the third Business Day prior to each Guarantor Payment Date;

“CMHC” means Canada Mortgage Housing Corporation and its successors;

“CMHC Guide” means the Canadian Registered Covered Bond Programs Guide issued by CMHC on June 12, 2013, as the same may be supplemented, amended or replaced by CMHC from time to time;

“Covered Bond” means each covered bond issued or to be issued pursuant to the Program and which is or is to be constituted under the Trust Deed;

“Covered Bond Legislative Framework” means the legislative framework established by Part I.1 of the National Housing Act (Canada);

“DBRS” means DBRS Limited and its successors;

“Financial Instruments” means cheques, bills of exchange or other similar instruments, whether negotiable or non-negotiable;

| - 3 - |

“Fitch” means Fitch Ratings Ltd. and its successors;

“GDA Provider” means The Bank of Nova Scotia in its capacity as GDA provider under the Guaranteed Deposit Account Contract or any successor or additional GDA provider appointed from time to time thereunder;

“Governmental Authority” means the government of Canada or any other nation, or of any political subdivision thereof, whether provincial, territorial, state, municipal or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government, including any supra-national bodies, the Superintendent or other comparable authority or agency;

“Guaranteed Deposit Account Contract” means the guaranteed deposit account contract between the Guarantor, the GDA Provider, the Account Bank, the Bond Trustee and the Cash Manager dated the Program Date (as amended and/or supplemented and/or restated from time to time);

“Guarantor Acceleration Notice” means a notice in writing from the Bond Trustee to the Bank, as issuer, and the Guarantor, that each Covered Bond of each Series is immediately due and repayable and that all amounts payable by the Guarantor in respect of its guarantee will thereupon immediately become due and payable;

“Guarantor Accounts” means the Standby GDA Account and the Standby Transaction Account and such other accounts as may be held by the Standby Account Bank for the Guarantor;

“Guarantor Agreement” means the limited partnership agreement in respect of the Guarantor entered into on the Program Date by and among Scotiabank Covered Bond GP Inc., 0000000 Canada Inc., the Bond Trustee and The Bank of Nova Scotia, as Limited Partner and any other parties who accede thereto in accordance with its terms (as amended and/or restated and/or supplemented from time to time);

“Guarantor Payment Date” means the 17th day of each month or if not a Business Day the next following Business Day;

“Mandate” or “Mandates” means the Standby Transaction Account Mandate and/or the Standby GDA Account Mandate and/or the mandates relating to any other Guarantor Accounts with the Standby Account Bank, as the case may be;

“Material Adverse Event” means an effect that is materially adverse to the ability of the Standby GDA Provider to perform its obligations under this Agreement or the Standby Bank Account Agreement;

“Moody’s” means Xxxxx’x Investors Service, Inc. and its successors;

| - 4 - |

“Persons” includes individuals, corporations, limited and unlimited liability companies, general and limited partnerships, associations, trusts, unincorporated organisations, joint ventures and Governmental Authorities;

“Priorities of Payments” means the orders of priority for the allocation and distribution of amounts standing to the credit of the Guarantor in the Guarantor Accounts opened and operated in connection with the Program in different circumstances and “Priority of Payments” means any one of the foregoing;

“Program” means the U.S.$15,000,000,000 registered covered bond program established by the Issuer on the Program Date which may be increased by the Issuer and the Guarantor in accordance with the terms of the Program Agreement and applicable regulatory requirements;

“Program Date” means on or about July 19, 2013;

“Rating Agencies” means Fitch, Moody’s and DBRS and each, a “Rating Agency”, and any other internationally recognised rating agency that may rate the Covered Bonds from time to time;

“Rating Agency Condition” means a confirmation in writing by the Rating Agencies that the then current ratings of all series of Covered Bonds then outstanding will not be downgraded or withdrawn as a result of the relevant event or matter;

“Secured Creditors” means, inter alios, the Bond Trustee (in its own capacity and on behalf of the holders of the Covered Bonds), the holders of the Covered Bonds, the Standby Account Bank, the Standby GDA Provider, the Bank and any other person which becomes a secured creditor from time to time pursuant to the terms of the Security Agreement;

“Security Agreement” means the general security agreement dated as of July 19, 2013 by and among, inter alios, the Guarantor and the Bond Trustee for itself and the benefit of secured creditors of the Guarantor (as amended and/or supplemented and/or restated from time to time);

“Standby Account Bank Notice” means a written notice from the Guarantor (or the Cash Manager on its behalf) to the Standby Account Bank stating that the appointment of the Standby Account Bank under the Standby Bank Account Agreement is to become operative and that the Standby GDA Account and the Standby Transaction Account (if indicated in such notice) are to be opened and held with the Standby Account Bank in the name of the Guarantor;

| - 5 - |

“Standby Account Bank Required Ratings” means the threshold ratings of (i) P-1 with respect to the short-term unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank by Moody’s, (ii) F1 with respect to the short-term issuer default rating of the Standby Account Bank by Fitch, (iii) A with respect to long-term issuer default rating of the Standby Account Bank by Fitch; and (iv) either (A) R-1 (middle) with respect to the short-term unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank by DBRS, or (B) A (low) with respect to the long-term unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank by DBRS;

“Standby GDA Account” means the account in the name of the Guarantor held with the Standby Account Bank and maintained subject to the terms of this Agreement, the Standby Guaranteed Deposit Account Contract and the Security Agreement or such additional or replacement account as may be in place from time to time;

“Standby GDA Account Mandate” means the bank account mandate between the Guarantor and the Standby Account Bank relating to the operation of the Standby GDA Account;

“Standby GDA Agreement” or “Standby Guaranteed Deposit Account Agreement” means the standby guaranteed deposit account contract dated as of July 19, 2013 by and among the Standby GDA Provider, the Cash Manager, the Guarantor and the Bond Trustee (as amended and/or supplemented and/or restated from time to time);

“Standby Transaction Account” means the account in the name of the Guarantor held with the Standby Account Bank and maintained subject to the terms of this Agreement and the Security Agreement or such additional or replacement account as may be in place from time to time;

“Standby

Transaction Account Mandate” means the bank account mandate between the Guarantor and the Standby Account Bank relating

to the operation of the Standby Transaction Account;

“Superintendent”

means the Superintendent of Financial Institutions appointed pursuant to the Office of the Superintendent of Financial Institutions

Act (Canada);

“Transaction Documents” means the agreements and

documents relating to the Program that are available for inspection during normal business hours on any Business Day at the executive

office of the Issuer set out in the recitals; and

“Trust Deed” means

the trust deed dated as of July 19, 2013 between the Issuer, the Guarantor and the Bond Trustee (as amended and/or supplemented

and/or restated from time to time).

| - 6 - |

| 1.2 | Interpretation |

In this Agreement:

| (a) | “this Agreement” has the same meaning as “Standby Bank Account Agreement” in the Master Definitions and Construction Agreement; |

| (b) | words denoting the singular number only will include the plural and vice versa; |

| (c) | words denoting one gender only will include the other genders; |

| (d) | words “including” and “includes” mean “including (or includes) without limitation”; |

| (e) | in the computation of periods of time from a specified date to a later specified date, unless otherwise expressly stated, the word “from” means “from and including” and the words “to” and “until” each mean “to but excluding” and if the last day of any such period is not a Business Day, such period will end on the next Business Day; |

| (f) | when calculating the period of time “within” which or “following” which any act or event is required or permitted to be done, notice given or steps taken, the date which is the reference date in calculating such period is excluded from the calculation and if the last day of any period is not a Business Day, such period will end on the next Business Day unless otherwise expressly stated; |

| (g) | references to any statutory provision will be deemed also to refer to any statutory modification or re-enactment thereof or any statutory instrument, order or regulation made thereunder or under any such re-enactment; |

| (h) | references to any agreement or other document will be deemed also to refer to such agreement or document as amended, varied, supplemented or novated from time to time; |

| (i) | the inclusion of a table of contents, the division into Articles, Sections, clauses, paragraphs and schedules and the insertion of headings are for convenient reference only and are not to affect or be used in the construction or interpretation; |

| (j) | reference to a statute will be construed as a reference to such statute as the same may have been, or may from time to time be, amended or re-enacted to the extent such amendment or re-enactment is substantially to the same effect as such statute on the date hereof; |

| - 7 - |

| (k) | reference to a time of day will be construed as a reference to Toronto time unless the context requires otherwise and a “month” is a reference to a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month save that, where any such period would otherwise end on a day which is not a Business Day, it will end on the next Business Day, unless that day falls in the calendar month succeeding that in which it would otherwise have ended, in which case it will end on the preceding Business Day provided that, if a period starts on the last Business Day in a calendar month or if there is no numerically corresponding day in the month in which that period ends, that period will end on the last Business Day in that later month (and references to “months” will be construed accordingly); and |

| (l) | references to any person will include references to such person’s heirs, executors, personal administrators, successors, permitted assigns and transferees, as applicable, and any person deriving title under or through such person. |

Article 2

Standby Transaction Account and Standby GDA Account

| 2.1 | Instructions from the Cash Manager |

Following delivery of a Standby Account Bank Notice and opening of the Standby Transaction Account and Standby GDA Account in accordance with Section 3.1(Opening of Standby Transaction Account and Standby GDA Account, Signing and Delivery of Mandates), the Standby Account Bank will, subject to Sections 2.4 (No Negative Balance) and 5.3 (Consequences of a Guarantor Acceleration Notice), comply with any direction of the Guarantor (or the Cash Manager on its behalf) given on a Business Day to effect a payment by debiting any one of the Standby Transaction Account or the Standby GDA Account and any additional or replacement bank accounts opened in the name of the Guarantor from time to time with the prior written consent of the Bond Trustee, if such direction (i) is in writing, is given by telephone and confirmed in writing not later than 5:00 p.m. (Toronto time) on the day on which such direction is given, or is given by the internet banking service provided by the Standby Account Bank, and (ii) complies with the Standby Transaction Account Mandate or the Standby GDA Account Mandate as appropriate (such direction will constitute an irrevocable payment instruction).

| 2.2 | Timing of Payment |

The Standby Account Bank agrees that if directed pursuant to Section 2.1 (Instructions from the Cash Manager) to make any payment then, subject to Sections 2.4 (No Negative Balance) and 5.3 (Consequences of a Guarantor Acceleration Notice) below, it will effect the payment specified in such direction not later than the day specified for payment therein and for value on the day specified therein provided that, if any direction specifying that a cash payment be made on the same day as the direction is given is received later than 12:00 p.m. on any Business Day, the Standby Account Bank will make such payment at the commencement of business on the following Business Day for value on such following Business Day.

| - 8 - |

| 2.3 | Standby Account Bank and Standby GDA Provider Charges |

The charges of the Standby Account Bank and the Standby GDA Provider for the operation of each of the Guarantor Accounts maintained with the Standby Account Bank and the Standby GDA Provider will be debited to the Standby Transaction Account only on each Guarantor Payment Date, and the Guarantor by its execution hereof irrevocably agrees that this will be done. The charges will be payable in accordance with the relevant Priority of Payments at rates that are generally applicable to the business customers of the Standby Account Bank and the Standby GDA Provider provided that if there are insufficient funds standing to the credit of the Standby Transaction Account to pay such charges after payment by or on behalf of the Guarantor of any higher ranking obligations in the relevant Priority of Payment the Standby Account Bank and the Standby GDA Provider will not be relieved of their obligations in respect of any of the Guarantor Accounts. For greater certainty (i) charges that may be made by the Standby Account Bank and the Standby GDA Provider hereunder may include any and all fees and service charges relating to the Guarantor Accounts and chargebacks for any cheques, drafts and other payments items dishonoured or otherwise returned to the Standby Account Bank or the Standby GDA Provider in respect of the Guarantor Accounts, and (ii) payments to the Standby Account Bank and the Standby GDA Provider rank pro rata and pari passu with payments to the asset monitor, among others in the relevant Priority of Payments.

| 2.4 | No Negative Balance |

Notwithstanding the provisions of Section 2.1 (Instructions from the Cash Manager), amounts will only be withdrawn from any Guarantor Account to the extent that such withdrawal does not cause the relevant Guarantor Account to have a negative balance.

Article 3

Opening of Accounts and Mandates

| 3.1 | Opening of Standby Transaction Account and Standby GDA Account, Signing and Delivery of Mandates |

| (a) | Upon delivery by the Guarantor (or the Cash Manager on its behalf) to the Standby Account Bank of a Standby Account Bank Notice, the Guarantor (or the Cash Manager on its behalf) will include with such Standby Account Bank Notice a completed Standby GDA Account Mandate and Standby Transaction Account Mandate in the form attached hereto as Schedule 1 (Form of Mandate) or such other form as the Standby Account Bank may from time to time deliver to the Guarantor (or the Cash Manager on its behalf) prior to delivery of a Standby Account Bank Notice, provided such additional form is acceptable to the Guarantor (or the Cash Manager on its behalf), acting reasonably. |

| (b) | Promptly upon receipt by the Standby Account Bank of a Standby Bank Account Notice from the Guarantor together with the completed Standby GDA Account Mandate and Standby Transaction Account Mandate, the Standby Account Bank will confirm receipt of same to the Bond Trustee and that such mandates are operative and will open and hold the Standby Transaction Account and the |

| - 9 - |

Standby GDA Account for the Guarantor in accordance with the terms of this Agreement.

| (c) | For greater certainty, the Standby Account Bank acknowledges that such mandates and any other mandates delivered from time to time pursuant to the terms hereof will be subject to the terms of the Security Agreement, this Agreement and the Standby GDA Agreement and to the extent of any inconsistency between the terms of such agreements and such mandates, the terms of such agreements will govern. |

| 3.2 | Amendment or Revocation |

The Standby Account Bank agrees that it will notify the Bond Trustee as soon as is reasonably practicable and in accordance with Article 12 (Notices) if it receives any amendment to or revocation of the Standby GDA Account Mandate or the Standby Transaction Account Mandate relating to the Guarantor Accounts (other than a change of Authorized Signatory, which may be made from time to time by the Guarantor (or the Cash Manager on its behalf)) and will require the prior written consent of the Bond Trustee to any such amendment or revocation (other than a change of Authorized Signatory, which may be made from time to time by the Guarantor (or the Cash Manager on its behalf)) but, unless such Mandate is revoked, the Standby Account Bank may continue to comply with such Mandate (as it may from time to time be amended in accordance with the provisions of this Section 3.2) unless it receives notice in writing from the Bond Trustee to the effect that a Guarantor Acceleration Notice has been served on the Guarantor and will, thereafter, act solely on the instructions of the Bond Trustee or such person as the Bond Trustee may designate and in accordance with the terms of those instructions as provided in Section 5.3 (Consequences of a Guarantor Acceleration Notice) of this Agreement.

Article 4

Acknowledgement by the Standby Account Bank

| 4.1 | Restriction on Standby Account Bank’s Rights |

Notwithstanding anything to the contrary in the Mandates, the Standby Account Bank hereby:

| (a) | agrees that, in its capacity as Standby Account Bank, it will not exercise any lien or, to the extent permitted by law, any set-off or transfer any sum standing to the credit of or to be credited to any of the Guarantor Accounts in or towards satisfaction of any liabilities owing to it by any Person (including any liabilities owing to it by the Guarantor or the Bond Trustee); |

| (b) | without prejudice to its rights as a Secured Creditor under the Security Agreement, agrees that it will not, solely in its capacity as Standby Account Bank and Standby GDA Provider provide, procure, or take any steps whatsoever to recover any amount due or owing to it pursuant to this Agreement which could result in, the winding-up or liquidation of the Guarantor or the making of an |

| - 10 - |

administration order in relation to the Guarantor in respect of any of the liabilities of the Guarantor whatsoever for one year plus one day after all Covered Bonds are paid in full;

| (c) | agrees that it will promptly notify the Guarantor, the Bond Trustee and the Cash Manager if compliance with any instruction would cause the relevant Guarantor Account(s) to which such instruction relates to have a negative balance; and |

| (d) | acknowledges that the Guarantor has, pursuant to the Security Agreement, inter alia, assigned by way of security all its rights, title, interest and benefit, present and future, in and to, all sums from time to time standing to the credit of the Guarantor Accounts and all of its rights under this Agreement to the Bond Trustee (for itself and on behalf of the Secured Creditors). |

| 4.2 | Monthly Statement |

Unless and until directed otherwise by the Bond Trustee, the Standby Account Bank will and is hereby authorized to provide each of the Cash Manager, the Guarantor and the Bond Trustee with a written statement in respect of each Guarantor Account delivered in accordance with Section 12 (Notices) on a monthly basis and also as soon as reasonably practicable after receipt of a written request for a statement.

Article 5

Indemnity and Guarantor Acceleration Notice

| 5.1 | Standby Account Bank to Comply with Cash Manager’s Instructions |

Unless otherwise directed in writing by the Bond Trustee pursuant to Section 5.3 (Consequences of a Guarantor Acceleration Notice), in making any transfer or payment from any Guarantor Account in accordance with this Agreement, the Standby Account Bank will be entitled to act, without further inquiry, as directed by the Cash Manager pursuant to Section 2.1 (Instructions from the Cash Manager) and to rely as to the amount of any such transfer or payment on the Cash Manager’s instructions in accordance with the relevant Mandate, and the Standby Account Bank will have no liability hereunder to the Cash Manager, the Guarantor or the Bond Trustee for having acted on such instructions.

| 5.2 | Guarantor’s Indemnity |

Subject to the prior ranking obligations set out in the relevant Priority of Payments, the Standby Account Bank and the Standby GDA Provider will each be indemnified to the extent of funds then standing to the credit of the Guarantor Accounts against any loss, cost, damage, charge or expense incurred by the Standby Account Bank or the Standby GDA Provider in complying with any instruction delivered pursuant to and in accordance with this Agreement or the Standby Guaranteed Deposit Account Contract, respectively, save that this indemnity will not extend to (i) the charges of the Standby Account Bank or the Standby GDA Provider (if any) for the operation of such accounts other than as provided in Section 2.3 (Standby Account Bank and Standby GDA Provider Charges) of this Agreement; and (ii) any loss, cost, damage, charge or

| - 11 - |

expense arising from any material breach by the Standby Account Bank of its obligations under this Agreement or any material breach by the Standby GDA Provider of its obligations under the Standby Guaranteed Deposit Account Contract, and if necessary, as determined by a court of competent jurisdiction in a final non-appealable decision. For greater certainty, payments to the Standby Account Bank and the Standby GDA Provider rank pro rata and pari passu with each other and with payments to the asset monitor, among others in the relevant Priority of Payments. The Guarantor will not amend the Priorities of Payments if such amendment negatively affects any payments (including the priority thereof) to the Standby Account Bank or the Standby GDA Provider without the consent of the Standby Account Bank or the Standby GDA Provider, as the case may be.

| 5.3 | Consequences of a Guarantor Acceleration Notice |

The Standby Account Bank acknowledges that, if it receives notice in writing from the Bond Trustee to the effect that the Bond Trustee has served a Guarantor Acceleration Notice on the Guarantor all right, authority and power of the Cash Manager in respect of each of the Guarantor Accounts will be terminated and be of no further effect and the Standby Account Bank agrees that it will, upon receipt of such notice from the Bond Trustee, comply with the directions of the Bond Trustee in relation to the operation of each of the Guarantor Accounts. Following receipt of such notice, the Standby Account Bank will be entitled to act, without further inquiry, on any direction received by the Bond Trustee pursuant to this Section 5.3 (Consequences of a Guarantor Acceleration Notice) and to rely as to the amount of any such transfer or payment on the Bond Trustee’s instructions in accordance with the relevant Mandate, and the Standby Account Bank will have no liability hereunder to the Cash Manager, the Guarantor or the Bond Trustee for having acted on such instructions.

Article 6

Change of Bond Trustee or Standby Account Bank

| 6.1 | Change of Bond Trustee |

If there is any change in the identity of the Bond Trustee, the parties to this Agreement will execute such documents and take such action as the successor Bond Trustee and the outgoing Bond Trustee may reasonably require for the purpose of vesting in the successor Bond Trustee the rights and obligations of the outgoing Bond Trustee under this Agreement and under the Security Agreement and releasing the outgoing Bond Trustee from any future obligations under this Agreement. Notice thereof will be given to the Rating Agencies for so long as any of the Covered Bonds remain outstanding.

| 6.2 | Limitation of Liability of Bond Trustee |

It is hereby acknowledged and agreed that by its execution of this Agreement, the Bond Trustee will not assume or have any of the obligations or liabilities of the Standby Account Bank, the Cash Manager or the Guarantor under this Agreement and that the Bond Trustee has agreed to become a party to this Agreement for the purpose only of taking the benefit of this Agreement and agreeing to amendments to this Agreement pursuant to Article 17 (Amendments, Modification, Variation or Waiver). For the avoidance of doubt, the parties to this Agreement

| - 12 - |

acknowledge that the rights and obligations of the Bond Trustee are governed by the Security Agreement. Any right which may be exercised or determination which may be made under this Agreement by the Bond Trustee may be exercised or made in the Bond Trustee’s absolute discretion without any obligation to give reasons therefor, and the Bond Trustee will not be responsible for any liability occasioned by so acting, except if acting in breach of the standard of care set out in Section 11.1 (Standard of Care) of the Security Agreement.

| 6.3 | Change of Standby Account Bank |

If the identity of the Standby Account Bank changes, the Cash Manager, the Guarantor and the Bond Trustee will execute such documents and take such actions as the new Standby Account Bank and the outgoing Standby Account Bank and the Bond Trustee may require for the purpose of vesting in the new Standby Account Bank the rights and obligations of the outgoing Standby Account Bank and releasing the outgoing Standby Account Bank from its future obligations under this Agreement.

| 7.1 | Termination Events |

The Guarantor (or the Cash Manager on its behalf):

| (a) | may (with the prior written consent of the Bond Trustee, which consent shall not be withheld unless the Bond Trustee determines that the termination of this Agreement would be materially prejudicial to the interests of the Covered Bondholders) terminate this Agreement in the event that the matters specified in paragraph (i), (vi) or (vii) below occur; |

| (b) | will (with the prior written consent of the Bond Trustee, which consent shall not be withheld unless the Bond Trustee determines that the termination of this Agreement would be materially prejudicial to the interests of the Covered Bondholders), and the Bond Trustee may in such circumstances, terminate this Agreement in the event that any of the matters specified in paragraphs (iii) to (v) (inclusive) below occur; and |

| (c) | in the event that any of the matters specified in paragraph (ii) below occur, the Guarantor will (or will cause the Cash Manager to) take the actions described in Section 7.6 and the Guarantor will terminate this Agreement, |

in each case by serving a written notice of termination on the Standby Account Bank in accordance with Article 12 (Notices) (such termination to be effective three Business Days following service of such notice and, in the case of (c), no later than five Business Days following the occurrence of any of the matters specified therein) which will direct the Standby Account Bank to transfer all funds held in the Guarantor Accounts to replacement accounts under the terms of a new bank account agreement (the “New Standby Bank Account Agreement”) and a new guaranteed deposit account contract (the “New Standby GDA

| - 13 - |

Agreement”) to be entered into by the parties hereto (excluding

the Standby Account Bank) substantially on the same terms as this Agreement and the Standby GDA Agreement, respectively, in any

of the following circumstances:

| (i) | if a deduction or withholding for or on account of any taxes is imposed, or it appears likely that such a deduction or withholding will be imposed, in respect of the interest payable on any Guarantor Account; |

| (ii) | if one or more Rating Agencies downgrades the rating of the unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank or the Standby Account Bank’s issuer default rating, as applicable, below the Standby Account Bank Required Ratings; |

| (iii) | if the Standby Account Bank, otherwise than for the purposes of the amalgamation or reconstruction as is referred to in paragraph (iv) below, ceases or, through an authorized action of the board of directors of the Standby Account Bank, threatens to cease to carry on all or substantially all of its business or the Standby Account Bank; |

| (iv) | if an order is made or an effective resolution is passed for the winding-up of the Standby Account Bank except a winding-up for the purposes of or pursuant to a solvent amalgamation or reconstruction the terms of which have previously been approved in writing by the Guarantor and the Bond Trustee (such approval not to be unreasonably withheld or delayed); |

| (v) | if proceedings are initiated against the Standby Account Bank under any applicable liquidation, insolvency, bankruptcy, sequestration, composition, reorganisation (other than a reorganisation where the Standby Account Bank is solvent) or other similar laws (including, but not limited to, presentation of a petition for an administration order) and (except in the case of presentation of petition for an administration order) such proceedings are not, in the reasonable opinion of the Guarantor, being disputed in good faith with a reasonable prospect of success or an administration order is granted or an administrative receiver or other receiver, liquidator, trustee in sequestration or other similar official is appointed in relation to the Standby Account Bank or in relation to the whole or any substantial part of the undertaking or assets of the Standby Account Bank, or an encumbrancer takes possession of the whole or any substantial part of the undertaking or assets of the Standby Account Bank, or a distress, execution or diligence or other process is levied or enforced upon or sued out against the whole or any substantial part of the undertaking or assets of the Standby Account Bank and such possession or process (as the case may be) is not discharged or otherwise ceases to apply within 30 days of its commencement, or the Standby Account Bank initiates or consents to judicial proceedings relating to itself under applicable liquidation, insolvency, bankruptcy, composition, |

| - 14 - |

reorganisation or other similar laws or makes a conveyance or assignment for the benefit of its creditors generally;

| (vi) | default is made by the Standby Account Bank in the performance or observance of any of its covenants and obligations, or a breach by the Standby Account Bank is made of any of its representations and warranties, respectively, under Sections 8.1(d), 8.1(e), 8.1(f), 8.1(g), 8.1(h) or 8.1(i); or |

| (vii) | if the Standby Account Bank materially breaches its other obligations under this Agreement or the Standby Guaranteed Deposit Account Contract, provided that the Rating Agency Condition has been satisfied with respect to the termination of this Agreement following such breach. |

| 7.2 | Notification of Termination Event |

Each of the Guarantor, the Cash Manager and the Standby Account Bank undertakes and agrees to notify the Bond Trustee in accordance with Section 12 (Notices) promptly upon becoming aware thereof of any event which would or could entitle the Bond Trustee to serve a notice of termination pursuant to Section 7.1 (Termination Events).

| 7.3 | Automatic Termination |

| (a) | This Agreement will automatically terminate (if not terminated earlier pursuant to this Article 7) on the date falling 90 days after the termination of the Guarantor Agreement and notice thereof to the parties to this Agreement, provided that all amounts payable under Section 2.3 (Standby Account Bank and Standby GDA Provider Charges) and Section 5.2 (Guarantor’s Indemnity) have been paid in accordance with the terms of this Agreement. |

| (b) | This Agreement shall automatically terminate (if not terminated earlier pursuant to this Article 7) upon the termination of the Standby Guaranteed Deposit Account Contract pursuant to Article 5 therein. |

| 7.4 | Termination by Standby Account Bank |

The Standby Account Bank may terminate this Agreement and cease to operate the Guarantor Accounts at any time on giving not less than 90 days’ prior written notice thereof ending on any Business Day which does not fall on a Guarantor Payment Date or less than ten (10) Business Days before a Guarantor Payment Date to each of the other parties hereto provided that such termination will not take effect (i) until a replacement Standby Account Bank with ratings by the Rating Agencies equal to or greater than each of the Standby Account Bank Required Ratings has entered into an agreement in form and substance similar to this Agreement; and (ii) the Rating Agency Condition has been satisfied in respect thereof. For greater certainty, the Standby Account Bank will not be responsible for any costs or expenses occasioned by such termination and cessation. In the event of such termination and cessation the Standby Account Bank will use commercially reasonable efforts to assist the other parties hereto to effect an

| - 15 - |

orderly transition of the banking arrangements documented hereby and, for greater certainty, at no cost to the Standby Account Bank.

| 7.5 | Notice of Termination/Resignation to CMHC |

Upon any termination or resignation of the Standby Account Bank hereunder, the Guarantor shall provide notice to CMHC of such termination or resignation and of the Standby Account Bank’s replacement contemporaneously with the earlier of (i) notice of such termination or resignation and replacement to a Rating Agency, (ii) notice of such termination or resignation and replacement being provided to or otherwise made available to Covered Bondholders, and (iii) five (5) Business Days following such termination or resignation and replacement (unless the replacement Standby Account Bank has yet to be identified at that time, in which case notice of the replacement Standby Account Bank may be provided no later than ten (10) Business Days thereafter). Any such notice shall include (if known) the reasons for the termination or resignation of the Standby Account Bank, all information relating to the replacement Standby Account Bank required by the CMHC Guide and the new agreement or revised and amended copy of this Agreement to be entered into with the replacement Standby Account Bank.

| 7.6 | Replacement of Standby Account Bank Under Certain Circumstances |

If one or more Rating Agencies downgrades the rating of the unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank or the Standby Account Bank’s issuer default rating, as applicable, below the Standby Account Bank Required Ratings, no later than five (5) Business Days following such occurrence, the Guarantor (or the Cash Manager on its behalf) will do the following:

| (a) | engage a replacement Standby Account Bank with ratings by the Rating Agencies equal to or greater than each of the Standby Account Bank Required Ratings and enter into the New Standby Bank Account Agreement and the New Standby GDA Agreement; |

| (b) | subject to Section 7.6(c), direct the Standby Account Bank to transfer all funds held in the Guarantor Accounts to replacement accounts under the terms of the New Standby Bank Account Agreement and the New Standby GDA Agreement (it being understood that all such funds must be transferred within the five (5) Business Day period to such replacement accounts); and |

| (c) | to the extent it is not practicable within the five (5) Business Day period to transfer the funds held in the Guarantor Accounts to replacement accounts under the terms of the New Standby Bank Account Agreement and the New Standby GDA Agreement, within 30 days following such occurrence, direct the Standby Account Bank to transfer all funds held in the Guarantor Accounts to replacement accounts under the terms of the New Standby Bank Account Agreement and the New Standby GDA Agreement (it being understood that all such funds must be transferred within the 30 day period to such replacement accounts), provided that, during such 30 day period, any amounts received into the Guarantor Accounts shall be transferred or otherwise deposited to the replacement accounts under the |

| - 16 - |

terms of the New Standby Bank Account Agreement and the New Standby GDA Agreement, as applicable, within five (5) Business Days of receipt.

Article 8

Representations And Warranties; COVENANT

| 8.1 | Standby Account Bank Representations, Warranties and Covenants |

The Standby Account Bank represents and warrants to, and covenants with, each of the Guarantor and the Bond Trustee at the date hereof, on each date on which an amount is credited to any Guarantor Account held with the Standby Account Bank and on each Guarantor Payment Date, that:

| (a) | it is a Schedule I Bank existing under the laws of Canada and duly qualified to do business in every jurisdiction where the nature of its business requires it to be so qualified, except where the failure to qualify would not constitute a Material Adverse Event; |

| (b) | (i) the execution, delivery and performance by the Standby Account Bank of this Agreement are within the Standby Account Bank’s corporate powers, (ii) have been duly authorized by all necessary corporate action, and (iii) do not contravene or result in a default under or conflict with (1) the charter or by-laws of the Standby Account Bank, (2) any law, rule or regulation applicable to the Standby Account Bank, or (3) any order, writ, judgment, award, injunction, decree or contractual obligation binding on or affecting the Standby Account Bank or its property; |

| (c) | it is not a non-resident of Canada within the meaning of the Income Tax Act (Canada); and |

| (d) | it possesses the necessary experience, qualifications, facilities and other resources to perform its responsibilities in relation to its duties and obligations hereunder and the other Transaction Documents to which it is a party; |

| (e) | it will comply with the provisions of, and perform its obligations under, this Agreement and the other Transaction Documents to which it is a party; |

| (f) | it is and will continue to be in regulatory good standing and in material compliance with and under all Laws applicable to its duties and obligations hereunder and the other Transaction Documents to which it is a party; |

| (g) | it is and will continue to be in material compliance with its internal policies and procedures (including risk management policies) relevant to its duties and obligations hereunder and the other Transaction Documents to which it is a party; |

| (h) | it will exercise reasonable skill and care in the performance of its obligations hereunder and the other Transaction Documents to which it is a party; |

| - 17 - |

| (i) | it will comply with the CMHC Guide and all material legal and regulatory requirements applicable to the conduct of its business so that it can lawfully attend to the performance of its obligations hereunder and the other Transaction Documents to which it is a party; and |

| (j) | the unsecured, unsubordinated and unguaranteed debt obligations of the Standby Account Bank rated by each of the Rating Agencies are at or above each of the Standby Account Bank Required Ratings. |

| 8.2 | Notification and Survival |

The Standby Account Bank undertakes to notify the Guarantor and the Bond Trustee immediately if, at any time during the term of this Agreement, any of the statements contained Section 8.1 (Standby Account Bank Representations, Warranties and Covenants) ceases to be true. The representations, warranties and covenants set out in Section 8.1 (Standby Account Bank Representations, Warranties and Covenants) will survive the signing and delivery of this Agreement.

| 9.1 | Non-Petition |

The Guarantor, the Cash Manager, the Standby Account Bank and the Standby GDA Provider agree that they will not institute or join any other Person or entity in instituting against, or with respect to, the Guarantor, or any general partners of the Guarantor, any bankruptcy or insolvency event so long as any Covered Bonds issued by the Issuer will be outstanding or there will not have elapsed one year plus one day since the last day on which any such securities will have been outstanding. The foregoing provision will survive the termination of this Agreement by any of the parties hereto.

| 10.1 | Further Assurances |

The parties hereto agree that they will co-operate fully to do all such further acts and things and execute any further documents as may be necessary or reasonably desirable to give full effect to the arrangements contemplated by this Agreement.

| - 18 - |

| 11.1 | Confidentiality |

None of the parties hereto will during the term of this Agreement or after its termination disclose to any Person whatsoever (except as provided herein, in accordance with the CMHC Guide, the Covered Bond Legislative Framework or in any of the Transaction Documents to which it is a party or with the authority of the other parties hereto or so far as may be necessary for the proper performance of its obligations hereunder or unless required by law or any applicable stock exchange requirement or any governmental, regulatory or other taxation authority or ordered to do so by a court of competent jurisdiction or by the Canada Revenue Agency) any information relating to the business, finances or other matters of a confidential nature of any other party hereto of which it may in the ordinary course of its duties hereunder have become possessed and each of the parties hereto will use all reasonable endeavours to prevent any such disclosure.

| 12.1 | Notices |

Any notices to be given pursuant to this Agreement to any of the parties hereto will be in writing and will be sufficiently served if sent by prepaid first class mail, by hand, e-mail or facsimile transmission and will be deemed to be given (if by e-mail or facsimile transmission) when dispatched, (if delivered by hand) on the day of delivery if delivered before 5:00 p.m. (Toronto time) on a Business Day or on the next Business Day if delivered thereafter or on a day which is not a Business Day or (if by first class mail) when it would be received in the ordinary course of the post and will be sent:

| (a) | in the case of The Bank of Nova Scotia in its capacity as Cash Manager, to The Bank of Nova Scotia, at its Executive Offices, Scotia Plaza, 00 Xxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx X0X 0X0 (facsimile number 416-945-4001) for the attention of the Managing Director, Alternate Funding, e-mail: xxxx.xxxxxxxx@xxxxxxxxxx.xxx; |

| (b) | in the case of the Guarantor, to Scotiabank Covered Bond Guarantor Limited Partnership, x/x Xxx Xxxx xx Xxxx Xxxxxx, at its Executive Offices, Scotia Plaza, 00 Xxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx X0X 0X0 (facsimile number 416-945-4001) for the attention of the Managing Director, Alternate Funding, e-mail: xxxx.xxxxxxxx@xxxxxxxxxx.xxx; |

| (c) | in the case of the Standby Account Bank and Standby GDA Provider, to Canadian Imperial Bank of Commerce, Brookfield Place, 11th Floor, 000 Xxx Xxxxxx, Xxxxxxx, Xxxxxxx, X0X 258 (facsimile number 416-594-7192) for the attention of Vice President, Treasury, email: Xxxxxx.Xxxxxxxxxxxxx@xxxx.xx; and |

| (d) | in the case of the Bond Trustee, to Computershare Trust Company of Canada, 000 Xxxxxxxxxx Xxxxxx, 00xx Xxxxx, Xxxxxxx, Xxxxxxx, X0X 0X0 |

| - 19 - |

(facsimile number 416-981-9777) for the attention of the Manager, Corporate Trust, email: xxxxxxxxxxxxxx.xxxxxxx@xxxxxxxxxxxxx.xxx,

or to such other address or facsimile number or for the attention of such other person or entity as may from time to time be notified by any party to the others by written notice in accordance with the provisions of this Section.

| 13.1 | Interest Payments on Standby Transaction Account |

In respect of each period from (and including) the first day of each month (or, in respect of the first such period, the first applicable day) to (but excluding) the last day of each month, the Standby Account Bank will pay, on the 10th Business Day after month end, interest in arrears on any cleared credit balances on the Standby Transaction Account and any other accounts opened by the Guarantor with the Standby Account Bank other than the Standby GDA Account at rates that are generally applicable to the business customers of the Standby Account Bank.

| 13.2 | Interest Payments on Standby GDA Account |

Notwithstanding Section 13.1 above, interest will be paid on the Standby GDA Account in accordance with the terms of the Standby Guaranteed Deposit Account Contract.

Article 14

Payments and Withholding

| 14.1 | Payments and Withholding |

The parties agree that payments required to be made hereunder will be made in accordance with Article 2 (Standby Transaction Account and Standby GDA Account) and that all payments by the Standby Account Bank under this Agreement will be made in full without any deduction or withholding (whether in respect of set-off, counterclaim, duties, taxes, charges or otherwise whatsoever) unless the deduction or withholding is required by law, in which event the Standby Account Bank will:

| (a) | ensure that the deduction or withholding does not exceed the minimum amount required by law; |

| (b) | pay to the relevant taxation or other authorities within the period for payment permitted by applicable law the full amount of the deduction or withholding; |

| (c) | furnish to the Guarantor and the Bond Trustee within the period for payment permitted by the relevant law, either: |

| (i) | an official receipt of the relevant taxation or other authorities involved in respect of all amounts so deducted or withheld; or |

| - 20 - |

| (ii) | if such receipts are not issued by the taxation or other authorities concerned on payment to them of amounts so deducted or withheld, a certificate of deduction or equivalent evidence of the relevant deduction or withholding; and |

| (d) | account to the Guarantor in full by credit to the Standby GDA Account for an amount equal to the amount of any rebate, repayment or reimbursement of any deduction or withholding which the Standby Account Bank has made pursuant to this Article 14 and which is subsequently received by the Standby Account Bank and, for greater certainty, the Standby Account Bank will have no obligation to obtain any rebate, repayment or reimbursement of any such deduction or withholding. |

| 15.1 | Entire Agreement |

This Agreement and the Standby GDA Agreement contain the entire agreement between the parties hereto in relation to the services to be performed hereunder and supersede any prior agreements, understandings, arrangements, statements or representations relating to such services. Nothing in this Article or Agreement will operate to limit or exclude any liability for fraud.

| 16.1 | Assignment |

Save as provided in or contemplated in this Agreement, no party hereto (other than the Bond Trustee) may assign or transfer any of its rights or obligations hereunder, and the Standby Account Bank may not act through any branch outside of the Province of Ontario, without the prior written consent of the other parties hereto and the Rating Agency Condition having been satisfied in respect of any such assignment or transfer. If any party assigns any of its obligations under this Agreement as permitted by this Agreement, such party will provide at least 10 Business Days’ prior written notice of such assignment to DBRS.

| 16.2 | Assignment to Bond Trustee |

Notwithstanding the provisions of Section 16.1 above, the parties hereto acknowledge that the Guarantor may assign all its rights, title and interest in this Agreement to the Bond Trustee, for the benefit of the Secured Creditors, in accordance with and pursuant to the terms of the Security Agreement.

Article 17

limitation of liability

| - 21 - |

| 17.1 | Limitation of Liability |

Scotiabank Covered Bond Guarantor Limited Partnership is a limited partnership formed under the Limited Partnerships Act (Ontario), a limited partner of which is, except as expressly required by law, only liable for any of its liabilities or any of its losses to the extent of the amount that the limited partner has contributed or agreed to contribute to its capital.

Article 18

AmendmentS, modification, variation or waiver

| 18.1 | Amendments, Modification, Variation or Waiver |

| (a) | Any amendment, modification, variation or waiver to this Agreement will be made only with the prior written consent of each party to this Agreement. No waiver of this Agreement will be effective unless it is in writing and signed by (or by some Person duly authorised by) each of the parties. Each proposed amendment or waiver of this Agreement that is considered by the Guarantor to be a material amendment, modification, variation or waiver will be subject to satisfaction of the Rating Agency Condition. For certainty, any amendment to (i) the definition of “Standby Account Bank Required Ratings” that lowers the ratings specified therein, or (ii) the consequences of breaching a Standby Account Bank Required Rating that makes such consequences less onerous, shall be deemed to be a material amendment. The Guarantor (or the Cash Manager on its behalf) will deliver notice to the Rating Agencies of any amendment or waiver which does not require satisfaction of the Rating Agency Condition with respect thereto provided that failure to deliver such notice will not constitute a breach of the obligations of the Guarantor under this Agreement. The Guarantor (or the Cash Manager on its behalf) will deliver notice to CMHC from time to time of any amendment, variation or waiver with respect to which notice to CMHC is required by the CMHC Guide, provided that failure to deliver such notice will not constitute a breach of the obligations of the Guarantor under this Agreement. No single or partial exercise of, or failure or delay in exercising, any right under this Agreement will constitute a waiver or preclude any other or further exercise of that or any other right. |

| (b) | Notwithstanding the foregoing, if at any time the Issuer determines that any one rating agency shall no longer be a Rating Agency, then, so long as (i) the Program is in compliance with the terms of the CMHC Guide, and (ii) each outstanding series of Covered Bonds is rated by at least two Rating Agencies, the ratings triggers for such rating agency will no longer be applicable to the Program without any action or formality, including for greater certainty satisfaction of the Rating Agency Condition with respect to any Rating Agency or consent or approval of the Bond Trustee or the holders of the Covered Bonds. Any amendments to this Agreement to reflect the foregoing shall be deemed not to be a material amendment and may be made without the requirement for satisfaction |

| - 22 - |

of the Rating Agency Condition with respect to any Rating Agency or consent or approval of the Bond Trustee or the holders of the Covered Bonds.

Article 19

Exclusion of Third Party Rights

| 19.1 | Exclusion of Third Party Rights |

Except as otherwise expressly provided in this Agreement, the parties hereto intend that this Agreement will not benefit, or create any right or cause of action on behalf of, any Person other than a party hereto and that no Person, other than a party hereto, will be entitled to rely on the provisions of this Agreement in any proceeding.

| 20.1 | Scope of Duty |

The Standby Account Bank undertakes to perform only such duties as are expressly set forth in this Agreement and to deal with the Guarantor Accounts with the degree of skill and care that the Standby Account Bank accords to all accounts and funds maintained and held by it on behalf of its customers. Notwithstanding any other provision of this Agreement, the parties agree that the Standby Account Bank will not be liable for any action taken by it or any of its directors, officers or employees in accordance with this Agreement except, subject to Section 5.1 (Standby Account Bank to Comply with Cash Manager’s Instructions), for its or their own gross negligence or wilful misconduct, and if necessary, as determined by a court of competent jurisdiction in a final non-appealable decision. In no event will the Standby Account Bank be liable for (i) losses or delays resulting from force majeure, computer malfunctions, interruption of communication facilities or other causes beyond the Standby Account Bank’s control or for indirect or consequential damages, or (ii) any loss due to any altered, forged, fraudulent or unauthorized Financial Instruments.

Article 21

Waiver Of Formalities

| 21.1 | Waiver of Formalities |

The Guarantor hereby waives in favour of the Standby Account Bank certain statutory or other customary formalities of the Bills of Exchange Act (Canada) which include, for greater certainty, formalities relating specifically to presentment, protest, noting and notice, with respect to all Financial Instruments prepared, signed or endorsed and delivered to the Standby Account Bank hereunder; and the Standby Account Bank will not, in any circumstances, be liable for the failure or omission to carry out any such formalities in connection with any Financial Instrument.

| - 23 - |

| 22.1 | Counterparts |

This Agreement may be executed in any number of counterparts (manually, e-mail or by facsimile) and by different parties hereto in separate counterparts, each of which when so executed will be deemed to be an original and all of which when taken together will constitute one and the same instrument.

| 23.1 | Governing Law |

This Agreement will be governed by, and construed in accordance with, the laws of the Province of Ontario and the federal laws of Canada applicable therein.

| 23.2 | Submission to Jurisdiction |

Each party to this Agreement hereby irrevocably submits to the non-exclusive jurisdiction of the courts of the Province of Ontario in any action or proceeding arising out of or relating to this Agreement.

[The remainder of this page is intentionally left blank]

IN WITNESS WHEREOF the parties hereto have executed this Agreement the day and year first before written.

| The Bank of nova scotia, as Cash Manager and Issuer | ||

| Per: | /s/ Xxx Xxxxx | |

| Name: Xxx Xxxxx | ||

| Title: Managing Director and Head, Funding and Liquidity Management | ||

| COMPUTERSHARE trust company of canada, as Bond Trustee | ||

| Per: | /s/ Xxxx Xxxxxx | |

| Name: Xxxx Xxxxxx | ||

| Title: Corporate Trust Officer | ||

| Per: | /s/ Xxxxxxx Xxxx | |

| Name: Xxxxxxx Xxxx | ||

| Title: Associate Trust Officer | ||

| SCOTIABANK COVERED BOND GUARANTOR LIMITED PARTNERSHIP by its managing general partner SCOTIABANK COVERED BOND GP INC. | ||

| Per: | /s/ Xxxx Xxxxxxxx | |

| Name: Xxxx Xxxxxxxx | ||

| Title: President and Secretary | ||

| CANADIAN IMPERIAL BANK OF COMMERCE, as Standby Account Bank and Standby GDA Provider | ||

| Per: | /s/ Xxxxxxx Xxx | |

| Name: Xxxxxxx Xxx | ||

| Title: Vice-President | ||

| Per: | /s/ Xxxx Xxxxxxxxx | |

| Name: Xxxx Xxxxxxxxx | ||

| Title: Vice-President | ||

Form of Mandate

In the form attached

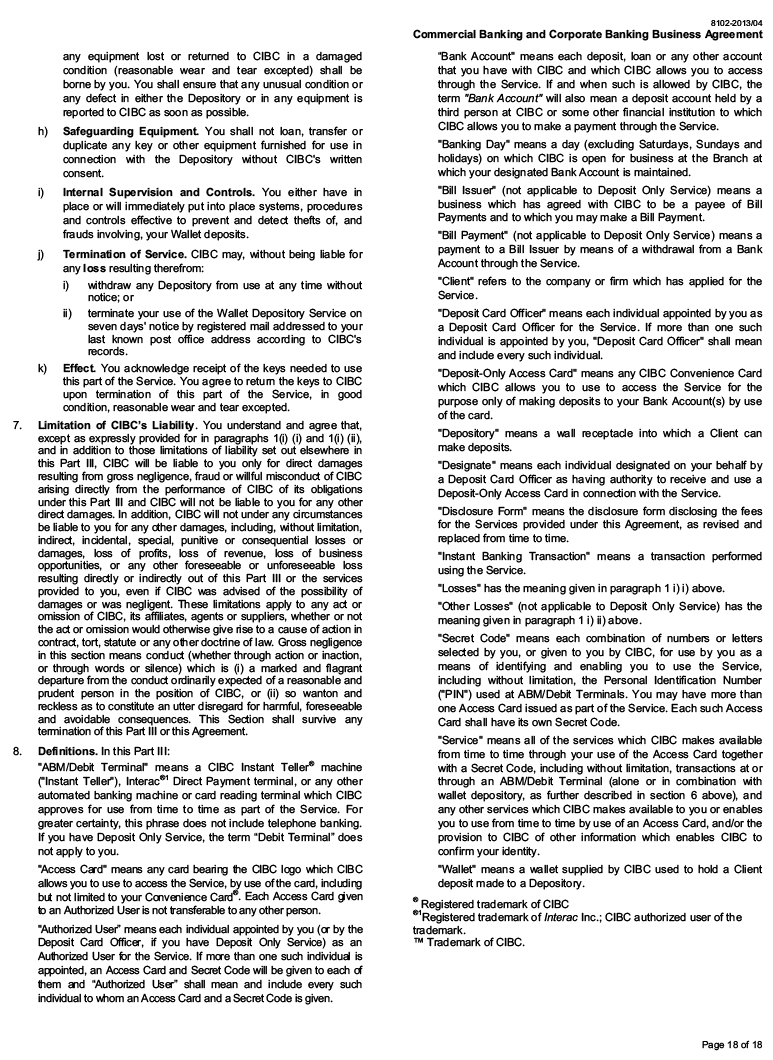

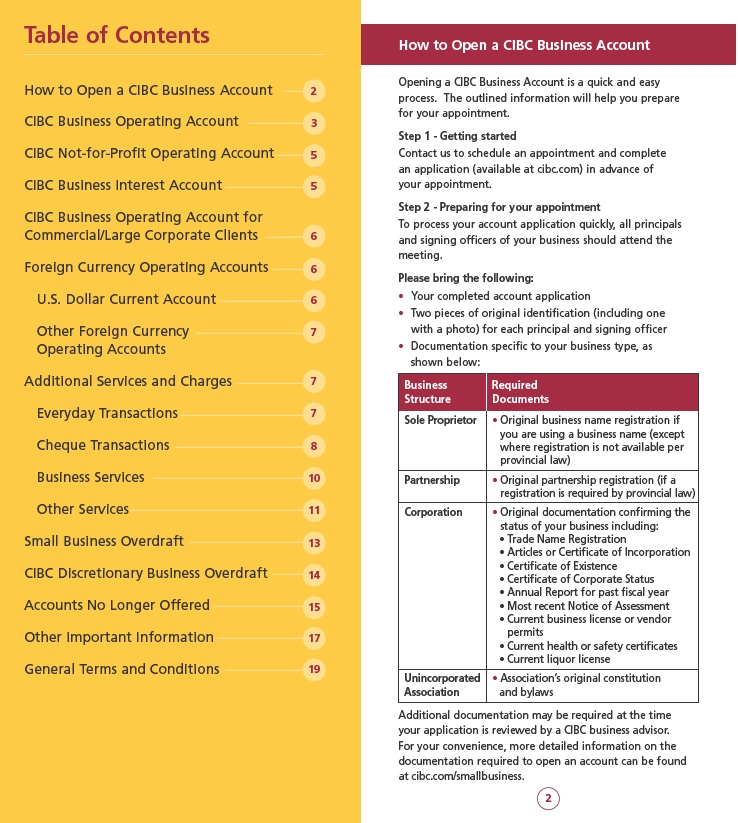

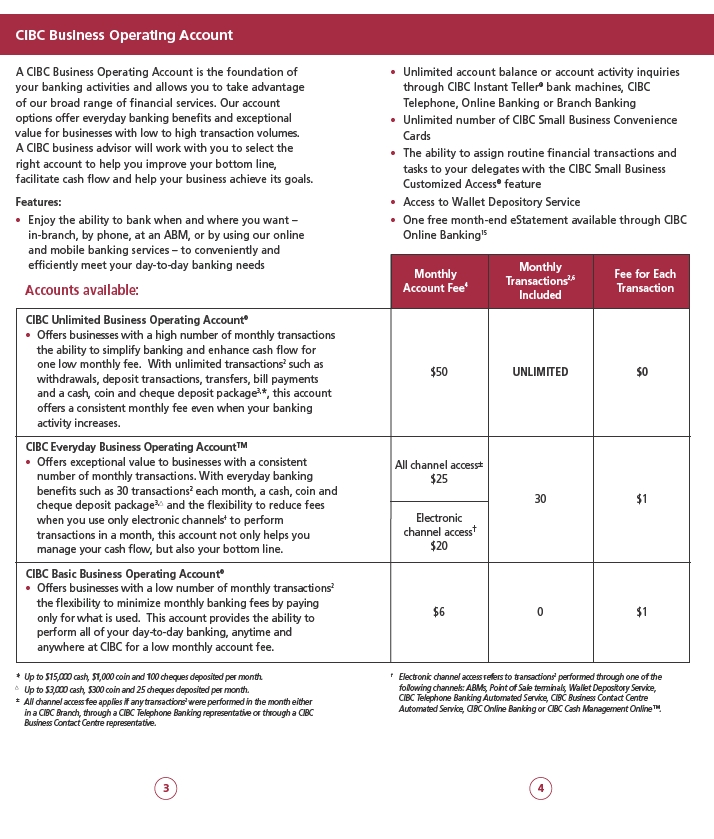

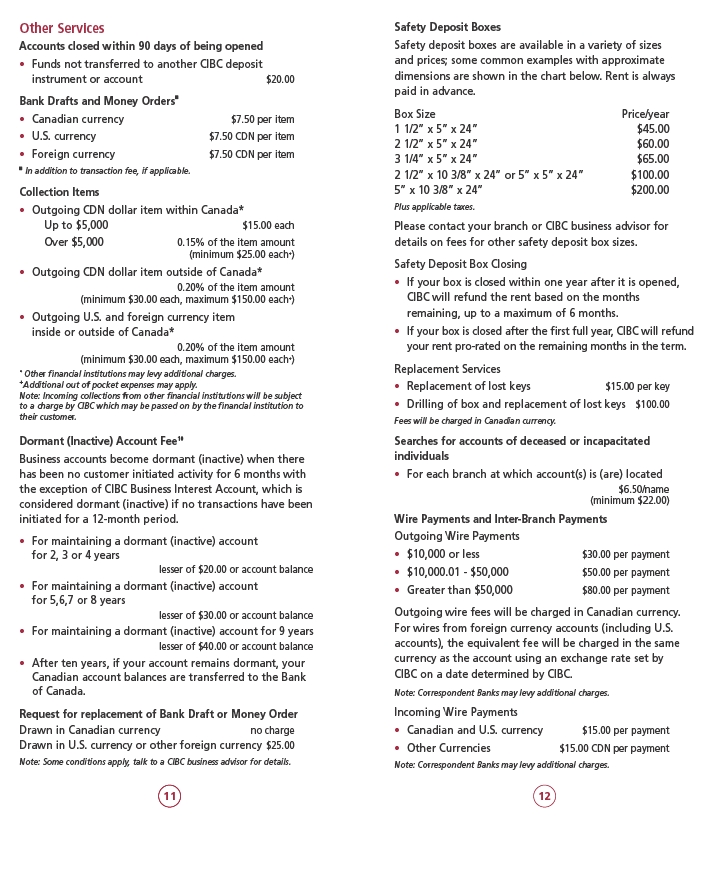

Commercial Banking and Corporate Banking Business

Account Operating Terms and Agreements

Commercial Banking and Corporate Banking Business

Account Operating Terms and Agreements

Our Commitment to You

Understanding Our Hold Policy on Cheques

What’s

Your Privacy is Protected

inside

Commercial Banking and Corporate Banking Business Agreement

8102-2013/04

TABLE OF CONTENTS

Our Commitment to You – To Exceed Your Expectations 3 Understanding our Hold Policy on Cheques 6 Your Privacy is Protected 7 Commercial Banking and Corporate Banking Business Agreement 9

Page 2 of 18

OUR COMMITMENT TO YOU:

OUR COMMITMENT TO YOU:

TO EXCEED YOUR EXPECTATIONS

As a CIBC Client, you should expect nothing less than the best possible service every time you deal with one of our representatives in person, by letter, on the telephone or when doing your banking electronically through our banking machines or Online Banking.

Our aim is to build a long-term relationship with you. The foundation of this relationship is our Service Commitment – to anticipate and exceed your expectations. Our Service Commitment sets out the standards that our Clients can expect from CIBC, and that we demand of ourselves.

EVERYONE AT CIBC IS ACCOUNTABLE TO YOU, OUR CLIENT

From the Client Service Representative in your branch/business centre to the Chief Executive Officer – everyone at CIBC is accountable for our Service Commitment.

SIMPLE BEGINNING: TALK OPENLY WITH YOU

Wherever you do business at CIBC, you can expect us to be open and forthcoming. This applies to our written documents as well – we’re working to put our documents in plain language, to make them easier for you to read and understand.

CANDID EXPLANATIONS OF OUR SERVICE FEES

We’ll explain the rates, terms and conditions relating to our products and services clearly, including any fees or sales commissions that may apply. We’ll also alert you that certain investments may carry greater risks. If, for some reason, we cannot provide a product or service, we’ll explain why and suggest alternatives. Our service fees are based on three principles:

1. They should be simple to understand.

2. They should reflect our commitment to deliver options and value.

3. They should provide you with choices to reduce or even eliminate certain fees.

YOURPRIVACYISPROTECTED

An important part of the CIBC Service Commitment is your right to privacy. Even as we expand our products and services, and the technology we use to provide them, keeping your information and affairs confidential is fundamental to the way we do business.

Page 3 of 18

OUR PROCESS FOR RESOLVING YOUR COMPLAINTS

We have created a process for dealing with client concerns and complaints that we believe is both effective and efficient. We expect every CIBC employee who receives a client complaint to take ownership, and ensure that the complaint is resolved quickly.

If you have a complaint or concern, we encourage you to follow the complaint procedure outlined here.

STEP 1

WHERE YOU DO BUSINESS WITH US

In most cases, a complaint is resolved simply by telling us about it and discussing it with us. You should be able to get swift results by talking to our employees or Manager where you do business with us. If they can’t resolve the problem to your satisfaction, they will immediately refer you to a Client Care Specialist who will make every effort to resolve the problem quickly and to your satisfaction.

STEP 2

BUSINESS CONTACT CENTRE

If you are uncomfortable discussing the issue with our employees or the Manager of the location where the problem has occurred, or if they have not resolved the problem to your satisfaction, you can contact the CIBC Business Contact Centre directly.

Contacting the Business Contact Centre

Via Phone & Fax

Phone: 0 000 000-0000 Main Line Fax: 0 000 000-0000

Phone: 0 000 000-0000 Clients in Quebec Fax: 0 000 000-0000

NOTE: If your CIBC Relationship Manager provided you with contact numbers for the Business Contact Centre that are different from those listed above, please continue to use those from your Relationship Manager.

Via Mail

Toronto Office Quebec Office

CIBC Business Contact Centre Centre de Services aux Entreprises

0000 Xxxxx Xxxxxx, 00xx Xxxxx 1155 rue Xxxx Xxxxxxxx Ouest, Bureau 330 Toronto, Ontario Montreal, Quebec Canada M2M 4G3 Canada H3B 4P9

Be sure to include:

Your name

Your address where you prefer to be reached

If you prefer, fax number with area code

The nature of your complaint

Details relevant to the matter and with whom you have already discussed the issue

If you are dissatisfied with the decision of the CIBC Business Contact Centre, you may contact or be directed to the CIBC Ombudsman.

Page 4 of 18

STEP 3

CIBC OMBUDSMAN

The CIBC Ombudsman’s most important task is to review the details of any complaint objectively and impartially. Assuming you have followed the complaint escalation steps outlined above, the CIBC Ombudsman will acknowledge your complaint right away.

Then, providing legal action has not been taken on the matter, the Ombudsman immediately goes to work.

In most cases, you will receive a decision regarding your concern within ten working days.

YoucanreachtheCIBCOmbudsmanby:

Telephone: 0 000 000-0000 or (000) 000-0000 in Toronto Fax: 0 000 000-0000 or (000) 000-0000 in Toronto E-mail: xxxxxxxxx@xxxx.xxx Write to: CIBC Ombudsman

X.X. Xxx 000, Xxxxxxxx Xxxxx, Xxxxxxx, XX X0X 0X0

If the above steps do not resolve your concern, you may consider escalating the matter further.

OMBUDSMAN FOR BANKING SERVICES AND INVESTMENTS (OBSI)

You can contact the OBSI who is independent from CIBC, and whose purpose is to review your personal or business complaint when you cannot accept the decision of the CIBC Ombudsman.

You can reach the Ombudsman for Banking Services and Investments by:

Telephone: 0 000 000-0000 Fax: 0 000 000-0000 E-mail: xxxxxxxxx@xxxx.xx Web Site: xxx.xxxx.xx

Write to: Ombudsman for Banking Services and Investments P. O. Xxx 000 XXX. Xxxxxxxx, Xxxxxxx, XX X0X 0X0

THE FINANCIAL CONSUMER AGENCY OF CANADA

The Financial Consumer Agency of Canada (FCAC) supervises federally regulated financial institutions, such as CIBC, to ensure they comply with federal consumer protection laws.

The FCAC also helps educate consumers and monitors industry codes of conduct and public commitments designed to protect the interest of consumers.

Federal consumer protection laws affect you in a number of ways. For example, financial institutions must provide you with information about their fees, interest rates and complaint handling procedures.

For more information, please contact the FCAC by:

Telephone: 0 000 000-0000 Web Site: xxx.xxxx-xxxx.xx.xx

If you have a regulatory complaint, you can contact the FCAC in writing at:

Financial Consumer Agency of Canada 6th Floor, Enterprise Building 000 Xxxxxxx Xxx. Xxxx, Xxxxxx, XX X0X 0X0

The FCAC will determine whether the financial institution is in compliance. It will not, however, resolve individual consumer complaints.

THE PRIVACY COMMISSIONER OF CANADA

If your concern involves a privacy issue you may contact the Office of the Privacy Commissioner of Canada by:

Telephone: (000) 000-0000 or 0 000 000-0000 Fax: (000) 000-0000 Web Site: xxx.xxxxxxx.xx.xx

Page 5 of 18

ADDITIONAL INFORMATION FOR OUR BUSINESS AND AGRICULTURE CLIENTS

THE CIBC BUSINESS CREDIT PROCESS

Business Credit is essential to many agricultural or business clients. As part of our commitment to open communications, the following outlines the steps involved in the CIBC credit application approval process.

APPLYING FOR BUSINESS CREDIT

At any CIBC Branch or office where agricultural or business affairs are conducted, we will provide clear direction on how to apply for credit for your business and how to develop an effective business plan.

THE CREDIT APPROVAL PROCESS

CIBC assesses each business credit application on its own merits. The key determining factors in obtaining credit include: the soundness of your business plan, the ability of your business to repay the loan requested, the long-term viability of your business, the credit history of your business, if any, and the personal credit history of the key principal (s) of your business.

Once your application is approved, CIBC will advise you of the terms and conditions of the financing arrangement for your business, including the information and documentation we will need. At your business’ request, CIBC will be happy to provide the requirements in writing.

IF YOUR BUSINESS CREDIT APPLICATION IS DECLINED

To the extent permitted by law or regulation, CIBC will inform you what the main reasons for the decision are, and at the same time review with you what requirements are necessary for us to reconsider your business credit application. We’ll also provide information on alternative sources of financing, such as government assistance programs and venture capital.

IF YOUR BUSINESS CIRCUMSTANCES CHANGE

Sometimes clients who have a credit relationship with us experience a significant change in their business. This could include financial difficulty or, conversely, a need for additional funds due to rapid growth. If any such changes occur, CIBC will review your existing arrangements to determine next steps. We may ask you for additional information, and we’ll give you reasonable opportunity to provide it.

If CIBC’s review determines that a change in our credit relationship is necessary, CIBC will provide you with at least 30 days notice of what those changes will be, unless we believe, based on reasonable grounds, that a shorter notice period is needed to protect our interest. The changes might include amendments to your terms, conditions, fees or lending margins.

Part of the CIBC Service Commitment mandate is to meet the changing needs of our business and agricultural clients. For that reason, we believe the sooner we talk, the sooner we can work together towards viable solutions

UNDERSTANDING OUR HOLD POLICY ON CHEQUES

For purposes of this policy:

“Cheque” also includes certified cheques, bank drafts, money orders and other instruments

Saturday, Sunday and holidays are not business days

UNDERSTANDING HOLD PERIODS

When you deposit a cheque in your Business Account, a hold period may apply to allow time for the cheque to clear. The funds will appear in your account at the time of deposit, but you may not be able to access them until the hold period expires.

Even after the hold period expires, there is no guarantee that a cheque will not be returned to us unpaid. If a cheque is returned unpaid for any reason at any time, either during or after the expiry of the hold period, we have the right to charge the amount of the cheque to your account.

We may also accept cheques from you on “collection”, meaning that only if and when CIBC receives payment from the financial institution on which the cheque is drawn will the funds be credited to your account and you have access to the funds.

Page 6 of 18

HOW LONG ARE FUNDS HELD?

The length of the hold period for cheques depends on the currency, amount of the cheque and other factors:

• For a CDN$ cheque drawn on a financial institution’s branch located in Canada, the normal length of time we will hold funds is 4 business days after the day of deposit. The maximum hold periods are as follows:

Cheque Amount Way You Deposit Maximum Hold Period $1,500 or less In branch 4 business days after day of deposit By ABM or any other way 5 business days after day of deposit* Greater than $1,500 In branch 7 business days after day of deposit By ABM or any other way 8 business days after day of deposit* * For the CIBC Wallet Depository Service, the day of deposit is considered to be the day that the wallet’s contents are accepted for deposit and processed by CIBC.

• For a non-CDN$ cheque drawn on a financial institution’s branch located in Canada, the normal length of time we will hold funds is 10 business days. The maximum hold period is 20 business days.

• For a non-CDN$ cheque drawn on a financial institution’s branch located outside of Canada, the normal length of time we will hold funds is 15 business days. The maximum hold period is estimatedtobe 30businessdays.

REASONS WE MAY HOLD THE FUNDS BEYOND THE MAXIMUM PERIOD

We may extend the maximum hold periods in some circumstances, including (but not limited to) where:

CIBC has reasonable grounds to believe that the deposit is being made for illegal or fraudulent purposes in relation to an account

CIBC has reasonable grounds to believe that there is material increased credit risk an account has been open for less than 90 days the cheque is not encoded with magnetic ink character recognition or is not readable by operational systems (for example, if damaged or mutilated) the cheque has been endorsed more than once the cheque is deposited six months or more after the date of the cheque The hold period under these circumstances is estimated to be 30 business days and could be longer for non-CDN$ cheques drawn on a financial institution’s branch located outside of Canada.

ACCESS TO DEPOSITED FUNDS LIMIT

An Access to Deposited Funds Limit may apply to cheque deposits you make in branch, at an ABM or any other way. This is the dollar amount you will have access to until the hold period expires on your deposit. CIBC may change the Access to Deposited Funds Limit at any time and without notice to you.

CIBC’s Hold Policy and Access to Deposited Funds Limits are subject to the terms and conditions of the Commercial Banking and Corporate Banking Business Agreement, which governs your account.

YOUR PRIVACY IS PROTECTED

DISCLOSURE NOTICE

Doing business with a financial institution involves providing information about yourself. At CIBC, you have control over how your information is obtained, used and given out. Your information is kept confidential and your privacy is protected. This is explained in our brochure, “Your Privacy is Protected”. Please pick up this brochure at any branch or office of CIBC, or on our Web site: xxx.xxxx.xxx. This disclosure notice contains a short summary.

We obtain information about you to: identify you or locate you protect us both against error and fraud

understand your needs and eligibility for products and services recommend particular products and services to meet your needs provide ongoing service comply with legal or regulatory requirements.

If you are an individual client:

the Income Tax Act requires us to ask for your Social Insurance Number when opening an interest bearing or investment account we may verify some of the information you give us with your employer or your references health information you have given to CIBC or a CIBC insurance company is not shared within the CIBC group.

Page 7 of 18

YOU CAN EXPECT US TO PROTECT YOUR PRIVACY

Your information and the business you do with us is kept in strict confidence. Only authorized personnel have access to your information. We collect, use and disclose personal information only for purposes that a reasonable person would consider appropriate in the circumstances. We don’t sell your information to third parties. Our procedures and systems are designed to protect your information from error, loss and unauthorized access. We keep your information only as long as it is needed. We monitor our compliance with applicable privacy legislation.

We may review and analyze your use of products and services, including transactions in your accounts, to help protect you from unauthorized use of your accounts, to help us serve you better, and to tell you about other products and services. We also collect and analyze information from other sources for the same reasons.

YOU CAN GIVE — OR WITHDRAW — YOUR CONSENT