EXECUTION VERSION 741967910 19619932 SECOND AMENDMENT TO CREDIT AGREEMENT THIS SECOND AMENDMENT (the “Amendment”) to that certain CREDIT AGREEMENT, dated as of June 21, 2019 (as amended, restated, supplemented or otherwise modified from time to time,...

EXECUTION VERSION 741967910 19619932 SECOND AMENDMENT TO CREDIT AGREEMENT THIS SECOND AMENDMENT (the “Amendment”) to that certain CREDIT AGREEMENT, dated as of June 21, 2019 (as amended, restated, supplemented or otherwise modified from time to time, the “Agreement”), among XXXXXX XXXX EDUCATORS CORPORATION, a Delaware corporation (the “Borrower”), the Lenders party thereto (the “Lenders”), and PNC BANK, NATIONAL ASSOCIATION, as Administrative Agent (the “Administrative Agent”) is dated as of July 12, 2021. WHEREAS, the Borrower desires that the Agreement be amended on the terms and conditions set forth herein; NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged), the parties hereto agree as follows: 1. AMENDMENTS. Upon satisfaction of the conditions set forth in Section 2, the Agreement shall be amended as follows: 1.1 The second paragraph of the Credit Agreement is amended by replacing “$225,000,000” with “$325,000,000”. 1.2 The last sentence of the definition of “Commitment” in Section 1.01 of the Credit Agreement is replaced with the following: “As of the Second Amendment Effective Date, the aggregate amount of the Lenders’ Commitments is $325,000,000.” 1.3 The following definitions in Section 1.01 of the Credit Agreement are deleted in their entirety and replaced with the following: “Anti-Terrorism Law” means any law in force or hereinafter enacted related to terrorism, money laundering, or Sanctions, including Executive Order No. 13224, the USA PATRIOT Act, the International Emergency Economic Powers Act, 50 U.S.C. 1701, et. seq., the Trading with the Enemy Act, 50 U.S.C. App. 1, et. seq., 18 U.S.C. § 2332d, and 18 U.S.C. § 2339B, and any regulations or directives promulgated under these provisions. “Maturity Date” means July 12, 2026. “Reportable Compliance Event” means that: (a) any Covered Entity becomes a Sanctioned Person, or is charged by indictment, criminal complaint, or similar charging instrument, arraigned, custodially detained, penalized or the subject of an assessment for a penalty, or enters into a settlement with an Official Body in connection with any Sanctions or other Anti-Terrorism Law or Anti-Corruption law, or any predicate crime to any Anti-Terrorism Law or Anti-Corruption Law, or has knowledge of facts or circumstances to the effect that it is reasonably likely that any aspect of its operations represents a violation of any Anti-Terrorism Law or Anti-Corruption Law; or (b) any Covered Entity engages in a transaction that has caused or may cause the

Second Amendment to Credit Agreement 741967910 19619932 2 Lenders or Administrative Agent to be in violation of any Anti-Terrorism Laws, including a Covered Entity’s use of any proceeds of the Loans to fund any operations in, finance any investments or activities in, or, make any payments to, directly or indirectly, a Sanctioned Person or Sanctioned Jurisdiction. “Sanctioned Person” means (a) a Person that is the subject of sanctions administered by OFAC or the U.S. Department of State (“State”), including by virtue of being (i) named on OFAC’s list of “Specially Designated Nationals and Blocked Persons”; (ii) organized under the laws of, ordinarily resident in, or physically located in a Sanctioned Jurisdiction; (iii) owned or controlled 50% or more in the aggregate, by one or more Persons that are the subject of sanctions administered by OFAC; (b) a Person that is the subject of sanctions maintained by the European Union (“E.U.”), including by virtue of being named on the E.U.’s “Consolidated list of persons, groups and entities subject to E.U. financial sanctions” or other, similar lists; (c) a Person that is the subject of sanctions maintained by the United Kingdom (“U.K.”), including by virtue of being named on the “Consolidated List Of Financial Sanctions Targets in the U.K.” or other, similar lists; or (d) a Person that is the subject of sanctions imposed by any Official Body of a jurisdiction whose laws apply to this Agreement. “Threshold Amount” means, with respect to all Insurance Subsidiaries, as of any date of determination, twenty-five percent (25%) of the net aggregate admitted assets less separate account assets (as set forth on the financial statements of the Insurance Subsidiaries most recently provided pursuant to Section 5.01(c)). 1.4 Section 1.01 of the Credit Agreement is amended by inserting the following new definitions in proper alphabetical order: “Anti-Corruption Laws” means the United States Foreign Corrupt Practices Act of 1977, as amended, the UK Xxxxxxx Xxx 0000, and any other similar anti- corruption laws or regulations administered or enforced in any jurisdiction in which the Borrower or any of its Subsidiaries conduct business. “Official Body” means the government of the United States of America or any other nation, or of any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government (including any supra-national bodies such as the European Union or the European Central Bank) and any group or body charged with setting financial accounting or regulatory capital rules or standards (including the Financial Accounting Standards Board, the Bank for International Settlements or the Basel Committee on Banking Supervision or any successor or similar authority to any of the foregoing).

Second Amendment to Credit Agreement 741967910 19619932 3 “Sanctioned Jurisdiction” means any country, territory, or region that is the subject of sanctions administered by (a) the U.S. government, including those administered by OFAC or (b) the United Nations Security Council, the European Union, any European Union member state, Her Majesty’s Treasury of the United Kingdom or other relevant sanctions authority. “Sanctions” means sanctions administered or enforced from time to time by the U.S. government, including OFAC, the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury or other relevant sanctions authority. “Second Amendment Effective Date” means July 12, 2021. 1.5 The definition of “Sanctioned Country” in Section 1.01 of the Credit Agreement is hereby deleted. 1.6 Article I of the Credit Agreement is amended by inserting the following new Section 1.07 at the end thereof: 1.07 “LIBOR Notification”. Section 2.11(b) of this Agreement provides a mechanism for determining an alternative rate of interest in the event that the London interbank offered rate is no longer available or in certain other circumstances. The Administrative Agent does not warrant or accept any responsibility for and shall not have any liability with respect to, the administration, submission or any other matter related to the London interbank offered rate or other rates in the definitions of “LIBO Rate”, “Daily LIBOR Rate” or with respect to any alternative or successor rate thereto, or replacement rate therefor. 1.7 Section 2.11(b) of the Credit Agreement is deleted and replaced with the following: (b) Benchmark Replacement Setting. (i) Announcements Related to LIBOR. On March 5, 2021, the ICE Benchmark Administration, the administrator of LIBOR (the “IBA”) and the U.K. Financial Conduct Authority, the regulatory supervisor for the IBA, announced in a public statement the future cessation or loss of representativeness of overnight/Spot Next, 1-week, 1-month, 2-month, 3-month, 6-month and 12- month USD LIBOR tenor settings (collectively, the “Cessation Announcements”). The parties hereto acknowledge that, as a result of the Cessation Announcements, a Benchmark Transition Event occurred on March 5, 2021 with respect to USD LIBOR under clauses (1) and (2) of the definition of Benchmark Transition Event below; provided however, no related Benchmark Replacement Date occurred as of such date. (ii) Benchmark Replacement. Notwithstanding anything to the contrary herein or in any other Loan Document (and any agreement executed in

Second Amendment to Credit Agreement 741967910 19619932 4 connection with a Swap Contract shall be deemed not to be a “Loan Document” for purposes of this Section 2.11(b)), if a Benchmark Transition Event, an Early Opt- in Election or an Other Benchmark Rate Election, as applicable, and its related Benchmark Replacement Date have occurred prior to the Reference Time in respect of any setting of the then-current Benchmark, then (x) if a Benchmark Replacement is determined in accordance with clause (1) or (2) of the definition of “Benchmark Replacement” for such Benchmark Replacement Date, such Benchmark Replacement will replace such Benchmark for all purposes hereunder and under any Loan Document in respect of such Benchmark setting and subsequent Benchmark settings without any amendment to, or further action or consent of any other party to, this Agreement or any other Loan Document and (y) if a Benchmark Replacement is determined in accordance with clause (3) of the definition of “Benchmark Replacement” for such Benchmark Replacement Date, such Benchmark Replacement will replace such Benchmark for all purposes hereunder and under any Loan Document in respect of any Benchmark setting at or after 5:00 p.m. (New York City time) on the fifth (5th) Business Day after the date notice of such Benchmark Replacement is provided to the Lenders without any amendment to, or further action or consent of any other party to, this Agreement or any other Loan Document so long as the Administrative Agent has not received, by such time, written notice of objection to such Benchmark Replacement from Lenders comprising the Required Lenders. (iii) Benchmark Replacement Conforming Changes. In connection with the implementation of a Benchmark Replacement, the Administrative Agent will have the right to make Benchmark Replacement Conforming Changes from time to time and, notwithstanding anything to the contrary herein or in any other Loan Document, any amendments implementing such Benchmark Replacement Conforming Changes will become effective without any further action or consent of any other party to this Agreement or any other Loan Document. (iv) Notices; Standards for Decisions and Determinations. The Administrative Agent will promptly notify the Borrower and the Lenders of (1) any occurrence of a Benchmark Transition Event, a Term SOFR Transition Event, an Early Opt-in Election, or an Other Benchmark Rate Election, as applicable, and its related Benchmark Replacement Date, (2) the implementation of any Benchmark Replacement, (3) the effectiveness of any Benchmark Replacement Conforming Changes, (4) the removal or reinstatement of any tenor of a Benchmark pursuant to paragraph (v) below and (5) the commencement or conclusion of any Benchmark Unavailability Period. Any determination, decision or election that may be made by the Administrative Agent or, if applicable, any Lender (or group of Lenders) pursuant to this Section 2.11(b) including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection, will be conclusive and binding absent manifest error and may be made in its or their sole discretion and without consent from any other party to this Agreement or any

Second Amendment to Credit Agreement 741967910 19619932 5 other Loan Document, except, in each case, as expressly required pursuant to this Section 2.11(b). (v) Unavailability of Tenor of Benchmark. Notwithstanding anything to the contrary herein or in any other Loan Document, at any time (including in connection with the implementation of a Benchmark Replacement), (1) if the then-current Benchmark is a term rate (including Term SOFR or USD LIBOR) and either (A) any tenor for such Benchmark is not displayed on a screen or other information service that publishes such rate from time to time as selected by the Administrative Agent in its reasonable discretion or (B) the regulatory supervisor for the administrator of such Benchmark has provided a public statement or publication of information announcing that any tenor for such Benchmark is or will be no longer representative, then the Administrative Agent may modify the definition of “Interest Period” for any Benchmark settings at or after such time to remove such unavailable or non-representative tenor and (2) if a tenor that was removed pursuant to clause (1) above either (A) is subsequently displayed on a screen or information service for a Benchmark (including a Benchmark Replacement) or (B) is not, or is no longer, subject to an announcement that it is or will no longer be representative for a Benchmark (including a Benchmark Replacement), then the Administrative Agent may modify the definition of “Interest Period” for all Benchmark settings at or after such time to reinstate such previously removed tenor. (vi) Benchmark Unavailability Period. Upon the Borrower’s receipt of notice of the commencement of a Benchmark Unavailability Period, the Borrower may revoke any request for a Loan bearing interest based on USD LIBOR, conversion to or continuation of Loans bearing interest based on USD LIBOR to be made, converted or continued during any Benchmark Unavailability Period and, failing that, the Borrower will be deemed to have converted any such request into a request for a Loan of or conversion to ABR Loans. During any Benchmark Unavailability Period or at any time that a tenor for the then-current Benchmark is not an Available Tenor, the component of the Alternate Base Rate based upon the then-current Benchmark or such tenor for such Benchmark, as applicable, will not be used in any determination of the Alternate Base Rate. (vii) Term SOFR Transition Event. Notwithstanding anything to the contrary herein or in any other Loan Document and subject to the proviso below in this paragraph, if a Term SOFR Transition Event and its related Benchmark Replacement Date have occurred prior to the Reference Time in respect of any setting of the then-current Benchmark, then (1) the applicable Benchmark Replacement will replace the then-current Benchmark for all purposes hereunder or under any Loan Document in respect of such Benchmark setting (the “Secondary Term SOFR Conversion Date”) and subsequent Benchmark settings, without any amendment to, or further action or consent of any other party to, this Agreement or any other Loan Document; and (2) Loans outstanding on the Secondary Term SOFR Conversion Date bearing interest based on the then-current Benchmark shall be deemed to have been converted to Loans bearing interest at the Benchmark

Second Amendment to Credit Agreement 741967910 19619932 6 Replacement with a tenor approximately the same length as the interest payment period of the then-current Benchmark; provided that, this paragraph (vii) shall not be effective unless the Administrative Agent has delivered to the Lenders and the Borrower a Term SOFR Notice. For the avoidance of doubt, the Administrative Agent shall not be required to deliver a Term SOFR Notice after a Term SOFR Transition Event and may do so in its sole discretion. (viii) Certain Defined Terms. As used in this Section 2.11(b): “Available Tenor” means, as of any date of determination and with respect to the then-current Benchmark, as applicable, (x) if the then current Benchmark is a term rate or is based on a term rate, any tenor for such Benchmark that is or may be used for determining the length of an Interest Period pursuant to this Agreement as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed from the definition of “Interest Period” pursuant to paragraph (v) of this Section 2.11(b), or (y) if the then current Benchmark is not a term rate nor based on a term rate, any payment period for interest calculated with reference to such Benchmark pursuant to this Agreement as of such date. “Benchmark” means, initially, USD LIBOR; provided that if a Benchmark Transition Event, a Term SOFR Transition Event, an Early Opt- in Election, or an Other Benchmark Rate Election, as applicable, and its related Benchmark Replacement Date have occurred with respect to USD LIBOR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to paragraph (ii) of this Section 2.11(b). “Benchmark Replacement” means, for any Available Tenor, the first alternative set forth in the order below that can be determined by the Administrative Agent for the applicable Benchmark Replacement Date: (1) the sum of: (A) Term SOFR and (B) the related Benchmark Replacement Adjustment; (2) the sum of: (A) Daily Simple SOFR and (B) the related Benchmark Replacement Adjustment; (3) the sum of: (A) the alternate benchmark rate that has been selected by the Administrative Agent and the Borrower as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to (I) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (II) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement for the then-current Benchmark for U.S.

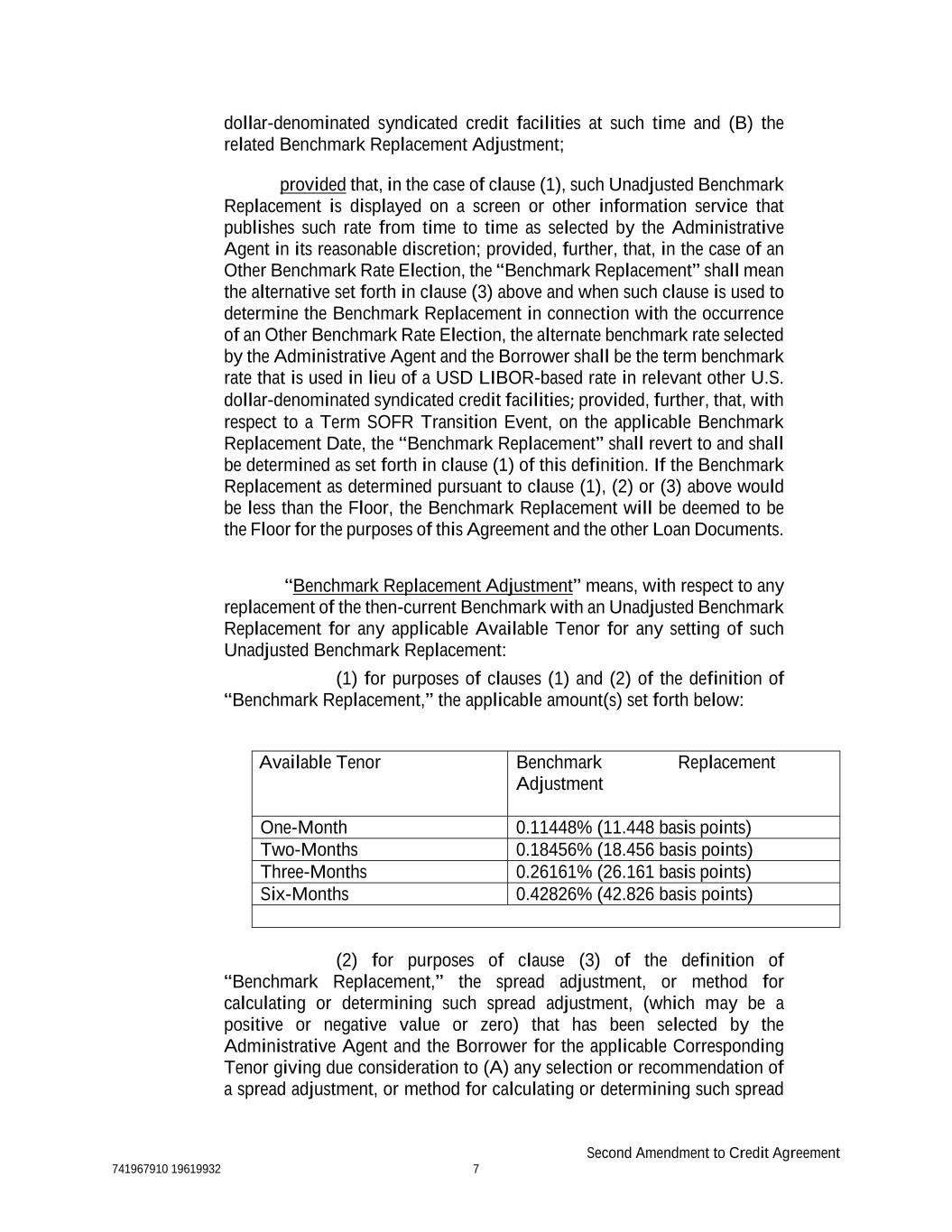

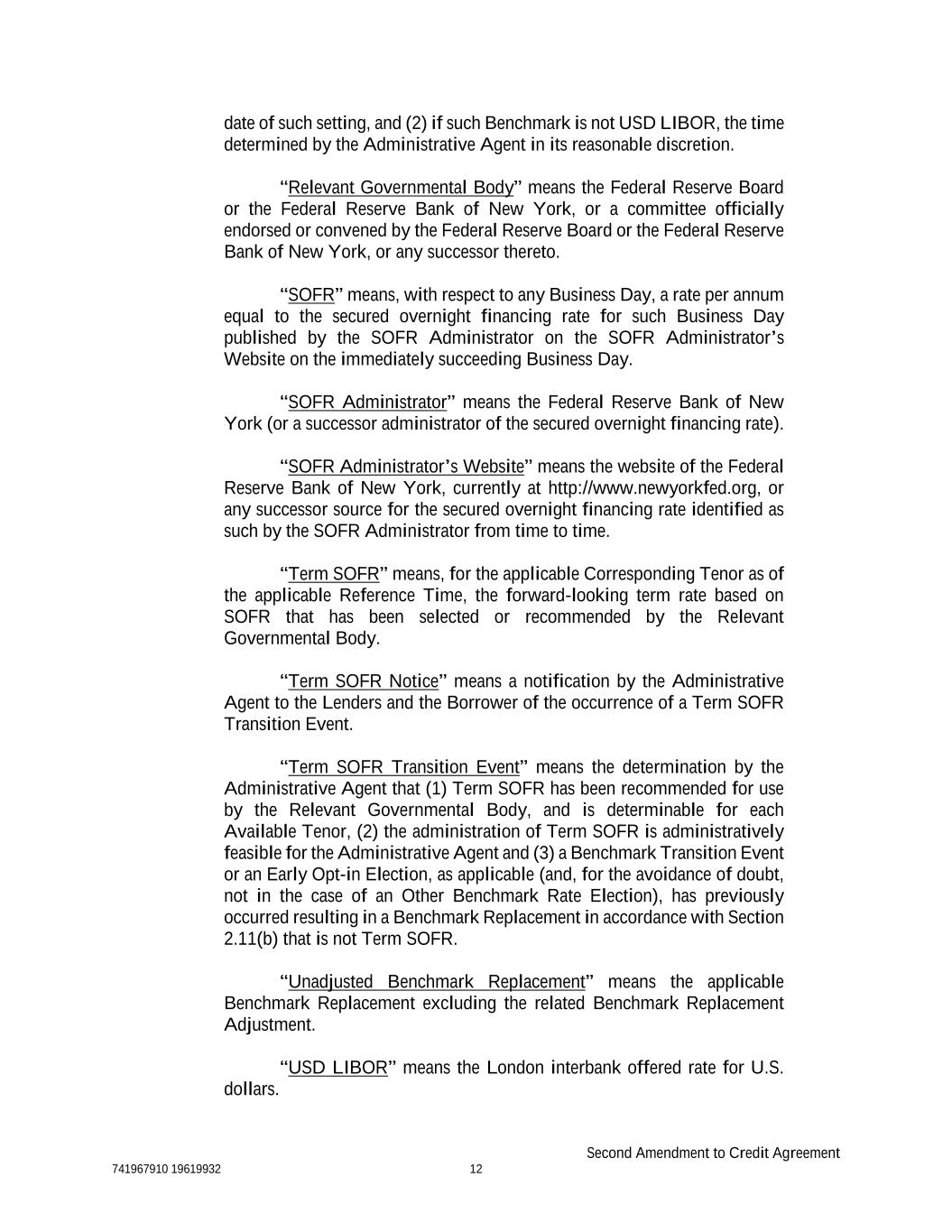

Second Amendment to Credit Agreement 741967910 19619932 7 dollar-denominated syndicated credit facilities at such time and (B) the related Benchmark Replacement Adjustment; provided that, in the case of clause (1), such Unadjusted Benchmark Replacement is displayed on a screen or other information service that publishes such rate from time to time as selected by the Administrative Agent in its reasonable discretion; provided, further, that, in the case of an Other Benchmark Rate Election, the “Benchmark Replacement” shall mean the alternative set forth in clause (3) above and when such clause is used to determine the Benchmark Replacement in connection with the occurrence of an Other Benchmark Rate Election, the alternate benchmark rate selected by the Administrative Agent and the Borrower shall be the term benchmark rate that is used in lieu of a USD LIBOR-based rate in relevant other U.S. dollar-denominated syndicated credit facilities; provided, further, that, with respect to a Term SOFR Transition Event, on the applicable Benchmark Replacement Date, the “Benchmark Replacement” shall revert to and shall be determined as set forth in clause (1) of this definition. If the Benchmark Replacement as determined pursuant to clause (1), (2) or (3) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents. “Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement for any applicable Available Tenor for any setting of such Unadjusted Benchmark Replacement: (1) for purposes of clauses (1) and (2) of the definition of “Benchmark Replacement,” the applicable amount(s) set forth below: Available Tenor Benchmark Replacement Adjustment One-Month 0.11448% (11.448 basis points) Two-Months 0.18456% (18.456 basis points) Three-Months 0.26161% (26.161 basis points) Six-Months 0.42826% (42.826 basis points) (2) for purposes of clause (3) of the definition of “Benchmark Replacement,” the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Administrative Agent and the Borrower for the applicable Corresponding Tenor giving due consideration to (A) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread

Second Amendment to Credit Agreement 741967910 19619932 8 adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body on the applicable Benchmark Replacement Date or (B) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated syndicated credit facilities; provided that, if the then-current Benchmark is a term rate, more than one tenor of such Benchmark is available as of the applicable Benchmark Replacement Date and the applicable Unadjusted Benchmark Replacement will not be a term rate, the Available Tenor of such Benchmark for purposes of this definition of “Benchmark Replacement Adjustment” shall be deemed to be the Available Tenor that has approximately the same length (disregarding business day adjustments) as the payment period for interest calculated with reference to such Unadjusted Benchmark Replacement. “Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Base Rate,” the definition of “Business Day,” the definition of “Interest Period,” timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that the Administrative Agent decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof by the Administrative Agent in a manner substantially consistent with market practice (or, if the Administrative Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Administrative Agent determines that no market practice for the administration of such Benchmark Replacement exists, in such other manner of administration as the Administrative Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents). “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark: (1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof);

Second Amendment to Credit Agreement 741967910 19619932 9 (2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date determined by the Administrative Agent, which date shall promptly follow the date of the public statement or publication of information referenced therein; (3) in the case of a Term SOFR Transition Event, the date that is set forth in the Term SOFR Notice provided to the Lenders and the Borrower pursuant to this Section 2.11(b), which date shall be at least 30 days from the date of the Term SOFR Notice; or (4) in the case of an Early Opt-in Election or an Other Benchmark Rate Election, the sixth (6th) Business Day after the date notice of such Early Opt-in Election or an Other Benchmark Rate Election, as applicable, is provided to the Lenders, so long as the Administrative Agent has not received, by 5:00 p.m. (New York City time) on the fifth (5th) Business Day after the date notice of such Early Opt-in Election or an Other Benchmark Rate Election, as applicable, is provided to the Lenders, written notice of objection to such Early Opt-in Election or an Other Benchmark Rate Election, as applicable, from Lenders comprising the Required Lenders. For the avoidance of doubt, (i) if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination and (ii) the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (1) or (2) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: (1) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (2) a public statement or publication of information by an Official Body having jurisdiction over the Administrative Agent, the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Bank of New York, an insolvency official with jurisdiction

Second Amendment to Credit Agreement 741967910 19619932 10 over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (3) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) or an Official Body having jurisdiction over the Administrative Agent announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer representative. For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). “Benchmark Unavailability Period” means the period (if any) (x) beginning at the time that a Benchmark Replacement Date pursuant to clauses (1) or (2) of that definition has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with this Section 2.11(b) and (y) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with this Section 2.11(b). “Corresponding Tenor” with respect to any Available Tenor means, as applicable, either a tenor (including overnight) or an interest payment period having approximately the same length (disregarding business day adjustment) as such Available Tenor. “Daily Simple SOFR” means, for any day, SOFR, with the conventions for this rate (which will include a lookback) being established by the Administrative Agent in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for business loans; provided, that if the Administrative Agent decides that any such convention is not administratively feasible for the Administrative Agent, then the

Second Amendment to Credit Agreement 741967910 19619932 11 Administrative Agent may establish another convention in its reasonable discretion. “Early Opt-in Election” means, if the then-current Benchmark is USD LIBOR, the occurrence of: (1) a notification by the Administrative Agent to (or the request by the Borrower to the Administrative Agent to notify) each of the other parties hereto that at least five currently outstanding U.S. dollar-denominated syndicated credit facilities at such time contain (as a result of amendment or as originally executed) a SOFR-based rate (including SOFR, a term SOFR or any other rate based upon SOFR) as a benchmark rate (and such syndicated credit facilities are identified in such notice and are publicly available for review), and (2) the joint election by the Administrative Agent and the Borrower to trigger a fallback from USD LIBOR and the provision by the Administrative Agent of written notice of such election to the Lenders. “Floor” means the benchmark rate floor, if any, provided in this Agreement initially (as of the execution of this Agreement, the modification, amendment or renewal of this Agreement or otherwise) with respect to USD LIBOR or, if no floor is specified, zero. “ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time by the International Swaps and Derivatives Association, Inc. or such successor thereto. “Other Benchmark Rate Election” means, if the then-current Benchmark is USD LIBOR, the occurrence of: (x) either (i) a request by the Borrower to the Administrative Agent , or (ii) notice by the Administrative Agent to the Borrower, that, at the determination of the Borrower or the Administrative Agent, as applicable, U.S. dollar-denominated syndicated credit facilities at such time contain (as a result of amendment or as originally executed), in lieu of a USD LIBOR based rate, a term benchmark rate as a benchmark rate, and (y) the Administrative Agent, in its sole discretion, and the Borrower jointly elect to trigger a fallback from USD LIBOR and the provision, as applicable, by the Administrative Agent of written notice of such election to the Borrower and the Lenders. “Reference Time” with respect to any setting of the then-current Benchmark means (1) if such Benchmark is USD LIBOR, 11:00 a.m. (London time) on the day that is two London banking days preceding the

Second Amendment to Credit Agreement 741967910 19619932 12 date of such setting, and (2) if such Benchmark is not USD LIBOR, the time determined by the Administrative Agent in its reasonable discretion. “Relevant Governmental Body” means the Federal Reserve Board or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board or the Federal Reserve Bank of New York, or any successor thereto. “SOFR” means, with respect to any Business Day, a rate per annum equal to the secured overnight financing rate for such Business Day published by the SOFR Administrator on the SOFR Administrator’s Website on the immediately succeeding Business Day. “SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate). “SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, currently at xxxx://xxx.xxxxxxxxxx.xxx, or any successor source for the secured overnight financing rate identified as such by the SOFR Administrator from time to time. “Term SOFR” means, for the applicable Corresponding Tenor as of the applicable Reference Time, the forward-looking term rate based on SOFR that has been selected or recommended by the Relevant Governmental Body. “Term SOFR Notice” means a notification by the Administrative Agent to the Lenders and the Borrower of the occurrence of a Term SOFR Transition Event. “Term SOFR Transition Event” means the determination by the Administrative Agent that (1) Term SOFR has been recommended for use by the Relevant Governmental Body, and is determinable for each Available Tenor, (2) the administration of Term SOFR is administratively feasible for the Administrative Agent and (3) a Benchmark Transition Event or an Early Opt-in Election, as applicable (and, for the avoidance of doubt, not in the case of an Other Benchmark Rate Election), has previously occurred resulting in a Benchmark Replacement in accordance with Section 2.11(b) that is not Term SOFR. “Unadjusted Benchmark Replacement” means the applicable Benchmark Replacement excluding the related Benchmark Replacement Adjustment. “USD LIBOR” means the London interbank offered rate for U.S. dollars.

Second Amendment to Credit Agreement 741967910 19619932 13 1.8 Section 3.16 of the Credit Agreement is deleted in its entirety and replaced with the following: SECTION 3.16 (a) Sanctions and other Anti-Terrorism Laws. No Covered Entity: (i) is a Sanctioned Person, nor any employees, officers, directors, affiliates, consultants, brokers or agents acting on a Covered Entity’s behalf in connection with this Agreement is a Sanctioned Person; (ii) directly, or indirectly through any third party, engages in any transactions or other dealings with any Sanctioned Person or Sanctioned Jurisdiction, or which otherwise are prohibited by any laws of the United States or laws of other applicable jurisdictions relating to Sanctions and other Anti-Terrorism Laws; (b) Anti-Corruption Laws; Sanctions and Other Anti-Terrorism Laws. Each Covered Entity has (a) conducted its business in compliance with all Anti-Corruption Laws, Sanctions and other Anti-Terrorism Laws and (b) has instituted and maintains policies and procedures designed to ensure compliance with such laws. 1.9 Section 5.11 of the Credit Agreement is deleted in its entirety and replaced with the following: SECTION 5.11 Sanctions and other Anti-Terrorism Laws; Anti-Corruption Laws. (a) The Borrower covenants and agrees that it shall immediately notify the Administrative Agent and each of the Lenders in writing upon the occurrence of a Reportable Compliance Event. (b) Each Covered Entity will conduct their business in compliance with all Anti-Corruption Laws, Sanctions and other Anti-Terrorism Laws and maintain policies and procedures designed to ensure compliance with such laws. 1.10 The following new sections are added at the end of Article VI: SECTION 6.11 Sanctions and other Anti-Terrorism Laws. The Borrower hereby covenants and agrees that until the Maturity Date, the Borrower will not, and will not permit any its Subsidiaries to: (a) become a Sanctioned Person or allow its employees, officers, directors, affiliates, consultants, brokers, and agents acting on its behalf in connection with this Agreement to become a Sanctioned Person; (b) directly, or, to its knowledge, indirectly through a third party, engage in any transactions or other dealings with any Sanctioned Person or Sanctioned Jurisdiction, including any use of the proceeds of the Loans to fund any operations in, finance any investments or activities in, or, make any payments to, a Sanctioned

Second Amendment to Credit Agreement 741967910 19619932 14 Person or Sanctioned Jurisdiction; (c) repay the Loans with funds derived from any unlawful activity; (d) engage in any transactions or other dealings with any Sanctioned Person or Sanctioned Jurisdiction prohibited by any laws of the United States or other applicable jurisdictions relating to economic sanctions and any Anti- Terrorism Laws; or (f) cause any Lender or Administrative Agent to violate any sanctions administered by OFAC. SECTION 6.12 Anti-Corruption Laws. The Borrower hereby covenants and agrees that until the Maturity Date, the Borrower will not, and will not permit any its Subsidiaries to directly or indirectly, use the Loans or any proceeds thereof for any purpose which would breach any Anti-Corruption Laws in any jurisdiction in which any Covered Entity conducts business. 1.11 Section 7.1(f) is hereby amended by deleing “or 6.09” and replacing it with “, 6.09, 6.11 or 6.12”. 1.12 Article VIII of the Credit Agreement is amended by inserting the following new section at the end thereof. Erroneous Payments. (a) If the Administrative Agent notifies a Lender or Issuing Bank, or any Person who has received funds on behalf of a Lender or Issuing Bank such Lender or Issuing Bank (any such Lender, Issuing Bank, or other recipient, a “Payment Recipient”) that the Administrative Agent has determined in its sole discretion (whether or not after receipt of any notice under immediately succeeding clause (b)) that any funds received by such Payment Recipient from the Administrative Agent or any of its Affiliates were erroneously transmitted to, or otherwise erroneously or mistakenly received by, such Payment Recipient (whether or not known to such Lender, Issuing Bank, or other Payment Recipient on its behalf) (any such funds, whether received as a payment, prepayment or repayment of principal, interest, fees, distribution or otherwise, individually and collectively, an “Erroneous Payment”) and demands the return of such Erroneous Payment (or a portion thereof), such Erroneous Payment shall at all times remain the property of the Administrative Agent and shall be segregated by the Payment Recipient and held in trust for the benefit of the Administrative Agent, and such Lender or Issuing Bank shall (or, with respect to any Payment Recipient who received such funds on its behalf, shall cause such Payment Recipient to) promptly, but in no event later than two Business Days thereafter, return to the Administrative Agent the amount of any such Erroneous Payment (or portion thereof) as to which such a demand was made, in same day funds (in the currency so received), together with interest thereon in respect of each day from and including the date such Erroneous Payment (or portion thereof) was received by such Payment Recipient to the date such amount is repaid to the Administrative Agent in same day funds at the greater of the Federal Funds Effective Rate and a rate determined by the Administrative

Second Amendment to Credit Agreement 741967910 19619932 15 Agent in accordance with banking industry rules on interbank compensation from time to time in effect. A notice of the Administrative Agent to any Payment Recipient under this clause (a) shall be conclusive, absent manifest error. (b) Without limiting immediately preceding clause (a), each Lender or Issuing Bank, or any Person who has received funds on behalf of a Lender or Issuing Bank such Lender or Issuing Bank, hereby further agrees that if it receives a payment, prepayment or repayment (whether received as a payment, prepayment or repayment of principal, interest, fees, distribution or otherwise) from the Administrative Agent (or any of its Affiliates) (x) that is in a different amount than, or on a different date from, that specified in a notice of payment, prepayment or repayment sent by the Administrative Agent (or any of its Affiliates) with respect to such payment, prepayment or repayment, (y) that was not preceded or accompanied by a notice of payment, prepayment or repayment sent by the Administrative Agent (or any of its Affiliates), or (z) that such Lender or Secured Party, or other such recipient, otherwise becomes aware was transmitted, or received, in error or by mistake (in whole or in part) in each case: (i) (A) in the case of immediately preceding clauses (x) or (y), an error shall be presumed to have been made (absent written confirmation from the Administrative Agent to the contrary) or (B) an error has been made (in the case of immediately preceding clause (z)), in each case, with respect to such payment, prepayment or repayment; and (ii) such Lender or Issuing Bank shall (and shall cause any other recipient that receives funds on its respective behalf to) promptly (and, in all events, within one Business Day of its knowledge of such error) notify the Administrative Agent of its receipt of such payment, prepayment or repayment, the details thereof (in reasonable detail) and that it is so notifying the Administrative Agent pursuant to this Section titled “Erroneous Payments”. (c) Each Lender or Issuing Bank hereby authorizes the Administrative Agent to set off, net and apply any and all amounts at any time owing to such Lender or Issuing Bank under any Loan Document, or otherwise payable or distributable by the Administrative Agent to such Lender or Issuing Bank from any source, against any amount due to the Administrative Agent under immediately preceding clause (a) or under the indemnification provisions of this Agreement. (d) In the event that an Erroneous Payment (or portion thereof) is not recovered by the Administrative Agent for any reason, after demand therefor by the Administrative Agent in accordance with immediately preceding clause (a), from any Lender or Issuing Bank that has received such Erroneous Payment (or portion thereof) (and/or from any Payment Recipient who received such

Second Amendment to Credit Agreement 741967910 19619932 16 Erroneous Payment (or portion thereof) on its respective behalf) (such unrecovered amount, an “Erroneous Payment Return Deficiency”), upon the Administrative Agent’s notice to such Lender or Issuing Lender at any time, (i) such Lender or Issuing Bank shall be deemed to have assigned its Loans (but not its Commitments) in an amount equal to the Erroneous Payment Return Deficiency (or such lesser amount as the Administrative Agent may specify) (such assignment of the Loans (but not Commitments), the “Erroneous Payment Deficiency Assignment”) at par plus any accrued and unpaid interest (with the assignment fee to be waived by the Administrative Agent in such instance), and is hereby (together with the Borrower) deemed to execute and deliver an Assignment and Assumption with respect to such Erroneous Payment Deficiency Assignment, and such Lender or Issuing Bank shall deliver any Notes evidencing such Loans to the Borrower or the Administrative Agent, (ii) the Administrative Agent as the assignee Lender shall be deemed to acquire the Erroneous Payment Deficiency Assignment, (iii) upon such deemed acquisition, the Administrative Agent as the assignee Lender shall become a Lender or Issuing Bank, as applicable, hereunder with respect to such Erroneous Payment Deficiency Assignment and the assigning Lender or assigning Issuing Bank shall cease to be a Lender or Issuing Bank, as applicable, hereunder with respect to such Erroneous Payment Deficiency Assignment, excluding, for the avoidance of doubt, its obligations under the indemnification provisions of this Agreement and its applicable Commitments which shall survive as to such assigning Lender or assigning Issuing Bank and (iv) the Administrative Agent may reflect in the Register its ownership interest in the Loans subject to the Erroneous Payment Deficiency Assignment. The Administrative Agent may, in its discretion, sell any Loans acquired pursuant to an Erroneous Payment Deficiency Assignment and upon receipt of the proceeds of such sale, the Erroneous Payment Return Deficiency owing by the applicable Lender or Issuing Bank shall be reduced by the net proceeds of the sale of such Loan (or portion thereof), and the Administrative Agent shall retain all other rights, remedies and claims against such Lender or Issuing Bank (and/or against any recipient that receives funds on its respective behalf). For the avoidance of doubt, no Erroneous Payment Deficiency Assignment will reduce the Commitments of any Lender or Issuing Bank and such Commitments shall remain available in accordance with the terms of this Agreement. In addition, each party hereto agrees that, except to the extent that the Administrative Agent has sold a Loan (or portion thereof) acquired pursuant to an Erroneous Payment Deficiency Assignment, and irrespective of whether the Administrative Agent may be equitably subrogated, the Administrative Agent shall be contractually subrogated to all the rights and interests of the applicable Lender or Issuing Bank under the Loan Documents with respect to each Erroneous Payment Return Deficiency (the “Erroneous Payment Subrogation Rights”). (e) The parties hereto agree that an Erroneous Payment shall not pay, prepay, repay, discharge or otherwise satisfy any Obligations owed by the Borrower, except, in each case, to the extent such Erroneous Payment is, and

Second Amendment to Credit Agreement 741967910 19619932 17 solely with respect to the amount of such Erroneous Payment that is, comprised of funds received by the Administrative Agent from the Borrower or any other Loan Party for the purpose of making such Erroneous Payment. (f) To the extent permitted by applicable law, no Payment Recipient shall assert any right or claim to an Erroneous Payment, and hereby waives, and is deemed to waive, any claim, counterclaim, defense or right of set-off or recoupment with respect to any demand, claim or counterclaim by the Administrative Agent for the return of any Erroneous Payment received, including without limitation waiver of any defense based on “discharge for value” or any similar doctrine. (g) Each party’s obligations, agreements and waivers under this Section titled “Erroneous Payments” shall survive the resignation or replacement of the Administrative Agent, the termination of the Commitments and/or the repayment, satisfaction or discharge of all Obligations (or any portion thereof) under any Loan Document. 1.13 Schedule 2.01 of the Credit Agreement is replaced with Schedule 2.01 attached hereto. 2. CONDITIONS PRECEDENT. This Amendment shall become effective when the following conditions have been met: (a) the Administrative Agent shall have received this Amendment duly executed by the Borrower, the Administrative Agent and each Lender, and notice thereof shall have been given by the Administrative Agent to the Borrower and the Lenders; (b) The Administrative Agent shall have received a favorable written opinion (addressed to the Administrative Agent and the Lenders and dated the Second Amendment Effective Date) of counsel for the Borrower, covering such other matters relating to the Borrower, this Amendment and the Credit Agreement as the Administrative Agent shall reasonably request. The Borrower hereby requests such counsel to deliver such opinion. (c) The Administrative Agent shall have received such documents and certificates as the Administrative Agent or its counsel may reasonably request relating to the organization, existence and good standing of the Borrower, the authorization of this Amendment, incumbency and any other legal matters relating to the Borrower, this Amendment or the Credit Agreement, all in form and substance satisfactory to the Administrative Agent and its counsel. (d) The Administrative Agent shall have received a certificate, dated the Second Amendment Effective Date and signed by the President, a Vice President or an Executive Officer of the Borrower, confirming compliance with the conditions set forth in paragraphs (a) and (b) of Section 4.02 of the Credit Agreement and certifying that there has not been a Material Adverse Effect since December 31, 2020.

Second Amendment to Credit Agreement 741967910 19619932 18 (e) The Administrative Agent shall have received all fees and other amounts due and payable on or prior to the Second Amendment Effective Date, including, to the extent invoiced, reimbursement or payment of all out-of-pocket expenses required to be reimbursed or paid by the Borrower hereunder. (f) All consents and regulatory approvals and licenses required to effectuate the transactions contemplated hereby shall have been obtained and there shall not be any legal or regulatory prohibitions or restrictions on the transactions contemplated hereby. 3. REPRESENTATIONS AND WARRANTIES. After giving effect to this Amendment, the following statements by the Borrower shall be true and correct (and the Borrower, by its execution of this Amendment, hereby represents and warrants to the Administrative Agent and each Lender that such statements are true and correct as at such times): 3.1 the representations and warranties set forth in Article III of the Agreement are true and correct as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct as of such earlier date; 3.2 no Default has occurred and is continuing; 3.3 the Borrower has the full power to enter into, execute, deliver and carry out this Amendment and the execution, delivery and performance by the Borrower of this Amendment and the consummation of the transactions contemplated hereby and thereby are within its corporate powers, have been duly authorized by all necessary corporate action (including, without limitation, shareholder approval, if required) and do not contravene or conflict with the Borrower’s articles of incorporation or bylaws; 3.4 each of the Borrower and its Subsidiaries has received all material governmental and other consents and approvals (if any shall be required) necessary for the execution, delivery and performance of this Amendment, and such execution, delivery and performance do not and will not contravene or conflict with, or create a Lien or right of termination or acceleration under, any Requirement of Law or Contractual Obligation binding upon the Borrower or such Subsidiaries; and 3.5 this Amendment has been duly and validly executed and delivered by the Borrower and constitutes the legal, valid and binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, except to the extent that enforceability of this Amendment may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforceability of creditors’ rights generally or limiting the right of specific performance and general concepts of equity. 4. MISCELLANEOUS. 4.1 Continuing Effectiveness, etc. This Amendment shall be deemed to be an amendment to the Agreement, and the Agreement as amended hereby, shall remain in full force

Second Amendment to Credit Agreement 741967910 19619932 19 and effect and is hereby ratified, approved and confirmed in each and every respect. After the effectiveness of this Amendment in accordance with its terms, all references to the Agreement in the Loan Documents or in any other document, instrument, agreement or writing shall be deemed to refer to the Agreement as amended hereby. Each other Loan Document is hereby ratified, approved and confirmed in each and every respect. This Amendment is a Loan Document. 4.2 Headings. The various headings of this Amendment used herein are for convenience of reference only, are not part of this Amendment and shall not affect the construction of, or be taken into consideration in interpreting, this Amendment. 4.3 Execution in Counterparts. This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or other electronic imaging means (e.g. “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart of this Amendment. 4.4 Incorporation of Credit Agreement Provisions. The provisions of Sections 1.03, 9.03, 9.06, 9.07, 9.09, and 9.10 of the Agreement are incorporated herein by reference as if fully set forth herein, mutatis mutandis. [Remainder of page intentionally left blank]

S-2 Second Amendment to Credit Agreement 741967910 00000000 PNC BANK, NATIONAL ASSOCIATION, as Administrative Agent

S-4 Second Amendment to Credit Agreement 741967910 19619932 LENDERS PNC BANK, NATIONAL ASSOCIATION, as a Lender

S-6 Second Amendment to Credit Agreement 741967910 19619932 NTAC:3NS-20 THE NORTHERN TRUST COMPANY, as a Lender By: ____________________________ Name: Xxxxxxxxxxx X XxXxxx Title: Senior Vice President

S-7 Second Amendment to Credit Agreement 741967910 00000000 U.S. BANK NATIONAL ASSOCIATION, as a Lender By:___________________________________ Name: Xxxxx X. Xxxxxxxx Title: Vice President

Second Amendment to Credit Agreement 741967910 00000000 KEYBANK NATIONAL ASSOCIATION, as a Lender By: Name: Xxxxxx Xxxxxxxxx Title: Vice President

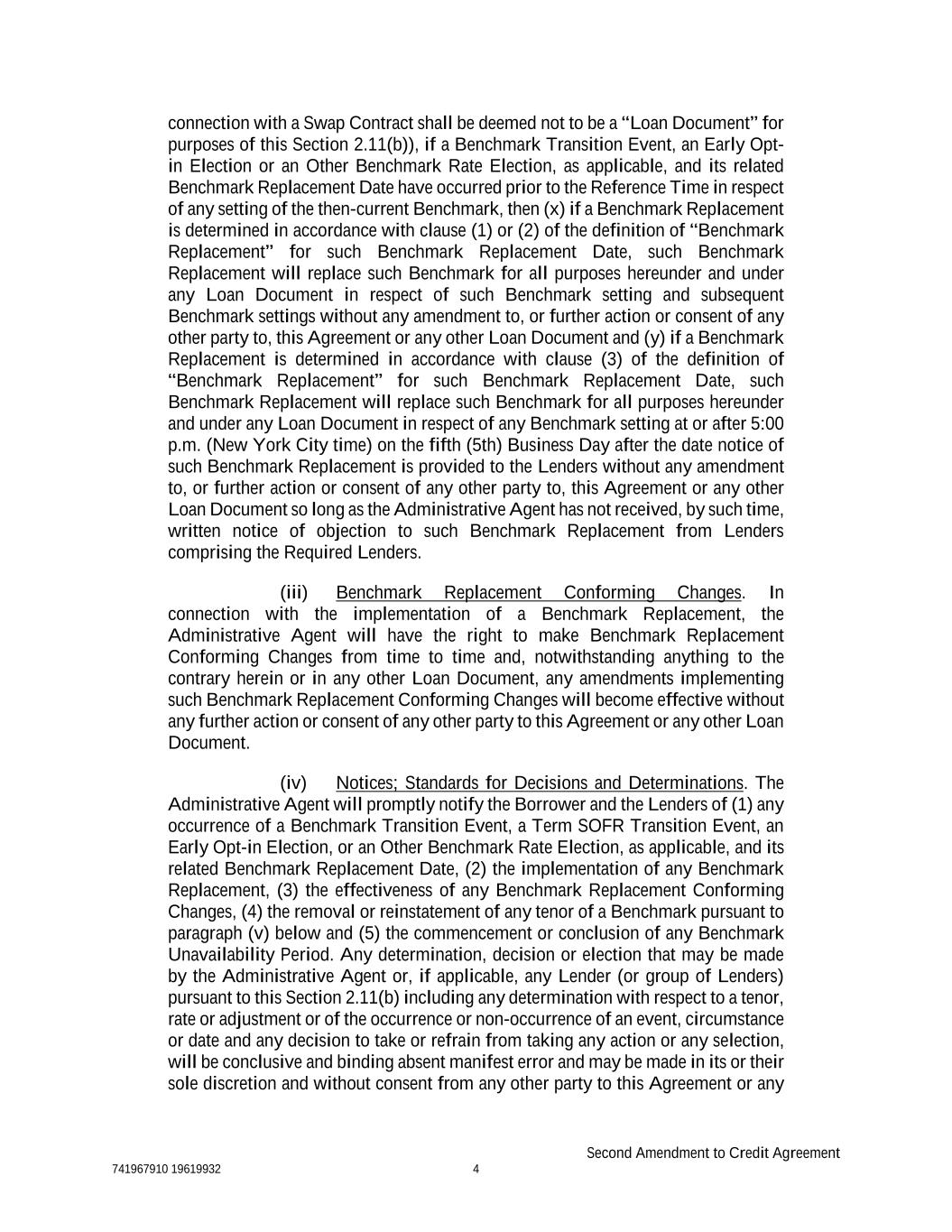

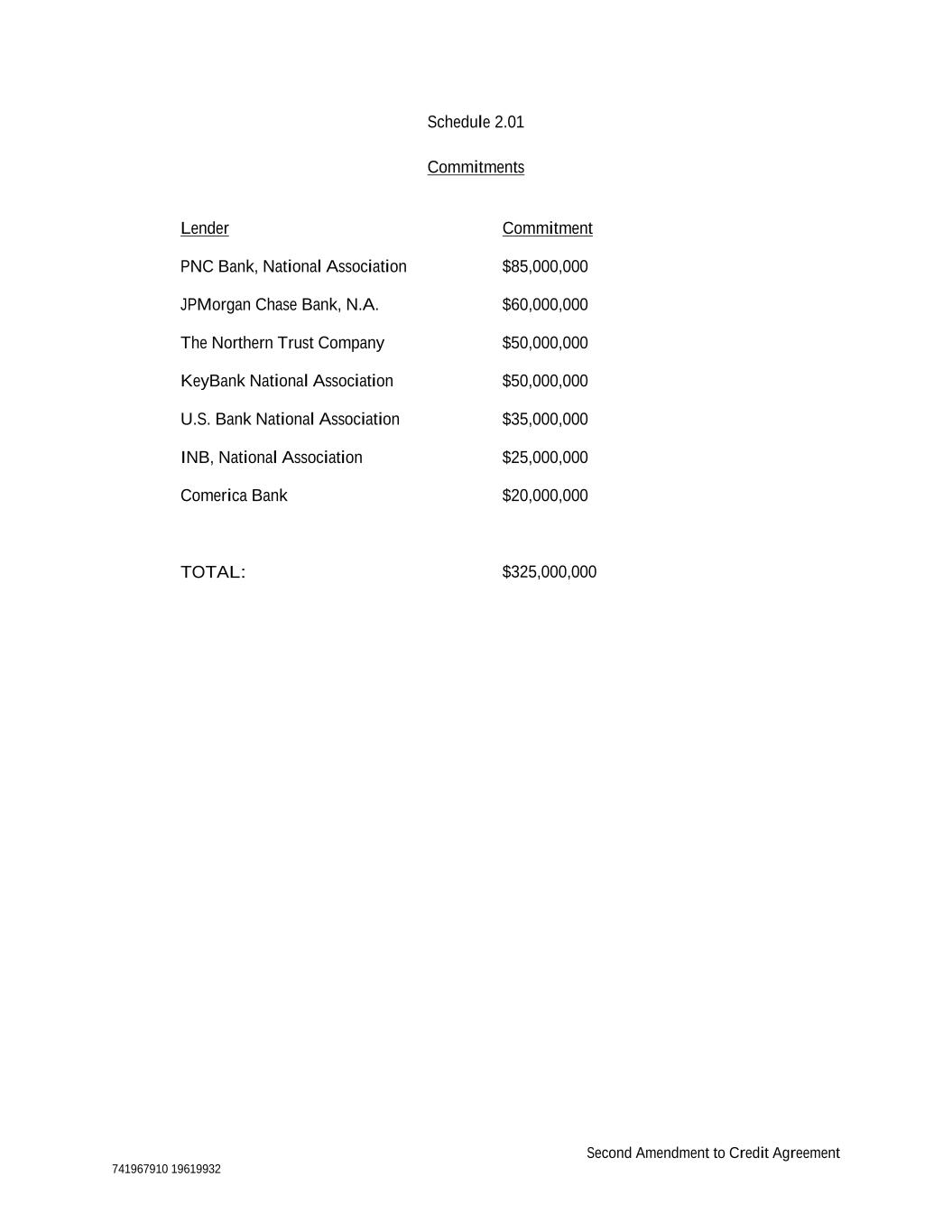

Second Amendment to Credit Agreement 741967910 19619932 Schedule 2.01 Commitments Lender Commitment PNC Bank, National Association $85,000,000 JPMorgan Chase Bank, N.A. $60,000,000 The Northern Trust Company $50,000,000 KeyBank National Association $50,000,000 U.S. Bank National Association $35,000,000 INB, National Association $25,000,000 Comerica Bank $20,000,000 TOTAL: $325,000,000