POINT BEACH NUCLEAR PLANT POWER PURCHASE AGREEMENT BETWEEN FPL ENERGY POINT BEACH, LLC AND WISCONSIN ELECTRIC POWER COMPANY DATED AS OF DECEMBER 19, 2006

Exhibit 10.46(a)

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

Wisconsin Energy Corporation has requested confidential treatment of certain portions of this document pursuant to an application for confidential treatment sent to the SEC. Wisconsin Energy has omitted such portions from this filing and filed them separately with the SEC. Such omissions are designated as "[**]".

POINT BEACH NUCLEAR PLANT

BETWEEN

FPL ENERGY POINT BEACH, LLC

AND

WISCONSIN ELECTRIC POWER COMPANY

DATED AS OF DECEMBER 19, 2006

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

TABLE OF CONTENTS

| ARTICLE I: DEFINITIONS |

1 | |||

| 1.1. |

Defined Terms | 1 | ||

| 1.2. |

Rules of Interpretation | 13 | ||

| 1.3. |

Accounting Terms | 14 | ||

| 1.4. |

Legal Representation | 14 | ||

| ARTICLE II: PURCHASE OF CAPACITY, ENERGY, AND ANCILLARY SERVICES |

14 | |||

| 2.1. |

Capacity Sale and Purchase | 14 | ||

| 2.2. |

Energy Sale and Purchase | 14 | ||

| 2.3. |

Ancillary Services | 15 | ||

| 2.4. |

Replacement Energy and Replacement Capacity | 16 | ||

| 2.5. |

Financial Transmission Rights | 17 | ||

| 2.6. |

Title and Risk of Loss | 18 | ||

| 2.7. |

Delivery Point | 18 | ||

| 2.8. |

Capacity Accreditation | 18 | ||

| 2.9. |

Uprates | 18 | ||

| 2.10. |

Right of First Offer | 20 | ||

| 2.11. |

Reactive Power | 20 | ||

| 2.12. |

Station Service | 21 | ||

| 2.13. |

CT Capacity | 21 | ||

| ARTICLE III: PAYMENTS |

21 | |||

| 3.1. |

Purchase Payments | 21 | ||

| 3.2. |

Peak Adjustment Payment | 22 | ||

| ARTICLE IV: SCHEDULING |

22 | |||

| 4.1. |

Scheduling | 22 | ||

| 4.2. |

Failure to Schedule | 23 | ||

| ARTICLE V: MAINTENANCE AND OPERATION |

23 | |||

| 5.1. |

Scheduled Maintenance | 23 | ||

| 5.2. |

Derate Notices | 24 | ||

| 5.3. |

Operation | 25 | ||

| ARTICLE VI: METERING |

28 | |||

| 6.1. |

Metering | 28 | ||

| ARTICLE VII: BILLING AND PAYMENT |

29 | |||

| 7.1. |

Billing and Payment | 29 | ||

| ARTICLE VIII: PERFORMANCE SECURITY |

30 | |||

| 8.1. |

Seller Performance Security | 30 | ||

i

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| 8.2. |

Buyer Performance Security | 30 | ||

| 8.3. |

Draws; Replenishments | 30 | ||

| 8.4. |

Reporting | 31 | ||

| ARTICLE IX: FORCE MAJEURE |

31 | |||

| 9.1. |

Conditions of Excuse for Seller | 31 | ||

| 9.2. |

Conditions of Excuse for Buyer | 31 | ||

| 9.3. |

Burden of Proof | 32 | ||

| 9.4. |

Payment and Security Obligations Not Excused | 32 | ||

| 9.5. |

Time Limits | 32 | ||

| 9.6. |

Deadline Extended | 32 | ||

| ARTICLE X: EVENTS OF DEFAULT; REMEDIES |

33 | |||

| 10.1. |

List of Events of Default | 33 | ||

| 10.2. |

Remedies | 34 | ||

| 10.3. |

Rights of Specific Performance | 35 | ||

| 10.4. |

Limitation of Liability | 35 | ||

| 10.5. |

Disclaimer of Warranties | 35 | ||

| ARTICLE XI: REPRESENTATIONS, WARRANTIES AND COVENANTS |

36 | |||

| 11.1. |

Representations and Warranties of Buyer | 36 | ||

| 11.2. |

Representations and Warranties of Seller | 37 | ||

| 11.3. |

Covenants of Seller | 38 | ||

| ARTICLE XII: INDEMNITY |

38 | |||

| 12.1. |

By Seller | 38 | ||

| 12.2. |

Indemnification by Buyer | 39 | ||

| 12.3. |

Joint Negligence | 39 | ||

| 12.4. |

Responsibility for Employees | 39 | ||

| 12.5. |

Notice and Participation | 39 | ||

| 12.6. |

Payment of Indemnification Claims | 40 | ||

| 12.7. |

Survival of Obligation | 40 | ||

| ARTICLE XIII: TERM |

40 | |||

| 13.1. |

Term | 40 | ||

| 13.2. |

Termination | 41 | ||

| 13.3. |

Effect of Termination | 41 | ||

| ARTICLE XIV: ADMINISTRATIVE COMMITTEE |

41 | |||

| 14.1. |

Purpose | 41 | ||

| 14.2. |

Membership | 41 | ||

| 14.3. |

Meetings | 41 | ||

| 14.4. |

Functions | 42 | ||

| 14.5. |

Expenses | 42 | ||

ii

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| ARTICLE XV: NOTICES |

42 | |||

| 15.1. Notices in Writing |

42 | |||

| 15.2. Date of Notification |

43 | |||

| 15.3. Oral Notice in Emergency |

43 | |||

| ARTICLE XVI: CONFIDENTIALITY |

43 | |||

| 16.1. Non-Disclosure to Third Parties |

43 | |||

| 16.2. Definition of Proprietary Information |

44 | |||

| 16.3. Limitations on Required Disclosure |

44 | |||

| 16.4. Remedies |

44 | |||

| 16.5. Survival of Confidentiality |

45 | |||

| ARTICLE XVII: INSURANCE |

45 | |||

| 17.1. Coverage and Amounts of Seller |

45 | |||

| 17.2. Insurance Certificates |

46 | |||

| 17.3. Coverage For Full Term |

47 | |||

| ARTICLE XVIII: ASSIGNMENT |

47 | |||

| 18.1. Binding Effect |

47 | |||

| 18.2. Assignment |

47 | |||

| 18.3. Change in Control |

48 | |||

| ARTICLE XIX: DISPUTE RESOLUTION |

48 | |||

| 19.1. General Provisions |

48 | |||

| 19.2. Negotiation |

48 | |||

| 19.3. Binding Upon Parties |

49 | |||

| 19.4. Continued Performance |

49 | |||

| ARTICLE XX: COMPLIANCE WITH LAWS; TAXES |

49 | |||

| 20.1. Compliance with Laws |

49 | |||

| 20.2. Mobile-Sierra |

49 | |||

| 20.3. Taxes and Other Charges |

49 | |||

| ARTICLE XXI: CHANGE IN LAW |

50 | |||

| 21.1. Change in Law |

50 | |||

| 21.2. Future Attributes |

50 | |||

| 21.3. MISO Changes |

51 | |||

| ARTICLE XXII: MISCELLANEOUS |

51 | |||

| 22.1. Recording Telephone Conversations |

51 | |||

| 22.2. Governing Law |

51 | |||

| 22.3. Entire Agreement; Amendment |

52 | |||

| 22.4. No Implied Waiver |

52 | |||

| 22.5. Severability |

52 | |||

| 22.6. No Exclusivity/Dedication of Assets |

53 | |||

| 22.7. Expenses |

53 | |||

iii

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| 22.8. Counterparts |

53 | |||

| 22.9. Survival |

53 | |||

| 22.10. Individual Responsibility |

53 | |||

| 22.11. No Duty To Third Parties |

53 | |||

| 22.12. Forward Contract |

54 | |||

| 22.13. Press Releases |

54 | |||

| Exhibits |

||

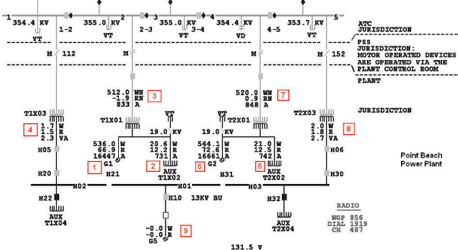

| Exhibit A |

Delivered Energy Charges | |

| Exhibit B |

Buyer’s Capacity Amount | |

| Exhibit C |

Delivered Energy Charge Shaping Factor | |

| Exhibit D |

Diagram of Metering Devices | |

| Exhibit E |

Form of Seller’s Guaranty | |

| Exhibit F |

Form of Letter of Credit | |

| Exhibit G |

Peak Adjustment Payment | |

| Exhibit H |

Scheduling Provisions | |

| Exhibit I |

MAIN Guide No. 3A Standards |

iv

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

This POWER PURCHASE AGREEMENT is made and entered into as of December 19, 2006, by and between FPL ENERGY POINT BEACH, LLC, a Wisconsin limited liability company (“Seller”), and WISCONSIN ELECTRIC POWER COMPANY, a Wisconsin corporation (“Buyer”) (hereinafter the parties hereto are sometimes referred to collectively as the “Parties,” or individually as a “Party”).

W I T N E S S E T H:

WHEREAS, Buyer is a public utility which operates a system for generation and distribution of electric power in the States of Wisconsin and Michigan; and

WHEREAS, Buyer intends to transfer to Seller all of its rights, title, and interests in and to the Point Beach Nuclear Plant, a nuclear-powered electric generating facility consisting of two generating units and facilities, equipment, supplies and improvements (including the CT) located in Xxx Xxxxxx, Xxxxxxxxx, XXX Operating License Nos. Unit 1 – DPR 24 and Unit 2 – DPR 27, as more specifically described in the Asset Sale Agreement (“Point Beach”); and

WHEREAS, in order to continue serving its customers following transfer of Buyer’s interests in the Facilities to Seller, Buyer desires to purchase, and Seller desires to sell, Capacity, Energy, and all associated Ancillary Services on the terms, and subject to the conditions, set forth below.

NOW, THEREFORE, in consideration of the recitals and the mutual promises, covenants and agreements contained herein and in the Asset Sale Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto hereby agree as follows:

ARTICLE I: DEFINITIONS

1.1. Defined Terms

As used in this Agreement, the following terms shall have the following meanings:

“Accredited Capacity” means Capacity or Replacement Capacity that (a) meets the resource adequacy requirements in Module E of the Transmission Provider Tariff (“Module E”) for Buyer’s Network Load, a portion of which may include Capacity or Replacement Capacity that satisfies the requirement for a Local Capacity Resource for Buyer’s Network Load and (b) is measured in accordance with the MAIN Guide No. 3A standards; provided, however, that if either or both requirements in (a) or (b) is inapplicable, then Accredited Capacity means Capacity or Replacement Capacity that meets the applicable requirements for Capacity (the “Effective Capacity Requirements”) of any Governing Authority having jurisdiction over Buyer, including any Capacity from the Facilities that may be deemed available under the Effective Capacity Requirements even if the Facilities are not operating.

“Administrative Committee” has the meaning set forth in Article XIV.

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Affiliate” has the meaning given such term in Rule 12b-2 under the Securities Exchange Act of 1934.

“Agreement” means this Power Purchase Agreement entered into by Seller and Buyer.

“Ancillary Services” means those services that during the Term are necessary to support the transmission of electric capacity and energy, or support the generation or transmission of Energy from the Facilities or Replacement Capacity, as applicable, while maintaining reliable operation of the transmission system, associated with or otherwise corresponding to the Capacity of the Facilities or Replacement Capacity, as applicable, and/or output of Energy at such time, which Ancillary Services shall include reactive power and frequency response service.

“Asset Sale Agreement” means that certain Asset Sale Agreement between Buyer and Seller, dated as of the date hereof.

“Associate” means, with respect to any Party, any officer, director, trustee, fiduciary, employee, agent, representative, contractor or subcontractor of such Party and any shareholder, partner, member or other owner of such Party.

“ATC” means the American Transmission Company LLC.

“Authorization” means any license, permit, approval, consent, filing, waiver, exemption, variance, clearance, entitlement, allowance, franchise or other authorization, whether corporate, governmental, regulatory or otherwise.

“Balancing Authority Function” means the operating authority that maintains the load resource balancing and reliability for the balancing authority area in which the Facilities are located.

“Billing Cycle” means each calendar month during the Term and any partial calendar month at the beginning or end of the Term.

“Business Day” means any day other than Saturday, Sunday, or any NERC holiday or any other day on which commercial banks in Milwaukee, Wisconsin are required to be closed.

“Buyer” has the meaning set forth in the preamble hereto.

“Buyer Performance Security” means any performance security that may be required to be posted by Buyer pursuant to Section 8.2.

“Buyer’s Capacity Amount” means, for any given time, the applicable amount set forth in Exhibit B. The Capacity of the Facilities, and the associated amounts in the column in Exhibit B entitled “Capacity of the Facilities,” shall be revised during the Term upon written notice from Seller to Buyer providing the results of any Performance Testing of the Facilities conducted in accordance with the MAIN Guide No. 3A Standards (or with the Effective Capacity Requirements, if applicable).

2

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Buyer’s Energy Amount” means, for any period of time, an aggregate amount of Energy (including Replacement Energy) associated with the Buyer’s Capacity Amount (excluding the CT Capacity) for such period of time.

“Buyer’s Guarantor” means a Person that, at the time of the execution and delivery of any guaranty issued pursuant to Section 8.2, is a direct or indirect owner of Buyer and (a) has an Investment Grade Credit Rating and a consolidated Net Worth of at least five hundred million dollars ($500,000,000.00); or (b) is reasonably acceptable to Seller as having a verifiable creditworthiness and Net Worth sufficient to secure Buyer’s Guarantor’s obligations under any guaranty issued pursuant to Section 8.2.

“Calculation Reconstitution Program” means the specific project to validate and integrate calculations and setpoints at Point Beach described in that certain Point Beach Nuclear Plant Calculation Review and Reconstruction Project Plan, CRR-PB-PP, Revision 3, dated January 27, 2006.

“Calendar Year” means a twelve-month period beginning January 1 and ending December 31.

“Capacity” means, on or as of any date of determination, a power generation unit’s capability to generate a specific amount of electrical energy at a given point in time.

“Change in Control” means any one or more of the following events that occurs with respect to Seller, or with respect to any Person which is a direct or indirect owner of a majority of the ownership interests in Seller: (i) a transfer of a majority of the ownership interests in Seller or such Person; (ii) a change in the general partner of any such Person; (iii) any consolidation or merger of Seller or any such Person in which Seller or such Person, as the case may be, is not the continuing or surviving entity, other than a consolidation or merger of a Person in which the holders of such Person’s ownership interests immediately before the consolidation or merger shall, upon consummation of the consolidation or merger, own at least 50% of the equity of the surviving entity; or (iv) any other event or circumstance in which “control” (as defined in Rule 12b-2 under the Securities Exchange Act of 1934) of Seller or of any such Person is transferred to another Person.

“Change in Law” has the meaning set forth in Section 21.1.

“Claims” means all third party claims or actions, threatened or filed and, whether groundless, false, fraudulent or otherwise, that directly or indirectly relate to the subject matter of an indemnity, and the resulting losses, damages, expenses, reasonable attorneys’ fees and court costs.

“Communications Protocol” has the meaning set forth in Section 5.3(b)(i).

“CPNode” means the commercial pricing nodes established by the Transmission Provider for both Unit 1 and Unit 2 (as of the Effective Date, such nodes are WEC.PTBHGB1 (for Unit 1) and WEC.PTBHGB2 (for Unit 2)); provided, that if this Agreement only applies to one Unit, then the CPNode shall be the applicable commercial pricing node for such Unit.

3

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“CPT” or “Central Prevailing Time” means, with respect to any particular time in question, Central Standard Time or Central Daylight Time in effect at such time.

“Credit Rating” means, with respect to an entity, the rating assigned to such entity’s unsecured, senior long-term debt obligations (not supported by third party credit enhancements) by Moody’s or S&P or, in the event such rating is not assigned, then the issuer rating assigned by S&P or Moody’s with respect to such entity.

“CT” means the existing No. 2 fuel oil-fired combustion turbine generator located at the Facilities site.

“Delivered Energy” means, for any period of time, the sum of the Net Energy Output plus Replacement Energy delivered to the Delivery Point and confirmed by Buyer in accordance with the scheduling provisions in Exhibit H, part (b)(iii).

“Delivered Energy Charge” has the meaning set forth in Section 3.1(a).

“Delivered Energy Payment” has the meaning set forth in Section 3.1(a).

“Delivery Point” has the meaning set forth in Section 2.7.

“Derate” means an event or condition which causes the Net Energy Output to be less than [**] of the associated Buyer’s Capacity Amount (excluding the CT Capacity), or causes the MISO FinSched to be less than [**] of the associated Buyer’s Capacity Amount (excluding the CT Capacity), unless such event or condition resulting in a reduction in the MISO FinSched was agreed to by Buyer, excluding any ramp up or ramp down of the Facilities associated with Seller’s nuclear fuel management procedures scheduled in accordance with Section 5.1.

“Derate Notice” has the meaning set forth in Section 5.2.

“Designated Network Resource” or “DNR” means a resource deliverable to the Buyer’s Network Load designated as a “Network Resource” as defined under the applicable Transmission Provider Tariff and related documents. The term DNR shall apply to the Facilities and to the resource selected by Seller, and accepted by MISO as a WEPCO Designated Network Resource, and accepted by the applicable regional reliability council, to provide Replacement Capacity for Buyer in accordance with the terms and conditions of this Agreement.

“Dispatch Authority Function” means the Buyer’s Trading and Operations Group in its Wholesale Energy & Fuels department.

“Dispute” means any controversy, claim or dispute of whatsoever nature, arising out of or relating to this Agreement or the making, validity, execution, performance, discharge, termination, or breach hereof.

“Dispute Resolution Procedures” means the dispute resolution procedures for Disputes set forth in Article XIX.

4

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Early Termination Date” has the meaning set forth in Section 10.2.

“Effective Capacity Requirements” has the meaning set forth in the definition of Accredited Capacity.

“Effective Date” means the Closing Date, as defined in the Asset Sale Agreement.

“Electric Reliability Organization” or “ERO” has the meaning set forth in 18 C.F.R. § 39.1.

“Energy” means electric energy expressed in MWh.

“Event of Default” has the meaning set forth in Section 10.1.

“Facilities” means Point Beach excluding any Uprate not accepted by Buyer pursuant to Section 2.9(a); provided, that after the Unit 1 Termination Date (if not the same as the Unit 2 Termination Date), the term “Facilities” shall exclude Unit 1 for the remainder of the Term of this Agreement; provided, further, that if for any reason this Agreement terminates earlier with respect to Xxxx 0, but not Unit 1, then after the Unit 2 Termination Date, the term “Facilities” shall exclude Unit 2 for the remainder of the Term of this Agreement.

“FASB” means the Financial Accounting Standards Board.

“FERC” means the Federal Energy Regulatory Commission.

“Financial Bilateral Transaction” has the meaning ascribed to such term by the Transmission Provider in the applicable Transmission Provider Tariff or related documents, as such relevant meaning or relevant term may be modified from time to time.

“Force Majeure” means any cause or occurrence beyond the reasonable control of and without the fault or negligence of the Party claiming Force Majeure which causes the Party to be unable to, or otherwise materially impairs its ability to, perform its obligations hereunder and which by the exercise of reasonable foresight such Party could not have been reasonably expected to avoid and could not have been prevented or avoided by such Party through the exercise of reasonable diligence. Subject to the foregoing, such causes or occurrences may include any acts of God; acts of the public enemy; wars; blockades; insurrections; riots; epidemics; landslides; lightning; earthquakes; fires; storms; floods; washouts; civil disturbances; strikes, lockouts, work stoppages or other labor actions that affect the U.S. electric generation or utility industry as a whole, including operation of the Facilities; shutdowns or reductions in the Facilities’ output or capabilities required, caused by, or related to directives, orders or requirements of the NRC or any other Governing Authority that affect the U.S. nuclear generation industry as a whole; shutdowns or reductions in the Facilities’ output directly related to the Calculation Reconstitution Program, but only if such shutdown or reduction occurs 12 months after the Effective Date; and any other cause, whether of the kind herein enumerated or otherwise, which, despite all reasonable efforts of such Party to prevent or mitigate its effects, prevents or delays the performance of a Party, or prevents the obtaining of the benefits of performance by the other Party, and is not within the control of the Party claiming excuse. The following acts, events

5

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

or causes shall in no event constitute an event of Force Majeure: (i) any lack of profitability to a Party or any losses incurred by a Party or any other financial consideration of a Party; (ii) unavailability of funds or financing; (iii) an event caused by conditions of national or local economics or markets; (iv) any failure of equipment which is not itself directly caused by an event which would otherwise independently constitute a Force Majeure; (v) strikes, lockouts, work stoppages or other labor actions that affect the operation of the Facilities but do not affect the U.S. electric generation or utility industry as a whole; (vi) changes in market conditions that affect the cost or availability of equipment, materials, supplies or services, including the Facilities’ fuel supply or the cost of power from resources other than the Facilities; (vii) failures of third parties, unless such failures are caused by an event which would otherwise constitute a Force Majeure event hereunder, if experienced by a Party and the Party claiming Force Majeure is relying on such third party in order to discharge any of such Party’s duties or obligations hereunder; (viii) climatic temperature and humidity conditions; and (ix) shutdowns or reductions in the Facilities output or capabilities required, caused by, or related to, directives, orders or requirements of the NRC or any other Governing Authority that do not apply to the U.S. nuclear electric generation industry as a whole. The curtailment, unavailability or interruption of transmission service shall not constitute a Force Majeure event unless the Transmission Provider directs the curtailment or interruption of transmission service over all, or substantially all, of the transmission system owned and/or controlled by the Transmission Owner in the State of Wisconsin.

“GAAP” means generally accepted accounting principles in the United States, as in effect from time to time, consistently applied, except as to consistency for mandated changes imposed by appropriate accountancy administrative bodies (including the FASB) or regulatory authorities.

“Generation Offer” has the meaning ascribed to such term by MISO in the applicable Transmission Provider Tariff or related documents, as such relevant meaning or relevant term may be modified from time to time.

“Governing Authority” means the federal government of the United States, and any state, county or local government, and any regulatory department, body, political subdivision, commission, bureau, administration, agency, instrumentality, ministry, court, judicial or administrative body, taxing authority, or other authority of any of the foregoing (including, without limitation, any corporation or other entity owned or controlled by any of the foregoing), MISO, ERO, NRC, any other regional reliability council, the Transmission Provider and any other regional transmission organization, in each case having jurisdiction over any or all of the Parties, the Facilities or the Transmission Provider’s transmission system, whether acting under express or delegated authority.

“Gross Receipts Tax” means the tax imposed by the State of Wisconsin pursuant to Sections 76.28 and 76.29 of the Wisconsin Statutes as amended.

“Gross Receipts Tax Payment” has the meaning set forth in Section 20.3(d).

“Indemnified Person” has the meaning set forth in Section 12.5.

6

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Indemnifying Person” has the meaning set forth in Section 12.5.

“Insufficient Credit Status” means, as to Buyer or Seller, or if Buyer is providing collateral in the form of a guaranty, the Buyer’s Guarantor, or if Seller is providing collateral in the form of a guaranty, Seller’s Guarantor, that: (a) such Person does not have a Credit Rating or such Person’s Credit Rating is not Investment Grade or is determined by either Moody’s or S&P to not be Investment Grade; or (b) the maturity of any indebtedness of such Person which in the aggregate exceeds one hundred million dollars ($100,000,000) or five percent of the shareholders’ equity of such Person, whichever is less, is accelerated by the holder or holders thereof as a result of a default thereunder, or such holders have the right to accelerate such indebtedness (without regard to any requirements relating to notice, the passage of time or both) as a result of a payment default or a default with respect to a failure by Buyer or Seller (or Buyer’s Guarantor or Seller’s Guarantor), as applicable, to comply with a financial covenant.

“Interconnection Agreement” means the Generation Transmission Interconnection Agreement by and between Buyer and ATC dated as of November 1, 2000, as revised by the Second Revision issued on January 2, 2002.

“Investment Grade” means a Credit Rating of at least BBB- by S&P and Baa3 by Moody’s; provided, that if an entity is rated by only S&P or Moody’s, as applicable, then such Credit Rating shall be at least the rating stated above by S&P or Moody’s, as applicable. In the event that a Credit Rating from one of S&P or Xxxxx’x is at or above Investment Grade and the Credit Rating from the other rating agency is below Investment Grade with respect to a Person or its obligations, then such Person and its obligations shall be considered to not have an Investment Grade Credit Rating.

“Law” means any federal, state and local laws, statutes, regulations, rules, codes, orders, judgments, decrees or ordinances enacted, adopted, issued or promulgated by any Governing Authority, including any Authorizations issued to a Party or by which a Party or the Facilities may be bound (including any of the foregoing pertaining to electrical, building, zoning, environmental and occupational safety and health requirements) or any published directive, guideline, requirement or other governmental restriction which has the force of law or any determination by, or interpretation of, any of the foregoing by any Governing Authority, binding on a given Person in a relevant jurisdiction.

“Letter of Credit” means an irrevocable standby letter of credit, substantially in the form attached hereto as Exhibit F and which (i) is issued by a U.S. commercial bank or the U.S. branch of a foreign bank with total assets of at least ten billion U.S. dollars ($10,000,000,000) having a Credit Rating of A- or higher by S&P or A3 or higher by Moody’s; and (ii) permits presentation for drawing at a bank located in Milwaukee, Wisconsin.

“LMP” means the “Locational Marginal Price” at the relevant CPNode for the relevant hour(s) and day(s) for the MISO Day-Ahead Market or MISO Real-Time Market, as applicable, as posted by the Transmission Provider.

7

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Local Capacity Resource” has the meaning set forth in the Transmission Provider Tariff.

“MAIN Guide No. 3A Standards” means the standards attached as Exhibit I.

“Maintenance Schedule” has the meaning set forth in Section 5.1(a).

“Metering Devices” has the meaning set forth in Section 6.1(a).

“MISO” means the Midwest Independent Transmission System Operator, Inc.

“MISO Day-Ahead Market” means the Day-Ahead Market as defined in the applicable Transmission Provider Tariff.

“MISO FinSched” means a Financial Bilateral Transaction for a given Operating Day that is subsequently settled in the MISO Day Ahead Market with a source point, delivery point and sink point at the CPNode.

“MISO FinSched Energy” means the quantity of MWh Scheduled on MISO FinScheds for a given Operating Day.

“MISO Market” means the MISO Real-Time Market or the MISO Day-Ahead Market.

“MISO Market Time” means Eastern Standard Time or as otherwise set forth in the Transmission Provider Tariff.

“MISO Real-Time Market” means the Real-Time Market as defined in the applicable Transmission Provider Tariff.

“Module E” has the meaning set forth in the definition of Accredited Capacity.

“Moody’s” means Xxxxx’x Investor Services, Inc.

“MW” means a megawatt.

“MWh” means megawatt-hours.

“XXXX” means Nuclear Electric Insurance Limited.

“NERC” means the North American Electric Reliability Council.

“Net Energy Output” means, for any hour during a Billing Cycle and with respect to the Facilities (excluding the CT), (a) if the Facilities (excluding the CT) are operating, total Energy output of the Facilities (excluding the CT) as measured at the Delivery Point, less Station Service Load (provided such Station Service Load is netted as provided in Section 2.12), which amounts shall be calculated at the applicable Metering Devices, multiplied by a fraction, the numerator of which is the Capacity of the Facilities (excluding the CT) and the denominator of which is the sum of (i) the Capacity of the Facilities (excluding the CT) and (ii) the Capacity of any Uprate not accepted by Buyer pursuant to Section 2.9(a) (provided that Net Energy Output can in no event be less than zero), or (b) if the Facilities (excluding

8

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

the CT) are not operating, zero. For the avoidance of doubt, all Energy generated by the Units must first satisfy Buyer’s Energy Amount before any Energy from the Units is made available to third parties.

“Net Worth” means the dollar value calculated by subtracting liabilities from total assets (excluding goodwill and other intangible assets described in FASB Statement 142) as such terms are determined in accordance with GAAP.

“Network Load” has the meaning set forth in the Transmission Provider Tariff.

“Non-Defaulting Party” has the meaning set forth in Section 10.2.

“Notice Time” means the time no later than two (2) hours prior to the deadline for submission to the Transmission Provider of Generation Offers for the next Operating Day.

“NRC” means the United States Nuclear Regulatory Commission.

“Off-Peak” means all hours that are not On-Peak hours.

“Offer” has the meaning given such term in Section 2.10.

“On-Peak” means hour ending 0700 CPT through hour ending 2200 CPT, Monday through Friday, excluding NERC holidays.

“Operating Contact” has the meaning set forth in Section 14.2.

“Operating Day” has the meaning ascribed to such term by MISO in the applicable Transmission Provider Tariff or related documents, as such relevant meaning or relevant term may be modified from time to time.

“Party” has the meaning set forth in the preamble hereto.

“Peak Adjustment Payment” has the meaning set forth in Section 3.2.

“Peak Period” has the meaning set forth in Exhibit G.

“Performance Test” has the meaning set forth in Section 5.3(d)(ii).

“Permitted Assignee” has the meaning set forth in Section 18.2.

“Person” means any legal or natural person, including any individual, corporation, partnership, limited liability company, joint stock company, association, joint venture, trust, Governing Authority or international body or agency, or other entity.

“Planned Uprate” means the extended power uprate, based on licensing and engineering evaluations completed by Westinghouse Electric Company (nuclear steam supply system supplier for Point Beach), Stone & Xxxxxxx Engineering Corporation, and Siemens-Westinghouse (turbine-generator original equipment manufacturer), designed to

9

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

increase the reactor thermal output of each Unit by approximately 8.6% (or approximately 45 MWe per Unit).

“Point Beach” has the meaning given such term in the second recital to this Agreement.

“Prime Rate” means, for any period, the rate per annum expressed as a daily percentage, in effect on the first day of such period, as published from time to time in the money rates section of The Wall Street Journal representing the base rate on corporate loans posted by at least seventy-five percent (75%) of the nation’s thirty (30) largest banks. If for any reason such rate is not available, “Prime Rate” means the rate per annum which JPMorgan Chase Bank announces in New York from time-to-time as its prime or base lending rate for corporate customers.

“Proprietary Information” has the meaning set forth in Section 16.2.

“Prudent Utility Practice” means any applicable practices, methods and acts engaged in or approved by a significant portion of (a) as to Seller, the nuclear power electric generating industry in the United States of America, or (b) as to Buyer, the electric utility industry in the United States of America, during the relevant time period, or the practices, methods and acts which, in the exercise of reasonable judgment by a prudent nuclear operator (or prudent utility operator, if applicable to Buyer) in light of the facts known or which should reasonably have been known at the time the decision was made, could have been expected to accomplish the desired result consistent with good business practices, reliability, safety, expedition and the requirements of any Governing Authority having jurisdiction. “Prudent Utility Practice” is not intended to be limited to the optimum practice, method or act to the exclusion of all others, but rather to the acceptable practices, methods or acts generally accepted (a) as to Seller, by the nuclear power electric generating industry in the United States of America or (b) as to Buyer, by the electric utility industry in the United States of America.

“PSCW” means the Public Service Commission of Wisconsin.

“Reactive Power” means the reactive power capability of the Facilities as set forth in the Interconnection Agreement.

“Related Entity” has the meaning set forth in Section 18.2(c).

“Replacement Capacity” means, at any time, Accredited Capacity supplied to Buyer by Seller from any DNR (other than the Facilities) or from any other generation resource satisfying the requirements of a Local Capacity Resource associated with Buyer’s Network Load (other than the Facilities) to fulfill, in whole or in part, Seller’s obligation to supply Accredited Capacity under this Agreement. Replacement Capacity, when combined with Accredited Capacity from the Facilities, shall not exceed the Buyer’s Capacity Amount. In addition, Replacement Capacity shall (a) not be committed for sale to any third party, and (b) be accredited at all times to serve Buyer’s Capacity requirements.

“Replacement Energy” means, at any time, Energy supplied to Buyer by Seller from any resource other than the Facilities to fulfill, in part or in whole, Seller’s obligation hereunder

10

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

to deliver Energy which, when combined with the Net Energy Output of the Facilities, shall not exceed the Buyer’s Energy Amount applicable to Buyer at such time under this Agreement.

“S&P” means Standard & Poor’s Ratings Group (A Division of The XxXxxx-Xxxx Companies).

“SCADA” means supervisory, control and data acquisition technology and equipment.

“Schedule”, “Scheduled” or “Scheduling” means the actions of Seller, Buyer and/or their designated representatives, of notifying, requesting and confirming to each other and to any third party the quantity and type of Energy to be delivered on any Operating Day (a) submitted to MISO by Seller as Seller’s Generation Offer from the Facilities for a relevant Operating Day during the Term pursuant to this Agreement, or (b) submitted to MISO by Seller and accepted by Buyer as a Financial Bilateral Transaction for a relevant Operating Day during the Term pursuant to this Agreement.

“Scheduled Maintenance Outage” has the meaning set forth in Section 5.1(a).

“Seller” has the meaning set forth in the preamble hereto.

“Seller Performance Security” means the performance security required to be posted by Seller pursuant to Section 8.1.

“Seller’s Guarantor” means a Person that, at the time of the execution and delivery of the Seller’s Guaranty, is a direct or indirect owner of Seller and (a) has an Investment Grade Credit Rating and a consolidated Net Worth of at least five hundred million dollars ($500,000,000.00); or (b) is reasonably acceptable to Buyer as having a verifiable creditworthiness and Net Worth sufficient to secure Seller’s Guarantor’s obligations under the Seller’s Guaranty.

“Seller’s Guaranty” has the meaning set forth in Section 8.1.

“Senior Executives” has the meaning set forth in Section 19.2.

“Senior Financial Officer” means an officer of Seller or of an Affiliate of Seller having financial and accounting expertise reasonably satisfactory to Buyer.

“Station Service Load” means all electric service requirements used in connection with the operation and maintenance of the Facilities and any improvements thereto, including auxiliary, stand-by, supplemental, back-up maintenance and interruptible power.

“Target Capacity Factor” means [**].

“Tax” means (i) any tax (including but not limited to franchise tax), charge, fee, levy or other assessment imposed by any Governing Authority and based on or measured with respect to net income or profits, including any interest, penalties or additions attributable or imposed with respect thereto, and (ii) any other tax, charge, levy, fee or other assessment

11

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

imposed by any Governing Authority, including any transfer, gross receipts, sales, use, service, occupation, ad valorem, property, payroll, personal property, excise, severance, premium, stamp, documentary, license, registration, social security, employment, unemployment, disability, environmental (including but not limited to taxes under Section 59A of the Internal Revenue Code of 1986), add-on, value added, withholding (whether payable directly or by withholding and whether or not requiring the filing of a tax return therefor), commercial rent and occupancy tax, and (iii) any estimated tax, deficiency assessment, interest, penalties and additions to tax or additional amounts in connection with any of the foregoing, imposed by any Governing Authority; provided, that “Tax” does not include any Gross Receipts Tax.

“Term” means the period from and after the Effective Date to and including the date and time of the later of the Unit 1 Termination Date or the Xxxx 0 Xxxxxxxxxxx Xxxx.

“Transferee” has the meaning set forth in Section 16.1.

“Transferor” has the meaning set forth in Section 16.1.

“Transmission Owner” means ATC.

“Transmission Provider” means MISO with respect to its function as the regional transmission organization and/or with respect to its function as market operator of the MISO Market, as applicable; in the event either of such functions is performed by a separate entity, “Transmission Provider” shall refer to such entity as and where applicable in this Agreement.

“Transmission Provider Tariff” means the “Open Access Transmission and Energy Market Tariff for the Midwest Independent Transmission System Operator, Inc.,” or any tariff of a successor to the MISO, and any related procedures or rules published by the Transmission Provider, including the “Business Practice Manual” related thereto.

“Unit” means Unit 1 or Unit 2.

“Unit 1” means Point Beach Nuclear Plant Unit 1 and related facilities as more specifically described in the Asset Sale Agreement.

“Unit 1 Termination Date” has the meaning set forth in Section 13.1.

“Unit 2” means Point Beach Nuclear Plant Unit 2 and related facilities as more specifically described in the Asset Sale Agreement.

“Unit 2 Termination Date” has the meaning set forth in Section 13.1.

“Unscheduled Outage” means any Derate of the Facilities other than a Scheduled Maintenance Outage.

12

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

“Uprate” means, with respect to each Unit, an increase in the maximum thermal power level at which such Unit may operate under its NRC license as such license may be amended after the date hereof.

“VAR” or “VARs” means Volt-Amps-Reactive, a measure of reactive power.

“Variable Interest Entity” or “VIE” has the meaning set forth in the FASB Interpretation No. 46 (Revised December 2003) as issued and amended from time to time by FASB.

“Weekly Schedule” has the meaning set forth in Section 2.4(a).

“Wisconsin Energy Group” means the collective group of companies identified as affiliates in the most recent Form 10-K filed at the U.S. Securities and Exchange Commission by Wisconsin Energy Corporation.

“Worker’s Compensation Laws” means all Laws relating to employment-related accidents and diseases and the benefits, insurance and other compensation required in relation thereto.

1.2. Rules of Interpretation

In this Agreement and in any Appendices, Exhibits or Schedules attached hereto, except to the extent that the context requires otherwise:

| (a) | The Table of Contents and the headings of the Articles and Sections herein have been inserted as a matter of convenience for reference only and shall not control or affect the meaning or construction of any of the terms or provisions hereof; |

| (b) | The singular includes the plural and the masculine includes the feminine and neuter unless the context requires otherwise; |

| (c) | References to any document, agreement or Law, including this Agreement, shall be deemed to include references to (i) all appendices, exhibits, and schedules attached thereto and (ii) such document, agreement or Law as amended, modified, supplemented, replaced or restated from time to time in accordance with its terms (if applicable) and (where applicable) subject to compliance with the requirements set forth therein; |

| (d) | The Exhibits hereto are incorporated herein by this reference and are intended to be a part of this Agreement; provided, however, that in the event of a conflict between the terms of an Exhibit and the terms of the remainder of this Agreement, the terms of the remainder of the Agreement shall take precedence; |

| (e) | References to “Articles,” “Sections,” clauses, “Paragraphs,” “Appendices,” “Exhibits,” or “Schedules,” are to articles, sections, clauses, paragraphs, appendices, exhibits or schedules of this Agreement; |

| (f) | All references to a particular Person shall include a reference to such Person’s successors and permitted assigns; |

| (g) | The words “herein,” “hereof” and “hereunder” shall refer to this Agreement as a whole and not to any particular section or subsection of this Agreement; the |

13

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| words “include,” “includes” or “including” shall mean “including, but not limited to;” |

| (h) | The term “day” shall mean a calendar day commencing at 12:00 a.m. CPT and whenever an event is to be performed or a payment is to be made by a particular date and the date in question falls on a day that is not a Business Day, the event shall be performed or the payment shall be made on the next succeeding Business Day; the term “week” shall mean a seven consecutive day period; the term “month” shall mean a calendar month; provided, that when a period measured in months commences on a date other than the first day of a month, the period shall run from the date on which it starts to the corresponding date in the next month and, as appropriate, to succeeding months thereafter; and the term “year” shall mean a Calendar Year; and |

| (i) | All monetary references contained herein refer to U.S. dollars. |

1.3. Accounting Terms

All accounting terms used herein shall be construed in accordance with GAAP unless the context or use requires a different interpretation.

1.4. Legal Representation

This Agreement was negotiated and prepared by both Parties with the advice of counsel to the extent deemed necessary by each Party; the Parties have agreed to the wording of this Agreement; and none of the provisions hereof shall be construed against one Party on the ground that such Party is the author or drafter of this Agreement or any part hereof.

ARTICLE II: PURCHASE OF CAPACITY, ENERGY, AND

ANCILLARY SERVICES

2.1. Capacity Sale and Purchase

Subject to the terms and conditions of this Agreement, Seller agrees to sell and supply to Buyer, and Buyer agrees to accept and purchase from Seller, all Accredited Capacity (i) from the Facilities for the duration of the Term and (ii) associated with Replacement Capacity that Seller supplies to Buyer pursuant to the terms of this Agreement. Furthermore, except as otherwise specifically provided for herein, Seller shall not sell or commit to sell the Capacity of the Facilities during the Term to any party other than Buyer.

2.2. Energy Sale and Purchase

| (a) | Subject to the terms and conditions of this Agreement, for the duration of the Term, Seller shall sell and deliver to Buyer at the Delivery Point, and Buyer shall accept and purchase, (i) the Net Energy Output and (ii) all Replacement Energy that Seller delivers to Buyer pursuant to the terms of this Agreement. The amount of all Energy sold to Buyer as Scheduled by Seller and purchased by Buyer from Seller as confirmed by Buyer in accordance with Exhibit H, for any period of time, shall be the aggregate amount of Delivered Energy for such period of time. Furthermore, except as otherwise specifically provided for herein, Seller shall not |

14

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| sell or commit to sell the Net Energy Output during the Term to any party other than Buyer. |

| (b) | The Parties acknowledge and agree that any increases in Capacity, Energy or Ancillary Services from the Facilities (excluding the Energy (and Ancillary Services related thereto) from the CT), whether due to changes in ambient conditions or otherwise (other than that attributable to Uprates not accepted by Buyer in accordance with Sections 2.9(a) or (b), as applicable), are included in the Buyer’s Capacity Amount and Net Energy Output to be provided hereunder. |

2.3. Ancillary Services

| (a) | The sale of Capacity and Energy hereunder from the Facilities (or in respect of any Replacement Capacity as provided in Section 2.4(c)) to Buyer shall include the Ancillary Services associated with such Capacity and Energy from the Facilities (or in respect of any Replacement Capacity as provided in Section 2.4(c)). Seller agrees to provide and/or execute any documents or agreements necessary to transfer to Buyer any revenue and any other benefits and rights received from third parties by Seller in providing such Ancillary Services. For all periods during which such documents and agreements are not in effect, Seller agrees to credit to Buyer such revenues as provided in Section 3.1(b) until such time as an agreement is executed. Further, to the extent permitted by Law, Seller hereby assigns and delegates to Buyer all rights and obligations Seller may have to reach agreement with the Transmission Provider or Transmission Owner, as applicable, as to the appropriate entitlement of revenues for Ancillary Services provided by the Facilities (or in respect of any Replacement Capacity as provided in Section 2.4(c)) under the applicable Transmission Provider Tariff and/or under the Interconnection Agreement, as applicable. |

| (b) | To the extent that Seller’s unexcused failure to deliver Ancillary Services to Buyer results in any increased cost, damage or penalty incurred by Buyer, Seller shall reimburse Buyer for any such increased cost, damage or penalty within 10 Business Days of invoice receipt therefor. Any invoice submitted by Buyer to Seller pursuant to this Section 2.3(b) shall include a written statement explaining in reasonable detail the calculation of the amount owed by Seller. The amount of such cost, damages or penalty to be reimbursed shall not exceed an amount equal to the increased costs or penalties actually incurred by Buyer. Notwithstanding the preceding sentence, in the event that during the Term there exists a market for the purchase and sale of Ancillary Services, then (i) if Seller fails to provide an Ancillary Service required to be delivered hereunder from the Facilities, Seller shall use commercially reasonable efforts to provide Buyer with a replacement for such Ancillary Service and (ii) if Seller is unsuccessful in satisfying its obligation under clause (i), Seller shall reimburse Buyer for the market-clearing price for such undelivered Ancillary Service. |

| (c) | Notwithstanding the foregoing, in no event shall Seller be required to reduce its Net Energy Output below the Energy associated with the Target Capacity Factor for the purpose of providing Ancillary Services to Buyer. |

15

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

2.4 Replacement Energy and Replacement Capacity

| (a) | Replacement Energy. Subject to the provisions of this Agreement, Seller may provide Buyer with Replacement Energy as set forth below in this Section 2.4(a) during a Scheduled Maintenance Outage or an Unscheduled Outage, but only to the extent of any associated Derate. Seller may provide Replacement Energy from a source that differs from the DNR selected by Seller to supply Replacement Capacity, if any. |

| (i) | Unscheduled Outage Replacement Energy Notices |

If the event or condition constituting the Derate is an Unscheduled Outage, Seller shall telephonically notify the Dispatch Authority Function of Seller’s election in accordance with Section 2.4(a)(iii) below (to provide or not to provide Replacement Energy) as soon as practicable but no later than the Notice Time on the day following the day the Derate commenced with confirmation (by email or facsimile) within 24 hours. Seller’s election shall be effective based on a “Weekly Schedule”, which means seven consecutive days beginning at 00:00 MISO Market Time on any day of the week following the appropriate Notice Time and ending at 23:59 MISO Market Time on the seventh day. Seller shall provide Buyer notice of its intent to continue or discontinue its Replacement Energy election no later than two (2) Business Days prior to the commencement of the applicable Weekly Schedule.

| (ii) | Scheduled Maintenance Replacement Energy Notices |

If the event or condition constituting the Derate is a Scheduled Maintenance Outage, Seller shall telephonically notify the Dispatch Authority Function of Seller’s election in accordance with Section 2.4(a)(iii) below to provide or not to provide Replacement Energy no later than two (2) Business Days prior to the scheduled commencement of such Scheduled Maintenance Outage with confirmation (by email or facsimile) within 24 hours. Seller’s election shall be effective based on a Weekly Schedule. Seller shall provide Buyer notice of its intent to continue or discontinue its Replacement Energy election no later than two (2) Business Days prior to the commencement of the applicable Weekly Schedule.

| (iii) | Replacement Energy Scheduling |

Any Replacement Energy Scheduled hereunder shall be Scheduled in accordance with Article IV, subject to the following: Replacement Energy may only be Scheduled and delivered on a continuous basis in either (A) a single, fixed quantity or (B) a quantity varied to reflect expected changes in the Net Energy Output (e.g., changes in output or ramp rates or expected resolution of outages with respect to the Facilities) such that the aggregate of such Replacement Energy and the Net Energy Output will result in a single, fixed quantity.

16

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| (b) | Replacement Capacity |

| (i) | Subject to the provisions of this Agreement, if at any time the Accredited Capacity of the Facilities is less than the Buyer’s Capacity Amount, then Seller may provide Buyer with Replacement Capacity but only to the extent that the Accredited Capacity of the Facilities is less than the Buyer’s Capacity Amount. In no event shall Seller provide Replacement Capacity for a period of less than 12 months; provided, that if the MISO market provides for a capacity product of less than 12 months, Seller may provide Replacement Capacity for such shorter period of capacity product, but in no event less than one month or less than the Peak Period in the event Accredited Capacity is unavailable for any month in the applicable Peak Period; provided, further, that if the applicable regional reliability council or any other Governing Authority requires Replacement Capacity to be provided for a period of time greater than as set forth in the preceding proviso in order for such Replacement Capacity to be deemed Accredited Capacity, then Seller may only provide Replacement Capacity for a period no less than as mandated by such Governing Authority. Seller shall notify the Dispatch Authority Function of the source of such Replacement Capacity as soon as practicable. Subject to the terms of this Agreement, if at any xxxx Xxxxxx does not deliver Accredited Capacity from the Facilities or Replacement Capacity, in either case in an amount equal to Buyer’s Capacity Amount, Seller shall be required to pay Buyer liquidated damages equal to [**] (“Accredited Capacity Liquidated Damages”) for each MW-month (or portion thereof) of each such shortfall. At Buyer’s election, Seller shall be required to pay Accredited Capacity Liquidated Damages within five (5) Business Days of invoice receipt therefor. |

| (ii) | The amount, if any, by which the Accredited Capacity Liquidated Damages incurred in any calendar month exceed the Delivered Energy Payment due and payable for such month is referred to as the “Monthly Excess Accredited Capacity Liquidated Damages Amount”. In no event shall the sum of the Monthly Excess Accredited Capacity Liquidated Damages Amounts accrued during any Calendar Year exceed [**]. |

| (c) | When supplying Replacement Capacity, to the extent there are Ancillary Services associated with the Replacement Capacity obtained by Seller, Seller shall supply such Ancillary Services to Buyer at no additional cost or expense to Buyer. |

2.5. Financial Transmission Rights

Buyer shall be entitled to all financial transmission rights and all other rights and benefits with and from the Transmission Provider associated with the Capacity, Energy and Ancillary Services being purchased from the Facilities. Seller shall cooperate in good faith with Buyer to ensure that such financial transmission rights and other rights and benefits are effectively assigned and transferred to Buyer at no additional cost to Buyer. Further, Seller hereby assigns and delegates to Buyer all rights and obligations Seller may have to reach agreement with the Transmission Provider as to the appropriate entitlement of such financial transmission rights under the applicable Transmission Provider Tariff.

17

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

2.6. Title and Risk of Loss

Title to and risk of loss related to the Capacity, Energy and Ancillary Services being purchased hereunder shall transfer from Seller to Buyer at the Delivery Point. Seller warrants that it will deliver to Buyer such Capacity, Energy and Ancillary Services free and clear of all liens, security interests, claims and encumbrances or any interest therein or thereto by any Person.

2.7. Delivery Point

The “Delivery Point” for Energy (including Replacement Energy) delivered pursuant to this Agreement is the CPNode.

2.8. Capacity Accreditation

Seller shall, at its sole cost and expense, take all reasonable actions required to cause the Buyer’s Capacity Amount and any Replacement Capacity to be Accredited Capacity, including the satisfaction of all applicable requirements to establish and maintain the DNR status (as defined under the applicable Transmission Provider Tariff and acceptable to the applicable regional reliability council and the Transmission Provider, as applicable), and including Local Capacity Resource status in relation to Buyer’s Network Load, of the Facilities or the source of the Replacement Capacity for Buyer.

2.9. Uprates

| (a) (i) | Seller shall use its commercially reasonable efforts to complete the Planned Uprate by June 1, 2012; provided, however, that Seller shall have the right, consistent with Prudent Utility Practice, to change the date for the completion of the Planned Uprate so long as Seller provides Buyer with advance written notice of such change no later than June 1, 2010 and at least two years prior to the expected completion date of the Planned Uprate. Upon completion of the Planned Uprate the actual Capacity increase associated with the Planned Uprate, as determined by Performance Tests pursuant to Section 5.3(d)(ii), shall become a part of the Buyer’s Capacity Amount, and Exhibit B shall be adjusted to include the increase in Capacity related to such Planned Uprate. The procedures for Uprates described in Section 2.9(b) shall not apply to the Planned Uprate. The Planned Uprate shall not be included in Delivered Energy until the transmission upgrades, if any, required for the Planned Uprate have been completed in accordance with the applicable transmission studies performed by ATC and/or MISO. |

| (ii) | Any transmission upgrade costs to be assessed upon Seller as a direct result of the Capacity increase of the Planned Uprate (the “Planned Uprate Transmission Upgrade Costs”) shall be reimbursed by Buyer. Buyer’s payment therefor shall be due within 10 days after Seller’s actual payment of such costs and the receipt by Buyer of an invoice for such payment together with documentation setting forth such Planned Uprate Transmission Upgrade Costs in reasonable detail. |

18

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| (iii) | Notwithstanding subsection (ii), Buyer may, in its discretion, by written notice to Seller, within 120 days after receipt of notification of the amount of such Planned Uprate Transmission Upgrade Costs to be assessed upon Seller, decline to accept the Capacity, Energy and Ancillary Services of the Planned Uprate under this Agreement, in which case Buyer shall not be obligated to purchase any of such products associated with the Planned Uprate or to reimburse Seller for any such Planned Upgrade Transmission Upgrade Costs. In the event that Buyer declines the Planned Uprate as provided above, Seller shall have the right to sell to any third party the incremental Capacity, Energy and associated Ancillary Services generated at the Facilities as a direct result of the Planned Uprate; provided, that all Energy generated by the Units must first satisfy Buyer’s Energy Amount before any Energy from the Units is made available to third parties. |

| (iv) | In the event of any Uprate project proposed by Seller that consists both of the Planned Uprate and any other Uprate, Seller shall cause one or more transmission studies to be performed that separately identify the transmission requirements and associated costs for the Planned Uprate and any such other Uprate proposed by Seller. The transmission costs associated with the Planned Uprate shall be determined based on a transmission study that assumes no other Uprate has been or will be completed. |

| (b) | Seller agrees to sell and Buyer agrees to purchase any Capacity, Energy and Ancillary Services related to any Uprate (other than the Planned Uprate) upon the same terms and conditions as provided in this Agreement, effective upon the completion of any such Uprate; provided, however, Buyer may, by written notice to Seller, within 120 days after receipt of notification of the amount of such transmission costs to be assessed upon Seller, decline to purchase the Capacity, Energy and Ancillary Services of any such Uprate that Buyer determines, in its discretion, would either (1) cause transmission disruptions or impose incremental transmission costs on the Buyer or (2) materially diminish the capacity factor of the Facilities, in which case Buyer shall not be obligated to purchase any such products from such Uprate. Unless Buyer declines such Uprate as provided above, the Parties shall promptly adjust the Buyer’s Capacity Amount on Exhibit B to account for the Capacity of such Uprate, as determined pursuant to Performance Tests pursuant to Section 5.3(d)(ii), to take effect upon the completion of such Uprate. An Uprate (other than the Planned Uprate) shall not be included as Delivered Energy until the transmission upgrades, if any, required for such Uprate have been completed in accordance with the applicable transmission studies performed by ATC and/or MISO. In the event that Buyer declines any Uprate as provided above, Seller shall have the right to sell to any third party the incremental Capacity, Energy and associated Ancillary Services generated at the Facilities as a direct result of such Uprate not accepted by the Buyer; provided, that all Energy generated by the Units must first satisfy Buyer’s Energy Amount before any Energy from the Units is made available to third parties. |

19

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| (c) | Notwithstanding anything to the contrary in this Agreement, changes to the Buyer’s Capacity Amount resulting from the Planned Uprate or any other Uprate shall be conditioned upon the receipt of all requisite regulatory approvals, applicable to such Planned Uprate or any other Uprate, by the Party to whom such regulatory approvals apply. |

| (d) | In the event any Uprate is not accepted by Buyer, then Net Energy Output shall be provided as follows: (i) Buyer shall first receive Buyer’s Energy Amount; (ii) Seller shall receive an amount of Energy associated with any unaccepted Uprate second; and (iii) if any of the Net Energy Output exceeds the sum of (i) and (ii) above, such additional Energy shall be prorated as provided in the definition of Net Energy Output. |

2.10. Right of First Offer

Except as otherwise specifically provided for in this Agreement, during the Term, Seller shall not have the right to sell or otherwise transfer any Capacity, Energy or Ancillary Services from the Facilities to another Person (whether by way of a power purchase agreement or otherwise) without first offering (the “Offer”), subject to all requisite regulatory approvals, such Capacity, Energy or Ancillary Services to the Buyer at least 18 months prior to the Unit 1 Termination Date and at least 18 months prior to the Xxxx 0 Xxxxxxxxxxx Xxxx. Such Offer shall be for the full output of the Unit (including any Uprate affected during the Term), made in the form of a proposed contract to the Buyer and shall be open for acceptance to the Buyer for a period of ninety (90) days. In the event the Buyer accepts such Offer, the Seller and Buyer shall proceed to the execution of such proposed contract in an expeditious manner; provided, Buyer must procure all of its requisite regulatory approvals at least six (6) months prior to the Xxxx 0 Xxxxxxxxxxx Xxxx xx Xxxx 0 Termination Date, as applicable, or such Offer shall be deemed to have expired.

2.11. Reactive Power

Without limiting the general application of Section 2.3:

| (a) | Seller agrees that it shall not have any rights to the production or absorption, if applicable, of Reactive Power and that Seller shall, consistent with the requirements of any Governing Authority, not operate the Facilities to produce real power at a level or in a manner that compromises its ability to operate the Facilities to produce or absorb, if applicable, Reactive Power to maintain the output voltage or power factor at the applicable CPNode in any agreement governing Seller’s obligation to produce or absorb, if applicable, Reactive Power consistent with the Interconnection Agreement. |

| (b) | If requested by the Transmission Provider, without additional charge under this Agreement, Seller shall adjust Reactive Power (as so requested), subject to Prudent Utility Practice. As between the Parties, Buyer shall have the right to receive any compensation paid by any third party for Reactive Power (including for any increases in reactive power output or capability of the Facilities after the Effective Date) produced or absorbed by the Facilities. Any disagreement about |

20

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| the amount of such compensation shall be resolved in accordance with the Dispute Resolution Procedures. |

2.12. Station Service

During any period in which any Unit is operating, Seller shall be permitted to satisfy the Station Service Load using Energy generated by any such Unit. If Seller is not able to self-supply Energy to satisfy Station Service Load, Seller shall compensate Buyer for Energy to serve the Station Service Load at the MISO Real-Time Market LMP for the appropriate CPNode, including any transmission or settlement charges associated with such Energy, during any period of time in which the Facilities are not operating or are not generating sufficient Energy to meet the Station Service Load of the Facilities. In the event that any fees, damages, penalties or transmission charges are assessed against Buyer by any Governing Authority in connection with the Station Service Load or any Energy obtained to serve the Station Service Load, Seller shall reimburse Buyer for such fees, damages, penalties or transmission charges within 10 Business Days of invoice receipt therefor. Any invoice submitted by Buyer to Seller pursuant to this Section 2.12 shall include a written statement explaining in reasonable detail the calculation of the amount due from Seller. As of the date of execution of this Agreement, the Station Service Load related to each Unit is calculated as approximately five MW. In the event such amount is materially changed for any reason, Seller shall give Buyer prompt written notice of such change.

2.13. CT Capacity

The CT Capacity shall be provided by the Seller to the Buyer under this Agreement as part of the Accredited Capacity delivered from the Facilities. Seller shall be responsible for all costs associated with the CT in Seller’s operation and maintenance of the Facilities as provided herein, and the operation and maintenance of the CT and the provision to Buyer of the Accredited Capacity therefrom will not result in any additional cost to the Buyer. Seller shall use commercially reasonable efforts to ensure that the Accredited Capacity associated with the CT shall be at least fifteen (15) MW during the Peak Period. Seller is responsible for all payments to (and is entitled to all revenue from) Transmission Provider associated with the dispatch of Energy from the CT. The Seller shall not replace or retire the CT without first giving to Buyer at least two (2) years prior written notice.

ARTICLE III: PAYMENTS

3.1. Purchase Payments

The amounts to be paid to the Seller by the Buyer for purchases of Capacity, Energy and Ancillary Services under this Agreement shall be determined as follows:

| (a) | Delivered Energy Payment. With respect to each Billing Cycle, Buyer shall make a payment to Seller equal to the sum of (i) the product of: (A) the applicable “Delivered Energy Charge” set forth in Exhibit A; (B) the applicable Delivered Energy Charge Shaping Factor set forth in Exhibit C; and (C) the sum of the MISO FinSched Energy (on-peak and off-peak as appropriate) for the Operating Days in such Billing Cycle, and (ii) any Gross Receipts Tax Payment applicable |

21

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

| to the invoice for such Billing Cycle (pursuant to Section 20.3(d))(each, a “Delivered Energy Payment”). |

| (b) | Ancillary Services. The Delivered Energy Payment includes payment for any and all Ancillary Services received by Buyer, and no additional payment from Buyer in respect thereof shall be due at any time. For the avoidance of doubt, Seller specifically agrees that it shall not be entitled to any payment for reactive power under this Agreement, notwithstanding its obligation to operate the Facilities in accordance with Section 2.10. Any and all revenues Seller receives from the Transmission Provider for Ancillary Services from the Facilities in each Billing Cycle shall be credited to Buyer and offset with any other payments due from Buyer to Seller under this Agreement (unless otherwise directly transferred to Buyer as provided in Section 2.3). |

| (c) | Accredited Capacity. The Delivered Energy Payment includes payment for any and all Accredited Capacity constituting Buyer’s Capacity Amount provided to Buyer under this Agreement based on the aggregate amount of Delivered Energy for such Billing Cycle, and no additional payment from Buyer in respect thereof shall be due at any time. The sole purchase price for such Accredited Capacity shall be the Delivered Energy Payment for such Delivered Energy. For the avoidance of doubt, no payment shall be owed by Buyer for Accredited Capacity if the Delivered Energy Payment for any Billing Cycle is zero; provided, however, that, notwithstanding the foregoing, Seller shall be obligated to provide Accredited Capacity as provided in this Agreement. |

3.2. Peak Adjustment Payment

If applicable, Seller shall make a payment to Buyer as determined in accordance with Exhibit G (each, a “Peak Adjustment Payment”).

ARTICLE IV: SCHEDULING

4.1. Scheduling

Seller shall submit its Generation Offers and Financial Bilateral Transactions in accordance with applicable Transmission Provider rules and procedures and must offer Unit 1 and Unit 2 in the MISO Day-Ahead Market and the MISO Real-Time Market for dispatch as must run generation units with a dispatch minimum for each hour equal to no less than the full expected Net Energy Output of Unit 1 and Unit 2 (consistent with the Transmission Provider Tariff). Notwithstanding the foregoing, Seller shall have the option to not Schedule Energy from Xxxx 0 xxx/xx Xxxx 0 in the MISO Day-Ahead Market in instances when Xxxx 0 xxx Xxxx 0 are being ramped up to return to service following a Scheduled Maintenance Outage or an Unscheduled Outage; provided, however, that Seller shall hold harmless, defend and indemnify Buyer from and against any charges or fees, including Revenue Sufficiency Guaranty (as defined in the Transmission Provider Tariff) charges, levied on Buyer as a result of Seller’s Scheduling in the MISO Real-Time Market. Seller shall offer the CT in the MISO Day-Ahead Market and the MISO Real-Time Market in accordance with the Transmission Provider Tariff. Exhibit H includes other scheduling provisions applicable to this Agreement.

22

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

4.2. Failure to Schedule

| (a) | If Seller fails to Schedule Energy (including Replacement Energy) in accordance with Section 2.4(a)(iv) or Section 4.1, as applicable, and such failure is not excused under the terms of this Agreement, then Seller shall pay to Buyer, within five (5) Business Days of receipt of an invoice therefor, an amount equal to (i) the MISO Day-Ahead Market LMP for such applicable period multiplied by the Energy that Seller failed to Schedule, plus any charges, penalties, damages, fees and other costs, including Transmission Provider charges, incurred by Buyer resulting from such failure, minus (ii) the amount of the Delivered Energy Payment that Buyer would have incurred under this Agreement had the Energy been Scheduled. Any invoice submitted by Buyer to Seller pursuant to this Section 4.2(a) shall include a written statement explaining in reasonable detail the calculation of the amount due from Seller. |

| (b) | If Buyer fails to Schedule Energy (including Replacement Energy) that is Scheduled by Seller in accordance with Exhibit H of this Agreement, and such failure is not excused under the terms of this Agreement, then Buyer shall pay to Seller, within five (5) Business Days of receipt of an invoice therefor, an amount equal to (i) the amount of the Delivered Energy Payment that Seller would have received under this Agreement had the Energy been Scheduled by Buyer, minus (ii) the MISO Day-Ahead Market LMP for such applicable period multiplied by the Energy that Buyer failed to Schedule, plus any charges, penalties, damages, fees and other costs, including Transmission Provider charges, incurred by Seller resulting from such failure. Any invoice submitted by Seller to Buyer pursuant to this Section 4.2(b) shall include a written statement explaining in reasonable detail the calculation of the amount due from Buyer. |

ARTICLE V: MAINTENANCE AND OPERATION

5.1. Scheduled Maintenance

| (a) | Scheduling Procedure. |

Subject to subsection (b) below, Seller shall submit to Buyer a schedule of maintenance of the Facilities (each, a “Maintenance Schedule” and each item thereon a “Scheduled Maintenance Outage”) for each Calendar Year and a projection of scheduled outages for the following four years thereafter no later than twelve (12) months before the beginning of any year (or not later than three (3) months prior to the deadline for submittal of any such schedule to the Transmission Provider or any other applicable Governing Authority, if earlier); except that within thirty (30) days following the Effective Date, Seller shall submit to Buyer a Maintenance Schedule for the remainder of the Calendar Year in which the Effective Date occurs and for the following Calendar Year. Each Maintenance Schedule shall meet the requirements set forth in Section 5.1(b).

Within thirty (30) days of receipt of such Maintenance Schedule, Buyer may request reasonable modifications therein to the extent the requested modifications are not contrary to Prudent Utility Practice. Subject to subsection (b) below,

23

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

Buyer and Seller shall work together to schedule Scheduled Maintenance Outages to meet their mutual requirements and the requirements of the Transmission Provider and/or Transmission Owner, it being understood that Buyer shall consider, among other things, its reserve requirements, energy delivery commitments, costs of replacement power and other generating resources and expected loads in requesting such reasonable modifications; provided, that in the event of a disagreement, such scheduling shall be resolved by the Administrative Committee. All Scheduled Maintenance Outages shall be of a duration that is no longer than that reasonably necessary to carry out the required maintenance activities. Seller shall provide notice to Buyer as soon as practicable but in any event no later than forty-eight (48) hours prior to the expected cessation of maintenance activities and shall promptly inform Buyer of the completion of such activities.

Scheduled Maintenance Outages for the subsequent three (3) year period of the Maintenance Schedule may only be rescheduled within a period of time from 30 days prior to the projected start of such Scheduled Maintenance Outage to 30 days after the projected end of such Scheduled Maintenance Outage; provided, however, that no Scheduled Maintenance Outage in such subsequent three (3) year period may be rescheduled so that all or any portion of such Scheduled Maintenance Outage falls within a different Calendar Year; and provided, further, that if Seller experiences an extended Unscheduled Outage and desires to move a Scheduled Maintenance Outage into a prior or subsequent Calendar Year, any such rescheduling shall require the consent of Buyer, not to be unreasonably withheld.

| (b) | Limitations on Scheduled Maintenance Outages |

Scheduled Maintenance Outages may not occur during the Peak Period.

5.2. Derate Notices

In the event of any Derate, Seller must notify the Dispatch Authority Function and the Balancing Authority Function telephonically of such Derate as soon as practicable after Seller becomes aware of the necessity or occurrence thereof (each, a “Derate Notice”), with written confirmation within 24 hours of such oral notice. During any ongoing Derate, Seller shall provide updates as often as practicable, but no less than daily, to the Dispatch Authority Function of the nature and expected duration of such Derate as well as the magnitude and timing of actual and expected output changes of the Facilities and such other information as may assist Buyer in assessing the reliability and expected quantity of output from the Facilities, and Seller shall provide the Dispatch Authority Function with oral notice (confirmed promptly by email or facsimile) as much prior notice as practicable of when the Derate is expected to be remedied.

24

CONFIDENTIAL AND PROPRIETARY

EXECUTION VERSION

5.3. Operation

| (a) | Operation |