Contract

Exhibit 10.6

THIS WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR QUALIFIED UNDER ANY STATE OR FOREIGN SECURITIES LAWS AND MAY NOT BE OFFERED FOR SALE, SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED OR ASSIGNED UNLESS (I) A REGISTRATION STATEMENT COVERING SUCH SHARES IS EFFECTIVE UNDER THE SECURITIES ACT AND IS QUALIFIED UNDER APPLICABLE STATE AND FOREIGN LAW OR (II) THE TRANSACTION IS EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS UNDER THE SECURITIES ACT AND THE QUALIFICATION REQUIREMENTS UNDER APPLICABLE STATE AND FOREIGN LAW AND, IF THE CORPORATION REQUESTS, AN OPINION REASONABLY SATISFACTORY TO THE CORPORATION TO SUCH EFFECT HAS BEEN RENDERED BY COUNSEL.

WARRANT

COMMON STOCK

| Warrant Certificate No.: 4 | Original Issue Date: March 31, 2015 |

FOR VALUE RECEIVED, EXCO RESOURCES, INC., a Texas corporation (the “Company”), hereby certifies that ENERGY STRATEGIC ADVISORY SERVICES LLC, a Delaware limited liability company (“ESAS”), or its registered assigns (ESAS or any such registered assigns, the “Holder”) is entitled to purchase from the Company 25,000,000 duly authorized, validly issued, fully paid and nonassessable shares of Common Stock (the “Warrant Shares”) at a purchase price per share of $10.00 (subject to adjustment as provided herein, the “Exercise Price”), all subject to the terms, conditions and adjustments set forth below in this Warrant. Certain capitalized terms used herein are defined in Section 1 hereof.

This Warrant has been issued pursuant to the Services and Investment Agreement, dated as of March 31, 2015, between the Company, the Holder and certain other parties thereto (as the same may be amended or amended and restated from time to time in accordance with its terms, the “Services Agreement”).

1. Definitions. As used in this Warrant, the following terms have the respective meanings set forth below:

“Adjusted Stock Price” shall mean the Stock Price as adjusted (a) to take into account stock splits, combinations, reverse stock splits that have occurred during the Measurement Period and (b) to add the amounts of all dividends paid for each share of such stock during the Measurement Period.

“Affiliate” means, with respect to any Person, any Person that (a) directly or indirectly (through one or more subsidiaries) controls such Person, (b) is controlled directly or indirectly (through one or more subsidiaries) by such Person, (c) is under the common control, whether directly or indirectly (through one or more subsidiaries), with such Person by the same ownership or control of the parent or general partner of such Person, or (d) is the successor or

surviving Person by a merger or consolidation of any such Person pursuant to applicable Law. For purposes of this definition “control” means (i) the direct or indirect ownership of fifty percent (50%) of the outstanding voting securities or the beneficial interest of another Person or (ii) the ability to direct the management, policies or business decisions of another Person.

“Aggregate Exercise Price” means an amount equal to the product of (a) the number of Warrant Shares in respect of which this Warrant is then being exercised pursuant to Section 4 hereof, multiplied by (b) the Exercise Price in effect as of the Exercise Date in accordance with the terms of this Warrant.

“Announcement Date” means April 1, 2015, the date on which the transactions contemplated by the Services Agreement were announced to the public.

“Board” means the board of directors of the Company.

“Business Day” means any day, except a Saturday, Sunday or legal holiday, on which banking institutions in the city of Dallas, Texas are authorized or obligated by law or executive order to close.

“Change in Control” means the sale of all or substantially all of the capital stock, assets or business of the Company, by merger, consolidation, sale of assets or otherwise (other than a merger or consolidation in which all or substantially all of the Persons who were beneficial owners of the Common Stock immediately prior to such transaction beneficially own, directly or indirectly, more than fifty percent (50%) of the outstanding securities entitled to vote generally in the election of directors of the resulting, surviving or acquiring corporation in such transaction).

“Common Stock” means the shares of common stock, par value $0.001 per share, of the Company, and any capital stock into which such Common Stock shall have been converted, exchanged or reclassified following the date hereof.

“Convertible Securities” means any securities (directly or indirectly) convertible into or exchangeable for Common Stock, but excluding Options.

“ESAS Forfeiture Event” has the meaning given to such term in the Services Agreement.

“EXCO Forfeiture Event” has the meaning given to such term in the Services Agreement.

“Execution Date” has the meaning given to such term in the Services Agreement.

“Exercise Date” means, for any given exercise of this Warrant, the date on which the conditions to such exercise as set forth in Section 4 hereof shall have been satisfied at or prior to 5:00 p.m., Dallas, Texas time, on a Business Day, including, without limitation, the receipt by the Company of the Notice of Exercise, the Warrant and the Aggregate Exercise Price.

“Exercise Period” is defined in Section 3 hereof.

- 2 -

“Fair Market Value” means, with respect to any security, as of any particular date: (a) the volume weighted average of the closing sales prices of such security for such day on all domestic securities exchanges on which such security may at the time be listed; (b) if there have been no sales of such security on any such exchange on any such day, the average of the highest bid and lowest asked prices for such security on all such exchanges at the end of such day; (c) if on any such day such security is not listed on a domestic securities exchange, the closing sales price of such security as quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association for such day; or (d) if there have been no sales of such security on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association on such day, the average of the highest bid and lowest asked prices for such security quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association at the end of such day; in each case, averaged over twenty (20) consecutive Trading Days ending on the Trading Day immediately prior to the day as of which “Fair Market Value” is being determined. If at any time such security is not listed on any domestic securities exchange or quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association, the “Fair Market Value” of such security shall be the fair market value per share as determined in good faith jointly by the Board and the Holder.

“Incremental Fraction” is defined in Section 4(b)(iv).

“Initial Value Date” means March 31, 2015, the last Trading Day prior to the Announcement Date.

“Measurement Period” means the period commencing on and including the Announcement Date and ending on the Performance Measurement Date; provided that, with respect to any Incentive Payment (as defined in the Services Agreement), it means the one-year period ending on the applicable anniversary of the Execution Date.

“Notice of Exercise” is defined in Section 4(a)(ii).

“Options” means any warrants or other rights or options to subscribe for or purchase Common Stock or Convertible Securities.

“Original Issue Date” means March 31, 2015, the date on which the Warrant was issued by the Company pursuant to the Services Agreement.

“OTC Bulletin Board” means the Financial Industry Regulatory Authority OTC Bulletin Board electronic inter-dealer quotation system.

“Peer Group Member” means any Person listed on Schedule A hereto; provided, however, if during the Measurement Period:

(a) two Peer Group Members merge or otherwise combine into a single Person, the surviving Person shall remain a Peer Group Member and the non-surviving Person shall be removed from the Peer Group;

- 3 -

(b) a Peer Group Member merges into or otherwise combines with a Person that is not a member of the Peer Group and is not the surviving Person, such Peer Group Member shall be removed from the Peer Group; and

(c) a Peer Group Member files a petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code or liquidation under Chapter 7 of the U.S. Bankruptcy Code, such Person shall remain as part of the Peer Group.

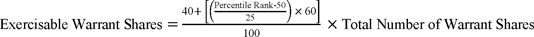

“Percentile Rank” shall be calculated as follows:

(a) The Performance Scores of the Company and all of the Peer Group Members shall be ordered from highest to lowest (for the avoidance of doubt the highest shall be the largest positive amount and the lowest shall be the largest negative amount).

(b) The Percentile Rank shall then be calculated based on the following formula:

“Performance Measurement Date” shall mean the fourth (4th) anniversary of the Execution Date.

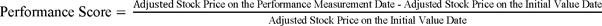

“Performance Score” shall be calculated, with respect to any Person, based on the following formula:

“Person” means any individual, sole proprietorship, partnership, limited liability company, corporation, joint venture, trust, incorporated organization or government or department or agency thereof.

“Pink OTC Markets” means the OTC Markets Group Inc. electronic inter-dealer quotation system, including OTCQX, OTCQB and OTC Pink.

“Securities Act” is defined in Section 11 hereof.

“Stock Price” means, with respect to any Person, the Fair Market Value of the common stock of such Person or, if no common stock exists for such Person, the security of such Person that would be most similar to common stock of a corporation.

“Termination Date” has the meaning given to such term in the Services Agreement.

“Trading Day” means any Business Day on which any domestic securities exchange on which the Common Stock is listed is open for trading or on which the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association is open for quoting and trading, as applicable.

- 4 -

“Warrant” means this Warrant and all warrants issued upon division or combination of, or in substitution for, this Warrant.

2. Vesting and Exercisability of Warrant Shares.

(a) The Warrant Shares shall vest and become exercisable only in accordance with the provisions of this Section 2.

(b) Subject to the terms and conditions hereof, none of the Warrant Shares shall be exercisable prior to the Performance Measurement Date, and the Warrant Shares shall be exercisable on or after the Performance Measurement Date only as follows:

(i) If the Company’s Percentile Rank is less than 50 on the Performance Measurement Date, none of the Warrant Shares shall be exercisable, and all of the Warrant Shares shall be immediately cancelled and forfeited.

(ii) If the Company’s Percentile Rank is greater than or equal to 50 and less than 75 on the Performance Measurement Date, then the number of Warrant Shares that shall become exercisable on the Performance Measurement Date will be calculated based on the following formula:

The remainder of the Warrant Shares shall be immediately cancelled and forfeited.

(iii) If the Company’s Percentile Rank is greater than or equal to 75 on the Performance Measurement Date, all of the Warrant Shares shall become exercisable on the Performance Measurement Date.

Notwithstanding the foregoing: (A) if the Company terminates the Services Agreement other than for ESAS Forfeiture Event, or ESAS (or its permitted successors or assigns) terminates the Services Agreement for EXCO Forfeiture Event, in each case, prior to the fourth (4th) anniversary of the Execution Date, all of the Warrant Shares shall fully vest and become exercisable on the Termination Date and (B) if the Company terminates the Services Agreement for ESAS Forfeiture Event, or ESAS terminates the Services Agreement for any reason other than EXCO Forfeiture Event, in each case, prior to the fourth (4th) anniversary of the Execution Date, all of the Warrant Shares shall be immediately cancelled and forfeited.

3. Term of Warrant. Subject to the terms and conditions hereof, this Warrant may be exercised at any time or from time to time after the earlier of the Termination Date (solely in connection with a termination in accordance with clause (A) in the immediately preceding paragraph) or the fourth (4th) anniversary of the Execution Date and prior to 5:00 p.m., Dallas, Texas time, on the sixth (6th) anniversary of the Execution Date or, if such day is not a Business Day, on the next preceding Business Day (the “Exercise Period”). Notwithstanding anything to the contrary herein, (a) if the Closing (as defined in the Services Agreement) does

- 5 -

not occur, then this Warrant shall automatically terminate and shall become void and of no force or effect upon the termination of the Services Agreement in accordance with its terms and (b) this Warrant shall not be exercisable unless and until the Required Shareholder Approval has been obtained.

4. Exercise of Warrant.

(a) Exercise Procedure. This Warrant may be exercised from time to time on any Business Day during the Exercise Period, for all or any part of the vested and unexercised Warrant Shares, upon:

(i) surrender of this Warrant to the Company at its then principal executive offices (or an indemnification undertaking with respect to this Warrant in the case of its loss, theft or destruction), together with a Notice of Exercise in the form attached hereto as Exhibit A (each, a “Notice of Exercise”), duly completed (including specifying the number of Warrant Shares to be purchased) and executed; and

(ii) payment to the Company of the Aggregate Exercise Price in accordance with Section 4(b) hereof.

(b) Payment of the Aggregate Exercise Price. Payment of the Aggregate Exercise Price shall be made, at the option of the Holder as expressed in the Notice of Exercise, by the following methods:

(i) by delivery to the Company of a certified or official bank check payable to the order of the Company or by wire transfer of immediately available funds to an account designated in writing by the Company, in the amount of such Aggregate Exercise Price;

(ii) by instructing the Company to withhold a number of Warrant Shares then issuable upon exercise of this Warrant with an aggregate Fair Market Value as of the Exercise Date equal to such Aggregate Exercise Price;

(iii) by surrendering to the Company Common Stock, including Warrant Shares previously acquired by the Holder, with an aggregate Fair Market Value as of the Exercise Date equal to such Aggregate Exercise Price; provided, that such payment will not conflict with, or result in a breach or violation of, any of the terms or provisions of, or constitute a default under (in each case, with or without notice or lapse of time, or both), or result, in the acceleration of, or the creation of any lien under, any indenture, mortgage, deed of trust, loan agreement or other agreement, instrument, contract or other arrangement to which the Company or any of its subsidiaries is a party or by which the Company or any of its subsidiaries is bound or to which any of the property or assets of the Company or any of its subsidiaries is subject; or

(iv) any combination of the foregoing.

In the event of any withholding of Warrant Shares or Common Stock pursuant to clause (ii), (iii) or (iv) above where the number of shares whose value is equal to the Aggregate Exercise Price is not a whole number, the number of shares withheld by or surrendered to the Company shall be rounded up to the nearest whole share (the fractional amount that is needed to round up to the whole share, “Incremental Fraction”), and the Company shall make a cash payment to the Holder (by delivery of a certified or official bank check or by wire transfer of immediately available funds) in an amount equal to the product of (x) such Incremental Fraction multiplied by (y) the Fair Market Value per share of Common Stock as of the Exercise Date.

- 6 -

(c) Delivery of Stock Certificates. Upon receipt by the Company of the Notice of Exercise, surrender of this Warrant and payment of the Aggregate Exercise Price (in accordance with Section 4(a) hereof), the Company shall, as promptly as practicable, and in any event within five (5) Business Days thereafter, execute (or cause to be executed) and deliver (or cause to be delivered) to the Holder a certificate or certificates representing the Warrant Shares issuable upon such exercise, together with cash in lieu of any fraction of a share, as provided in Section 4(d) hereof. The stock certificate or certificates so delivered shall be, to the extent possible, in such denomination or denominations as the exercising Holder shall reasonably request in the Notice of Exercise and shall be registered in the name of the Holder or, subject to compliance with Section 6 hereof, such Person’s name as shall be designated in the Notice of Exercise. This Warrant shall be deemed to have been exercised and such certificate or certificates of Warrant Shares shall be deemed to have been issued, and the Holder or any other Person so designated to be named therein shall be deemed to have become a holder of record of such Warrant Shares for all purposes, as of the Exercise Date.

(d) Fractional Shares. The Company shall not be required to issue a fractional Warrant Share upon exercise of any Warrant. As to any fraction of a Warrant Share that the Holder would otherwise be entitled to purchase upon such exercise, the Company shall pay to such Holder an amount in cash (by delivery of a certified or official bank check or by wire transfer of immediately available funds) equal to the product of (i) such fraction multiplied by (ii) the Fair Market Value of one Warrant Share on the Exercise Date.

(e) Delivery of New Warrant. Unless the purchase rights represented by this Warrant shall have expired or shall have been fully exercised, the Company shall, at the time of delivery of the certificate or certificates representing the Warrant Shares being issued in accordance with Section 4(c) hereof, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the unexpired and unexercised Warrant Shares called for by this Warrant. Such new Warrant shall in all other respects be identical to this Warrant.

(f) Valid Issuance of Warrant and Warrant Shares; Payment of Taxes. With respect to the exercise of this Warrant, the Company hereby represents, covenants and agrees:

(i) this Warrant is, and any Warrant issued in substitution for or replacement of this Warrant shall be, upon issuance, duly authorized and validly issued;

(ii) all Warrant Shares issuable upon the exercise of this Warrant pursuant to the terms hereof shall be, upon issuance, and the Company shall take all such actions as may be necessary or appropriate in order that such Warrant Shares are, validly issued, fully paid and non-assessable, issued without violation of any preemptive or similar rights of any shareholder of the Company;

- 7 -

(iii) the Company shall take all such actions as may be necessary to ensure that all such Warrant Shares are issued without violation by the Company of any applicable law or governmental regulation or any requirements of any domestic securities exchange upon which shares of Common Stock or other securities constituting Warrant Shares may be listed at the time of such exercise (except for official notice of issuance which shall be immediately delivered by the Company upon each such issuance); and

(iv) the Company shall use its commercially reasonable efforts to cause the Warrant Shares, immediately upon such exercise, to be listed on any domestic securities exchange upon which shares of Common Stock or other securities constituting Warrant Shares are listed at the time of such exercise.

(g) Conditional Exercise. Notwithstanding any other provision hereof, if an exercise of any portion of this Warrant is to be made in connection with a public offering or a sale of the Company (pursuant to a merger, sale of stock, or otherwise), such exercise may, at the election of the Holder, be conditioned upon the consummation of such transaction, in which case such exercise shall not be deemed to be effective until immediately prior to the consummation of such transaction.

(h) Reservation of Shares. During the Exercise Period, the Company shall at all times reserve and keep available out of its authorized but unissued Common Stock, solely for the purpose of issuance upon the exercise of this Warrant, the maximum number of Warrant Shares issuable upon the exercise of this Warrant, and the par value per Warrant Share shall at all times be less than or equal to the applicable Exercise Price. The Company shall not increase the par value of any Warrant Shares receivable upon the exercise of this Warrant above the Exercise Price then in effect, and shall take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable shares of Common Stock upon the exercise of this Warrant.

5. Adjustment Exercise Price and to Number of Warrant Shares. The number of Warrant Shares issuable upon exercise of this Warrant shall be subject to adjustment from time to time as provided in this Section 5 (in each case, after taking into consideration any prior adjustments pursuant to this Section 5).

(a) Dividends, Subdivision and Combination of Common Stock. If the Company shall, at any time or from time to time after the Original Issue Date, (i) pay a dividend or make any other distribution upon the Common Stock payable in shares of Common Stock, Options, Convertible Securities or cash or other property or (ii) subdivide (by any stock split, recapitalization or otherwise) its outstanding shares of Common Stock into a greater number of shares, the Exercise Price in effect immediately prior to any such dividend, distribution or subdivision shall be proportionately reduced and the number of Warrant Shares issuable upon exercise of this Warrant shall be proportionately increased. If the Company at any time combines (by combination, reverse stock split or otherwise) its outstanding shares of Common Stock into a smaller number of shares, the Exercise Price in effect immediately prior to such combination shall be proportionately increased and the number of Warrant Shares issuable upon exercise of this Warrant shall be proportionately decreased. Any adjustment under this Section 5(a) shall become effective at the close of business on the date the dividend, subdivision or combination becomes effective.

- 8 -

(b) Reorganization, Reclassification, Merger, Consolidation or Disposition of Assets. In the event of any (i) capital reorganization of the Company, (ii) reclassification of the stock of the Company (other than a change in par value or from par value to no par value or from no par value to par value or as a result of a stock dividend or subdivision, split-up or combination of shares), (iii) consolidation or merger of the Company with or into another Person, (iv) sale of all or substantially all of the Company’s assets to another Person or (v) other similar transaction (other than any such transaction covered by Section 5(a) hereof), in each case which entitles the holders of Common Stock to receive (either directly or upon subsequent liquidation) stock, securities or assets with respect to or in exchange for Common Stock, each Warrant shall, immediately after such reorganization, reclassification, consolidation, merger, sale or similar transaction, remain outstanding and shall thereafter, in lieu of or in addition to (as the case may be) the number of Warrant Shares then exercisable under this Warrant, be exercisable for the kind and number of shares of stock or other securities or assets of the Company or of the successor Person resulting from such transaction to which the Holder would have been entitled upon such reorganization, reclassification, consolidation, merger, sale or similar transaction if the Holder had exercised this Warrant in full immediately prior to the time of such reorganization, reclassification, consolidation, merger, sale or similar transaction and acquired the applicable number of Warrant Shares then issuable hereunder as a result of such exercise (without taking into account any limitations or restrictions on the exercisability of this Warrant); and, in such case, appropriate adjustment (in form and substance satisfactory to the Holder) shall be made with respect to the Holder’s rights under this Warrant to insure that the provisions of this Section 5 hereof shall thereafter be applicable, as nearly as possible, to this Warrant in relation to any shares of stock, securities or assets thereafter acquirable upon exercise of this Warrant (including, in the case of any consolidation, merger, sale or similar transaction in which the successor or purchasing Person is other than the Company, an immediate adjustment in the Exercise Price to the value per share for the Common Stock reflected by the terms of such consolidation, merger, sale or similar transaction, and a corresponding immediate adjustment to the number of Warrant Shares acquirable upon exercise of this Warrant without regard to any limitations or restrictions on exercise, if the value so reflected is less than the Exercise Price in effect immediately prior to such consolidation, merger, sale or similar transaction). The provisions of this Section 5(b) shall similarly apply to successive reorganizations, reclassifications, consolidations, mergers, sales or similar transactions. The Company shall not effect any such reorganization, reclassification, consolidation, merger, sale or similar transaction unless, prior to the consummation thereof, the successor Person (if other than the Company) resulting from such reorganization, reclassification, consolidation, merger, sale or similar transaction, shall assume, by written instrument substantially similar in form and substance to this Warrant and satisfactory to the Holder, the obligation to deliver to the Holder such shares of stock, securities or assets which, in accordance with the foregoing provisions, such Holder shall be entitled to receive upon exercise of this Warrant. Notwithstanding anything to the contrary contained herein, with respect to any corporate event or other transaction contemplated by the provisions of this Section 5(b), the Holder shall have the right to elect prior to the consummation of such event or transaction, to give effect to the exercise rights contained in Section 2 hereof instead of giving effect to the provisions contained in this Section 5(b) with respect to this Warrant.

- 9 -

(c) Certain Events. If any event of the type contemplated by the provisions of this Section 5 but not expressly provided for by such provisions (including, without limitation, the granting of stock appreciation rights, phantom stock rights or other rights with equity features) occurs, then the Board shall make an appropriate adjustment in the Exercise Price and the number of Warrant Shares issuable upon exercise of this Warrant so as to protect the rights of the Holder in a manner consistent with the provisions of this Section 5; provided, that no such adjustment pursuant to this Section 5(d) shall increase the Exercise Price or decrease the number of Warrant Shares issuable as otherwise determined pursuant to this Section 5.

(d) Certificate as to Adjustment.

(i) As promptly as reasonably practicable following any adjustment of the Exercise Price, but in any event not later than fifteen (15) days thereafter, the Company shall furnish the Holder with notice setting forth in reasonable detail such adjustment and the facts upon which it is based and certifying the calculation thereof.

(ii) As promptly as reasonably practicable following the receipt by the Company of a written request by the Holder, but in any event not later than ten (10) Business Days thereafter, the Company shall furnish to the Holder a certificate of an executive officer certifying the Exercise Price then in effect and the number of Warrant Shares or the amount, if any, of other shares of stock, securities or assets then issuable upon exercise of the Warrant.

(e) Notices. In the event:

(i) that the Company shall take a record of the holders of its Common Stock (or other capital stock or securities at the time issuable upon exercise of the Warrant) for the purpose of entitling or enabling them to receive any dividend or other distribution, to receive any right to subscribe for or purchase any shares of capital stock of any class or any other securities, or to receive any other security;

(ii) of any Change in Control;

(iii) of any capital reorganization of the Company, any reclassification of the Common Stock of the Company, any consolidation or merger of the Company with or into another Person, or sale of all or substantially all of the Company’s assets to another Person; or

(iv) of the voluntary or involuntary dissolution, liquidation or winding-up of the Company;

then, and in each such case, the Company shall send or cause to be sent to the Holder at least fifteen (15) days prior to the applicable record date or the applicable expected effective date, as the case may be, for the event, a written notice specifying, as the case may be, (A) the record date for such dividend, distribution, or other right or action, and a description of such dividend, distribution or other right or action to be taken or (B) the effective date on which such Change in Control, reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation or winding-up is proposed to take place and a brief description of such event, and the date, if any is to be fixed, as of which the books of the Company shall close or a record shall be taken with respect to which the holders of record of Common Stock (or such other capital stock or securities

- 10 -

at the time issuable upon exercise of the Warrant) shall be entitled to exchange their shares of Common Stock (or such other capital stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation or winding-up, and the amount per share and character of such exchange applicable to the Warrant and the Warrant Shares.

6. Transfer of Warrant. Prior to all of the Warrant Shares becoming exercisable or being cancelled and forfeited in accordance with Section 2(b) hereof, this Warrant and all rights hereunder shall not be assignable or transferable, in whole or in part; provided, however, the Holder may assign or transfer this Warrant and all rights hereunder, in whole or in part, to any Affiliate of the Holder, upon written request by the Holder, and written consent of the Company, such consent not to be unreasonably withheld. After all of the Warrant Shares have become exercisable or have been cancelled and forfeited in accordance with Section 2(b) hereof, this Warrant and all rights hereunder shall be assignable or transferable, in whole or in part. Holder shall not effect any such assignment or transfer pursuant to this Section 6 unless (i) such assignment or transfer complies with all federal and state securities laws and all assignment or transfer conditions referred to in the legend endorsed hereon and (ii) Holder surrenders this Warrant to the Company at its then principal executive offices with a properly completed and duly executed Assignment in the form attached hereto as Exhibit B in connection with the making of such transfer. Upon such compliance, consent, surrender and delivery, the Company shall execute and deliver a new Warrant or Warrants in the name of such Person or Persons and in the denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant, if any, not so assigned and this Warrant shall promptly be cancelled. Any attempt to assign or transfer this Warrant or any rights hereunder contrary to the provisions of this Section 6 shall be null and void.

7. Holder Not Deemed a Shareholder; Limitations on Liability. Except as otherwise specifically provided herein, prior to the issuance to the Holder of the Warrant Shares to which the Holder is then entitled to receive upon the due exercise of this Warrant, the Holder shall not be entitled to vote or receive dividends or be deemed the holder of shares of capital stock of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the Holder, as such, any of the rights of a shareholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a shareholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

8. Replacement and Division.

(a) Replacement on Loss. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and upon delivery of an indemnity reasonably satisfactory to it and, in case of mutilation, upon surrender of such Warrant for cancellation to the Company, the Company at its own expense shall execute and deliver to the Holder, in lieu hereof, a new Warrant of like tenor and exercisable for an equivalent number of Warrant Shares as the Warrant so lost, stolen, mutilated or destroyed; provided, that, in the case of mutilation, no indemnity shall be required if this Warrant in identifiable form is surrendered to the Company for cancellation.

- 11 -

(b) Division and Combination of Warrant. Subject to compliance with the applicable provisions of this Warrant as to any transfer or other assignment which may be involved in such division or combination, this Warrant may be divided or, following any such division of this Warrant, subsequently combined with other Warrants, upon the surrender of this Warrant or Warrants to the Company at its then principal executive offices, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the respective Holders or their agents or attorneys. Subject to compliance with the applicable provisions of this Warrant as to any transfer or assignment which may be involved in such division or combination, the Company shall at its own expense execute and deliver a new Warrant or Warrants in exchange for the Warrant or Warrants so surrendered in accordance with such notice. Such new Warrant or Warrants shall be of like tenor to the surrendered Warrant or Warrants and shall be exercisable in the aggregate for an equivalent number of Warrant Shares as the Warrant or Warrants so surrendered in accordance with such notice.

9. No Impairment. The Company shall not, by amendment of its Articles of Incorporation or Bylaws, or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed by it hereunder, but shall at all times in good faith assist in the carrying out of all the provisions of this Warrant.

10. Compliance with the Securities Act. The Holder, by acceptance of this Warrant, agrees to comply in all respects with the provisions of this Section 11 and the restrictive legend requirements set forth on the face of this Warrant and further agrees that such Holder shall not offer, sell or otherwise dispose of this Warrant or any Warrant Shares to be issued upon exercise hereof except under circumstances that will not result in a violation of the Securities Act of 1933, as amended (the “Securities Act”). This Warrant and all Warrant Shares issued upon exercise of this Warrant (unless registered under the Securities Act) shall be stamped or imprinted with a legend in substantially the following form:

“THIS WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR QUALIFIED UNDER ANY STATE OR FOREIGN SECURITIES LAWS AND MAY NOT BE OFFERED FOR SALE, SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED OR ASSIGNED UNLESS (I) A REGISTRATION STATEMENT COVERING SUCH SHARES IS EFFECTIVE UNDER THE ACT AND IS QUALIFIED UNDER APPLICABLE STATE AND FOREIGN LAW OR (II) THE TRANSACTION IS EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS UNDER THE ACT AND THE QUALIFICATION REQUIREMENTS UNDER APPLICABLE STATE AND FOREIGN LAW AND, IF THE CORPORATION REQUESTS, AN OPINION REASONABLY SATISFACTORY TO THE CORPORATION TO SUCH EFFECT HAS BEEN RENDERED BY COUNSEL.”

- 12 -

11. Warrant Register. The Company shall keep and properly maintain at its principal executive offices books for the registration of the Warrant and any transfers thereof. The Company may deem and treat the Person in whose name the Warrant is registered on such register as the Holder thereof for all purposes, and the Company shall not be affected by any notice to the contrary, except any assignment, division, combination or other transfer of the Warrant effected in accordance with the provisions of this Warrant.

12. Notices. Any notice, request, instruction, correspondence or other document to be given hereunder by any party to another shall be in writing and delivered in person or by courier service requiring acknowledgement of receipt or mailed by certified mail, postage prepaid and return receipt requested, or by facsimile or e-mail of a .pdf, as follows: (or at such other address for a party as shall be specified in a notice given in accordance with this Section 13).

| If to the Company: |

EXCO Resources, Inc. 00000 Xxxxx Xxxxx Xxxxx 0000 Xxxxxx, Xxxxx 00000 Attention: Xxxxxxx X. Boeing Telephone: (000) 000-0000 Facsimile: (000) 000-0000 E-mail: xxxxxxx@xxxxxxxxxxxxx.xxx | |

| with a copy to: |

Akin Gump Xxxxxxx Xxxxx & Xxxx LLP One Bryant Park Bank of America Xxxxx Xxx Xxxx, XX 00000-0000 Attention: Xxxxxx X. Xxxxxx, Esq. Telephone: (000) 000-0000 Facsimile: (000) 000-0000 E-mail: xxxxxxx@xxxxxxxx.xxx | |

| If to the Holder: |

Energy Strategic Advisory Services LLC 000 Xxxxxxxx Xxxxx, Xxxxx 000 Xxxxxx, Xxxxx 00000 Attention: Xxxxxxxx Xxxxxxx, Executive Vice President, CFO Telephone: (000) 000-0000 Facsimile: (000) 000-0000 E-mail: xxxxxxxxx@xxxxxxxxxxxxxx.xxx | |

- 13 -

| with a copy to: |

Bracewell & Xxxxxxxx LLP 000 Xxxxxxxxx Xxxxxx, Xxxxx 0000 Xxxxxxx, Xxxxx 00000 Attn: Xxxxx X. Xxxxxx Telephone: (000) 000-0000 Facsimile: (000) 000-0000 E-mail: xxxxx.xxxxxx@xxxxx.xxx |

Notice given by personal delivery or courier shall be effective upon actual receipt. Notice given by mail shall be effective upon actual receipt or, if not actually received, the fifth Business Day following deposit with the U.S. Post Office. Notice given by email shall be effective upon actual receipt if received during the recipient’s normal business hours, or at the beginning of the recipient’s next Business Day after receipt if not received during the recipient’s normal business hours. In the event party provides notice by email, then, no later than two (2) Business Days following such email notice, the notifying party shall deliver a hard copy of such notice to each other party by personal delivery or courier or by mail. If a date specified herein for giving any notice or taking any action is not a Business Day (or if the period during which any notice is required to be given or any action taken expires on a date which is not a Business Day), then the date for giving such notice or taking such action (and the expiration date of such period during which notice is required to be given or action taken) shall be the next day which is a Business Day. Any party may change any address to which Notice is to be given to it by giving Notice as provided above of such change of address.

13. Equitable Relief. Each of the Company and the Holder acknowledges that a breach or threatened breach by such party of any of its obligations under this Warrant would give rise to irreparable harm to the other party hereto for which monetary damages would not be an adequate remedy and hereby agrees that in the event of a breach or a threatened breach by such party of any such obligations, the other party hereto shall, in addition to any and all other rights and remedies that may be available to it in respect of such breach, be entitled to equitable relief, including a restraining order, an injunction, specific performance and any other relief that may be available from a court of competent jurisdiction.

14. Entire Agreement. This Warrant, together with the Services Agreement, constitutes the sole and entire agreement of the parties to this Warrant with respect to the subject matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Warrant and the Services Agreement, the statements in the body of this Warrant shall control.

15. Successor and Assigns. This Warrant and the rights evidenced hereby shall be binding upon and shall inure to the benefit of the parties hereto and the successors of the Company and the successors and permitted assigns of the Holder. Such successors and/or permitted assigns of the Holder shall be deemed to be a Holder for all purposes hereunder.

- 14 -

16. No Third-Party Beneficiaries. This Warrant is for the sole benefit of the Company and the Holder and their respective successors and, in the case of the Holder, permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Warrant.

17. Headings. The headings in this Warrant are for reference only and shall not affect the interpretation of this Warrant.

18. Amendment and Modification; Waiver. Except as otherwise provided herein, this Warrant may only be amended, modified or supplemented by an agreement in writing signed by each party hereto. No waiver by the Company or the Holder of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any rights, remedy, power or privilege arising from this Warrant shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

19. Severability. It is the intent of the parties that the provisions contained in this Warrant shall be severable. Should any provisions, in whole or in part, be held invalid as a matter of Law, such holding shall not affect the other portions of this Warrant, and such portions that are not invalid shall be given effect without the invalid portion.

20. Governing Law. This Warrant and the documents delivered pursuant hereto and the legal relations between the parties shall be governed by, construed and enforced in accordance with the laws of the State of Texas, without regard to principles of conflicts of laws that would direct the application of the laws of another jurisdiction.

21. Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Warrant or the transactions contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the State of Texas in each case located in the city of Dallas and County of Dallas, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding. Service of process, summons, notice or other document by certified or registered mail to such party’s address set forth herein shall be effective service of process for any suit, action or other proceeding brought in any such court. The parties irrevocably and unconditionally waive any objection to the laying of venue of any suit, action or any proceeding in such courts and irrevocably waive and agree not to plead or claim in any such court that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum.

22. Counterparts. This Warrant may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Facsimile, .pdf or other electronic transmission of copies of signatures shall constitute original signatures for all purposes of this Warrant and any enforcement hereof.

- 15 -

23. No Strict Construction. This Warrant shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted.

24. Purchase Restrictions. Prior to the Performance Measurement Date, the holder of this Warrant shall comply with the restrictions applicable to, and obligations of, ESAS set forth in Section 5.24 of the Services Agreement.

[SIGNATURE PAGE FOLLOWS]

- 16 -

IN WITNESS WHEREOF, the Company has duly executed this Warrant on the Original Issue Date.

| EXCO RESOURCES, INC. | ||

| By: |

/s/ Xxxxxx X. Xxxxxx | |

| Name: |

Xxxxxx X. Xxxxxx | |

| Title: |

President and Chief Executive Officer | |

EXCO Resources, Inc.

Signature Page to Warrant – Tranche 4

| Accepted and agreed, | ||

| ENERGY STRATEGIC ADVISORY SERVICES LLC | ||

| By: |

/s/ C. Xxxx Xxxxxx | |

| Name: |

C. Xxxx Xxxxxx | |

| Title: |

Executive Chairman | |

EXCO Resources, Inc.

Signature Page to Warrant – Tranche 4

SCHEDULE A

Peer Group Members

Swift Energy Company

Xxxxx Energy, Inc.

Halcón Resources Corporation

Xxxxxxxx Resources, Inc.

XxxxXxxxx Energy, Inc.

Xxxxxxxx Petroleum Corporation

Xxx Energy Corporation

PetroQuest Energy, Inc.

Oasis Petroleum Inc.

Rosetta Resources Inc.

Magnum Hunter Resources Corporation

EP Energy Corp.

Xxxx Xxxxxxx Corporation

Northern Oil & Gas, Inc.

Ultra Petroleum Corp.

Chesapeake Energy Corporation

WPX Energy, Inc.

Schedule A

EXHIBIT A

NOTICE OF EXERCISE

In accordance with and subject to the terms and conditions hereof and of the attached Warrant (the “Warrant”), the undersigned holder (the “Holder”) hereby irrevocably elects to exercise the right to purchase shares of Common Stock of EXCO Resources, Inc., a Texas corporation (the “Company”), evidenced by the Warrant. Capitalized terms used herein and not otherwise defined herein shall have the respective meanings set forth in the Warrant.

Payment of Exercise Price. Pursuant to Section 4(b) of the Warrant, the Holder represents that such Holder has tendered the Exercise Price for each of the Warrants evidenced hereby being exercised in the aggregate amount of $ in the indicated combination of:

| ¨ |

CERTIFIED BANK CHECK payable to the order of the Company ($___________). | |

| ¨ |

OFFICIAL BANK CHECK payable to the order of the Company ($___________). | |

| ¨ |

WIRE TRANSFER in immediately available funds to the account designated by the Company for such purpose ($___________). | |

| ¨ |

WITHHELD WARRANT SHARES otherwise issuable upon exercise of this Warrant, pursuant to the cashless exercise procedure set forth in Section 4(b)(ii) of the Warrant ($_________). | |

| ¨ |

COMMON STOCK, pursuant to the cashless exercise procedure set forth in Section 4(b)(iii) of the Warrant ($_________). | |

Amount of Warrant Shares. In accordance with Sections 2 and 4 of the Warrant, the number of shares to be so issued is [NUMBER OF SHARES TO BE ISSUED TO HOLDER].

Delivery of Warrant Shares. Pursuant to Section 4(c) of the Warrant, the Company shall deliver the shares to be issued in the name of the Holder to the following address:

[NAME]

[ADDRESS TO WHICH SHARES TO BE SENT]

The Holder requests, if applicable, that a new Warrant certificate evidencing the remaining balance of the Warrants evidenced hereby be issued and delivered to the Holder in accordance with Section 4(e) of the Warrant.

Date: [ ], 20[__]

[ ]

EXHIBIT B

FORM OF ASSIGNMENT

For value received and subject to the terms set forth in Section 6 of the Warrant, hereby sells, assigns and transfers all of the rights of the undersigned under the attached Warrant (No. ) with respect to the number of shares of Common Stock covered thereby set forth below, unto:

| Name of Assignee |

Address |

No. of Shares |

| Dated: ____________________ | ||

| [__________________________________] | ||

| ___________________________________ | ||

| Name: | ||

| Title: | ||

Signature Guaranteed:

| By: |

|

The signature should be guaranteed by an eligible guarantor institution (banks, stockbrokers, savings and loan associations and credit unions with membership in an approved signature guarantee medallion program) pursuant to Rule 17Ad-15 under the Securities Exchange Act of 1934.

| ACKNOWLEDGED AND ACCEPTED: |

| EXCO RESOURCES, INC.

|

|

Name: |

| Title: |