Contract

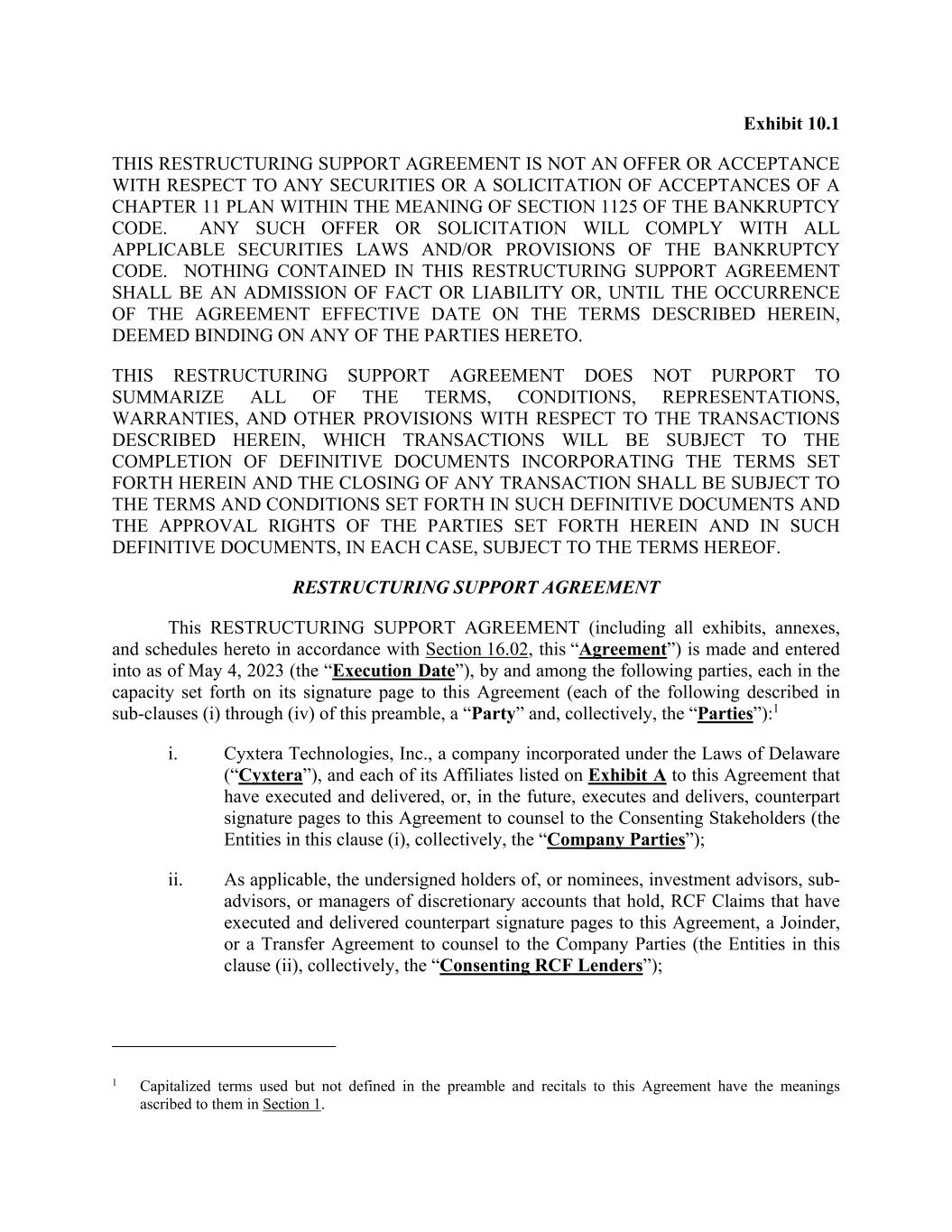

Exhibit 10.1 THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. NOTHING CONTAINED IN THIS RESTRUCTURING SUPPORT AGREEMENT SHALL BE AN ADMISSION OF FACT OR LIABILITY OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED HEREIN, DEEMED BINDING ON ANY OF THE PARTIES HERETO. THIS RESTRUCTURING SUPPORT AGREEMENT DOES NOT PURPORT TO SUMMARIZE ALL OF THE TERMS, CONDITIONS, REPRESENTATIONS, WARRANTIES, AND OTHER PROVISIONS WITH RESPECT TO THE TRANSACTIONS DESCRIBED HEREIN, WHICH TRANSACTIONS WILL BE SUBJECT TO THE COMPLETION OF DEFINITIVE DOCUMENTS INCORPORATING THE TERMS SET FORTH HEREIN AND THE CLOSING OF ANY TRANSACTION SHALL BE SUBJECT TO THE TERMS AND CONDITIONS SET FORTH IN SUCH DEFINITIVE DOCUMENTS AND THE APPROVAL RIGHTS OF THE PARTIES SET FORTH HEREIN AND IN SUCH DEFINITIVE DOCUMENTS, IN EACH CASE, SUBJECT TO THE TERMS HEREOF. RESTRUCTURING SUPPORT AGREEMENT This RESTRUCTURING SUPPORT AGREEMENT (including all exhibits, annexes, and schedules hereto in accordance with Section 16.02, this “Agreement”) is made and entered into as of May 4, 2023 (the “Execution Date”), by and among the following parties, each in the capacity set forth on its signature page to this Agreement (each of the following described in sub-clauses (i) through (iv) of this preamble, a “Party” and, collectively, the “Parties”):1 i. Cyxtera Technologies, Inc., a company incorporated under the Laws of Delaware (“Cyxtera”), and each of its Affiliates listed on Exhibit A to this Agreement that have executed and delivered, or, in the future, executes and delivers, counterpart signature pages to this Agreement to counsel to the Consenting Stakeholders (the Entities in this clause (i), collectively, the “Company Parties”); ii. As applicable, the undersigned holders of, or nominees, investment advisors, sub- advisors, or managers of discretionary accounts that hold, RCF Claims that have executed and delivered counterpart signature pages to this Agreement, a Joinder, or a Transfer Agreement to counsel to the Company Parties (the Entities in this clause (ii), collectively, the “Consenting RCF Lenders”); 1 Capitalized terms used but not defined in the preamble and recitals to this Agreement have the meanings ascribed to them in Section 1.

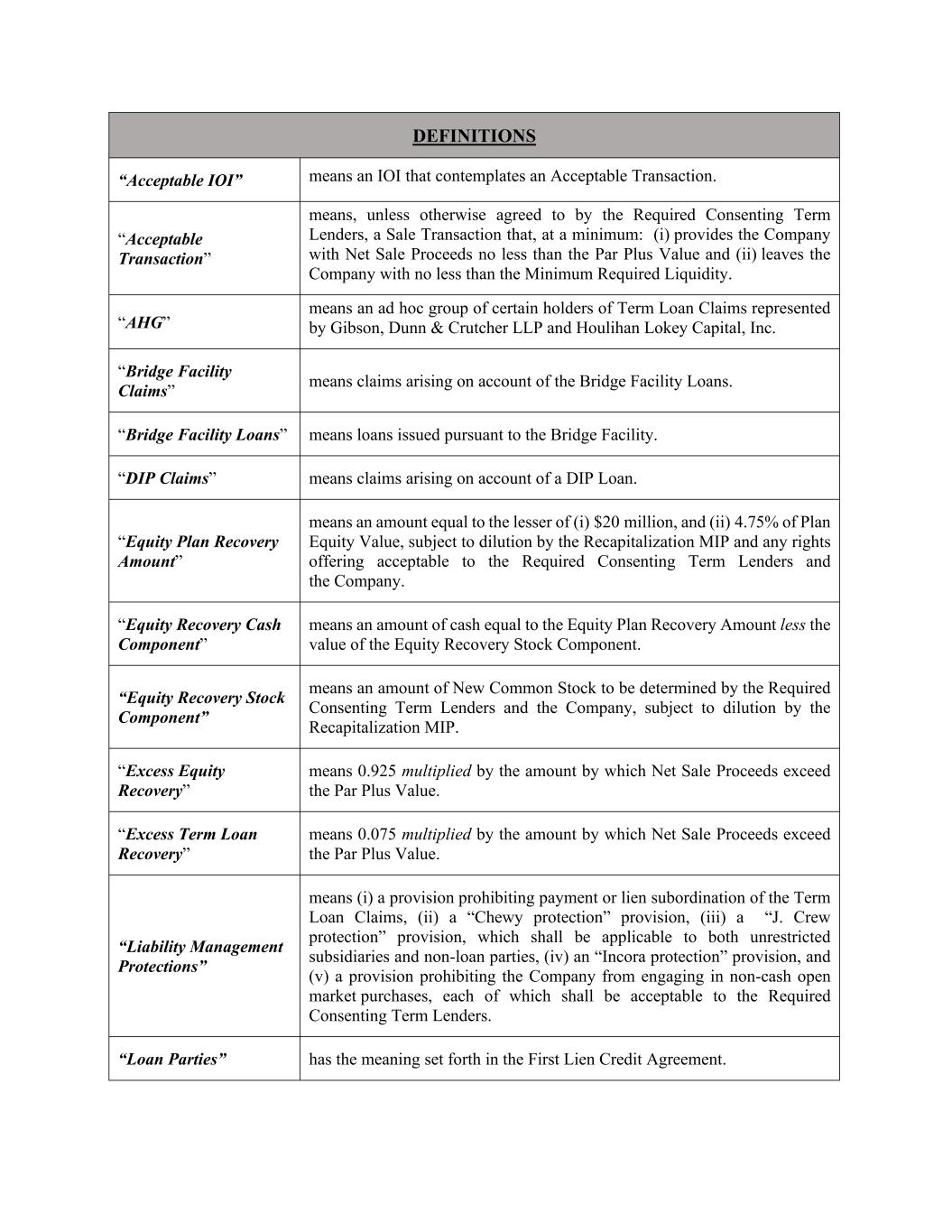

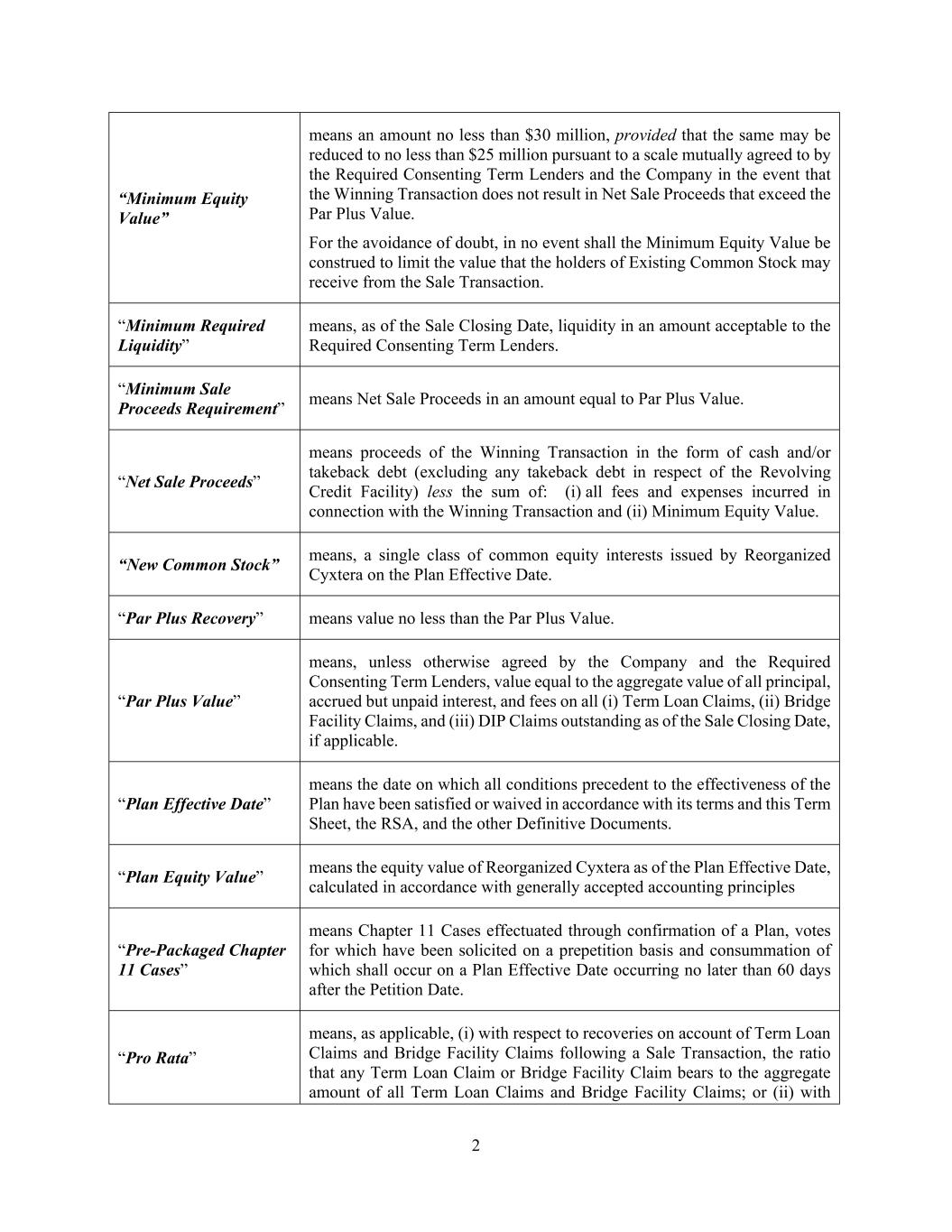

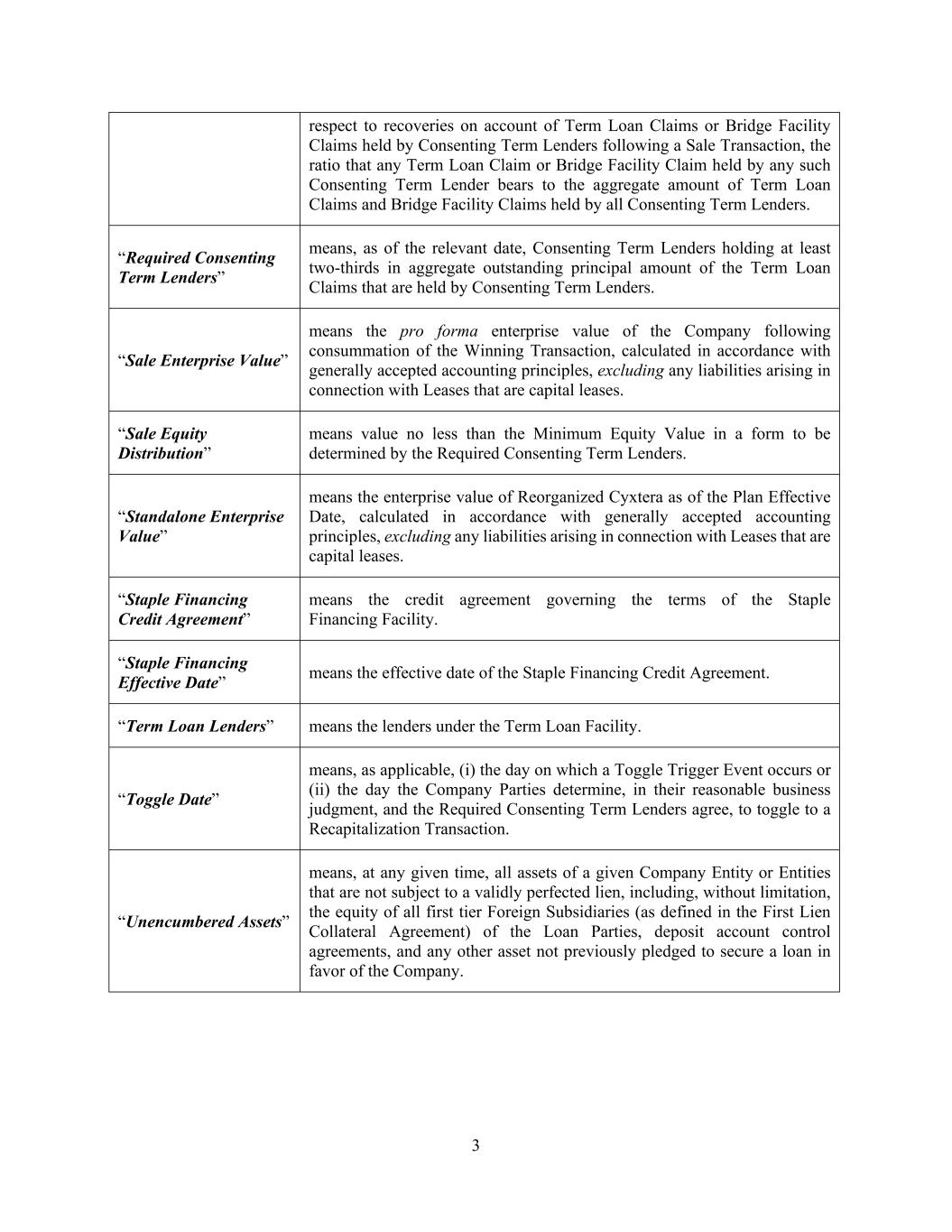

3 “Acceptable Transaction” has the meaning set forth in the Restructuring Term Sheet. “Affiliate” has the meaning set forth in section 101(2) of the Bankruptcy Code as if such Entity was a debtor in a case under the Bankruptcy Code. “Agreement” has the meaning set forth in the preamble to this Agreement and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules hereto in accordance with Section 16.02 (including the Restructuring Term Sheet). “Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived by the appropriate Party or Parties in accordance with this Agreement. “Agreement Effective Period” means, with respect to a Party, the period from the Agreement Effective Date to the Termination Date applicable to that Party. “AHG” has the meaning set forth in the recitals to this Agreement. “AHG Lease Restructuring Advisor” means an advisor to the AHG with respect to the analysis, negotiation, modification, assumption, and/or rejection of the Company Parties’ unexpired lease portfolio. “AHG Professionals” means (i) Xxxxxx, Xxxx & Xxxxxxxx LLP, as legal counsel to the AHG; (ii) Xxxxxxxx Xxxxx Capital, Inc., as financial advisor to the AHG; (iii) the AHG Lease Restructuring Advisor; (iv) one local legal counsel retained by the AHG in connection with the Restructuring Transactions; and (v) any other advisors retained by the AHG with the consent of the Company Parties (not to be unreasonably withheld, conditioned, or delayed). “Alternative Restructuring Proposal” means any written or oral plan, inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to a sale, disposition, new- money investment, restructuring, reorganization, merger, amalgamation, acquisition, consolidation, dissolution, debt investment, equity investment, liquidation, asset sale, share issuance, tender offer, recapitalization, plan of reorganization, share exchange, business combination, joint venture, debt incurrence (including, without limitation, any debtor-in- possession financing or exit financing) or similar transaction involving any one or more Company Parties or the debt, equity, or other interests in any one or more Company Parties that is an alternative to one or more of the Restructuring Transactions. “Bankruptcy Code” has the meaning set forth in the recitals to this Agreement. “Bankruptcy Court” means the United States Bankruptcy Court in which the Chapter 11 Cases are commenced or another United States Bankruptcy Court with jurisdiction over the Chapter 11 Cases. “Bidding Procedures” means procedures governing the submission and evaluation of bids to purchase some or all of the Company’s assets or equity.

4 “Bidding Procedures Motion” means the motion to be filed by the Debtors in the Chapter 11 Cases seeking entry of the Bidding Procedures Order. “Bidding Procedures Order” means an order of the Bankruptcy Court approving the Bidding Procedures. “Bridge Facility” has the meaning set forth in the Restructuring Term Sheet. “Bridge Facility Documents” means the credit agreement governing the Bridge Facility (as defined in the Restructuring Term Sheet) and any other agreements, documents, and instruments delivered or entered into in connection therewith, including, without limitation, any guarantee agreements, pledge and collateral agreements, intercreditor agreements, and other security documents. “Business Day” means any day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state of New York. “Causes of Action” means any claims, interests, damages, remedies, causes of action, demands, rights, actions, controversies, proceedings, agreements, suits, obligations, liabilities, accounts, defenses, offsets, powers, privileges, licenses, liens, indemnities, guaranties, and franchises of any kind or character whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, liquidated or unliquidated, secured or unsecured, assertable, directly or derivatively, matured or unmatured, suspected or unsuspected, whether arising before, on, or after the Petition Date, in contract, tort, law, equity, or otherwise. Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by law or in equity; (b) the right to object to or otherwise contest Company Claims/Interests; (c) claims pursuant to section 362 or chapter 5 of the Bankruptcy Code; (d) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in section 558 of the Bankruptcy Code; and (e) any avoidance actions arising under chapter 5 of the Bankruptcy Code or under similar local, state, federal, or foreign statutes and common law, including fraudulent transfer laws. “Chapter 11 Cases” has the meaning set forth in the recitals to this Agreement. “Claim” has the meaning ascribed to it in section 101(5) of the Bankruptcy Code. “Company Claims/Interests” means any Claim against, or Equity Interest in, a Company Party, including the RCF Claims and the Term Loan Claims. “Company Parties” has the meaning set forth in the recitals to this Agreement. “Company Professionals” means (i) Xxxxxxxx & Xxxxx LLP; (ii) Guggenheim Securities, LLC; and (iii) Alix Partners, LLP, each in its capacity as advisor to the Company Parties. “Company Releasing Party” means each of the Company Parties, and, to the maximum extent permitted by law, each of the Company Parties, on behalf of their respective Affiliates and Related Parties.

5 “Confidentiality Agreement” means an executed confidentiality agreement, including with respect to the issuance of a “cleansing letter” or other public disclosure of material non- public information agreement, in connection with any proposed Restructuring Transactions. “Confirmation Order” means the confirmation order with respect to the Plan. “Consenting Lenders” has the meaning set forth in the preamble of this Agreement. “Consenting RCF Lenders” has the meaning set forth in the preamble of this Agreement. “Consenting Sponsors” has the meaning set forth in the preamble of this Agreement. “Consenting Sponsors’ Professionals” means Xxxxxx & Xxxxxxx, LLP in its capacity as advisor to the undersigned Consenting Sponsors. “Consenting Stakeholder Releasing Party” means, each of, and in each case in its capacity as such: (a) the Consenting Stakeholders; (b) the Prepetition Agent; (c) to the maximum extent permitted by Law, each current and former Affiliate of each Entity in clause (a) through the following clause (d); and (d) to the maximum extent permitted by Law, each Related Party of each Entity in clause (a) through this clause (d). “Consenting Stakeholders” has the meaning set forth in the preamble to this Agreement. “Consenting Term Lenders” has the meaning set forth in the preamble to this Agreement. “Debtors” means the Company Parties that commence Chapter 11 Cases. “Definitive Documents” means all documents, instruments, deeds, notifications, agreements, and filings related to documentation, implementation, and consummation of the Restructuring Transactions, including, without limitation: (A) the Plan; (B) the Confirmation Order; (C) the Disclosure Statement; (D) the Disclosure Statement Order; (E) the First Day Pleadings and all orders sought pursuant thereto; and (F) the Plan Supplement; (G) the DIP Order; (H) the DIP Documents; (I) the Exit Facility Documents; (J) the Solicitation Materials; (K) the First Lien Credit Agreement Amendment; (L) the Sale Documents; (M) the Bridge Facility Documents; and (N) the Scheduling Order, including any amendments, modifications, or supplements thereto. “Diligence Materials” means (i) a DIP Facility sizing analysis; (ii) an analysis of projected lease and executory contract rejections and renegotiations in the context of a Recapitalization Transaction, including damage calculations under section 502(b)(6) of the Bankruptcy Code; (iii) an analysis of potential cost savings associated with the renegotiation of existing leases and contracts in the context of a Sale Transaction; (iv) both (A) a preliminary 1Q2023 financial update, including reasonably detailed MD&A, key operational KPIs such as churn and occupancy, and an overview of 2QTD trends, and (B) a draft 10Q filing in respect of 1Q2023, (v) updated financial and operational guidance for FY2023; (vi) a reasonably detailed revenue build-up for FY2023; (vii) a reasonably detailed budget, including with respect to

6 projected capital expenditures for FY2023 and FY2024; (viii) an updated 13-week cash flow forecast; (ix) an updated business plan, which shall have a case accounting for a potential Recapitalization Transaction and a status quo case, (x) a detailed summary of all employee retention and incentive programs applicable to the Company Parties, including aggregate amounts implicated, duration, timing of payments, number of employees included, supporting detail prepared by the Company’s compensation consultant and, solely with respect to any insiders and key management-level employees, an employee-by-employee breakdown of the timing and amount of contemplated payments; and (xi) an update on the Marketing Process, including the identity of each potential bidder that has been contacted and the identity of each potential bidder that has signed a confidentiality agreement with the Company Parties. “DIP Agent” means the administrative agent under the DIP Credit Agreement, its successors, assigns, or any replacement agent appointed pursuant to the terms of the DIP Credit Agreement, each of which shall be acceptable to the Required Consenting Term Lenders and the Company Parties. “DIP Credit Agreement” means the debtor-in-possession financing credit agreement by and among certain Company Parties, the DIP Agent, and the lenders party thereto setting forth the terms and conditions of the DIP Facility. “DIP Documents” means, collectively, the DIP Credit Agreement and any other agreements, documents, and instruments delivered or entered into in connection therewith, including, without limitation, any guarantee agreements, pledge and collateral agreements, intercreditor agreements, and other security documents. “DIP Facility” means the new superpriority secured term loans to be made in accordance with the DIP Credit Agreement. “DIP Order” means, as applicable, the interim and final orders of the Bankruptcy Court setting forth the terms of the debtor-in-possession financing, which shall be consistent with the DIP Credit Agreement. “Disclosure Statement” means the related disclosure statement with respect to the Plan. “Disclosure Statement Order” means an order entered by the Bankruptcy Court approving the adequacy of the Disclosure Statement. “Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code. “Equity Interests” means, collectively, the shares (or any class thereof), common stock, preferred stock, limited liability company interests, and any other equity, ownership, or profits interests of any Company Party, and options, warrants, rights, or other securities or agreements to acquire or subscribe for, or which are convertible into the shares (or any class thereof) of, common stock, preferred stock, limited liability company interests, or other equity, ownership, or profits interests of any Company Party (in each case whether or not arising under or in connection with any employment agreement). “Execution Date” has the meaning set forth in the preamble to this Agreement.

7 “Exit Facilities” means the First-Out Take-Back Debt Facility and the Second-Out Take-Back Debt Facility. “Exit Facility Documents” means the credit agreements governing the Exit Facilities and any other agreements, documents, and instruments delivered or entered into in connection therewith, including, without limitation, any guarantee agreements, pledge and collateral agreements, intercreditor agreements, and other security documents. “Final Bids” means final bids submitted by the Potential Purchasers in the Marketing Process. “First Day Pleadings” means the first-day pleadings that the Company Parties, in consultation with the Consenting Term Lenders, determine are necessary or desirable to file. “First Lien Claims” means, collectively, the RCF Claims and the Term Loan Claims. “First Lien Credit Agreement” means that certain First Lien Credit Agreement, dated as of May 17, 2017, among Cyxtera DC Holdings, as the borrower, the lenders from time to time party thereto, and Citibank, N.A., as administrative agent for such lenders (as amended, supplemented or otherwise modified from time to time). “First Lien Credit Agreement Amendment” means that certain amendment to the First Lien Credit Agreement as described in the Restructuring Term Sheet. “First Lien Credit Documents” means the First Lien Credit Agreement, the First Lien Credit Agreement Amendment, and any other agreements, documents, and instruments delivered or entered into in connection therewith, including, without limitation, any guarantee agreements, pledge and collateral agreements, intercreditor agreements, and other security documents. “First-Out Take-Back Debt Facility” means a senior secured, first lien “first-out” term loan facility, in form and substance acceptable to the Required Consenting Term Lenders, to be issued on the Plan Effective Date in accordance with the Restructuring Term Sheet. “General Milestones” means the milestones set forth in Section 4.01(a) of this Agreement. “In-Court Dual Track Milestones” means the milestones set forth in Section 4.01(c) of this Agreement. “In-Court Recap Milestones” means the milestones set forth in Section 4.01(d) of this Agreement. “Independent Directors” means Xxxxx Xxxxxxx and Xxxx Xxxxxx, in their capacity as independent directors of the board of Cyxtera, and one additional director of the board of Cyxtera reasonably acceptable to the Company Parties and the Required Consenting Term Lenders whom the Company Parties shall use commercially reasonable efforts to obtain the necessary consents for and appoint prior to May 12, 2023.

8 “IOIs” means indications of interest submitted by the Potential Purchasers in the Marketing Process. “Joinder” means a joinder to this Agreement substantially in the form attached to this Agreement as Exhibit D. “Launch Date” means April 14, 2023. “Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction (including the Bankruptcy Court). “Marketing Process” has the meaning set forth in the Restructuring Term Sheet. “Milestones” means the General Milestones, the In-Court Dual Track Milestones, the In-Court Recap Track Milestones, and the Out-of-Court Milestones set forth in Section 4 of this Agreement. “Out-of-Court Milestones” means the milestones set forth in Section 4.01(b) of this Agreement. “Parties” has the meaning set forth in the preamble to this Agreement. “Permitted Transferee” means each transferee of any Company Claims/Interests who meets the requirements of Section 9.01. “Petition Date” means the first date any of the Company Parties commences a Chapter 11 Case. “Plan” means the joint plan of reorganization filed by the Debtors under chapter 11 of the Bankruptcy Code that embodies the Restructuring Transactions. “Plan Effective Date” means the occurrence of the effective date of the Plan according to its terms. “Plan Supplement” means the compilation of documents and forms of documents, schedules, and exhibits to the Plan that will be filed by the Debtors with the Bankruptcy Court. “Potential Purchasers” means a group of potential transaction counterparties participating in the Marketing Process to be determined by the Company Parties in consultation with the AHG Professionals. “Prepetition Agent” means Citibank, N.A., in its capacity as administrative and collateral agent under the First Lien Credit Agreement.

9 “Purchase Agreement” means the asset or stock purchase agreement to be entered into as part of the Sale Transaction by and among the Company Parties, as sellers, and the Winning Bidder (if any). “Qualified Marketmaker” means an Entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt). “RCF Claims” means any Claim on account of the Revolving Credit Facility. “Recapitalization Transaction” has the meaning set forth in the recitals to this Agreement. “Related Party” means, with respect to any person or Entity, each of, and in each case in its capacity as such, current and former directors, managers, officers, committee members, members of any governing body, equity holders (regardless of whether such interests are held directly or indirectly), affiliated investment funds or investment vehicles, managed accounts or funds, predecessors, participants, successors, assigns, subsidiaries, Affiliates, partners, limited partners, general partners, principals, members, management companies, fund advisors or managers, employees, agents, trustees, advisory board members, financial advisors, attorneys (including any other attorneys or professionals retained by any current or former director or manager in his or her capacity as director or manager of an Entity), accountants, investment bankers, consultants, representatives, and other professionals and advisors of such person or Entity and any such person’s or Entity’s respective heirs, executors, estates, and nominees. “Released Claim” means, with respect to any Releasing Party, any Claim or Cause of Action that is released by such Releasing Party under Section 15 of this Agreement. “Released Company Parties” means each of, and in each case in its capacity as such: (a) Company Party; (b) current and former Affiliates of each Entity in clause (a) through the following clause (c); and (c) each Related Party of each Entity in clause (a) through this clause (c). “Released Parties” means each Released Company Party and each Released Stakeholder Party. “Released Stakeholder Parties” means each of, and in each case in its capacity as such: (a) Consenting Stakeholder; (b) the Prepetition Agent; (c) current and former Affiliates of each Entity in clause (a) through the following clause (d); and (d) each Related Party of each Entity in clause (a) through this clause (d). “Releases” means the releases contained in Section 15 of this Agreement. “Releasing Parties” means, collectively, each Company Releasing Party and each Consenting Stakeholder Releasing Party.

10 “Required Consenting Lenders” means, as of the relevant date, Consenting Lenders holding at least 50.01% of the aggregate outstanding principal amount of the First Lien Claims that are held by Consenting Lenders. “Required Consenting RCF Lenders” means, as of the relevant date, Consenting Lenders holding at least 66.67% of the aggregate outstanding principal amount of RCF Claims that are held by Consenting Lenders. “Required Consenting Term Lenders” means, as of the relevant date, Consenting Lenders holding at least 66.67% of the aggregate outstanding principal amount of the Term Loan Claims that are held by Consenting Lenders. “Required Consenting Stakeholders” means the Required Consenting Term Lenders and the Consenting Sponsors. “Restructuring Effective Date” means, as applicable, the Plan Effective Date or the Sale Closing Date. “Restructuring Term Sheet” has the meaning set forth in the recitals to this Agreement. “Restructuring Transactions” has the meaning set forth in the recitals to this Agreement. “Rules” means Rule 501(a)(1), (2), (3), and (7) of the Securities Act. “Sale Documents” means all agreements, instruments, pleadings, orders or other related documents utilized to implement the Marketing Process and consummate the Sale Transaction, including, but not limited to, the Bidding Procedures, Bidding Procedures Motion, Bidding Procedures Order, and Purchase Agreement, each of which shall contain terms and conditions that are materially consistent with this Agreement. “Sale Transaction” has the meaning set forth in the recitals to this Agreement. “Scheduling Order” means an order scheduling a combined hearing regarding confirmation of the Plan and approval of the Disclosure Statement; “Second-Out Take-Back Debt Facility” means a senior secured, first lien “second-out” term loan facility, in form and substance acceptable to the Required Consenting Term Lenders, to be issued on the Plan Effective Date in accordance with the Restructuring Term Sheet. “Securities Act” means the Securities Act of 1933, as amended. “Solicitation Materials” means all materials to be distributed in connection with solicitation of votes to approve the Plan. “Special Committee” means a newly established committee of Xxxxxxx’s board of directors comprised of the Independent Directors, which shall be delegated exclusive power and

14 a. the Company Parties shall have appointed (A) a Chief Restructuring Officer, who shall be acceptable to the Required Consenting Term Lenders and shall report to the Special Committee; provided that, for the avoidance of doubt, the Required Consenting Term Lenders hereby consent to the appointment of Xxxx Xxxx as the Chief Restructuring Officer and (B) the Independent Directors; b. the Company Parties shall establish the Special Committee; and c. the Company Parties and the Required Consenting Term Lenders shall decide, in their reasonable judgment, whether to (A) continue pursuing the out-of-court Marketing Process, or (B) pursue, after filing the Chapter 11 Cases, (1) a Recapitalization Transaction or (2) a dual track process that allows the Company Parties to “toggle” between a Recapitalization Transaction or a Sale Transaction; (v) No later than 2 weeks after the execution of this Agreement, the Company Parties shall provide the AHG and the Consenting Sponsors’ Professionals with copies of all material first-day filings, pleadings, and other first-day documentation in connection with a potential chapter 11 filing; (vi) In the event a Toggle Date occurs, the Company Parties shall commence the Chapter 11 Cases no later than 5 Business Days after the Toggle Date; and (vii) No later than May 14, 2023, the Petition Date shall have occurred. (b) Out-of-Court Milestones. Solely to the extent that the Toggle Date has not occurred, the following Milestones shall apply: (i) The Company Parties shall request that Potential Purchasers submit IOIs from Potential Purchasers no later than 4 weeks after the Launch Date (the “IOI Deadline”); (ii) No later than 3 Business Days after the IOI Deadline, the Company Parties shall provide the AHG Professionals with a reasonably detailed summary of recent Potential Purchaser activity; (iii) The Company Parties shall request that Potential Purchasers submit Final Bids no later than 9 weeks after the Launch Date (the “Final Bid Deadline”); (iv) No later than the Final Bid Deadline, the Company Parties shall provide the AHG Professionals with a copy of each Final Bid received; (v) No later than 3 Business Days after the Final Bid Deadline, the Company Parties shall provide the AHG Professionals with a reasonably detailed summary of Potential Purchaser activity;

15 (vi) No later than 13 weeks after the Launch Date, the Company Parties shall have negotiated and signed the Purchase Agreement to effectuate an Acceptable Transaction; (vii) No later than 3 Business Days after execution of the Purchase Agreement, the Company Parties shall provide the AHG Professionals with a reasonably detailed summary of recent Potential Purchaser activity; and (viii) No later than August 15, 2023, the Sale Transaction shall have closed (“Sale Closing Date”). (c) In-Court Dual Track Milestones. To the extent the Company Parties and the Required Consenting Term Lenders have agreed to continue to pursue a Sale Transaction in parallel with the Recapitalization Transaction, the following Milestones shall apply: (i) No later than 5 days prior to the Petition Date, the Company Parties shall have delivered to the AHG and the Consenting Sponsors DIP Documents that are reasonably acceptable to the Required Consenting Term Lenders; (ii) On the Petition Date, the Company Parties shall file (A) the Plan (which shall afford the Company Parties flexibility to “toggle” between a Sale Transaction and a Recapitalization Transaction), (B) the Disclosure Statement, (C) a motion seeking entry of Scheduling Order (if applicable), and (D) the Bidding Procedures Motion; (iii) No later than 2 Business Days after the Petition Date, subject to Bankruptcy Court availability, the Bankruptcy Court shall have entered (A) the interim DIP Order and (B) the Scheduling Order (if applicable); (iv) No later than 10 Business Days after the Petition Date, the Company Parties shall provide the AHG Professionals with a detailed update as to the status of negotiations with counterparties to executory contracts and leases on a contract-by-contract basis; (v) Subject to the availability of the Bankruptcy Court, if applicable, the Bidding Procedures Order shall be entered no later than 30 days after the Petition Date; (vi) No later than 30 days after the Petition Date, the Bankruptcy Court shall have entered the final DIP Order; (vii) If applicable, the deadline for submitting qualified bids pursuant to the Bidding Procedures shall be no later than 45 days after the Petition Date; (viii) If applicable, any auction to select a winning bid pursuant to the Bidding Procedures shall commence no later than 60 days after the Petition Date; (ix) If applicable, an order approving a Sale Transaction (on a conditional basis if such Sale Transaction is to be consummated pursuant to the Plan and on a final basis if such Sale Transaction is consummated pursuant to section 363 of the Bankruptcy Code) shall be entered by the Bankruptcy Court no later than 70 days after the Petition Date;

17 Section 5. Commitments of the Consenting Lenders. 5.01. General Commitments. (a) During the Agreement Effective Period, each Consenting Lender severally, and not jointly, agrees, in respect of all of its Company Claims/Interests, to: (i) use commercially reasonable efforts and take to all reasonable actions necessary to support the Restructuring Transactions and vote and exercise any powers or rights available to it (including in any board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which they are legally entitled to participate) in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions; (ii) use commercially reasonable efforts to cooperate with and assist the Company Parties in obtaining additional support for the Restructuring Transactions from the Company Parties’ other stakeholders, including to obtain support for the Restructuring Transactions from holders of at least two-thirds of the First Lien Claims; (iii) use commercially reasonable efforts to oppose any party or person from taking any actions contemplated in Section 5.03(b); (iv) give any notice, order, instruction, or direction to the Prepetition Agent necessary to give effect to the Restructuring Transactions; (v) take, and direct the Prepetition Agent to take, all actions reasonably necessary in furtherance of the Sale Transaction, if applicable; and (vi) negotiate in good faith and use commercially reasonable efforts to execute and implement the Definitive Documents that are consistent with this Agreement to which it is required to be a party. (b) During the Agreement Effective Period, each Consenting Lender severally, and not jointly, agrees, in respect of all of its Company Claims/Interests, that it shall not directly or indirectly: (i) object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions; (ii) propose, file, support, or vote for any Alternative Restructuring Proposal; (iii) file any motion, pleading, or other document with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement or the Plan; (iv) initiate, or have initiated on its behalf, any litigation or proceeding of any kind with respect to the Chapter 11 Cases, this Agreement, or the other Restructuring Transactions contemplated herein against the Company Parties or the other Parties other than to

19 (iv) not change, withdraw, amend, or revoke (or cause to be changed, withdrawn, amended, or revoked) any vote or election referred to in clauses (i) and (ii) above. (b) During the Agreement Effective Period, each Consenting Lender, in respect of each of its Company Claims/Interests, will support, and will not directly or indirectly object to, delay, impede, or take any other action to interfere with any motion or other pleading or document filed by a Company Party in the Bankruptcy Court that is consistent with this Agreement. Section 6. Commitments of the Consenting Sponsors. 6.01. Affirmative Commitments. During the Agreement Effective Period, each of the Consenting Sponsors severally, and not jointly, agrees to: (a) use commercially reasonable efforts and take all reasonable actions necessary to support the Restructuring Transactions and vote and exercise any powers or rights available to it (including in any board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which they are legally entitled to participate) in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions; (b) negotiate in good faith and use commercially reasonable efforts to execute and implement the Definitive Documents that are not inconsistent with this Agreement to which it is required to be a party in order for the Restructuring Transactions to be implemented; and (c) negotiate in good faith any reasonable and appropriate additional or alternative provisions or agreements to address any legal, financial, or structural impediment that may arise that would prevent, hinder, impede, delay, or are necessary to effectuate the consummation of the Restructuring Transactions. 6.02. Negative Commitments. During the Agreement Effective Period, each of Consenting Sponsors severally, and not jointly, agrees that it shall not, directly or indirectly, and shall not direct any other Entity to: (a) object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions; (b) propose, file, support, or vote for any Alternative Restructuring Proposal; (c) file any motion, pleading, or other document with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is materially inconsistent with this Agreement or the Plan; (d) object to, delay, impede, or take any other action to interfere with entry of any Sale Document and/or consummation of any Sale Transaction; (e) initiate, or have initiated on its behalf, any litigation or proceeding of any kind with respect to the Chapter 11 Cases, this Agreement, or the other Restructuring Transactions contemplated in this Agreement against the Company Parties or the other Parties other than to

21 (ii) affect the ability of any Consenting Sponsor to consult with any Consenting Stakeholder, the Company Parties, or any other party in interest in the Chapter 11 Cases (including any official committee and the United States Trustee); (iii) restrict any Consenting Sponsor in its capacity as the manager or operator of fund Entities other than the Company Parties; or (iv) prevent any Consenting Sponsor from enforcing this Agreement or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement. Section 7. Commitments of the Company Parties. 7.01. Affirmative Commitments. Except as set forth in Section 7.03, during the Agreement Effective Period, the Company Parties agree to: (a) use best efforts to (i) pursue the Restructuring Transactions on the terms, and in accordance with the Milestones set forth in this Agreement, and (ii) obtain necessary Bankruptcy Court approval of the Definitive Documents to consummate the Restructuring Transactions; (b) consult with the AHG Professionals regarding the Marketing Process, subject to the AHG Professionals’ non-disclosure agreements, and the AHG Professionals may suggest additional Potential Purchasers, provided that in no event shall the AHG Professionals disclose to the AHG the identity of Potential Purchasers; (c) continue reaching out to Potential Purchasers, including Potential Purchasers suggested by the AHG Professionals, in the Company Parties’ business judgment and in good faith; (d) share with the AHG Professionals any marketing materials used in the Marketing Process and provide regular updates to the AHG Professionals regarding the status thereof, including, among other things, a list of Potential Purchasers contacted by the Company Parties; (e) support and take all steps reasonably necessary and desirable to consummate the Restructuring Transactions in accordance with this Agreement; (f) to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, support and take all steps reasonably necessary or desirable to address and resolve any such impediment; (g) support and seek approval of all of the debtor and third-party releases, injunctions, discharge, indemnity, and exculpation provisions provided in the Plan, which shall be in form and substance acceptable to the Required Consenting Term Lenders and the Consenting Sponsors; (h) use commercially reasonable efforts to obtain any and all required regulatory and/or third-party approvals for the Restructuring Transactions;

22 (i) negotiate in good faith and use commercially reasonable efforts to execute, deliver, and perform its obligations under the Definitive Documents and any other required agreements to effectuate and consummate the Restructuring Transactions as contemplated by this Agreement and the other Definitive Documents; (j) use commercially reasonable efforts to seek additional support for the Restructuring Transactions from their other material stakeholders to the extent reasonably prudent; (k) to the extent reasonably practicable, provide counsel for the AHG and counsel for the Consenting Sponsors a review period of (i) at least three (3) calendar days (or such shorter review period as is necessary or appropriate under the circumstances) prior to the date when the Company Parties intend to file any Definitive Document with the Bankruptcy Court and (ii) at least one (1) calendar day (or such shorter review period as necessary or appropriate) prior to the date when the Company intends to file any other material pleading with the Bankruptcy Court (but excluding monthly or quarterly operating reports, retention applications, fee applications, fee statements, and any declarations in support thereof or related thereto); (l) provide a reasonable opportunity to counsel to any Consenting Stakeholders materially affected by any filing to review draft copies of other documents that the Company Parties intend to file with the Bankruptcy Court, as applicable; (m) to the extent applicable, object to any motion filed with the Bankruptcy Court by any person (i) seeking the entry of an order terminating the Company Parties’ exclusive right to file and/or solicit acceptances of a plan of reorganization or (ii) seeking the entry of an order terminating, annulling, or modifying the automatic stay (as set forth in section 362 of the Bankruptcy Code) with regard to any material asset that, to the extent such relief was granted, would have a material adverse effect on or delay the consummation of the Restructuring Transactions; and (n) to the extent applicable, not file any pleading seeking entry of an order, and object to any motion filed with the Bankruptcy Court by any person seeking the entry of an order, (i) directing the appointment of an examiner or a trustee, (ii) converting the Chapter 11 Cases to cases under chapter 7 of the Bankruptcy Code, (iii) dismissing the Chapter 11 Cases, or (iv) for relief that (x) is inconsistent with this Agreement in any material respect or (y) would reasonably be expected to frustrate the purposes of this Agreement, including by preventing or delaying the consummation of the Restructuring Transactions. 7.02. Negative Commitments. Except as set forth in Section 7.03, during the Agreement Effective Period, each of the Company Parties shall not directly or indirectly: (a) object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions; (b) incur any material indebtedness or equity financing without prior written consent of the Required Consenting Term Lenders;

23 (c) sell or dispose of any material assets without prior written consent of the Required Consenting Term Lenders; (d) transfer any assets, other than cash, outside of the ordinary course of business to any person or Entity that is not a Loan Party or Guarantor (as such terms are defined in the First Lien Credit Agreement); (e) assume or reject any executory contract or lease without prior written consent of the Required Consenting Term Lenders; (f) take any action, or encourage any other person or Entity to take any action, directly or indirectly, that would reasonably be expected to breach or be inconsistent with this Agreement, or take any other action, directly or indirectly, that would reasonably be expected to interfere with, or impede acceptance or approval of, implementation and consummation of the Restructuring Transactions, this Agreement, the Confirmation Order, or the Plan; (g) subject to Section 7.03 hereof, propose, file, support, or vote for any Alternative Restructuring Proposal; (h) modify the Plan, in whole or in part, in a manner that is not consistent with this Agreement in all material respects; or (i) file any motion, pleading, or Definitive Documents with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement or the Plan. 7.03. Additional Provisions Regarding Company Parties’ Commitments. (a) Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement shall require a Company Party or the board of directors, board of managers, or similar governing body of a Company Party (including any special committee of such governing body, as applicable), after consulting with counsel, to take any action or to refrain from taking any action with respect to the Restructuring Transactions to the extent taking or failing to take such action would be inconsistent with applicable Law or its fiduciary obligations under applicable Law, and any such action or inaction pursuant to this Section 7.037.03 shall not be deemed to constitute a breach of this Agreement; provided that notwithstanding anything to the contrary herein, each Consenting Stakeholder reserves its rights to challenge any action taken by the Company Parties in reliance on this Section 7.037.03. (b) Notwithstanding anything to the contrary in this Agreement (but subject to Section 7.037.03), each Company Party and their respective directors, officers, employees, investment bankers, attorneys, accountants, consultants, and other advisors or representatives shall have the rights to: (a) consider and respond to Alternative Restructuring Proposals; (b) provide access to non-public information concerning any Company Party to any Entity or enter into Confidentiality Agreements or nondisclosure agreements with any Entity; (c) maintain or continue discussions or negotiations with respect to Alternative Restructuring Proposals; (d) otherwise respond to and participate in any inquiries, proposals, discussions, or negotiation of Alternative Restructuring Proposals; and (e) enter into or continue discussions or negotiations

25 Interests, no Consenting Stakeholder shall Transfer any Equity Interests, other than as part of a Sale Transaction in accordance with the terms of this Agreement, that would, in the reasonable determination of the Company Parties, result in an “ownership change” within the meaning of Section 382 of the Internal Revenue Code of 1986, as amended. 9.02. Upon compliance with the requirements of Section 9.01, the transferor shall be deemed to relinquish its rights (and be released from its obligations) under this Agreement to the extent of the rights and obligations in respect of such transferred Company Claims/Interests. Any Transfer in violation of Section 9.01 shall be void ab initio. 9.03. This Agreement shall in no way be construed to preclude the Consenting Stakeholders from acquiring additional Company Claims/Interests; provided, however, that (a) such additional Company Claims/Interests shall automatically and immediately upon acquisition by a Consenting Stakeholder be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to counsel to the Company Parties or counsel to the Consenting Stakeholders) and (b) such Consenting Stakeholder must provide notice of such acquisition (including the amount and type of Company Claim/Interest acquired) to counsel to the Company Parties within five (5) Business Days of the closing of such acquisition. 9.04. This Section 9 shall not impose any obligation on any Company Party to issue any “cleansing letter” or otherwise publicly disclose information for the purpose of enabling a Consenting Stakeholder to Transfer any of its Company Claims/Interests. Notwithstanding anything to the contrary herein, to the extent a Company Party and another Party have entered into a Confidentiality Agreement, the terms of such Confidentiality Agreement shall continue to apply and remain in full force and effect according to its terms, and this Agreement does not supersede any rights or obligations otherwise arising under such Confidentiality Agreements. 9.05. Notwithstanding Section 9.01, a Qualified Marketmaker that acquires any Company Claims/Interests with the purpose and intent of acting as a Qualified Marketmaker for such Company Claims/Interests shall not be required to execute and deliver a Transfer Agreement in respect of such Company Claims/Interests if (i) such Qualified Marketmaker subsequently Transfers such Company Claims/Interests (by purchase, sale assignment, participation, or otherwise) within five (5) Business Days of its acquisition to a transferee that is an Entity that is not an Affiliate, affiliated fund, or affiliated Entity with a common investment advisor; (ii) the transferee otherwise is a Permitted Transferee under Section 9.01; and (iii) the Transfer otherwise is a permitted Transfer under Section 9.01. To the extent that a Consenting Stakeholder is acting in its capacity as a Qualified Marketmaker, it may Transfer (by purchase, sale, assignment, participation, or otherwise) any right, title or interests in Company Claims/Interests that the Qualified Marketmaker acquires from a holder of the Company Claims/Interests who is not a Consenting Stakeholder without the requirement that the transferee be a Permitted Transferee. 9.06. The Company Parties understand that the Consenting Lenders are engaged in a wide range of financial services and businesses, and, in furtherance of the foregoing, the Company Parties acknowledge and agree that the obligations set forth in this Agreement shall only apply to the trading desk(s) and/or business group(s) of the Consenting Lender that

28 remains uncured for five (5) Business Days after such terminating Consenting Lenders transmit a written notice in accordance with Section 16.11 hereof detailing any such breach; (b) the making publicly available, modification, amendment, or filing of any of the Definitive Documents without the consent of the Required Consenting Term Lenders in accordance with this Agreement; (c) any Company Party (i) withdraws the Plan, (ii) publicly announces its intention not to support the Restructuring Transactions, or (iii) files, publicly announces, executes, responds to, or supports an Alternative Restructuring Proposal or definitive agreement with respect thereto; (d) the issuance by any governmental authority, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable ruling or order that (i) enjoins the consummation of a material portion of the Restructuring Transactions and (ii) remains in effect for ten (10) Business Days after such terminating Consenting Lenders transmit a written notice in accordance with Section 16.11 hereof detailing any such issuance; provided, that this termination right may not be exercised by any Party that sought or requested such ruling or order in contravention of any obligation set out in this Agreement; (e) the failure to meet a Milestone, which has not been waived or extended in a manner consistent with this Agreement, unless such failure is the result of any act, omission, or delay on the part of a terminating Consenting Lender in violation of its obligations under this Agreement; (f) the Company Parties fail to timely pay in full the AHG Professional’s reasonable, documented fees and expenses in accordance with Section 13 hereof; (g) any Company Party (i) voluntarily commences any case or files any petition seeking bankruptcy, winding up, dissolution, liquidation, administration, moratorium, reorganization, or other relief under any federal, state, or foreign bankruptcy, insolvency, administrative receivership, or similar law now or hereafter in effect, except as contemplated by this Agreement, unless waived by the Required Consenting Term Lenders, (ii) consents to the institution of, or fails to contest in a timely and appropriate manner, any involuntary proceeding or petition described in the immediately preceding clause (i), (iii) applies for or consents to the appointment of a receiver, administrator, administrative receiver, trustee, custodian, sequestrator, conservator, or similar official with respect to any Company Party or for a substantial part of such Company Party’s assets, (iv) makes a general assignment or arrangement for the benefit of creditors, or (v) takes any corporate action for the purpose of authorizing any of the foregoing; (h) an order is entered by the Bankruptcy Court granting relief from the automatic stay imposed by section 362 of the Bankruptcy Code authorizing any party to proceed against any material asset of the Company Parties and such order materially and adversely affects any Company Party’s ability to operate its business in the ordinary course or consummate the Restructuring Transactions; (i) upon the occurrence of a termination event in Section 12.02 of this Agreement;

29 (j) any Company Party files any motion or pleading with the Bankruptcy Court that is not consistent in all material respects with this Agreement and such motion has not been withdrawn within five (5) Business Days of receipt by the Company Parties of written notice from the Required Consenting Term Lenders that such motion or pleading is inconsistent with this Agreement; (k) entry of a DIP Order that is not acceptable to the Required Consenting Term Lenders; (l) the Company Parties file any Definitive Document that is not acceptable to the Required Consenting Term Lenders; (m) a Company Party files any motion, application, or adversary proceeding challenging the validity, enforceability, perfection, or priority of, or seeking avoidance or subordination of, any portion of the Company Claims/Interests or asserts any other cause of action against the Consenting Lenders or with respect or relating to such Company Claims/Interests, the First Lien Credit Agreement, any Bridge Facility Documents, or any Loan Document (as such term is defined in each of the foregoing credit agreements or documents) or the prepetition liens securing the Company Claims/Interests or challenging the validity, enforceability, perfection, or priority of, or seeking avoidance or subordination of, any portion of the Company Claims/Interests or asserting any other cause of action against the Consenting Lenders or with respect or relating to such Company Claims/Interests or the prepetition liens securing the Company Claims/Interests other than a claim or cause of action arising from or related to such Consenting Lenders’ breach of this Agreement or any other Definitive Documents; (n) the occurrence of any default or event of default under the Bridge Facility Documents, First Lien Credit Documents, DIP Documents, or DIP Order, as applicable, that has not been cured or waived (if susceptible to cure or waiver) by the applicable percentage of lenders in accordance with the terms of the Bridge Facility Documents, DIP Documents or DIP Order, as applicable; (o) the Company Parties lose the exclusive right to file a plan or plans of reorganization or to solicit acceptances thereof pursuant to section 1121 of the Bankruptcy Code; (p) the Bankruptcy Court enters an order denying confirmation of the Plan; (q) the entry of an order by the Bankruptcy Court, or the filing of a motion or application by any Company Party seeking an order (without the prior written consent of the Required Consenting Stakeholders, not to be unreasonably withheld), (i) converting one or more of the Chapter 11 Cases of a Company Party to a case under chapter 7 of the Bankruptcy Code, (ii) appointing an examiner with expanded powers beyond those set forth in sections 1106(a)(3) and (4) of the Bankruptcy Code or a trustee in one or more of the Chapter 11 Cases of a Company Party, or (iii) rejecting this Agreement; or (r) the Consenting Sponsors terminate this Agreement pursuant to Section 12.03 hereof.

33 under this Agreement are cumulative and are not exclusive of any other remedies provided by Xxx. Section 15. Mutual Releases. 15.01. Releases. (a) Releases by the Company Releasing Parties. Except as expressly set forth in this Agreement, effective on (and only upon) the Plan Effective Date or the Sale Closing Date (if the Sale Transaction occurs out of court), as applicable, and only with respect to each Party that has not terminated its obligations under this Agreement except to the extent set forth in Section 12.06 hereof, in exchange for good and valuable consideration, the adequacy of which is hereby confirmed, each Released Party shall hereby be deemed released and discharged by each and all of the Company Releasing Parties, in each case on behalf of themselves and their respective successors, assigns, and representatives, and any and all other Entities who may purport to assert any Cause of Action, directly or derivatively, by, through, for, or because of the foregoing Entities, from any and all Causes of Action, whether known or unknown, including any derivative claims, asserted or assertable on behalf of any of the Company Releasing Parties that such of the foregoing Entities would have been legally entitled to assert in their own right (whether individually or collectively) or on behalf of the holder of any Claim against, or interest in, a Company Releasing Party, based on or relating to, or in any manner arising from, in whole or in part, the Company Releasing Parties (including the management, ownership, or operation of the Company Parties), the purchase, sale, or rescission of any security of the Company Parties, the subject matter of, or the transactions or events giving rise to, any Company Claim/Interest that is treated in the Plan, the business or contractual arrangements between any Company Party and any Released Party, the Company Parties’ in or out of court restructuring efforts, intercompany transactions, the DIP financing, the exit financing, the Sale Transaction, the Chapter 11 Cases, this Agreement, the Definitive Documents, or any Restructuring Transaction, contract, instrument, release, or other agreement or document created or entered into in connection with this Agreement, the Definitive Documents, or the Plan, the filing of the Chapter 11 Cases, the pursuit of confirmation, the pursuit of consummation, the administration and implementation of the Plan, including the issuance or distribution of securities pursuant to the Plan, or the distribution of property under the Plan or any other related agreement, or upon any other act, or omission, transaction, agreement, event, or other occurrence taking place on or before the Plan Effective Date or the Sale Closing Date, as applicable. (b) Releases by the Consenting Stakeholder Releasing Parties. Except as expressly set forth in this Agreement, effective on (and only upon) the Plan Effective Date or the Sale Closing Date (if the Sale Transaction occurs out of court), as applicable, and only with respect to each Party that has not terminated its obligations under this Agreement except to the extent set forth in Section 12.06 hereof, in exchange for good and valuable consideration, the adequacy of which is hereby confirmed, each Released Party is hereby deemed released and discharged by each and all of the Consenting Stakeholder Releasing Parties, in each case on behalf of themselves and their respective successors, assigns, and representatives, and any and all other Entities who may purport to assert any Cause of Action, directly or derivatively, by, through, for, or because of the foregoing Entities, from any and all Causes of Action, whether known or unknown, including any derivative claims, asserted or assertable on behalf of any of the

36 16.03. Further Assurances. Subject to the terms of this Agreement, each Party hereby covenants and agrees to cooperate with each other in good faith with respect to the pursuit, approval, implementation, and consummation of the Restructuring Transactions, the Sale Transaction, the Recapitalization Transaction, and the Plan. Subject to the other terms of this Agreement, the Parties agree to execute and deliver such other instruments and perform such acts, in addition to the matters herein specified, as may be reasonably appropriate or necessary, or as may be required by order of the Bankruptcy Court, from time to time, to effectuate the Restructuring Transactions, as applicable. 16.04. Complete Agreement. Except as otherwise explicitly provided herein, this Agreement constitutes the entire agreement among the Parties with respect to the subject matter hereof and supersedes all prior agreements, oral or written, among the Parties with respect thereto, other than any Confidentiality Agreement. 16.05. GOVERNING LAW; SUBMISSION TO JURISDICTION; SELECTION OF FORUM. THIS AGREEMENT IS TO BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED IN SUCH STATE, WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS PRINCIPLES THEREOF. Each Party hereto agrees that it shall bring any action or proceeding in respect of any claim arising out of or related to this Agreement, to the extent possible, in the Bankruptcy Court, and solely in connection with claims arising under this Agreement: (a) irrevocably submits to the exclusive jurisdiction of the Bankruptcy Court; (b) waives any objection to laying venue in any such action or proceeding in the Bankruptcy Court; and (c) waives any objection that the Bankruptcy Court is an inconvenient forum or does not have jurisdiction over any Party hereto. 16.06. TRIAL BY XXXX XXXXXX. EACH PARTY HERETO IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. 16.07. Execution of Agreement. This Agreement may be executed and delivered in any number of counterparts and by way of electronic signature and delivery, each such counterpart, when executed and delivered, shall be deemed an original, and all of which together shall constitute the same agreement. Except as expressly provided in this Agreement, each individual executing this Agreement on behalf of a Party has been duly authorized and empowered to execute and deliver this Agreement on behalf of said Party. 16.08. Rules of Construction. This Agreement is the product of negotiations among the Company Parties and the Consenting Stakeholders, and in the enforcement or interpretation hereof, is to be interpreted in a neutral manner, and any presumption with regard to interpretation for or against any Party by reason of that Party having drafted or caused to be drafted this Agreement, or any portion hereof, shall not be effective in regard to the interpretation hereof. The Company Parties and the Consenting Stakeholders were each represented by counsel during the negotiations and drafting of this Agreement and continue to be represented by counsel.

37 16.09. Successors and Assigns; Third Parties. This Agreement is intended to bind and inure to the benefit of the Parties and their respective successors and permitted assigns, as applicable. Other than with respect to the Released Parties and the Parties referenced in Section 16.12, there are no third party beneficiaries under this Agreement, and the rights or obligations of any Party under this Agreement may not be assigned, delegated, or transferred to any other person or Entity. 16.10. Relationship Among the Parties. It is understood and agreed that no Party to this Agreement has any duty of trust or confidence in any form with any other Party, and, except as provided in this Agreement, there are no agreements, commitments, or undertakings between or among them. In this regard, it is understood and agreed that any Party to this Agreement may trade in Company Claims/Interests without the consent of the Company Parties, as the case may be, or any other Party, subject to applicable securities laws, the terms of any applicable non- disclosure agreement, and the terms of this Agreement; provided that no Party shall have any responsibility for any such trading by any other Party by virtue of this Agreement. No prior history, pattern, or practice of sharing confidences among or between the Parties shall in any way affect or negate this understanding and agreement. 16.11. Notices. All notices hereunder shall be deemed given if in writing and delivered, by electronic mail, courier, or registered or certified mail (return receipt requested), to the following addresses (or at such other addresses as shall be specified by like notice): (a) if to a Company Party, to: Company Cyxtera Technologies, Inc. Attention: Xxxxxx Xxxxx, Chief Legal Counsel E-mail address: xxxxxx.xxxxx@xxxxxxx.xxx with copies to: Xxxxxxxx & Xxxxx LLP 000 Xxxxxxxxx Xxxxxx Xxx Xxxx, XX 00000 Attention: Xxxxxxxxxxx Xxxxxx, Xxxxx X. Xxxxxx E-mail addresses: xxxxxxxxxxx.xxxxxx@xxxxxxxx.xxx xxxxx.xxxxxx@xxxxxxxx.xxx (b) if to a Consenting Xxxx Xxxxxx, to: Xxxxxx, Xxxx & Xxxxxxxx LLP 000 Xxxx Xxx Xxx Xxxx, XX 00000 Attention: Xxxxx X. Xxxxxxxxx, Xxxxxx Xxxxxxxxxx E-mail addresses: xxxxxxxxxx@xxxxxxxxxx.xxx, xxxxxxxxxxx@xxxxxxxxxx.xxx (c) if to a Consenting Sponsor, to:

Company Parties’ Signature Page to the Restructuring Support Agreement CYXTERA COMMUNICATIONS, LLC CYXTERA DATA CENTERS, INC. CYXTERA DC HOLDINGS, INC. CYXTERA DC PARENT HOLDINGS, INC. CYXTERA FEDERAL GROUP, INC. CYXTERA MANAGEMENT, INC. CYXTERA NETHERLANDS B.V. CYXTERA TECHNOLOGIES, INC. CYXTERA TECHNOLOGIES MARYLAND, INC. CYXTERA HOLDINGS, LLC CYXTERA EMPLOYER SERVICES, LLC CYXTERA TECHNOLOGIES, LLC CYXTERA CANADA, LLC CYXTERA DIGITAL SERVICES, LLC CYXTERA COMMUNICATIONS CANADA, ULC CYXTERA CANADA TRS, ULC CYXTERA TECHNOLOGY UK LIMITED CYXTERA UK TRS LIMITED By: Name: Xxxxxx X. Xxxxxxx Authorized Signatory

Consenting Stakeholder Signature Page to the Restructuring Support Agreement [CONSENTING STAKEHOLDER] _____________________________________ Name: Title: Address: E-mail address(es): Aggregate Amounts Beneficially Owned or Managed on Account of: RCF Claims Term Loan Claims Equity Interests

EXHIBIT A Company Parties

EXHIBIT B Restructuring Term Sheet

CYXTERA TECHNOLOGIES, INC., ET AL. RESTRUCTURING TERM SHEET May 4, 2023 This term sheet (the “Term Sheet”) summarizes the material terms and conditions of proposed transactions (the “Restructuring Transactions”) to restructure the existing indebtedness of, and equity interests in, Cyxtera Technologies, Inc. and its direct and indirect subsidiaries (“Cyxtera,” or the “Company”). The Restructuring Transactions will be consummated through a Sale Transaction or the Plan filed in the Chapter 11 Cases on the terms, and subject to the conditions, set forth in the Restructuring Support Agreement (together with the exhibits and schedules attached to such agreement, including this Term Sheet, each as may be amended, restated, supplemented, or otherwise modified from time to time in accordance with the terms thereof, the “RSA”).1 THIS TERM SHEET IS NEITHER AN OFFER WITH RESPECT TO ANY SECURITIES NOR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. NOTHING CONTAINED IN THIS TERM SHEET SHALL BE AN ADMISSION OF FACT OR LIABILITY. THIS TERM SHEET DOES NOT ADDRESS ALL TERMS THAT WOULD BE REQUIRED IN CONNECTION WITH THE PROPOSED RESTRUCTURING TRANSACTIONS OR THAT WILL BE SET FORTH IN THE DEFINITIVE DOCUMENTATION. Without limiting the generality of the foregoing, this Term Sheet and the undertakings contemplated herein are subject in all respects to the negotiation, execution, and delivery of definitive documentation acceptable to the Company and the Consenting Lenders, as applicable. The regulatory, tax, accounting, and other legal and financial matters and effects related to the Restructuring Transactions and any related restructuring or similar transaction have not been fully evaluated and any such evaluation may affect the terms and structure of any Restructuring Transactions or related transactions. This Term Sheet is proffered in the nature of a settlement proposal in furtherance of settlement discussions. Accordingly, this Term Sheet and the information contained herein are entitled to protection from any use or disclosure to any party or person pursuant to Rule 408 of the Federal Rules of Evidence and any other applicable rule, statute, or doctrine of similar import protecting the use or disclosure of confidential settlement discussions. 1 Terms used but not defined herein shall have the meanings ascribed to them elsewhere in this Term Sheet or in the RSA to which this Term Sheet is attached.

2 OVERVIEW Restructuring Summary The Restructuring Transactions will be accomplished through either (i) a potential Sale Transaction or (ii) a potential recapitalization of the Company’s balance sheet (the “Recapitalization Transaction”) implemented through cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the Bankruptcy Court pursuant to the RSA. To the extent the Company pursues the Recapitalization Transaction, the RSA will obligate the Company and Consenting Lenders to support a plan of reorganization (the “Plan”) that will effectuate the Restructuring Transactions on the terms and conditions set forth in this Term Sheet. To the extent the Company pursues a Sale Transaction, the Restructuring Transactions may be effectuated either out of court or in the Chapter 11 Cases, including pursuant to the Plan. This Term Sheet contemplates a restructuring in two potential phases: i. The Marketing Process (Phase 1). In late March / early April 2023, the Company, with the assistance of their investment banker, Guggenheim Securities, LLC, launched a marketing process (the “Marketing Process”) to determine the highest and best bona fide offer, in the Company’s business judgment, to purchase some or all of the Company’s business enterprise (the “Sale Transaction”). The Sale Transaction may be implemented, at the reasonable discretion of the Company and the Required Consenting Term Lenders, either out of court or in court through the Chapter 11 Cases, including through the Plan. ii. Recapitalization Transaction (Phase 2). To the extent the Marketing Process does not result in an Acceptable Transaction by the Sale Closing Date, or if one or more of the other Toggle Trigger Events occurs, the Company shall promptly terminate the Marketing Process (unless otherwise agreed by the Required Consenting Term Lenders) and, within 5 Business Days of the Toggle Date, commence the Chapter 11 Cases to implement the Recapitalization Transaction as set forth in this Term Sheet, the RSA, and the other Definitive Documents. In the event that the Company Parties and Required Consenting Term Lenders agree to continue the Marketing Process and/or consummate a Sale Transaction in the Chapter 11 Cases, including through the Plan, then the Company Parties and Required Consenting Term Lenders agree to negotiate, in good faith, any necessary and conforming changes to the terms hereunder. Current Indebtedness The Company is subject to the following prepetition obligations: • RCF Claims. The Company is party to that certain first lien, multi-currency revolving credit facility (the “Revolving Credit Facility”) issued pursuant to that certain First Lien Credit Agreement, dated as of May 1, 2017, by and among Cyxtera DC Parent Holdings, Inc., Colorado Buyer Inc., as borrower, the first lien lenders party thereto, and Citibank, N.A. as administrative and collateral agent (as amended, supplemented, or otherwise modified from time to time, the “First Lien Credit Agreement”). As of the date hereof,

4 Consenting Xxxx Xxxxxxx, work expeditiously to consummate the transaction contemplated thereby (the “Winning Transaction”). First Lien Credit Agreement Amendment The First Lien Credit Agreement shall be amended (such amendment, the “First Lien Credit Agreement Amendment”) to include, among other things, and in each case as reasonably acceptable to the AHG and the Company, (i) the Liability Management Protections; (ii) the removal or limitation of all non-ordinary course capacity with respect to negative covenants, including permitted indebtedness, permitted liens, permitted investments, restricted payments, asset dispositions and reinvestment rights, affiliate transactions, fundamental changes, and sale leaseback transactions; and (iii) a limited carve out to permit incurrence of the Bridge Facility. The First Lien Credit Agreement Amendment shall close concurrently with the Bridge Facility. Bridge Financing In support of the Marketing Process and the Restructuring Transactions, certain of the Consenting Term Lenders shall provide the Company, concurrently with entry into the RSA, with a super-senior secured term loan financing facility in an aggregate principal amount of $50 million (the “Bridge Facility,” and such lenders, the “Bridge Facility Lenders”) on terms reasonably acceptable to the AHG and the Company, which terms shall in any event include: • Timing: The documents governing the Bridge Facility shall become effective, and proceeds thereof shall be disbursed, concurrently with the First Lien Credit Agreement Amendment and in any event no later than May 4, 2023. A portion of the Bridge Facility proceeds may, at the election of the Company and Required Consenting Term Lenders, be funded into escrow and/or subject to a delayed draw mechanic. • Participation: At the election of the Required Consenting Term Lenders, participation may be made available to all holders of First Lien Claims on a pro rata basis, subject to a customary backstop by certain of the Consenting Term Lenders (the “Backstop Parties”), which shall be in form and substance acceptable to the AHG and the Company. • Maturity: Coterminous with the existing maturity date of the Term Loan Facility. • Interest: SOFR plus 500 bps. • Backstop Fee: 600 bps, payable in cash at closing pro rata to the Backstop Parties. • Commitment Fee: 300 bps, payable in cash at closing pro rata to the Bridge Facility Lenders, including, for the avoidance of doubt, the Backstop Parties. • Priority: The Bridge Facility shall be senior in right of payment to the Term Loan Facility and shall be secured by a pari passu lien on all collateral securing the Term Loan Facility (the “Bridge Financing Liens”).

7 Term Lenders, each holder of a Term Loan Claim shall receive (i) its Pro Rata share of the Par Plus Recovery and (ii) solely to the extent such holder is a Consenting Term Lender, its Pro Rata share of the Excess Term Loan Recovery, if applicable. • Existing Common Stock: Following the Sale Closing Date (if the Sale Transaction closes out of court), holders of the Existing Common Stock shall receive (i) their pro rata share of the Sale Equity Distribution and (ii) their pro rata share of the Excess Equity Recovery, if applicable; provided that if holders of Existing Common Stock receive or retain, following a Sale Transaction, value in excess of the Minimum Equity Value, such excess shall reduce the Minimum Equity Value on a dollar-for-dollar basis unless holders of Bridge Facility Claims and Term Loan Claims have received their Pro Rata share of the Par Plus Recovery. Company Status The Company may be public or private following consummation of the Sale Transaction, if any. THE RECAPITALIZATION TRANSACTION (PHASE 2) General Unless otherwise agreed to by the Required Consenting Term Lenders, the Company shall toggle from pursuing the Sale Transaction to pursuing the Recapitalization Transaction upon the occurrence of one or more of the following (each, a “Toggle Trigger Event”): i. any Out-of-Court Milestone is breached; ii. no Acceptable IOI is received by the IOI Deadline; iii. no Acceptable Bid is received by the Final Bid Deadline; iv. on the Sale Closing Date, the Company is unable to, or in the reasonable judgment of both the Company and the Required Consenting Term Lenders will not be able to (a) satisfy the Minimum Sale Proceeds Requirement and/or (b) retain the Minimum Required Liquidity as contemplated in this Term Sheet; or v. the Marketing Process is terminated. Notwithstanding anything to the contrary herein or in the RSA, unless otherwise agreed to by the Required Consenting Term Lenders, the Company shall file the Chapter 11 Cases on the earlier of (a) May 14, 2023, and (b) within 5 Business Days following the Toggle Date. DIP Financing Pursuant to the Recapitalization Transaction, the Company shall seek approval of a non-amortizing, super-senior secured debtor-in-possession financing facility (the “DIP Facility,” the loans advanced thereunder, the “DIP Loans,” and the lenders thereunder, the “DIP Lenders”) subject to a competitive marketing process. If the DIP Facility is provided by certain Consenting Term Lenders, then (i) the DIP Facility shall be made available to all Consenting Lenders on a pro rata basis; (ii) the DIP Facility shall convert into the First-Out Take-Back Debt Facility on the Plan Effective Date; (iii) the adequate protection provided by the Company to

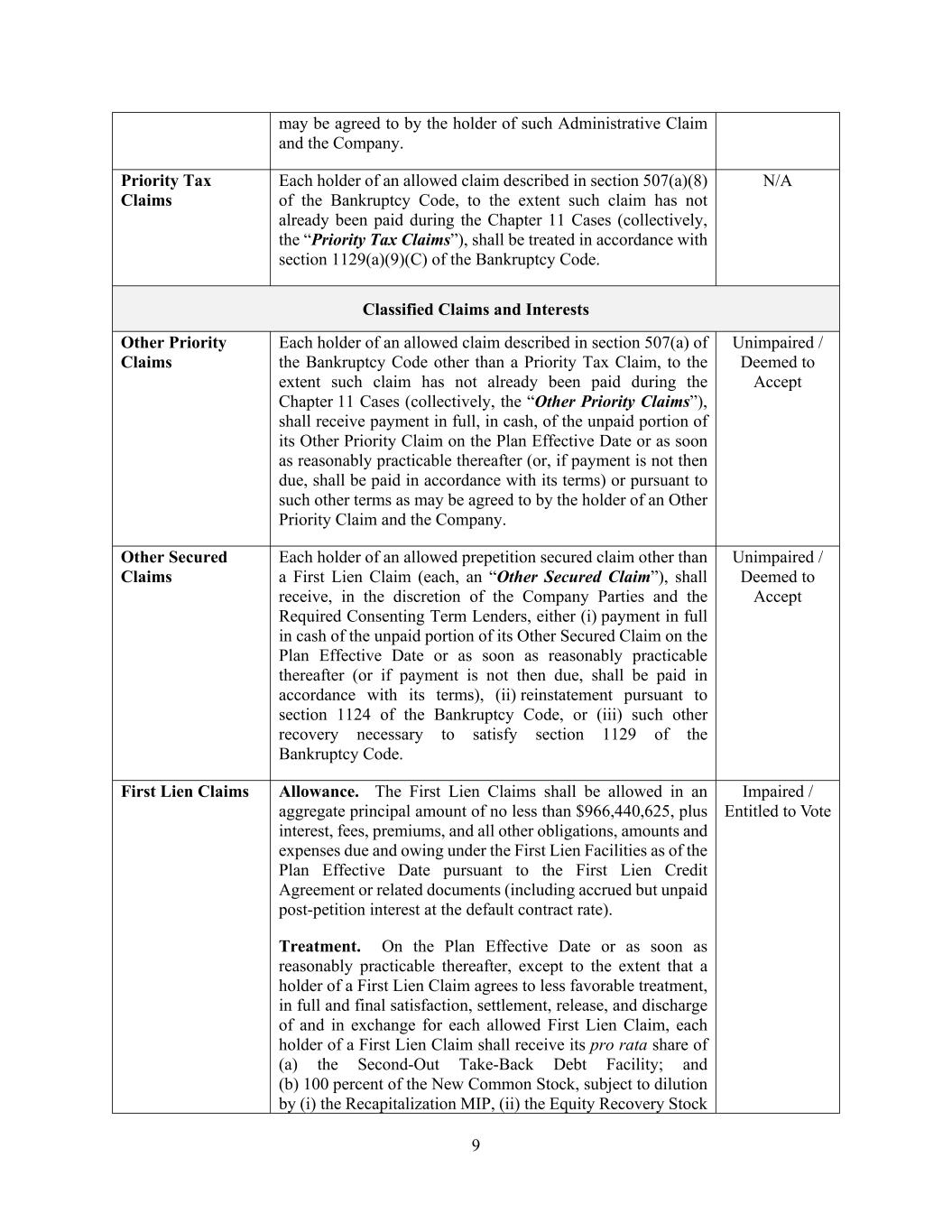

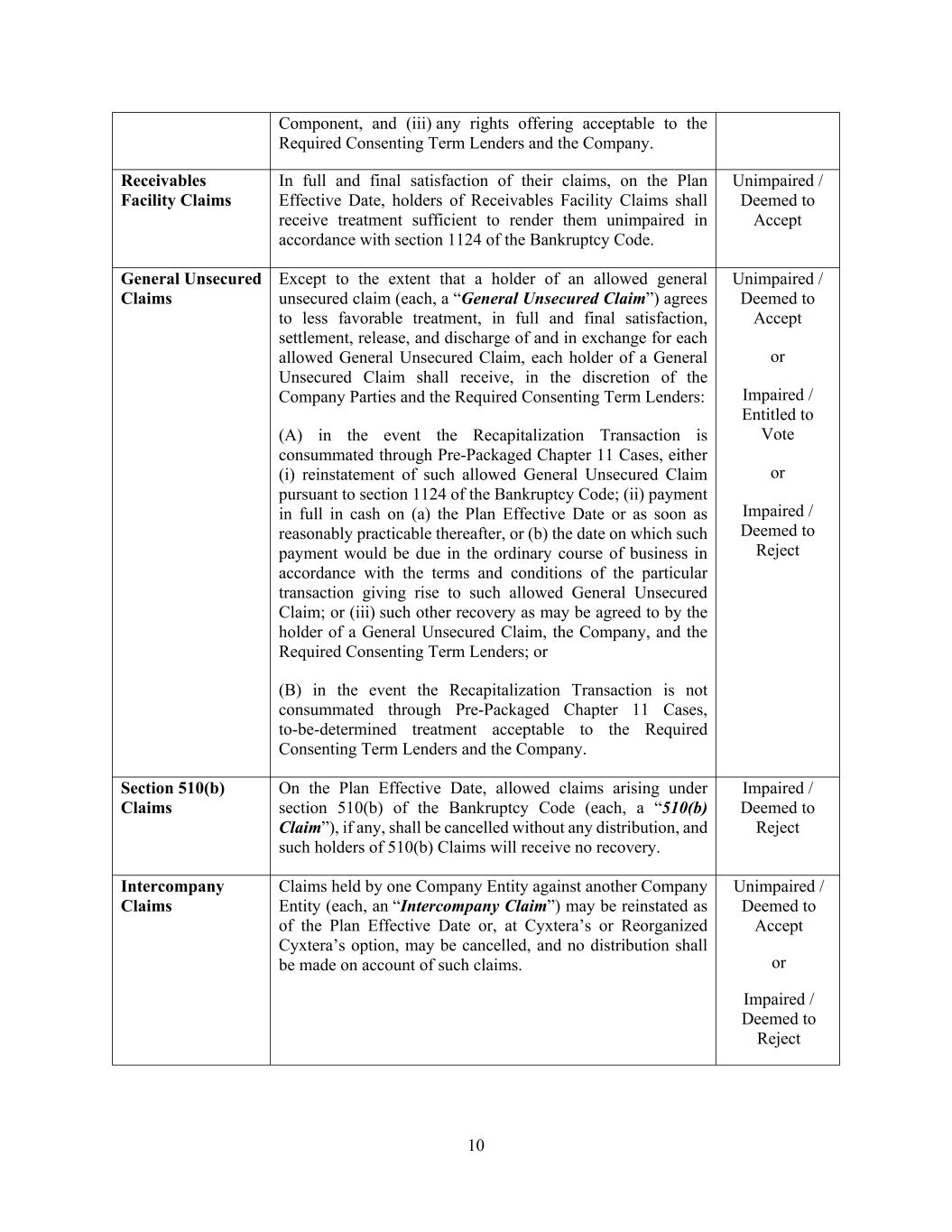

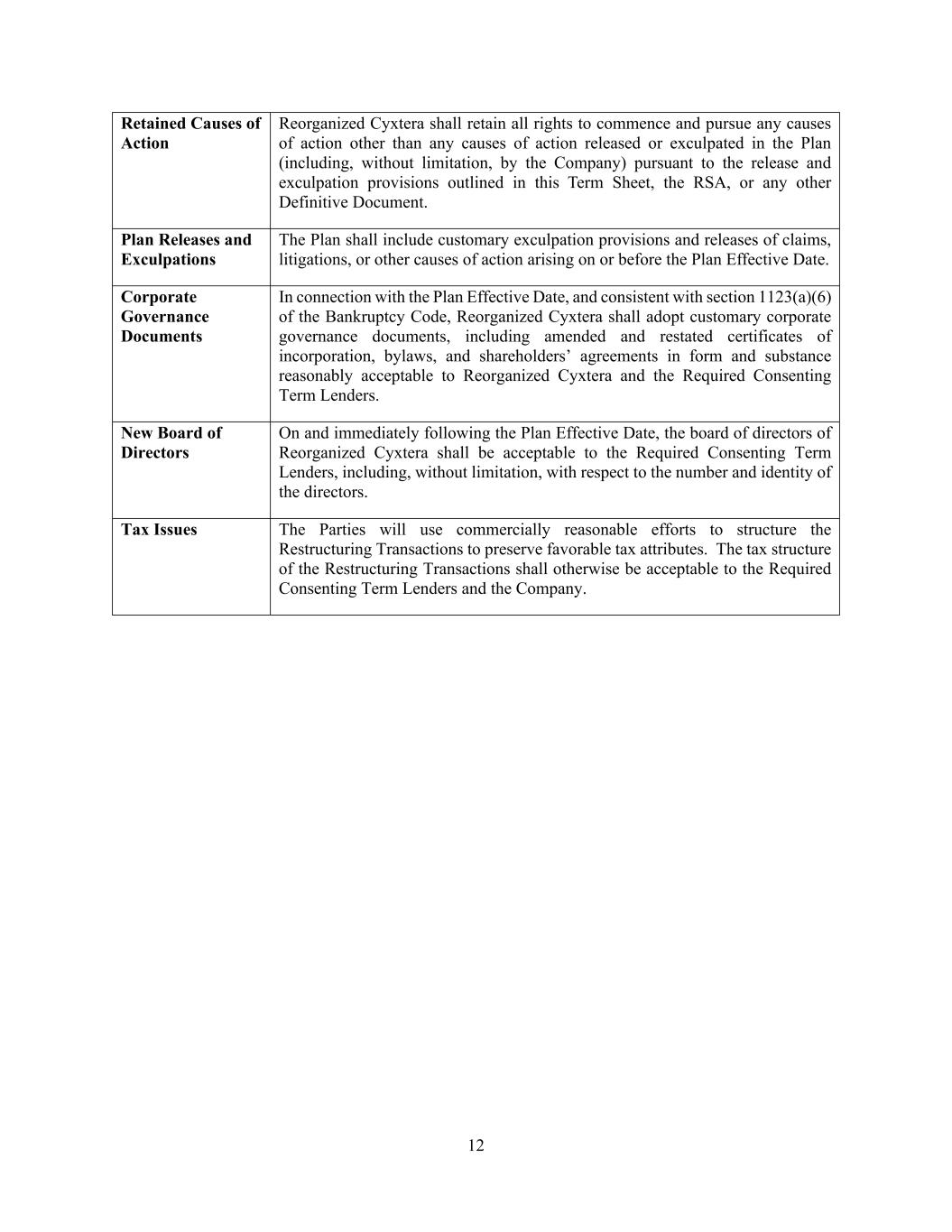

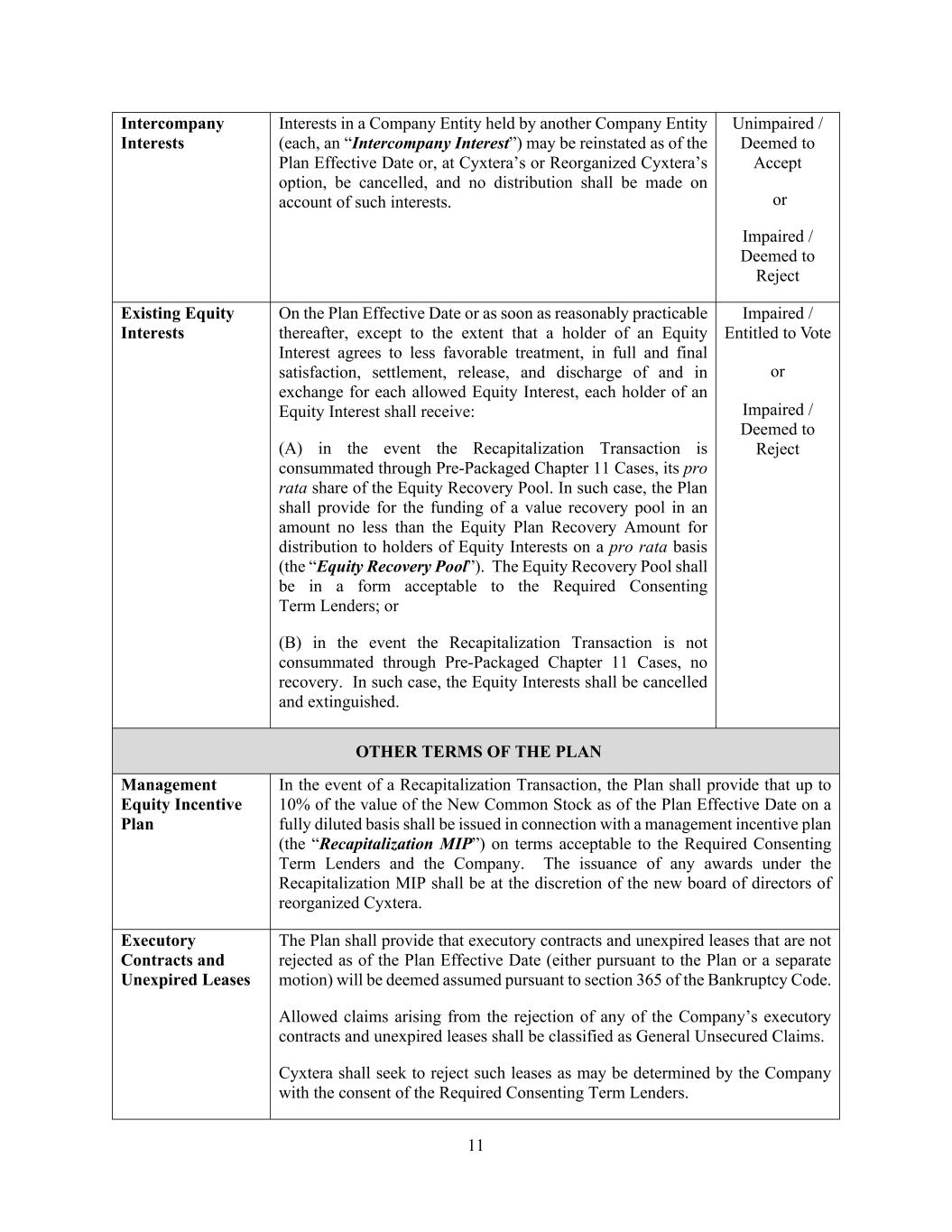

8 the DIP Lenders shall include (x) current payment in cash of default interest on account of such DIP Lenders’ Term Loan Claims and, as applicable, Bridge Facility Claims, and (y) payment of the DIP Lenders’ reasonable, documented professional fees incurred during the Chapter 11 Cases, among other adequate protection acceptable to the DIP Lenders, the Required Consenting Term Lenders, and the Company; and (iv) the Company shall use commercially reasonable efforts to obtain a rating for the DIP Facility from each of Xxxxx’x and S&P. Subject to a standard market check, unless otherwise consented to by the Required Consenting Term Lenders, the Bridge Facility shall, at the election of the Required Consenting Term Lenders, either be (i) refinanced by the DIP Facility or (ii) roll into the DIP Facility on a pari passu or senior basis upon entry of the final DIP Order. Any roll-up ratio shall be acceptable to the Required Consenting Term Lenders and the Company. Exit Financing On the Plan Effective Date, the reorganized Company (the “Reorganized Cyxtera”) shall enter into the following Exit Facilities: (i) a senior secured, first lien “first-out” term loan facility (the “First-Out Take-Back Debt Facility”), and (ii) a senior secured, first lien “second-out” term loan facility (the “Second-Out Take-Back Debt Facility” and, together with the First-Out Take-Back Debt Facility, the “Exit Facilities”). The terms, conditions, structure, and principal amount of the Exit Facilities shall be in form and substance acceptable to the Required Consenting Term Lenders and the Company. In any event, the aggregate quantum of the First-Out Take-Back Debt Facility and the Second-Out Take-Back Debt Facility shall not exceed 60 percent of Standalone Enterprise Value, unless otherwise agreed by the Required Consenting Term Lenders and the Company. CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS UNDER THE RECAPITALIZATION TRANSACTION Type of Claim Treatment Impairment / Voting Unclassified Non-Voting Claims DIP Claims On the Plan Effective Date, each holder of an allowed DIP Claim shall receive either (i) its pro rata share of the First-Out Take-Back Debt Facility or (ii) payment in full in cash. N/A Administrative Claims Each holder of an allowed administrative claim, including claims of the type described in section 503(b)(9) of the Bankruptcy Code to the extent such claim has not already been paid during the Chapter 11 Cases (each, an “Administrative Claim”), shall receive payment in full, in cash, of the unpaid portion of its allowed Administrative Claim on the Plan Effective Date or as soon as reasonably practicable thereafter (or, if payment is not then due, shall be paid in accordance with its terms) or pursuant to such other terms as N/A