STOCK PURCHASE AGREEMENT BETWEEN GUSHAN ENVIRONMENTAL ENERGY LIMITED, ENGEN INVESTMENTS LIMITED, GOLD HERO HOLDINGS LIMITED AND SILVER HARVEST HOLDINGS LIMITED, 39/F, Two International Finance Centre Central Hong Kong Tel: (852) 2509 7888 Fax: (852)...

Exhibit 4.8

BETWEEN

GUSHAN ENVIRONMENTAL ENERGY LIMITED,

XXXXX INVESTMENTS LIMITED,

GOLD HERO HOLDINGS LIMITED

AND

SILVER HARVEST HOLDINGS LIMITED,

39/F, Two International Finance Centre

0 Xxxxxxx Xxxxxx

Xxxxxxx

Xxxx Xxxx

Tel: (000) 0000 0000

Fax: (000) 0000 0000

Table of Contents

| Page | ||||

| 1. Definitions |

1 | |||

| 2. Purchase and Sale Agreements |

3 | |||

| 3. Earn-Out Arrangements |

4 | |||

| 4. Gold Hero’s and Silver Harvest’s Representations and Warranties Concerning Transaction |

6 | |||

| 5. Representations and Warranties Concerning Gushan Shares |

7 | |||

| 6. Representations and Warranties Concerning Engen Shares |

8 | |||

| 7. Pre-Closing Covenants |

9 | |||

| 8. Post-Closing Covenants |

9 | |||

| 9. Conditions to Xxxxxxxxxx xx Xxxxx |

00 | |||

| 00. Termination |

12 | |||

| 11. Restricted Securities |

12 | |||

| 12. Miscellaneous |

13 | |||

| Exhibit A - Form of Escrow Agreement |

22 | |||

| Exhibit B - Form of sale and purchase agreement |

23 | |||

STOCK PURCHASE AGREEMENT

(this “agreement”)

22 September 2010

PARTIES

GUSHAN ENVIRONMENTAL ENERGY LIMITED, a business company incorporated with limited liability under the laws of the Cayman Islands, with its registered office at Century Yard, Cricket Square, Xxxxxxxx Drive, X.X. Xxx 0000, Xxxxx Xxxxxx XX0-000, Xxxxxx Xxxxxxx (“Gushan”)

XXXXX INVESTMENTS LIMITED, a business company incorporated with limited liability under the laws of British Virgin Islands, with its registered office at X.X. Xxx 000, Xxxxxxxx Xxxxxxxxxxxxx Xxxxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx (“Engen”), and a wholly-owned subsidiary of Gushan

GOLD HERO HOLDINGS LIMITED

, a business company incorporated with limited liability under the laws of British Virgin Islands, with its registered office at X.X. Xxx 000, Xxxxxxxx Xxxxxxxxxxxxx Xxxxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx

(“Gold Hero”)

, a business company incorporated with limited liability under the laws of British Virgin Islands, with its registered office at X.X. Xxx 000, Xxxxxxxx Xxxxxxxxxxxxx Xxxxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx

(“Gold Hero”)

SILVER HARVEST HOLDINGS LIMITED

, a business company incorporated with limited liability under the laws of British Virgin Islands, with its registered office at X.X. Xxx 000, Xxxxxxxx Xxxxxxxxxxxxx Xxxxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx

(“Silver Harvest”), collectively, the foregoing companies are referred to as the “Parties”

, a business company incorporated with limited liability under the laws of British Virgin Islands, with its registered office at X.X. Xxx 000, Xxxxxxxx Xxxxxxxxxxxxx Xxxxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx

(“Silver Harvest”), collectively, the foregoing companies are referred to as the “Parties”

BACKGROUND

This agreement contemplates a transaction in which Gold Hero and Silver Harvest will purchase from Gushan, and Gushan will sell to each of Gold Hero and Silver Harvest, shares of Engen in return for cash.

Following the consummation of the transactions contemplated by this agreement, Gold Hero will own 18% and Silver Hero will own 15%, respectively, of the issued and outstanding share capital of Engen. Simultaneously, Gold Hero will subscribe from

Gushan, and Gushan will issue to Gold Hero 24,000,000 ordinary shares of Gushan, of which 6,000,000 ordinary shares will be delivered to Gold Hero at the Closing, and 18,000,000 ordinary shares will be placed in escrow subject to release according

to a three-year earn-out that is tied to the financial performance of Xxxx Xxxx Xxx Xxx Copper Company Limited

(“Xxx Xxx”), which will become an indirect subsidiary of Gushan following the consummation of the transactions contemplated in the sale and purchase agreement dated as of the date hereof (the

“PRC SPA”), between True Excel Holdings Limited,

(“Xxx Xxx”), which will become an indirect subsidiary of Gushan following the consummation of the transactions contemplated in the sale and purchase agreement dated as of the date hereof (the

“PRC SPA”), between True Excel Holdings Limited,

The Parties agree as follows.

| 1. | Definitions. |

“Aggregate Adjusted Net Income” means the lesser of (i) the Aggregate Net Income and (ii) the Aggregate Guaranteed Net Income.

“Aggregate Earn-Out” means an amount, whether positive or negative, as determined pursuant to the formula set forth in §3(a)(i) below.

“Aggregate Guaranteed Net Income” means RMB190,000,000.

| Stock Purchase Agreement | Page | 1 |

“Aggregate Max Earn-Out” means 18,000,000 Gushan Shares.

“Aggregate Net Income” means the sum of the net income of Xxx Xxx for the fiscal years ending 31 December 2010, 31 December 2011, and 31 December 2012, as set forth in the 2010 Earn-Out Statement and the 2011 & 2012 Earn-Out Statements.

“Auditor” means Gushan’s independent auditor as of the relevant date.

“Cash” means cash and cash equivalents (including marketable securities and short-term investments) calculated in accordance with United States GAAP applied on a consistent basis.

“Closing” has the meaning set forth in §2(c) below.

“Closing Date” has the meaning set forth in §2(c) below.

“Election Notice” means written notice from Gushan notifying the selling Holder that Gushan intends to exercise its Right of First Refusal as to some or all of the Engen Shares held by such Holder with respect to any Proposed Transfer.

“Engen Share” means any ordinary share of Engen.

“Escrow Agent” has the meaning set forth in §2(a) below

“Gushan Share” means any ordinary share, HK$0.00001 per share, of Gushan.

“Material Adverse Effect” or “Material Adverse Change” means any effect or change that would be materially adverse to the business of Gushan, taken as a whole, or to the ability of any Party to consummate timely the transactions contemplated by this agreement; provided that none of the following will be deemed to constitute, and none of the following will be taken into account in determining whether there has been, a Material Adverse Effect or Material Adverse Change: (a) any adverse change, event, development, or effect arising from or relating to (1) general business or economic conditions, including such conditions related to the business of Gushan, (2) national or international political or social conditions, including the engagement by the Peoples’ Republic of China in hostilities, whether pursuant to the declaration of a national emergency or war, or the occurrence of any military or terrorist attack upon either, or any of its territories, possessions, or diplomatic or consular offices or upon any military installation, equipment or personnel of either, (3) financial, banking, or securities markets (including any disruption thereof and any decline in the price of any security or any market index), (4) changes in generally accepted accounting principles, (5) changes in laws, rules, regulations, orders, or other binding directives issued by any governmental entity, or (6) the taking of any action contemplated by this agreement and the other agreements contemplated by this agreement, (b) any existing event, occurrence, or circumstance with respect to which either or both of Gold Hero and Silver Harvest has knowledge as of this date, and (c) any adverse change in or effect on the business of Gushan that is cured before the earlier of (1) the Closing Date and (2) the date on which this agreement is terminated pursuant to §10 hereof.

“Party” has the meaning set forth in the preface above.

“Person” means an individual, a partnership, a corporation, a limited liability company, an association, a joint stock company, a trust, a joint venture, an unincorporated organization, any other business entity or a governmental entity (or any department, agency, or political

| Stock Purchase Agreement | Page | 2 |

subdivision thereof).

“Proposed Transfer” means any assignment, sale, offer to sell, pledge, mortgage, hypothecation, encumbrance, disposition of or any other like transfer or encumbering of any Engen Shares purchased pursuant to this agreement (or any interest therein) proposed by any of Gold Hero or Silver Harvest.

“Prospective Transferee” means any person to whom either Gold Hero or Silver Harvest proposes to make a Proposed Transfer.

“Right of First Refusal” means the right, but not an obligation, of Gushan, or its permitted transferees or assigns, to purchase some or all of the Engen Shares purchased by each of Gold Hero and Silver Harvest under this agreement with respect to a Proposed Transfer, on the terms and conditions specified in the Transfer Notice.

“Transfer Notice” means written notice from a either Gold Hero or Silver Harvest setting forth the terms and conditions of a Proposed Transfer.

“Y1 Actual Net Income” means the net income of Xxx Xxx as set forth in the 2010 Earn-Out Statement (as defined below).

“Y1 Adjusted Net Income” means the lesser of (i) Y1 Actual Net Income and (ii) Y1 Guaranteed Net Income.

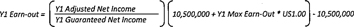

“X0 Xxxx-Xxx” means an amount, whether positive or negative, as determined pursuant to the formula set forth above.

“Y1 Guaranteed Net Income” means RMB30,000,000.

“Y1 Max Earn-Out” means 6,000,000 Gushan Shares.

“U.S. GAAP” means Generally Accepted Accounting Principles in the United States of America.

“2010 Statement” has the meaning set forth in §3(b)(i) below

“2011 & 2012 Statements” has the meaning set forth in §3(b)(ii) below.

| 2. | Purchase and Sale Agreements. |

| (a) | Basic Transaction. On the terms and subject to the conditions of this agreement, (1) each of Gold Hero and Silver Harvest agrees to purchase from Gushan, and Gushan agrees to sell to each of Gold Hero and Silver Harvest 1,800 and 1,500 Engen Shares, respectively, and (2) Gold Hero agrees to purchase from Gushan and Gushan agrees to allot and issue and sell to Gold Hero 24,000,000 Gushan Shares, in each case for the consideration specified below in this §2. Upon closing, Gushan shall (1) allot and issue 6,000,000 ordinary shares, credited as fully paid at par, to Gold Hero and deliver to Gold Hero share certificates representing 6,000,000 of such Gushan Shares and (2) allot and issue share 18,000,000 ordinary shares, credited as fully paid at par, to an escrow agent designated by Gushan (the “Escrow Agent”), and deliver to the Escrow Agent certificates representing 18,000,000 Gushan Shares (such shares, the aggregate “Earn-Out Consideration”), which shares shall be subject to certain contingent earn-out arrangements, as |

| Stock Purchase Agreement | Page | 3 |

| discussed in more detail below. |

| (b) | Purchase Price. (i) Gold Hero agree to pay Gushan at the Closing US$ 474,545 in consideration for the Engen Shares to be purchased by it, (ii) Silver Harvest agrees to pay to Gushan at the Closing US$395,455 in consideration for the Engen Shares to be purchased by it, and (iii) Gold Hero agrees to pay to Gushan US$1,764,000 at the Closing in consideration for 24,000,000 Gushan Shares, in each case by delivery of Cash payable by wire transfer or delivery of other immediately available funds to an account designated by Gushan. |

| (c) | Closing. The closing of the transactions contemplated by this agreement (the “Closing”) will take xxxxx xx 000, Xxxxx Merchants Tower, Shun Tak Centre, 000-000 Xxxxxxxxx Xxxx Xxxxxxx, Xxxxxx Xxx, Xxxx Xxxx, beginning at 9:00 a.m. local time on the second business day following the satisfaction or waiver of all conditions to the obligations of the Parties to consummate the transactions contemplated in this agreement (other than conditions with respect to actions the respective Parties will take at the Closing itself) or any other date the Parties mutually determine (the “Closing Date”); except that the Closing Date will be no later than 22 March 2011. |

| (d) | Deliveries at Closing. At the Closing, (i) the Parties shall deliver to each other the various instruments and documents referred to in §8(b) below, (ii) Gushan will allot and issue 6,000,000 ordinary shares credited as fully paid at par to Gold Hero and will deliver to Gold Hero share certificates representing 6,000,000 Gushan Shares, and enter Gold Hero in the register of members of Gushan in respect of such shares, (iii) Gushan will deliver duly executed instruments of transfer, in the names of Gold Hero and Silver Harvest in respect of 1,800 and 1,500 Engen Shares, (iv) Engen will deliver resolutions of the board of directors of Engen approving the foregoing transfers, and Engen will also deliver to each of Gold Hero and Silver Harvest share certificates representing 1,800 and 1,500 Engen Shares, respectively, (v) Gold Hero and Silver Harvest shall deliver to Gushan at the Closing US$474,545, and US$395,455, respectively, (v) Gushan will allot and issue 18,000,000 ordinary shares, credited as fully paid at par in the name of the Escrow Agent, to be held in escrow and deliver to the Escrow Agent share certificates representing such 18,000,000 Gushan Shares, and (vi) Gold Hero shall deliver to Gushan US$1,764,000. |

| 3. | Earn-Out Arrangements. |

| (a) | The Earn-Out Consideration payable to Gold Hero shall be determined as follows: |

| (i) | Upon such date as determined pursuant to the procedures set forth in §3(b) below, the Escrow Agent will release from escrow to Gold Hero a number of Gushan Shares equal to the quotient of the X0 Xxxx-Xxx divided by $1.00; provided, however, if the X0 Xxxx-Xxx is a negative number, Gold Hero shall either (i) return to Gushan that number of Gushan Shares equal to the absolute value of the quotient of the X0 Xxxx-Xxx divided by $1.00 or (ii) pay to Gushan an amount in Cash equal to the X0 Xxxx-Xxx. |

| (ii) | The X0 Xxxx-Xxx shall be determined in accordance with the following formula: |

| Stock Purchase Agreement | Page | 4 |

| (iii) | Upon such date as determined pursuant to the procedures set forth in §3(b) below, the Escrow Agent will release from escrow to Gold Hero a number of Gushan Shares equal to the quotient of the Aggregate Earn-Out divided by $1.00; provided, however, if the Aggregate Earn-Out is a negative number, Gold Hero shall either (i) return to Gushan that number of Gushan Shares equal to the absolute value of the quotient of the Aggregate Earn-Out divided by $1.00 or (ii) pay to Gushan an amount in Cash equal to the Aggregate Earn-Out. |

| (iv) | The Aggregate Earn-Out shall be determined as follows: |

| (b) | Earn-Out Statements and Procedures. |

| (i) | On or before 30 April 2011, Gushan shall provide each of Gold Hero and Silver Harvest with a copy of an audit memorandum of Xxx Xxx for the twelve months ended 31 December 2010 and a written statement setting forth the computation of the net income for such period, each as prepared by the Auditor in accordance with U.S. GAAP (such statements, collectively, the “2010 Statement”). |

| (ii) | On or before 30 April 2013, Gushan shall provide each of Gold Hero and Silver Harvest with a copy of an audit memorandum of Xxx Xxx for each of the twelve months ended 31 December 2011 and 31 December 2012 and a written statement setting forth the computation of the net income for such periods, each as prepared by the Auditor in accordance with U.S. GAAP (such statements, collectively, the “2011 & 2012 Statements” and each of the 2010 Statement and the 2011 & 2012 Statements, an “Earn-Out Statement”). |

| (iii) | Upon receipt of an Earn-Out Statement, Gold Hero will have thirty (30) days in which to examine the Earn-Out Consideration Statement and the information set forth therein (the “Earn-Out Examination Period”). During the Earn-Out Examination Period, Gold Hero’s experts must have reasonable access to the books, records (including financial statements), properties and personnel of Xxx Xxx and each subsidiary during regular business hours for purposes of verifying the accuracy and fairness of the presentation of such Earn-Out Statement and Gushan shall cause Xxx Xxx to reasonably cooperate with Gold Hero and its experts. The Auditors shall issue a Final Earn-Out Statement (as defined below) at the end of the Earn-Out Examination Period unless Gold Hero delivers a notice in writing to Gushan (an “Objection Notice”) on or before the end of the relevant Earn-Out Examination Period, indicating that Gold Hero disagrees with the Earn-Out Statement (which Objection Notice will set forth in reasonable detail the matters subject to dispute so that Gushan can determine from the face of the Objection Notice the substance of the objections). Gold Hero and Gushan shall then discuss and attempt to resolve through negotiation |

| Stock Purchase Agreement | Page | 5 |

| such disputed items (the “Disputed Items”) for a period not to exceed ten (10) days following receipt of an Objection Notice. Upon such resolution, if any, the Earn-Out Statement shall be amended accordingly and the Auditor shall issue a Final Earn-Out Statement. |

| (iv) | If Disputed Items remain at the conclusion of such ten (10) day period, then the Disputed Items must be submitted by the Parties to the Auditor to be reviewed as promptly as reasonably practicable and, upon completion of such review, the Auditor shall deliver a written notice to Gold Hero and Gushan setting forth the its resolution of each Disputed Item (which resolution will be determined in accordance with the relevant terms of this §3(b), as applicable) and the amount of Aggregate Earn-Out Consideration that Gushan is required to pay to Gold Hero and the Auditor shall amend the Earn-Out Statement accordingly and issue a Final Earn-Out Statement. Gold Hero, on the one hand, and Gushan, on the other hand, each shall pay their own fees and expenses incurred in connection with any such review and 50% of the fees and expenses of the Auditor. |

| (v) | The “Final Earn-Out Statement” will be based on the Earn-Out Statement as amended in accordance with this section and issued by the Auditors and will be final, conclusive and binding on the Parties. |

| (vi) | If payment by Gushan of Earn-Out Consideration pursuant to the Earn-Out Statement for the relevant period is required following the issuance of a Final Earn-Out Statement, Gushan will, (a) within five (5) business days of the date of such Final Earn-Out Statement, deliver to the Escrow Agent a securities disbursement instruction indicating the number of Gushan Shares which will be released from escrow and delivered to Gold Hero, as determined pursuant to §3(a), together with the relevant instrument of transfer; and (b) will, at the reasonable cost of Gold Hero, register such shares in the name of Gold Hero or its nominee. |

| (vii) | Any Gushan Shares held by the Escrow Agent upon the earlier of (i) the date immediately following the payment of the Aggregate Earn-Out Amount and (ii) 22 September 2013, will be automatically cancelled. |

| 4. | Gold Hero’s and Silver Harvest’s Representations and Warranties Concerning Transaction. |

| (a) | Each of Gold Hero and Silver Harvest jointly and severally represents and warrants to Engen and Gushan that the statements contained in this §4(a) are correct and complete as of the date of this agreement and will be correct and complete as of the Closing Date (as though made then and as though the Closing Date were substituted for the date of this agreement throughout this §4(a)). |

| (i) | Organization of Gold Hero and Silver Harvest. Each of Gold Hero and Silver Harvest is a corporation duly organized, validly existing, and in good standing under the laws of the British Virgin Islands. |

| Stock Purchase Agreement | Page | 6 |

| (ii) | Authorization of Transaction. Each of Gold Hero and Silver Harvest has full power and authority (including full corporate or other entity power and authority) to execute and deliver this agreement and to perform its respective obligations hereunder. This Agreement constitutes the valid and legally binding obligation of each of Gold Hero and Silver Harvest, enforceable in accordance with its terms and conditions. Neither Gold Hero nor Silver Harvest need give any notice to, make any filing with, or obtain any authorization, consent, or approval of any government or governmental agency in order to consummate the transactions contemplated by this agreement. The execution, delivery, and performance of this agreement and all other agreements contemplated by this agreement have been duly authorized by each of Gold Hero and Silver Harvest. |

| (iii) | Non-contravention. Neither the execution and delivery of this agreement, nor the consummation of the transactions contemplated by this agreement, will (A) violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any government, governmental agency, or court of the People’s Republic of China or to which either of Gold Hero or Silver Harvest is subject or any provision of their respective governing documents or (B) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify, or cancel, or require any notice under any agreement, contract, lease, license, instrument, or other arrangement to which either of Gold Hero or Silver Harvest is a party or by which either is bound or to which any of their respective assets are subject. |

| (iv) | Regulation S. Neither Gold Hero nor Silver Harvest are U.S. persons; Gold Hero and Silver Harvest are each purchasing shares of Engen in offshore transactions; Gold Hero is purchasing Gushan Shares in an offshore transaction, as such terms are defined in Regulation S (“Regulation S”) under the Securities Act of 1934, as amended (the “Securities Act”). Neither Gold Hero nor Silver Harvest nor any persons acting on their behalf have engaged or will engage in any directed selling efforts (within the meaning of Regulation S) with respect to the Securities, and each of Gold Hero and Silver Harvest Purchaser and its affiliates have complied and will comply with the offering restrictions requirement of Regulation S; |

| 5. | Representations and Warranties Concerning Gushan Shares. |

Gushan represents and warrants to Gold Hero that the statements contained in this §5 are correct and complete as of the date of this agreement and will be correct and complete as of the Closing Date (as though made then and as though the Closing Date were substituted for the date of this agreement throughout this §5).

| (a) | Organisation, Qualification, and Corporate Power. Gushan is a corporation duly organized, validly existing, and in good standing under the laws of the Cayman Islands. Gushan is authorized to conduct business and is in good standing under the laws of each jurisdiction where such qualification is required, except where the lack of such qualification would not have a Material Adverse Effect. Gushan has full corporate power and authority to carry on the business in which it is engaged and to own and use the properties owned and used by it. |

| Stock Purchase Agreement | Page | 7 |

| (b) | Capitalization. The entire authorized share capital of Gushan consists of 38,000,000,000 Gushan Shares, of which 166,831,943 Gushan Shares are issued and outstanding. All issued and outstanding Gushan Shares have been duly authorized, are validly issued, fully paid, and non-assessable. Except as publicly disclosed, there are no outstanding or authorized options, warrants, purchase rights, subscription rights, conversion rights, exchange rights, or other contracts or commitments that could require Gushan to issue, sell, or otherwise cause to become outstanding any of its authorized but unissued share capital. Except as publicly disclosed, there are no outstanding or authorized stock appreciation, phantom stock, profit participation, or similar rights with respect to Gushan. |

| (c) | Non-contravention. To the knowledge of Gushan, neither the execution and delivery of this agreement, nor the consummation of the transactions contemplated by this agreement, will violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any government, governmental agency, or court to which Gushan is subject or any provision of the charter or bylaws of Gushan, except where the violation would not have a Material Adverse Effect. Except as otherwise disclosed herein, to the knowledge of Gushan and except as provided herein, Gushan does not need to give any notice to, make any filing with, or obtain any authorization, consent, or approval of any government or governmental agency in order for the Parties to consummate the transactions contemplated by this agreement, except where the failure to give notice, to file, or to obtain any authorization, consent, or approval would not have a Material Adverse Effect. |

| 6. | Representations and Warranties Concerning Engen Shares |

Engen represents and warrants to Gold Hero and Silver Harbor that the statements contained in this §6 are correct and complete as of the date of this agreement and will be correct and complete as of the Closing Date (as though made then and as though the Closing Date were substituted for the date of this agreement throughout this §6).

| (a) | Organisation, Qualification, and Corporate Power. Engen is a corporation duly organised, validly existing, and in good standing under the laws of the British Virgin Islands. Engen is authorized to conduct business and is in good standing under the laws of each jurisdiction where such qualification is required, except where the lack of such qualification would not have a Material Adverse Effect. Engen has full corporate power and authority to carry on the business in which it is engaged and to own and use the properties owned and used by it. |

| (b) | Capitalization. The entire authorized share capital of Engen consists of 50,000 Engen Shares, of which 10,000 Engen Shares are issued and outstanding. All issued and outstanding Engen Shares have been duly authorized, are validly issued, fully paid, and non-assessable. There are no outstanding or authorized options, warrants, purchase rights, subscription rights, conversion rights, exchange rights, or other contracts or commitments that could require Engen to issue, sell, or otherwise cause to become outstanding any of its authorised but unissued share capital. There are no outstanding or authorized stock appreciation, phantom stock, profit participation, or similar rights with respect to Engen. |

| (c) | Non-contravention. To the knowledge of Engen, neither the execution and delivery of this agreement, nor the consummation of the transactions contemplated by this |

| Stock Purchase Agreement | Page | 8 |

| agreement, will violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any government, governmental agency, or court to which Engen is subject or any provision of the charter or bylaws of Engen, except where the violation would not have a Material Adverse Effect. To the knowledge of Engen, Engen does not need to give any notice to, make any filing with, or obtain any authorisation, consent, or approval of any government or governmental agency in order for the Parties to consummate the transactions contemplated by this agreement, except where the failure to give notice, to file, or to obtain any authorisation, consent, or approval would not have a Material Adverse Effect. |

| 7. | Pre-Closing Covenants. |

The Parties agree as follows with respect to the period between the execution of this agreement and the Closing.

| (a) | General. Each of the Parties will use its reasonable best efforts to take all actions and to do all things necessary to consummate and make effective the transactions contemplated by this agreement (including satisfaction, but not waiver, of the Closing conditions set forth in §8(b) below). |

| (b) | Notices and Consents. Each of Gushan and Engen shall give any notices to third parties, and shall use their respective reasonable best efforts to obtain any third party consents that either of Gold Hero or Silver Harvest may reasonably request in connection with the matters referred to in §5(c) above. Each of the Parties will give any notices to, make any filings with, and use its reasonable best efforts to obtain any authorizations, consents, and approvals of governments and governmental agencies in connection with the matters referred to in §4(a)(i), §5(c), and §6(c) above. |

| (c) | PRC Transaction. All conditions precedent to the consummation of the transaction contemplated in the PRC SPA have been satisfied, including, without limitation, any relevant filings, notices, authorizations, consents, and approvals of governments and governmental agencies. |

| 8. | Post-Closing Covenants. |

| (a) | In case at any time after the Closing any further action is necessary or desirable to carry out the purposes of this agreement, each of the Parties will take any further action (including the execution and delivery of such further instruments and documents) any other Party reasonably may request, all at the sole cost and expense of the requesting Party. |

| (b) | Right of First Refusal. |

| (i) | Grant. Subject to the terms of §11 below, each of Gold Hero and Silver Harvest (each, a “Holder”) hereby unconditionally and irrevocably grants to the Gushan a Right of First Refusal to purchase all or any portion of the Engen Shares that such Holder may propose to transfer in a Proposed Transfer, at or below the price as offered to the Prospective Transferee and on the same terms and conditions as those offered to the Prospective Transferee. |

| Stock Purchase Agreement | Page | 9 |

| (ii) | Notice. Each Holder proposing to make a Proposed Transfer must deliver a Transfer Notice to Gushan not later than forty-five (45) days prior to the consummation of such Proposed Transfer. Such Transfer Notice shall contain the material terms and conditions (including price and form of consideration) of the Proposed Transfer and the identity of the Prospective Transferee. To exercise its Right of First Refusal under this §8(b), Gushan must deliver an Election Notice to the selling Key Holder within fifteen (15) days after delivery of the Transfer Notice. |

| (iii) | Consideration; Closing. The closing of the purchase of Engen Shares by Gushan pursuant to this §8(b) shall take place, and all payments from Gushan shall have been delivered to the selling Holder, by the later of (i) the date specified in the Transfer Notice as the intended date of the Proposed Transfer and (ii) ninety (90) days after delivery of the Transfer Notice. |

| (iv) | Transfer Void: Equitable Relief. Any Proposed Transfer not made in compliance with the requirements of this §8(b) shall be null and void ab initio, shall not be recorded by the register of members of Engen and shall not be recognized by Engen. Each Holder hereto acknowledges and agrees that any breach of this §8(b) would result in substantial harm to Gushan and Engen for which monetary damages alone could not adequately compensate. Therefore, the Holders hereto unconditionally and irrevocably agree that any non-breaching party hereto shall be entitled to seek protective orders, injunctive relief and other remedies available at law or in equity (including, without limitation, seeking specific performance or the rescission of purchases, sales and other transfers of Engen Shares not made in strict compliance with this Agreement). |

| 9. | Conditions to Obligation to Close. |

| (a) | Conditions to Gold Hero’s and Silver Harvest’s Obligation. Gold Hero’s and Silver Harvest’s obligation to consummate the transactions to be performed respectively by them in connection with the Closing is subject to satisfaction of the following conditions: |

| (i) | The representations and warranties set forth in §5 and §6 above must be true and correct in all material respects at and as of the Closing Date, except to the extent that such representations and warranties are qualified by the term “material,” or contain terms such as “Material Adverse Effect” or “Material Adverse Change,” in which case such representations and warranties (as so written, including the term “material” or “Material”) must be true and correct in all respects at and as of the Closing Date; |

| (ii) | Each of Gushan and Engen must have performed and complied with all their respective covenants hereunder in all material respects through the Closing, except to the extent that such covenants are qualified by the term “material,” or contain terms such as “Material Adverse Effect” or “Material Adverse Change,” in which case the responsible Party must have performed and complied with all of such covenants (as so written, including the term “material” or “Material”) in all respects through the Closing; and |

| (iii) | The relevant Parties must have entered into side agreements in form and |

| Stock Purchase Agreement | Page | 10 |

| substance as set forth in Exhibits A through B attached hereto and the same must be in full force and effect. |

Either of Gold Hero or Silver Harvest may waive any condition specified in this §9(a) if it executes a writing so stating at or before the Closing.

| (b) | Conditions to Gushan’s Obligation. Gushan’s obligation to consummate the transactions to be performed it in connection with the Closing is subject to satisfaction of the following conditions: |

| (i) | The representations and warranties set forth in §4(a) above must be true and correct in all material respects at and as of the Closing Date, except to the extent that such representations and warranties are qualified by the term “material,” or contain terms such as “Material Adverse Effect” or “Material Adverse Change,” in which case such representations and warranties (as so written, including the term “material” or “Material”) must be true and correct in all respects at and as of the Closing Date; |

| (ii) | Each of Gold Hero and Silver Harvest must have performed and complied with all their respective covenants hereunder in all material respects through the Closing, except to the extent that such covenants are qualified by the term “material,” or contain the terms such as “Material Adverse Effect,” or “Material Adverse Change,” in which case each of Gold Hero and Silver Harvest must have performed and complied with all of such covenants (as so written, including the term “material” or “Material”) in all respects through the Closing; |

| (iii) | There may not be any injunction, judgment, order, decree, ruling, or charge in effect preventing consummation of any of the transactions contemplated by this agreement; |

| (iv) | All actions to be taken by each of Gold Hero and Silver Harvest in connection with consummation of the transactions contemplated by this agreement and all certificates, opinions, instruments, and other documents required to effect the transactions contemplated by this agreement will be reasonably satisfactory in form and substance to Gushan and Engen; and |

| (v) | The relevant Parties must have entered into side agreements in form and substance as set forth in Exhibits A through B attached hereto and the same must be in full force and effect; |

| (vi) | A Capital Verification Report

must have been issued by a registered accounting firm in the PRC in respect of the acquisition of 100% of the equity of Xxx Xxx by True Excel Holdings Limited from Xxxx Xxxx

must have been issued by a registered accounting firm in the PRC in respect of the acquisition of 100% of the equity of Xxx Xxx by True Excel Holdings Limited from Xxxx Xxxx

and Xxx Xxxxxx

and Xxx Xxxxxx

and the increase in registered capital of Xxx Xxx from RMB10 million to RMB40 million.

and the increase in registered capital of Xxx Xxx from RMB10 million to RMB40 million. |

Either of Gushan or Engen may waive any condition specified in this §9(b) if it executes a writing so stating at or before the Closing.

| Stock Purchase Agreement | Page | 11 |

| 10. | Termination. |

| (a) | Termination of Agreement. The Parties may terminate this agreement as provided below: |

| (i) | The Parties may terminate this agreement by mutual written consent any time before the Closing; |

| (ii) | Any Party may terminate this agreement by giving written notice to any other Party any time before the Closing (A) if a Party has breached any representation, warranty, or covenant contained in this agreement (other than the representations and warranties in §5 above) in any material respect, the terminating Party has notified the breaching Party of the breach, and the breach has continued without cure for a period of 30 days after the notice of breach or (B) if the Closing has not have occurred on or before 22 March 2012, by reason of the failure of any condition precedent under §9(b) hereof (unless the failure results primarily from Gold Hero or Engen itself breaching any representation, warranty, or covenant contained in this agreement). |

| (b) | Effect of Termination. If any Party terminates this agreement pursuant to §10 (a) above, all rights and obligations of the Parties hereunder will terminate without any liability of any Party to any other Party (except for any liability of any Party then in breach). |

| 11. | Restricted Securities. |

| (a) | Gold Hero understands that the Gushan Shares to be allotted and issued to it and/or the Escrow Agent pursuant to this Agreement have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of Gold Hero’s representations as expressed herein. Gold Hero understands that such Gushan Shares purchased pursuant to this agreement are “restricted securities” under applicable United States federal and state securities laws and that, pursuant to these laws, Gold Hero must hold such Gushan Shares indefinitely unless they are registered with the SEC and qualified by state authorities, or an exemption from such registration and qualification requirements is available. Gold Hero acknowledges that Gushan has no obligation to register or qualify such Gushan Shares for resale. Gold Hero further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for such Gushan Shares, and on requirements relating to Gushan which are outside of Gushan’s control, and which Gushan is under no obligation and may not be able to satisfy. |

| (b) | Each of Gold Hero and Silver Harvest understands that the Engen Shares purchased pursuant to this agreement have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the representations of each of Gold Hero and Silver Harvest as expressed herein. Each of Gold Hero and Silver Harvest understands that such Engen Shares are “restricted securities” under |

| Stock Purchase Agreement | Page | 12 |

| applicable United States federal and state securities laws and that, pursuant to these laws, each of Gold Hero and Silver Harvest must hold such Engen Shares indefinitely unless they are registered with the SEC and qualified by state authorities, or an exemption from such registration and qualification requirements is available. Each of Gold Hero and Silver Harvest acknowledges that Engen has no obligation to register or qualify such Engen Shares for resale. Each of Gold Hero and Silver Harvest further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for such Engen Shares, and on requirements relating to Engen which are outside of Xxxxx’x control, and which Engen is under no obligation and may not be able to satisfy. |

| (c) | Gold Hero understands that the Gushan Shares purchased pursuant to this agreement will bear the following legend: |

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS AND, ACCORDINGLY, MAY NOT BE OFFERED, SOLD, TRANSFERRED, ASSIGNED, PLEDGED, HYPOTHECATED OR OTHERWISE DISPOSED OF EXCEPT (A) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT AND, TO THE EXTENT REQUIRED, ANY APPLICABLE STATE SECURITIES LAWS OR (B) UPON DELIVERY OF AN OPINION OF COUNSEL REASONABLY ACCEPTABLE TO THE ISSUER THAT AN EXEMPTION FROM REGISTRATION UNDER THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS IS AVAILABLE.”

| (d) | Each of Gold Hero and Silver Harvest understands that the Engen Shares purchased pursuant to this agreement will bear the following legend: |

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS AND, ACCORDINGLY, MAY NOT BE OFFERED, SOLD, TRANSFERRED, ASSIGNED, PLEDGED, HYPOTHECATED OR OTHERWISE DISPOSED OF EXCEPT (A) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT AND, TO THE EXTENT REQUIRED, ANY APPLICABLE STATE SECURITIES LAWS OR (B) UPON DELIVERY OF AN OPINION OF COUNSEL REASONABLY ACCEPTABLE TO THE ISSUER THAN AN EXEMPTION FROM REGISTRATION UNDER THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS IS AVAILABLE.”

| 12. | Miscellaneous. |

| (a) | Press Releases and Public Announcements. Except as provided herein, no Party may issue any press release or make any public announcement relating to the subject matter of this agreement before the Closing without the prior written approval of the other Parties; except that any Party may make any public disclosure it believes in good faith is required by applicable law, rules, regulations, rules of any self-regulating organisation or any listing or trading agreement concerning its publicly traded securities (in which case the disclosing Party will use its reasonable best efforts to advise the other Party before making the disclosure). Gushan issue a press release announcing the execution and delivery of this Agreement, the PRC SPA, and each of the exhibits hereto, summarizing the transactions contemplated thereby and file a Current Report on Form 6-K attaching such press release. As soon as practicable after either the Termination of this Agreement or the Closing, as |

| Stock Purchase Agreement | Page | 13 |

| applicable, Gushan shall issue a press release announcing such Termination or Closing. |

| (b) | No Third-Party Beneficiaries. This agreement does not confer any rights or remedies upon any Person other than the Parties and their respective successors and permitted assigns. |

| (c) | Entire Agreement. This agreement (including the documents referred to in this agreement) constitutes the entire agreement between the Parties and supersedes any prior understandings, agreements, or representations by or between the Parties, written or oral, to the extent they relate in any way to the subject matter hereof. |

| (d) | Succession and Assignment. This agreement binds and inures to the benefit of the Parties named in this agreement and their respective successors and permitted assigns. No Party may assign either this agreement or any of his, her, or its rights, interests, or obligations hereunder without the prior written approval of the other Parties. |

| (e) | Counterparts. This agreement may be executed in one or more counterparts (including by means of facsimile), each of which is deemed an original but all of which together constitute the same instrument. |

| (f) | Headings. The section headings contained in this agreement are inserted for convenience only and do not affect in any way the meaning or interpretation of this agreement. |

| (g) | Notices. All notices, requests, demands, claims, and other communications hereunder must be in writing. Any notice, request, demand, claim, or other communication hereunder will be deemed duly given (i) when delivered personally to the recipient, (ii) 1 business day after being sent to the recipient by reputable overnight courier service (charges prepaid), (iii) 1 business day after being sent to the recipient by facsimile transmission or electronic mail, or (iv) 4 business days after being mailed to the recipient by certified or registered mail, return receipt requested and postage prepaid, and addressed to the intended recipient as set forth below: |

| If to Gushan: | Chief Financial Officer | Copy to: | Xxxxx Xxxxxxxx | |||

| Gushan Environmental Energy Ltd. | Sidley Austin | |||||

| Century Yard, | 39/f, | |||||

| Cricket Square, | Two International | |||||

| Xxxxxxxx Drive, | Finance Centre, | |||||

| P.O. Box 2681GT, | 8 Finance Street, | |||||

| Xxxxxx Town, Grand Cayman, | Central, Hong Kong | |||||

| British West Indies, Cayman islands | ||||||

| If to Gold Hero: | Gold Hero Holdings Ltd. | |||||

c/o: Xxxx Xxxxxx

|

||||||

| P.O. Box 957, | ||||||

| Offshore Incorporation Centre, | ||||||

| Tortola, | ||||||

| British Virgin Islands | ||||||

| Stock Purchase Agreement | Page | 14 |

| If to Silver Harvest | Silver Harvest Holdings Ltd | |

|

c/o: Xxx Xxx

P.O. Box 957, Offshore Incorporation Centre, Tortola, British Virgin Islands | ||

Any Party may change the address to which notices, requests, demands, claims, and other communications hereunder are to be delivered by giving the other Party notice in the manner herein set forth.

| (h) | Governing Low. This Agreement is governed by and construed in accordance with the laws of the British Virgin Islands without giving effect to any choice or conflict of law provision or rule that would cause the application of the laws of any jurisdiction other than the British Virgin Islands. |

| (i) | Amendments and Waivers. No amendment of any provision of this agreement will be valid unless in writing and signed by all Parties. No waiver by any Party of any provision of this agreement or any default, misrepresentation, or breach of warranty or covenant hereunder, whether intentional or not, will be valid unless in writing and signed by the Party making such waiver, nor will any such waiver be deemed to extend to any prior or subsequent default, misrepresentation, or breach of warranty or covenant hereunder or affect in any way any rights arising by virtue of any prior or subsequent such occurrence. |

| (j) | Severability. Any term or provision of this agreement that is invalid or unenforceable in any situation in any jurisdiction does not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. |

| (k) | Survival. Those covenants and agreements set forth in this Agreement that, by their terms, are to have effect after the Closing shall survive for the period contemplated by such covenants and agreements. |

| (I) | Expenses. Each Party will bear each of its own costs and expenses (including legal fees and expenses) incurred in connection with this agreement and the transactions contemplated by this agreement. Without limiting the generality of the foregoing, all transfer, documentary, sales, use, stamp, registration and other such taxes, and all conveyance fees, recording charges and other fees and charges (including any penalties and interest) incurred in connection with the consummation of the transactions contemplated by this agreement must be paid by Gold Hero and Silver Harvest when due, and each of Gold Hero and Silver Harvest shall, at its own expense, file ail necessary tax returns and other documentation with respect to all such taxes, fees and charges, and, if required by applicable law, the Parties will, and will cause their Affiliates to, join in the execution of any such tax returns and other documentation. |

| (m) | Construction. The Parties have participated jointly in negotiating and drafting this agreement. If an ambiguity or question of intent or interpretation arises, this agreement will be construed as if drafted jointly by the Parties and no presumption |

| Stock Purchase Agreement | Page | 15 |

| or burden of proof will arise favoring or disfavoring any Party by virtue of the authorship of any of the provisions of this agreement. Any reference to any federal, state, local, or foreign statute or law will be deemed also to refer to all rules and regulations promulgated thereunder, unless the context requires otherwise. The word “including” means including without limitation. |

| (n) | Incorporation of Exhibits. The Exhibits identified in this agreement are incorporated in this agreement by reference and made a part hereof. |

| (o) | Governing Language. This agreement has been negotiated and executed by the Parties in English. If any translation of this agreement is prepared for convenience or any other purpose, the provisions of the English version prevail. |

| (p) | Dispute Resolution. |

| (i) | The Parties shall resolve their disputes informally to the maximum extent possible. The parties shall negotiate all matters of joint concern in good faith, with the intention of resolving issues between them in a mutually satisfactory manner. Only disputes within the scope of this agreement are subject to this §12(p)(i). However, nothing in this §12(p)(i) precludes the parties from exercising their arbitration rights pursuant to §12(p)(iii) following the period specified in §12(p)(ii). Each Party will bear its own attorney’s fees and costs in connection with the internal dispute resolution process; except, to the extent the parties otherwise agree in writing to incur certain costs to support the internal dispute resolution process, such costs will be shared equally by the parties. No statements made in connection with internal dispute resolution efforts will be considered admissions or statements against interest by either party. The parties will not attempt to introduce such statements at any later trial, arbitration, or mediation between the parties. |

| (ii) | If a dispute, controversy, or claim arises out of or in relation to this agreement, then within seven Business Days after a written request by either party, duly authorized representatives will promptly confer to resolve the dispute. If these representatives cannot resolve the dispute or either of them determines they are not making progress toward the resolution of the dispute within 30 Business Days after their initial conference, then the dispute will be settled by arbitration in accordance with the UNCITRAL Arbitration Rules in force at the date of commencement of the arbitration. |

| (iii) | In any arbitration pursuant to this §12(p)(iii).0: |

| (A) | the place of arbitration will be Hong Kong; |

| (B) | the languages to be used in the arbitral proceedings will be English and Putonghua; |

| (C) | the appointing authority will be the Hong Kong International Arbitration Centre; |

| (D) | three arbitrators will be appointed, one each by the claimant and the respondent, and one (the “presiding arbitrator”) by the appointing |

| Stock Purchase Agreement | Page | 16 |

| authority; where there are multiple parties (whether as claimant and/or as respondent), the multiple claimants (jointly) shall appoint one arbitrator and/or the multiple respondents (jointly), shall appoint one arbitrator. |

| (iv) | When three arbitrators have been appointed in any arbitration, the award will be given by a majority decision. If there is no majority, the award will be made by the presiding arbitrator of the arbitral tribunal alone. |

| (v) | Any award given by an arbitral tribunal will be final and binding. By agreeing to arbitration, the parties waive irrevocably their right to any form of appeal, review or recourse to any state court or other judicial authority, insofar as such waiver may validly be made and insofar as any award in such arbitration may not be refused enforcement under the provisions of the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards. |

| (vi) | The parties hereby agree that their choice of the UNCITRAL Arbitration Rules is made pursuant to Article 19 of the UNCITRAL Model Law on International Commercial Arbitration. In addition to the UNCITRAL Arbitration Rules, the parties agree that the arbitration will be conducted according to the International Bar Association Rules of Evidence. |

*****

| Stock Purchase Agreement | Page | 17 |

IN WITNESS WHEREOF, the Parties are executing this Stock Purchase Agreement in multiple counterparts as of the date first above written.

| GUSHAN ENVIRONMENTAL ENERGY LIMITED | ||

| By: | /s/ XXXXX Xxx Sun Xxxxxx | |

| Name: | XXXXX Xxx Sun Xxxxxx | |

| Title: | President | |

Stock Purchase Agreement

| XXXXX INVESTMENTS LIMITED | ||

| By: | /s/ Xxxxx Xxx Sun Xxxxxx | |

| Name: | Xxxxx Xxx Sun Xxxxxx | |

| Title: | Sole Director | |

Stock Purchase Agreement

| GOLD HERO HOLDINGS LIMITED | ||

| By: | /s/ XXXX Xxxxxx | |

| Name: |

XXXX Xxxxxx

| |

| Title: | Sole Director | |

SILVER HARVEST HOLDINGS LIMITED

| ||

| By: | /s/ XXX Xxx | |

| Name: |

XXX Xxx

| |

| Title: | Sole Director | |

Stock Purchase Agreement

Exhibit A

Form of

Escrow Agreement between the Escrow Agent, and Gushan Environmental Energy Limited

Stock Purchase Agreement

Exhibit B

Form of

sale and purchase agreement to be entered into between True Excel Holdings Limited as the

purchaser and

as the vendors for the purchase of 100% interest in the share

as the vendors for the purchase of 100% interest in the share

capital of and increase in the share capital to RMB40,000,000 in Xxxx Xxxx Xxx Xxx Copper

Company Limited

Stock Purchase Agreement