2282 & 2300 DEFOOR HILLS ROAD PURCHASE AND SALE AGREEMENT BETWEEN SWH WYATT DEFOOR HILLS LLC, a Georgia limited liability company, and SWH WYATT 2282 DEFOOR HILLS LLC, a Georgia limited liability company collectively, AS SELLER AND THRE GLOBAL...

Exhibit 10.2

2282 & 2300 XXXXXX HILLS ROAD

BETWEEN

SWH XXXXX XXXXXX HILLS LLC,

a Georgia limited liability company,

and

SWH XXXXX 2282 XXXXXX HILLS LLC,

a Georgia limited liability company

collectively, AS SELLER

AND

THRE GLOBAL INVESTMENTS LLC,

a Delaware limited liability company,

AS PURCHASER

As of May 15, 2018

Page#

|

ARTICLE 1: PURCHASE AND SALE |

1 |

|

|

|

1.1 |

Agreement of Purchase and Sale1 |

|

|

|

1.2 |

Property Defined3 |

|

|

|

1.3 |

Permitted Exceptions3 |

|

|

|

1.4 |

Purchase Price3 |

|

|

|

1.5 |

Payment of Purchase Price3 |

|

|

|

1.6 |

Xxxxxxx Money3 |

|

|

|

1.7 |

Independent Consideration3 |

|

|

ARTICLE 2: TITLE AND SURVEY |

4 |

|

|

|

2.1 |

Title Examination; Commitment for Title Insurance4 |

|

|

|

2.2 |

Survey4 |

|

|

|

2.3 |

Title Objections; Cure of Title Objections4 |

|

|

|

2.4 |

Conveyance of Title5 |

|

|

|

2.5 |

Pre-Closing “Gap” Title Defects6 |

|

|

ARTICLE 3: INSPECTION PERIOD |

6 |

|

|

|

3.1 |

Right of Inspection6 |

|

|

|

3.2 |

Right of Termination8 |

|

|

|

3.3 |

Operating Agreements, Brokerage Agreements and Property Management Agreement.8 |

|

|

ARTICLE 4: CLOSING |

8 |

|

|

|

4.1 |

Time and Place8 |

|

|

|

4.2 |

Seller’s Obligations at Closing8 |

|

|

|

4.3 |

Purchaser’s Obligations at Closing10 |

|

|

|

4.4 |

Credits and Prorations11 |

|

|

|

4.5 |

Closing Costs13 |

|

|

|

4.7 |

Conditions Precedent to Obligation of Seller15 |

|

|

|

4.8 |

Post-Closing Escrow15 |

|

|

ARTICLE 5: REPRESENTATIONS, WARRANTIES AND COVENANTS |

15 |

|

|

|

5.1 |

Representations and Warranties of Seller15 |

|

|

|

5.2 |

Knowledge Defined18 |

|

|

|

5.3 |

Survival of Seller’s Representations and Warranties18 |

|

|

|

5.4 |

Covenants of Seller19 |

|

|

|

5.6 |

Survival of Purchaser’s Representations and Warranties20 |

|

|

|

5.7 |

Covenants of Purchaser20 |

|

|

ARTICLE 6: DEFAULT |

21 |

|

|

|

6.1 |

Default by Purchaser21 |

|

|

|

6.2 |

Default by Seller21 |

|

|

|

6.3 |

Notice of Default; Opportunity to Cure21 |

|

|

|

6.4 |

Recoverable Damages; No Consequential or Punitive Damages22 |

|

|

|

7.1 |

Minor Damage22 |

|

|

|

7.2 |

Major Damage22 |

|

|

|

7.3 |

Definition of “Major” Loss or Damage23 |

|

|

ARTICLE 8: COMMISSIONS |

23 |

|

|

|

8.1 |

Brokerage Commissions23 |

|

|

ARTICLE 9: DISCLAIMERS AND WAIVERS |

24 |

|

|

|

9.1 |

No Reliance on Documents24 |

|

|

|

9.2 |

DISCLAIMERS24 |

|

|

ARTICLE 10: MISCELLANEOUS |

25 |

|

|

|

10.1 |

Confidentiality25 |

|

|

|

10.2 |

Public Disclosure26 |

|

|

|

10.3 |

Discharge of Obligations26 |

|

|

|

10.4 |

Assignment27 |

|

|

|

10.5 |

Notices27 |

|

|

|

10.6 |

Modifications28 |

|

|

|

10.7 |

Tenant Notification Letters28 |

|

|

|

10.8 |

Calculation of Time Periods28 |

|

|

|

10.9 |

Successors and Assigns29 |

|

|

|

10.10 |

Entire Agreement29 |

|

|

|

10.11 |

Further Assurances29 |

|

|

|

10.12 |

Counterparts29 |

|

|

|

10.13 |

Severability29 |

|

|

|

10.14 |

Applicable Law29 |

|

|

|

10.15 |

No Third Party Beneficiary29 |

|

|

|

10.16 |

Exhibits and Schedules30 |

|

|

|

10.17 |

Captions30 |

|

|

|

10.18 |

Construction30 |

|

|

|

10.21 |

TIME OF ESSENCE31 |

|

|

|

10.22 |

Portfolio Purchase. .31 |

|

|

|

10.23 |

Audit Information. .31 |

|

ii

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”) is made and entered into this 15th day of May, 2018 (the “Effective Date”), by and among SWH XXXXX XXXXXX HILLS LLC, a Georgia limited liability company (“2300 Seller”), and SWH XXXXX 2282 XXXXXX HILLS LLC, a Georgia limited liability company (“2282 Seller”; 2300 Seller and 2282 Seller being collectively known as, “Seller”), and THRE GLOBAL INVESTMENTS LLC, a Delaware limited liability company (“Purchaser”).

WITNESsEtH:

1.1Agreement of Purchase and Sale

. Subject to the terms and conditions hereinafter set forth, Seller agrees to sell and convey and Purchaser agrees to purchase the following:

(a)those certain parcels of real property located in Xxxxxx County, Georgia, more particularly described on:

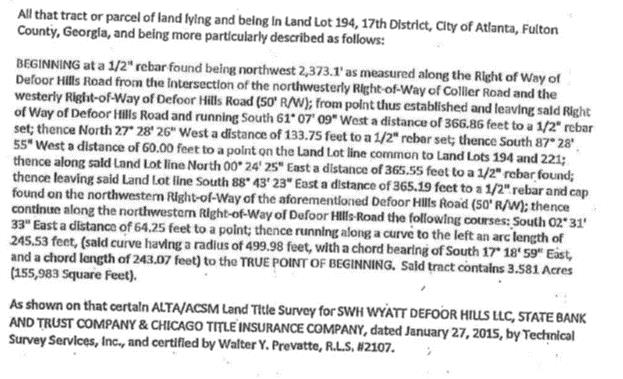

(i)Exhibit A-1 attached hereto and made a part hereof, together with all and singular the rights and appurtenances pertaining to such property, including any right, title and interest of Seller (if any) in and to easements, adjacent streets, alleys or rights-of-way (the property described in clause (a)(i) of this Section 1.1 being herein referred to collectively as the “2300 Land”);

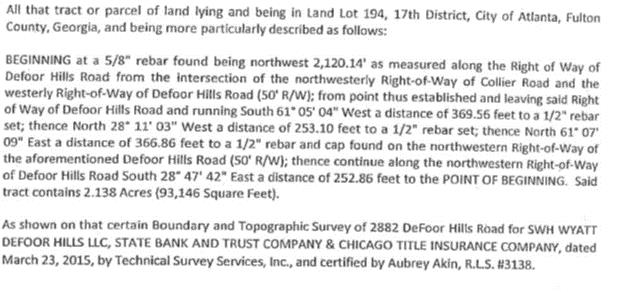

(ii)Exhibit A-2 attached hereto and made a part hereof, together with all and singular the rights and appurtenances pertaining to such property, including any right, title and

interest of Seller (if any) in and to adjacent streets, alleys or rights-of-way (the property described in clause (a)(ii) of this Section 1.1 being herein referred to collectively as the “2282 Land”; collectively, the 2300 Land and 2282 Land shall be known as, the “Land”);

(b)the buildings, structures, fixtures and other improvements on the Land, including specifically, without limitation, those certain buildings known as 2300 and 2282 Xxxxxx Hills located thereon (the property described in clause (b) of this Section 1.1 being herein referred to collectively as the “Improvements;” the Land and the Improvements are hereinafter sometimes collectively referred to as the “Real Property”);

(c)all of Seller’s right, title and interest in and to all tangible personal property upon the Land or within the Improvements listed on Exhibit B attached hereto and made a part hereof (the “Personal Property Schedule”), including specifically, without limitation, furniture, equipment, tools and supplies, and other items of personal property owned by Seller (excluding cash and software) used exclusively in connection with the operation of the Land and the Improvements (except for any such items owned by Tenants [as hereinafter defined] lawfully occupying the Improvements according to the provisions of any applicable Lease) (the property described in clause (c) of this Section 1.1 being herein referred to collectively as the “Personal Property”);

(d)all of Seller’s right, title and interest in and to all lease agreements listed and described on Exhibit C attached hereto and made a part hereof (each, a “Lease” and being herein referred to collectively, the “Leases”), pursuant to which any portion of the Land or Improvements is used or occupied by anyone other than Seller (each, a “Tenant” and collectively, the “Tenants”);

(e)all of Seller’s right, title and interest in and to (i) all assignable contracts and agreements (collectively, the “Operating Agreements”) listed and described on Exhibit D attached hereto and made a part hereof (the “Operating Agreements Schedule”), relating to the upkeep, repair, maintenance or operation of the Land, Improvements or Personal Property which shall extend beyond the Closing Date (as defined in Section 4.1 hereof), to the extent that Purchaser agrees to assume the same in accordance with Section 3.3;

(f)all of Seller’s right, title and interest in and to (i) all assignable existing warranties and guaranties issued to Seller in connection with the Improvements or the Personal Property, (ii) all development rights and entitlements in connection with the Land or the Improvements, (iii) the name of the Improvements, (iv) all licenses and permits relating to the Land or Improvements, and (v) all plans and specifications relating to the Land or the Improvements (collectively, the “Intangibles”); and

(g)all of Seller’s right title and interest in and to all contracts relating to the construction and design of the Improvements that were entered into by Seller (the “Construction Contracts”); provided, however, (i) Seller shall only be obligated to assign a Construction Contract if it is assignable on its face pursuant to the terms of such contract, provided, Seller will use commercially reasonable efforts, at no cost to Seller, to obtain consent to assign any Construction Contract that is not assignable on its face, but receipt of any such consent (or assignment of such a Construction Contract without consent) shall not be a condition to Closing,

2

and (ii) Purchaser does not agree to assume any obligations or liability of Seller under the Construction Contracts, or to any contractor or other counterparty to the Construction Contracts, or otherwise under the Construction Contracts.

.The Land, the Improvements, the Personal Property, the Leases, the Operating Agreements, and the Intangibles relating to the: (i) 2300 Parcel are herein collectively referred to as the “2300 Property”, and (ii) 2282 Parcel are herein collectively referred to as the “2282 Property.” The 2300 Property and the 2282 Property are hereinafter sometimes referred to collectively as the “Property” or the “Properties.”

. The Property shall be conveyed subject to the matters which are, or are deemed to be, “Permitted Exceptions” pursuant to Article II hereof (herein referred to collectively as the “Permitted Exceptions”).

. Seller is to sell and Purchaser is to purchase the Property for a total of Thirty-Four Million Six Hundred Thousand and No/100 Dollars ($34,600,000.00) (the “Purchase Price”). No portion of the Purchase Price shall be allocated, nor attributable, to any items of Personal Property.

. The Purchase Price, as increased or decreased by prorations and adjustments as herein provided, shall be payable in full at Closing in cash by wire transfer of immediately available federal funds to Escrow Agent (hereinafter defined) to be wired to such bank accounts designated by Seller in writing to Escrow Agent prior to the Closing (collectively, the “Seller Accounts”).

. Within three (3) business days after the Effective Date, Purchaser shall deposit with Chicago Title Insurance Company (the “Escrow Agent and “Title Company”), having its office at 000 Xxxxx Xxxxxx, Xxx Xxxx, XX 00000; Attention Xxxxxxx Xxxxxxx, Esq.; email: xxxx.xxxxxxx@xxx.xxx, telephone: (000) 000-0000, the sum of Two Million and No/100 Dollars ($2,000,000.00) (the “Xxxxxxx Money”) in good funds, either by certified bank or cashier’s check or by federal wire transfer. The Escrow Agent shall hold the Xxxxxxx Money in an interest-bearing account in accordance with the terms and conditions of the escrow instructions attached as Schedule 6.1 hereto and this Agreement. All interest accruing on such sum shall become a part of the Xxxxxxx Money and shall be distributed as Xxxxxxx Money in accordance with the terms of this Agreement.

. In addition to, and not in lieu of the delivery to Escrow Agent of the Xxxxxxx Money, Purchaser shall deposit with Escrow Agent to be delivered by Escrow Agent to Seller, within three (3) business days after the Effective Date, the amount of One Hundred and No/100 Dollars ($100.00). Seller and Purchaser hereby mutually acknowledge and agree said sum represents adequate bargained for consideration for Seller’s execution and delivery of this Agreement and Purchaser’s right to inspect the Property pursuant to Article III hereof. Said sum is in addition to and independent of any other consideration or payment provided for in this Agreement and is nonrefundable in all events.

3

2.1Title Examination; Commitment for Title Insurance

. During the Inspection Period (as defined in Section 3.1 hereof), Purchaser shall be entitled to examine title to the Property. During the Inspection Period, Purchaser shall order from a the Title Company at Purchaser’s expense, an ALTA title insurance commitment (the “Title Commitment”) covering the Property, showing all matters affecting title to the Property and binding the Title Company to issue at Closing an Owner’s Policy of Title Insurance in the full amount of the Purchase Price pursuant to Section 2.4 hereof. Purchaser shall instruct the Title Company to deliver to Purchaser, Seller and the surveyor described in Section 2.2 below copies of the Title Commitment and copies of all instruments referenced in Schedule B and Schedule C thereof.

. During the Inspection Period, Purchaser shall, at Purchaser’s expense, order from a reputable surveyor or surveying firm, licensed by the state in which the Property is located, to survey the Property and prepare and deliver to Purchaser, the Title Company and Seller an ALTA/NSPS survey thereof (the “Survey”) reflecting the total area of the Property, the location of all improvements, recorded easements and encroachments, if any, located thereon and all building and set back lines and other matters of record with respect thereto.

2.3Title Objections; Cure of Title Objections

. Purchaser shall have until the expiration of the Inspection Period to notify Seller, in writing, of such objections as Purchaser may have to anything contained in the Title Commitment or the Survey. Any item contained in the Title Commitment or any matter shown on the Survey to which Purchaser does not object prior to the end of the Inspection Period shall be deemed a Permitted Exception. If Purchaser shall notify Seller of objections to title or to matters shown on the Survey prior to the expiration of the Inspection Period, Seller shall have the right, but not the obligation (except as to Monetary Objections (as defined in this Section 2.3 below)), to cure such objections. Within five (5) days after receipt of Purchaser’s notice of objections, Seller shall notify Purchaser in writing whether Seller elects to attempt to cure such objections. If Seller elects to attempt to cure, and provided that Purchaser shall not have terminated this Agreement in accordance with Section 3.2 hereof, Seller shall have until five (5) business days prior to the Closing Date to attempt to remove, satisfy or cure the same. If Seller elects not to cure any objections specified in Purchaser’s notice (other than the Monetary Objections), or if Seller is unable to effect a cure five (5) business days prior to the Closing Date, Purchaser shall have the following options: (a) to accept a conveyance of the Property subject to the Permitted Exceptions, specifically including any matter objected to by Purchaser which Seller is unwilling or unable to cure (other than the Monetary Objections), and without reduction of the Purchase Price; or (b) to terminate this Agreement by sending written notice thereof to Seller, and upon delivery of such notice of termination, this Agreement shall terminate and the Xxxxxxx Money shall be returned to Purchaser, and thereafter neither party hereto shall have any further rights, obligations or liabilities hereunder except to the extent that any right, obligation or liability set forth herein expressly survives termination of this Agreement. If Seller notifies Purchaser that Seller does not intend to attempt to cure any title objection (other than the Monetary Objections), or if, having commenced attempts to cure any objection, Seller later notifies Purchaser that Seller shall be unable to effect a cure thereof (other than the Monetary Obligations), Purchaser shall, within five (5) business days after such notice has been given, notify Seller in writing whether

4

Purchaser shall elect to accept the conveyance under clause (a) or to terminate this Agreement under clause (b). Notwithstanding the foregoing, Seller shall be obligated to release of record without need for objection by Purchaser, any Monetary Objections such that the Monetary Objections shall not appear in the Title Policy (hereinafter defined). For purposes of this Agreement, “Monetary Objections” shall mean (v) any mortgage, deed to secure debt, deed of trust, security interest or similar security instrument entered into by Seller encumbering all or any part of the Property, (w) any mechanic’s, materialman’s or similar lien (unless resulting from any act or omission of Purchaser or any of its agents, contractors, representatives or employees or any tenant of the Property), (x) the lien of ad valorem real or personal property taxes, assessments and governmental charges affecting all or any portion of the Property which are delinquent and (y) any judgment of record against Seller in the county or other applicable jurisdiction in which the Property is located.

. At Closing, Seller shall convey and transfer to Purchaser such title to the Property as will enable the Title Company to irrevocably commit to issue to Purchaser, at Purchaser’s expense, an ALTA Owner’s Policy of Title Insurance (the “Title Policy”) covering the Property, insuring Purchaser as owner of good and marketable fee simple title to the Property in the full amount of the Purchase Price, subject only to the Permitted Exceptions, and containing the endorsements that the Title Company agreed to issue during the Inspection Period. Notwithstanding anything contained herein to the contrary, the Property shall be conveyed subject to the following matters, which shall be deemed to be Permitted Exceptions:

(a)the rights of Tenants, as tenants only, under the Leases and any modifications to the Leases entered into between the Effective Date and Closing in accordance with this Agreement and, approved in writing by Purchaser in accordance with the terms of this Agreement, without options to purchase or rights of first refusal to purchase the Property;

(b)the lien of all ad valorem real estate taxes and assessments not yet due and payable as of the Closing Date, subject to adjustment as herein provided;

(c)local, state and federal laws, ordinances or governmental regulations, including but not limited to, building and zoning laws, ordinances and regulations, now or hereafter in effect relating to the Property; and

(d)items appearing of record or shown on the Survey and, in either case, not objected to by Purchaser or waived or deemed waived by Purchaser in accordance with Sections 2.3 or 2.5 hereof.

2.5Pre-Closing “Gap” Title Defects

. Whether or not Purchaser shall have furnished to Seller any notice of title objections pursuant to the foregoing provisions of this Agreement, Purchaser may, at or prior to Closing, notify Seller in writing of any objections to title first raised by the Title Company or the Surveyor and first arising between (a) the date which is the earlier of (i) the effective date of Purchaser’s Title Commitment referred to above and (ii) the expiration date of the Inspection Period, and (b) the Closing Date. With respect to any objections to title set forth in such notice, Seller shall have the same option to cure and Purchaser shall have the same option to accept title subject to such matters or to terminate this Agreement and receive a return of the Xxxxxxx Money as those which apply to any notice of objections made by Purchaser before

5

the expiration of the Inspection Period; provided however, Seller shall be obligated to cure any Monetary Objections. If Seller elects in writing prior to the Closing Date to attempt to cure any such matters, the Closing Date shall be automatically extended by a reasonable additional time to effect such a cure, but in no event shall the extension exceed ten (10) days after the original Closing Date.

.

(a)Prior to the Effective Date, Seller has delivered to Purchaser the information (to the extent in Seller’s possession or control) with respect to the Property listed in Exhibit E attached hereto and made a part hereof and such materials shall be deemed the “Deliveries” for all purposes hereunder. By execution of this Agreement, Purchaser acknowledges receipt of the Deliveries for all purposes hereunder.

(b)During the period beginning upon the Effective Date and ending at 5:00 p.m. (local time at the Property) on May 21, 2018 (hereinafter referred to as the “Inspection Period”), Purchaser shall have the right to make a physical inspection of the Property and to examine at such place or places at the Property, in the offices of the property manager or elsewhere as the same may be located, or through an electronic data room of Broker (hereinafter defined), any operating files maintained by Seller or their property manager in connection with the leasing, maintenance and/or management of the Property, including, without limitation, the Leases, Operating Agreements, Brokerage Agreements (hereinafter defined), insurance policies, bills, invoices, receipts and other general records relating to the income and expenses of the Property, surveys, plans and specifications, warranties for services and materials provided to the Property, but excluding materials not directly related to the leasing, maintenance and/or management of the Property such as Seller’s internal memoranda, financial projections, budgets, appraisals, accounting and tax records and similar proprietary or confidential information.

(c)Purchaser understands and agrees that any on-site inspections of the Property shall be conducted upon at least twenty-four (24) hours prior written notice to Seller, which notice may be given by electronic mail to (both) XxXxxxxxxx Xxxxxxx at XxXxxxxxxx@xxxxx.xxx and Xxxxx Xxxxx at xxxxx@xxxxx.xxx, and, if Seller so elects, in the presence of Seller or their representative. If Purchaser desires to do any invasive testing, sampling or drilling at the Property (including, without limitation, any “Phase II” environmental testing), Purchaser shall do so only after notifying Seller and obtaining Seller’s prior written consent thereto, which consent may be granted or withheld in Seller’s sole discretion and may be subject to any terms and conditions imposed by Seller in its sole discretion. Purchaser shall promptly restore any affected part of the Property which is subjected to any such invasive testing, sampling, or drilling, or otherwise affected by Purchaser’s inspection, to substantially the same condition which existed prior to any such inspections, tests, sampling or drilling, at Purchaser’s sole cost and expense, subject to the Excluded Matters (hereinafter defined). Purchaser agrees to indemnify against and hold Seller harmless from any claim for liabilities, costs, expenses (including reasonable attorneys’ fees actually incurred), actual damages from personal injury or property damage arising out of or resulting from the inspection of the Property

6

by Purchaser or its agents, provided however, such indemnity, obligation and liability under this Agreement shall not extend to or include (1) any pre-existing Property condition or matter merely discovered by Purchaser or (2) any diminution of value of the Property related thereto or any claims that are attributable to the negligence or willful misconduct of Seller or its agents or employees (collectively, the “Excluded Matters”), such obligation to indemnify and hold harmless Seller shall survive Closing or any termination of this Agreement for a period of one (1) year. Prior to any on-site inspection of the Property by Purchaser or by any agent of Purchaser, Purchaser shall deliver to Seller a certificate of insurance evidencing Purchaser’s insurance coverage naming Seller, Seven Oaks Management, LLC and State Bank and Trust Company as additional insureds, with limits of liability with a broad form contractual liability endorsement and with a combined single limit of not less than $2,000,000 per occurrence for bodily injury and property damage, automobile liability coverage including owned and hired vehicles with a combined single limit of $2,000,000 per occurrence for bodily injury and property damage, and an excess umbrella liability policy for bodily injury and property damage in the amount of $5,000,000, all of which insurance shall be on an “occurrence form” and otherwise in such forms reasonably acceptable to Seller and with an insurance company reasonably acceptable to Seller and (if reasonably available from Purchaser’s insurer) shall provide that no cancellation or reduction thereof shall be effective until at least thirty (30) days after receipt by Seller of written notice thereof. All inspections shall occur at reasonable times agreed upon by Seller and Purchaser and shall be conducted so as not to interfere unreasonably with use of the Property by Seller or its tenants.

(d)During the Inspection Period and subject to the availability of the Tenants, Purchaser shall have the right to arrange to meet with representatives of the Tenants to discuss the Property; provided that Purchaser provides Seller with at least two (2) business days’ prior written notice of its intention to conduct such interview with such tenants and provided further that Seller shall be permitted to have a representative present at such interview.

. Seller agrees that if Purchaser determines (such determination to be made in Purchaser’s sole discretion) that the Property is not suitable for its purposes for any reason or no reason, Purchaser shall have the right to terminate this Agreement by giving written notice thereof to Seller prior to the expiration of the Inspection Period (an “Inspection Termination Notice”). If Purchaser gives to Seller an Inspection Termination Notice prior to the expiration of the Inspection Period, this Agreement shall terminate and the Xxxxxxx Money shall be returned to Purchaser. Time is of the essence with respect to the provisions of this Section 3.2. If Purchaser fails to give Seller an Inspection Termination Notice prior to the expiration of the Inspection Period, Purchaser shall no longer have any right to terminate this Agreement under this Section 3.2 and the Xxxxxxx Money shall become non-refundable to Purchaser, except as otherwise expressly provided in this Agreement.

3.3Operating Agreements, Brokerage Agreements and Property Management Agreement. Prior to the expiration of the Inspection Period, Purchaser will advise Seller in writing of which Operating Agreements it will assume and which Operating Agreements Seller shall terminate at or prior to Closing. Seller shall pay any termination fees or other charges necessary to terminate as of or prior to Closing any such Operating Agreements which Purchaser does not agree to assume, and Purchaser shall not be required to assume such Operating Agreements at Closing. In any event, Seller shall not assign, and Purchaser shall not assume, the brokerage agreements

7

described on Exhibit G (the “Brokerage Agreements”) and Seller shall terminate on or before Closing any other existing leasing agreement or property management agreement relating to the Property.

. The consummation of the transaction contemplated hereby (“Closing”) shall occur in escrow with the Title Company on June 5, 2018 (the “Closing Date”). At Closing, Seller and Purchaser shall perform the obligations set forth in, respectively, Section 4.2 and Section 4.3, the performance of which obligations shall be concurrent conditions.

4.2Seller’s Obligations at Closing

. At Closing, Seller shall for each of the Properties:

(a)deliver to Purchaser duly executed limited warranty deeds (each, a “Deed”) in the form of Exhibit H-1 and Exhibit H-2 attached hereto, conveying the 2300 Land and Improvements thereon and the 2282 Land and Improvements thereon, respectively, subject only to the Permitted Exceptions, together with a Georgia PT-61 Real Estate Transfer Tax Form for each parcel;

(b)deliver to Purchaser a duly executed xxxx of sale in the form of Exhibit I attached hereto, conveying the Personal Property and Intangibles to Purchaser;

(c)deliver to Purchaser a duly executed assignment and assumption of leases (the “Assignment and Assumption of Leases”) in the form of Exhibit J attached hereto;

(d)deliver to Purchaser a duly executed assignment and assumption agreement of operating agreements (the “Assignment and Assumption of Operating Agreements and Construction Contracts”) in the form of Exhibit K attached hereto;

(e)deliver to Purchaser such Tenant Estoppel Certificates (as defined in Section 5.4(b) hereof) as are in Seller’s possession;

(f)deliver to Purchaser a duly executed tenant notice letter (the “Tenant Notice Letter”) in the form of Exhibit L attached hereto;

(g)deliver to Purchaser a certificate from each Seller in the form of Exhibit M-1 and Exhibit M-2 attached hereto, dated as of the Closing Date and executed on behalf of each Seller by a duly authorized officer thereof, stating that the representations and warranties of Seller contained in this Agreement are true and correct in all material respects as of the Closing Date with appropriate modifications of those representations and warranties made in Section 5.1 hereof to reflect any changes therein, including without limitation, any changes resulting from actions under Section 5.4 hereof or identifying any representation or warranty which is not, or no longer is, true and correct and explaining the state of facts giving rise to the change. In no event shall Seller be liable to Purchaser for, or be deemed to be in default hereunder by reason of, any breach of representation or warranty which results from any change that (i) occurs between the Effective Date and the Closing Date and (ii) is expressly permitted under the terms of this Agreement or is beyond the reasonable control of Seller to prevent; provided, however, that the

8

occurrence of a change which is not permitted hereunder or is beyond the reasonable control of Seller to prevent shall, constitute the non-fulfillment of the condition set forth in Section 4.6(b); if, despite changes or other matters described in such certificate, the Closing occurs, Seller’s representations and warranties set forth in this Agreement shall be deemed to have been modified by all statements made in such certificate; such certificate shall be subject to the limitations set forth in Section 5.3 hereof;

(h)deliver to the Title Company such evidence as the Title Company may reasonably require as to the authority of the person or persons executing documents on behalf of Seller and an owner’s affidavit sufficient to deliver the Title Policy to Purchaser;

(i)deliver to Purchaser affidavits duly executed by each Seller stating that Seller is not a “foreign person” within the meaning of Section 1445 of the Internal Revenue Code of 1986, as amended in the form of Exhibit N-1 and Exhibit N-2 attached hereto;

(j)deliver to Purchaser an executed certification by Seller in the form attached hereto as Exhibit O;

(k)deliver to Purchaser duly executed by each Seller a Seller’s Affidavit of Residence in the form attached hereto as Exhibit P-1 and Exhibit P-2 attached hereto;

(l)deliver to Purchaser duly executed by Broker a Broker’s Lien Waiver substantially in the form attached hereto as Exhibit Q attached hereto;

(m)a closing statement (the “Closing Statement”) executed by each Seller and to be mutually executed by Purchaser and consistent with this Agreement in the form required by Escrow Agent, and each party shall be entitled to receive a copy of the Closing Statement executed by the other party;

(n)deliver to Purchaser the original Leases, Operating Agreements and Intangibles if and to the extent the same are in the possession or control of Seller or Seller’s agents, together with such leasing files and records which are material in connection with the continued operation, leasing and maintenance of the Property; provided, however, the items in this subsection (k) may be delivered directly to Purchaser’s property manager promptly after Closing. Purchaser shall reasonably cooperate with Seller for a period of one (1) year after Closing in case of Seller’s need in response to any legal requirement, a tax audit, tax return preparation or litigation threatened or brought against Seller, by allowing Seller and its agents or representatives access, upon reasonable advance notice (which notice shall identify the nature of the information sought by Seller), at all reasonable times to examine and make copies of any and all of the foregoing described instruments, files and records delivered by Seller to Purchaser in accordance with this subsection (j), which right shall survive the Closing for a period of one (1) year;

(o)deliver to Purchaser possession and occupancy of the Property, subject to the Permitted Exceptions;

(p)deliver a copy of the Escrow Agreement (hereinafter defined) executed by Seller; and

9

(q)deliver such additional documents as shall be reasonably required by the Title Company to consummate the transaction contemplated by this Agreement.

4.3Purchaser’s Obligations at Closing

. At Closing, Purchaser shall:

(a)Deliver the Purchase Price in immediately available federal funds by wire transfer to Escrow Agent, as increased or decreased by prorations and adjustments as herein provided, which shall be wired to the Seller Accounts pursuant to Section 1.5 above prior to 3:00 p.m.(local time at the Property), on the Closing Date;

(b)deliver to Seller counterparts executed by Purchaser of the Assignment and Assumption of Leases, Assignment and Assumption of Operating Agreements, Tenant Notice Letter and Closing Statement;

(c)if required by Title Company, deliver to the Title Company such evidence the Title Company may reasonably require as to the authority of the person or persons executing documents on behalf of Purchaser;

(d)deliver a copy of the Escrow Agreement executed by Purchaser; and

(e)deliver such additional documents as shall be reasonably required by the Title Company to consummate the transaction contemplated by this Agreement.

.

(a)All income and expenses in connection with the operation of each of the Properties shall be apportioned, as of 12:01 a.m. (local time at the Property) on the Closing Date, as if Purchaser were vested with title to the Property during the entire Closing Date, such that, except as otherwise expressly provided to the contrary in this Agreement, Seller shall have the benefit of income and the burden of expenses for the day preceding the Closing Date and the Purchaser shall have the benefit of income and the burden of expenses for the Closing Date and thereafter. Such prorated items shall include, without limitation, the following:

(i)rents, if any, as and when collected (the term “rents” as used in this Agreement includes all payments due and payable by Tenants under the Leases); uncollected rent and other income shall not be prorated; and any prepaid rents for the period following the Closing Date shall be paid over by Seller to Purchaser;

(ii)taxes (including personal property taxes on the Personal Property) and assessments levied against the Property;

(iii)payments under the Operating Agreements assumed by Purchaser;

(iv)gas, electricity and other utility charges for which Seller is liable, if any, such charges to be apportioned at Closing on the basis of the most recent meter reading occurring prior to Closing; and

10

(v)any other operating expenses or other items pertaining to the Property which are customarily prorated between a purchaser and a Seller in the area in which the Property is located.

In the event that final bills are not available or cannot be issued prior to Closing for any item being prorated under this Section 4.4, then Purchaser and Seller agree to allocate such items on a fair and equitable basis as soon as such bills are available, final adjustment to be made as soon as reasonably possible after the Closing.

(b)Notwithstanding anything contained in the foregoing provisions:

(i)At Closing, (A) Seller shall credit to the account of Purchaser the amount of any security deposits shown in the Leases as having been paid (to the extent such security deposits have not been applied against delinquent rents or otherwise as provided in the Leases), and if any security deposits are held in the form of letters of credit, Seller shall deliver the original letter of credit to Purchaser with appropriate documents executed by Seller transferring the letter of credit to Purchaser, and (B) Purchaser shall credit to the account of Seller all refundable cash or other deposits posted with utility companies serving the Property, or, at Seller’s option, Seller shall be entitled to receive and retain such refundable cash and deposits.

(ii)Any taxes paid at or prior to Closing shall be prorated based upon the amounts actually paid. If taxes and assessments for the current year have not been paid before Closing, Seller shall be charged at Closing an amount equal to that portion of such taxes and assessments which relates to the period before Closing and Purchaser shall pay the taxes and assessments prior to their becoming delinquent. Any such apportionment made with respect to a tax year for which the tax rate or assessed valuation, or both, have not yet been fixed shall be based upon the tax rate and/or assessed valuation last fixed. To the extent that the actual taxes and assessments for the current year differ from the amount apportioned at Closing, the parties shall make all necessary adjustments by appropriate payments between themselves following Closing.

(iii)Seller shall receive the entire advantage of any discounts for the prepayment by it of any taxes, water rates or sewer rents.

(iv)As to gas, electricity and other utility charges, Seller may, on notice to Purchaser, elect to pay one or more of all of said items accrued to the date hereinabove fixed for apportionment directly to the person or entity entitled thereto, and to the extent Seller so elects, such item shall not be apportioned hereunder, and Seller’s obligation to pay such item directly in such case shall survive the Closing.

(v)Supplementing Section 4.1(a)(1) above, additional or escalation rent based upon tenant’s share of real estate taxes and operating expenses (collectively, “Overage Rent”) shall be adjusted and prorated on an if, as and when collected basis. The following shall apply to the extent Overage Rent is billed on the basis of landlord’s estimates or an annual budget, which is subject to subsequent reconciliation and readjustment with each such Tenant at the end of the applicable year: At least three (3) business days prior to the Closing Date, Seller shall provide Purchaser with a reconciliation statement for calendar year 2018 through the Closing Date, with

11

all necessary supporting documentation, as to the Overage Rent paid by the Tenants for calendar year 2018. Such reconciliation statement shall indicate any difference between the Overage Rent paid by the tenants (based on Seller’s annual 2018 budget for real estate taxes and operating expenses) and the amount that should have been paid by the tenants through the Closing Date (based on the actual expenses covering such time period). If Seller has collected more on account of such Overage Rent than such actual amount for such time period, then the amount of such difference shall be credited to Purchaser at the Closing. If Seller has collected less from the tenants for Overage Rents than the actual amounts for such time period, then the amount of such under-collected rents shall be paid and delivered to Seller after year-end billing to tenants and actual receipt by Purchaser of payment from said tenants. Any Seller proposed prorations relating to Overage Rent shall be subject to Purchaser’s review and reasonable approval. Upon written request of either party to the other delivered on or before one (1) year from the Closing Date, Overage Rent shall be reprorated as of Closing.

(vi)The Personal Property is included in this sale without further charge.

(vii)Purchaser shall be responsible for the payment of (A) all Tenant Inducement Costs (as defined in this Section 4.4(b)(vii) below) and leasing commissions which become due and payable (whether before or after Closing) as a result of any extensions, renewals or expansions of existing Leases, approved in accordance with Section 5.4 hereof, between the Effective Date and the Closing Date, and (B) any remaining Tenant Inducement Costs and leasing commissions which become due and payable from and after the Closing Date arising pursuant to the initial term of any existing Lease; provided, however, at Closing, Seller shall credit to the account of Purchaser any remaining Tenant Inducement Costs and leasing commissions arising pursuant to the initial term of any existing Lease and which remain unpaid by Seller as of the Closing Date (including, without limitation, a credit for any remaining free rent or rent abatement under the initial term of the Lease for the periods from and after the Closing Date), which amount shall be updated and certified to by Seller on the Closing Date. If, as of the Closing Date, Seller shall have paid any Tenant Inducement Costs or leasing commissions for which Purchaser is responsible pursuant to the foregoing provisions, Purchaser shall reimburse Seller therefor at Closing. For purposes hereof, the term “Tenant Inducement Costs” shall mean any out-of-pocket payments required under a Lease to be paid by the landlord thereunder to or for the benefit of the Tenant thereunder which is in the nature of a tenant inducement, including specifically, without limitation, tenant improvement costs, lease buyout costs, and any moving, design, and/or refurbishment costs and free rent or rent abatement under the initial term of the Lease.

(viii)Unpaid and delinquent rent collected by Seller and Purchaser after the Closing Date shall be delivered as follows: (A) if Seller collects any unpaid or delinquent rent for the Property, Seller shall, within fifteen (15) days after the receipt thereof, deliver to Purchaser any such rent to be applied in accordance with the Rent Waterfall (hereinafter defined), and (B) if Purchaser collects any unpaid or delinquent rent from the Property, Purchaser shall, within fifteen (15) days after the receipt thereof, deliver to Seller any such rent in accordance with the Rent Waterfall to which Seller is entitled to hereunder relating to the period prior to the Closing Date. Seller and Purchaser agree that all rent received by Seller or Purchaser from and after the Closing Date shall be applied first to current rentals and then to delinquent rentals, if any, in inverse order of maturity (the “Rent Waterfall”). Purchaser shall use commercially reasonable

12

efforts for a period of one hundred eighty (180) after Closing to collect all rents in the usual course of Purchaser’s operation of the Property, but Purchaser shall not be obligated to institute any lawsuit or other collection procedures to collect delinquent rents. Seller may not pursue collection as to any rent not collected by Purchaser.

(ix)The provisions of this Section 4.4 shall survive Closing.

. Seller shall pay (a) any transfer or documentary stamp tax which becomes payable by reason of the transfer of the Property, (b) the fees of any counsel representing it in connection with this transaction and (c) one-half (½) of any escrow fee which may be charged by the Escrow Agent. Purchaser shall pay (t) any intangibles tax associated with any loan obtained by Purchaser; (u) the fees of any counsel representing Purchaser in connection with this transaction; (w) the fee for the title examination and the Title Commitment and the premium for the Title Policy; (x) the cost of the Survey; (y) the recording fee for the Deed; and (z) one-half (½) of any escrow fees charged by the Escrow Agent. All other costs and expenses incident to this transaction and the closing thereof shall be paid by the party incurring same.

4.6Conditions Precedent to Obligation of Purchaser

. The obligation of Purchaser to consummate the transaction hereunder shall be subject to the fulfillment on or before the Closing Date of all of the following conditions, any or all of which may be waived by Purchaser in writing in its sole discretion:

(a)Seller shall have delivered to Purchaser all of the items required to be delivered to Purchaser pursuant to the terms of this Agreement, including but not limited to, those provided for in Section 4.2.

(b)All of the representations and warranties of Seller contained in this Agreement shall be true and correct in all material respects as of the Closing Date (with appropriate modifications permitted under this Agreement or not adverse to Purchaser).

(c)Seller shall have performed and observed, in all material respects, all covenants and agreements of this Agreement to be performed and observed by Seller as of the Closing Date.

(d)Tenant estoppel certificates (“Tenant Estoppel Certificates”) executed by each tenant under the Leases, shall have been delivered to Purchaser at least three (3) business days prior to the Closing Date (the “Tenant Estoppel Delivery Date”), with such estoppel certificates (i) to be substantially in the form attached hereto as Exhibit F and made a part hereof, (ii) to be dated within thirty (30) days prior to the Closing Date, (iii) consistent with the terms of the Leases as contained in the copies of the Leases delivered by Seller to Purchaser, and (iv) disclosing no defaults, disputes or controversies under the Leases as of the date thereof; provided, however, that if Seller has not delivered the Tenant Estoppel Certificates by the Closing Date, Seller or Purchaser shall each have the right, to extend the Closing Date to obtain the required Tenant Estoppel Certificates until the earlier to occur of (i) five (5) business days after the Tenant Estoppel Certificates have been delivered to Purchaser or (ii) thirty (30) days after the originally scheduled Closing Date, by delivering written notice of such extension to the other party on or prior to the Tenant Estoppel Delivery Date. The delivery of said Tenant

13

Estoppel shall be a condition of Closing, but the failure or inability of Seller to obtain and deliver said Tenant Estoppel, Seller having used reasonable efforts to obtain the same, shall not constitute a default by Seller under this Agreement.

(e)Upon the sole condition of payment of the premium, at Closing, the Title Company shall irrevocably commit to issue to Purchaser the Title Policy, dated as of the date and time of the recording of the Deed, in the amount of the Purchase Price, insuring Purchaser as owner of good and marketable fee simple title to the Property, free and clear of liens, subject only to the Permitted Exceptions, and containing the endorsements that the Title Company agreed to issue during the Inspection Period;

If any of the conditions in this Section 4.6 have not been satisfied (or otherwise waived in writing by Purchaser) prior to or on the Closing Date (as the same may be extended or postponed as provided in this Agreement) and subject to and without limitation of the provisions of Section 6.2 to the extent the failure of the closing condition is a Seller default, Purchaser shall have the right to terminate this Agreement by written notice to Seller given prior to the Closing, whereupon Escrow Agent shall return the Xxxxxxx Money to Purchaser and except for those provisions of this Agreement which by their express terms survive the termination of this Agreement, no party hereto shall have any other or further rights or obligations under this Agreement.

4.7Conditions Precedent to Obligation of Seller

. The obligation of Seller to consummate the transaction hereunder shall be subject to the fulfillment on or before the Closing Date of all of the following conditions, any or all of which may be waived by Seller in its sole discretion:

(a)Seller shall have received the Purchase Price as adjusted pursuant to and payable in the manner provided for in this Agreement.

(b)Purchaser shall have delivered to Seller all of the items required to be delivered to Seller pursuant to the terms of this Agreement, including but not limited to, those provided for in Section 4.3.

(c)All of the representations and warranties of Purchaser contained in this Agreement shall be true and correct in all material respects as of the Closing Date.

(d)Purchaser shall have performed and observed, in all material respects, all covenants and agreements of this Agreement to be performed and observed by Purchaser as of the Closing Date.

. Five Hundred Thousand and No/100 DOLLARS ($500,000.00) of the Purchase Price shall not be paid to Seller at Closing but shall be deposited in a separate interest-bearing escrow account with Title Company (“Post-Closing Escrow”). Funds from the Post-Closing Escrow will be available (1) for Seller to pay Purchaser for any adjustments pursuant to Article 4 of this Agreement and (2) to satisfy any obligation or liability of Seller under this Agreement or the Closing Documents. Any funds remaining in the Post-Closing Escrow as of December 30, 2018 with respect to which Purchaser has not asserted a claim shall be disbursed to Seller. The availability of funds in the Post-Closing Escrow is in addition to any other remedy of Purchaser and does not limit any liability or obligation of Seller under this

14

Agreement or any Closing Document. At Closing, Seller, Purchaser and Title Company shall execute the escrow agreement in the form attached hereto as Exhibit R (the “Escrow Agreement”) to implement the provisions of this Section 4.8.

ARTICLE 5:

REPRESENTATIONS, WARRANTIES AND COVENANTS

5.1Representations and Warranties of Seller

. Seller hereby makes the following representations and warranties to Purchaser as of the Effective Date:

(a)Organization and Authority. Each Seller has been duly organized and is validly existing under the laws of the State of Georgia. Seller has the full right and authority to enter into this Agreement and to transfer all of the Property to be conveyed by Seller pursuant hereto and to consummate or cause to be consummated the transactions contemplated herein to be made by Seller. The person or persons signing this Agreement on behalf of each Seller is authorized to do so.

(b)Pending Actions. There is no action, suit, arbitration, unsatisfied order or judgment, governmental investigation or proceeding pending, or to Seller’s knowledge threatened, against Seller or the Property or the transaction contemplated by this Agreement.

(c)Leases. Seller is the landlord under the Leases. Except as set forth in Exhibit C, there are no other leases or occupancy agreements to which Seller is a party affecting the Property and Exhibit C contains a true, correct and complete list of all documents constituting the Leases. The copies of the Leases delivered by Seller to Purchaser are true, correct and complete copies. Except as otherwise set forth in the Leases, to Seller’s knowledge, no presently effective rent concessions have been given to any Tenants and no rent has been paid in advance by any Tenants respecting a period subsequent to the Closing. No Tenants have asserted in writing any claims, defenses or offsets to rent accruing from and after the Closing Date. To Seller’s knowledge, except as disclosed in writing by Seller to Purchaser, no material default, delinquency or breach exists on the part of any tenant under the Leases. There are no material defaults or breaches on the part of the landlord under any Lease. Notwithstanding anything to the contrary contained in this Agreement, Seller does not represent or warrant that any particular Lease shall be in force or effect at Closing or that the tenants under the Leases shall have performed their obligations thereunder. The termination of any Lease prior to Closing with Purchaser’s prior written consent by reason of the tenant’s default shall not affect the obligations of Purchaser under this Agreement in any manner or entitle Purchaser to an abatement of or credit against the Purchase Price or give rise to any other claim on the part of Purchaser.

(d)Lease Brokerage. There are no lease brokerage agreements, leasing commission agreements or other agreements providing for payments of any amounts for leasing activities or procuring tenants with respect to the Property that will be an obligation of Purchaser after Closing.

(e)Tenant Inducement Costs. Schedule 5.1(e) sets forth a true, correct and complete list of all Tenant Inducement Costs and leasing commissions outstanding under the Leases.

15

(f)Operating Agreements. Exhibit D contains a true, correct and complete list of all of the Operating Agreements affecting the Property. The copies of the Operating Agreements delivered by Seller to Purchaser are true, correct and complete copies. To Seller’s knowledge, no default exists under the Operating Agreements.

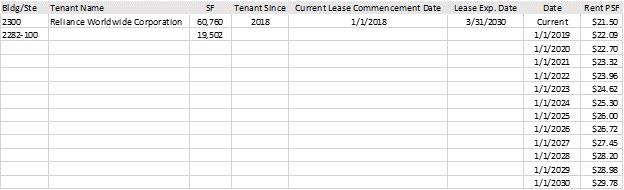

(g)RWC Certification. The partial rent roll for Reliance Worldwide Corporation attached hereto as Schedule 5.1(g) is true and correct.

(h)No Violations. Seller has not received prior to the Effective Date any written notification from any governmental or public authority (i) that the Property is in violation of any applicable fire, health, building, use, occupancy or zoning laws or Environmental Laws (hereinafter defined) or (ii) that any work is required to be done upon or in connection with the Property, where such work remains outstanding and, if not addressed, would have a material adverse effect on the use of the Property as currently owned and operated.

(i)Taxes and Assessments. True and complete copies of the most recent real estate tax bills for the Property have been delivered to Purchaser. Seller has not filed, and has not retained anyone to file, notices of protests against, or to commence action to review, real property tax assessments against the Property.

(j)Condemnation. No condemnation proceedings relating to the Property are pending or, to Seller’s knowledge, threatened.

(k)Insurance. To each Seller’s knowledge, Seller has not received any written notice from any insurance company or board of fire underwriters of any defects or inadequacies in or on the Property or any part or component thereof that would materially and adversely affect the insurability of the Property or cause any material increase in the premiums for insurance for the Property that have not been cured or repaired.

(l)Environmental Matters. Except as set forth in any environmental assessment reports in Seller’s possession and delivered to Purchaser or as otherwise disclosed in writing by Seller to Purchaser, to Seller’s knowledge, no governmental or quasi-governmental authority has determined that there are any Hazardous Substances in, on or under the Property in violation of Environmental Laws with respect to the Property. As used herein, “Hazardous Substances” means all hazardous or toxic materials, substances, pollutants, contaminants, or wastes currently identified as a hazardous substance or waste in the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (commonly known as “CERCLA”), as amended, the Superfund Amendments and Reauthorization Act (commonly known as “XXXX”), the Resource Conservation and Recovery Act (commonly known as “RCRA”), or any other federal, state or local legislation or ordinances relating to pollution or the protection or regulation of human health, natural resources or the environment applicable to the Property (together with CERCLA, XXXX and RCRA, “Environmental Laws”).

(m)OFAC. Seller (i) has not been designated as a “specifically designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website, xxxxx://xxx.xxxxxxxx.xxx/xxxx/xxxxxxxxx/xxxxxxx.xxx, or at any replacement website or other

16

replacement official publication of such list and (ii) is currently in compliance with and will at all times during the term of this Agreement (including any extension thereof) remain in compliance with the regulations of the Office of Foreign Asset Control of the Department of the Treasury and any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action relating thereto.

(n)ERISA. Seller is not an “employee benefit plan” as defined in Section 3(3) of the Employee Retirement Income Security Act of 1974 (“ERISA”), which is subject to Title I of ERISA, or a “plan” as defined in Section 4975(e)(1) of the Internal Revenue Code, of 1986, as amended (the “Code”) which is subject to Section 4975 of the Code; and (ii) the assets of Seller do not constitute “plan assets” of one or more such plans for purposes of Title I of ERISA or Section 4975 of the Code; and (iii)(a) Seller is not a “governmental plan” within the meaning of Section 3(32) of ERISA, and assets of Seller do not constitute plan assets of one or more such plans; or (b) transactions by or with Seller are not in violation of state statutes applicable to Seller regulating investments of and fiduciary obligations with respect to governmental plans.

(o)No employees. There are no employees who are employed by Seller or engaged by Seller in the operation, management or maintenance of the Property whose employment will continue as an obligation of Purchaser after Closing.

(p)No Options or Rights of First Refusal. There are no existing and effective options or rights of first refusal to purchase the Property.

(q)Construction Contracts. Schedule 5.1(q) contains a true, correct and complete list of all Construction Contracts entered into by Seller affecting the Property. The documents constituting the Construction Contracts that are delivered to Purchaser by Seller are true, correct and complete copies of all of the Construction Contracts affecting the Property, including any and all amendments relating thereto. To Seller’s knowledge, no default or breach exists on the part of Seller or any other party to the Construction Contracts. All sums required to be paid by Seller under the Construction Contracts have been paid in full.

. References to the “knowledge” of Seller shall refer only to the actual knowledge of XxXxxxxxxx Xxxxxxx, the Manager of Seller, who is the person responsible for overseeing the management and operation of the Property for Seller, and shall not be construed, by imputation or otherwise, to refer to the knowledge of any property manager, or to any other officer, agent, manager, representative or employee of or any affiliate thereof or to impose any duty to investigate the matter to which such actual knowledge, or the absence thereof, pertains.

5.3Survival of Seller’s Representations and Warranties

. The representations and warranties of Seller set forth in Section 5.1 as updated by the certificate of Seller to be delivered to Purchaser at Closing in accordance with Section 4.2(g) hereof, shall survive Closing for a period of six (6) months from and after the Closing Date. No claim for a breach of any representation or warranty of Seller shall be actionable or payable (a) if the breach in question results from or is based on a condition, state of facts or other matter which was known to Purchaser prior to Closing, (b) unless the valid claims for all such breaches collectively

17

aggregate more than Thirty-Five Thousand and No/100ths Dollars ($35,000.00) (the “Floor”), in which event the full amount of such valid claims shall be actionable, up to but not exceeding the amount of the Cap (as defined in this Section 5.3 below), and (c) unless written notice containing a description of the specific nature of such breach shall have been given by Purchaser to Seller prior to the expiration of said six (6) month period and an action shall have been commenced by Purchaser against Seller on or before December 30, 2018. As used herein, the term “Cap” shall mean Five Hundred Thousand and No/100 Dollars ($500,000.00). In no event shall Seller’s aggregate liability to Purchaser for breach of any representation or warranty of Seller in this Agreement or the certificate to be delivered by Seller at Closing pursuant to Section 4.2(g) hereof exceed the amount of the Cap. The Floor and the Cap shall not be applicable to any credits and prorations under Section 4.4, Seller’s indemnity under Section 8.1 or Seller’s fraud.

. Seller hereby covenant with Purchaser as follows:

(a)From the Effective Date hereof until the Closing or earlier termination of this Agreement, Seller shall use reasonable efforts to operate and maintain the Property in a manner generally consistent with the manner in which Seller have operated and maintained the Property prior to the date hereof and shall not encumber or modify exceptions to title affecting the Property.

(b)Seller shall use reasonable efforts (but without obligation to incur any cost or expense) to obtain and deliver to Purchaser prior to Closing, the Tenant Estoppel Certificates signed by each tenant occupying space in the Improvements; provided that delivery of such signed Tenant Estoppel Certificates shall be a condition of Closing only to the extent set forth in Section 4.6(d) hereof; and in no event shall the inability or failure of Seller to obtain and deliver said Tenant Estoppels (Seller having used reasonable efforts as set forth above) be a default of Seller hereunder. Seller shall provide to Purchaser copies of the Tenant Estoppel Certificates for review and comments prior the Tenant Estoppel Certificates being sent to the tenants under the Leases.

(c)From the Effective Date hereof until the Closing or earlier termination of this Agreement, Seller shall not terminate any Lease, modify any Lease, or enter into new leases of the Property (herein called a “New Lease”), without Purchaser’s prior written approval. A copy of any New Lease which Seller wishes to execute between the Effective Date and the Closing Date shall be submitted to Purchaser prior to execution by Seller. Purchaser agrees to notify Seller in writing within five (5) business days after its receipt thereof of either its approval or disapproval, including all Tenant Inducement Costs and leasing commissions to be incurred in connection therewith. If Purchaser fails to notify Seller in writing of its approval or disapproval within the five (5) day time period for such purpose set forth above, such failure shall be deemed the disapproval by Purchaser. If Purchaser notifies Seller that it does not approve the proposed New Lease, then Seller shall not enter into such New Lease. At Closing, Purchaser shall reimburse Seller for any Tenant Inducement Costs, leasing commissions or other expenses, including legal fees, incurred by Seller pursuant to a New Lease approved in writing by Purchaser.

(d)From the Effective Date hereof until the Closing or earlier termination of this Agreement, Seller shall not terminate any Operating Agreement, modify any Operating

18

Agreement, or enter into new operating agreements relating to the Property, without Purchaser’s prior written approval.

(e)From the Effective Date through the Closing or earlier termination of this Agreement, Seller will not discuss or negotiate with any third party the sale or other disposition of any of the Property, or enter into any contract (whether binding or not) regarding any sale or other disposition of the Property.

(f)From the Effective Date through the Closing, to the extent Seller receives actual notice thereof, Seller will advise Purchaser of any litigation or any proceeding or any administrative hearing (including condemnation) before any governmental agency which is instituted against Seller or the Property, or any written default notices notices of violations of law affecting the Property.

(g)From the Effective Date through the Closing, Seller will not enter into new construction contracts or amend or terminate existing Construction Contracts, without the prior written consent of Purchaser.

5.5Representations and Warranties of Purchaser

. Purchaser hereby represents and warrants to Seller:

(a)Organization and Authority. Purchaser has been duly organized and is validly existing under the laws of the State of Delaware. Purchaser has the full right, power and authority to purchase the Property as provided in this Agreement and to carry out Purchaser’s obligations hereunder, and all requisite action necessary to authorize Purchaser to enter into this Agreement and to carry out its obligations hereunder have been, or by the Closing shall have been, taken. The person signing this Agreement on behalf of Purchaser is authorized to do so.

(b)Pending Actions. There is no action, suit, arbitration, unsatisfied order or judgment, government investigation or proceeding pending against Purchaser which, if adversely determined, could individually or in the aggregate materially interfere with the consummation of the transaction contemplated by this Agreement.

(c)ERISA. Purchaser is not an “employee benefit plan” as defined in Section 3(3) of ERISA, which is subject to Title I of ERISA, or a “plan” as defined in Section 4975(e)(1) of the Code, which is subject to Section 4975 of the Code; and (ii) the assets of Purchaser do not constitute “plan assets” of one or more such plans for purposes of Title I of ERISA or Section 4975 of the Code; and (iii)(a) Purchaser is not a “governmental plan” within the meaning of Section 3(32) of ERISA, and assets of Purchaser do not constitute plan assets of one or more such plans; or (b) transactions by or with Purchaser are not in violation of state statutes applicable to Purchaser regulating investments of and fiduciary obligations with respect to governmental plans.

5.6Survival of Purchaser’s Representations and Warranties

. All representations and warranties of Purchaser shall survive Closing for a period of six (6) months from and after the Closing Date.

19

. Purchaser hereby covenants with Seller that Purchaser shall, in connection with its investigation of the Property during the Inspection Period order a Phase I environmental report property with respect to the Property, and, except for Excepted Claims (hereinafter defined) irrevocably waives any claim against Seller arising from the presence of Hazardous Substances on the Property.

. If the sale of the Property as contemplated hereunder is not consummated due to Purchaser’s default hereunder, Seller shall be entitled, as its sole and exclusive remedy, to terminate this Agreement and receive the Xxxxxxx Money as liquidated damages for the failure of Purchaser to close the purchase of the Property as obligated hereunder and not as a penalty, it being agreed between the parties hereto that the actual damages to Seller in the event of such breach are impractical to ascertain and the amount of the Xxxxxxx Money is a reasonable estimate thereof, Seller hereby expressly waiving and relinquishing any and all other remedies at law or in equity. The right to retain the Xxxxxxx Money as full liquidated damages is Seller’s sole and exclusive remedy in the event of default hereunder by Purchaser, and Seller hereby waives and releases any right to (and hereby covenants that they shall not) xxx Purchaser: (a) for specific performance of this Agreement, or (b) to recover actual damages in excess of the Xxxxxxx Money. Purchaser hereby waives and releases any right to (and hereby covenants that it shall not) xxx Seller or seek or claim a refund of the Xxxxxxx Money (or any part thereof) on the grounds it is unreasonable in amount and exceeds Seller’s actual damages or that its retention by Seller constitutes a penalty and not agreed upon and reasonable liquidated damages. This Section 6.1 is subject to Section 6.4 hereof.

. If the sale of the Property as contemplated hereunder is not consummated due to Seller’s default hereunder, Purchaser shall be entitled, as its sole remedy, either (a) to terminate this Agreement and receive the return of the Xxxxxxx Money, and Seller shall reimburse Purchaser for Purchaser’s due diligence costs not to exceed $50,000 within ten (10) days after Purchaser’s submission to Seller of invoices reasonably supporting such costs (“Purchaser’s Costs”), ,or (b) to enforce specific performance of Seller’s obligation to execute the documents required to convey the Property to Purchaser, it being understood and agreed that the remedy of specific performance shall not be available to enforce any other obligation of Seller hereunder. Purchaser expressly waives its rights to seek damages in the event of Seller’s default hereunder. Purchaser shall be deemed to have elected to terminate this Agreement and receive back the Xxxxxxx Money and payment of Purchaser’s Costs if Purchaser fails to file suit for specific performance against Seller in a court having jurisdiction in the county and state in which the Property is located, on or before sixty (60) days following the date upon which Closing was to have occurred. The provisions of this Section 6.2 shall survive any termination of this Agreement.

6.3Notice of Default; Opportunity to Cure

. Neither Seller nor Purchaser shall be deemed to be in default hereunder until and unless such party has been given written notice of its failure to comply with the terms hereof and thereafter does not cure such failure within five (5) business days after receipt of such notice; provided, however, that this Section 6.3 (i) shall not be applicable to a Purchaser’s failure to deposit the Xxxxxxx Money on the date required hereunder

20

or to a party’s failure to make any deliveries required of such party, including the Purchase Price, on the Closing Date and, accordingly, (ii) shall not have the effect of extending the due date of the Xxxxxxx Money hereunder or the Closing Date.

6.4Recoverable Damages; No Consequential or Punitive Damages

. Notwithstanding Sections 6.1 and 6.2 hereof, in no event shall the provisions of Sections 6.1 and 6.2 limit the damages recoverable by either party against the other party due to the other party’s express obligation to indemnify such party in accordance with Sections 3.1(b) or 8.1 of this Agreement. In no event shall either Seller or Purchaser be responsible or liable for any consequential or punitive damages resulting from a breach of this Agreement. The provisions of this Section 6.4 shall survive the Closing or any termination of this Agreement.

. In the event of loss or damage to the Property or any portion thereof which is not “major” (as defined in Section 7.3 hereof), this Agreement shall remain in full force and effect provided Seller, at Seller’s expense, performs any necessary repairs or, at Seller’s option, assign to Purchaser all of Seller’s right, title and interest to any claims and proceeds Seller may have with respect to any casualty insurance policies or condemnation awards relating to the Property in question. If Seller elects to perform repairs upon the Property, Seller shall use reasonable efforts to complete such repairs promptly and the Closing Date shall be extended for a period not to exceed fifteen (15) business days in order to allow for the completion of such repairs. If Seller elects to assign a casualty claim to Purchaser, the Purchase Price shall be reduced by any uninsured loss and the amount equal to the deductible amount under Seller’s insurance policy(ies), provided however, if the amount of the deductible is a permitted operating expense under the Leases that may be passed-through to the tenants under the Leases, Purchaser will remit to Seller the amount of the deductible if and when collected by Purchaser under the Leases. Upon Closing, full risk of loss with respect to the Property shall pass to Purchaser.

. In the event of a “major” loss or damage, Purchaser may terminate this Agreement by written notice to Seller, in which event the Xxxxxxx Money shall be returned to Purchaser. If Purchaser has not elected to terminate this Agreement within ten (10) days after Seller has sent Purchaser written notice of the occurrence of major loss or damage, then Purchaser shall be deemed to have elected to proceed with Closing, in which event Seller shall, at Seller’s option, either (a) perform any necessary repairs at Seller’s expense, or (b) assign to Purchaser all of Seller’s right, title and interest to any claims and proceeds Seller may have with respect to any casualty insurance policies or condemnation awards relating to the premises in question. If Seller elects to perform repairs upon the Property, Seller shall use reasonable efforts to complete such repairs promptly and the Closing Date shall be extended for a period not to exceed fifteen (15) business days in order to allow for the completion of such repairs. If Seller elects to assign a casualty claim to Purchaser, the Purchase Price shall be reduced by an amount equal to the deductible amount under Seller’s insurance policy(ies); provided however, if the amount of the deductible is a permitted operating expense under the Leases that may be passed-through to the tenants under the Leases, Purchaser will remit to Seller the amount of the deductible if and when collected by Purchaser under the Leases. Upon Closing, full risk of loss with respect to the Property shall pass to Purchaser.

21

7.3Definition of “Major” Loss or Damage

. For purposes of Sections 7.1 and 7.2, “major” loss or damage refers to the following: (a) loss or damage to the Property or any portion thereof such that the cost of repairing or restoring the premises in question to a condition substantially identical to that of the premises in question prior to the event of damage would be, in the opinion of an architect selected by Seller and reasonably approved in writing by Purchaser, equal to or greater than One Million and No/100ths Dollars ($1,000,000.00), (ii) any casualty or condemnation that gives any tenant under the Leases the right to terminate its Lease, and (iii) any loss due to a condemnation which permanently and materially impairs the current use, access to or operation of the Property or causes the Property to not be in compliance with applicable law, . If Purchaser does not give notice to Seller of Purchaser’s reasons for disapproving an architect within five (5) business days after receipt of notice of the proposed architect, Purchaser shall be deemed to have approved the architect selected by Seller.

. Each of Purchaser and Seller represents and warrants to the other that it has not dealt with any broker or agent in the negotiation of this transaction except Xxxxxxx & Xxxxxxxxx of Georgia, LLC (“Broker”) (to which Broker Seller shall pay a commission upon Closing pursuant to a separate agreement). Seller agrees that if any person or entity makes a claim against Purchaser or asserts any lien or any other right against the Property for brokerage commissions or finder’s fees related to the sale of any of the Property by Seller to Purchaser, and such claim is made by, through, or on account of any acts or alleged acts of Seller and/or any of its representatives, Seller shall protect, indemnify, defend, and hold the Purchaser free and harmless from and against any and all loss, liability, cost, damage, and expense (including reasonable attorneys’ fees) in connection therewith. Purchaser agrees that if any person or entity makes a claim against Seller or asserts a lien or any other right against any property of Seller, for brokerage commissions or finder’s fees related to the sale of the Property by Seller to Purchaser, and such claim is made by, through, or on account of any acts or alleged acts of Purchaser and/or any of its representatives, Purchaser shall protect, indemnify, defend and hold Seller free and harmless from and against any and all loss, liability, cost, damage and expense (including reasonable attorneys’ fees) in connection therewith. The provisions of this Section 8.1 shall survive Closing or any termination of this Agreement.

ARTICLE 9:

DISCLAIMERS AND WAIVERS

. Except for the Excepted Claims (hereinafter defined), Seller makes no representation or warranty as to the truth, accuracy or completeness of any materials, data or information delivered by Seller to Purchaser in connection with the transaction contemplated hereby. Purchaser acknowledges and agrees that all materials, data and information delivered by Seller to Purchaser in connection with the transaction contemplated hereby are provided to Purchaser as a convenience only and that any reliance on or use of such materials, data or information by Purchaser shall be at the sole risk of Purchaser, except for the Excepted Claims. Without limiting the generality of the foregoing provisions, Purchaser acknowledges and agrees that (a) any environmental or other report with respect to the Property which is delivered by Seller to Purchaser shall be for general informational purposes only, (b)

22