FINANCIAL INSTITUTIONS, INC.

Exhibit 10.1

FINANCIAL INSTITUTIONS, INC.

2009 MANAGEMENT STOCK INCENTIVE PLAN

2013 PERFORMANCE PROGRAM

MASTER AGREEMENT

This 2013 Performance Program Master Agreement (this “Master Agreement”) relating to a grant (the “Award”) of restricted stock of Financial Institutions, Inc. (the “Company”), dated as of the Award Date set forth in the Award Certificate, is made by and between the Company and each Participant pursuant to the Financial Institutions, Inc. 2009 Management Stock Incentive Plan (the “Plan”). The Award Certificate is included with and made part of this Master Agreement. In this Master Agreement and each Award Certificate, unless the context otherwise requires, words and expressions shall have the meanings given to them in the Plan, except as herein defined.

Section 1. Definitions. For purposes of the Award and this Master Agreement, the following terms shall have the following meanings:

(a) “Award Certificate” means the separate certificate given to each Participant specifying the Award Date, Number of Shares, Award Period, Payout Percentage, the applicable Performance Requirements and for each Performance Requirement, the Percentage of Shares subject to each Performance Requirement and the applicable Measurement Period and Service Period for such Participant’s Award.

(b) “Award Period” means the period beginning on the starting date and ending on the end date specified in the Participant’s Award Certificate.

(c) “Board” means the Board of Directors of Financial Institutions, Inc.

(d) “Code” means the Internal Revenue Code of 1986, as amended.

(e) “Committee” means the Management Development and Compensation Committee of the Board. Any reference herein to the Committee shall be deemed to include any person to whom any duty of the Committee has been delegated pursuant to Section 6(a) of this Master Agreement.

(f) “Common Stock” means the shares of common stock of the Company, par value $0.01 per share.

(g) “Disability” means (i) in the case of a Participant whose employment with the Company or a Subsidiary is subject to the terms of an employment or consulting agreement that includes a definition of “Disability,” the meaning set forth in such employment or consulting agreement during the period that such employment or consulting agreement remains in effect; and (ii) in all other cases, the meaning as set forth under the Company’s long-term disability plan applicable to the Participant as may be amended from time to time, and in the event the Company does not maintain any such plan with respect to a Participant, a physical or mental condition resulting from bodily injury, disease or mental disorder which renders the Participant incapable of continuing his or her usual and customary employment with the Company or a Subsidiary, as the case may be, for a period of not less than 120 days or such other period as may be required by applicable law.

(h) “Earned Shares” means Shares that have become earned based on achievement of specified performance requirements in accordance with the provisions of Schedule A to this Master Agreement.

(i) “Fair Market Value” means the closing price of the Company’s Common Stock on the listing exchange on the relevant date, or, if there was no trading in such stock on the relevant date, the closing price on the last preceding day on which there was trading activity.

(j) “Participant” means an employee who has received an Award Certificate under which an Award has been granted under the Plan.

(k) “Retirement” shall mean the resignation or termination of employment after attainment of an age and years of service required for payment of an immediate pension pursuant to the terms of any qualified defined benefit retirement plan maintained by the Company or a Subsidiary in which the Participant participates; provided, however, that no resignation or termination prior to a Participant’s 62nd birthday shall be deemed a retirement unless the Committee so determines in its sole discretion; and provided further that the resignation or termination of employment other than a termination of employment for Cause after attainment of age 62 shall be deemed a retirement if the Participant does not participate in a qualified defined benefit retirement plan maintained by the Company or a Subsidiary.

(l) “Service Period” means the period beginning on the starting date and ending on the end date specified in the Participant’s Award Certificate that is applicable to

(m) “Subsidiary” means any subsidiary of the Company within the meaning of Rule 405 of the Securities Act of 1933, as amended.

(n) “Vested Shares” means Earned Shares that have become vested, nonforfeitable and transferable based on satisfaction of specified service requirements in accordance with the provisions of Schedule A to this Master Agreement.

Section 2. Grant of Restricted Stock. Subject to the provisions of this Master Agreement and the provisions of the Plan and the Award Certificate, the Committee grants to the Participant named in the Award Certificate, as of the Award Date, an Award of the Number of Shares of the Company’s Common Stock set forth in the Award Certificate. The grant of shares of Common Stock to the Participant is an award of restricted stock (as defined in the Plan), and such shares of restricted stock are referred to herein as the “Shares.”

Section 3. Earned and Vested Shares. Subject to Section 4 of this Master Agreement, the number of Shares, if any, that shall become Earned Shares and Vested Shares is, in each case, determined in accordance with the provisions of Schedule A to this Master Agreement. Shares that do not become both Earned Shares and Vested Shares in accordance with the provisions of Schedule A to this Master Agreement shall be forfeited to the Company.

2

Section 4. Effects of Certain Events.

(a) General. Subject to Sections 4(b) through 4(d) of this Master Agreement, in the event that a Participant’s employment with the Company is terminated before all or a portion of the Shares become Vested Shares, all Shares that are not Vested Shares as of the date of such termination are automatically forfeited.

(b) Death or Disability. In the event of a Participant’s death or termination of employment due to Disability during the Award Period, performance shall be calculated as of the date of the Participant’s death or termination of employment due to Disability, and the Earned Shares, if any, from such performance, shall be distributed on a pro-rata basis as soon as administratively practicable following the Participant’s death or termination of employment due to Disability. The pro-rata portion shall be determined by multiplying the number of Earned Shares by a fraction, the numerator of which is the number of completed months in the Award Period during which the participant was employed by the Company or a Subsidiary, and the denominator of which is the number of months in the Award Period.

(c) Retirement. If a Participant terminates employment during the Award Period due to Retirement, then the Award shall continue and the Earned Shares shall be distributed on a pro-rata basis on the date that active Participants receive such distributions under this Master Agreement, based on actual performance during the applicable Measurement Period. The pro-rata portion shall be determined as follows:

(i) With respect to the portion of the Award that is subject to the EPS Performance Requirement, the pro-rata portion shall be determined by multiplying the number of Earned Shares subject to the EPS Performance Requirement by a fraction, the numerator of which is the number of completed months in the EPS Measurement Period during which the participant was employed by the Company or a Subsidiary, and the denominator of which is the number of months in the EPS Measurement Period. For the avoidance of doubt, because the EPS Measurement Period is one year, a Participant who terminates employment due to Retirement after the end of the EPS Measurement Period shall receive the full number of Earned Shares subject to the EPS Performance Requirement without proration.

(ii) With respect to the portion of the Award that is subject to the Relative TSR Performance Requirement, the pro-rata portion shall be determined by multiplying the number of Earned Shares subject to the Relative TSR Performance Requirement by a fraction, the numerator of which is the number of completed months in the TSR Measurement Period during which the participant was employed by the Company or a Subsidiary, and the denominator of which is the number of months in the TSR Measurement Period. For the avoidance of doubt, because the TSR Measurement Period is three years, a Participant who terminates employment due to Retirement at any time during the Award Period shall receive a pro-rated portion of the Earned Shares subject to the Relative TSR Performance Requirement.

(d) Change in Control. In the event of a change in control of the Company (as defined in the Plan), all of a Participant’s Shares shall immediately become Vested Shares, unless directed otherwise by a resolution of the Committee adopted prior to and specifically relating to the occurrence of such change in control.

3

Section 5. Dividends. No dividends shall accrue or be paid to the Participant with respect to any Shares subject to the Award that have not become Vested Shares or that are subject to any restrictions or conditions on the record date for dividends, unless the Committee provides otherwise.

Section 6. Miscellaneous

(a) Administration. The Award shall be administered by the Committee. The Committee shall have authority to interpret the Award, the Award Certificate and this Master Agreement, to prescribe rules and regulations relating to the Award, the Award Certificate and this Master Agreement, to take any other actions it deems necessary or advisable for the administration of the Award, the Award Certificate and this Master Agreement and shall retain all general authority granted to it under Section 2 of the Plan. In accordance with applicable law, the Committee may delegate any of the responsibilities under this Master Agreement to the Chief Executive Officer of the Company or the Finance or Human Resources departments of the Company, or may receive recommendations from such individuals and departments regarding such responsibilities.

(b) Amendment. The Committee may, at any time, amend, modify or terminate this Master Agreement; provided, however that termination of this Master Agreement after the end of the applicable Measurement Period but before Shares become Vested Shares will not reduce Participants’ rights to receive Vested Shares for the Performance Period. Termination or amendment of this Master Agreement during the applicable Measurement Period may be retroactive to the beginning of such Measurement Period, at the discretion of the Committee. If a change in control occurs, no amendment or termination may adversely affect existing Awards without the consent of the Participant.

(c) Adjustments. As provided by the Plan, in the event of any change in the Common Stock of the Company by reason of any stock dividend, stock split, recapitalization, reorganization, merger, consolidation, split-up, combination, or exchange of Shares, or of any similar change affecting the Common Stock, the Shares shall be adjusted automatically consistent with such change to prevent substantial dilution or enlargement of the rights granted to, or available for, the Participant hereunder. Furthermore, the Committee shall adjust the Performance Requirements to the extent (if any) it determines that the adjustment is necessary or advisable to preserve the intended incentives and benefits to reflect any material change in corporate capitalization, any material corporate transaction (such as a reorganization, combination, separation, merger, acquisition, or any combination of the foregoing), or any complete or partial liquidation of the Company, or any other similar special circumstances, including the issuance of a significant number of shares of Common Stock.

(d) No Transferability. The Shares may not be sold, transferred, pledged, assigned, encumbered, or otherwise alienated or hypothecated until they become fully vested and transferable in accordance with this Master Agreement and then only to the extent permitted under this Master Agreement, the Award Certificate, the Plan and by applicable securities laws. Prior to full vesting and transferability, all rights with respect to the Shares granted to a Participant under the Plan shall be available, during such Participant’s lifetime, only to such Participant.

4

(e) No Right to Continued Employment. The terms and conditions of the Award, the Award Certificate, this Master Agreement and the Plan shall not be deemed to constitute a contract of employment between the Company and a Participant. Such employment is hereby acknowledged to be an “at will” employment relationship that can be terminated at any time for any reason, or no reason, with or without cause, and with or without notice, except as otherwise provided in a written employment agreement. Nothing in the Award, the Award Certificate, this Master Agreement or the Plan shall be deemed to give a Participant the right to be retained in the service of the Company as an employee or to interfere with the right of the Company to discipline or discharge a Participant at any time.

(f) Rights as a Shareholder. Except for the transfer and other restrictions set forth elsewhere in this Master Agreement (including the limitations on dividends set forth in Section 5 of this Master Agreement), the Award Certificate and the Plan, the Participant, as record holder of the Shares, shall possess all the rights of a holder of the Company’s Common Stock (including voting); provided, however, that prior to becoming vested and transferable the certificates representing such Shares shall be held by the Company for the benefit of the Participant. As the Shares become Vested Shares, the Company shall, as applicable, either remove the notations on any Shares issued in book entry form which have vested or deliver to the Participant a certificate or certificates evidencing the number of Vested Shares (or, in either case, such lesser number of Shares as may result after giving effect to Section 6(g) of this Master Agreement).

(g) Withholding Taxes. The Company shall be entitled to require payment of any amounts required by federal, state or local tax law to be withheld with respect to the transfer or vesting of the Shares, or any other taxable event related thereto. The Company may permit the Participant to make such payment in one or more of the forms specified below:

(i) by cash or check made payable to the Company;

(ii) by the deduction of such amount from other compensation payable to the Participant, including without limitation, salary, bonus and other compensation;

(iii) by tendering shares of Common Stock already owned by the Participant or Vested Shares which have a then current fair market value not greater than the amount necessary to satisfy the Company’s withholding obligation based on the minimum statutory withholding rates for federal, state and local income tax and payroll tax purposes; or

(iv) in any combination of the foregoing.

In the event the Participant fails to provide timely payment of all sums required by the Company pursuant to this Section, the Company shall have the right and option, but not obligation, to treat such failure as an election by the Participant to provide all or any portion of such required payment by means of tendering Vested Shares in accordance with Section 6(g)(iii) of this Master Agreement.

(h) Legend. Each share certificate representing the Shares shall bear a legend indicating that such Shares are “Restricted Stock” and are subject to the provisions of this Master Agreement and the Plan.

5

(i) Stock Power. Concurrently with the grant of the Award, the Participant shall deliver to the Company a stock power, endorsed in blank, relating to the Shares. Such stock power shall be in the form attached to the Award Certificate as Exhibit A. The stock power with respect to any certificate representing Shares that do not vest shall be completed in the name of the Company by an officer of the Company, and the Shares shall be returned to either authorized but unissued shares or treasury shares, depending on their original source.

(j) Coordination with Plan and the Award Certificate. The Participant hereby acknowledges receipt of a copy of the Plan and the Award Certificate and agrees to be bound by all of the terms and provisions thereof including any that may conflict with those contained in this Master Agreement.

(k) Notices. All notices to the Company shall be in writing and sent to the Company’s Director of Human Resources at the Company’s offices. Notices to the Participant shall be addressed to the Participant at the Participant’s home or work address, including via interoffice mail, as it appears on the Company’s records. Any such notices may be made in electronic format or through means of online or other electronic transmission.

(l) Compensation Recovery Policy. Notwithstanding any other provision of this Master Agreement to the contrary, any Shares granted and/or issued hereunder, and/or any amount received with respect to any sale of any such Shares, shall be subject to potential cancellation, recoupment, rescission, payback or other action in accordance with the terms of the Company’s compensation recovery policy, if any, or any similar policy that the Company may adopt from time to time (the “Policy”). The Participant agrees and consents to the Company’s application, implementation and enforcement of (i) the Policy that may apply to the Participant and (ii) any provision of applicable law relating to cancellation, rescission, payback or recoupment of compensation, including, but not limited to Section 10D of the Securities Exchange Act of 1934, as amended, and any regulations promulgated, or national securities exchange listing conditions adopted, with respect thereto, and expressly agrees that the Company may take such actions as are necessary to effectuate the Policy or applicable law without further consent or action being required by the Participant. To the extent that the terms of this Master Agreement and the Policy or any similar policy conflict, then the terms of such policy shall prevail.

(m) Excise Tax Cap. In the event that a Participant becomes entitled to any payment or benefit under this Master Agreement (such benefits together with any other payments or benefits payable to the Participant under any other agreement with the Participant, or plan or policy of the Company, are referred to in the aggregate as the “Total Payments”), if all or any part of the Total Payments will be subject to the tax imposed by Section 4999 of the Code, or any similar tax that may hereafter be imposed (the “Excise Tax”), then:

(i) Within 30 days following the Participant’s termination of employment, the Company will notify the Participant in writing: (1) whether the payments and benefits under this Master Agreement, when added to any other payments and benefits making up the Total Payments, exceed an amount equal to 299% of the Participant’s “base amount” as defined in Section 280G(b)(3) of the Code (the “299% Amount”); and (2) the amount that is equal to the 299% Amount.

6

(ii) The payments and benefits under this Master Agreement shall be reduced such that the Total Payments do not exceed the 299% Amount, so that no portion of the payments and benefits under this Master Agreement will be subject to the Excise Tax. Any payment or benefit so reduced will be permanently forfeited and will not be paid to the Participant.

(iii) The calculation of the 299% Amount and the determination of how much the Participant’s payments and benefits must be reduced in order to avoid application of the Excise Tax will be made by the Company’s public accounting firm prior to the Participant’s termination of employment, which firm must be reasonably acceptable to the Participant (the “Accounting Firm”). The Company will cause the Accounting Firm to provide detailed supporting calculations of its determinations to the Company and the Participant. Notice must be given to the Accounting Firm within 15 business days after an event entitling the Participant to a payment under this Master Agreement. All fees and expenses of the Accounting Firm will be borne solely by the Company.

(iv) For purposes of making the reduction of amounts payable under this Master Agreement, such amounts will be eliminated in compliance with the requirements of Section 409A of the Code, to the extent applicable.

(n) Regulatory Prohibition. Notwithstanding any other provision of this Agreement to the contrary, any payments made to a Participant pursuant to this Master Agreement, or otherwise, are subject to and conditioned upon their compliance with Section 18(k) of the Federal Deposit Insurance Act (12 U.S.C. 1828(k)) and 12 C.F.R. Part 359.

(o) Governing Law. This Master Agreement, to the extent not otherwise governed by the Code or the laws of the United States, shall be governed by the laws of the State of New York, without reference to principles of conflict of laws, and construed accordingly.

* * * * *

7

FINANCIAL INSTITUTIONS, INC.

2009 MANAGEMENT STOCK INCENTIVE PLAN

2013 PERFORMANCE PROGRAM MASTER AGREEMENT

SCHEDULE A

Section 1. Definitions. For purposes of the Award and this Master Agreement, the following terms shall have the following meanings:

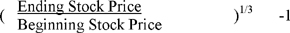

(a) “Company TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of a share of common stock in the Company due to stock appreciation and dividends, assuming dividends are reinvested on the ex-dividend date. For this purpose, the “Beginning Stock Price” shall mean the average closing sales prices of the Company’s common stock on the NASDAQ Stock Market for the 20-day trading period immediately prior to the beginning of the TSR Measurement Period, assuming dividends are reinvested; and, the “Ending Stock Price” shall mean the average closing sales prices of the Company’s common stock on the NASDAQ Stock Market for the 20-day trading period immediately prior to the last day of the TSR Measurement Period (or such other period as the Committee may determine), assuming dividends are reinvested. the Company TSR is calculated as follows:

(b) “Earnings Per Share” or “EPS” means diluted earnings per share, as such amount is reported on the Company’s audited financial statements for the EPS Measurement Period.

(c) “EPS Measurement Period” means the period beginning on January 1, 2013 and ending on December 31, 2013.

(d) “Measurement Period” means the EPS Measurement Period or the TSR Measurement Period, as applicable.

(e) “Payout Percentage” means, with regard to any Participant, the threshold, target and maximum percentage of Shares that may become Earned Shares based on attainment of the Performance Requirements, each as set forth in a Participant’s Award Certificate.

(f) “Performance Goals” means the threshold, target and maximum performance goals for each Performance Requirement, as set forth in Section 5 of Schedule A to this Master Agreement.

(g) “Performance Requirements” means the performance requirements, as set forth in Section 5 of Schedule A to this Master Agreement.

(h) “Reference Group” means all companies whose common stock is included in the Company’s peer group, as determined by the Committee, at the start of the TSR Measurement Period, other than (i) companies that cease to be included in the Company’s peer group during the TSR Measurement Period solely due to merger, acquisition, liquidation or similar events fundamentally changing the identity and nature of the company, as determined by the Committee in its sole discretion, and (ii) companies that cease to be included in the Company’s peer group other than on account of events described in the preceding clause (i) and which also cease to have common stock publicly traded on an exchange or on a recognized market system or the over-the-counter market.

8

(i) “Reference Group TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of the shares of common stock of the companies in the Reference Group during the TSR Measurement Period. The Reference Group TSR is calculated in a manner consistent with the calculation of Company TSR.

(j) “Relative Total Shareholder Return” or “Relative TSR” means the comparison of the Company TSR to the Reference Group TSR.

(k) “Service Period” means the period beginning on the starting date and ending on the end date specified in the Participant’s Award Certificate.

(l) “TSR Measurement Period” means the period beginning on January 1, 2013 and ending on December 31, 2015.

Section 2. Earned Shares. Subject to the Committee’s authority to adjust the number of Earned Shares as described in Section 7 of this Schedule A, the Earned Shares at the end of the Performance Period is determined based on the achievement of:

(a) the Gateway Requirement, as set forth in Section 3 of this Schedule A;

(b) the Individual Performance Requirement, as set forth in Section 4 of this Schedule A; and

(c) the Performance Requirements, as set forth in Section 5 of this Schedule A.

Section 3. Gateway Requirement. If Five Star Bank’s Composite “CAMELS” rating in place as of December 31st of each year in the Award Period is not a composite rating of “2” or better, all Shares issued under this Master Agreement shall be forfeited and shall not become Vested Shares.

Section 4. Individual Performance Requirement. If the Participant does not receive a minimum performance rating of “satisfactory” for the Performance Period, as determined by the Company in its sole discretion, all Shares issued under this Master Agreement shall be forfeited and shall not become Earned Shares.

9

Section 5. Performance Requirements. The Shares are divided into two components based on the Performance Requirement that applies to such Shares as set forth in a Participant’s Award Certificate. The applicable Performance Goals at threshold, target and maximum for each Performance Requirement are as follows:

| Performance Goals | ||||||||||||

| Performance Requirement |

Threshold | Target | Maximum | |||||||||

| Earnings Per Share |

$ | [ | ] | $ | [ | ] | $ | [ | ] | |||

| Relative TSR |

[ | ]% | [ | ]% | [ | ]% | ||||||

(a) Below Threshold. In the event that the Company’s actual performance for the relevant period does not meet the threshold for a Performance Requirement, no Shares shall be Earned Shares for such Performance Requirement.

(b) Performance Goals Achievement. For each Performance Requirement, the Number of Shares that become Earned Shares based on the achievement of that Performance Requirement’s Performance Goals at threshold, target and maximum is equal to the product of (i) the Number of Shares subject to the Performance Requirement; and (ii) the Payout Percentage set forth in the Participant’s Award Certificate at threshold, target or maximum, respectively, rounded down to a whole number.

(c) Interpolation. If the Company’s actual performance for the Performance Period is between threshold and target for the Performance Requirement, or between target and maximum for the Performance Requirement, the number of Earned Shares for that Performance Requirement is equal to the product of: (i) the Number of Shares subject to the Performance Requirement; and (ii) the actual performance achievement, determined using straight line interpolation between the threshold and the target (or the target and maximum, as applicable) from the Participant’s Payout Percentage set forth in the Participant’s Award Certificate, rounded down to a whole number.

(d) Above Maximum. If the Company’s actual performance for the Performance Period is at or above maximum for a Performance Requirement, the number of Earned Shares is equal to the product of: (i) the Number of Shares subject to the Award; and (ii) the Payout Percentage set forth in the Participant’s Award Certificate at maximum, rounded down to a whole number.

(e) Negative TSR Modifier. Regardless of the level of achievement against the Relative TSR Performance Requirement, in the event that Company TSR is less than zero, the number of Earned Shares for the Relative TSR Performance Requirement shall be determined pursuant to this Section; provide, however, that the number of Earned Shares shall not exceed the product of: (i) the Number of Shares subject to the Relative TSR Performance Requirement; and (ii) the Performance Range set forth in the Participant’s Award Certificate at target, rounded down to a whole number.

(f) Earned Shares. The total number of Number of Shares that become Earned Shares shall be the sum of the number of Earned Shares for each Performance Requirement.

Section 6. Actual Performance. The Committee shall review and approve the actual Earnings Per Share for the EPS Measurement Period and the Relative TSR for the TSR Measurement Period.

10

Section 7. Final Number of Earned Shares. The number of Earned Shares may be adjusted upward or downward by the Committee, in its sole and absolute discretion, to a whole number, not to exceed the Number of Shares set forth in that Participant’s Award Certificate.

Section 8. Vested Shares. Subject to Section 4 of the Master Agreement, the Earned Shares shall become Vested Shares only if the Participant provides substantial services to the Company or a Subsidiary and remains in the continuous employment of the Company or a Subsidiary through the last day of the Service Period.

EXAMPLE (for illustration purposes only)

Suppose a Participant received an Award and his or her Award Certificate provided for a Number of Shares of 1,000 and a Payout Percentage as follows:

| Threshold |

Target | Maximum | ||||||

| 40% |

80 | % | 100 | % | ||||

The Performance Requirements and Performance Goals were as set forth above in this Schedule X. Xxxxxxx the performance results for the Performance Period are as follows:

| Performance Requirement |

Performance Result | Level Achieved | ||||

| Earnings Per Share |

$ | [ | ] | Target | ||

| Relative TSR |

[ | ]% | Maximum | |||

The Earned Shares for each Performance Requirement would be determined as follows:

| • | The number of Earned Shares for the Earnings Per Shares Performance Requirement would be 400 Shares (1,000 Shares x 80% (Target) x 50%). |

| • | The number of Earned Shares for the Relative TSR Performance Requirement would be 500 Shares (1,000 Shares x 100% (Maximum) x 50% (Weighting Percentage)). |

| • | The total number of Earned Shares for the Award would be 900 Shares (400 Earned Shares for the Earnings Per Shares Performance Requirement plus 500 Earned Shares for the Relative TSR Performance Requirement). |

11