LEASE

Exhibit 10.17

Atlanta Operations Center

WBBD : 3343

PID: 506975

between

FIRST STATES INVESTORS 3300, LLC

and

WACHOVIA BANK, NATIONAL ASSOCIATION

Dated as of September 22, 2004

Property Address:

3579 - 0000 Xxxxxxx Xxx.

Xxxxxxx, XX

________________________________________________________________________________________________________________________

Table of Contents | Page | |||

USE | 1 | |||

1.1 | Basic Lease Information; Definitions | 1 | ||

1.2 | Leased Premises | 23 | ||

1.3 | Term | 24 | ||

1.4 | Options to Renew | 24 | ||

1.5 | Use | 27 | ||

1.6 | Survival | 28 | ||

1.7 | Release Premises | 28 | ||

ARTICLE II RENTAL, OPERATING EXPENSES AND REAL ESTATE TAXES | 32 | |||

2.1 | Rental Payments | 32 | ||

2.2 | Operating Expenses | 34 | ||

2.3 | Real Estate Taxes | 41 | ||

2.4 | Budget | 45 | ||

2.5 | Audit Rights | 47 | ||

ARTICLE III BUILDING SERVICES, IDENTITY, SIGNAGE, AND MANAGEMENT | 49 | |||

3.1 | Building Standard and Above Standard Services | 49 | ||

3.2 | Separate Charge Parking Areas | 56 | ||

3.3 | Graphics and Building Directory | 57 | ||

3.4 | Building Signage; Exclusivity | 57 | ||

3.5 | Tenant’s Exterior Equipment | 60 | ||

3.6 | Building Management | 62 | ||

ARTICLE IV CARE OF PREMISES; LAWS, RULES AND REGULATIONS | 64 | |||

4.1 | Surrender of Leased Premises | 64 | ||

4.2 | Access of Landlord to Leased Premises | 65 | ||

4.3 | Nuisance | 66 | ||

4.4 | Legal Compliance | 66 | ||

4.5 | Rules of Building | 67 | ||

4.6 | Use and Violations of Insurance Coverage | 67 | ||

4.7 | Environmental Laws | 68 | ||

4.8 | Prohibited Uses | 69 | ||

ARTICLE V LEASEHOLD IMPROVEMENTS AND REPAIRS | 70 | |||

5.1 | Leasehold Improvements | 70 | ||

5.2 | Alterations | 70 | ||

5.3 | Leasehold Improvements; Tenant Property | 71 | ||

5.4 | Mechanics Liens | 71 | ||

5.5 | Repairs by Landlord | 72 | ||

5.6 | Repairs by Tenant | 72 | ||

5.7 | Demising Work | 73 | ||

5.8 | Payment of Refund Amount Per Section 26 of Purchase Agreement | 76 | ||

ARTICLE VI CONDEMNATION, CASUALTY AND INSURANCE | 76 | |||

6.1 | Condemnation | 76 | ||

-i-

________________________________________________________________________________________________________________________

Table of Contents | Page | |||

6.2 | Damages from Certain Causes | 78 | ||

6.3 | Casualty Clause | 78 | ||

6.4 | Property Insurance | 80 | ||

6.5 | Liability Insurance | 80 | ||

6.6 | Hold Harmless | 81 | ||

6.7 | WAIVER OF RECOVERY | 81 | ||

ARTICLE VII DEFAULTS, REMEDIES, BANKRUPTCY, SUBORDINATION | 82 | |||

7.1 | Default and Remedies | 82 | ||

7.2 | Insolvency or Bankruptcy | 84 | ||

7.3 | Negation of Lien for Rent | 84 | ||

7.4 | Attorney’s Fees | 85 | ||

7.5 | No Waiver of Rights | 85 | ||

7.6 | Holding Over | 85 | ||

7.7 | Subordination | 86 | ||

7.8 | Estoppel Certificate | 87 | ||

7.9 | Subsequent Documents | 87 | ||

7.10 | Interest Holder Privileges | 87 | ||

ARTICLE VIII ASSIGNMENT AND SUBLETTING | 88 | |||

8.1 | General | 88 | ||

8.2 | Landlord’s General Offer Rights | 89 | ||

8.3 | Landlord’s Offer Rights For Retail Conversion Transactions | 91 | ||

8.4 | Profit Payments Re: Certain Assignments and Subleases | 93 | ||

8.5 | Transactions Exempt From Section 8.2, 8.3 and 8.4 | 94 | ||

8.6 | Miscellaneous | 94 | ||

8.7 | Sublease SNDAs | 95 | ||

ARTICLE IX TRANSFERS OF LANDLORD’S ESTATE | 96 | |||

9.1 | General | 96 | ||

9.2 | Tenant’s Right of First Refusal | 98 | ||

ARTICLE X EXPANSION RIGHTS | 100 | |||

10.1 | Tenant Expansion Notices | 100 | ||

10.2 | Landlord Expansion Response | 100 | ||

10.3 | Expansion Space Leases | 100 | ||

10.4 | Subordination of Expansion Space Rights | 103 | ||

10.5 | Duration | 104 | ||

10.6 | Disputes | 104 | ||

ARTICLE XI TERMINATION RIGHTS | 104 | |||

11.1 | Wachovia’s Termination Right | 104 | ||

11.2 | Effect of Termination | 105 | ||

ARTICLE XII DISPUTE RESOLUTION | 106 | |||

12.1 | Approvals and Consents | 106 | ||

12.2 | Dispute Resolution | 107 | ||

-ii-

________________________________________________________________________________________________________________________

Table of Contents | Page | |||

12.3 | Conduct of the Arbitration | 108 | ||

12.4 | Alternative Means of Arbitration with AAA | 109 | ||

ARTICLE XIII TENANT REMEDIES | 109 | |||

13.1 | Generally | 109 | ||

13.2 | Offset Rights | 110 | ||

ARTICLE XIV MISCELLANEOUS | 110 | |||

14.1 | Notices | 110 | ||

14.2 | Brokers | 110 | ||

14.3 | Binding on Successors | 111 | ||

14.4 | Rights and Remedies Cumulative | 111 | ||

14.5 | Governing Law | 111 | ||

14.6 | Rules of Construction | 111 | ||

14.7 | Authority and Qualification | 111 | ||

14.8 | Severability | 112 | ||

14.9 | Quiet Enjoyment | 112 | ||

14.10 | Limitation of Personal Liability | 112 | ||

14.11 | Memorandum of Lease | 112 | ||

14.12 | Master Agreement | 112 | ||

14.13 | Amendments | 113 | ||

14.14 | Entirety | 113 | ||

14.15 | References | 113 | ||

14.16 | Counterpart Execution | 113 | ||

14.17 | No Partnership | 113 | ||

14.18 | Captions | 113 | ||

14.19 | Required Radon Notice | 113 | ||

14.20 | Changes by Landlord | 113 | ||

14.21 | Waiver of Jury Trial | 114 | ||

14.22 | Termination of Lease | 114 | ||

ARTICLE XV ADDITIONAL PROVISIONS | 115 | |||

15.1 | Existing Mortgage(s) | 115 | ||

15.2 | Existing Xxxxxxxxx(s) | 115 | ||

15.3 | Agreements Benefiting the Property | 115 | ||

15.4 | Usufruct | 115 | ||

-iii-

________________________________________________________________________________________________________________________

EXHIBITS | ||

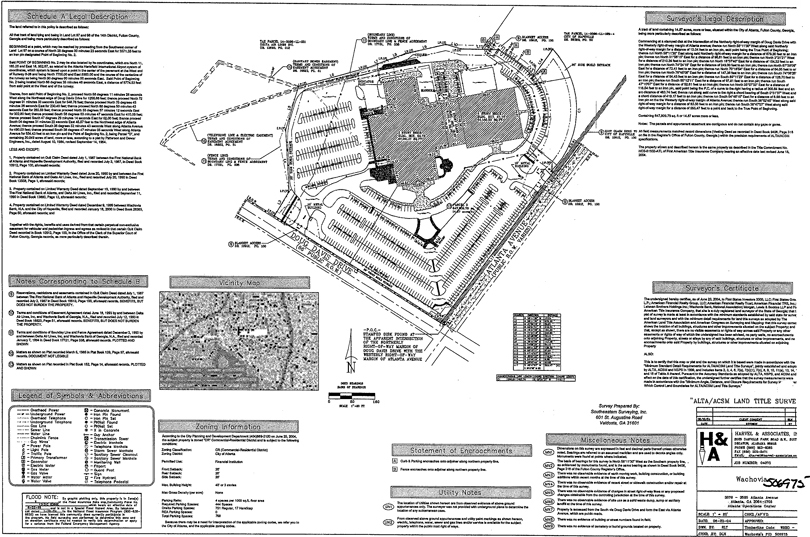

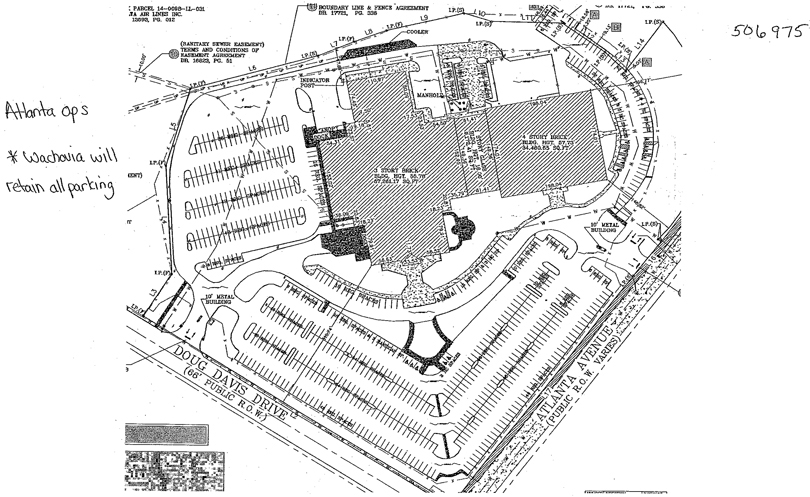

Exhibit A | Description of the Land | |

Exhibit A-1 | Site Plan | |

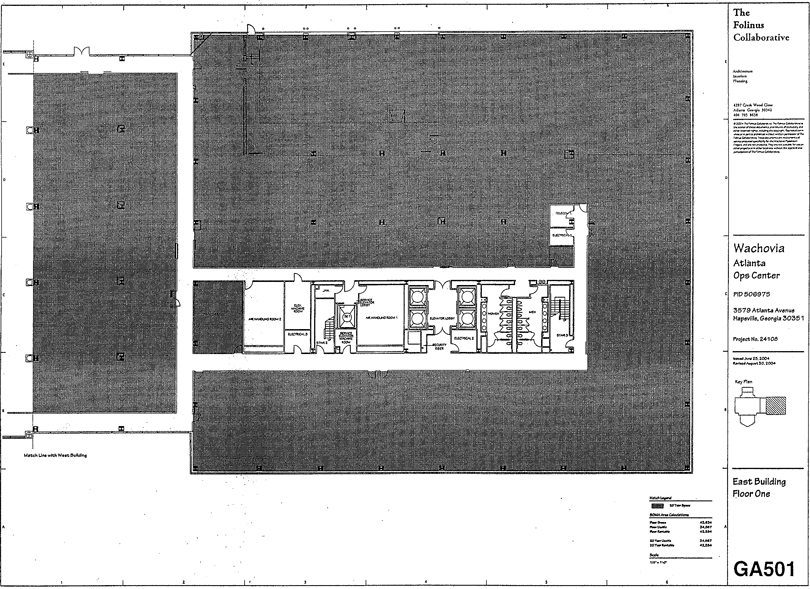

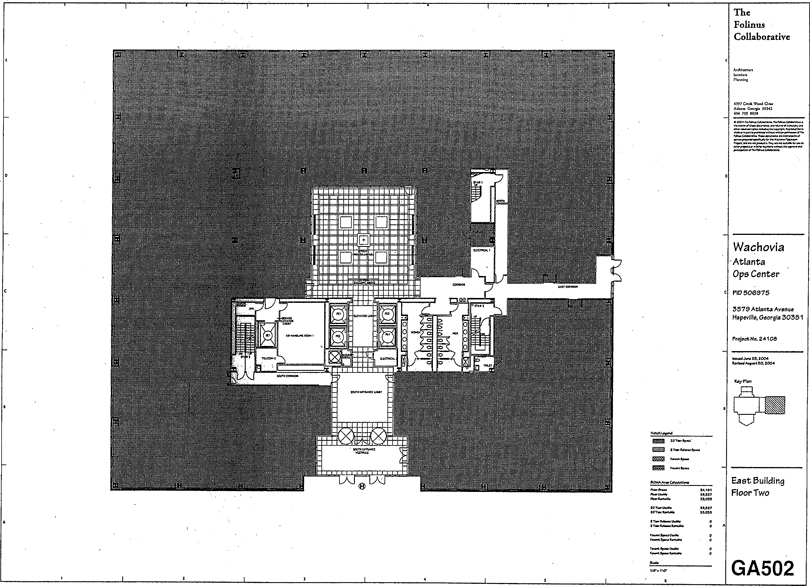

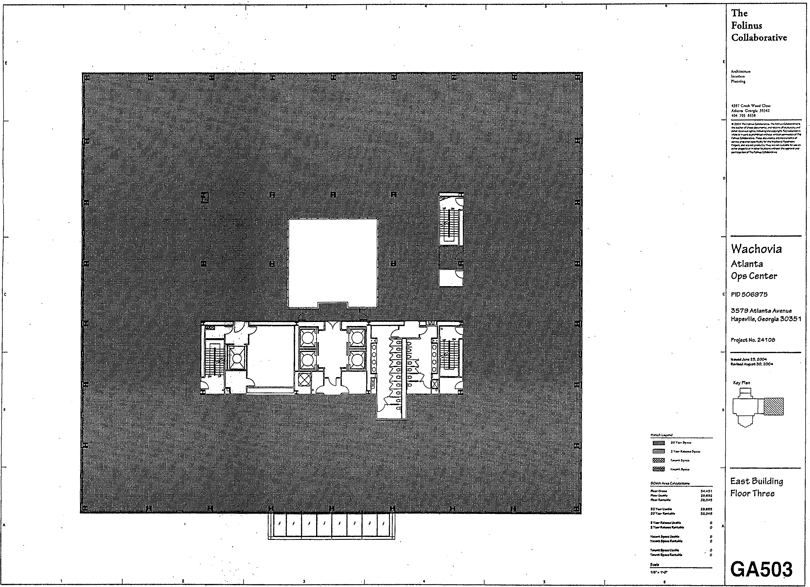

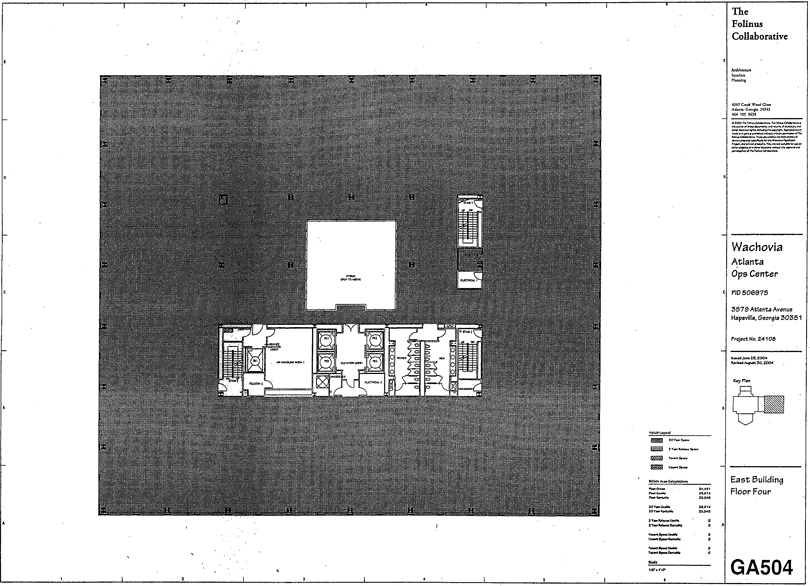

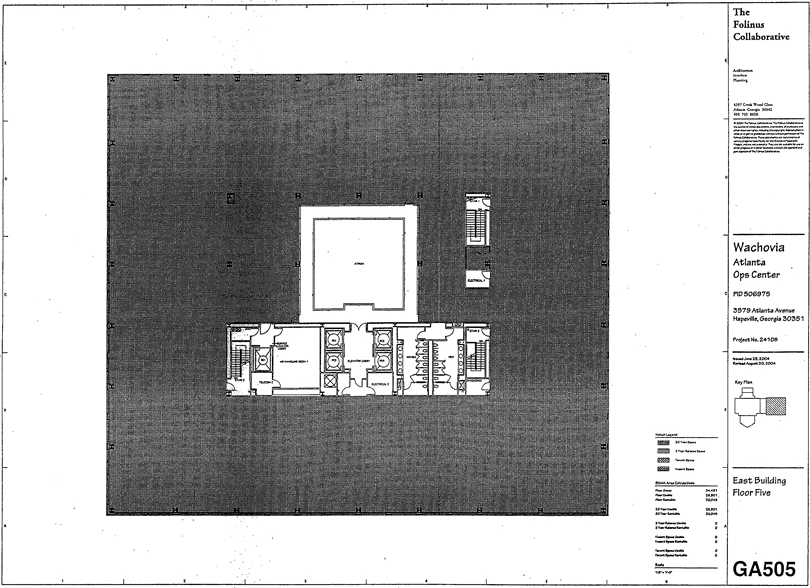

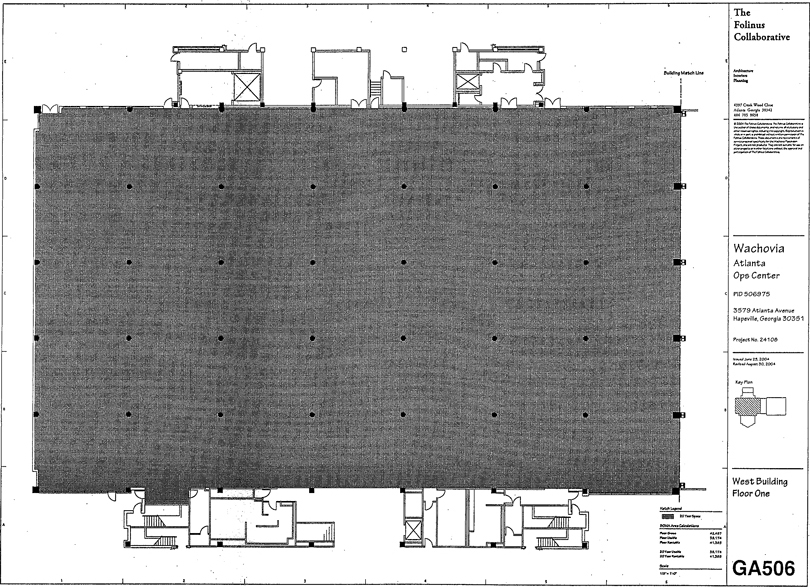

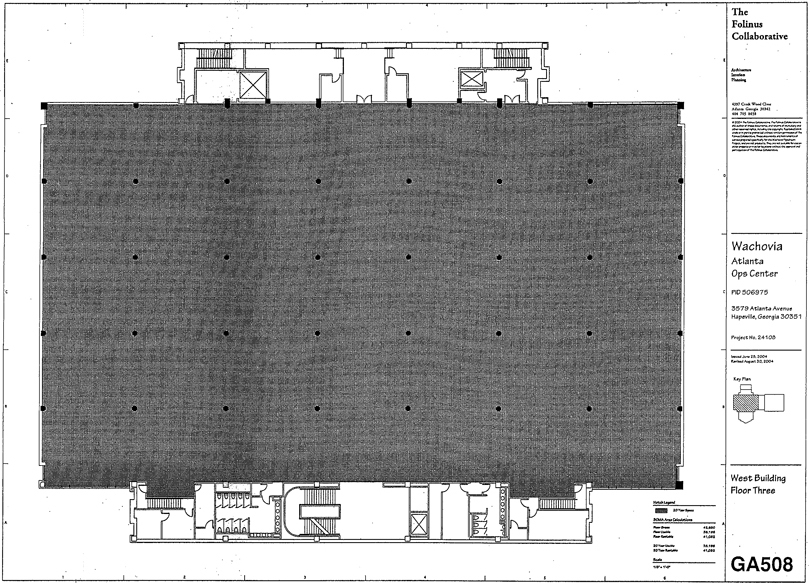

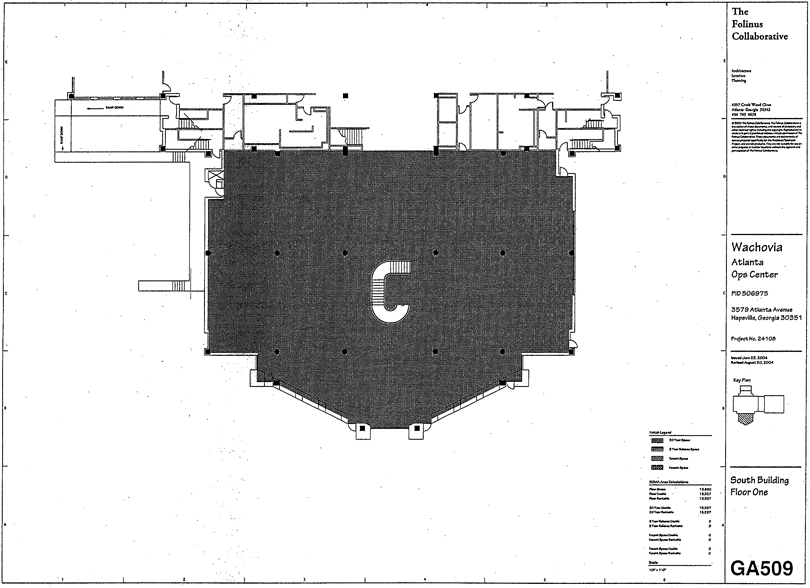

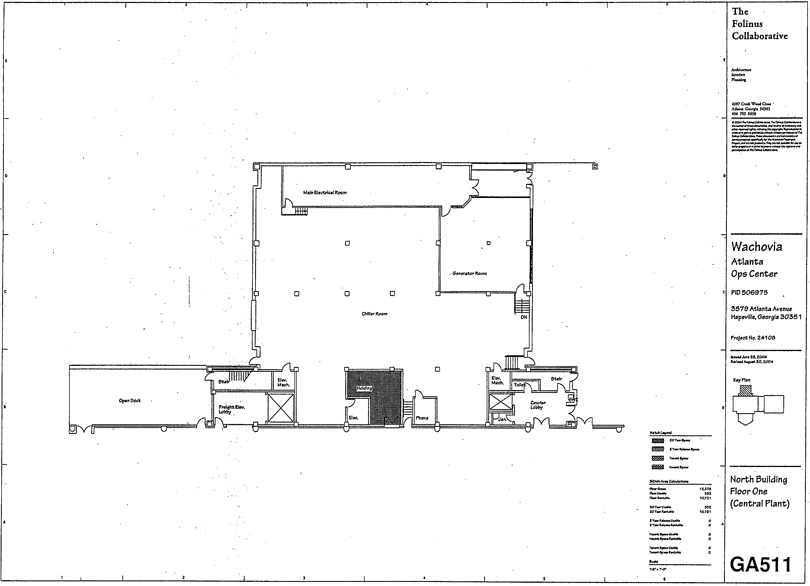

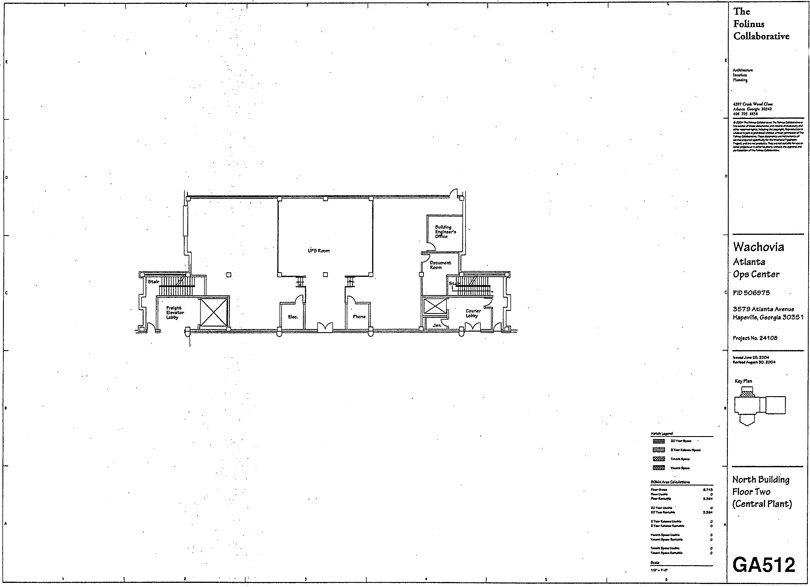

Exhibit B | Leased Premises | |

Exhibit B-1 | Release Premises | |

Exhibit C | Property Specific Information | |

Exhibit D-l | Form of Mortgage Subordination, Non-Disturbance and | |

Attornment Agreement | ||

Exhibit D-2 | Form of Ground Lease Subordination, Non-Disturbance and | |

Attornment Agreement | ||

Exhibit D-3 | Form of Subtenant Subordination, Non-Disturbance and | |

Attornment Agreement | ||

Exhibit E | Forms of Estoppel Certificates | |

-iv-

________________________________________________________________________________________________________________________

LEASE AGREEMENT

THIS LEASE AGREEMENT (this “Lease”) is made and entered into as of September 22, 2004, by and between FIRST STATES INVESTORS 3300, LLC, a Delaware limited liability company (hereinafter called “Landlord”), and WACHOVIA BANK, NATIONAL ASSOCIATION, a national banking association (hereinafter called “Tenant”). Terms with initial capital letters used in this Lease shall have the meanings assigned for such terms in Section 1.1(b).

BACKGROUND

A. Tenant, as seller, and Landlord, as purchaser, are parties to the Purchase Agreement, pursuant to which Tenant agreed to sell and convey to Landlord, and Landlord agreed to purchase from Tenant, the Property as well certain other properties not covered by this Lease.

B. The closing of the Purchase Agreement as to the Property has occurred as of the date hereof, and this Lease is being executed and delivered thereat pursuant to the Purchase Agreement.

C. Wachovia Corporation, a North Carolina corporation, has agreed to guaranty and act as surety for the performance of Tenant’s obligations hereunder pursuant to that certain Lease Guaranty dated of even date herewith.

D. Tenant and Landlord are parties to the Master Agreement (i) which contains certain additional covenants with respect to the subject matter of this Lease and certain other leases as more particularly provided therein, and (ii) which, during the Integration Period, shall be deemed integrated with, and constitute a part of, this Lease (and if, during the Integration Period, there shall be a conflict between the terms and provisions of the Master Agreement and those of this Lease, the terms and provisions of the Master Agreement control and govern).

ARTICLE I

BASIC LEASE INFORMATION, LEASED PREMISES, TERM, AND USE

1.1 | Basic Lease Information; Definitions |

(a) The following Basic Lease Information is hereby incorporated into and made a part of this Lease. Each reference in this Lease to any information and definitions contained in the Basic Lease Information shall mean and refer to the information and definitions hereinbelow set forth.

Commencement Date: | September 22, 2004. | |

Expiration Date: | September 30, 2024 | |

Initial Term: | Commencing on the Commencement Date, and, unless extended or sooner terminated as herein provided, ending on Expiration Date. | |

-1-

________________________________________________________________________________________________________________________

Leased Premises: | The Original Leased Premises, subject to additions to, and/or deletions from, the Leased Premises as herein provided. The “Original Leased Premises” shall be and consist of the areas of the Property identified on Exhibit B hereto as being demised and leased to Tenant hereunder, including the areas of the Building so identified and, if applicable, any Drive-Through Banking Facilities so identified. Each time there is an addition to, or deletion from, the Leased Premises as provided herein, including pursuant to Section 1.7 (Release Premises), Section 6.1 (Condemnation), Article X (Expansion Rights) and Article XI (Termination Rights), Landlord and Tenant, within thirty (30) days thereafter, shall execute and deliver a written instrument confirming the same, which instrument shall (x) set forth the then Net Rentable Area of the Leased Premises, the Annual Basic Rent and Tenant’s Occupancy Percentage, and (y) be accompanied by a revised Exhibit B hereto showing the then location and configuration of the Leased Premises. References herein to the Leased Premises shall not include any Release Premises, except to the extent that former Release Premises are, at Tenant’s election, added to the Leased Premises as expressly provided in Section 1.7 hereof. | |

Release Premises: | All those certain portions of the Building identified on Exhibit X-x hereto as being “Release Premises”, subject to deletions from the Release Premises pursuant to Section 1.7 (by virtue of either Tenant electing to add all or any portion of the Release Premises to the Leased Premises pursuant to Section 1.7(c) or Tenant electing to surrender any portion of the Release Premises prior to the end of the Preliminary Period pursuant to Section 1.7(d)(1) hereof). Each time there is a deletion from the Release Premises as herein provided, Landlord and Tenant, within thirty (30) days thereafter, shall execute and deliver a written instrument confirming the same, which instrument shall (x) set forth the then Net Rentable Area of the Release Premises and Tenant’s Occupancy Percentage, and (y) be accompanied by a revised Exhibit X-x hereto showing the then location and configuration of the Release Premises. | |

Landlord’s Address for Notices: | First States Investors 3300, LLC c/o American Financial Realty Trust 680 Xxx Xxxx Xxxx, Xxxxx 000 Xxxxxxxxxx, Xxxxxxxxxxxx 00000 Xxxxxxxxx: Operations Fax: (000) 000-0000 | |

with a copy to: | American Financial Realty Trust 680 Xxx Xxxx Xxxx, Xxxxx 000 Xxxxxxxxxx, Xxxxxxxxxxxx 00000 | |

-2-

________________________________________________________________________________________________________________________

Attention: General Counsel Fax: (000) 000-0000 | ||

Tenant’s Address for Notices: | Wachovia Bank, N.A. Corporate Real Xxxxxx 0000 Xxxxxxx Xxxxx, XX0000 Xxxxxxx, XX 30388 Attention: Xxxx Xxxxxxx, Ops Leader, AVP Fax: (000) 000-0000 | |

with a copy to: | Wachovia Bank, N.A. Corporate Real Estate 225 Water Street, Suite 850 Jacksonville, FL 32202 Attention: Xxxx X. Xxxx, SVP Fax: (000) 000-0000 | |

and to: | Wachovia Bank, N.A. Corporate Real Estate 401 X. Xxxxx Street, 18th Floor Charlotte, NC 28202 Attention: Xxxxx Xxxxxx, AVP Fax: (000) 000-0000 | |

and to: | Wachovia Bank, N.A. Corporate Legal Division 301 S. College Street, 30th Floor, NC0630 Charlotte, NC 28288-0630 Attention: Xxxxxxx Xxxxxx (PID # 506975) Fax: (000) 000-0000 | |

and to: | Wachovia Corporate Real Estate 201 X. Xxxxx St., 21st FI, NC0114 Charlotte, NC 28288-0114 Attn: Lease Administration (PID #506975) | |

Interest Holder’s Address for Notices: | Xxxxxx Brothers Holdings Inc. Commercial Mortgage Surveillance Group 399 Park Avenue, 0xx xxxxx Xxx Xxxx, Xxx Xxxx 00000 Xxxxxxxxx: Xxxxxxx Manna Fax: (000) 000-0000 | |

with a copy to: | Dechert LLP 4000 Xxxx Atlantic Tower | |

-3-

________________________________________________________________________________________________________________________

0000 Xxxx Xxxxxx Xxxxxxxxxxxx, Xxxxxxxxxxxx 19103 Attention: Xxxxx X. Xxxxx, Esq. Fax: (000) 000-0000 | ||

(b) As used in this Lease, the following terms shall have the respective meanings indicated below, and such meanings are incorporated in each such provision where used as if fully set forth therein:

“AAA” shall mean the American Arbitration Association.

“Above Standard Services” shall have the meaning assigned to such term in Section 3.1 (c).

“Above Standard Services Rent” shall mean any and all charges required to be paid by Tenant for Above Standard Services as expressed in Section 3.1(c).

“Actual Delivery Date” shall have the meaning assigned to such term in Section 10.3.

“Additional Rent” means Tenant’s Operating Expense Share, Tenant’s Tax Share, Above Standard Services Rent and all other sums (other than Annual Basic Rent) that Tenant is obligated to pay to or reimburse Landlord for by the terms of this Lease.

“Affiliate” of any party, shall mean any other person controlling, controlled by, or under common control with such party; the term “control”, as used herein, shall mean both (i) the possession, direct or indirect, of the power to direct or cause the direction, of the management and policies of such controlled party or other person, and (ii) the ownership, directly or indirectly, of more than fifty percent (50%) of the equity (i.e., the voting stock, general or other partnership interests, membership interests and/or other equity or beneficial interests) of such party or other person.

“Alterations” shall have the meaning assigned to such term in Section 5.2.

“Annual Basic Rent” shall mean the annual basic rent payable by Tenant under this Lease for the Leased Premises, which Annual Basic Rent shall, from time to time, be equal to the sum of (I) the product of (i) the Annual Basic Rent Factor, multiplied by (ii) the Net Rentable Area of the Base Leased Premises, plus (II) if any Short-Term Additional Space is then part of the Leased Premises, then, as to each thereof, the product of (i) the STAS Basic Rental Factor for such Short-Term Additional Space, multiplied by (ii) the Net Rentable Area of such Short-Term Additional Space. The Annual Basic Rent due under this Lease shall be re-calculated each time there is a change in (x) the Net Rentable Area of the Leased Premises (due to additions to, or deletions from, the Leased Premises), (y) the Annual Basic Rent Factor (including a change in the Initial ABR Factor pursuant to the proviso in the definition thereof), or (z) the STAS Basic Rental Factor for any Short-Term Additional Space; with any such re-calculation being effective as of the date of such change. Upon any such re-calculation, Landlord and Tenant shall execute and deliver a written instrument confirming the same, and incorporating the same into this Lease.

-4-

________________________________________________________________________________________________________________________

“Annual Basic Rent Factor” (i) for the Initial Term, shall mean a rate, per RSF, per annum, equal to the Initial ABR Factor, except, that (x) effective as of the first day of the sixth (6th) Lease Year, the Annual Basic Rent Factor shall be increased to be 101.5% of the Initial ABR Factor, (y) effective as of the first date of the eleventh (11th) Lease Year, the Annual Basic Rent Factor shall be increased to be 101.5% of the Annual Basic Rent Factor immediately prior to the eleventh (11th) Lease Year, and (z) effective as of the first date of the sixteenth (16th) Lease Year, the Annual Basic Rent Factor shall be increased to be 101.5% of the Annual Basic Rent Factor immediately prior to the sixteenth (16th) Lease Year, and (ii) for each Renewal Term, shall mean the rate, per square foot of Net Rentable Area, for such Renewal Term that is described and determined pursuant to Section 1.4(c)(1) hereof.

“Applicable Rate” shall mean an annual rate of interest equal to the lesser of (i) the greater of (a) the Prime Rate plus three percent (3%) and (b) thirteen (13%) percent, and (ii) the maximum contract interest rate per annum allowed by law.

“Appraiser” shall mean an independent licensed real estate broker, or independent licensed appraiser, having at least ten (10) years’ experience in brokering commercial leasing transactions, or appraising commercial income properties, as the case may be, in the Market Area involving properties similar to the Property, and who shall be associated with a nationally or regionally recognized real estate brokerage or appraisal firm, with local offices within, or in the vicinity of, the Market Area, which firm is not under contract with or otherwise so associated with either Landlord or Tenant as to reasonably impair its or their ability to render impartial judgments.

“Arbitration Notice” shall have the meaning assigned to such term in Section 12.2(a).

“Assignment” shall have the meaning assigned to such term in Section 8.1.1.

“ATM” shall mean automated teller machine.

“Audit Notice” shall have the meaning assigned to such term in Section 2.5.

“Availability Date” shall have the meaning assigned to such term in Section 10.2.

“Available Leasable Areas” shall have the meaning assigned to such term in Section 10.1.

“Bank Divestiture Transaction” shall have the meaning assigned to such term in Section 8.5.1.

“Base Building” shall mean, collectively, (i) the Building’s foundations and footings, and its structural slabs, beams, columns, girders, members and supports, (ii) the Building’s roof(s) and roof terraces, exterior walls (including facade), exterior windows and exterior entrances (including entrance doors), and (iii) Building Systems.

“Base Leased Premises” shall mean, collectively, (i) the Original Leased Premises (for so long thereafter as the same shall remain demised hereunder), (ii) any Coterminous Former Release Premises (if, as and when the same are added to the Leased Premises pursuant to

-5-

________________________________________________________________________________________________________________________

Section 1.7(e), and for so long thereafter as the same shall remain demised hereunder), and (iii) any Coterminous Expansion Space (if, as and when the same are added to the Leased Premises pursuant to Section 10.4, and for so long thereafter as the same shall remain demised hereunder).

“BOMA” shall mean the Building Owners and Managers Association.

“Budget” shall have the meaning assigned to such term in Section 2.4(a).

“Budget Year” shall have the meaning assigned to such term in Section 2.4(a).

“Building” shall mean the building (or building complex) located upon the Land and identified on Exhibit A-l.

“Building Identification Signage” shall have the meaning assigned to such term in Section 3.4(a).

“Building Operating Hours” shall be the hours, designated as such, on Exhibit C hereto.

“Building Rules” shall have the meaning assigned to such term in Section 4.5.

“Building Signage” shall have the meaning assigned to such term in Section 3.4(a).

“Building Standard Services” shall have the meaning assigned to such term in Section 3.1(a).

“Building Standards” shall mean materials of the type, quality and quantity generally used throughout the Building and in Comparable Buildings.

“Building System HVAC Service” shall have the meaning assigned to such term in Section 3.1(a).

“Building Systems” shall mean the utility and service systems (including electrical, gas, plumbing, condenser water, elevator, HVAC, communication, life safety and other mechanical systems) of the Building, but only up to, and not beyond, the point of distribution to any Leasable Areas and/or the point of connection to the separate facilities of a particular tenant or other occupant.

“Building’s CW System” shall have the meaning assigned to such term in Section 3.1(b).

“Building’s Loading & Delivery Facilities” shall have the meaning assigned to such term in Section 3.1(a).

“Bureau of Labor Statistics” shall mean the U.S. Department of Labor, Bureau of Labor Statistics.

“Business Days” shall mean all days except Saturdays, Sundays and Holidays.

“Casualty” shall have the meaning assigned to such term in Section 6.3(a).

-6-

________________________________________________________________________________________________________________________

“Change in Control Transaction” shall have the meaning assigned to such term in Section 8.1.1.

“Closing” shall mean the closing and transfer of title to the Property to Landlord pursuant to the Purchase Agreement.

“Commencement Date” shall have the meaning assigned to such term in Section 1.1(a).

“Common Areas” shall mean (i) the Building’s lobbies and corridors (located outside of Leasable Areas), including the Building’s elevators, escalators, stairways and other Building Systems providing ingress and egress thereto and therefrom, (ii) the Building’s loading and freight delivery areas (located outside of Leasable Areas), including any freight elevators located therein, (iii) the Building’s lavatories (located outside of Leasable Areas), (iv) the Building’s electrical, telephone and other utility or service rooms, closets and shafts (located outside of Leasable Areas), (v) the Parking Areas, (vi) the sidewalks, curb areas, plazas, walkways, driveways and other passageways upon the Land, together with any other landscaped areas of the Land (other than any Drive-Through Banking Facilities which, as herein-above provided, comprise part of the Leased Premises), and (vii) any other areas of the Property available, from time to time, for the common use of tenants and other occupants of the Property (and their customers, guests and invitees).

“Communications Equipment” shall have the meaning assigned to such term in Section 3.5(a).

“Comparable Buildings” shall mean buildings within the Market Area that have a use, quality, age, configuration and construction that is comparable to that of the Building.

“Contemplated OE Includable Capital Item” shall have the meaning assigned to such term in Section 2.4(a).

“Contemplated Sublease Area” shall have the meaning assigned to such term in Section 8.2.1.

“Contract of Sale” shall have the meaning assigned to such term in Section 9.1.1.

“Coterminous Expansion Space” shall have the meaning assigned to such term in Section 10.3.

“Coterminous Former Release Premises” shall have the meaning assigned to such term in Section 1.7(e).

“Damaged Property” shall have the meaning assigned to such term in Section 6.3(a).

“Damages Period” shall have the meaning assigned to such term in Section 7.1(b).

“Demising Work” shall have the meaning assigned to such term in Section 5.7(a).

“Demising Work Costs” shall have the meaning assigned to such term in Section 5.7(a).

-7-

________________________________________________________________________________________________________________________

“Drive-Through Banking Facility” shall mean the portion of the Leased Premises, if any, identified as a Drive-Through Banking Facility on Exhibit B hereto.

“Early Termination Date” shall have the meaning assigned to such term in Section 11.1.

“Electric Utility Company” shall have the meaning assigned to such term in Section 3.1(a).

“Eligible Sublease” shall have the meaning assigned to such term in Section 8.7.1.

“Environmental Information” shall have the meaning assigned to such term in Section 47(a).

“Environmental Matters” shall have the meaning assigned to such term in Section 4.7(a).

“Exempt LL Transfer” shall have the meaning assigned to such term in Section 9.1.1.

“Expansion Rights” shall have the meaning assigned to such term in Section 10.3.

“Expansion Space” shall have the meaning assigned to such term in Section 10.3.

“Expansion Space Acceptance” shall have the meaning assigned to such term in Section 10.3.

“Expiration Date” shall have the meaning assigned to such term in Section 1.1(a).

“Event of Default” shall have the meaning assigned to such term in Section 7.1(a).

“Existing Mortgage” shall have the meaning assigned to such term in Section 15.1.

“Existing Xxxxxxxxx” shall have the meaning assigned to such term in Section 15.2.

“Fair Market Rental Value Per RSF”, for any Leasable Area at any time, shall mean the fixed rent, per RSF, per annum, that (at the time in question) would be offered and accepted under an arm’s-length net lease (i.e., a lease under which the tenant separately pays its proportionate share of all operating expenses, real estate taxes, utilities and other pass-throughs, without any “base year” or “stop”) between an informed and willing tenant (that is not then a tenant of any Leasable Area) and an informed and willing landlord, neither of whom is under any compulsion to enter into such transaction, demising such Leasable Area (determined with reference to market for space in Comparable Buildings that is comparable in size, location and quality to such Leasable Area), assuming (i) such arm’s length net lease will demise the Leasable Area in its then “AS IS” condition (except that if such Leasable Area is already a part of the Leased Premises, then assuming a condition and state of repair consistent with the requirements of this Lease), and (ii) such arm’s length net lease will be for a term equal to the then typical initial term of such a lease in the aforementioned market, and further assuming the following factors (and, based thereon, making any appropriate adjustments to the fixed rent which would otherwise be offered and accepted for such an arm’s length net lease pursuant to the foregoing provisions of this definition): (I) that the tenant will not receive, and the landlord will not provide

-8-

________________________________________________________________________________________________________________________

or pay, (w) any workletter, (x) any improvement, relocation, moving or other allowance or contribution, (y) any rent abatement or other reduced or free rent period, or (z) any other allowance or concession, in connection with the tenant’s leasing of the Leasable Area (except that if such Leasable Area is Short-Term Expansion Space, then assuming that the tenant is entitled to a free rent period equal in length to the free rent period that Tenant is entitled to, pursuant to Section 10.4(g), with respect to such Short-Term Expansion Space); (II) that the landlord will not pay any brokers’ fee or commission in connection with the tenant’s leasing of the Leasable Area; (III) that such arm’s length net lease provides for the landlord’s inclusion, and the tenant’s payment, of amortized capital expenditures in operating expenses to the same extent as provided in this Lease; and (IV) that the creditworthiness of the tenant is the same as that of Tenant.

“Final Budget” shall have the meaning assigned to such term in Section 2.4(d).

“Final Contract of Sale” shall have the meaning assigned to such term in Section 9.1.1.

“Final SLC Plans & Specifications” shall have the meaning assigned to such term in Section 5.7(b).

“Final SLC Space Plan” shall have the meaning assigned to such term in Section 5.7(b).

“Fiscal Period” shall have the meaning assigned to such term in Section 2.3(a).

“Force Majeure Events” means events beyond Landlord’s or Tenant’s (as the case may be) control, which shall include, without limitation, all labor disputes, governmental regulations or controls, war, fire or other casualty, inability to obtain any material or services, acts of God, or any other cause not within the reasonable control of Landlord or Tenant (as the case may be).

“FSG” shall mean (i) FIRST STATES GROUP, L.P., a Delaware limited partnership, or (ii) a person constituting an immediate or remote successor to FIRST STATES GROUP, L.P. by virtue of one or more mergers, consolidations and/or transfers of all, or substantially all, the assets of FIRST STATES GROUP, L.P. (or another person described in this clause (ii)).

“GAAP” shall mean generally accepted accounting principles, consistently applied.

“Governmental Authority” means the United States, the state, county, city and political subdivision in which the Property is located or that exercises jurisdiction over the Property, Landlord or Tenant, and any agency, department, commission, board, bureau or instrumentality of any of the foregoing that exercises jurisdiction over the Property, Landlord or Tenant.

“Gross Revenue” shall mean all gross rental income of Landlord generated from the operation of the Property, including basic rents, additional rents and other charges collected from Tenant and other tenants or occupants of the Property, but excluding (a) any such rents and other charges which represent payment or reimbursement for any utilities or services provided to tenants or other occupants of the Property which are not provided to Tenant under this Lease without a separate charge, (b) revenue received by Landlord for parking (whether from Tenant, other tenants or occupants of the Property or otherwise), or from vending areas, cafeterias, fitness centers, etc., and (c) any revenue received by Landlord from any further development or

-9-

________________________________________________________________________________________________________________________

leasing of the Property. In no event shall the term “gross rental income”, as used in this definition, ever be deemed to include (i) security deposits, unless and until such deposits are applied as rental income, (ii) interest on bank accounts for the operation of the Property, (iii) proceeds from the sale or refinancing of the Property (or any portion thereof), (iv) insurance proceeds or dividends received from any insurance policies pertaining to physical loss or damage to the Property, (v) condemnation awards or payments received in lieu of condemnation of the Property and (vi) any trade discounts and rebates received in connection with the purchase of personal property or services in connection with the operation of the Property.

“Hazardous Materials” means any flammable materials, explosive materials, radioactive materials, asbestos-containing materials, the group of organic compounds known as polychlorinated biphenyls and any other hazardous, toxic or dangerous waste, substance or materials defined as such in (or for purposes of) the federal Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended, 42 U.S.C. §§ 9601 to 9675, the federal Hazardous Materials Transportation Act, 42 U.S.C. §§ 5101 to 5127, the federal Solid Waste Disposal Act as amended by the Resources Conservation and Recovery Act of 1976, 42 U.S.C. §§ 6901 to 6992k, the federal Toxic Substance Control Act, 15 U.S.C. §§ 2601 to 2692 or any other Legal Requirement from time to time in effect regulating, relating to or imposing liability or standards of conduct concerning any hazardous, toxic or dangerous waste, substance or material.

“Holidays” shall mean New Year’s Day, Xxxxxx Xxxxxx Xxxx Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Thanksgiving Day, Christmas Day and any and all other dates observed as bank holidays by national banks. If, in the case of any holiday described above, a different day shall be observed than the respective day described above, then that day that constitutes the day observed by national banks in the State on account of such holiday shall constitute the Holiday under this Lease.

“HVAC” shall mean heating, ventilating and air conditioning.

“Initial ABR Factor” shall mean $5.95 per RSF, per annum; provided, however, that if the provisions of Section 8 of the Master Agreement are applicable, then, effective as of the first (1st) day of the third Lease Year, the Initial ABR Factor shall be re-calculated in accordance therewith. Upon any such re-calculation, Landlord and Tenant shall execute and deliver a written instrument confirming the same, and incorporating the same into this Lease.

“Initial Term” shall have the meaning assigned to such term in Section 1.1(a).

“Interest Holder” shall mean each of (i) any Overlessor with which Tenant has entered into an Xxxxxxxxx SNDA, and (ii) any Mortgagee with which Tenant has entered into a Mortgage SNDA.

“Integrated Properties” shall mean all the Portfolio Properties, in which, at the time in question, space is demised under a lease which, at the time in question, is defined as an “Integrated Lease” pursuant to the provisions of the Master Agreement.

“Integration Period” shall mean all periods within the Term during which this Lease is defined as an “Integrated Lease” pursuant to the provisions of the Master Agreement.

-10-

________________________________________________________________________________________________________________________

“JAMS” shall mean Judicial Arbitration & Mediation Services, Inc.

“KWHs” shall have the meaning assigned to such term in Section 3.1(a).

“Land” shall mean the parcel(s) of land identified on Exhibit A hereto.

“Landlord” shall mean only the owner of Landlord’s Estate, at the time in question; it being agreed that: (I) during the Integration Period, the foregoing provisions of this definition shall not be construed to relieve Landlord Named Herein, or any subsequent Landlord, from the obligations of Landlord under this Lease accruing during the period that it is Landlord hereunder or thereafter; (II) upon any transfer of Landlord’s Estate that complies with the provisions of Article IX hereof, but results in the end of the Integration Period (and upon each subsequent transfer of Landlord’s Estate that complies with the provisions of Article IX hereof), the transferor shall thereby be relieved and freed of all obligations of Landlord under this Lease accruing after such transfer; and (III) upon any transfer of Landlord’s Estate, the transferee shall thereby be deemed to have assumed all obligations of Landlord under this Lease accruing after such transfer (and, during the Integration Period, such transferee shall also be deemed to have assumed all the obligations of Landlord under the Master Agreement).

“Landlord Appointed Property Manager” shall have the meaning assigned to such term in Section 3.6(a).

“Landlord Budget Objection” shall have the meaning assigned to such term in Section 2.4(f).

“Landlord Default Notice” shall have the meaning assigned to such term in Section 7.10.

“Landlord Electrical Invoice” shall have the meaning assigned to such term in Section 3.1(a).

“Landlord Event of Default” shall have the meaning assigned to such term in Section 13.1(a).

“Landlord Expansion Response” shall have the meaning assigned to such term in Sectibn 10.2.

“Landlord Initiated Contest” shall have the meaning assigned to such term in Section 2.3(c).

“Landlord Management Period” shall have the meaning assigned to such term in Section 3.6(a).

“Landlord Named Herein” shall mean FIRST STATES INVESTORS 3300, LLC.

“Landlord Party” shall mean any principal (which shall include any shareholder, partner, member or other owner, direct or indirect, disclosed or undisclosed) of Landlord, or any director, officer, employee, agent or contractor of Landlord (or of any principal of Landlord).

-11-

________________________________________________________________________________________________________________________

“Landlord Repairs” shall have the meaning assigned to such term in Section 5.5(a).

“Landlord’s Average Cost Per KWH” shall have the meaning assigned to such term in Section 3.1(a).

“Landlord’s Estate” shall mean the estate and interest of Landlord in the Property, including fee title to the Property and/or the lessee’s interest in an Xxxxxxxxx affecting the Property.

“Landlord’s Liens” shall have the meaning assigned to such term in Section 7.3(a).

“Landlord’s Offer Notice” shall have the meaning assigned to such term in Section 9.2.1.

“Landlord’s Preliminary Notice” shall have the meaning assigned to such term in Section 9.3.1.

“Landlord’s RCT Period” shall have the meaning assigned to such term in Section 8.3.2.

“Landlord’s RCT Termination Notice” shall have the meaning assigned to such term in Section 8.3.2.

“Landlord’s RCT Termination Option” shall have the meaning assigned to such term in Section 8.3.2.

“Landlord’s Recapture Notice” shall have the meaning assigned to such term in Section 8.2.2.

“Landlord’s Recapture Option” shall have the meaning assigned to such term in Section 8.2.2.

“Landlord’s Recapture Period” shall have the meaning assigned to such term in Section 8.2.2.

“Landlord’s Restoration Work” shall have the meaning assigned to such term in Section 6.3(a).

“Landlord’s RFR Notice” shall have the meaning assigned to such term in Section 9.3.2.

“Landlord’s Transfer Notice” shall have the meaning assigned to such term in Section 9.2.4.

“Leased Premises” shall have the meaning assigned to such term in Section 1.1(a). For purposes of this Lease, the Leased Premises, at any time, shall be deemed to consist only of the space within the inside surfaces of all the demising walls, exterior windows and entrances, and structural ceilings and floors, bounding the areas comprising the Leased Premises, at such time.

“Leasable Area Submeters” shall have the meaning assigned to such term in Section 3.1(a).

-12-

________________________________________________________________________________________________________________________

“Leasable Areas” shall, at any time, mean all areas of the Building that are then leased (or occupied), available for lease (or occupancy), or otherwise susceptible of being leased (or occupied), by tenants (or other occupants); whether or not the same are then being marketed or are then capable of being legally or physically occupied.

“Lease Year” means (i) the period commencing on the Commencement Date and ending on the last day of the calendar month in which the first (1st) anniversary of the Commencement Date occurs (sometimes herein referred to as the first Lease Year), and (ii) each period of twelve (12) consecutive calendar months thereafter occurring within the Term (i.e., the second Lease Year commences upon the expiration of first Lease Year and ends one (1) year later, and all subsequent Lease Years commence upon the expiration of the prior Lease Year), except, that the last Lease Year during the Term ends on the last day of the Term.

“Leasehold Improvements” shall mean all improvements, betterments and/or equipment installed within, and affixed or attached to, the Leased Premises, so as to become a part thereof, by, or on behalf of, Tenant (or any Tenant Party) (including (x) such improvements, betterments and/or equipment constructed or installed by Tenant prior to the date hereof, or such improvements, betterments and/or equipment constructed or installed by Tenant pursuant to Section 5.2 hereof). Without limiting the foregoing, the term Leasehold Improvements shall be deemed to include (i) permanent interior walls, permanent floor coverings (e.g., wall-to-wall carpeting, but not area rugs or other un-affixed carpeting), permanent wall coverings (e.g., wall paper, wood paneling) and drop ceilings, (ii) basic light fixtures (but not chandeliers or other lighting fixtures above the quality of Building Standard), (iii) doors, door hardware, (iv) window blinds, (v) to the extent that any portion of the Leased Premises is, immediately prior to the end of the Term, being used as a retail banking branch, the vaults, vault doors, teller counters and under-counter steel located in such portion of the Leased Premises, and, with respect to the Drive-Through Banking Facilities (if any), the pneumatic tubing and kiosks thereat, and (vi) Tenant’s line, riser and other connections to the Building Systems. Notwithstanding the foregoing provisions of this definition, in no event shall the term “Leasehold Improvements” be deemed to include any property included within the definitions of “Base Building” or “Tenant Property” hereunder.

“Legal Requirements” means any law, statute, ordinance, order, rule, regulation or requirement of a Governmental Authority.

“LL Rent Schedule” shall have the meaning assigned to such term in Section 9.2.1.

“LL Transfer” shall have the meaning assigned to such term in Section 9.1.1.

“LL Transfer Permitted Encumbrances” shall have the meaning assigned to such term in Section 9.2.1.

“LRW Estimate” shall have the meaning assigned to such term in Section 6.3(a).

“Management Designation Notice” shall have the meaning assigned to such term in Section 3.6(c).

-13-

________________________________________________________________________________________________________________________

“Market Area” shall mean the metropolitan area within which the Property is located, which area may be more particularly identified on Exhibit C hereto.

“Master Agreement” shall mean that certain Master Agreement Regarding Leases by and between Landlord Named Herein and Wachovia, dated as of the date hereof.

“Measurement Standard” shall mean the Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-1989, as promulgated by BOMA.

“Monthly Estimated OE Payments” shall have the meaning assigned to such term in Section 2.2(b).

“Mortgage” shall mean any mortgage or deed of trust which may now or hereafter affect the Property (and/or an Xxxxxxxxx).

“Mortgagee” shall mean any holder of any Mortgage.

“Mortgage SNDA” shall mean a subordination, non-disturbance and attornment agreement between a Mortgagee and Tenant in the form annexed as Exhibit D-1 hereto, and in proper form for recording, together with such changes thereto that are both proposed by a Mortgagee and approved by Tenant; it being agreed that Tenant shall not unreasonably withhold its approval of any such proposed change so long as (i) such proposed change is customary (at the time in question), and (ii) such proposed change does not (to more than a de minimis extent) decrease Tenant’s rights, or increase Tenant’s obligations, from those contained in the form of Mortgage SNDA annexed as Exhibit D-1 hereto.

“Net Rentable Area”, of any Leasable Area, shall mean the number of RSF comprising the same determined in conformity with the Measurement Standard. References herein to the Net Rentable Area “of the Building” shall be deemed to mean the aggregate Net Rentable Area of all the Leasable Areas of the Building, as so determined. The final, and conclusively binding, determinations of the Net Rentable Areas of the Leased Premises (as the same exist on the Commencement Date), the Release Premises (as the same exist on the Commencement Date) and the Building (as the same exists on the Commencement Date) are as specified in Exhibit C hereto.

“Net Sublease Consideration” shall have the meaning assigned to such term in Section 8.4.2.

“Non-Consent Alterations” shall have the meaning assigned to such term in Section 5.2(c).

“Non-Dedicated Parking Areas” shall mean all portions of the Parking Areas other than Tenant Dedicated Parking Areas.

“Notice Parties” shall mean (i) in case of Landlord, the parties identified, with addresses, in Section 1.1(a) under the heading “Landlord’s Address for Notices” (as the same may be modified consistent with the provisions of Section 14.1 hereof), and (ii) in the case of Tenant, the

-14-

________________________________________________________________________________________________________________________

parties identified, with addresses, in Section 1.1(a) under the heading “Tenant’s Address for Notices” (as the same may be modified consistent with the provisions of Section 14.1 hereof).

“NPV Profit Amount” shall have the meaning assigned to such term in Section 8.2.3.

“OE Overpayment” shall have the meaning assigned to such term in Section 2.2(f).

“OE Includable Capital Item” shall have the meaning assigned to such term in Section 2.2(c)(3).

“OE Underpayment” shall have the meaning assigned to such term in Section 2.2(f).

“Operating Expenses” shall have the meaning assigned to such term in Section 2.2(b).

“Operating Expense Statement” shall have the meaning assigned to such term in Section 2.2(f).

“Original Leased Premises” shall have the meaning assigned to such term in Section 1.1(a).

“OT Building System HVAC Service” shall have the meaning assigned to such term in Section 3.1(c).

“Other Building Signage” shall have the meaning assigned to such term in Section 3.4(a).

“Other Demising Work” shall have the meaning assigned to such term in Section 5.7(a).

“Other Demising Work Costs” shall have the meaning assigned to such term in Section 5.7(a).

“Other Leasable Area Submeters” shall have the meaning assigned to such term in Section 3.1(a).

“Other Permitted Leases” shall have the meaning assigned to such term in Section 9.2.1.

“Other Qualified Rooftop Equipment” shall have the meaning assigned to such term in Section 3.5(d).

“Outside Completion Date” shall have the meaning assigned to such term in Section 6.3(d).

“Outside Expiration Date” shall mean September 30, 2054.

“Xxxxxxxxx” shall mean any ground lease, or other xxxxxxxxx, of the Property or any part thereof, now or hereafter existing.

“Overlessor” shall mean any lessor under an Xxxxxxxxx.

-15-

________________________________________________________________________________________________________________________

“Xxxxxxxxx SNDA” shall mean a subordination, non-disturbance and attornment agreement between an Overlessor and Tenant in the form annexed as Exhibit D-2 hereto, and in proper form for recording, together with such changes thereto that are both proposed by an Overlessor and approved by Tenant; it being agreed that Tenant shall not unreasonably withhold its approval of any such proposed change so long as (i) such proposed change is customary (at the time in question), and (ii) such proposed change does not (to more than a de minimis extent) decrease Tenant’s rights, or increase Tenant’s obligations, from those contained in the form of Xxxxxxxxx SNDA annexed as Exhibit D-2 hereto.

“Parking Areas” shall mean the parking areas and facilities for the Property as indicated on Exhibit A-1 hereto, together with (i) any walkways, driveways and other passageways upon the Land providing ingress and egress between such areas and facilities and the Building and/or between such areas and facilities and the Building, and (ii) any additional improvements now or hereafter located on the Land related to the foregoing areas and facilities.

“Personnel Costs” shall have the meaning assigned to such term in Section 2.2(c).

“Portfolio Properties” shall mean all properties acquired by Landlord pursuant to the Purchase Agreement.

“Preliminary Period” shall mean the first two Lease Years (i.e., the period commencing on the Commencement Date and expiring on the last date of the second (2nd) Lease Year).

“Premises Submeter” shall have the meaning assigned to such term in Section 3.1(a).

“Primary Demising Work” shall have the meaning assigned to such term in Section 5.7(a).

“Primary Demising Work Costs” shall have the meaning assigned to such term in Section 5.7(a).

“Prime Rate” shall mean the “prime rate” announced by Wachovia Bank, National Association, or its successor, from time to time (or if the “prime rate” is discontinued, the rate announced as that being charged to said bank’s most credit-worthy commercial borrowers).

“Prohibited Uses” shall have the meaning assigned to such term in Section 4.8(b).

“Property” means, collectively, (i) the Land, and (ii) all improvements now or hereafter located on the Land, including (x) the Building (inclusive of all improvements, betterments and/or equipment that, from time to time, are affixed or attached thereto, or otherwise constitute a part thereof), (y) the Common Areas (within or outside of the Building), including all sidewalks, curbs, plazas, paved walkways, driveways and other passageways upon the Land (as well as any other landscaping upon the Land), and (z) any Drive-Through Banking Facilities which comprise part of the Leased Premises, and (iii) any personal property belonging to Landlord which is located within or upon the Land and/or Building, and used in connection with the operation thereof.

“Property Manager” shall have the meaning assigned to such term in Section 3.6(a).

-16-

________________________________________________________________________________________________________________________

“Purchase Agreement” shall mean that certain Agreement of Sale and Purchase by and between Wachovia, as seller, and Landlord Named Herein, as purchaser, dated as of May 10, 2004.

“Qualified Damage” shall have the meaning assigned to such term in Section 6.3(b).

“RCT Termination Date” shall have the meaning assigned to such term in Section 8.3.3.

“RE Tax Contest” shall have the meaning assigned to such term in Section 2.3(c).

“Real Estate Taxes” shall have the meaning assigned to such term in Section 2.3(b).

“Recapture Effective Date” shall have the meaning assigned to such term in Section 8.2.3.

“Release Premises” shall have the meaning assigned to such term in Section 1.1(a).

“Release Premises Election Date” shall mean the last day of the sixth (6th) full calendar month of the second (2nd) Lease Year.

“Release Space Expiration Date” shall have the meaning assigned to such term in Section 1.7(d).

“Relevant Books and Records” shall have the meaning assigned to such term in Section 2.5(a).

“Remedial Work”, as to any portion of the Property (including the Leasable Areas or the Common Areas), means the removal, relocation, elimination, remediation or encapsulation of Hazardous Materials from such portion(s) of the Property and, to the extent thereby required, the reconstruction and rehabilitation of such portion(s) of the Property pursuant to, and in compliance with, the provisions of this Lease.

“Renewal Appraisal Notice” shall have the meaning assigned to such terms in Section 1.4(e).

“Renewal Option” and “Renewal Options” shall have the meanings assigned to such terms in Section 1.4(a).

“Renewal Option Notice Date” shall mean, with respect to any Renewal Option, the date on which Tenant sends Tenant’s Renewal Notice to Landlord as provided in Section 1.4.

“Renewal Term” and “Renewal Terms” shall have the meanings assigned to such terms in Section 1.4(a).

“Rent” means Annual Basic Rent and Additional Rent.

“Requesting Party” shall have the meaning assigned to such term in Section 12.1(a)(i).

-17-

________________________________________________________________________________________________________________________

“Required Above Standard Services” shall have the meaning assigned to such term in Section 3.1(c).

“Responding Party” shall have the meaning assigned to such term in Section 12.1(a)(i).

“Retail Conversion Transaction” shall have the meaning assigned to such term in Section 8.1.1.

“RFR Contract” shall have the meaning assigned to such term in Section 9.2.5.

“RFR Exercise Period” shall have the meaning assigned to such term in Section 9.2.4.

“RFR Period” shall have the meaning assigned to such term in Section 9.1.1.

“RSF” shall mean rentable square feet.

“Scheduled Delivery Date” shall have the meaning assigned to such term in Section 10.3.

“SEC” means the Securities and Exchange Commission.

“Section 8.5 Transaction” shall have the meaning assigned to such term in Section 8.5.1.

“Security Areas” shall have the meaning assigned to such term in Section 4.2.

“Self-Insurance Net Worth Test” shall mean, as of any date, that (i) Tenant has a net worth of at least $1,000,000,000, and (ii) Tenant’s long-term senior unsecured debt obligations are rated at least BBB (or its equivalent) by Standard & Poor’s and Baa2 (or its equivalent) by Xxxxx’x as of that date; provided that if Tenant is rated by only one of Standard & Poor’s or Xxxxx’x, such obligations shall have such rating from Standard & Poor’s or Xxxxx’x, as the case may be, and a comparable rating from another nationally-recognized rating agency.

“Separate Charge Parking Areas” shall mean the portions of the Parking Areas that are designated as “Separate Charge Parking Areas” on Exhibit A-1 hereto.

“Separately Leasable Condition”, when used with respect to any space in the Building, shall mean that such space (subject to the construction within such space of leasehold improvements of the type and nature normally found within legally occupied Leasable Areas) is legally capable of being separately leased to a tenant for general office purposes (or, in the case of ground floor space, general office, retail or banking purposes), including (i) being separately demised from any other Leasable Area (i.e., bounded by demising walls), (ii) having an independent means of ingress and egress (i.e., independent of any other Leasable Area) to, and from, the outside of the Building or to and from the Common Areas that serve such space, and (iii) being otherwise served by such Common Areas, whether general or limited, that, assuming the construction within such space of leasehold improvements of the type and nature normally found within legally occupied Leasable Areas, shall be legally sufficient to permit such space to separately leased as herein-above provided in this definition. The term “leasehold improvements”, as used herein, shall mean improvements and betterments to, and within the

-18-

________________________________________________________________________________________________________________________

confines of, a demised Leasable Area, over and above the components of the Base Building therein.

“Service Failure” shall have the meaning assigned to such term in Section 3.1(f).

“Short-Term Additional Space” shall mean each of (i) the Short-Term Former Release Space (if, as and when the same are added to the Leased Premises pursuant to Section 1.7(f), and for so long thereafter as the same shall remain demised hereunder), or (ii) any Short-Term Expansion Space (if, as and when the same are added to the Leased Premises pursuant to Section 10.3, and for so long thereafter as the same shall remain demised hereunder).

“Short-Term Former Release Space” shall have the meaning assigned to such term in Section 1.7(f).

“Short-Term Expansion Space” shall have the meaning assigned to such term in Section 10.3.

“SLC Plans & Specifications” shall have the meaning assigned to such term in Section 5.7(b).

“SLC Space Plan” shall have the meaning assigned to such term in Section 5.7(b).

“SNDA” shall mean any of a Mortgage SNDA, an Xxxxxxxxx SNDA and a Sublease SNDA.

“STAS Basic Rental Factor”, for any Short-Term Additional Space, shall, at any time, mean the rate, per square foot of Net Rentable Area, then applicable to such Short-Term Additional Space, as set forth (i) in the case of Short-Term Former Release Space, (x) in Section 1.7(f)(2), for all periods prior to the end of the Initial Term, and (y) in Section 1.4(c)(2), for any Renewal Terms, and (ii) in the case of any Short-Term Expansion Space, (xx) in Section 10.4(e)(2), for all periods prior to the end of the Initial Term (as well any Renewal Term during which such Short-Term Expansion Space is first added to the Leased Premises), and (yy) in Section 1.4(c)(2), for any Renewal Terms (other than the Renewal Term during which such Short-Term Expansion Space is first added to the Leased Premises).

“State” shall mean the State in which the Property is located.

“Sublease” shall mean any sublease demising the whole or any portion(s) of the Leased Premises.

“Subtenant” shall mean the subtenant under a Sublease.

“Sublease SNDA” shall mean a subordination, non-disturbance and attornment agreement between Landlord and a Subtenant in the form annexed as Exhibit D-3 hereto, and in proper form for recording, together with such changes thereto that are both proposed by a Subtenant and approved by Landlord; it being agreed that Landlord shall not unreasonably withhold its approval of any such proposed change so long as (i) such proposed change is customary (at the time in question), and (ii) such proposed change does not (to more than a de

-19-

________________________________________________________________________________________________________________________

minimis extent) decrease Landlord’s rights, or increase Landlord’s obligations, from those contained in the form of Sublease SNDA annexed as Exhibit D-3 hereto.

“Surrender Release Space” shall have the meaning assigned to such term in Section 1.7(d).

“Tax Statement” shall have the meaning assigned to such term in Section 2.3(a).

“Tenant” shall mean only the owner of Tenant’s estate and interest under this Lease, at the time in question; but the foregoing provisions of this definition shall not be construed to relieve Tenant Named Herein, or any subsequent Tenant, from the obligations of Tenant accruing during the period that it is Tenant hereunder or thereafter.

“Tenant Budget Objection” shall have the meaning assigned to such term in Section 2.4(b).

“Tenant Business Group” shall have the meaning assigned to such term in Section 8.5.1.

“Tenant Controlled Contest” shall have the meaning assigned to such term in Section 2.3(c).

“Tenant Created Lien” shall have the meaning assigned to such term in Section 5.4(b).

“Tenant-Dedicated Parking Areas” shall mean the portions of the Parking Areas that are designated as “Tenant Dedicated Parking Areas” on Exhibit A-1 hereto.

“Tenant Expansion Notice” shall have the meaning assigned to such term in Section 10.1.

“Tenant Lien Cure Period” shall have the meaning assigned to such term in Section 5.4(b).

“Tenant Management Agreement” shall have the meaning assigned to such term in Section 3.6(c).

“Tenant Managed Property” shall have the meaning assigned to such term in Section 3.6(c).

“Tenant Management Period” shall have the meaning assigned to such term in Section 3.6(c).

“Tenant Management Services” shall have the meaning assigned to such term in Section 3.6(c).

“Tenant Named Herein” shall mean WACHOVIA BANK, NATIONAL ASSOCIATION.

“Tenant Party” shall mean (i) any principal (which shall include any shareholder, partner, member or other owner, direct or indirect, disclosed or undisclosed) of Tenant, or any director, officer, employee, agent or contractor of Tenant (or of any principal of Tenant), or (ii) any

-20-

________________________________________________________________________________________________________________________

Subtenant or other person claiming by, through or under Tenant (directly or indirectly), or any principal, director, officer, employee, agent or contractor of such Subtenant or such other person.

“Tenant Prominence Period” shall have the meaning assigned to such term in Section 3.4(b).

“Tenant Property” shall mean all movable personal property or trade fixtures (including any cabling or wiring installed within ceilings, ducts or chases of the Building but not permanently embedded within the walls of the Building) installed or maintained by, or at the instance of, Tenant (or any Tenant Party) within the Leased Premises (or, as expressly permitted hereunder, any areas outside of the Leased Premises). Without limiting the foregoing, the term Tenant Property shall be deemed to include the following: (i) any furniture, furnishings and equipment; (ii) moveable partitions and systems furniture; (iii) business, telecommunications and audio-visual equipment; (iv) computers, computer equipment, software and peripherals; (v) security systems and equipment; (vi) paintings and/or other works of art or decoration; (vii) all of Tenant’s signage (whether exterior or interior), including Building Identification Signage and Tenant’s Exterior Signage (but excluding Tenant’s Monuments); (viii) ATMs connected to or located within the Building, or situated as freestanding structures on the Property, and any ATM related equipment; (ix) safes; (x) safe deposit boxes (including the nests or frames thereof); (xi) any equipment within the Leased Premises relating to Tenant’s separate service systems (including, if within the Leased Premises,

Tenant’s Supplemental HVAC Equipment); (xii) Tenant’s Exterior Equipment (including Tenant’s Rooftop Equipment and, if outside the Leased Premises, Tenant’s Supplemental HVAC Equipment); and (xiii) specialty fixtures, such as chandeliers or other lighting fixtures above the quality of Building Standard.

“Tenant Required Contest” shall have the meaning assigned to such term in Section 2.3(c).

“Tenant Sub-Manager” shall have the meaning assigned to such term in Section 3.6(c).

“Tenant’s Allotted CW Capacity” shall have the meaning assigned to such term in Section 3.1(b).

“Tenant’s Building Signage” shall have the meaning assigned to such term in Section 3.4(a).

“Tenant’s Dedicated Electrical Capacity” shall have the meaning assigned to such term in Section 3.1(a).

“Tenant’s Exclusive Period” shall have the meaning assigned to such term in Section 10.3.

“Tenant’s Existing Exterior Equipment” shall have the meaning assigned to such term in Section 3.5(a).

“Tenant’s Exterior Equipment” shall have the meaning assigned to such term in Section 3.5(c).

-21-

________________________________________________________________________________________________________________________

“Tenant’s Occupancy Percentage” shall mean a fraction, expressed as a percentage, (i) the numerator of which is the Net Rentable Area of the Leased Premises (and, during the Preliminary Period to the extent provided in Section 1.7 hereof, the Net Rentable Area of the Release Premises) at the time the determination is made, and (ii) the denominator of which is Net Rentable Area of the Building. Tenant’s Occupancy Percentage shall be re-calculated each time there is a change in the Net Rentable Area of the Leased Premises (due to additions to, or deletions from, the Leased Premises) (or, as applicable pursuant to Section 1.7 hereof, the Release Premises, due to additions thereto, or deletions therefrom); with any such re-calculation (and Tenant’s obligations in respect of Additional Rent payable on the basis of Tenant’s Occupancy Percentage) being effective as of the date of such change. Upon any such recalculation, Landlord and Tenant shall execute and deliver a written instrument confirming the same, and incorporating the same into this Lease.

“Tenant’s Offer Notice” shall have the meaning assigned to such term in Section 8.2.1.

“Tenant’s Operating Expense Share” shall have the meaning assigned to such term in Section 2.2(a).

“Tenant’s Renewal Notice” shall have the meaning assigned to such term in Section 1.4(b).

“Tenant Repairs” shall have the meaning assigned to such term in Section 5.6(a).

“Tenant’s RCT Notice” shall have the meaning assigned to such term in Section 8.3.1.

“Tenant’s RFR Exercise Notice” shall have the meaning assigned to such term in Section 9.3.3.

“Tenant’s RFR Option” shall have the meaning assigned to such term in Section 9.3.3.

“Tenant’s ROFO Option” shall have the meaning assigned to such term in Section 9.2.2.

“Tenant’s ROFO Exercise Notice” shall have the meaning assigned to such term in Section 9.2.2.

“Tenant’s Rooftop Equipment” shall have the meaning assigned to such term in Section 3.5(d).

“Tenant’s Supplemental HVAC Equipment” shall have the meaning assigned to such term in Section 3.1(b).

“Tenant’s Tax Share” shall have the meaning assigned to such term in Section 2.3(a).

“Tenant’s Title Insurer” shall have the meaning assigned to such term in Section 9.2.3.

“Tenant’s Transfer Period” shall have the meaning assigned to such term in Section 8.2.4.

-22-

________________________________________________________________________________________________________________________

“Tenant’s Transfer Notice” shall have the meaning assigned to such term in Section 8.2.4.

“Tenant’s Reimbursement Amount” shall have the meaning assigned to such term in Section 5.7(b).

“Term” shall have the meaning assigned to such term in Section 1.3.

“Termination Rights Exercise Notice” shall have the meaning assigned to such term in Section 11.1.

“Third Party Leasing Rights” shall have the meaning assigned to such term in Section 10.4.

“Threshold Alteration Amount” shall have the meaning assigned to such term in Section 5.2(c).

“Vacate Space” shall have the meaning assigned to such term in Section 11.1.

“Wachovia” shall mean (i) Tenant Named Herein, or (ii) a person constituting an immediate or remote successor to Tenant Named Herein by virtue of one or more mergers, consolidations and/or transfers of all, or substantially all, the assets of Tenant Named Herein (or another person described in this clause (ii)).

“Wachovia Party” shall mean Wachovia or any Affiliate of Wachovia.

“Wachovia’s Termination Right” shall have the meaning assigned to such term in Section 11.1.

As used in this Lease, (i) the phrase “and/or” when applied to one or more matters or things shall be construed to apply to any one or more or all thereof as the circumstances warrant at the time in question, (ii) the terms “herein” “hereof” and “hereunder” and words of similar import, shall be construed to refer to this Lease as a whole, and not to any particular Article or Section, unless expressly so stated, (iii) the term “including”, whenever used herein, shall mean “including without limitation”, except in those instances where it is expressly provided otherwise, (iv) the term “person” shall mean a natural person, a partnership, a corporation, a limited liability company, and/or any other form of business or legal association or entity, (v) the term “alterations” shall mean any alterations, additions, removals and/or any other changes, and (vii) the term “contractor” shall include any construction manager, general contractor, subcontractor or other trade contractor.

1.2 | Leased Premises |

Subject to and upon the terms hereinafter set forth, Landlord does hereby lease and demise to Tenant, and Tenant does hereby lease and take from Landlord, the Leased Premises. Tenant shall be entitled to the following as appurtenances to the Leased Premises: (I) the right to use, and permit Tenant Parties and/or the customers, invitees and guests of Tenant or any Tenant Parties, to use, (a) on an exclusive basis, the Tenant-Dedicated Parking Areas and (b) on a non-

-23-

________________________________________________________________________________________________________________________

exclusive basis (in common with Landlord and other tenants or occupants of the Property, their customers, invitees and guests), the Non-Dedicated Parking Areas and all the other Common Areas; (II) all rights and benefits appurtenant to, or necessary or incidental to, the use and enjoyment of the Leased Premises by Tenant for the purposes permitted by Section 1.5 hereof, including the right of Tenant, its employees and invitees, in common with Landlord and other persons, to use any non-exclusive easements and/or licenses in, about or appurtenant to the Property, including the non-exclusive right to use any walkways, tunnels, and skywalks connected to the Property; and (III) all other rights and benefits provided to Tenant with respect to the Property pursuant to this Lease (including the rights granted to Tenant to use the roof of the Building, and other portions of the Property located outside of the Premises, pursuant to Section 3.5 hereof).

1.3 | Term |

The Initial Term of this Lease shall be as defined in Section 1.1(a), which Initial Term may be renewed and extended as provided in Section 1.4 hereof (the Initial Term and, to the extent renewed and extended, the Renewal Terms, are hereinafter collectively called the “Term”). Tenant is in possession of the Leased Premises as of the date of this Lease and shall accept the Leased Premises in its “AS-IS” condition, as of the Commencement Date, subject to all applicable Legal Requirements and matters of title heretofore affecting the same. Landlord has made no representation or warranty (express or implied) regarding the suitability of the Leased Premises or the Building for the conduct of Tenant’s business, and Tenant waives any warranty

(express or implied) that (a) the Leased Premises, the Common Areas or the Building generally are suitable for Tenant’s intended purposes, or (b) the Leased Premises, the Common Areas or the Building generally are now in compliance with Legal Requirements in effect on the Commencement Date. Except as otherwise expressly set forth in this Lease, in no event shall Landlord have any obligation for any defects existing on the Commencement Date in the Leased Premises, the Common Areas or the Building generally, or any legal limitation on the use thereof.

1.4 | Options to Renew |

(a) Subject to the conditions hereinafter set forth, Tenant is hereby granted options (individually, a “Renewal Option” and, collectively, the “Renewal Options”) to renew the Term with respect to all, or any portion of, the Leased Premises as then demised hereunder for six (6) successive periods of five (5) years each (individually, a “Renewal Term” and collectively the “Renewal Terms”); provided that the Term shall not extend, for any portion of the Leased Premises, beyond the Outside Expiration Date.

(b) The first Renewal Term (if the first Renewal Option is exercised) shall commence at the expiration of the Initial Term, and each subsequent Renewal Term (if the pertinent Renewal Option is exercised) shall commence at the expiration of the immediately preceding Renewal Term. Tenant shall exercise each of its Renewal Options, if at all, by delivering notice of such exercise to Landlord (each, a “Tenant’s Renewal Notice”) not later than twelve (12) months prior to the then current expiration of the Term. In any case that Tenant exercises a Renewal Option with respect to less than all of the Leased Premises as then demised hereunder, Tenant shall identify the portion(s) of the Leased Premises with respect to which the Renewal

-24-

________________________________________________________________________________________________________________________

Option is being exercised. IN ORDER TO PREVENT TENANT’S INADVERTENT FORFEITURE OF ANY THEN REMAINING RENEWAL OPTION, IF TENANT SHALL FAIL TO TIMELY EXERCISE ANY AVAILABLE RENEWAL OPTION, TENANT’S RIGHT TO EXERCISE SUCH RENEWAL OPTION SHALL NOT LAPSE UNTIL LANDLORD SHALL DELIVER TO TENANT WRITTEN NOTICE THAT SUCH NOTICE OF EXERCISE HAS NOT BEEN DELIVERED AND TENANT SHALL THEREAFTER FAIL TO EXERCISE SUCH RENEWAL OPTION WITHIN TEN (10) BUSINESS DAYS FOLLOWING THE DELIVERY OF SUCH NOTICE.

(c) Tenant’s leasing of the Leased Premises during any Renewal Term shall be upon all the then executory terms and conditions of this Lease (as applicable prior to such Renewal Term), except as follows:

(1) The Annual Basic Rent Factor for each Renewal Term shall be equal to the Fair Market Rental Value Per RSF of the Base Leased Premises for the Renewal Term (as determined by the parties or, in the absence of their agreement, determined by appraisal, all as herein-after provided); provided, however, that:

(A) if, as of the commencement of such Renewal Term, both (i) Tenant hereunder is a Wachovia Xxxxx, and (ii) the Integration Period has not ended, then the Annual Basic Rent Factor for such Renewal Term shall be adjusted as provided in Section 2 of the Master Agreement, as applicable;

(B) if, as of the commencement of such Renewal Term, the Tenant hereunder is not a Wachovia Party (whether or not the Integration Period has ended), then the Annual Basic Rent Factor for such Renewal Term shall not exceed a rate equal to 110% of the Annual Basic Rent Factor on the last day of the Initial Term or immediately preceding Renewal Term, as applicable; and

(C) if, as of the commencement of such Renewal Term, (i) the Tenant hereunder is a Wachovia Party, and (ii) the Integration Period has ended, then the Annual Basic Rent Factor for such Renewal Term shall not exceed the following: (x) in the case of the first Renewal Term, a rate equal to 110% of the Annual Basic Rent Factor on the last day of the Initial Term; and (y) in the case of each subsequent Renewal Term, a rate equal to 105% of the Annual Basic Rent Factor for the immediately preceding Renewal Term.

(2) The STAS Basic Rental Factor for each Short-Term Additional Space for each Renewal Term shall be equal to the Fair Market Rental Value Per RSF of such Short-Term Additional Space for such Renewal Term (as determined by the parties or, in the absence of their agreement, determined by appraisal, all as herein-after provided).

(d) Within thirty (30) days following the Renewal Option Notice Date with respect to any Renewal Option,

Landlord shall deliver to Tenant, a proposal setting forth Landlord’s determination of the Fair Market Rental Value Per RSF for the Leased Premises for the pertinent Renewal Term (which, if the Leased Premises as to which such Renewal Option is exercised includes any Short-Term Additional Space, then such determination shall include separate components for the Fair Market Rental Value Per RSF for the Base Leased Premises, and the

-25-

________________________________________________________________________________________________________________________

Fair Market Rental Value Per RSF of the Short-Term Additional Space). Thereafter, and until the delivery of a Renewal Appraisal Notice, Landlord and Tenant shall endeavor to reach agreement as to the Fair Market Rental Value Per RSF of the Leased Premises for the pertinent Renewal Term (and, as applicable, each component thereof).

(e) If Landlord and Tenant are unable to reach a definitive agreement as to the Fair Market Rental Value Per RSF for Leased Premises for any Renewal Term within sixty (60) days following the Renewal Option Notice Date, then either Landlord or Tenant, by written notice thereof to the other party (herein called a “Renewal Appraisal Notice”), may cause such Fair Market Rental Value Per RSF to be submitted for resolution in accordance with the following provisions of this Section 1.4(e):

(1) Within thirty (30) days after delivery of the Renewal Appraisal Notice, Landlord and Tenant shall each select and engage an Appraiser to determine such Fair Market Rental Value Per RSF. If either party fails to select and engage an Appraiser within such time, and if such failure continues for more than five (5) Business Days following such party’s receipt of written notice that states in all capital letters (or other prominent display) that such party has failed to select an Appraiser as required under the Lease and will be deemed to have waived certain rights granted to it under the Lease unless it selects an Appraiser within five (5) Business Days, then the Appraiser engaged by the other party shall select the second Appraiser.