Pricing Agreement

Exhibit 1.2

August 10, 2015

Barclays Capital Inc.

As representative of the several Underwriters

named in Schedule I (the “Representative”)

Ladies and Gentlemen:

Barclays PLC (the “Company”) proposes to issue US$1,500,000,000 aggregate principal amount of 5.25% Fixed Rate Senior Notes due 2045 (the “Notes”). Each of the Underwriters hereby undertakes to purchase at the subscription price set forth in Schedule II hereto, the amount of Notes set forth opposite the name of such Underwriter in Schedule I hereto, such payment to be made at the Time of Delivery set forth in Schedule II hereto. The obligations of the Underwriters hereunder are several but not joint.

Each of the provisions of the Underwriting Agreement—Standard Provisions, dated September 4, 2014 (the “Underwriting Agreement”), is incorporated herein by reference in its entirety, and shall be deemed to be a part of this Agreement to the same extent as if such provisions had been set forth in full herein; and each of the representations and warranties set forth therein shall be deemed to have been made at and as of the date of this Agreement, except that each representation and warranty with respect to the Prospectus in Section 2 of the Underwriting Agreement shall be deemed to be a representation and warranty as of the date of the Prospectus and also a representation and warranty as of the date of this Agreement in relation to the Prospectus as amended or supplemented relating to the Notes. Each reference to the Representatives herein and in the provisions of the Underwriting Agreement so incorporated by reference shall be deemed to refer to you. Unless otherwise defined herein, terms defined in the Underwriting Agreement are used herein as therein defined. The Representative designated to act on behalf of each of the Underwriters of Designated Securities pursuant to Section 14 of the Underwriting Agreement and the address referred to in such Section 14 is set forth in Schedule II hereto.

An amendment to the Registration Statement, or a supplement to the Prospectus, as the case may be, relating to the Designated Securities, in the form heretofore delivered to you, is now proposed to be filed with the Commission.

The Applicable Time for purposes of this Pricing Agreement is 5:30 PM New York time on August 10, 2015. Each “free writing prospectus” as defined in Rule 405 under the Securities Act for which each party hereto has received consent to use in accordance with Section 7 of the Underwriting Agreement is listed in Schedule III hereto and is attached as Exhibit A and Exhibit B hereto.

If the foregoing is in accordance with your understanding, please sign and return to us the counterpart hereof, and upon acceptance hereof by you, on behalf of each of the Underwriters, this letter and such acceptance hereof, including the provisions of the Underwriting Agreement incorporated herein by reference, shall constitute a binding agreement between each of the Underwriters on the one hand and the Company on the other.

| Very truly yours, |

| /s/ Miray Muminoglu |

| Name: Miray Muminoglu Title: Director, Capital markets Execution |

Accepted as of the date hereof

at New York, New York

On behalf of itself and each of the other

Underwriters

| BARCLAYS CAPITAL INC. |

| /s/ Xxx Xxxxxxxx |

| Name: Xxx Xxxxxxxx Title: Managing Director |

[Signature Page to Pricing Agreement]

SCHEDULE I

| Principal Amount of the Notes |

||||

| Underwriter |

||||

| Barclays Capital Inc. |

$ | 1,237,500,000 | ||

| ANZ Securities, Inc. |

$ | 15,000,000 | ||

| Xxxxxxxx Xxxx Van, LLC |

$ | 7,500,000 | ||

| BMO Capital Markets Corp. |

$ | 15,000,000 | ||

| Capital One Securities, Inc. |

$ | 15,000,000 | ||

| CIBC World Markets Corp. |

$ | 15,000,000 | ||

| Xxxxxx Xxxxxxxx, LLC |

$ | 7,500,000 | ||

| Fifth Third Securities, Inc. |

$ | 15,000,000 | ||

| Great Pacific Securities |

$ | 7,500,000 | ||

| ING Financial Markets LLC |

$ | 15,000,000 | ||

| Xxxxxxxx Financial Group, Inc. |

$ | 7,500,000 | ||

| Mizuho Securities USA Inc. |

$ | 15,000,000 | ||

| Multi-Bank Securities, Inc. |

$ | 7,500,000 | ||

| Natixis Securities Americas LLC |

$ | 15,000,000 | ||

| PNC Capital Markets LLC |

$ | 15,000,000 | ||

| Xxxxxx X. Xxxxxxx & Company, Inc. |

$ | 7,500,000 | ||

| Scotia Capital (USA) Inc. |

$ | 15,000,000 | ||

| Skandinaviska Enskilda Xxxxxx XX (publ) |

$ | 15,000,000 | ||

| SMBC Nikko Securities America, Inc. |

$ | 15,000,000 | ||

| TD Securities (USA) LLC |

$ | 15,000,000 | ||

| Telsey Advisory Group LLC |

$ | 7,500,000 | ||

| U.S. Bancorp Investments, Inc. |

$ | 15,000,000 | ||

| Total |

$ | 1,500,000,000 | ||

SCHEDULE II

Title of Designated Securities:

US$ 1,500,000,000 5.25% Fixed Rate Senior Notes due 2045

Price to Public:

99.760% of principal amount

Subscription Price by Underwriters:

98.885% of principal amount

Form of Designated Securities:

The Notes will be represented by one or more global notes registered in the name of Cede & Co., as nominee of The Depository Trust Company issued pursuant to the Senior Debt Securities Indenture dated November 10, 2014 between the Company and The Bank of New York Mellon acting through its London Branch, as trustee (the “Trustee”)

Securities Exchange, if any:

The New York Stock Exchange

Maturity Date:

The stated maturity of the principal of the Notes will be August 17, 2045.

Interest Rate:

Interest will accrue on the Notes from the date of their issuance. Interest will accrue on the Notes at a rate of 5.25% per year from and including the date of issuance.

Interest Payment Dates:

Interest will be payable on the Notes semi-annually in arrear on February 17 and August 17 of each year, commencing on February 17, 2016 and ending on the Maturity Date.

Record Dates:

The Business Day immediately preceding each Interest Payment Date (or, if the Notes are held in definitive form, the 15th Business Day preceding each Interest Payment Date).

Sinking Fund Provisions:

No sinking fund provisions.

Redemption Provisions for Notes:

The Notes are redeemable, at the option of the Company, in the event of various tax law changes that have specified consequences, as described further in, and subject to the conditions specified in, the prospectus supplement dated August 10, 2015 relating to the Notes.

Time of Delivery:

August 17, 2015 by 9:30 AM New York time.

Specified Funds for Payment of Subscription Price of Designated Securities:

By wire transfer to a bank account specified by the Company in same day funds.

Value Added Tax:

(a) If the Company is obliged to pay any sum to the Underwriters under this Agreement and any value added tax (“VAT”) is properly charged on such amount, the Company shall pay to the Underwriters an amount equal to such VAT on receipt of a valid VAT invoice;

(b) If the Company is obliged to pay a sum to the Underwriters under this Agreement for any fee, cost, charge or expense properly incurred under or in connection with this Agreement (the “Relevant Cost”) and no VAT is payable by the Company in respect of the Relevant Cost under paragraph (a) above, the Company shall pay to the Underwriters an amount which:

(i) if for VAT purposes the Relevant Cost is consideration for a supply of goods or services made to the Underwriters, is equal to any input VAT incurred by the Underwriters on that supply of goods and services, but only if and to the extent that the Underwriters are unable to recover such input VAT from HM Revenue & Customs (whether by repayment or credit) provided, however, that the Underwriters shall reimburse the Company for any amount paid by the Company in respect of irrecoverable input VAT pursuant to this paragraph (i) if and to the extent such input VAT is subsequently recovered from HM Revenue & Customs (whether by repayment or credit);

(ii) if for VAT purposes the Relevant Cost is a disbursement properly incurred by the Underwriters under or in connection with this Agreement as agent on behalf of the Company, is equal to any VAT paid on the Relevant Cost by the Underwriters provided, however, that the Underwriters shall use best endeavors to procure that the actual supplier of the goods or services which the Underwriters received as agent issues a valid VAT invoice to the Company.

Closing Location: Linklaters LLP, Xxx Xxxx Xxxxxx, Xxxxxx XX0X 0XX, Xxxxxx Xxxxxxx.

Name and address of Representative:

Designated Representative: Barclays Capital Inc.

Address for Notices:

Barclays Capital Inc.

000 Xxxxxxx Xxxxxx

Xxx Xxxx, XX 00000

Attn: Syndicate Registration

Selling Restrictions:

Each Underwriter of Designated Securities has represented, warranted and agreed that:

| a) | it has only communicated or caused to be communicated, and will only communicate or cause to be communicated, any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Xxx 0000 (the “FSMA”)) received by it in connection with the issue or sale of any Designated Securities in circumstances in which Section 21(1) of the FSMA does not apply to the Company; and |

| b) | it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the Designated Securities in, from or otherwise involving the United Kingdom. |

With respect to sales of the Designated Securities in Canada, each Underwriter of Designated Securities represents to and agrees with the Company that, directly or indirectly, it shall sell the Designated Securities only to purchasers purchasing as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus and Registration Exemptions and “permitted clients” as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Other Terms and Conditions:

As set forth in the prospectus supplement dated August 10, 2015 relating to the Notes, incorporating the Prospectus dated May 2, 2014 relating to the Notes.

SCHEDULE III

Issuer Free Writing Prospectus:

Final Term Sheet for the Notes, dated August 10, 2015, attached hereto as Exhibit A.

Barclays PLC Fixed Income Investor Presentation: H1 2015 Interim Management Statement, dated July 29, 2015, attached hereto as Exhibit B.

Exhibit A

Final Term Sheet for the Notes, dated August 10, 2015

Free Writing Prospectus

Filed Pursuant to Rule 433

Reg-Statement No.

333-195645

USD 1.5bn 5.25% Fixed Rate Senior Notes due 2045

Pricing Term Sheet

| Issuer: | Barclays PLC | |

| Notes: | USD 1.5bn 5.25% Fixed Rate Senior Notes due 2045 | |

| Expected Issue Ratings1: | Baa3 (Xxxxx’x) / BBB (S&P) / A (Fitch) | |

| Status: | Senior Debt / Unsecured | |

| Legal Format: | SEC registered | |

| Principal Amount: | USD 1,500,000,000 | |

| Trade Date: | August 10, 2015 | |

| Settlement Date: | August 17, 2015 (T+5) | |

| Maturity Date: | August 17, 2045 | |

| Coupon: | 5.25% | |

| Interest Payment Dates: | Semi-annually in arrear on February 17 and August 17 in each year, commencing on February 17, 2016 and ending on the Maturity Date | |

| Coupon Calculation: | 30/360, following, unadjusted | |

| Business Days: | New York, London | |

| U.K. Bail-in Power Acknowledgement: | Yes. See section entitled “Description of Senior Notes—Agreement with Respect to the Exercise of U.K. Bail-in Power” in the Preliminary Prospectus Supplement dated August 10, 2015 (the “Preliminary Prospectus Supplement”). | |

| Tax Redemption | If there is a Tax Event (as defined in the Preliminary Prospectus Supplement), the Issuer may, at its option, at any time, redeem the notes, in whole but not in part, at a redemption price equal to 100% of their principal amount, together with any accrued but unpaid interest to (but excluding) the date fixed for redemption, as further described and subject to the conditions specified in the Preliminary Prospectus Supplement. | |

| Benchmark Treasury: | T 2.5 02/15/45 | |

| Spread to Benchmark: | 235bps | |

| Reoffer Yield: | 5.266% | |

| Issue Price: | 99.760% | |

| Underwriting Discount: | 0.875% | |

| Net Proceeds: | USD 1,483,275,000 | |

| Sole Bookrunner: | Barclays Capital Inc. | |

| 1 | Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. |

| Co-managers: | ANZ Securities, Inc., Xxxxxxxx Xxxx Van, LLC, BMO Capital Markets Corp., Capital One Securities, Inc., CIBC World Markets Corp., Xxxxxx Xxxxxxxx, LLC, Fifth Third Securities, Inc., Great Pacific Securities, ING Financial Markets LLC, Xxxxxxxx Financial Group, Inc., Mizuho Securities USA Inc., Multi-Bank Securities, Inc., Natixis Securities Americas LLC, PNC Capital Markets LLC, Xxxxxx X. Xxxxxxx & Company, Inc., Scotia Capital (USA) Inc., Skandinaviska Enskilda Xxxxxx XX (publ), SMBC Nikko Securities America, Inc., TD Securities (USA) LLC, Telsey Advisory Group LLC, U.S. Bancorp Investments, Inc. | |

| Risk Factors: | An investment in the notes involves risks. See “Risk Factors” section beginning on page S-6 of the Preliminary Prospectus Supplement. | |

| Denominations: | USD 200,000 and integral multiples of USD 1,000 in excess thereof | |

| ISIN/CUSIP: | US06738EAJ47 / 00000X XX0 | |

| Settlement: | DTC; Book-entry; Transferable | |

| Documentation: | To be documented under the Issuer’s shelf registration statement on Form F-3 (No. 333-195645) and to be issued pursuant to the Senior Debt Indenture dated November 10, 2014 between the Issuer and The Bank of New York Mellon acting through its London Branch, as trustee (the “Trustee”) | |

| Listing: | We will apply to list the notes on the New York Stock Exchange | |

| Governing Law: | New York law | |

| Definitions: | Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus Supplement | |

The Issuer has filed a registration statement (including a prospectus dated May 2, 2014 (the “Prospectus”) and the Preliminary Prospectus Supplement) with the U.S. Securities and Exchange Commission (“SEC”) for this offering. Before you invest, you should read the Prospectus and the Preliminary Prospectus Supplement for this offering in that registration statement, and other documents the Issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by searching the SEC online database (XXXXX®) at xxx.xxx.xxx. Alternatively, you may obtain a copy of the Prospectus and the Preliminary Prospectus Supplement from Barclays Capital Inc. by calling 0-000-000-0000.

Exhibit B

| Free Writing Prospectus | ||||

| Filed Pursuant to Rule 433 | ||||

| Reg-Statement No. | ||||

| 333-195645 |

Fixed Income Investor Presentation

H1 2015 Interim Management Statement

29 July 2015

Continued good progress in H1

Increased Group adjusted pre-tax profits by 11%, with Core up 10%

Positive cost to income jaws: Group adjusted costs of £8.3bn, down 7%

Core business continued to perform well: PBT of £4.2bn and XxX of 11.1%

Further progress on Non-Core: £2.7bn of capital released and RWAs reduced to £57bn

Building capital: CET1 ratio increased to 11.1% and leverage ratio increased to 4.1%

Continued progress on resolving legacy litigation and conduct matters

2 | Barclays H1 2015 Fixed Income Investor Presentation

Accelerating delivery of shareholder value

1 Strategy – focus on what we are good at and where we are good at it

Focus on 3 major core markets – UK, US and South Africa

- With appropriate international network

Take advantage of increased synergies and cross selling between businesses

Accelerate Non-Core run-down

Build on strong Investment Bank performance to generate sustainable economic returns

Continue to progress our UK and US structural reform plans

Emphasise digital innovation and legacy platform improvements to drive efficiency and customer penetration

2 Value Creation

Increase revenue growth to at least market growth

Reallocate capital to the core

Reallocate costs from unproductive activities

Resolve remaining conduct issues

New Non-Core guidance of c.£20bn RWAs in 2017, when we expect to re-integrate

A high and progressive dividend needs to make up a significant portion of annual shareholder return over time

- Prudent to hold dividend at 6.5p for 2015

Committed to other 2016 targets, and over time will:

- Continue to improve CET1 ratio to end-state

- Bring down our cost to income ratio into the mid ‘50s

- Generate a return on equity above the cost of equity

3 High performance ethic with strong values and customer focus

Evaluate the balance between customers and clients, staff, community and shareholders

Build a customer led culture

More external and less internal focused

Streamline processes and increase individual accountability

Decentralise activities back into the businesses

Accelerate the work on culture and values

3 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Performance Overview

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Summary Group financials: H1 adjusted PBT up 11%

Six months ended – June (£m) 2014 2015 % change

Income 13,332 12,982 (3%)

Impairment (1,086) (973) 10%

Total operating expenses (8,877) (8,262) 7%

– Costs to achieve (CTA) (494) (316) 36%

– Litigation and conduct (211) (134) 36%

Adjusted profit before tax 3,349 3,729 11%

Tax (1,109) (1,077) 3%

NCI and other equity interests (480) (497) (4%)

Adjusted attributable profit 1,760 2,155 22%

Adjustments

– Own credit 52 410

– Gain on US Xxxxxx acquisition assets – 496

– Gain on valuation of a component of the defined retirement benefit liability – 429

– Provisions for ongoing investigations and litigation primarily relating to Foreign Exchange – (800)

– Provisions for UK customer redress (900) (1,032)

– Loss on sale of Spanish business – (118)

Statutory profit before tax 2,501 3,114 25%

Statutory attributable profit 1,126 1,611 43%

Basic earnings per share1 10.9p 13.1p

Return on average shareholders’ equity1 6.5% 7.7%

Dividend per share 2.0p 2.0p

H1 financial performance2

Group PBT increased 11% to £3.7bn reflecting improvements in all Core operating businesses

Income decreased 3% to £13.0bn due to Non-Core run-down

- Core income increased 2%, primarily driven by Barclaycard

Impairment improved 10% to £1.0bn; loan loss rate reduced 5bps to 40bps

Costs fell by 7% to £8.3bn primarily driven by savings from strategic cost programmes, especially in Non-Core and the Investment Bank

- CTA and litigation and conduct charges also reduced

- Excluding CTA, total Group cost base was £7.9bn

Attributable profit was £2.2bn, resulting in XxX of 7.7% and EPS of 13.1p

- Core XxX was 11.1%, with dilution on Group XxX from Non-Core of 3.4%

Further provision of £850m for UK customer redress made in Q215

- £600m for PPI and £250m for Packaged Bank Accounts

Gain of £496m recognised in Q215 on the Xxxxxx settlement

Statutory PBT increased 25% to £3.1bn, after conduct provisions and other adjusting items

Dividend of 1p declared for Q215

- 6.5p dividend planned for FY15, flat on FY14

1 EPS and XxX calculations are based on adjusted attributable profit, also taking into account tax credits on AT1 coupons | 2 Adjusted metrics unless stated otherwise |

5 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Strengthening key financial metrics

Fully Loaded CET1 ratio1

9.1% 9.5% 9.9% 10.2% 10.3% 10.6% 11.1%

Xxx-00 Xxx-00 Xxx-00 Xxx-00 Xxx-00 Xxx-00 Jun-15

RWAs (£bn) 442 436 411 413 402 396 377

Leverage ratio2

3.0% 3.1% 3.4% 3.5% 3.7% 3.7% 4.1%

Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15

Leverage exposure (£bn) 1,365 1,326 1,353 1,324 1,233 1,255 1,139

Liquidity and funding

L&A to customers Deposits from customers

89% 89% 88%

LDR3

309 349 310 347 306 347

Dec-14 Mar-15 Jun-15

Liquidity pool (£bn) 149 148 145

Estimated CRD IV liquidity coverage ratio 124% 122% 121%

NSFR4 102% 106%

Dec-14 Mar-15 Jun-15

Highlights

Progressive strengthening of key balance sheet metrics

RWAs reduced to £377bn, improving the CET1 ratio to 11.1%

Leverage exposure decreased by £116bn to £1,139bn (Mar 2015: £1,255bn), driving an increase in the leverage ratio to 4.1%

Liquidity position remains robust with liquidity pool of £145bn and LCR of 121%

Funding profile remains conservative and well diversified

Overall funding requirements expected to reduce further as Non-Core is run down

Continued proactive transition in Q2 towards holding company capital and funding model:

- Raised $1bn of senior unsecured debt at Barclays PLC which was used to subscribe for senior unsecured debt at Barclays Bank PLC

In H1 15, we issued £6bn of term debt, of which £5bn was public. This includes $4bn of senior unsecured debt issued by Barclays PLC, a £1bn covered bond from Barclays Bank PLC, and $1bn from the Dryrock programme in Delaware

1 Based on Barclays interpretation of the final CRD IV text and latest EBA technical standards | 2 Jun-15 and Mar-15 based on end-point CRR definition of Tier 1 capital for the numerator and the CRR definition of leverage exposure as adopted by the European Union delegated act. This is broadly consistent with the BCBS 270 definition, which was the basis of Jun-14, Sep-14 and Dec-14 comparatives. Dec-13 and Mar-14 not comparable to the estimates as of Jun-14 onwards due to different basis of preparation: estimated ratio and T1 capital based on PRA leverage ratio calculated as fully loaded CRD IV T1 capital adjusted for certain PRA defined deductions, and a PRA adjusted leverage exposure measure. | 3 Loan: deposit ratio for PCB, Barclaycard, Africa Banking and Non-Core retail | 4 NSFR based on the final guidelines published by the BCBS in October 2014. NSFR disclosed semi-annually

6 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

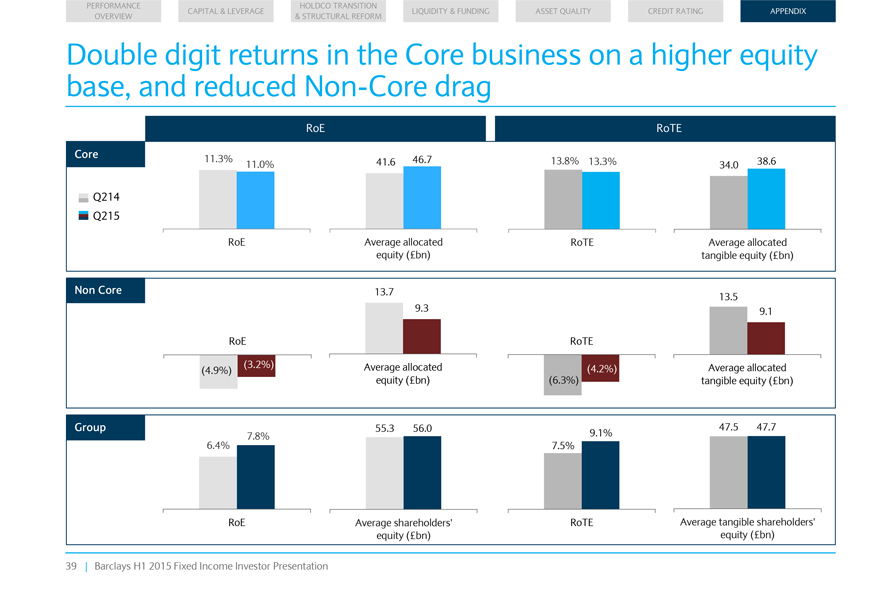

Q2 Core performance: Positive jaws and PBT up 6%

Three months ended (£m) Jun-14 Jun-15 % change

Income 6,397 6,520 2%

Impairment (456) (488) (7%)

Total operating expenses (3,975) (3,888) 2%

– Costs to achieve (237) (184) 22%

– Litigation and conduct (136) (41) 70%

Profit before tax 1,993 2,105 6%

Attributable profit 1,171 1,273 9%

Financial performance measures

Average allocated equity £41.6bn £46.7bn

Return on average tangible equity 13.8% 13.3%

Return on average equity 11.3% 11.0%

Cost:income ratio 62% 60%

Basic EPS contribution 7.2p 7.7p

Jun-14 Jun-15

CRD IV RWAs £324bn £320bn

Leverage exposure £971bn £973bn

Financial performance

PBT increased 6% to £2.1bn driven by particularly strong performance in the Investment Bank

- Investment Bank PBT increased 35%

- PCB PBT increased 10%1

- Barclaycard PBT increased 8%

- Africa Banking PBT remained broadly in line

Income rose 2% to £6.5bn driven by strong growth in Barclaycard and steady income across the other businesses

Impairment increased 7% driven by volume growth

- Remains low relative to historical levels, reflecting the improved UK economic environment

Total costs reduced 2% to £3.9bn reflecting reduced litigation and conduct charges, lower CTA and savings from strategic cost programmes

- Remain focused on delivery of 2016 target

Attributable profit was £1.3bn with EPS contribution of 7.7p

XxX was 11.0% on a significantly increased capital base

- Average allocated equity grew £5bn year-on-year to £47bn

1 Excluding the impact of the loss on sale of the US Wealth business and US Wealth customer redress |

7 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Non-Core: Continued shrinkage and capital recycling

Three months ended (£m) Jun-14 Mar-15 Jun-15

– Businesses 245 122 153

– Securities and Loans 66 (73) (42)

– Derivatives (26) (39) (79)

Income 285 10 32

Impairment (82) (29) (8)

Total operating expenses (468) (239) (282)

– Costs to achieve (17) (11) (12)

– Litigation and conduct (10) (9) (36)

Loss before tax (337) (256) (256)

Attributable loss (294) (199) (203)

Financial performance measures

Average allocated equity £13.7bn £10.3bn £9.3bn

Period end allocated equity £12.7bn £9.7bn £8.3bn

Return on average equity drag1 (4.9%) (3.4%) (3.2%)

Basic EPS contribution (1.8p) (1.2p) (1.2p)

Jun-14 Mar-15 Jun-15

CRD IV RWAs £87.5bn £64.8bn £56.6bn

Leverage exposure £382bn £236bn £166bn

Highlights

Period end allocated equity reduced by £4.4bn year-on-year to

£8.3bn, including a £1.4bn reduction in Q215

RWAs reduced a further £8bn in the quarter, with derivative RWAs reducing £5bn and securities and loans RWAs reducing £3bn

Income was £32m, reflecting sales of income generating assets

Credit impairment improved to £8m, driven by the impact of the sale of the Spanish business and improved performance in Europe retail

Costs reduced 40% year-on-year to £282m reflecting the exit of the Spanish, UAE, commodities and several principal investment businesses

Attributable loss was £203m, but with the continued reduction in allocated equity, the Non-Core drag on Group XxX reduced to 3.2%

1 Return on average equity and average tangible equity for Barclays Non-Core represents its impact on the Group, being the difference between Barclays Group returns and Barclays Core returns. This does not represent the return on average equity and average tangible equity of the Non-Core business |

8 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Capital & Leverage

PERFORMANCE

HOLDCO TRANSITION

CAPITAL & LEVERAGE

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

OVERVIEW

& STRUCTURAL REFORM

Continued strengthening of CET1 ratio

Fully loaded (FL) CRD IV CET1 ratio progression1

+50bps

10.3%

10.6%

11.1%

>11%

9.1%

Dec-13

Dec-14

Mar-15

Jun-15

2016

Target

FL CRD IV CET1 ratio grew 50bps in Q2 2015 to 11.1% (Mar 2015: 10.6%), already meeting the end 2016 target

FL CRD IV CET1 capital increased by £0.2bn to £42.0bn in Q2, driven by £1.2bn profit for the quarter, less £900m for own credit and dividends and a net £100m reduction for reserves and regulatory adjustments

While we expect to continue to grow our CET1 ratio over time, we expect to stay around 11% throughout the rest of 2015

Confident that our planned trajectory positions us well to meet expected future regulatory requirements

RWA reduction (£bn)1

(5%)

442

402

396

c.400

377

Dec-13

Dec-14

Mar-15

Jun-15

2016

Guidance

RWAs reduced by £19bn to £377bn in Q2 (Mar 15: £396bn), mainly driven by an £8bn reduction in Non-Core to £57bn, and foreign exchange impacts (which were broadly hedged for CET1 ratio)

The reduction in Non-Core was primarily a result of reductions in fixed income financing activities, derivatives compressions, and disposals

1 Based on Barclays interpretation of the final CRD IV text and latest EBA technical standards. Following the full implementation of CRD IV reporting in 2014, the previously reported 31 December 2013 RWAs were revised by £6.9bn to £442bn and fully loaded CET1 ratio by (0.2%) to 9.1% |

10 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

RWAs: Closely managed to support business growth and capital ratio accretion

RWAs (£bn)1

396 8 8 1 5 377

Mar-15 Core 2 Non-Core2 Net model and methodology updates Other 3 Jun-15

Highlights

RWAs reduced by £19bn reflecting underlying trading book reductions in the Non-Core and Investment Bank

In Core, the Investment bank reduction was partially offset by business growth of mortgages in PCB and in the US for Barclaycard

Net Non-Core run-down of £8bn, reflecting the trading book reductions and also exit from Pakistan

Model and methodology driven updates resulted in a net £1.2bn increase due to a change in policy in relation to SFTs

1 Bridge items do not reconcile to start and end points due to rounding | 2 Excludes model and methodology driven movements | 3 Includes foreign exchange movements of £4.6bn. This does not include movements for modelled counterparty risk or modelled market risk |

11 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Non-Core: Further RWA and leverage reductions

RWAs by type (£bn)

48% 110 752 65 18 11 57 10 31

31 26 c.20 16 15 12 9 8 9

Dec-13 Dec-14 Mar-15 Jun-15 2017

Guidance

Operational risk1 Securities and loans Derivatives Businesses

Leverage exposure by type (£bn)

57% 382 2772 18 Original 236 2016 13 guidance 114 £180bn 166 101 5 83

107 99 56 39 23 22 Jun-14 Dec-14 Mar-15 Jun-15

Businesses Securities and loans Derivatives Other

1 Operational risk plus DTAs | 2 Total reflects rounding |

12 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Continued progress on the transition towards end-state capital structure

Evolution of capital structure

17.4% ³17%

Total capital ratio Total capital ratio

3.4% ³2.9%

(£12.8bn) T2 (incl. P2A)

T2

2.0%

1.8% (£6.7bn) AT1 (incl. P2A)

Legacy T1

c. 1.5%

1.1% (£4.2bn1) AT1 CCCB/ Internal buffer

Sectoral

buffers 2.0%

G-SII

2.5%

Capital

11.1% Conservation buffer

(£42.0bn) 1.6% P2A

CET1

4.5%

Barclays H1 15 capital structure (PRA Transitional) CET1 Barclays’ ‘target’ end-state capital structure

Fully loaded CRD IV capital position

Transitional and fully loaded total capital ratios increased by 60bps to

17.4% (Mar 15: 16.8%), and 60bps to 16.2% (Mar 15: 15.6%) respectively, primarily reflecting CET1 ratio progress

We continue to transition towards our end-state capital structure which currently assumes at least 17% of total capital

We aim to manage our capital structure in an efficient manner:

- Expect to build an additional 90bps of AT1 to reach 2% in end-state through balanced issuance over time

- Quantum of Tier 2 capital in end-state to maintain a total capital ratio of at least 17% will be informed by TLAC and MREL rules, as well as relative pricing of Tier 2 and senior unsecured debt

Pillar 2A requirement2

Barclays 2015 Pillar 2A requirement as per the PRA’s Individual Capital

Guidance (ICG) is 2.8%. The ICG is subject to at least annual review

- CET1 of 1.6% (assuming 56% of total P2A requirement)

- AT1 of 0.5% (assuming 19% of total P2A requirement)

- T2 of 0.7% (assuming 25% of total P2A requirement)

The PRA consultation on the Pillar 2 framework (CP1/15), and Basel Committee consultations and reviews of approaches to Pillar 1 and Pillar 2 risk might further impact the Pillar 2A requirement in the future

1 Net of other regulatory adjustments and deductions relating to AT1s of £130m | 2 Point in time assessment made at least annually, by the PRA, to reflect idiosyncratic risks not fully captured under Pillar 1 |

13 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Significant management focus on maintaining robust capital buffers above future mandatory distribution restrictions

CET1 requirements1 (as at 1 January except H1)

Minimum CRD IV requirement Trajectory of fully loaded CET1 ratio, assuming >11% target by 2016 is met after which we build towards c.12% in end state

Pillar 2A

Capital conservation buffer (CET1) Mandatory distribution restriction level3

G-SII buffer (CET1) Sliding scale of restrictions4

Estimated c.12%

11.1%

12.0% c.150bps

Management buffer

10.0% c.£16bn 10.6% 60%

2.0%

Capital (410bps) buffer 9.5% 1.5% 40%

8.0% 8.4% 1.0% 20%

7.2% 0.5% 1.3% 1.9% 2.5%

6.0% 0.6% 0%

1.6% 1.6% 1.6% 1.6% 1.6%

4.0%

2.0% 4.5% 4.5% 4.5% 4.5% 4.5%

0.0%

Jun-15 Jan-16 Jan-17 Jan-18 Jan-19

Estimated buffers1,2 (vs. AT1 7% trigger and 1 January MDA restrictions)

To AT1 c.£16bn c.£17bn c.£18bn c.£19bn c.£20bn

7% trigger

To MDA n/a c.£16bn c.£13bn c.£9bn c.£6bn

restriction

Maintained robust capital buffers above minimum CET1 requirements and Contingent Capital triggers:

AT1 securities and PRA 7% expectation: c.410bps or £16bn

T2 contingent capital: c.570bps or £21bn5

Expect to build towards c.12% in end-state, including an internal management buffer of c.150bps above the current regulatory expectation of 10.6% in 20196

The internal management buffer is critical to guard against mandatory distribution restrictions3, which are applicable from 1 Jan 2016 on a phased-in basis under CRD IV

The internal management buffer, which is intended to absorb fluctuations in the CET1 ratio, is recalibrated frequently

The ‘target’ end-state CET1 ratio could be revised in case of changes to minimum CET1 requirement or internal reassessment

In addition to the internal management buffer, Barclays recovery plan actions are calibrated to take effect ahead of breaching the CBR

(Combined Buffer Requirement)

1 This analysis is presented for illustrative purposes only and is not a forecast of Barclays’ results of operations or capital position or otherwise. The analysis is based on certain assumptions, which cannot be assured and are subject to change, including: straight line progress towards meeting our CET1 ratio targets; constant RWAs of £400bn as per 2016 guidance from 1 Jan 2016 onwards; holding constant the P2A at 2015 level (which may not be the case as the requirement is subject to at least annual review); and CET1 resources not required to meet any shortfall to the AT1 or T2 components of the minimum capital requirement. Proposals in the FSB Consultative Document on the “Adequacy of loss-absorbing capacity of global systemically important banks in resolution”, published 10 Nov 2014 not considered. While not impacting mandatory distribution restrictions, this does not take into account any potential PRA buffer expectations | 2 Buffers (except Jun-15) calculated assuming straightline CET1 growth to 1 Jan 2019 expectation | 3 CRD IV rules on mandatory distribution restrictions apply from 1 January 2016 onwards based on transitional CET1 requirements. As per CRD Art. 141, restrictions on distributions (dividends and other payments in respect of ordinary shares, payments on AT1 securities and variable compensation) would apply in case of a breach of the Combined Buffer Requirement as defined in CRD Art 128(6) | 4 Calculated as profits multiplied by an MDA factor, both as defined in CRD Art. 141. and the PRA rule book implementing CRD IV | 5 Based on the CRD IV CET1 transitional (FSA October 2012 statement) the ratio was 12.7% as at 30 June 2015 based on £47.9bn of transitional CRD IV CET1 capital and £377bn of RWAs | 6 Barclays current regulatory target is to meet a FL CRD IV CET1 ratio of 9% by 2019, plus a Pillar 2A add-on (currently 1.6%). Pillar 2A requirements for 2015 held constant out to end-state for illustrative purposes. The PRA buffer is assumed to be below the combined buffer requirement of 4.5% in end-state albeit this might not be the case. CCCB, other systemic and sectoral buffer assumed to be zero

14 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Leverage ratio strengthened further towards target

Leverage ratio progression1

+40bps

>4%

3.7% 3.7% 4.1%

3.0%

Dec-13 1 Dec-14 Mar-15 Jun-15 2016

Target

Leverage exposure (£trn)1

BCBS 270

impact

(9%)

1.36

1.26

1.23 1.14

Dec-13 Dec-14 Mar-15 Jun-15

Leverage ratio grew by 40bps to 4.1% (Mar 2015: 3.7%), already meeting our 2016 target

The 40bps quarterly improvement was primarily driven by a £116bn reduction in leverage exposure and fully loaded tier 1 capital growth of £0.2bn

Leverage ratio already in excess of expected 2019 regulatory minimum requirement of 3.7%

Leverage exposure decreased by £116bn in Q2 0000, xxxxxxxxx xxxxxx by reductions in Barclays Non-Core

The £70bn reduction in Barclays Non-Core was mainly a result of an accelerated reduction in fixed income financing activities and reductions in derivatives exposures

Leverage exposure in our Core businesses decreased by £46bn to £973bn, primarily driven by reductions in derivatives exposure and trading portfolio assets due to a reduction in trading activity, portfolio optimisations and FX movements

1 Jun-15 and Mar-15 based on fully loaded CRR definition of Tier 1 capital for the numerator and the CRR definition of leverage exposure as adopted by the relevant European Union delegated act. This is broadly consistent with the BCBS 270 definition, which was the basis of the Dec-14 comparative. Dec-13 is not comparable to the estimates as of Jun-14 onwards due to different basis of preparation: estimated ratio and T1 capital based on PRA leverage ratio calculated as fully loaded CRD IV T1 capital adjusted for certain PRA defined deductions, and a PRA adjusted leverage exposure measure. |

15 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Leverage ratio increased to 4.1%

Leverage exposure1 (£bn)

L&A and other assets2 Derivatives

SFTs Undrawn commitments

Leverage ratio1

4.1%

3.7% 3.7%

3.4%

1,353

105 1,233 1,255

228 115 114 1,139

157 170 112

117

288

271 262 226

732 690 709 684

Jun-14 Dec-14 Mar-15 Jun-15

Highlights

Improvement in leverage ratio driven by decrease in leverage exposure and growth in capital

Leverage exposures during Q2 15 decreased by £116bn to £1,139bn mainly driven by decrease in leverage exposure in Non-Core, reduction in the IB and foreign exchange movements

Leverage exposure in our Core businesses decreased by £46bn to £973bn, primarily driven by reductions in derivatives exposure and trading portfolio assets due to a reduction in trading activity, portfolio optimisation and FX movements

Loans and advances and other assets decreased by £25bn to £684bn due to a reduction in trading portfolio assets

1 Jun-15 and Mar-15 based on end-point CRR definition of Tier 1 capital for the numerator and the CRR definition of leverage exposure as adopted by the European Union delegated act. This is broadly consistent with the BCBS 270 definition, which was the basis of Jun-14 and Dec-14 comparatives | 2 Loans and advances and other assets net of regulatory deductions and other adjustments |

16 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Holding company transition and structural reform

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Barclays PLC parent company accounts

Barclays PLC parent company balance sheet

Balance sheet

FY 14 H1 15

Notes £m £m

Assets

Investment in subsidiary 33,743 34,303

Loans and advances to subsidiary 2,866 5,318

Derivative financial instrument 313 194

Other assets 174 184

Total assets 37,096 39,999

Liabilities

Deposits from banks 528 519

Subordinated liabilities 810 800

Debt securities in issue 2,056 4,518

Other liabilities 10 -

Total liabilities 3,404 5,837

Shareholders’ equity

Called up share capital 4,125 4,193

Share premium account 16,684 17,330

Other equity instruments 4,326 4,326

Capital redemption reserve 394 394

Retained earnings 8,163 7,919

Total shareholders’ equity 33,692 34,162

Total liabilities and shareholders’ equity 37,096 39,999

Notes

Barclays PLC is the holding company of the Barclays Group

The HoldCo’s primary assets currently are its investments in, and loans and advances made to, its sole subsidiary, Barclays Bank PLC, the operating company

As Barclays is committed to issuing most capital and term senior unsecured debt out of the HoldCo going forward, the HoldCo balance sheet is expected to increase

Notes to the parent company balance sheet

Investment in subsidiary

The investment in subsidiary of £34,303m (2014: £33,743m) represents investments made into Barclays Bank PLC, including £4,326m (2014: £4,326m) of AT1 securities

Loans and advances to subsidiary and debt securities in issue

During H1 2015, Barclays PLC issued $4bn of Fixed Rate Senior Notes, accounted for as debt securities in issue. The proceeds raised through these transactions were used to make $4bn of Fixed Rate Senior Loans to Barclays Bank PLC, with a ranking corresponding to the notes issued by Barclays PLC

18 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Refinancing out of Holding Company supports achieving future Total Loss Absorbing Capacity (TLAC)1 requirements

(£bn) Jun-15

PRA transitional Common Equity Tier 1 capital 42

PRA transitional Additional Tier 1 regulatory capital 11

Barclays PLC (HoldCo) 4

Barclays Bank PLC (OpCo) 7

PRA transitional Tier 2 regulatory capital 13

Barclays PLC (HoldCo) 1

Barclays Bank PLC (OpCo) 12

PRA transitional total regulatory capital 66

Barclays PLC (HoldCo) vanilla term senior unsecured debt2 5

Barclays Bank PLC (OpCo) vanilla term senior unsecured debt3 22

Total term vanilla senior unsecured debt 93

RWAs 377

Leverage exposure 1,139

Proxy risk-weighted TLAC ratio ~ 25%

Proxy leverage based TLAC ratio ~ 8%

Proactive transition towards a HoldCo funding and capital model positions us well to meet potential future TLAC requirements

While requirements remain to be set, Barclays’ current expectation is a multi-year conformance period

Expect TLAC conformance to be achieved primarily through refinancing OpCo term senior unsecured debt out of the HoldCo

Based on Barclays current interpretation of TLAC requirements, our proxy TLAC ratio is 25%4 assuming that all Barclays Bank PLC vanilla term senior unsecured debt is refinanced from HoldCo and in the future, subordinated to OpCo operating liabilities

– Around half of our OpCo vanilla term senior unsecured debt matures before 20195 and could therefore be refinanced at HoldCo

– Further flexibility to meet future requirements through partially refinancing our £33bn of OpCo structured notes into vanilla HoldCo senior unsecured term debt

We currently do not intend to use HoldCo senior unsecured debt proceeds to subscribe for OpCo liabilities on a subordinated basis until required to do so by end state TLAC requirements

The future TLAC-ratio should further benefit from CET1 capital growth and further debt issuance towards end-state expectations

As TLAC rules are finalised, and as we approach implementation date, we will assess the appropriate composition and quantum of our future TLAC stack

Further clarity on MREL requirements expected from the Bank of England in Q315 and final rules on TLAC from the FSB in Q415

1 For illustrative purposes only reflecting Barclays’ interpretation of the FSB Consultative Document on “Adequacy of loss-absorbing capacity of global systemically important banks in resolution”, published 10 November 2014, including certain assumptions on the inclusion or exclusion of certain liabilities where further regulatory guidance is necessary. Evolving regulation, including the implementation of MREL beginning 1 Jan 2016 and any subsequent regulatory policy interpretations, may require a change to the current approach | 2 Barclays PLC issued term senior unsecured debt assumed to qualify for consolidated TLAC purposes | 3 Comprise all outstanding Barclays Bank PLC issued public and private vanilla term senior unsecured debt, regardless of residual maturity. This excludes £33bn of notes issued under the structured notes programmes | 4 Including the 4.5% combined buffer requirement which needs to be met in CET1. The combined buffer requirement comprises a 2% G-SII buffer and 2.5% capital conservation buffer on a fully phased in basis. | 5 Please see maturity profile of outstanding OpCo term senior unsecured debt on slide 48

19 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Managing the risk profile of Holding Company term senior unsecured debt today and in end-state

Managing HoldCo term senior debt credit profile in transition1

Barclays PLC (HoldCo) External term senior unsecured debt

Subscription of internal OpCo senior unsecured debt2

Barclays Bank PLC (OpCo) External term senior unsecured debt OpCo Operating Liabilities

We are currently using senior proceeds raised by Barclays PLC to subscribe for senior unsecured debt in Barclays Bank PLC

In a resolution scenario today, this should result in pari passu treatment between internally and externally issued OpCo senior unsecured debt1

Senior HoldCo investors should also be supported by OpCo capital and subordinated debt in current state

Delivering robust credit profile for HoldCo term senior unsecured investors in end-state3

Barclays PLC (HoldCo) External term senior unsecured debt, plus refinanced OpCo term senior unsecured debt

Subscription of internal “TLAC-eligible” debt4

Barclays Bank PLC (OpCo) Operating Liabilities less HoldCo refinanced term senior unsecured debt

Refinancing profile

OpCo Senior HoldCo Senior

Total capital Total capital

Barclays Proxy TLAC ratio evolution4

As we transition towards a HoldCo capital and term funding model, quantum of HoldCo term senior unsecured debt increases materially over time while outstanding OpCo term senior unsecured debt materially reduces

If HoldCo term senior unsecured debt proceeds are used to subscribe for TLAC-eligible debt in an OpCo in end-state, the structural subordination that would arise for HoldCo creditors should be mitigated by the increasing balance of term senior unsecured debt at the HoldCo and commensurate reducing balance of term senior unsecured debt at the OpCo

1 Barclays’ expectations of the creditor hierarchy in a resolution scenario; assumes internal subordination not imposed during transition | 2 HoldCo investments can be viewed in Barclays PLC parent company balance sheet, on slide 18 | 3 Assumes that most or all of the term non-structured senior unsecured funding currently outstanding at Barclays Bank PLC has been refinanced out of Barclays PLC | 4 Barclays’ Proxy TLAC ratio as illustrated on slide 19 reflecting Barclays’ interpretation of the FSB Consultative Document on “Adequacy of loss-absorbing capacity of global systemically important banks in resolution”, published 10 November 2014, including certain assumptions on the inclusion or exclusion of certain liabilities where further regulatory guidance is necessary. Evolving regulation, including the implementation of MREL beginning 1 Jan 2016 and any subsequent regulatory policy interpretations, may require a change to the current approach

20 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Progressing with plans for structural reform

Evolving group structure

Barclays PLC

UK ring-fenced bank

Newly established material UK bank

Barclays’ provider of retail and corporate products to UK customers

Substantial presence in the UK market with over 16 million customers

Barclays Bank PLC & international entities

Existing banking entities

International diversified business model, including international retail products, investment banking and corporate products

Will include Barclays Bank PLC, Barclays Africa and US IHC

Key strategic priority throughout Barclays Group

Continuous dialogue with key regulators to evolve plans

Maintaining financial robustness of all parts of the group critical in our planning

Does not signify a change to capital allocation strategy

We expect to be able to share more detail on our plans towards year end subject to our ongoing discussions with regulators

Implications for bondholders

Barclays PLC (HoldCo)

Progressive issuer of AT1 and Tier 2 capital

Expect material increase in term senior unsecured funding over time as Barclays Bank PLC term senior unsecured debt is refinanced out of the HoldCo

Diversification post structural reform retained at Barclays PLC

Barclays Bank PLC and other current and future operating subsidiaries

Capital and term senior unsecured funding needs expected to be met largely through internal TLAC

Secured funding to be issued out of the operating subsidiary holding the relevant assets

Barclays Bank PLC will continue to issue short-term wholesale funding (e.g. CDs, CPs and ABCPs) Areas of uncertainty

Location of issuance of structured notes dependant on final rules around TLAC-eligibility

Potential for some external issuance of capital and term senior unsecured debt in local markets to meet local funding and regulatory requirements

21 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Liquidity & Funding

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Maintaining a robust liquidity position, with pool well in excess of internal and external minimum requirements

High quality liquidity pool (£bn)

127 149 145

22 27 28

62 85 86

43 37 31

Dec-13 Dec-14 Jun-15

Cash & Deposits at Central Banks Government Bonds Other Available Liquidity

Estimated CRD IV/Basel 3 liquidity ratios

Metric Dec-14 Jun-15 Expected 100% requirement date

LCR1 124% 121% 1 January 2018

Surplus £30bn £26bn

NSFR2 102% 106% 1 January 2018

Surplus to 30-day Barclays-specific LRA

Dec-14 Jun-15

LRA 124% 119%

Surplus £29bn £23bn

Key messages

Stable liquidity position with the Group liquidity pool at £145bn, providing a surplus to internal and external minimum requirements

Quality of the pool remains high:

- 80% held in cash, deposits with central banks and high quality government bonds

- 93% of government bonds are securities issued by UK, US, Japanese, French, German, Danish, Swiss and Dutch sovereigns

Even though not a regulatory requirement, the size of our liquidity pool is 2.1x that of wholesale debt maturing in less than a year

1 LCR estimated based on the EU delegated act | 2 Estimated based on the final BCBS rules published in October 2014 |

23 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

We maintain access to stable and diverse sources of funding, across customer deposits and wholesale debt

Broadly self-funded retail businesses1(£bn)

91% 89% 88%

000 000 000 309 347 306

Dec-13 Dec-14 Jun-15

Retail LDR Deposits from customers L&A to customers

Total funding

Customer deposits Secured term funding Sub. debt Short-term debt and other deposits Unsecured term funding

£522bn £508bn £490bn

14% 13% 12%

14% 13% 13%

7% 4% 8% 4% 7% 4%

62% 62% 64%

Dec-13 Dec-14 Jun-15

Key messages

Group Loan to Deposit Ratio (LDR) and the LDR for PCB, Barclaycard and Africa Banking at 98% and 88% respectively1

Excess customer deposits in PCB, Barclaycard and Africa Banking predominantly used to fund the liquidity buffer requirements for these businesses, making them broadly self funded

Overall funding requirements for the Group reducing as Non-Core assets are run down

2015 Funding Plan

We guided to issuance of a gross amount of £10-15bn in 2015 across public and private senior unsecured, secured and subordinated debt. This is materially below term maturities of £23bn in 2015, of which £9bn remaining this year

In H1 15, we issued £6bn publicly against this plan, including $4bn of senior unsecured debt from the HoldCo in two transactions, a £1bn covered bond from Barclays Bank PLC, and two tranches of $500m US cards securitisation from Barclays Bank Delaware

We intend to maintain access to diverse sources of wholesale funding, through different products, currencies, maturities and channels

We expect to be a measured issuer of AT1 securities over the next few years

1 LDR for PCB, Barclaycard, Africa Banking and Non-Core retail |

24 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Continue to access diverse wholesale funding sources across multiple products, currencies and maturities

Wholesale funding by product

7% 12% 11% 25%

13% 15% 4% 13%

Depostis from banks CDs and CPs ABCPs Public benchmark MTNs Privately placed MTNs Covered bonds / ABS Suborindated liabilities1 Other2

By remaining maturity1: WAM net of liquidity pool ³ 120 months

24% 21% 13% 12% 7% 7% 12% 4%

£ 1 month > 1 mth but £ 3 mths > 3 mths but £ 6 mths > 6 mths but £ 9 mths > 9 mths but £ 12 mths > 1 year but £ 2 years > 2 years but £ 5 years1 > 5 years2

By currency1 USD EUR GBP Others

As at 30 June 2015 39% 31% 17% 13%

As at 31 December 2014 35% 32% 25% 8%

Key messages

Overall funding requirements for the Group reducing as we de-lever the balance sheet. Total wholesale funding (excluding repurchase agreements) decreased in H1 15 to £157bn, by £14bn from 31 December 2014

- £68bn matures in less than one year, while £20bn matures within one month (31 December 2014: £75bn and £17bn respectively)

£6bn of term funding (net of early redemptions) issued in 2015. Activity includes:

- $4bn public benchmark senior unsecured debt issued by Barclays PLC

- £1bn of Covered bonds issued by Barclays Bank PLC

We have £23bn of term funding maturing in 2015 (£9bn remaining for July to December) and £13bn maturing in 2016

We expect to issue a gross amount of £10-15bn in 2015 across public and private senior unsecured, secured and subordinated debt and to maintain a stable and diverse funding base by type, currency and distribution channel

1 Given different accounting treatments, AT1 capital is not included in outstanding subordinated liabilities, while T2 contingent capital notes are included | 2 Primarily comprised of fair valued deposits (£5bn) and secured financing of physical gold (£4bn) |

25 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX Asset quality

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Continued strong Core asset quality

Impairment charge (£m)

44 41 45

LLR (bps)

(7%)

000 000 000

Q214 Q115 Q215

Highlights

Impairment increased 7% year-on-year to £488m

- LLR remained broadly flat at 45bps reflecting stable retail performance and a lack of any notable single name charges in wholesale

PCB impairment increased 4%, though remains at relatively low levels due to the improving UK economic environment, with LLR of 18bps

Barclaycard impairment increased 2%, accompanied by loans and advances growth of 11%. LLR reduced 26bps to 283bps

Africa Banking impairment increased 3% reflecting wholesale impairments in CIB, partially offset by lower impairment in RBB

PCB

17 14 18

LLR (bps)

(4)%

95 79 99

Q214 Q115 Q215

Barclaycard

309 305 283

(2)%

268 290 273

Q214 Q115 Q215

Africa Banking

111 94 112

(3)%

100 90 103

Q214 Q115 Q215

Impairment (£m)

27 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

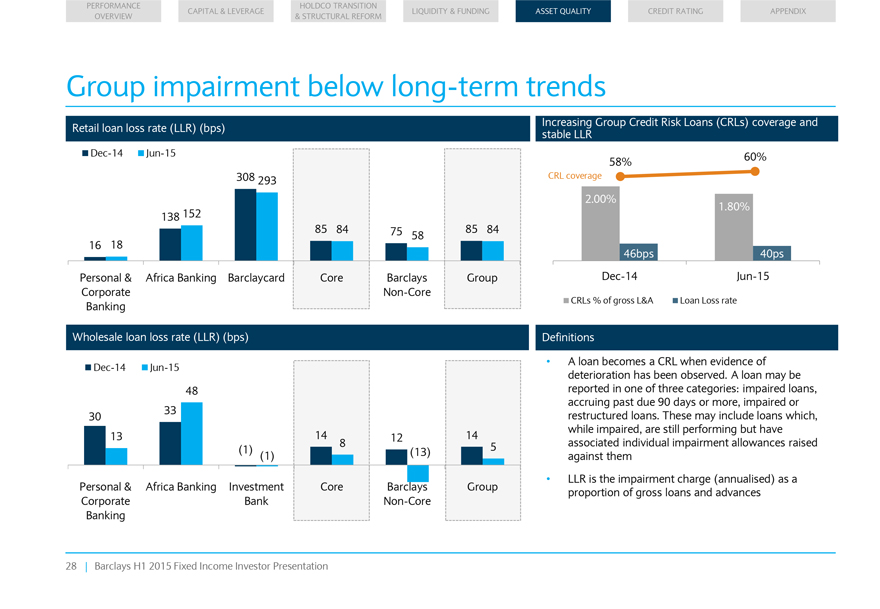

Group impairment below long-term trends

Retail loan loss rate (LLR) (bps)

Dec-14 Jun-15

308 293

138 152

85 84 75 58 85 84

16 18

Personal & Corporate Banking Africa Banking Barclaycard Core Barclays Non-Core Group

Increasing Group Credit Risk Loans (CRLs) coverage and stable LLR

58% 60%

CRL coverage

2.00%

1.80%

46bps 40ps Dec-14 Jun-15

CRLs % of gross L&A Loan Loss rate

Wholesale loan loss rate (LLR) (bps)

Dec-14 Jun-15

48 33 30

13 14 12 14

8 5 (1) (13) (1)

Personal & Corporate Banking Africa Banking Investment Bank Core Barclays Non-Core Group

Definitions

A loan becomes a CRL when evidence of deterioration has been observed. A loan may be reported in one of three categories: impaired loans, accruing past due 90 days or more, impaired or restructured loans. These may include loans which, while impaired, are still performing but have associated individual impairment allowances raised against them

LLR is the impairment charge (annualised) as a proportion of gross loans and advances

28 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW CAPITAL & LEVERAGE HOLDCO TRANSITION & STRUCTURAL REFORM LIQUIDITY & FUNDING ASSET QUALITY CREDIT RATING APPENDIX

Reduced exposure to Eurozone periphery

Exposures by geography (£bn)1

Spain Italy Portugal Ireland

59.0 4.9 7.9 22.7 23.5 2012 52.8 6.7 6.3 20.6 19.2 2013 43.2 4.8 4.8 18.0 15.6 2014 25.5 3.5 4.2 15.5 2.3

Jun-15

Key Messages

The vast majority of the exposures to Spain have been disposed of as of 2 January 2015

Exposure to Spain, Italy, Portugal and Ireland reduced further, down 41% to £25.6bn in June 2015 in line with Non-Core strategy

Total net exposure to Greece is £35m (2014: £27m)

Local net funding mismatches decreased

- Portugal: €1.7bn funding gap (2014: €1.9bn)

- Italy: €4.8bn funding gap (2014: €9.9bn)

We continue to explore options to exit our other European retail and corporate exposures or materially reduce the capital they consume

Exposures by asset class (£bn)

Sovereign Financial institutions Corporate Residential mortgages Other retail lending

59.2 6.3 32.5 9.3 5.7 5.4 2012 53.1 5.9 31.4 7.1 6.5 2.2 2013 43.2 2.6 16.6 4.3 17.7 2.0 2014 25.6 2.3 14.6 3.7 3.3 1.6

Jun-15

1 Net on balance sheet |

29 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Credit ratings

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Recent industry-wide credit rating agency (CRA) actions reflect evolving bank resolution frameworks

Ratings1 S&P Xxxxx’x Fitch

Standalone rating bbb+ Baa2 a

Barclays PLC (B PLC - HoldCo)

Senior long-term BBB / Stable Baa3 / Stable A / Stable

Senior short-term X-0 X-0 X0

Xxxx 0 XXx Xxx0 X-

XX0 B+ n/a BB+

Barclays Bank PLC (BB PLC - OpCo)

Senior long-term A- / Stable A2 / Stable A / Stable

Senior short-term X-0 X-0 X0

X0 XxXxx XXx - XXX-

XX0 BB+ Ba1 BBB

XX0 XXX- Xxx0/Xx0 X-

Xxxx 0 XX Xx0/Xx0 XXX-/XXx

Rating action

YTD 2015 – Industry wide

Actions taken on certain UK, German, Austrian and Swiss non-operating holding companies and operating companies following reassessment of government support and review of “Additional Loss Absorbing Capacity” (ALAC)

Bank rating actions globally following implementation of new bank rating methodology and reassessment of the likelihood of sovereign support

Actions taken on banks in the EU, global systemically important banks in the US and Switzerland, and on banks in Hong Kong on 19 May 2015

Rating action

B PLC:

B PLC:

B PLC and BB PLC:

YTD 2015 –

3 Feb 2015: long-term senior rating

28 May 2015: long-term senior rating

19 May 2015: long-

Barclays specific

downgraded by two notches to BBB

downgraded by three notches to Baa3

and short-term senior

due to removal of government support

and short-term by one notch to P-3 due

ratings affirmed as

9 June 2015: AT1 securities upgraded

to removal of sovereign support

Barclays standalone

by one notch to B+

28 May 2015: subordinate ratings

credit rating was rated

upgraded by one notch to Baa3 due to

at the previous

BB PLC:

application of “loss given failure”

Sovereign Support

9 June 2015: senior long- and short-

analysis

Floor and therefore did

term ratings downgraded by one notch

not benefit from

to A-/A-2 due to removal of

BB PLC:

sovereign support

government support, partially offset by

17 Mar 2015: senior ratings affirmed

uplift

ALAC

and outlook changed to Stable

Barclays carries a stable outlook with S&P,

Xxxxx’x and Fitch

Recent industry-wide CRA announcements were driven by evolving resolution frameworks which involved:

The reassessment of the likelihood of sovereign support for senior creditors resulting in downward pressure on senior credit ratings

Rating methodology updates and changes to reflect cushion of junior debt that would absorb losses ahead of senior bank creditors that partially or fully offset sovereign support notch removal

There was no impact on Barclays’ standalone credit ratings

Action on bank HoldCos more punitive:

No uplift for loss absorbing capacity provided to senior creditors to offset sovereign support notch removal, and/or

Expected increase in thickness of the senior layer which will benefit LGD over time not taken into account

As implementation of bank resolution frameworks are progressing at different paces across jurisdictions, timelines for CRA action differ

1 Definitions of securities classes for comparison purposes and not necessarily in line with the respective CRA’s own definitions |

31 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Barclays manages and reserves for potential rating actions in the liquidity pool

Contractual credit rating downgrade exposure

Total cumulative cash outflow

(£bn)

One-notch

Two-notch

Securitisation derivatives

2

3

Contingent liabilities

2

2

Derivatives margining

0

0

Liquidity facilities

1

2

Total

5

7

Key Messages

Barclays now has a stable outlook with all credit rating agencies

Total contractual credit rating downgrade exposure reduced by £9bn from £16bn at December 2014, prior to the S&P rating downgrade

The table on the left hand side shows contractual collateral requirements and contingent obligations following potential future one and two notch long-term and associated short-term simultaneous downgrades of Barclays Bank PLC across all credit rating agencies1

1 These numbers do not include the potential liquidity impact from loss of unsecured funding, such as from money market funds or loss of secured funding capacity |

32 | Barclays H1 2015 Fixed Income Investor Presentation

Summary1

Diversified international bank focused on delivering more sustainable and

Strategy driving simpler, focused improved returns and balanced Group structure

Focused on high growth businesses where we have competitive advantage, eliminating marginal or declining businesses

Core businesses delivered adjusted Return on Equity (XxX) of 11.1%

Core businesses performing well

On track to deliver a reduction in costs to <£14.5bn in 2016

Solid CET1 ratio of 11.1% and good track record of managing RWAs as we Capital and leverage ratios run-down Barclays Non-Core (BNC) and reinvest in core businesses continue to improve

Leverage ratio of 4.1%. Additional planned reductions in leverage exposure mainly through reductions in BNC

Robust liquidity position and well

Robust liquidity position with 121% Liquidity Coverage Ratio (LCR) diversified funding profile

Diversified funding base, combining customer deposits and wholesale funding, in multiple currencies, formats and tenors

Progressing plans on structural reform

Regulation

Proactive and practical approach to managing regulatory changes

Established track record of adapting to regulatory developments

1 Figures as at Jun-15 unless otherwise stated

33 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Appendix

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

PCB: PBT up 10% excluding impact of US Wealth1

Three months ended (£m) Jun-14 Jun-15 % change

– Personal 1,027 1,005 (2%)

– Corporate 889 970 9%

– Wealth 272 235 (14%)

Income 2,188 2,210 1%

Impairment (95) (99) (4%)

Total operating expenses (1,314) (1,352) (3%)

– Costs to achieve (58) (97) (67%)

– Litigation and conduct (9) (23) (156%)

Profit before tax2 780 709 (9%)

Attributable profit 559 500 (11%)

Financial performance measures

Average allocated equity £17.2bn £18.1bn

Return on average tangible equity 17.5% 14.9%

Return on average equity 13.1% 11.2%

Cost:income ratio 60% 61%

Loan loss rate 17bps 18bps

Net interest margin 2.93% 2.99%

Jun-14

Jun-15

Loans and advances to customers £216.7bn £217.5bn

Customer deposits £298.3bn £298.5bn

CRD IV RWAs £117.9bn £120.6bn

Impact of the US Wealth business1 –

Illustrative

Illustrative

Jun-15

Three months ended (£m) Jun-15 % change

Income (12) 2,222 2%

Total operating expenses (83) (1,269) 3%

Costs to achieve (56) (41) 29%

Litigation and conduct (20) (3) 67%

Other net (expenses)/income (55) 5 n/a

Profit before tax (150) 859 10%

Cost:income ratio 57%

Financial performance

PCB results were impacted by £150m of charges relating to the announced disposal of the US Wealth business and customer redress in the US

Excluding £12m of charges to income, £83m to operating expenses and £55m loss on sale, PBT would have increased 10%

Excluding the impact of US Wealth1, total income increased 2%

Personal income reduced 2% driven by mortgage margin pressure from existing customer rate switching and a reduction in fee income, partially offset by balance growth and improved savings margins

Corporate income increased 9% due to balance growth in both lending and deposits and improved deposit margins, partially offset by reduced margins in the lending business

Impairment increased 4% due to loan growth

Costs fell 3% excluding the impact of US Wealth1, reflecting savings from restructuring of the branch network and technology improvements to increase automation

1 Relates to the loss on sale of the US Wealth business and US Wealth customer redress | 2 Q215 includes (£50m) of other net expenses |

35 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Barclaycard: Continued growth with PBT up 8%

Three months ended (£m)

Jun-14

Jun-15

% change

Income

1,082

1,222

13%

Impairment

(268)

(273)

(2%)

Total operating expenses

(443)

(527)

(19%)

– Costs to achieve

(23)

(31)

(35%)

Profit before tax

396

429

8%

Attributable profit

285

307

8%

Financial performance measures

Average allocated equity

£5.8bn

£6.3bn

Return on average tangible equity

24.7%

24.9%

Return on average equity

19.7%

19.7%

Cost:income ratio

41%

43%

Loan loss rate

309bps

283bps

Net interest margin

8.92%

9.31%

Jun-14

Jun-15

Loans and advances to customers

£33.2bn

£36.9bn

Customer deposits

£5.9bn

£7.7bn

CRD IV RWAs

£37.7bn

£40.3bn

Financial performance

PBT increased 8% resulting in an XxX of 19.7%

Income grew 13% to £1.2bn driven by business growth and favourable FX movements in US Cards, partially offset by the impact of rate capping from European Interchange Fee Regulation

Impairment increased 2%, while loans and advances grew 11%

Delinquency rates remained stable and LLR improved 26bps to 283bps

Costs increased 19% to £527m reflecting continued investment in business growth, adverse FX movements and the impact of one-offs, including certain marketing costs and non-recurrence of VAT refund in Q214

Excluding these one-offs, operating expenses increased 8%

Total income (£m) – Q215

300

504

418

Loans and advances to customers at amortised cost (£bn) – Jun-15

7.3

15.8

13.8

UK Cards US Cards Other1

1 Includes Barclaycard Business Solutions, Germany and Southern Europe Cards business |

36 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION

& STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Africa Banking: XxX increased to 9.7% and RoTE of 13.2%

Three months ended (£m)

Jun-14

Jun-15

% change

Income

895

910

2%

Impairment

(100)

(103)

(3%)

Total operating expenses

(553)

(564)

(2%)

– Costs to achieve

(8)

(7)

13%

Profit before tax

244

245

-

Attributable profit

78

96

23%

Financial performance measures

Average allocated equity2

£3.8bn

£3.9bn

Return on average tangible equity2

11.3%

13.2%

Return on average equity2

8.1%

9.7%

Cost:income ratio

62%

62%

Loan loss rate

111bps

112bps

Net interest margin

5.83%

5.87%

Jun-14

Jun-15

Loans and advances to customers

£33.8bn

£33.8bn

Customer deposits

£33.2bn

£34.4bn

CRD IV RWAs

£36.5bn

£36.4bn

Financial performance1

Based on average rates, ZAR depreciated against GBP by 4% in Q215 against Q214. Comments on business performance are based on reported results in GBP:

PBT was broadly flat at £245m, though XxX increased to 9.7% and RoTE to 13.2% driven by a 23% increase in attributable profit

Income increased 2%

Growth in Retail and Business Banking (RBB) in South Africa and in the Wealth, Investment Management and Insurance (WIMI) business

Corporate and Investment Banking (CIB) was impacted by lower trading performance

Impairment increased 3% reflecting wholesale impairments in CIB and additional coverage on performing loans, partially offset by lower impairment in RBB

Costs increased 2% reflecting inflationary pressures, resulting in higher staff costs, partially offset by the benefits of strategic cost programmes

1 Africa Banking business unit performance based on BAGL results in addition to Egypt and Zimbabwe | 2 Barclays share of the statutory equity of the BAGL entity (together with that of the Barclays Egypt and Zimbabwe businesses which remain outside the BAGL corporate entity), as well as the Barclays’ goodwill on acquisition of these businesses. The tangible equity for RoTE uses the same basis but excludes both the Barclays’ goodwill on acquisition and the goodwill and intangibles held within the BAGL statutory equity |

37 | Barclays H1 2015 Fixed Income Investor Presentation

PERFORMANCE OVERVIEW

CAPITAL & LEVERAGE

HOLDCO TRANSITION & STRUCTURAL REFORM

LIQUIDITY & FUNDING

ASSET QUALITY

CREDIT RATING

APPENDIX

Investment Bank: PBT up 35% with double digit XxX

Three months ended (£m)

Jun-14 Jun-15 % change

Banking 727 708 (3%)

Markets 1,403 1,442 3%

Credit 270 272 1%

Equities 629 616 (2%)

Macro 504 554 10%

Income1 2,154 2,150 -

Impairment release/(charge) 7 (12) >(100)%

Total operating expenses (1,594) (1,373) 14%

Costs to achieve (152) (32) 79%

Litigation and conduct (85) (13) 85%

Profit before tax 567 765 35%

Attributable profit 204 417 >100%

Financial performance measures

Average allocated equity £15.5bn £14.8bn

Return on average tangible equity 5.6% 12.2%

Return on average equity 5.3% 11.5%

Cost:income ratio 74% 64%

Jun-14 Jun-15

CRD IV RWAs £123.9bn £115.3bn

Financial performance

The returns focused strategy generated strong performance, as income remained consistent, while efficient use of capital and a 14% reduction in costs led to a significant increase in XxX to 11.5%

Income was in line at £2.2bn

Banking decreased 3% driven by lower debt and equity underwriting income, partly offset by higher financial advisory fees

Credit increased 1% driven by higher income in credit flow trading, partially offset by lower income in securitised products

Equities decreased 2% due to reductions in equity derivatives and cash equities, partially offset by increased income in equity financing

Macro increased 10% due to higher income in rates and currency products, reflecting increased market volatility