STOCK PURCHASE AGREEMENT

Exhibit

10.1

THIS STOCK PURCHASE AGREEMENT (this "Agreement"), dated as

of April 11, 2008, is made by and between American Business Holdings, Inc., a

Delaware corporation ("Seller"), and each

of Xxxx Xxxxx Xxxxxx, Xxxx Xxxxx Xxxxxx and Verifica International, Ltd.

(collectively, "Buyers").

RECITALS

A. Seller

owns all of the issued and outstanding membership shares (the "Shares") of

Tissakin

Ltd., a Democratic Republic of Congo corporation (the "Company"), which

Shares constitute,

as of the date hereof, all of the issued and outstanding capital stock of

tfefCompany.

B. Buyers

hold 80,000,000 shares of common stock, $0,001 par value per share, of

Seller

and Buyers have agreed to transfer 79,000,000 of such shares (the "Purchase Price

Shares") back to

Seller for cancellation (the "Repurchase").

C. In

connection with the Repurchase, Buyers wish to acquire from Seller, and Seller

wishes to

transfer to Buyers, the Shares, upon the terms and subject to the conditions set

forth herein.

Accordingly,

the parties hereto agree as follows:

1. Purchase and Sale of

Stock.

(a) Purchased Shares.

Subject to the terms and conditions provided below, Seller shall sell and

transfer to Buyers and Buyers shall purchase from Seller, on the Closing Date

(as defined in Section 1(c)), all of the Shares.

(b) Purchase Price. The

purchase price for the Shares shall be the transfer and delivery by Buyers to

Seller~of the Purchase Price Shares, deliverable as provided in Section

2(b).

(c) Closing. The closing

of the transactions contemplated in this Agreement (the "Closing") shall take

place as soon as practicable following the execution of this Agreement and shall

be subject to a Securities Purchase Agreement being duly executed between the

Seller, Xxxx Xxx and the persons signatory thereto. The date

on which the Closing occurs shall be referred to herein as the Closing

Date (the

"Closing

Date").

2. Closing.

(a) Transfer of Shares.

At the Closing, Seller shall deliver to Buyers certificates

representing the Shares, duly endorsed to Buyers or as directed by Buyers, which

delivery

shall vest Buyers with good and marketable title to all of the issued and

outstanding shares of

capital stock of the Company, free and clear of all liens and

encumbrances.

(b) Payment of Purchase

Price. At the Closing, Buyers shall deliver to Seller a certificate

or certificates representing the Purchase Price Shares duly endorsed to Seller,

which

1

delivery

shall vest Seller with good and marketable title to the Purchase Price Shares,

free and clear of all liens and encumbrances.

3. Representations and

Warranties of Seller. Seller represents and warrants to Buyers as of the

date hereof as follows:

(a) Corporate Authorization:

Enforceability. The execution, delivery and performance by Seller of this

Agreement is within the corporate powers and has been, duly authorized by all

necessary corporate action on the part of Seller. This Agreement has been duly

executed and delivered by Seller and constitutes the valid and binding agreement

of Seller, enforceable against Seller in accordance with its terms, except to

the extent that its enforceability may be subject to applicable bankruptcy,

insolvency, reorganization, moratorium and similar Laws affecting the

enforcement of creditors' rights generally and by general equitable

principles.

(b) Governmental

Authorization. The execution, delivery and performance by Seller of this

Agreement requires no consent, approval, Order, authorization or action by or in

respect of, or filing with, any Governmental Authority.

(c) Non-Contravention:

Consents. The execution, delivery and performance by Seller of this

Agreement and the consummation of the transactions contemplated hereby do not

(i) violate the certificate of incorporation or bylaws of Seller or (ii) violate

any applicable Law or Order.

4. Representations and

Warranties of Buyers. Buyers represent and warrant to Seller as of the

date hereof as follows:

(a) Enforceability. The

execution, delivery and performance by Buyers of this Agreement are within

Buyers' powers. This Agreement has been duly executed and delivered by Buyers

and constitutes the valid and binding agreement of Buyers, enforceable against

Buyers in accordance with its terms, except to the extent that its

enforceability may be subject to applicable bankruptcy, insolvency,

reorganization, moratorium and similar laws affecting the enforcement of

creditors' rights generally and by general equitable principles.

(b) Governmental

Authorization. The execution, delivery and performance by Buyers of this

Agreement require no consent, approval, Order, authorization or action by or in

respect of, or filing with, any Governmental Authority.

(c) Non-Contravention:

Consents. The execution, delivery and performance by Buyers of this

Agreement, and the consummation of the transactions contemplated hereby do not

violate any applicable Law or Order.

(d) Purchase for

Investment. Buyers are financially able to bear the economic risks of

acquiring an interest in the Company and the other transactions contemplated

hereby, and have no need for liquidity in this investment. Buyers have such

knowledge and experience in financial and business matters in general, and with

respect to businesses of a nature similar to the business of the Company, so as

to be capable of evaluating the merits and risks of, and making an informed

business decision with regard to, the acquisition of the Shares. Buyers are

acquiring the Shares solely for their own account and not with a view to or for

resale in connection with

2

any

distribution or public offering thereof, within the meaning of any applicable

securities laws and regulations, unless such distribution or offering is

registered under the Securities Act of 1933, as amended (the "Securities Act"), or

an exemption from such registration is available. Buyers have (i) received all

the information they have deemed necessary to make an informed investment

decision with respect to the acquisition of the Shares, (ii) had an opportunity

to make such investigation as they have desired pertaining, to the Company and

the acquisition of an interest therein, and to verify the information which is,

and has been, made available to them and (iii) had the opportunity to ask

questions of Seller concerning the Company. Buyers have received no public

solicitation or advertisement with respect to the offer or sale of the Shares.

Buyers realize that the Shares are "restricted securities" as that term is

defined in Rule 144 promulgated by the Securities and Exchange Commission under

the Securities Act, the resale of the Shares is restricted by federal and state

securities laws and, accordingly, the Shares must be held indefinitely unless

their resale is subsequently registered under the Securities Act or an exemption

from such registration is available for their resale. Buyers understand that any

resale of the Shares by them must be registered under the Securities Act (and

any applicable state securities law) or be effected in circumstances that, in

the opinion of counsel for the Company at the time, create an exemption or

otherwise do not require registration under the Securities Act (or applicable

state securities laws). Buyers acknowledge and consent that certificates now or

hereafter issued for the Shares will bear a legend substantially as

follows:

THE

SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR QUALIFIED UNDER

ANY APPLICABLE STATE SECURITIES LAWS (THE "STATE ACTS"), HAVE BEEN ACQUIRED FOR

INVESTMENT AND MAY NOT BE SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED

EXCEPT PURSUANT TO A REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND

QUALIFICATION UNDER THE STATE ACTS OR PURSUANT TO EXEMPTIONS FROM SUCH

REGISTRATION OR QUALIFICATION REQUIREMENTS (INCLUDING, IN THE CASE OF THE

SECURITIES ACT, THE EXEMPTIONS AFFORDED BY SECTION 4(1) OF THE SECURITIES ACT

AND,RULE 144 THEREUNDER). AS A PRECONDITION TO ANY SUCH TRANSFER, THE ISSUER OF

THESE SECURITIES SHALL BE FURNISHED WITH AN OPINION OF COUNSEL OPINING AS TO THE

AVAILABILITY OF EXEMPTIONS FROM SUCH REGISTRATION AND QUALIFICATION AND/OR SUCH

OTHER EVIDENCE AS MAY BE SATISFACTORY THERETO THAT ANY SUCH TRANSFER WILL NOT

VIOLATE THE SECURITIES LAWS.

Buyers

understand that the Shares are being sold to them pursuant to the exemption from

registration contained in Section 4(1) of the Securities Act and that Seller is

relying upon the representations made herein as one of the bases for claiming

the Section 4(1) exemption.

(e) Liabilities. Following the Closing, Seller will have no debts,

liabilities or obligations relating to the Company or its business or

activities, whether before or after the Closing, and there are no outstanding

guaranties, performance or payment bonds, letters of credit or other contingent

contractual obligations that have been undertaken by Seller directly or indirectly

in relation to the Company or its business and that may survive the

Closing.

3

(f) Title to Purchase Price

Shares. Buyers are the sole record and beneficial owners of the Purchase

Price Shares. At Closing, Buyers will have good and marketable title to the

Purchase Price Shares, which Purchase Price Shares are, and at the Closing will

be, free and clear of all options, warrants, pledges, claims, liens and

encumbrances, and any restrictions or limitations prohibiting or restricting

transfer to Seller, except for restrictions on transfer as contemplated by

applicable securities laws.

(g) Capitalization. As of

the date hereof, Seller owns the Shares, which shares represent 100% of the

authorized, issued and outstanding capital stock of the Company. The Shares are

duly authorized, validly issued, fully-paid, non-assessable and free and clear

of any Liens.

5. Indemnification and

Release.

(a) Indemnification.

Buyers covenant and agree to jointly and severally indemnify,

defend, protect and hold harmless Seller, and its officers, directors,

employees, stockholders,

agents, representatives and affiliates (collectively, together with Seller, the

"Seller

Indemnified Parties")

at all times from and after the date of this Agreement from and against all

losses,

liabilities, damages, claims, actions, suits, proceedings, demands, assessments,

adjustments,

costs and expenses (including specifically, but without limitation, reasonable

attorneys*

fees and expenses of investigation), whether or not involving a third party

claim and regardless

of any negligence of any Seller Indemnified Party (collectively, "Losses"), incurred

by any

Seller Indemnified Party as a result of or arising from (i) any breach of the

representations

and warranties of Buyers set forth herein or in certificates delivered in

connection

herewith, (ii) any breach or nonfulfillment of any covenant or agreement on the

part of Buyers

under this Agreement, (iii) any debt, liability or obligation of the Company,

whether incurred

or arising prior to the date hereof or after, (iv) any debt, liability or

obligation of Seller for

actions taken prior to that certain share exchange agreement by and between

Seller and Wealthlink

Co., Ltd., a Cayman Islands company (the "Share Exchange"), (v)

the conduct and operations

of the business of the Company whether before or after the Closing, (vi) claims

asserted

against the Company whether arising before or after the Closing and whether in

connection

with the transactions contemplated hereunder or otherwise, or (vii) any federal

or state

income tax payable by Seller and attributable to the transaction contemplated by

this Agreement

or activities prior to the Share Exchange or with respect to the Company after

the Share

Exchange.

(b) Third Party

Claims.

(i) If

any claim or liability (a "Third-Party Claim")

should be asserted against any of the Seller Indemnified Parties (the "Indemnitee") by a

third party after the Closing for which Buyers have an indemnification

obligation under the terms of Section 5(a), then the Indemnitee shall notify

Buyers (the "Indemnitor") within

20 days after the Third-Party Claim is asserted by a third party (said

notification being referred to as a "Claim Notice") and

give the Indemnitor a reasonable opportunity to take part in any examination of

the books and records of the Indemnitee relating to such Third-Party

Claim and

to assume the defense of such Third-Party Claim and in connection therewith and

to conduct any proceedings or negotiations relating thereto and necessary or

appropriate to defend the Indemnitee and/or settle the Third-Party

4

Claim.

The expenses (including reasonable attorneys' fees) of all negotiations,

proceedings, contests, lawsuits or settlements with respect to any Third-Party

Claim shall be borne by the Indemnitor. If the Indemnitor agrees to assume the

defense of any Third-Party Claim in writing within 20 days after the Claim

Notice of such Third-Party Claim has been delivered, through counsel reasonably

satisfactory to Indemnitee, then the Indemnitor shall be entitled to control the

conduct of such defense, and shall be responsible for any expenses of the

Indemnitee in connection with, the defense of such Third-Party Claim so long as

the Indemnitor continues such defense until the final resolution of such

Third-Party Claim. The Indemnitor shall be responsible for paying all

settlements made or judgments entered with respect to any Third-Party Claim the

defense of which has been assumed by the Indemnitor. Except as provided in

subsection (ii) below, both the Indemnitor and the Indemnitee must approve any

settlement of a Third-Party Claim. A failure by the Indemnitee to timely give

the Claim Notice shall not excuse Indemnitor from any indemnification liability

except only to the extent that the Indemnitor is materially and adversely

prejudiced by such failure.

(ii) If

the Indemnitor shall not agree to assume the defense of any Third-Party Claim in

writing within 20 days after the Claim Notice of such Third-Party Claim has been

delivered, or shall fail to continue such defense until the final resolution of

such Third-Party Claim, then the Indemnitee may defend against such Third-Party

Claim in such manner as it may deem appropriate and the Indemnitee may settle

such Third-Party Claim, in its sole discretion, on such terms as it may deem

appropriate. The Indemnitor shall promptly reimburse the Indemnitee for the

amount of all settlement payments and expenses, legal and otherwise, incurred by

the Indemnitee in connection with the defense or settlement of such Third-Party

Claim. If no settlement of such Third-Party Claim is made, then the Indemnitor

shall satisfy any judgment rendered with respect to such Third-Party Claim

before the Indemnitee is required to do so, and pay all expenses, legal or

otherwise, incurred by the Indemnitee in the defense against such Third-Party

Claim.

(c) Non-Third-Partv

Claims. Upon discovery of any claim for which Buyers have an

indemnification obligation under the terms of this Section 5 which does not

involve a claim by a third party against the Indemnitee, the Indemnitee shall

give prompt notice to Buyers of such claim and, in any case, shall give Buyers

such notice within 30 days of such discovery. A failure by Indemnitee to timely

give the foregoing notice to Buyers shall not excuse Buyers from any

indemnification liability except to the extent that Buyers are materially and

adversely prejudiced by such failure.

(d) Release. Buyers, on behalf of

themselves and their Related Parties, hereby release and forever discharge

Seller and its individual, joint or mutual, past and present representatives,

Affiliates, officers, directors, employees, agents, attorneys, stockholders,

controlling persons, subsidiaries, successors and assigns (individually, a

"Releasee" and collectively, "Releasees") from any and all claims, demands,

proceedings, causes of action, orders, obligations, contracts, agreements, debts

and liabilities whatsoever, whether known or unknown, suspected or unsuspected,

both at law and in equity, which Buyers or any of their Related Parties now have

or have ever had against any Releasee. Buyers hereby irrevocably convenant to

refrain from, directly or indirectly, asserting any claim or demand, or

commencing, instituting

or causing to be commenced, any proceeding of any kind against any Releasee,

based upon any matter released hereby. "Related Parties"

shall mean, with respect to Buyers, (i) any

5

Person

that directly or indirectly controls, is directly or indirectly controlled by,

or is directly or indirectly under common control with Buyers, (ii) any Person

in which Buyers hold a Material Interest or (iii) any Person with respect to

which any Buyer serves as a general partner or a trustee (or in a similar

capacity). For purposes of this definition, "Material Interest"

shall mean direct or indirect beneficial ownership (as defined in Rule 13d-3

under the Securities Exchange Act of 1934, as amended) of voting securities or

other voting interests representing at least ten percent (10%) of the

outstanding voting power of a Person or equity securities or other equity

interests representing at least ten percent (10%) of the outstanding equity

securities or equity interests in a Person.

(e) Waiver. Buyers

understand and agree that all of their rights, if any, under California Civil

Code Section 1542 are expressly waived. Buyers understand that Section 1542

provides as follows:

A

general release does not extend to claims that a creditor does not know or

suspect to exist in his favor at the time of executing the release, which if

known by him, must have materially affected his settlement with the

debtor.

Buyers

understand that waiving their rights under California Civil Code Section 1542

means that even if they should eventually suffer some damage arising out of

their employment or relationship with Seller, that they will not be able to make

any claim for those damages, even as to claims which may now exist, but which

they do not know exist, and which if known would have affected their decision to

sign this Agreement.

6. Definitions. As used

in this Agreement:

(a) "Affiliate" means,

with respect to any Person, any other Person directly or indirectly controlling,

controlled by or under common control with the first Person. For the purposes of

this definition, "Control." when used

with respect to any Person, means the possession, directly or indirectly, of the

power to (i) vote 10% or more of the securities having ordinary voting power for

the election of directors (or comparable positions) of such Person or (ii)

direct or cause the direction of the management and policies of such Person,

whether through the ownership of voting securities, by contract or otherwise,

and the terms "Controlling" and

"Controlled"

have meanings correlative to the foregoing;

(b) "Governmental

Authority" means any domestic or foreign governmental or regulatory

authority;

(c) "Law" means any

federal, state or local statute, law, rule, regulation, ordinance, code, Permit,

license, policy or rule of common law;

(d) "Lien" means, with

respect to any property or asset, any mortgage, lien, pledge, charge, security

interest, encumbrance or other adverse claim of any kind in respect of such

property or asset. For purposes of this Agreement, a Person will be deemed to

own, subject to a Lien, any property or asset which it has acquired or holds

subject to the interest of a vendor or lessor under any conditional sale

agreement, capital lease or other title retention agreement relating to such

property or asset;

6

(e) "Order" means any

judgment, injunction, judicial or administrative order or

decree;

(f) "Permit" means any

government or regulatory license, authorization, permit,

franchise, consent or approval; and

(h) "Person" means an

individual, corporation, partnership, limited liability company, association,

trust or other entity or organization, including a government or political

subdivision or an agency or instrumentality thereof.

7. Miscellaneous.

(a) Counterparts. This

Agreement may be signed in any number of counterparts, each of which will be

deemed an original but ail of which together shall constitute one and the same

instrument.

(b) Amendments and

Waivers.

(i) Any

provision of this Agreement may be amended or waived if, but only

if, such amendment or waiver is in writing and is signed, in the case of an

amendment, by each

party to this Agreement, or in the case of a waiver, by the party against whom

the waiver is to be

effective.

(ii) No

failure or delay by any party in exercising any right, power or privilege

hereunder will operate as a waiver thereof nor will any single or partial

exercise thereof preclude

any other or further exercise thereof or the exercise of any other right, power

or privilege.

The rights and remedies herein provided will be cumulative and not exclusive of

any rights or

remedies provided by Law.

(c) Successors and

Assigns. The provisions of this Agreement will be binding upon and inure

to the benefit of the parties hereto and their respective successors and

assigns; provided that no party may assign,

delegate or otherwise transfer (including by operation of Law) any of its rights

or obligations under this Agreement without the consent of each other party

hereto.

(d) No Third Party

Beneficiaries. This Agreement is for the sole benefit of the parties

hereto and their permitted successors and assigns and nothing herein expressed

or implied will give or be construed to give to any Person, other than the

parties hereto, those referenced in Section 5 above, and such permitted

successors and assigns, any legal or equitable rights hereunder.

(e) Governing Law. This

Agreement will be governed by, and construed in accordance with, the internal

substantive law of the State of Delaware.

(f) Headings. The

headings in this Agreement are for convenience of reference only and will not

control or affect the meaning or construction of any provisions

hereof.

7

(g) Entire Agreement.

This Agreement constitutes the entire agreement among the

parties with respect to the subject matter of this Agreement. This Agreement

supersedes

ail prior agreements and understandings, both oral and written, between the

parties with

respect to the subject matter hereof of this Agreement.

(h) Severability. If any

provision of this Agreement or the application of any such

provision to any Person or circumstance is held invalid, illegal or

unenforceable in any respect

by a court of competent jurisdiction, the remainder of the provisions of this

Agreement (or the

application of such provision in other jurisdictions or to Persons or

circumstances other than

those to which it was held invalid, illegal or unenforceable) will in no way be

affected, impaired

or invalidated, and to the extent permitted by applicable Law, any such

provision will be

restricted in applicability or reformed to the minimum extent required for such

provision to be enforceable.

This provision will be interpreted and enforced to give effect to the original

written intent of

the parties prior to the determination of such invalidity or

unenforceability.

(i) Notices. Any notice,

request or other communication hereunder shall be given in

writing and shall be served either personally, by overnight delivery or

delivered by mail, certified

return receipt and addressed to the following addresses:

(a) If

to Buyers:

Syed

Xxxxx Xxxxxx

American

Business Investments

00000

Xxxxxxxx Xxxx. Xxxxx 000

Xxxxx

Xxxxxx, Xxxxxxxxxx 00000

With a

copy to:

Xxxxxx

& Jaclin, LLP

000 Xxxxx

0 Xxxxx, Xxxxx 000

Xxxxxxxxx,

Xxx Xxxxxx 00000

Attention:

Xxxx Xxxxx, Esq.

(b) If

to Seller:

American

Business Holdings, Inc.

[insert

new address]

With a

copy to:

Sichenzia

Xxxx Xxxxxxxx Xxxxxxx, LLP

00

Xxxxxxxx, 00xx

Xxxxx

Xxx Xxxx,

Xxx Xxxx 00000

Attention:

Xxxx X. Xxxx, Esq.

[REMAINDER

OF PAGE LEFT BLANK]

8

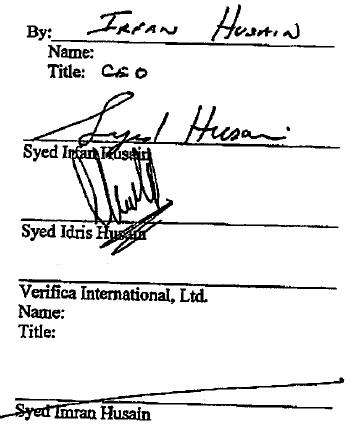

(SIGNATURE

PAGE TO STOCK PURCHASE AGREEMENT)

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly

executed and delivered, effective as of the date first above

written.

AMERICAN

BUSINESS HOLDINGS, INC.

9

[SIGNATURE

PAGE TO STOCK PURCHASE AGREEMENT]

IN WITNESS WHEREOF, the parties hereto

have caused this Agreement to be duly executed

and delivered, effective as of the date first above written.

AMERICAN

BUSINESS HOLDINGS, INC.

10