OFFICE LEASE AGREEMENT

Exhibit 10.1

EXECUTION VERSION

Between

FSP 00 XXXXX XXXXX XXXXXX CORP.,

a Delaware corporation,

as

Landlord

and

TARGET CORPORATION,

a Minnesota corporation,

as

Tenant

Premises:

00 Xxxxx Xxxxx Xxxxxx, Xxxxxxxxxxx, Xxxxxxxxx

Minneapolis, Minnesota

BASIC LEASE INFORMATION

| Effective Date: | February 29, 2012 | |

| Tenant: | TARGET CORPORATION, | |

| a Minnesota corporation | ||

| Tenant’s Address: | TARGET CORPORATION | |

| Target Property Development | ||

| Attn: Real Estate Portfolio Management/Minneapolis, MN/T-9348 | ||

| 0000 Xxxxxxxx Xxxx, XXX 00X | ||

| Xxxxxxxxxxx, Xxxxxxxxx 00000 | ||

| and | ||

| TARGET CORPORATION | ||

| Corporate Real Estate | ||

| Attn: Director, Corporate Real Estate | ||

| 0000 Xxxxxxxx Xxxx | ||

| Xxxxxxxxxxx, Xxxxxxxxx 00000 | ||

| Contact: | Telephone: (000) 000-0000 | |

| Landlord: | FSP 00 XXXXX XXXXX XXXXXX CORP., | |

| a Delaware corporation | ||

| Landlord’s Address: | FSP 00 XXXXX XXXXX XXXXXX CORP. | |

| c/o FSP Property Management LLC | ||

| 000 Xxxxxxxxx Xxxxx | ||

| Xxxxx 000 | ||

| Xxxxxxxxx, Xxxxxxxxxxxxx 00000 | ||

| Contact: | Telephone: (000) 000-0000 | |

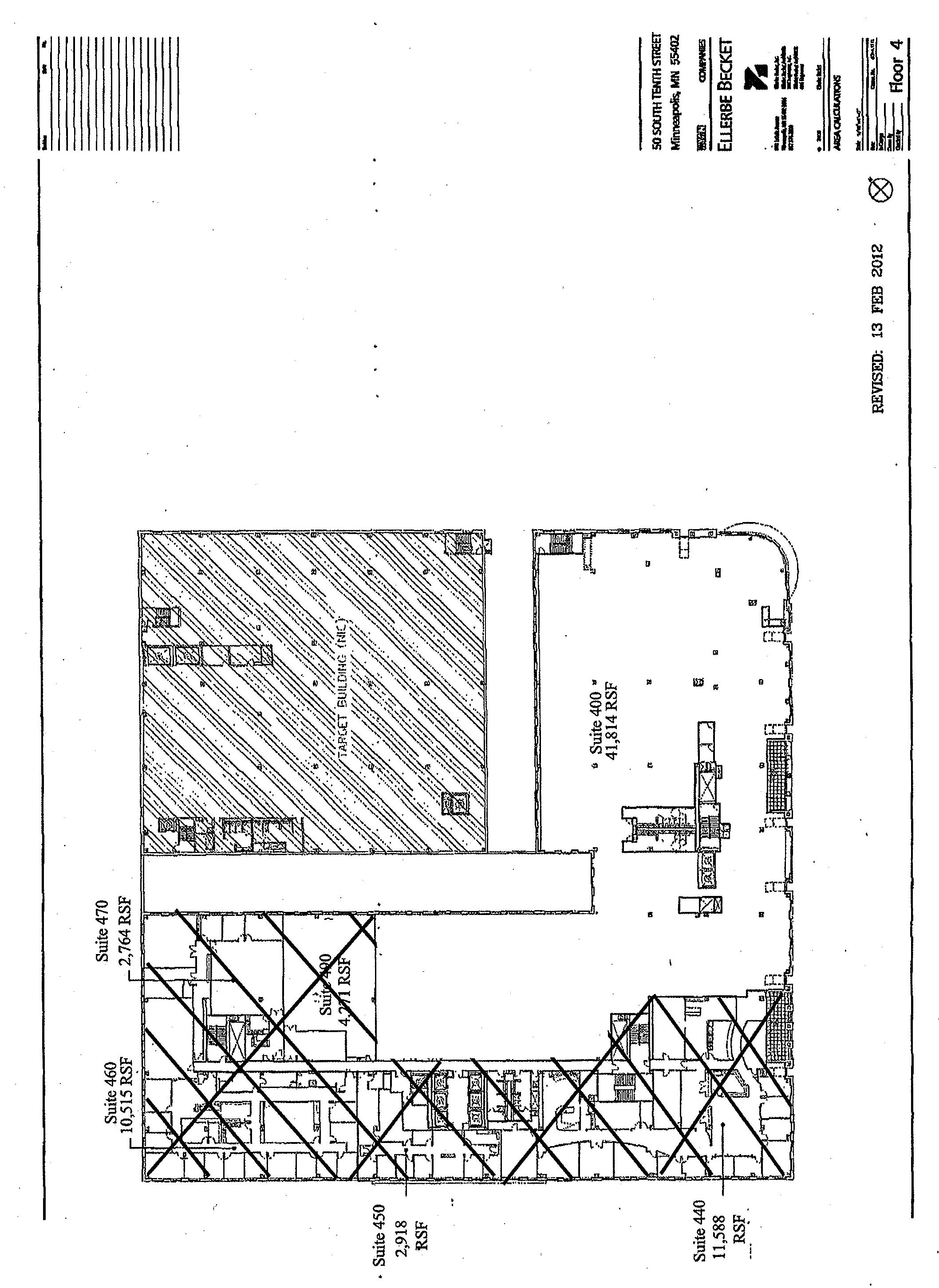

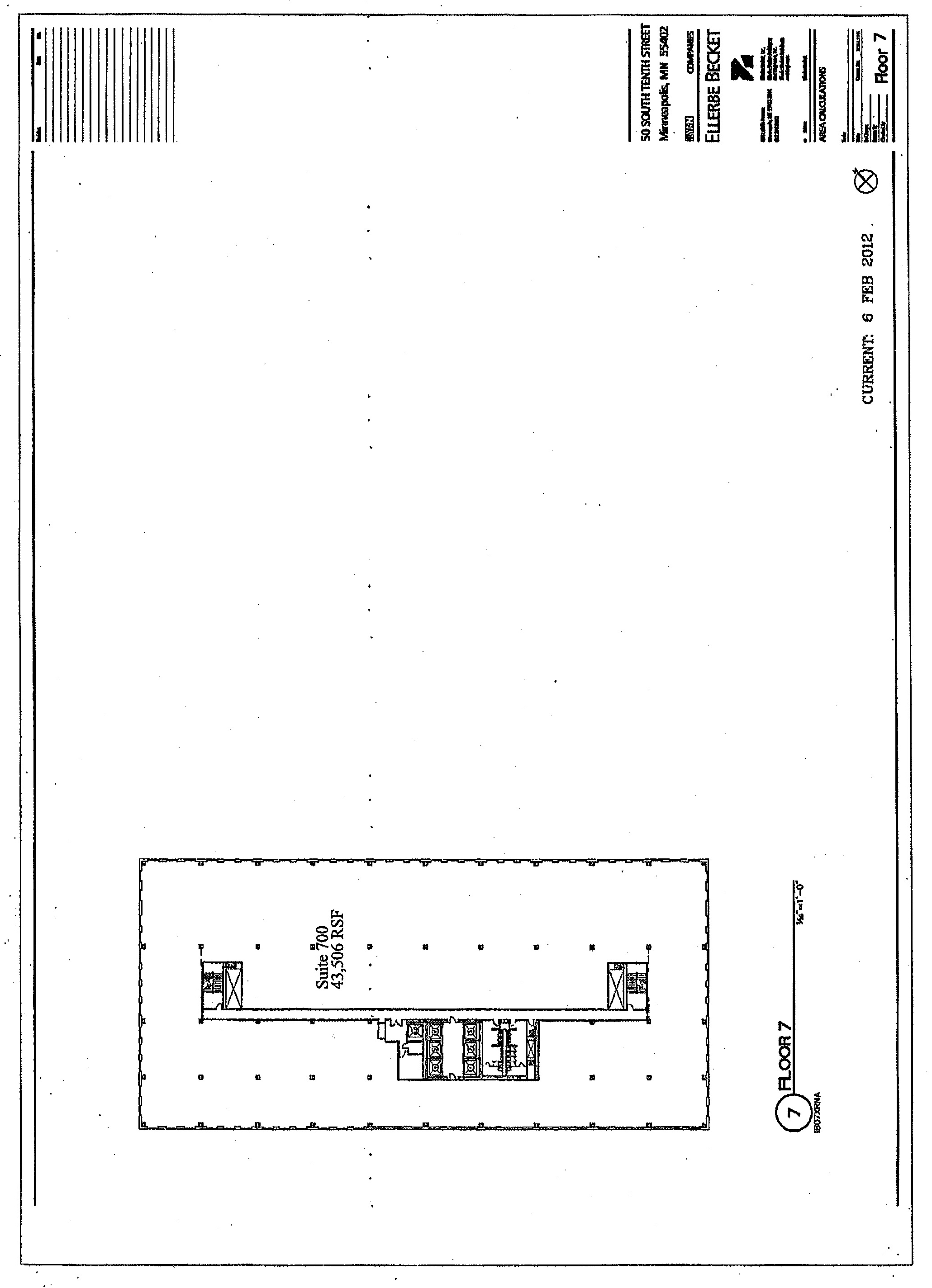

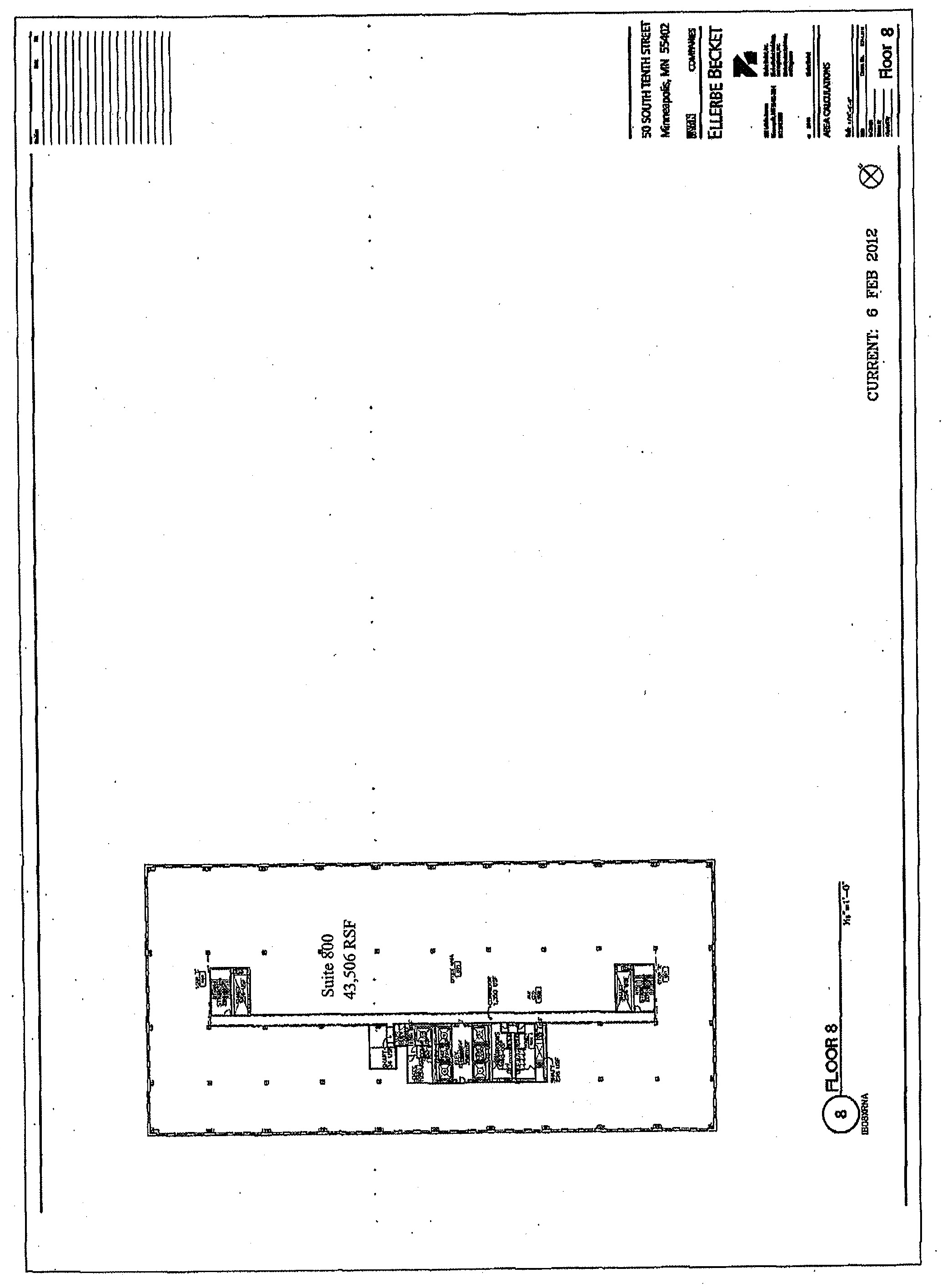

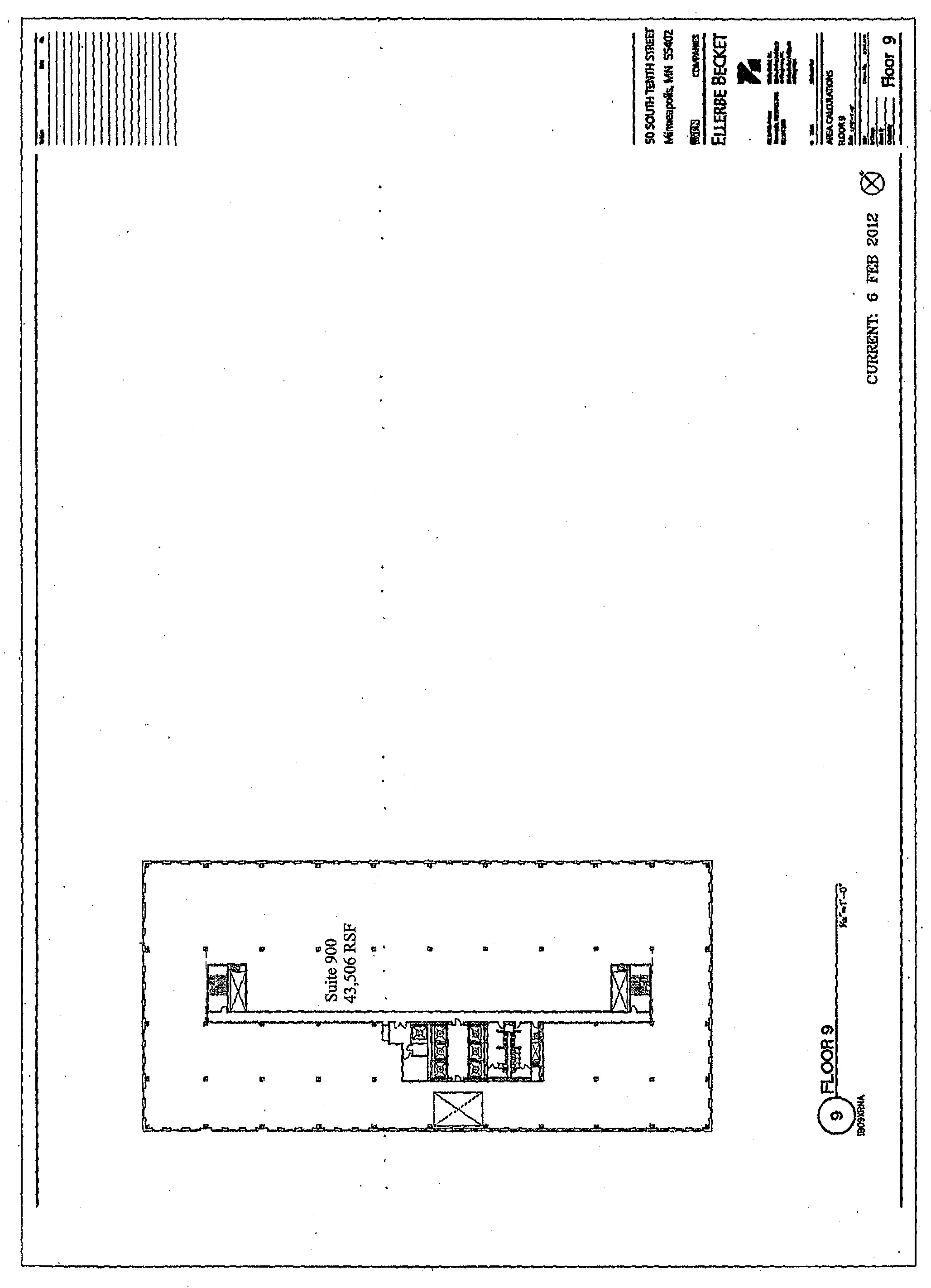

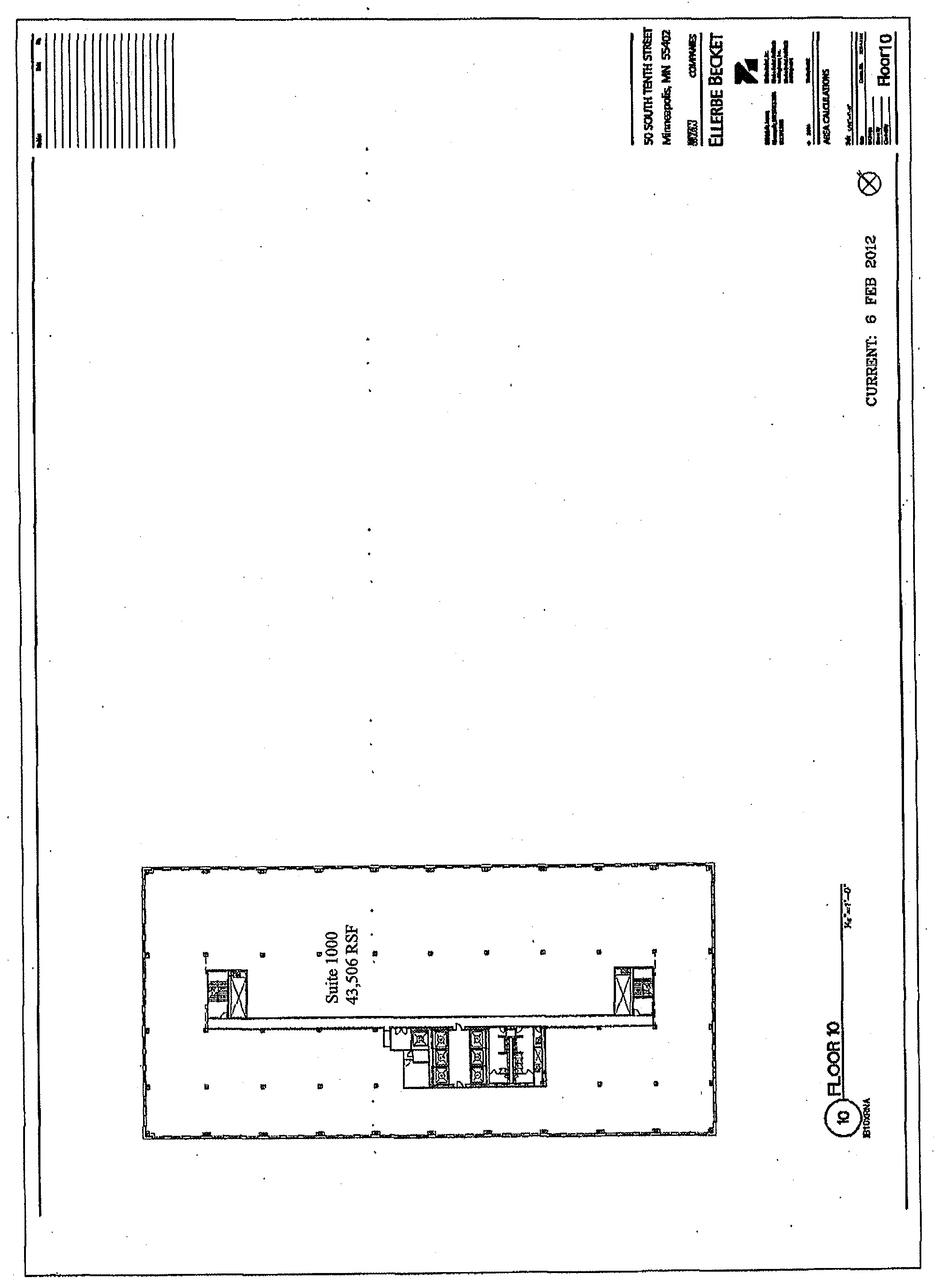

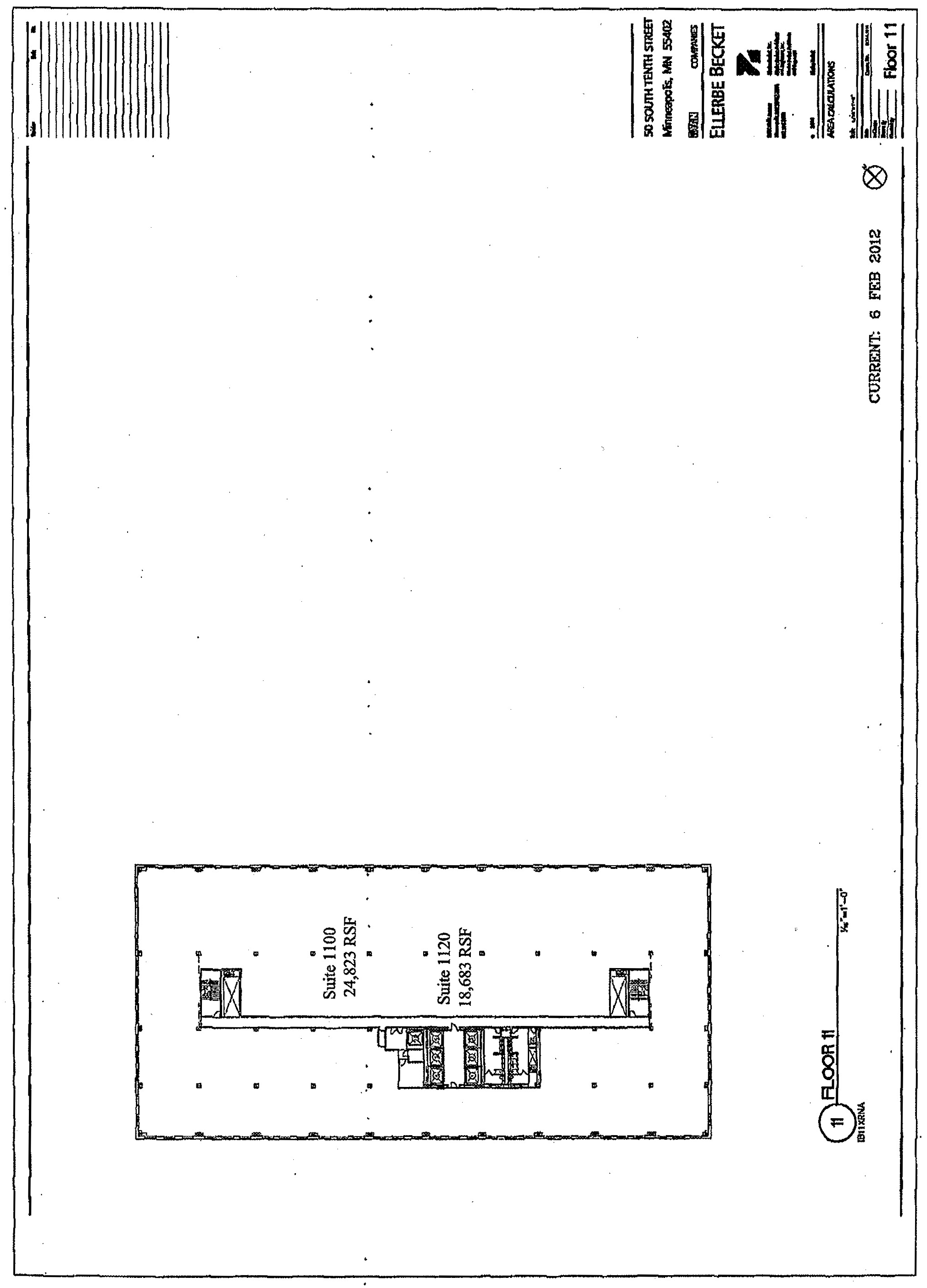

| Initial Premises: | 259,344 RSF on Floors 7-11 and a portion of Floor 4 of the Building, as follows: | |

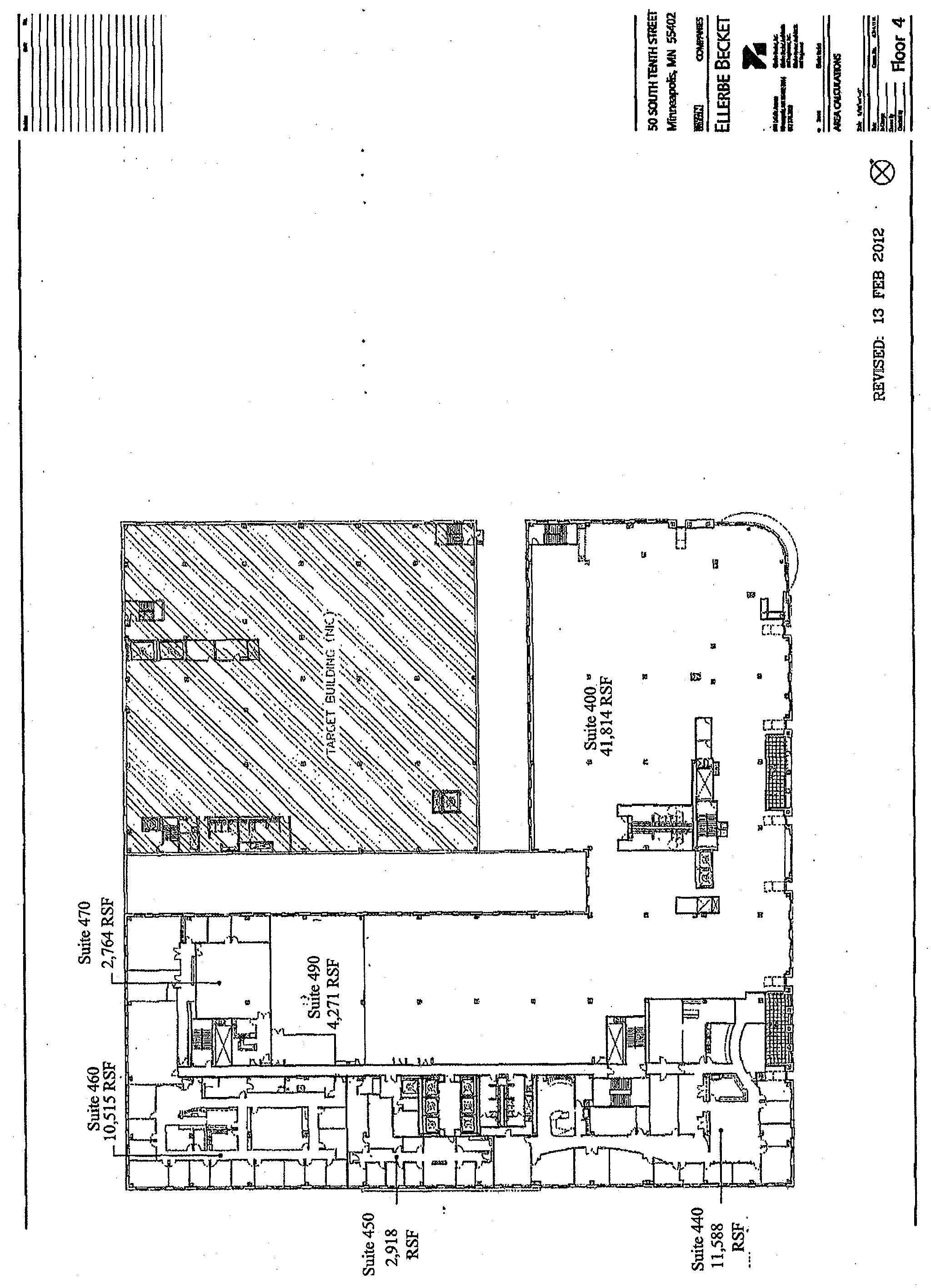

| Floor 4 | 41,814 RSF | |

| Floor 7 | 43,506 RSF | |

| Floor 8 | 43,506 RSF | |

| Floor 9 | 43,506 RSF | |

| Floor 10 | 43,506 RSF | |

| Floor 11 | 43,506 RSF | |

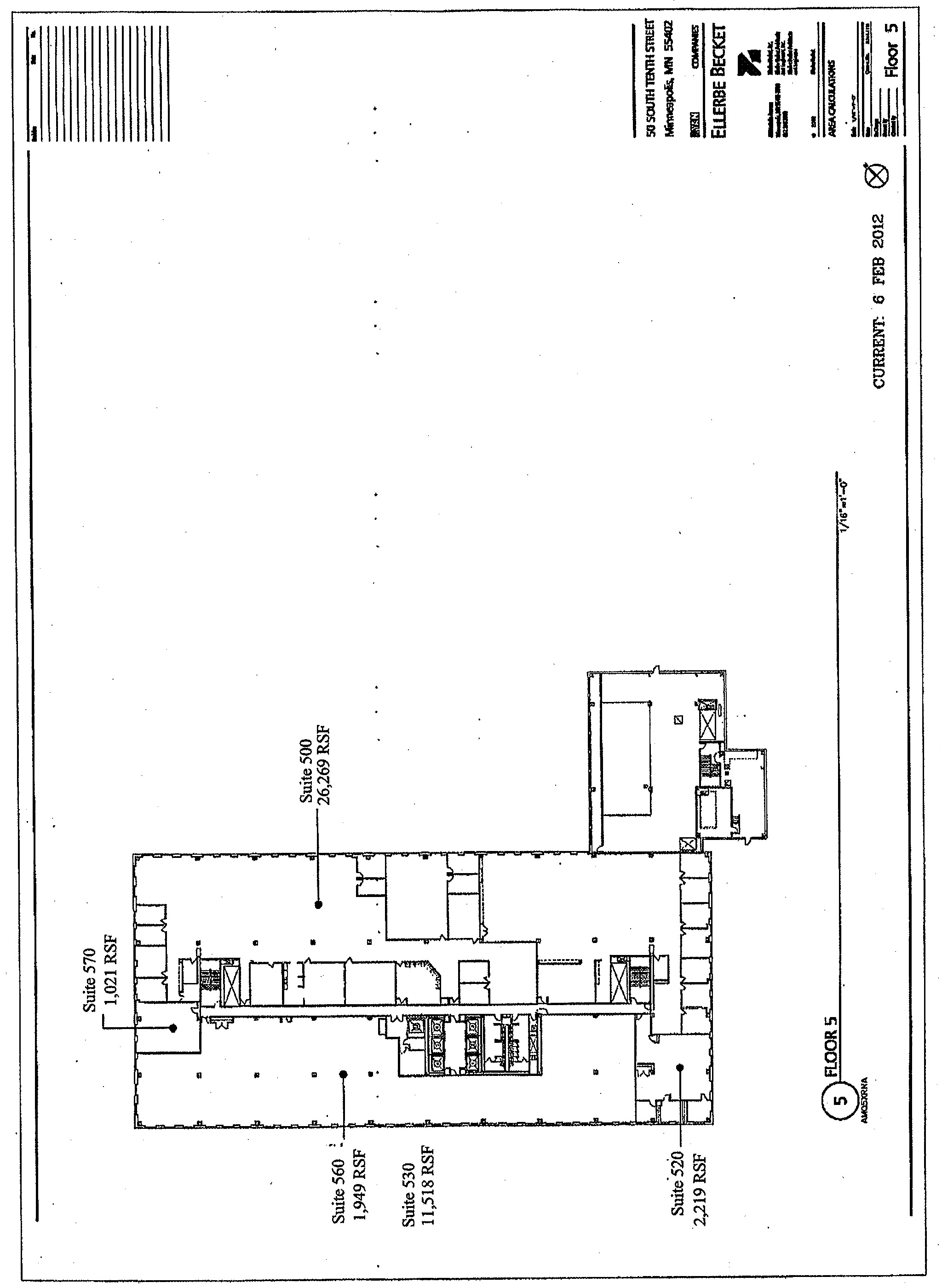

The Initial Premises are outlined on the plan attached to this Lease as Exhibit “B”.

Put Premises

and Put Premises

Commencement Dates:

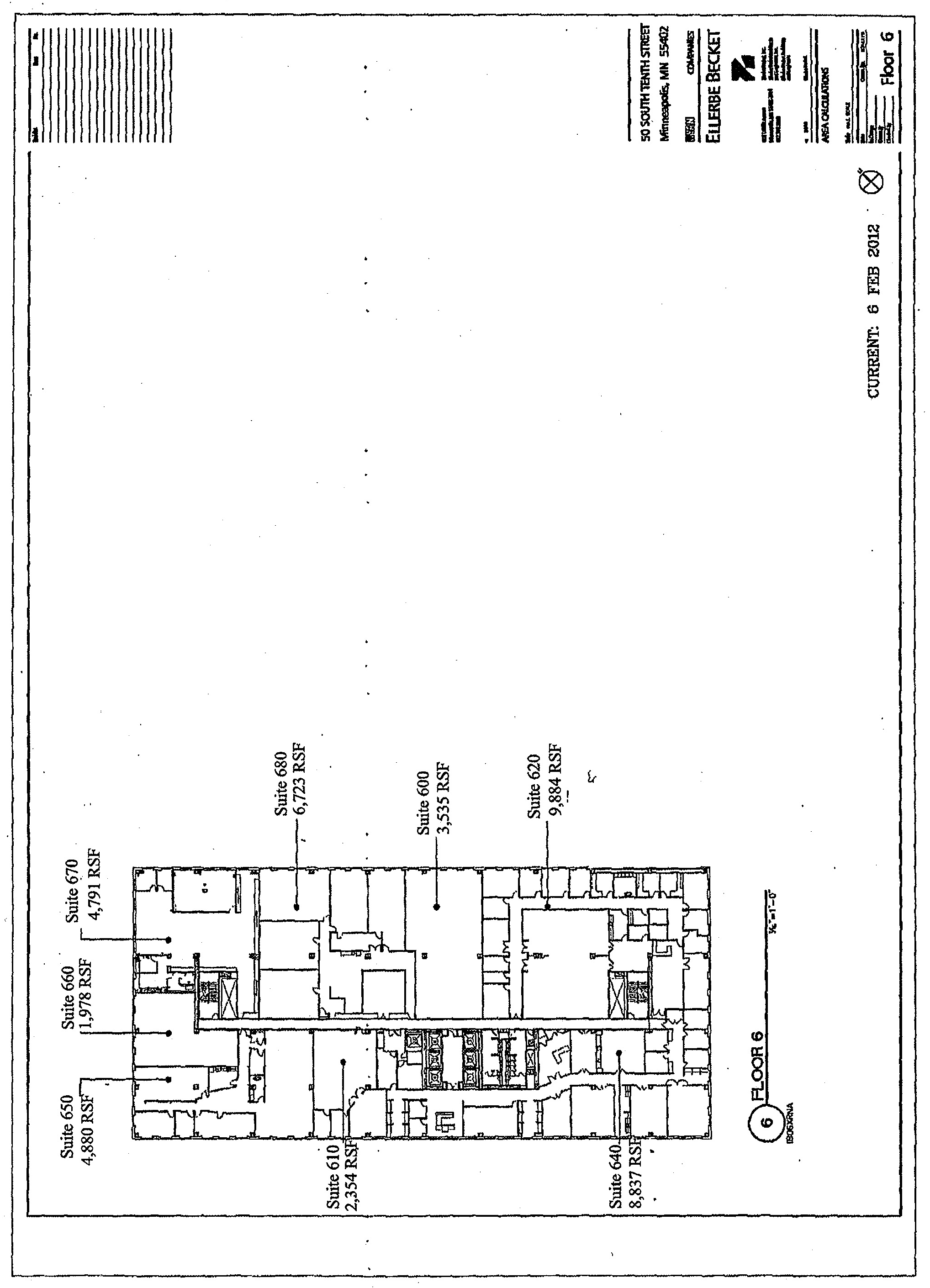

| Floor: | Put Premises RSF: | Space Components: |

Put Premises Commencement Dates: |

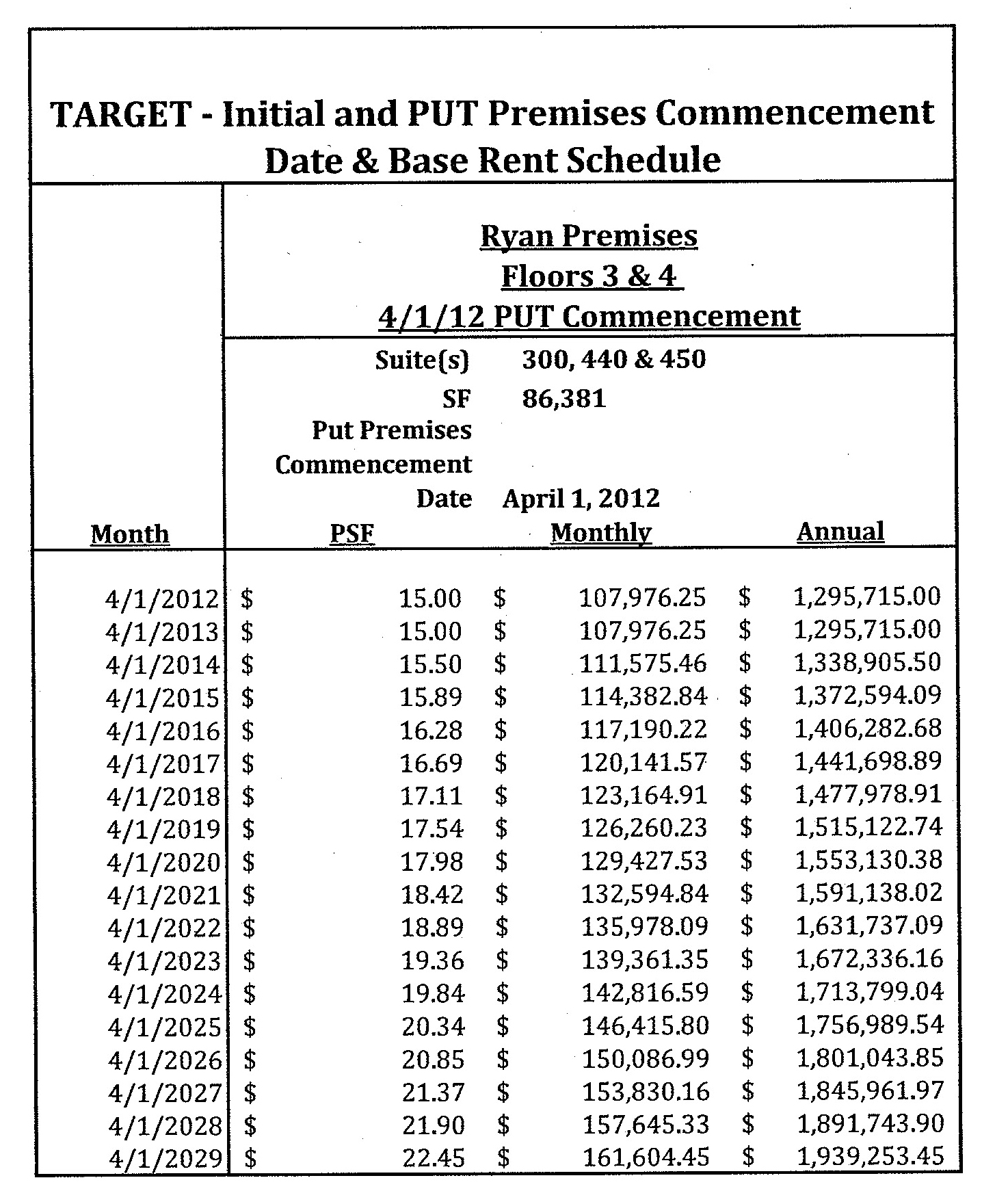

| Floor 4 | 14,506 RSF | Suite 440 and 450 | Xxxxx 0, 0000 |

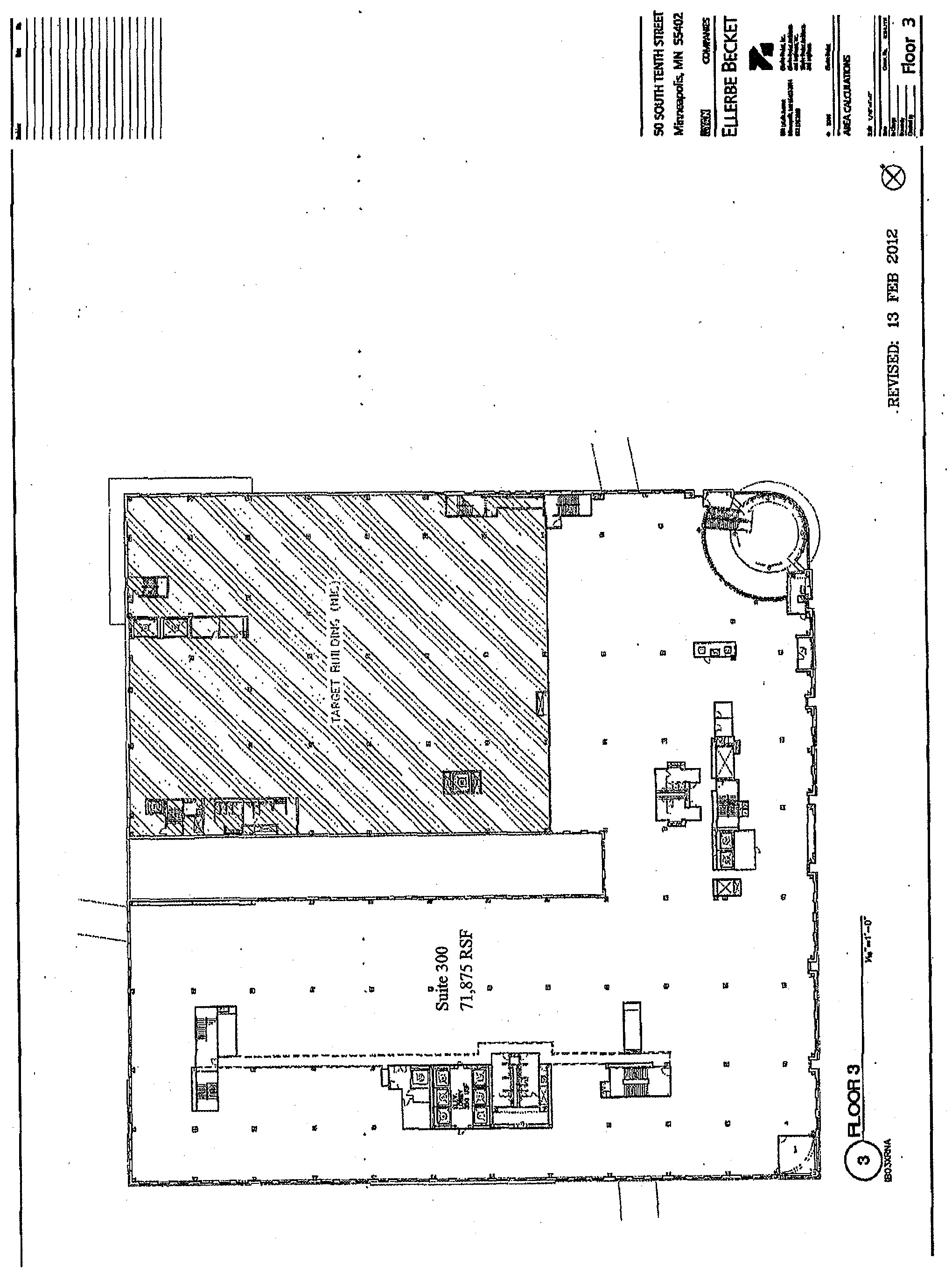

| Xxxxx 3 | 71,875 RSF | Suite 300 | April 1, 2012 |

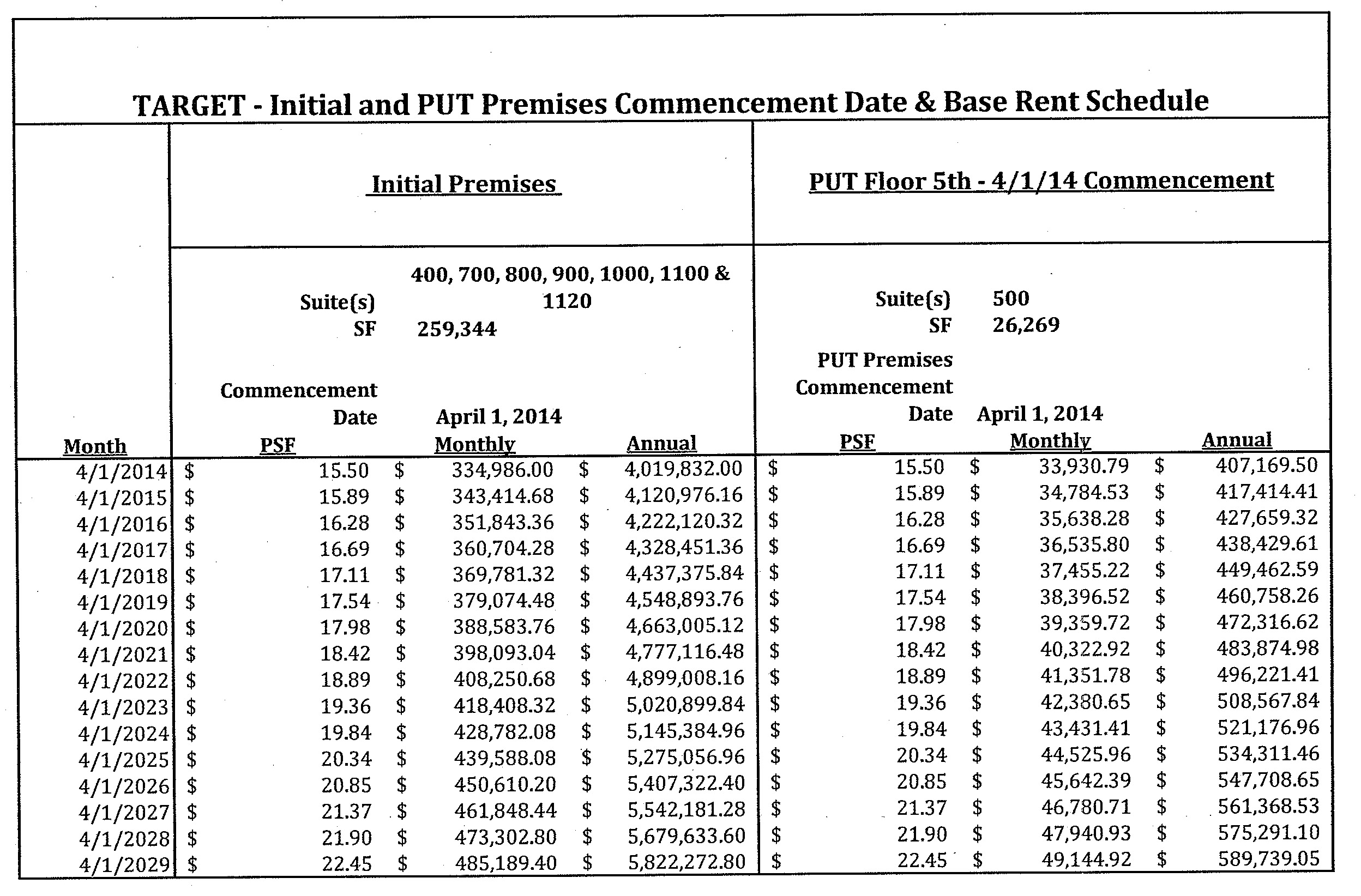

| Floor 5 | 26,269 RSF | Suite 500 | April 1, 2014 |

| Floor 5 | 16,707 RSF | Suites 570, 560, 530 and 520 | May 1, 2016 |

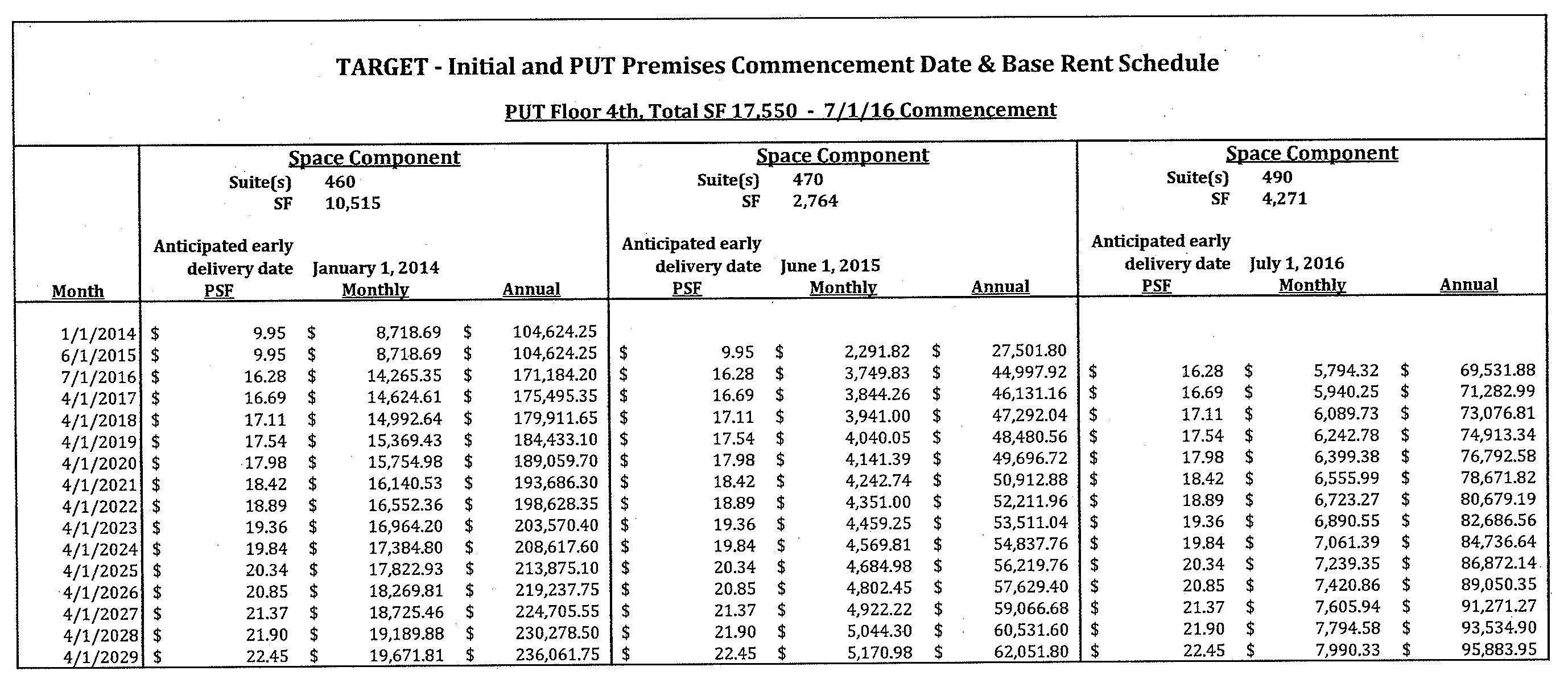

| Floor 4 | 17,550 RSF | Suites 490, 470 and 460 | July 1, 2016 |

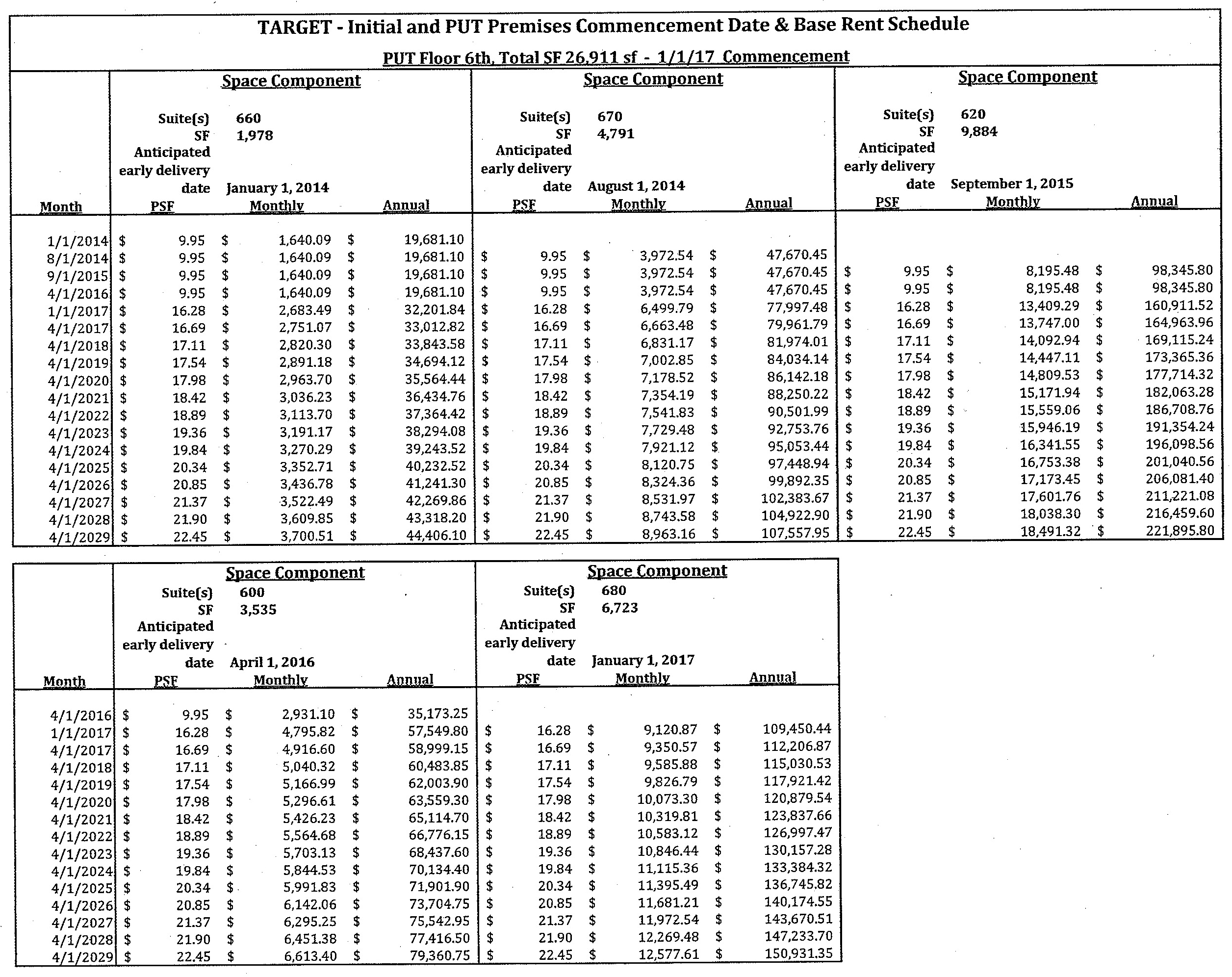

| Floor 6 | 26,911 RSF | Suites 680, 660, 620, 600 and 670 | January 1, 2017 |

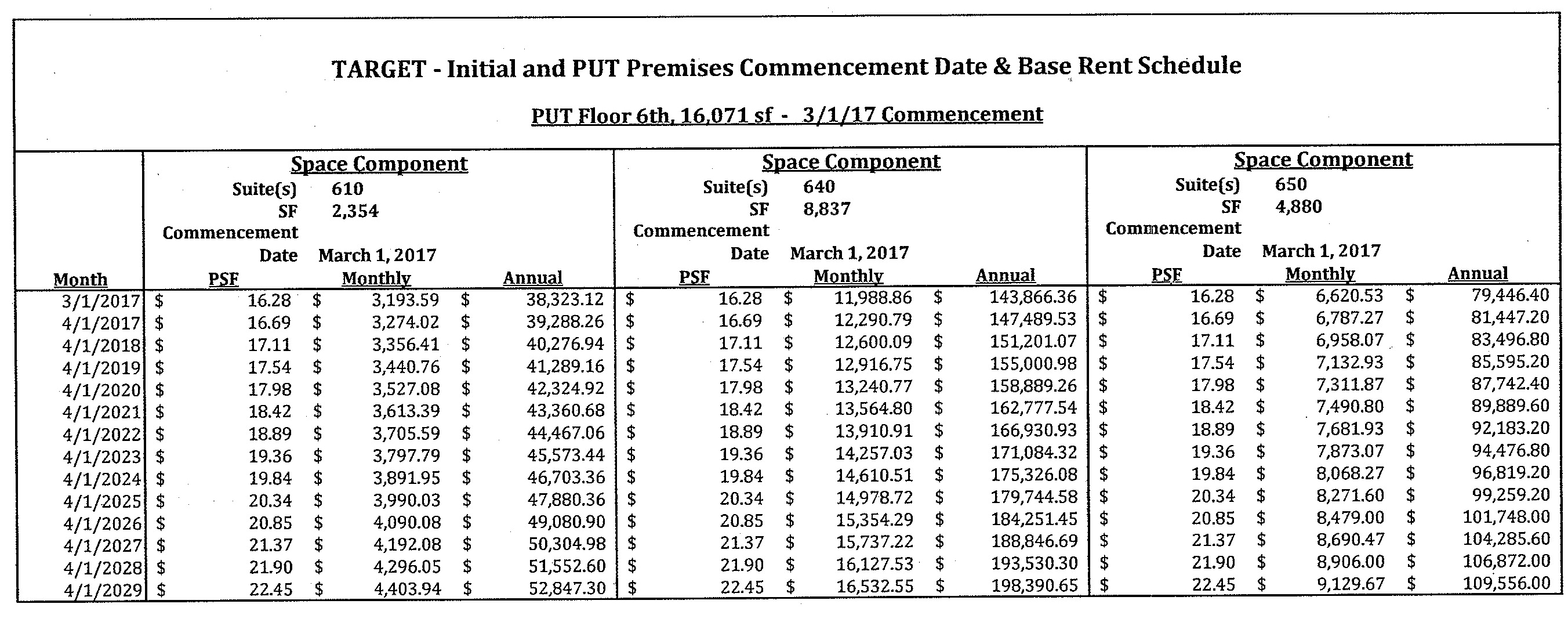

| Floor 6 | 16,071 RSF | Suites 610, 640 and 650 | March 1, 2017 |

| Total: | 189,889 RSF |

The Put Premises are outlined on the plan attached to this Lease as Exhibit “C”.

| Building: | The office building (the “Building”) located on a parcel of land (the “Property”) at 00 Xxxxx Xxxxx Xxxxxx, Xxxx of Minneapolis, Hennepin County, Minnesota and as legally described on Exhibit “A”. |

| Lease Term: | With respect to the Initial Premises, sixteen (16) years, commencing on April 1, 2014 (the “Commencement Date”) and ending at 5:00 p.m. on March 31, 2030 (the “Expiration Date”), subject to adjustment, extension and earlier termination as provided in this Lease. |

| The Lease Term with respect to the Put Premises shall commence on each of the respective Put Premises Commencement Dates, as provided above (or such earlier date as any Space Component of the Put Premises is delivered to Tenant, as further provided in Section 3(a)), and expire on the Expiration Date, subject to adjustment, extension and earlier termination as provided in this Lease. | |

| Renewal Options: | Two (2) Renewal Options of Five (5) years each, as more fully set forth in Section 3(d). |

| Base Rent: | The amounts set forth in the schedule attached as Exhibit “E”. |

| Rent: | Base Rent, Tenant’s Share of Basic Operating Costs and REOA expenses and all other sums that Tenant may owe to Landlord under this Lease. |

| Tenant Incentive Payment: | $23,950,000.00. |

| Permitted Use: | So long as the Tenant is Target Corporation, general office purposes, all ancillary uses related to Tenant’s business, including but not limited to planograms and showrooms, and, to the extent consistent with Class A office space, all other uses not prohibited by law. If Target Corporation is no longer the Tenant, then general office purposes, plus all other uses not prohibited by law and consistent with Class A office space. Notwithstanding the foregoing, in no event shall the Premises be used for any of the following purposes (i) data center or call center (except as used by Target Corporation as part of its internal and customary business operations), or (ii) retail or medical (except for Target Corporation employees only). |

| Tenant’s Share of Basic Operating Costs: |

A fraction, the numerator of which is the Rentable Square Foot area of the Premises, from time to time, and the denominator of which is the Rentable Square Foot area of the Office Area, Building, the Complex or the Project, as applicable. |

| Initial Liability Insurance Amount: | $5,000,000.00 |

| Brokers: | Keewaydin Real Estate Advisors (Xxxxx Xxxxxxx), for Tenant and C.B. Xxxxxxx Xxxxx (Xxxx XxXxxx), for Landlord |

The foregoing Basic Lease Information is incorporated into and made a part of the Lease identified above. If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

TABLE OF CONTENTS

| Page | ||

| 1. | DEFINITIONS | 1 |

| 2. | LEASE GRANT; GRANT OF EASEMENTS | 7 |

| 3. | LEASE TERM; ACCEPTANCE OF PREMISES; STORAGE SPACE | 8 |

| 4. | USE | 10 |

| 5. | PAYMENT OF RENT; TENANT INCENTIVE PAYMENT | 10 |

| 6. | BASIC OPERATING COSTS; THIRD-PARTY MANAGEMENT COMPANY; TAX CONTESTS | 11 |

| 7. | LATE PAYMENTS; DISHONORED CHECKS. | 18 |

| 8. | SECURITY DEPOSIT | 19 |

| 9. | SERVICES TO BE FURNISHED BY LANDLORD | 19 |

| 10. | GRAPHICS; SIGNAGE; NAMING RIGHTS; SECURITY | 21 |

| 11. | TELECOMMUNICATIONS | 22 |

| 12. | REPAIR AND MAINTENANCE BY LANDLORD | 22 |

| 13. | MAINTENANCE BY TENANT | 23 |

| 14. | REPAIRS BY TENANT | 23 |

| 15. | ALTERATIONS, ADDITIONS, IMPROVEMENTS. | 24 |

| 16. | LAWS AND REGULATION; DISABILITY LAWS; BUILDING RULES AND REGULATIONS | 25 |

| 17. | ENTRY BY LANDLORD | 27 |

| 18. | ASSIGNMENT AND SUBLETTING | 27 |

| 19. | MECHANIC’S LIENS | 29 |

| 20. | INSURANCE | 29 |

| 21. | INDEMNITY | 31 |

| 22. | WAIVER OF SUBROGATION RIGHTS | 31 |

| 23. | CASUALTY DAMAGE | 31 |

| 24. | CONDEMNATION | 32 |

| 25. | DAMAGES FROM CERTAIN CAUSES | 33 |

| 26. | DEFAULT BY TENANT. | 33 |

| 27. | DEFAULT BY LANDLORD | 35 |

| 28. | QUIET ENJOYMENT | 36 |

| 29. | REPRESENTATIONS, WARRANTIES AND COVENANTS | 36 |

| 30. | HOLDING OVER | 37 |

| 31. | RIGHTS RESERVED TO LANDLORD | 37 |

| 32. | SUBORDINATION TO MORTGAGE; ESTOPPEL AGREEMENT | 37 |

| 33. | LEASEHOLD MORTGAGE | 38 |

| 34. | ATTORNEYS’ FEES | 39 |

| 35. | NO IMPLIED WAIVER | 39 |

| 36. | INDEPENDENT OBLIGATIONS | 39 |

| 37. | RECOURSE LIMITATION | 39 |

| 38. | NOTICES | 40 |

| 39. | SEVERABILITY | 40 |

| 40. | RECORDATION | 40 |

| 41. | GOVERNING LAW | 40 |

| 42. | FORCE MAJEURE | 40 |

| 43. | TIME OF PERFORMANCE | 40 |

| 44. | TRANSFERS BY LANDLORD | 40 |

| 45. | COMMISSIONS | 40 |

| 46. | FINANCIAL STATEMENTS | 41 |

| 47. | TENANT’S STANDING AND XXXXXXXXX | 00 |

| 00. | PUBLIC REPORTING | 41 |

| 49. | WAIVER OF WARRANTIES AND ACCEPTANCE OF CONDITION | 41 |

| 50. | MERGER OF ESTATES | 42 |

| 51. | SURVIVAL OF INDEMNITIES AND COVENANTS | 42 |

| 52. | HEADINGS | 42 |

| 53. | ENTIRE AGREEMENT; AMENDMENTS | 42 |

| 54. | EXHIBITS | 42 |

| 55. | JOINT AND SEVERAL LIABILITY | 42 |

| 56. | MULTIPLE COUNTERPARTS | 42 |

| 57. | EXISTING SEVENTH FLOOR LEASE | 42 |

| 58. | MULTI-TENANT BUILDING | 43 |

| 59. | RETAIL AREA USAGE | 43 |

| EXHIBIT ”A” | PROPERTY DESCRIPTION |

| EXHIBIT “B” | FLOOR PLAN OF INITIAL PREMISES |

| EXHIBIT “C” | FLOOR PLAN OF PUT PREMISES |

| EXHIBIT “D” | PERMITTED ENCUMBRANCES |

| EXHIBIT “E” | BASE RENT SCHEDULE |

| EXHIBIT “F” | RULES AND REGULATIONS |

| EXHIBIT “G” | TENANT IMPROVEMENTS AGREEMENT |

| EXHIBIT “H” | COMMENCEMENT DATE MEMORANDUM |

| EXHIBIT “I” | CONFIDENTIALITY AGREEMENT |

| EXHIBIT “J” | JANITORIAL SPECIFICATIONS |

| EXHIBIT “K” | STORAGE SPACE |

| EXHIBIT “L” | FORM OF SNDA |

| EXHIBIT “M” | FORM OF MEMORANDUM OF LEASE |

| EXHIBIT “N” | EXISTING RETAIL AREA LEASES |

THIS OFFICE LEASE AGREEMENT (“Lease”) is executed as of the Effective Date by and between FSP 00 XXXXX XXXXX XXXXXX CORP., a Delaware corporation (“Landlord”), and TARGET CORPORATION, a Minnesota corporation (“Tenant”).

W I T N E S S E T H:

1. DEFINITIONS. Capitalized terms used in this Lease and not defined elsewhere have the meanings given them below:

“After Hours HVAC Rate” means initially $35.00 per zone per hour, which rate shall remain for at least the first twelve (12) calendar months after the Effective Date. Landlord may adjust the After Hours HVAC Rate from time to time, not more than once each calendar year as part of the budgeting process, as reasonably determined necessary by Landlord, based on an analysis by Landlord’s independent consultant of Landlord’s actual costs of providing HVAC during other than Normal Business Hours.

“Alterations” shall have the meaning given such term in Section 15(a) hereto.

“Base Building Signage” shall have the meaning given such term in Section 10(a) hereto.

“Base Rent” means the “Base Rent” set forth in the Basic Lease Information.

“Basic Operating Costs” shall have the meaning given to such term in Section 6(c) hereto.

“Broker” shall mean the broker(s) identified in the Basic Lease Information.

“Building” means the office and retail building located upon the Property, containing eleven (11) floors of Rentable Area adjacent to and above a separately-owned two-story department store and a three-level public parking garage, together with a street level lobby area adjoining Xxxxx 00xx Xxxxxx and loading dock, a portion of which is owned by Landlord, on the block bounded by Xxxxxxxx Xxxx, XxXxxxx Xxxxxx, Xxxxx 0xx Xxxxxx and Xxxxx 00xx Xxxxxx. The address of the Building is 00 Xxxxx Xxxxx Xxxxxx, Xxxxxxxxxxx, Xxxxxxxxx. Notwithstanding the foregoing, the Building will not include any portion of the Project not owned by Landlord.

“Building Standard” means the level of service or type of equipment standard in the Building or the type, brand and/or quality of materials Landlord designates from time to time to be the minimum type, brand or quality to be used in the Building or the exclusive type, grade or quality of material to be used in the Building. The Building Standard shall at all times be consistent with a Class A office building standards in the Market Area.

“Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the Laws of the State, or are in fact closed in, the State.

“Claims” means any and all liabilities, obligations, damages, claims, suits, losses, causes of action, lien, judgments and expenses (including court costs, reasonable attorneys’ fees and costs of investigation) of any kind, nature or description.

“Commencement Date” with respect to the Initial Premises means the Commencement Date as defined in the Basic Lease Information. “Commencement Date” with respect to the Put Premises means each of the respective Put Premises Commencement Dates, as set forth in the Basic Lease Information, as modified by Section 3(a).

“Commitment” means that certain title commitment with an effective date of October 20, 2011 issued by Old Republic National Title Insurance Company covering the Complex.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 1 |

“Common Areas” means all areas, spaces, facilities and equipment (whether or not located within the Building, but excluding Service Areas) made available by Landlord for the common and joint use of Landlord, Tenant and others designated by Landlord using or occupying space in the Building, including, but not limited to, entrances and exits providing ingress and egress to and from the Building, all access drives and entrances providing ingress and egress to and from the Property and the Building, loading and receiving docks, walkways, skyways, sidewalks and driveways necessary for access to the Building, Building lobbies, atriums, landscaped areas, public corridors, public rest rooms (specifically excluding those on full floors leased by Tenant), Building stairs, escalators and elevators open to the public, service elevators (provided that such service elevators shall be available only for tenants of the Building and others designated by Landlord), drinking fountains, and any such other areas and all other improvements, equipment and facilities the common use of which is necessary or convenient for the existence, maintenance and safe operation of the Property and the Building. Landlord shall not: (i) make any material changes to any of the Common Areas in the Building without the prior written consent of Tenant; (ii) permit the use of any Common Areas in any manner inconsistent with the standards of a Class A office building; and (iii) Landlord shall not permit the use of any of the Common Areas for any public events or the sale of any merchandise, equipment or services without the prior written consent of Tenant, which consent shall not be unreasonably withheld, conditioned or delayed; provided, however, Landlord is expressly authorized to permit the Common Areas to be used for ATM machines, shoe shine stands, or a management office or access to a management office for the Building. Notwithstanding the foregoing, Landlord’s obligations with respect to the Common Areas only apply to the extent the Common Areas are owned or controlled by Landlord.

“Complex” means the Property and the Building.

“Condemnation” shall have the meaning given such term in Section 24 hereto.

“Constant Dollars” means the present value of the U.S. dollar to which such phrase refers. An adjustment shall occur on January 1 of the sixth (6th) calendar year following the Effective Date, and thereafter at five (5) year intervals. Constant Dollars shall be determined by multiplying the dollar amount to be adjusted by a fraction, the numerator of which is the Current Index Number and the denominator of which is the Base Index Number. The “Base Index Number” shall be the level of the Index for the month of the date of the Effective Date; the “Current Index Number” shall be the level of the Index for the month of September of the year preceding the adjustment year; the “Index” shall be the Consumer Price Index for All Urban Consumers, U.S. City Average, All items, published by the Bureau of Labor Statistics of the United States Department of Labor (base year 1982-84=100), or any successor index thereto as hereinafter provided. If publication of the Index is discontinued, or if the basis of calculating the Index is materially changed, then Landlord and Tenant shall substitute for the Index comparable statistics as computed by an agency of the United States Government or, if none, by a substantial and responsible periodical or publication of recognized authority most closely approximating the result which would have been achieved by the Index.

“Corporate Transaction” means (i) an assignment or subletting to any entity resulting from a consolidation, merger or reorganization by or with Tenant; (ii) an assignment or subletting in connection with a sale of not less than fifty percent (50%) of the assets of Tenant; (iii) an assignment or subletting to any parent, subsidiary or affiliate of Tenant controlled by, under common control with or controlling Tenant; (iv) an assignment which may result by operation of law or by a change in the ownership of Tenant’s stock; or (v) a transaction involving the public offering of Tenant’s stock on a national stock exchange irrespective of the percentage of stock being offered in such public offering.

“Date of Condemnation” shall have the meaning given such term in Section 24 hereto.

“Default Rate” means the lesser of the following: (i) the rate of eight percent (8%) per annum; or (ii) the maximum rate of interest then permissible for a commercial loan to Tenant in the State.

“Defaulting Party” shall have the meaning given such term in Section 22 hereto.

“Disability Laws” shall have the meaning given such term in Section 15(a) hereto.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 2 |

“Discount Department Store Business” means those companies designated by the U.S. Securities and Exchange Commission Division of Corporate Finance Standard Industrial Classification Code List as “5331 Retail – Variety Stores,” other than Target Corporation.

“Dispute” shall have the meaning given such term in Section 6(g) hereto.

“Effective Date” means Effective Date as set forth in the Basic Lease Information.

“Event of Default” shall have the meaning given such term in Section 26(a) hereto.

“Existing Retail Area Leases” means those leases for the Retail Area as set forth on Exhibit “N” attached hereto.

“Existing Seventh Floor Lease” means the lease between FSP 00 Xxxxx Xxxxx Xxxxxx LLC, as successor in interest to 900 Nicollet, LLC, as landlord, and Tenant, as tenant, dated May 17, 2005, with respect to all of the Rentable Area on Floor 7 of the Building.

“Expiration Date” means the Expiration Date, as defined in the Basic Lease Information.

“Exterior Building Signage” shall have the meaning given such term in Section 10(b) hereto.

“Force Majeure” means acts of God, significant variations from normal weather conditions reasonably expected during the period in question, war, terrorist act, civil commotion, riots, strikes, picketing, or other labor disputes, governmental laws or regulations, unavailability of labor or materials despite the use of commercially reasonable efforts and utilizing comparable substitutions or damage to work in progress by reason of fire or other casualty or causes beyond the reasonable control of a party (other than financial reasons).

“Hazardous Materials” means any of the following, in any amount: (a) any petroleum or petroleum product, asbestos in any form, urea formaldehyde and polychlorinated biphenyls; (b) any radioactive substance; (c) any toxic, infectious, reactive, corrosive, ignitable or flammable chemical or chemical compound; and (d) any chemicals, materials or substances, whether solid, liquid or gas, defined as or included in the definitions of hazardous substances, hazardous wastes, hazardous materials, extremely hazardous wastes, restricted hazardous wastes, toxic substances, toxic pollutants, solid waste, or words of similar import in any federal, state or local Law now existing or existing on or after the Effective Date as the same may be interpreted by government offices and agencies.

“Hazardous Materials Laws” means any federal, state or local statutes, laws, ordinances or regulations now existing or existing after the Effective Date that control, classify, regulate, list or define Hazardous Materials.

“Initial Premises” means the Initial Premises as set forth in the Basic Lease Information.

“Landlord Related Party” means any officer, director, partner, employee, member, agent or contractor of Landlord.

“Landlord’s Affiliates” means FSP 00 Xxxxx Xxxxx Xxxxxx LLC.

“Landlord’s Mortgagee” shall have the meaning given such term in Section 32(a) hereto.

“Landlord’s Notice Address” shall mean the address of Landlord set forth on the signature page of this Lease.

“Landlord’s Work” shall have the meaning given such term in Section 3(b) hereto.

“Laws” means any law, regulation, rule, order, statute or ordinance of any governmental or private entity in effect on or after the Effective Date and applicable to the Complex or the use or occupancy of the Complex, including, without limitation, Hazardous Materials Laws, Rules and Regulations and Permitted Encumbrances.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 3 |

“Lease Term” means the Lease Term set forth in the Basic Lease Information.

“Leasehold Mortgage” shall have the meaning given such term in Section 33 hereto.

“Leasehold Mortgagee” shall have the meaning given such term in Section 33 hereto.

“Market Area” means the Minneapolis Central Business District.

“Minor Non-Structural Alterations” shall have the same meaning given such term in Section 15(a).

“Miscellaneous Power” shall have the meaning given such term in Section 9(a)(6) hereto.

“Mortgage” shall have the meaning given such term in Section 32(a) hereto.

“Net Current Assets” means the amount by which the value of a company's current assets (excluding intangible assets if any, unless said intangible assets are otherwise disclosed in publicly available documents in which event such intangible assets will be included) exceeds its current liabilities. If and for so long as Tenant is a publicly-traded entity, Net Current Assets will be measured as disclosed in Tenant’s publicly available documents (e.g., 10K, 10Q filings).

“Non-Structural Alterations” shall have the meaning given such term in Section 15(a) hereto.

“Normal Business Holidays” means New Years Day, Memorial Day, July 4th (Independence Day), Labor Day, Thanksgiving and Christmas Day and any other day which shall be recognized by office tenants generally (excluding federal or state banking institutions) as a national holiday on which office employees are not required to work.

“Normal Business Hours” for the Building means 7:00 a.m. to 6:00 p.m. on Monday through Friday, and 8:00 a.m. to 1:00 p.m. on Saturday, exclusive of Normal Business Holidays.

“Occupant” means any Person from time to time entitled to the use and occupancy of any portion of the Complex under an ownership right or any lease, sublease, license, concession, or other similar agreement.

“OFAC” shall have the meaning given such term in Section 29(g) hereto.

“Office Area” means the office portion of the Building, consisting of 449,233 square feet of Rentable Area on floors 3 through 11 and any Common Areas associated therewith.

“Permitted Encumbrances” means all easements, declarations, encumbrances, covenants, conditions, reservations, restrictions and other matters now or after the Effective Date affecting title to the Complex. The Permitted Encumbrances as of the Effective Date are set forth on Exhibit “D” and approved by Tenant.

“Permitted Use” means the Permitted Use set forth in the Basic Lease Information.

“Permittee” means all Occupants and the officers, directors, employees, agents, contractors, customers, vendors, suppliers, visitors, invitees, licensees, subtenants, and concessionaires of Occupants insofar as their activities relate to the intended use and occupancy of the Complex.

“Person” means any individual, corporation, association, partnership, limited liability company, trust, governmental authority or other legal entity.

“Premises” means the total space subject to this Lease, from time to time, consisting of portions of the Put Premises, as each Space Component is delivered to Tenant, and the Initial Premises, as of the Commencement Date with respect to the Initial Premises. Whenever Tenant is leasing all of the Rentable Area on a floor in the Building, such floor shall be deemed to have no Common Areas, and all elevator lobbies, restrooms and corridors shall be deemed a part of the Premises.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 4 |

“Primary Lease” shall have the same meaning given such term in Section 32(a) of this Lease.

“Primary Lease Recognition Agreement” shall have the same meaning as given such term in Section 32(a) of this Lease.

“Project” means the Complex, and the other land and improvements subject to either (i) the REOA, or (ii) any of the skyway agreements burdening the Complex.

“Property” means the land described in Exhibit ”A” attached hereto and incorporated herein by reference.

“Put Premises” means the Put Premises set forth in the Basic Lease Information.

“Put Premises Commencement Dates” means the Put Premises Commencement Dates set forth in the Basic Lease Information, or such earlier date as any Space Component is delivered to Tenant pursuant to Section 3(a) of this Lease.

“Remedies Notice” shall have the meaning given such term in Section 33(c) hereto.

“Renewal Options” means the Renewal Options set forth in the Basic Lease Information, as more fully described in Section 3(d).

“Rent” means, collectively, the Base Rent, Tenant’s Share of Basic Operating Costs (as provided in Section 6), and all other sums of money becoming due and payable to Landlord under this Lease.

“Rentable Area” of the Premises and the Building means the Rentable Area, as calculated in accordance with the American National Standards Institute’s Standard Method of Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-1996. All references to “RSF” mean the square feet of Rentable Area of a particular space, as set forth in the Basic Lease Information.

“Rentable Area of the Building” means (and is hereby deemed to be) 485,648 square feet of Rentable Area, consisting of the Office Area and the Retail Area, but specifically excluding storage space as identified in Section 3(e) of this Lease.

“Rentable Area of the Premises” means (and is hereby deemed to be) the number of square feet of Rentable Area of the Premises, from time to time, as set forth in the Basic Lease Information, irrespective of whether the same should be more or less as a result of variations resulting from later re-measurement or actual construction and completion of the Premises for occupancy, but specifically excluding storage space as identified in Section 3(e) of this Lease.

“REOA” means collectively items 4, 5, 6, 7, 8 and 9 on the attached “Exhibit D,” as the same may be amended from time to time.

“Retail Area” means the retail portion of the Building, consisting of 36,415 square feet of Rentable Area on floors 1 and 2 and any Common Areas associated therewith.

“Rules and Regulations” means the rules and regulations for the Complex set forth on Exhibit ”F” attached to this Lease and incorporated herein by reference, and any rules and regulations that are adopted or altered by Landlord in accordance with Section 27 of Exhibit ”F”. In the event of a conflict between Exhibit ”F” and the terms and conditions of the Lease, the terms and conditions of the Lease will control.

“Service Areas” means those areas, spaces, facilities and equipment serving the Building (whether or not located within the Building) to which Tenant will have limited access, to the extent provided in this Lease or as otherwise permitted by Landlord from time to time upon request of Tenant, including, but not limited to, risers, service elevators, mechanical, telephone, equipment, electrical, janitorial and similar rooms and air and water refrigeration equipment.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 5 |

“Service Failure” shall have the meaning given such term in Section 9(c) hereto.

“SNDA” shall have the meaning given such term in Section 32(d) hereto.

“Space Component” means each of the individual suites contained within the Put Premises, as shown in the chart set forth in the Basic Lease Information and on the attached Exhibit “E”.

“State” means the State of Minnesota.

“Substitute Tenant” shall have the meaning given such term in Section 26(f) hereto.

“Tangible Net Worth” means the excess of the value of tangible assets (i.e., assets excluding those which are intangible such as goodwill, patents and trademarks, unless otherwise disclosed in Tenant’s publicly available documents in which event such intangible assets will be included) over liabilities. If and for so long as Tenant is a publicly-traded entity, Tangible Net Worth will be measured as disclosed in Tenant’s publicly available documents (e.g., 10K, 10Q filings).

“Target Affiliated Entities” means one or more entities owned or controlled by Target Corporation or one or more entities owned or controlled by an entity which owns or controls Target Corporation.

“Taxes” means all taxes, rates, charges, levies and installments of assessments levied or assessed against and currently due and payable on the Property, the Building and any improvements within the Project (but excluding any income, profit, business or similar tax imposed on Landlord’s income unless, and then only to the extent, such tax imposed on Landlord’s income is levied, in whole or in part, in lieu of taxes, rates, charges, levies and assessments levied against the Property and/or the Building and further excluding any taxes, rates, charges, levies and assessments which are levied or assessed against the Property or the Building if and to the extent, such taxes, rates, charges, levies and assessments are levied, in whole or in part, in lieu of any income, profit, business or similar tax otherwise payable by Landlord) imposed by any Taxing Authority. Taxes will include interest on deferred installments of special assessments but, except as set forth in the following sentence, will not include penalties or interest resulting in delinquent payments. Taxes will include attorneys’ fees, expert witnesses fees, court costs and other charges including, without limitation, penalties or interest resulting from delinquent payments to the extent they arise out of a proceeding wherein the Landlord contests the taxes, or the amount thereof, in accordance with Section 6(c)(6). For the purpose of computing Taxes: (i) installments of special assessments will not be prepaid except as required by law or previously approved in writing by Tenant; (ii) Taxes will not include taxes, rates, charges, levies or assessments which were due and payable in the calendar year or years preceding the calendar year in which the Commencement Date occurs; and (iii) if Landlord is provided with a choice of periods over which assessments are spread and Landlord elects a period other than the longest period available without the prior written consent to Tenant, then at Tenant’s option, Taxes will be computed on the basis of the longest period available and interest on the assessment or assessments in question will be computed at the rate which would have been paid on the assessment or assessments in question had the same been spread over the longest period available.

“Taxing Authority” means any authority having the direct or indirect power to tax, including but not limited to, (a) any city, county, state or federal entity, (b) any school, agricultural, lighting, drainage or other improvement or special assessment district, including, without limitation, the Minneapolis Downtown Improvement District, (c) any governmental agency, or (d) any private entity having the authority to assess the Property under any of the Permitted Encumbrances.

“Tenant Improvements” means those improvements to the Premises which Tenant elects to construct or have constructed in the Premises in accordance with the Tenant Improvements Agreement.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 6 |

“Tenant Improvements Agreement” means the agreement between Tenant and Landlord for construction of improvements within the Premises, excepting Minor Non-Structural Alterations, attached as Exhibit “G” of this Lease.

“Tenant Incentive Payment” means the Tenant Incentive Payment described in the Basic Lease Information and defined in Section 5(b).

“Tenant’s Notice Address” shall mean the address of Tenant set forth on the signature page of this Lease.

“Tenant Related Party” means any officer, director, partner, employee, agent or contractor of Tenant.

“Tenant’s Share” means the proportion which the Rentable Area of the Premises, from time to time, bears to the Rentable Area of the Office Area, the Building, the Complex, or the Project, as applicable.

“Tenant’s Share of Basic Operating Costs” shall have the same meaning as set forth in the Basic Lease Information.

“Transfer” shall have the meaning given such term in Section 18(b) hereto.

2. LEASE GRANT; GRANT OF EASEMENTS. Subject to all of the other terms and conditions of this Lease:

(a) Landlord leases to Tenant, and Tenant leases from Landlord, the Premises together with all rights, benefits, easements, appurtenances, and hereditaments attaching, belonging, or pertaining to the Premises and the non-exclusive right to use the Common Areas;

(b) During the Lease Term, Landlord hereby grants and conveys to Tenant for Tenant’s use and for the use of Tenant’s Permittees, in common with others entitled to use the same, a non exclusive easement for use of the Common Areas for all purposes for which they are intended, together with such access to the Common Areas as is reasonably necessary for such purposes;

(c) During the Lease Term, Landlord hereby grants and conveys to Tenant, a non-exclusive right and easement to (i) tap into and use the Building systems from time to time and (ii) install, operate, maintain, repair, relocate and remove utility lines, conduits, ducts, cables and other facilities exclusively serving the Premises within those portions of the Common Areas intended for such utility lines and facilities. If a utility provider requires an easement, license or other limited access right as a condition to providing utility services required by Tenant, Landlord shall promptly execute such reasonable documentation as is necessary to satisfy this requirement and/or authorize Tenant to execute such documentation as applicable;

(d) During the Lease Term, Landlord hereby grants and conveys to Tenant for its use and for the use of designated Occupants of the Premises, an easement for the installation, replacement, operation, maintenance and repair of the Tenant’s signage provided for in this Lease, together with access over, under, upon, through and across the Complex to install, replace, maintain, repair and operate utility lines necessary to provide such identification signs and accent lights with power to illuminate the same; and

(e) Landlord hereby grants and conveys to Tenant and to its contractors, materialmen and laborers a temporary license for access and passage over and across such portions of the Complex as shall be reasonably necessary for Tenant to construct and/or maintain improvements and equipment within or serving the Premises; provided, however, that such license shall be in effect only during periods when actual construction and/or maintenance is being performed and provided further that the use of such license shall not be exercised so as to unreasonably interfere with the use and operation of such portions of the Building by other Occupants.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 7 |

3. LEASE TERM; ACCEPTANCE OF PREMISES; STORAGE SPACE.

(a) This Lease shall continue in full force during a period beginning on the Effective Date of this Lease (although the Lease Term shall not commence and no Rent shall accrue with respect to the Initial Premises or any Space Component of the Put Premises until any such space becomes a part of the Premises, as provided herein) and ending on the Expiration Date, unless this Lease is terminated early or extended to a later date pursuant to any other term or provision hereof. Notwithstanding the schedule of the Put Premises Commencement Dates set forth in the Basic Lease Information, Tenant acknowledges and agrees that the attached Exhibit “E” contains a schedule of the anticipated early delivery date with respect to each Space Component, and that the Put Premises Commencement Date with respect to each such Space Component shall be the date the existing tenant has vacated such Space Component and removed all of its personal property therefrom. If any of the existing tenants of any of the Space Components should surrender a Space Component even earlier than the dates set forth on Exhibit “E”, Landlord may provide Tenant with written notice thereof, and Tenant shall accept delivery of such Space Component on the earlier of (i) the date three (3) months after Landlord notifies Tenant of such early availability of such Space Component; or (ii) the date Tenant would have been required to take delivery of such Space Component under the preceding sentence.

(b) Subject to Landlord’s Work, Tenant shall accept delivery of the Initial Premises and each Space Component of the Put Premises in its “as is, where is” condition. Prior to delivering any Space Component of the Put Premises to Tenant, Landlord shall, at Landlord’s expense, cause the following work (“Landlord’s Work”) to be completed with respect to each such Space Component: (i) all existing Building systems, including HVAC and plumbing, shall be fully balanced and in good working order; (ii) all existing light fixtures shall be fully operational; (iii) any discolored existing ceiling tiles within the Space Component shall be replaced; and (iv) all signage shall be removed. Landlord represents and warrants, to Landlord’s knowledge, that each Space Component including, but not limited to Common Areas and restrooms, met all Disability Laws at the time of construction thereof.

(c) On or about the Commencement Date with respect to the Initial Premises and the date Landlord delivers each Space Component to Tenant, Landlord and Tenant shall execute a Commencement Date Memorandum in the form attached hereto as Exhibit “H” confirming the Commencement Date and the acceptance by Tenant of such component of the Premises.

(d) So long as no Event of Default exists at the time of such election, Tenant may renew this Lease for two (2) consecutive additional periods of five (5) years each on the same terms provided in this Lease by delivering written notice of the exercise thereof to Landlord, specifying the floors that Tenant elects to retain and Tenant’s suggested Market Rate (defined below) not earlier than twenty-four (24) months and not later than eighteen (18) months before the Expiration Date. If Tenant validly exercises a Renewal Option, on or before the commencement date of the extended Lease Term in question, Landlord and Tenant shall execute an amendment to this Lease extending the Lease Term on the same terms provided in this Lease.

(1) Tenant may renew any amount of space in the Premises in excess of 225,000 RSF, provided all renewal space shall be in full floor increments, and all floors returned to Landlord shall constitute one contiguous block of space.

(2) The Base Rent payable for each month during each such extended Lease Term shall be the prevailing rental rate (the “Market Rate”), at the commencement of such extended Lease Term, for space of equivalent quality, size and utility in the Market Area, with the length of the extended Lease Term and the credit standing of Tenant to be taken into account. The Market Rate shall include all economic components and financial inducements then being offered to tenants in the Market Area including, but not limited to, rental rate, rent abatement, escalations and tenant improvements. Within thirty (30) days after receipt of written notice of Tenant’s exercise of a Renewal Option, Landlord shall give to Tenant a written determination of Market Rate. In the event that Landlord fails to provide to Tenant its determination of Market Rate within thirty (30) days after receipt of Tenant’s written notice of its exercise of a Renewal Option, then the current Lease Term will be extended by one (1) day for each day that Landlord fails to timely give to Tenant its written determination of the Market Rate until such time that Landlord delivers to Tenant its written determination of the Market Rate (e.g., for illustrative purposes only, if Landlord does not deliver to Tenant its determination of the Market Rate until forty (40) days after receipt of Tenant’s written notice of its exercise of a Renewal Option, then the Lease Term would be extended by ten (10) days). Notwithstanding the preceding sentence, in the event that Landlord fails to provide to Tenant its determination of Market Rate within thirty (30) days after receipt of Tenant’s written notice of its exercise of a Renewal Option, Tenant may elect to rescind its exercise of such Renewal Option by written notice to Landlord, in which event this Lease will terminate on the Expiration Date, as said Expiration Date may have been extended pursuant this Section 3(d)(2).

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 8 |

(3) Upon Landlord’s delivery to Tenant of its determination of the Market Rate, Tenant shall have thirty (30) days in which to give written notice to Landlord that Tenant (a) disagrees with Landlord’s proposed Market Rate, or (b) accepts Landlord’s proposed Market Rate. If Tenant disagrees with Landlord’s determination of the Market Rate for an extension of the Lease Term, Tenant will deliver notice of such disagreement, together with Tenant’s proposed Market Rate, to Landlord within thirty (30) days of Tenant’s receipt of Landlord’s determination. The parties will then attempt in good faith to agree upon the Market Rate. If the parties fail to agree within forty-five (45) additional days, then the Market Rate shall be determined by three (3) brokers as provided in this Section 3(d)(3). Each of the parties will, within seven (7) Business Days after the end of the period for Landlord and Tenant to attempt to agree on the Market Rate, appoint a commercial real estate broker. Within seven (7) Business Days after each party has appointed a broker, the two brokers shall select a third broker. If the two brokers are unable to agree on the selection of a third broker, either Landlord or Tenant may petition the president of the Minnesota Commercial Association of Real Estate to appoint the third broker. Each of the three brokers must be a licensed real estate broker in the State and have at least ten (10) years of full-time commercial real estate brokerage experience with projects comparable to the Complex. None of the three brokers may have any material financial or business interest in common with either of the parties or amongst each other. Within seven (7) Business Days of the appointment of the third broker, Landlord and Tenant will each submit to the three brokers its respective determination of the Market Rate and any related information, which may be different than a party’s initial submission to the other party. Within twenty one (21) days after the appointment of the third broker, the three brokers will review each party’s submittal (and such other information as the three brokers deem necessary) and will each select, in total and without modification, the submittal presented by either Landlord or Tenant as the Market Rate. If all three brokers select one party’s submittal, the Market Rate shall be the submittal selected by the three brokers. If two of the brokers select one party’s submittal and the other broker selects the other party’s submittal, the Market Rate shall be the submittal selected by the two brokers. Subject to the previous sentence, if the three brokers timely receives one party’s submittal, but not both, the three brokers must designate the submitted proposal as the Market Rate for the applicable extension of the Lease Term. Any determination of Market Rate made by the three brokers in violation of the provisions of this Section 3(d)(3) shall be beyond the scope of authority of the three brokers and shall be null and void, in which event the selection process provided above will apply again with three new brokers. Each party shall pay the fees, costs and expenses of the broker it selects and shall pay one-half (½) of all fees, costs and expenses of the third broker. The Market Rate determined pursuant to the foregoing provision shall be final and binding on Landlord and Tenant, unless Tenant delivers to Landlord written notice within ten (10) days of the determination of the Market Rate pursuant to this Section 3(d)(3) that Tenant is withdrawing its exercise of the Renewal Option, in which event this Lease will terminate on the Expiration Date, as said Expiration Date may have been extended pursuant to Section 3(d)(2) above. Notwithstanding the foregoing, if the Market Rate has not been determined on or before the date that is twelve (12) months before the Expiration Date, as said Expiration Date may have been extended pursuant to Section 3(d)(2) above, Tenant will be deemed to have withdrawn its exercise of the Renewal Option, in which event this Lease will terminate on the Expiration Date, as said Expiration Date may have been extended pursuant to Section 3(d)(2) above.

(4) Tenant shall have no further renewal options unless expressly granted by Landlord in writing.

Tenant’s rights under this Section 3(d) shall terminate if: (i) this Lease or Tenant’s right to possession of the Premises is terminated; or (ii) Tenant fails to timely exercise its option under this Section 3(d) time being of the essence with respect to Tenant’s exercise thereof. The provisions of this Section 3(d) are personal to Target Corporation and are not assignable, except that if Target Corporation assigns this Lease to any of the Target Affiliated Entities pursuant to Section 18(a) of this Lease, such Target Affiliated Entity will be permitted to exercise the Renewal Options.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 9 |

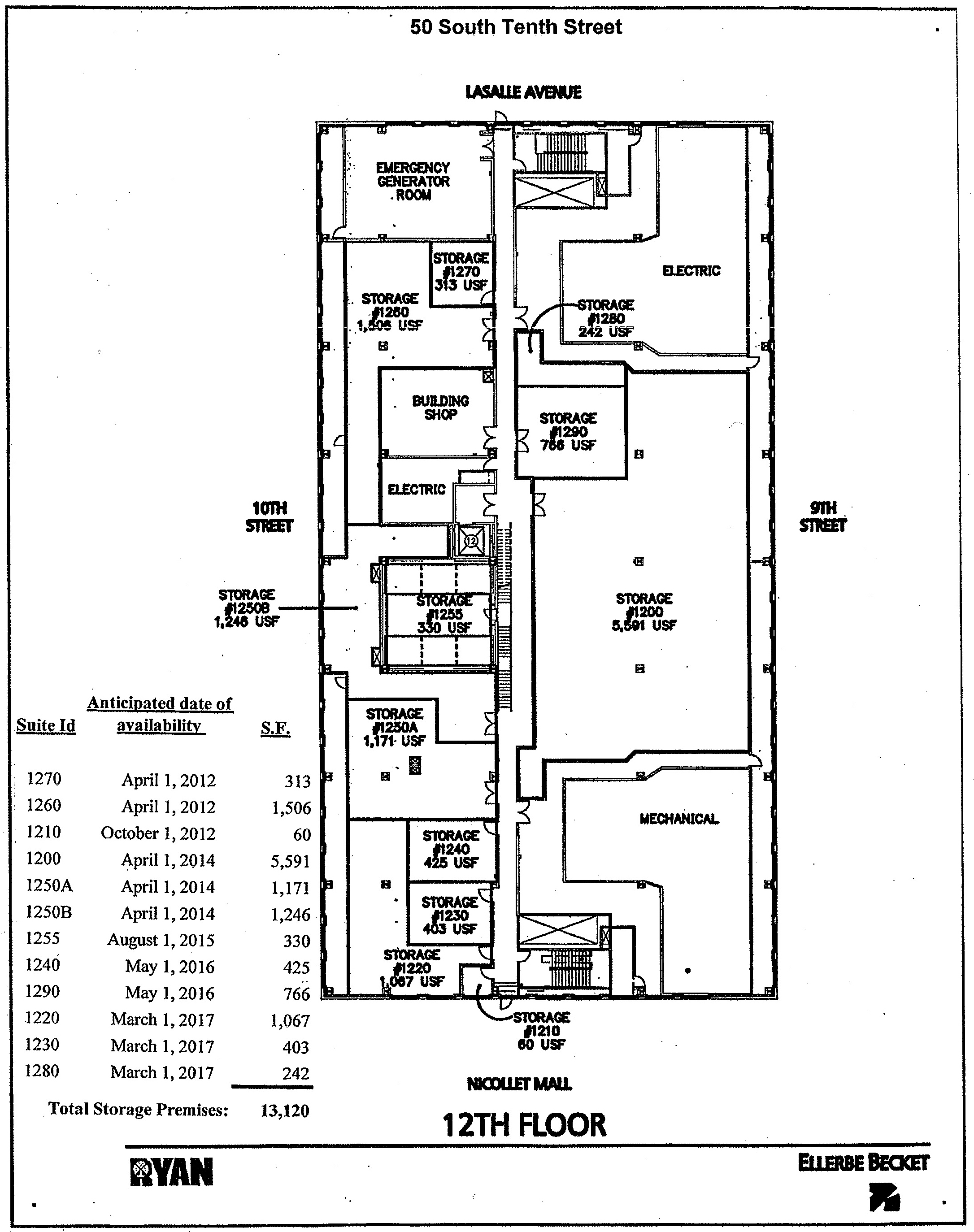

(e) Tenant is currently subleasing 6,791 square feet of storage space in the Building, as depicted on the attached Exhibit “K”, which space will be included as part of this Lease for the Lease Term, as the same may be extended, as of April 1, 2014. Landlord shall put to Tenant, and Tenant shall lease from Landlord, the balance of the reasonably usable storage space in the Building (also depicted on the attached Exhibit “K”) up to a total of 13,120 square feet of storage space in the Building for the Lease Term, as the same may be extended, as such space becomes available. The gross rental rate for all storage space under lease, from time to time, shall be $9.00 per usable square foot, commencing January 1, 2012, which amount shall increase by 2.5% on January 1, 2013 and each January 1 thereafter during the Lease Term, as the same may be extended. Exhibit “K” also sets forth the anticipated date that each component of such space will become available. The provisions of this Section 3(e) are personal to Target Corporation and is not assignable. If Tenant surrenders a portion of the Premises with respect to any Renewal Term, Tenant must relinquish a portion of the storage space approximately equal to the percentage of the Premises surrendered.

4. USE. The Premises shall, if used, be used solely for the Permitted Use and for no other purpose. Tenant shall: (i) lock the doors to the Premises and take other reasonable steps to secure the Premises and the personal property of all Tenant Related Parties and any of its Permittees in the Common Areas and the Complex, from unlawful intrusion, theft, fire and other hazards; (ii) keep and maintain in good working order all security and safety devices installed in the Premises by or for the benefit of Tenant (such as locks and smoke detectors); and (iii) cooperate with Landlord and other tenants in the Building on Building safety matters. Tenant acknowledges that Landlord is not a guarantor of the security or safety of Tenant, its employees and invitees or their property; and that, except for those obligations of Landlord to provide security expressly provided in this Lease, such security and safety matters are the responsibility of Tenant and the local law enforcement authorities.

5. PAYMENT OF RENT; TENANT INCENTIVE PAYMENT.

(a) Except as otherwise expressly provided in this Lease, the Rent shall be due and payable to Landlord in advance in monthly installments on the first (1st) day of each calendar month during the Lease Term, at Landlord’s address as provided on the signature page of this Lease or to such other person or at such other address or pursuant to such wiring instructions as Landlord may from time to time designate in writing. Landlord may, at its option, xxxx Tenant for Rent, but no delay or failure by Landlord in providing such a xxxx shall relieve Tenant from the obligation to pay the Base Rent on the first (1st) day of each month as provided herein. All payments shall be in the form of a check or electronic funds transfer, unless otherwise agreed by Landlord, provided that payment by check shall not be deemed made if the check is not duly honored with good funds. The Rent shall be paid without notice, demand, abatement, deduction or offset, except as otherwise expressly provided in this Lease or as may be provided at law and/or in equity. If the Lease Term as to any component of the Premises commences on other than the first (1st) day of a calendar month, then the Base Rent for such partial month for such component shall be prorated on a daily basis at the rental rate applicable to that portion of the Lease Term and Tenant shall pay such prorated amount to Landlord within ten (10) days following the applicable Commencement Date. If the Lease Term commences or ends at any time other than the first day of a calendar month, Tenant’s Share of Basic Operating Costs shall be prorated for such calendar month according to the number of days of the Lease Term in such calendar month and Tenant shall pay such prorated amount to Landlord within ten (10) days following the applicable Commencement Date as to the Lease Term of the applicable component of the Premises or Expiration Date, as applicable. The Base Rent rates for each Space Component and for the Initial Premises, from time to time, are set forth in the schedules included in the Basic Lease Information.

(b) In lieu of any tenant improvement allowance, abatement of rent or any other lease concessions, Landlord shall pay to Tenant, by wire transfer, by the later to occur of (i) December 31, 2011, or (ii) five (5) Business Days after the Effective Date, a tenant incentive payment (the “Tenant Incentive Payment”) in the amount of Twenty Three Million Nine Hundred Fifty Thousand Dollars ($23,950,000). If Landlord fails to pay the Tenant Incentive Payment to Tenant on or before the due date thereof, Tenant may deduct such amount from the Rent next coming due under this Lease, in which case the outstanding unpaid amount shall accrue interest at the rate of eight percent (8%) per annum, compounded monthly, until fully repaid.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 10 |

6. BASIC OPERATING COSTS; THIRD-PARTY MANAGEMENT COMPANY; TAX CONTESTS.

(a) Commencing on the Commencement Date with respect to the Initial Premises or the date each Space Component is delivered to Tenant, as applicable, and throughout the Lease Term, Tenant shall pay to Landlord Tenant’s Share of Basic Operating Costs. On or before the date that is thirty (30) days after the Effective Date and sixty (60) days prior to the commencement of each calendar year during the Lease Term thereafter, Landlord shall provide Tenant with a then current estimate of Basic Operating Costs for the upcoming calendar year, and thereafter Tenant shall pay, as additional rental, in equal monthly installments, the estimated Tenant’s Share of Basic Operating Costs for the calendar year in question. In addition, if Landlord determines in good faith that any component of Operating Costs of the Complex or the Project has changed or is going to change prior to the end of a calendar year, Landlord shall have the right to revise its estimate of Operating Costs of the Complex or the Project to take into account such change and Tenant shall pay such adjusted amount thereafter; provided, however, Landlord agrees it will not revise the original estimate of Operating Costs of the Complex or the Project more than two times in any calendar year. The failure of Landlord to estimate Basic Operating Costs and provide said estimate on an annual basis shall in no event relieve Tenant of its obligation to pay Tenant’s Share of Basic Operating Costs; provided, however, Tenant may pay Tenant’s Share of Basic Operating Costs based on the most recent estimate received by Tenant until Landlord provides an updated estimate to Tenant of Tenant’s Share of Basic Operating Costs. In the event the Building is not at least one hundred percent (100%) occupied during any year of the Lease Term (including the calendar year in which the Lease Term commences with respect to any component of the Premises), the Basic Operating Costs shall be “grossed up” by increasing the variable components of Basic Operating Costs to the amount which Landlord projects would have been incurred had the Building been one hundred percent (100%) occupied during such year, such amount to be annualized for any partial year. Landlord agrees that property taxes shall be based on annual assessments and shall not be “grossed up.” All Basic Operating Costs of the Building shall be fairly allocated between the office and retail portions of the Building and neither the office portion nor the retail portion of the Building shall be required to subsidize the operation or costs of the other.

(b) On or before April 1 of each calendar year during Tenant’s occupancy (including the calendar year following the year in which the Lease Term is terminated or expires), or as soon thereafter as possible, Landlord shall furnish to Tenant a statement of Tenant’s Share of Basic Operating Costs (the “Statement”) for the prior year. In the event of an underpayment by Tenant because of any difference between the amount, if any, collected by Landlord from Tenant for the estimated Tenant’s Share of Basic Operating Costs and the actual amount of Tenant’s Share of Basic Operating Costs, such underpayment shall be paid to Landlord within forty-five (45) days after receipt by Tenant of an invoice therefore. In the event of an overpayment by Tenant because of any difference between the amount, if any, collected by Landlord from Tenant for the estimated Tenant’s Share of Basic Operating Costs and the actual amount of Tenant’s Share of actual Basic Operating Costs, and provided that no monetary Event of Default has occurred and is continuing, Landlord shall, at Tenant’s election, either credit such overpayment against Rent or refund the overpayment in cash to Tenant. If a monetary Event of Default exists, Landlord shall credit such overpayment against delinquent Rent and any remaining balance against Tenant’s next installment of Rent. Any overpayment by Tenant during the last year of the then existing Lease Term shall be refunded by Landlord to Tenant within thirty (30) days following the expiration of such Lease Term. The obligation to refund underpayments and overpayments shall survive the expiration of this Lease.

(c) “Basic Operating Costs” means all direct and, to the extent provided in Section 6(c)(11), indirect costs and expenses incurred in each calendar year of operating, maintaining, repairing, managing and, to the extent specifically provided below, owning the Complex or the Project, as applicable, including, without limitation, the following:

(1) Wages, salaries, benefits and other compensation of all employees engaged in the direct management, operation and maintenance of the Complex or the Project with the title not higher than general manager (or professional equivalent), including, without limitation, employer’s social security taxes, unemployment taxes or insurance and any other taxes which may be levied on such wages, salaries and other compensation, and the cost of medical, disability and life insurance and pension or retirement benefits for such employees; provided, however, with respect to employees engaged in the operation and maintenance of other buildings owned by Landlord (or an affiliate of Landlord), other than the Complex, such items shall be fairly apportioned among all such buildings;

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 11 |

(2) Cost of leasing or purchasing all supplies, tools, equipment and materials used in the operation, maintenance, repair and management of the Complex or the Project;

(3) Except to the extent the same are paid directly or separately by Tenant (in which case the equivalent costs attributable to any other tenant shall be excluded so that, for example, if Tenant pays separately for electricity used in the Premises, there shall be excluded from Basic Operating Costs, the cost of electricity furnished to all other tenants) to the applicable provider or to Landlord, the cost of all utilities for the Complex or the Project (both interior and exterior), including, without limitation, the cost of water and power, electrical utilities, sewage, heating, lighting, air conditioning and ventilation for the Complex or the Project. Subject to Section 9(a)(6) of this Lease, so long as the Tenant is Target Corporation or any of the Target Affiliated Entities, it shall have the right, but not the obligation, to separately meter (to the extent reasonably possible) some or all of the utilities serving the Premises, from time to time, at its sole cost and expense. After the completion of any separate metering, Tenant shall pay for the consumption and other charges related to such utility services directly to the utility provider. Tenant shall, upon the written request of Landlord, provide to Landlord copies of any utility bills and other bills related to items for which Tenant directly contacts pursuant to the terms of this Lease. Any separate metering shall be performed in accordance with Section 15 or Exhibit “G” of this Lease, as applicable;

(4) Cost of all maintenance and service agreements for the Complex and surrounding grounds, including, but not limited to, janitorial service, pest control, security service and access control equipment, equipment leasing, energy management system leasing, snow removal, landscape maintenance, alarm service, window cleaning, caulking, metal finishing, trash collection and removal and elevator maintenance, re-painting, re-striping, seal-coating, cleaning, sweeping, patching and repairing loading dock areas and other paved surfaces serving the Building; provided, however, so long as the Tenant is Target Corporation or any of the Target Affiliated Entities and Target Corporation and any of the Target Affiliated Entities collectively occupy at least 225,000 RSF of the Office Area, Landlord shall allow Target Corporation or any of such Target Affiliated Entities to directly contract and pay for the following services and supplies for the Premises: janitorial and related supplies, and security (to the extent permitted pursuant to Section 10(d)). To the extent that Target Corporation or any of the Target Affiliated Entities pays directly for utilities pursuant to Section 6(c)(3) above, or any other services, or performs such services itself, the cost of providing such services shall not be included in Basic Operating Costs in determining Tenant’s Share of the Basic Operating Costs; provided, however, the cost of such services shall be deemed to be gross revenue received by Landlord from the Building for purposes of determining the management fee. Notwithstanding the preceding sentences of this Section 6(c)(4), if Tenant is reasonably dissatisfied with any of such services provided by or at the direction of Landlord that Tenant is entitled to directly contract for, and Tenant remains reasonably dissatisfied with any of such services after providing Landlord with written notice and a reasonable opportunity to address Tenant’s dissatisfaction, then, if Tenant elects to pay directly for or perform any of such services, the cost of such services shall not be deemed to be gross revenue received by Landlord from the Building for purposes of determining the management fee. If Target Corporation or any of the Target Affiliated Entities provides its own janitorial services to the Premises, it shall use contractors reasonably acceptable to Landlord and it shall comply with the Janitorial Specifications attached as Exhibit “J”, which Landlord and Tenant may mutually agree to change from time to time. Landlord and Tenant further agree that all janitorial services and maintenance of the Premises, whether provided by Landlord or Tenant, shall be performed in a first-class manner, consistent with a Class A building in the Market Area. Neither Landlord nor Tenant shall permit deferred maintenance to exist with respect to any of its respective maintenance obligations;

(5) Cost of all insurance relating to the Complex or the Project, including, but not limited to, fire and extended coverage insurance, terrorism, earthquake and flood insurance, environmental insurance, rental interruption insurance and liability insurance applicable to the Complex or the Project and Landlord’s personal property used in connection therewith, or other coverages as may be reasonably required by Landlord from time to time, plus the cost of all deductible payments made by Landlord in connection therewith;

(6) All Taxes that are due and payable for the applicable calendar year (if the amount of Taxes payable for any calendar year is changed by final determination of legal proceedings, settlement, or otherwise, such changed amount shall be the Taxes for such year), Landlord may, but is not obligated to, contest the amount or validity, in whole or in part, of any Taxes;

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 12 |

(7) Cost of repairs and general maintenance for the Complex or the Project (excluding such repairs and general maintenance paid by insurance proceeds or by Tenant or other third parties);

(8) Costs of performing responsibilities allocable to the Project and costs of contributions allocable to the Common Areas and operation of the Project, including costs, expenses and charges incurred by Landlord in connection with public sidewalks, walkways, skyways, rights of way or other public facilities, or any easements or other appurtenances to the Complex or the Project;

(9) Legal expenses incurred with respect to the Complex or the Project which relate directly to the operation of the Complex or the Project and which benefit all of the tenants of the Complex or the Project generally, such as legal proceedings to xxxxx offensive activities or uses or reduce property taxes, but excluding legal expenses related to the collection of Rent or to the sale, leasing or financing of the Complex or for legal proceedings brought against another tenant within the Complex which shall not be included;

(10) Expenses incurred in order to comply with any federal, state or municipal law, code or ordinance, or regulation which was not promulgated, or which was promulgated but not in effect or applicable to the Complex or the Project as of the Effective Date of this Lease;

(11) Except as excluded in Section 6(d)(7) below, amortization of the cost of installation of capital investment items and, notwithstanding Section 6(d)(7), amortization of the cost of installation of capital investment items which: (A) Landlord reasonably believes will either (i) reduce (or avoid increases in) Basic Operating Costs, or (ii) promote safety; or (B) may be required in order to comply with any federal, state or municipal law, code or ordinance, or regulation which was not promulgated, or which was promulgated but was not in effect or applicable to the Complex or the Project, as of the Effective Date of this Lease. All costs of such capital investment items shall be amortized, together with an amount equal to interest at eight percent (8%) per annum, with the amortization schedule being determined in accordance with generally accepted accounting principles and in no event shall the amortization period be less than three years or extend beyond the remaining useful life of the Building;

(12) Costs of ad valorem tax consultants;

(13) such other reasonable and necessary costs, expenses and charges as may ordinarily be incurred in connection with managing, maintaining, repairing and operating a Class A office building project similar to the Complex or the Project; and

(14) Fee for management services, whether provided by an independent management company, by Landlord or by any affiliate of Landlord, but only to the extent that the costs of such services do not exceed competitive costs for comparable services in comparable buildings of the class, type, size, age and location of the Building in the Market Area; provided, however, beginning on the Commencement Date with respect to the Initial Premises, so long as Tenant is Target Corporation and Target Corporation or any of the Target Affiliated Entities leases all of the Office Area, the annual management fee charged to Target Corporation or any of the Target Affiliated Entities as an Operating Cost shall be an amount equal to two percent (2%) of the gross revenue received by Landlord from the Building in each calendar year during the Lease Term.

(d) Notwithstanding anything to the contrary in this Lease, Basic Operating Costs shall not include any expenses or costs for the following items:

(1) Except as provided in Section 6(c)(11), depreciation or amortization of the Building or its contents or components;

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 13 |

(2) Expenses for the preparation of space (including tenant finish out costs) or other similar type work which Landlord performs for any tenant or prospective tenant of the Complex or Project;

(3) Expenses incurred in leasing or obtaining new tenants or retaining existing tenants, including, but not limited to, marketing costs, tenant improvement allowances and leasing commissions;

(4) Except as provided in Section 6(c)(9), legal expenses;

(5) Interest, amortization or other costs associated with any mortgage, loan or refinancing of the Complex;

(6) Any ground rent incurred for the Complex;

(7) Except as may be required as a result of Tenant Improvements, Alterations or the negligence or willful misconduct of Tenant, any material capital costs with respect to Building systems which are required within the Building and the Premises during the first thirty-six (36) months after the Commencement Date with respect to the Initial Premises (i.e. April 1, 2014) that under generally accepted accounting principles are required to be classified as capital expenditures, and the related amortization thereof;

(8) All costs incurred in connection with or directly related to the original construction of the Complex or the Project (as distinguished from the operation, repair and maintenance thereof);

(9) Costs of correcting defects in or inadequacy of the initial design or construction of the Complex or the Project, or repair and replacement of any of the original materials or equipment required as a result of such defects or inadequacies;

(10) The costs of any repair to remedy material damage caused by or resulting from the negligence of any other tenants in the Complex or the Project, including their agents, servants, employees or invitees, to the extent such other tenants, including their agents, servants, employees or invitees are reasonably identifiable;

(11) Any items to the extent Landlord is reimbursed by insurance or otherwise compensated, including direct reimbursement by any tenant, less the out-of-pocket cost of collection;

(12) A bad debt loss, rent loss or reserves for bad debts or rent loss;

(13) Any item of cost which is includable in Basic Operating Costs but which represents an amount paid to an affiliate of Landlord or an affiliate of any partner or shareholder of Landlord, to the extent the same is in excess of the fair market value of said item or service;

(14) All interest or penalties incurred as a result of Landlord’s failure to pay any costs as the same shall become due and any other costs due to Landlord’s breach of this Lease;

(15) Costs of alterations of space or other improvements made for specific tenants of the Building (other than Tenant), including bringing such areas of the other tenant’s premises into compliance with the provisions of applicable governmental requirements and/or Disability Laws;

(16) Costs of replacements to personal property for which depreciation costs are expressly included as Basic Operating Costs;

(17) Costs of excess or additional services provided to any tenant in the Project which are directly billed to such tenant;

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 14 |

(18) Costs of repairs due to casualty or condemnation to the extent reimbursed by third parties;

(19) Costs for the removal and/or remediation of Hazardous Materials (other than fluorescent or high-intensity discharge lamps, CFCs, petroleum products and other Hazardous Materials customarily found in the operation, maintenance and repair of comparable office buildings in the Market Area and other than Hazardous Materials released by Tenant or its Permittees);

(20) The cost of any item or service otherwise included in Basic Operating Costs to the extent Landlord, the building manager, or any officer or employee of either receives from suppliers of goods or services any “kick-backs”, finder’s fees, expediting fees or similar fees in connection with such item or service;

(21) The cost of sculptures, paintings or other artwork;

(22) Costs incurred in advertising or promoting the Building for any purpose;

(23) Except for equipment required for periodic maintenance (e.g., scissor lift), rentals and other related costs, if any, incurred with leasing air conditioning, security or other building operating management systems, elevators or other equipment and facilities which, if purchased by Landlord, would ordinarily be considered a capital expenditure;

(24) Contributions to or memberships in any organizations, whether professional, political, civic or charitable, other than those customarily joined by managers of Class A office buildings in the Market Area from time to time including, without limitation, BOMA;

(25) Travel, entertainment and related expenses incurred by Landlord or its agents and employees, except to the extent directly attributable to the management of the Complex;

(26) Any charge or incrementally higher cost for any Basic Operating Costs greater than that paid by any other tenant within the Office Area of the Building such that Landlord shall not treat Tenant any less favorably than any other existing or future tenant of the building with respect to Basic Operating Costs; and

(27) Any LEED certification/re-certification expenses. Notwithstanding the preceding sentence, Tenant will, at no cost or expense to Tenant, reasonably cooperate with Landlord in providing Landlord with requested information for any certification/recertification process. Such information may include, but is not limited to, utilities invoices and recycling data, and the answering of questionnaires and surveys.

(e) The following items of income shall be credited to, and result in a corresponding reduction of the Basic Operating Costs:

(1) all cash discounts, trade discounts and quantity discounts received by Landlord in the operation of the Project to the extent the non-discounted costs were fully included in Basic Operating Costs; and

(2) any refunds, credits or other payments or compensation received by Landlord in connection with goods or services to the extent the costs incurred by Landlord in providing those goods and services were included in Basic Operating Costs; provided, however, the credit will, in each instance, be limited to the amount of the cost in question included in the Basic Operating Costs.

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 15 |

(f) So long as Tenant is Target Corporation or any of the Target Affiliated Entities and Target Corporation or any of the Target Affiliated Entities collectively occupy all of the Office Area, Target Corporation (on behalf of itself and any of the Target Affiliated Entities) shall have the right to review and make recommendations regarding the specifications for the services and the level of service provided in the Office Area, and shall have the right to participate in the development of an annual Basic Operating Costs budget for the Office Area. At least ninety (90) days prior to the end of each calendar year, Landlord shall provide to Tenant its proposed annual Basic Operating Costs budget for the Office Area a detailed statement of the estimated Basic Operating Costs, detailing the methods of allocation, the quality and quantity of services to be provided in the Project during such Fiscal Year, the costs of which are included in Basic Operating Costs, and Tenant’s Share of Basic Operating Costs. Landlord will make available to Tenant, in the office of Landlord’s local property manager, such reasonable background information as is necessary for Tenant to evaluate such statement, and within thirty (30) days of the date of delivery by Landlord to Tenant of such statement and background, Landlord and Tenant will meet to review and discuss comments and/or recommendations made by Tenant with respect to the quantity and quality of services, the cost of which are included in annual Basic Operating Costs, and with respect to other matters associated therewith, which recommendations Landlord will in good faith consider and incorporate into such estimate to the extent the same are reasonable, always with a view, however, to operating and maintaining the Building in accordance with the Laws and in first class condition, consistent with comparable Class A office buildings in the Market Area. All services contracted for by or performed on behalf of Landlord shall be at commercially reasonable rates commensurate with those rates generally available competitively in the Market Area. Target Corporation shall have fifteen (15) Business Days after the 30-day meeting period to disapprove the following service or supply contracts for the Building: janitorial, metal maintenance, fire and security alarm monitoring, other security services, HVAC maintenance contract, or restroom supplies. Target Corporation’s right to disapprove any such service or supply contracts will be subject to Target Corporation establishing either that the service or supply contractor is not a qualified and competent service or supply provider or its rates are not commercially reasonable. If Target Corporation disapproves any of the service or supply contracts listed above, Landlord and Target Corporation will meet within ten (10) Business Days after Landlord’s receipt of Target Corporation’s notice of disapproval in an attempt to reach agreement, in a commercially reasonable manner, on the service or supply contract in question. If, after such meeting, Landlord and Target Corporation have not reached agreement with respect to such service or supply contract, Landlord shall be entitled to make the final decision with respect thereto; provided, however, if Target Corporation has provided reasonable evidence to Landlord that it can obtain the service(s) or supply provider(s) or provide the service(s) itself at a cost and expense lower that Landlord, then Target Corporation shall be allowed, at its sole election, to perform such service(s) or obtain such service(s) or supply providers, in accordance with Sections 6(c)(3) and 6(c)(4) of this Lease, in which case the equivalent costs attributable to any other tenant shall be excluded from Basic Operating Costs. Except as expressly provided to the contrary in this Lease, Landlord and Target Corporation acknowledge that the Basic Operating Costs budget is only an estimate of anticipated expenditures, and nothing contained herein shall be deemed (i) to limit Target Corporation’s obligation to pay Tenant’s Share of Basic Operating Costs or other items of Additional Rent, whether or not actual Basic Operating Costs or other Additional Rent exceed the amounts in the Basic Operating Costs budget, or (ii) to preclude Landlord from incurring expenditures in excess of or in addition to those set forth in the Basic Operating Costs budget, to the extent required in connection with the performance of Landlord’s obligations under this Lease or deemed necessary or desirable by Landlord in connection with the prudent operation of the Complex or the Project.

(g) If there exists any dispute as to the calculation of Tenant’s Share of Basic Operating Costs (a “Dispute”), the events, errors, acts or omissions giving rise to the Dispute shall not constitute a breach or default by Landlord nor shall Landlord be liable to Tenant, except as specifically provided below. If there is a Dispute, Tenant shall so notify Landlord in writing within sixty (60) days after receipt of the Statement. Such notice shall specify the items in Dispute. Notwithstanding the existence of a Dispute, Tenant shall timely pay the amount in dispute as and when required under this Lease, provided such payment shall be without prejudice to Tenant’s position. Upon notice of such Dispute, Landlord shall thereafter provide Tenant with such supplementary information regarding the items in Dispute as may be reasonably requested by Tenant in an effort to resolve such Dispute; provided, however, that Landlord shall not be required to provide any supplementary information to Tenant unless all sums shown to be due by Tenant on the Statement are paid in full. If Landlord and Tenant are unable to resolve such Dispute, such Dispute shall be referred to a mutually satisfactory third party certified public accountant for final resolution, subject to the audit rights of Tenant contained in Section 6(h). The cost of such certified public accountant shall be paid by the party found to be least accurate (in terms of dollars in dispute). If a Dispute is resolved in favor of Tenant, Landlord shall, within thirty (30) days thereafter, at Tenant’s option either refund any overpayment to Tenant or credit the overpayment to Tenant’s next installment of Rent, together with interest from the time of such overpayment at eight percent (8%) per annum. The determination of such certified public

| OFFICE LEASE AGREEMENT/TARGET CORPORATION – Page 16 |