STANDARD OFFICE/LOFT LEASE FORM

Exhibit 10.5

STANDARD OFFICE/LOFT LEASE FORM

Agreement of Lease, made as of this 14th day of April, in the year 2009, by and between 00 XXXXXXXXXX XXXXXX LLC, a limited liability company, having a mailing address c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000, as landlord, (“Landlord”), and ETSY, INC., a Delaware corporation qualified to do business in the State of New York, having an address of 000 Xxxx Xxxxxx, 0xx Xxxxx, Xxxxxxxx, Xxx Xxxx 00000, as tenant (“Tenant”).

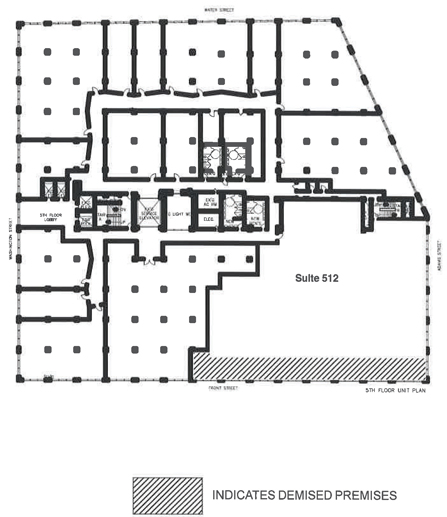

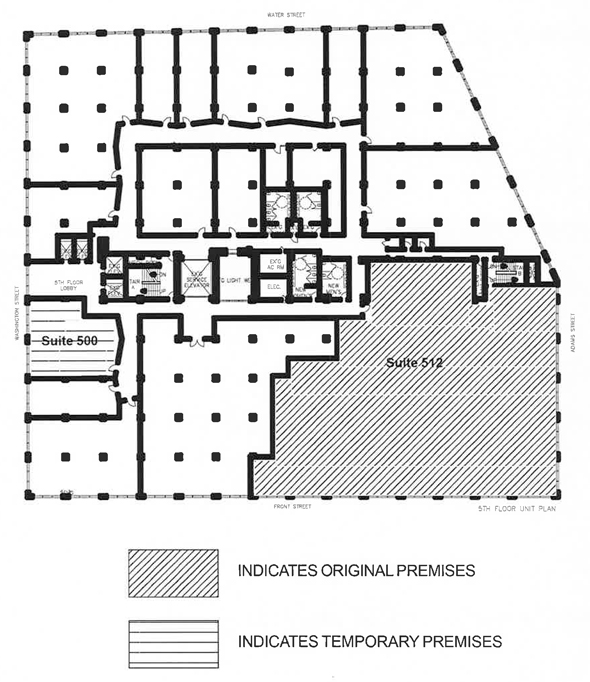

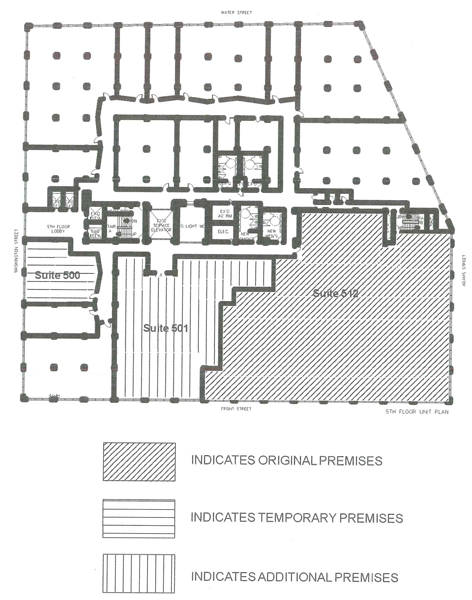

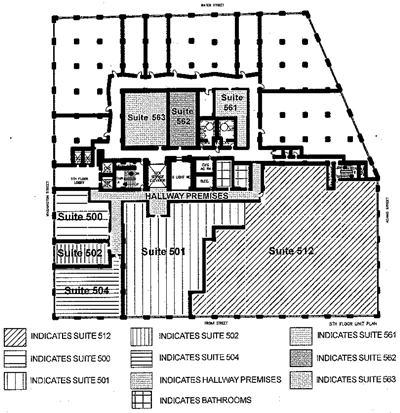

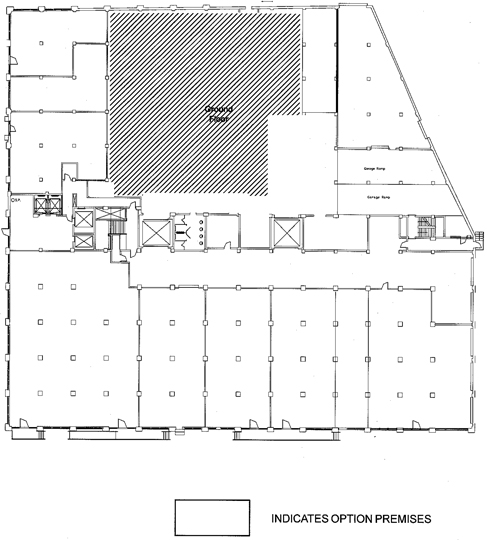

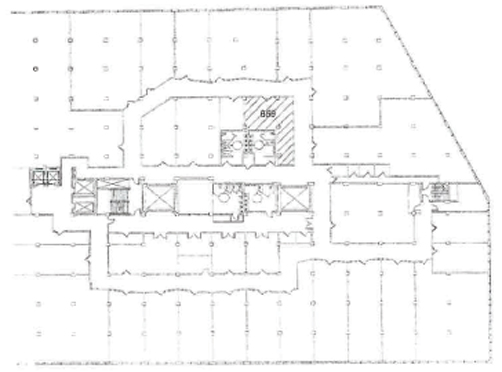

Witnesseth: Landlord hereby leases to Tenant and Tenant hereby leases from Landlord certain premises known as Suite 512 on the fifth (5th) floor of that certain building (the “Building”) known as 00 Xxxxxxxxxx Xxxxxx in the Borough of Brooklyn, County of Kings and City and State of New York (which premises are herein the “demised premises” and are located in the approximate location of said floor shown on the drawing designated Exhibit A attached hereto and hereby made a part hereof) at the rents provided herein for a term (the “Term”) of seven (7) years (unless such term shall sooner cease, terminate or expire as hereinafter provided). The Term shall commence on August 1, 2009 (the “Commencement Date”) and end on July 31, 2016 (the “Expiration Date”), both dates inclusive.

The parties hereto, for themselves, their heirs, distributees, executors, administrators, legal representatives, successors and assigns, hereby covenant and agree as follows:

| Page 1 |

|

|||||

| Page 2 |

|

|||||

| Page 3 |

|

|||||

| Page 4 |

|

|||||

| Page 5 |

|

|||||

| Page 6 |

|

|||||

| Page 7 |

|

|||||

| Page 8 |

|

|||||

| Page 9 |

|

|||||

| Page 10 |

|

|||||

| Page 11 |

|

|||||

| Page 12 |

|

|||||

| Page 13 |

|

|||||

| Page 14 |

|

|||||

| Page 15 |

|

|||||

| Page 16 |

|

|||||

| Page 17 |

|

|||||

| Page 18 |

|

|||||

| Page 19 |

|

|||||

See rider and exhibits attached hereto and hereby made a part hereof.

| Page 20 |

|

|||||

In Witness Whereof, Landlord and Tenant have respectively executed this Lease as of the day and year first above written.

| 00 XXXXXXXXXX XXXXXX LLC | ||

| By: | DW Associates, L.P., as managing member | |

| By: |

| |

|

| ||

| (Landlord) | ||

| ETSY, INC. | ||

| By: |

| |

|

| ||

| (Tenant) | ||

ACKNOWLEDGEMENT

| STATE OF NEW YORK | ||

| SS.: | ||

| COUNTY OF Kings |

On the 14th day of April in the year 2009, before me, the undersigned, a Notary Public in and for said State, personally appeared Xxxxx Xxxxxx, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same in his/her capacity, and that by his/her signature on the instrument, the individual, or the person upon behalf of which the individual acted, executed the instrument.

| XXXXX X. XXXXXXXX | ||||

| Notary Public, State of New York No. 02FE6153435 Qualified in Monroe County Commission Expires October 02, 2010 |

| |||

|

| ||||

| NOTARY PUBLIC | ||||

| Page 21 |

|

|||||

LEASE FORM INDEX

| Clause |

Page |

Clause |

Page |

|||||||

| Additional Covenants |

6 | Garbage |

6 | |||||||

| Alterations |

4 | Inability to Perform |

12 | |||||||

| As Is |

3 | Landlord’s Access to Demised Premises |

5 | |||||||

| Assignments & Subleases |

9 | Landlord’s Defaults |

11 | |||||||

| Bankruptcy |

10 | Laws, Compliance With |

5 | |||||||

| Base Rent |

1 | Memorandum of Lease |

13 | |||||||

| Building Alterations |

7 | No Waiver |

11 | |||||||

| Building Services |

3 | Notices |

12 | |||||||

| Captions & Counterparts |

12 | Partial Surrender |

9 | |||||||

| Casualty |

8 | Quiet Enjoyment |

12 | |||||||

| Consents and Approvals |

12 | Real Estate Taxes |

3 | |||||||

| Definitions, Successors & Assigns |

12 | Relocation |

9 | |||||||

| Demolition |

9 | Repairs |

4 | |||||||

| Directory |

13 | Rules and Regulations |

7 | |||||||

| Electricity |

3 | Security Deposit |

2 | |||||||

| Eminent Domain |

8 | Signs |

6 | |||||||

| End of Term |

12 | Subordination |

10 | |||||||

| Entire Agreement |

13 | Tenant Defaults |

10 | |||||||

| Estoppel Certificate |

10 | Tenant’s Insurance |

7 | |||||||

| Excavation Shoring |

7 | Use |

1 | |||||||

| Failure to Give Possession |

3 | Utilities & Other Services |

3 | |||||||

| Federal Tax Identification Number |

13 | Waiver of Trial by Jury |

12 | |||||||

| Page 22 |

|

|||||

RIDER ATTACHED TO AND FORMING A PART OF LEASE DATED AS OF APRIL 14, 2009 BY AND BETWEEN 00 XXXXXXXXXX XXXXXX LLC (“LANDLORD”) AND ETSY, INC. (“TENANT”) FOR PREMISES KNOWN AS SUITE 512 IN THE BUILDING KNOWN AS 00 XXXXXXXXXX XXXXXX, XXXXXXXX, XX

In the event of any inconsistency between the provisions of this rider and the provisions of the Lease to which this rider is attached, the provisions of this rider shall control.

43. Water Charges: If Tenant requires, uses or consumes water for any purpose in the demised premises other than ordinary lavatory purposes (of which fact Landlord shall be the sole judge), Landlord may install a water meter and thereby measure Tenant’s water consumption for all purposes. Tenant shall pay Landlord for the cost of the meter and the cost of the installation. Throughout the duration of Tenant’s occupancy, Tenant shall keep said meter and installation equipment in good working order and repair at Tenant’s own cost and expense. In the event Tenant fails to maintain the meter and installation equipment in good working order and repair (of which fact Landlord shall be the sole judge) Landlord may cause such meter and equipment to be replaced or repaired, and collect the cost thereof from Tenant as additional rent. Tenant agrees to pay for water consumed as shown on said meter as and when bills are rendered, and in the event Tenant defaults in the making of such payment, Landlord may pay such charges and collect the same from Tenant as additional rent. To the extent not included in the payment of Real Estate Taxes, Tenant covenants and agrees to pay, as additional rent, Tenant’s Percentage of the sewer rent, charge or any other tax, rent or levy above such amounts charged in the Base Tax Year which now or hereafter is assessed, imposed or a lien upon the demised premises, or the realty of which they are a part, pursuant to any law, order or regulation made or issued in connection with the use, consumption, maintenance or supply of water, the water system or sewage or sewage connection or system. If the demised premises is supplied with water through a meter which measures the water consumption of other tenants as well as the demised premises, Tenant shall pay to Landlord, as additional rent, on the first day of each month, that portion of the meter charges that relate to Tenant’s use. Independently of, and in addition to, any of the remedies reserved to Landlord hereinabove or elsewhere in this Lease, Landlord may xxx for and collect any monies to be paid by Tenant, or paid by Landlord, for any of the reasons or purposes hereinabove set forth.

44. Electric Current:

A. Supplementing Article 5 hereof, electricity shall be furnished to Tenant on a “submetering” basis. Tenant shall pay Landlord (or at Landlord’s option, Landlord’s agent) as additional rent within ten (10) days following demand made therefor for all electricity furnished to and/or consumed in the demised premises on a submetering basis from and after the date possession of the demised premises is delivered to Tenant at charges, terms and rates, including, without limitation, fuel adjustments and taxes, equal to the SC-4 rate for Consolidated Edison plus five percent (5%) for transmission line loss and other redistribution costs. If, in Landlord’s reasonable judgment, Tenant’s use shall require more than one (1) submeter in the demised premises, Landlord shall install additional submeter(s) in the demised premises at Tenant’s sole cost and expense. If there is more than one submeter in the demised premises, each meter may be computed and billed separately in accordance with the rates and terms set forth herein. If any tax is imposed upon Landlord’s receipt from the sale or resale of electrical energy or gas or telephone service to Tenant by any federal, state or municipal authority, Tenant covenants and

| Rider page 1 |

|

agrees that where permitted by law, Tenant’s pro-rata share of such taxes shall be passed on to and included in the amount charged to, and paid by Tenant to Landlord as additional rent. If the demised premises’ submeters and/or the submeters are not functional, then for the period such meters are not functioning, the parties agree that, at Landlord’s option, Tenant’s annual actual cost for electricity shall be deemed to be a sum equal to $2.50 times the agreed rentable square foot area of the demised premises, changed in the same percentage as any increases in the cost to Landlord for electricity for the entire Building subsequent to January 1, 2009 because of electric rate, time of day charges, service classification or market price changes. Tenant, shall not, without Landlord’s prior written consent in each instance, connect any fixtures, appliances or equipment (other than a reasonable number of table and floor lamps, typewriters, personal computers, copy machines and similar small office machines used in modern day offices) to the Building’s electric distribution system nor make any alteration or addition to the electrical system of the demised premises. Should Landlord grant such consent, all additional risers or other equipment required therefor shall be provided by Landlord upon notice to Tenant, and all reasonable and out-of-pocket cost and expenses of Landlord in connection therewith shall be paid by Tenant as additional rent upon demand by Landlord.

B. Landlord reserves the right to discontinue furnishing electric current to Tenant on a submetering basis at any time upon not less than sixty (60) days’ notice to Tenant. If Landlord elects not to furnish electric current to Tenant on a submetering basis, Tenant shall arrange to obtain electric current directly from the public utility company supplying electric current to the Building; and in that event, all risers, equipment and other facilities which may be required for Tenant to obtain electric current directly from such public utility corporation and may already be in the Building, may be used by Tenant at no additional charge to Tenant. If Landlord exercises its right to discontinue furnishing electric current to Tenant, this Lease shall continue in full force and effect and shall be unaffected thereby, except only that, from and after the effective date of such discontinuance, Landlord shall not be obligated to furnish electric current to Tenant on a submetering basis; however, if Tenant is unable to obtain direct electric service by the effective date of such discontinuance, so long as Tenant continues to make reasonable efforts to obtain direct electric service, Landlord shall continue to provide electric service until Tenant has obtained direct electric service. If Landlord has discontinued electric service and, in Landlord’s reasonable judgment, additional risers are required in order to supply electricity to the demised premises, such risers shall be installed by Landlord at Landlord’s reasonable expense, and in any event, any such installation shall be maintained by Landlord, at its expense and shall be subject to such reasonable conditions as the utility company may require. Landlord’s election to not furnish electric current to Tenant shall not be deemed a lessening or diminution of services within the meaning of any law, rule or regulation now or hereafter enacted, promulgated or issued.

45. Initial Work: Notwithstanding anything to the contrary contained herein, Landlord shall, at its expense, perform, or cause to be performed, the work set forth on Exhibit B attached hereto and hereby made a part hereof, except that Tenant acknowledges that Landlord shall not install the wooden floors or the acoustical treatment described in Exhibit B (such work is herein collectively referred to as “Landlord’s Work”). Landlord’s Work shall be performed in accordance with Legal Requirements using Building standard materials in a workmanlike manner. Tenant shall perform all other work (“Tenant’s Work”) necessary for it to use the demised premises as contemplated in this Lease and such work shall be performed in accordance with the Legal Requirements, at its sole expense, pursuant to plans, drawings and specifications therefor prepared by Tenant and submitted to, and approved by Landlord and subject to the terms of this Lease, including, without limitation, Article 10 hereof. If the substantial completion of

| Rider page 2 |

|

the Landlord’s Work is delayed by reason of: (i) any act or omission of Tenant or any of its employees, agents or contractors; or (ii) any failure (not due to any act or omission of Landlord or any of its employees, agents or contractors) caused solely by Tenant or its agents to plan or execute Tenant’s Work (as hereafter defined) with reasonable speed and diligence, or (iii) any material changes by Tenant in the plans or specifications or any material changes or substitutions requested by Tenant; or (iv) Tenant’s failure to furnish plans, information, details and specifications Landlord requests from Tenant, or subsequent changes thereto; or (v) Tenant’s request for materials, finishes or installations other than Landlord’s standard as identified in Exhibit B hereto; or (vi) the performance or incompletion of work by a party employed or retained by Tenant; then Landlord’s Work shall be deemed substantially completed on the date when the same would have been substantially completed but for such delay and, in addition, Tenant shall pay to Landlord all costs and damages which Landlord may sustain by reason of such delay. Landlord agrees that it will use commercially reasonable efforts to complete the Landlord’s Work on or before the Commencement Date, provided that Tenant has satisfied the Documentary Requirements on or before April 15, 2009 and in such event, for each day after the Commencement Date that Landlord’s work has not been substantially completed, the Free Rent Period shall be extended by one day. If Tenant claims that some or all of Landlord’s Work have not been completed by Landlord upon the date Landlord notifies Tenant that Landlord has substantially completed Landlord’s Work, Tenant shall, within ten (10) days of said date (or ten (10) days following the date Tenant opens for the transaction of business, whichever date shall be sooner), submit to Landlord a written list of the Landlord’s Work that Tenant claims remains to be performed by Landlord, and Landlord shall have forty five (45) days thereafter to complete such work. If Landlord fails to complete such work, the sole remedy of Tenant shall be to complete such work and Tenant shall have the right to set off the reasonable cost thereof from the rent due Landlord in order to reimburse Tenant for the cost and expense of completion of the work. Upon written request of Landlord, Tenant will, within five (5) days following request, furnish to Landlord a written statement that Tenant is in occupancy of the demised premises, that Landlord’s Work has been completed in accordance with Landlord’s obligations or in lieu thereof, a list of the work Tenant claims to be incomplete.

46. Air Conditioning: Tenant shall, at its own cost and expense operate, maintain, clean, repair and replace the air conditioning system, equipment and facilities (hereinafter called the “AC System”) now or hereafter located in or servicing solely the demised premises (including, but not limited to, the periodic cleaning and/or replacements of filters, replacement of fuses and belts, the calibration of thermostats and all startup and shut down maintenance of the system, equipment and facilities) and provide a repair and maintenance contract in form reasonably satisfactory to Landlord with an air conditioning contractor or servicing organization approved by Landlord; provided, however, that Landlord may elect at any time to enter into a contract with an air conditioning contractor or servicing organization to provide repair and maintenance to the AC System (provided such contract or charges are commercially reasonable) in which event, Tenant shall pay Landlord for the cost of such contract as additional rent hereunder within ten (10) days following demand made therefor. At Landlord’s sole option, such contract may include other air conditioning systems, equipment and facilities, in which event, Tenant shall pay Landlord within ten (10) days following demand therefor for the cost of such contract to the extent that it relates to the AC System, as additional rent hereunder. If any permit or license is required for the operation of the AC System, such license or permit shall be in place as of the Commencement Date and Tenant shall, at Tenant’s expense, thereafter obtain and maintain any such permit or license unless Landlord elects to obtain the same on Tenant’s behalf and at Tenant’s expense. Any additions or other alterations to the AC System shall require Landlord’s

| Rider page 3 |

|

prior written consent pursuant to Article 10 hereof and the consent of the contractor with a contract covering maintenance of the AC System. The electricity furnished to and/or consumed by the AC System shall be paid for by Tenant in accordance with Article 44 hereof.

47. Cleaning/Trash Services: Tenant shall obtain and pay for cleaning services for the demised premises at Tenant’s sole cost and expense. Tenant shall pay Landlord $245.30 per month as additional rent hereunder on or before the first (1st) day of each month during the Term hereof and during all additional periods Tenant is in possession of the demised premises and/or in occupancy of the demised premises for ordinary office trash collection from a location designated by Landlord, subject to reasonable adjustment from time to time, to reflect Landlord’s standard trash collection charges based upon the relative size of the space occupied by a tenant.

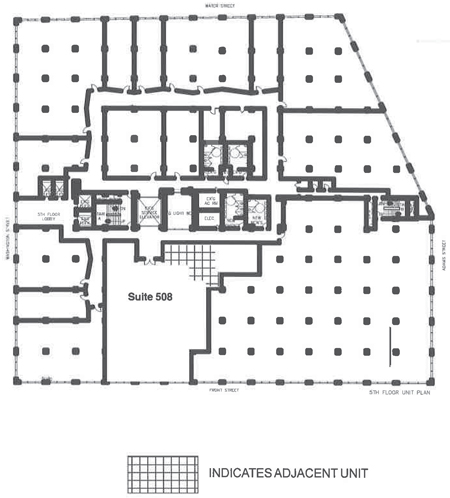

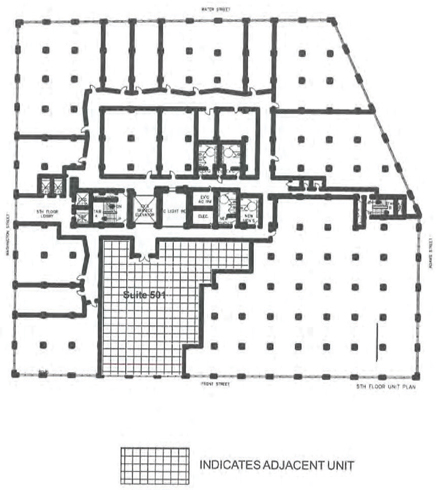

48. Adjacent Unit Option: “Adjacent Unit” means Suite 508 in the Building, which premises is in the approximate location shown on Exhibit C attached hereto and hereby made a part hereof. Provided that Tenant is not in default beyond applicable notice and cure periods (the “Option Requirement”), then Tenant shall have the option to add the Adjacent Unit to the demised premises for the remainder of the term of this Lease commencing on February 1, 2011, upon the same terms and conditions provided herein, except that (a) the term “Tenant’s Percentage” shall be amended to be 6.312%, (b) the monthly additional rent charge for ordinary office trash collection pursuant to Article 47 of the Lease shall be amended so that it shall be $354.57 per month and (c) the annual base rent payable under Article 2 of the Lease shall be amended so that commencing on February 1, 2011 and thereafter during the balance of the term of the Lease it shall be as follows (dates inclusive):

| February 1, 2011 to July 31, 2011: | $513,767.10/year — $42,813.93/month | |

| August 1, 2011 to July 31,2012: | $529,180.11/year — $44,098.34/month | |

| August 1, 2012 to July 31, 2013: | $545,055.52/year — $45,421.29/month | |

| August 1, 2013 to July 31, 2014: | $561,407.18/year — $46,738.93/month | |

| August 1, 2014 to July 31, 2015: | $620,775.32/year — $51,731.28/month | |

| August 1, 2015 to July 31, 2016: | $637,846.64/year — $53,153.89/month |

If the Option Requirement is not met, then the option to add the Adjacent Unit to the demised premises shall be deemed waived. Tenant shall give written notice to Landlord on or before September 1, 2010 to elect to add the Adjacent Unit to the demised premises, or such option shall be deemed waived. Tenant’s offer to add the Adjacent Unit to the demised premises shall be for the premises in “as is” condition for a term corresponding to the balance of the term of this Lease except that the Adjacent Unit shall be delivered free and clear of all occupants. Additional Rent as it relates to the Adjacent Unit with respect to the increase in Real Estate Taxes shall not be due for the period prior to July 1, 2011. If the option to add the Adjacent Unit to the demised premises shall be duly and timely exercised, the parties will, at the request of either, execute an agreement in form for recording, evidencing such addition to the demised premises and modifying the Lease as described in (a), (b) and (c) above.

49. Option to Renew:

A. Tenant shall have the option to extend the term of this Lease for an additional term of FIVE (5) years (such five (5) year period commencing August 1, 2016 and ending on July 31, 2021 (dates inclusive) being the “Renewal Period”), upon the same terms and conditions as provided herein except that (i) Tenant shall not have an option to add the Adjacent Unit to the demised premises and (ii) the annual base rent payable during the Renewal Period shall be as set forth in this Agreement, and except that Tenant shall have no further extension options; provided

| Rider page 4 |

|

that the Option Requirement is met. If all of the aforesaid conditions are not met, then the option to extend the term of this Lease shall be deemed waived. Tenant shall give written notice to Landlord on or before November 1, 2015 of its election to extend the term of this Lease, or such option shall be deemed waived. If the extension option shall be duly and timely exercised, the parties will, at the request of either, execute an agreement in form for recording, evidencing such extension and all references in this Lease to the term hereof shall be deemed to mean the term as so extended, except where expressly otherwise provided. If the term of this Lease is duly extended as herein provided and Tenant failed to timely exercise Tenant’s option for the Adjacent Unit (i.e., the demised premises consists of Suite 512 only), then the annual base rent payable by Tenant under the Lease shall be amended so that during the Renewal Period it shall be as follows:

the greater of (i) the Fair Market Rental (hereinafter defined) for the demised premises for the Renewal Period or (ii) $37,551.86 for the first year of the Renewal Period, $38,678.42 for the second year of the Renewal Period, $39,838.77 for the third year of the Renewal Period, $41,033.94 for the fourth year of the Renewal Period and $42,264.95 for the last year of the Renewal Period.

If, however, the term of this Lease is duly extended as herein provided and Tenant timely exercise Tenant’s option for the Adjacent Unit (i.e., the demised premises consists of Suite 512 and Suite 508), then the annual base rent payable by Tenant under the Lease shall be amended so that during the Renewal Period it shall be as follows:

the greater of (i) the Fair Market Rental (hereinafter defined) for the demised premises for the Renewal Period or (ii) $54,748.51 for the first year of the Renewal Period, $56,390.96 for the second year of the Renewal Period, $58,082.69 for the third year of the Renewal Period, $59,825.17 for the fourth year of the Renewal Period and $61,619.93 for the last year of the Renewal Period.

“Fair Market Rental” means the highest annual base rent which Landlord could reasonably expect to obtain from a third party for the demised premises as of November 1, 2015 if Landlord put the demised premises on the market for lease in its “as is” condition for a term corresponding to the applicable extension term including annual increases in base rent of 3% per annum in the annual base rent and taking into account the fact that the Base Tax Year will not be modified during the Renewal Period. If Tenant duly elects to extend the term of this Lease and Landlord and Tenant are unable to reach a written agreement as to the Fair Market Rental on or before January 1, 2016, such dispute shall be resolved exclusively by resort to the “Arbitration” (as defined below). If Tenant duly elects to extend the term of this Lease and the Fair Market Rental is not determined by Arbitration or by written agreement of Landlord and Tenant on or before July 31, 2016, then the annual base rent payable under the Lease shall be (i) $450,314.48 payable in equal monthly installments of $37,526.21 in the event Tenant failed to timely exercise its option to add the Adjacent Unit to the demised premises or (ii) 656,982.08 payable in equal monthly installments of 54,748.51 in the event Tenant timely exercised its option to add the Adjacent Unit to the demised premises, during the period commencing on August 1, 2016 and ending on the earlier of: that date a written agreement is signed and delivered by Landlord and Tenant as to the annual base rent for the Renewal Period or that date upon which the annual base rent is finally determined by Arbitration as set forth in the following paragraph; provided, however, that when the annual base rent for the Renewal Period is finally determined by written agreement or by Arbitration, then the Lease shall be retroactively amended so that the annual

| Rider page 5 |

|

base rent during the Renewal Period shall be as determined in accordance with the first sentence of this paragraph and Tenant shall pay within ten (10) days following the date the annual base rent is finally determined pursuant to the first sentence of this paragraph any amounts owed as annual base rent.

B. The “Arbitration” shall operate as described in this paragraph. If by January 1, 2016 Landlord and Tenant have failed to reach a written agreement on the Fair Market Rental, then on or before January 15, 2016: Landlord shall choose (and pay the costs of) a person who is then (and for the previous ten years has been) a licensed real estate broker engaged in leasing offices located in downtown Brooklyn and D.U.M.B.O. (and obtain the acceptance of the person chosen) to act as one of the arbitrators, Tenant shall choose (and pay the costs of) a person who is then (and for the previous ten years has been) a licensed real estate broker engaged in leasing offices located in downtown Brooklyn and D.U.M.B.O. (and obtain the acceptance of the person chosen) to act as one of the arbitrators, and each party shall notify the other of the name, address and telephone number of the person who has been selected by it and has agreed with it to act as an arbitrator. If either Landlord or Tenant does not obtain the acceptance of a person satisfying the aforesaid qualifications to act as an arbitrator on its behalf and notify the other party of the contact information for such a person on or before January 15, 2016, then the other party may have the American Arbitration Association appoint an arbitrator, at the party lacking an arbitrator’s expense. The two arbitrators shall endeavor to reach an agreement as to what the Fair Market Rental should be; and if the two arbitrators cannot agree in writing on what the Fair Market Rental should be on or prior to February 28, 2016, they shall choose a third person (who is a licensed commercial real estate broker for at least ten years engaged in leasing office space in downtown Brooklyn and D.U.M.B.O.) mutually acceptable to them (and obtain the acceptance of such selection from the person they have selected) to act as the third arbitrator. If the two arbitrators cannot agree as to whom the third arbitrator shall be or if they are unable to obtain the acceptance of a third arbitrator prior to March 30, 2016, then Landlord or Tenant may have the American Arbitration Association appoint a third arbitrator. Landlord and Tenant shall split equally the costs of the third arbitrator. The arbitrators selected by Landlord and Tenant shall each prepare their own determination of the figure (the “Proposed Determination”) that should be the Fair Market Rental and submit their respective Proposed Determinations in writing to the third arbitrator within ten (10) days after the third arbitrator is chosen. If a determination is not submitted to the third arbitrator by Landlord or Tenant within said ten (10) days, then the Proposed Determination for such arbitrator shall be deemed to be (i) $460,000.00 for the first year of the Renewal Period in the event Tenant failed to timely exercise Tenant’s option to add the Adjacent Unit to the demised premises or (ii) $665,000.00 for the first year of the Renewal Period in the event Tenant timely exercised Tenant’s option to add the Adjacent Unit to the demised premises, with 3% compounded annual increases thereafter for the annual base rent and the other business terms shall be as they were in the last year of the term of this Lease. The third arbitrator shall meet with the first two arbitrators to review and discuss the Proposed Determination submitted by each of them or deemed to have been submitted by each of them, and promptly thereafter issue his or her own determination in writing to Landlord and Tenant. The determination of the third arbitrator shall be made on the basis of which Proposed Determination is closest to what the third arbitrator believes the Fair Market Rental should be, and such determination of the third arbitrator must be made only by his or her selecting one of the Proposed Determinations submitted or deemed to have been submitted by the other arbitrators. The determination of the third arbitrator (or the determination mutually agreed to by the first two arbitrators, if such written agreement is reached by them before the selection of a third arbitrator is required) shall be binding and conclusive on Landlord and Tenant subject to the final determination reached by Arbitration or mutual agreement of the first two arbitrators not being less than that described in the last sentence of the previous paragraph of this Article.

| Rider page 6 |

|

50. Broker: Tenant warrants and represents to Landlord that Tenant has not had any conversations, correspondence or dealings with any real estate broker, agent or finder in connection with this Lease and/or concerning the renting or leasing of premises located in the Building other than Xxxxxxx & Xxxxxxxxx, having an office at 00 Xxxx 00xx Xxxxxx, Xxx Xxxx, Xxx Xxxx 00000 (“Broker”) and Tenant covenants and agrees to indemnify, defend and hold Landlord harmless on demand from and against any and all costs, expenses or liability (including reasonable attorneys’ fees) for any compensation, commissions, fees and charges claimed by any broker, agent or finder other than Broker in connection with this Lease and/or concerning the renting or leasing of premises located in the Building due to conversations, correspondence or dealings of Tenant with the claimant. Landlord shall pay Broker any commission which may be payable with respect to this Lease pursuant to a separate agreement.

51. ICIP/CEP/ECSP:

A. Tenant’s percentage share of the Building is: 4.367%. Landlord and Tenant acknowledge that Landlord may apply for or has already applied for a certificate of eligibility from the Department of Finance of the City of New York determining that Landlord is eligible to apply for exemption from tax payments for the Building pursuant to the provisions of Section 11-256 through 11-267 (the “ICIP Program”) of the Administrative Code of the City of New York and the regulations promulgated pursuant to the ICIP Program. Any such tax exemption for the Building is referred to as “Tax Exemption” and the period of such Tax Exemption is referred to as the “Tax Exemption Period”. Landlord agrees that Tenant shall not be required to (a) pay Taxes or charges which become due because of the willful neglect or fraud by Landlord in connection with the ICIP Program or (b) otherwise relieve or indemnify Landlord from any personal liability arising under the ICIP Program, except where imposition of such Taxes, charges or liability is occasioned by actions of Tenant in violation of this Lease. Tenant agrees (i) to report to Landlord, as often as is necessary under such regulations, the number of workers engaged in employment in the demised premises, the nature of each worker’s employment and the residency of each worker and to provide access to the demised premises by employees and agents of the Department of Finance of the City of New York at all reasonable times at the request of Landlord, (ii) that any work performed by Tenant or any person or entity claiming through or under Tenant shall be subject to the requirements of Executive Order No. 50 (April 25, 1980) and the Rules and Regulations promulgated thereunder (collectively, “EO 50”) and the ICIP Program and (iii) that Tenant will comply with and cause its general contractor, construction manager, and all other subcontractors (collectively, the “Contractors”) to comply with EO 50 and the ICIP Program. Tenant represents to the Landlord that, within the seven (7) years immediately preceding the date of this Lease, Tenant has not been adjudged by a court of competent jurisdiction to have been guilty of (x) an act, with respect to a building, which is made a crime under the provisions of Article 150 of the Penal Law of the State of New York or any similar law of another state, or (y) any act made a crime or violation by the provisions of Section 235 of the Real Property Law of the State of New York, nor is any charge for a violation of such laws presently pending against Tenant. Upon request of Landlord, from time to time, Tenant agrees to update said representation when required because of the ICIP Program and regulations thereunder. Tenant further agrees to cooperate with Landlord in compliance with such ICIP Program and regulations to aid Landlord in obtaining and maintaining the Tax Exemption and, if requested by Landlord, to post a notice in a conspicuous place in the demised premises and to publish a notice in a newspaper of general circulation in the City of New York, in such form as

| Rider page 7 |

|

shall be prescribed by the Department of Finance stating that persons having information concerning any violation by Tenant of Section 235 of the Real Property Law or any Section of Article 150 of the Penal Law or any similar law of another jurisdiction may submit such information to the Department of Finance to be considered in determining Landlord’s eligibility for benefits. Tenant acknowledges that its obligations may be greater if Landlord fails to obtain a Tax Exemption, and agrees that Landlord shall have no liability to Tenant nor shall Tenant be entitled to any abatement or diminution of rent if Landlord fails to obtain a Tax Exemption.

B. Landlord has applied or may hereafter apply to make the demised premises eligible for the New York City Commercial Enhancement Program (“CEP”). If Tenant is deemed eligible for CEP, any reduction in real property taxes on the Tenant’s Percentage thereof will be passed through to the Tenant after deducting the fee payable in connection with the CEP application. Tenant understands that the minimum required expenditure for any given space to be eligible for CEP is $2.50 per square foot or $25 per square foot, depending on the length and nature of this Lease. Tenant also understands that all abatements granted under CEP are contingent upon Landlord’s payment of real estate taxes, water or sewer charges, and/or other lienable charges during the benefit period. Benefits will be revoked if such charges are not paid as provided in the relevant law.

C. Tenant agrees to submit a complete Energy Cost Savings Program (“ECSP”) application to the New York City Department of Business Services (“DBS”) as directed by Landlord or Landlord’s representative. Tenant agrees to comply with ECSP and DBS rules and regulations regarding same. This includes the submission of all appropriate documentation required for the ECSP approval including, but not limited to, one week of payroll information current at the time of application submittal, disclosing the identity of all company principals, and the like. Landlord will cooperate with Tenant’s application process as it may pertain to the supplying of Landlord requisite information. If Tenant has an existing lease at the time of ECSP building approval, it must submit the completed ECSP application to DBS within ninety (90) days of such approval and notification by Landlord.

D. In no event shall Landlord have any liability to Tenant if Landlord fails to obtain the benefits, in whole or in part, of any tax abatement, credit or exemption described in this Article or otherwise.

52. Green Clause

| A. | Tenant, recognizing that the Landlord has made efforts and is continuing to make efforts to cause the Building to be “green” and/or environmentally friendly, and as a special inducement to Landlord to enter into this Lease, covenants and agrees to comply with the following: |

| a. | Landlord shall initially install in connection with Landlord’s Work and thereafter Tenant shall cause all light bulbs in the demised premises to be replaced with Energy Star qualified light bulbs and agrees to dispose of all light bulbs in accordance with Legal Requirements; |

| b. | In the event Tenant is permitted to install light fixtures, bulbs and other lighting equipment pursuant to this Lease (a) Tenant shall be required to install infrared/sensor energy saver light switches; (b) all such lighting equipment will be Energy Star qualified and (c) all such lighting equipment shall be disposed of in accordance with Legal Requirements; |

| Rider page 8 |

|

| c. | Tenant shall make reasonable efforts to turn off any lights in the demised premises when such lights are not in use; |

| d. | Tenant shall make reasonable efforts to clean the filter in the air conditioning unit(s) located in the demised premises at least four (4) times per calendar year; |

| e. | Tenant shall use and cause Tenant’s cleaning contractor, if any, to use “green” or eco-friendly, non-toxic cleaning products to clean the demised premises; |

| f. | Tenant acknowledges that smoking within the demised premises or the Building is expressly prohibited by Landlord and by Legal Requirements and hereby agrees that neither Tenant, nor its agents, contractors, employees or invitees shall be permitted to smoke in the demised premises or the Building; and |

| g. | Tenant shall make reasonable efforts to reduce the need for air conditioning which efforts may include the use of fans in the demised premises and/or the installation of blinds on the windows of the demised premises; provided however, that Tenant obtains Landlord’s approval for such installation, to the extent required in this Lease. |

| B. | Tenant acknowledges that any failure by Tenant to comply with the provisions of this Article 52 shall constitute a default which shall be subject to the provisions of Article 28 of this Lease. Additionally, Tenant shall pay all costs, expenses, fines, penalties, or damages that may be imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this Article 52, and, at Tenant’s sole cost and expense, shall indemnify, defend and hold Landlord harmless (including reasonable legal fees and expenses) from and against any actions, claims and suits arising from such noncompliance, utilizing counsel reasonably satisfactory to Landlord. |

END OF RIDER

| Rider page 9 |

|

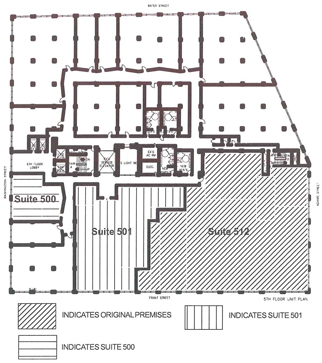

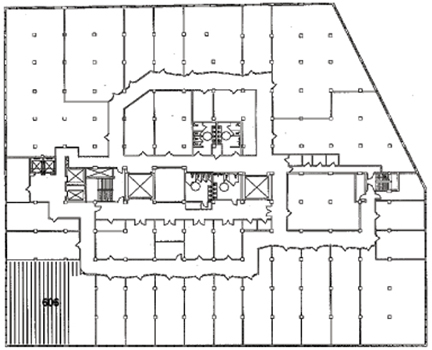

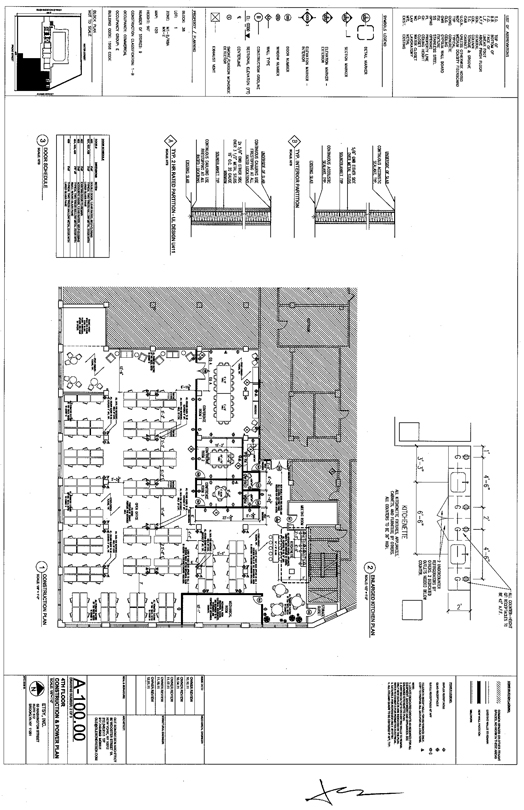

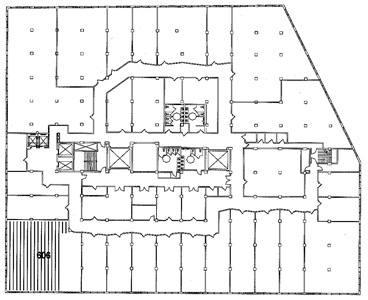

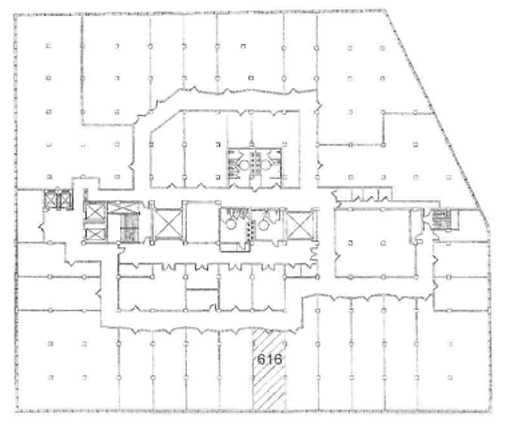

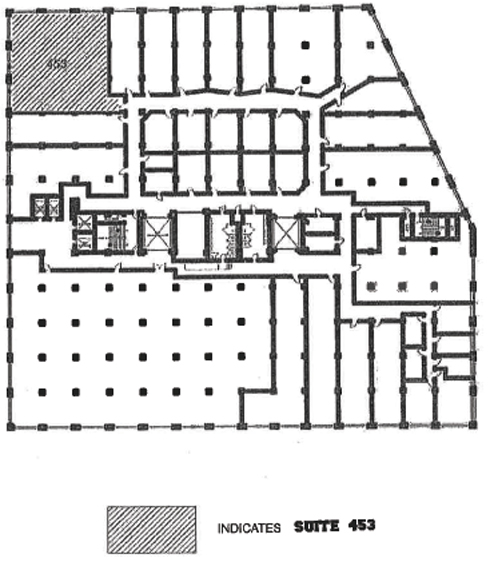

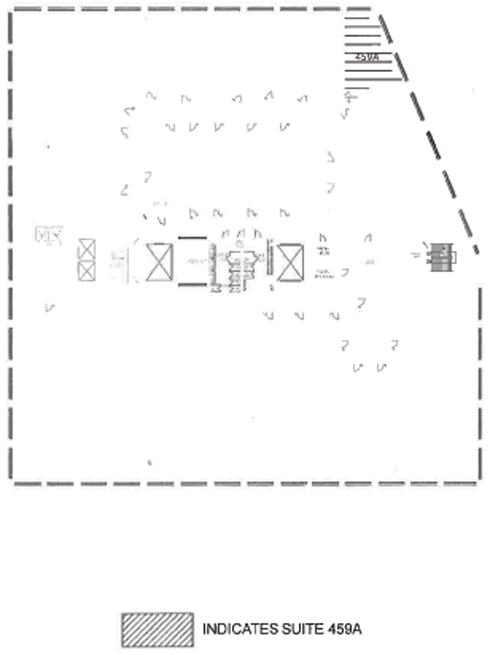

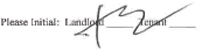

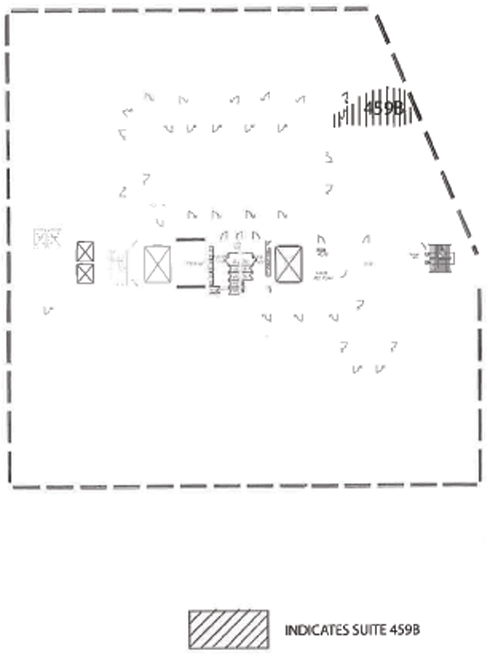

Exhibit “A”

Diagram of the Demised Premises

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

| ||||

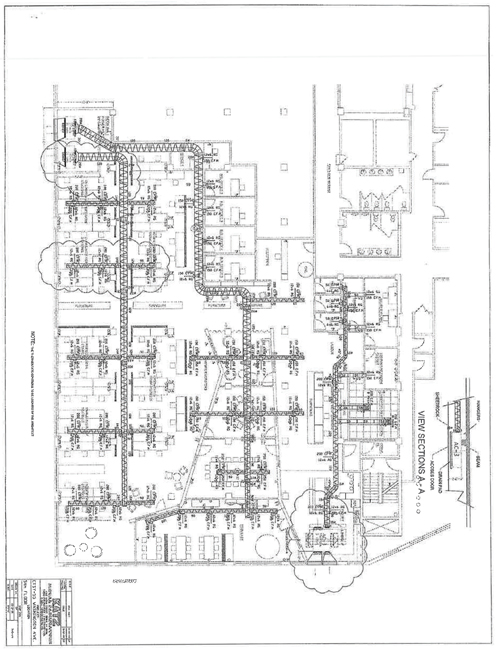

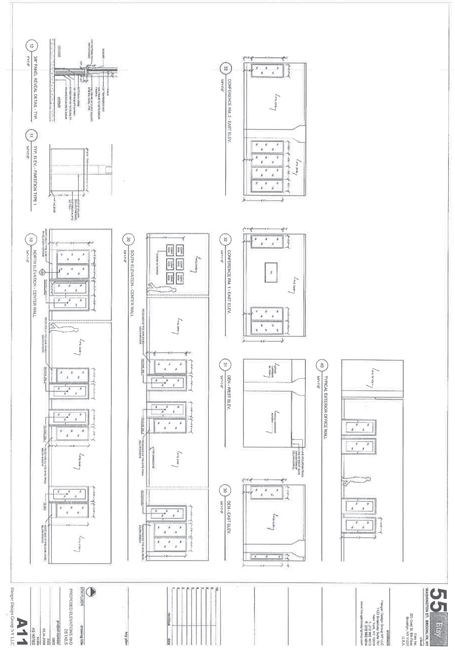

Exhibit “B”

Landlord’s Work

| ||||

Exhibit “B” cont’d.

| ||||

Exhibit “B” cont’d.

| ||||

Exhibit “B” cont’d.

| ||||

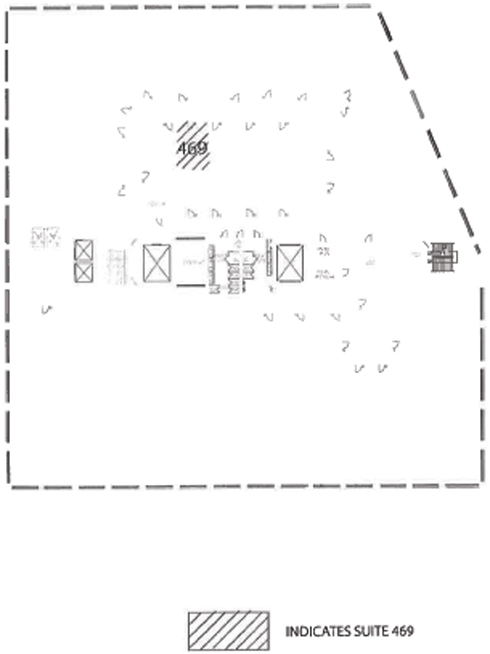

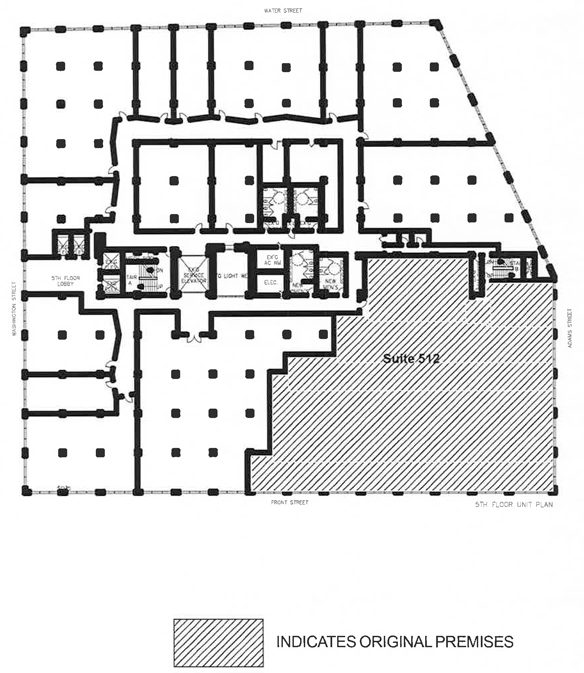

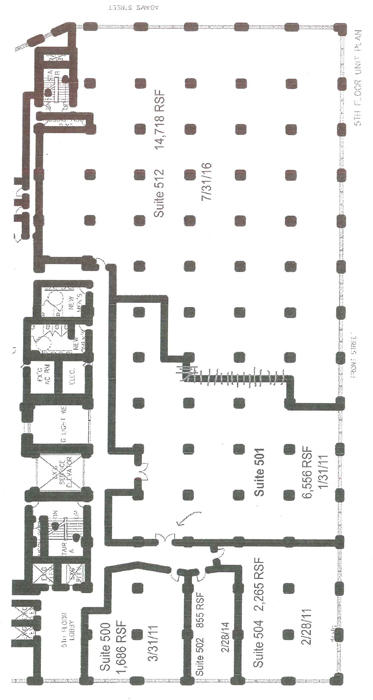

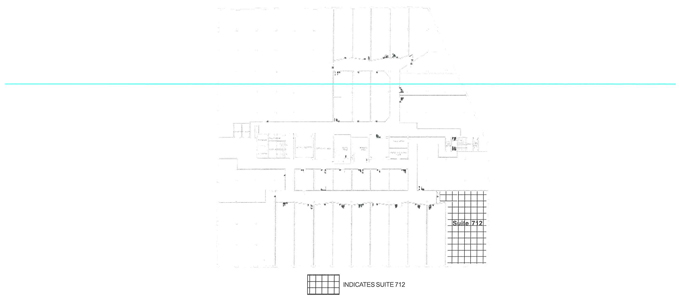

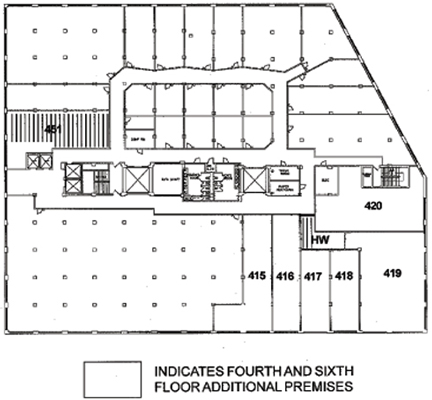

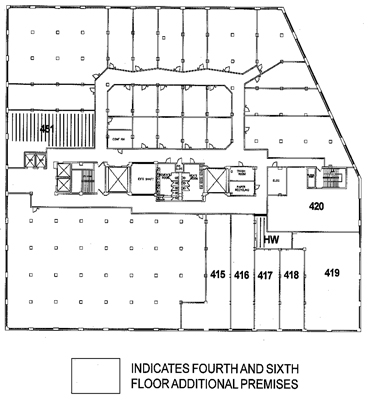

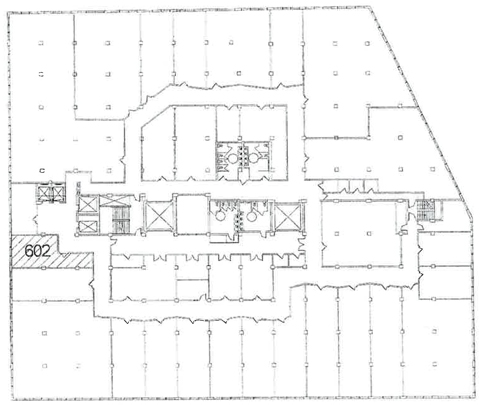

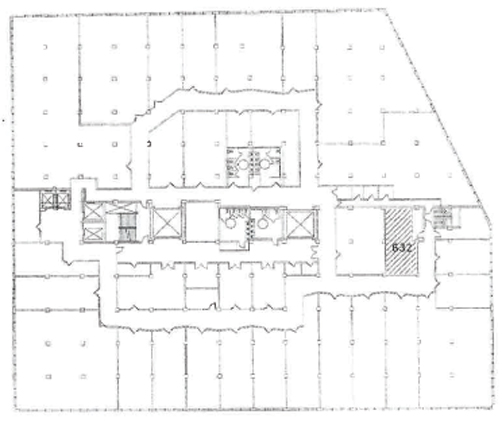

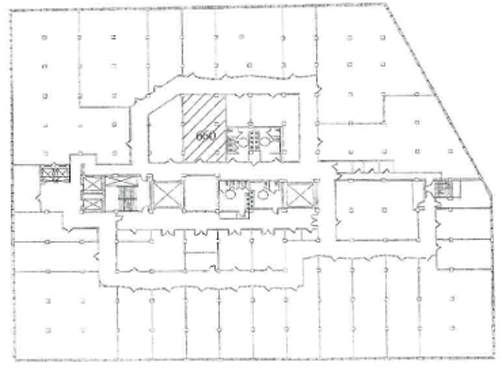

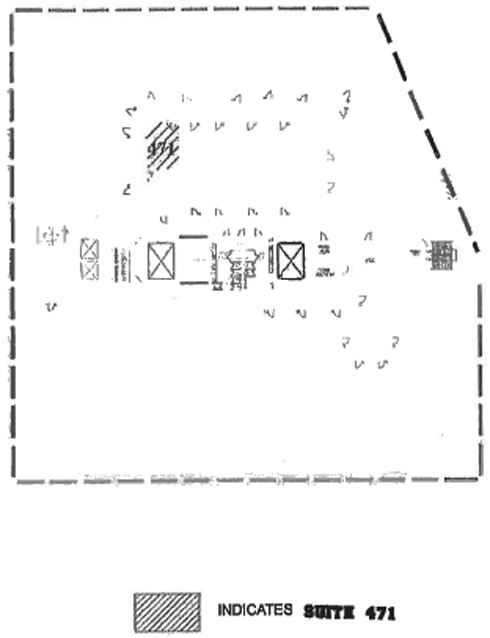

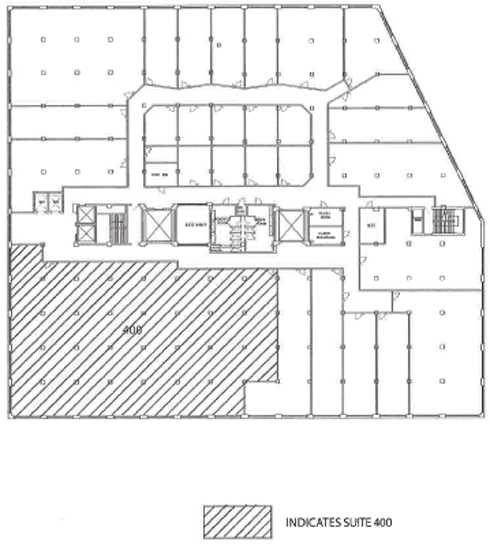

Exhibit “C”

Diagram of the Adjacent Unit

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

| ||||

LEASE AMENDMENT

AGREEMENT, made as of the 1st day of December, 2009, between 55 WASHINGTON STREET, LLC, a limited liability company, having an office c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxx Xxxx, Xxx Xxxx 00000 (hereinafter “Landlord”), and ETSY, INC., a Delaware corporation, qualified to do business in the state of New York, having an office at 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000 (hereinafter “Tenant”).

W I T N E S S E T H :

WHEREAS Landlord and Tenant entered into that certain lease dated as of April 14, 2009 with respect to certain premises known as Suite 512 located in the building (the “Building”) known as 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxx Xxxx (with such lease being hereinafter referred to as the “Lease”), and

WHEREAS the parties now desire to modify the Lease in certain respects, as hereinafter provided.

NOW, THEREFORE, in consideration of the mutual covenants herein contained, it is agreed as follows:

FIRST: Unless the context otherwise clearly indicates a contrary intent or unless specifically provided herein, each term used in this Agreement which is defined in the Lease shall be deemed to have the meaning ascribed to such term in the Lease.

SECOND: Effective as of December 1, 2009, Article 48 of the Lease shall be amended so that the term “Adjacent Unit” shall mean Suite 501 in the Building and all references throughout the Lease to the Adjacent Unit shall mean Suite 501 in the Building, Further, Exhibit C attached to the Lease shall hereby be deleted and the Exhibit C attached hereto shall be substituted in lieu thereof.

THIRD: Tenant warrants and represents to Landlord that it has not dealt with any real estate broker, agent or finder in connection with the transactions described in this Agreement and Tenant agrees to indemnify, defend and hold Landlord harmless on demand from and against any and all costs, expenses or liability (including reasonable attorneys’ fees) for any compensation, commissions, fees and charges claimed by any broker, agent or finder with respect to this Agreement or the negotiation of the terms thereof due to the dealings of Tenant with the claimant.

FOURTH: This Agreement may not be changed, modified or cancelled orally, Except as hereinabove modified and amended, and as so modified and amended, the Lease is hereby ratified and confirmed in all respects and shall be binding upon the parties hereto and their respective successors and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the xxxx and year first above written.

| 00 XXXXXXXXXX XXXXXX LLC | ||||||

| By: DW Associates, L.P. | ||||||

| By: |

| |||||

|

| ||||||

| (“Landlord”) | ||||||

| XXXXX X. XXXXXXXX Notary Public, State of New York No. 02FE6153435 Qualified in Monroe County Commission Expires October 02, 2010 |

ETSY, INC. | |||||

| By: |

| |||||

|

| ||||||

| (“Tenant”) | ||||||

| State of New York | ||

| } SS: | ||

| County of Kings |

On the 1st day of December in the year 2009 before me, the undersigned, a Notary Public in and for said State, personally appeared Xxxx Xxxxxxxxx, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me that he executed the same in his capacity, and that by his signature on the instrument, the individual or the person upon behalf of which the individual acted, executed the instrument.

|

|

|

| Notary Public |

| XXXXX X. XXXXXXXX Notary Public, State of New York No. 02FE6153435 Qualified in Monroe County Commission Expires October 02, 2010 |

| 2 |

|

|||||||

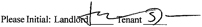

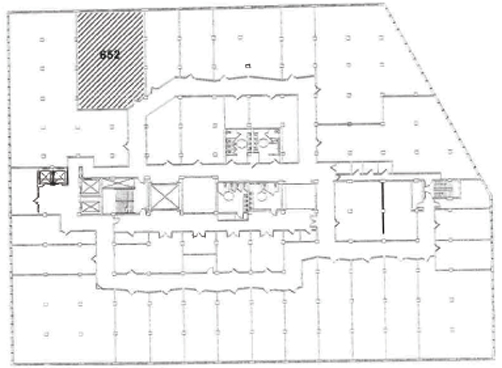

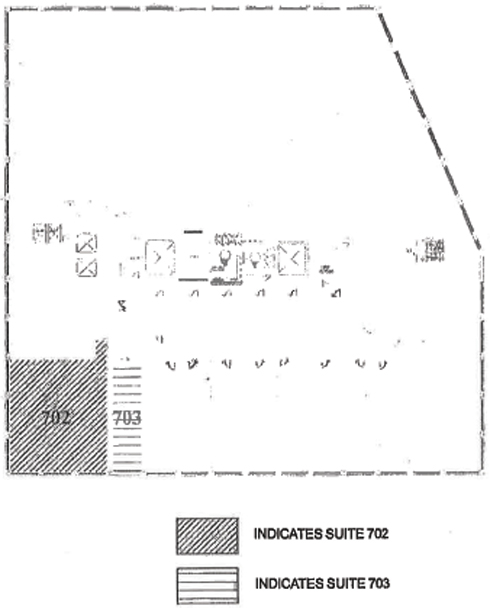

Exhibit “C”

Diagram of the Adjacent Unit

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

| ||||

DEAL SHEET – Additional Space and extension

| Current Premises: | 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxxxx 000 (approx. 14,718rsf) and Suite 500 (approx. 1,686rsf) - TOTAL rsf of 16,404rsf. | |||

| Additional Premises: | Suite 501 (approx. 6,556rsf) for a NEW TOTAL of 22,960rsf | |||

| Tenant: | Etsy, Inc. | |||

| Guarantor: | None | |||

| Rent for Suite 501: | $158,382.59/yr — $13,198.55/mo. ($24.16/rsf) | |||

| New Rent: | 8/15/10 – 7/31/11: | $552,167.10/yr — $46,013.93/mo. | ||

| 8/1/11 – 7/31/12: | $568,732.11,/yr — $47,344.34/mo. | |||

| 8/1/12 – 7/31/13: | $585,794.07/yr — $48,816.17/mo. | |||

| 8/1/13 – 7/31/14: | $603,367.89/yr — $50,280.66/mo. | |||

| 8/1/14 – 7/31/15: | $667,447.20/yr — $55,620.60/mo. | |||

| 8/1/15 – 7/31/16: | $687,470.62/yr — $57,289.22/mo. | |||

| Rent Credit: | Tenant to receive a rent credit in the amount of $22,198.55 to be applied in two installments; one in the amount of $13,198.55 towards August 2010 and the second in the amount of $9,000.00 towards September 2010. | |||

| Real Estate Taxes: | As of 8/15/10 new % is 6.813% | |||

| trash charge: | As of 8/15/10 new is $382.67 | |||

| Heat: | included | |||

| Electric: | same as current | |||

| Security Deposit: | We currently have $320,000.00 that is to be reduced on 12/31/10 so we will change the amount of which the security will be reduced to; $303,601.45 on 12/1/10, $286,686.91 on 12/1/11 and $269,137.36 on 12/1/12. | |||

| Landlord’s Work: | See attached exhibit B | |||

| Lease: | E-mail the lease to ******** @xxxx.xxx | |||

Exhibit “B”

Landlord’s Work

Landlord will do the following work once at Landlord’s expense promptly after the date hereof and shall substantially complete the same by the Commencement Date subject only to force majeure:

1. Paint all interior walls of the demised premises with two (2) coats of Building standard white paint

2. Supply and install separate Building standard electrical meter and Building standard: circuit breaker box, electrical outlets, voice and data outlets and light fixtures within the demised premises.

3. Supply and install Building standard perimeter baseboard heating and thermostatic valve(s).

4. Supply and install a Building standard ceiling mounted air-conditioning system in the demised premises and do the ductwork and distribution.

The foregoing work will be performed by contractors selected by Landlord, using materials, methods and procedures standard to the Building. Any work not expressly specified herein and any work necessary to have the demised premises comply with codes attributable to Tenant’s particular manner of use of the demised premises shall be furnished and installed at Tenant’s cost and expense. The cost of any Tenant extras shall be payable simultaneously with the authorization by Tenant of such extra work. Any existing construction shall be accepted by Tenant in “as is” condition.

LEASE AMENDMENT

AGREEMENT, made as of the 1st day of March, 2010, by and between 00 XXXXXXXXXX XXXXXX LLC, a limited liability company, having an office c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000, (“Landlord”), and ETSY INC., a Delaware corporation, qualified to do business in the State of New York, having an address of 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000 (“Tenant”).

W I T N E S S E T H :

WHEREAS Landlord and Tenant entered into that certain lease dated as of April 14, 2009 (the “Original Lease”) covering certain premises known as Suite 512 (“Original Premises”) more particularly described in the Original Lease and located on the fifth (5th) floor in the building known as 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxx Xxxx; and

WHEREAS by that certain lease amendment dated as of December 1, 2009 (the “First Amendment”) by and between Landlord and Tenant, Landlord modified the lease in certain respects (the Original Lease and the First Amendment are hereinafter collectively referred to as the “Lease”); and

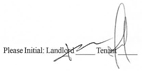

WHEREAS Tenant is desirous of leasing from Landlord, on a temporary basis, certain additional premises known as Suite 500 located in the Building and whereas Landlord is desirous of leasing Suite 500 to Tenant, on a temporary basis, subject to the provisions, conditions, covenants and agreements set forth herein; and

NOW, THEREFORE, in consideration of the mutual covenants herein contained, the parties hereto agree as follows:

FIRST: Each term used in this Agreement shall have the meaning ascribed to such term in the Lease, except as expressly amended herein.

SECOND: From April 1, 2010 to March 31, 2011 (the “Temporary Period”), Landlord leases to Tenant and Tenant leases from Landlord certain premises known as Suite 500 located on the fifth (5th) floor of the Building (hereinafter referred to as the “Temporary Premises”) which premises are located substantially in the location shown hatched on the plan attached hereto as “Exhibit A” and hereby made a part hereof. Landlord has not made and does not make any representation as to the physical condition or any other matter affecting or relating to the Temporary Premises except as is herein specifically set forth, and Tenant specifically acknowledges that no such representation has been made. Tenant further acknowledges that Landlord has afforded Tenant the opportunity for a full and complete investigation, examination and inspection of the Temporary Premises and Tenant agrees to accept the Temporary Premises “as is” (it being understood that the parties agree that Exhibit B attached to the Original Lease shall not apply to the Temporary Premises). Notwithstanding anything to the contrary contained herein, Landlord shall, at its expense, perform, or cause to be performed all work necessary to (i) install two (2) window air-conditioning units, (ii) build one (1) conference room with sheetrock walls in the location shown on Exhibit D which is attached hereto and made a part hereof, and (iii) install one (1) door in the location shown on Exhibit D (such work is herein collectively referred to as “Landlord’s Temporary Premises Work”).

THIRD: Prior to April 1, 2010, Tenant shall deliver to Landlord insurance satisfying the provisions of the Lease covering the Temporary Premises.

FOURTH: During the Temporary Period and all additional days the Temporary Premises is in Tenant’s possession (i) the term “demised premises” shall be deemed to refer to the Original Premises and the Temporary Premises and the plan attached to the Lease as Exhibit A is deleted therefrom and the plan attached hereto as Exhibit A is substituted in lieu thereof; (ii) the term “Tenant’s Percentage” as defined in Article 4 and Article 51 of the Lease shall be amended to be 4.868%; and (iii) the monthly additional rent charge for ordinary office trash collection payable pursuant to Article 47 of the Lease shall be $273.40.

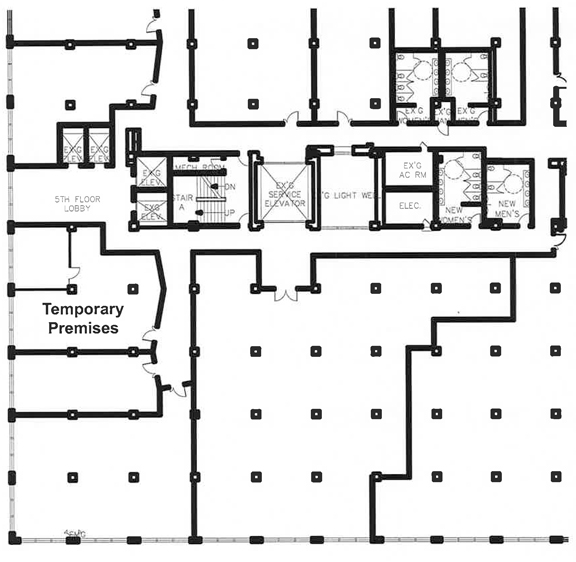

FIFTH: During the balance of the term of the Lease after the Temporary Period and after the Temporary Premises is no longer in tenant’s possession (i) the term “demised premises” shall be deemed to refer to the Original Premises and the plan then attached to the Lease as Exhibit A shall be deleted therefrom and the plan attached hereto as Exhibit E is substituted in lieu thereof; (ii) the term “Tenant’s Percentage” as defined in Article 4 and Article 51 of the Lease shall be amended to be 4.367%; and (iii) the monthly additional rent charge for ordinary office trash collection payable pursuant to Article 47 of the Lease shall be $245.30.

| 1 |

|

|||||||

SIXTH: As of the date hereof, the annual base rent payable under Article 2 of the Lease is hereby amended so that commencing on April 1, 2010 and thereafter during the balance of the term of the Lease it shall be as follows (dates inclusive):

April 1, 2010 to July 31, 2010: $384,273.00/year — $32,022.75/month

August 1, 2010 to March 31, 2011: $393,784.51/year — $32,815.38/month

April 1, 2011 to July 31, 2011: $355,384.51/year — $29,615.38/month

August 1, 2011 to July 31, 2012: $365,157.58/year — $30,429.80/month

August 1, 2012 to July 31, 2013: $375,199.41/year — $31,266.62/month

August 1, 2013 to July 31, 2014: $385,517.39/year — $32,126.45/month

August 1, 2014 to July 31, 2015: $425,497.38/year — $35,458.12/month

August 1, 2015 to July 31, 2016: $437,198.56/year — $36,433.21/month

SEVENTH: Tenant warrants and represents to Landlord that it has not dealt with any real estate broker, agent or finder in connection with the leasing of the Temporary Premises and the other transactions described in this Agreement and Tenant agrees to indemnify, defend and hold Landlord harmless on demand from and against any and all costs, expenses or liability (including reasonable attorneys’ fees) for any compensation, commissions, fees and charges claimed by any broker, agent or finder with respect to this Agreement, the Temporary Premises or the negotiation of the terms hereof due to the dealings of Tenant with the claimant.

EIGHTH: Except as expressly modified and amended herein, and as so modified and amended, the Lease is hereby ratified and confirmed in all respects and shall be binding upon the parties hereto and their respective successors and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

| 00 XXXXXXXXXX XXXXXX LLC | ||

| By: | DW Associates, L.P., as managing member | |

| By: |

| |

|

| ||

| (Landlord) | ||

| ETSY INC. | ||

| By: |

| |

|

| ||

| (Tenant) | ||

| State of New York | ||

| } SS: | ||

| County of Kings |

On the 17th day of March in the year 2010 before me, the undersigned, a Notary Public in and for said State, personally appeared Xxxxx X Xxxxxxxxx, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me that (s)he executed the same in his/her capacity, and that by his/her signature on the instrument, the individual or the person upon behalf of which the individual acted, executed the instrument.

| ||||

|

| ||||

| XXXXXXXXX X. XXXXXXXX Notary Public - State of New York No. 01CO6181901 Qualified in New York County My Commission Expires February 11, 2012 |

Notary Public |

| 2 |

|

|||||||

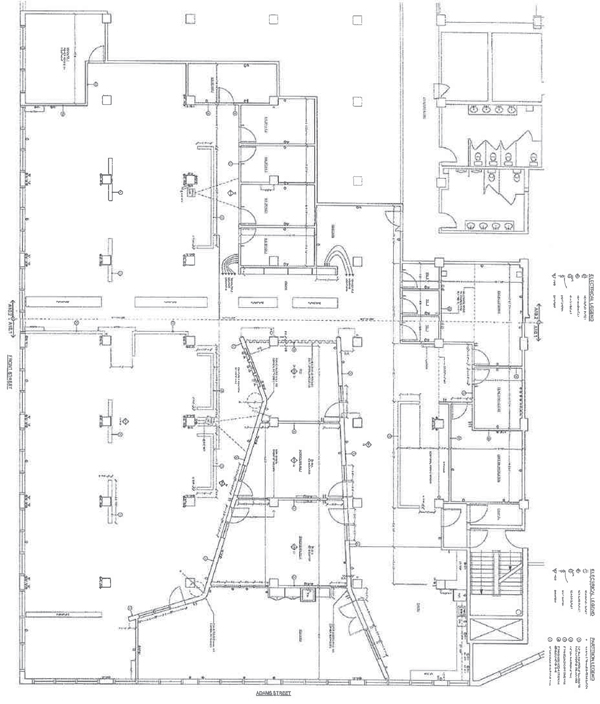

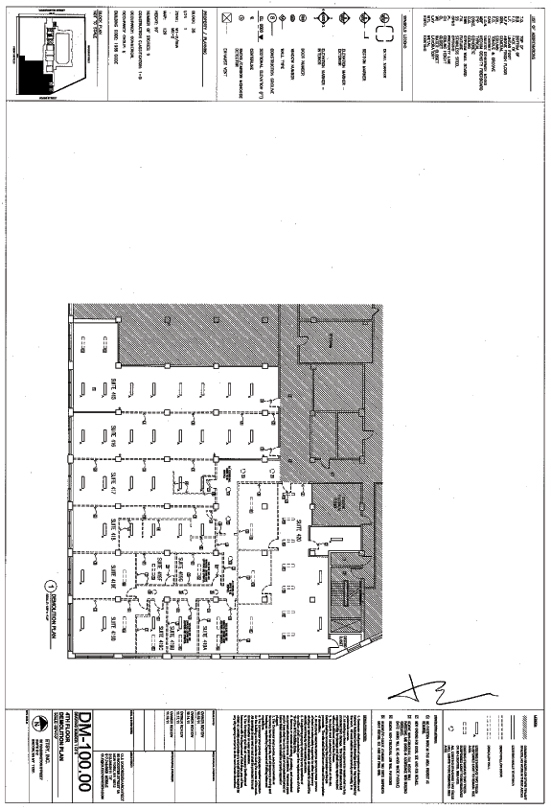

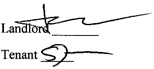

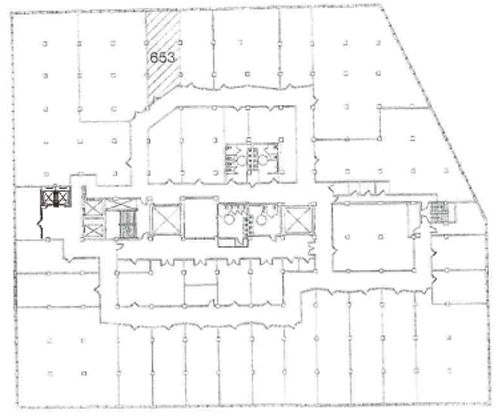

Exhibit “A”

Diagram of the Demised Premises

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

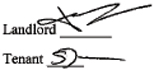

Exhibit “D”

Landlord’s Temporary Premises Work

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

Exhibit “E”

Diagram of the Demised Premises

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

LEASE AMENDMENT

AGREEMENT, made as of the 1st day of April, 2010, by and between 00 XXXXXXXXXX XXXXXX LLC, a limited liability company, having an office c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000, (“Landlord”), and ETSY INC., a Delaware corporation, qualified to do business in the State of New York, having an address of 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000 (“Tenant”).

W I T N E S S E T H :

WHEREAS Landlord and Tenant entered into that certain lease dated as of April 14, 2009 (the “Original Lease”) covering certain premises known as Suite 512 (“Original Premises”) more particularly described in the Original Lease and located on the fifth (5th) floor in the building known as 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxx Xxxx; and

WHEREAS by that certain lease amendment dated as of December 1, 2009 (the “First Amendment”) by and between Landlord and Tenant, Landlord modified the lease in certain respects; and

WHEREAS by that certain lease amendment dated as of March 1, 2010 (the “Second Amendment”) by and between Landlord and Tenant, Tenant added certain temporary additional space to the demised premises ((the Original Lease, the First Amendment and the Second Amendment are hereinafter collectively referred to as the “Lease”); and

WHEREAS Tenant is desirous of modifying the Lease to permit Tenant’s use of a stove in the demised premises subject to the terms and conditions contained in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants herein contained, the parties hereto agree as follows:

FIRST: Each term used in this Agreement shall have the meaning ascribed to such term in the Lease, except as expressly amended herein.

SECOND: The Lease shall hereby be amended by added the following Article 53 thereto:

53. Use of Stove: Notwithstanding anything to the contrary contained herein, Tenant shall, at Tenant’s sole cost and expense, be permitted to install an electric induction range with a convection oven (the “Stove”) within Suite 512; provided however, that (i) the Stove shall only be used by Tenant’s caterer to heat meals for Tenant’s employees not more than ten (10) times each month, (ii) Tenant must comply with all Legal Requirements, including without limitation, any requirements of the Fire Department and/or Department of Buildings with respect to the installation and use of the Stove, which may include, without limitation, Tenant’s installation of a fan or other ventilation system as may be necessary in order to comply with Legal Requirements, (iii) Tenant shall be solely responsible for obtaining any licenses or permits required for the installation and/or use of the Stove and (iv) Landlord has the right, at Tenant’s sole cost and expense, to remove, or cause Tenant to remove, the Stove at any time Landlord believes such removal is necessary for any reason.

THIRD: Tenant warrants and represents to Landlord that it has not dealt with any real estate broker, agent or finder in connection with the terms described in this Agreement and Tenant agrees to indemnify, defend and hold Landlord harmless on demand from and against any and all costs, expenses or liability (including reasonable attorneys’ fees) for any compensation, commissions, fees and charges claimed by any broker, agent or finder with respect to this Agreement or the negotiation of the terms hereof due to the dealings of Tenant with the claimant.

FOURTH: Except as expressly modified and amended herein, and as so modified and amended, the Lease is hereby ratified and confirmed in all respects and shall be binding upon the parties hereto and their respective successors and assigns.

| 1 |

|

|||||||

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

| 00 XXXXXXXXXX XXXXXX LLC | ||

| By: | DW Associates, L.P., as managing member | |

| By: |

| |

|

| ||

| (Landlord) | ||

| ETSY INC. | ||

| By: |

| |

|

| ||

| (Tenant) | ||

| State of New York | ||

| } SS: | ||

| County of Kings |

On the 7th day of April in the year 2010 before me, the undersigned, a Notary Public in and for said State, personally appeared Xxxxx Xxxxxxxxx, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me that (s)he executed the same in his/her capacity, and that by his/her signature on the instrument, the individual or the person upon behalf of which the individual acted, executed the instrument.

| ||||

|

| ||||

| Xxxxxxx Xxxxxx Attorney & Counselor at Law State of New York No. 02UN6193020 Qualified in Kings County Term Expires September 8, 2012 |

Notary Public |

| 2 |

|

|||||||

LEASE AMENDMENT

AGREEMENT, made as of the 15th day of July, 2010, by and between 00 XXXXXXXXXX XXXXXX LLC, a limited liability company, having an office c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000, (“Landlord”), and ETSY INC., a Delaware corporation, qualified to do business in the State of New York, having an address of 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000 (“Tenant”).

W I T N E S S E T H :

WHEREAS Landlord and Tenant entered into that certain lease dated as of April 14, 2009 (the “Original Lease”) covering certain premises known as Suite 512 (“Original Premises”) more particularly described in the Original Lease and located on the fifth (5th) floor in the building known as 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxx Xxxx; and

WHEREAS by that certain lease amendment dated as of December 1, 2009 (the “First Amendment”) by and between Landlord and Tenant, Landlord modified the lease in certain respects; and

WHEREAS by that certain lease amendment dated as of March 1, 2010 (the “Second Amendment”) by and between Landlord and Tenant, Tenant temporarily leased certain additional premises in the Building known as Suite 500 (the “Temporary Premises”) (the Original Lease, the First Amendment and the Second Amendment are hereinafter collectively referred to as the “Lease”); and

WHEREAS Tenant is desirous of extending the term of the Lease for the Temporary Premises and leasing from Landlord certain additional premises known as Suite 501 located in the Building and whereas Landlord is desirous of leasing Suite 500 to Tenant, subject to the provisions, conditions, covenants and agreements set forth herein; and

NOW, THEREFORE, in consideration of the mutual covenants herein contained, the parties hereto agree as follows:

FIRST: Each term used in this Agreement shall have the meaning ascribed to such term in the Lease, except as expressly amended herein.

SECOND: The term of the Lease is hereby extended, for the Temporary Premises only, upon the same terms, covenants and conditions set forth in the Lease, except as expressly amended herein, for approximately five (5) years and four (4) months so that it shall expire on July 31, 2016, unless sooner terminated, upon the terms set forth herein. Tenant hereby acknowledges that it has no right to extend the term of the Lease beyond July 31, 2016.

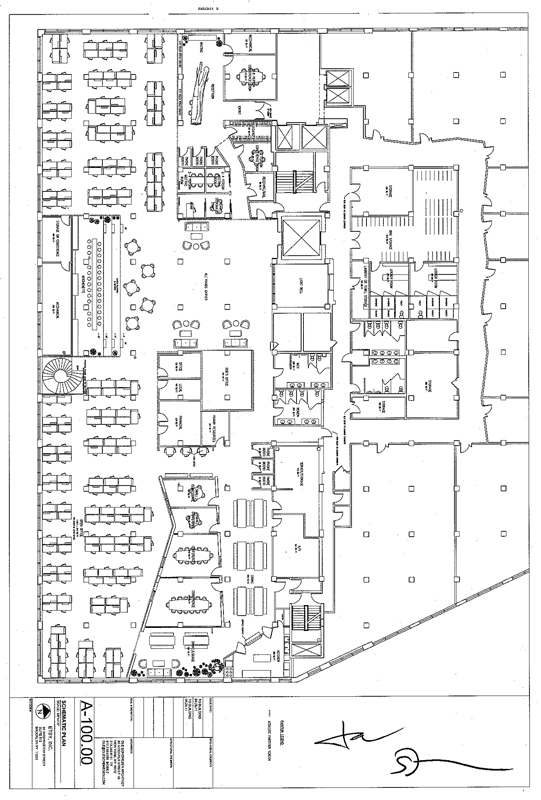

SECOND: From and after September 15, 2010, Landlord leases to Tenant and Tenant leases from Landlord certain premises known as Suite 501 located on the fifth (5th) floor of the Building (hereinafter referred to as the “Additional Premises”) which premises are located substantially in the location shown hatched on the plan attached hereto as “Exhibit A” and hereby made a part hereof. Landlord has not made and does not make any representation as to the physical condition or any other matter affecting or relating to the Additional Premises except as is herein specifically set forth, and Tenant specifically acknowledges that no such representation has been made. Tenant further acknowledges that Landlord has afforded Tenant the opportunity for a full and complete investigation, examination and inspection of the Additional Premises and Tenant agrees to accept the Additional Premises “as is”. Notwithstanding anything to the contrary contained herein, Landlord shall, at its expense, perform, or cause to be performed all work necessary to complete all work as shown on Exhibit B which is attached hereto and made a part hereof (such work is herein referred to as “Landlord’s Additional Premises Work”).

THIRD: Prior to September 15, 2010, Tenant shall deliver to Landlord insurance satisfying the provisions of the Lease covering the Additional Premises.

FOURTH: From September 15, 2010 to July 31, 2016 (i) the term “demised premises” shall be deemed to refer to the Original Premises, the Temporary Premises and the Additional Premises and the plan attached to the Lease as Exhibit A is deleted therefrom and the plan attached hereto as Exhibit A is substituted in lieu thereof; (ii) the term “Tenant’s Percentage” as defined in Article 4 and Article 51 of the Lease shall be amended to be 6.813%; and (iii) the monthly additional rent charge for ordinary office trash collection payable pursuant to Article 47 of the Lease shall be $382.67.

| 1 |

|

|||||||

FIFTH: As of the date hereof, the annual base rent payable under Article 2 of the Lease is hereby amended so that commencing on September 15, 2010 and thereafter during the balance of the term of the Lease it shall be as follows (dates inclusive):

September 15, 2010 to July 31, 2011: $552,167.10/year — $46,013.93/month

August 1, 2011 to July 31, 2012: $568,732.11/year — $47,344.34/month

August 1, 2012 to July 31, 2013: $585,794.07/year — $48,816.17/month

August 1, 2013 to July 31, 2014: $603,367.89/year — $50,280.66/month

August 1, 2014 to July 31, 2015: $667,447.20/year — $55,620.60/month

August 1, 2015 to July 31, 2016: $687,470.62/year — $57,289.22/month

SIXTH: Provided Tenant is not in default under its obligations under this Lease on September 1, 2010, October 1, 2010 and November 1, 2010, Tenant shall be entitled to a rent credit in the sum of $34,000.00 which shall be applied by Landlord in three (3) installments; two (2) installments of $12,500.00 against the monthly installments of the annual base rent payable under this Lease with respect to September 2010 and October 2010 and one (1) installment of $9,000.00 against the annual base rent payable under this Lease with respect to November 2010. In no event shall the rent credit payable under this paragraph exceed $34,000.00. Notwithstanding the foregoing, if, prior to the Expiration Date (as the same may be amended from time to time), the demised premises are surrendered by Tenant or if Landlord obtains possession of the demised premises prior to the Expiration Date due to default(s) by Tenant under this Lease, then, in either case, Tenant shall immediately pay Landlord $34,000.00 as additional rent hereunder and such payment obligation shall expressly survive the expiration or termination of this Lease.

SEVENTH: Article 3 of the Lease is hereby amended from and after the date hereof, so that if (i) Tenant is not then in default hereunder and has not been in default beyond applicable notice and cure periods from the Commencement Date and their shall not have occurred an event which, with the giving of notice or passage of time, shall constitute a default by Tenant under this Lease, Tenant shall be permitted to reduce the security deposit to $303,601.45 as of December 1, 2010, (ii) Tenant is not then in default hereunder and has not been in default beyond applicable notice and cure periods and their shall not have occurred an event which, with the giving of notice or passage of time, shall constitute a default by Tenant under this Lease, Tenant shall be permitted to further reduce the security deposit to $286,686.91 as of December 1, 2011 and (iii) Tenant is not then in default hereunder and has not been in default beyond any applicable notice and cure periods and their shall not have occurred an event which, with the giving of notice or passage of time, shall constitute a default by Tenant under this Lease, Tenant shall be permitted to reduce the security deposit to $269,137.36 as of December 1, 2012.

EIGHTH: Tenant warrants and represents to Landlord that it has not dealt with any real estate broker, agent or finder in connection with the leasing of the Additional Premises and the other transactions described in this Agreement and Tenant agrees to indemnify, defend and hold Landlord harmless on demand from and against any and all costs, expenses or liability (including reasonable attorneys’ fees) for any compensation, commissions, fees and charges claimed by any broker, agent or finder with respect to this Agreement, the Additional Premises or the negotiation of the terms hereof due to the dealings of Tenant with the claimant.

NINTH: Except as expressly modified and amended herein, and as so modified and amended, the Lease is hereby ratified and confirmed in all respects and shall be binding upon the parties hereto and their respective successors and assigns.

| 2 |

|

|||||||

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

| 00 XXXXXXXXXX XXXXXX LLC | ||

| By: | DW Associates, L.P., as managing member | |

| By: |

| |

|

| ||

| (Landlord) | ||

| ETSY INC. | ||

| By: |

| |

|

| ||

| (Tenant) | ||

| State of New York | ||

| } SS: | ||

| County of Kings |

On the 10th day of August in the year 2010 before me, the undersigned, a Notary Public in and for said State, personally appeared Xxxxxx Xxxxxxx, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me that (s)he executed the same in his/her capacity, and that by his/her signature on the instrument, the individual or the person upon behalf of which the individual acted, executed the instrument.

|

|

|

| Notary Public |

| XXXXX X. XXXXXXXX |

| Notary Public, State of New York |

| No. 02FE6153435 |

| Qualified in Monroe County |

| Commission Expires October 02, 2010 |

| 3 |

|

|||||||

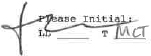

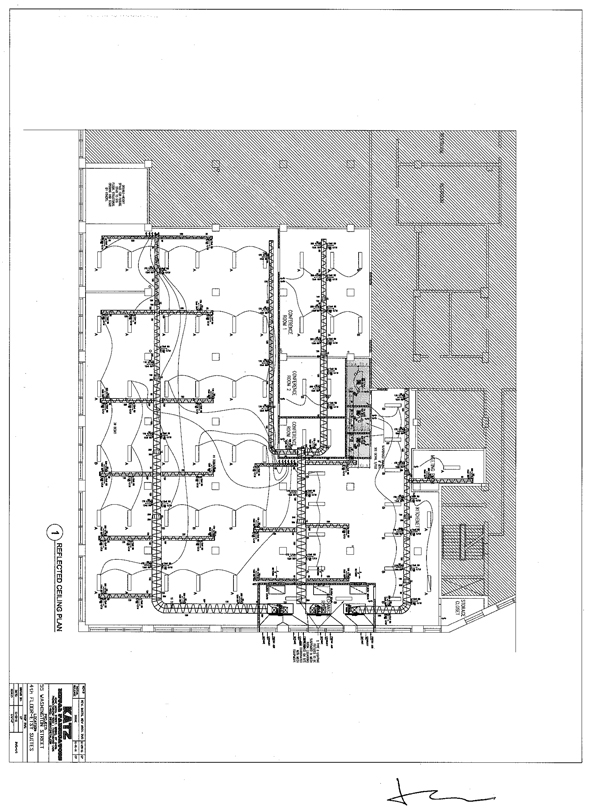

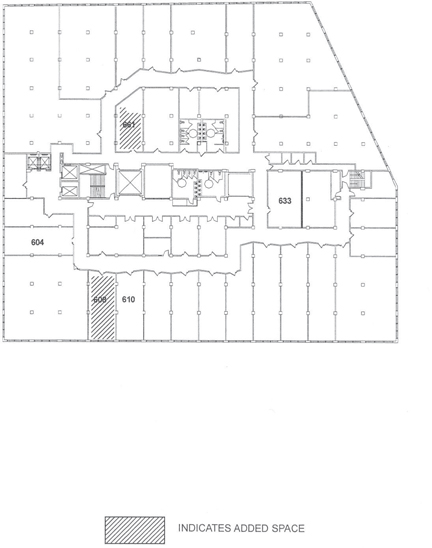

Exhibit “A”

Diagram of the Demised Premises

[Not to scale; all dimensions approximate; subject to actual conditions.]

00 XXXXXXXXXX XXXXXX, 0XX XXXXX

Exhibit B

Landlord’s Work

Landlord will do the following work once at Landlord’s expense promptly after the date hereof and shall substantially complete the same by the Commencement Date subject only to force majeure:

1. Paint all interior walls and ceiling of the demised premises with two (2) coats of Building standard white paint.

2. Supply and install separate Building standard electrical meter and Building standard: circuit breaker box, electrical outlets, voice and data outlets and light fixtures within the demised premises.

3. Supply and install Building standard perimeter baseboard heating and thermostatic valve(s).

4. Supply and install an A/C unit and Building standard ceiling ductwork and distribution.

5. Supply and install a Building standard office door at the location shown on the attached Exhibit C.

6. Remove the wall dividing Xxxxx 000 xxx Xxxxx 000 at the location shown on the attached Exhibit C.

The foregoing work will be performed by contractors selected by Landlord, using materials, methods and procedures standard to the Building. Any work not expressly specified herein and any work necessary to have the demised premises comply with codes attributable to Tenant’s particular manner of use of the demised premises shall be furnished an installed at Tenant’s cost and expense. The cost of any Tenant extras shall be payable simultaneously with the authorization by Tenant of such extra work. Any existing construction shall be accepted by Tenant in “as is” condition.

| 5 |

|

|||||||

Exhibit C

| 6 |

|

|||||||

LEASE AMENDMENT

AGREEMENT, made as of the 1st day of October, 2010, by and between 00 XXXXXXXXXX XXXXXX LLC, a limited liability company, having an office c/o Two Trees Management Co. LLC, 00 Xxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000, (“Landlord”), and ETSY INC., a Delaware corporation, qualified to do business in the State of New York, having an address of 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxx, Xxx Xxxx 00000 (“Tenant”).

W I T N E S S E T H :

WHEREAS Landlord and Tenant entered into that certain lease dated as of April 14, 2009 (the “Original Lease”) covering certain premises known as Suite 512 (“Original Premises”) more particularly described in the Original Lease and located on the fifth (5th) floor in the building (the “Building”) known as 00 Xxxxxxxxxx Xxxxxx, Xxxxxxxx, Xxx Xxxx; and

WHEREAS by that certain lease amendment dated as of December 1, 2009 (the “First Amendment”) by and between Landlord and Tenant, Landlord modified the lease in certain respects; and

WHEREAS by that certain lease amendment dated as of March 1, 2010 (the “Second Amendment”) by and between Landlord and Tenant, Tenant temporarily leased certain additional premises in the Building known as Suite 500 (hereinafter referred to as “Suite 500” or the “Temporary Premises”)

WHEREAS, by that certain lease amendment dated as of April 1, 2010 (the “Third Amendment”) by and between Landlord and Tenant, Landlord modified the lease in certain respects; and

WHEREAS by that certain lease amendment dated as of July 15, 2010 (the “Fourth Amendment”) by and between Landlord and Tenant, Tenant extended its lease of Suite 500 and leased certain additional premises in the Building known as Suite 501 (hereinafter referred to as the “Additional Premises” or “Suite 501”) (the Original Lease, the First Amendment, the Second Amendment, the Third Amendment and the Fourth Amendment are hereinafter collectively referred to as the “Lease”); and

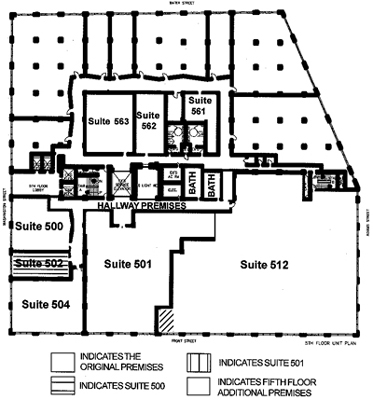

WHEREAS Tenant is desirous of leasing from Landlord certain additional premises known as Suite 712 in the Building and whereas Landlord is desirous of leasing Suite 712 to Tenant, subject to the provisions, conditions, covenants and agreements set forth herein; and

NOW, THEREFORE, in consideration of the mutual covenants herein contained, the parties hereto agree as follows:

FIRST: Each term used in this Agreement shall have the meaning ascribed to such term in the Lease, except as expressly amended herein.

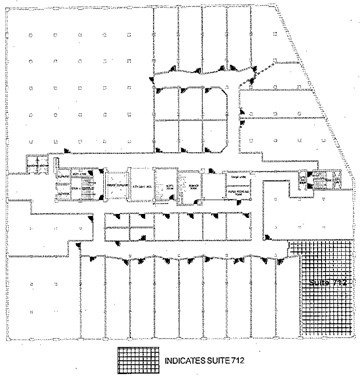

SECOND: From and after November 1, 2010, Landlord leases to Tenant and Tenant leases from Landlord certain premises known as Suite 712 located on the seventh (7th) floor of the Building (hereinafter referred to as “Suite 712”) which premises are located substantially in the location shown hatched on the plan attached hereto as “Exhibit A” and hereby made a part hereof. Landlord has not made and does not make any representation as to the physical condition or any other matter affecting or relating to Suite 712 except as is herein specifically set forth, and Tenant specifically acknowledges that no such representation has been made. Tenant further acknowledges that Landlord has afforded Tenant the opportunity for a full and complete investigation, examination and inspection of Suite 712 and Tenant agrees to accept Suite 712 “as is”.

THIRD: Prior to November 1, 2010, Tenant shall deliver to Landlord insurance satisfying the provisions of the Lease covering Suite 712.

FOURTH: From November 1, 2010 to July 31, 2016 (i) the term “demised premises” shall be deemed to refer to the Original Premises, Xxxxx 000, Xxxxx 000 and Suite 712 and the plan attached to the Lease as Exhibit A is deleted therefrom and the plan attached hereto as Exhibit A is substituted in lieu thereof; (ii) the term “Tenant’s Percentage” as defined in Article 4 and Article 51 of the Lease shall be amended to be 7.706%; and (iii) the monthly additional rent charge for ordinary office trash collection payable pursuant to Article 47 of the Lease shall be $432.80.

| 1 |

|

|||||||

FIFTH: As of the date hereof, the annual base rent payable under Article 2 of the Lease is hereby amended so that commencing on November 1, 2010 and thereafter during the balance of the term of the Lease it shall be as follows (dates inclusive):

November 1, 2010 to July 31, 2011: $624,840.38/year — $52,070.03/month

August 1, 2011 to July 31, 2012: $643,585.59/year — $53,632.13/month

August 1, 2012 to July 31, 2013: $662,893.16/year — $55,241.10/month

August 1, 2013 to July 31, 2014: $682,779.95/year — $56,898.33/month

August 1, 2014 to July 31, 2015: $755,149.44/year — $62,929.12/month

August 1, 2015 to July 31, 2016: $777,803.92/year — $64,816.99/month

SIXTH: The Lease is hereby amended by adding the following Article 53:

53. Adjacent Units