KIRKLAND LAKE GOLD INC. as Issuer and COMPUTERSHARE TRUST COMPANY OF CANADA as Trustee SUPPLEMENTAL INDENTURE November 7, 2012 STIKEMAN ELLIOTT LLP

XXXXXXXX LAKE GOLD INC.

as Issuer

and

COMPUTERSHARE TRUST COMPANY OF CANADA

as Trustee

__________________________________________________________________

November 7, 2012

__________________________________________________________________

STIKEMAN ELLIOTT LLP

TABLE OF CONTENTS

| ARTICLE 1

INTERPRETATION | ||

| Section 1.1 | Definitions | 2 |

| Section 1.2 | Rules of Interpretation | 2 |

| Section 1.3 | Language | 3 |

| Section 1.4 | Successors and Assigns | 3 |

| Section 1.5 | Benefits of Indenture | 4 |

| Section 1.6 | Schedules | 4 |

| ARTICLE 2 THE SERIES 2 DEBENTURES | ||

| Section 2.1 | Form and Terms of Series 2 Debentures | 4 |

| Section 2.2 | Concerning Interest | 12 |

| Section 2.3 | Form of Declaration for Removal of Legend | 13 |

| ARTICLE 3 ADDITIONAL COVENANTS OF THE CORPORATION | ||

| Section 3.1 | Additional Covenants | 13 |

| ARTICLE 4 SUPPLEMENTAL INDENTURE SUPPLEMENTAL TO ORIGINAL INDENTURE | ||

| Section 4.1 | Supplemental Indenture and Paramountcy | 13 |

| ARTICLE 5 CONFIRMATION BY TRUSTEE | ||

| Section 5.1 | Confirmation by Trustee | 13 |

| ARTICLE 6 ACCEPTANCE OF TRUSTS BY TRUSTEE | ||

| Section 6.1 | Acceptance of Trust | 14 |

| ARTICLE 7 EXECUTION AND FORMAL DATE | ||

| Section 7.1 | Execution | 14 |

| Section 7.2 | Formal Date | 14 |

ADDENDA

| Schedule A | Form of Series 2 Debenture |

| Schedule B | Form of Series 2 Redemption Notice |

| Schedule C | Form of Series 2 Maturity Notice |

| Schedule D | Form of Series 2 Change of Control Notice |

| Schedule E | Form of Series 2 Put Exercise Notice |

| Schedule F | Form of Series 2 Declaration for Removal of Legend |

( ii )

THIS SUPPLEMENTAL INDENTURE is made as of the 7th day of November, 2012

BETWEEN:

XXXXXXXX LAKE GOLD INC., a corporation established under the laws of Canada

(hereinafter called the “Corporation”)

- and -

COMPUTERSHARE TRUST COMPANY OF CANADA, a trust company existing under the laws of Canada

(hereinafter called the “Trustee”).

RECITALS:

| A. |

The Corporation and the Trustee entered into the Original Indenture (as defined below) providing for the issue of Debentures (as defined below) from time to time under the Original Indenture and any indentures which might thereafter be executed in supplement thereof of an unlimited aggregate principal amount in one or more series subject to compliance with the provisions and conditions set forth in the Original Indenture. |

| B. |

Pursuant to Article 16 of the Original Indenture, the Trustee and the Corporation shall enter into a supplemental indenture providing for the issuance of Additional Debentures (as defined below). |

| C. |

The Corporation wishes to create and issue the Series 2 Debentures (as defined below) to be created and issued in the manner hereinafter appearing. |

| D. |

The Corporation is duly authorized to create and issue the Series 2 Debentures to be issued as herein provided. |

| E. |

When certified by the Trustee and issued as provided in the Original Indenture, all necessary steps in relation to the Corporation will have been duly enacted, passed and/or confirmed and other proceedings taken and conditions complied with to make the creation and issue of the Series 2 Debentures proposed to be issued hereunder legal, valid and binding on the Corporation all in accordance with the terms of the Original Indenture as supplemented hereby. |

| F. |

The foregoing recitals are made as representations and statements of fact by the Corporation and not by the Trustee. |

NOW THEREFORE in consideration of the premises, covenants and agreements contained herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties, the parties hereby covenant, agree and declare as follows:

- 2 -

ARTICLE 1

INTERPRETATION

Section 1.1 Definitions

In this Supplemental Indenture and in the Series 2 Debentures, unless there is something in the subject matter or context inconsistent therewith, all terms capitalized but not defined shall have the meanings given to such terms in the Original Indenture and the following expressions shall have the following meanings:

“Original Indenture” means the indenture entered into between the Corporation and the Trustee dated as of July 19, 2012 providing for the creation and issuance of the Initial Debentures;

“Series 2 90% Redemption Right” has the meaning ascribed thereto in Section 2.1(j);

“Series 2 Change of Control Conversion Right” has the meaning ascribed thereto in Section 2.1(j);

“Series 2 Change of Control Notice” has the meaning ascribed thereto in Section 2.1(j);

“Series 2 Maturity Notice” has the meaning ascribed thereto in Section 2.1(g);

“Series 2 Put Date” has the meaning ascribed thereto in Section 2.1(j);

“Series 2 Put Right” has the meaning ascribed thereto in Section 2.1(j);

“Series 2 Debentures” means the Debentures designated as “7.5% Convertible Unsecured Subordinated Debentures” and described in Section 2.1;

“Supplemental Indenture”, “hereto”, “herein”, “hereby”, “hereunder”, “hereof” and similar expressions refer to this Supplemental Indenture and not to any particular Article, Section, Subsection, clause or other portion hereof and include any and every instrument supplemental or ancillary hereto, as the same may be amended, amended and restated or supplemented from time to time;

“Series 2 Total Put Price” has the meaning ascribed thereto in Section 2.1(j) .

Section 1.2 Rules of Interpretation

In this Supplemental Indenture:

| (a) |

Number and Gender - Words importing the singular number or masculine gender shall include the plural number or the feminine or neuter genders, and vice versa. |

- 3 -

| (b) |

References - All references to Articles, Sections, Subsection s, clauses and Schedules refer, unless otherwise specified, to articles, sections, subsections, clauses and schedules of this Supplemental Indenture. | |

| (c) |

Including - Words and terms denoting inclusiveness (such as “include” or “includes” or “including”), whether or not so stated, are not limited by and do not imply limitation of their context or the words or phrases which precede or succeed them. | |

| (d) |

Headings, etc. - The division of this Supplemental Indenture into Articles and Sections, the provision of a Table of Contents and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Supplemental Indenture or of the Series 2 Debentures. | |

| (e) |

Day not a Business Day - In the event that any day on or before which any action required to be taken hereunder is not a Business Day, then such action shall be required to be taken on or before the requisite time on the next succeeding day that is a Business Day. | |

| (f) |

Applicable Law - This Supplemental Indenture and the Series 2 Debentures shall be construed in accordance with the laws of the Province of Ontario and the laws of Canada applicable therein and shall be treated in all respects as Ontario contracts. | |

| (g) |

Monetary References - Whenever any amount of money is referred to here in, such amount shall be deemed to be in lawful money of Canada unless otherwise expressed. | |

| (h) |

Invalidity, etc. - Any provision hereof which is prohibited or unenforceable shall be ineffective only to the extent of such prohibition or unenforceability, without invalidating the remaining provisions hereof. |

Section 1.3 Language

Each of the parties hereto hereby acknowledges that it has consented to and requested that this Supplemental Indenture and all documents relating thereto including, without limiting the generality of the foregoing, the form of Debenture attached hereto as Schedule A, be drawn up in the English language only. Chacune des parties aux présentes reconnaît qu’elle a demandé que la présente convention et tous les documents s’y rattachant, notamment le texte des débentures joint aux présentes à titre d’annexe A, soient rédigés en anglais seulement.

Section 1.4 Successors and Assigns

All covenants and agreements in this Supplemental Indenture by the Corporation shall bind its Successors and assigns, whether expressed or not.

- 4 -

Section 1.5 Benefits of Indenture

Nothing in this Supplemental Indenture or in the Series 2 Debentures, express or implied, shall give to any Person, other than the parties hereto and their successors hereunder, any paying agent and the holders of Series 2 Debentures (and each such person who becomes a holder of Series 2 Debentures), any benefit or any legal or equitable right, remedy or claim under the Indenture.

Section 1.6 Schedules

The following Schedules form part of this Supplemental Indenture:

| Schedule A | - | Form of Series 2 Debenture | |

| Schedule B | - | Form of Series 2 Redemption Notice | |

| Schedule C | - | Form of Series 2 Maturity Notice | |

| Schedule D | - | Form of Series 2 Change of Control Not ice | |

| Schedule E | - | Form of Series 2 Put Exercise Notice | |

| Schedule F | - | Form of Series 2 Declaration for Removal of Legend |

ARTICLE 2

THE SERIES 2 DEBENTURES

Section 2.1 Form and Terms of Series 2 Debentures

| (a) |

The second series of Debentures (the “Series 2 Debentures”) authorized for issue immediately is limited to an aggregate principal amount of $69,000,000 and shall be designated as “7.5% Convertible Unsecured Subordinated Debentures”. | |

| (b) |

The Series 2 Debentures shall be dated as of November 7, 2012, regardless of their actual date of issue, shall mature on December 31, 2017 and shall bear interest from November 7, 2012 at the rate of 7.5% per annum, payable in equal semiannual payments on June 30 and December 31 in each year, except the first payment, which shall be made on December 31, 2012, and which shall include accrued and unpaid interest for the period from and including November 7, 2012 to but excluding December 31, 2012 ($11.10 per $1,000 principal amount of Series 2 Debentures) and the last such payment shall fall due on December 31, 2017, payable after as well as before maturity and after as well as before default, with interest on amounts in default at the same rate, compounded semiannually and calculated based on a 365day year. On or before 11:00 a.m. (Toronto time) on the Business Day prior to the date any payment is to be made, the Corporation shall provide the Trustee with a Written Direction of the Corporation specifying the payments to be made. The Trustee shall not be responsible for calculating the amount of interest owing, but shall be entitled to rely absolutely on the Written Direction of the Corporation specifying the payments to be made. | |

| (c) |

The Series 2 Debentures will be redeemable by the Corporation in accordance with the terms of Article 4 of the Original Indenture, provided that the Series 2 Debentures will not be redeemable before December 31, 2015, except in the event of the satisfaction of certain conditions after a Change of Control has occurred as outlined herein. On and after December 31, 2015 and prior to December 31, 2017, the Series 2 Debentures may be redeemed in whole at any time or in part from time to time at the option of the Corporation on notice as provided for in Section 4.3 of the Original Indenture at a Redemption Price for the Series 2 Debentures equal to their principal amount provided that the Current Market Price immediately preceding the date on which such notice of redemption is given is not less than 130% of the Conversion Price and the Corporation shall have provided to the Trustee an Officer’s Certificate confirming such Current Market Price. The Redemption Notice for the Series 2 Debentures shall be in the form of Schedule B. Holders of the Series 2 Debentures being redeemed shall be entitled to receive, in addition to the Redemption Price, accrued and unpaid interest in respect thereof for the period up to but excluding the Redemption Date from and including the latest Interest Payment Date. |

- 5 -

| (d) |

The Series 2 Debentures will be subordinated to the Senior Indebtedness of the Corporation in accordance with the provisions of Article 5 of the Original Indenture; provided, however, that nothing contained in this Original Indenture, as supplemented hereby, shall in any way or manner restrict the Corporation from incurring, directly or indirectly, any additional indebtedness, including indebtedness that ranks senior to the Debentures, or from mortgaging, pledging or charging real or personal property or properties of the Corporation or its Subsidiaries, if any, to secure any indebtedness. | |

| (e) |

The Corporation will use reasonable commercial efforts to cause the Series 2 Debentures be listed and posted for trading on the TSX on March 8, 2013, such listing to be maintained so long as any such Series 2 Debentures remain outstanding and to maintain its status as a reporting issuer (or the equivalent thereof) in Alberta, British Columbia and Ontario not in default of Applicable Securities Legislation. | |

| (f) |

Upon and subject to the provisions and conditions of Article 6 of the Original Indenture, the holder of each Series 2 Debenture shall have the right, at such holder’s option, at any time prior to 5:00 p.m. (Toronto time) on the earlier of the last Business Day immediately preceding the Maturity Date and the last Business Day immediately preceding the date specified by the Corporation for redemption of the Series 2 Debentures by notice to the holders of Series 2 Debentures in accordance with Section 2.1(c) and Section 4.3 of the Original Indenture (the earlier of which will be the “Time of Expiry” for the purposes of Article 6 of the Original Indenture in respect of the Series 2 Debentures), to convert the whole or, in the case of a Debenture of a denomination in excess of $1,000, any part which is $1,000 or an integral multiple thereof, of the principal amount of such Debenture into Freely Tradeable Shares at the Conversion Price for the Series 2 Debentures in effect on the Date of Conversion. |

- 6 -

|

The Conversion Price for the Series 2 Debentures in effect on the date hereof for each Share to be issued upon the conversion of Series 2 Debentures shall be equal to $13.70 such that approximately 72.9927 Shares shall be issued for each $1,000 principal amount of Series 2 Debentures so converted. Holders converting their Series 2 Debentures shall be entitled to receive, in addition to the applicable number of Freely Tradeable Shares, accrued and unpaid interest in respect of such Debentures for the period from and including the last Interest Payment Date on which interest was paid in full in accordance with the Original Indenture, as supplemented hereby, to but excluding the Date of Conversion. The Conversion Price applicable to, and the Shares, securities or other property receivable on the conversion of the Series 2 Debentures, is subject to adjustment pursuant to the provisions of Section 6.4 of the Original Indenture. | ||

| (g) |

On redemption or on maturity of the Series 2 Debentures, the Corporation may, at its option and subject to the provisions of Sections 4.6, 4.10 and 7.8 of the Original Indenture, as applicable, and subject to regulatory approval, if required, elect to satisfy its obligation to pay the principal amount of the Series 2 Debentures, in whole or in part, by issuing and delivering Freely Tradeable Shares to the holders of Series 2 Debentures. If the Corporation elects to exercise such option, it shall deliver a Redemption Notice or a maturity notice (the “Series 2 Maturity Notice”), as the case may be, to the holders of the Series 2 Debentures in the form of Schedule B or Schedule C, as applicable. | |

| (h) |

The Series 2 Debentures shall be issued as one or more Global Debentures in denominations of $1,000 and integral multiples of $1,000 and the Trustee is hereby appointed as registrar and transfer agent for the Series 2 Debentures. Each Series 2 Debenture issued as a Global Debenture and the certificate of the Trustee endorsed thereon shall be issued in substantially the form set out in Schedule A, with such insertions, omissions, substitutions or other variations as shall be required or permitted by the Original Indenture, as supplemented hereby, and may have imprinted or otherwise reproduced thereon such legend or legends or endorsements, not inconsistent with the provisions of the Original Indenture, as supplemented hereby, as may be required to comply with any law or with any rules or regulations pursuant thereto or with any rules or regulations of any securities exchange or securities regulatory authority or to conform with general usage, all as may be determined by the representative of the Corporation executing such Global Debentures in accordance with Section 2.7 of the Original Indenture, as conclusively evidenced by its execution of a Global Debenture. Each Series 2 Debenture shall additionally bear such distinguishing letters and numbers as the Trustee shall approve. Notwithstanding the foregoing, an Series 2 Debenture may be in such other form or forms as may, from time to time, be approved by a resolution of the directors or as specified in an Officer’s Certificate. The Series 2 Debentures may be engraved, lithographed, printed, mimeographed or typewritten or partly in one form and partly in another. |

- 7 -

|

The Series 2 Debentures shall be represented by one or more Global Debentures. Beneficial interests in Global Debentures will be represented through Participants on behalf of the applicable Beneficial Debentureholders in accordance with the rules and procedures of the Depository. Any circumstances other than or in addition to those set forth in Section 3.2 of the Original Indenture in which any Global Debentures may be exchanged for Debentures in registered form that are not Global Debentures, or transferred to and registered in the name of a person other than the Depository for such Global Debentures or a nominee thereof, shall be determined by the Corporation at the time of issue. | ||

| (i) |

Upon and subject to the provisions and conditions of Article 10 of the Original Indenture, the Corporation may elect, from time to time, to issue and solicit bids to sell sufficient Freely Tradeable Shares in order to raise funds to satisfy its Interest Obligation, in whole or in part, on the Series 2 Debentures on any Interest Payment Date. | |

| (j) |

Upon the occurrence of a Change of Control, and subject to the provisions and conditions of this Section 2.1(j), holders of Series 2 Debentures have a right to (i) require the Corporation to purchase their Series 2 Debentures or (ii) convert their Series 2 Debentures. The terms and conditions of such rights are set forth below: |

| (i) |

Upon the occurrence of a Change of Control, each holder of Series 2 Debentures shall have the right (i) to require the Corporation to purchase (the “Series 2 Put Right”), on the date (the “Series 2 Put Date”) which is 30 days following the date upon which the Trustee delivers a Series 2 Change of Control Notice (as defined below) to the holders of Series 2 Debentures, all or any part of such holder’s Series 2 Debentures in accordance with the requirements of Applicable Securities Legislation at a price equal to 100% of the principal amount thereof plus accrued and unpaid interest on such Series 2 Debentures up to, but excluding, the Series 2 Put Date (less any tax required to be withheld) (collectively, the “Series 2 Total Put Price”), which will be payable in cash or (ii) to convert (the “Series 2 Change of Control Conversion Right”) all or any part of such holder’s Series 2 Debentures at the Series 2 Change of Control Conversion Price (as defined below). | |

| (ii) |

The Series 2 Change of Control Conversion Price shall be calculated as follows: | |

|

CoCCP = ECP/(1+(CP x (c/t))) where: | ||

|

CoCCP is the Series 2 Change of Control Conversion Price; | ||

|

ECP = is the Conversion Price in effect on the Effective Date; |

- 8 -

|

CP = initial premium 30.5% | ||

| c = the number of days from and including the Effective Date to but excluding the Maturity Date; and | ||

| t = the number of days from and including November 7, 2012 to but excluding the Maturity Date. | ||

| (iii) |

The Corporation will, as soon as practicable after the occurrence of a Change of Control and in any event no later than five Business Days thereafter, give written notice to the Trustee of the Change of Control. Such written notice of the Corporation shall be in the form of Schedule D and shall state the Series 2 Total Put Price and the Series 2 Change of Control Conversion Price. The Trustee will, as soon as practicable thereafter, and in any event no later than two Business Days after receiving notice from the Corporation of the occurrence of a Change of Control, provide such written notice to the holders of Series 2 Debentures of the Change of Control (the “Series 2 Change of Control Notice”). | |

| (iv) |

To exercise the Series 2 Put Right or the Series 2 Change of Control Conversion Right, the holder of Series 2 Debentures must deliver to the Trustee, not less than five Business Days prior to the Series 2 Put Date, written notice of the holder’s exercise of such right in the form attached as Schedule E together with (a) the Series 2 Debentures with respect to which the right is being exercised, duly endorsed for transfer, or (b) if the Series 2 Debentures have been issued as Global Debentures, a duly endorsed form of transfer. | |

| (v) |

If 90% or more in aggregate principal amount of Series 2 Debentures outstanding on the date the Corporation provides notice of a Change of Control to the Trustee have been tendered for purchase pursuant to the Series 2 Put Right or converted pursuant to the Series 2 Change of Control Conversion Right in accordance with Section 2.1(j)(iii), the Corporation has the right (but not the obligation) upon written notice provided to the Trustee prior to the Series 2 Put Date, to redeem all the remaining outstanding Series 2 Debentures on the Series 2 Put Date at the Series 2 Total Put Price (the “Series 2 90% Redemption Right”). | |

| (vi) |

Upon receipt of written notice that the Corporation shall exercise the Series 2 90% Redemption Right and acquire the remaining Series 2 Debentures, the Trustee shall as soon as reasonably possible provide written notice to all holders of Series 2 Debentures that did not previously exercise the Series 2 Put Right that: |

| (A) |

The Corporation has exercised the Series 2 90% Redemption Right and will purchase all outstanding Series 2 Debentures on the Series 2 Put Date at the Series 2 Total Put Price, including a calculation of such holder’s Series 2 Total Put Price; |

- 9 -

| (B) |

Such holders must transfer their Series 2 Debentures to the Trustee on the same terms as those holders that exercised the Series 2 Put Right and must send their respective Series 2 Debentures, duly endorsed for transfer, or their duly endorsed form of transfer, as applicable, to the Trustee within 10 days after sending of such notice; and | |

| (C) |

Subject to Section 2.1(j)(xvi), the rights of such holders under the terms of the Series 2 Debentures cease as of the Series 2 Put Date provided the Corporation has paid the Series 2 Total Put Price to, or to the order of, the Trustee, and thereafter the Series 2 Debentures shall not be considered to be outstanding and the holder shall not have any right except to receive the Series 2 Total Put Price upon surrender and delivery of such holders’ Series 2 Debentures in accordance with the Original Indenture, as supplemented hereby. |

| (vii) |

The Corporation shall, on or before 11:00 a.m., (Toronto time) on the Business Day immediately prior to the Series 2 Put Date, deposit with the Trustee or any paying agent to the order of the Trustee by an electronic funds transfer such sums of money as may be sufficient to pay the Series 2 Total Put Price of the Series 2 Debentures to be purchased or redeemed by the Corporation on the Series 2 Put Date plus the amount payable in lieu of any fractional Shares issuable upon the conversion of the Series 2 Debentures converted on the Series 2 Put Date and on or before the Series 2 Put Date certificates or other evidence of the Shares issuable upon the conversion of the Series 2 Debentures converted on the Series 2 Put Date. The Trustee shall disburse such payments and deliver such certificates or other evidence of the Shares only upon receiving the required funds and certificates or other evidence of the Shares. To the extent requested by the Trustee, the Corporation shall also deposit with the Trustee a sum of money sufficient to pay any charges or expenses which may be incurred by the Trustee in connection with such purchase and/or redemption and/or conversion, as the case may be. Every such deposit shall be irrevocable. From the sums so deposited, the Trustee shall pay or cause to be paid to the holders of such Series 2 Debentures, the Series 2 Total Put Price, and interest, if any, to which they are entitled on the Corporation’s purchase or redemption, and/or the amount payable in lieu of any fractional Shares and certificates or other evidence of the Shares issuable upon the conversion, of the Series 2 Debentures. The Trustee shall not be responsible for calculating the amount of monies or Shares owing but shall be entitled to rely on the Written Direction of the Corporation specifying the payments to be made and/or Shares to be issued. |

- 10 -

| (viii) |

In the event that one or more of such Series 2 Debentures being purchased or converted in accordance with this Section 2.1(j) becomes subject to purchase or conversion in part only, upon surrender of such Series 2 Debentures for payment of the Series 2 Total Put Price or delivery of the Shares issuable upon conversion of such Series 2 Debentures plus payment of an amount in cash in lieu of any fractional Shares, certificates or other evidence of one or more new Series 2 Debentures for the portion of the principal amount of the Series 2 Debentures not purchased shall be delivered to the holder thereof or upon the holder’s order without charge. | |

| (ix) |

Series 2 Debentures for which holders have exercised the Series 2 Put Right and Series 2 Debentures which the Corporation has elected to redeem in accordance with this Section 2.1(j) shall become due and payable on the Series 2 Put Date, in the same manner and with the same effect as if it were the date of maturity specified in such Series 2 Debentures, anything therein or herein to the contrary notwithstanding, and from and after such Series 2 Put Date, if the money necessary to purchase or redeem the Series 2 Debentures shall have been deposited as provided in this Section 2.1(j) and affidavits or other proof satisfactory to the Trustee as to the publication and/or mailing of such notices shall have been lodged with it, interest on the Series 2 Debentures shall cease. If any question shall arise as to whether any notice has been given as above provided and such deposit made, such question shall be decided by the Trustee whose decision shall be final and binding upon all parties in interest. | |

| (x) |

Series 2 Debentures for which holders have exercised the Series 2 Change of Control Conversion Right in accordance with this Section 2.1(j) shall be converted on the Series 2 Put Date, and from and after such Series 2 Put Date, if the Freely Tradeable Shares and payment in lieu of any fractional Shares, if applicable, issuable and payable upon such conversion of the Series 2 Debentures shall have been deposited as provided in this Section 2.1(j) and affidavits or other proof satisfactory to the Trustee as to the publication and/or mailing of such notices shall have been lodged with it, interest on the Series 2 Debentures shall cease. If any question shall arise as to whether any notice has been given as above provided and such deposit made, such question shall be decided by the Trustee whose decision shall be final and binding upon all parties in interest. | |

| (xi) |

In case the holder of any Series 2 Debenture to be converted, purchased or redeemed in accordance with this Section 2.1(j) shall fail on or before the Series 2 Put Date to so surrender such holder’s Series |

- 11 -

2 Debenture or duly endorsed form of transfer or shall not within such time accept payment of the moneys payable, or take delivery of certificates, if any, representing any Shares issuable in respect thereof, or give such receipt therefor, if any, as the Trustee may require, such moneys may be set aside in trust, or such certificates may be held in trust without interest, either in the deposit department of the Trustee or in a chartered bank, and such setting aside shall for all purposes be deemed a payment to the Debentureholder of the sum so set aside and, to that extent, the Series 2 Debenture shall thereafter not be considered as outstanding hereunder and the Debentureholder shall have no other right except to receive payment out of the moneys so paid and deposited, or to take delivery of the certificates so deposited, upon surrender and delivery up of such holder’s Series 2 Debenture, of the money set aside plus accrued and unpaid interest to the Series 2 Put Date and subsequent distribution and accretions, on such Shares, if any, as the case may be. Subject to applicable law, in the event that any money, or certificates, required to be deposited hereunder with the Trustee or any depository or paying agent on account of principal, premium, if any, or interest, if any, on Series 2 Debentures issued hereunder shall remain so deposited for a period of ten years from the Series 2 Put Date, then such moneys, or certificates, together with any accumulated interest thereon, shall at the end of such period be paid over or delivered over by the Trustee or such depository or paying agent to the Corporation and the Trustee shall not be responsible to Debentureholders for any amounts owing to them and, subject to applicable law, thereafter the holder of an Series 2 Debenture in respect of which such money was so repaid to the Corporation shall have no rights except to obtain the payment of the money or certificates due from the Corporation, subject to any limitation period provided by the laws of Ontario. Notwithstanding the foregoing, the Trustee will pay any remaining funds deposited hereunder prior to the expiry of ten years after the Series 2 Put Date to the Corporation upon receipt from the Corporation of an unconditional letter of credit from a Canadian chartered bank in an amount equal to or in excess of the amount of the remaining funds. If the remaining funds are paid to the Corporation prior to the expiry of ten years after the Series 2 Put Date, the Corporation shall reimburse the Trustee for any amounts required to be paid by the Trustee to a holder of an Series 2 Debenture in respect thereof after the date of such payment of the remaining funds to the Corporation but prior to ten years after the Series 2 Put Date and such letter of credit shall be reduced to the extent of the amount of such disbursement. If the Corporation fails to so reimburse the Trustee, the Trustee may draw on the letter of credit.

| (xii) |

Subject to the provisions above related to Series 2 Debentures converted, purchased or purchased in part, all Series 2 Debentures redeemed and paid under this Section 2.1(j) shall forthwith be delivered to the Trustee and cancelled and no Series 2 Debentures shall be issued in substitution therefor. |

- 12 -

| (xiii) |

The Corporation will publicly announce the results of the purchases made pursuant to Section 2.1(j) as soon as practicable after the Series 2 Put Date. | |

| (xiv) |

The Corporation will comply with all Applicable Securities Legislation in the event that the Corporation is required to repurchase Series 2 Debentures pursuant to Section 2.1(j). | |

| (xv) |

No fractional Shares shall be issued upon conversion of Series 2 Debentures but in lieu thereof the Corporation shall satisfy fractional interests by a cash payment. In the event the Corporation is required to deliver Freely Tradeable Shares, the conditions of paragraph (c) of Section 4.10 of the Original Indenture shall apply, mutatis mutandis to such obligation. Holders of Debentures who elect to exercise the Series 2 Change of Control Conversion Right shall be entitled to receive and shall accept, in lieu of the number of Shares such holders would have been entitled to receive, such number of Shares or other securities or assets that such holders would have been entitled to if such holders had been the registered holders of the applicable number of Shares on the Effective Date. | |

| (xvi) |

Upon conversion of the Series 2 Debentures, if the principal amount (or any portion thereof) to which a holder is entitled is subject to withholding taxes pursuant to Section 7.8 of the Original Indenture the Trustee, on the Written Direction of the Corporation but for the account of the holder, shall provide reasonable assistance to effect the sale, through the investment banks, brokers or dealers selected by the Corporation, out of the Freely Tradeable Shares issued by the Corporation for this purpose, such number of Freely Tradeable Shares that is sufficient to yield net proceeds (after payment of all costs) to cover the amount of taxes required to be withheld, and shall remit same on behalf of the Corporation to the proper tax authorities within the period of time prescribed for this purpose under applicable laws. |

| (k) |

The Trustee shall be provided with the documents and instruments referred to in subsections 2.5(b), (c) and (d) of the Original Indenture with respect to the Series 2 Debentures, mutatis mutandis, prior to the issuance of the Series 2 Debentures. |

Section 2.2 Concerning Interest

Subject to Section 2.1(b) with respect to the calculation of interest in respect of the initial interest payment to be paid on the Series 2 Debentures, all Series 2 Debentures issued hereunder, whether originally or upon exchange or in substitution for previously issued Series 2 Debentures which are interest bearing, shall bear interest from and including their issue date or from and including the last Interest Payment Date to which interest shall have been paid or made available for payment on the outstanding Series 2 Debentures, whichever shall be the later, to but excluding the next Interest Payment Date.

13

Section 2.3 Form of Declaration for Removal of Legend

The form of declaration for the removal the U.S. Securities Act Legend with respect to the Series 2 Debentures is set forth in Schedule F hereto.

ARTICLE 3

ADDITIONAL COVENANTS OF THE CORPORATION

Section 3.1 Additional Covenants

The Corporation will take all reasonable steps and actions and do all such acts and things as may be required to maintain (as long as it meets the minimum listing requirements of such institution) the listing and posting for trading of the Series 2 Debentures, if listed, and the Shares on the TSX.

ARTICLE 4

SUPPLEMENTAL INDENTURE SUPPLEMENTAL TO

ORIGINAL INDENTURE

Section 4.1 Supplemental Indenture and Paramountcy

This Supplemental Indenture is supplemental to the Original Indenture, and the Original Indenture shall henceforth be read in conjunction with this Supplemental Indenture, and the Original Indenture shall henceforth have effect so far as practicable as if all the provisions of the Original Indenture and this Supplemental Indenture were contained in the one instrument. The Original Indenture is and shall remain in full force and effect with regards to all matters governing the Debentures, except as the Original Indenture is supplemented by this Supplemental Indenture.

Notwithstanding the foregoing, in the event of any inconsistency between the provisions of any section of this Supplemental Indenture and the provisions of the Original Indenture, the provisions of this Supplemental Indenture shall prevail.

ARTICLE 5

CONFIRMATION BY TRUSTEE

Section 5.1 Confirmation by Trustee

The Trustee hereby confirms by its execution and delivery of this Supplemental Indenture that the provisions of Article 16 of the Original Indenture have been satisfied in connection with the creation and issuance of the Series 2 Debentures.

14

ARTICLE 6

ACCEPTANCE OF TRUSTS BY TRUSTEE

Section 6.1 Acceptance of Trust

The Trustee hereby accepts the trusts in this Supplemental Indenture declared and provided and agrees to perform the same upon the terms and conditions set forth herein and in the Original Indenture, as supplemented hereby.

ARTICLE 7

EXECUTION AND FORMAL DATE

Section 7.1 Execution

This Supplemental Indenture may be executed and delivered including by facsimile or other means of electronic transmission in several counterparts, each of which when so executed shall be deemed to be an original and such counterparts together shall constitute one and the same instrument.

Section 7.2 Formal Date

For the purpose of convenience this Supplemental Indenture may be referred to as bearing the formal date of November 7, 2012, irrespective of the actual date of execution hereof.

[Remainder of this page intentionally left blank.]

IN WITNESS whereof the parties hereto have executed these presents.

| XXXXXXXX LAKE GOLD INC. | ||

| By: | (Signed) Xxxxx Xxxxxxxxxxx | |

| Name: | Xxxxx Xxxxxxxxxxx | |

| Title: | Chief Executive Officer | |

| COMPUTERSHARE TRUST COMPANY OF CANADA | ||

| By: | (Signed) Xxxxxx Xxxxxx | |

| Name: | Xxxxxx Xxxxxx | |

| Title: | Corporate Trust Officer | |

| By: | (Signed) Xxxxxx Xxxxx | |

| Name: | Xxxxxx Xxxxx | |

| Title: | Corporate Trust Officer | |

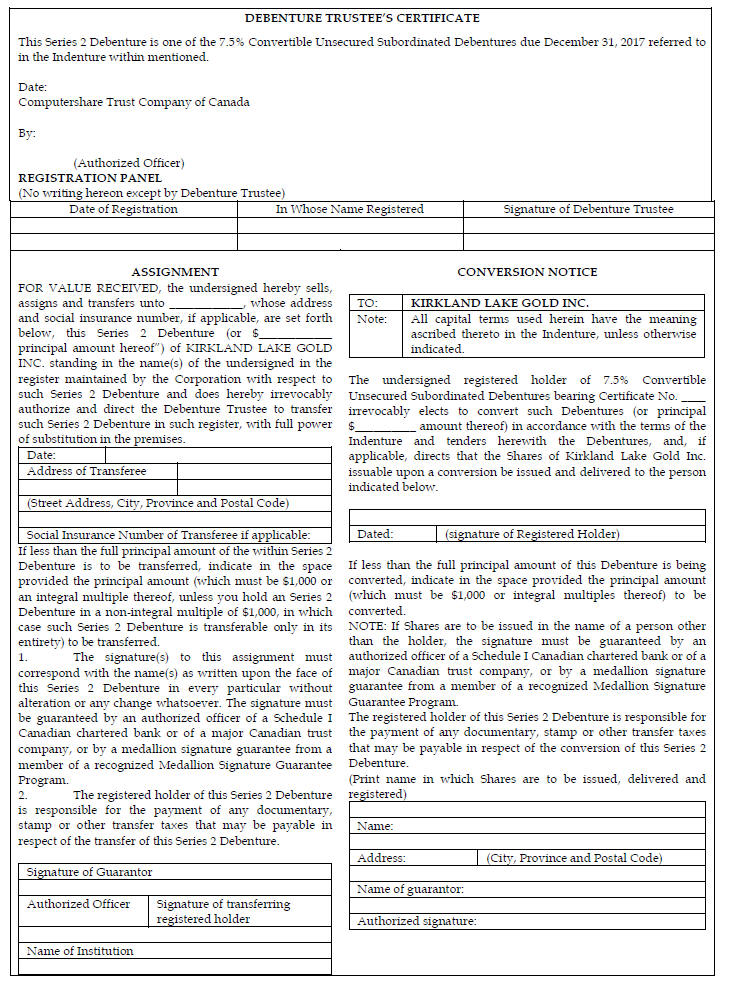

SCHEDULE A

FORM

OF SERIES 2 DEBENTURE

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE MARCH 8, 2013.

[U.S. Securities Act Legend to be Inserted for U.S. Purchasers]

XXXXXXXX LAKE GOLD INC.

(A corporation governed by

the laws of Canada)

7.5% CONVERTIBLE UNSECURED SUBORDINATED DEBENTURES

DUE

DECEMBER 31, 2017

| [CUSIP ● | |

| No. ● | ISIN ●] |

XXXXXXXX LAKE GOLD INC. (the “Corporation”) for value received hereby acknowledges itself indebted and, subject to the provisions of the Indenture (as supplemented, the “Indenture”) dated as of July 19, 2012 between the Corporation and Computershare Trust Company of Canada (the “Trustee”), as supplemented by the Supplemental Indenture dated as of November 7, 2012 between the Corporation and the Trustee, promises to pay to ● as the registered holder hereof on December 31, 2017 (the “Maturity Date”) or on such earlier date as the principal amount hereof may become due in accordance with the provisions of the Indenture the principal sum of ● ($●) in lawful money of Canada on presentation and surrender of this Series 2 Debenture at the main branch of the Trustee in Xxxxxxx, Xxxxxxx, in accordance with the terms of the Indenture and, subject as hereinafter provided, to pay interest on the principal amount hereof from and including the date hereof, at the rate of 7.5% per annum, in like money in arrears in semiannual instalments (less any tax required by l aw to be withheld) on June 30 and December 31 in each year, except that the first payment will be made on December 31, 2012 and will include accrued and unpaid interest for the period from and including November 7, 2012 to but excluding December 31, 2012 and the last such payment shall fall due on December 31, 2017, and, should the Corporation at any time make default in the payment of any principal, premium, if any, or interest, to pay interest on the amount in default at the same rate, in like money and on the same dates.

Interest hereon shall be payable by electronic funds transfer to the registered holder hereof and, subject to the provisions of the Indenture, the making of such transfer of funds shall, to the extent of the sum represented thereby (plus the amount of any tax withheld), satisfy and discharge all liability for interest on this Series 2 Debenture.

This Series 2 Debenture is one of the Debentures issued or issuable in one or more series under the provisions of the Indenture. The authorized principal amount of the Series 2 Debentures is limited to an aggregate principal amount of $69,000,000 in lawful money of Canada and the authorized principal amount of Additional Debentures which may be issued under the Indenture is unlimited. Reference is hereby expressly made to the Indenture of a description of the terms and conditions upon which the Series 2 Debentures are or are to be issued and held and the rights and remedies of the holders of the Series 2 Debentures and of the Corporation and of the Trustee, all to the same effect as if the provisions of the Indenture were herein set forth to all of which provisions the holder of this Series 2 Debenture by acceptance hereof assents.

A-1

The Series 2 Debentures are issuable only in denominations of $1,000 and integral multiples thereof. Upon compliance with the provisions of the Indenture, Series 2 Debentures of any denomination may be exchanged for an equal aggregate principal amount of Series 2 Debentures in any other authorized denomination or denominations.

The whole, or if this Series 2 Debenture is in a denomination in excess of $1,000 any part of which is $1,000 or an integral multiple thereof, of the principal of this Series 2 Debenture is convertible, at the option of the holder hereof, upon surrender of this Series 2 Debenture at the principal office of the Trustee in the City of Toronto, at any time but not after 5:00 p.m. (Toronto time) on the earlier of the last Business Day immediately preceding the Maturity Date and the last Business Day immediately preceding the date specified for redemption of this Series 2 Debenture, into Freely Tradeable Shares at a conversion price of $13.70 (the “Conversion Price”) per Share, being a rate of approximately 72.9927 Shares for each $1,000 principal amount of Series 2 Debentures, all subject to the terms and conditions and in the manner set forth in the Indenture. The Indenture makes provision for the adjustment of the Conversion Price in the events therein specified. No fractional Shares will be issued on any conversion but in lieu thereof, the Corporation will satisfy such fractional interest by a cash payment equal to the Current Market Price of such fractional interest determined in accordance with the Indenture. Holders converting their Series 2 Debentures shall be entitled to receive, in addition to the applicable number of Freely Tradeable Shares, accrued and unpaid interest in respect of such Debentures as provided in the Indenture. No Fully Registered Debentures may be converted during the period from the close of business on the Record Date preceding the Interest Payment Date (being June 15 and December 15 in each year) to and including such Interest Payment Date, commencing December 31, 2012, as the registers of the Trustee will be closed during such periods.

The Series 2 Debenture may be redeemed at the option of the Corporation on the terms and conditions set out in the Indenture at the redemption price therein set out. This Series 2 Debenture is not redeemable before December 31, 2015, except in the event of the satisfaction of certain conditions after a Change of Control has occurred. On and after December 31, 2015, and prior to the Maturity Date, this Series 2 Debenture is redeemable at the option of the Corporation provided that the Corporation files with the Trustee on the day that notice of redemption of this Series 2 Debenture is first given an Officer’s Certificate of the Corporation certifying that the volume weighted average trading price per Share on the Toronto Stock Exchange (or elsewhere in accordance with the Indenture) for the 20 consecutive trading days ending on the fifth trading day immediately preceding the date on which such notice is given, is at least 130% of the Conversion Price then in effect.

Upon the occurrence of a Change of Control, each holder of Series 2 Debentures may (i) require (the “Put Right”) the Corporation to purchase on the date (the “Put Date”) that is 30 days following the giving of notice by the Trustee of the Change of Control the whole or any part of such holder’s Series 2 Debentures at a price equal to 100% of the principal amount of such Series 2 Debentures plus accrued and unpaid interest up to, but excluding, the Put Date or (ii) to convert (the “Series 2 Change of Control Conversion Right”) all or any part of such holder’s Series 2 Debentures at the Series 2 Change of Control Conversion Price. If 90% or more of the principal amount of all Series 2 Debentures outstanding on the date the Corporation provides notice of a Change of Control to the Trustee have been tendered for purchase pursuant to the Put Right or conversion pursuant to the Series 2 Change of Control Conversion Right, the Corporation has the right (but not the obligation) to purchase all the remaining outstanding Series 2 Debentures on the Put Date at the same price and in the same form as the Series 2 Debentures purchased pursuant to the Put Right.

A-2

As more specifically provided in the Indenture, if a takeover bid for Series 2 Debentures, within the meaning of the Securities Act (Ontario) is made and 90% of the principal amount of all the Series 2 Debentures (other than Series 2 Debentures held at the date of the takeover bid by or on behalf of the Offeror, Associates or Affiliates of the Offeror or anyone acting jointly or in concert with the Offeror) are taken up and paid for by the Offeror, the Offeror will be entitled to acquire the Series 2 Debentures of those holders who did not accept the offer on the same terms as the Offeror acquired the first 90% of the principal amount of the Series 2 Debentures.

The Corporation may, on notice as provided in the Indenture, at its option (subject to any applicable regulatory approval and as provided in the Indenture), elect to satisfy the obligation to repay the principal amount of this Series 2 Debenture on the Maturity Date or on redemption by the issue of that number of Freely Tradeable Shares obtained by dividing the principal amount of this Series 2 Debenture by 95% of the Current Market Price on the Maturity Date or the date fixed for redemption, as the case may be.

The indebtedness evidenced by this Series 2 Debenture, and by all other Series 2 Debentures now or hereafter certified and delivered under the Indenture, is a direct unsecured obligation of the Corporation, and is subordinated in right of payment, to the extent and in the manner provided in the Indenture, to the prior payment of all Senior Indebtedness and indebtedness to trade creditors of the Corporation, whether outstanding at the date of the Indenture or thereafter created, incurred, assumed or guaranteed. This Series 2 Debenture is subordinate to claims or creditors of the Corporation’s Subsidiaries, if any, except to the extent the Corporation is a creditor of such Subsidiaries ranking at least pari passu with such other creditors.

The principal hereof may become or be declared due and payable before the stated maturity in the events, in the manner, with the effect and at the times provided in the Indenture.

The Indenture contains provisions making binding upon all holders of Debentures outstanding hereunder (or in certain circumstances, specific series of Debentures) resolutions passed at meetings of such holders held in accordance with such provisions and instruments signed by the holders of a specified majority of Debentures outstanding (or specific series), which resolutions or instruments may have the effect of amending the terms of this Series 2 Debenture or the Indenture.

This Series 2 Debenture may only be transferred, upon compliance with the conditions prescribed in the Indenture, in one of the registers to be kept at the principal office of the Trustee in Toronto, Ontario and in such other place or places as the Corporation with the approval of the Trustee may designate. No transfer of this Series 2 Debenture shall be valid unless made on the register by the Trustee upon surrender of this Series 2 Debenture for cancellation by the registered holder hereof or his executors or administrators or other legal representatives, or his or their attorney duly appointed by an instrument in form and substance satisfactory to the Trustee and upon compliance with such reasonable requirements as the Trustee may prescribe. Thereupon a new Series 2 Debenture or Series 2 Debentures in the same aggregate principal amount shall be issued to the transferee in exchange herefor.

A-3

This Series 2 Debenture shall not become obligatory for any purpose until it shall have been certified by the Trustee under the Indenture.

The Indenture is and this Debenture shall be governed by and construed in accordance with the laws of the Province of Ontario and the laws of Canada applicable therein.

Capitalized words or expressions used in this Series 2 Debenture shall, unless otherwise defined herein, have the meaning ascribed thereto in the Indenture. In the event that the terms and conditions stated in this Debenture conflict, or are inconsistent with, the terms and conditions of the Indenture, the Indenture shall prevail and take priority.

IN WITNESS WHEREOF XXXXXXXX LAKE GOLD INC. has caused this Debenture to be signed by its authorized signatories as of the 7th day of November, 2012.

|

[Unless this certificate is presented by an authorized representative of CDS Clearing and Depository Services Inc. (“CDS”) to the issuer or its agent for registration of transfer, exchange or payment, and any certificate issued in respect thereof is registered in the name of CDS & CO, or in such other name as is requested by an authorized representative of CDS (and any payment is made to CDS & CO or to such other entity as is requested by an authorized representative of CDS), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL since the registered holder hereof, CDS & CO, has a property interest in the securities represented by this certificate herein and it is a violation of its rights for another person to hold, transfer or deal with this certificate.] |

||

| XXXXXXXX LAKE GOLD INC. | ||

| By: ____________________________________ | ||

| Name: | ||

| Title: | ||

A-4

A-5

EXHIBIT 1

TO FORM OF SERIES 2 DEBENTURE

XXXXXXXX LAKE GOLD INC.

(A corporation governed by

the laws of Canada)

7.5% CONVERTIBLE UNSECURED SUBORDINATED DEBENTURES DUE

DECEMBER 31, 2017

| [CUSIP ● | |

| No. ● | ISIN ●] |

Initial Principal Amount: $●

| Date |

Amount of Increase |

Amount of Decrease |

New Principal Amount |

Authorization |

A-6

SCHEDULE B

FORM OF SERIES 2 REDEMPTION

NOTICE

XXXXXXXX LAKE GOLD INC.

7.5% CONVERTIBLE UNSECURED

SUBORDINATED DEBENTURES

REDEMPTION NOTICE

| To: | Holders of 7.5% Convertible Unsecured Subordinated Debentures (the “Debentures”) of XXXXXXXX LAKE GOLD INC. (the “Corporation”) |

| Note: | All capitalized terms used herein have the meanings ascribed thereto in the Indenture mentioned below, unless otherwise indicated. |

Notice is hereby given pursuant to Section 4.3 of the Indenture (the “Indenture”) dated as of July 19, 2012 between the Corporation and Computershare Trust Company of Canada (the “Trustee”), as supplemented by the Supplemental Indenture dated as of November 7, 2012 between the Corporation and the Trustee, that $● aggregate principal amount of Debentures outstanding will be redeemed as of (the “Redemption Date”), upon payment of a redemption amount of $● for each $1,000 principal amount of Debentures, being equal to the aggregate of (i) $●, and (ii) all accrued and unpaid interest thereon to but excluding the Redemption Date (collectively, the “Redemption Price”).

The Redemption Price will be payable upon presentation and surrender of the Debentures called for redemption at the following corporate trust office:

Computershare Trust Company of

Canada

000 Xxxxxxxxxx Xxxxxx

0xx Xxxxx, Xxxxx Xxxxx

Xxxxxxx, Xxxxxxx

X0X 0X0

Attention: Manager,

Corporate Trust

Facsimile: (000) 0000000

The interest upon the principal amount of Debentures called for redemption shall cease to be payable from and after the Redemption Date, unless payment of the Redemption Price, plus accrued and unpaid interest, shall not be made on presentation for surrender of such Debentures at the abovementioned corporate trust office on or after the Redemption Date or prior to the setting aside of the Redemption Price, plus accrued and unpaid interest, pursuant to the Indenture.

[Pursuant to Section 4.6 of the Indenture, the Corporation hereby elects to satisfy its obligation to pay to holders of Debentures the Redemption Price, [in whole/in part,] by issuing and delivering to the holders that number of Freely Tradeable Shares obtained by dividing the aggregate principal amount of Debentures by 95% of the Current Market Price of the Shares on the Redemption Date. $● aggregate principal amount of Debentures will be redeemed by the Corporation pursuant to its Share Redemption Right.

B-1

No fractional Shares shall be delivered upon the exercise by the Corporation of the Share Redemption Right but, in lieu thereof, the Corporation shall pay the cash equivalent thereof determined on the basis of the Current Market Price of Shares on the Redemption Date (less any tax required to be deducted, if any).] [Delete as appropriate.]

In this connection, upon presentation and surrender of the Debentures for payment on the Redemption Date, the Corporation shall, on the Redemption Date, make delivery to the Trustee, at the abovementioned corporate trust office, for delivery to and on account of the holders, [the cash to which holders are entitled] [and/or] [the number of Freely Tradeable Shares (in book based or certificated form) to which holders are entitled] and cash equal to all accrued and unpaid interest to the Redemption Date [together with the cash equivalent in lieu of all fractional Shares].

DATED: ●

| XXXXXXXX LAKE GOLD INC. | |

| By: | |

| Name: | |

| Title: | |

| By: | |

| Name: | |

| Title: | |

B-2

SCHEDULE C

FORM OF SERIES 2 MATURITY NOTICE

XXXXXXXX LAKE GOLD INC.

7.5% CONVERTIBLE UNSECURED

SUBORDINATED DEBENTURES

MATURITY NOTICE

| To: | Holders of 7.5% Convertible Unsecured Subordinated Debentures (the “Debentures”) of XXXXXXXX LAKE GOLD INC. (the “Corporation”) |

| Note: | All capitalized terms used herein have the meanings ascribed thereto in the Indenture mentioned below, unless otherwise indicated. |

Notice is hereby given pursuant to Section 4.10(b) of the Indenture (the “Indenture”) dated as of July 19, 2012 between the Corporation and Computershare Trust Company of Canada, as trustee (the “Trustee”), as supplemented by the Supplemental Indenture dated as of November 7, 2012 between the Corporation and the Trustee, that the Debentures are due and payable as of December 31, 2017 (the “Maturity Date”) and the Corporation hereby advises the holders of Debentures that pursuant to Section 4.10 of the Indenture, the Corporation hereby elects to satisfy its obligation to repay the Debentures [in whole/in part] [Delete as appropriate] by issuing and delivering to the holders that number of Freely Tradeable Shares equal to the number obtained by dividing the aggregate principal amount of such Debentures by 95% of the Current Market Price of the Shares on the Maturity Date. $● aggregate principal amount of Debentures will be repaid by the Corporation pursuant to its Share Repayment Right. Upon presentation and surrender of the Debentures, the Corporation shall pay or cause to be paid in cash to the holder all accrued and unpaid interest to the Maturity Date, together with the cash equivalent representing fractional Shares [and cash in respect of the Debentures not subject to the Share Repayment Right], and shall, on the Maturity Date, send to the Trustee the Freely Tradeable Shares (in book-based or certificated for m) to which the holder is entitled.

DATED: ●

| XXXXXXXX LAKE GOLD INC. | |

| By: | |

| Name: | |

| Title: | |

| By: | |

| Name: | |

| Title: | |

C-1

SCHEDULE D

FORM OF SERIES 2 CHANGE OF CONTROL

NOTICE

XXXXXXXX LAKE GOLD INC.

7.5% CONVERTIBLE UNSECURED

SUBORDINATED DEBENTURES

CHANGE OF CONTROL NOTICE

| To: | Holders of 7.5% Convertible Unsecured Subordinated Debentures (the “Debentures”) of XXXXXXXX LAKE GOLD INC. (the “Corporation”) |

| Note: | All capitalized terms used herein have the meanings ascribed thereto in the Indenture mentioned below, unless otherwise indicated. |

Notice is hereby given pursuant to Section 2.1(j) of the Indenture dated as of July 19, 2012 between the Corporation and Computershare Trust Company of Canada, as trustee (the “Trustee”), as supplemented by the Supplemental Indenture dated as of November 7, 2012 between the Corporation and the Trustee (collectively, (the “Indenture”), that:

| (a) |

a Change of Control occurred on ●, 20● (the “Effective Date”) details of which are the following: [Insert details of Change of Control]; | |

| (b) |

each holder of Debentures shall have the right (i) to require the Corporation to purchase, on ●, 20●, [being the date which is 30 days following the date upon which the Trustee has delivered this Series 2 Change of Control Notice to the holders] (the “Put Date”), all or any part of its Debentures in accordance with Applicable Securities Legislation at a price equal to 100% of the principal amount of its Debentures plus accrued and unpaid interest thereon up to, but excluding, the Put Date (collectively, the “Total Put Price”); or (ii) to convert its Debentures at the Series 2 Change of Control Conversion Price (as defined below); and | |

| (c) |

you are entitled to withdraw your election to require the Corporation to purchase or convert your Debentures by providing notice to the Trustee by facsimile transmission or letter advising the Trustee of such withdrawal no later than the close of business on the third Business Day immediately preceding the Put Date, such notice to the Trustee shall include your name, the principal amount of the Debentures delivered for purchase and a statement that you are withdrawing your election to have such Debentures purchased or converted. |

The Series 2 Change of Control Conversion Price is equal to $● and is calculated as follows:

COCCP = ECP/(1+(CP x (C/t))) where:

COCCP is the Series 2 Change of Control Conversion Price;

ECP =

is the Conversion Price in effect on the Effective Date;

CP = initial

premium 30.5%;

D-1

c = the number of days from and

including the Effective Date to but excluding the Maturity Date; and

t = the

number of day from and including November 7, 2012 to but excluding the Maturity

Date

Be advised that if 90% or more in aggregate principal amount of Debentures outstanding on the date of this Series 2 Change of Control Notice have been tendered for purchase or conversion, the Corporation has the right (but not the obligation) upon written notice to the Trustee prior to the Put Date to redeem all remaining outstanding Debentures on the Put Date at the Total Put Price.

Upon presentation and surrender of the Debentures, (i) in the event that a Debentureholder elects to exercise the Put Right, the Corporation shall satisfy the Total Put Price in cash, and (ii) in the event that a Debentureholder elects to convert its Debentures pursuant to the Series 2 Change of Control Conversion Right, the Corporation shall issue and deliver the Freely Tradeable Shares (in bookbased or certificated for m) to which the holder is entitled and pay or cause to be paid in cash the cash equivalent representing fractional Shares, if any.

DATED: ●

| XXXXXXXX LAKE GOLD INC. | |

| By: | |

| Name: | |

| Title: | |

| By: | |

| Name: | |

| Title: | |

D-2

SCHEDULE E

FORM OF SERIES 2 PUT EXERCISE

NOTICE

PUT EXERCISE NOTICE

| To: | XXXXXXXX LAKE GOLD INC. (the “Corporation”) |

| Note: | All capitalized terms used herein have the meanings ascribed thereto in the Indenture mentioned below, unless otherwise indicated. |

The undersigned registered holder of 7.5% Convertible Unsecured Subordinated Debentures [bearing Certificate No.●] revocably elects to [put such Debentures (or $● principal amount thereof*) to the Corporation to be purchased by the Corporation on (the “Put Date”) at a price of $1,000 for each $1,000 principal amount of Debentures plus all accrued and unpaid interest thereon to, but excluding, the Put Date (collectively, the “Total Put Price”)][and] [convert such Debentures (or $● principal amount thereof*) at the Series 2 Change of Control Conversion Price][complete/delete as appropriate], all in accordance with the terms of the Indenture dated as of July 19, 2012 between the Corporation and Computershare Trust Company of Canada, as trustee, (the “Indenture”) and tenders herewith the Debentures.

| Dated: | |||

| (Signature of Registered Holder) |

| * |

If less than the full principal amount of the Debentures, indicate in the space provided the principal amount which must be $1,000 or integral multiples thereof. |

Upon presentation and surrender of the Debentures with this form at the following corporate trust office:

Computershare Trust Company of

Canada

000 Xxxxxxxxxx Xxxxxx

0xx Xxxxx, Xxxxx Xxxxx

Xxxxxxx, Xxxxxxx

X0X 0X0

Attention: Manager,

Corporate Trust

Facsimile: (000) 0000000

(i) in the event that a Debentureholder elected to exercise the Put Right, the Corporation shall satisfy the Total Put Price in cash, and (ii) in the event that a Debentureholder elected to convert its Debentures pursuant to the Series 2 Change of Control Conversion Right, the Corporation shall issue and deliver the Freely Tradeable Shares (in bookbased or certificated form) to which the holder is entitled and pay or cause to be paid in cash the cash equivalent representing fractional Shares, if any, each on the Put Date and in accordance with the Indenture.

E-1

The interest upon the principal amount of Debentures put to the Corporation or converted shall cease to be payable from and after the Put Date unless payment of the Total Put Price or delivery of the Shares issuable upon conversion of the Debentures plus payment of such amount in cash in lieu of any fractional Shares, as applicable, shall not be made on presentation for surrender of such Debentures at the above mentioned corporate trust office on the Put Date or prior to the setting aside of the Total Put Price or the Shares issuable upon conversion of the Debentures plus such amount in cash in lieu of any fractional Shares pursuant to the Indenture.

E-2

SCHEDULE F

FORM OF SERIES 2 DECLARATION FOR

REMOVAL OF LEGEND

| To: | Computershare Trust Company of Canada |

| as registrar and transfer agent | |

| for the 7.5% Convertible Unsecured Subordinated Debentures, | |

| of Xxxxxxxx Lake Gold Inc. | |

| 0xx Xxxxx, Xxxxx Tower | |

| 000 Xxxxxxxxxx Xxxxxx | |

| Xxxxxxx, XX X0X 0X0 | |

| Xxxxxx |

The undersigned (a) acknowledges that the sale of the securities of Xxxxxxxx Lake Gold Inc. (the “Corporation”) to which this declaration relates is being made in reliance on Rule 904 of Regulation S (“Regulation S”) under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and (b) certifies that: (1) the undersigned is not an “affiliate” of the Corporation as that term is defined in Rule 405 under the U.S. Securities Act, (2) the offer of such securities was not made to a person in the United States and either (A) at the time the buy order was originated, the buyer was outside the United States or the seller and any person acting on its behalf reasonably believed that the buyer was outside the United States, or (B) the transaction was executed on or through the facilities of the Toronto Stock Exchange, and neither the seller nor any person acting on its behalf knows that the transaction has been prearranged with a buyer in the United States, (3) neither the seller nor any affiliate of the seller nor any person acting on behalf of any of them has engaged or will engage in any “directed selling efforts” (as defined in Regulation S) in the United States in connection with the offer and sale of such securities, (4) the sale is bona fide and not for the purpose of “washing off” the resale restrictions imposed because the securities are “restricted securities” (as that term is defined in Rule 144(a)(3) under the Securities Act), (5) the seller does not intend to replace the securities sold in reliance on Rule 904 of Regulation S with fungible unrestricted securities, and (6) the contemplated sale is not a transaction or part of a series of transactions which, although in technical compliance with Regulation S, is part of a plan or scheme to evade the registration provisions of the U.S. Securities Act.

Dated: ___________________

| By: | |

| Name: | |

| Title: |

F-1

Affirmation By Seller’s BrokerDealer (required for sales in accordance with Section (b)(2)(B) above)

We have read the foregoing representations of our customer, _________________________ (the “Seller”) dated _______________________ , with regard to our sale, for such Seller’s account, of the securities of the Corporation described therein, and on behalf of ourselves we certify and affirm that (A) we have no knowledge that the transaction had been prearranged with a buyer in the United States, (B) the transaction was executed on or through the facilities of the Toronto Stock Exchange, (C) neither we, nor any person acting on our behalf, engaged in any directed selling efforts in connection with the offer and sale of such securities, and (D) no selling concession, fee or other remuneration is being paid to us in connection with this offer and sale other than the usual and customary broker’s commission that would be received by a person executing such transaction as agent. Terms used herein have the meanings given to them by Regulation S under the U.S. Securities Act.

| Name of Firm | |

| By: | |

| Authorized officer | |

| Date: | |

F-2