CONTENTS

Exhibit 4 (a) (i)

Project Offspring

16 December 2005

CONTENTS

| CLAUSE |

PAGE | |||

| 1. | DEFINITIONS | 5 | ||

| 2. | CORPORATE OWNERSHIP/STRUCTURE OF THE ACQUISITION | 9 | ||

| 3. | SALE AND PURCHASE OF THE PURCHASED COMPANIES’ SHARES; RIGHTS TO PROFITS | 11 | ||

| 4. | PURCHASE PRICE; ESTIMATED PURCHASE PRICE; TRANSFER ACCOUNTING DOCUMENTS; CONDITIONS OF PAYMENT | 12 | ||

| 5. | CLOSING; CLOSING CONDITIONS | 20 | ||

| 6. | SELLERS’ WARRANTIES | 24 | ||

| 7. | REMEDIES | 34 | ||

| 8. | TAXES | 38 | ||

| 9. | PURCHASER’S WARRANTIES | 44 | ||

| 10. | COVENANTS | 45 | ||

| 11. | PURCHASER INDEMNITY | 49 | ||

| 12. | CONFIDENTIALITY/PRESS RELEASES | 50 | ||

| 13. | ASSIGNMENT OF RIGHTS AND UNDERTAKINGS | 50 | ||

| 14. | GUARANTEES | 51 | ||

| 15. | COSTS AND TAXES | 51 | ||

| 16. | NOTICES | 51 | ||

| 17. | MISCELLANEOUS | 53 |

Annexes

| Annex (D)(ii) | Environmental VDD Reports | |

| Annex 2.2(a) | JV (Holding) Shares | |

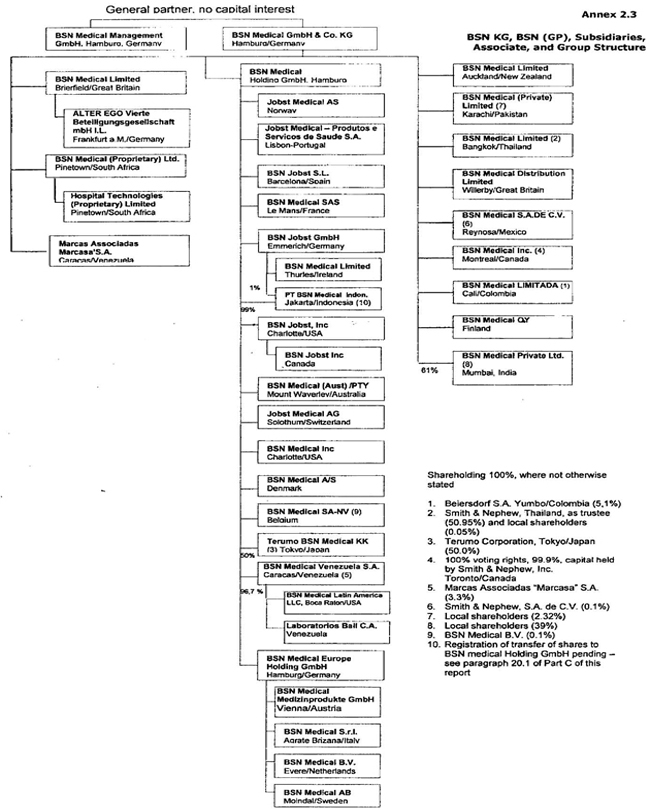

| Annex 2.3 | BSN KG, BSN (GP), Subsidiaries, Associate, and BSN Group Structure | |

| Annex 3.2 | Draft Transfer Agreement | |

| Annex 3.3(a) | Consent by JV (Holding) and BSN (GP) | |

| Annex 3.3(b) | Shareholder resolution BSN (GP) | |

| Annex 3.3(c) | Waiver by JV (Holding) and BSN (GP) | |

| Annex 3.4 | Pre-Closing Transfers | |

| Annex 4.1 | Purchase Price Calculation Mechanism and Calculation of Estimated Purchase Price | |

| Annex 4.2(a) | Form of Transfer Balance Sheet (listed as 4.2 in the Reference Deed) | |

| Annex 4.8(a)(i) | Specific Accounting Treatments | |

| Annex 5.4(e) | Holdings in BSN Group Companies by members of the Sellers’ Groups | |

| Annex 5.4(f) | Minority Holdings in BSN Group Companies by third parties | |

| Annex 5.4(g) | Draft Application Commercial Register for special legal succession | |

| Annex 6.2(a)(v) | Partnership Agreement of BSN KG and Articles of Association of BSN (GP) | |

| Annex 6.2(b) (i) | 2004 Individual BSN Accounts and 2004 Consolidated BSN Accounts (listed as 6.2 (b) in the Reference Deed) | |

| Annex 6.2(c)(i) | Real Property owned by BSN Group Companies | |

| Annex 6.2(c)(ii) | Real Property leased by BSN Group Companies as lessor or as lessee | |

| Annex 6.2(d)(i) | Intellectual Property Rights of BSN Group Companies | |

| Annex 6.2(d)(iii) | Employee Invention Issues | |

| Annex 6.2(f) | Material Agreements of BSN Group Companies | |

| Annex 6.2(g)(i) | Collective Bargaining Agreements of BSN Group Companies | |

| Annex 6.2(g)(ii) | Key Employees of BSN Group Companies | |

| Annex 6.2(h) | Insurance Policies of BSN Group Companies | |

| Annex 6.2(i) | Litigation with respect to BSN Group Companies | |

| Annex 6.2(j) | Exceptions to Ordinary Course of Operation | |

| Annex 6.2(k) | BSN Group - Pension Schemes | |

| Annex 6.3(a)(i) | Articles of Association of JV (Holding) | |

| Annex 6.5 (a) | List of Individuals relevant for Seller’s Knowledge (listed as 6.5 in the Reference Deed) | |

| Annex 7.2(a) | Aggregate liability of individual Sellers | |

| Annex 7.4 | List of Individuals relevant for Purchaser’s Knowledge | |

| Annex 9.2(b) | S&N UK Pension Indemnity | |

| Annex 14(a) | Undertaking of Montagu Equity Capital Limited | |

| Transfer Agreement | ||

| Exhibit 5.2(a) | Further Payment Details | |

| Exhibit 5.2(b) | Confirmation of Set-Off and Settlement Agreement | |

| Exhibit 5.3(b) | Release Agreement | |

| Annex 1 | Copy Overdraft Offer Document | |

| Annex 2 | Copy Deed of Pledge | |

| Exhibit 5.7 | Substitute Annex 2.2(a) Sale and Purchase Agreement | |

THIS AGREEMENT is made on 16 December 2005

AMONG:

| (1) | BEIERSDORF AG, whose registered office is at ▇▇▇▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ (“Beiersdorf” or “Seller 1”); |

| (2) | PRIMAVERA LUXEMBOURG INTERNATIONAL S.A., whose registered office is at ▇▇▇ ▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ (“Seller 2”); |

| (3) | ▇▇▇▇▇ & NEPHEW (OVERSEAS) LTD., whose registered office is at ▇▇ ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ (“Seller 3”); |

| (4) | ▇▇▇▇▇ & NEPHEW S.A.S, whose registered office is at ▇▇▇ ▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇ (“Seller 4”); |

| (5) | ▇▇▇▇▇ & NEPHEW S.A., whose registered office is at ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇, ▇/▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇-▇-▇, San ▇▇▇▇ Gespi – 08970, Barcelona, Spain (“Seller 5”); |

Seller 2, Seller 3, Seller 4, and Seller 5 are hereinafter collectively referred to as the “S&N Sellers” and each of them as an “S&N Seller”.

Seller 1, Seller 2, Seller 3, Seller 4, and Seller 5 are hereinafter collectively referred to as the “Sellers” and each of them as a “Seller”.

| (6) | ▇▇▇▇▇ & NEPHEW PLC, whose registered office is at ▇▇ ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ (“S&N PLC”); and |

| (7) | DEUKALION SECHZIGSTE VERMÖGENSVERWALTUNGS-GMBH, registered under HRB 75817 in Frankfurt am Main, with its registered office c/o: JF Vermögensverwaltungsgesellschaft mbH, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇ (the “Purchaser”). |

The Sellers, S&N PLC and the Purchaser are hereinafter collectively referred to as the “Parties”, and each of them as a “Party”.

RECITALS

| (A) | In ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ and S&N PLC combined certain parts of their respective professional medical businesses in the areas of wound care, phlebology and non-invasive orthopaedics (such business as currently conducted being referred to as the “Business”). The Business is carried out through a joint venture (the “Joint Venture”) in the form of a German limited partnership (GmbH & Co. Kommanditgesellschaft), BSN medical GmbH & Co. KG (“BSN KG”). BSN KG is resident and has its headquarters in Hamburg, Germany. The limited partners of BSN KG are Seller 1 and ▇▇▇▇▇ & Nephew JV (Holding) GmbH, Frankfurt am Main, Germany (“JV (Holding)”), a wholly-owned (indirect) subsidiary of S&N PLC held directly by Sellers 2 to 5. The general partner of BSN KG is BSN medical Management GmbH (“BSN (GP)”), a German limited liability company, resident and having its headquarters in Hamburg, Germany. BSN (GP) does not hold any interest in BSN KG’s capital or results (ohne Beteiligung am Vermögen oder Ertrag) Each of Seller 1 and JV (Holding) holds a 50 per cent. partnership interest in BSN KG and 50 per cent. of the shares in BSN (GP). |

| (B) | Seller 1 wishes to sell all of its interest in BSN KG and its share in BSN (GP), and the Purchaser wishes to acquire such interest and share. |

| (C) | Sellers 2 to 5 wish to sell all of their shares in JV (Holding), and the Purchaser wishes to acquire those shares and thereby acquire, together with the interest and share referred to at Recital (B), 100% of BSN KG and the Business. |

- 4 -

| (D) | The Purchaser, prior to entering into this agreement (the “Agreement”), has had made available to it due diligence materials supplied by the BSN Group as well as various due diligence reports prepared by advisers engaged by Beiersdorf and S&N PLC (together the “Data Room Information”) as well as the Vendor Legal Due Diligence Report prepared by Ashurst, Flick ▇▇▇▇▇ Schaumburg and various other law firms on behalf of the Sellers dated 7 December 2005 (the “Legal VDD Report”), the Vendor Financial and Tax Due Diligence Report prepared by KPMG on behalf of the Sellers dated 18 October 2005 (the “Financial Tax VDD Report”) and the Vendor Environmental Due Diligence Reports prepared by URS Corporation on behalf of the Sellers a list of which are set out in Annex (D)(ii) (the “Environmental VDD Reports”) (the Legal VDD Report, the Financial and Tax VDD Report and the Environmental VDD Reports collectively the “VDD Reports”) and has been given the opportunity to undertake a thorough review of the Business in the context of a competitive auction process in particular from a commercial, financial, pensions, environmental, intellectual property, tax and legal perspective. |

The VDD Reports are all stored on a CD-Rom for purposes of evidence which has been handed over for safe keeping to the acting notary. The Data Room Information (including the index thereto (the “Data Room Index”) is currently in the process of being stored on a CD-Rom and will be handed over for safe keeping to the acting notary for purpose of evidence, subject to the Sellers’ and the Purchaser’s prior approval.

THE PARTIES AGREE AS FOLLOWS:

| 1. | DEFINITIONS |

In this agreement the following expressions (when capitalised) have the following meanings unless the context otherwise requires:

| Expression |

Where defined | |

| “2004 Accounts” | Section 7.1(b)(i) | |

| “2004 BSN Accounts” | Section 6.2(b)(i) | |

| “2004 Consolidated BSN Accounts” | Section 6.2(b)(i) | |

| “2004 Individual BSN Accounts” | Section 6.2(b)(i) | |

| “2004 JV (Holding) Accounts” | Section 6.3(b)(i) | |

| “2005 BSN Accounts” | Section 5.8(a) | |

| “2005 JV (Holding) Accounts” | Section 6.3 (b)(ii) | |

| “Accounting Documents” | Section 4.9(a) | |

| “Acquisition” | Section 5.2(b) | |

| “Affiliated Companies” | Section 4.9(b) | |

| “Agreed Rate” | Section 4.10(a) | |

| “Agreement” | Recital (D) | |

| “ALTER EGO” | Section 8.3(a)(ix) | |

| “Associate” | Section 2.3 | |

| “Beiersdorf” | Parties’ section | |

- 5 -

| Expression |

Where defined | |

| “BSN (GP)” | Recital (A) | |

| “BSN (GP) Registered Share Capital” | Section 2.2(b) | |

| “BSN (GP) Shares” | Section 2.2(b) | |

| “BSN GAAP” | Section 4.8(a)(iii) | |

| “BSN Group” | Section 2.3 | |

| “BSN Group Companies” | Section 2.3 | |

| “BSN KG” | Recital (A) | |

| “BSN KG Interests” | Section 2.2(c) | |

| “BSN KG Registered Liability Capital” | Section 2.2(c) | |

| “BSN Management Accounts” | Section 6.2(b)(ii) | |

| “BSN medical Holding PL Agreement” | Section 2.4 | |

| “BSN Team” | Section 10.2(g) | |

| “Business” | Recital (A) | |

| “Business Day” | Section 17.4 | |

| “Capital Loss Account” | Section 2.2(c) | |

| “Cash” | Section 4.2(c) | |

| “Certain Funds Date” | Section 5.2(a) | |

| “Changed Circumstances” | Section 4.8(c) | |

| “Clearing Account” | Section 2.2(c) | |

| “Closing” | Section 5.1 | |

| “Closing Condition(s)” | Section 5.2 | |

| “Closing Date” | Section 5.1 | |

| “Data Room Index” | Recital (D) | |

| “Data Room Information” | Recital (D) | |

| “De Minimis Amount” | Section 7.3 | |

| “Draft Transfer Balance Sheet” | Section 4.7(a) | |

| “Environmental VDD Reports” | Recital (D) | |

| “Estimated Purchase Price” | Section 4.4 | |

| “Expected Tax Accrual” | 8.3(a)(i) | |

| “Financial and Tax VDD Report” | Recital (D) | |

- 6 -

| Expression |

Where defined | |

| “Financial Debt” | Section 4.2(d) | |

| “Fixed Capital Account” | Section 2.2(c) | |

| “German GAAP” | Section 4.8(b) | |

| “German Sale Trade Tax | Section 8.10(b) | |

| “Hyperion Balance Sheet” | Section 4.2(a) | |

| “IFRS” | Section 4.8(a) | |

| “Information Memorandum” | Section 6.4(b)(ii) | |

| “Information Providers” | Section 7.9 | |

| “Intellectual Property Rights” | Section 6.2(d)(i) | |

| “Joint Venture” | Recital (A) | |

| “JV (Holding)” | Recital (A) | |

| “JV (Holding) Clearing Account” | Section 2.2(c) | |

| “JV (Holding) Material Agreements” | Section 6.3(f) | |

| “JV (Holding) Purchase Price” | Section 4.2(f) | |

| “JV (Holding) Registered Share Capital” | Section 2.2(a) | |

| “JV (Holding) Shares” | Section 2.2(a) | |

| “JV (Holding) Transfer Accounts” | Section 4.7(c) | |

| “Key Employee(s)” | Section 6.2(g)(ii) | |

| “Legal VDD Report” | Recital (D) | |

| “Liability Cap” | Section 7.2(a) | |

| “Line Item Values” | Section 4.2(b) | |

| “Material Agreements” | Section 6.2(f) | |

| “Net Working Capital” | Section 4.2(e) | |

| “Notices” | Section 16.1 | |

| “Partnership Accounts” | Section 2.2(c) | |

| “Party(ies)” | Parties’ section | |

| “Pension Arrangements” | Section 4.2(h) | |

| “Pension Deficit” | Section 4.2(g) | |

| “Pension Schemes” | Section 6.2(k) | |

| “Pre-Transfer Date BSN Accounts” | Section 5.8(b) | |

- 7 -

| Expression |

Where defined | |

| “Pre-Transfer Date Dividends” | Section 3.1(b) | |

| “Purchase Price” | Section 4.1 | |

| “Purchase Price Adjustment” | Section 4.6(b) | |

| “Purchase Price Certificate” | Section 4.7(d) | |

| “Purchased Companies” | Section 2.2(d) | |

| “Purchased Companies’ Shares” | Section 2.2(d) | |

| “Purchaser” | Parties’ section | |

| “Purchaser’s Warranties” | Section 9.1 | |

| “Reference Net Working Capital” | Section 4.1(d) | |

| “Regulation” | Section 5.2(b) | |

| “Related Party Agreements” | Section 6.2(f)(v) | |

| “Relevant Companies” | Section 8.2(c) | |

| “Relevant Tax Period” | Section 8.1 | |

| “Review Period” | Section 4.9(a) | |

| “S&N PLC” | Parties’ section | |

| “S&N Sellers” | Parties’ section | |

| “S&N Sellers’ Knowledge” | Section 6.5(c) | |

| “S&N UK Pension Indemnity” | Section 9.2(b) | |

| “S&N Warranties” | Section 6.1 | |

| “Seller 1” | Parties’ section | |

| “Seller 1 BSN (GP) Share” | Section 2.2(b)(i) | |

| “Seller 1 BSN KG Interest” | Section 2.2(c)(i) | |

| “Seller 1 Clearing Account” | Section 2.2(c) | |

| “Seller 2” | Parties’ section | |

| “Seller 2 JV (Holding) Shares” | Section 2.2(a)(i) | |

| “Seller 3” | Parties’ section | |

| “Seller 3 JV (Holding) Shares” | Section 2.2(a)(ii) | |

| “Seller 4” | Parties’ section | |

| “Seller 4 JV (Holding) Share” | Section 2.2(a)(iii) | |

| “Seller 5” | Parties’ section | |

- 8 -

| Expression |

Where defined | |

| “Seller 5 JV (Holding) Share” |

Section 2.2(a)(iv) | |

| “Seller’s Knowledge” |

Section 6.5(a) | |

| “Sellers’ Warranties” |

Section 6.1 | |

| “Sellers” |

Parties’ section | |

| “Senior Employee” |

Section 10.2(j) | |

| “Signing Date” |

Section 6.1 | |

| “Subsidiary(ies)” |

Section 2.3 | |

| “Tax” |

Section 8.1 | |

| “Tax Contest” |

Section 8.6(b) | |

| “Taxing Authority” |

Section 8.1 | |

| “Third Party Claim” |

Section 7.5(b) | |

| “Threshold” |

Section 7.3 | |

| “Title Warranties” |

Section 7.2(a) | |

| “Transfer Agreement” |

Section 3.2 | |

| “Transfer Balance Sheet” |

Section 4.7(b) | |

| “Transfer Date” |

Section 4.3 | |

| “VDD Reports” |

Recital (D) | |

| 2. | CORPORATE OWNERSHIP/STRUCTURE OF THE ACQUISITION |

| 2.1 | Particulars of JV (Holding), BSN (GP) and BSN KG |

| (a) | JV (Holding) is a limited liability company (Gesellschaft mit beschränkter Haftung) organised under the laws of Germany with its registered office at Frankfurt am Main, Germany, and registered with the Commercial Register (Handelsregister) of the Lower Court (Amtsgericht) at Frankfurt am Main, Germany, under the registered number (Handelsregisternummer) HR B 50430. |

| (b) | BSN (GP) is a limited liability company (Gesellschaft mit beschränkter Haftung) organised under the laws of Germany with its registered office at Hamburg, Germany, and registered with the Commercial Register of the Lower Court at Hamburg, Germany, under the registered number HR B 78374. |

| (c) | BSN KG is a limited partnership (Kommanditgesellschaft) organised under the laws of Germany with its registered office at Hamburg, Germany, and registered with the Commercial Register of the Lower Court at Hamburg, Germany, under the registered number HR A 95551. |

- 9 -

| 2.2 | Capital of JV (Holding), BSN (GP) and BSN KG |

| (a) | The registered share capital (Stammkapital) of JV (Holding) amounts to EUR 50,133,750 (the “JV (Holding) Registered Share Capital”). The JV (Holding) Registered Share Capital is divided into the following shares (Geschäftsanteile), which are held by Sellers 2 to 5 as follows: |

| (i) | Primavera Luxembourg International S.A holds one JV (Holding) preference share in the nominal amount (Nennbetrag) of EUR 8,250 and two JV (Holding) ordinary shares in the nominal amount of EUR 25,000 and EUR 702,150 respectively (together the “Seller 2 JV (Holding) Shares”); |

| (ii) | ▇▇▇▇▇ & Nephew (Overseas) Limited holds four JV (Holding) preference shares in the nominal amounts of EUR 20,150, EUR 26,400, EUR 4,450 and EUR 23,300 respectively (the “Seller 3 JV (Holding) Shares”); |

| (iii) | ▇▇▇▇▇ & Nephew S.A. (France) holds one JV (Holding) preference share in the nominal amount of EUR 49,265,750 (the “Seller 4 JV (Holding) Share”); and |

| (iv) | ▇▇▇▇▇ & Nephew S.A. (Spain) holds one JV (Holding) preference share in the nominal amount of EUR 58,300 (the “Seller 5 JV (Holding) Share”) |

(the Seller 2 JV (Holding) Shares, the Seller 3 JV (Holding) Shares, the Seller 4 JV (Holding) Share, and the Seller 5 JV (Holding) Share being collectively referred to as the “JV (Holding) Shares”).

| (b) | The registered share capital of BSN (GP) amounts to EUR 25,000 (the “BSN (GP) Registered Share Capital”). The BSN (GP) Registered Share Capital is divided into the following two shares (hereinafter collectively referred to as the “BSN (GP) Shares”): |

| (i) | one BSN (GP) Share in the nominal amount of EUR 12,500 which is held by the Seller 1 (the “Seller 1 BSN (GP) Share”); and |

| (ii) | one BSN (GP) Share in the nominal amount of EUR 12,500 which is held by JV (Holding). |

| (c) | The registered liability capital (eingetragenes Kommanditkapital und zugleich Haftkapital) of BSN KG amounts to EUR 50,000,000 (the “BSN KG Registered Liability Capital”). The BSN KG Registered Liability Capital is divided into the following limited liability interests (Kommanditanteile) (collectively referred to as the “BSN KG Interests”): |

| (i) | one BSN KG Interest in the nominal amount of EUR 25,000,000 which is held by Seller 1 (hereinafter referred to as the “Seller 1 BSN KG Interest”); and |

| (ii) | one BSN KG Interest in the nominal amount of EUR 25,000,000 which is held by JV (Holding). |

BSN KG keeps records of partner’s accounts of the Seller 1 and JV (Holding). Each partner’s account consists of a fixed capital account (the “Fixed Capital Account”), which accounts for the nominal amount of each BSN KG Interest and additional amounts resulting from the formation of BSN KG, a capital loss account (the “Capital Loss Account”) and a clearing account (the “Clearing Account”). These three accounts are collectively referred to as the “Partnership Accounts”. The Clearing Account in the name of Seller 1 is referred to as the “Seller 1 Clearing Account” and the Clearing Account in the name of JV (Holding) is referred to as the “JV (Holding) Clearing Account”.

- 10 -

| (d) | JV (Holding), BSN (GP) and BSN KG are collectively referred to as the “Purchased Companies”. The JV (Holding) Shares, the Seller 1 BSN (GP) Share and the Seller 1 BSN KG Interest are collectively referred to as the “Purchased Companies’ Shares”. |

| 2.3 | Subsidiaries and Associate of BSN KG; BSN Group |

BSN KG holds shares or interests, directly or indirectly, in the wholly owned or majority-owned subsidiaries (i.e. direct and indirect holdings of more than 50%) as set out in Annex 2.3 (collectively the “Subsidiaries”, and each a “Subsidiary”) and in the associate (i.e. direct and indirect holdings of 50% or less) as set out in Annex 2.3 (the “Associate”). BSN KG and its Subsidiaries and Associate are collectively referred to as the “BSN Group” or the “BSN Group Companies”. Annex 2.3 sets out the structure of the Purchased Companies, the Subsidiaries and the Associate. The only Associate is Terumo BSN medical KK, Japan.

| 2.4 | Profit and Loss Pooling Agreement |

BSN KG and BSN medical Holding GmbH have entered into a profit and loss pooling agreement (Ergebnisabführungsvertrag) dated 5 October 2004 as amended on 1 December 2005 (the “BSN medical Holding PL Agreement”).

| 3. | SALE AND PURCHASE OF THE PURCHASED COMPANIES’ SHARES; RIGHTS TO PROFITS |

| 3.1 | Sale and Purchase of the Shares; Right to Profits |

| (a) | The Sellers hereby sell, and the Purchaser hereby purchases, with economic effect (wirtschaftlicher Wirkung) from the Transfer Date the Purchased Companies’ Shares, upon the terms and conditions of this Agreement, as follows: |

| (i) | Seller 1 sells to the Purchaser the Seller 1 BSN (GP) Share; |

| (ii) | Seller 1 sells to the Purchaser the Seller 1 BSN KG Interest (including any positive balances on its Fixed Capital Account and Capital Loss Account); |

| (iii) | Seller 2 sells to the Purchaser the Seller 2 JV (Holding) Shares; |

| (iv) | Seller 3 sells to the Purchaser the Seller 3 JV (Holding) Shares; |

| (v) | Seller 4 sells to the Purchaser the Seller 4 JV (Holding) Share; and |

| (vi) | Seller 5 sells to the Purchaser the Seller 5 JV (Holding) Share. |

The sale and purchase of the Purchased Companies’ Shares hereunder shall, subject to Section 3.1(b) below, include any and all rights (including rights to undistributed profits for periods prior to the Transfer Date) pertaining to the Purchased Companies’ Shares as at the Transfer Date. The sale and purchase of the Seller 1 BSN KG Interest encompasses the Seller 1 Clearing Account and any and all rights and obligations pertaining thereto (subject to Sections 9.2(b) and 9.2(c) below).

| (b) | The Purchased Companies, the BSN Group Companies and the Associate shall be entitled prior to the Transfer Date to distribute profits available for distribution under relevant laws in respect of any period up to the Transfer Date (the “Pre-Transfer Date Dividends”). |

- 11 -

| (c) | The Purchaser purchases the Purchased Companies’ Shares with the benefit of all undistributed profits (save only for the Pre-Transfer Dividends) and other income and benefits accrued up to, including and after the Transfer Date and subject to all obligations (including tax) incurred and risks associated in respect of the period after and including the Transfer Date. |

| 3.2 | Separate Transfer Document |

The Sellers and the Purchaser agree that the Purchased Companies’ Shares sold and purchased hereunder are not transferred by virtue of this Agreement but will be transferred with effect in rem (mit dinglicher Wirkung) at the Closing by means of a separate notarial transfer deed substantially in the form attached hereto as Annex 3.2 (the “Transfer Agreement”).

| 3.3 | Consents |

| (a) | Each of JV (Holding) as limited partner and BSN (GP) as general partner of BSN KG has given its consent to the sale and transfer of the Seller 1 BSN KG Interest by Seller 1 to the Purchaser as attached hereto as Annex 3.3(a). |

| (b) | Seller 1 and JV (Holding) as the sole shareholders of BSN (GP) have held a shareholders meeting (Gesellschafterversammlung) of BSN (GP) and resolved and declared to expressly consent to the sale and transfer of the Seller 1 BSN (GP) Share by Seller 1 to the Purchaser as attached hereto as Annex 3.3(b). |

| (c) | JV (Holding) and BSN (GP) have expressly waived any and all rights of first refusal as well as any and all other pre-emptive or similar rights it may have with respect to the sale and transfer of the Seller 1 BSN KG Interest and/or the Seller 1 BSN (GP) Share by Seller 1 to the Purchaser, as attached hereto as Annex 3.3(c). |

| 3.4 | Pre-Closing Transfers |

The Sellers undertake that, if so requested by Purchaser in writing, they will procure that the direct shareholders of those BSN Group Companies listed in Annex 3.4 shall immediately prior to the Closing sell and transfer on terms reasonably requested by the Purchaser and at the prices specified in Annex 3.4 (after complying with all applicable laws, including without limitation any employee and works council notification and consultation requirements) their entire shareholdings in such Companies to such directly or indirectly wholly-owned subsidiary of the Purchaser as the Purchaser may nominate in writing. The consideration for any such sale and transfer shall be left open on inter-company account. For the avoidance of doubt, these transfers shall be ignored and deemed not to have occurred for the purposes of the Transfer Balance Sheet and the calculation of the Purchase Price. Any such transfers shall be at the full risk and cost (including, without limitation, any resultant Taxes) of the Purchaser.

| 4. | PURCHASE PRICE; ESTIMATED PURCHASE PRICE; TRANSFER ACCOUNTING DOCUMENTS; CONDITIONS OF PAYMENT |

| 4.1 | Purchase Price |

The total purchase price (the “Purchase Price”) to be paid by the Purchaser for the items sold and purchased under Section 3.1(a) above shall be the aggregate of:

| (a) | the total enterprise value of the BSN Group and the Associate being fixed at EUR 1,030,000,000 (one billion and thirty million euros); |

minus

| (b) | the Financial Debt of the BSN Group as at the end of the day immediately preceding the Transfer Date and as derived from the Transfer Balance Sheet; |

- 12 -

plus

| (c) | the Cash of the BSN Group as at the end of the day immediately preceding the Transfer Date and as derived from the Transfer Balance Sheet; |

plus or minus

| (d) | the amount by which the Net Working Capital of the BSN Group as at the end of the day immediately preceding the Transfer Date and as derived from the Transfer Balance Sheet exceeds or (as the case may be) falls short of EUR 116,000,000 (one hundred and sixteen million euros) (the “Reference Net Working Capital”); |

plus

| (e) | EUR 12,500 in respect of the nominal amount of the Seller 1 BSN (GP) Share; |

plus or minus

| (f) | the JV (Holding) Purchase Price; |

minus

| (g) | the lower of the Pension Deficit and EUR 8,000,000 (eight million euros), |

and shall be finally determined on the basis of Section 4 and the purchase price calculation mechanism as set out in Annex 4.1., provided that there shall be no double-accounting of any asset or liability in (d) or (f) with, or representing, Cash or Financial Debt. Seller 1 will procure that there will be a nil balance on the Seller 1 Clearing Account and the S&N Sellers will procure that there will be a nil balance on the JV (Holding) Clearing Account, in each case as at the day immediately preceding the Transfer Date and at any time thereafter until Closing.

Annex 4.1 also contains estimates for the various items and an indicative calculation of the Estimated Purchase Price pursuant to Section 4.4 below on the basis of the latest forecast available at the Signing Date and an assumed Transfer Date of 1 January 2006.

The Parties hereby irrevocably agree that, for all purposes, and in particular (but without limitation) for purposes of Section 8.10 below (unless and to the extent another allocation is applied by the Tax authorities): (a) 85% of the sum of (i) the Purchase Price minus (ii) EUR 12,500 for the Seller 1 BSN (GP) Share, and minus (iii) the JV (Holding) Purchase Price is attributable to BSN KG’s (direct and indirect) participations in the Subsidiaries and the Associate and (b) the remaining 15% of the sum of (i) the Purchase Price minus (ii) EUR 12,500 for the Seller 1 BSN (GP) Share and minus (iii) the JV (Holding) Purchase Price is attributable to any and all other assets and liabilities of BSN KG.

| 4.2 | Defined Terms |

For the purpose of this Agreement:

| (a) | the “Hyperion Balance Sheet” means the detailed balance sheet prepared by region and by group for the purpose of preparation of the BSN Group’s annual or, as the case may be, quarterly accounts for the relevant date in accordance with BSN GAAP consistent with prior practice in the form set out in Annex 4.2(a) (with the exception of the columns headed “Net Working Capital” and “Net Financial Debt”); |

| (b) | “Line Item Values” means the respective values set out in column 3 of the Transfer Balance Sheet of the items set out in column 2 thereof (headed “Line Item”) (subject to the items in Annex 4.8(a)(i)); |

- 13 -

| (c) | “Cash” means the total Line Item Values of those items checked in column 5 of the Transfer Balance Sheet (headed “Net Financial Debt”) under the heading “Liquid Assets” in column 2 thereof (subject to the items in Annex 4.8(a)(i)); |

| (d) | “Financial Debt” means the total Line Item Values of all the items checked in column 5 of the Transfer Balance Sheet (headed “Net Financial Debt”) under the heading “Other Liabilities” in the Liabilities and Shareholders Equity Section thereof (subject to the items in Annex 4.8(a)(i)); |

| (e) | “Net Working Capital” means the total Line Item Values of the items checked in column 4 of the Transfer Balance Sheet (headed “Net Working Capital”) in the Assets section thereof less the total Line Item Values of the items checked in the said column 4 in the Liabilities and Shareholders’ Equity section thereof; |

| (f) | “JV (Holding) Purchase Price” means: |

| (i) | the face value of the receivable from S&N PLC as stated in the JV (Holding) Transfer Accounts; | |||

| plus | (ii) | the tax recoverable at the Transfer Date (but only up to a maximum of EUR 500,000 if the Transfer Date is 1 January 2006) as stated in the JV (Holding) Transfer Accounts; | ||

| plus | (iii) | cash at bank or in hand as stated in the JV (Holding) Transfer Accounts; | ||

| plus | (iv) | EUR 12,500 for its share in BSN (GP); | ||

| minus | (v) | EUR 8,422,350 in respect of the purchase price of the 11,723,000 preference shares in BSN medical Inc., Canada (if the purchase thereof takes place on or after the Transfer Date); | ||

| minus | (vi) | any amount paid by JV (Holding) under the S&N UK Pension Indemnity in accordance with Section 9.2(b) below on or after the Transfer Date or the amount due and payable in respect thereof, up to the Closing Date; | ||

| minus | (vii) | liabilities in respect of pensions (except to the extent taken into account in paragraph (vi) above), tax provisions and other creditors as stated in the JV (Holding) Transfer Accounts; | ||

| (g) | “Pension Deficit” means the aggregate for all defined benefit Pension Arrangements of the difference between the present value of the defined benefit obligation and the fair value of the plan assets, both calculated as at the Transfer Date, using methods and assumptions consistent with prior year financial statements, taking into account (a) the requirements of International Accounting Standard “Employee Benefits”, IAS 19 and reflecting relevant market conditions as at the Transfer Date. For the avoidance of doubt, any IAS 19 unrecognised actuarial gains and losses will be fully recognised in the Provision at the Transfer Date (no adoption of the actual gain/loss “corridor mechanism”) and no allowance will be made for redundancies arising in future; and (b) the results of full IAS 19 actuarial valuations of the defined benefit Pension Arrangements as at the Transfer Date, based on full and accurate member data and plan asset values at that date. If a liability to make a payment to the ▇▇▇▇▇ & Nephew UK Pension Scheme is provided for, a corresponding receivable shall be included to the extent of the amount due under the Pension Indemnity; |

| (h) | “Pension Arrangements” means each formal or informal agreement, arrangement, plan or policy for the provision of retirement, death, disability or other related benefits (including but not limited to any deferred compensation, termination indemnities and post-retirement health, medical and dental plans but excluding jubilee payments and old age part time payments (Altersteilzeit)) given |

- 14 -

| on or in connection with leaving service for and in respect of the employees, directors or former employees or directors of the BSN Group in respect of which any member of the BSN Group is under any present, future or contingent (e.g. survivor and/or dependants’ benefits) contractual or constructive liability at the Transfer Date). |

For convenience, reference is made to the S&N Sellers’ pre-Closing covenants with respect to JV (Holding) set out in Sections 10.2(a) and 10.2(m) below.

| 4.3 | The Transfer Date |

For all purposes of this Agreement, the “Transfer Date” shall be:

| (a) | 1 January 2006, 0.00 hrs, provided the Closing takes place in accordance with Section 5.1 below on or before 25 February 2006; or |

| (b) | 1 April 2006, 0.00 hrs, if the Closing has not taken place before 26 February 2006 and takes place in accordance with Section 5.1 below on or after 2 April 2006 and on or before 26 May 2006; or |

| (c) | 1 July 2006, 0.00 hrs, if the Closing has not taken place before 27 May 2006 and takes place in accordance with Section 5.1 below on or after 2 July 2006 and on or before 25 August 2006. |

If the Closing has not taken place before 25 August 2006, the Transfer Date shall be moved by one or more additional three-months periods to the first day of a calendar quarter until all Closing Conditions pursuant to Section 5.2 below are satisfied and the Closing can and does occur within a period of eight (8) weeks after such date, subject to a final backstop date for Closing of the date specified in Section 5.3.

| 4.4 | Estimated Purchase Price |

As of the date of this Agreement and based on the financial information provided by the Sellers to the Purchaser and assuming a Transfer Date of 1 January 2006, 0:00 hrs, the Parties have estimated that the Financial Debt, the Cash and the Net Working Capital in the Transfer Balance Sheet and the JV (Holding) Purchase Price will have the amounts set against them in each case as set forth in Annex 4.1, resulting in an estimated Purchase Price of EUR 978,921,500 (nine hundred and seventy-eight million, nine hundred and twenty-one thousand, five hundred euros) (the “Estimated Purchase Price”). If the Transfer Date as determined pursuant to Section 4.3 is expected to fall on a date other than 1 January 2006, Sellers shall no less than ten (10) Business Days prior to the anticipated Closing Date deliver to the Purchaser their good faith best estimate of the Financial Debt, the Cash, the Net Working Capital, the JV (Holding) Purchase Price, and the Estimated Purchase Price as at the proposed Transfer Date in writing, together with reasonable supporting financial information. If Purchaser disagrees with any item delivered by the Sellers, the Parties shall negotiate in good faith to agree such item and the Estimated Purchase Price no later than five (5) Business Days prior to the anticipated Closing Date. If no agreement is reached, the Estimated Purchase Price delivered by the Sellers pursuant to this Section 4.4 shall apply.

| 4.5 | Payment of the Purchase Price |

| (a) | If, on or before the Closing Date, the Accounting Documents are available and have been agreed by the Parties or are otherwise final and binding upon the Parties in accordance with Sections 4.7 to 4.9 below, the Purchase Price shall be calculated from those Accounting Documents and paid by the Purchaser to the Sellers at the Closing as specified in Section 5.4(c). |

| (b) | To the extent that not all of the Accounting Documents are available or are agreed by the Parties or are otherwise final and binding upon the Parties in accordance |

- 15 -

| with Sections 4.7 to 4.9 below at least five (5) Business Days before the Closing, the Estimated Purchase Price determined or agreed pursuant to Section 4.4 shall be paid by the Purchaser to the Sellers at the Closing. |

| (c) | If Section 4.5(b) applies, the Purchase Price shall be calculated and paid in accordance with the following provisions of this Section 4 and Section 5.4(c). |

| 4.6 | Purchase Price Adjustment |

| (a) | If the Purchase Price exceeds the Estimated Purchase Price, the Purchaser shall pay to the Sellers an amount equal to such excess; if it falls short of the Estimated Purchase Price, the Sellers shall pay to the Purchaser an amount equal to such shortfall. Whether there is such an excess or shortfall shall be determined in accordance with the procedure set out in Sections 4.7 to 4.9 below. |

| (b) | Any amount calculated in accordance with Section 4.6(a) above (hereinafter referred to as a “Purchase Price Adjustment”) shall be paid as follows: |

| (i) | Any Purchase Price Adjustment owed by the Purchaser to the Sellers shall be paid by the Purchaser within five (5) Business Days after the amount thereof has been determined under Section 4.7 to 4.9 into the respective Sellers’ accounts as nominated in accordance with Section 4.11(a). |

| (ii) | Any Purchase Price Adjustment owed by the Sellers shall be paid by the Sellers within five (5) Business Days after the amount thereof has been determined under Sections 4.7 to 4.9 below into the Purchaser’s account set forth as nominated in accordance with Section 4.11(b). |

| (c) | For the avoidance of doubt, it is expressly agreed that there will be no purchase price adjustments, for any reason whatsoever, with respect to the fixed enterprise value of the BSN Group and the Associate set out in Section 4.1(a) above. |

| (d) | Any payments under this Section 4.6: |

| (i) | to the Sellers, shall be paid as to 50 per cent. to Seller 1 and as to 50 per cent. to Seller 2; |

| (ii) | to the Purchaser, shall be paid as to 50 per cent. by Seller 1 and as to 50 per cent. by Seller 2. |

| 4.7 | Preparation of Draft Transfer Balance Sheet |

| (a) | The Sellers jointly, and/or (after the Closing) the Purchaser in accordance with any Sellers’ joint instructions, shall instruct and cause the management of each of BSN (GP) and the BSN Group Companies to prepare and deliver pursuant to Section 4.7(b) within twenty (20) Business Days of the Transfer Date and in accordance with the accounting principles and treatments set out or referred to in Section 4.8 below consolidated financial statements of BSN KG and its Subsidiaries and (to the extent and in the manner consolidated in the 2004 Consolidated BSN Accounts) associates (provided, however, that BSN medical Venezuela (including its subsidiaries BSN medical Latin America LLC and Laboratorios Ball CA) have become wholly-owned subsidiaries and, thus, shall be fully consolidated) including, without limitation, the Hyperion Balance Sheet used in the preparation of the same (together the “Draft Transfer Balance Sheet”) as at the end of the day immediately preceding the Transfer Date and, if that is 31 December 2005, with respect to the year 2005, or, if the Transfer Date is a later date, with respect to the period commencing on 01 January 2006 and ending at the end of the day immediately preceding the Transfer Date as if those accounts were year end accounts. |

- 16 -

| (b) | Once the Draft Transfer Balance Sheet has been prepared in accordance with Section 4.7(a) it will be delivered without undue delay to the Sellers who shall use the same (with any necessary adjustments) to prepare a balance sheet in the form set out in Annex 4.2(a) (the “Transfer Balance Sheet”) in accordance with the treatments and principles set out or referred to in Section 4.8 below and with line items therein checked as indicated in Annex 4.2(a) under the headings “Net Working Capital” and “Net Financial Debt”. The Purchaser (post-Closing) shall procure that the Sellers and their advisers shall have all such access to the management, employees, accounting records and other financial information of the Purchased Companies, the BSN Group and (to the extent possible) the Associate as is reasonably necessary for the purpose of preparation of the Transfer Balance Sheet and shall allow the Sellers to take copies of all such documents for such purpose. |

| (c) | S&N PLC shall also prepare financial statements for JV (Holding) as at the end of the day immediately preceding the Transfer Date and, if that is 31 December 2005, with respect to the year 2005, or, if the Transfer Date is a later date, with respect to the period commencing on 1 January 2006 and ending at the end of the day immediately preceding the Transfer Date as if those accounts were year end accounts (the “JV (Holding) Transfer Accounts”). If the JV (Holding) Transfer Accounts have not been prepared (as set out above) prior to the Closing, the Purchaser shall procure that such preparation shall be carried out by the BSN Group Companies as instructed by S&N PLC in accordance with the above, save for mandatory accounting requirements under applicable law and subject to correction of manifest errors. |

| (d) | The Sellers shall deliver the Transfer Balance Sheet and the JV (Holding) Transfer Accounts to the Purchaser without undue delay and in any event within twenty (20) Business Days after receipt of the Draft Transfer Balance Sheet pursuant to Section 4.7(b) together with a calculation of: |

| (i) | the Financial Debt; |

| (ii) | the Cash; |

| (iii) | the Net Working Capital; |

| (iv) | the JV (Holding) Purchase Price; and |

| (v) | the Purchase Price, |

in each case in accordance with Sections 4.1 to 4.8 as derived from the information contained in the Transfer Balance Sheet and the JV (Holding) Transfer Accounts (the “Purchase Price Certificate”). Without prejudice to Section 15, all costs of the BSN Group Companies arising out of or in connection with the preparation of the Draft Transfer Balance Sheet shall be borne by BSN KG, all costs arising out of or in connection with the Transfer Balance Sheet shall be borne by Seller 1 (as to 50%) and the S&N Sellers (as to 50%), and all costs arising out of or in connection with the JV (Holding) Transfer Accounts shall be borne by the S&N Sellers.

| 4.8 | Basis of preparation of Draft Transfer Balance Sheet and Transfer Balance Sheet |

| (a) | The Draft Transfer Balance Sheet and the Transfer Balance Sheet shall be prepared: |

| (i) | in accordance with the specific accounting treatments set out in Annex 4.8(a)(i); and, subject thereto, |

| (ii) | in accordance with IFRS (as defined below); |

- 17 -

| (iii) | adopting the same accounting principles, policies, treatments, classifications and categorisations as were used in the preparation of the 2004 Consolidated BSN Accounts, as there applied, including in relation to the exercise of accounting discretion and judgment (“BSN GAAP”); |

For the avoidance of doubt, paragraph (i) shall take precedence over paragraphs (ii) and (iii) and paragraph (ii) shall take precedence over paragraph (iii).

For the purpose of this Agreement “IFRS” means the body of pronouncements issued by the International Accounting Standards Board (IASB) as adopted for use in the European Union further to the IAS Regulation (EC 1606/2002), including International Financial Reporting Standards and interpretations approved by the IASB, International Accounting Standards and Standing Interpretations Committee interpretations approved by the predecessor International Accounting Standards Committee as in force and applied at the date of this Agreement.

| (b) | The JV (Holding) Transfer Accounts shall be prepared adopting the same accounting principles, policies, treatments, classifications and categorisations as were used in the preparation of the 2004 JV (Holding) Accounts, as there applied, including in relation to the exercise of accounting discretion and judgment and, subject thereto, in accordance with those generally accepted in Germany (“German GAAP”) and as supplemented by BSN GAAP. |

| (c) | The cut-off for taking account of facts, circumstances, assessments and prospects arising or becoming known after Closing (together referred to as “Changed Circumstances”) for the purpose of the Draft Transfer Balance Sheet and the Transfer Balance Sheet shall be the day of receipt of the Accounting Documents (as defined below) by the Purchaser. Any Changed Circumstances resulting from or in connection with the sale of the Purchased Companies and the actions of the Purchaser towards the BSN Group and the Business or JV (Holding) after Closing and any transfers requested under Section 3.4 above shall be ignored in preparing the Draft Transfer Balance Sheet and the Transfer Balance Sheet. |

| 4.9 | Review of Accounting Documents |

| (a) | The Purchaser (including, without limitation, advisers engaged by it) shall be entitled to review the Transfer Balance Sheet, the Hyperion Balance Sheet, the JV (Holding) Transfer Accounts and the Purchase Price Certificate (together the “Accounting Documents”) within twenty (20) Business Days of the later of receipt of the Accounting Documents and receipt of the 2005 BSN Accounts and (if any) the Pre-Transfer Date BSN Accounts (the “Review Period”). Any objections to the Accounting Documents shall be notified to all of the Sellers specifying in writing each individual item and reason(s) for such objection(s), together with written quantification of each item in dispute. If the Purchaser does not duly notify any objections to the Accounting Documents within the Review Period, the Accounting Documents shall become final and binding upon the Parties upon expiration of the Review Period. All costs arising out of or in connection with the review shall be borne by the reviewing party alone. |

| (b) | The Parties and their advisers shall have full access to the management, employees, accounting records and other financial information of the Purchased Companies, the BSN Group Companies including (to the extent possible) the Associate (including in each case personnel, records and information maintained or held by the Sellers, S&N PLC or any of their Affiliated Companies and their respective accountants and other advisers) as is reasonably necessary for the review of the Accounting Documents in accordance with Section 4.9(a) above. The Sellers shall, and shall procure that their affiliated companies within the meaning of Section 15 et seq. of the German Stock Corporation Act (Aktiengesetz) (“Affiliated Companies”) and advisers shall grant such access and permit the taking of copies for such purpose and the Sellers jointly, and (after Closing) the Purchaser, shall procure that the Purchased Companies and the BSN Group Companies grant such access and permit the taking of copies for such purpose. |

- 18 -

| (c) | In the event that the Purchaser notifies any objections to the Accounting Documents, the Purchaser, Seller 1 and S&N PLC (on behalf of Seller 2-5) shall then attempt to reach an agreement on the treatment of such objections. Any amendments unanimously agreed upon by the Purchaser, Seller 1 and S&N PLC (on behalf of Sellers 2-5) shall be incorporated for documentary purposes into the Accounting Documents affected by those amendments. To the extent that such unanimous amendments are made, the Accounting Documents shall become final and binding upon all Parties. |

| (d) | Any objections upon which the Purchaser, Seller 1 and S&N PLC (on behalf of Sellers 2-5) do not reach an agreement according to Section 4.9(c) above shall be decided upon by a written expert opinion (Schiedsgutachten) in accordance with Section 317 Sub-section 1 of the German Civil Code (Bürgerliches Gesetzbuch) from an expert to be appointed unanimously by the Purchaser, Seller 1 and S&N PLC (on behalf of Sellers 2-5) which shall be final and binding upon all Parties (Schiedsgutachter). Section 4.9(b) above shall apply to the expert process mutatis mutandis. The accounting treatments and principles set out or referred to in Section 4.8 above will be binding upon the expert. The expert’s opinion shall only be within the range of the opinions of the Parties. |

| (e) | If all of the Parties do not agree upon the expert within ten (10) Business Days after receipt of notice from the Party requiring the appointment, then the expert shall be appointed upon the request of either of Seller 1 or S&N PLC (on behalf of Sellers 2-5) and/or the Purchaser, as the case may be, by the Chairman of the Board of the German Institute of Public Auditors in Germany (Vorsitzender des Vorstands des Instituts der Wirtschaftsprüfer in Deutschland e.V.) in Düsseldorf, Germany. The expert shall not have been previously, or be currently, retained or employed by any of the Parties or by any of their Affiliated Companies. The expert shall be an accountant from a major international accountancy firm. |

| (f) | Upon request by the expert, the Parties shall make an appropriate advance payment in respect of the costs and expenses of the expert which shall be borne as to 25% by Seller 1, as to 25% by the S&N Sellers jointly and as to 50% by the Purchaser. The expert may decide in its equitable discretion (nach billigem Ermessen) upon the final allocation of the costs and expenses (including the costs of the Parties’ advisers and counsel), taking into account (amongst other things) the degree of success or otherwise of the respective Party and the reasonableness of the respective Parties in adopting any particular line of argument; any expert appointed shall adjudicate on its own without engaging any other experts or advisers, save that it may take legal advice on the interpretation of any provision of this Agreement. |

| (g) | Any balance sheet assessments or valuations or other determinations contained in a final and binding expert’s opinion within the scope of the expert’s mandate shall become final and binding upon all Parties upon receipt of the written expert’s opinion by all Parties and shall be incorporated for documentary purposes by the expert into the Accounting Document(s) affected by such determinations. |

| 4.10 | Due Date; Increased Purchase Price and Default Interest |

| (a) | The Estimated Purchase Price or (if known at Closing) the Purchase Price as the case may be increased by an amount equal to notional interest at a rate of 2 percentage points per annum over three months EURIBOR (as published in the Handelsblatt on the morning of the first day of each consecutive 3 month period (the “Agreed Rate”) from and including the Transfer Date to and including the Closing Date. Such additional amount shall be payable at Closing. |

- 19 -

| (b) | The additional amount to be paid under Section 4.10(a) shall be calculated by reference to notional interest on a daily basis on the basis of actual days elapsed and a calendar year of 360 days. |

| (c) | Any payment obligations of the Parties under this Agreement shall (without affecting the right of the Parties to further damages) bear default interest at the rate of 2 percentage points per annum over the Agreed Rate. Such interest shall be payable on demand. |

| 4.11 | Payments |

| (a) | The Purchase Price or any Purchase Price Adjustment, as the case may be, to be paid by the Purchaser to the Sellers, as the case may be, shall be paid in Euros by way of wire transfer - to be credited on the same day - free of any costs and fees to the payor’s bank, irrevocably and without any reservations (unwiderruflich und vorbehaltlos) to those accounts nominated by the respective Seller(s) to the Purchaser in writing at least five (5) Business Days prior to the due date for such payment. |

| (b) | Any Purchase Price Adjustment or other sum to be paid by any of the Sellers hereunder shall be paid in Euros by way of wire transfer - to be credited on the same day - free of any costs and fees of the payor’s bank, irrevocably and without any reservations (unwiderruflich und vorbehaltlos), into an account to be nominated by the Purchaser to the respective Seller in writing at least five (5) Business Days prior to the due date for payment. |

| 4.12 | No Right to Set-off |

Any right of the Purchaser to set-off and/or to withhold any payments due under or in connection with this Agreement is hereby expressly waived and excluded except for claims which are expressly agreed by the respective Seller to be undisputed or finally adjudicated (res iudicatae; rechtskräftig entschieden).

| 5. | CLOSING; CLOSING CONDITIONS |

| 5.1 | Closing; Closing Date |

The consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place at the offices of Flick ▇▇▇▇▇ Schaumburg, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇ ▇ ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇.

| (a) | on the fifth Business Day after the last of the Closing Conditions set forth in Section 5.2 below has been fulfilled or waived by all of the Parties entitled to waive the same, provided the Closing would take place after the Transfer Date (pursuant to Section 4.3 above); or |

| (b) | if pursuant to Section 5.1(a) above (but for the proviso) the Closing would take place prior to the Transfer Date, the Closing shall instead take place on the first Business Day following the Transfer Date; or |

| (c) | at any other time or place which all of the Sellers and the Purchaser mutually agree upon |

(the day on which Closing occurs in accordance with this Agreement being referred to as the “Closing Date”). Closing shall not take place prior to 12 February 2006 if at that time the 2005 BSN Accounts have not been prepared pursuant to Section 5.8 below unless the Sellers otherwise agree.

- 20 -

| 5.2 | Closing Conditions |

The obligations of the Sellers and the Purchaser to carry out the Closing shall be subject to satisfaction or waiver by the Party entitled to such waiver (in the manner set out in Section 5.5 below) of each of the following conditions to Closing (collectively the “Closing Conditions”, and each a “Closing Condition”):

| (a) | If Closing has not occurred on or before 31 May 2006 (the “Certain Funds Date”), the Purchaser having sufficient financing available on terms satisfactory to it (acting reasonably) for it to be able to pay the Purchase Price, any additional amount due under Section 4.10 above and otherwise to meet its obligations under or in connection with this Agreement, provided that if such financing is available on the terms of the commitments referred to in Section 9.1 (e) below (including, for the avoidance of doubt, finance within the parameters of the market flex referred to in those documents) this condition shall be deemed to have been satisfied. |

| (b) | The European Commission shall have cleared the acquisition of the Purchased Companies’ Shares by the Purchaser in the manner provided for in this Agreement (the “Acquisition”). This condition shall be deemed satisfied if the European Commission (i) has declared the concentration compatible with the Common Market pursuant to Article 6 Section 1 lit. b, Article 6 Section 2, Article 8 Section 1 or Article 8 Section 2 of the Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (hereinafter referred to as the “Regulation”) on an unconditional basis or subject only to such conditions or obligations that are acceptable to Purchaser (acting reasonably) or (ii) the concentration is deemed declared compatible with the Common Market pursuant to Article 10 Section 6 of the Regulation. |

| (c) | Any applicable waiting period under the United States ▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇ Antitrust Improvements Act 1976 (as amended) and the regulations made thereunder relating to the Acquisition shall have expired or been terminated. |

| (d) | The South African Competition Authorities (which for the purposes of this Agreement means, collectively, the Competition Commission, the Competition Tribunal and the Competition Appeal Court, established under and in terms of sections 19, 26 and 36 of the Competition Act, Number 89 of 1998 (as amended), respectively) shall have approved the Acquisition on an unconditional basis or subject only to conditions or obligations as may be acceptable to the Purchaser (acting reasonably). |

| (e) | The Mexican Federal Antitrust Commission (Comision Federal de Competencia or “CFC”) shall have cleared the Acquisition on an unconditional basis or subject only to such conditions or obligations as may be acceptable to the Purchaser (acting reasonably); provided, however, that the Closing Condition in this Section 5.2(e) shall be deemed satisfied if, once the Acquisition has been notified to the CFC, any applicable waiting period to obtain a resolution from the CFC, under the Mexican Federal Antitrust Law (Ley Federal de Competencia Economica) and the regulations made thereunder, shall have expired. |

| 5.3 | Consequences of Failure to Close |

| (a) | If Closing has not occurred, at the latest, by 25 August 2006 the Sellers (jointly) or the Purchaser may rescind this Agreement (Rücktritt vom Vertrag) by written notice to the other Parties with a copy to the acting notary. If this Agreement is rescinded in accordance with this Section 5.3(a), this Agreement shall cease to have force and effect for all Parties and shall not create any binding obligation between the Parties except that Sections 12 (Confidentiality), 14 (Guarantees), 15 (Costs and Taxes), 16 (Notices) and 17 (Miscellaneous) and Section 5.3(b) shall remain in force and effect and such rescission shall be without prejudice to any claim that any party may have for breach of its obligations hereunder prior to such rescission. |

- 21 -

| (b) | If the Closing has not occurred as a result of any of the Closing Condition(s) set out in Section 5.2 above not being satisfied as a result of any breach or non-fulfilment by the Purchaser of its obligations hereunder, the Purchaser shall in full and final settlement of all claims and to the exclusion of any further claims for damages reimburse to the Sellers all out-of-pocket fees, costs and expenses incurred in connection with the sale or proposed sale of the Purchased Companies’ Shares, including the out-of-pocket costs of the auction process, the preparation of legal and financial due diligence, the preparation and negotiation of this Agreement with the Purchaser and other parties and the fees, costs and expenses of all advisers in connection with all of the foregoing. The Purchaser’s liability under this Section 5.3(b) shall be capped at EUR 10,000,000. |

| 5.4 | Actions on the Closing Date |

On the Closing Date and immediately prior to the Closing, the Sellers shall procure the transfer of the entire share capital of such entities as may be specified by Purchaser under Section 3.4 above to the nominated transferees in accordance with Section 3.4 on transfers as set out in Annex 3.4. Thereafter, at the Closing, the Parties shall simultaneously (Zug um Zug) take the following actions:

| (a) | The Sellers shall deliver to the Purchaser duly executed resignation letters, effective at or prior to the Closing Date, of the members of JV (Holding)’s management board (Geschäftsführung) and of the members of the Partners Committee with respect to BSN KG and BSN (GP). |

| (b) | The Sellers and JV (Holding), as the case may be and to the extent they are shareholders of the respective companies, shall hold shareholders’ meetings of each of JV (Holding), BSN KG and BSN (GP) and pass shareholders’ resolutions granting exoneration (Entlastung) to each of the management board members of JV (Holding), BSN KG and BSN (GP) as well as to each of the members of the Partners Committee for any period ending prior to or on the Closing Date. |

| (c) | The Purchaser shall pay the Purchase Price or (as the case may be in accordance with Section 4.5 above) the Estimated Purchase Price together with the amount determined in accordance with Section 4.10 above as to 50 per cent. to Seller 1 and as to 50 per cent. to the S&N Sellers (in respect of which Sellers 3, 4 and 5 shall be entitled to receive EUR 74,300, EUR 49,265,750 and EUR 58,300 respectively and Seller 2 shall be entitled to receive the balance). |

| (d) | Each of the Sellers shall transfer the Purchased Companies’ Shares sold by such Seller under this Agreement, in each case to the Purchaser or as it may (in respect of all or any of the Purchased Companies’ Shares) otherwise direct by way of the Transfer Agreement. |

| (e) | The Sellers shall procure the transfer to the Purchaser or as it may direct by means of transfers in the agreed form, of all shares in any of the BSN Group Companies owned by the Sellers or any person or company within their respective groups. No further consideration shall be payable by the Purchaser for such transfers. A list of these shareholdings is set out in Annex 5.4(e). |

| (f) | The Sellers shall use all reasonable endeavours (both before and, if applicable, after Closing) to procure, upon the Purchaser’s request, the transfer to the Purchaser or as it may direct by means of transfers in the agreed form of all those shares in those BSN Group Companies that are owned by persons other than the BSN Group Companies or the Sellers or companies in their respective groups and that are set out in Annex 5.4(f). No further consideration shall be payable by the Purchaser for such transfers. |

| (g) | Seller 1 and the Purchaser shall, and Seller 1 and the S&N Sellers shall procure that JV (Holding) and BSN (GP) shall, sign the application for registration of the |

- 22 -

| withdrawal of Seller 1 as limited partner in BSN KG and the acquisition by the Purchaser (and/or its nominee) of the Seller 1 BSN KG Interest by the Purchaser by means of a special legal succession (Sonderrechtsnachfolge) substantially in the form set forth in Annex 5.4(g) which shall be certified by the acting notary. The Parties will instruct the acting notary to file such application for registration with the Commercial Register of the Local Court of Hamburg, Germany, subsequent to presentation of proof of the receipt of the Purchase Price or (as the case may be in accordance with Section 4.5 above) the Estimated Purchase Price by the Sellers as evidenced by execution of the Closing Memorandum. |

| (h) | The Sellers shall deliver to the Purchaser duly executed releases of all security interests granted by the Sellers in respect of borrowings or other financial debt over the Purchased Companies’ Shares, if any, (or, in the absence thereof, shall declare that there are no such security interests) or by the BSN Group Companies over any of their assets, conditional only upon repayment of the underlying debt obligation and otherwise on terms reasonably satisfactory to the Purchaser. |

| (i) | The S&N Sellers shall deliver to Purchaser the original S&N UK Pension Indemnity (as defined in Section 9.2(b)). |

| (j) | The Parties shall enter into, or shall procure that their respective Affiliated Companies enter into, “hold separate” arrangements, if any, in accordance with Section 10.1(b) below. |

| (k) | The Parties shall sign a Closing Memorandum recording the satisfaction or waiver, as the case may be, of the Closing Conditions, recording the steps taken to achieve Closing and confirming that Closing has taken place. |

| 5.5 | Simultaneous Closing |

Closing shall not occur unless

| (a) | all of the matters in Section 5.4 (other than Section 5.4(f)) above occur or are waived by all Parties; and |

| (b) | if Closing has not occurred by the Certain Funds Date, the Closing Condition in Section 5.2(a) has been satisfied or has been waived by the Purchaser (and prior to the Certain Funds Date the said Closing Condition shall be ignored for the purpose of this Section 5.5 and Section 5.2); and |

| (c) | the Closing Conditions in Sections 5.2(b) to (e) above have been satisfied or to the extent permitted by law waived by all the Parties. |

For the avoidance of doubt, if any of the actions under Section 5.4(f) above does not take place, no Party shall be entitled to refuse the consummation of the other actions under Section 5.4 above in order to effect the Closing.

| 5.6 | Change of Control Provisions |

| (a) | Each of the Sellers irrevocably waives and shall procure the waiver by its Affiliated Companies of (in each case conditional upon Closing taking place) the operation of any provision of any of the Related Party Agreements that would take effect upon the change in control of the Purchased Companies as a result of this Agreement and shall not exercise any right it may have under such provisions in the course of the transactions contemplated by this Agreement or upon the making of any changes to the internal corporate group structure carried out by the Purchaser and the BSN Group Companies after the Closing provided the Purchaser gives the relevant Seller prior notice thereof. The foregoing waiver and undertaking is given by Beiersdorf on behalf of itself and each of its Affiliated Companies and by S&N PLC on behalf of itself and each of its Affiliated Companies, in each case in favour of the Purchaser, BSN KG and each of the BSN Group Companies. |

- 23 -

| (b) | The Sellers (up to Closing) and the Purchaser (after Closing) shall procure that (in each case conditional upon Closing taking place) neither BSN KG nor any of its Subsidiaries exercises any rights that it may have under any such change of control provisions under the Related Party Agreements in the course of the transactions contemplated by this Agreement or upon the making of any changes to the internal corporate group structure carried out by the Purchaser and the BSN Group Companies after the Closing. |

| 5.7 | The Associate |

The Sellers shall assist the Purchaser in obtaining all such duly executed consents, waivers and declarations from the third party shareholder of the Associate as the Purchaser may reasonably require to ensure the continuation of the existing BSN Group structure post-Closing, provided however, that a failure to do so, for whatever reason, does not release any Party from its obligation to effect the Closing under this Agreement.

| 5.8 | The 2005 BSN Accounts |

The Sellers (but with respect of JV (Holding) the S&N Sellers only) shall procure that

| (a) | the statutory consolidated financial statements of BSN KG and the statutory financial statements of JV (Holding), BSN (GP) and each of the BSN Group Companies for the financial period ending on 31 December 2005 (together the “2005 BSN Accounts”) are (i) prepared in accordance with applicable accounting standards and statutory requirements and consistent with past practice, (ii) audited and certified without qualification and (iii) finally approved (festgestellt) by the respective shareholders’ meeting or any other corporate body responsible therefor or by Seller 1 and S&N PLC; and |

| (b) | if the Transfer Date is after 1 January 2006 consolidated financial statements of BSN KG and financial statements of JV (Holding), BSN (GP) and each of the BSN Group Companies for the financial period commencing on 1 January 2006 and ending on the day immediately preceding the Transfer Date (together the “Pre-Transfer Date BSN Accounts”) are (i) prepared in accordance with applicable accounting standards and statutory requirements and in consistence with past practice as if those were year-end statements and (ii) finally approved (festgestellt) by the respective shareholders’ meeting or any other corporate body responsible therefor or by Seller 1 and S&N PLC. |

If the 2005 BSN Accounts or the Pre-Transfer Date BSN Accounts, as the case may be, have not been prepared, audited (to the extent applicable) and/or approved (as set out above) prior to the Closing, the Purchaser shall procure that such preparation, audit and/or approval shall be carried out by the BSN Group Companies as instructed by the Sellers in accordance with the above save for mandatory accounting requirements under applicable law and subject to correction of manifest error.

| 6. | SELLERS’ WARRANTIES |

| 6.1 | Form and Scope of Sellers’ Warranties |

Each Seller hereby severally (but not jointly) warrants to the Purchaser by way of an independent promise of guarantee pursuant to Section 311 Sub-Section 1 of the German Civil Code (selbständiges Garantieversprechen im Sinne des § 311 Abs. 1 BGB) within the scope and subject to the requirements and limitations provided in Section 7 hereof or otherwise in this Agreement that the statements set forth in this Section 6 (the “Sellers’ Warranties”) are correct as of the date of this Agreement (the “Signing Date”) and, in the case of the Title Warranties, at the Closing and, in the case of the Sellers Warranties

- 24 -

set out in Sections 6.2(b)(iii) and 6.3(b)(ii), at the date delivered to the Purchaser save that the Sellers’ Warranties set out in Section 6.3 (the “S&N Warranties”) are given by the S&N Sellers only. The Sellers and the Purchaser agree that the Sellers’ Warranties are not granted, and shall not be qualified and construed as, quality guarantees concerning the object of the purchase (Garantien für die Beschaffenheit der Sache) within the meaning of Sections 443, 444 of the German Civil Code. With the exception of the Warranties contained in Section 6.2(a)(iv), the terms “BSN Group Companies” and “BSN Group” in this Section 6 shall not include the Associate.

| 6.2 | Sellers’ Warranties |

| (a) | Corporate Status and Authority |

| (i) | Each Seller and S&N PLC is duly incorporated and validly existing under the laws of Germany, Luxembourg, England, France and Spain respectively and each has all requisite corporate power and authority to own its assets and to carry out its business. |

| (ii) | The execution and performance by the Sellers and S&N PLC of this Agreement and the consummation of the transactions contemplated hereby are within the corporate powers of the Sellers and have been duly authorised by all necessary corporate action on part of the Sellers. |

| (iii) | The execution and performance by each Seller and S&N PLC of this Agreement and the consummation of the transactions contemplated herein do not (i) violate their respective articles of association or by-laws or (ii) violate any applicable law, regulation, judgement, injunction or order binding on that Seller or S&N PLC as the case may be, and (iii) there is no action, law suit, investigation or proceeding pending against, or, to the Seller’s Knowledge of, threatened against, any Seller or S&N PLC before any court, arbitration panel or governmental authority which in any manner challenges or seeks to prevent, alter or delay the transactions contemplated herein. |

| (iv) | The statements in Section 2 above regarding the BSN Group Companies and BSN (GP) are correct. All the outstanding shares of the BSN Group Companies identified in Annex 2.3 as being owned by a BSN Group Company have been validly issued, are fully paid in, either in cash or in kind, have not been repaid and are free from any encumbrances or other rights of third parties, and, with the exception of the Associate (in respect of which details have been disclosed to the Purchaser), there are no pre-emptive rights, options, voting arrangements or other rights of third parties to acquire any of the shares of any of the BSN Group Companies, in each case except under statutory law or under the articles of association of such entities. |

| (v) | The BSN KG and BSN (GP) have been duly established and are validly existing under German law. Annex 6.2(a)(v) contains a true and correct list of the partnership agreement of BSN KG and of the articles of association of BSN (GP). The BSN KG Interests and the BSN (GP) Shares have been validly issued, are fully paid in, either in cash or in kind, have not been repaid and are free from any encumbrances or other rights of third parties, and there are no pre-emptive rights, options, voting arrangements or other rights of third parties to acquire any of the BSN KG Interests and the BSN (GP) Shares, in each case except under statutory law or under the articles of association listed in Annex 6.2(a)(v). |

| (vi) | Subject to Sections 3.3 and 5.2 above, Seller 1 is entitled to freely dispose of the Seller 1 BSN KG Interest and the Seller 1 BSN (GP) Share without such disposal infringing any rights of a third party. |

- 25 -

| (vii) | None of BSN KG, BSN (GP) or the other BSN Group Companies is insolvent or over indebted (überschuldet). No bankruptcy, insolvency or judicial composition proceedings concerning any of BSN KG, BSN (GP) or the other BN Group Companies have been applied for by any of those companies or any of the Sellers or any third party. |

| (b) | Financial Statements |

| (i) | Prior to the Signing Date, the Sellers have delivered to the Purchaser the audited financial statements of BSN KG for the fiscal year ended 31 December 2004 (the “2004 Individual BSN Accounts”) and the audited consolidated financial statements of BSN KG for the fiscal year ended 31 December 2004 (the “2004 Consolidated BSN Accounts”) attached as Annex 6.2(b)(i) (together including all notes thereon the “2004 BSN Accounts”). The 2004 Individual BSN Accounts have been prepared, as of 31 December 2004, in accordance with German GAAP as supplemented by BSN GAAP and present a true and fair view, within the meaning of Section 264 Sub-Section 2 of the German Commercial Code (Handelsgesetzbuch), of the assets and liabilities (Vermögenslage), financial condition (Finanzlage) and results of operations (Ertragslage) of BSN KG for the period referenced therein. The 2004 Consolidated BSN Accounts have been prepared, as of their date, in accordance with IFRS as supplemented by BSN GAAP consistently applied and present a true and fair view of the assets and liabilities, financial condition and results of operations of the BSN Group on a consolidated basis for the period and as at the date referenced therein. |

| (ii) | The Sellers have delivered to the Purchaser the consolidated management accounts as at and to 31 October 2005 for the BSN Group (the “BSN Management Accounts”). The BSN Management Accounts, with the exception of any forecasts or projections contained therein, have been carefully and diligently prepared in accordance with BSN GAAP on a consistent basis with prior periods, are derived from the accounting records and systems of the BSN Group, and reflect fairly in all material respects the items and positions set out therein. |

| (iii) | The 2005 BSN Accounts and the Pre-Transfer Date BSN Accounts, if applicable, will when prepared, audited, certified (the latter two only with regard to the 2005 BSN Accounts) and finally approved (festgestellt) in accordance with Section 5.8 have been prepared in accordance with the applicable accounting standards and statutory requirements, consistently applied, and present a true and fair view of the assets and liabilities, financial condition and results of operations of the BSN Group on a consolidated basis or the respective BSN Group Company on an individual basis for the period and as at the date referenced therein. |

| (c) | Real Property |

To the Seller’s Knowledge,

| (i) | Annex 6.2(c)(i) contains a complete list of real property owned by the BSN Group Companies; |

| (ii) | Annex 6.2(c)(ii) contains a complete list of real property leased or rented by the BSN Group Companies as of the Signing Date, whether as lessee or as lessor, where the respective lessee’s payment obligations under the relevant lease agreement exceeds a value of EUR 100,000 per annum and where the lease agreement cannot be terminated by the respective BSN Group Company on 12 months’ notice or less without penalty; and |

- 26 -

| (iii) | any other real property used by the BSN Group Companies for manufacturing but not listed in Annex 6.2(c)(i) and Annex 6.2(c)(ii) is not material for the operation of the Business. |

| (d) | Intellectual Property Rights |

To the Seller’s Knowledge

| (i) | All trademarks and designs (including applications therefor) set out in Annex 6.2(d)(i) and all those patents and utility models (including applications therefor) set out in Annex 6.2(d)(i), as well as the patent families derived from them, including but not limited to all continuations, continuations-in-part, divisionals and re-examinations thereof, are either owned by the BSN Group Companies or used by them on the basis of valid licence agreements in respect of which, to the Sellers’ Knowledge, no notices of termination has been given or received by the respective BSN Group Company (hereinafter referred to as the “Intellectual Property Rights”); other than the Intellectual Property Rights, there are no intellectual property rights which are material to the Business; and the Intellectual Property Rights owned by any of the BSN Group Companies are validly existing and are duly registered in the name of the relevant BSN Group Company and to Seller’s Knowledge no third party is materially infringing the Intellectual Property Rights, nor does BSN Group’s use of the Intellectual Property Rights materially infringe any third party’s intellectual property rights; |

| (ii) | except as disclosed to the Purchaser prior to the Signing Date, the Intellectual Property Rights are not subject to any pending proceedings for opposition, cancellation, revocation or rectification which may negatively materially affect the operation of the Business nor to Seller’s Knowledge are they being materially infringed by third parties. To the Seller’s knowledge, all fees necessary to maintain the Intellectual Property Rights owned by any BSN Group Company have been paid, all necessary renewal applications have been filed and all other material steps necessary for their maintenance have been taken; |

| (iii) | except as set out in Annex 6.2(d)(iii) all material inventions underlying the Intellectual Property Rights owned by any BSN Group Company and made by employees of any of the BSN Group Companies have been duly claimed and remunerated (when due) in accordance with applicable laws. |

| (e) | Compliance with Permits |