FIFTH AMENDED AND RESTATED MASTER LETTER OF CREDIT FACILITY AGREEMENT

Exhibit 10.2

FIFTH AMENDED AND RESTATED MASTER LETTER OF CREDIT FACILITY

AGREEMENT

This Fifth Amended and Restated Master Letter of Credit Facility Agreement (this "Agreement") is entered into at Columbus, Ohio, as of the 30th day of September, 2014 (the “Effective Date”), by and between U.S. BANK NATIONAL ASSOCIATION, a national banking association (the "Bank"), and M/I HOMES, INC., an Ohio corporation (the "Company").

1. | Letter of Credit Facility. |

1.1. Generally. Subject to the terms and conditions hereof, Bank, upon the proper application by the Company, will issue standby letters of credit in the form of Exhibit "A" attached hereto, or such other form as the Bank may approve from time to time (each, a "Letter of Credit" and collectively, “Letters of Credit”), provided that the aggregate stated value of Letters of Credit issued hereunder and under the Superseded Agreements (as hereinafter defined) outstanding at any one time shall in no event exceed $10,000,000.00 (the "Facility"), and provided, further, that all Letters of Credit issued under this Section 1.1 shall expire not later than thirty-seven (37) months from the date of issuance. The Company's right to obtain the issuance of Letters of Credit under the Facility shall terminate on September 30, 2015.

Each request for a Letter of Credit submitted by the Company shall, at the option of the Bank, be accompanied by the following materials (collectively, the "LC Application Materials"):

a. | An application (the "Application") in the form of Exhibit "B" attached hereto and made a part hereof, or such other form as the Bank may require from time to time; |

b. | Cash (the "Cash Collateral") in an amount equal to not less than 101% of the face amount of the applicable Letter of Credit, which the Bank shall deposit in an Account (hereinafter defined); |

c. | Such information as the Bank reasonably requests regarding the intended use of the Letter of Credit; |

d. | Such other documents or materials as the Bank may request from time to time. |

With respect to each request for the issuance of a Letter of Credit, the Company shall present the LC Application Materials to the Bank not later than noon, Columbus, Ohio time, on a Business Day that is not less than four (4) Business Days prior to the Business Day on which issuance of the Letter of Credit is desired. "Business Day" means a day which is not a Saturday or Sunday or a legal holiday and on which the Bank is not required by law or other governmental action to close in Ohio.

Each Letter of Credit issued by the Bank shall be deemed issued subject to the following:

a. | The executed reimbursement agreement (the "Reimbursement Agreement") dated July 27, 2009, and attached hereto as Exhibit "C"; and |

b. | The executed security agreement (the "Security Agreement") dated July 27, 2009, and attached hereto as Exhibit "D". |

At the request of the Company, and subject to the terms and conditions of this Agreement, the Bank shall issue Letters of Credit on behalf of one or more Company Subsidiaries (hereinafter defined), provided, however, that the applicable Company Subsidiary(ies) and the Company shall be jointly and severally liable for all obligations pursuant to this Agreement, the Reimbursement Agreement, and the other Loan Documents.

Notwithstanding anything in the Reimbursement Agreement to the contrary, to the extent that any provision of this Agreement or the Security Agreement is inconsistent with the Reimbursement Agreement, the terms of this Agreement and the Security Agreement shall prevail. Specifically, without limitation: (i) the security interest granted by the Company to the Bank pursuant to the Reimbursement Agreement shall be limited to the Collateral (as defined in the Security Agreement), and the Bank shall not file any financing statement that contains a collateral description that is broader than such definition of Collateral, and (ii) except for the Collateral and the Cash Collateral, as to which the Bank’s rights shall include all rights contained in this Agreement, the Reimbursement Agreement and the Security Agreement, the Bank shall not set off or apply any deposits (general or special, time or demand, provisional or final) at any time held or other indebtedness at any time owing by Bank to or for the credit or the account of the Company.

1.2 Account(s). The Bank shall deposit the Cash Collateral in one or more accounts at the Bank specified in the Security Agreement (each, an "Account"). Each Account shall be an interest bearing account (unless the Company requests a non-interest bearing account) satisfactory to the Bank, including as of the Effective Date, without limitation, money market accounts and commercial paper open accounts. The Cash Collateral applicable to a given Letter of Credit shall be held in the Account until the earlier of (a) the occurrence of a draw pursuant to the Letter of Credit, or (b) the expiration of the Letter of Credit. Upon the expiration of a Letter of Credit, provided that no draws have been made upon such Letter of Credit, Bank shall remit to the Company an amount equal to the Cash Collateral together with any interest earned thereon.

1.3 Letter of Credit Draws. In the event that the Bank pays any sum (a "LC Draw Amount") drawn by the beneficiary of an outstanding Letter of Credit (a "LC Draw"), interest shall immediately start to accrue on the LC Draw Amount at the Adjusted One Month LIBOR Rate (hereinafter defined), and such interest shall continue to accrue until reimbursement in full to the Bank. In the event that the LC Draw Amount (together with accrued interest) has not been repaid to Bank within ten (10) Business Days, then the Bank may, without further notice to the Company and at Bank’s sole option, reimburse itself from the Account applicable to the Letter of Credit. In the event that the funds contained in the Account are not sufficient to reimburse the Bank for the LC Draw Amount plus accrued interest, the Bank shall have the right to declare any remaining funds due and payable by written notice to the Company. Such funds shall continue to bear interest at the Adjusted One Month LIBOR Rate until fully repaid by the Company.

2. | Interest Rate; Fees. |

2.1. Adjusted One Month LIBOR Rate. As used herein, "Adjusted One Month LIBOR Rate" shall mean an annual rate equal to two and one-half percent (2.50%) plus the greater of: (a) the One-Month LIBOR Rate, or (b) one and one-half percent (1.50%). "One Month LIBOR Rate" shall mean the one-month LIBOR rate quoted by the Bank from Reuters Screen LIBOR01 Page or any successor thereto, which shall be that one-month LIBOR rate in effect two New York Banking Days prior to the Reprice Date, adjusted for any reserve requirement and any subsequent costs arising from a change in government regulation, such rate rounded up to the nearest one-sixteenth percent and such rate to be reset monthly on each Reprice Date. The term "New York Banking Day" means any date (other than a Saturday or Sunday) on which commercial banks are open for business in New York, New York. The term "Reprice Date" means the first day of each month. If an LC Draw occurs other than on the Reprice Date, the initial one-month LIBOR rate shall be that one-month LIBOR rate in effect two New York Banking Days prior to the date of the LC Draw, which rate plus the percentage described above shall be in effect until the next Reprice Date. Lender’s internal records of applicable interest rates shall be determinative in the absence of manifest error.

2.2. Fees, Costs, Expenses. In consideration of the issuance of each Letter of Credit, the Company agrees to pay to the Bank, for the sole benefit of the Bank, Bank's customary letter of credit negotiation and documentation fees (which fees shall not exceed $500.00 for each Letter of Credit), all such fees being due and payable at the time of issuance of such Letter of Credit.

With respect to the period through September 30, 2014, the Company also agrees to pay to the Bank a fee (which shall accrue on a daily basis, but be due and payable quarterly in arrears upon the issuance of a statement to the Company by the Bank) equal to the sum of (a) an amount equal to an annualized rate of one and one-half percent (1.50%) on the daily outstanding balance of all Letters of Credit pursuant to the Facility during such calendar quarter; and (b) an amount equal to an annualized rate of one-quarter of one percent (0.25%) on the daily unused portion of the Facility during such calendar quarter (i.e., $10,000,000.00 minus the daily outstanding balance of all Letters of Credit pursuant to the Facility).

With respect to the period after September 30, 2014 through September 30, 2015, the Company also agrees to pay to the Bank a fee (which shall accrue on a daily basis, but be due and payable quarterly in arrears upon the issuance of a statement to the Company by the Bank) equal to the sum of (a) an amount equal to an annualized rate of one and one-half percent (1.50%) on the daily outstanding balance of all Letters of Credit pursuant to the Facility during such calendar quarter; and (b) an amount equal to an annualized rate of one-quarter of one percent (0.25%) on the daily unused portion of the Facility during such calendar quarter (i.e., $10,000,000.00 minus the daily outstanding balance of all Letters of Credit pursuant to the Facility).

With respect to the period following September 30, 2015, the Company shall, in addition, pay to the Bank a variable fee (which shall be due and payable quarterly in arrears upon the issuance of a statement to the Company by the Bank) equal to an annualized rate of one and one-half percent (1.50%) on the average daily outstanding balance of all Letters of Credit pursuant to the Facility

during such calendar quarter; such quarterly payments shall continue until a quarter occurs when there are no such outstanding Letters of Credit.

Additionally, the Company agrees to pay on demand by the Bank all other reasonable and actual costs and expenses incidental to or incurred in connection with (a) the Facility and the preparation of this Agreement and the other Loan Documents (as hereinafter defined), and any subsequent amendments or modifications thereof, (b) the enforcement of the rights of the Bank in connection therewith, and (c) any litigation, contest, dispute, proceeding or action in any way relating to the Collateral (as hereinafter defined), this Agreement or the other Loan Documents, whether any of the foregoing are incurred prior to or after maturity, the occurrence of an Event of Default, or the rendering of a judgment. Such costs and expenses shall include, but not be limited to, reasonable attorneys' fees and out-of-pocket expenses of the Bank. All indebtedness, debts and liabilities, including, without limitation, principal, interest, indemnification obligations, prepayment fees, late charges, collection costs, attorneys' fees and expenses, of the Company to the Bank arising under or in connection with this Agreement or the other Loan Documents are hereafter referred to collectively as the "Obligations.")

Upon the occurrence of an Event of Default as defined in Section 6.1, the payment of any fees, costs and expenses set forth in this Section 2.2 may be charged (via automatic debit) by the Bank to any Account.

All fees shall be fully earned by the Bank, as applicable, pursuant to the foregoing provisions of this Agreement on the due date thereof and, except as otherwise set forth herein or required by applicable law, shall not be subject to rebate, refund or proration. All fees provided for in this Section 2.2 shall be deemed to be for compensation for services and are not, and shall not be deemed to be, interest or any other charge for the use, forbearance or detention of money.

2.3 Letter of Credit Reserves. If any change in any law or regulation or in the interpretation or application thereof by any court or other governmental authority charged with the administration thereof shall either (a) impose, modify, deem or make applicable any reserve, special deposit, assessment or similar requirements against Letters of Credit issued by the Bank, or (b) impose on the Bank any other condition regarding this Agreement or the Facility, and the result of any event referred to in clause (a) or (b) above shall be to increase the cost to the Bank of issuing or maintaining any Letter of Credit or the Facility (which increase in cost shall be the result of the Bank's reasonable allocation of the aggregate of such cost increases resulting from such events), then, upon demand by the Bank, the Company shall immediately pay to the Bank additional amounts which shall be sufficient to compensate the Bank for such increased cost, together with interest on each such amount from the date demanded until payment in full thereof at a rate per annum equal to the Adjusted Daily LIBOR Rate. A certificate as to such increased cost incurred by the Bank, submitted by the Bank to the Company, shall be conclusive, absent manifest error, as to the amount thereof. This provision shall survive the termination of this Agreement and shall remain in full force and effect until there is no existing or future obligation of the Bank under any Letter of Credit.

2.4 Further Assurances. The Company hereby agrees to do and perform any and all acts and to execute any and all further instruments reasonably requested by the Bank more fully to effect the purposes of this Agreement and the issuance of Letters of Credit hereunder, and further agrees

to execute any and all instruments reasonably requested by the Bank in connection with the obtaining and/or maintaining of any insurance coverage applicable to any Letter of Credit.

3. Warranties and Representations. In order to induce the Bank to enter into this Agreement and to make the Facility available to the Company, the Company warrants and represents to the Bank that each of the following statements is true and correct:

3.1. Corporate Organization and Authority. The Company (a) is a corporation duly organized, validly existing and in good standing under the laws of the State of Ohio; (b) has all requisite corporate power and authority and all necessary licenses and permits to own and operate its properties and to carry on its business as now conducted and as presently proposed to be conducted; and (c) is not doing business or conducting any activity in any jurisdiction in which it has not duly qualified and become authorized to do business, except where the failure to so qualify will not have a Material Adverse Effect. "Material Adverse Effect" means a material adverse effect upon (i) the business (present or future), condition (financial or otherwise), operations, performance or properties of the Company, (ii) the ability of the Company to perform its obligations under this Agreement, the Reimbursement Agreement, the Security Agreement and/or the other documents contemplated herein or therein and/or executed in connection herewith or therewith, any mortgage, any guaranty, or any other agreement or instrument (collectively, the "Loan Documents"), or (iii) the rights and remedies of the Bank under the Loan Documents.

3.2. Borrowing is Legal and Authorized. (a) The Executive Committee of the Board of Directors of the Company has duly authorized the execution and delivery of the Loan Documents, and the Loan Documents constitute valid and binding obligations of the Company enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency, moratorium and other similar laws affecting creditors' rights generally; and (b) the execution of the Loan Documents and the compliance by the Company with the applicable provisions thereof (i) are within the corporate powers of the Company, and (ii) are legal and will not conflict with, result in any breach in any of the provisions of, constitute a default under, or result in the creation of any lien or encumbrance upon any property of the Company under the provisions of, any agreement, charter instrument, bylaw or other instrument to which the Company is a party or by which it is bound.

3.3. Taxes. All tax returns required to be filed by the Company in any jurisdiction have in fact been filed, and all taxes, estimated payments, assessments, fees and other governmental charges or levies upon the Company, or upon any of its property or assets or in respect of its franchises, businesses or income, which are due and payable have been paid, except those (a) contested in good faith by the Company, by appropriate proceedings diligently instituted and conducted, and (b) with respect to which any reserve or other appropriate provision, as shall be required in accordance with generally accepted accounting principles consistently applied ("GAAP"), shall have been made therefor. The Company does not know of any proposed additional tax assessment against it. The accruals for taxes on the books of the Company for its current fiscal period are adequate.

3.4. Compliance with Law. The Company is not in violation of any laws, ordinances, governmental rules or regulations to which it is subject, except to the extent that such a violation or failure does not have or is not likely to have a Material Adverse Effect.

3.5. Litigation; Adverse Effects. There is no action, suit, audit, proceeding, administrative proceeding, investigation or arbitration (or series of related actions, suits, audits, proceedings, investigations or arbitrations) before or by any governmental authority or private arbitrator pending or, to the knowledge of the Company, threatened against the Company or any property of the Company challenging the validity or the enforceability of any of the Loan Documents, or which, if adversely determined, shall have or is reasonably likely to have a Material Adverse Effect. The Company is not subject to or in default with respect to any final judgment, writ, injunction, restraining order or order of any nature, decree, rule or regulation of any court or governmental authority, in each case which shall have or is likely to have a Material Adverse Effect.

3.6. No Insolvency. On the date of this Agreement and after giving effect to all indebtedness of the Company, the Company (a) will be able to pay its obligations as they become due and payable; (b) has assets, the present fair saleable value of which exceeds the amount that will be required to pay its probable liability on its obligations as the same become absolute and matured; (c) has sufficient property, the sum of which at a fair valuation exceeds all of the Company's indebtedness; and (d) will have sufficient capital to engage in its business. The determination of the foregoing for the Company takes into account all of the Company's properties and liabilities, regardless of whether, or the amount at which, any such property or liability is included on a balance sheet of the Company prepared in accordance with GAAP, including property such as contingent contribution or subrogation rights, business prospects and goodwill. The determination of the sum of the Company's properties at the present fair salable value has been made on a going concern basis.

3.7. Government Consent. Neither the nature of the Company or of its business or properties, nor any relationship between the Company and any other entity or person, nor any circumstance in connection with the execution of this Agreement, is such as to require a consent, approval or authorization of, or filing, registration or qualification with, any governmental authority on the part of the Company as a condition to the execution and delivery of the Loan Documents.

3.8. No Defaults. No event has occurred and no condition exists which would constitute an Event of Default pursuant to this Agreement. The Company is not in violation in any respect of any term of any material agreement, charter instrument, bylaw or other material instrument to which it is a party or by which it may be bound, which violation would have a Material Adverse Effect.

3.9. Warranties and Representations. On the date of the issuance of any Letter of Credit pursuant to the Facility, the warranties and representations set forth in this Section 3 shall be true and correct on and as of such date with the same effect as though such warranties and representations had been made on and as of such date, except to the extent that such warranties and representations expressly relate to an earlier date.

4. Company Business Covenants. The Company covenants that on and after the date of this Agreement until terminated pursuant to the terms of this Agreement, or so long as any of the indebtedness provided for herein remains unpaid:

4.1. Payment of Taxes. The Company shall pay all taxes, estimated payments, assessments and governmental charges or levies imposed upon it or its property or assets or in respect of any of its franchises, businesses, income or property before any penalty or interest accrues thereon; provided, however, that no such taxes, estimated payments, assessments and governmental charges are required to be paid if being contested in good faith by the Company, by appropriate proceedings diligently instituted and conducted, without any of the same becoming a lien upon the Cash Collateral, and if such reserve or other appropriate provision, if any, as shall be required in accordance with GAAP, shall have been made therefor.

4.2. Maintenance of Properties and Corporate Existence. The Company shall do or cause to be done all things necessary (i) to preserve and keep in full force and effect its existence, rights and franchises, and (ii) to maintain its status as a corporation duly organized and existing and in good standing under the laws of the state of its organization.

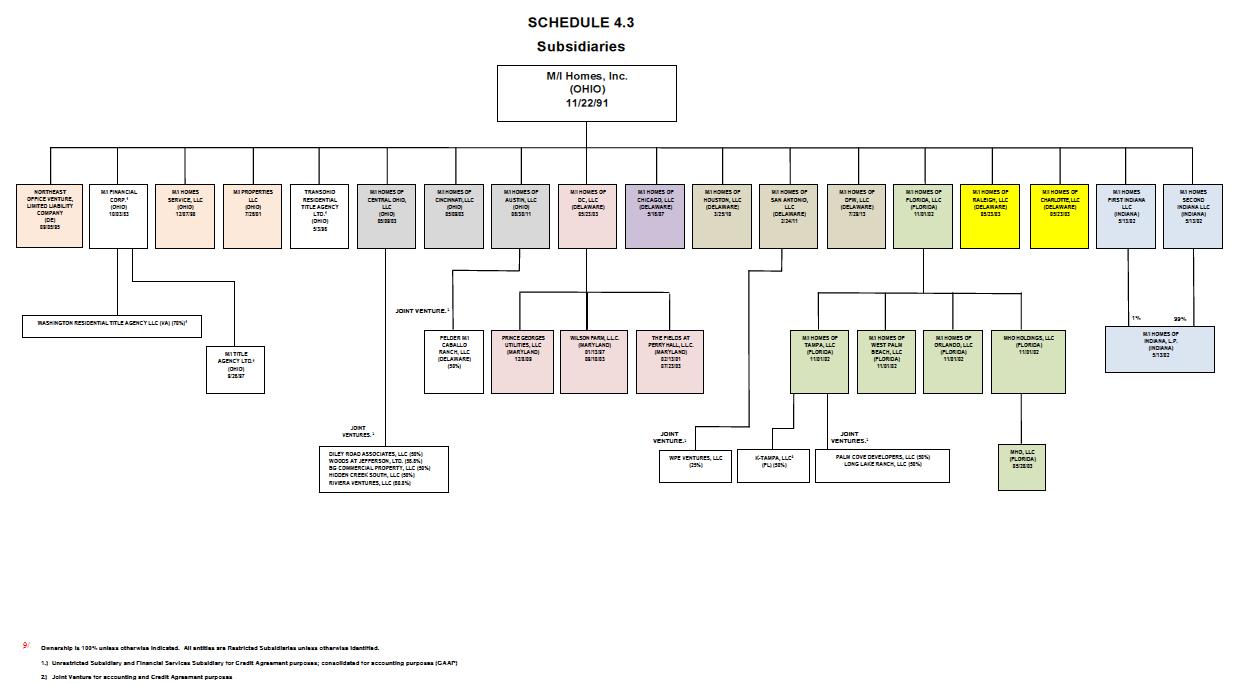

4.3. Subsidiaries. Except as disclosed in Schedule 4.3 attached hereto as amended from time to time (the "Company Subsidiaries"), the Company has no wholly-owned subsidiaries and conducts business only in the name of the Company. The Company will promptly notify the Bank upon the creation of any additional Company Subsidiaries; provided, that so long as Bank is a lender in the Company’s primary credit agreement, notices to Bank as lender as required under such credit agreement of the creation of any additional Company Subsidiaries shall satisfy the requirements of this Section 4.3.

5. Financial Information and Reporting. As long as the Company is listed on the New York Stock Exchange, is publicly traded and timely Securities and Exchange Commission filings for the Company are generally available on XXXXX Online, the Company will have no additional financial information or reporting requirements hereunder, but if any of the foregoing shall cease to be true, then at the request of the Bank, the Company shall provide such tax returns and other financial information and reports as the Bank may from time to time reasonably require.

6. Default.

6.1. Events of Default. Each of the following shall constitute an "Event of Default" hereunder: (a) the Company fails to make any payment of fees, principal or interest in connection with this Agreement when due; (b) the Company fails to perform or observe any covenant contained in Sections 1, 2, 3, 4 or 5 of this Agreement; (c) the Company fails to comply with any other provision of this Agreement or (subject to any shorter cure period as may be set forth in any of the following agreements) any provision contained in any security agreement, reimbursement agreement or other agreement now or hereafter executed by the Company in connection with the Facility in favor of the Bank, and such failure continues for more than 10 days after such failure shall first become known to any officer of the Company; (d) any warranty, representation or other statement by or on behalf of the Company contained in this Agreement or in any other Loan Document or in any instrument or certificate furnished in compliance with or in reference hereto or thereto is false or misleading in any material respect; (e) the Company becomes insolvent or makes an assignment for the benefit of creditors, or consents to the appointment of a trustee, receiver or liquidator; (f) bankruptcy, reorganization, composition, arrangement, insolvency, dissolution or liquidation

proceedings are instituted by the Company, or bankruptcy, reorganization, composition, arrangement, insolvency, dissolution or liquidation proceedings are instituted against the Company which are not stayed or dismissed within 60 days; (g) the default by Company or any Company Subsidiary with respect to any Obligation or indebtedness to the Bank; or (h) a Change of Control of the Company shall have occurred.

For purposes of this Agreement, a "Change of Control" of the Company shall mean any of the following: (a) any Person or group (as that term is understood under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations thereunder) shall have acquired beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of a percentage (based on voting power, in the event different classes of stock shall have different voting powers) of the voting stock of the Company equal to at least fifty percent (50%); or (b) as of any date a majority of the Board of Directors of the Company consists of individuals who were not either (i) directors of the Company as of the corresponding date of the previous year, (ii) selected or nominated to become directors by the Board of Directors of the Company of which a majority consisted of individuals described in clause (b)(i) above or (iii) selected or nominated to become directors by the Board of Directors of the Company of which a majority consisted of individuals described in clause (b)(i) above and individuals described in clause (b)(ii) above. For purposes of the definition of “Change of Control,” “Person” shall mean shall mean an individual, a partnership (including without limitation a joint venture), a limited liability company (including without limitation a joint venture), a corporation (including without limitation a joint venture), a business trust, a joint stock company, a trust, an unincorporated association or any other entity of whatever nature (including without limitation a joint venture).

6.2. Default Remedies. If an Event of Default exists, the Bank may immediately exercise any right, power or remedy permitted to the Bank by law or any provision of this Agreement and the Security Agreement, provided that any outstanding Letter of Credit for which the Bank has Cash Collateral in accordance with the requirements of this Agreement and the Security Agreement shall remain in full force and effect in accordance with its terms, subject to the Bank’s rights pursuant to this Agreement and the Security Agreement with respect to the Cash Collateral that secures such Letter of Credit. In addition, following the occurrence of an Event of Default, the Bank shall have no further obligation to issue additional Letters of Credit pursuant to the Facility.

7. Miscellaneous.

7.1. Notices. All communications under the Loan Documents shall be in writing and shall be mailed by certified mail, postage prepaid, or sent by commercial overnight courier:

(i) if to the Bank, at the following address, or at such other address as may have been furnished in writing to the Company by the Bank:

U.S. Bank National Association

00 Xxxx Xxxxx Xxxxxx, 00xx Xxxxx

Xxxxxxxx, Xxxx 00000

Attn: Commercial Real Estate

(ii) if to the Company, at the following address, or at such other address as may have been furnished in writing to the Bank by the Company:

M/I Homes, Inc.

0 Xxxxxx Xxxx

Xxxxxxxx, Xxxx 00000

Attn: Chief Financial Officer

(b) Any notice so addressed and stamped, if mailed by certified mail, shall be deemed to be given on the second business day following the postmark date, or if sent by commercial overnight courier, shall be deemed to be given when delivered.

7.2. Successors and Assigns. This Agreement and the Loan Documents shall inure to the benefit of and be binding upon the heirs, successors and assigns of each of the parties. Notwithstanding the foregoing, the Company shall not have the right to assign its rights or obligations under this Agreement or the Loan Documents.

7.3. Entire Agreement. The Loan Documents embody the entire agreement and understanding between the Company and the Bank and supersede all prior agreements and understandings between the Company and the Bank relating to the subject matter thereof.

7.4. Reinstatement. Notwithstanding any other provision of this Agreement, all of the rights, claims, interests and authorizations in favor of the Bank under this Agreement shall be reinstated and revived, and all of such rights, claims, interests and authorizations shall be fully enforceable, if at any time any amount paid to the Bank or any of their respective affiliates on account of any Obligation is thereafter required to be restored or returned by the Bank as a result of the bankruptcy, insolvency or reorganization of the Company, or any other person, or as a result of any other fact or circumstance, all as though such amount had not been paid.

7.5. Amendment and Waiver; Duplicate Originals. All references to this Agreement and the other Loan Documents shall also include all amendments, extensions, renewals, modifications and substitutions thereto and thereof. The provisions of this Agreement and the other Loan Documents may be amended, and the observance of any term of this Agreement and the other Loan Documents may be waived, with (and only with) the written consent of the Company and the Bank; provided, however that nothing herein shall change the sole discretion of the Bank (as set forth elsewhere in this Agreement) to make advances, determinations, decisions or to take or refrain from taking other actions. Two or more duplicate originals of this Agreement may be signed by the parties, each of which shall be an original but all of which together shall constitute one and the same instrument. This Agreement amends, restates, releases and supersedes that certain Master Letter of Credit Facility Agreement by and between the Bank and the Company dated as of July 27, 2009, that certain Amended and Restated Master Letter of Credit Facility Agreement by and between the Bank and the Company dated as of August 16, 2010, that certain Second Amended and Restated Master Letter of Credit Facility Agreement by and between the Bank and the Company dated as of September 30, 2011, that certain Third Amended and Restated Master Letter of Credit Facility Agreement by and between the Bank and the Company dated as of September 30, 2012, and that

certain Fourth Amended and Restated Master Letter of Credit Facility Agreement by and between the Bank and the Company dated as of September 30, 2013 (collectively, the “Superseded Agreements”).

7.6. Severability; Enforceability; Governing Law; Jurisdiction; Venue; and Service of Process. Any provision of this Agreement or the other Loan Documents which is prohibited or unenforceable in any jurisdiction, as to such jurisdiction, shall be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. No delay or failure or other course of conduct by the Bank in the exercise of any power or right shall operate as a waiver thereof, nor shall any single or partial exercise of the same preclude any other or further exercise thereof, or the exercise of any other power or right. All of the rights and remedies of the Bank, whether evidenced hereby or by any other agreement or instrument, shall be cumulative and may be exercised singularly or concurrently.

The validity of this Agreement and the other Loan Documents, their construction, interpretation and enforcement, and the rights of the parties hereto and thereto shall be determined under, governed by and construed in accordance with the laws of the State of Ohio (without reference to the choice of law principles thereof), but giving effect to applicable federal laws. The parties agree that all actions or proceedings arising in connection with this Agreement and the other Loan Documents shall be tried and litigated only in the state and federal courts located in the County of Franklin, State of Ohio.

The Company hereby submits, for itself and in respect of its property, generally and unconditionally, to the jurisdiction of the aforesaid courts and waives, to the extent permitted under applicable law, any right it may have to assert the doctrine of forum non conveniens or to object to venue to the extent any proceeding is brought in accordance with this Section 7.6.

The Company hereby waives personal service of the summons, complaint or other process issued in any action or proceeding and agrees that service of such summons, complaint or other process may be made by registered or certified mail addressed to the Company at the address for notices set forth in Section 7.1 of this Agreement and that service so made shall be deemed completed upon the earlier of the Company's actual receipt thereof or 3 days after deposit in the United States mails, proper postage prepaid.

Nothing in this Agreement shall be deemed or operate to affect the right of the Bank to serve legal process in any other manner permitted by law, or to preclude the enforcement by the Bank of any judgment or order obtained in such forum or the taking of any action under this Agreement or the other Loan Documents to enforce same in any other appropriate forum or jurisdiction.

7.7. No Consequential Damages. No claim may be made by the Company, or by any of its affiliates, or their respective directors, officers, employees, attorneys or agents, against the Bank, or any of its affiliates, directors, officers, employees, attorneys or agents for any special, indirect or consequential damages in respect of any breach or wrongful conduct (whether the claim therefor is based on contract, tort or duty imposed by law) in connection with, arising out of or in any way related to the transactions contemplated and relationship established by the Loan Documents, or

any act, omission or event occurring in connection therewith, and the Company hereby waives, releases and agrees not to xxx upon any such claim for any such damages, whether or not accrued and whether or not known or suspected to exist in its favor.

7.8. Indemnity; Assumption of Risk. The Company agrees to indemnify the Bank, and its affiliates, directors, officers, employees, agents and advisors (each an "Indemnitee"), against, and hold each Indemnitee harmless from, any and all claims, liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses and disbursements of any kind or nature whatsoever (including, without limitation, reasonable fees and disbursements of counsel) which may be imposed on, incurred by, or asserted against any Indemnitee arising out of, in connection with, or as a result of (i) the execution or delivery of this Agreement or any other Loan Document or any other document, agreement or instrument contemplated hereby or thereby, the performance by the parties hereto or thereto of their respective obligations hereunder or thereunder or the consummation of the transactions contemplated hereby or thereby, (ii) any Letter of Credit or the use of the proceeds therefrom (including any refusal by the Bank to honor a demand for payment under a Letter of Credit if the documents presented in connection with such demand do not strictly comply with the terms of such Letter of Credit), or (iii) any actual or prospective claim, litigation, proceeding or investigation (including, without limitation, any investigation instituted or conducted by any governmental agency or instrumentality) relating to any of the foregoing, whether based on contract, tort or any other theory and regardless of whether any Indemnitee is a party thereto; provided that such indemnity shall not, as to any Indemnitee, be available to the extent that such losses, claims, damages, liabilities or related expenses are determined by a court of competent jurisdiction by final and non-appealable judgment to have resulted from the gross negligence or willful misconduct of such Indemnitee.

As among the Company and the Bank, the Company assumes all risks of the acts and omissions of, or misuse of Letters of Credit by the respective beneficiaries of such Letters of Credit. In furtherance and not in limitation of the foregoing, the Bank shall not be responsible (other than as a result of its gross negligence or willful misconduct): (i) for the form, validity, sufficiency, accuracy, genuineness or legal effect of any document submitted by any party in connection with the application for and issuance of a Letter of Credit, even if it should in fact prove to be in any or all respects invalid, insufficient, inaccurate, fraudulent, or forged; (ii) for the validity or sufficiency of any instrument transferring or assigning or purporting to transfer or assign a Letter of Credit or the rights or benefits thereunder or proceeds thereof, in whole or in part, which may prove to be invalid or ineffective for any reason; (iii) for failure of the beneficiary of a Letter of Credit to comply fully with conditions required in order to draw upon such Letter of Credit; (iv) for errors, omissions, interruptions or delays in transmission or delivery of any messages, by mail, cable, telegraph, telex, facsimile transmission or otherwise; (v) for errors in interpretation of technical terms; (vi) for any loss or delay in the transmission or otherwise of any document required in order to make a drawing under any Letter of Credit or of the proceeds of any drawing under such Letter of Credit; or (viii) for any consequences arising from causes beyond the control of the Bank including, without limitation, any act or omission, whether rightful or wrongful, of any government, court or other governmental agency or authority. None of the above shall affect, impair, or prevent the vesting of any of the Bank's rights or powers under this subsection 7.8.

7.9. WAIVER OF RIGHT TO TRIAL BY JURY. EACH PARTY HERETO HEREBY VOLUNTARILY, KNOWINGLY, IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE (WHETHER BASED UPON CONTRACT, TORT OR OTHERWISE) BETWEEN OR AMONG THEM ARISING OUT OF OR IN ANY WAY RELATED TO THIS AGREEMENT, ANY OTHER LOAN DOCUMENT, OR ANY RELATIONSHIP AMONG THE COMPANY AND THE BANK. THIS PROVISION IS A MATERIAL INDUCEMENT TO THE BANK TO PROVIDE THE FINANCING DESCRIBED HEREIN OR IN ANY OTHER LOAN DOCUMENT.

7.10. Interest Rate Limitation. Notwithstanding anything in this Agreement to the contrary, if at any time the interest rate applicable to the Facility, together with all fees, charges and other amounts which are treated as interest on the Facility under applicable law (collectively the "Charges"), shall exceed the maximum lawful rate (the "Maximum Rate") which may be contracted for, charged, taken, received or reserved by the Bank in accordance with applicable law, the rate of interest payable in respect of the Facility hereunder, together with all Charges payable in respect thereof, shall be limited to the Maximum Rate.

7.11. Important Information About Procedures For Opening A New Account. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an Account. When the Company opens an Account the Bank will ask for the depositor's name, address and other information that will allow the Bank to identify the depositor. The Bank may also ask to see other documents that substantiate the depositor's identity.

7.12. Capital Adequacy. If there shall occur, after the date of this Agreement, any adoption or implementation of, or change to, any Regulation, or interpretation or administration thereof, which shall have the effect of imposing on Bank (or Bank’s holding company) any increase or expansion of or any new: tax (excluding taxes on or measured by its overall income and franchise taxes), charge, fee, assessment or deduction of any kind whatsoever, or reserve, capital adequacy, special deposits or similar requirements against credit extended by, assets of, or deposits with or for the account of Bank or other conditions affecting the extensions of credit evidenced by the Letters of Credit, and the result of any of the foregoing is that Bank (or Bank’s holding company) has incurred increased costs or reductions in the amounts received or receivable by it hereunder in an amount that Bank reasonably deems to be material, then the Company shall pay to Bank such additional amount as Bank reasonably deems necessary to compensate Bank for any increased cost to Bank attributable to the extension(s) of credit evidenced by the Letters of Credit and/or for any reduction in the rate of return on Bank’s capital and/or Bank’s revenue attributable to such extension(s) of credit. As used above, the term "Regulation" shall include any federal, state or international law, governmental or quasi-governmental rule, regulation, policy, guideline or directive (including but not limited to the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act and enactments, issuances or similar pronouncements by the Bank for International Settlements, the Basel Committee on Banking Regulations and Supervisory Practices or any similar authority and any successor thereto) that applies to Bank. Bank’s determination of the additional amount(s) due under this Section 7.12, in accordance with the foregoing, shall be binding in the absence of manifest error, and such amount(s) shall be payable within thirty (30) days of demand and, if recurring, as otherwise

billed by Bank. Such demand or xxxx or any notice provided therewith shall set forth in reasonable detail the basis for Bank’s determination and the calculation of such amounts. Notwithstanding anything in this Agreement to the contrary, Bank shall not demand compensation for any reduction referred to in this Section 7.12 or payment or reimbursement of other amounts under this Section 7.12 if it shall not at the time be the general policy or practice of Bank to demand such compensation, payment or reimbursement in similar circumstances under comparable provisions of other letter of credit facility agreements.

7.13. Definitions, Exhibits and Schedules.

Definitions:

"Account" is defined in Section 1.2.

"Act" is defined in Section 7.11.

"Adjusted One Month LIBOR Rate" is defined in Section 2.1.

"Agreement" is defined in the preamble.

"Application" is defined in Section 1.1.

"Bank" is defined in the preamble.

"Business Day" is defined in Section 1.1.

"Cash Collateral" is defined in Section 1.1.

"Change of Control" is defined in Section 6.1.

"Charges" is defined in Section 7.10.

"Company" is defined in the preamble.

"Company Subsidiaries" is defined in Section 4.3.

"Event of Default" is defined in Section 6.1.

"Facility" is defined in Section 1.1.

"GAAP" is defined in Section 3.3.

"LC Application Materials" is defined in Section 1.1.

"LC Draw" is defined in Section 1.3.

"LC Draw Amount" is defined in Section 1.3.

"Letter of Credit" is defined in Section 1.1.

"Loan Documents" is defined in Section 3.1.

"Material Adverse Effect" is defined in Section 3.1.

"Maximum Rate" is defined in Section 7.10.

"New York Banking Day" is defined in Section 2.1.

"Obligations" is defined in Section 2.2.

"One Month LIBOR Rate" is defined in Section 2.1.

"Reimbursement Agreement" is defined in Section 1.1.

“Person” is defined in Section 6.1.

"Reprice Date" is defined in Section 2.1.

"Security Agreement" is defined in Section 1.1.

"Superseded Agreements" is defined in Section 7.5.

Exhibits:

Exhibit A Form of Letter of Credit

Exhibit B Form of Application

Exhibit C Reimbursement Agreement

Exhibit D Security Agreement

Schedules:

Schedule 4.3 Schedule of Company Subsidiaries

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Company and the Bank have caused this Agreement to be duly executed as of the Effective Date first written above.

M/I HOMES, INC.,

an Ohio corporation

By:

Its: Senior Vice President, Finance and Business

Development and Treasurer

U.S. BANK NATIONAL ASSOCIATION,

a national banking association

By:

Its:

EXHIBIT A

Form of Letter of Credit

U.S. BANK NATIONAL ASSOCIATION SWIFT: XXXXXX00XXX

INTERNATIONAL DEPT. SL-MO-L2IL TELEX:

000 XXXXXX XXXXXX TELEPHONE: 000-000-0000

XX. XXXXX, XX 00000 FACSIMILE: 000-000-0000

DATE:

BENEFICIARY:

OUR IRREVOCABLE LETTER OF CREDIT NO. SLCLSTL0XXXX

GENTLEMEN:

WE HEREBY ISSUE OUR IRREVOCABLE LETTER OF CREDIT NO. SLCLSTL0XXXX IN FAVOR OF YOURSELVES FOR THE ACCOUNT OF UP TO THE AGGREGATE AMOUNT OF USD (AMOUNT IN WORDS AND 00/100 UNITED STATES DOLLARS) AVAILABLE BY YOUR DRAFT AT SIGHT DRAWN ON U.S. BANK NATIONAL ASSOCIATION, ST. LOUIS, MISSOURI ACCOMPANIED BY:

A DATED AND SIGNED STATEMENT APPEARING ON ITS FACE TO BE EXECUTED BY

BENEFICIARY OR DULY AUTHORIZED AGENT THEREOF CERTIFYING THAT:

“

.”

THIS INSTRUMENT MUST BE PRESENTED WITH THE ABOVE REFERENCED DOCUMENTS FOR NEGOTIATION.

DRAFTS MUST BE DRAWN AND PRESENTED AT U.S. BANK NATIONAL ASSOCIATION, INTERNATIONAL DEPT., SL-MO-L2IL, 000 XXXXXX XXXXXX, XX. XXXXX, XXXXXXXX 00000 NOT LATER THAN (EXPIRY DATE).

EACH DRAFT MUST STATE THAT IT IS “DRAWN UNDER U.S. BANK NATIONAL ASSOCIATION, ST. LOUIS, MISSOURI LETTER OF CREDIT NO. SLCLSTL0XXXX DATED (ISSUANCE DATE).”

WE HEREBY ENGAGE WITH THE DRAWERS OF ALL DRAFTS DRAWN UNDER AND IN COMPLIANCE WITH THE TERMS OF THIS CREDIT, THAT SUCH DRAFTS WILL BE DULY HONORED UPON PRESENTATION TO THE DRAWEE.

CANCELLATION OF LETTER OF CREDIT PRIOR TO EXPIRY: THIS LETTER OF CREDIT AND AMENDMENTS, IF ANY, MUST BE RETURNED TO US FOR CANCELLATION WITH BENEFICIARY’S STATEMENT THAT THE LETTER OF CREDIT IS BEING RETURNED FOR

CANCELLATION. IN THE ABSENCE OF BENEFICIARY’S STATEMENT WE WILL CONSIDER THE LETTER OF CREDIT RETURNED FOR CANCELLATION.

THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (2007 REVISION) INTERNATIONAL CHAMBER OF COMMERCE PUBLICATION NUMBER 600.

VERY TRULY YOURS,

U.S. BANK NATIONAL ASSOCIATION

________________________________

AUTHORIZED SIGNATURE/

EXHIBIT B

Form of Application

Bank Use Only: LC Xx. Xxxx Rec'd | |||||

800 NicoIlet Mall | 0000 Xxxxx Xxx | 000 X Xxxxxxxxx Xxx. | 721 Locust SI. | 000 XX 0xx Xxx. | |

BC-MN-H2OG | PlIWA.T9IN | XX-XX-00X | XX-XX-X0XX | XX-XX-X0XX | |

Xxxxxxxxxxx, XX 00000 | Xxxxxxx, XX 00000 | Xxxxxxxxx, XX 00000 | Xx. Xxxxx, XX 00000 | Xxxxxxxx, XX 00000 | |

(000) 000-0000 00000 | (000)000-0000 | (000) 000-0000 | (3141418-2875 | (000) 000-0000 | |

FAX (000) 000-0000 | FAX (000) 000-0000 | FAX (000) 000-000000000 | FAX (000) 000-0000 | FAX (000) 000-0000 | |

APPLICATION FOR STANDBY LETTER OF CREDIT

The undersigned ("Applicant") hereby requests U.S. Bank National Association (Bank") to establish an irrevocable Letter of Credit (hereinafter "Credit") as set forth below in such language as Bank may deem appropriate, with such variations from such terms as Bank may determine in its discretion are necessary and are not materially inconsistent with this Application. and to forward the same directly, or through Bank's correspondent, to the Beneficiary.

In Favor of ("Beneficiary (") (include name & address): | For the Account of Applicant (or, if different from Applicant, the "Account Party") (include name & address) | |

Advising Bank (if any): | Amount $ Expiration Date. | |

To be available by drafts at sight drawn on Bank or, at Bank's op ion, by a written or authenticated SWIFT/telex demand for payment. | ||

o If checked, Applicant requests Bank to issue the Credit in the form of the attached document signed by Applicant and labeled "Exhibit A'. | ||

The Credit shall be subject to the current revision of (choose one): o the International Standby Practices (ISP), published by the International Chamber of Commerce ("ICC"). or o the Uniform Customs and Practice for Documentary Credits (UCP), published by the ICC. | ||

Document(s), if any, required to accompany drawing(s): | ||

Additional Conditions: | ||

In consideration of Bank's issuance of the Credit, Applicant agrees to the terms and conditions as set forth herein, in any attachments, exhibits or addenda, and in the most recent Continuing Reimbursement Agreement executed by Applicant.

Applicant Name: | Account Number: |

Authorized Signature; | Telephone: |

Printed Name. Title: | Date: |

If the Account Party listed above is not the Applicant: In consideration of Bank's issuance of the Credit, the Account Party hereby agrees. if Applicant fails to pay when due any amounts owing to Bank under this Application, Applicant's Continuing Reimbursement Agreement, or the Credit, the Account Party shall pay the same to Bank upon demand.

Account Party Name: | Account Number: |

Authorized Signature: | Telephone: |

Printed Name: Title: | Date: |

Draft Version 4 - Last Revised 5 December 2006 Rev 2006

EXHIBIT C

Form of Reimbursement Agreement

US BANK

CONTINUING REIMBURSEMENT AGREEMENT FOR

LETTERS OF CREDIT

Including U.S. Bank Global Trade WoricaSM

This Continuing Reimbursement Agreement for Letters of Credit is made effective this 27th day of July, 2009 by and between U.S. BANK NATIONAL ASSOCIATION ("Bank') and MA HOMES, INC, ("Applicant).

In consideration of the issuance by Bank or an affiliate of Bank (each such affiliated issuer, an "Other Issuer') of one or more Credits, Applicant agrees that the following terms shall apply to each Application and each Credit issued by Bank or any Other Issuer (either or both referred to herein as "Bank").

1. The Credit,

(a)From time to time, Applicant may request Bank to issue or to request one of its subsidiaries or affiliates to issue one or more letters of credit (each, a 'Credit') substantially in accordance with the terms of any application (each, an 'Application') submitted to Bank by Applicant. All Credits will be deemed irrevocable unless otherwise stated in an Application. Bank may either issue the Credit or request one of its affiliates to issue the Credit. Bank may sell, assign or participate all or any part of its rights and obligations under this Agreement, the Application and the Credit, Without limiting the foregoing, any Other Issuer may sell a participation in all or any part of its rights and obligations under this Agreement and the Credit to Bank.

(b)Bank hereby is authorized to set forth in the Credit the terms appearing in the Application, with such modifications as Bank in its discretion may determine are appropriate or necessary and are not materially different from such terms,

(c)All communications relating to the Credit will be sent at Applicant's risk. Bank shall have no responsibility for any inaccuracy of translation, or any error or delay in transmission or delivery by mail, telecommunication or any other method outside of Bank's reasonable control. including all communications made through a correspondent.

(d)Neither Bank no its correspondents shall be in any way responsible for the performance of any beneficiary's obligations to Applicant or for the form, sufficiency, accuracy, genuineness, authority of person signing, falsification or legal effect, of any documents required by the Credit it such documents appear in order on their face. Whether the documents conform to the terms of the Credit and whether arty demand is timely and in proper form shall be independently determined by Bank in its sole discretion, which determination shall be final and binding on Applicant.

(e)Subject to Section 8(b), Bank may in its discretion honor Applicant's request to increase the amount of the Credit, extend the time for making and honoring of demands under the Credit and otherwise modify the terms and conditions governing the Credit. In the event of any extension of the maturity or time for negotiation or presentation of the drafts or documents or any other modification of the terms or provisions of, or increase in the amount of, the Credit at the request or with the consent of Applicant, this Agreement shall be binding upon Applicant with regard to (i) the Credit as so increased or otherwise modified, (ii) drafts, documents and properly covered thereby, (iii) any action taken by Bank or Bank's correspondents in accordance with such extension, increase or other modification; and (w) any draft paid by Bank or any of Bank's correspondents which is dated on or before the expiration of any time limit expressed in the Credit, regardless of when drawn or presented for payment and when or whether negotiated, provided the required documents are presented prior to the expiration of the Credit.

(f) Applicant shall promptly review all information, documents and instruments delivered to Applicant from time to time by Bank, Including any Credits upon issuance and any amendments and all related presentations and negotiations, and shall notify Bank Within five banking days after receipt if Applicant claims that Bank has failed to comply with Applicant's instructions or Bank's obligations with respect to the Credit, has wrongfully honored or dishonored any presentation under the Credit or claims any other irregularity. It Applicant does not so notify Bank within such time period, Applicant shall be conclusively deemed to have waived and shall be precluded from asserting such claim(s).

2. Internet-Based Letter of Credit Services ("Internet ServIces").

(a)If requested by Applicant and agreed to by Bank, Bank will grant Applicant access to Bank's letter of credit-related Internet Services. U.S. Bank Global Trade Works is an example of one such Internet Service, Bank's Internet Services may be used by Applicant for the processing and issuance of Credits in accordance with the terms of this Agreement Bank shall post Rules of Use of the Internet Services within each such Service. Applicant's initial use of an Internet Service shall constitute Applicant's acceptance of the Rules of Use.

(b)Applicant agrees to use the Internet Services In accordance with the security procedures established by Bank. Due to emerging technologies and ensuing changes in security practices, Bank reserves the right to supplement or change its security procedures from time to time upon reasonable notice to Applicant. Applicant shall designate one or more Security Administrators. The Security Administrator is responsible for setting up Applicant's Internet Services and for establishing internal security procedures related to such services, Including without limitation, accepting software for delivery, assigning users, establishing authority levels, distributing passwords and other security devices and procedures related to the Internet Services. Designation of any Security Administrator may be amended or revoked upon written notice to Bank. Bank shall have a reasonable time to act on any such notice.

(c)Applicant Is responsible for maintaining the security and confidentiality of all IDS, passwords and other security devices issued to or by Applicant (collectively, 'Applicant's Internal Security Service). Applicant shall not permit unauthorized individuals to use Applicant's Internal Security Devices to access the Internet Services. Applicant is responsible for the actions of any individuals using Applicants Internal Security Devices to access to the Internet Services and Applicant shall be bound by any transmission to Bank that is accepted in accordance with the established security procedures. Applicant shall promptly notify Bank if Applicant has actual knowledge that its Internal Security Devices have been compromised. Applicant agrees to defend and indemnify Bank against any claims, losses, damages, costs, expenses, fines and other liabilities arising out of Applicant's failure to maintain the security and confidentiality of Applicant's Internal Security Devices or arising out of the unlawful use of any Internet Services by Applicant or any person who obtains access to the Internet Services using Applicants Internal Security Devices.

3. Reimbursement Obligations Applicant promises to pay Bank on demand at the address specified In the Application for Credit n the following amounts:

(a) The amount of each draft or other request for payment (hereinafter called a 'draft") drawn under the Credit (whether drawn before, on or, if In accordance with the law applicable to the Credit, after the expiration date stated In the Credit). For amounts payable in United States currency, Applicant agrees to reimburse Bank in United States currency. For amounts payable in other currencies, Applicant agrees to reimburse Bank an equivalent amount In United Slates currency at Bank's then current selling rate for such foreign currencies or Applicant will reimburse Bank by sending the foreign currency amount due Bank by wire transfer to the account and location designated by Bank, or at Bank's option, in any other currency, piece, form and manner acceptable to Bank. Upon request, Applicant xxxx pay Bank in advance, in United States currency, alt sums necessary for Bank to pay all such drafts upon presentation whether payable in United States currency or otherwise If the draft is a time draft, Applicant shall make payment without demand sufficiently in advance of its maturity to enable Bank to arrange tar funds to reach the place of payment when due.

(b) All commissions, at the rate fixed by Bank, shall be payable from time to time at such intervals as Bank may require and shall be nonrefundable, whether or not the Credit is drawn upon, reduced in time or amount or otherwise modified. Applicant also agrees to pay all of Bank's other standard tees and charges related to Credits,

(c) All taxes, levies, imposts, duties, charges, fees, deductions or withholdings of any nature whatsoever paid or incurred by Bank in connection with this Agreement, the Credit or any related transactions, and any liability with respect thereto (including but not limited to interest, penalties and expenses),

(d) Interest on all amounts due under this Agreement from the applicable due date until paid will be variable at the per annum rate fixed from time to time by Bank. Interest shall be calculated on the basis of a 360-day year and the actual number of days elapsed. Interest accrued hereunder shall be due and payable on the first day of each calendar month.

(e) Without limiting Applicant's obligations to any Other Issuer, but without duplication, Applicant promises to pay Bank on demand, at the Bank International Banking Office designated by Bank, an amount equal to all amounts which Bank pays or becomes obligated to pay to any Other Issuer with respect to the Credit, whether as a participant in the Credit or otherwise.

(f) notwithstanding any other provision of this Agreement, Applicant's obligation to make any payment hereunder to any Other Issuer shall, to the extent of such payment, be satisfied by payment to Bank as set forth In this Agreement.

(g) Applicant hereby authorizes Bank to automatically deduct from any of as accounts with Bank, all amounts which become due to Bank under this Agreement. Applicant will pay all fees on the account which result from the automatic deductions, including any overdraft/NSF charges. If for any reason Bank does not charge the account for any amount due, or it an automatic deduction is reversed, the amount due is still owing to Bank as set forth herein.

4 Security and Insurance.

(a)As security for payment of any and all of Applicant's obligations to Bank and any other Issuer under this Agreement, any Credit or any other indebtedness of Applicant to Bank and any Other Issuer, Applicant hereby grants Bank a continuous and continuing interest In (I) all property of Applicant or in which Applicant has an interest (including, but not limited to, all bank accounts Applicant maintains with Bank and all proceeds thereof) and which Is now or hereafter for any reason in the possession or control of, or in transit to, Bank, Bank's affiliates or the agent or bailee thereof, and (ii) any and all bills of lading, other documents of title, policies, certificates of insurance, chattel paper, and general Intangibles accompanying or relative to a Credit or any drafts drawn thereunder, and any and all inventory, goods and other property shipped under, in connection with or relative to a Credit or any drafts drawn thereunder. In addition to all other rights which Bank may have, Applicant hereby authorizes Bank to set off and apply any and all deposits (general of special, time or demand, provisional or final) at any time held and other indebtedness at any time owing by Bank to or for the credit or the account of Applicant against any and all of the obligations of Applicant now or hereafter existing under this Agreement, irrespective of whether Bank shall have made any demand under this Agreement and although such deposits, indebtedness or obligations may be unmatured or contingent.

(b)If at any time Bank requires collateral (or additional collateral), Applicant will, on demand, assign and deliver to Bank as security for any and all obligations of Applicant now or hereafter existing under this Agreement collateral of a type and value satisfactory to Bank or make such cash payment as Bank may require and execute and deliver to Bank such security agreements, pledge agreements, or other documents requested by Bank covering such collateral,

(c)Al Bank's request, Applicant will execute any financing statements and other documents or instruments as Bank may require to perfect the security interests granted or contemplated hereunder and will pay the cost of any filings in connection therewith.

(d)For commercial credits, Applicant shall keep any property described in the Credit adequately covered by Insurance satisfactory to Bank, issued by companies satisfactory to Bank, and at Bank's request will furnish certificates or evidence thereof and will assign insurance policies or certificates to Bank and make losses, adjustments or proceeds payable to Bank. It any such policies procured by Applicant fails to provide for payment of the loss thereunder. Applicant hereby makes the loss payable to Bank under such policy and assigns to Bank all proceeds of such policy and agrees to accept proceeds of all insurance as Bank's agent and to hold same in trust for Bank, arid forthwith to deliver the same to Bank, with Applicant's endorsement where necessary, and Bank or any of Banks officers are hereby Irrevocably empowered, with power of substitution, to endorse any check in the name of Applicant received In payment of any loss or adjustment.

(e)Bank shall not be liable for any failure to collect or demand payment of, or to protest or give any notice of non-payment of, any collateral or any part thereof or for any delay in so doing, nor shall Bank be under any obligation to take any action whatsoever with respect to the collateral or any part thereof. Bank shall use reasonable care in the custody and preservation of the collateral in Bank's possession but need not take any steps to preserve rights against prior parties or to keep the collateral identifiable. Bank shall have no obligation to comply with any recording, re-recording, filing, re-filing or other legal requirement necessary to establish or maintain the validity, ovary or enforceability of, or Bank's right in and to, the collateral, or any part thereof. Bank may exercise any right of Applicant with respect to any collateral. Bank may endorse Applicant's name on any and all notes, checks, drafts, bills of exchange, money orders or commercial paper included in the collateral or representing the proceeds thereof.

5. Default and Remedies:

(a) Time is of the essence in this Agreement, The occurrence of any of the following shall be an Event of Default hereunder:

(i) Default in payment or performance of any of Applicant's obligations hereunder or under any promissory note or other agreement between Bank and Applicant;

(ii) Default under any security documents securing Applicant's obligations hereunder, whether executed by Applicant or any other person;

(ill) Levy or proceeding against any property of Applicant or any guarantor of Applicant's obligations hereunder ('Guarantor);

(iv) Death, dissolution, termination of existence, insolvency or business failure of, appointment of a receiver for any part of the property of, assignment for the benefit of creditors by, commencement of any proceeding under any bankruptcy or insolvency laws by or against, or entry of judgment against, Applicant or any Guarantor,

(v) Any warranty, representation or statement made or furnished to Bank by Applicant or any Guarantor proves to have been false in any material respect when made or furnished;

(vi) Any event which gives the holder of any debt obligation of Applicant or any Guarantor the right to accelerate its maturity, whether or not such right is exercised;

(vii) Any guaranty of Applicant's obligations hereunder ceases to be, or is asserted by any person not to be, in full force and effect; or

(viii) Any material adverse change in the financial condition or management Of Applicant or any Guarantor, or if Bank for any reason in good faith, deems itself insecure.

(b) Upon the occurrence of any Event of Default and at any time thereafter, Bank at its option and in addition to all other rights of Bank under this Agreement, any related agreement and applicable law, may (I) without notice or demand declare the amount for which the Credit was issued and any other amounts owing hereunder immediately due and payable; and (ii) exercise any and all rights and remedies of a secured party under the Uniform Commercial Code and other applicable law.

6. Certain Warranties.

(a)Applicant warrants that the execution, delivery and performance of this Agreement are within its authority and are not in contravention of law, of any terms of any agreement, instrument, order or judgment to which Applicant is a party or by which it or its property may be bound or of any provision of its charter document or bylaws, and that it has obtained all necessary approvals and consents therefor.

(b)Applicant represents and warrants that any Credit, and transactions related thereto, shall be in compliance with any federal, state, local and foreign laws, regulations, treaties or customs applicable to Bank or Customer, including without limitation the regulations

promulgated by Office of Foreign Assets Control (OFAC), and any other foreign or domestic legal restriction on doing business with certain individuals or countries.

(c)Applicant will procure promptly all necessary licenses for the export, import, shipping or warehousing of, or payment for property covered by the Credit and will comply with all foreign and U.S. laws, rules and regulations (including exchange control regulations) now or hereafter applicable to the transaction related to the Credit or applicable to the execution, delivery and performance by Applicant of this Agreement.

7. Changes to Laws and Regulations. If any adoption of or change in law or regulation, or in the interpretation or administration thereof by any official authority shall impose on Bank any tax, charge, fee, deduction or withholding of any kind whatsoever, or shall Impose or modify any reserve requirements, standards regarding capital adequacy or any other conditions affecting this Agreement or the Credit, and the result of any of the foregoing shall be to Increase the cost to Bank of issuing and maintaining the Credit, reduce the amount of any sum receivable by Bank hereunder or reduce the rate of return on Bank's capital, then Applicant shall pay to Bank upon demand such additional amount or amounts as Bank may specify to be necessary to compensate Bank for such additional costs incurred or reduction suffered.

8. General Terms and Conditions.

(a)Each Application shall be subject to all terms and conditions of this Agreement. In addition, this Agreement shall apply to each Credit issued or confirmed by Bank at the request of Applicant, including, without limitation, all Credits (if any) previously opened and outstanding on the date hereof.

(b)Notwithstanding any other term hereof, Applicant understands and agrees that the Credit can be revoked or amended only with the consent of the beneficiary of the Credit, Bank or Other Issuer of the Credit and any confirming bank.

(c)If Applicant requests Bank to issue a Credit for the account of a third party, whether affiliated with Applicant or otherwise (the 'Account Party'), the Account Party shall have no rights against Bank Bank may deal with Applicant as if Applicant were the named Account Party.

(d)Applicant shall give Bank prior written notice of any change of name, address or place of business. Any notice of any nature by Applicant to Bank must be given at Bank's office to which the application was submitted.

(e)The singular includes the plural. If Applicant consists of more than one person. the obligations of Applicant hereunder are loint and several and are binding upon any marital community of which any Applicant is a member. This Agreement shall be binding on Applicant, its successors and assigns, and shall inure to the benefit of Bank or Bank's successors, transferees and assigns. Notwithstanding the foregoing, Applicant may not assign its rights under this agreement without Bank's prior written consent.

(f)Notwithstanding the title appearing on any Credit instrument, the rights and obligations of Bank and Applicant with respect to the Credit shall be as set forth herein.

(g)The Application and/or the Credit will set forth which rules or customs apply to the corresponding Credit. Such rules and customs may include, but are not limited to, the International Standby Practices, as published by the International Chamber of Commerce (-1SP") or the Uniform Customs and Practice for Documentary Credits, as published by the International Chamber of Commerce ("UCP'). In any event, the rules or practices set forth in the Credit are incorporated herein and shall govern the Credit. This Agreement and the Credit shall be governed by the internal laws of the State in which the credit was issued and the United States of America (the 'Governing Laws'), except to the extent such laws are inconsistent with the rules adopted in the Application as set forte above.

(h)When possible, each provision of this Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under such law, such provision shall be ineffective to the extent of such prohibition or invalidity without invalidating the remainder of such provision or the remaining provisions of this Agreement.

(i) Applicant hereby indemnifies and agrees to defend and hold harmless Bank, its officers, directors, agents, successors and assigns, from and against any and all liabilities, claims, demands, losses and expenses (including without limitation legal costs and attorney fees incurred in any appellate proceeding, proceeding under the bankruptcy code or receivership and post-judgment attorney fees incurred in enforcing any judgment), arising from or in connection with this Agreement, the Credit or any related transaction, except to the extent such claims arise from Bank's gross negligence or willful misconduct.

(j) Any action, inaction or omission taken or suffered by Bank or by any of Bank's correspondents under or In connection with the Credit or any relative drafts, documents or property, if in good faith and in conformity with foreign or United States laws, regulations or customs applicable thereto, shall be binding upon Applicant and shall not place Bank or any of Bank's correspondents under any resulting liability to Applicant.

Without limiting the generality of the foregoing. Bank and Bank's correspondents may act in reliance upon any oral, telephonic, telegraphic, electronic or written request or notice believed in good faith to have been authorized by Applicant, whether or not in fact given or signed by an authorized person.

(k) Bank's waiver of any right on any occasion or occasions shall not be construed as a bar or waiver of any other right or of such right on any other occasion. Applicant hereby waives and agrees not to assert any defense under any applicable statute of limitations, to the fullest extent permitted by law,

(l) Without notice to any Applicant and Without affecting Bank's rights or Applicant's obligations, Bank may deal in any manner with any person who at any time is liable for, or provides any collateral for, any obligations of Applicant to Bank. Without limiting the foregoing, Bank may impair, release (with or without substitution of new collateral) and fall to perfect a security interest in, any collateral provided by any person; and xxx, tail to xxx, agree not to xxx, release, and settle or compromise with, any person.

(m) Except as otherwise provided herein or in any Credit, all notices and other communications required or permitted to be given to any party hereto shall be in writing or an electronic medium that is retrievable in a perceivable form and shall be deemed given when delivered by hand, electronically, by overnight courier, or when deposited in the United States mail, postage prepaid, addressed as set forth in the Application.

(n) Whether or not litigation or arbitration is commenced, Applicant promises to pay all attorney fees and other costs and expenses incurred by Bank in collecting overdue amounts or construing or enforcing any provision of this Agreement or the Credit, including but not limited to reasonable attorney fees at trial, in any arbitration, appellate proceeding, proceeding under the bankruptcy code or receivership and post-judgment attorney fees incurred in enforcing any judgment.

(o) If the Credit is issued pursuant to a ban agreement or other separate agreement, the terms of such other agreement shall control in the event of a conflict between the terms of this Agreement and such other agreement.

(p) This Agreement is a continuing agreement and shall remain in effect until terminated, amended or replaced. This Agreement may be terminated by Applicant or Bank by giving notice of termination to the other and may be amended or replaced by a written agreement signed by Applicant and accepted by Bank; provided, however that no such termination, amendment or replacement shall alter or affect the undertaking of Applicant or Bank with respect to any Credit issued, or commitment to issue, prior to such termination, amendment or replacement.

(q) This Agreement, as supplemented by the laws, rules and customs incorporated herein by subpart (g) to this part, and as supplemented by the terms of the Application, it any, constitutes the entire understanding between Bank and Applicant with respect to the matters treated herein and specifically supersedes any prior or contemporaneous oral agreements.

(r) Nothing in this Agreement shall be construed as imposing any obligation on Bank to issue any Credit Each Credit shall be issued by Bank in its sole discretion and at Its sole option.

(s) Bank is authorized, but not obligated, to record electronically or otherwise any telephone and other oral communications between Bank and Applicant.

(t) All terms and conditions on the attached Schedule 1, and any replacement Schedule 1 are hereby incorporated herein. Applicant may change the provisions of Schedule 1 by executing and delivering a new Schedule 1 to Bank,

(u) In the event Applicant submits an Application or other instruction by facsimile transmission (each, a "Faxed Document"), Applicant agrees: (I) each Faxed Document shall be deemed to be an original document and shall be effective for all purposes as if It were an original; (ii) Applicant shall retain the original of any Faxed Document and shall deliver it to Bank upon request; (ill) if Applicant sends Bank a manually signed confirmation of a Faxed Document, Bank shall have no duty to compare it to Me previously received Faxed Document nor shall a have any liability or duty to act should the contents of the written confirmation differ therefrom. Any manually signed confirmation of a Faxed Document must be conspicuously marked 'Previously transmitted by facsimile". Bank will not be liable for issuance of duplicate letters of credit or amendments thereto that result from Bank's receipt of confirmations not so marked; (iv) Bank cannot effectively determine whether a particular facsimile request is valid, Therefore Applicant shall have sole responsibility for the security of using facsimile transmissions and for any authorized or unauthorized Faxed Document received by Bank, purportedly on behalf of Applicant.

9. IMPORTANT NOTICE. ORAL AGREEMENTS OR COMMITMENTS TO LOAN MONEY, EXTEND CREDIT OR TO FORBEAR FROM ENFORCING PREPAYMENT OF A DEBT INCLUDING VERBAL PROMISES TO EXTEND OR RENEW SUCH DEBT ARE NOT ENFORCEABLE.

Applicant acknowledges receipt of a completed copy of this Agreement.

IN WITNESS WHEREOF, this Agreement has been executed and delivered as of the day and year first above written.

APPLICANT: BANK

Mil HOMES, INC. X.X.XXXX NATIONAL ASSOCIATION

By:______________________ By:______________________

Name: Name:

Title: Title:

SCHEDULE 1

AUTHORIZATION

CONTINUING REIMBURSEMENT AGREEMENT FOR

LETTERS OF CREDIT

The provisions of this Schedule 1 are hereby incorporated into and made a part of the Continuing Reimbursement Agreement for Letters of Credit ("Agreement') executed by and between U.S. BANK NATIONAL ASSOCIATION, ("Bank') and MA HOMES, INC. ("Applicant"), dated July 27, 2009. Capitalized terms not otherwise defined herein shall have the meanings assigned to them in the Agreement.