THIRD AMENDMENT TO OFFICE LEASE

Exhibit 10.17

THIRD AMENDMENT TO OFFICE LEASE

THIS THIRD AMENDMENT TO OFFICE LEASE DOCUMENT (this “Amendment”) dated 8/1/07 is entered into by and between WTCC AUSTIN INVESTORS V, L.P., (“Landlord”), a Delaware limited partnership, and NETSPEND CORPORATION (“Tenant”), a Delaware corporation, with reference to the following:

A. Pursuant to that certain Lease Agreement dated August 11, 2003, by and between Crescent Real Estate Funding VIII, L.P., Landlord’s predecessor-in-interest, and Tenant (the “Original Lease”), as amended by that certain First Amendment to Office Lease dated August 2, 2005 (the “First Amendment”), as further amended by that certain Second Amendment to Office Lease dated September 6, 2006 (the “Second Amendment”), Landlord has leased to Tenant approximately 50,830 Rental Square Feet of space designated as Suite Nos. 1010, 1200, 1300, and 1350 (the “Premises”) in the building known as Austin Centre located at 701 Brazos, Xxxxxx, Xxxxxx County, Texas (the “Building”). The Original Lease and the Amendments thereto are collectively referred to herein as the “Lease”.

B. Landlord and Tenant now desire to further amend the Lease as set forth below. Unless otherwise expressly provided in this Amendment, capitalized terms used in this Amendment shall have the same meanings as in the Lease.

FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

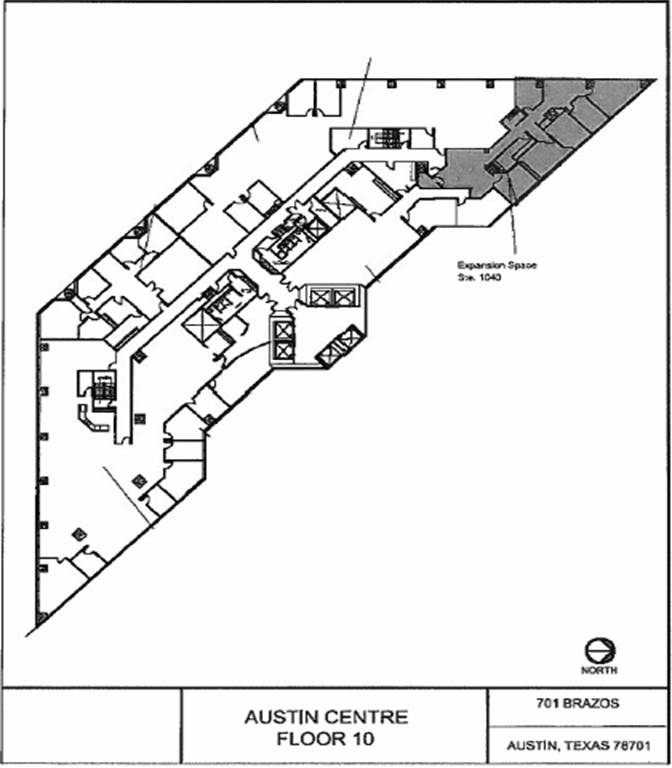

1. Expansion Space. The Lease is hereby modified and amended to include, effective as of the effective date, certain space containing an additional 2,675 square feet of Rentable Square Feet, located on the 10th floor of the Building and known as Suite No. 1040, as shown on Exhibit “A” attached hereto (the “Expansion Space”). Tenant hereby acknowledges that the Expansion Space is leased by Tenant subject to all terms and conditions of the Lease, as amended hereby.

2. Premises. From and after the Expansion Date as defined herein, the term “Premises” wherever used in the Lease shall mean and include the Original Premises, together with the Expansion Space, collectively consisting of approximately 53,505 Rentable Square Feet. As used herein, “Expansion Date” means the later of: (i) the date Tenant’s leasehold improvements are substantially completed (or would have been substantially completed except for delays caused by Tenant) in accordance with Exhibit C attached hereto and made a part hereof for all purposes, or (ii) September 1, 2007. Notwithstanding the foregoing, if Tenant occupies all or any part of the Premises prior to (i) or (ii) above, the Expansion Date shall be the date of such occupancy. Within five (5) business days after the Expansion Date or the written request of Landlord thereafter, Tenant shall execute and deliver to Landlord a declaration specifying and verifying, among other things, the Expansion Date and Termination Date, the number of rentable square feet, Tenant’s Share of Operating Costs, the rent schedule, prepaid rent, if any, the amount of the security deposit, and such other information relating to the Lease as the Landlord may reasonably request, including acceptance of construction.

3. Lease Term for Expansion Space. Tenant’s lease of the Expansion Space shall commence on the Effective Date and shall terminate on August 31, 2009 (the “Expansion Term”), which is the date the initial Lease Term shall terminate, provided, however, the early termination provision of Paragraph 3D of the Original Lease and Paragraph 3 of the Second Amendment, shall not apply to the Expansion Space, and Expansion Term set forth in this Third Amendment and the Tenant shall not have any right of early termination of the Expansion Term and Expansion Space set forth in this Third Amendment.

4. Base Rent. Commencing on the Expansion Date, Tenant shall pay monthly rental (“Base Rent”) for the Expansion Space at the same time and place and in the manner provided in the Lease according to the following rental schedule:

|

Lease Months |

|

Rent |

|

|

|

|

|

09/01/07 – 08/31/09 |

|

$3,789.58 per month (based on a rental rate of $17.00 per square foot of Rentable Area per year) |

5. Leasehold Improvements. Landlord shall construct leasehold improvements in the Expansion Space in accordance with the Work Letter attached hereto as Exhibit “B.”

6. Section 4.A. is amended and restated in its entirety to read as follows:

A. Payments. As consideration for this Lease, Tenant shall pay Landlord, without any demand, setoff or deduction, the total amount of Base Rent, Tenant’s Pro Rata Share of the Operating Expenses (defined in Section 4.D.) and all other sums payable by Tenant under this Lease (all of which are sometimes collectively referred to as “Rent”). In addition to the taxes that are included as operating expenses under Section 4.D.(5), Tenant shall pay and be liable for all rental, gross receipts, sales and use, or other taxes, if any (but excluding income and estate taxes), imposed upon or measured by rents, receipts or income attributable to ownership, use, occupancy, rental, leasing, operation or possession of the Premises, provided, however, any amounts paid by the tenant shall under this Section 4.A. and shall not be treated as Operating Expenses under Section 4.D. Tax Expenses under this Section 4.A. shall include, without limitation: (i) any tax on the rent or other revenue from the Property, or any portion thereof, or as against the business of owning or leasing the Property, or any portion thereof, including any business, gross margins or similar tax payable by Landlord which is attributable to rent or other revenue derived from the Property, (ii) any assessment, tax, fee, levy, or charge allocable to or measured by the area of the Premises or the Rent payable hereunder. The monthly Base Rent and the Operating Expense Payment shall be due in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent for the first full calendar month of the Term shall be payable upon the execution of this Lease by Tenant. All other items of Rent shall be due and payable by Tenant on or before 30 days after billing by Landlord. All payments of Rent shall be by good and sufficient check or by other means (such as

automatic debit or electronic transfer) acceptable to Landlord. If the Term commences on a day other than the first day of a calendar month, the monthly Base Rent and the Operating Expense Payment for the month shall be prorated on a daily basis based on a 360 day calendar year. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due. No endorsement or statement on a check or letter accompanying a check or payment shall be considered an accord and satisfaction, and either party may accept such check or payment without such acceptance being considered a waiver of any rights such party may have under this Lease or applicable Law. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease.

7. Operating Expenses.

(a) Tenant shall pay its Pro Rata Share of all Operating Expenses in accordance with the Lease (as amended hereby). Commencing on the Expansion Date, Tenant’s pro rata share of all operating expenses is 15.5690%.

(b) Section 4.D.(5) of the Original Lease is hereby amended and restated in its entirety to read as follows:

(5) Real estate taxes, assessments, business taxes, excises, association dues, fees, levies, charges and other taxes of every kind and nature whatsoever, general and special, extraordinary and ordinary, foreseen and unforeseen, including interest on installment payments, which may be levied or assessed against or arise in connection with ownership, use, occupancy, rental, leasing, operation or possession of the Property, including personal property taxes for property that is owned by Landlord and used exclusively in connection with the operation, maintenance and repair of the Property, or substituted, in whole or in part, for a tax previously in existence by any taxing authority, or assessed in lieu of a tax increase, or paid as rent under any ground lease. Real estate taxes do not include Landlord’s income or estate taxes (except to the extent provided above).

8. The Lease is amended to provide that a new Section 4.E.(12) is added as follows:

(12) Rental, gross receipts, sales and use, or other taxes, if any, imposed upon or measured by rents, receipts or income attributable to ownership, use, occupancy, rental, leasing, operation or possession of the Property which have been paid by tenants pursuant to Section 4.A.

9. Nothing in this Third Amendment will change or modify the terms and conditions of the Lease as it pertains to parking, except as set forth in the attached Exhibit “C.”

10. Notice. All notices, requests or documents permitted or required to be delivered under the Lease to Landlord shall be sent to the following address pursuant to Section 1.M. of the Original Lease:

|

Austin Centre: |

|

|

|

|

|

|

|

Landlord: |

|

With a copy to: |

|

|

|

|

|

WTCC AUSTIN |

|

Xxxxxx Street Capital |

11. Broker. Tenant represents and warrants that it has not been represented by any broker other than HerronWiliams in connection with the execution of this Amendment. Tenant shall indemnify and hold harmless Landlord and its designated property management, construction and marketing firms, and their respective partners, members, affiliates and subsidiaries, and all of their respective officers, directors, shareholders, employees, servants, partners, members, representatives, insurers and agents from and against all claims (including costs of defense and investigation) of any broker or agent or similar party claiming by, through or under Tenant in connection with this Amendment.

12. Miscellaneous. This Amendment shall become effective only upon full execution and delivery of this Amendment by Landlord and Tenant. This Amendment contains the parties’ entire agreement regarding the subject matter covered by this Amendment, and supersedes all prior correspondence, negotiations, and agreements, if any, whether oral or written, between the parties concerning such subject matter. There are no contemporaneous oral agreements, and there are no representations or warranties between the parties not contained in this Amendment. Except as modified by this Amendment, the terms and provisions of the Lease shall remain in full force and effect, and the Lease, as modified by this Amendment, shall be binding upon and shall inure to the benefit of the parties hereto, their successors and permitted assigns. Landlord represents to Tenant that the person signing this Amendment on behalf of Landlord is authorized to execute this Amendment without the necessity of obtaining any other signature, and that this Amendment is fully binding on Landlord.

[SIGNATURES ON FOLLOWING PAGE]

EXECUTED to be effective as of 8-1-07, the Effective Date.

LANDLORD:

WTCC AUSTIN INVESTORS V, L.P.,

a Delaware limited partnership

|

By: |

WTCC Austin Mezz GP V, L.L.C., |

|||||||

|

|

a Delaware limited liability company, |

|||||||

|

|

its General Partner |

|||||||

|

|

|

|||||||

|

|

By: |

WTCC Austin Mezz V, L.P., |

||||||

|

|

|

a Delaware limited partnership, |

||||||

|

|

|

its Sole Member |

||||||

|

|

|

|

||||||

|

|

|

By: |

WTCC Austin GP V, L.L.C., |

|||||

|

|

|

|

a Delaware limited liability company, |

|||||

|

|

|

|

its General Partner |

|||||

|

|

|

|

|

|||||

|

|

|

|

By: |

Xxxxxx TCC Austin Holdings V, L.L.C., |

||||

|

|

|

|

|

a Delaware limited liability company, |

||||

|

|

|

|

|

its Sole Member |

||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

By: |

Xxxxxx Street Real Estate Fund V, L.P., |

|||

|

|

|

|

|

|

a Delaware limited partnership, |

|||

|

|

|

|

|

|

its Managing Member |

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

By: |

Xxxxxx Street Managers V, L.P., |

||

|

|

|

|

|

|

|

a Delaware limited partnership, |

||

|

|

|

|

|

|

|

its General Partner |

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

By: |

WSC Managers V, Inc., |

|

|

|

|

|

|

|

|

|

a Delaware corporation, |

|

|

|

|

|

|

|

|

|

its General Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxx X. Xxxxx |

|

|

|

|

|

|

|

|

Name: |

Xxxxx X. Xxxxx |

|

|

|

|

|

|

|

|

Title: |

Vice President |

[Signatures continue on following page]

|

|

TENANT: |

|

|

|

|

|

|

|

|

|

NETSPEND CORPORATION, |

|

|

|

|

a Delaware corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxx Xxxxxx |

|

|

|

Name: |

Xxxx Xxxxxx |

|

|

|

Title: |

CFO |

|

EXHIBIT “B”

WORK LETTER

1. Approved Construction Documents.

(a) Tenant’s Information. Within 10 business days after the Effective Date of this Amendment, Tenant shall submit to Landlord (i) the name of a representative of Tenant who has been designated as the person responsible for receiving all information from and delivering all information to Landlord relating to the construction of the Landlord Work (as defined below), and (ii) all information necessary for the preparation of complete, detailed architectural, mechanical, electrical and plumbing drawings and specifications for construction of the Landlord Work in the Expansion Space, including Tenant’s partition and furniture layout, reflected ceiling, telephone and electrical outlets and equipment rooms, initial provider(s) of telecommunications services, doors (including hardware and keying schedule), glass partitions, windows, critical dimensions, imposed loads on structure, millwork, finish schedules, security devices, if any, which Tenant desires or Landlord requires to have integrated with other Building safety systems, and HVAC and electrical requirements (including Tenant’s connected electrical loads and the National Electrical Code (NFPA-70) Design Load Calculations), together with all supporting information and delivery schedules (“Tenant’s Information”).

(b) Construction Documents. Following Landlord’s execution of the Amendment and receipt of Tenant’s Information, Landlord’s designated architectural/engineering firm shall prepare and submit to Tenant all finished and detailed architectural drawings and specifications, including mechanical, electrical and plumbing drawings (the “Construction Documents”). In addition, Landlord shall advise Tenant of the number of days of Tenant Delay (as defined below) attributable to extraordinary requirements (if any) contained in Tenant’s Information. Landlord (or its designated representative) reserves the right to designate the location(s) of all of Tenant’s mechanical, electrical or other equipment and the manner in which such equipment will be connected to Building systems.

(c) Approved Construction Documents. Within 5 Business Days after receipt, Tenant shall (i) approve and return the Construction Documents to Landlord, or (ii) provide Landlord Tenant’s written requested changes to the Construction Documents, in which event Landlord shall have the Construction Documents revised (as Landlord deems appropriate) and resubmitted to Tenant for approval within 3 Business Days after receipt. If Tenant fails to request changes within such 5 Business Day period, Tenant shall be deemed to have approved the Construction Documents. Upon Tenant’s approval, the Construction Documents shall become the “Approved Construction Documents.” By granting approval of the Construction Documents (whether such approval is expressly granted or deemed given as provided above), Tenant shall be deemed to have confirmed by means of calculations or metering that the available capacity of the Building electrical system will support Tenant’s electrical requirements.

2. Pricing and Bids. Landlord shall seek 3 competitive bids from general contractors from Landlord’s approved bidding list. Only subcontractors from Landlord’s approved subcontractor list shall be allowed to work on the mechanical, electrical and plumbing

components of the Building. Landlord and Tenant shall mutually agree on the selection of the general contractor.

3. Landlord’s Contributions. Landlord will provide a construction allowance not to exceed $17,869.00 (the “Construction Allowance”), toward the cost of constructing the Landlord Work. Payments shall be made directly to Landlord’s contractor performing the Landlord Work. The cost of (a) all space planning, design, consulting or review services and construction drawings, (b) extension of electrical wiring from Landlord’s designated location(s) to the Expansion Space, (c) purchasing and installing all building equipment for the Expansion Space (including any submeters and other above building standard electrical equipment approved by Landlord), (d) required metering, re-circuiting or re-wiring for metering, equipment rental, engineering design services, consulting services, studies, construction services, cost of billing and collections, (e) materials and labor, and (f) an asbestos survey of the Expansion Space if required by applicable Law, shall all be included in the cost of the Landlord Work and may be paid out of the Construction Allowance, to the extent sufficient funds are available for such purpose. Tenant acknowledges that an asbestos survey will probably be required by applicable Law and that the time required for such asbestos surveys should be incorporated in Tenant’s construction planning. The Construction Allowance made available to Tenant under this Work Letter must be utilized for its intended purpose within 180 days after the Effective Date or be forfeited with no further obligation on the part of Landlord. To the extent that any portion of the construction allowance is left after the completion of the Landlord work (the “Excess Allowance”), Tenant may use the Excess Allowance to make improvements to the Leased Premises defined in the Original Lease, First Amendment, or Second Amendment, provided, however, if the Excess Allowance is not used for such purposes by January 31, 2008, the Excess Allowance shall be deemed forfeited.

4. Construction.

(a) General Terms. Subject to the terms of this Work Letter, Landlord agrees to cause leasehold improvements to be constructed in the Premises (the “Landlord Work”) in a good and workmanlike manner in accordance with the Approved Construction Documents. Tenant acknowledges that Landlord is not an architect or engineer, and that the Landlord Work will be designed and performed by independent architects, engineers and contractors. Accordingly, Landlord does not guarantee or warrant that the Approved Construction Documents will comply with Laws or be free from errors or omissions, nor that the Landlord Work will be free from defects, and Landlord will have no liability therefor. In the event of such errors, omissions or defects, and upon Tenant’s written request, Landlord will use commercially reasonable efforts to cooperate with Tenant in enforcing any applicable warranties. In addition, Landlord’s approval of the Construction Documents or the Landlord Work shall not be interpreted to waive or otherwise modify the terms and provisions of the Lease, as amended. Except with respect to the economic terms set forth in Paragraph 3 of this Work Letter, the terms and provisions contained in this Work Letter shall survive the completion of the Landlord Work and shall govern in all applicable circumstances arising under the Lease throughout the term of the Lease, including the construction of future improvements in the Expansion Space. Tenant acknowledges that Tenant’s Information and the Approved Construction Documents must comply with (i) the definitions used by Landlord for the electrical terms used in this Work Letter, (ii) the electrical and HVAC design capacities of the Building, (iii) Landlord’s policies

concerning communications and fire alarm services, and (iv) Landlord’s policies concerning Tenant’s electrical design parameters, including harmonic distortion. Upon Tenant’s request, Landlord will provide Tenant a written statement outlining items (i) through (iv) above.

(b) ADA Compliance. Landlord shall, as an Operating Expense, be responsible for ADA (and any applicable state accessibility standard) compliance for the core areas of the Building (including elevators, Common Areas, and service areas), the Building’s parking facilities and all points of access into the Building. Tenant shall, at its expense, be responsible for ADA (and any applicable state accessibility standard) compliance in the Expansion Space, including restrooms on any floor now or hereafter leased or occupied in its entirety by Tenant, its Affiliates or transferees. Landlord shall not be responsible for determining whether Tenant is a public accommodation under ADA or whether the Approved Construction Documents comply with ADA requirements, including submission of the Approved Construction Documents for review by appropriate state agencies. Such determinations, if desired by Tenant, shall be the sole responsibility of Tenant.

(c) Substantial Completion. The Landlord Work shall be deemed to be “Substantially Complete” on the date that all Landlord Work (other than any details of construction, mechanical adjustment or any other similar matter, the noncompletion of which does not materially interfere with Tenant’s use or occupancy of the Expansion Space) has been performed. Time is of the essence in connection with the obligations of Landlord and Tenant under this Work Letter. Landlord shall not be liable or responsible for any claims incurred (or alleged) by Tenant due to any delay in achieving Substantial Completion for any reason. Tenant’s sole and exclusive remedy for any delay in achieving Substantial Completion for any reason other than Tenant Delay (defined below) shall be the resulting postponement (if any) of the commencement of rental payments for the Expansion Space under this Amendment. “Tenant Delay” means any act or omission of Tenant or its agents, employees, vendors or contractors that actually delays the Substantial Completion of the Landlord Work, including: (i) Tenant’s failure to furnish information or approvals within any time period specified in the Amendment, including the failure to prepare or approve preliminary or final plans by any applicable due date; (ii) Tenant’s selection of non-building standard equipment or materials; (iii) changes requested or made by Tenant to previously approved plans and specifications; or (iv) performance of work in the Expansion Space by Tenant or Tenant’s contractor(s) during the performance of the Landlord Work.

5. Costs.

(a) Change Orders and Cost Overruns. Landlord’s approval is required in advance of all changes to, and deviations from, the Approved Construction Documents (each, a “Change Order”), including any (i) omission, removal, alteration or other modification of any portion of the Landlord Work, (ii) additional architectural or engineering services, (iii) changes to materials, whether building standard materials, specially ordered materials, or specially fabricated materials, or (iv) cancellation or modification of supply or fabrication orders. Except as otherwise expressly provided in this Work Letter, all costs of the Landlord Work in excess of the Construction Allowance including Change Orders requested by Tenant and approved by Landlord which increase the cost of the Landlord Work (collectively, “Cost Overruns”) shall be paid by Tenant to Landlord within 10 days of receipt of Landlord’s invoice. In addition, at

Landlord’s election, Landlord may require Tenant to prepay any projected Cost Overruns within 10 days of receipt of Landlord’s invoice for same. Landlord may stop or decline to commence all or any portion of the Landlord Work until such payment (or prepayment) of Cost Overruns is received. On or before the Commencement Date, and as a condition to Tenant’s right to take possession of the Expansion Space, Tenant shall pay Landlord the entire amount of all Cost Overruns, less any prepaid amounts. Tenant’s failure to pay, when due, any Cost Overruns or the cost of any Change Order shall constitute an event of default under the Lease.

(b) Construction Management Fee. Within 10 days following the date of invoice, Tenant shall, for supervision and administration of the construction and installation of the Landlord Work, pay Landlord a construction management fee equal to 2.5% of the aggregate contract price for the Landlord Work, which may be paid from the unused portion of the Construction Allowance (if any). Tenant’s failure to pay such construction management fee when due shall constitute an event of default under the Lease.

6. Acceptance. By taking possession of the Expansion Space, Tenant agrees and acknowledges that (i) the Expansion Space is usable by Tenant as intended; (ii) Landlord has no further obligation to perform any Landlord Work or other construction (except punchlist items, if any, agreed upon by Landlord and Tenant in writing): and (iii) both the Building and the Expansion Space are satisfactory in all respects.

EXHIBIT C

TO

THIRD AMENDMENT TO OFFICE LEASE BETWEEN

WTCC AUSTIN INVESTORS V, L.P., AS LANDLORD, AND

NETSPEND CORPORATION, AS TENANT

PARKING

(a) Conversion of Unreserved Space to Reserved Space. Tenant shall convert one of its existing unreserved parking spaces in the Omni Austin Hotel Downtown parking garage to a reserved space (the “Additional Reserved Space”) in the Omni Austin Hotel Downtown parking garage. Tenant agrees to rent the Additional Reserved Space through the Expansion Term of the Lease. Tenant shall rent the Additional Reserved Space unless and until Landlord releases Tenant from such space after Tenant gives at least sixty (60) days prior written notice to Landlord that Tenant desires to relinquish the Additional Reserved Space, but Landlord shall be under no obligation to later make available to Tenant any space relinquished by Tenant. Rates may be changed from time to time by the operator(s) of the garage(s). As rental for the Additional Reserved Space provided to Tenant hereunder, Tenant shall pay to Landlord or the operator of the garage, as may be designated from time to time by Landlord, monthly in advance in the same manner and in addition to the Base Rent provided in the Lease, rental on the Additional Reserved Space at the initial rate of $250.00 plus tax per month. Tenant may from time-to-time lease additional spaces on a month to month basis (subject to availability, if any) in other offsite locations leased by Landlord at market rates plus tax for any spaces in other garages or surface lots.

(b) Miscellaneous. Tenant shall comply with all traffic, security, safety and other rules and regulations promulgated from time to time by Landlord or the Garage Operator. Tenant shall indemnify and hold harmless Landlord from and against all claims, losses, liabilities, damages, costs and expenses (including, but not limited to, attorneys’ fees and court costs) arising or alleged to arise out of Tenant’s use of any such parking spaces, whether or not caused or alleged to be caused by Landlord’s negligence. In the event any of the above unrelinquished parking spaces are or become unavailable at any time or from time to time throughout the Term, whether due to casualty or any other cause beyond Landlord’s reasonable control, this Lease shall continue in full force and effect; provided, however, Tenant shall be entitled to an abatement of the rent due for any such unrelinquished space for so long as it is unavailable for use by Tenant during normal Building hours.