PERFORMANCE SHARE UNIT AWARD AGREEMENT

Exhibit 10.10

XXXXXXX, INC.

PERFORMANCE SHARE UNIT AWARD AGREEMENT

GRANT

This Performance Share Unit Award Agreement (this “Agreement”) evidences the grant by Xxxxxxx, Inc., a Delaware corporation (the “Company”), pursuant to the Xxxxxxx, Inc. 2018 Stock Incentive Plan (the “Plan”), to _______________ (“Participant”), an employee of the Company, of a combined standard “target” amount of __________ Performance Share Units,* with each such Performance Share Unit representing the right to receive, to the extent then vested, an amount payable in Stock, with such amount determined as provided in Section 3 below, subject to the terms and conditions of this Agreement. This award (this “Award”) of Performance Share Units is granted effective as of February ___, 2023 (the “Grant Date”).

XXXXXXX, INC.

By: ________________________________

Title: ______________________________

By accepting this Award by signing below, Participant accepts and agrees to be bound by all of the terms and conditions of this Award, including the Terms and Conditions set forth below and the terms and conditions of the Plan. (Participant’s failure to sign below will indicate Participant’s decision not to accept this Award, in which case the granting of this Award will be null and void.)

Participant: _____________________

* | As further described in the Terms and Conditions below, these Performance Share Units may vest and be payable at 100% upon achievement of applicable target performance ranges based on Company CAGR and Adjusted EBITDA (and subject to continued employment), or may vest and be payable at up to 200%, or less than 100% (or not at all), depending on the applicable performance ranges achieved for such metrics. Furthermore, as described in the Terms and Conditions below, this Agreement also provides for a potential additional bonus “kicker” amount of __________ Performance Share Units that may vest and be payable at 100% upon achievement of the applicable TSR target performance range (and subject to continued employment), or may vest and be payable at up to 200%, or less than 100% (or not at all), depending on the applicable performance range achieved. |

1.Award of Performance Share Units. This Agreement evidences the award by the Company to Participant of a combined standard “target” amount of __________ Performance Share Units, subject to the terms and conditions herein, as well as all applicable terms and conditions contained in the Plan, which are hereby incorporated by reference. Each such Performance Share Unit represents the right to receive, upon the vesting (as described herein) of the Performance Share Unit, one share of Stock.

As described in Sections 2(a) and (b) below, the standard __________ Performance Share Units subject to this Agreement may vest and be payable at 100% upon achievement of the respective target performance ranges, or may vest and be payable at up to 200%, or less than 100% (or not at all), depending on the applicable performance ranges achieved. Furthermore, as described in Section 3(c) below, this Agreement provides for an potential additional bonus “kicker” amount of __________ Performance Share Units, equal to 50% of the standard Performance Share Units, that may vest and be payable at 100% upon achievement of the applicable target performance range, or may vest and be payable at up to 200%, or less than 100% (or not at all), depending on the applicable performance range achieved.

The Performance Share Units hereunder will receive Dividend Equivalents with respect to the number of shares of Stock covered thereby, which will be accrued in cash at target levels (and trued up as appropriate, as determined by the Committee, generally following the 3 fiscal year vesting cycle described in Section 3 below). Dividend Equivalents accrued with respect to Performance Share Units earned shall be paid out at the same time that the Performance Share Units to which they relate vest and are paid out pursuant to the terms of Sections 3 and 4 below. (To the extent that Performance Share Units are not earned, not vested, or forfeited, no Dividend Equivalents will be payable with respect to such Performance Share Units.)

Prior to the actual payment with respect to any Performance Share Unit (and applicable Dividend Equivalents), such Performance Share Unit (and applicable Dividend Equivalents) will represent an unfunded, unsecured obligation of the Company, payable (if at all) only from the general assets of the Company. Participant shall have no voting rights in the Company by virtue of holding the Performance Share Units awarded. If any term or condition set forth in this Agreement is inconsistent with the Plan, the Plan shall control. A copy of the Plan will be made available to Participant upon written request to the Secretary of the Company.

2.Definitions. In addition to the other definitions contained herein or in the Plan, the following capitalized terms shall have the following meanings for purposes of this Agreement:

(a)“Adjusted EBITDA” means adjusted EBITDA as disclosed in the Company’s SEC filings.

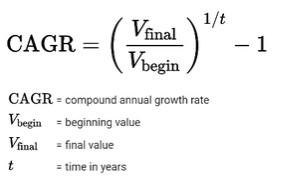

(b)“CAGR” means compound annual growth rate calculated as net revenue for fiscal year 2025 divided by net revenue for fiscal year 2023, both raised to the power 1 divided by the t (time in years) minus 1.

(c)“Dividend Equivalent” means an amount payable (if any) in cash or Stock (as determined by the Committee), as described herein, equal to the dividend that would have been paid to Participant if the share of Stock with respect to which a Performance Share Unit relates had been owned by Participant at the time of the dividend.

(d)“TSR” means total shareholder return calculated as the profit or loss from net share price change, over a given period, including reinvestment of dividends.

All capitalized terms not otherwise defined in this Agreement shall have the respective meanings of such terms as defined in the Plan.

(a)Vesting of Performance Share Units. Subject to the requirement that Participant remains in the continuous employ of the Company or a Subsidiary through December 31, 2025, in a position of equivalent or greater responsibility as on the Grant Date (provided, however, that the Committee or its permitted designee may waive, at any time on or after the Grant Date, the requirement that Participant’s employment position be one of equivalent or greater responsibility as on the Grant Date), the Performance Share Units shall vest (i.e., shall no longer be subject to a “substantial risk of forfeiture” under Section 409A) as follows:

(1)__________ of the standard Performance Share Units (representing 50% of such Performance Share Units) shall vest on December 31, 2025, and be paid out, pursuant to Section 4 below, at 100%, if the Committee, in its discretion, determines that the 3-year CAGR for the Company’s 3 fiscal years of 2023, 2024 and 2025 falls within the target performance range of 7% to 7.9%.

Furthermore, as set forth on the attached Schedule A, if the Committee, in its discretion, determines that the 3-year CAGR for the Company’s 3 fiscal years of 2023, 2024 and 2025 falls above or below, as the case may be, the target performance range of 7% to 7.9%, then in accordance with such Schedule A, such __________ of Performance Share Units may be payable at up to 200%, or may be payable at less than 100% (or not at all), depending on the applicable 3-year CAGR achieved.

(2)__________ of the standard Performance Share Units (representing 50% of such Performance Share Units) shall vest on December 31, 2025, and be paid out, pursuant to Section 4 below, at 100%, if the Committee, in its discretion, determines that the 3-year average Adjusted EBITDA margin for the Company’s 3 fiscal years of 2023, 2024 and 2025 falls within the target performance range of 21% to 21.9%.

Furthermore, as set forth on the attached Schedule B, if the Committee, in its discretion, determines that the 3-year average Adjusted EBITDA margin for the Company’s 3 fiscal years of 2023, 2024 and 2025 falls above or below, as the case may be, the target performance range of 21% to 21.9%, then in accordance with such Schedule B, such __________ of Performance Share Units may be payable at up to 200%, or may be payable at less than 100% (or not at all), depending on the applicable 3-year average Adjusted EBITDA margin achieved.

(3)In addition to any of the standard __________ Performance Share Units awarded pursuant to this Agreement that vest and are payable as described in Sections 2(a)(1) and (2) above, if the Committee, in its discretion, determines that the 3-year TSR of the Company for the Company’s 3 fiscal years of 2023, 2024 and 2025, benchmarked to the S&P 500, falls within a target performance range of 65% to 74.9%, then an additional bonus “kicker” amount of __________ Performance Share Units, equal to 50% of the standard Performance Share Units, shall vest, and be payable pursuant to Section 4 below.

Furthermore, as set forth on the attached Schedule C, if the Committee, in its discretion, determines that the 3-year TSR of the Company for the Company’s 3 fiscal years of 2023, 2024 and 2025, benchmarked to the S&P 500, falls above or below, as the case may be, the target performance range of 65% to 74.9%, then in accordance with such Schedule C, such additional potential bonus “kicker” amount of __________ Performance Share Units may be payable at 200%,

or may be payable at 80% (or not at all), depending on the applicable 3-year TSR of the Company achieved.

(b)Effect of Termination of Employment. Except as otherwise provided below, if Participant’s employment with the Company or a Subsidiary terminates for any reason prior to December 31, 2025, then all Performance Share Units awarded hereunder shall be cancelled and forfeited for no consideration effective immediately as of the date of such termination of employment (with any such cancellation and forfeiture to be automatic and not require notice or other action by the Company), and Participant shall have no further rights with respect to such Performance Share Units. Notwithstanding the foregoing, if Participant’s termination of employment is due to death or Disability, then the standard __________ Performance Share Units awarded pursuant to this Agreement (but no portion of the additional bonus “kicker” amount of Performance Share Units described in Section 3(a)(3) above) shall vest at 100% (as if the target performance ranges described in Sections 3(a)(1) and (2) above had been met) and, subject to the provisions of Section 4 below (including the applicable March 15th deadline for payment), such standard Performance Share Units shall be paid out to the estate of the Participant or the Participant, as applicable, within 90 days following the date of the Participant’s death or Disability, as applicable.

A transfer between the Company and a Subsidiary, or between Subsidiaries, shall not be treated as a termination of employment with the Company or a Subsidiary under this Agreement.

4.Settlement of Award. The Performance Share Units awarded hereunder (and applicable Dividend Equivalents) shall become payable upon vesting (as described in Section 3 above) and be paid out in Stock (rounded down to the nearest share), subject to the terms and conditions of this Agreement, no later than March 15 of the calendar year following the calendar year of vesting (i.e., March 15 of the calendar year following the calendar year in which the Performance Share Units no longer are subject to a substantial risk of forfeiture under Section 409A).

(a)Entire Agreement. This Agreement, which incorporates all of the terms and conditions of the Plan, constitutes the entire agreement of the parties hereto with respect to this Award and the Performance Share Units awarded hereunder and supersedes any and all prior agreements between the parties, whether written or oral, with respect thereto. Participant acknowledges that Participant has had the opportunity to engage legal counsel, as chosen by Participant, and that Participant has been afforded an opportunity to review this Agreement with such legal counsel. No representation, inducement, promise, or agreement or other similar understanding between the parties not embodied herein or in the Plan shall be of any force or effect, and no party will be liable or bound in any manner for any warranty, representation, or covenant except as specifically set forth herein or in the Plan.

(b)Withholding of Taxes. The Company or a Subsidiary shall have the right upon the vesting or payout, as applicable, of this Award to take such action, if any, as it deems necessary or appropriate to satisfy applicable federal, state and local tax withholding requirements arising out of the vesting or payout, as applicable, of this Award, including (but not limited to) withholding from any amounts due Participant.

(c)Modification and Amendment. No modification or amendment of this Agreement shall be valid unless it is in writing and signed by the party against which enforcement is sought, except where provided to the contrary in Section 5(e) below; provided, however, that the Performance Share Units awarded hereunder, and the shares of stock of the Company generally reflected thereby, may be adjusted in accordance with the terms of the Plan.

(d)Governing Law; Headings; Number. This Agreement and the Award made and actions taken hereunder shall be governed and construed in accordance with the Delaware General Corporation Law, to

the extent applicable, and in accordance with the laws of the State of Georgia in all other respects. The section and subsection headings contained herein are for the purpose of convenience of reference only and are not intended to define or limit the contents of said sections and subsections. Whenever appropriate herein, words used in the singular in this Agreement may mean the plural, and the plural may mean the singular.

(e)Section 409A and Tax Consequences. This Agreement and the Performance Share Units awarded hereunder, and any payments made pursuant thereto, are intended to comply with the provisions of Section 409A of the Code, and any applicable Treasury Regulations or other Treasury guidance issued thereunder, (“Section 409A”), to the extent applicable, or an exception thereto, and will be administered, interpreted and construed in a manner consistent with such intent (and, in this connection, it is intended that any adjustments made or actions taken pursuant to the Plan shall be made in compliance with the requirements of Section 409A). Each amount payable pursuant to this Agreement with respect to any Performance Share Units is designated as a separate identified payment for purposes of Section 409A. Should any provision of this Agreement be found not to comply with Section 409A (or to not otherwise be exempt from the provisions of Section 409A), to the extent applicable, it may be modified and given effect, in the sole discretion of the Company and without requiring Participant’s consent, in such manner as the Company determines to be necessary or appropriate, if possible, to comply with (or otherwise be exempt from) Section 409A. The Company does not, however, assume any economic burdens associated with Section 409A. In addition, nothing in this Agreement shall constitute a representation by the Company to Participant regarding the tax consequences of this Award of Performance Share Units, and the Company expressly disavows any covenant to maintain favorable or avoid unfavorable tax treatment. The Company will not be liable to Participant for any tax, interest, or penalties that may arise as a result of this Award of Performance Share Units under applicable U.S. or foreign law. Participant is encouraged to consult a tax advisor regarding any tax consequences of this Award of Performance Share Units to Participant.

(f)Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same agreement. Facsimile and PDF copies of signed signature pages (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., xxx.xxxxxxxx.xxx) shall be deemed binding originals.

[End of document (except Schedules); remainder of page intentionally blank.]

Schedule A1

Revenue Growth

3-Year CAGR | % Payout |

10% or Higher | 200% |

9 – 9.9% | 180% |

8 – 8.9% | 140% |

7 – 7.9% (“Target”) | 100% (“Target”) |

6 – 6.9% | 60% |

5 – 5.9% | 20% |

Below 5% | 0% |

1 Note that the “Target” 100% payout number of Performance Share Units determined based on revenue growth represents half of the total 25% of the overall target equity-based awards to Participant in the form of Performance Share Units, which overall target equity-based awards are comprised (i) 75% of restricted stock and (ii) 25% of Performance Share Units (which Performance Share Units are evidenced by this Agreement).

Schedule B2

Adjusted EBITDA Margin

3-Year Avg. Adjusted EBITDA Margin | % Payout |

24% or Higher | 200% |

23 – 23.9% | 180% |

22 – 22.9% | 140% |

21 – 21.9% (“Target”) | 100% (“Target”) |

20 – 20.9% | 60% |

19 – 19.9% | 20% |

Below 19% | 0% |

2 Note that the “Target” 100% payout number of Performance Share Units determined based on Adjusted EBITDA margin represents half of the total 25% of the overall target equity-based awards to Participant in the form of Performance Share Units, which overall target equity-based awards are comprised (i) 75% of restricted stock and (ii) 25% of Performance Share Units (which Performance Share Units are evidenced by this Agreement).

Schedule C3

TSR “Kicker”

3-Year TRS Relative to S&P 500 | % Payout |

75% or Higher | 200% |

65 – 74.9% (“Target”) | 100% (“Target”) |

50 – 64.5% | 80% |

Below 50% | 0% |

3 Note that the “Target” 100% payout number of “kicker” Performance Share Units determined based on TSR is a kicker amount equal to half of the total 25% of the overall target equity-based awards to Participant in the form of Performance Share Units, which overall target equity-based awards are comprised (i) 75% of restricted stock and (ii) 25% of Performance Share Units (which Performance Share Units are evidenced by this Agreement).