Contract

Schedule "G" to the SPD Share Purchase Agreement

THIS OFFERING IS BEING MADE ONLY IN JURISDICTIONS WHERE THE SHARES MAY BE LAWFULLY OFFERED FOR SALE. NO OFFER IS MADE NOR WILL SUBSCRIPTIONS BE ACCEPTED FROM RESIDENTS OF ANY JURISDICTION WHERE THE OFFER AND SALE OF THE SHARES WILL CONTRAVENE APPLICABLE SECURITIES LAWS. THIS OFFERING IS NOT BEING MADE TO U.S. PERSONS (AS THAT TERM IS DEFINED IN REGULATION S).

| PRIVATE PLACEMENT |

| SUBSCRIPTION AGREEMENT OF COMMON SHARES |

INSTRUCTIONS TO PURCHASER

| I . |

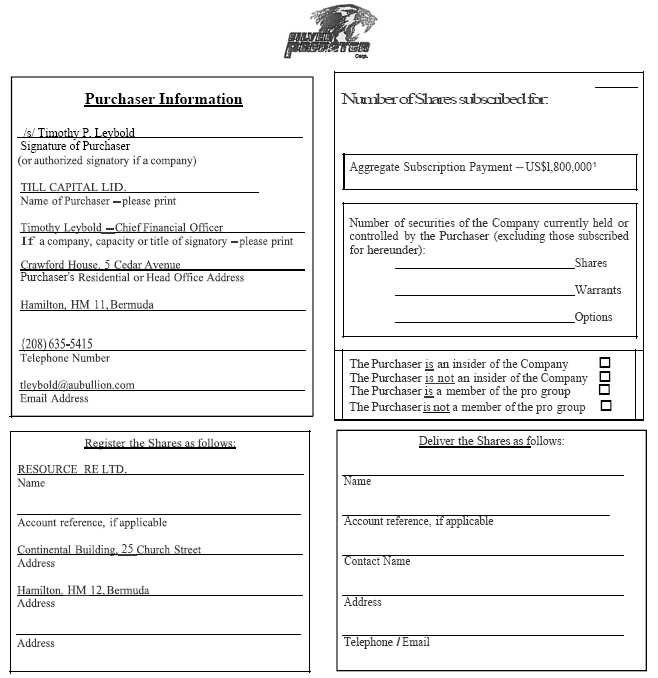

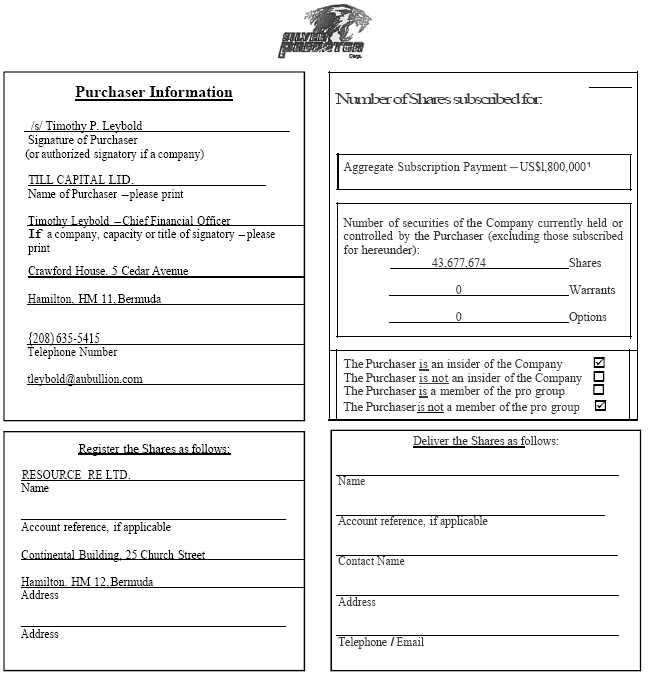

Page 1- Complete all the information in the boxes on page I and sign where indicated. |

| 2. |

Schedule "A" or "B'' - Complete either the Corporate Placee Registration Form attached hereto as Schedule "A" or the Confirmation of Previously Filed Corporate Placee Registration Form attached hereto as Schedule "B". |

| 3. |

Schedule "C" - If you are an "accredited investor", then complete the "Accredited Investor Questionnaire" attached hereto as Schedule "B". |

| 4. |

Pages 6 & 7 - If you are not an "accredited investor" and are resident in Canada, then ensure that you have completed either of sections 8(e)(iii) or (iv) on pages 6 or 7 of this Subscription. |

| 5. |

Payment - Send a bank draft, certified cheque along with your completed forms to the address below. If you wish to pay by wire transfer, refer to Schedule "D". |

The completed forms and any cheques should be delivered to:

Attention: Xxxxx Xx Xxxxxx, Corporate Secretary

SILVER

PREDATOR CORP.

#800 - 0000 Xxxx Xxxxxxxx Xxxxxx

Xxxxxxxxx, Xxxxxxx

Xxxxxxxx, Xxxxxx X0X 0X0

Fax: (000) 000-0000

Email:

xxxxxxxxx@xxxxxxxxxxxxxx.xxx

Should you have any questions regarding the completion of this Subscription and the attached Schedules please contact Xxxxx Xx Xxxxxx at (000) 000-0000.

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT - COMMON SHARES

ACCEPTANCE: The Company hereby accepts the subscription as set forth above on the tenns and conditions contained in this Subscription Agreement.

Dated at Vancouver, British Columbia, this ______________day of _________________________________________2014.

SILVER PREDATOR CORP.

Per:

____________________________________________

(AuthorizedSignatory)

| I. |

Aggregate Subscription Payment to be converted into Canadian dollars using the noon rate of exchange published by the Bank of Canada on the business day immediately preceding the Closing Date. |

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT· COMMON SHARES

ACCEPTANCE: The Company hereby accepts the subscription as set forth above on the terms and conditions contained in this Subscription Agreement.

Dated at Vancouver, British Columbia, this 17 day of April, 2014.

SILVER PREDATOR CORP.

| Per: | /s/ Xxxxxxx Xxxxxxx | |

| (AuthorizedSignatory) |

| 1. |

Aggregate Subscription Payment to be converted into Canadian dollars using the noon rate of exchange published by the Bank of Canada on the business day immediately preceding the Closing Date. |

TO: SILVER PREDATOR CORP.

1. Subscription. The undersigned (the "Purchaser") hereby tenders to SILVER PREDATOR CORP. (the "Company" or the "Issuer") this subscription offer which, upon acceptance by the Company, will constitute an agreement (the "Subscription Agreement") of the Purchaser with the Company to purchase from the Company the number of Shares (as defined below) set out on page 1 hereof at the Purchase Price, on the terms and subject to the conditions set forth in this Subscription Agreement.

By its acceptance of this offer, the Company covenants, agrees and confirms that the Purchaser will have the benefit of all of the representations, warranties, covenants, agreements, terms and conditions set forth hereunder.

2. Definitions. In this Subscription Agreement, unless the context otherwise requires:

| (a) |

"Accredited Investor Status Certificate" means the accredited investor status certificate required to be completed by a Purchaser who is a resident of Canada, in the form of Schedule "C" attached hereto; | |

|

| ||

| (b) |

"affiliate", "distribution" and "insider" have the respective meanings ascribed to them in the Securities Act (British Columbia); | |

|

| ||

| (c) |

"Closing" means the completion of the issue and sale by the Company and the purchase by the Purchaser of the Shares pursuant to this Subscription Agreement; | |

|

| ||

| (d) |

"Closing Date" means May 15, 2014 or such other date mutually agreed by the Company and the Purchaser; | |

|

| ||

| (e) |

"Closing Time" means 10:00 a.m. (Pacific time) on the Closing Date or such other time as the Company and the Purchaser may determine; | |

|

| ||

| (f) |

"Common Share" means common shares without par value in the capital of the Company; | |

|

| ||

| (g) |

"Designated Provinces" means Ontario, British Columbia and Alberta; | |

|

| ||

| (h) |

"material" means material in relation to the Company; | |

|

| ||

| (i) |

"material change" means any change in the business, operations, assets, liabilities, ownership or capital of the Company (except the transactions contemplated herein) that would reasonably be expected to have a significant effect on the market price or value of the Shares and includes a decision to implement such a change made by the board of directors of the Company or by senior management of the Company who believe that confirmation of the decision by the board of directors is probable; | |

|

| ||

| (j) |

"Offering" means the offering of such number of Common Shares for an aggregate subscription price of US$ l ,800,000 to the Purchaser converted into Canadian dollars using the noon rate of exchange published by the Bank of Canada on the business day immediately preceding the Closing Date; | |

|

| ||

| (k) |

"Public Record" means all information and materials filed by the Company with the Commissions and which are available through the SEDAR website (including all exhibits and schedules thereto and documents incorporated by reference therein) from January 1, 2012 to the date hereof; | |

|

| ||

| (1) |

"Purchase Price" means the price per Share, equal to the greater of: (i) the volume weighted average trading price of the Common Shares on the Stock Exchange for the seven trading days immediately preceding the date that is two days before the Closing Date; and (ii) the minimum price permitted by the Stock Exchange. | |

|

| ||

| (m) |

"Purchaser" means Till Capital Ltd.; | |

|

| ||

| (n) |

"Regulation S" means Regulation S under the U.S. Securities Act; |

2

| (o) |

"Securities Commissions" means, collectively, the secunt1es commission or other securities regulatory authority in each of the Designated Provinces; | |

| (p) |

"Securities Laws" means, collectively, the applicable securities laws of each of the Designated Provinces and the respective regulations and rules made and forms prescribed thereunder together with all applicable published policy statements, blanket orders, rulings and notices of the Securities Commissions; | |

| (q) |

"SEDAR" means the System for Electronic Document Analysis and Retrieval; | |

| (r) |

"Shares" means common shares of the Company offed for sale to the Purchaser pursuant to this Offering; | |

| (s) |

"Stock Exchange" means the TSX Venture Exchange; | |

| (t) |

"U.S. Person" means a U.S. Person as that term is defined in Regulation S under the U.S. Securities Act; and | |

| (u) |

"U.S. Securities Act" means the United States Securities Act of 1933, as amended and rules and regulations thereunder. |

3. Delivery and Payment. The Purchaser agrees that the following shall be delivered to the Company at the address set out on the face page hereof, at such time as the Company may advise:

| (a) |

a completed and duly signed copy of this Subscription Agreement; | |

| (b) |

if the Purchaser is not an individual and will hold more than 5% of the Issuer's issued and outstanding common shares upon completion of the Offering, a fully executed corporate placee registration form in the form set out in Schedule "A" unless the Purchaser has filed such a form with the Stock Exchange within the last year and it is still current, in which case the Purchaser will deliver confirmation of such filing in the form set out in Schedule "B". | |

| (c) |

if the Purchaser is purchasing as an "accredited investor", a completed and duly signed copy of the Accredited Investor Status Certificate; | |

| (d) |

any other documents required by applicable securities laws which the Company requests; and | |

| (e) |

a wire transfer made payable on or before the Closing Date (or such other date as the Company may advise) in same day freely transferable Canadian funds at par in Vancouver, British Columbia to "SILVER PREDATOR CORP." representing the aggregate purchase price payable by the Purchaser for the Shares, or such other method of payment against delivery of the Shares as the Company may accept. |

The Purchaser acknowledges and agrees that such undertakings, questionnaires and other documents, when executed and delivered by the Purchaser, will form part of and will be incorporated into this Subscription Agreement with the same effect as if each constituted a representation and warranty or covenant of the Purchaser hereunder in favour of the Company. The Purchaser consents to the filing of such undertakings, questionnaires and other documents as may be required to be filed with the Stock Exchange or other securities regulatory authority in connection with the transactions contemplated hereby. The Purchaser acknowledges and agrees that this offer, the Purchase Price and any other documents delivered in connection herewith will be held by the Company until such time as the Company accepts or rejects this offer.

4. Closing. The transactions contemplated hereby will be completed at the Closing at the offices of the Company at Suite 800, 1199 West Hastings Street, Vancouver, British Columbia. At the Closing, the Company will issue the Shares subscribed and paid for hereunder and deliver them such Shares to the Purchaser at the address set forth on the cover page hereof.

5. General Representations, Warranties and Covenants of the Company. By accepting this offer, the Company represents and warrants to the Purchaser as follows:

3

| (a) |

the Company and its subsidiaries are valid and subsisting corporations duly incorporated and in good standing under the laws of the jurisdictions in which they are incorporated, continued or amalgamated; | |

| (b) |

the Company has all requisite corporate power and capacity to enter into, and carry out its obligations under, this Subscription Agreement and this Subscription Agreement is a legal, valid and binding obligation of the Company; | |

| (c) |

no Offering Memorandum has been or will be provided to the Purchaser; | |

| (d) |

the Company has complied, or will comply, with all applicable corporate and securities laws and regulations in connection with the offer, sale and issuance of the Shares, and in connection therewith has not engaged in any "direct selling efforts," as such term is defined in Regulation S, or any "general solicitation or general advertising" as described in Regulation D of the U.S. Securities Act; | |

| (e) |

on the Closing Date, the Company will have taken all corporate steps and proceedings necessary to approve the transactions contemplated hereby, including the execution and delivery of this Subscription Agreement; | |

| (t) |

the Company and its subsidiaries are the beneficial owners of the properties, business and assets or the interests in the properties, business or assets referred to in its Public Record and except as disclosed therein, all agreements by which the Company or its subsidiaries holds an interest in a property, business or asset are in good standing according to their terms, and the properties are in good standing under the applicable laws of the jurisdictions in which they are situated; | |

| (g) |

the financial statements comprised in the Public Record accurately reflect the financial position of the Company as at the date thereof, and no adverse material changes in the financial position of the Company have taken place since the date of the Company's last financial statements except as filed in the Public Record; | |

| (h) |

neither the Company nor any of its subsidiaries is a party to any actions, suits or proceedings which could materially affect its business or financial condition, and to the best of the Company's knowledge no such actions, suits or proceedings have been threatened as at the date hereof, except as disclosed in the Public Record; | |

| (i) |

except as set out in the Public Record or herein, no person has any right, agreement or option, present or future, contingent or absolute, or any right capable of becoming a right, agreement or option for the issue or allotment of any unissued common shares of the Company or any other security convertible or exchangeable for any such shares or to require the Company to purchase, redeem or otherwise acquire any of the issued or outstanding Shares of the Company; |

| (j) |

the entering into and performance by the Company will not, on the Closing Date, constitute a default under any term or provision of the constating documents or resolutions of the Company, or any judgment, decree, order, statute, rule or regulation, or any agreement or instrument applicable to the Company which in any way materially adversely affects the Company or the condition (financial or otherwise) of the Company or which would have any material effect upon the ability of the Company to perform its obligations arising under this Subscription Agreement; |

| (k) |

the Shares will, at the time of Closing, be duly allotted, validly issued, fully paid and non- assessable and will be free of all liens, charges and encumbrances and the Company will reserve sufficient shares in the treasury of the Company to enable it to issue the Shares; | |

| (1) |

the outstanding Shares are now, and will be on the Closing Date, listed on the Stock Exchange; | |

| (m) |

on the Closing Date, no order ceasing or suspending trading in the securities of the Company nor prohibiting the sale of such securities will have been issued to the Company or its directors, officers or promoters and, to the knowledge of the Company, no investigations or proceedings for such purposes are pending or threatened; |

4

| (n) |

prior to the Closing Date, the Company will have obtained all required approvals from the Stock Exchange in order to permit the completion of the transactions contemplated hereby; | |

| (o) |

the Company will use reasonable commercial efforts to satisfy as expeditiously as possible any conditions of the Stock Exchange required to be satisfied prior to the Exchange's acceptance of the Company's notice of the Offering; | |

| (p) |

the Company will use its best efforts to obtain all necessary approvals for this Offering; | |

| (q) |

as at the Closing Date, the Company is a reporting issuer in good standing under the securities laws of the Provinces of British Columbia, Alberta and Ontario and the Company will use its commercially reasonable best efforts to maintain its status; and | |

| (r) |

the Company has full corporate authority to issue the Shares at the Closing Time. |

6. Acceptance or Rejection. The Company will have the right to accept or reject this offer in whole or in part at any time at or prior to the Closing Time. The Purchaser acknowledges and agrees that the acceptance of this offer will be conditional upon the sale of the Shares to the Purchaser being exempt from any prospectus or offering memorandum requirements of all applicable Securities Laws and the equivalent provisions of securities laws of any other applicable jurisdiction. The Company will be deemed to have accepted this offer upon the Company's execution of the acceptance form on the face page of this Subscription Agreement and the delivery at the Closing of the certificates representing the Shares to or upon the direction of the Purchaser in accordance with the provisions hereof.

If this subscription is rejected in whole, any cheques or other forms of payment delivered to the Company will be promptly returned to the Purchaser without interest or deduction. If this subscription is accepted only in part, a cheque representing any refund for that portion of the subscription for the Shares which is not accepted will be promptly delivered to the Purchaser without interest or deduction.

7. Purchaser's Representations and Warranties. The Purchaser represents and warrants to the Company, as representations and warranties that are true as of the date of this offer and will be true as of the Closing Date, that:

| (a) |

Authorization and Effectiveness. If the Purchaser is a corporation, or other unincorporated entity, the Purchaser is a valid and existing entity, has the necessary capacity and authority to execute and deliver this offer and to observe and perform its covenants and obligations hereunder and has taken all necessary corporate action in respect thereof. If the Purchaser is an individual, partnership, syndicate or other form of unincorporated organization, the Purchaser has the necessary legal capacity and authority to execute and deliver this offer and to observe and perform its covenants and obligations hereunder and has obtained all necessary approvals in respect thereof. In either case, whether the Purchaser is a corporation, individual, or an unincorporated entity, upon acceptance by the Company, this offer will constitute a legal, valid and binding contract of the Purchaser enforceable against the Purchaser in accordance with its terms and will not result in a violation of any of the Purchaser's constating documents, or equivalent, or any agreement to which the Purchaser is a party or by which it is bound; | |

| (b) |

Residence. The Purchaser is a resident of the jurisdiction referred to under "Name and Address of Purchaser" set out on the face page hereof and: (i) is not a U.S. Person or a resident of the United States nor is it purchasing the Shares for the account or benefit of a U.S. Person or a resident of the United States; (ii) was not offered the Shares in the United States; and (iii) did not execute or deliver this Subscription Agreement in the United States; | |

| (c) |

Purchasing as Principal. Except to the extent contemplated herein, the Purchaser is purchasing the Shares as principal (as defined in applicable Securities Laws), for its own account and not for the benefit of any other person; | |

| (d) |

Purchasing as Agent or Trustee. In the case of the purchase by the Purchaser of the Shares as agent or trustee for any principal whose identity is disclosed or undisclosed or identified by account number only, each beneficial purchaser of the Shares for whom the Purchaser is acting, is purchasing its Shares as principal for its own account, and not for the benefit of any other person, for investment only and not with a view to resale or distribution, and the beneficial purchaser is properly described in subparagraph (e)(i), (ii), (iii) or (iv) below, and the Purchaser has due and proper authority to act as agent or trustee for and on behalf of such beneficial purchaser in connection with the transactions contemplated hereby; |

5

| (e) |

Purchaser Has Benefit of Statutory Exemptions. Unless it satisfies the requirements under subparagraph 8(d), the Purchaser is (or is deemed to be) purchasing the Shares as principal for its own account, not for the benefit of any other person, for investment only and not with a view to the resale or distribution of all or any of the Shares, it is resident in or otherwise subject to applicable securities laws of the jurisdiction set under ''Name and Address of Purchaser" on the face page hereof and it fully complies with one or more of the criteria set forth below: |

| (i) |

it is resident in or otherwise subject to applicable securities laws of Canada and it is an "accredited investor", as such term is defined in National Instrument 45-106 - Prospectus and Registration Exemptions of the Canadian Securities Adilllnistrators adopted under the securities legislation of the Canadian jurisdictions ("NI 45-106"), it was not created or used solely to purchase or hold securities as an accredited investor as described in paragraph (m) of the definition of "accredited investor" in NI 45-106, and it has concurrently executed and delivered an Accredited Investor Status Certificate in the form attached as Schedule "C" to this Subscription Agreement and has initialled or placed a check xxxx in Appendix "A" to Schedule "C" thereto indicating that the Purchaser satisfies one of the categories of "accredited investor" set forth in such definition; or | |

| (ii) |

it is resident in or otherwise subject to applicable securities laws of Canada and it has an aggregate acquisition cost for the Shares of not less than $150,000 paid in cash at the time of the trade and it was not created or used solely to purchase or hold securities in reliance on this exemption from the registration and prospectus requirements of applicable securities laws; or | |

| (iii) |

it is resident in or otherwise subject to applicable securities laws of Canada (other than Ontario) and it is (if applicable, please initial): |

| (A) |

a "director", "executive officer" or "control person" (as such terms are defined in NI 45-106 and reproduced in Schedule "C" of this Subscription Agreement) of the Company, or of an affiliate of the Company; or | |

| (B) |

a "spouse" (as such term is defined in NI 45-106 and reproduced in Schedule "C" of this Subscription Agreement), parent, grandparent, brother, sister, child or grandchild of any person referred to in subparagraph (A) above; or | |

| (C) |

a parent, grandparent, brother, sister, child or grandchild of the spouse of any person referred to in subparagraph (A) above; or | |

| (D) |

a close personal friend of any person referred to in subparagraph (A) above and, if requested by the Company, will provide a signed statement describing the relationship with any of such persons; or | |

| (E) |

a close business associate of any person referred to in subparagraph (A) above and, if requested by the Company, will provide a signed statement describing the relationship with any of such persons; or |

6

| (F) |

a "founder" of the Company (as such term is defined in NI 45-106 and reproduced in Schedule C of this Subscription Agreement), or a spouse, parent, grandparent, brother, sister, child, grandchild, close personal friend or close business associate of a founder of the Company and, if requested by the Company, will provide a signed statement describing the relationship with such founder of the Company; or | |

| (G) |

a parent, grandparent, brother, sister, child or grandchild of a spouse of a founder of the Company; or | |

| (H) |

a person of which a majority of the voting securities are beneficially owned by, or a majority of directors are, persons described in subparagraphs (A) through (G) above; or | |

| (I) |

a trust or estate of which all of the beneficiaries or a majority of the trustees or executors are persons described in subparagraphs (A) through (G) above; or |

|

(Note: for the purposes of subparagraph (D) and (F) above, a person is not a "close personal friend" solely because the individual is a relative or a member of the same organization, association or religious group or because the individual is a client, customer orformer client or customer, nor is an individual a close personal friend as a result of being a close personal friend of a close personal friend of one of the listed individuals above, rather the relationship must be direct. A close personal friend is one who knows the director, executive officer, founder or control person well enough and has known them for a sufficient period of time to be in a position to assess their capabilities and trustworthiness. Further, for the purposes of subparagraph (E) and (F) above, a person is not a "close business associate" solely because the individual is a client, customer, former client or customer, nor is the individual a close business associate if they are a close business associate of a close business associate of one of the listed individuals above, rather the relationship must be direct. A close business associate is an individual who has had sufficient prior dealings with the director, executive officer, founder or control person to be in a position to assess their capabilities and trustworthiness.); or | ||

| (iv) |

it is resident in or otherwise subject to applicable securities laws of Ontario and it is (if applicable, please initial): |

| _______ | (A) |

a "founder" of the Company, or an "affiliate" of a "founder" of the Company (as such terms are defmed in NI 45-106 and reproduced in Schedule "C" of this Subscription Agreement); or | |

| (B) |

a "spouse" (as such term is defmed in NI 45-106 and reproduced in Schedule "C" of this Subscription Agreement), parent, brother, sister, grandparent, grandchild or child of an executive officer, director or "founder" of the Company; or | ||

| (C) |

a person that is a "control person" of the Company; or |

| (v) |

it is resident in or otherwise subject to applicable securities laws of Canada and it is an employee, executive officer, director or consultant (as such terms (other than employee) are defmed in NI 45-106 and reproduced in Schedule "C" of this Subscription Agreement) of the Company and its participation in the trade is voluntary, meaning it is not induced to participate in the trade by expectation of employment or appointment or continued employment or appointment with, or engagement or continued engagement to provide services to, as applicable, the Company; |

7

| (f) |

Company or Unincorporated Organization. If the Purchaser, or any beneficial purchaser referred to in subparagraph (d) above, is a corporation or a partnership , syndicate, trust or other form of unincorporated organization, the Purchaser or such beneficial purchaser was not incorporated or created solely, nor is it being used primarily, to permit purchases without a prospectus under applicable law; | |

| (g) |

Absence of Offering Memorandum. The offering and sale of the Shares to the Purchaser were not made as a result of any advertising in the printed media of general and regular paid circulation, radio or television or any other form of advertisement and, except for this Subscription Agreement, the only documents, if any, delivered or otherwise furnished to the Purchaser in connection with such offering and sale were a term sheet, copies of news releases issued by the Company and other publicly available documents, which documents the Purchaser acknowledges do not, individually or collectively, constitute an offering memorandum or similar document; | |

| (h) |

No Undisclosed Information. The Shares are not being purchased by the Purchaser as a result of any material information concerning the Company that has not been publicly disclosed and the Purchaser's decision to tender this offer and acquire the Shares has not been made as a result of any oral or written representation as to fact or otherwise made by or on behalf of the Company or any other person other than as set'out in this Subscription Agreement and the decision is otherwise based entirely upon currently available public information concerning the Company; | |

| (i) |

Investment Suitability. The Purchaser has obtained, to the extent it or he deems necessary, its own professional advice with respect to the risks inherent in the investment in the Shares, and the suitability of the investment in the Shares in light of its financial condition and investment needs; and the Purchaser, and any beneficial purchaser referred to in subparagraph (d) above, has such knowledge and experience in financial and business affairs as to be capable of evaluating the merits and risks of the investment hereunder in the Shares and is able to bear the economic risk of loss of such investment; | |

| (j) |

Source of Subscription Funds. |

| (i) |

none of the subscription funds used for the purchase of the Shares (the "Subscription Funds") (A) will represent proceeds of crime for the purposes of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), (B) have been or will be derived from or related to any activity that is deemed criminal under the laws of Canada, the United States or any other jurisdiction , or (C) are being tendered on behalf of a person or entity who has not been identified to the Purchaser, and | |

| (ii) |

the Purchaser shall promptly notify the Company if the Purchaser discovers that any of the representations in paragraph (i) above ceases to be true, and to provide the Company with appropriate information in connection therewith; and |

| (k) |

Absence of Certain Representations. No person has made to the Purchaser any written or oral representation: |

| (i) |

that any person will resell or repurchase any of the Shares; | |

| (ii) |

that any person will refund the purchase price of any of the Shares; or | |

| (iii) |

as to the future price or value of the Shares. |

| (l) |

International Purchaser. If the Purchaser is resident outside of Canada and the United States, the Purchaser : |

| (i) |

is knowledgeable of, or has been independently advised as to the applicable securities laws of the securities regulatory authorities (the "Authorities") having application in the jurisdiction in which the Purchaser is resident (the "International Jurisdiction") which would apply to the acquisition of the Shares, if any; |

8

| (ii) |

is purchasing the Shares pursuant to exemptions from the prospectus and registration or equivalent requirements under the applicable securities laws of the Authorities in the International Jurisdiction or, if such is not applicable, the Purchaser is permitted to purchase the Shares under the applicable securities laws of the Authorities in the International Jurisdiction without the need to rely on any exemption; | |

| (iii) |

confirms that the applicable securities laws of the Authorities in the International Jurisdiction do not require the Issuer to make any filings or seek any approvals of any nature whatsoever from any Authority of any kind whatsoever in the International Jurisdiction in connection with the issue and sale or resale of the Shares; and | |

| (iv) |

confirms that the purchase of the Shares by the Purchaser does not trigger: |

| (A) |

an obligation to prepare and file a registration statement, offering memorandum, prospectus, offering circular or similar document, or any other report with respect to such purchase in the International Jurisdiction; or | |

| (B) |

continuous disclosure reporting obligations of the Issuer in the International Jurisdiction; and |

| (v) |

the Purchaser will, if requested by the Issuer, comply with such other requirements as the Issuer may reasonably require. |

The Purchaser acknowledges and agrees that the foregoing representations and warranties are made by it with the intention that they may be relied upon in determining its eligibility or (if applicable) the eligibility of others on whose behalf it is contracting hereunder to purchase the Shares under relevant securities legislation. The Purchaser further agrees that by accepting delivery of the Shares on the Closing Date, it shall be representing and warranting that the foregoing representations and warranties are true and correct as at the Closing Date with the same force and effect as if they had been made by the Purchaser at the time of the Closing and that they shall survive the purchase by the Purchaser of the Shares and shall continue in full force and effect notwithstanding any subsequent disposition by the Purchaser of the Shares. The Purchaser undertakes to notify the Company immediately of any change in any representation, warranty or other information relating to the Purchaser set forth herein which takes place prior to the Closing Time.

8. Finder's Fee to Certain Investment Institutions. [Intentionally Deleted.]

9. Purchaser's Expenses. The Purchaser acknowledges and agrees that except as otherwise provided herein, all costs and expenses incurred by the Purchaser (including any fees and disbursements of special counsel retained by the Purchaser) relating to the purchase of the Shares shall be borne by the Purchaser.

10. Resale Restrictions. The Purchaser understands and acknowledges that the Shares will be subject to certain resale restrictions under applicable Securities Laws and the Purchaser agrees to comply with such restrictions. The Purchaser also acknowledges that it has been advised to consult its own legal advisors with respect to applicable resale restrictions and that it is solely responsible (and the Company is not in any manner responsible) for complying with such restrictions.

For purposes of complying with applicable Securities Laws and National Instrument 45-102 Resale of Securities, as well as Stock Exchange policies, the Purchaser understands and acknowledges that when issued all the certificates representing the Shares, as well as all certificates issued in exchange for or in substitution of the foregoing securities, will bear the following legends:

"WITHOUT PRIOR WRITTEN APPROVAL OF TSX VENTURE EXCHANGE AND COMPLIANCE WITH ALL APPLICABLE SECURITIES LEGISLATION, THE SECURITIES REPRESENTED BY THIS CERTIFICATE MAY NOT BE SOLD, TRANSFERRED, HYPOTHECATED OR OTHERWISE TRADED ON OR THROUGH THE FACILITIES OF CANADIAN RESIDENT UNTIL TSX VENTURE EXCHANGE OR OTHERWISE IN CANADA OR TO OR FOR THE BENEFIT OF A <9>,2014."

"UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE <9>,2014."

9

(with the "< >"completed to reflect a date that is four months plus one day following the Closing Date.)

14. Legal and Tax Advice. The Purchaser acknowledges and agrees that it is solely responsible for obtaining its own legal and tax advice as it considers appropriate in connection with the execution, delivery and performance by it of this Subscription Agreement and the completion of the transactions contemplated hereby.

15. No Statutory Right of Rescission or Damages; Additional Acknowledgements. The Purchaser acknowledges and agrees that:

| (a) |

no securities commission or similar regulatory authority has reviewed or passed on the merits of the Shares; | |

| (b) |

there is no government or other insurance covering the Shares; | |

| (c) |

there are risks associated with the purchase of the Shares; | |

| (d) |

there are restrictions on the purchaser's ability to resell the securities and it is the responsibility of the purchaser to find out what those restrictions are and to comply with them before selling the securities; | |

| (e) |

the issuer has advised the purchaser that the issuer is relying on an exemption from the requirements to provide the purchaser with a prospectus and to sell securities through a person registered to sell securities under the Securities Act and, as a consequence of acquiring securities pursuant to this exemption, certain protections, rights and remedies provided by the Securities Act, including statutory rights of rescission or damages, will not be available to the purchaser | |

| (f) |

as a consequence of acquiring the Shares pursuant to exemptions from registration and prospectus requirements under the Securities Laws, certain protections, rights and remedies provided by the Securities Laws, including statutory rights of rescission or damages, will not be available to the Purchaser; | |

| (g) |

except for this Subscription Agreement as otherwise set forth herein, it has relied solely upon publicly available information relating to the Company and not relied upon any oral or written representation as to fact or otherwise made by or on behalf of the Company except as expressly set forth herein and such publicly available information having been delivered to the Purchaser; | |

| (h) |

the Purchaser, or, where the Purchaser is not purchasing as principal, each beneficial purchaser, has such knowledge in financial and business affairs as to be capable of evaluating the merits and risks of its investment and is able to bear the economic risk of loss of its investment; | |

| (i) |

the Company may be required to provide to the applicable securities regulatory authorities and to the Stock Exchange a list setting forth the identities of the beneficial purchaser of the Shares; |

| (j) |

notwithstanding that the Purchaser may be purchasing Shares as an agent on behalf of an undisclosed principal, the Purchaser agrees to provide, on request, particulars as to the identity of such undisclosed principal as may be required by the Company in order to comply with the foregoing; |

| (k) |

none of the Shares have been or will be registered under the U.S. Securities Act or the securities laws of any state and may not be offered or sold, directly or indirectly, in the United States to, or for the account or benefit of, a U.S. person (as defined in Regulation S), which definition includes, but is not limited to, an individual resident in the United States and an estate or trust of which any executor or administrator or trustee, respectively, is a U.S. person and any partnership or company organized or incorporated under the laws of the United States unless registered under the U.S. Securities Act and the securities laws of all applicable states or unless an exemption from such registration is available, and the Company has no obligation or present intention of filing a registration statement under the U.S. Securities Act in respect of any of the Shares; |

| (l) |

the Purchaser acknowledges and agrees that: |

10

| (i) |

the offer to purchase the Shares was not made to the Purchaser in the United States; | |

| (ii) |

this Agreement was delivered to, executed and delivered by the Purchaser outside the United States; | |

| (iii) |

the Purchaser is not, and will not be purchasing the Shares for the account or benefit of, any U.S. Person or person in the United States; | |

| (iv) |

the current structure of this transaction and all transactions and activities contemplated hereunder is not a scheme to avoid the registration requirements of the 1933 Act; | |

| (v) |

the Purchaser and any person for whose account it is acquiring the Shares, if applicable, has no intention to distribute either directly or indirectly any of the Securities in the United States, except in compliance with the 1933 Act; | |

| (vi) |

if the Purchaser is a corporation, partnership or other legal entity incorporated or organized in the United States, the Purchaser's affairs are controlled and directed from outside of the United States, its purchase of the Securities was not solicited in the United States, no part of the transaction which is the subject of this Subscription Agreement occurred in the United States, and the Issuer has informed the Purchaser that no market for the Securities currently exists in the United States; and | |

| (vii) |

the entering into of this Agreement and the transactions contemplated hereby will not result in the violation of any of the terms and provision of any laws applicable to or constating documents of, the Purchaser or of any agreement, written or oral, to which the Purchaser may be a part or by which he or she is or may be bound ; and |

| (m) |

if the Stock Exchange imposes escrow or other resale restrictions on the Shares then the Purchaser agrees to be bound by such restrictions . |

16. No Revocation. The Purchaser agrees that this offer is made for valuable consideration and may not be withdrawn, cancelled, terminated or revoked by the Purchaser without the consent of the Company. Further, the Purchaser expressly waives and releases the Company from all rights of withdrawal or rescission to which the Purchaser might otherwise be entitled pursuant to the Securities Laws.

17. Indemnity. The Purchaser agrees to indemnify and hold harmless the Company and its directors, officers, employees, agents, advisers and shareholders from and against any and all loss, liability, claim, damage and expense (including, but not limited to, any and all fees, costs and expenses reasonably incurred in investigating, preparing or defending against any claim, law suit, administrative proceeding or investigation whether commenced or threatened) arising out of or based upon any representation or warranty of the Purchaser contained herein being untrue in any material respect or any breach or failure by the Purchaser to comply with any covenant or agreement made by the Purchaser herein.

18. Collection of and Use of Personal Information.

| (a) |

The Purchaser (on its own behalf and, if applicable, on behalf of any person for whose benefit the Purchaser is subscribing) acknowledges and consents to the fact the Issuer is collecting the Purchaser's (and any beneficial purchaser's) personal information for the purpose of completing the Purchaser' subscription. The Purchaser (on its own behalf and, if applicable, on behalf of any person for whose benefit the Purchaser is subscribing) acknowledges and consents to the Issuer retaining the personal information for as long as permitted or required by applicable law or business practices. The Purchaser (on its own behalf and, if applicable, on behalf of any person for whose benefit the Purchaser is subscribing) further acknowledges and consents to the fact the Issuer may be required by applicable securities laws, stock exchange rules, and Investment Industry Regulatory Organization of Canada rules to provide regulatory authorities any personal information provided by the Purchaser respecting itself (and any beneficial purchaser). The Purchaser represents and warrants that it has the authority to provide the consents and acknowledgements set out in this paragraph on behalf of all beneficial purchaser. |

11

| (b) |

The Purchaser and disclosed principal, if applicable, hereby acknowledges and consents to: (i) the disclosure by the Purchaser and the Issuer of Personal Information (defined below) concerning the Purchaser to any Securities Commission, or to the Stock Exchange and its affiliates, authorized agent, subsidiaries and divisions, if applicable; and (ii) the collection, use and disclosure of Personal Information by the Stock Exchange for the following purposes (or as otherwise identified by the Stock Exchange, from time to time): |

| (i) |

to conduct background checks; | |

| (ii) |

to verify the Personal Information that has been provided about the Purchaser; | |

| (iii) |

to consider the suitability of the Purchaser as a holder of securities of the Issuer; | |

| (iv) |

to consider the eligibility of the Issuer to list and continue to be listed on the Stock Exchange; | |

| (v) |

to provide disclosure to market participants as the security holdings of the Issuer's shareholders, and their involvement with any other reporting issuers, issuers subject to a cease trade order or bankruptcy, and information respecting penalties, sanctions or personal bankruptcies, and possible conflicts of interest with the Issuer; | |

| (vi) |

to detect and prevent fraud; | |

| (vii) |

to conduct enforcement proceedings; and | |

| (viii) |

to perform other investigations as required by and to ensure compliance with all applicable rules, policies, rulings and regulations of the Stock Exchange, securities legislation and other legal and regulatory requirements governing the conduct and protection of the public markets in Canada. |

| (c) |

The Purchaser also acknowledges that: (i) the Stock Exchange also collects additional Personal Information from other sources, including securities regulatory authorities in Canada or elsewhere, investigative law enforcement or self-regulatory organizations, and regulations service providers to ensure that the purposes set forth above can be accomplished; (ii) the Personal Information the Stock Exchange collects may also be disclosed to the agencies and organizations referred to above or as otherwise permitted or required by law, and they may use it in their own investigations for the purposes described above; (iii) the Personal Information may be disclosed on the Stock Exchange's website or through printed materials published by or pursuant to the direction of the Stock Exchange; and (iv) the Stock Exchange may from time to time use third parties to process information and provide other administrative services, and may share the information with such providers. | |

| (d) |

If the Purchaser is resident in Ontario, the public official who can answer questions about the Ontario Securities Commission's indirect collection of Personal Information is the Administrative Assistant to the Director of Corporate Finance, Ontario Securities Commission, Xxxxx 0000, Xxx 00, 00 Xxxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx, X0X 0X0, Telephone 000-000-0000. | |

| (e) |

Herein, "Personal Information" means any information about the Purchaser required to be disclosed to a Securities Commission or the Exchange, whether pursuant to a Securities Commission or Stock Exchange form or a request made by a Securities Commission or the Stock Exchange including the Corporate Placee Registration Form attached hereto. |

19. Modification. Subject to the terms hereof, neither this Subscription Agreement nor any provision hereof shall be modified, changed, discharged or terminated except by an instrument in writing signed by the party against whom any waiver, change, discharge or termination is sought.

20. Assignment. The terms and provisions of this Subscription Agreement shall be binding upon and enure to the benefit of the Purchaser, the Company and their respective successors and assigns; provided that this Subscription Agreement shall not be assignable by any party without the prior written consent of the other party.

12

21. Miscellaneous . All representations, warranties, agreements and covenants made or deemed to be made by the Purchaser herein will survive the execution and delivery, and acceptance, of this offer and the Closing.

22. Governing Law. This Subscription Agreement shall be governed by and construed in accordance with the laws of the Province of British Columbia and the federal laws of Canada applicable therein. The Purchaser on its own behalf and, if applicable, on behalf of others for whom it is contracting hereunder, hereby irrevocably attorns to the exclusive jurisdiction of the courts of the Province of British Columbia with respect to any matters arising out of this Subscription Agreement.

23. Counterpart and Facsimile Subscriptions. This Subscription Agreement may be signed in counterparts, including counterparts by means of facsimile or scanned PDF via email transmission, each of which will be deemed an original, but all of which, taken together, and delivered will constitute one and the same Agreement. This Subscription Agreement will not be effective as to any party hereto until such time as this Agreement or a counterpart thereof has been executed and delivered, by facsimile or otherwise, by each party hereto.

24. Entire Agreement and Headings. This Subscription Agreement (including the schedules hereto) contains the entire agreement of the parties hereto relating to the subject matter hereof and there are no representations, covenants or other agreements relating to the subject matter hereof except as stated or referred to herein. This Subscription Agreement may be amended or modified in any respect by written instrument only. The headings contained herein are for convenience only and shall not affect the meanings or interpretation hereof.

26. Time of Essence. Time shall be of the essence of this Subscription Agreement.

27. Effective Date. This Subscription Agreement is intended to be effective and binding upon the parties on acceptance by the Company.

END OF TERMS

13

SCHEDULE "A"

FORM 4C

CORPORATE PLACEE REGISTRATION FORM

This Form will remain on file with the Exchange and must be completed if required under section 4(b) of Part II of Form 4B. The corporation, trust, portfolio manager or other entity (the "Placee") need only file it on one time basis, and it will be referenced for all subsequent Private Placements in which it participates. If any of the information provided in this Form changes, the Placee must notify the Exchange prior to participating in further placements with Exchange listed Issuers. Ifas a result of the Private Placement, the Placee becomes an Insider of the Issuer, Insiders of the Placee are reminded that they must file a Personal Information Form (2A) or, if applicable, Declarations, with the Exchange.

| I. |

Placee Information: |

| (a) |

Name: Till Capital Ltd. | |

| (b) |

Complete Address : Xxxxxxxx Xxxxx, 0 Xxxxx Xxxxxx, Xxxxxxxx, XX 00 Xxxxxxx | |

| (x) |

Jurisdiction oflncorporation or Creation: Bermuda |

| 2. | (a) | Is the Placee purchasing securities as a portfolio manager: (Yes/No)? No |

| (b) |

Is the Placee carrying on business as a portfolio manager outside of Canada: (Yes/No)? No |

| 3. |

Ifthe answer to 2(b) above was "Yes", the undersigned certifies that: | |

| (a) |

it is purchasing securities of an Issuer on behalf of managed accounts for which it is making the investment decision to purchase the securities and has full discretion to purchase or sell securities for such accounts without requiring the client's express consent to a transaction; | |

| (b) |

it carries on the business of managing the investment portfolios of clients through discretionary authority granted by those clients (a "portfolio manager" business) in _______________ [jurisdiction], and it is permitted by law to carry on a portfolio manager business in that jurisdiction; | |

| (c) |

it was not created solely or primarily for the purpose of purchasing securities of the Issuer; | |

| (d) |

the total asset value of the investment portfolios it manages on behalf of clients is not less than $20,000,000; and | |

| (e) |

it has no reasonable grounds to believe, that any of the directors, senior officers and other insiders of the Issuer, and the persons that carry on investor relations activities for the Issuer has a beneficial interest in any of the managed accounts for which it is purchasing. | |

| 4. |

Ifthe answer to 2(a). above was "No", please provide the names and addresses of Control Persons of the Placee: |

| Name * | City | Province or State | Country |

|

* If the Control Person is not an individual, provide the name of the individual that makes the investment decisions on behalf of the Control Person. | |

| 5. |

Acknowledgement - Personal Information and Securities Laws |

| (a) |

"Personal lnfonnation" means any information about an identifiable individual, and includes information contained in sections 1, 2 and 4, as applicable, of this Fonn. |

The undersigned hereby acknowledges and agrees that it has obtained the express written consent of each individual to:

| (i) |

the disclosure of Personal Information by the undersigned to the Exchange (as defined in Appendix 68) pursuant to this Form; and | |

| (ii) |

the collection, use and discloslll'e of Personal lnfonnation by the Exchange for the purposes described in Appendix 68 or as otherwise identified by the Exchange, from time to time. |

| (b) |

The undersigned acknowledges that it is bound by the provisions of applicable Securities Law, including provisions concerning the filing of insider reports and reports of acquisitions. |

(a) Dated and certified (if applicable), acknowledged and agreed, at Hayden, Idaho on April 17, 2014

| Till Capital Ltd. | ||

| (Name of Purchaser - please print) |

||

| : | By:/s/ Xxxxxxx X. Xxxxxxx | |

| (Authorized Signature) | ||

| Chief Financial Offier | ||

| (Official Capacity - please print) | ||

| Xxxxxxx Xxxxxxx | ||

| (Please print name of individual whose signature appears above) | ||

Corporate Placee Signature Page (SPD Subscription)

SCHEDULE B

CONFIRMATION OF PREVIOUSLY FILED CORPORATE PLACEE REGISTRATION FORM

TO: SILVER PREDATOR CORP.

In connection with the proposed subscription for common shares of Silver Predator Corp., the undersigned hereby confirms that the undersigned has previously filed a Form 4C - Corporate Placee Registration Form with the TSX Venture Exchange and that the information in such Corporate Placee Registration Form is accurate and up-to- date as of the date hereof.

Dated ___________________________________________, 2014.

| (Name of Purchaser - please print) | |

| (Authorized Signature) | |

| (Official Capacity - please print) | |

| (Please print name of individual whose signature appears above) |

X-x

SCHEDULE "C"

ACCREDITED INVESTOR STATUS CERTIFICATE

TO: SILVER PREDATOR CORP. (the "Company")

In connection with the purchase of Shares of the Company (the "Shares") by the undersigned subscriber or, if applicable, the principal on whose behalf the undersigned is purchasing as agent (the "Subscriber" for the purposes of this Schedule "C"), the Subscriber hereby represents, warrants, covenants and certifies to the Company that:

1. The Subscriber is purchasing or is deemed to be purchasing the Shares as principal for its own account or complies with the provisions of paragraph 8(d) of the Subscription Agreement;

2. The Subscriber is an "accredited investor" within the meaning of National Instrument 45-106 entitled "Prospectus and Registration Exemptions" ("NI 45-106") by virtue of satisfying the indicated criterion as set out in this Schedule "C";

3. The Subscriber was not created or used solely to purchase or hold securities as an accredited investor as described in paragraph (m) of the definition of "accredited investor" in NI45-106; and

4. Upon execution of this Schedule "C" by the Subscriber, this Schedule "C" shall be incorporated into and form a part of the Subscription Agreement.

Dated: ______________________________, 2014

| Print name of Subscriber | |

| By: Signature | |

| Print name of Signatory (if different from Subscriber) | |

| Title |

IMPORTANT: PLEASE INITIAL THE APPLICABLE PROVISION IN

APPENDIX "A" ON THE NEXT PAGES

B-1

APPENDIX "A"

TO SCHEDULE "C"

NOTE:

THE

SUBSCRIBER MUST INITIAL BESIDE THE APPLICABLE PORTION OF THE DEFINITION BELOW.

Accredited Investor - (defined in National Instrument 45-106) means:

| _________ | (a) |

a Canadian financial institution, or a Schedule III bank; or |

|

| ||

| _________ | (b) |

the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada); or |

|

| ||

| _________ | (c) |

a subsidiary of any person referred to in paragraphs (a) or (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary; or |

|

| ||

| _________ | (d) |

a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, other than a person registered solely as a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador); or |

|

| ||

| _________ | (e) |

an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d); or |

|

| ||

| _________ | (f) |

the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly-owned entity of the Government of Canada or a jurisdiction of Canada; or |

|

| ||

| _________ | (g) |

a municipality, public board or commission in Canada and a metropolitan community, school board, the Comite de gestion de la taxe scolaire de l'ile de Montreal or an intermunicipal management board in Quebec; or |

|

| ||

| _________ | (h) |

any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government; or |

|

| ||

| _________ | (i) |

a pension fund that is regulated by either the Office of the Superintendent of Financial Institutions (Canada) or a pension commission or similar regulatory authority of a jurisdiction of Canada; or |

|

| ||

| _________ | (j) |

an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000; or |

|

| ||

| _________ | (k) |

an individual whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; or |

|

| ||

|

(Note: if individual accredited investors wish to purchase through wholly-owned holding companies or similar entities, such purchasing entities must qualify under section (t) below, which must be initialled.) | ||

|

| ||

| _________ | (l) |

an individual who, either alone or with a spouse, has net assets of at least $5,000,000; or |

B-2

| _________ | (m) |

a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements; or |

| _________ | (n) |

an investment fund that distributes or has distributed its securities only to |

| (i) |

a person that is or was an accredited investor at the time of the distribution, | |

| (ii) |

a person that acquires or acquired securities in the circumstances referred to in sections 2.10 or 2.19 of National Instrument 45-106, or | |

| (iii) |

a person described in paragraph (i) or (ii) that acquires or acquired securities under section 2.18 of National Instrument 45-106; or |

| _________ | (o) |

an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Quebec, the securities regulatory authority, has issued a receipt; or |

| _________ | (p) |

a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be; or |

| _________ | (q) |

a person acting on behalf of a fully managed account managed by that person, if that person |

| (i) |

is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction , and | |

| (ii) |

in Ontario, is purchasing a security that is not a security of an investment fund; or |

| _________ | (r) |

a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded; or |

| _________ | (s) |

an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (d) or paragraph (i) in form and function; or |

| _________ | (t) |

a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors (as defined in National Instrument 45-106); or |

| _________ | (u) |

an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser; or |

| (i) |

a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Quebec, the regulator as an accredited investor. |

For the purposes hereof:

| (a) |

"affiliate" means an issuer connected with another issuer because | |

| (i) |

one of them is the subsidiary of the other; or | |

| (ii) |

each of them is controlled by the same person. | |

B-3

| (b) |

"Canadian financial institution" means | |

| (i) |

an association governed by the Cooperative Credit Associations Act (Canada) or a central cooperative credit society for which an order has been made under section 473(1) of that Act, or | |

| (ii) |

a bank, loan corporation, trust company, trust corporation, insurance company, treasury branch, credit union, caisse populaire, financial services cooperative, or league that, in each case, is authorized by an enactment of Canada or a jurisdiction of Canada to carry on business in Canada or a jurisdiction of Canada; | |

| (c) |

"consultant" means, for an issuer, a person, other than an employee, executive officer, or director of the issuer or of a related entity of the issuer, that | |

| (i) |

is engaged to provide services to the issuer or a related entity of the issuer, other than services provided in relation to a distribution, | |

| (ii) |

provides the services under a written contract with the issuer or a related entity of the issuer, and | |

| (iii) |

spends or will spend a significant amount of time and attention on the affairs and business of the issuer or a related entity of the issuer, | |

and includes

| (iv) |

for an individual consultant, a corporation of which the individual consultant is an employee or shareholder, and a partnership of which the individual consultant is an employee or partner, and | |

| (v) |

for a consultant that is not an individual, an employee, executive officer, or director of the consultant, provided that the individual employee, executive officer, or director spends or will spend a significant amount of time and attention on the affairs and business of the issuer or a related entity of the issuer; |

| (d) |

"control person" means any person that owns or directly or indirectly exercises control or direction over securities of an issuer carrying votes which, if exercised, would entitle the first person to elect a majority of the directors of the issuer, unless that first person holds the voting securities only to secure an obligation; | |

| (e) |

"director" means | |

| (i) |

a member of the board of directors of a company or an individual who performs similar functions for a company, and | |

| (ii) |

with respect to a person that is not a company, an individual who performs functions similar to those of a director of a company; | |

| (f) |

"eligibility adviser" means | ||

| (i) |

a person that is registered as an investment dealer and authorized to give advice with respect to the type of security being distributed, and | ||

| (ii) |

in Saskatchewan and Manitoba, also means a lawyer who is a practicing member in good standing with a law society of a jurisdiction of Canada or a public accountant who is a member in good standing of an institute or association of chartered accountants, certified general accountants or certified management accountants in a jurisdiction of Canada provided that the lawyer or public accountant must not | ||

| (A) |

have a professional, business or personal relationship with the issuer, or any of its directors, executive officer, founders, or control persons, and | ||

| (B) |

have acted for or been retained personally or otherwise as an employee, executive officer, director, associate or partner of a person that has acted for or been retained by the issuer or any of its directors, executive officers, founders or control persons within the previous 12 months; | ||

B-4

| (g) |

"executive officer" means, for an issuer, an individual who is |

| (i) |

a chair, vice-chair or president, | |

| (ii) |

a vice-president in charge of a principal business unit, division or function including sales, finance or production, or | |

| (iii) |

performing a policy-making function in respect of the issuer; |

| (h) |

"financial assets" means |

| (i) |

cash, | |

| (ii) |

securities, or | |

| (iii) |

a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation; |

| (i) | "foreign jurisdiction" means a country other than Canada or a political subdivision of a country other than Canada; |

| (j) | "founder" means, in respect of an issuer, a person who, |

| (i) |

acting alone, in conjunction, or in concert with one or more persons, directly or indirectly, takes the initiative in founding, organizing or substantially reorganizing the business of the issuer, and | |

| (ii) |

at the time of the trade is actively involved in the business of the issuer; |

|

(k) |

"fully managed account" means an account of a client for which a person makes the investment decisions if that person has full discretion to trade in securities for the account without requiring the client's express consent to a transaction; |

| (1) | "investment fund" has the same meaning as in National Instrument 81-106 Investment Fund Continuous Disclosure; |

| (m) | "jurisdiction" means a province or territory of Canada except when used in the term foreign jurisdiction; |

| (n) | "local jurisdiction" means the jurisdiction in which the Canadian securities regulatory authority is situate; |

| (o) | "non-redeemable investment fund" has the same meaning as in National Instrument 21-101 Marketplace Operation; |

| (p) | "person" includes |

| (i) |

an individual, | |

| (ii) |

a corporation, | |

| (iii) |

a partnership, trust, fund and an association, syndicate, organization or other organized group of persons, whether incorporated or not, and | |

| (iv) |

an individual or other person in that person's capacity as a trustee, executor, administrator or personal or other legal representative; |

| (q) |

"regulator" means, for the local jurisdiction, the Executive Director or Director or la Commission des valeurs mobilieres du Quebec as defined under securities legislation of the local jurisdiction; |

| (r) |

"related liabilities" means |

| (i) |

liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets, or |

B-5

| (ii) |

liabilities that are secured by financial assets; |

| (s) |

"Schedule III bank" means an authorized foreign bank named in Schedule III of the Bank Act (Canada); | |

| (t) |

"spouse" means, an individual who, | |

| (i) |

is married to another individual and is not living separate and apart within the meaning of the Divorce Act (Canada), from the other individual, | |

| (ii) |

is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender, or | |

| (iii) |

in Alberta, is an individual referred to in paragraph (i) or (ii), or is an adult interdependent partner within the meaning of the Adult Interdependent Relationships Act (Alberta); | |

| (u) |

"subsidiary" means an issuer that is controlled directly or indirectly by another issuer and includes a subsidiary of that subsidiary. |

All monetary references are in Canadian Dollars.

B-6

SCHEDULE "D"

PAYMENT INSTRUCTIONS

Deliver a certified cheque or bank draft before the Closing Date in same day freely transferable Canadian funds at par in Vancouver, British Columbia to:

SILVER PREDATOR CORP.

800 - 0000

Xxxx Xxxxxxxx Xxxxxx

Xxxxxxxxx, Xxxxxxx Xxxxxxxx, Xxxxxx X0X 0X0

Attention: Xxxxx Xx Xxxxxx, Corporate Secretary

Tel: 000-000-0000

or

Send funds by wire transfer according to instructions on Page C-2 (following this page).