SERIES D PREFERRED SHARE SUBSCRIPTION AGREEMENT dated as of September 23, 2019 among 36Kr Holdings Inc. Dagang Feng Palopo Holding Limited PARTIES LISTED ON SCHEDULE I and PARTIES LISTED ON SCHEDULE II

CONFIDENTIAL

SERIES D PREFERRED SHARE

dated as of

September 23, 2019

among

Dagang Feng

Palopo Holding Limited

PARTIES LISTED ON SCHEDULE I

and

PARTIES LISTED ON SCHEDULE II

TABLE OF CONTENTS

|

|

|

|

PAGE |

|

|

|

|

|

|

|

ARTICLE 1 |

|

|

|

DEFINITIONS |

|

1 | |

|

|

|

|

|

|

Section 1.01. |

Definitions |

|

1 |

|

Section 1.02. |

Other Defined Terms |

|

7 |

|

|

|

|

|

|

|

ARTICLE 2 |

|

|

|

PURCHASE AND SALE OF SHARES |

|

8 | |

|

|

|

|

|

|

Section 2.01. |

Subscription and Issuance of Shares |

|

8 |

|

Section 2.02. |

Closing |

|

8 |

|

|

|

|

|

|

|

ARTICLE 3 |

|

|

|

REPRESENTATIONS AND WARRANTIES OF THE WARRANTORS |

|

8 | |

|

|

|

|

|

|

Section 3.01. |

Organization, Good Standing and Qualification |

|

8 |

|

Section 3.02. |

Capitalization |

|

9 |

|

Section 3.03. |

Corporate Structure; Subsidiaries |

|

10 |

|

Section 3.04. |

Authorization |

|

10 |

|

Section 3.05. |

Valid Issuance of Shares |

|

10 |

|

Section 3.06. |

Consents; No Conflicts |

|

10 |

|

Section 3.07. |

Restructuring |

|

11 |

|

Section 3.08. |

Offering |

|

11 |

|

Section 3.09. |

Compliance with Laws; Consents |

|

11 |

|

Section 3.10. |

Tax Matters |

|

12 |

|

Section 3.11. |

Financial Statements |

|

12 |

|

Section 3.12. |

Liabilities |

|

12 |

|

Section 3.13. |

Actions |

|

12 |

|

Section 3.14. |

Material Contracts |

|

12 |

|

Section 3.15. |

Title; Properties |

|

14 |

|

Section 3.16. |

Intellectual Property Rights |

|

14 |

|

Section 3.17. |

Labor and Employment Matters |

|

14 |

|

Section 3.18. |

No Brokers |

|

15 |

|

Section 3.19. |

Co-Founder Noncompetition |

|

15 |

|

Section 3.20. |

Full Disclosure |

|

15 |

|

Section 3.21. |

No Changes |

|

15 |

|

|

|

|

|

|

|

ARTICLE 4 |

|

|

|

REPRESENTATIONS AND WARRANTIES OF THE INVESTORS |

|

16 | |

|

|

|

|

|

|

Section 4.01. |

Organization and Good Standing |

|

16 |

|

Section 4.02. |

Authorization |

|

16 |

|

Section 4.03. |

Consents; No Conflicts |

|

16 |

|

Section 4.04. |

Financing |

|

16 |

|

Section 4.05. |

Purchase for Own Account |

|

16 |

|

Section 4.06. |

Restricted Securities |

|

17 |

|

Section 4.07. |

No Brokers |

|

17 |

|

|

|

|

|

|

|

ARTICLE 5 |

|

|

|

CONDITIONS OF THE INVESTORS’ OBLIGATIONS TO CONSUMMATE THE CLOSING |

|

17 | |

|

|

|

|

|

|

Section 5.01. |

Representations and Warranties |

|

17 |

|

Section 5.02. |

Performance |

|

17 |

|

Section 5.03. |

Authorizations |

|

17 |

|

Section 5.04. |

Proceedings and Documents |

|

17 |

|

Section 5.05. |

Register of Members |

|

17 |

|

Section 5.06. |

Memorandum and Articles |

|

17 |

|

Section 5.07. |

Transaction Documents |

|

18 |

|

Section 5.08. |

Restructuring |

|

18 |

|

Section 5.09. |

Employment Agreement, Non-Competition, Non-Solicitation, IP Assignment and Confidentiality Agreement |

|

18 |

|

Section 5.10. |

No Material Adverse Effect |

|

18 |

|

Section 5.11. |

Closing Certificate |

|

18 |

|

|

|

|

|

|

|

ARTICLE 6 |

|

|

|

CONDITIONS OF THE COMPANY’S OBLIGATIONS TO CONSUMMATE THE CLOSING |

|

18 | |

|

|

|

|

|

|

Section 6.01. |

Representations and Warranties |

|

18 |

|

Section 6.02. |

Performance |

|

18 |

|

Section 6.03. |

Transaction Documents |

|

18 |

|

|

|

|

|

|

|

ARTICLE 7 |

|

|

|

CONFIDENTIALITY AND XXX-XXXXXXXXXX |

|

00 | |

|

|

|

|

|

|

Section 7.01. |

Confidentiality |

|

18 |

|

|

|

|

|

|

|

ARTICLE 8 |

|

|

|

EXECUTORY PERIOD COVENANTS |

|

19 | |

|

|

|

|

|

|

Section 8.01. |

Restructuring |

|

19 |

|

Section 8.02. |

Conduct of the Company |

|

19 |

|

Section 8.03. |

Notice of Certain Events |

|

19 |

|

Section 8.04. |

Access |

|

19 |

|

Section 8.05. |

Most Favorable Rights |

|

19 |

|

Section 8.06. |

Compliance with Laws |

|

20 |

|

Section 8.07. |

Filing of Memorandum and Articles |

|

20 |

|

Section 8.08. |

Transfer of Trademarks |

|

20 |

|

|

ARTICLE 9 |

|

|

|

TERMINATION |

|

20 | |

|

|

|

|

|

|

Section 9.01. |

Termination |

|

20 |

|

|

|

|

|

|

|

ARTICLE 10 |

|

|

|

INDEMNIFICATION |

|

20 | |

|

|

|

|

|

|

Section 10.01. |

Survival |

|

20 |

|

Section 10.02. |

Indemnification by Warrantors |

|

21 |

|

Section 10.03. |

Notice of Claims |

|

21 |

|

Section 10.04. |

Limitation of Liability |

|

21 |

|

Section 10.05. |

Exclusive Remedy |

|

22 |

|

|

|

|

|

|

|

ARTICLE 11 |

|

|

|

MISCELLANEOUS |

|

22 | |

|

|

|

|

|

|

Section 11.01. |

Further Assurances |

|

22 |

|

Section 11.02. |

Successors and Assigns |

|

22 |

|

Section 11.03. |

Third-Party Beneficiaries |

|

23 |

|

Section 11.04. |

Governing Law |

|

23 |

|

Section 11.05. |

Dispute Resolution |

|

23 |

|

Section 11.06. |

Notices |

|

24 |

|

Section 11.07. |

Specific Performance |

|

24 |

|

Section 11.08. |

Fees and Expenses |

|

24 |

|

Section 11.09. |

Finder’s Fee |

|

24 |

|

Section 11.10. |

Severability |

|

25 |

|

Section 11.11. |

Amendments and Waivers |

|

25 |

|

Section 11.12. |

No Waiver |

|

25 |

|

Section 11.13. |

Delays or Omissions |

|

25 |

|

Section 11.14. |

No Presumption |

|

25 |

|

Section 11.15. |

Headings and Subtitles; Interpretation |

|

26 |

|

Section 11.16. |

Counterparts |

|

26 |

|

Section 11.17. |

Entire Agreement |

|

26 |

|

Section 11.18. |

Independent Nature of Investors’ Obligations and Rights |

|

26 |

|

|

|

|

|

|

Schedules and Exhibits |

|

| |

|

|

|

|

|

|

Schedule I |

List of the Investors |

|

I-1 |

|

Schedule II |

List of Certain Group Companies |

|

II-1 |

|

Schedule III |

Address for Notices |

|

III-1 |

|

Schedule IV |

Restructuring |

|

IV-1 |

|

Schedule V |

List of Company’s Related Parties |

|

V-1 |

|

Schedule VI |

Disclosure Schedule |

|

VI-1 |

|

Schedule VII |

Capitalization Table |

|

VII-1 |

|

Schedule VIII |

List of Trademarks to be Transferred |

|

VIII-1 |

|

Exhibit A |

Form of Second Amended and Restated Memorandum and Articles of Association |

|

A-1 |

|

Exhibit B |

Form of Amended and Restated Shareholders Agreement |

|

B-1 |

|

Exhibit C |

Form of Closing Certificate |

|

C-2 |

SERIES D PREFERRED SHARE SUBSCRIPTION AGREEMENT

THIS SERIES D PREFERRED SHARE SUBSCRIPTION AGREEMENT (this “Agreement”) is made and entered into on September 23, 2019 by and among:

1. 36Kr Holdings Inc., an exempted company with limited liability incorporated under the Laws of the Cayman Islands (the “Company”),

2. Xx. Xxxxxx Feng (a PRC citizen, with ID number of 000000000000000000, the “Co-Founder”),

3. Palopo Holding Limited, a business company incorporated under the Laws of the British Virgin Islands (the “Co-Founder Holdco”),

4. each Person listed on Schedule I hereto (each, an “Investor” and collectively, the “Investors”), and

5. each Person listed on Schedule II hereto.

Each of the parties to this Agreement is referred to herein individually as a “Party” and collectively as the “Parties”.

RECITALS

A. The Group (as defined below) has conducted the Restructuring (as defined below), upon the completion of which, the Company has become the Controlling holding company of the Group (other than the Company).

B. The Investors wish to invest in the Company by subscribing for Series D Preferred Shares to be issued by the Company pursuant to the terms and subject to the conditions of this Agreement, and the Company wishes to issue and sell Series D Preferred Shares to the Investors pursuant to the terms and subject to the conditions of this Agreement.

C. The Parties desire to enter into this Agreement and make the respective representations, warranties, covenants and agreements set forth herein on the terms and conditions set forth herein.

WITNESSETH

NOW, THEREFORE, in consideration of the foregoing recitals, the mutual promises hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties intending to be legally bound hereto hereby agree as follows:

ARTICLE 1

DEFINITIONS

Section 1.01. Definitions. The following terms shall have the meanings ascribed to them below:

“Accounting Standards” means generally accepted accounting principles in the United States in effect from time to time, applied on a consistent basis.

“Action” means any charge, claim, action, complaint, petition, investigation, appeal, suit, litigation, grievance, inquiry or other proceeding, whether administrative, civil, regulatory or criminal, whether at law or in equity, or otherwise under any applicable Law, and whether or not before any mediator, arbitrator or Governmental Authority.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly Controlling, Controlled by, or under common Control with such Person.

“Business Day” means any day that is not a Saturday, Sunday, legal holiday or other day on which commercial banks are required or authorized by Law to be closed in the PRC, Hong Kong or the Cayman Islands.

“Lotus” means Lotus Walk Inc.

“Charter Documents” means, with respect to a particular legal entity, the articles of incorporation, certificate of incorporation, formation or registration (including, if applicable, certificates of change of name), memorandum of association, articles of association, bylaws, articles of organization, limited liability company agreement, trust deed, trust instrument, operating agreement, joint venture agreement, business license, or similar or other constitutive, governing, or charter documents, or equivalent documents, of such entity.

“Closing Date” means the date of the Closing.

“Company Owned IP” means any Intellectual Property owned by or exclusively licensed to any Group Company.

“Company Registered IP” means any Intellectual Property for which registrations are owned by or held in the name of, or for which applications have been made in the name of, any Group Company.

“Consent” means any consent, approval, authorization, release, waiver, permit, grant, franchise, concession, agreement, license, exemption or order of, registration, certificate, declaration or filing with, or report or notice to, any Person, including any Governmental Authority.

“Contract” means a contract, agreement, indenture, note, bond, loan, instrument, lease, mortgage, franchise, license, commitment, purchase order, and other legally binding arrangement, whether written or oral.

“Control” of a given Person means the power or authority, whether exercised or not, to direct the business, management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, as trustee, personal representative or executive, by Contract, credit arrangement or otherwise. The terms “Controlled” and “Controlling” have meanings correlative to the foregoing.

“Equity Securities” means, with respect to any Person, any shares, any and all shares of capital stock, membership interests, units, profits interests, ownership interests, equity interests, registered capital, and other equity securities of such Person, and any right, warrant, option, call, commitment, conversion privilege, preemptive right or other right to acquire any of the foregoing, or security convertible into, exchangeable or exercisable for any of the foregoing, or any Contract providing for the acquisition of any of the foregoing, shares, awards, options, warrants, interests, rights under any equity appreciation, phantom equity, equity plans or similar plans or schemes with respect to such Person, and, with respect to the Company, shall include any Ordinary Shares, awards, options, warrants, interests, rights under the ESOP.

“ESOP” means (i) any equity incentive, purchase or participation plan, employee stock option plan or similar plan of the Company approved and adopted in accordance with the Shareholders Agreement, or (ii) the shares reserved and subject to item (i), as the case may be.

“Governmental Authority” means any government of any nation, federation, province, state or locality or any other political subdivision thereof, any entity, authority or body exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including any government authority, agency, department, board, commission or instrumentality of the PRC or any other country, or any political subdivision thereof, any court, tribunal or arbitrator, and any self-regulatory organization.

“Governmental Order” means any applicable order, ruling, decision, verdict, decree, writ, subpoena, mandate, command, directive, consent, approval, award, judgment, injunction or other similar determination or finding by, before or under the supervision of any Governmental Authority.

“Group Company” means each of the companies listed on Schedule II attached hereto, and each other entity whose financial statements are consolidated with those of any Group Company in accordance with the Accounting Standards, and “Group” refers to all of Group Companies collectively.

“Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China.

“Indebtedness” of any Person means, without duplication, each of the following of such Person: (i) all indebtedness for borrowed money, (ii) all obligations issued, undertaken or assumed as the deferred purchase price of property or services (other than trade payables incurred in the ordinary course of business), (iii) all reimbursement or payment obligations with respect to letters of credit, surety bonds and other similar instruments, (iv) all obligations evidenced by notes, bonds, debentures or similar instruments, including obligations so evidenced that are incurred in connection with the acquisition of properties, assets or businesses, (v) all indebtedness created or arising under any conditional sale or other title retention agreement, or incurred as financing, in either case with respect to any property or assets acquired with the proceeds of such indebtedness (even though the rights and remedies of the seller or bank under such agreement in the event of default are limited to repossession or sale of such property), (vi) all obligations that are capitalized (including capitalized lease obligations), (vii) all obligations under banker’s acceptance, letter of credit or similar facilities, (viii) all obligations to purchase, redeem, retire, defease or otherwise acquire for value any Equity Securities of such Person, (ix) all obligations in respect of any interest rate swap, hedge or cap agreement, and (x) all guarantees issued in respect of the Indebtedness referred to in clauses (i) through (ix) above of any other Person, but only to the extent of such Indebtedness guaranteed.

“Indemnifiable Loss” means, with respect to any Person, any action, claim, dispute, proceeding, cost, damage, deficiency, disbursement, expense, liability, loss, obligation, penalty, Taxes, settlement or judgment of any kind or nature imposed on or otherwise incurred or suffered by such Person, provided that the Indemnifiable Loss shall exclude any mental and emotional distress, and any speculative, consequential, exemplary or punitive damages.

“Intellectual Property” means any and all (i) patents, patent rights and applications therefor and reissues, reexaminations, continuations, continuations-in-part, divisions, and patent term extensions thereof, (ii) inventions (whether patentable or not), discoveries, improvements, concepts, innovations and industrial models, (iii) registered and unregistered copyrights, copyright registrations and applications, mask works and registrations and applications therefor, author’s rights and works of authorship (including artwork, software, computer programs, source code, object code and executable code, firmware, development tools, files, records and data, and related documentation), (iv) URLs, web sites, web pages and any part thereof, (v) technical information, know-how, trade secrets, drawings, designs, design protocols, specifications, proprietary data, customer lists, databases, proprietary processes, technology, formulae, and algorithms and other intellectual property, (vi) trade names, trade dress, trademarks, domain names, service marks, logos, business names, and registrations and applications therefor, and (vii) the goodwill symbolized, associated with or represented by the foregoing.

“Joint Venture Companies” means, collectively, 36Kr Global Holding (HK) Limited, (株式会社) 36Kr Japan and KRASIA PLUS PTE. LTD.

“Key Employee” means each of the Co-Founder, XXXXX Xxxxxx (with PRC ID Number 000000000000000000) and XX Xxxx (with PRC ID Number 000000000000000000).

“Knowledge” means, with respect to the Warrantors, the actual knowledge of the Warrantors after reasonable inquiry.

“Law” or “Laws” means any and all provisions of any applicable constitution, treaty, statute, law, regulation, ordinance, code, rule, or rule of common law, any governmental approval, concession, grant, franchise, license, agreement, directive, requirement, or other governmental restriction or any similar form of decision of, or determination by, or any interpretation or administration of any of the foregoing by, any Governmental Authority, in each case as amended, and any and all applicable Governmental Orders.

“Liabilities” means, with respect to any Person, all liabilities, obligations and commitments of such Person of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due.

“Licenses” means (i) all licenses, sublicenses, and other Contracts to which any Group Company is a party and pursuant to which any third party is authorized to use, exercise or receive any benefit from any material Company IP, and (ii) all licenses, sublicenses and other Contracts to which any Group Company is a party and pursuant to which such Group Company is authorized to use, exercise, or receive any benefit from any material Intellectual Property of another Person, in each case except for (A) agreements involving “off-the-shelf” commercially available software, and (B) non-exclusive licenses to customers in the ordinary course of business consistent with past practice.

“Lien” means any claim, charge, easement, encumbrance, lease, covenant, security interest, lien, option, pledge, rights of others, or restriction (whether on voting, sale, transfer, disposition or otherwise), whether imposed by Contract, understanding, law, equity or otherwise.

“Majority Investors” means the Investors subscribing for 50% of the Shares hereunder.

“Material Adverse Effect” means any event, occurrence, fact, condition, change or development that has had or has or could reasonably be expected to have a material adverse effect on (i) the business, properties, assets, operations, results of operations, financial condition or Liabilities of the Group taken as a whole, with an adverse impact greater in value than 30% of the total net assets of the Group on a consolidated basis as of the Statement Date, or which cause the Company to be explicitly prohibited from conducting the principal business as presently being conducted, excluding any effect resulting from (A) changes in Accounting Standards or changes in the regulatory accounting requirements applicable to any industry in which the Group operates, (B) changes in the general economic or political conditions, (C) changes (including changes of applicable Laws) or conditions generally affecting the industry in which the Group operates, (D) acts of war, sabotage or terrorism or natural disasters, (E) the announcement or consummation of the transactions contemplated by the Transaction Documents, (F) any action taken (or omitted to be taken) at the request of any Investor or (G) any action taken by the Company that is required, contemplated or permitted pursuant to this Agreement, provided that any event, occurrence, fact, condition, change or development referred to in clause (B) through (D) immediately above shall be taken into account in determining whether a Material Adverse Effect has occurred or could reasonably be expected to occur to the extent that such event, occurrence, fact, condition, change or development has an adverse effect on the Group that is disproportionate to the effect on other similar companies operating in the same industry, (ii) the ability of the Warrantors to consummate the transactions contemplated by any of the Transaction Documents on a timely basis or to perform the obligations under the Transaction Documents, or (iii) the validity and the enforceability of this Agreement against the Warrantors.

“Memorandum and Articles” means the second amended and restated memorandum of association of the Company and the second amended and restated articles of association of the Company substantially in the form attached hereto as Exhibit A, to be adopted in accordance with applicable Law on or before the Closing pursuant to the terms of this Agreement and effective from the Closing Date.

“Ordinary Shares” means the Company’s ordinary shares, par value US$0.0001 per share.

“Permitted Liens” means (i) Liens for Taxes not yet delinquent or the validity of which are being contested in good faith and for which there are adequate reserves on the applicable financial statements, (ii) Liens disclosed on the Financial Statements, (iii) Liens incurred in the ordinary course of business, or (iv) other Liens which would not have a Material Adverse Effect.

“Person” means any individual, corporation, partnership, limited partnership, proprietorship, association, limited liability company, firm, trust, estate or other enterprise or entity.

“PRC” means the People’s Republic of China, but solely for the purposes of this Agreement and the other Transaction Documents, excluding Hong Kong, the Macau Special Administrative Region and the islands of Taiwan.

“Related Party” means, to the Knowledge of the Warrantors, (i) any shareholder that beneficially owns five percent (5%) or more of the share capital of any Group Company, (ii) any officer or director of any Group Company, any immediate family member of any of the foregoing in clauses (i) and (ii), and any Affiliate of any of the foregoing in clauses (i) and (ii), except for any other Group Company. The Company’s Related Parties include without limitation the Persons set forth on Schedule V.

“Restructuring” means the transactions and actions set forth in Schedule IV hereto.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Series A-1 Preferred Shares” means the Series A-1 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series A-2 Preferred Shares” means the Series A-2 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series B-1 Preferred Shares” means the Series B-1 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series B-2 Preferred Shares” means the Series B-2 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series B-3 Preferred Shares” means the Series B-3 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series B-4 Preferred Shares” means the Series B-4 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series C-1 Preferred Shares” means the Series C-1 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series C-2 Preferred Shares” means the Series C-2 Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Series D Preferred Shares” means the Series D Preferred Shares of the Company, par value US$0.0001 per share, with the rights and privileges as set forth in the Memorandum and Articles.

“Shareholders Agreement” means the Amended and Restated Shareholders Agreement to be entered into by and among the parties named therein on or prior to the Closing, which shall be substantially in the form attached hereto as Exhibit B.

“Tax” means (i) in the PRC: (A) any national, provincial, municipal, or local taxes, charges, fees, levies, or other assessments, including, without limitation, all net income (including enterprise income tax and individual income withholding tax), turnover (including value-added tax, business tax, and consumption tax), resource (including urban and township land use tax), special purpose (including land value-added tax, urban maintenance and construction tax, and additional education fees), property (including urban real estate tax and land use fees), documentation (including stamp duty and deed tax), filing, recording, social insurance (including pension, medical, unemployment, housing, and other social insurance withholding), tariffs (including import duty and import value-added tax), and estimated and provisional taxes, charges, fees, levies, or other assessments of any kind whatsoever, (B) all interest, penalties (administrative, civil or criminal), or additional amounts imposed by any Governmental Authority in connection with any item described in clause (A) above, and (C) any form of transferee liability imposed by any Governmental Authority in connection with any item described in clauses (A) and (B) above and (ii) in any jurisdiction other than the PRC: all similar liabilities as described in clause (i)(A), (i)(B) and (i)(C) above.

“Tax Return” means any return, report or statement showing Taxes, used to pay Taxes, or required to be filed with respect to any Tax (including any elections, declarations, schedules or attachments thereto, and any amendment thereof), including any information return, claim for refund, amended return or declaration of estimated or provisional Tax.

“Transaction Documents” means this Agreement, the Shareholders Agreement, the Memorandum and Articles and each of the other agreements and documents delivered or otherwise required in connection with implementing the transactions contemplated by any of the foregoing.

“Warrantors” means, collectively, the Group Companies (except for the Joint Venture Companies), the Co-Founder and the Co-Founder Holdco.

Section 1.02. Other Defined Terms. The following terms shall have the meanings defined for such terms in the Sections set forth below:

|

Agreement |

|

Preamble |

|

Arbitration Notice |

|

Section 11.05(a) |

|

Balance Sheet |

|

Section 3.11 |

|

Closing |

|

Section 2.02(a) |

|

Company |

|

Preamble |

|

Company IP |

|

Section 3.16(a) |

|

Disclosure Schedule |

|

Article 3 |

|

Dispute |

|

Section 11.05(a) |

|

Financial Statements |

|

Section 3.11 |

|

Financing Terms |

|

Section 7.01 |

|

HKIAC |

|

Section 11.05(b) |

|

HKIAC Rules |

|

Section 11.05(b) |

|

Indemnified Party |

|

Section 10.03 |

|

Indemnifying Party |

|

Section 10.03 |

|

Investor |

|

Preamble |

|

Material Contracts |

|

Section 3.14(a) |

|

Parties |

|

Preamble |

|

Purchase Price |

|

Section 2.01 |

|

Shares |

|

Section 2.01 |

|

Statement Date |

|

Section 3.11 |

ARTICLE 2

PURCHASE AND SALE OF SHARES

Section 2.01. Subscription and Issuance of Shares. Subject to the terms and conditions of this Agreement, at the Closing (as defined below), each Investor, severally and not jointly, agrees to subscribe for and purchase, and the Company agrees to issue and sell to such Investor, that number of Series D Preferred Shares set forth opposite such Investor’s name on Schedule I attached hereto (the “Shares”), with each Investor to pay as consideration for such Shares the aggregate purchase price set forth opposite such Investor’s name on Schedule I attached hereto (the “Purchase Price”). The capitalization table of the Company immediately before and after the Closing is attached as Schedule VII hereto.

Section 2.02. Closing.

(a) Closing. The consummation of the subscription and issuance of the Shares with respect to each Investor pursuant to Section 2.01 (the “Closing”) shall take place remotely via the exchange of documents and signatures as soon as practicable, but in no event later than five Business Days after all closing conditions specified in Article 5 and Article 6 hereof have been waived or satisfied (other than those conditions to be satisfied at the Closing, but subject to the satisfaction or waiver thereof at the Closing), or at such other time and place as the Company and the Investors shall mutually agree in writing.

(b) Deliveries by the Company at Closing. At the Closing, the Company shall deliver to each Investor (i) the updated register of members of the Company, certified by the registered agent of the Company as a true copy, reflecting the issuance to such Investor of the Shares being purchased by such Investor at the Closing, and (ii) copies of the certificate or certificates issued in the name of such Investor representing the Shares being purchased by such Investor at the Closing, with the duly executed original copies of which delivered to such Investor within ten (10) Business Days after the Closing.

(c) Deliveries by the Investors at Closing. At the Closing, each Investor shall pay its respective Purchase Price by wire transfer of immediately available funds in U.S. dollars to an account designated by the Company, provided that transfer instructions shall be delivered to each Investor at least five (5) Business Days prior to the Closing.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE WARRANTORS

Subject to such exceptions as may be fairly and specifically set forth in the disclosure schedule delivered by the Warrantors to the Investors as of the date hereof (the “Disclosure Schedule”) as set forth in Schedule VI hereto (it being understood that an item disclosed in one section of the Disclosure Schedule shall be deemed to be disclosed with respect to any other section of the Disclosure Schedule where the reference of such item would be apparent), each of the Warrantors jointly and severally represents and warrants to the Investors, as of the date hereof and as of the Closing, that:

Section 3.01. Organization, Good Standing and Qualification. Each Group Company is duly organized, validly existing and in good standing (or equivalent status in the relevant jurisdiction) under the Laws of the place of its incorporation or establishment and has all requisite power and authority to own its properties and assets and to carry on its business as now conducted and as proposed to be conducted, and to perform its obligations under each Transaction Document to which it is a party. Each Group Company is qualified to do business in each jurisdiction (or equivalent status in the relevant jurisdiction) in which it is currently transacting business, except where failure to be so qualified would not have a Material Adverse Effect.

Section 3.02. Capitalization.

(a) Capitalization. (i) The authorized share capital of the Company is and immediately prior to the Closing shall be US$500,000 divided into (A) a total of 4,274,029,001 authorized Ordinary Shares, 176,843,000 of which shall be issued and outstanding, (B) a total of 65,307,000 authorized Series A-1 Preferred Shares, all of which shall be issued and outstanding, (C) a total of 101,261,000 authorized Series A-2 Preferred Shares, all of which shall be issued and outstanding, (D) a total of 250,302,000 authorized Series B-1 Preferred Shares, all of which shall be issued and outstanding, (E) a total of 14,593,000 authorized Series B-2 Preferred Shares, all of which shall be issued and outstanding, (F) a total of 56,105,000 authorized Series B-3 Preferred Shares, all of which shall be issued and outstanding, (G) a total of 20,982,000 authorized Series B-4 Preferred Shares, all of which shall be issued and outstanding, (H) a total of 164,876,000 authorized Series C-1 Preferred Shares, all of which shall be issued and outstanding, (I) a total of 12,545,000 authorized Series C-2 Preferred Shares, all of which shall be issued and outstanding, and (J) a total of 39,999,999 authorized Series D Preferred Shares, none of which shall be issued and outstanding. (ii) The authorized share capital of the Company immediately after the Closing shall be US$500,000 divided into (A) a total of 4,274,029,001 authorized Ordinary Shares, 176,843,000 of which shall be issued and outstanding, (B) a total of 65,307,000 authorized Series A-1 Preferred Shares, all of which shall be issued and outstanding, (C) a total of 101,261,000 authorized Series A-2 Preferred Shares, all of which shall be issued and outstanding, (D) a total of 250,302,000 authorized Series B-1 Preferred Shares, all of which shall be issued and outstanding, (E) a total of 14,593,000 authorized Series B-2 Preferred Shares, all of which shall be issued and outstanding, (F) a total of 56,105,000 authorized Series B-3 Preferred Shares, all of which shall be issued and outstanding, (G) a total of 20,982,000 authorized Series B-4 Preferred Shares, all of which shall be issued and outstanding, (H) a total of 164,876,000 authorized Series C-1 Preferred Shares, all of which shall be issued and outstanding, (I) a total of 12,545,000 authorized Series C-2 Preferred Shares, all of which shall be issued and outstanding, and (J) a total of 39,999,999 authorized Series D Preferred Shares, all of which shall be issued and outstanding.

(b) No Other Securities. Except as contemplated under the Transaction Documents or as in connection with the Restructuring, or as set forth in Section 3.02(b) of the Disclosure Schedule, (i) there are no other authorized or outstanding Equity Securities of any Group Company; (ii) no Equity Securities of any Group Company are subject to any preemptive rights, rights of first refusal (except to the extent provided by applicable Laws) or other rights to purchase such Equity Securities or any other rights with respect to such Equity Securities, and (iii) no Group Company is a party or subject to any Contract that affects or relates to the voting or giving of written consents with respect to, or the right to cause the redemption, or repurchase of, any Equity Security of such Group Company.

(c) Issuance and Status. Except as set forth in Section 3.02(c) of the Disclosure Schedule, all outstanding share capital or registered capital, as the case may be, of each Group Company have been duly and validly issued, are fully paid and nonassessable, and are free of any and all Liens (except for any restrictions on transfer under the Transaction Documents and applicable Laws). Except as contemplated under the Transaction Documents or as in connection with the Restructuring, or as set forth in Section 3.02(c) of the Disclosure Schedule, there are no (i) resolutions pending to increase the share capital or registered capital of any Group Company or cause the liquidation, winding up, or dissolution of any Group Company, nor has any distress, execution or other process been levied against any Group Company, (ii) dividends which have accrued or been declared but are unpaid by any Group Company, (iii) obligations, contingent or otherwise, of any Group Company to repurchase, redeem, or otherwise acquire any Equity Securities, or (iv) outstanding or authorized equity appreciation, phantom equity, equity plans or similar rights with respect to any Group Company.

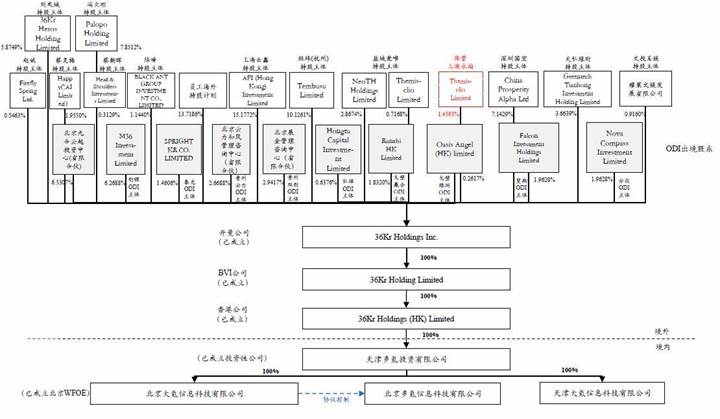

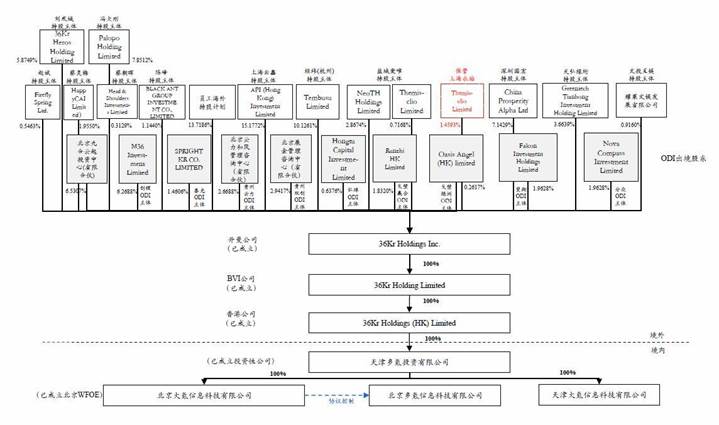

Section 3.03. Corporate Structure; Subsidiaries. Section 3.03 of the Disclosure Schedule sets forth a structure chart showing the Group Companies, and indicating the ownership and Control relationships among the Group Companies upon the completion of the Restructuring, the nature of the legal entity which each Group Company constitutes and the jurisdiction in which each Group Company was organized. Except as set forth in Section 3.03 of the Disclosure Schedule, no Group Company owns or Controls, directly or indirectly, any Equity Security, interest or share in any other Person outside of the Group or is or was a participant in any joint venture, partnership or similar arrangement outside of the Group. No Group Company is obligated to make any investment in or capital contribution in or on behalf of any other Person.

Section 3.04. Authorization. Each Warrantor has all requisite power and authority to execute and deliver the Transaction Documents to which it is a party and to carry out and perform its obligations thereunder. All actions on the part of each party to the Transaction Documents (other than the Investors) necessary for the authorization, execution and delivery of the Transaction Documents, the performance of all obligations of each such party, and, in the case of the Company, the authorization, issuance (or reservation for issuance), sale and delivery of the Shares, have been taken or will be taken prior to the Closing. Each Transaction Document has been duly executed and delivered by each party thereto (other than the Investors) and constitutes valid and legally binding obligations of such party, enforceable against such party in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other Laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by Laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

Section 3.05. Valid Issuance of Shares. The Shares, when issued, delivered and paid for in accordance with the terms of this Agreement for the consideration expressed herein, will be duly and validly issued, fully paid and non-assessable, free from any Liens (except for any restrictions on transfer under applicable Laws and under the Transaction Documents). The issuance of the Shares is not subject to any preemptive rights, rights of first refusal or similar rights, other than those that have been duly waived in full or contemplated under the Transaction Documents.

Section 3.06. Consents; No Conflicts. All Consents from or with any Governmental Authority or any other Person required in connection with the execution, delivery and performance of the Transaction Documents, and the consummation of the transactions contemplated by the Transaction Documents, in each case on the part of any party thereto (other than the Investors) have been duly obtained or completed (as applicable) and are in full force and effect. The execution, delivery and performance of each Transaction Document by each party thereto (other than the Investors) do not, and the consummation by each such party of the transactions contemplated thereby will not, with or without notice or lapse of time or both, (i) result in any violation of, be in conflict with, or constitute a default under any provision of any Charter Document of any Group Company, (ii) result in any violation of, be in conflict with, or constitute a default under, require any consent under any Governmental Order or any applicable Laws, (iii) result in any violation of, be in conflict with, or constitute a default in any material respect under, require any consent under, or give rise to any material right of termination, amendment, modification, acceleration or cancellation under, or give rise to any augmentation or acceleration of any material Liability of any Group Company under, any Material Contract, or (iv) result in the creation of any Lien upon any of the material properties or assets of any Group Company other than Permitted Liens.

Section 3.07. Restructuring. All Consents from or with any Governmental Authority or with any other person in connection with the Restructuring have been obtained and all notifications or filings that may be required under the applicable Laws in connection with the Restructuring have been duly completed in accordance with the applicable Laws.

Section 3.08. Offering. Subject to the accuracy of the Investors’ representations set forth in Article 4 of this Agreement, the offer, issuance and sale of the Shares are exempt from the qualification, registration and prospectus delivery requirements of the Securities Act and any other applicable securities Laws.

Section 3.09. Compliance with Laws; Consents.

(a) Except as set forth in Section 3.09(a) of the Disclosure Schedule (provided that such exception has not had, and would not have any Material Adverse Effect), each Group Company is, and during the three years preceding the Closing Date has been, in compliance with all applicable Laws. None of the Group Companies has received any notice, letter, or oral communication from any Governmental Authority regarding any violation, or failure on the part of such entity to comply with, any applicable Laws in all material respects, or required any Group Company to undertake, or to bear material cost of, any remedial action of any nature.

(b) Except as set forth in Section 3.09(b) of the Disclosure Schedule (provided that such exception has not had, and would not have any Material Adverse Effect), all Consents from or with the relevant Governmental Authorities required in respect of the due and proper establishment and operations of each Group Company as now conducted have been duly obtained or completed in accordance with all applicable Laws in all material respects.

(c) No Group Company nor any director, agent, employee or any other person acting for or on behalf of any member of the Group Companies has at any time taken any action, directly or indirectly, in violation of the U.S. Foreign Corrupt Practices Act of 1977, as amended, or other applicable anti-bribery or anti-corruption laws (the “Anti-Bribery Laws”), and each Group Company conducts and has at all times conducted its business in compliance with Anti-Bribery Laws.

(d) Each Group Company complies and has at all times complied with all applicable economic and financial sanctions Laws and regulations of the United States of America, the United Kingdom, the European Union (or any Member State thereof), the United Nations and each other jurisdiction in which it operates or to which it is subject, including, without limitation those administered or enforced by the United States Department of Treasury’s Office of Foreign Assets Control or the United States Department of States.

(e) The Group Companies have no pending or potential liabilities arising from non-compliance of employment, social security and housing provident fund related legal requirements in excess of US$10,000 in total.

Section 3.10. Tax Matters.

(a) Except as set forth in Section 3.10(a) of the Disclosure Schedule, each Group Company has timely filed all Tax Returns that are required to have been filed by it with any Governmental Authority, except to the extent that any failure to do so would not have a Material Adverse Effect, and all such Tax Returns are accurate and complete in all material respects.

(b) Except as set forth in Section 3.10(b) of the Disclosure Schedule, each Group Company has timely paid all Taxes owed by it which are due and payable (whether or not shown on any Tax Return) and timely withheld and remitted to the appropriate Governmental Authority all Taxes which it is obligated to withhold and remit from amounts owing to any employee, creditor, customer or third party, except, in each case, to the extent that any failure to do so would not have a Material Adverse Effect.

Section 3.11. Financial Statements. The unaudited consolidated balance sheet and statements of operations and cash flows for the Group Companies as of and for the year ended December 31, 2018 and the unaudited consolidated balance sheet (the “Balance Sheet”) and statements of operations and cash flows for the Group Companies as of and for the three months ended March 31, 2019 (the “Statement Date”) (collectively, the financial statements referred to above, the “Financial Statements”) shall be delivered to the Investors at request. The Financial Statements (i) have been prepared in accordance with the Accounting Standards applied on a consistent basis throughout the period involved, (ii) are based the books and records of the Group Companies, and (iii) fairly present in all material respects the financial condition and position of the Group Companies as of the dates indicated therein and the results of operations and cash flows of the Group Companies for the periods indicated therein, except in the case of unaudited financial statements for the omission of notes thereto and subject to normal year-end audit adjustments that are not expected to be material.

Section 3.12. Liabilities. No Group Company has any material Liabilities of the type required to be disclosed on a balance sheet except for (i) Liabilities set forth in the Balance Sheet that have not been satisfied since the Statement Date, (ii) Liabilities incurred since the Statement Date in the ordinary course of the Group’s business consistent with its past practices. None of the Group Companies is a guarantor of any material Liabilities of any other Person (other than a Group Company).

Section 3.13. Actions. Except as set forth in Section 3.13 of the Disclosure Schedule, (i) there is no Action pending or, to the Knowledge of the Warrantors, threatened against or affecting any Group Company with respect to its businesses or proposed business activities, (ii) there is no judgment or award unsatisfied against any Group Company, nor is there any Governmental Order in effect and binding on any Group Company or their respective assets or properties, and (iii) there is no Action pending by any Group Company against any third party nor does any Group Company intend to commence any such Action, except, in each of (i), (ii) and (iii) above, as would not have a Material Adverse Effect.

Section 3.14. Material Contracts.

(a) Section 3.14(a) of the Disclosure Schedule contains a complete and accurate list of all Material Contracts as of the date hereof. “Material Contracts” means, collectively, each Contract to which a Group Company or any of its properties or assets is bound or subject to (but excluding (i) any Contracts that have been fully performed by all parties thereto, with no continuing obligations whatsoever by any party thereto, and (ii) any Contracts that are in connection with the Restructuring) that:

(i) involves obligations (contingent or otherwise) or payments in excess of US$200,000 per annum,

(ii) involves Intellectual Property that is material to a Group Company (other than generally-available “off-the-shelf” shrink-wrap software licenses obtained by the Group on non-exclusive and non-negotiated terms), including without limitation, the Licenses,

(iii) restricts the ability of a Group Company to compete or to conduct or engage in any business or activity in any territory,

(iv) is with a Related Party,

(v) involves Indebtedness, an extension of credit, a guaranty, surety or assumption of any obligation or any secondary or contingent Liabilities, deed of trust, or the grant of a Lien, in each case in excess of US$200,000 ,

(vi) involves the lease, license, sale, use, disposition or acquisition of a material amount of assets or of a business,

(vii) involves the establishment, contribution to, or operation of a partnership, joint venture, alliance or similar entity,

(viii) is with any Government Authority (other than any Contract entered into in the ordinary course of business),

(ix) is the physical basis of the operation of the Group Companies legally, including but not limited to the lease agreement of the registered address and business address of each of the Group Companies; and

(x) is otherwise material to the Group Companies taken as a whole.

(b) Each Material Contract is a valid and binding agreement of the Group Company that is a party thereto, the performance of which does not and will not violate any applicable Law or Governmental Order, and is in full force and effect and enforceable against such Group Company and any other party thereto, except (A) as may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, and (B) as may be limited by laws relating to the availability of specific performance, injunctive relief or other remedies in the nature of equitable remedies. Each Group Company has duly performed all of its obligations under each Material Contract, and no breach or default, alleged breach or alleged default, or event which would (with the passage of time, notice or both) constitute a breach or default thereunder by such Group Company or, to the Warrantors’ Knowledge, by any other party thereto, has occurred. No Group Company has given notice (whether or not written) that it intends to terminate a Material Contract or that any other party thereto has breached, violated or defaulted under any Material Contract. No Group Company has received any notice (whether written or not) that it has breached, violated or defaulted under any Material Contract or that any other party thereto intends to terminate such Material Contract.

Section 3.15. Title; Properties. Except as set forth in Section 3.15 of the Disclosure Schedule, each Group Company has good and valid title to, or in the case of leased property and assets have valid leasehold interests in, all of its respective material assets, whether real, personal, tangible or intangible (including those reflected in the Balance Sheet, together with all assets acquired thereby since the Statement Date, but excluding those that have been disposed of since the Statement Date in the ordinary course of business consistent with its past practice), in each case free and clear of all Liens, other than Permitted Liens. No Group Company has joint ownership, together with any other person which is not a Group Company, in respect of any material property or assets which are used in connection with the business of such Group Company.

Section 3.16. Intellectual Property Rights.

(a) Company IP. Each Group Company owns or otherwise has sufficient rights to all Intellectual Property necessary and sufficient to conduct its business as currently conducted by such Group Company (the “Company IP”) without any conflict with or infringement of the rights of any other Person, except as would not have a Material Adverse Effect.

(b) IP Ownership. Except as disclosed in Section 3.16(b) of the Disclosure Schedule, all Company Registered IP is owned by and registered or applied for solely in the name of a Group Company, is valid and subsisting and has not been abandoned, and all necessary registration, maintenance and renewal fees with respect thereto and currently due have been satisfied. No Company Owned IP is subject to any proceeding or outstanding Governmental Order or settlement agreement or stipulation that (i) restricts in any manner the use, transfer or licensing thereof, or the making, using, sale, or offering for sale of any Group Company’s products or services, by any Group Company or (ii) may affect the validity, use or enforceability of such Company Owned IP, except, in each case of (i) and (ii) above, as would not have a Material Adverse Effect.

(c) Infringement, Misappropriation and Claims. No Group Company has violated, infringed or misappropriated in any material respect any Intellectual Property of any other Person, nor has any Group Company received any written notice alleging any of the foregoing, except to the extent that any such infringement or violation would not have a Material Adverse Effect. To the Knowledge of the Warrantors, no Person has violated, infringed or misappropriated any material Company IP of any Group Company, and no Group Company has given any written notice to any other Person alleging any of the foregoing.

(d) Protection of IP. Each Group Company has taken reasonable and appropriate steps to protect, maintain and safeguard material Company IP and made the applicable filings, registrations and payments of fees in all material respects in connection with the foregoing.

Section 3.17. Labor and Employment Matters. Except as set forth in Section 3.17 of the Disclosure Schedule, each Group Company has complied with all applicable Laws related to labor or employment, including provisions thereof relating to wages, hours, working conditions, benefits, retirement, social welfare, equal opportunity and collective bargaining, except as would not have a Material Adverse Effect. There is not pending or, to the Knowledge of the Warrantors, threatened, any Action relating to the violation or alleged violation of any applicable Laws by any Group Company related to labor or employment, including any charge or complaint filed by an employee with any Governmental Authority or any Group Company.

Section 3.18. No Brokers. Neither any Group Company, any Warrantor nor any of their respective Affiliates has any Contract with any broker, finder or similar agent with respect to the transactions contemplated by this Agreement or by any other Transaction Documents, and none of them has incurred any Liability for any brokerage fees, agents’ fees, commissions or finders’ fees in connection with any of the Transaction Documents or the consummation of the transactions contemplated therein.

Section 3.19. Co-Founder Noncompetition. Except as set forth in Section 3.19 of the Disclosure Schedule, none of the Co-Founder and his Affiliates has, directly or indirectly, (i) engaged in or assisted others in engaging in any business that directly or indirectly compete with the business of the Company (“Restricted Business”) as of the Closing; (ii) had an interest in any Person that engages directly or indirectly in the Restricted Business in any capacity, including as a partner, shareholder, member, employee, director, principal, agent, trustee or consultant; or (iii) intentionally interfered in any material respect with the business relationships (whether formed prior to or after the date of this Agreement) between any Group Company and business partners of such Group Company. Notwithstanding the foregoing, the Co-Founder may own, directly or indirectly, solely as an investment, securities of any Person traded on any national securities exchange if such Co-Founder is not a controlling Person of, or a member of a group which controls, such Person and does not, directly or indirectly, own 1% or more of any class of securities of such Person.

Section 3.20. Full Disclosure. No representation or warranty by the Warrantors in this Agreement and no statement contained in the Disclosure Schedules to this Agreement or any certificate or other document furnished or to be furnished to the Investors pursuant to the Transaction Documents contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they are made, not misleading.

Section 3.21. No Changes. Since the Statement Date, except as set forth in Section 3.21 of the Disclosure Schedule, no Group Company has conducted:

(a) any purchase, acquisition, sale, lease, disposal of or other transfer of any assets that are individually or in the aggregate material to its business, whether tangible or intangible, other than the purchase or sale of inventory in the ordinary course of business consistent with its past practice;

(b) any waiver, termination, cancellation, settlement or compromise of a material and valuable right, debt or claim;

(c) any incurrence, creation, assumption, repayment, satisfaction, or discharge of (a) any material Lien (other than Permitted Liens) or (b) any Indebtedness or guarantee, or the making of any loan or advance (other than that are incurred in the ordinary course of business consistent with its past practice);

(d) any amendment to or waiver under any Charter Document;

(e) any declaration, setting aside or payment or other distribution in respect of any share of any Group Company;

(f) any material change in accounting methods or practices or any revaluation of any of its assets;

(g) any agreement or commitment to do any of the things described in this Section 3.21.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF THE INVESTORS

Each Investor hereby represents and warrants to the Company, severally and not jointly and with respect to itself only, as of the date hereof and as of the Closing, that:

Section 4.01. Organization and Good Standing. Such Investor is duly organized, validly existing and in good standing under the Laws of the place of its incorporation or establishment.

Section 4.02. Authorization. Such Investor has all requisite power and authority to execute and deliver the Transaction Documents to which it is a party and to carry out and perform its obligations thereunder. All actions on the part of such Investor (and, as applicable, its officers, directors and shareholders) necessary for the authorization, execution and delivery of the Transaction Documents to which it is a party, and the performance of all obligations of such Investor thereunder, have been taken or will be taken prior to the Closing. Each Transaction Document has been duly executed and delivered by such Investor (to the extent such Investor is a party), constitutes valid and legally binding obligations of such Investor, enforceable against such Investor in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other Laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by Laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

Section 4.03. Consents; No Conflicts. All Consents from or with any Governmental Authority or any other Person required in connection with the execution, delivery and performance of the Transaction Documents, and the consummation of the transactions contemplated by the Transaction Documents, in each case on the part of such Investor, have been duly obtained or completed (as applicable) and are in full force and effect. The execution, delivery and performance of each Transaction Document by such Investor do not, and the consummation by such Investors of the transactions contemplated thereby will not, with or without notice or lapse of time or both, (i) result in any violation of, be in conflict with, or constitute a default under any provision of any Charter Document of such Investor, (ii) result in any violation of, be in conflict with, or constitute a default under, in any material respect, any Governmental Order or any applicable Laws, (iii) result in any violation of, be in conflict with, or constitute a default in any material respect under, or give rise to any material right of termination, amendment, modification, acceleration or cancellation under, or give rise to any augmentation or acceleration of any material Liability of such Investor, or (iv) result in the creation of any Lien upon any of the material properties or assets of such Investor.

Section 4.04. Financing. Each Investor has, or will have prior to the Closing, sufficient cash, available lines of credit or other sources of immediately available funds to enable it to make payment of the Purchase Price and any other amounts to be paid by it hereunder.

Section 4.05. Purchase for Own Account. The Shares will be acquired for such Investor’s own account, not as a nominee or agent, and not with a view to or in connection with the sale or distribution of any part thereof.

Section 4.06. Restricted Securities. Such Investor understands that (i) the Shares are restricted securities within the meaning of Rule 144 under the Securities Act and (ii) the Shares are not registered or listed publicly and must be held indefinitely unless they are subsequently registered or listed publicly or an exemption from such registration or listing is available.

Section 4.07. No Brokers. Neither such Investor nor any of its Affiliates has any Contract with any broker, finder or similar agent with respect to the transactions contemplated by this Agreement or by any other Transaction Documents, and none of them has incurred any Liability for any brokerage fees, agents’ fees, commissions or finders’ fees in connection with any of the Transaction Documents or the consummation of the transactions contemplated therein.

ARTICLE 5

CONDITIONS OF THE INVESTORS’ OBLIGATIONS TO CONSUMMATE THE CLOSING

The obligations of each Investor to consummate the Closing under Article 2 of this Agreement are subject to the fulfillment, on or prior to the Closing, or waiver by such Investor, of the following conditions:

Section 5.01. Representations and Warranties. Each of the representations and warranties of the Warrantors contained in Article 3 that are qualified by materiality or Material Adverse Effect shall be true and correct in all respects, and each of the representations and warranties of the Warrantors contained in Article 3 that are not qualified by materiality or Material Adverse Effect shall be true and correct in all material respects, in each case, when made and on and as of the Closing with the same effect as though such representations and warranties had been made on and as of the date of such Closing, except in either case for those representations and warranties that address matters only as of a particular date, which representations shall have been true and correct as of such particular date.

Section 5.02. Performance. Each Warrantor shall have performed and complied with, in all material respects, all of its obligations and conditions contained in the Transaction Documents that are required to be performed or complied with by them on or before the Closing.

Section 5.03. Authorizations. No provision of any applicable Laws shall prohibit the consummation of the Closing. The Warrantors shall have obtained all authorizations, approvals, waivers or permits of any Governmental Authority necessary for the consummation of all of the transactions contemplated by this Agreement and other Transaction Documents.

Section 5.04. Proceedings and Documents. All corporate and other proceedings in connection with the transactions to be completed at the Closing and all documents incident thereto shall have been completed, and each Investor shall have received all such counterpart original or other copies of such documents as it may reasonably request.

Section 5.05. Register of Members. The Company shall have delivered to the Investors a true copy of the Company’s updated register of members reflecting the Investor’s ownership of the shares as of the Closing.

Section 5.06. Memorandum and Articles. The Memorandum and Articles shall have been duly adopted, and reasonable evidence thereof shall have been delivered to the Investors.

Section 5.07. Transaction Documents. Each of the parties to the Transaction Documents, other than the Investors, shall have executed and delivered such Transaction Documents to the Investors.

Section 5.08. Restructuring. The Restructuring shall have been completed.

Section 5.09. Employment Agreement, Non-Competition, Non-Solicitation, IP Assignment and Confidentiality Agreement. Each Key Employee shall have entered into an employment agreement and a non-competition, non-solicitation, IP assignment and confidentiality agreement or an agreement containing non-competition, non-solicitation, IP assignment and confidentiality provisions with the applicable Group Company, in form and substance reasonably satisfactory to the Investors.

Section 5.10. No Material Adverse Effect. Since the date hereof and up until and including the Closing, there shall have been no Material Adverse Effect.

Section 5.11. Closing Certificate. Each Investor shall have received a certificate executed and delivered by the chief financial officer of the Company to certify that the conditions specified in Section 5.01 and Section 5.02 of this Agreement have been fulfilled as of the Closing Date, substantially in the form and substance as attached hereto in Exhibit C.

ARTICLE 6

CONDITIONS OF THE COMPANY’S OBLIGATIONS TO CONSUMMATE THE CLOSING

The obligations of the Company to consummate the Closing under Article 2 of this Agreement, unless otherwise waived in writing by the Company, are subject to the fulfillment on or before the Closing of each of the following conditions:

Section 6.01. Representations and Warranties. The representations and warranties of each Investor contained in Article 4 that are qualified by materiality shall be true and correct in all respects, and the representations and warranties of the Investors contained in Article 4 that are not qualified by materiality shall be true and correct in all material respects, in each case when made and on and as of the Closing with the same effect as though such representations and warranties had been made on and as of the date of the Closing, except in either case for those representations and warranties that address matters only as of a particular date, which representations shall have been true and correct as of such particular date.

Section 6.02. Performance. Each Investor shall have performed and complied with, in all material respects, all obligations and conditions contained in this Agreement that are required to be performed or complied with by each Investor on or before the Closing.

Section 6.03. Transaction Documents. Each of the Investors shall have executed and delivered to the Company each Transaction Document to which such Investor is a party.

ARTICLE 7

CONFIDENTIALITY AND NON-DISCLOSURE

Section 7.01. Confidentiality. The terms and conditions of the Transaction Documents (collectively, the “Financing Terms”), including their existence, shall be considered confidential information and shall not be disclosed by any of the Parties to any other Person, except that (i) each Party, as appropriate, may disclose any of the Financing Terms to its current or bona fide prospective investors, employees, investment bankers, lenders, accountants and attorneys, in each case only where such Persons are under appropriate nondisclosure obligations; (ii) each Investor may disclose any of the Financing Terms to its fund manager, as applicable, and the employees thereof so long as such Persons are under appropriate nondisclosure obligations; and (iii) if any Party is requested or becomes legally compelled (including without limitation, pursuant to securities Laws) to disclose the existence or content of any of the Financing Terms in contravention of the provisions of this Section, such Party shall promptly provide the other Parties with written notice of that fact so that such other Parties may seek a protective order, confidential treatment or other appropriate remedy and in any event shall furnish only that portion of the information that is legally required and shall exercise reasonable efforts to obtain reliable assurance that confidential treatment will be accorded such information.

ARTICLE 8

EXECUTORY PERIOD COVENANTS

Section 8.01. Restructuring. The Company shall cause each of the Group Companies to use its commercially reasonable efforts to complete the Restructuring in accordance with the terms and conditions set forth in Schedule IV on or prior to the Closing.

Section 8.02. Conduct of the Company. Between the date hereof and the Closing, except as in connection with the Restructuring or as the Majority Investors otherwise agree in writing, the Warrantors shall cause each of the Group Companies to conduct its businesses in the ordinary course consistent with past practice and to use its reasonable best efforts to preserve intact its business organizations and relationships with third parties. Without limiting the generality of the foregoing, from the date hereof until the Closing, except as in connection with the Restructuring or as the Majority Investors otherwise agree in writing, the Warrantors shall not permit any of the Group Companies to (i) take any action that would make any representation and warranty of the Company inaccurate at the Closing, (ii) merge or consolidate with any other Person or acquire a material amount of assets from any other Person, (iii) sell, purchase, assign, lease, transfer, pledge, encumber or otherwise dispose of any material asset except pursuant to existing Contracts or commitments or otherwise in the ordinary course consistent with past practice, or (iv) authorize, approve or agree to any of the foregoing.

Section 8.03. Notice of Certain Events. If at any time before the Closing, any Warrantor comes to know of any material fact or event which is in any material way inconsistent with any of the representations and warranties made by the Warrantors in this Agreement, then the Warrantors shall promptly notify each of the Investors of such fact or event.

Section 8.04. Access. Between the date hereof and the Closing, the Warrantors shall permit the Investors, or any representative thereof, to (a) visit and inspect the properties of the Group Companies, (b) inspect the contracts, books of account, records, ledgers, and other documents and data of the Group Companies, (c) discuss the business, affairs and finances of the Group Companies with officers and employees of the Group Companies, during regular working hours with reasonable prior notice to the Group Companies and in such a manner so as not to unreasonably interfere with their normal operations.

Section 8.05. Most Favorable Rights. Each of the Warrantors warrants, acknowledges and undertakes to Lotus that, it has not agreed, and it will not agree, without the prior written consent of Lotus, to grant any terms in respect of the subscription of the Series D Preferred Shares or rights in the Company to any shareholders (other than the Lotus) representing less than 3% of the total share capital of the Company following the Closing that are more favorable to such shareholder than the terms applicable to Lotus.

Section 8.06. Compliance with Laws. As soon as reasonably practicable after the Closing, the Warrantors shall use their reasonable best efforts to cause the Group Companies to obtain, and maintain in good standing all licenses, permits, consents and authorizations required to be obtained by such Group Company under all applicable Laws necessary for the operation of their respective businesses, including without limitation, Network Cultural Business Permit (网络文化经营许可证), the Permit for Internet News and Information Services (互联网新闻信息服务许可证), Online Publishing Service License (网络出版服务许可证), and Permit for Internet Audio-Video Program Service (信息网络传播视听节目许可证).

Section 8.07. Filing of Memorandum and Articles. Within fifteen (15) Business Days following the Closing, the Memorandum and Articles shall have been duly filed with the Registrar of Companies of the Cayman Islands.

Section 8.08. Transfer of Trademarks. As soon as reasonably practicable after the Closing, the trademarks listed in Schedule VIII shall be transferred to the applicable Group Company.

ARTICLE 9

TERMINATION

Section 9.01. Termination. This Agreement may be terminated prior to the Closing (i) by mutual written consent of the Parties, (ii) by either the Company, on the one hand, or any Investor, on the other hand, by written notice to the other, if the Closing has not been consummated by October 23, 2019, or (iii) by either the Company, on the one hand, or any Investor, on the other hand, by written notice to the other, if there has been a material misrepresentation or material breach of a covenant or agreement contained in this Agreement on the part of such Investor or the Warrantors, respectively, and such breach, if curable, has not been cured within thirty days of such notice, or (iv) by either the Company, on the one hand, or any Investor, on the other hand, by written notice to the other, if, due to change of applicable Laws, the consummation of the transactions contemplated hereunder would become prohibited under applicable Laws; provided that upon any Investor’s exercise of its termination rights in accordance with this Section 9.01, this Agreement shall stay valid and be binding upon on the Parties other than such Investor unless and until all the Investors or all the Parties (as applicable) exercise their termination rights under this Section 9.01. If this Agreement is so terminated as provided, this Agreement will be of no further force or effect except that the termination will not relieve any Party from any liability for any breach of this Agreement arising prior to the date of termination.

ARTICLE 10

INDEMNIFICATION

Section 10.01. Survival. The representations and warranties of the Warrantors and the Investors and their respective Affiliates contained in the Transaction Documents shall survive the Closing until the first anniversary of the Closing Date. The covenants and agreements of the Warrantors and the Investors and their respective Affiliates contained in the Transaction Documents shall survive the Closing until fully performed or discharged.

Section 10.02. Indemnification by Warrantors. From and after the Closing, each of the Warrantors, jointly and severally, shall indemnify and hold harmless each Investor and its Affiliates and its and its Affiliates’ respective Representatives, together with their successors and permitted assigns, from and against any and all Indemnifiable Loss actually suffered by such Persons resulting from, arising out of or relating to: (i) any breach of any representation, or warranty of the Warrantors contained in this Agreement, (ii) the nonperformance, partial or total, of any agreement or covenant of the Warrantors contained in this Agreement; and (iii) the lack of requisite permits and licenses as set forth in Section 8.06.