AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER

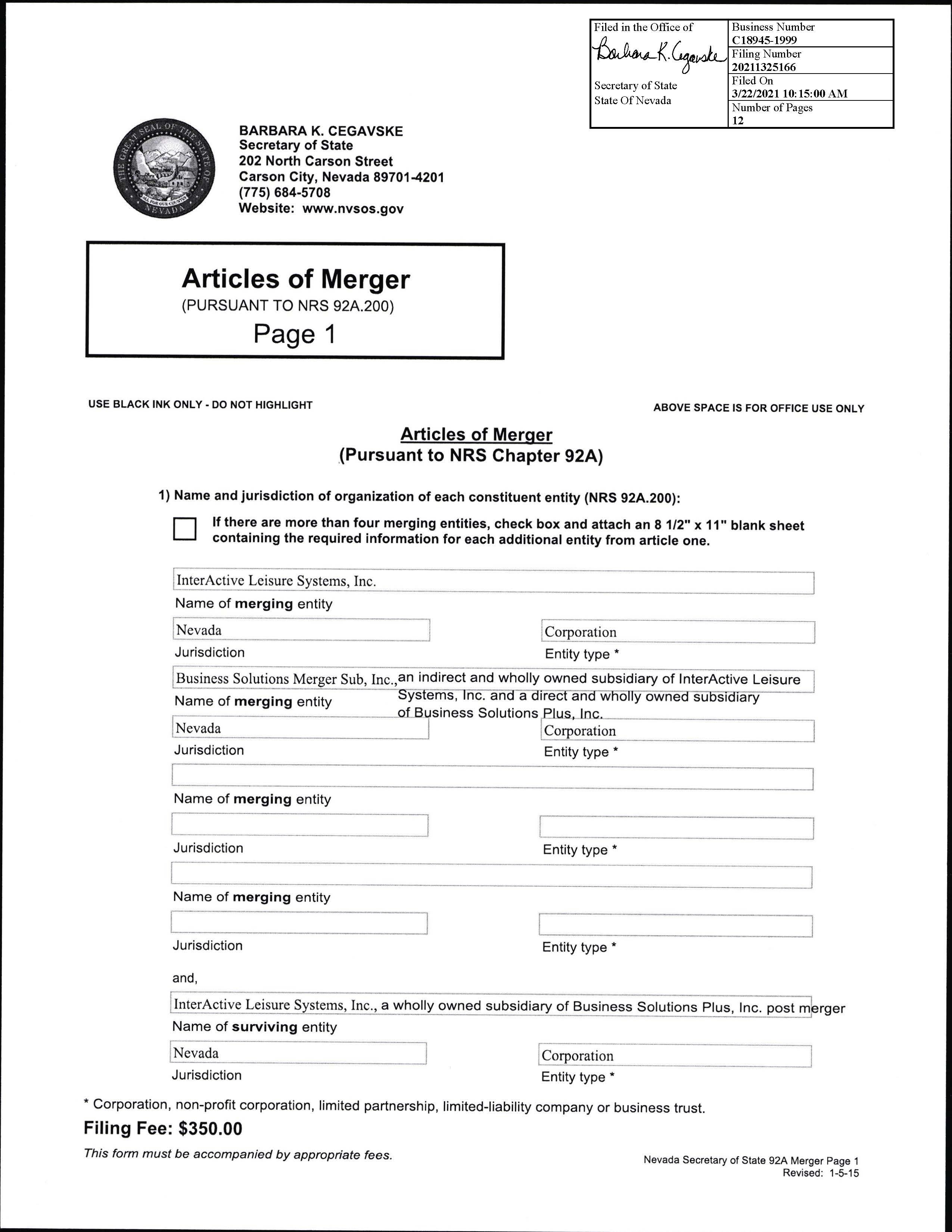

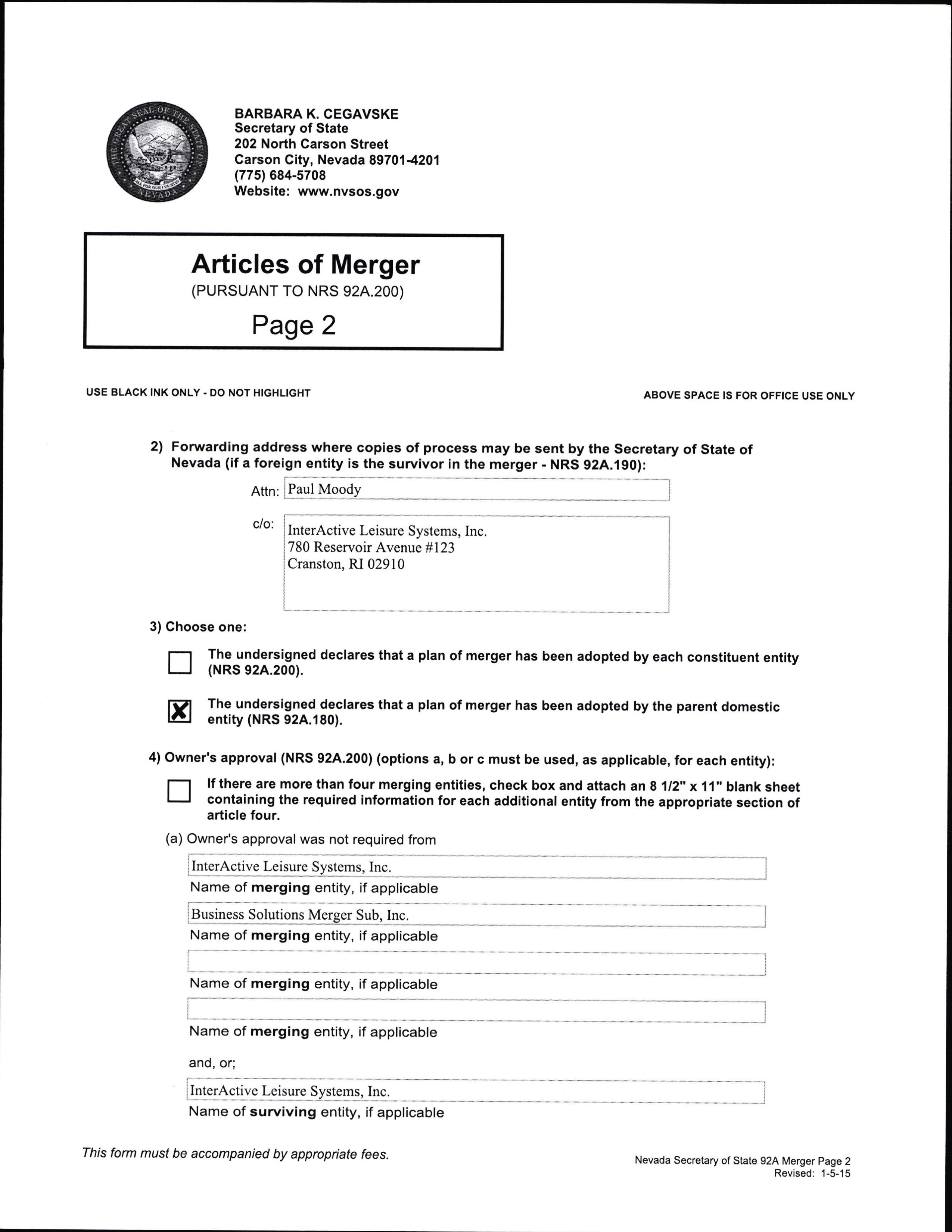

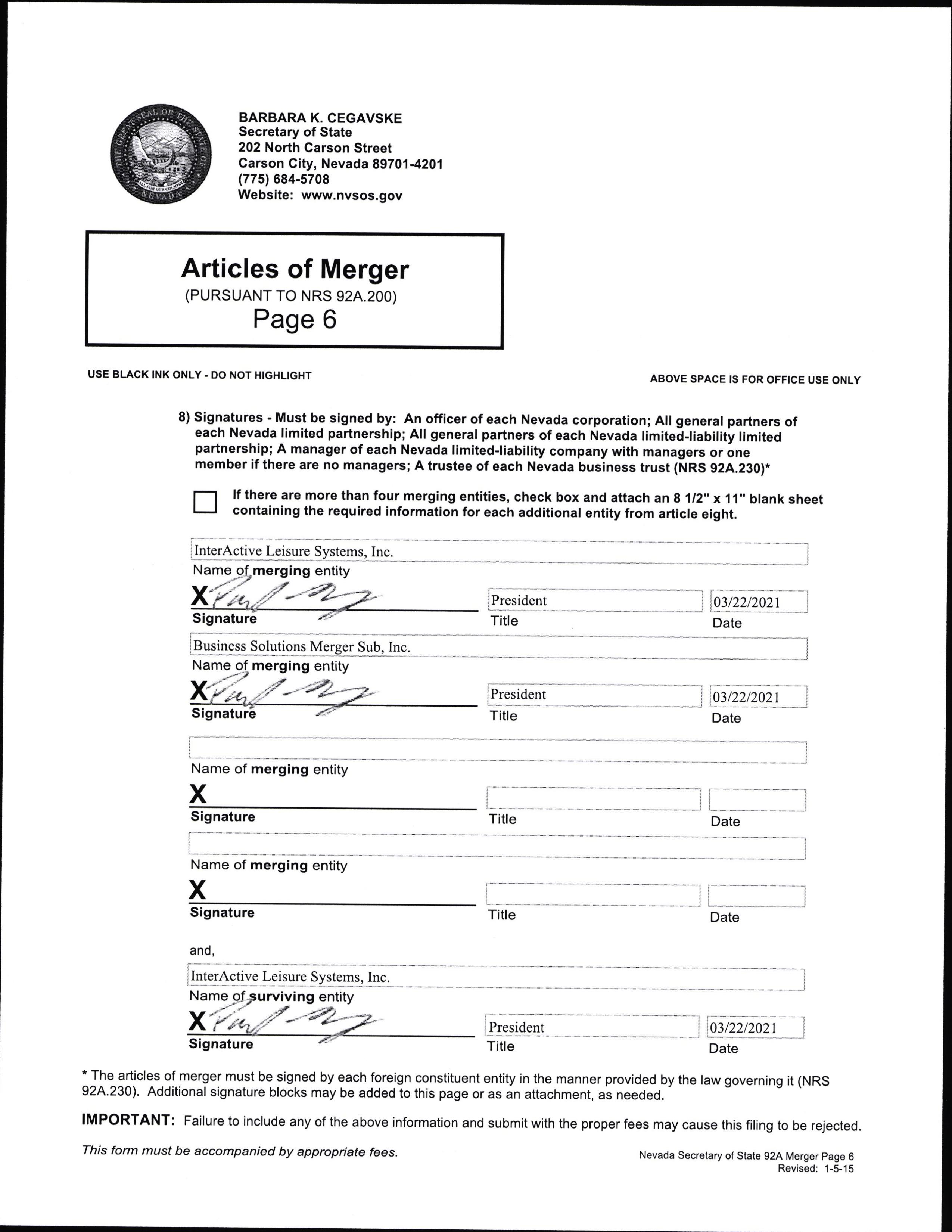

This AGREEMENT AND PLAN OF MERGER (the “Agreement”), entered into as of March 22, 2021, by and among InterActive Leisure Systems, Inc., a Nevada corporation (“Predecessor”), Business Solutions Plus, Inc., a Nevada corporation (“Successor”) and a direct, wholly owned subsidiary of Predecessor, and Business Solutions Merger Sub, Inc., a Nevada corporation (“Merger Sub”) and a direct, wholly owned subsidiary of Successor.

The Articles of Incorporation of Predecessor state that any act or transaction by or involving the Predecessor, other than the election or removal of directors of the Predecessor, that requires for its adoption under the NRS or the Articles of Incorporation of Predecessor the approval of the stockholders of the Predecessor, shall require in addition the approval of the stockholders of Business Solutions Plus, Inc. (or any successor thereto by merger), by the same vote as is required by the Articles of Incorporation and/or the Bylaws of the Predecessor.

1. Merger. At the Effective Time and in accordance with this Agreement and the provisions set forth in NRS 92A.180, 92A.200, NRS 92A.230 and NRS 92A.250, Predecessor shall be merged with and into Merger Sub, (the “Merger”), and Predecessor shall be the surviving corporation, (hereinafter sometimes referred to as the (“Surviving Corporation”). At the Effective Time, the separate corporate existence of Merger Sub shall cease, and Predecessor shall become the wholly owned subsidiary of Successor, and Successor shall become the publicly traded company, as the successor issuer.

2. Effective Time. As soon as practicable on or after the date hereof, the Surviving Corporation shall file this Agreement with the Articles of Merger in accordance with the relevant provisions of the NRS, and with the Secretary of State of the State of Nevada (the “Secretary of State”) and shall make all other filings or recordings required under the NRS, if any to effectuate the Merger. The Merger shall become effective on March 31, 2021 at 4:00 PM Eastern Standard Time (the date and time the Merger becomes effective being referred to herein as the “Effective Time”).

3. Effects of Merger. The Merger shall have the effects set forth in this Agreement and in the applicable provisions set forth in NRS 92A.250. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, (i) right and title to all assets (including real estate and other property) owned by, and every contract right possessed by, the Predecessor and Merger Sub shall vest in the Surviving Corporation, and (ii) all liabilities and obligations of the Predecessor and Merger Sub shall become the liabilities and obligations of the Surviving Corporation. The vesting of such rights, title, liabilities, and obligations in the Surviving Corporation shall not be deemed to constitute an assignment or an undertaking or attempt to assign such rights, title, liabilities and obligations. The conversion of securities of Predecessor into the identical and equivalent securities of Successor will not constitute a sale, resale or different security. Securities issued by Successor pursuant to the merger shall be deemed to have been acquired at the same time as the securities of the Predecessor exchanged in the merger. Successor securities issued solely in exchange for the securities of Predecessor as part of a reorganization of the Predecessor into a holding company structure. Stockholders received securities of the same class evidencing the same proportional interest in the holding company as they held in the Predecessor, and the rights and interests of the stockholders of such securities are substantially the same as those they possessed as stockholders of the Predecessor’s securities. Immediately following the merger, Successor has no significant assets other than securities of the Predecessor and its existing subsidiary(s) and has the same assets and liabilities on a consolidated basis as the Predecessor had before the merger. Stockholders of Predecessor shall be the stockholders of Successor. Successor common stock will trade in the OTC Markets under the Predecessor ticker symbol “IALS” under which the common stock of Predecessor previously listed and traded until a new ticker symbol change has been released into the marketplace by the Financial Industry Regulatory Authority.

4. Articles of Incorporation. As of the date hereof and immediately prior to the Effective time, the articles of incorporation of the Predecessor shall be the articles of incorporation of the Surviving Corporation until thereafter amended as provided therein or by the NRS.

5. Bylaws. From and after the Effective Time, the bylaws of the Predecessor, as in effect immediately prior to the Effective Time, shall constitute the bylaws of the Surviving Corporation until thereafter amended as provided therein or by applicable law.

6. Directors. The directors of Predecessor in office immediately prior the Effective Time shall be the Directors of the Surviving Corporation and will continue to hold office from the Effective Time until the earlier of their resignation or removal or until their successors are duly elected or appointed and qualified.

7. Officers. The officers of Predecessor in office immediately prior to the Effective Time shall be the officers of the Surviving Corporation and will continue to hold office from the Effective Time until the earlier of their resignation or removal or until their successors are duly elected or appointed and qualified.

8. Conversion of Securities. At the Effective Time, by virtue of the merger and without any action on the part of the holder thereof;

(a) Conversion of Predecessor Common Stock. Each share of Predecessor Common Stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Successor Common Stock;

(b) Conversion of Predecessor Common Stock Held as Treasury Stock. Each share of Predecessor Common Stock issued and outstanding held in the Predecessor’s treasury shall be cancelled and retired.

(c) Conversion of Predecessor Preferred Stock. Each share of Predecessor Preferred Stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Successor Preferred Stock having the same designations, rights, power, and preferences, and the qualifications, limitations, and restrictions thereof, as the corresponding share of the Predecessor Preferred Stock.

(d) Conversion of Predecessor Preferred Stock Held as Treasury Stock. Each share of Predecessor Preferred Stock issued and outstanding held in the Predecessor’s treasury shall be cancelled and retired.

(e) Conversion of Options, Warrants, Purchase Rights, Units or Other Securities of Predecessor. Each option, warrant, purchase right, unit or other security of Predecessor convertible into shares of Predecessor Capital Stock shall become convertible into the same number of shares of Successor Capital Stock as such security would have received if the security had been converted into shares of Predecessor Capital Stock immediately prior to the Effective Time, and Successor shall reserve for purposes of the exercise of such options, warrants, purchase rights, units or other securities an equal number of shares of Successor Capital Stock as Predecessor had reserved.

(f) Conversion of Successor Common Stock. Each share of Successor Common Stock issued and outstanding held in the name of Predecessor immediately prior to the Effective Time shall be cancelled and retired and resume the status of authorized and unissued shares of Successor Common Stock.

(g) Conversion of Merger Sub Common Stock. Each share of Merger Sub common Stock will be converted into one validly issued, fully paid and non-assessable share of common stock of the Surviving Corporation.

(h) Rights of Certificate Holders. Upon conversion thereof in accordance with this Section 8, all shares of Predecessor Capital Stock shall no longer be outstanding and shall cease to exist, and each holder of a certificate representing any such shares except, in all cases, as set forth in Section 11 herein. In addition, each outstanding book-entry that, immediately prior to the Effective Time, evidenced shares of Predecessor Capital Stock shall, from and after the Effective Time, be deemed and treated for all corporate purposes to evidence the ownership of the same number of shares of Successor Capital Stock.

9. Other Agreements. At the Effective Time, Successor shall assume any obligation of Predecessor to deliver or make available shares of Predecessor Capital Stock under any agreement or employee benefit plan not referred to in Section 8 herein to which Predecessor is a party. Any reference to Predecessor Capital Stock under any such agreement or employee benefit plan shall be issuable in lieu of each share of Predecessor Capital Stock required to be issued by any such agreement or employee benefit plan, subject to subsequent adjustment as provided in any such agreement or employee benefit plan.

10. Further Assurances. From time to time, as and when required by the Surviving Corporation or by its successors or assigns, there shall be executed and delivered on behalf of Predecessor such deeds and other instruments, and there shall be taken or caused to be taken by it all such further and other action, as shall be appropriate, advisable or necessary in order to vest perfect or conform, of record or otherwise, in the Surviving Corporation, the title to and possession of all property, interests, assets, rights, privileges, immunities, powers, franchises and authority of Predecessor, and otherwise to carry out the purposes of this Agreement, and the officers and directors of the Surviving Corporation are fully authorized, in the name and on behalf of Predecessor or otherwise, to take any and all such action and to execute and deliver any and all such deeds and other instruments.

11. Certificates. At and after the Effective Time until thereafter surrendered for transfer or exchange in the ordinary course, each outstanding certificate which immediately prior thereto represented shares of Predecessor Capital Stock shall be deemed for all purposes to evidence ownership of and to represent the shares of Successor Capital Stock into which the shares of Predecessor Capital Stock represented by such certificate have been converted as herein provided and shall be so registered on the books and records of Successor and its transfer agent. At and after the Effective Time, the shares of capital stock of Successor shall be uncertificated; provided, that, any shares of capital stock of Successor that are represented by outstanding certificates of Predecessor pursuant to the immediately preceding sentence shall continue to be represented by certificates as provided therein and shall not be uncertificated unless and until a valid certificate representing such shares pursuant to the immediately preceding sentence is delivered to Successor’s transfer agent at which time such certificate shall be canceled and in lieu of the delivery of a certificate representing the applicable shares of capital stock of Successor, Successor shall (i) issue to such holder the applicable uncertificated shares of capital stock of Successor by registering such shares in Successor’s books and records as book-entry shares, upon which such shares shall thereafter be uncertificated and (ii) take all action necessary to provide such holder with evidence of the uncertificated book-entry shares, including any action necessary under applicable law in accordance therewith, including in accordance with NRS.

12. Amendment. The parties hereto, by mutual consent of their respective boards of directors, may amend, modify or supplement this Agreement prior to the Effective Time. Surviving Corporation shall cause to be filed with the Nevada Secretary of State such certificates or documents required to give effect thereto.

13. Termination. This Agreement may be terminated, and the Merger and the other transactions provided for herein may be abandoned, at any time prior to the Effective Time, whether before or after approval of this Agreement by the board of directors of Predecessor, Successor, and Merger Sub, or by action of the board of directors of Predecessor if it determines for any reason, in its sole judgment and discretion, that the consummation of the Agreement would be advisable or not and in the best interests of Predecessor and its stockholders.

14. Counterparts. This Agreement may be executed in one or more counterparts, and each such counterpart hereof shall be deemed to be an original instrument, but all such counterparts together shall constitute but one agreement.

15. Descriptive Headings. The descriptive headings herein are inserted for convenience of reference only and are not intended to be part of or to affect the meaning or interpretation of this Agreement.

16. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada.

INTERACTIVE LEISURE SYSTEMS, INC. (“PREDECESSOR”)

By: /s/ Xxxx Xxxxx

Name: Xxxx Xxxxx

Title: President, Secretary and Sole Director

BUSINESS SOLUTIONS PLUS, INC. (“SUCCESSOR”)

By: /s/ Xxxx Xxxxx

Name: Xxxx Xxxxx

Title: President, Secretary and Sole Director

BUSINESS SOLUTIONS MERGER SUB, INC. (“MERGER SUB”)

By: /s/ Xxxx Xxxxx

Name: Xxxx Xxxxx

Title: President, Secretary and Sole Director